Form 497K ETF Series Solutions

| |||||

Aptus Collared Investment Opportunity ETF Trading Symbol: ACIO Listed on Cboe BZX Exchange, Inc. | Summary Prospectus August 31, 2022, as supplemented on March 31, 2023 www.aptusetfs.com | ||||

Before you invest, you may want to review the Fund’s Prospectus and Statement of Additional Information (“SAI”), which contain more information about the Fund and its risks. The current Prospectus and SAI, each dated March 31, 2023, as supplemented from time to time, are incorporated by reference into this Summary Prospectus. You can find the Fund’s Prospectus, reports to shareholders, and other information about the Fund online at www.aptusetfs.com/funds/acio. You can also get this information at no cost by calling 1-800-617-0004 or by sending an e-mail request to ETF@usbank.com.

Investment Objective

The Aptus Collared Investment Opportunity ETF (formerly, Aptus Collared Income Opportunity ETF) (the “Fund”) seeks current income and capital appreciation.

Fees and Expenses of the Fund

The following table describes the fees and expenses you may pay if you buy, hold, and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||

| Management Fees | 0.79% | ||||

| Distribution and/or Service (12b-1) Fees | 0.00% | ||||

| Other Expenses | 0.00% | ||||

| Total Annual Fund Operating Expenses | 0.79% | ||||

Expense Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then continue to hold or redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | ||||||||

| $81 | $252 | $439 | $978 | ||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal year ended April 30, 2022, the Fund’s portfolio turnover rate was 48% of the average value of its portfolio.

Principal Investment Strategy

The Fund is an actively managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective principally by investing in a portfolio of U.S.-listed equity securities of any market capitalization and buying put options or an options collar (i.e., a mix of written (sold) call options and long (bought) put options) on the same underlying equity securities, a U.S. equity ETF, or on an index tracking a portfolio of U.S. equity securities (a “U.S. Equity Index”). The U.S. Equity Index, U.S. equity ETF, and the underlying equity securities may be of any market capitalization. The equity securities and options held by the Fund must be listed on a U.S.-exchange, and the equity securities may include common stocks of U.S. companies, American Depositary Receipts (“ADRs”) (i.e., receipts evidencing ownership of foreign equity securities), and real estate investment trusts (“REITs”). The Fund will typically limit investments in ADRs to approximately 20% of the Fund’s net assets.

1

Aptus Capital Advisors, LLC, the Fund’s investment adviser (“Aptus” or the “Adviser”), selects the Fund’s equity securities based on the Adviser’s assessment of the likelihood that the dividends paid by the issuer will increase or remain stable and based on the liquidity of the options available for such security. The Adviser considers factors primarily related to yield, earnings growth, revenue growth, and distribution history in assessing the likelihood that the dividends paid by an issuer will increase or remain stable. No more than 30% of the Fund’s net assets will typically be invested in companies in a single sector. The Adviser may replace a security if it believes another security offers a better value proposition, with a bias for low portfolio turnover.

The Fund’s options collar strategy typically consists of two components: (i) selling covered call options on up to 100% of the equity securities held by the Fund to generate premium from such options, while (ii) simultaneously reinvesting a portion of such premium to buy put options on the same underlying equity securities, a U.S. equity ETF, or the U.S. Equity Index to “hedge” or mitigate the downside risk associated with owning equity securities. The Fund seeks to generate income from the combination of dividends received from the equity securities held by the Fund and premiums received from the sale of options. Additionally, the Fund may purchase put options or utilize a combination of purchased and written (sold) put options (known as a “spread”) on one or more equity securities, a U.S. equity ETF, or a U.S. Equity Index to “hedge” or mitigate the downside risk associated with owning equity securities.

Call Options. A call option gives the purchaser the right to purchase shares of the reference asset at a specified strike price prior to a specified expiration date. The purchaser pays a cost (premium) to purchase the call option. In the event the reference asset appreciates in value, the value of the call option will generally increase, and in the event the reference asset declines in value, the call option may end up worthless to the holder and the premium may be lost. A written (sold) call option gives the seller the obligation to sell shares of the reference asset at a specified price (“strike price”) until a specified date (“expiration date”). The writer (seller) of the call option receives an amount (premium) for writing (selling) the option. In the event the reference asset appreciates above the strike price and the holder exercises the call option, the writer (seller) of the call option will have to pay the difference between the value of the reference asset and the strike price or deliver the reference asset (which loss is offset by the premium initially received), and in the event the reference asset declines in value, the call option may end up worthless and the writer (seller) of the call option retains the premium. The call options written by the Fund are “covered” because the Fund owns the reference asset at the time it sells the option.

Put Options. A put option gives the purchaser the right to sell shares of the reference asset at a strike price prior to its expiration date. The purchaser pays a cost (premium) to purchase the put option. In the event the reference asset declines in value below the strike price and the holder exercises its put option, the holder will be entitled to receive the difference between the value of the reference asset and the strike price (which gain is offset by the premium originally paid by the holder), and in the event the reference asset closes above the strike price as of the expiration date, the put option may end up worthless and the holder’s loss is limited to the amount of premium it paid.

A written (sold) put option gives the seller the obligation to buy shares of the reference asset at a strike price until its expiration date. The writer (seller) of the put option receives an amount (premium) for writing (selling) the option. In the event the reference asset declines in value below the strike price and the holder exercises the put option, the writer (seller) of the put option will have to pay the difference between the value of the reference asset and the strike price or deliver the reference asset (which loss is offset by the premium initially received), and in the event the reference asset appreciates in value, the put option may end up worthless and the writer (seller) of the put option retains the premium. The put options written by the Fund are considered “covered” when the Fund owns at least an equivalent number of put options on the same reference asset with the same expiration date and a higher strike price at the time it sells the options.

The Fund may write call options on up to 100% of each equity position held in the portfolio and will use a portion of the premium received from writing such call options to purchase put options. Call options written by the Fund will typically have a strike price that is higher than the current price of the reference asset, and put options purchased by the Fund will typically have a strike price that is lower (in some cases, significantly lower) than the current price of the reference asset. Options selected for the Fund will typically expire one week to nine months from their purchase date and will be rolled periodically (e.g., monthly) to continue generating income or to reflect the Adviser’s revised outlook on the underlying portfolio security. When an option is rolled, the Adviser simultaneously closes one option contract and opens another. The new contract opened can have a further-dated expiration (i.e., the option would be rolled “out”), higher strike price (i.e., rolled “up”), lower strike price (i.e., rolled “down”), or a combination of both a different expiration and strike.

In addition to the options strategies discussed above, the Fund may utilize a “bull call spread” options strategy. The Fund’s bull call spread strategy entails (i) the purchase of at-the-money call options (i.e., call options with a strike price roughly equal to the current price of the underlying asset) on an index or ETF tracking an index representing the U.S. equity market and (ii) writing (selling) out-of-the-money call options (i.e., call options with a strike price higher than the current price of the underlying asset) on the same index or ETF. The bull call spread strategy is intended to profit from moderate increases in the value of the reference asset (up to the strike price of the written call options). The Fund may also purchase call options on the securities held by the Fund to enable the Fund to further benefit from an increase in the value of such securities.

2

In addition, the Adviser may utilize a combination of purchased and written (sold) put or call options on the Cboe Volatility Index® (the “VIX® Index”). The VIX Index reflects a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index call and put options. The Fund may use VIX call or put options as a hedge when the market is experiencing a rapid change in volatility, and the Adviser generally expects to invest less than 1% of the Fund’s net assets in VIX Index call and put options at the time of investment.

As of July 31, 2022, the Fund invested a significant portion of its assets in the information technology sector.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The principal risks are presented in alphabetical order to facilitate finding particular risks and comparing them with other funds. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Some or all of these risks may adversely affect the Fund’s net asset value per share (“NAV”), trading price, yield, total return and/or ability to meet its objectives. For more information about the risks of investing in the Fund, see the section in the Fund’s Prospectus titled “Additional Information About the Funds.”

•Collared Options Strategy Risk. Writing and buying options are speculative activities and entail greater than ordinary investment risks. The Fund’s use of call and put options can lead to losses because of adverse movements in the price or value of the underlying security, which may be magnified by certain features of the options. When selling a call option, the Fund will receive a premium; however, this premium may not be enough to offset a loss incurred by the Fund if the price of the underlying security is above the strike price by an amount equal to or greater than the premium. The value of an option may be adversely affected if the market for the option becomes less liquid or smaller, and will be affected by changes in the value or yield of the option’s underlying security, an increase in interest rates, a change in the actual or perceived volatility of the stock market or the underlying security and the remaining time to expiration. Additionally, the value of an option does not increase or decrease at the same rate as the underlying security.

The Fund’s use of options may reduce the Fund’s ability to profit from increases in the value of the underlying securities. If the price of the underlying security of a written call option rises above its strike price, the value of the option and, consequently, the Fund may decline significantly more than if the Fund invested solely in the underlying security instead of using options. Similarly, if the price of the underlying security of a purchased put option remains above its strike price, the option may become worthless, and, consequently the value of the Fund may decline significantly more than if the Fund invested solely in the underlying security instead of using options.

•Depositary Receipt Risk. Depositary Receipts involve risks similar to those associated with investments in foreign securities, such as changes in political or economic conditions of other countries and changes in the exchange rates of foreign currencies. Depositary Receipts listed on U.S. exchanges are issued by banks or trust companies and entitle the holder to all dividends and capital gains that are paid out on the underlying foreign shares (“Underlying Shares”). When the Fund invests in Depositary Receipts as a substitute for an investment directly in the Underlying Shares, the Fund is exposed to the risk that the Depositary Receipts may not provide a return that corresponds precisely with that of the Underlying Shares.

•Derivative Securities Risk. The Fund invests in options that derive their performance from the performance of an underlying reference asset. Derivatives, such as the options in which the Fund invests, can be volatile and involve various types and degrees of risks, depending upon the characteristics of a particular derivative. Derivatives may entail investment exposures that are greater than their cost would suggest, meaning that a small investment in a derivative could have a substantial impact on the performance of the Fund. The Fund could experience a loss if its derivatives do not perform as anticipated, the derivatives are not correlated with the performance of their reference asset, or if the Fund is unable to purchase or liquidate a position because of an illiquid secondary market. The market for many derivatives is, or suddenly can become, illiquid. Changes in liquidity may result in significant, rapid, and unpredictable changes in the prices for derivatives.

•Equity Market Risk. The equity securities held in the Fund’s portfolio may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific issuers, industries, or sectors in which the Fund invests. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from issuers. In addition, local, regional or global events such as war, including Russia’s invasion of Ukraine, acts of terrorism, spread of infectious diseases or other public health issues, recessions, rising inflation, or other events could have a significant negative impact on the Fund and its investments. For example, the global pandemic caused by COVID-19, a novel coronavirus, and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, has had negative impacts, and in many cases severe impacts, on markets worldwide. The COVID-19 pandemic has caused prolonged disruptions to the normal business operations of companies around the world and the impact of such disruptions is hard to predict. Such events may affect certain

3

geographic regions, countries, sectors and industries more significantly than others. Such events could adversely affect the prices and liquidity of the Fund’s portfolio securities or other instruments and could result in disruptions in the trading markets.

•ETF Risks. The Fund is an ETF, and, as a result of an ETF’s structure, it is exposed to the following risks:

◦Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, Shares may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

◦Costs of Buying or Selling Shares. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid-ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

◦Shares May Trade at Prices Other Than NAV. As with all ETFs, Shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of Shares will approximate the Fund’s NAV, there may be times when the market price of Shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of Shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for Shares in the secondary market, in which case such premiums or discounts may be significant.

◦Trading. Although Shares are listed for trading on Cboe BZX Exchange, Inc. (the “Exchange”) and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that Shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than Shares, and this could lead to differences between the market price of the Shares and the underlying value of those Shares.

•Foreign Investment Risk. Because of the Fund’s investment in ADRs, changes in foreign economies and political climates are more likely to affect the Fund than a fund that invests exclusively in U.S. companies. There may be less government supervision of foreign markets, resulting in non-uniform accounting practices and less publicly available information. The value of foreign investments may be affected by changes in exchange control regulations, application of foreign tax laws (including withholding tax), changes in governmental administration or economic or monetary policy (in this country or abroad) or changed circumstances in dealings between nations.

•Management Risk. The Fund is actively managed and may not meet its investment objective based on the Adviser’s success or failure to implement investment strategies for the Fund.

•Market Capitalization Risk.

◦Large-Capitalization Investing. The securities of large-capitalization companies may be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. Large-capitalization companies may also be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes.

◦Mid-Capitalization Investing. The securities of mid-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of large-capitalization companies, but they may also be subject to slower growth than small-capitalization companies during times of economic expansion. The securities of mid-capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than large capitalization stocks or the stock market as a whole, but they may also be nimbler and more responsive to new challenges than large-capitalization companies. Some mid-capitalization companies have limited product lines, markets, financial resources, and management personnel and tend to concentrate on fewer geographical markets relative to large-capitalization companies.

◦Small-Capitalization Investing. The securities of small-capitalization companies may be more vulnerable to adverse issuer, market, political, or economic developments than securities of larger-capitalization companies. The securities of small-capitalization companies generally trade in lower volumes and are subject to greater and more unpredictable price changes than larger capitalization stocks or the stock market as a whole. Some small capitalization companies have limited product lines, markets, and financial and managerial resources and tend to concentrate on fewer geographical markets relative to larger capitalization companies. There is typically less publicly available information concerning smaller-capitalization

4

companies than for larger, more established companies. Small-capitalization companies also may be particularly sensitive to changes in interest rates, government regulation, borrowing costs and earnings.

•REIT Investment Risk. Investments in REITs involve unique risks. REITs may have limited financial resources, may trade less frequently and in limited volume, and may be more volatile than other securities. REITs may be affected by changes in the value of their underlying properties or mortgages or by defaults by their borrowers or tenants. Furthermore, these entities depend upon specialized management skills, have limited diversification and are, therefore, subject to risks inherent in financing a limited number of projects. In addition, the performance of a U.S. REIT may be affected by changes in the tax laws or by its failure to qualify for tax-free pass-through of income.

•Sector Risk. To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors.

◦Consumer Sectors Risk. The success of consumer product manufacturers and retailers is tied closely to the performance of domestic and international economies, interest rates, exchange rates, competition, consumer confidence, changes in demographics and consumer preferences. Companies in the consumer staples sector, such as companies that produce or sell food, beverage, and drug retail or other household items, may be adversely impacted by changes in global and economic conditions, rising energy prices, and changes in the supply or price of commodities. Companies in the consumer discretionary sector, such as automobile, textile, retail, and media companies, depend heavily on disposable household income and consumer spending, and may be strongly affected by social trends and marketing campaigns. These companies may be subject to severe competition, which may have an adverse impact on their profitability.

◦Financial Sector Risk. This sector can be significantly affected by changes in interest rates, government regulation, the rate of defaults on corporate, consumer and government debt, the availability and cost of capital, and fallout from the housing and sub-prime mortgage crisis. Insurance companies, in particular, may be significantly affected by changes in interest rates, catastrophic events, price and market competition, the imposition of premium rate caps, or other changes in government regulation or tax law and/or rate regulation, which may have an adverse impact on their profitability. This sector has experienced significant losses in the recent past, and the impact of more stringent capital requirements and of recent or future regulation on any individual financial company or on the sector as a whole cannot be predicted. In recent years, cyber attacks and technology malfunctions and failures have become increasingly frequent in this sector and have caused significant losses.

◦Information Technology Sector Risk. Market or economic factors impacting information technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs. Stocks of information technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Information technology companies are heavily dependent on patent and intellectual property rights, the loss or impairment of which may adversely affect profitability.

•Tax Risk. The use of derivatives strategies, such as writing (selling) and purchasing options and futures contracts and entering into forward contracts, involves complex rules that will determine for income tax purposes the amount, character and timing of recognition of the gains and losses the Fund realizes in connection therewith. The Fund expects to generate premiums from its sale of call options. These premiums typically will result in short-term capital gains for federal income tax purposes. In addition, stocks that are hedged with put options may not be eligible for long-term capital gains tax treatment. The Fund is not designed for investors seeking a tax efficient investment.

5

Performance

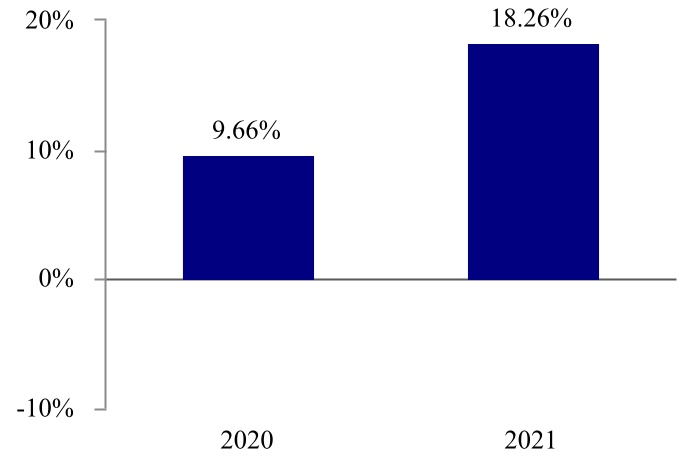

The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s performance for the calendar year ended December 31. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compared with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is also available on the Fund’s website at www.aptusetfs.com/funds/acio.

Calendar Year Total Return

For the year-to-date period ended June 30, 2022, the Fund’s total return was -11.37%. During the period of time shown in the bar chart, the Fund’s highest quarterly return was 11.91% for the quarter ended June 30, 2020, and the lowest quarterly return was -11.47% for the quarter ended March 31, 2020.

Average Annual Total Returns for the Period Ended December 31, 2021

| Aptus Collared Investment Opportunity ETF | 1 Year | Since Inception (7/9/2019) | ||||||

Return Before Taxes | 18.26% | 12.75% | ||||||

Return After Taxes on Distributions | 18.08% | 12.42% | ||||||

Return After Taxes on Distributions and Sale of Shares | 10.92% | 9.86% | ||||||

S&P 500® Index (reflects no deduction for fees, expenses, or taxes) | 28.71% | 22.91% | ||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

Management

Investment Adviser

Aptus Capital Advisors, LLC serves as investment adviser to the Fund.

Portfolio Managers

John D. (“JD”) Gardner, CFA, Chief Investment Officer and Managing Member at the Adviser, has been a portfolio manager of the Fund since its inception in July 2019.

John Luke Tyner, CFA, Portfolio Manager and Analyst at the Adviser, has been a portfolio manager of the Fund since August 2020.

David Wagner III, CFA, Portfolio Manager and Analyst at the Adviser, has been a portfolio manager of the Fund since August 2020.

6

Purchase and Sale of Shares

Shares are listed on the Exchange, and individual Shares may only be bought and sold in the secondary market through brokers at market prices, rather than NAV. Because Shares trade at market prices rather than NAV, Shares may trade at a price greater than NAV (premium) or less than NAV (discount).

The Fund issues and redeems Shares at NAV only in large blocks known as “Creation Units,” which only APs (typically, broker-dealers) may purchase or redeem. The Fund generally issues and redeems Creation Units in exchange for a portfolio of securities and/or a designated amount of U.S. cash.

Investors may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid-ask spread”). Recent information about the Fund, including its NAV, market price, premiums and discounts, and bid-ask spreads is available on the Fund’s website at www.aptusetfs.com/funds/acio.

Tax Information

Fund distributions are generally taxable as ordinary income, qualified dividend income, or capital gains (or a combination), unless your investment is in an IRA or other tax-advantaged account. Distributions on investments made through tax-deferred arrangements may be taxed later upon withdrawal of assets from those accounts.

Financial Intermediary Compensation

If you purchase Shares through a broker-dealer or other financial intermediary (such as a bank) (an “Intermediary”), the Adviser or its affiliates may pay Intermediaries for certain activities related to the Fund, including participation in activities that are designed to make Intermediaries more knowledgeable about exchange traded products, including the Fund, or for other activities, such as marketing, educational training or other initiatives related to the sale or promotion of Shares. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Any such arrangements do not result in increased Fund expenses. Ask your salesperson or visit the Intermediary’s website for more information.

7

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Results of the Annual General Meeting 2024

- /C O R R E C T I O N -- University of Bridgeport/

- SHAREHOLDER ACTION NOTICE: The Schall Law Firm Encourages Investors in Innoviz Technologies Ltd. with Losses of $100,000 to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share