Form 497K CASH ACCOUNT TRUST

DWS Tax-Exempt Portfolio

Summary Prospectus | August 1, 2021

|

Class/Ticker

|

Tax-Free Investment Class

|

DTDXX

|

Before you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, reports to shareholders, Statement of Additional Information (SAI) and other information about the fund online at dws.com/moneypros. You can also get this information at no cost by e-mailing a request to [email protected], calling (800) 730-1313 or asking your financial representative. The Prospectus and SAI, both dated August 1, 2021, as may be revised or supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Investment Objective

The fund seeks to provide maximum current income that is exempt from federal income taxes to the extent consistent with stability of capital.

Fees and Expenses

These are the fees and expenses you may pay when you buy, hold and sell shares. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

SHAREHOLDER FEES

|

(paid directly from your investment)

|

None

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a % of the value of your investment)

(expenses that you pay each year as a % of the value of your investment)

|

Management fee

|

0.08

|

|

Distribution/service (12b-1) fees

|

0.25

|

|

Other expenses

|

0.38

|

|

Total annual fund operating expenses

|

0.71

|

EXAMPLE

This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

|

$73

|

$227

|

$395

|

$883

|

Principal Investment Strategies

Main investments. The fund normally invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in municipal securities, the income from which is free from regular federal income tax and alternative minimum tax (AMT). This policy is fundamental and may not be changed without shareholder approval.

The fund is a money market fund that is managed in accordance with federal regulations, which govern the quality, maturity, diversity and liquidity of instruments in which a money market fund may invest.

The fund follows policies designed to maintain a stable $1.00 share price.

The fund may invest in municipal trust receipts (MTRs), general obligation and revenue notes and bonds, municipal obligations backed by third parties, obligations of the territories or Commonwealths of the US and other municipal instruments paying a fixed, variable or floating interest rate.

The fund is designed for investors in a moderate to high tax bracket who are interested in federal tax-exempt income along with the liquidity and stability that a money market fund is designed to offer.

Management process. Working in consultation with portfolio management, a credit team screens potential securities and develops a list of those that the fund may buy. Portfolio management, looking for attractive yield and weighing considerations such as credit quality, economic outlooks and possible interest rate movements, then decides which securities on this list to buy.

Portfolio management may consider information about Environmental, Social and Governance (ESG) issues in its fundamental research process and when making investment decisions.

Main Risks

There are several risk factors that could reduce the yield you get from the fund, cause the fund’s performance to trail that of other investments, or cause you to lose money.

1

Money market fund risk. You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time.

Market disruption risk. Geopolitical and other events, including war, terrorism, economic uncertainty, trade disputes, public health crises and related geopolitical events have led, and in the future may lead, to disruptions in the US and world economies and markets, which may increase financial market volatility and have significant adverse direct or indirect effects on the fund and its investments. Market disruptions could cause the fund to lose money, experience significant redemptions, and encounter operational difficulties. Although multiple asset classes may be affected by a market disruption, the duration and effects may not be the same for all types of assets.

Recent market disruption events include the pandemic spread of the novel coronavirus known as COVID-19, and the significant uncertainty, market volatility, decreased economic and other activity, increased government activity, including economic stimulus measures, and supply chain disruptions that it has caused. The full effects, duration and costs of the COVID-19 pandemic are impossible to predict, and the circumstances surrounding the COVID-19 pandemic will continue to evolve, including the risk of future increased rates of infection due to low vaccination rates and/or the lack of effectiveness of current vaccines against new variants. The pandemic has affected and may continue to affect certain countries, industries, economic sectors, companies and investment products more than others, may exacerbate existing economic, political, or social tensions and may increase the probability of an economic recession or depression. The fund and its investments may be adversely affected by the effects of the COVID-19 pandemic, and the pandemic may result in the fund and its service providers experiencing operational difficulties in coordinating a remote workforce and implementing their business continuity plans, among others.

The disruptions caused by the COVID-19 pandemic may magnify the impact of each of the other risks described in this “MAIN RISKS” section and may increase volatility in one or more markets in which the fund invests leading to the potential for greater losses for the fund.

Interest rate risk. Rising interest rates could cause the value of the fund’s investments — and therefore its share price as well — to decline. Conversely, any decline in interest rates is likely to cause the fund’s yield to decline,

and during periods of unusually low or negative interest rates, the fund’s yield may approach or fall below zero. A low or negative interest rate environment may prevent the fund from providing a positive yield or paying fund expenses out of current income and, at times, could impair the fund’s ability to maintain a stable $1.00 share price. Over time, the total return of a money market fund may not keep pace with inflation, which could result in a net loss of purchasing power for long-term investors. Recent and potential future changes in monetary policy made by central banks or governments are likely to affect the level of interest rates. Money market funds try to minimize this risk by purchasing short-term securities.

London Interbank Offered Rate (LIBOR), the benchmark rate for certain floating rate securities, is expected to be phased out by the end of 2021, although the US Dollar LIBOR phase out may extend past 2021 for certain existing contracts. The fund or the instruments in which the fund invests may be adversely affected by the phase out by, among other things, increased volatility or illiquidity. There remains uncertainty regarding the future use of LIBOR and the nature of any replacement reference rate and, accordingly, it is difficult to predict the impact to the fund of the transition away from LIBOR.

Credit risk. The fund's performance could be hurt and the fund's share price could fall below $1.00 if an issuer of a debt security suffers an adverse change in financial condition that results in the issuer not making timely payments of interest or principal, a security downgrade or an inability to meet a financial obligation.

Liquidity and transaction risk. The liquidity of portfolio securities can deteriorate rapidly due to credit events affecting issuers or guarantors or due to general market conditions and a lack of willing buyers. When there are no willing buyers and an instrument cannot be readily sold at a desired time or price, the fund may have to accept a lower price or may not be able to sell the instrument at all. If dealer capacity in debt instruments is insufficient for market conditions, it may further inhibit liquidity and increase volatility in the debt markets. Additionally, market participants other than the fund may attempt to sell debt holdings at the same time as the fund, which could cause downward pricing pressure and contribute to illiquidity. An inability to sell one or more portfolio securities can adversely affect the fund’s ability to maintain a $1.00 share price or prevent the fund from being able to take advantage of other investment opportunities.

Unusual market conditions, an unusually high volume of redemption requests or other similar conditions could cause the fund to be unable to pay redemption proceeds within a short period of time. If the fund is forced to sell securities at an unfavorable time and/or under unfavorable conditions, such sales may adversely affect the fund’s ability to maintain a $1.00 share price.

2

DWS Tax-Exempt Portfolio

Summary Prospectus August 1, 2021

Municipal securities risk. Municipal instruments may be susceptible to periods of economic stress, which could affect the market values and marketability of many or all municipal obligations of issuers in a state, US territory, or possession. For example, the COVID-19 pandemic has significantly stressed the financial resources of many municipal issuers, which may impair a municipal issuer’s ability to meet its financial obligations when due and could adversely impact the value of its bonds, which could negatively impact the performance of the fund. The fund could also be impacted by events in the municipal securities market, including the supply and demand for municipal securities. Negative events, such as severe fiscal difficulties, bankruptcy of one or more issuers, an economic downturn, unfavorable legislation, court rulings or political developments, or reduced monetary support from the federal government could hurt fund performance. Municipal securities may include revenue bonds, which are generally backed by revenue from a specific project or tax. The issuer of a revenue bond makes interest and principal payments from revenues generated from a particular source or facility, such as a tax on particular property or revenues generated from a municipal water or sewer utility or an airport. Revenue bonds generally are not backed by the full faith and credit and general taxing power of the issuer. The value of municipal securities is strongly influenced by the value of tax-exempt income to investors. Changes in tax and other laws, including changes to individual or corporate tax rates, could alter the attractiveness and overall demand for municipal securities.

Security selection risk. Although short-term securities are relatively stable investments, it is possible that the securities in which the fund invests will not perform as expected. This could cause the fund's returns to lag behind those of similar money market funds and could result in a decline in share price.

Municipal trust receipts risk. The fund’s investment in MTRs is subject to similar risks as other investments in debt obligations, including interest rate risk, credit risk and security selection risk. Additionally, investments in MTRs raise certain tax issues that may not be presented by direct investments in municipal securities. There is some risk that certain issues could be resolved in a manner that could adversely impact the performance of the fund.

Tax risk. Any distributions to shareholders that represent income from taxable securities will generally be taxable as ordinary income at both the state and federal levels, while other distributions, such as capital gains, are taxable to the same extent they would be for any mutual fund. New federal or state governmental action could adversely affect the tax-exempt status of securities held by the fund, resulting in a higher tax liability for shareholders and potentially hurting fund performance as well.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or

contracts that the fund owns or is otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the fund.

US territory and Commonwealth obligations risk. Adverse political and economic conditions and developments affecting any territory or Commonwealth of the US may, in turn, negatively affect the value of the fund’s holdings in such obligations.

Prepayment and extension risk. When interest rates fall, issuers of high interest debt obligations may pay off the debts earlier than expected (prepayment risk), and the fund may have to reinvest the proceeds at lower yields. When interest rates rise, issuers of lower interest debt obligations may pay off the debts later than expected (extension risk), thus keeping the fund’s assets tied up in lower interest debt obligations. Ultimately, any unexpected behavior in interest rates could increase the volatility of the fund’s yield and could hurt fund performance. Prepayments could also create capital gains tax liability in some instances.

Risks of holding cash. The fund will at times hold cash positions, which may hurt the fund’s performance. Cash positions may also subject the fund to additional risks and costs, including any fees imposed by the fund’s custodian for large cash balances.

Fees and gates risk. The fund has adopted policies and procedures such that the fund will be able to impose liquidity fees on redemptions and/or temporarily suspend (gate) redemptions for up to 10 business days in any 90 day period in the event that the fund's liquidity falls below required minimums. A liquidity fee would reduce the amount shareholders receive upon redemption of shares. Redemption gates would prevent shareholders from redeeming fund shares.

ESG investing risk. When portfolio management considers ESG factors in its fundamental research process and when making investment decisions, there is a risk that the fund may forgo otherwise attractive investment opportunities or increase or decrease its exposure to certain types of issuers and, therefore, may underperform funds that do not consider ESG factors.

Operational and technology risk. Cyber-attacks, disruptions or failures that affect the fund’s service providers or counterparties, issuers of securities held by the fund, or other market participants may adversely affect the fund and its shareholders, including by causing losses for the fund or impairing fund operations. For example, the fund’s or its service providers’ assets or sensitive or confidential information may be misappropriated, data may be corrupted and operations may be disrupted (e.g., cyber-attacks, operational failures or broader disruptions may cause the release of private shareholder information or confidential fund information, interfere with the processing

3

DWS Tax-Exempt Portfolio

Summary Prospectus August 1, 2021

of shareholder transactions, impact the ability to calculate the fund’s net asset value and impede trading). Market events and disruptions also may trigger a volume of transactions that overloads current information technology and communication systems and processes, impacting the ability to conduct the fund’s operations.

While the fund and its service providers may establish business continuity and other plans and processes that seek to address the possibility of and fallout from cyber-attacks, disruptions or failures, there are inherent limitations in such plans and systems, including that they do not apply to third parties, such as fund counterparties, issuers of securities held by the fund or other market participants, as well as the possibility that certain risks have not been identified or that unknown threats may emerge in the future and there is no assurance that such plans and processes will be effective. Among other situations, disruptions (for example, pandemics or health crises) that cause prolonged periods of remote work or significant employee absences at the fund’s service providers could impact the ability to conduct the fund’s operations. In addition, the fund cannot directly control any cybersecurity plans and systems put in place by its service providers, fund counterparties, issuers of securities held by the fund or other market participants.

Past Performance

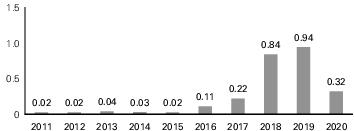

How a fund's returns vary from year to year can give an idea of its risk. Past performance may not indicate future results. All performance figures below assume that dividends were reinvested. The 7-day yield, which is often referred to as the “current yield,” is the income generated by the fund over a seven-day period. This amount is then annualized, which means that we assume the fund generates the same income every week for a year. For more recent performance figures and the current yield, go to dws.com (the Web site does not form a part of this prospectus) or call the telephone number included in this prospectus.

CALENDAR YEAR TOTAL RETURNS (%) (Tax-Free Investment Class)

Returns for other classes were different and are not shown here.

|

|

Returns

|

Period ending

|

|

Best Quarter

|

0.29%

|

June 30, 2019

|

|

Worst Quarter

|

0.00%

|

March 31, 2011

|

|

Year-to-Date

|

0.00%

|

June 30, 2021

|

Average Annual Total Returns

(For periods ended 12/31/2020 expressed as a %) (Tax-Free Investment Class)

(For periods ended 12/31/2020 expressed as a %) (Tax-Free Investment Class)

|

|

Class

Inception

|

1

Year

|

5

Years

|

10

Years

|

|

|

3/19/2007

|

0.32

|

0.48

|

0.25

|

Total returns would have been lower if operating expenses had not been reduced.

For more recent performance information, contact the financial services firm from which you obtained this prospectus.

Management

Investment Advisor

DWS Investment Management Americas, Inc.

Purchase and Sale of Fund Shares

Minimum Initial Investment ($)

|

|

Non-IRA

|

IRAs

|

Automatic

Investment

Plans

|

|

INV

|

2,000

|

1,000

|

250

|

There is no minimum investment for qualified retirement plans (such as 401(k), pension or profit sharing plans). There is no minimum additional investment. Accounts opened through a financial representative may have different minimum investment amounts.

To Place Orders

|

Mail

|

All Requests

|

DWS

Attn: Institutional Trading Desk

PO Box 219151

Kansas City, MO 64121-9151

|

|

Expedited Mail

|

DWS

210 West 10th Street

Kansas City, MO 64105-1614

|

|

|

Telephone

|

(800) 730-1313, M – F 8 a.m. – 6 p.m. ET

|

|

|

TDD Line

|

(800) 972-3006, M – F 8 a.m. – 7 p.m. ET

|

|

The fund is generally open on days when the New York Stock Exchange is open for regular trading. Initial investments must be sent by mail. You can make additional investments or sell shares of the fund on any business day by mail or by telephone.

The fund’s shares are available for purchase only by natural persons. The fund has implemented policies and procedures that are reasonably designed to limit beneficial ownership of the fund’s shares to natural persons.

Any new investors wishing to purchase shares of the fund may be required to demonstrate eligibility. If the fund subsequently determines that a beneficial owner of fund

4

DWS Tax-Exempt Portfolio

Summary Prospectus August 1, 2021

shares is not a natural person, then the fund, upon notice, will involuntarily redeem all of the shares of such ineligible investor and send the net proceeds to the investor.

Tax Information

The fund's distributions are generally exempt from regular federal income tax. A portion of the fund's dividends may be subject to federal income tax, including the federal alternative minimum tax.

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund, the Advisor, and/or the Advisor’s affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

5

DWS Tax-Exempt Portfolio

Summary Prospectus August 1, 2021 CATTEP-SUM

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Groupama Assurances Mutuelles calls for redemption of its undated subordinated bond (FR0011896513)

- Proposed Increase in Size of Offer for Subscription and Re-Opening of Offer for Subscription to Further Applications

- China's Yiwu Establishes Welcoming Committee to Attract International Buyers

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share