Form 497K CAUSEWAY CAPITAL MANAGEM

Causeway Emerging Markets Fund

Institutional Class (CEMIX)

Investor Class (CEMVX)

Summary Prospectus

January 27, 2023

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at www.causewayfunds.com/documents. You can also get this information at no cost by calling 1-866-947-7000 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, both dated January 27, 2023, are incorporated by reference into this summary prospectus.

The Fund’s investment objective is to seek long-term growth of capital.

The following table shows the fees and expenses that you pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Transaction Fees

(fees paid directly from your investment)

None

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Institutional Class |

Investor Class |

|||||||

| Management Fees | 1.00 | % | 1.00 | % | ||||

| Other Expenses(1) | 0.14 | % | 0.14 | % | ||||

| Shareholder Service Fees | Non | e | 0.25 | % | ||||

| Total Annual Fund Operating Expenses | 1.14 | % | 1.39 | % | ||||

| Expense Reimbursement(2) | (0.03 | )% | (0.03 | )% | ||||

| Total Annual Fund Operating Expenses After Expense Reimbursement | 1.11 | % | 1.36 | % | ||||

| (1) | “Other Expenses” have been restated to include estimated tax reclaim-related fees and expenses for the current fiscal period. |

| (2) | Under the terms of an expense limit agreement, the Investment Adviser has agreed to waive all or a portion of its advisory fee and, if necessary, reimburse expenses to keep the Fund’s “Total Annual Fund Operating Expenses” (excluding brokerage fees and commissions, shareholder service fees, interest, taxes, fees and expenses of other funds in which the Fund invests, tax reclaim-related fees and expenses, and extraordinary expenses) from exceeding 1.10% of the average daily net assets of each of the Institutional Class and Investor Class shares. The expense limit agreement will remain in effect until January 31, 2024 and may only be terminated earlier by the Fund’s Board or upon termination of the Fund’s investment advisory agreement. |

| CAUSEWAY EMERGING MARKETS FUND | 1 | |||

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The example reflects the effect of the expense limit agreement through January 31, 2024 only, and assumes no expense limit after that time. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Institutional Class | $ | 113 | $ | 359 | $ | 625 | $ | 1,383 | ||||||||

| Investor Class | $ | 138 | $ | 437 | $ | 758 | $ | 1,666 | ||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 68% of the average value of its portfolio.

Principal Investment Strategies and Risks

What are the Fund’s principal investment strategies?

The Fund normally invests at least 80% of its total assets in equity securities of companies in emerging (less developed) markets and other investments that are tied economically to emerging markets. Generally these investments include common stock, preferred and preference stock, depositary receipts, participation notes, warrants or other equity-related corporate obligations, and exchange-traded funds that invest in emerging markets.

The Investment Adviser uses a quantitative investment approach to purchase and sell investments for the Fund. To select securities, the Investment Adviser’s proprietary computer model analyzes “stock-specific” factors relating to valuation, growth, technical indicators, and competitive strength, and “top-down” factors relating to macroeconomics, currency, country and sector. Currently, the valuation factor category receives the highest overall weight in the model and stock-specific factors comprise approximately 75% of the score for a company. For each stock, the relative weight assigned to each stock-specific factor differs depending on its classification (for example, value, growth, momentum, capitalization or other classifications). The relative weights of these stock-specific factors are sometimes referred to as “contextual weights.” Factors and their weightings may change over time as the model is revised and updated, or if

the classification of a stock changes. In addition to its quantitative research, the Investment Adviser’s fundamental research analysts review certain of the quantitative outputs to attempt to identify and address special issues, such as significant corporate actions or management changes, which are difficult to detect quantitatively.

The Fund invests in companies in ten or more emerging markets. If the Fund invests in a country, the percentage of the Fund’s total assets attributable to that country is not expected to be greater than the weight of that country in the Fund’s benchmark, the MSCI Emerging Markets Index (Gross) (the “EM Index”), plus 5 percentage points, or less than the weight of that country in the EM Index minus 5 percentage points. For these purposes, emerging markets include, but are not limited to, countries included in the EM Index, which currently are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Kuwait, Malaysia, Mexico, Peru, the Philippines, Poland, Qatar, Saudi Arabia, South Africa, South Korea, Taiwan, Thailand, Turkey, and the United Arab Emirates. In addition, at the discretion of the Investment Adviser, the Fund may invest up to 10% of total Fund assets in companies in less developed emerging markets not included in the EM Index, such as countries included in the MSCI Frontier Markets Index and countries with similar economic characteristics. The Investment Adviser determines a company’s country by referring to: the stock exchange where its securities are principally traded; where it is registered, organized or incorporated; where its headquarters are located; its MSCI country classification; where it derives at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed; or where at least 50% of its assets are located. The Fund considers a country to be an emerging market if the country is included in the EM Index.

The Fund generally invests in companies with market capitalizations of US $500 million or greater at the time of investment and may invest in a wide range of industries. The Fund may use futures contracts, including futures contracts based on emerging markets indices, to obtain exposures to emerging markets for efficient cash management.

What are the main risks of investing in the Fund?

Market and Selection Risk. As with any mutual fund, the Fund’s value, and therefore the value of your Fund shares, may go down. This may occur because the value of a particular stock or stock market in which the Fund invests is falling, and it is possible that such changes will be sharp and unpredictable. Global economies are increasingly interconnected, and political, economic and other conditions and events (including, but not limited to, war, conflicts, natural disasters, pandemics, epidemics, inflation/deflation and social unrest) in one country or region might adversely impact a different country or region. Also, the Investment Adviser may select securities that underperform the stock market or other funds with similar investment objectives and investment strategies. If the value of the Fund’s investments goes down, you may lose money. We cannot guarantee that the Fund will achieve its investment objective.

| 2 | CAUSEWAY EMERGING MARKETS FUND |

Foreign and Emerging Markets Risk. The Fund’s investments in companies in emerging markets, including common stock, preferred and preference stocks, depositary receipts, participation notes, warrants or other equity-related corporate obligations, and exchange-traded funds that invest in emerging markets, involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. For example, the value of the Fund’s securities may be affected by social, political and economic developments and U.S. and foreign laws relating to foreign investment. The extent of economic development, political stability, market depth, infrastructure, capitalization and regulatory oversight in emerging markets can be less than in more developed foreign markets. Further, because the Fund invests in securities denominated in foreign currencies, the Fund’s securities may go down in value depending on foreign exchange rates. Other risks include trading, settlement, custodial, and other operational risks; withholding or other taxes; and the less stringent investor protection and disclosure standards of some foreign markets. All of these factors can make emerging markets securities less liquid, more volatile and harder to value than U.S. securities. These risks are higher for investments in frontier markets.

Quantitative Analysis Risk. Data for emerging markets companies may be less available, less accurate and/or less current than data for developed markets companies. The Investment Adviser will use quantitative techniques to generate investment decisions and its analysis and stock selection can be adversely affected if it relies on erroneous or outdated data. Any errors in the Investment Adviser’s quantitative methods may adversely affect the Fund’s performance. In addition, securities selected using quantitative analysis can perform differently from the market as a whole as a result of the factors used in the analysis, the weight assigned to a stock-specific factor for a stock or the weight placed on each factor, and changes in the factor’s historical trends. The factors used in quantitative analysis and the weight assigned to a stock-specific factor for a stock or the weight placed on each factor may not predict a security’s value, and the effectiveness of the factors can change over time. These changes may not be reflected in the current quantitative model.

Small and Medium Cap Risk. Some of the Fund’s investments may be in smaller and medium capitalization issuers. The values of securities of smaller and medium capitalization companies, which may be less well-known companies, can be more sensitive to, and react differently to, company, political, market, and economic developments than the market as a whole and other types of securities. Smaller and medium capitalization companies can have more limited product lines, markets, growth prospects, depth of management, and financial resources, and these companies may have shorter operating histories and less access to financing, creating additional risk. Smaller and medium capitalization companies in countries with less-liquid currencies may have additional difficulties in financing and conducting their businesses. Further, smaller and medium capitalization companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations, or may have difficulty in repaying any

loans that have floating rates. Because of these and other risks, securities of smaller and medium capitalization companies tend to be more volatile and less liquid than securities of larger capitalization companies. During some periods, securities of smaller and medium capitalization companies, as asset classes, have underperformed the securities of larger capitalization companies.

Derivatives Risk. The Fund’s use of futures contracts subjects the Fund to additional risks. Futures contracts are derivative instruments which can be volatile and involve special risks including leverage risk and basis risk (the risk that the value of the investment will not react in parallel with the value of the reference index), in addition to market risk, credit risk, liquidity risk, operational risk and legal risk. Participation notes, warrants or similar equity-related corporate obligations, which may be based on either an index or exposures selected by the Investment Adviser, may be used to obtain exposure to the China A-Share market, are also derivative instruments which can be volatile and involve special risks including counterparty risk, liquidity risk, and basis risk. These risks are in addition to the risks associated with the investments underlying such derivative instruments.

See “Investment Risks” in the prospectus for more information about the risks associated with the Fund.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The Fund may be an appropriate investment if you:

| • | Are seeking long-term growth of capital and can withstand the share price volatility of equity investing. |

| • | Are seeking to diversify a portfolio of equity securities to include emerging markets securities. |

| • | Can tolerate the increased volatility and currency fluctuations associated with investments in foreign securities, and especially emerging markets. |

| • | Are willing to accept the risk that the value of your investment may decline in order to seek long-term growth of capital. |

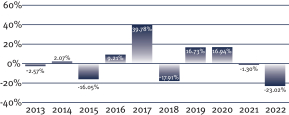

The bar chart and the performance table that follow provide some indication of the risks and volatility of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for one year, five and ten years, and since inception, compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. For current performance information, please visit www.causewayfunds.com.

| CAUSEWAY EMERGING MARKETS FUND | 3 |

Institutional Class:

During the period shown in the bar chart, the best quarter was 19.41% (12/31/2020) and the worst quarter was -23.01% (3/31/2020).

Average Annual Total Returns

After-tax returns are shown for the Institutional Class only; after-tax returns for the Investor Class will differ. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs).

For the periods ended December 31, 2022:

| Institutional Class | 1 Year | 5 Years | 10 Years | Since Inception (March 30, 2007) |

||||||||||||

| Fund Returns Before Taxes | -23.02 | % | -3.17 | % | 0.82 | % | 2.75 | % | ||||||||

| Fund Returns After Taxes on Distributions | -23.77 | % | -4.34 | % | 0.08 | % | 2.10 | % | ||||||||

| Fund Returns After Taxes on Distributions and Sale of Fund Shares | -12.92 | % | -2.00 | % | 0.88 | % | 2.38 | % | ||||||||

| Investor Class | ||||||||||||||||

| Fund Returns Before Taxes | -23.18 | % | -3.38 | % | 0.59 | % | 2.57 | % | ||||||||

| MSCI EM Index (Gross) (reflects no deduction for fees, expenses or taxes) | -19.74 | % | -1.03 | % | 1.81 | % | 3.00 | % | ||||||||

Investment Adviser

Causeway Capital Management LLC

Portfolio Managers

The Fund is managed by the following portfolio managers:

Joe Gubler, CFA, a director of the Investment Adviser, has served as the Fund’s portfolio manager since 2014.

Arjun Jayaraman, PhD, CFA, head of the quantitative research group at the Investment Adviser, has served as the Fund’s portfolio manager since 2007.

MacDuff Kuhnert, CFA, a director of the Investment Adviser, has served as the Fund’s portfolio manager since 2007.

Ryan Myers, a director of the Investment Adviser, has served on the Fund’s portfolio management team since 2021.

Purchase and Sale of Fund Shares: You may purchase, sell (redeem), or exchange shares of the Fund on any business day through your broker, by writing to the Fund at P.O. Box 219085, Kansas City, MO 64121-7159, telephoning the Fund at 1-866-947-7000 or visiting the Fund’s website at www.causewayfunds.com . Shares may be purchased by check or by wire, or through the automated clearing house. You may receive redemption proceeds by wire or by check.

Investor Class shares require a $5,000 minimum initial investment. Institutional Class shares require a $1 million minimum initial investment. There are no minimum amounts required for subsequent investments.

Tax Information: Distributions from the Fund are generally taxable to you as ordinary income or long-term capital gain, unless you are investing through a tax-deferred arrangement, such as an IRA or 401(k) plan.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase shares of the Fund through a broker or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker or financial intermediary and your salesperson to recommend the Fund over another investment. For more information, ask your salesperson or visit your financial intermediary’s website.

CCM-SM-002-1500

| 4 | CAUSEWAY EMERGING MARKETS FUND |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AUTODESK, INC. (NASDAQ: ADSK) INVESTOR ALERT: Bernstein Liebhard LLP Announces that a Securities Class Action Lawsuit Has Been Filed Against Autodesk, Inc.

- Motel 6 Receives Franchisees' Choice Designation for the Fourth Year in a Row

- BADMAD ROBOTS Announces Listing on Epic Games Store and Steam, Teams Up with Immutable X

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share