Form 497K Davis Fundamental ETF

|

Davis Select International ETF

|

|

|

|

A Portfolio of Davis Fundamental ETF Trust

Ticker: DINT | Listing Exchange: Cboe Global Markets, Inc.

|

||

|

Summary Prospectus

|

March 1, 2022

|

|

Before you invest, you may want to review the Fund’s prospectus and statement of additional information, which contain more information about the Fund and its risks. You can find

the Fund’s statutory prospectus, reports to shareholders, and other information about the Fund, at no cost, online at davisetfs.com/literature, by calling 1‑800‑279‑0279, or by sending an e-mail request to [email protected].

The current prospectus and statement of additional information, dated March 1, 2022, as may be further amended or supplemented are incorporated by reference into this summary prospectus. The Securities and Exchange Commission has not approved or

disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Investment Objective

The Fund seeks long-term growth of capital.

Fees and Expenses of the Fund

The following tables describe the fees and expenses that you will incur if you buy, hold, and sell shares of the Fund. Investors may

pay other fees such as usual and customary brokerage commissions and other fees to financial intermediaries, which are not reflected in the Example below, on their purchases and sales of shares.

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

Management Fees

|

0.55%

|

|

Other Expenses

|

0.09%

|

|

Total Annual Operating Expenses

|

0.64%

|

|

Less Fee Waiver or Expense Reimbursement(2)

|

0.00%

|

|

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements

|

0.64%

|

|

(1)

|

Davis Selected Advisers, L.P. has contractually agreed to waive fees and/or reimburse the Fund’s expenses to

the extent necessary to cap total annual fund operating expenses at 0.75% until March 1, 2023. After that date, there is no assurance that Davis Selected Advisers, L.P. will continue to waive fees and/or reimburse expenses. The agreement

cannot be terminated prior to that date, without the consent of the Board of Trustees.

|

Example.

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. This Example does not take into account brokerage commissions that you may pay when purchasing or selling shares. The

Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and the Fund’s operating

expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$65

|

$205

|

$357

|

$798

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher

portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s

performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 11% of the average value of its portfolio.

Principal Investment Strategies

This Fund is an actively managed exchange-traded fund (“ETF”). Davis Selected Advisers, L.P. (“Davis Advisors” or the “Adviser”), the

Fund’s investment adviser, uses the Davis Investment Discipline to invest the Fund’s portfolio principally in common stocks (including indirect holdings of common stock through depositary receipts) issued by foreign companies, including countries

with developed or emerging markets. The Fund may invest in large, medium or small companies without regard to market capitalization. The Fund will invest significantly (at least 40% of total assets under normal market conditions and at least 30% of

total assets if market conditions are not deemed favorable) in issuers (i) organized or located outside of the U.S.; (ii) whose primary trading market is located outside the U.S.; or (iii) doing a substantial amount of business outside the U.S.,

which the Fund considers to be a company that derives at least 50% of its revenue from business outside the U.S. or has at least 50% of its assets outside the U.S. Under normal market conditions, the Fund will invest in issuers representing at least

three different countries. These non-U.S. company investments may include American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs” and together “Depositary Receipts”). Depositary Receipts are receipts that represent ownership of

shares of a non-U.S. issuer held in trust by a bank or similar financial institution.

Davis Investment

Discipline. Each equity fund managed by Davis Advisors utilizes the Davis Investment Discipline. Davis Advisors conducts extensive research to try to identify businesses that possess characteristics that Davis Advisors believes foster the

creation of long-term value, such as proven management, a durable franchise and business model, and sustainable competitive advantages. Davis Advisors aims to invest in such businesses when they are trading at discounts to their intrinsic worth.

Davis Advisors emphasizes individual stock selection and believes that the ability to evaluate management is critical. Davis Advisors routinely visits managers at their places of business in order to gain insight into the relative value of different

businesses. Such research, however rigorous, involves predictions and forecasts that are inherently uncertain. After determining which companies Davis Advisors believes the Fund should own, Davis Advisors then turns its analysis to determining the

intrinsic value of those companies’ equity securities. Davis Advisors seeks companies whose equity securities can be purchased at a discount from Davis Advisors’ estimate of those companies’ intrinsic values, based upon fundamental analysis of cash

flows, assets and liabilities, and other criteria that Davis Advisors deems to be material on a company-by-company basis. Davis Advisors’ goal is to invest in companies for the long term (ideally, five years or longer, although this goal may not be

met). Davis Advisors considers selling a company’s equity securities if the securities’ market price exceeds Davis Advisors’ estimates of intrinsic value, if the ratio of the risks and rewards of continuing to own the company’s equity securities is

no longer attractive, to raise cash to purchase a more attractive investment opportunity, to satisfy net redemptions or for other purposes.

Principal Risks of Investing in Davis Select International ETF

You may lose money by investing in Davis Select International ETF and the Fund’s performance

could trail that of other investments. Investors in the Fund should have a long-term perspective and be able to tolerate potentially sharp declines in value.

The principal risks of investing in the Fund include:

Stock Market Risk.

Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices, including the possibility of sharp declines.

Common Stock Risk.

Common stock represents an ownership position in a company. An adverse event may have a negative impact on a company and could result in a decline in the price of its common stock. Common stock is generally subordinate to an issuer’s other

securities, including preferred, convertible and debt securities.

Market Trading

Risk. The Fund is subject to a number of market trading risks, which include the possibility of an inactive market for Fund shares, losses from trading in secondary markets, periods of high volatility and disruptions in the

creation/redemption process. ONE OR MORE OF THESE FACTORS, AMONG OTHERS, COULD LEAD TO THE FUND’S SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV. The

Fund’s market price may vary from the value of the Fund’s underlying portfolio holdings, particularly in times of market stress. This difference may be reflected as a spread between the bid and ask prices for the Fund shares during the day or a

premium or discount in the closing market price of the Fund when compared to the NAV. An investor may pay significantly more or receive significantly less than the underlying value of the Fund shares bought or sold.

Exchange-Traded

Fund Risk. The Fund is an actively managed exchange-traded fund and trades like common stock on an exchange. The Fund is subject to the

risks of owning the underlying securities, as well as the risks of owning an exchange-traded fund generally. The management fees of an actively managed exchange-traded fund are generally higher and can increase the Fund’s expenses. The market for the

Fund’s shares may become less liquid in response to the deteriorating liquidity in the market for the Fund’s underlying portfolio holdings. A loss of liquidity for Fund shares could lead to differences between the market price of the Fund shares and

the underlying value of the Fund shares.

Foreign Country

Risk. Securities of foreign companies (including Depositary Receipts) may be subject to greater risk as foreign economies may not be as strong or diversified, foreign political systems may not be as stable and foreign financial reporting

standards may not be as rigorous as they are in the United States. There may also be less information publicly available regarding the non-U.S. issuers and their securities. These securities may be less liquid (and, in some cases, may become

illiquid) and could be harder to value than more liquid securities.

Exposure to

Industry or Sector Risk. Subject to the Fund’s investment limitations, the Fund may have significant exposure to a particular industry or sector. Such exposure may cause the Fund to be more impacted by risks relating to and developments

affecting the industry or sector, and thus its net asset value may be more volatile than a fund without such levels of exposure. For example, if the Fund has significant exposure in a particular industry, then economic, regulatory, or other issues

that negatively affect that industry may have a greater impact on the Fund than on a fund that is more diversified.

China Risk –

Generally. Investment in Chinese securities may subject the Fund to risks that are specific to China. China may be subject to significant amounts of instability, including, but not limited to, economic, political, and social instability.

China’s economy may differ from the U.S. economy in certain respects, including, but not limited to, general development, level of government involvement, wealth distribution, and structure.

Headline Risk.

The Fund may invest in a company when the company becomes the center of controversy after receiving adverse media attention concerning its operations, long-term prospects, management or for other reasons. While Davis Advisors researches companies

subject to such contingencies, it cannot be correct every time, and the company’s stock may never recover or may become worthless.

Foreign Market

Risk. Because certain foreign holdings of the Fund may trade in a market that is closed when the market in which the Fund’s shares are listed is open, there may be changes between the last quote of the foreign holding from its closed

foreign market and the value of such security during the Fund’s domestic trading day. This in turn could lead to differences between the market price of the Fund’s shares and the underlying value of those shares.

Large-Capitalization

Companies Risk. Companies with $10 billion or more in market capitalization are considered by the Adviser to be large-capitalization companies. Large-capitalization companies generally experience slower rates of growth in earnings per share

than do mid- and small-capitalization companies.

Manager Risk.

Poor security selection or focus on securities in a particular sector, category or group of companies may cause the Fund to underperform relevant benchmarks or other funds with a similar investment objective. Even if the Adviser implements the

intended investment strategies, the implementation of the strategies may be unsuccessful in achieving the Fund’s investment objective.

Authorized

Participant Concentration Risk. Only an Authorized Participant (“AP”) (as defined in the “Creations and Redemptions” section of the Fund’s prospectus) may engage in creation and/or redemption transactions directly with the Fund. The Fund has a limited number of financial

intermediaries that act as APs. To the extent that these intermediaries exit the business or are unable or unwilling to proceed with creation and/or redemption orders with respect to the Fund and no other AP is able to step forward to create or

redeem Creation Units, Fund shares may trade at a discount to net asset value (“NAV”) and could face delisting. There are a limited number of financial institutions that may act as APs that post collateral for certain trades on an agency basis (i.e.,

on behalf of other market participants). To the extent that those APs exit the business or are unable to process creation and/or redemption orders and no other AP is able to step forward to do so, there may be a significantly diminished trading

market for the ETF’s shares. In addition, please note that this could in turn lead to differences between the market price of the ETF’s shares and the underlying value of those shares.

Cybersecurity Risk.

A cybersecurity breach may disrupt the business operations of the Fund or its service providers. A breach may allow an unauthorized party to gain access to Fund assets, customer data or proprietary information, or cause the Fund and/or its

service providers to suffer data corruption or lose operational functionality.

Emerging Market

Risk. Securities of issuers in emerging and developing markets may offer special investment opportunities, but present risks relating to political, economic or regulatory conditions not found in more mature markets, such as government

controls on foreign investments, government restrictions on the transfer of securities and less developed trading markets, exchanges, reporting standards and legal and accounting systems.

Depositary Receipts

Risk. Depositary receipts, consisting of American Depositary Receipts, European Depositary Receipts, and Global Depositary Receipts, are certificates evidencing ownership of shares of a foreign issuer. Depositary receipts are subject to many

of the risks associated with investing directly in foreign securities. Depositary receipts may trade at a discount (or a premium) to the underlying security and may be less liquid than the underlying securities listed on an exchange.

Fees and Expenses

Risk. The Fund may not earn enough through income and capital appreciation to offset the operating expenses of the Fund. All funds incur operating fees and expenses. Fees and expenses reduce the return that a shareholder may earn by

investing in the Fund, even when the Fund has favorable performance. A low-return environment, or a bear market, increases the risk that a shareholder may lose money.

Foreign Currency

Risk. The change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency. For example, when the Fund holds a security that is denominated in a

foreign currency, a decline of that foreign currency against the U.S. dollar would generally cause the value of the Fund’s shares to decline.

Mid- and

Small-Capitalization Companies Risk. Companies with less than $10 billion in market capitalization are considered by the Adviser to be mid- or small-capitalization companies. Mid- and small-capitalization companies typically have more

limited product lines, markets and financial resources than larger companies, and their securities may trade less frequently and in more limited volume than those of larger, more mature companies.

Your investment in the Fund is not a bank deposit and is not insured or guaranteed by the

Federal Deposit Insurance Corporation or any other government agency, entity or person.

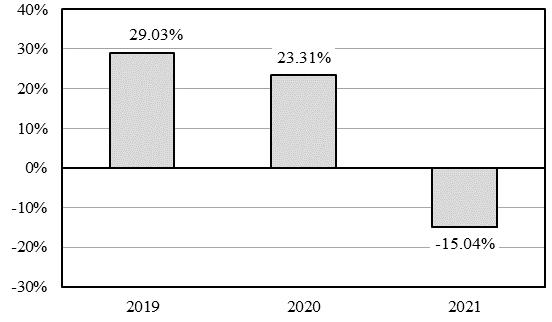

Performance Results

The bar chart below provides some indication of the risks of investing in the Fund by showing how the Fund’s investment results have

varied from year to year. The following table shows how the Fund’s average annual total returns, for the periods indicated, compare with those of the MSCI ACWI (All Country World Index) Ex. USA, a broad-based securities market index. The Fund’s past

performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated information on the Fund’s results can be obtained by visiting www.davisetfs.com or by calling 1‑800‑279‑0279.

After-tax returns are calculated using the highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through a tax-deferred arrangement, such as a 401(k) plan or an

individual retirement account.

|

Calendar Year Total Returns

|

|

|

Highest/Lowest quarterly results during the time period were:

Highest 22.38% (quarter ended June 30, 2020)

Lowest -21.52% (quarter ended March 31, 2020)

|

|

Average Annual Total Returns

(For the periods ended December 31, 2021)

|

Past 1 Year

|

Since Inception

(3/1/2018) |

|

Return before taxes

|

-15.04%

|

0.96%

|

|

Return after taxes on distributions

|

-15.41%

|

0.67%

|

|

Return after taxes on distributions and sale of shares

|

-8.54%

|

0.77%

|

|

MSCI ACWI (All Country World Index) Ex. USA reflects no deduction for fees, expenses or taxes

|

7.82%

|

5.98%

|

Management

Investment Adviser.

Davis Selected Advisers, L.P. serves as the Fund’s investment adviser.

Sub-Adviser. Davis

Selected Advisers–NY, Inc., a wholly owned subsidiary of the Adviser, serves as the Fund’s sub-adviser.

Portfolio Manager.

As of the date of this prospectus, the Portfolio Manager listed below is primarily responsible for the day-to-day management of the Fund’s portfolio.

|

Portfolio Manager

|

Experience with this Fund

|

Primary Title with Investment Adviser or Sub-Adviser

|

|

Danton Goei

|

Since March 2018

|

Vice President, Davis Selected Advisers–NY, Inc.

|

Purchase and Sale of Fund Shares

The Fund is an actively managed ETF. Individual shares of the Fund are listed on a national securities exchange. Individual shares may

only be bought and sold in the secondary market through a broker or dealer at a market price. As the price of Fund shares is based on the market price, and because ETF shares trade at a market price rather than at NAV, shares may trade at a price

greater than NAV (a premium) or less than NAV (a discount). An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of a Fund (the bid) and the lowest price a seller is willing

to accept for shares of a Fund (the ask) when buying or selling shares in the secondary market (the bid-ask spread). The Fund will only issue or redeem shares that have been aggregated into blocks of 50,000 shares or multiples thereof (“Creation

Units”) to APs who have entered into agreements with the Fund’s distributor. The Fund generally will issue or redeem Creations Units in return for a designated portfolio of securities (and an amount of cash) the Fund specifies each day (“Creation

Basket”). Current information regarding the net asset value, market price, premium and/or discount, and bid-ask spreads on a Fund can be obtained at www.davisetfs.com.

For important information about the purchase and sale of Fund shares and tax information, please see the “Buying and Selling Shares” section of the Fund’s prospectus.

Tax Information

If the Fund earns income or realizes capital gains, it intends to make distributions that may be taxed as ordinary income, qualified

dividend income or capital gains by federal, state and local authorities.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Davis Select International ETF through a broker-dealer or other financial intermediary (such as a bank), the Fund

and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer, or other intermediary, and your salesperson to recommend the Fund

over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Investment Company Act File No. 811-23181

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Convention Data Services Becomes Strategic Full-Service Registration and Integration Partner for Informa Markets' North American Event Portfolio

- LIM COLLEGE PRESENTS FIRST FASHION FUTURES AWARDS TO FASHINNOVATION AND AUTHENTIC BRANDS GROUP

- Orion Corporation: Disclosure Under Chapter 9 Section 10 of the Securities Market Act (BlackRock, Inc.)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share