Form 497K EDWARD JONES MONEY MARKE

|

Money Market Fund |

Summary Prospectus

July 1, 2021

INVESTMENT SHARES (TICKER JNSXX)

RETIREMENT SHARES (TICKER JRSXX)

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund, including the Statement of Additional Information and most recent reports to shareholders, online at www.edwardjones.com/moneymarket. You can also get this information at no cost by calling 1-800-441-2357 or by sending an email request to [email protected] or from your Edward Jones financial advisor. The Fund’s Prospectus and Statement of Additional Information, both dated July 1, 2021, as each may be amended or supplemented, are incorporated by reference into this Summary Prospectus.

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Not FDIC Insured + May Lose Value + No Bank Guarantee

Edward Jones Money Market Fund (the “Fund”)

Investment Objective

The Fund is a money market fund that seeks to maintain a stable net asset value (“NAV”) of $1.00 per share. The Fund’s investment objective is stability of principal and current income consistent with stability of principal.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold the Fund’s Investment Shares or Retirement Shares (collectively, “Shares” or “Fund Shares”).

| Investment Shares |

Retirement Shares |

|||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||

| Management Fee |

0.20% | 0.20% | ||||||||||||||||||

| Distribution (12b-1) Fee |

0.25% | 0.25% | ||||||||||||||||||

| Other Expenses |

0.23% | 0.60% | ||||||||||||||||||

| Shareholder Servicing Fees |

0.15% | 0.15% | ||||||||||||||||||

| Other Operating Expenses |

0.08% | 0.45% | ||||||||||||||||||

| Total Annual Fund Operating Expenses |

0.68% | 1.05% | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Less Fee Waivers and/or Expense Reimbursements1 |

None | 0.33% | ||||||||||||||||||

| Net Annual Fund Operating Expenses |

0.68% | 0.72% | ||||||||||||||||||

| 1 | Passport Research, Ltd. (“Passport Research” or the “Adviser”) has contractually agreed to waive fees and/or reimburse Fund operating expenses to the extent necessary to limit the Fund’s total annual Fund operating expenses (excluding acquired fund fees and expenses, portfolio transaction expenses, interest expense in connection with investment activities, taxes, and extraordinary or non-routine expenses) to an annual rate of 0.72% of the average daily net assets of the Fund’s Investment Shares and Retirement Shares (the “Expense Limitation Agreement”). Any payment made by the Adviser in connection with the Expense Limitation Agreement is subject to recoupment by the Adviser in the thirty-six (36) month period following the payment, if (i) requested by the Adviser, and (ii) the aggregate amount actually paid by a class of the Fund toward operating expenses (taking into account other recoupments) does not exceed the expense cap (a) at the time of the fee waiver and/or expense reimbursement and (b) at the time of the recoupment. This Expense Limitation Agreement will remain in effect until June 30, 2022, and may only be changed or eliminated with the approval of the Board of Trustees of the Fund (the “Board”) during such period. The Expense Limitation Agreement shall be automatically renewed for successive one-year periods thereafter unless Passport Research provides the Fund with written notice of its election to not renew the agreement at least 60 days prior to the end of the current one-year term. In addition to the Expense Limitation Agreement, the Adviser and/or its affiliates have agreed to voluntarily reimburse expenses (except fees paid to the Sub-adviser and Sub-Administrator, as defined below) or waive all or a portion of its fees for the Fund to attempt to maintain a positive yield for the Fund (the “Adviser Voluntary Reduction”). Further, Federated Investment Management Company (the “Sub-adviser”) and Federated Administrative Services (the “Sub-Administrator”) have agreed to voluntarily waive, to the extent necessary after implementation of the Adviser Voluntary Reduction, up to three basis points of their fees for the Fund to |

1

| attempt to maintain a positive yield (the “Federated Voluntary Reduction,” and together with the Adviser Voluntary Reduction, the “Voluntary Reductions”). The Voluntary Reductions are not subject to recoupment and can be discontinued at any time without advance notice. There is no guarantee that the Voluntary Reductions will continue or that the Fund will be able to maintain a positive yield. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund’s Investment Shares or Retirement Shares for the time periods indicated and then redeem all of your Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s Investment Shares and Retirement Shares operating expenses are as shown in the table above and remain the same (taking into account the contractual expense limitation until June 30, 2022). Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be:

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||||||

| Investment Shares |

$ | 69 | $ | 218 | $ | 379 | $ | 847 | ||||||||||||

| Retirement Shares |

$ | 74 | $ | 290 | $ | 536 | $ | 1,241 | ||||||||||||

Principal Investment Strategies

The Fund operates as a “government money market fund,” as such term is defined in or interpreted under Rule 2a-7 (“Rule 2a-7”) under the Investment Company Act of 1940, as amended (the “1940 Act”). A “government money market fund” is required to invest at least 99.5% of its total assets in cash, Government Securities (as defined below), repurchase agreements that are collateralized by cash or Government Securities, and/or shares of other “government money market funds.” Government Securities are obligations issued or guaranteed as to principal or interest by the U.S. government or its agencies or instrumentalities, including obligations issued by private issuers that are guaranteed as to principal or interest by the U.S. government or its agencies or instrumentalities.

“Government money market funds” are exempt from Rule 2a-7 requirements that permit money market funds to impose a liquidity fee and/or temporary redemption gates if the Fund’s liquidity falls below required minimums. While the Board may elect to subject the Fund to the liquidity fees and/or redemption gates requirements in the future after providing appropriate notice to shareholders, the Board has not elected to do so at this time.

Certain of the Government Securities in which the Fund invests are not backed by the full faith and credit of the U.S. government, such as those issued by the Federal Home Loan Mortgage Corporation (“Freddie Mac”), the Federal National Mortgage Association (“Fannie Mae”), and the Federal Home Loan Bank System. These entities are, however, supported through federal subsidies, loans, or other benefits. The Fund may also invest in Government Securities that are supported by the full faith and credit of the U.S. government, such as those issued by the Government National Mortgage Association (“Ginnie Mae”). Finally, the Fund may invest in Government Securities that are issued by entities whose activities are sponsored by the federal government, but that have no explicit financial support, such as those issued by the Federal Farm Credit System. Certain Government Securities are variable or floating rate securities, meaning that such obligations provide for adjustments in the interest rate on certain reset dates or whenever a specified interest rate index changes, respectively.

2

Rule 2a-7 governs the maturity, quality, liquidity, and diversification of money market fund investments. Under these requirements, the Fund must maintain a dollar-weighted average maturity (“WAM”) of 60 days or less and a dollar-weighted average life (“WAL”) to maturity of 120 days or less, and will only acquire securities maturing in 397 days (approximately 13 months) or less.

Principal Risks

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. The primary factors that may negatively impact the Fund’s ability to maintain a stable NAV, delay the payment of redemptions by the Fund, or reduce the Fund’s daily dividends are set forth below. The risks are ordered in alphabetical order after the first five risks, although the order of the risk factors does not indicate the significance of any particular risk factor.

| ∎ | Counterparty Credit Risk. A party to a transaction involving the Fund, including a counterparty to a repurchase agreement, may default or otherwise be unable or unwilling, or be perceived by the marketplace to be unable or unwilling, to meet its obligations. This could cause the Fund to suffer delays and incur costs or lose money in exercising its rights under the transaction. |

| ∎ | Interest Rate Risk. Prices of fixed-income securities generally fall when interest rates rise and generally rise when interest rates fall. In general, interest rate changes have a greater effect on the price of fixed income securities with longer maturities. Although variable and floating rate securities are generally less sensitive to interest rate changes than fixed rate instruments, the value of floating rate and variable rate securities may also decline if their interest rates do not rise as quickly, or as much, as general interest rates. Similarly, if interest rates decline, variable and floating rate securities generally will not increase in value as much as fixed rate instruments. A low or negative interest rate environment poses additional risks to the Fund because low yields on the Fund’s portfolio holdings may have an adverse impact on the Fund’s yield to its shareholders. During these conditions, it is possible that the Fund will generate an insufficient amount of income to pay its expenses, and that it will not be able to pay a daily dividend and may have a negative yield (i.e., it may lose money on an operating basis). Fluctuations in interest rates may also affect the liquidity of the fixed-income securities held by the Fund. As a result, it is possible that the Fund would, during these conditions, maintain a substantial portion of its assets in cash, on which it may earn little, if any, income. Recent and potential future changes in monetary policy made by central banks and/or their governments are likely to affect the level of interest rates. |

| ∎ | LIBOR Replacement Risk. The U.K. Financial Conduct Authority has announced that it intends to stop compelling or inducing banks to submit London Inter-Bank Offered Rate (“LIBOR”) rates after 2021. On March 5, 2021, the ICE Benchmark Administration (“IBA”) clarified that the publication of LIBOR on a representative basis will cease for the one-week and two-month U.S. dollar LIBOR settings immediately after December 31, 2021, and for the remaining U.S. dollar LIBOR settings immediately after June 30, 2023. The elimination of LIBOR may adversely affect the interest rates on, and value of, certain Fund investments for which the value is tied to |

3

| LIBOR. Alternatives to LIBOR are established or in development in most major currencies, including the Secured Overnight Financing Rate (SOFR), which is intended to replace U.S. dollar LIBOR. Markets are slowly developing in response to these new rates. Questions around liquidity impacted by these rates, and how to appropriately adjust these rates at the time of transition, remain a concern for the Fund. Accordingly, it is difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and fallbacks for both legacy and new products, instruments and contracts are commercially accepted. |

| ∎ | Stable NAV Risk. The Fund may not be able to maintain a stable $1.00 Share price at all times. If the Fund or another money market fund fails to maintain a stable NAV (or such perception exists in the marketplace), the Fund could be subject to increased redemptions, which may adversely impact the Fund’s Share price. |

| ∎ | Technology Risk. Various technologies are used in managing the Fund, consistent with its investment objective and strategy. For example, proprietary and third-party data and systems are utilized to support decision-making for the Fund. Data imprecision, software or other technology malfunctions, cyberattacks, programming inaccuracies and similar circumstances may impair the performance of these systems, which may negatively affect Fund performance. |

| ∎ | Call Risk. An issuer of a callable security held by the Fund may “call” or repay the security before its stated maturity, and the Fund may have to reinvest the proceeds in securities with lower yields, which would result in a decline in the Fund’s income, or in securities with greater risks or with other less favorable features. |

| ∎ | Economy Risk. The value of the Fund’s portfolio may decline in tandem with a drop in the overall value of the markets in which the Fund invests and/or other markets. Economic, political, and financial conditions or industry or economic trends and developments, as well as cyberattacks, government defaults, government shutdowns, war, acts of terrorism, regional conflicts, social unrest, and recessions, may, from time to time, and for varying periods of time, cause the Fund to experience volatility, illiquidity, shareholder redemptions, or other potentially adverse effects that could negatively impact the Fund’s performance. In addition, the impact of any epidemic, pandemic, natural disaster, spread of infectious illness or other public health issue, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Fund invests, which in turn could negatively impact the Fund’s performance and cause losses on your investment in the Fund. |

| ∎ | Government Securities Risk. Although Government Securities are considered to be among the safest investments, they are not guaranteed against price movements due to changing interest rates. Obligations issued by some U.S. government agencies are backed by the U.S. Treasury, while others are backed solely by the ability of the agency to borrow from the U.S. Treasury or by the agency’s own resources. |

| ∎ | Investing Share Purchase Proceeds Risk. On days during which there are net purchases of Fund Shares, the Fund must invest the proceeds at prevailing market yields or hold cash. If the Fund holds cash, or if the yield |

4

| of the securities purchased is less than that of the securities already in the portfolio, the Fund’s yield will likely decrease. Conversely, net purchases on days on which short-term yields rise will likely cause the Fund’s yield to increase. In the event of significant changes in short-term yields or significant net purchases, the Fund retains the discretion to close to new investments. However, the Fund is not required to close, and no assurance can be given that this will be done in any given circumstance. |

| ∎ | Issuer Credit Risk. It is possible that interest or principal on the Fund’s investment securities will not be paid when due. Government Securities generally have less credit risk than other fixed income securities, but are not completely free from credit risk. |

| ∎ | Issuer Focus Risk. To the extent that the Fund focuses its investments in securities issued or guaranteed by a small number of U.S. government agencies or instrumentalities that are not backed by the full faith and credit of the U.S. government, it may be more exposed to developments affecting an individual U.S. government agency or instrumentality than a fund that invests more broadly. |

| ∎ | Use of Amortized Cost Risk. In the unlikely event that the Board were to determine, pursuant to Rule 2a-7 that the extent of the deviation between the Fund’s amortized cost per Share and its market-based NAV per Share may result in material dilution or other unfair results to shareholders, the Board will cause the Fund to take such action as it deems appropriate to eliminate or reduce, to the extent practicable, such dilution or unfair results. |

| ∎ | Yield Risk. There is no guarantee that the Fund will provide a certain level of income or that any such income will exceed the rate of inflation. Further, the Fund’s yield will vary. |

Performance

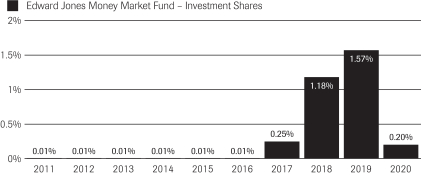

The bar chart and performance table below reflect historical performance data for the Fund and are intended to help you analyze the Fund’s investment risks in light of its historical returns. The bar chart shows the variability of the Fund’s Investment Shares total returns on a calendar year-by-year basis. The Average Annual Total Returns Table shows returns over the stated periods. The Fund’s performance will fluctuate, and past performance is not necessarily an indication of future results. Updated performance information for the Fund is available by contacting your Edward Jones financial advisor.

Within the periods shown in the bar chart, the highest quarterly return of the Investment Shares was 0.44% (quarter ended June 30, 2019), and the lowest quarterly return of the Investment Shares was 0.00% (quarter ended September 30, 2016).

5

The total return for the Investment Shares of the Fund from January 1, 2021 through March 31, 2021 was 0.00%.

Average Annual Total Returns

The following table represents the Fund’s Average Annual Total Returns for the calendar periods ended December 31, 2020.

| Share Class | 1 Year | 5 Years | 10 Years | Since Inception | ||||||||||||||||

| Investment Shares |

0.20 | % | 0.64 | % | 0.33 | % | 3.92 | %* | ||||||||||||

| Retirement Shares |

0.20 | % | 0.63 | % | 0.32 | % | 0.88 | %** | ||||||||||||

| * | Inception date of May 12, 1980. |

| **Inception | date of May 21, 2001. |

The 7-Day Net Yield of the Investment Shares as of December 31, 2020 was 0.01%. You may contact your Edward Jones financial advisor for the current 7-Day Net Yield.

Fund Management

The Fund’s investment adviser is Passport Research. The Fund’s sub-adviser is Federated Investment Management Company (“Sub-adviser”).

Purchase and Sale of Fund Shares

There is no minimum investment amount for the Fund. However, Edward D. Jones & Co., L.P. (“Edward Jones”), in its capacity as the Fund’s transfer agent, may charge you a $3.00 fee for any month in which you fail to maintain a $2,500 average monthly balance for Investment Shares or a $1,500 average monthly balance for Retirement Shares. Retirement Shares are eligible to be purchased or held only in retirement accounts. Investment Shares are eligible to be purchased or held only in non-retirement accounts.

You may purchase or redeem Shares of the Fund on any day the New York Stock Exchange (“NYSE”) is open for business. Shares may be purchased or redeemed through your Edward Jones financial advisor, by telephone, by mail, by check, by debit card or online.

Tax Information

The Fund’s distributions are taxable as ordinary income or capital gains except when your investment is through a 401(k) plan, an individual retirement account (“IRA”), or other tax-qualified investment plans, which are generally not subject to current tax. Transactions relating to Shares held in such accounts may, however, be taxable at some time in the future. You should consult your tax advisor regarding the rules governing your own tax-deferred arrangement.

Payments to Edward Jones

The Fund and/or its related companies pay Edward Jones for the sale of Shares and related services. Edward Jones is also the parent company of the Adviser. Accordingly, Edward Jones benefits from payments made by the Fund pursuant to the Investment Management and Administration Agreement between the Fund and the Adviser. These payments may create a conflict of interest by influencing Edward Jones and your Edward Jones financial advisor to suggest the Fund over another investment. Ask your Edward Jones financial advisor or visit the Edward Jones website (www.edwardjones.com/moneymarket) for more information.

6

Edward Jones Money Market Fund

12555 Manchester Road

Saint Louis, Missouri 63131

1-800-441-2357

www.edwardjones.com

Investment Company Act File No. 811-2993

CUSIP 48019P102

CUSIP 48019P201

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Edward JonesSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share