Form 497K CASH ACCOUNT TRUST

DWS Government & Agency Securities Portfolio

Summary Prospectus | August 1, 2021

|

Class/Ticker

|

DWS Government Cash Institutional Shares

|

DBBXX

|

Before you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, reports to shareholders, Statement of Additional Information (SAI) and other information about the fund online at dws.com/liqpros. You can also get this information at no cost by e-mailing a request

to [email protected], calling (800) 730-1313 or asking your financial representative. The Prospectus and SAI, both dated August 1, 2021, as may be revised or supplemented from time to time, are incorporated by reference into this Summary Prospectus.

Investment Objective

The fund seeks to provide maximum current income consistent with stability of capital.

Fees and Expenses

These are the fees and expenses you may pay when you buy, hold and sell shares. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

SHAREHOLDER FEES

|

(paid directly from your investment)

|

None

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a % of the value of your investment)

(expenses that you pay each year as a % of the value of your investment)

|

Management fee

|

0.05

|

|

Distribution/service (12b-1) fees

|

None

|

|

Other expenses

|

0.16

|

|

Total annual fund operating expenses

|

0.21

|

|

Fee waiver/expense reimbursement

|

0.03

|

|

Total annual fund operating expenses after fee waiver/

expense reimbursement

|

0.18

|

The Advisor has contractually agreed through July 31, 2022 to waive its fees and/or reimburse certain operating expenses of the DWS Government Cash Institutional Shares of the DWS Government & Agency Securities Portfolio to the extent necessary to maintain the total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest expenses) at a ratio no higher than 0.18%. The agreement may only be terminated with the consent of the fund’s Board.

EXAMPLE

This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then

redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses (including one year of capped expenses in each period) remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

|

$18

|

$65

|

$115

|

$265

|

Principal Investment Strategies

Main investments. The fund is a money market fund that is managed in accordance with federal regulations which govern the quality, maturity, diversity and liquidity of instruments in which a money market fund may invest.

The fund operates as a “government money market fund,” as such term is defined under federal regulations. As a government money market fund, the fund is required to invest at least 99.5% of its total assets at the time of investment in cash, US government securities, and/or repurchase agreements that are collateralized by these instruments.

The fund follows policies designed to maintain a stable $1.00 share price.

The fund pursues its objective by investing exclusively in the following types of investments:

■

US Treasury bills, notes, bonds and other obligations issued or guaranteed by the US government, its agencies or instrumentalities.

■

Repurchase agreements backed by these instruments. In a repurchase agreement, the fund buys securities at one price with a simultaneous agreement to sell back the securities at a future date at an agreed-upon price.

The fund may invest in floating and variable rate instruments (obligations that do not bear interest at fixed rates).

Management process. Working in consultation with portfolio management, a credit team screens potential securities and develops a list of those that the fund may

1

buy. Portfolio management, looking for attractive yield and weighing considerations such as credit quality, economic outlooks and possible interest rate movements, then decides which securities on this list to buy.

Main Risks

There are several risk factors that could reduce the yield you get from the fund, cause the fund’s performance to trail that of other investments, or cause you to lose money.

Money market fund risk. You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Advisor has no legal obligation to provide financial support to the fund, and you should not expect that the Advisor will provide financial support to the fund at any time.

Market risk. The market value of the securities in which the fund invests may be impacted by the prospects of individual issuers, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets.

Market disruption risk. Geopolitical and other events, including war, terrorism, economic uncertainty, trade disputes, public health crises and related geopolitical events have led, and in the future may lead, to disruptions in the US and world economies and markets, which may increase financial market volatility and have significant adverse direct or indirect effects on the fund and its investments. Market disruptions could cause the fund to lose money, experience significant redemptions, and encounter operational difficulties. Although multiple asset classes may be affected by a market disruption, the duration and effects may not be the same for all types of assets.

Recent market disruption events include the pandemic spread of the novel coronavirus known as COVID-19, and the significant uncertainty, market volatility, decreased economic and other activity, increased government activity, including economic stimulus measures, and supply chain disruptions that it has caused. The full effects, duration and costs of the COVID-19 pandemic are impossible to predict, and the circumstances surrounding the COVID-19 pandemic will continue to evolve, including the risk of future increased rates of infection due to low vaccination rates and/or the lack of effectiveness of current vaccines against new variants. The pandemic has affected and may continue to affect certain countries, industries, economic sectors, companies and investment products more than others, may exacerbate existing economic, political, or social tensions and may increase the probability of an economic recession or depression. The fund and its investments may be adversely affected by the effects of the COVID-19 pandemic, and the pandemic may result in

the fund and its service providers experiencing operational difficulties in coordinating a remote workforce and implementing their business continuity plans, among others.

The disruptions caused by the COVID-19 pandemic may magnify the impact of each of the other risks described in this “MAIN RISKS” section and may increase volatility in one or more markets in which the fund invests leading to the potential for greater losses for the fund.

Interest rate risk. Rising interest rates could cause the value of the fund’s investments — and therefore its share price as well — to decline. Conversely, any decline in interest rates is likely to cause the fund’s yield to decline, and during periods of unusually low or negative interest rates, the fund’s yield may approach or fall below zero. A low or negative interest rate environment may prevent the fund from providing a positive yield or paying fund expenses out of current income and, at times, could impair the fund’s ability to maintain a stable $1.00 share price. Over time, the total return of a money market fund may not keep pace with inflation, which could result in a net loss of purchasing power for long-term investors. Recent and potential future changes in monetary policy made by central banks or governments are likely to affect the level of interest rates. Money market funds try to minimize this risk by purchasing short-term securities.

If there is an insufficient supply of US government securities to meet investor demand, it could result in lower yields on such securities and increase interest rate risk for the fund.

London Interbank Offered Rate (LIBOR), the benchmark rate for certain floating rate securities, is expected to be phased out by the end of 2021, although the US Dollar LIBOR phase out may extend past 2021 for certain existing contracts. The fund or the instruments in which the fund invests may be adversely affected by the phase out by, among other things, increased volatility or illiquidity. There remains uncertainty regarding the future use of LIBOR and the nature of any replacement reference rate and, accordingly, it is difficult to predict the impact to the fund of the transition away from LIBOR.

Security selection risk. Although short-term securities are relatively stable investments, it is possible that the securities in which the fund invests will not perform as expected. This could cause the fund's returns to lag behind those of similar money market funds and could result in a decline in share price.

Repurchase agreement risk. If the party that sells the securities to the fund defaults on its obligation to repurchase them at the agreed-upon time and price, the fund could lose money.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is otherwise exposed to, may decline in financial health and become unable to

2

DWS Government & Agency Securities Portfolio

Summary Prospectus August 1, 2021

honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the fund.

Credit risk. The fund's performance could be hurt and the fund's share price could fall below $1.00 if an issuer of a debt security suffers an adverse change in financial condition that results in the issuer not making timely payments of interest or principal, a security downgrade or an inability to meet a financial obligation.

Some securities issued by US government agencies or instrumentalities are backed by the full faith and credit of the US government. Other securities that are supported only by the credit of the issuing agency or instrumentality are subject to greater credit risk than securities backed by the full faith and credit of the US government. This is because the US government might provide financial support, but has no obligation to do so, if there is a potential or actual loss of principal or failure to make interest payments.

Because of the rising US government debt burden, it is possible that the US government may not be able to meet its financial obligations or that securities issued by the US government may experience credit downgrades. Such a credit event may also adversely impact the financial markets and the fund.

Liquidity and transaction risk. The liquidity of portfolio securities can deteriorate rapidly due to credit events affecting issuers or guarantors or due to general market conditions and a lack of willing buyers. When there are no willing buyers and an instrument cannot be readily sold at a desired time or price, the fund may have to accept a lower price or may not be able to sell the instrument at all. If dealer capacity in debt instruments is insufficient for market conditions, it may further inhibit liquidity and increase volatility in the debt markets. Additionally, market participants other than the fund may attempt to sell debt holdings at the same time as the fund, which could cause downward pricing pressure and contribute to illiquidity. An inability to sell one or more portfolio securities can adversely affect the fund’s ability to maintain a $1.00 share price or prevent the fund from being able to take advantage of other investment opportunities.

Unusual market conditions, an unusually high volume of redemption requests or other similar conditions could cause the fund to be unable to pay redemption proceeds within a short period of time. If the fund is forced to sell securities at an unfavorable time and/or under unfavorable conditions, such sales may adversely affect the fund’s ability to maintain a $1.00 share price.

The fund is used as a cash management vehicle for the cash collateral received in connection with the securities lending program of the DWS family of funds. As a cash management vehicle for investment of cash collateral, the fund may be subject to greater shareholder concentrations and experience large purchases and redemptions

over a relatively short time period. Fund management considers these and other factors in constructing the fund's portfolio.

Prepayment and extension risk. When interest rates fall, issuers of high interest debt obligations may pay off the debts earlier than expected (prepayment risk), and the fund may have to reinvest the proceeds at lower yields. When interest rates rise, issuers of lower interest debt obligations may pay off the debts later than expected (extension risk), thus keeping the fund’s assets tied up in lower interest debt obligations. Ultimately, any unexpected behavior in interest rates could increase the volatility of the fund’s yield and could hurt fund performance. Prepayments could also create capital gains tax liability in some instances.

Risks of holding cash. The fund will at times hold cash positions, which may hurt the fund’s performance. Cash positions may also subject the fund to additional risks and costs, including any fees imposed by the fund’s custodian for large cash balances.

Operational and technology risk. Cyber-attacks, disruptions or failures that affect the fund’s service providers or counterparties, issuers of securities held by the fund, or other market participants may adversely affect the fund and its shareholders, including by causing losses for the fund or impairing fund operations. For example, the fund’s or its service providers’ assets or sensitive or confidential information may be misappropriated, data may be corrupted and operations may be disrupted (e.g., cyber-attacks, operational failures or broader disruptions may cause the release of private shareholder information or confidential fund information, interfere with the processing of shareholder transactions, impact the ability to calculate the fund’s net asset value and impede trading). Market events and disruptions also may trigger a volume of transactions that overloads current information technology and communication systems and processes, impacting the ability to conduct the fund’s operations.

While the fund and its service providers may establish business continuity and other plans and processes that seek to address the possibility of and fallout from cyber-attacks, disruptions or failures, there are inherent limitations in such plans and systems, including that they do not apply to third parties, such as fund counterparties, issuers of securities held by the fund or other market participants, as well as the possibility that certain risks have not been identified or that unknown threats may emerge in the future and there is no assurance that such plans and processes will be effective. Among other situations, disruptions (for example, pandemics or health crises) that cause prolonged periods of remote work or significant employee absences at the fund’s service providers could impact the ability to conduct the fund’s operations. In addition, the fund cannot directly control any

3

DWS Government & Agency Securities Portfolio

Summary Prospectus August 1, 2021

cybersecurity plans and systems put in place by its service providers, fund counterparties, issuers of securities held by the fund or other market participants.

Past Performance

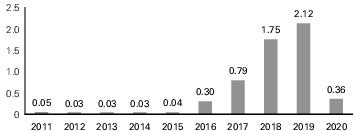

How a fund's returns vary from year to year can give an idea of its risk. Past performance may not indicate future results. All performance figures below assume that dividends were reinvested. The 7-day yield, which is often referred to as the “current yield,” is the income generated by the fund over a seven-day period. This amount is then annualized, which means that we assume the fund generates the same income every week for a year. For more recent performance figures and the current yield, go to institutional.dws.com/us/en-us/institutional/capabilities/liquidity-management.html (the Web site does not form a part of this prospectus) or call the telephone number included in this prospectus.

CALENDAR YEAR TOTAL RETURNS (%) (DWS Government Cash Institutional Shares)

Returns for other classes were different and are not shown here.

|

|

Returns

|

Period ending

|

|

Best Quarter

|

0.58%

|

June 30, 2019

|

|

Worst Quarter

|

0.01%

|

March 31, 2014

|

|

Year-to-Date

|

0.01%

|

June 30, 2021

|

Average Annual Total Returns

(For periods ended 12/31/2020 expressed as a %) (DWS Government Cash Institutional Shares)

(For periods ended 12/31/2020 expressed as a %) (DWS Government Cash Institutional Shares)

|

|

Class

Inception

|

1

Year

|

5

Years

|

10

Years

|

|

|

2/16/2007

|

0.36

|

1.06

|

0.55

|

Total returns would have been lower if operating expenses had not been reduced.

For more recent performance information, contact the financial services firm from which you obtained this prospectus.

Management

Investment Advisor

DWS Investment Management Americas, Inc.

Purchase and Sale of Fund Shares

Minimum Initial Investment

The minimum initial investment is $1,000,000, and there is no minimum additional investment.

The minimum investment requirement may be waived or lowered for investments effected through banks and other institutions that have entered into special arrangements with DWS Distributors, Inc. on behalf of the fund and for investments effected on a group basis by certain other entities and their employees, such as pursuant to a payroll deduction plan and for investments made in an Individual Retirement Account. The investment minimum may also be waived for certain other individuals such as trustees and officers of Cash Account Trust.

To Place Orders

The fund is available directly through DWS or through a financial representative, such as a broker or financial institution. You should contact a representative of your financial representative for instructions on how to buy or sell fund shares.

|

Mail

|

All Requests

|

DWS

Attn: Institutional Trading Desk

PO Box 219151

Kansas City, MO 64121-9151

|

|

Expedited Mail

|

DWS

210 West 10th Street

Kansas City, MO 64105-1614

|

|

|

Web Site

|

institutional.dws.com/us/en-us/

institutional/capabilities/liquidity-

management.html

|

|

|

Telephone

|

(800) 730-1313, M – F 8 a.m. – 6 p.m. ET

|

|

|

TDD Line

|

(800) 972-3006, M – F 8 a.m. – 7 p.m. ET

|

|

The fund is generally open on days when the New York Stock Exchange is open for regular trading. Initial investments must be sent by mail. You can make additional investments or sell shares of the fund on any business day by visiting our Web site, by mail, or by telephone; however you may have to elect certain privileges on your initial account application. If you are working with a financial representative, contact your financial representative for assistance with buying or selling fund shares.

Tax Information

The fund's distributions are generally taxable to you as ordinary income or capital gains, except when your investment is in an IRA, 401(k), or other tax-advantaged investment plan. Any withdrawals you make from such tax-advantaged investment plans, however, may be taxable to you.

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund, the Advisor, and/or the Advisor’s affiliates may pay the

4

DWS Government & Agency Securities Portfolio

Summary Prospectus August 1, 2021

intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

5

DWS Government & Agency Securities Portfolio

Summary Prospectus August 1, 2021 DGCFI-SUM

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ¡Felicidades! To Cadence's 2023 Latinx Students in Technology Scholarship Recipients

- Fuel Retailers Applaud EPA Action Allowing Summer Sales of E15

- Anodot Releases The State of Cloud Cost Optimization 2024 Report

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share