Form 497K Capitol Series Trust

| SHARE CLASS & TICKER | A Shares (FTVAX) | Institutional Shares (FTVSX) |

| C Shares (FTVCX) | R6 Shares (FTVZX) | |

| Investor Shares (FTVNX) |

| Fuller

& Thaler Behavioral Mid-Cap Value Fund Summary Prospectus January 30, 2023 |

|

Before You Invest

Before you invest, you may want to review the Fuller & Thaler Behavioral Mid-Cap Value Fund’s (the “Mid-Cap Value Fund” or the “Fund”) prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund including its statement of additional information (SAI) and most recent reports to shareholders, online at www.fullerthalerfunds.com. You can also get this information at no cost by calling 888-912-4562 or by sending an e-mail request to [email protected]. This Summary Prospectus incorporates by reference the Fund’s entire prospectus and SAI, each dated January 30, 2023.

Investment Objective

The Mid-Cap Value Fund seeks long-term capital appreciation.

Fees and Expenses of the Mid-Cap Value Fund

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may also pay commissions or other fees to their financial intermediary when they buy and hold shares of the Fund which are not reflected below. Certain financial intermediaries also may offer variations in Fund sales charges to their customers as described in Appendix A – Financial Intermediary Sales Charge Variations of the Fund’s Prospectus. More information about these and other discounts is available from your financial intermediary and as described under “CLASSES OF SHARES” in the Fund’s Prospectus. No initial sales charge is assessed on aggregated purchases of $1 million or more in all Fuller & Thaler Funds. You are also eligible for a discount on A Shares sales charges beginning with a minimum purchase of $50,000. The Fund also permits you to reduce the front-end sales charge you pay on A Shares by exercising your Rights of Accumulation or Letter of Intent privileges with respect to your investments in Fuller & Thaler Funds, as described under “CLASSES OF SHARES – A Shares” in the Fund’s Prospectus.

| Share Class | ||||||||||

| A | C | Investor | Institutional | R6 | ||||||

| Shareholder Fees | ||||||||||

| (fees paid directly from your investments) | ||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of the offering price) | 5.75% | None | None | None | None | |||||

| Maximum Deferred Sales Charge (Load) Imposed on Redemptions (as a percentage of the sale price) | 1.00% | 1.00% | None | None | None | |||||

| Share Class | ||||||||||

| A | C | Investor | Institutional | R6 | ||||||

| Annual Fund Operating Expenses | ||||||||||

| (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||

| Management Fees | 0.75% | 0.75% | 0.75% | 0.75% | 0.75% | |||||

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | 0.25% | None | None | |||||

| Other Expenses | 0.17%(1) | 0.09% | 0.26%(1) | 0.23%(1) | 0.08% | |||||

| Total Annual Fund Operating Expenses | 1.17% | 1.84% | 1.26% | 0.98% | 0.83% | |||||

| Expense Reductions(2) | (0.00)% | (0.14)% | (0.11)% | (0.13)% | (0.08)% | |||||

| Total Annual Fund Operating Expenses After Expense Reductions(2) | 1.17% | 1.70% | 1.15% | 0.85% | 0.75% | |||||

Fuller & Thaler Behavioral Mid-Cap Value Fund

Page 1 of 7

| Fuller & Thaler Behavioral Mid-Cap Value Fund | Summary Prospectus January 30, 2023 |

| (1) | The Capitol Series Trust (the “Trust”) has adopted an Administrative Services Plan (the “Services Plan”) for A Shares, Investor Shares, and Institutional Shares of the Funds. The Services Plan allows the A Shares, Investor Shares and Institutional Shares of the Fund to pay service organizations for the provision of certain administrative, recordkeeping and other non-distribution related shareholder services to A Share, Investor Share and Institutional Share shareholders. The Services Plan permits the Fund to make service fee payments at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to its A Shares and up to 0.20% of the Fund’s average daily net assets attributable to its Investor Shares or Institutional Shares. “Other Expenses” reported in the table above for A Shares, Investor Shares and Institutional Shares include an allocation of up to 0.03% of this services fee payable to the Fund’s investment adviser, Fuller & Thaler Asset Management, Inc. (“Fuller & Thaler” or the “Adviser”) for certain non-distribution related shareholder services that it provides pursuant to a Shareholder Services Agreement between the Trust and Fuller & Thaler adopted pursuant to the Services Plan. This Shareholder Services Agreement and fee allocation to Fuller & Thaler has been authorized by the Board of Trustees (the “Board”) of the Trust pursuant to the Services Plan, but has not been implemented as of the date of the Fund’s Prospectus. For additional information regarding the Services Plan, refer to “Service Fees – A Shares, Investor Shares and Institutional Shares” in the Fund’s Prospectus. |

| (2) | Effective January 27, 2023, Fuller & Thaler has contractually agreed to waive its management fee and/or reimburse Fund expenses so that total annual operating expenses do not exceed 1.20%, 1.70%, 1.15%, 0.85%, and 0.75% for A Shares, C Shares, Investor Shares, Institutional Shares and R6 Shares, respectively, of the Fund’s average daily net assets through January 31, 2024. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. |

Example:

The Example is intended to help you compare the cost of investing in shares of the Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the noted class of shares for the time periods indicated and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year, and the Fund’s operating expenses remain the same and the expense waiver/reimbursement remains in place for the contractual period only. Although your actual costs may be higher or lower, the Example shows what your costs would be based on these assumptions. The Example is based, for the first year, on Total Annual Fund Operating Expenses After Expense Reductions and, for all other periods, on Total Annual Fund Operating Expenses.

| Example: Assuming you redeem your shares at the end of each period | ||||||||

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years | ||||

| A Shares | $687 | $925 | $1182 | $1914 | ||||

| C Shares | $173 | $565 | $ 982 | $2147 | ||||

| Investor Shares | $117 | $389 | $ 681 | $1513 | ||||

| Institutional Shares | $ 87 | $299 | $ 529 | $1190 | ||||

| R6 Shares | $ 77 | $257 | $ 453 | $1018 | ||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). The Fund’s portfolio turnover rate for the fiscal year ended September 30, 2022 was 12% of the average value of its portfolio. High levels of portfolio turnover may indicate higher transaction costs and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example above, can adversely affect the Fund’s investment performance.

Fuller & Thaler Behavioral Mid-Cap Value Fund

Page 2 of 7

| Fuller & Thaler Behavioral Mid-Cap Value Fund | Summary Prospectus January 30, 2023 |

| Principal Investment Strategies |

The Fund seeks to achieve its objective by investing at least 80% of its net assets (plus borrowings for investment purposes) in common stocks of medium capitalization (“mid-cap”) companies based in the U.S. (“80% Policy”). The Fund must provide shareholders with 60 days’ prior written notice if it changes its 80% Policy. The Fund considers a company to be based in the U.S. if it is publicly traded in the U.S. and it satisfies one or more of the following additional criteria: it is incorporated in the U.S., it is headquartered in the U.S., its reported assets are primarily located in the U.S., or it derives the majority of its revenue from the U.S.

The Fund defines mid-cap companies as companies whose market capitalizations are generally in the middle of an upper and lower bound. For the upper bound, we use companies whose market capitalizations are generally equal to or below 40% of total US market capitalization, or companies whose market capitalizations are smaller than or equal to the largest company in the Russell MidCap® index, whichever results in the higher market capitalization break. For the lower bound, we use companies whose market capitalizations are generally above 3% of total US market capitalization, or companies whose market capitalizations are larger than the smallest company in the Russell MidCap® index, whichever results in the lower market capitalization break. Based on market capitalization data as of September 30, 2022, the market capitalization of a mid-cap company would be between $0.70 billion and $56.50 billion. This dollar amount will change due to market conditions. The size of the companies included in the Russell MidCap® Index will change as a result of market conditions and reconstitution of the Index.

The Fund seeks to achieve its investment objective by building a diversified portfolio of U.S. stocks in a disciplined process that applies the proprietary research of Fuller & Thaler, the Fund’s investment adviser, on the behavioral biases of other investors. Fuller & Thaler’s investment process is based on decades of research into behavioral finance. Behavioral finance is the study of how investors actually behave, as opposed to how they should behave, when making investment decisions. Professional investors are human, and like all humans, they make mistakes. Investors make mistakes because they have emotions, use imperfect rules of thumb, and have priorities beyond risk and return. Fuller & Thaler’s process identifies and exploits those mistakes. The Adviser’s analysis includes making educated predictions of when other investors – the “market” – have likely made a behavioral mistake, and in turn, have created a buying opportunity. There are two kinds of mistakes that produce buying opportunities: over-reaction and under-reaction. Investors may over-react to bad news and losses (e.g., panic) that may present opportunities in typically value-oriented stocks, or they may under-react to good news (e.g., not pay attention) that may present opportunities in typically growth-oriented stocks. At the individual stock level, Fuller & Thaler searches for events related to insider buying and other news that suggest investor over-reaction and draws from its more than 25 years of experience in analyzing events that suggest investor misbehavior. If these behaviors are present, Fuller & Thaler then proceeds to its fundamental analysis of the company. The portfolio managers generally sell when they believe investor misbehavior has reversed or the firm’s fundamentals deteriorate. There is no set length of time that the Fund expects to hold a particular security. The Fund seeks to deliver similar risk characteristics to the Russell MidCap® Value Index.

The Fund may also invest a portion of its assets in real estate investment trusts (“REITs”), Business Development Companies (BDCs), and Exchange Traded Funds (ETFs) whose investment characteristics are consistent with the Fund’s principal investment strategy REITs are pooled investment vehicles that generally invest in income-producing real estate or real estate-related loans or interests. The Fund will generally invest in liquid REITs that are included in the Russell MidCap® Index, the Fund’s benchmark index. A BDC is a form of unregistered closed-end investment company that typically invests in small and mid-sized businesses to help such companies grow in the initial stages of their development. An ETF is a marketable security that typically tracks a stock index or other basket of assets. Although similar in many ways, ETFs differ from mutual funds because ETF shares trade like common stock on an exchange, with a fluctuating price throughout the day as shares are bought and sold.

The Fund may also lend portfolio securities to brokers, dealers and other financial organizations that meet capital and other credit requirements or other criteria established by the Fund’s Board of Trustees. Loans of portfolio securities will be collateralized by liquid securities and cash. The Fund may invest cash collateral received in securities consistent with its principal investment strategy.

The Fund may invest in multiple sectors, and may concentrate its investments in a particular sector by investing greater than 25% of the Fund’s total assets in such sector when its Behavioral Strategy indicates that such concentration would be appropriate from an investment perspective. The Fund will not invest more than 25% of its net assets in any particular “industry” as that term is used in the Investment Company Act of 1940, as amended. The Fund typically expects to hold from 25 to 75 positions, with individual position sizes typically ranging up to 7% of the Fund’s net assets. Before trading, the portfolio managers review the portfolio’s characteristics relative to its benchmark, and may adjust position sizes to control exposures to sectors, volatility in relation to the market, and other characteristics.

Fuller & Thaler Behavioral Mid-Cap Value Fund

Page 3 of 7

| Fuller & Thaler Behavioral Mid-Cap Value Fund | Summary Prospectus January 30, 2023 |

| Principal Investment Risks |

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are listed below. Please see “Additional Information Regarding Principal Risks” in the Fund’s Prospectus for a more detailed description of the Fund’s risks. It is possible to lose money on an investment in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Market Risk. Movements in the stock market may adversely affect the securities held by the Fund on a daily basis, and as a result, such movements may negatively affect the Fund’s net asset value (“NAV”) and investment return. Prices for securities in which the Fund invests may move up or down, sometimes rapidly and unpredictably, as a result of market influences. The Fund’s investments may decline in value due to factors affecting securities markets generally, or particular industries or sectors represented in those markets. The Fund’s investments are subject to the following market-related risks, among others: inflation risk, geopolitical risks, including wars, terrorism, government shutdowns, and concerns about sovereign debt; natural and environmental disasters, including earthquakes, tsunamis and hurricanes; widespread disease, including pandemics and epidemics; and market manipulation and other fraudulent practices. For additional information regarding Market Risk, including the effect of pandemics such as the novel coronavirus disease, on financial markets, please see “Market Risk” in the section titled “Additional Information Regarding Principal Investment Risks” in the Fund’s Prospectus.

Equity Securities Risk. U.S. equity securities may react more strongly to changes in an issuer’s financial condition or prospects than other securities of the same issuer.

Mid-Cap Company Risk. Mid-cap companies involve greater risk of loss and price fluctuation than larger companies. Many of these companies are younger and have a more limited track record than larger companies. Their securities may trade less frequently and in more limited volume than those of more mature companies making them more volatile and more difficult to buy or sell at an acceptable price. These companies may also lack the managerial, financial or other resources necessary to implement their business plans or succeed in the face of competition.

Behavioral Strategy Risk. When taking investment positions, Fuller & Thaler will apply principles based on behavioral finance. In order to take advantage of behavioral biases, Fuller & Thaler generally focuses on certain markers of possible over-reaction. Securities identified using this type of strategy may perform differently from the market as a whole based on the following: the criteria used in the analysis; whether the criteria used are successful in predicting investor behavior; the weight placed on each criterion; and changes in the criteria’s historical trends. The criteria used in implementing this strategy and the weight placed on those criteria may not be predictive of a security’s value, and the effectiveness of the criteria can change over time. These changes may not be reflected in the current analytical approach used to implement the behavioral strategy. There can be no guarantee that Fuller & Thaler will be successful in applying behavioral finance principles to successfully predict investor behavior to exploit stock price anomalies.

BDC Risk. A BDC may invest in the equity and fixed income securities of smaller and developing companies as well as companies that are experiencing financial crises (“Portfolio Companies”). Investments in smaller and developing Portfolio Companies involve a greater risk of loss due to their youth and limited track records and are more susceptible to competition and economic and market changes due to limited products and market shares. Because Portfolio Companies may have limited capital resources, there is also a greater risk of default on fixed income securities issued and non-payment of dividends on any preferred and common stock issued. Investments in Portfolio Companies typically have limited liquidity. A BDC may use leverage (e.g. borrowing and the issuance of fixed income and preferred securities) to finance its own operations and may suffer significant losses if market fluctuations cause the BDC’s net asset value (“NAV”) to decline or if related interest charges exceed investment income. The Fund has no control over the investments made by BDCs, and BDCs are subject to additional risks such as the fact that their shares may trade at a market price above or below their NAVs or an active market may not develop for their shares.

ETF Risk. The Fund is subject to the performance of the ETFs in which it invests for the portion of the Fund’s assets that are so invested. Because the Fund invests its assets in shares of ETFs, the Fund indirectly owns the investments made by such ETFs. By investing in the Fund, you therefore indirectly assume the same types of risks as investing directly in such ETFs. The Fund’s investment performance is affected by the ETF’s investment performance. In addition, the Fund’s risks include the Underlying ETF’s principal risks.

Fee Layering Risk. When the Fund invests in another investment company such as a business development company or an ETF, the Fund will indirectly bear its proportionate share of any fees and expenses payable directly by the investment company. Therefore, the Fund will incur additional expenses, some of which are duplicative of the Fund’s own operational expenses.

Fuller & Thaler Behavioral Mid-Cap Value Fund

Page 4 of 7

| Fuller & Thaler Behavioral Mid-Cap Value Fund | Summary Prospectus January 30, 2023 |

Issuer Risk. The Fund will be affected by factors specific to the issuers of securities and other instruments in which the Fund invests, including actual or perceived changes in the financial condition or business prospects of such issuers.

Liquidity Risk. The lack of an active market for investments may cause delay in disposition or force a sale below fair value.

Management Risk. The Fund will be affected by the allocation determinations, investment decisions and techniques of the Fund’s management.

Regulatory Risk. Changes in government regulations may adversely affect the operations and value of the Fund or the companies in which it invests. Industries and markets that are not adequately regulated may be susceptible to the initiation of inappropriate practices that adversely affect the Fund or the companies in which it invests.

REIT and Real Estate-Related Investment Risk. Adverse changes in the real estate markets may affect the value of REIT and other real estate-related investments.

Sector Risk. The Adviser may allocate more of the Fund’s investments to a particular sector or sectors in the market. If the Fund invests a significant portion of its total assets in certain sectors, its investment portfolio will be more susceptible to the financial, economic, business, and political developments that affect those sectors.

Securities Lending Risk. The Fund may make secured loans of its portfolio securities in an amount not exceeding 33 ⅓% of the value of the Fund’s total assets. The risks in lending portfolio securities, as with other extensions of credit, consist of possible delay in recovery of the securities and possible loss of rights in the collateral should the borrower fail financially, including possible impairment of the Fund’s ability to vote the securities on loan. If a loan is collateralized by cash, the Fund typically will invest the cash collateral for its own account and may pay a fee to the borrower that normally represents a portion of the Fund’s earnings on the collateral. Because the Fund may invest collateral in any investments in accordance with its investment objective, the Fund’s securities lending transactions will result in investment leverage. The Fund bears the risk that the value of the investments made with collateral may decline.

Value Investing Risk. The determination that a security is undervalued is subjective. The market may not agree with the Adviser’s determination and the security’s price may not rise to what the Adviser believes is its full fair value.

| Performance Information |

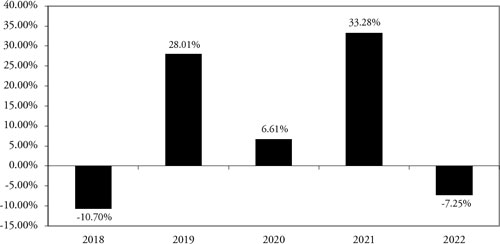

The performance information below provides some indication of the risks of investing in the Fund. The bar chart shows changes in the performance of the Institutional Shares from year to year.

The table shows the average annual returns of the Investor Shares, Institutional Shares and R6 Shares, for the periods of 1 Year, 5 Years and Since Inception compared to a broad-based market index, as applicable. The Fund’s A Shares and C Shares commenced operations on March 10, 2022, and performance information for A Shares and C Shares will be included when the share class has been operational for a full calendar year. The Fund’s A Shares and C Shares would have substantially similar annual returns to those classes presented herein because the shares are invested in the same portfolio of securities and the annual returns would differ only to the extent that the classes do not have the same expenses.

Visit www.fullerthalerfunds.com for more current performance information.

Past performance, before and after taxes, is not necessarily predictive of future performance.

Fuller & Thaler Behavioral Mid-Cap Value Fund

Page 5 of 7

| Fuller & Thaler Behavioral Mid-Cap Value Fund | Summary Prospectus January 30, 2023 |

MID-CAP VALUE FUND

Calendar Year Total Returns – Institutional Shares

Highest and Lowest Quarter Returns

(for periods shown in the bar chart)

| Highest | 10/1/2020 – 12/31/2020 | 25.93% |

| Lowest | 1/1/2020 – 3/31/2020 | (32.20)% |

AVERAGE

ANNUAL TOTAL RETURNS

(for periods ended 12/31/2022)

| Since | ||||||

| 1 Year | 1 Year | Inception(1) | ||||

| Mid-Cap Value Fund | ||||||

| Institutional Shares - Before Taxes | (7.25)% | 8.54% | 8.47% | |||

| Institutional Shares - After Taxes on Distributions(2) | (7.85)% | 8.20% | 8.13% | |||

| Institutional Shares - After Tax on Distributions and Sale of Fund Shares(2) | (4.02)% | 6.70% | 6.64% | |||

| Investor Shares - Before Taxes | (7.47)% | 8.25% | 8.18% | |||

| R6 Shares - Before Taxes | (7.15)% | 8.63% | 8.57% | |||

| A Shares - Before Taxes(1) | N/A | N/A | N/A | |||

| C Shares - Before Taxes(1) | N/A | N/A | N/A | |||

| Russell Midcap® Value Index (reflects no deduction for fees, expenses or taxes)(3) | (12.03)% | 5.72% | 5.75% |

| (1) | The inception date of Fund’s Institutional Shares, Investor Shares and R6 Shares is December 21, 2017. The Fund’s Class A Shares and Class C Shares commenced operations on March 10, 2022. Performance for A Shares and Class C Shares will be included when the respective share class has been operational for a full calendar year. |

| (2) | After-tax returns are estimated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are for Institutional Shares only. The Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than the Return After Taxes on Distributions for the same period if there was a loss realized on the sale of Fund shares. The benefit of the tax loss (to the extent it can be used to offset other gains) may result in a higher return. After-tax returns for other share classes will vary. |

| (3) | The Russell Midcap® Value Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. The Russell Midcap® Value Index measures the performance of those Russell Midcap® companies with lower price/book ratios and lower forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

Fuller & Thaler Behavioral Mid-Cap Value Fund

Page 6 of 7

| Fuller & Thaler Behavioral Mid-Cap Value Fund | Summary Prospectus January 30, 2023 |

| Management of the Fund |

Investment Manager. Fuller & Thaler Asset Management, Inc. (“Fuller & Thaler” or the “Adviser”)

Portfolio Managers

| ● | David Potter, CFA, Partner and Lead Portfolio Manager, has managed the Fund since its 2017 inception. |

| ● | Ryam Lee, CFA, Senior Analyst, has been an analyst on the Fund since its 2017 inception. |

Purchase and Sale of Fund Shares

| Minimum Initial Investment | Minimum Subsequent Investment |

| A Shares: $1,000 for most account types | A Shares: $50 for all account types |

| C Shares: $1,000 for most account types | C Shares: $50 for all account types |

| Investor Shares: $1,000 for most account types | Investor Shares: $50 for all account types |

| Institutional Shares: $100,000 for most account types | Institutional Shares: $50 for all account types |

| R6 Shares: $1,000,000 for most account types | R6 Shares: $50 for all account types |

| ● | Investments in A Shares and C Shares, when available, may be made only through your dealer or financial adviser. Other share classes may be purchased directly from the Fund. |

| ● | Minimum investment requirements are waived for any qualified group retirement plan. Minimum investment requirements may be modified for certain financial intermediaries that aggregate trades on behalf of investors. For additional information regarding waiver of investment minimums, please see “Classes of Shares” in the Fund’s Prospectus. |

To Place Buy or Sell Orders

| By mail: | Fuller & Thaler Behavioral Mid-Cap Value Fund |

| c/o Ultimus Fund Solutions, LLC | |

| PO Box 46707 | |

| Cincinnati, OH 45246-0707 | |

| By Phone: | 1-888-912-4562 |

You may also purchase and redeem shares through your dealer or financial adviser. Please contact your financial intermediary directly to find out if additional requirements apply.

| Tax Information |

The Fund’s distributions are generally taxable to you as ordinary income or capital gains, unless you are investing through a tax -deferred arrangement, such as a 401(k) plan or an individual retirement account. You should be aware that investments in tax-deferred accounts may be taxable at withdrawal. You should discuss any tax-related concerns with your tax adviser or attorney.

| Payments to Broker-Dealers and Other Financial Intermediaries |

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund, its distributor, its investment manager or their affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Fuller & Thaler Behavioral Mid-Cap Value Fund

Page 7 of 7

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- FEMSA Files 2023 SEC Annual Report

- SBA Announces 2024 Growth Accelerator Fund Competition Stage One Winners, Up to $3 Million in Prizes Awarded

- Green Water Labs to Host Community Clean-Up Event in Celebration of Earth Day 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share