Form 497K ETF Series Solutions

| AlphaClone Alternative Alpha ETF Trading Symbol: ALFA Listed on the Cboe BZX Exchange, Inc. Summary Prospectus July 31, 2021 alphaclonefunds.com | ||||

Before you invest, you may want to review the Fund’s prospectus and statement of additional information (“SAI”), which contain more information about the Fund and its risks. The current prospectus and SAI dated July 31, 2021, are incorporated by reference into this Summary Prospectus. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund online at alphaclonefunds.com/alternative-alpha-etf.html. You can also get this information at no cost by calling 1-800-617-0004 or by sending an e-mail request to ETF@usbank.com.

Investment Objective

The AlphaClone Alternative Alpha ETF (the “Fund”) seeks to track the price and yield, before fees and expenses, of the AlphaClone Hedge Fund Masters Index (the “Index”).

Fees and Expenses of the Fund

The following table describes the fees and expenses you may pay if you buy, hold, and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||

Management Fees | 0.65% | ||||

| Distribution and/or Service (12b-1) Fees | 0.00% | ||||

| Other Expenses | 0.00% | ||||

| Total Annual Fund Operating Expenses | 0.65% | ||||

Expense Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The Example does not take into account brokerage commissions that you may pay on your purchases and sales of Shares. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | ||||||||

| $66 | $208 | $362 | $810 | ||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal year ended March 31, 2021, the Fund’s portfolio turnover rate was 179% of the average value of its portfolio.

1

Principal Investment Strategies

The Fund uses a “passive management” (or indexing) approach to track the performance, before fees and expenses, of the Index.

AlphaClone Hedge Fund Masters Index

The Index utilizes a proprietary, quantitative Clone Score methodology developed by AlphaClone, Inc. (“AlphaClone”), the Fund’s index provider, to replicate the five most heavily weighted U.S. equity securities from each of the ten hedge funds and institutional investors with the highest Clone Scores (as described below). The Index was established by AlphaClone in 2017 and is composed of up to 50 U.S.-listed equity securities of small, mid, or large capitalization companies and reconstituted quarterly.

AlphaClone’s Clone Score methodology analyzes the historical returns of a given hedge fund’s or institutional investor’s holdings and assigns a Clone Score (i.e., ranking) to each such hedge fund and institutional investor based on such returns. Clone Scores are recalculated semi-annually. The Clone Score methodology incorporates information from hedge fund and institutional investor public disclosure filings (e.g., Form 13F filings) with the SEC to identify their disclosed holdings at the end of each quarter. Index constituents are equal weighted at the time of each reconstitution, although each individual constituent is limited to a 5% weighting at the time of each reconstitution.

The equity securities that may comprise the Index include, but are not limited to, U.S.-listed common and preferred stock of domestic and foreign companies, including those in emerging markets, real estate investment trusts (“REITs”), master limited partnerships (“MLPs”), and American Depositary Receipts (“ADRs”). Such securities may be issued by small, mid, or large capitalization companies and must meet certain liquidity thresholds at the time of reconstitution to be included in the Index.

The Fund’s Investment Strategy

The Fund attempts to invest all, or substantially all, of its assets in the component securities that make up the Index. The Fund expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will be 95% or better.

The Fund will generally use a “replication” strategy to achieve its investment objective, meaning the Fund generally will invest in all of the component securities of the Index in approximately the same proportion as in the Index. However, the Fund may use a “representative sampling” strategy, meaning it may invest in a sample of the securities in the Index whose risk, return and other characteristics closely resemble the risk, return and other characteristics of the Index as a whole, when the Fund’s investment adviser believes it is in the best interests of the Fund (e.g., when replicating the Index involves practical difficulties or substantial costs, an Index constituent becomes temporarily illiquid, unavailable or less liquid, or as a result of legal restrictions or limitations that apply to the Fund but not to the Index).

The Fund generally may invest in securities or other investments not included in the Index, but which the Fund’s investment adviser believes will help the Fund track the Index. For example, the Fund may invest in securities that are not components of the Index to reflect various corporate actions and other changes to the Index (such as reconstitutions, additions and deletions). On a day-to-day basis, the Fund also may hold money market mutual funds or short-term debt instruments that have terms-to-maturity of less than 397 days and exhibit high quality credit profiles, including U.S. government securities and repurchase agreements.

To the extent the Index concentrates (i.e., holds more than 25% of its total assets) in the securities of a particular industry or group of related industries, the Fund will concentrate its investments to approximately the same extent as the Index. Securities in the consumer, financial, and information technology sectors are expected to represent a significant portion of the Index, although specific sector exposures may change over time.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. The principal risks are presented in alphabetical order to facilitate finding particular risks and comparing them with other funds. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Some or all of these risks may adversely affect the Fund’s net asset value per share (“NAV”), trading price, yield, total return and/or ability to meet its objectives. For more information about the risks of investing in the Fund, see the section in the Fund’s Prospectus titled “Additional Information About the Fund.”

•ADR Risk. ADRs involve risks similar to those associated with investments in foreign securities, such as changes in political or economic conditions of other countries and changes in the exchange rates of foreign currencies. ADRs listed on U.S. exchanges are issued by banks or trust companies, and entitle the holder to all dividends and capital gains that are paid out on the underlying foreign shares.

•Concentration Risk. The Fund’s investments will be concentrated in an industry or group of industries to the extent that the Index is so concentrated. In such event, the value of the Shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries.

2

•Equity Market Risk. The equity securities held in the Fund’s portfolio may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific issuers, industries, or sectors in which the Fund invests. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from issuers. In addition, local, regional or global events such as war, acts of terrorism, spread of infectious diseases or other public health issues, recessions, or other events could have a significant negative impact on the Fund and its investments. For example, the global pandemic caused by COVID-19, a novel coronavirus, and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, has had negative impacts, and in many cases severe impacts, on markets worldwide. The COVID-19 pandemic has caused prolonged disruptions to the normal business operations of companies around the world and the impact of such disruptions is hard to predict. Such events may affect certain geographic regions, countries, sectors and industries more significantly than others. Such events could adversely affect the prices and liquidity of the Fund’s portfolio securities or other instruments and could result in disruptions in the trading markets.

•ETF Risks. The Fund is an ETF, and, as a result of an ETF’s structure, it is exposed to the following risks:

◦Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Fund has a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, Shares may trade at a material discount to NAV and possibly face delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

◦Costs of Buying or Selling Shares. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid-ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

◦Shares May Trade at Prices Other Than NAV. As with all ETFs, Shares may be bought and sold in the secondary market at market prices. Although it is expected that the market price of Shares will approximate the Fund’s NAV, there may be times when the market price of Shares is more than the NAV intra-day (premium) or less than the NAV intra-day (discount) due to supply and demand of Shares or during periods of market volatility. This risk is heightened in times of market volatility, periods of steep market declines, and periods when there is limited trading activity for Shares in the secondary market, in which case such premiums or discounts may be significant.

◦Trading. Although Shares are listed for trading on Cboe BZX Exchange, Inc. (the “Exchange”) and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that Shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of the Fund’s underlying portfolio holdings, which can be significantly less liquid than Shares, and this could lead to differences between the market price of the Shares and the underlying value of those Shares.

•Foreign Markets Risk. Investments in ADRs that provide exposure to non-U.S. securities involve certain risks that may not be present with investments in U.S. securities. For example, the value of non-U.S. securities may be subject to risk of decline due to foreign currency fluctuations or to political or economic instability. Investments in ADRs also may be subject to withholding or other taxes and may be indirectly subject to additional trading, settlement, custodial, and operational risks. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments.

•High Portfolio Turnover Risk. The Fund may trade all or a significant portion of the securities in its portfolio in connection with each rebalance and reconstitution of its Index. A high portfolio turnover rate increases transaction costs, which may increase the Fund’s expenses. Frequent trading may also cause adverse tax consequences for investors in the Fund due to an increase in short-term capital gains.

•MLP Risk. MLP investment returns are enhanced during periods of declining or low interest rates and tend to be negatively influenced when interest rates are rising. In addition, most MLPs are fairly leveraged and typically carry a portion of a “floating” rate debt. As such, a significant upward swing in interest rates would also drive interest expense higher. Furthermore, most MLPs grow by acquisitions partly financed by debt, and higher interest rates could make it more difficult to make acquisitions. MLP investments also entail many of the general tax risks of investing in a partnership. Limited partners in an MLP typically have limited control and limited rights to vote on matters affecting the partnership. Additionally, there is always the risk that an MLP will fail to qualify for favorable tax treatment.

•Models and Data Risk. The composition of the Index is heavily dependent on proprietary quantitative models as well as information and data supplied by third parties (“Models and Data”). When Models and Data prove to be incorrect or incomplete,

3

any decisions made in reliance thereon may lead to securities being included in or excluded from the Index that would have been excluded or included had the Models and Data been correct and complete. If the composition of the Index reflects such errors, the Fund’s portfolio can be expected to reflect the errors, too.

•Passive Investment Risk. The Fund is not actively managed, and its adviser would not sell shares of an equity security due to current or projected underperformance of a security, industry, or sector, unless that security is removed from the Index or the selling of shares of that security is otherwise required upon a reconstitution or rebalancing of the Index in accordance with the Index methodology.

•REIT Investment Risk. Investments in REITs involve unique risks. REITs may have limited financial resources, may trade less frequently and in limited volume, and may be more volatile than other securities. REITs may be affected by changes in the value of their underlying properties or mortgages or by defaults by their borrowers or tenants. Furthermore, these entities depend upon specialized management skills, have limited diversification and are, therefore, subject to risks inherent in financing a limited number of projects. In addition, the performance of a REIT may be affected by changes in the tax laws or by its failure to qualify for tax-free pass-through of income.

•Sector Risk. To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors.

◦Consumer Sectors Risk. The success of consumer product manufacturers and retailers is tied closely to the performance of domestic and international economies, interest rates, exchange rates, competition, consumer confidence, changes in demographics and consumer preferences. Companies in the consumer staples sector, such as companies that produce or sell food, beverage, and drug retail or other household items, may be adversely impacted by changes in global and economic conditions, rising energy prices, and changes in the supply or price of commodities. Companies in the consumer discretionary sector, such as automobile, textile, retail, and media companies, depend heavily on disposable household income and consumer spending, and may be strongly affected by social trends and marketing campaigns. These companies may be subject to severe competition, which may have an adverse impact on their profitability.

◦Financial Sector Risk. This sector can be significantly affected by changes in interest rates, government regulation, the rate of defaults on corporate, consumer and government debt, the availability and cost of capital, and fallout from the housing and sub-prime mortgage crisis. Insurance companies, in particular, may be significantly affected by changes in interest rates, catastrophic events, price and market competition, the imposition of premium rate caps, or other changes in government regulation or tax law and/or rate regulation, which may have an adverse impact on their profitability. This sector has experienced significant losses in the recent past, and the impact of more stringent capital requirements and of recent or future regulation on any individual financial company or on the sector as a whole cannot be predicted. In recent years, cyber attacks and technology malfunctions and failures have become increasingly frequent in this sector and have caused significant losses.

◦Information Technology Sector Risk. Market or economic factors impacting information technology companies and companies that rely heavily on technological advances could have a significant effect on the value of the Fund’s investments. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs. Stocks of information technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Information technology companies are heavily dependent on patent and intellectual property rights, the loss or impairment of which may adversely affect profitability.

•Smaller Companies Risk. The equity securities of smaller companies have historically been subject to greater investment risk than securities of larger companies. The prices of equity securities of smaller companies tend to be more volatile and less liquid than the prices of equity securities of larger companies.

•Tracking Error Risk. As with all index funds, the performance of the Fund and the Index may differ from each other for a variety of reasons. For example, the Fund incurs operating expenses and portfolio transaction costs not incurred by the Index. In addition, the Fund may not be fully invested in the securities of the Index at all times or may hold securities not included in the Index.

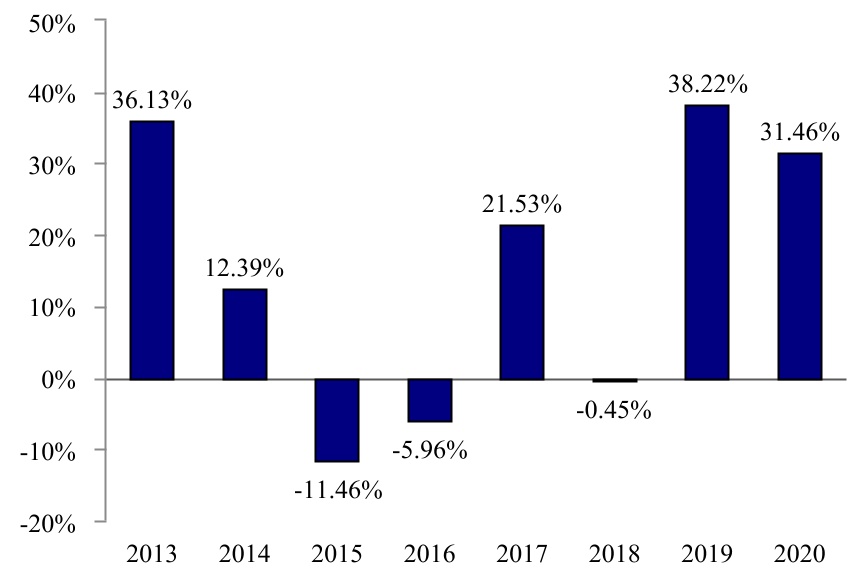

Performance

The following performance information indicates some of the risks of investing in the Fund. The bar chart shows the Fund’s performance for calendar years ended December 31. The table illustrates how the Fund’s average annual returns for the 1-year, 5-year, and since inception periods compare with those of a broad measure of market performance and the indexes tracked by the Fund during

4

the applicable period. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is available on the Fund’s website at www.alphaclonefunds.com.

Calendar Year Total Returns

For the year-to-date period ended June 30, 2021, the Fund’s total return was 10.08%. During the period of time shown in the bar chart, the Fund’s highest quarterly return was 27.53% for the quarter ended June 30, 2020, and the lowest quarterly return was -24.08% for the quarter ended March 31, 2020.

Average Annual Total Returns

For the Period Ended December 31, 2020

| AlphaClone Alternative Alpha ETF | 1 Year | 5 Year | Since Inception (5/30/2012) | ||||||||

Return Before Taxes | 31.46% | 15.63% | 14.24% | ||||||||

Return After Taxes on Distributions | 31.31% | 15.58% | 14.15% | ||||||||

Return After Taxes on Distributions and Sale of Shares | 18.73% | 12.63% | 11.87% | ||||||||

| AlphaClone Hedge Fund Masters Index/ AlphaClone Hedge Fund Downside Hedged Index1 (reflects no deduction for fees, expenses, or taxes) | 31.89% | 16.30% | 14.99% | ||||||||

| S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 18.40% | 15.22% | 15.35% | ||||||||

1 Effective December 27, 2017, the Fund’s investment objective changed to track the performance, before fees and expenses, of the AlphaClone Hedge Fund Masters Index. Prior to December 27, 2017, the Fund’s investment objective was to track the price and total return performance, before fees and expenses, of the AlphaClone Hedge Fund Downside Hedged Index. Performance shown for periods prior to December 27, 2017 is that of the AlphaClone Hedge Fund Downside Hedged Index.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

Portfolio Management

| Adviser | Exchange Traded Concepts, LLC (“ETC” or the “Adviser”) | ||||

| Portfolio Managers | Andrew Serowik, Todd Alberico, and Gabriel Tan, each a Portfolio Manager of the Adviser, serve as the portfolio managers of the Fund. Mr. Serowik has been a portfolio manager of the Fund since January 2020. Mr. Alberico and Mr. Tan have been portfolio managers of the Fund since June 2021. | ||||

5

Purchase and Sale of Shares

Shares are listed on the Exchange, and individual Shares may only be bought and sold in the secondary market through brokers at market prices, rather than NAV. Because Shares trade at market prices rather than NAV, Shares may trade at a price greater than NAV (premium) or less than NAV (discount).

The Fund issues and redeems Shares at NAV only in large blocks known as “Creation Units,” which only APs (typically, broker-dealers) may purchase or redeem. Creation Units generally consist of 25,000 Shares, though this may change from time to time. The Fund generally issues and redeems Creation Units in exchange for a portfolio of securities closely approximating the holdings of the Fund (the “Deposit Securities”) and/or a designated amount of U.S. cash.

Tax Information

Fund distributions are generally taxable as ordinary income, qualified dividend income, or capital gains (or a combination), unless your investment is in an IRA or other tax-advantaged account. Distributions on investments made through tax-deferred arrangements may be taxed later upon withdrawal of assets from those accounts.

Financial Intermediary Compensation

If you purchase Shares through a broker-dealer or other financial intermediary (such as a bank) (an “Intermediary”), the Adviser or its affiliates may pay Intermediaries for certain activities related to the Fund, including participation in activities that are designed to make Intermediaries more knowledgeable about exchange traded products, including the Fund, or for other activities, such as marketing, educational training or other initiatives related to the sale or promotion of Shares. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Any such arrangements do not result in increased Fund expenses. Ask your salesperson or visit the Intermediary’s website for more information.

6

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- South Florida City Launches Groundbreaking Initiative to Reduce Gun Violence and Foster Peace

- Renesas Reports Financial Results for the First Quarter Ended March 31, 2024

- Pioneering Bathroom Trends: 135th Canton Fair Attracts Industry Leaders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share