Form 497K DEUTSCHE DWS STATE TAX-F

DWS Massachusetts Tax-Free Fund

Summary Prospectus | August 1, 2021

|

Class/Ticker

|

T

|

SQMTX

|

Before you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, reports to shareholders, Statement of Additional Information (SAI) and other information about the fund online at dws.com/mutualpros. You can also get this information at no cost by e-mailing a request to [email protected], calling (800) 728-3337 or asking your financial representative. The Prospectus and SAI, both dated August 1, 2021, as may be revised or supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Investment Objective

The fund seeks income that is exempt from Massachusetts personal and federal income taxes.

Fees and Expenses

These are the fees and expenses you may pay when you buy, hold and sell shares. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you invest at least $250,000 in Class T shares in the fund. More information about these discounts is available from your financial representative and in the Investing in the Fund section in the prospectus (p. 15) and Purchase and Redemption of Shares in the fund’s SAI (p. II-15).

SHAREHOLDER FEES (paid directly from your investment)

|

Maximum sales charge (load) imposed on purchases, as % of

offering price

|

2.50

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a % of the value of your investment)

(expenses that you pay each year as a % of the value of your investment)

|

Management fee

|

0.44

|

|

Distribution/service (12b-1) fees

|

0.25

|

|

Interest expense

|

0.01

|

|

Other expenses1

|

0.33

|

|

Total other expenses

|

0.34

|

|

Total annual fund operating expenses

|

1.03

|

|

Fee waiver/expense reimbursement

|

0.16

|

|

Total annual fund operating expenses after fee waiver/

expense reimbursement

|

0.87

|

1 ”Other expenses“ for Class T are based on estimated amounts for the current fiscal year.

The Advisor has contractually agreed through July 31, 2022 to waive its fees and/or reimburse fund expenses to the extent necessary to maintain the fund’s total annual operating expenses (excluding certain expenses such as

extraordinary expenses, taxes, brokerage, interest expense and acquired fund fees and expenses) at a ratio no higher than 0.86% for Class T shares. The agreement may only be terminated with the consent of the fund’s Board.

EXAMPLE

This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses (including one year of capped expenses in each period) remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

|

$337

|

$554

|

$789

|

$1,464

|

PORTFOLIO TURNOVER

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may mean higher taxes if you are investing in a taxable account. These costs are not reflected in annual fund operating expenses or in the expense example, and can affect the fund's performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 30% of the average value of its portfolio.

Principal Investment Strategies

Main investments. Under normal circumstances, the fund invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in Massachusetts municipal securities. For purposes of this 80% requirement, Massachusetts municipal securities are securities

1

whose income is exempt from regular federal and Massachusetts state income taxes. The fund can also invest in obligations of US territories and Commonwealths (such as Puerto Rico, the US Virgin Islands and Guam) and their agencies and authorities, whose income is free from regular federal and Massachusetts state income tax. The fund may invest up to 20% of net assets in securities whose income is subject to the federal alternative minimum tax (AMT).

The fund can buy many types of municipal securities with no maturity restrictions. These may include, without limitation, revenue bonds (which are backed by revenues from a particular source) and general obligation bonds (which are typically backed by the issuer’s ability to levy taxes). They may also include private activity and industrial development bonds, pre-refunded bonds, municipal lease obligations and investments representing an interest therein.

The fund normally invests at least 80% of total assets in municipal securities of the top four grades of credit quality or, if unrated, determined by the fund’s investment advisor to be of similar quality. The fund could invest up to 20% of total assets in high yield, below investment-grade bonds (commonly referred to as “junk” bonds), which are those rated below the fourth highest rating category (i.e., grade BB/Ba and below). Compared to investment-grade bonds, junk bonds generally pay higher yields but have higher volatility and higher risk of default on payments.

Management process. Portfolio management looks for securities that appear to offer the best total return potential. In making buy and sell decisions, portfolio management typically weighs a number of factors, including economic outlooks, possible interest rate movements, yield levels across varying maturities, characteristics of specific securities, such as coupon, maturity date and call date, and changes in supply and demand within the municipal bond market.

Although portfolio management may adjust the fund’s duration (a measure of sensitivity to interest rates) over a wider range, they generally intend to keep it similar to that of the Bloomberg Barclays Municipal Bond Index, which is generally between five and nine years.

Portfolio management may consider information about Environmental, Social and Governance (ESG) issues in its fundamental research process.

Derivatives. Portfolio management generally may use interest rate swaps, which are a type of derivative (a contract whose value is based on, for example, indices, currencies or securities), to manage the duration of the investment portfolio (i.e., reducing or increasing the sensitivity of the fund's portfolio to interest rate changes).

Portfolio management may also use tender option bond transactions to seek to enhance potential gains. The fund may leverage its assets through the use of proceeds received through tender option bond transactions. In a

tender option bond transaction, the fund transfers fixed-rate long-term municipal bonds into a special purpose entity (a “TOB Trust”). A TOB Trust typically issues two classes of beneficial interests: short-term floating rate interests (“TOB Floaters”), which are sold to third party investors, and residual inverse floating rate interests (“TOB Inverse Floater Residual Interests”), which are generally held by the fund.

The fund may also use other types of derivatives (i) for hedging purposes; (ii) for risk management; (iii) for non-hedging purposes to seek to enhance potential gains; or (iv) as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions.

Main Risks

There are several risk factors that could hurt the fund’s performance, cause you to lose money or cause the fund’s performance to trail that of other investments. The fund may not achieve its investment objective, and is not intended to be a complete investment program. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Interest rate risk. When interest rates rise, prices of debt securities generally decline. The longer the duration of the fund’s debt securities, the more sensitive the fund will be to interest rate changes. (As a general rule, a 1% rise in interest rates means a 1% fall in value for every year of duration.) Recent and potential future changes in monetary policy made by central banks or governments are likely to affect the level of interest rates. Rising interest rates may prompt redemptions from the fund, which may force the fund to sell investments at a time when it is not advantageous to do so, which could result in losses. The fund may be subject to a greater risk of rising interest rates following periods of low rates, including the current low rate period. In addition, in response to the COVID-19 pandemic, as with other serious economic disruptions, governmental authorities and regulators have enacted significant fiscal and monetary policy changes, including providing direct capital infusions into companies, creating new monetary programs and lowering interest rates considerably. If these actions are modified or reversed or are ineffective in achieving their desired outcomes, the fund could be adversely affected by periods of heightened volatility and uncertainty.

London Interbank Offered Rate (LIBOR), the benchmark rate for certain floating rate securities, is expected to be phased out by the end of 2021, although the US Dollar LIBOR phase out may extend past 2021 for certain existing contracts. The fund or the instruments in which the fund invests may be adversely affected by the phase out by, among other things, increased volatility or illiquidity. There remains uncertainty regarding the future use of LIBOR

2

DWS Massachusetts Tax-Free Fund

Summary Prospectus August 1, 2021

and the nature of any replacement reference rate and, accordingly, it is difficult to predict the impact to the fund of the transition away from LIBOR.

Credit risk. The fund's performance could be hurt if an issuer of a debt security suffers an adverse change in financial condition that results in the issuer not making timely payments of interest or principal, a security downgrade or an inability to meet a financial obligation. Credit risk is greater for lower-rated securities.

Because the issuers of high yield debt securities, or junk bonds (debt securities rated below the fourth highest credit rating category), may be in uncertain financial health, the prices of their debt securities can be more vulnerable to bad economic news, or even the expectation of bad news, than investment-grade debt securities. Credit risk for high yield securities is greater than for higher-rated securities.

Because securities in default generally have missed one or more payments of interest and/or principal, an investment in such securities has an increased risk of loss. Issuers of securities in default have an increased likelihood of entering bankruptcy or beginning liquidation procedures which could impact the fund's ability to recoup its investment. Securities in default may be illiquid or trade in low volumes and thus may be difficult to value.

For securities that rely on third-party guarantors to support their credit quality, the same risks may apply if the financial condition of the guarantor deteriorates or the guarantor ceases to insure securities. Because guarantors may insure many types of securities, including subprime mortgage bonds and other high-risk bonds, their financial condition could deteriorate as a result of events that have little or no connection to securities owned by the fund.

Certain sectors of the municipal securities market such as hospitals, airports and mass transit providers may be disproportionately impacted by COVID-19 related cost increases and revenue declines, potentially resulting in heightened credit risk for issuers in these sectors.

Focus risk – Massachusetts municipal securities. Because the fund focuses its investments in Massachusetts municipal securities, its performance can be more volatile than that of a fund that invests more broadly, and it has a relatively large exposure to financial stresses affecting Massachusetts. For example, industries significant to the state’s economy, such as the technology, biotech, financial services or healthcare industries could experience downturns or fail to develop as expected, hurting the local economy. Fluctuations in unemployment levels or in the state or national economy could result in decreased tax revenues, including decreases in personal income tax, corporate business tax, or sales and use tax revenues, and other sources of revenue. Massachusetts could also face severe fiscal difficulties, for example, an economic downturn, increased expenditures on domestic security or reduced monetary support from the federal

government. For example, the pandemic spread of the novel coronavirus known as COVID-19 has significantly stressed the financial resources of the state and its municipalities, which may impair the issuer's ability to meet its financial obligations when due and could adversely impact the value of its bonds, which could negatively impact the performance of the fund. A default or credit rating downgrade of a small number of municipal security issuers could affect the market values and marketability of all Massachusetts municipal securities and hurt the fund’s performance.

Over time, these issues may impair the ability of the state, municipalities, or other authorities to repay their obligations or to pay debt service on those obligations and could result in a downgrade of Massachusetts' credit rating or the ratings of authorities or political subdivisions of Massachusetts, which may negatively impact the value of bonds issued by those entities.

Market risk. Deteriorating market conditions might cause a general weakness in the market that reduces the prices of securities in that market. Developments in a particular class of debt securities or the stock market could also adversely affect the fund by reducing the relative attractiveness of debt securities as an investment.

Market disruption risk. Geopolitical and other events, including war, terrorism, economic uncertainty, trade disputes, public health crises and related geopolitical events have led, and in the future may lead, to disruptions in the US and world economies and markets, which may increase financial market volatility and have significant adverse direct or indirect effects on the fund and its investments. Market disruptions could cause the fund to lose money, experience significant redemptions, and encounter operational difficulties. Although multiple asset classes may be affected by a market disruption, the duration and effects may not be the same for all types of assets.

Recent market disruption events include the pandemic spread of the novel coronavirus known as COVID-19, and the significant uncertainty, market volatility, decreased economic and other activity, increased government activity, including economic stimulus measures, and supply chain disruptions that it has caused. The full effects, duration and costs of the COVID-19 pandemic are impossible to predict, and the circumstances surrounding the COVID-19 pandemic will continue to evolve, including the risk of future increased rates of infection due to low vaccination rates and/or the lack of effectiveness of current vaccines against new variants. The pandemic has affected and may continue to affect certain countries, industries, economic sectors, companies and investment products more than others, may exacerbate existing economic, political, or social tensions and may increase the probability of an economic recession or depression. The fund and its investments may be adversely affected by the effects of the COVID-19 pandemic, and the pandemic may result in

3

DWS Massachusetts Tax-Free Fund

Summary Prospectus August 1, 2021

the fund and its service providers experiencing operational difficulties in coordinating a remote workforce and implementing their business continuity plans, among others.

The disruptions caused by the COVID-19 pandemic may magnify the impact of each of the other risks described in this “MAIN RISKS” section and may increase volatility in one or more markets in which the fund invests leading to the potential for greater losses for the fund.

Tax risk. Income from municipal securities held by the fund could be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the Internal Revenue Service or state tax authorities, or noncompliant conduct of a securities issuer. In such event, the value of such securities would likely fall, hurting fund performance and shareholders may be required to pay additional taxes. In addition, a portion of the fund’s otherwise exempt-interest distributions may be taxable to those shareholders subject to the federal AMT.

Private activity and industrial development bond risk. The payment of principal and interest on these bonds is generally dependent solely on the ability of the facility’s user to meet its financial obligations and the pledge, if any, of property financed as security for such payment.

Tender option bonds risk. The fund’s participation in tender option bond transactions may reduce the fund’s returns or increase volatility. Tender option bond transactions create leverage. Leverage magnifies returns, both positive and negative, and risk by magnifying the volatility of returns. An investment in TOB Inverse Floater Residual Interests will typically involve more risk than an investment in the underlying municipal bonds. The interest payment on TOB Inverse Floater Residual Interests generally will decrease when short-term interest rates increase. There are also risks associated with the tender option bond structure, which could result in terminating the trust. If a TOB Trust is terminated, the fund must sell other assets to buy back the TOB Floaters, which could negatively impact performance. Events that could cause a termination of the TOB Trust include a deterioration in the financial condition of the liquidity provider, a deterioration in the credit quality of underlying municipal bonds, or a decrease in the value of the underlying bonds due to rising interest rates.

Non-diversification risk. The fund is classified as non-diversified under the Investment Company Act of 1940, as amended. This means that the fund may invest in securities of relatively few issuers. Thus, the performance of one or a small number of portfolio holdings can affect overall performance.

Security selection risk. The securities in the fund’s portfolio may decline in value. Portfolio management could be wrong in its analysis of municipalities, industries, companies, economic trends, the relative attractiveness of different securities or other matters.

US territory and Commonwealth obligations risk. Adverse political and economic conditions and developments affecting any territory or Commonwealth of the US may, in turn, negatively affect the value of the fund’s holdings in such obligations. For example, in recent years, Puerto Rico has experienced a recession and difficult economic conditions, along with a severe natural disaster, which may negatively affect the value of any holdings the fund may have in Puerto Rico municipal obligations.

Derivatives risk. Risks associated with derivatives may include the risk that the derivative is not well correlated with the security, index or currency to which it relates; the risk that derivatives may result in losses or missed opportunities; the risk that the fund will be unable to sell the derivative because of an illiquid secondary market; the risk that a counterparty is unwilling or unable to meet its obligation; and the risk that the derivative transaction could expose the fund to the effects of leverage, which could increase the fund's exposure to the market and magnify potential losses.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the fund.

Liquidity risk. In certain situations, it may be difficult or impossible to sell an investment and/or the fund may sell certain investments at a price or time that is not advantageous in order to meet redemption requests or other cash needs. Unusual market conditions, such as an unusually high volume of redemptions or other similar conditions could increase liquidity risk for the fund, and in extreme conditions, the fund could have difficulty meeting redemption requests.

Prepayment and extension risk. When interest rates fall, issuers of high interest debt obligations may pay off the debts earlier than expected (prepayment risk), and the fund may have to reinvest the proceeds at lower yields. When interest rates rise, issuers of lower interest debt obligations may pay off the debts later than expected (extension risk), thus keeping the fund’s assets tied up in lower interest debt obligations. Ultimately, any unexpected behavior in interest rates could increase the volatility of the fund’s share price and yield and could hurt fund performance. Prepayments could also create capital gains tax liability in some instances.

ETF risk. Because ETFs trade on a securities exchange, their shares may trade at a premium or discount to their net asset value. An ETF is subject to the risks of the assets in which it invests as well as those of the investment strategy it follows. The fund may incur brokerage costs

4

DWS Massachusetts Tax-Free Fund

Summary Prospectus August 1, 2021

when it buys and sells shares of an ETF and also bears its proportionate share of the ETF’s fees and expenses, which are passed through to ETF shareholders.

Pricing risk. If market conditions make it difficult to value some investments, the fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value determined for an investment could be different from the value realized upon such investment’s sale. As a result, you could pay more than the market value when buying fund shares or receive less than the market value when selling fund shares.

Operational and technology risk. Cyber-attacks, disruptions or failures that affect the fund’s service providers or counterparties, issuers of securities held by the fund, or other market participants may adversely affect the fund and its shareholders, including by causing losses for the fund or impairing fund operations. For example, the fund’s or its service providers’ assets or sensitive or confidential information may be misappropriated, data may be corrupted and operations may be disrupted (e.g., cyber-attacks, operational failures or broader disruptions may cause the release of private shareholder information or confidential fund information, interfere with the processing of shareholder transactions, impact the ability to calculate the fund’s net asset value and impede trading). Market events and disruptions also may trigger a volume of transactions that overloads current information technology and communication systems and processes, impacting the ability to conduct the fund’s operations.

While the fund and its service providers may establish business continuity and other plans and processes that seek to address the possibility of and fallout from cyber-attacks, disruptions or failures, there are inherent limitations in such plans and systems, including that they do not apply to third parties, such as fund counterparties, issuers of securities held by the fund or other market participants, as well as the possibility that certain risks have not been identified or that unknown threats may emerge in the future and there is no assurance that such plans and processes will be effective. Among other situations, disruptions (for example, pandemics or health crises) that cause prolonged periods of remote work or significant employee absences at the fund’s service providers could impact the ability to conduct the fund’s operations. In addition, the fund cannot directly control any cybersecurity plans and systems put in place by its service providers, fund counterparties, issuers of securities held by the fund or other market participants.

Past Performance

How a fund's returns vary from year to year can give an idea of its risk; so can comparing fund performance to overall market performance (as measured by an appropriate market index). Past performance may not indicate future results. All performance figures below assume that dividends and distributions were reinvested. For more

recent performance figures, go to dws.com (the Web site does not form a part of this prospectus) or call the telephone number included in this prospectus.

Class T had not commenced investment operations as of the date of this prospectus. The performance figures for Class T shares are based on the historical performance of the fund’s Class S shares adjusted to reflect the higher expenses and applicable sales charges of Class T. Class S shares are offered in a separate prospectus.

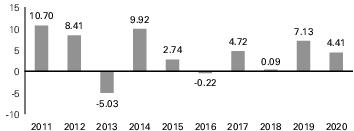

CALENDAR YEAR TOTAL RETURNS (%) (Class T)

These year-by-year returns do not include sales charges, if any, and would be lower if they did. Returns for other classes were different and are not shown here.

|

|

Returns

|

Period ending

|

|

Best Quarter

|

4.46%

|

June 30, 2011

|

|

Worst Quarter

|

-4.21%

|

June 30, 2013

|

|

Year-to-Date

|

0.70%

|

June 30, 2021

|

Average Annual Total Returns

(For periods ended 12/31/2020 expressed as a %)

(For periods ended 12/31/2020 expressed as a %)

After-tax returns reflect the historical highest individual federal income tax rates, but do not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares held in an IRA, 401(k) or other tax-advantaged investment plan.

|

|

Class

Inception

|

1

Year

|

5

Years

|

10

Years

|

|

Class T before tax

|

3/31/2017

|

1.80

|

2.66

|

3.91

|

|

After tax on distribu-

tions

|

|

-5.70

|

0.22

|

2.23

|

|

After tax on distribu-

tions and sale of fund

shares

|

|

-6.51

|

0.18

|

2.10

|

|

Bloomberg Barclays

Municipal Bond Index

(reflects no deduction for

fees, expenses or taxes)

|

|

5.21

|

3.91

|

4.63

|

|

Bloomberg Barclays

Massachusetts Exempt

Municipal Bond Index

(reflects no deduction for

fees, expenses or taxes)

|

|

5.29

|

3.68

|

4.38

|

The Advisor believes the additional Bloomberg Barclays Massachusetts Exempt Municipal Bond Index reasonably represents the fund's investment objective and strategies.

5

DWS Massachusetts Tax-Free Fund

Summary Prospectus August 1, 2021

Management

Investment Advisor

DWS Investment Management Americas, Inc.

Portfolio Manager(s)

Ashton P. Goodfield, CFA, Head of Investment Strategy Fixed Income. Portfolio Manager of the fund through September 30, 2021. Began managing the fund in 2014.

Michael J. Generazo, Senior Portfolio Manager Fixed Income. Portfolio Manager of the fund. Began managing the fund in 2018.

Matthew J. Caggiano, CFA, Senior Portfolio Manager Fixed Income. Portfolio Manager of the fund effective October 1, 2021.

Purchase and Sale of Fund Shares

Minimum Initial Investment ($)

|

|

Non-IRA

|

IRAs

|

UGMAs/

UTMAs

|

Automatic

Investment

Plans

|

|

T

|

1,000

|

500

|

1,000

|

500

|

For participants in all group retirement plans there is no minimum initial investment and no minimum additional investment for Class T. The minimum additional investment in all other instances is $50.

To Place Orders

|

Mail

|

All Requests

|

DWS

PO Box 219151

Kansas City, MO 64121-9151

|

|

Expedited Mail

|

DWS

210 West 10th Street

Kansas City, MO 64105-1614

|

|

|

Web Site

|

dws.com

|

|

|

Telephone

|

(800) 728-3337, M – F 8 a.m. – 7 p.m. ET

|

|

|

TDD Line

|

(800) 972-3006, M – F 8 a.m. – 7 p.m. ET

|

|

The fund is generally open on days when the New York Stock Exchange is open for regular trading. Initial investments must be sent by mail. You can make additional investments or sell shares of the fund on any business day by visiting our Web site, by mail, or by telephone; however you may have to elect certain privileges on your initial account application. If you are working with a financial representative, contact your financial representative for assistance with buying or selling fund shares. A financial representative separately may impose its own policies and procedures for buying and selling fund shares.

Class T shares are closed to new purchases, except in connection with the reinvestment of dividends or other distributions where Class T shares have been issued.

Tax Information

The fund's distributions are generally exempt from regular federal and Massachusetts state income tax. All or a portion of the fund's dividends may be subject to the federal alternative minimum tax.

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund, the Advisor, and/or the Advisor’s affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

6

DWS Massachusetts Tax-Free Fund

Summary Prospectus August 1, 2021 DMATF-T-SUM

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Vallourec announces an offering of $820 million of 8-year Senior Notes

- Amundi and Victory Capital announce plan to establish a strategic partnership:

- Dataocean AI Unveils NEW Brand, NEW Site, and NEW Multilingual Speech Corpus for Speech Foundation Models at ICASSP 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share