Form 497K ETF Series Solutions

ClearShares OCIO ETF Trading Symbol: OCIO Listed on NYSE Arca | Summary Prospectus September 30, 2022 www.clear-shares.com | ||||

Before you invest, you may want to review the Fund’s Prospectus and Statement of Additional Information (“SAI”), which contain more information about the Fund and its risks. The current Prospectus and SAI, each dated September 30, 2022, are incorporated by reference into this Summary Prospectus. You can find the Fund’s Prospectus, reports to shareholders, and other information about the Fund online at www.clear-shares.com/ocio. You can also get this information at no cost by calling 1-800-617-0004 or by sending an e-mail request to ETF@usbank.com.

Investment Objective

The ClearShares OCIO ETF (the “Fund”) seeks to outperform a traditional 60/40 mix of global equity and fixed income investments.

Fees and Expenses of the Fund

The following table describes the fees and expenses you may pay if you buy, hold, and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||

Management Fees | 0.55% | ||||

Distribution and/or Service (12b-1) Fees | 0.00% | ||||

Other Expenses | 0.00% | ||||

Acquired Fund Fees and Expenses1 | 0.08% | ||||

Total Annual Fund Operating Expenses | 0.63% | ||||

Less Fee Waiver2 | 0.01% | ||||

Total Annual Fund Operating Expenses Less Fee Waiver | 0.62% | ||||

1 Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies. Total Annual Fund Operating Expenses do not correlate to the expense ratios in the Fund’s Financial Highlights because the Financial Highlights include only the direct operating expenses incurred by the Fund and exclude Acquired Fund Fees and Expenses.

2 ClearShares LLC, the Fund’s investment adviser (the “Adviser”), has contractually agreed to waive certain amounts of the Fund’s management fee when the Fund invests in the ClearShares Ultra-Short Maturity ETF (the “Ultra-Short Maturity ETF”), for which the Adviser also serves as investment adviser. With respect to assets of the Fund invested in the Ultra-Short Maturity ETF, the Adviser will waive the Fund’s management fee in an amount equal to the management fee of the Ultra-Short Maturity ETF, at least through September 30, 2023. This arrangement may only be changed or eliminated by the Fund’s Board of Trustees upon 60 days’ written notice to the Adviser.

Expense Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then continue to hold or redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The Example does not take into account brokerage commissions that you may pay on your purchases and sales of Shares. The management fee waiver discussed in the table above is reflected only for the first year. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| $63 | $201 | $350 | $785 | |||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal year ended May 31, 2022, the Fund’s portfolio turnover rate was 51% of the average value of its portfolio.

Principal Investment Strategies

The Fund is an actively managed “fund of funds” and seeks to achieve its objective by investing primarily in other registered investment companies, including other actively managed exchange-traded funds (“ETFs”) and index-based ETFs (collectively, “Underlying Investments”), that provide exposure to a broad range of asset classes. The Underlying Investments may invest in equity securities of U.S. or foreign companies, debt obligations of U.S. or foreign companies or governments, or other assets. The Fund may also invest directly in such U.S. equity securities. The Fund allocates its assets across asset classes, industries, and geographic regions, subject to certain diversification and liquidity considerations. The Underlying Investments may provide exposure to foreign countries, including emerging markets.

The Fund is expected to typically invest approximately 40% to 70% of its total assets in equity securities (of any market capitalization), either through Underlying Investments that principally invest in U.S. or foreign equity securities, or directly in U.S. equity securities. Such Underlying Investments may invest principally in specific sectors of the economy, such as healthcare, financials, real estate, and energy, or in broader swaths of domestic, foreign, or global equity markets. Underlying Investments used for real estate exposure may invest some or all of their assets in real estate investment trusts (“REITs”), and Underlying Investments used for energy exposure may invest some or all of their assets in master limited partnerships (“MLPs”).

The Fund is expected to typically invest approximately 20% to 50% of its total assets in Underlying Investments that principally invest in debt obligations. Such Underlying Investments may invest in U.S. government debt, sovereign debt, U.S. and foreign corporate debt, high-yield debt (also known as “junk bonds”), mortgage debt, and structured debt, such as asset-backed securities. Such Underlying Investments may hold debt denominated in U.S. dollars or foreign currencies. The Fund has no limitation on the range of maturities or credit quality of the debt in which Underlying Investments may invest.

Blueprint Investment Partners LLC, the Fund’s investment sub-adviser (“Blueprint” or the “Sub-Adviser”), uses both “top-down” and “bottom-up” analyses in determining whether to purchase or sell a particular Underlying Investment or individual security.

The Sub-Adviser’s quantitative trend-based analysis focuses on identifying the investment styles, sectors, geographic regions and asset classes with the greatest potential for positive absolute returns and the highest returns relative to other styles, sectors, regions, and asset classes. Additionally, the Sub-Adviser’s analysis seeks to identify markets, asset classes, and strategies that are likely to encounter headwinds (i.e., negative economic factors) and negative returns over the next three to twelve months. The factors incorporated into the Sub-Adviser’s quantitative analysis include the price series and trend of each holding, credit spread levels (i.e., differences in yields among bonds of similar maturities but varying credit qualities), market volatility, the shape of the yield curve, energy prices, market correlations, and currency exchange rates amongst others.

The Sub-Adviser’s bottom-up fundamental analysis employs a rigorous research process designed to identify those asset classes with attractive absolute values and values relative to other asset classes. The valuation metrics and factors included in such analysis for equity-based Underlying Investments and individual securities include volatility, correlation, expected return, and dividend yields. For debt-based Underlying Investments and individual securities, the metrics used in such analysis include yield, credit spreads, duration, credit quality, and geographic location of issuers. For alternative investment Underlying Investments, the Sub-Adviser’s analysis considers levels of interest rates, equity and bond valuations, inflation rates, market volatility, market sentiment, and capital flows.

2

The Sub-Adviser selects specific Underlying Investments based on an evaluation of their market exposure, liquidity, cost, and historic tracking error relative to their underlying index or benchmark. The Sub-Adviser may adjust the Fund’s allocation to Underlying Investments as often as daily to take advantage of return opportunities or to avoid perceived downside market risks. The size of the Fund’s allocation to a particular Underlying Investment or a specific industry, sector, or region will generally reflect whether the Sub-Adviser considers the investment opportunity to be a shorter-term tactical investment (a medium conviction idea) or a longer-term cyclical opportunity (a high conviction idea).

Underlying Investments do not include ETFs or ETPs that employ high levels of leverage, derivatives, or illiquid investments or that seek to return the inverse of an underlying index or benchmark. The Fund will typically invest no more than 5% of its total assets in any single Underlying Investment or individual security.

The Fund may lend its portfolio securities to brokers, dealers, and other financial organizations. These loans, if and when made, may not exceed 33 1/3% of the total asset value of the Fund (including the loan collateral). By lending its securities, the Fund may increase its income by receiving payments from the borrower.

Principal Risks of Investing in the Fund

The principal risks of investing in the Fund are summarized below. The principal risks are presented in alphabetical order to facilitate finding particular risks and comparing them with other funds. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Some or all of these risks may adversely affect the Fund’s net asset value per share (“NAV”), trading price, yield, total return and/or ability to meet its objectives. For more information about the risks of investing in the Fund, see the section in the Fund’s Prospectus titled “Additional Information About the Funds.”

•Asset Allocation Risk. The Fund may favor an asset category or investment strategy that performs poorly relative to other asset categories and investment strategies for short or long periods of time.

•Currency Exchange Rate Risk. The Fund may invest in Underlying Investments that invest primarily in securities denominated in non-U.S. currencies. Changes in currency exchange rates and the relative value of non-U.S. currencies may affect the value of such investments and the value of your Shares. Currency exchange rates can be very volatile and can change quickly and unpredictably. As a result, the value of an investment in the Fund may change quickly and without warning and you may lose money.

•Emerging Markets Risk. The Fund’s Underlying Investments that provide exposure to securities traded in developing or emerging markets, and individual securities with such exposure, may involve substantial risk with respect to such securities due to limited information; different accounting, auditing, and financial reporting standards; a country’s dependence on revenue from particular commodities or international aid; and expropriation, nationalization, or other adverse political or economic developments. Political and economic structures in many emerging market countries may be undergoing significant evolution and rapid development, and such countries may lack the social, political and economic stability characteristics of more developed countries. Some of these countries may have failed to recognize private property rights in the past and, at times, have nationalized or expropriated the assets of private companies.

3

•Equity Market Risk. The Fund may invest directly or in Underlying Investments that invest primarily in common stocks. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from specific issuers. Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors or companies in which the Fund or its Underlying Investment invest. In addition, local, regional or global events such as war, including Russia’s invasion of Ukraine, acts of terrorism, spread of infectious diseases or other public health issues, recessions, rising inflation, or other events could have a significant negative impact on the Fund and its investments. For example, the global pandemic caused by COVID-19, a novel coronavirus, and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, has had negative impacts, and in many cases severe impacts, on markets worldwide. The COVID-19 pandemic has caused prolonged disruptions to the normal business operations of companies around the world and the impact of such disruptions is hard to predict. Such events may affect certain geographic regions, countries, sectors and industries more significantly than others. Such events could adversely affect the prices and liquidity of the Fund’s portfolio securities or other instruments and could result in disruptions in the trading markets.

•ETF Risks.

◦Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, Shares may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

◦Costs of Buying or Selling Shares. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid-ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

◦Shares May Trade at Prices Other Than NAV. As with all ETFs, Shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of Shares will approximate the Fund’s NAV, there may be times when the market price of Shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of Shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for Shares in the secondary market, in which case such premiums or discounts may be significant. Because securities held by the Fund may trade on foreign exchanges that are closed when the Fund’s primary listing exchange is open, the Fund is likely to experience premiums and discounts greater than those of domestic ETFs.

◦Trading. Although Shares are listed for trading on NYSE Arca, Inc. (the “Exchange”) and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that Shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than Shares, and this could lead to differences between the market price of the Shares and the underlying value of those Shares.

4

•Fixed Income Securities Risk. The Fund may invest in Underlying Investments that invest primarily in fixed income securities. Fixed income securities, such as bonds and certain asset-backed securities, involve certain risks, which include:

◦Call Risk. During periods of falling interest rates, an issuer of a callable bond held by the Fund may “call” or repay the security prior to its stated maturity, and the Fund may have to reinvest the proceeds at lower interest rates, resulting in a decline in the Fund’s income.

◦Credit Risk. Credit risk refers to the possibility that the issuer of a security will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of an investment in that issuer.

◦Duration Risk. Prices of fixed income securities with longer durations are more sensitive to interest rate changes than those with shorter durations.

◦Event Risk. Event risk is the risk that corporate issuers may undergo restructurings, such as mergers, leveraged buyouts, takeovers, or similar events financed by increased debt. As a result of the added debt, the credit quality and market value of a company’s bonds and/or other debt securities may decline significantly.

◦Extension Risk. When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these securities to fall.

◦Interest Rate Risk. Generally, the value of fixed income securities will change inversely with changes in interest rates. As interest rates rise, the market value of fixed income securities tends to decrease. Conversely, as interest rates fall, the market value of fixed income securities tends to increase. This risk will be greater for long-term securities than for short-term securities. In recent periods, governmental financial regulators, including the U.S. Federal Reserve, have taken steps to maintain historically low interest rates, which may increase interest rate risk. Changes in government intervention may have adverse effects on investments, volatility, and illiquidity in debt markets.

◦Maturity Risk. The value of fixed income investments is also dependent on their maturity. Generally, the longer the maturity of a fixed income security, the greater its sensitivity to changes in interest rates.

◦Prepayment Risk. When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the proceeds may have to be invested in securities with lower yields.

◦Variable and Floating Rate Instrument Risk. Floating or variable rate securities pay interest at rates that adjust in response to changes in a specified interest rate or reset at predetermined dates (such as the end of a calendar quarter). Securities with floating or variable interest rates are generally less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value if their interest rates do not rise as much, or as quickly, as comparable market interest rates. Although floating or variable rate securities are generally less sensitive to interest rate risk than fixed rate securities, they are subject to credit, liquidity and default risk and may be subject to legal or contractual restrictions on resale, which could impair their value.

•Foreign Securities Risk. The Fund may invest in Underlying Investments that invest primarily in foreign securities. Investments in foreign securities involve certain risks that may not be present with investments in U.S. securities. For example, investments in foreign securities may be subject to risk of loss due to foreign currency fluctuations or to political or economic instability. Investments in foreign securities also may be subject to withholding or other taxes and may be subject to additional trading, settlement, custodial, and operational risks. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. These risks may be enhanced for securities of companies organized in emerging market nations.

•Government Obligations Risk. The Fund may invest in Underlying Investments that primarily invest in securities issued by the U.S. or other governments. There can be no guarantee that the United States or another country will be able to meet its payment obligations with respect to such securities. Additionally, market prices

5

and yields of securities supported by the full faith and credit of the U.S. government or other countries may decline or be negative for short or long periods of time.

•High-Yield Securities Risk. The Fund may invest in Underlying Investments that primarily invest in high-yield securities (also known as “junk bonds”). Although high-yield securities generally pay higher rates of interest than investment grade bonds, high-yield securities are speculative, high risk investments that may cause income and principal losses for the Fund or its Underlying Investments and, consequently, negatively affect the value of the Fund. High-yield securities may be issued by companies that are restructuring, are smaller and less creditworthy, or are more highly indebted than other companies. This means that they may have more difficulty making scheduled payments of principal and interest. Changes in the value of high-yield securities are influenced more by changes in the financial and business position of the issuing company than by changes in interest rates when compared to investment grade securities. The Fund’s exposure to high-yield securities may subject it to a substantial degree of credit risk.

•Investment Company Risk. The risks of investing in investment companies, such as the Underlying Investments, typically reflect the risks of the types of instruments in which the investment companies invest. By investing in another investment company, the Fund becomes a shareholder of that investment company and bears its proportionate share of the fees and expenses of the other investment company. The Fund may be subject to statutory limits with respect to the amount it can invest in other ETFs, which may adversely affect the Fund’s ability to achieve its investment objective. Investments in ETFs are also subject to the “ETF Risks” described above.

•Management Risk. The Fund is actively managed and may not meet its investment objective based on the portfolio managers’ success or failure to implement investment strategies for the Fund.

•MLP Risk. The Fund may invest in Underlying Investments that principally invest in MLPs. MLP investment returns are enhanced during periods of declining or low interest rates and tend to be negatively influenced when interest rates are rising. In addition, most MLPs are fairly leveraged and typically carry a portion of a “floating” rate debt. As such, a significant upward swing in interest rates would also drive interest expense higher. Furthermore, most MLPs grow by acquisitions partly financed by debt, and higher interest rates could make it more difficult to make acquisitions. MLP investments also entail many of the general tax risks of investing in a partnership. Limited partners in an MLP typically have limited control and limited rights to vote on matters affecting the partnership. Additionally, there is always the risk that an MLP will fail to qualify for favorable tax treatment.

•Mortgage- and Asset-Backed Securities Risk. The Fund may invest in Underlying Investments that principally invest in mortgage- and asset-backed securities. Such securities are subject to credit, interest rate, prepayment, and extension risks (see “Fixed Income Securities Risk” above). These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates may quickly and significantly reduce the value of certain mortgage-backed securities.

•REIT Investment Risk. The Fund may invest in Underlying Investments that primarily invest in REITs. Investments in REITs involve unique risks. REITs may have limited financial resources, may trade less frequently and in limited volume, and may be more volatile than other securities. The risks of investing in REITs include certain risks associated with the direct ownership of real estate and the real estate industry in general. REITs are also subject to heavy cash flow dependency, defaults by borrowers, and self-liquidation.

•Sector Risk. To the extent the Fund invests, either directly or through Underlying Investments, more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors.

•Securities Lending Risk. There are certain risks associated with securities lending, including the risk that the borrower may fail to return the securities on a timely basis or even the loss of rights in the collateral deposited by the borrower, if the borrower should fail financially. The Fund could also lose money in the event of a decline in the value of collateral provided for loaned securities or a decline in the value of any investments made with cash collateral. As a result the Fund may lose money.

6

•Small and Mid-Sized Company Stock Risk. The Fund may invest directly or in Underlying Investments that primarily invest in the common stock of small- or mid-sized companies. Small to mid-sized company stocks have historically been subject to greater investment risk than large company stocks. The prices of small- to mid-sized company stocks tend to be more volatile and less liquid than large company stocks.

Performance

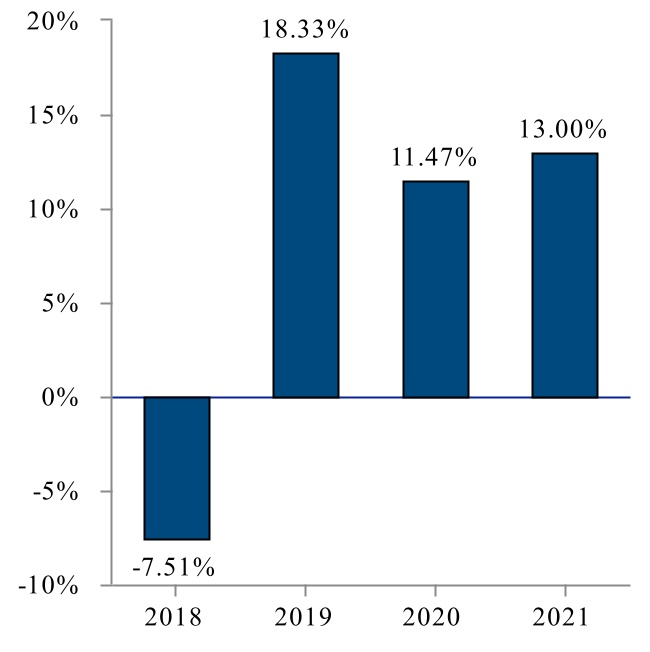

The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s performance for calendar years ended December 31. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is available on the Fund’s website at www.clear-shares.com.

Calendar Year Total Return

For the year-to-date period ended June 30, 2022, the Fund’s total return was -13.74%. During the period of time shown in the bar chart, the Fund’s highest quarterly return was 12.43% for the quarter ended June 30, 2020 and the lowest quarterly return was -13.08% for the quarter ended March 31, 2020.

Average Annual Total Returns

For the Period Ended December 31, 2021

| ClearShares OCIO ETF | 1 Year | Since Inception (6/26/17) | ||||||

| Return Before Taxes | 13.00% | 9.01% | ||||||

| Return After Taxes on Distributions | 12.16% | 8.27% | ||||||

| Return After Taxes on Distributions and Sale of Shares | 8.14% | 6.90% | ||||||

S&P Target Risk Growth Index (reflects no deduction for fees, expenses, or taxes) | 11.37% | 9.31% | ||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

7

Management

Investment Adviser: ClearShares LLC serves as investment adviser to the Fund.

Investment Sub-Adviser: Blueprint Investment Partners LLC serves as the investment sub-adviser to the Fund.

Portfolio Managers

Jonathan Robinson (Chief Executive Officer of Blueprint) and Brandon Langley (Chief Compliance Officer of Blueprint) have been the portfolio managers of the Fund since October 2021.

Purchase and Sale of Shares

Shares are listed on the Exchange, and individual Shares may only be bought and sold in the secondary market through brokers at market prices, rather than NAV. Because Shares trade at market prices rather than NAV, Shares may trade at a price greater than NAV (premium) or less than NAV (discount).

The Fund issues and redeems Shares at NAV only in large blocks known as “Creation Units,” which only APs (typically, broker-dealers) may purchase or redeem. The Fund generally issues and redeems Creation Units in exchange for a portfolio of securities and/or a designated amount of U.S. cash.

Investors may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid-ask spread”). Recent information about the Fund, including its NAV, market price, premiums and discounts, and bid-ask spreads is available on the Fund’s website at www.clear-shares.com.

Tax Information

Fund distributions are generally taxable as ordinary income, qualified dividend income, or capital gains (or a combination), unless your investment is in an IRA or other tax-advantaged account. Distributions on investments made through tax-deferred arrangements may be taxed later upon withdrawal of assets from those accounts.

Financial Intermediary Compensation

If you purchase Shares through a broker-dealer or other financial intermediary (such as a bank) (an “Intermediary”), the Adviser, Sub-Adviser, or their affiliates may pay Intermediaries for certain activities related to the Fund, including participation in activities that are designed to make Intermediaries more knowledgeable about exchange traded products, including the Fund, or for other activities, such as marketing, educational training or other initiatives related to the sale or promotion of Shares. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Any such arrangements do not result in increased Fund expenses. Ask your salesperson or visit the Intermediary’s website for more information.

8

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- u-blox Secures Significant Project Wins in the Robotic Lawnmower Market With its High-Precision Positioning Technology

- Phoenix Motor Strengthens Capital Structure by Negotiating Key Waiver with Note Holder

- OKX Continues to Lead in Trust and Transparency with 18th Consecutive Proof of Reserves, Amounting to USD22.3 Billion

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share