Form 497K BRANDES INVESTMENT TRUST

| Summary Prospectus January 28, 2023 |

|

Separately Managed Account Reserve Trust

SMARX

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, Reports to Shareholders, Statement of Additional Information and other information about the Fund online at https://www.brandes.com/us/funds/knowledgecenter/fund-library. You may also obtain this information at no cost by calling 1-800-395-3807 or by e-mail at [email protected]. The Fund’s Prospectus and Statement of Additional Information, both dated January 28, 2023, are incorporated by reference into this Summary Prospectus.

Investment Objective

The Brandes Separately Managed Account Reserve Trust (the “Separately Managed Account Reserve Trust” or “Fund”) seeks to maximize long-term total return.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

| Shareholder Fees (Fees paid directly from your investment) |

| None |

| Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment) | ||

| Management Fees (1),(2) | 0.00% | |

| Other Expenses (2),(3) | 0.00% | |

| Total Annual Fund Operating Expenses(2) | 0.00% |

| (1) | Investors pay any management fees, advisory fees or expenses at the wrap account level. The Fund does not pay any management fees, advisory fees or expenses to the Advisor or affiliates of the Advisor. |

| (2) | Investors in the Fund must be clients of “wrap account” programs sponsored by broker-dealers which have agreements with the Advisor, or certain other persons or entities. Investors pay management fees and other expenses at the wrap account level. See “Shareholder Information.” |

| (3) | Investors pay any ordinary expenses at the wrap account level. The Fund does not pay any ordinary expenses. |

| Example |

This Example illustrates the amount of expenses you could incur if the Advisor charged the Fund for its services.(1) This Example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The

Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||

| Portfolio Turnover |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 28.94% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests primarily in a diversified portfolio of debt securities. These include debt obligations issued or guaranteed by the U.S. Government and foreign governments and their agencies and instrumentalities, debt securities issued by U.S. and foreign companies, collateralized mortgage obligations, and U.S. and foreign mortgage-backed and asset-backed debt securities. The Fund may invest up to 60% of its total assets in non-U.S. dollar securities, and may engage in currency hedging. Brandes Investment Partners, L.P., the investment advisor to the Fund (the “Advisor”), uses the principles of value investing to analyze and select debt securities for the Fund’s investment portfolio. As part of this process, the Advisor reviews such measures as the issuer’s free cash flow, debt-to-equity ratio, earnings before interest, taxes, depreciation and amortization (“EBITDA”)-to-interest ratio, debt-to-EBITDA ratio, or other measures of credit worthiness in evaluating the securities of a particular issuer.

The Fund may invest in debt instruments of any maturity or with no maturity and it may invest in both investment-grade securities and non-investment grade securities (also known

| Summary Prospectus January 28, 2023 | 1 of 8 | Brandes Investment Trust |

as “high-yield bonds” or “junk bonds”). Up to 60% of the Fund’s total debt securities may be junk bonds. The Fund invests in debt securities that can be purchased at prices or yield premiums over U.S. Treasury securities (or other relatively risk-free securities) which the Advisor believes to be attractive based on the Advisor’s assessment of each security’s intrinsic value.

The Advisor primarily uses effective duration and modified duration measures (“duration”) to approximate the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates. Similarly, a portfolio with a longer average portfolio duration will be more sensitive to changes in interest rates than a portfolio with a shorter average portfolio duration. The average portfolio duration of the Fund typically will vary and, under normal market conditions, will range between one and ten years.

The Advisor will typically sell a security from the Fund’s portfolio when the Advisor’s research process identifies a significantly better investment opportunity. The Advisor may also sell certain portfolio securities from time to time in order to adjust the average maturity, duration or yield of the Fund’s portfolio or to meet requirements for redemption of Fund shares.

Principal Investment Risks

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. Principal risks of the Fund are as follows:

Market Risk. The market prices of the fund’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, tariffs and trade disruptions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. If the market prices of the fund’s securities fall, the value of your investment in the fund will go down.

Issuer Risk. The market price of a security can go up or down more than the market, or perform differently from the market, due to factors specifically relating to the security’s issuer, such as disappointing earnings reports, reduced demand for the issuer’s goods or services, poor management performance, major litigation relating to the issuer, changes in government regulation affecting the issuer or the competitive environment. The Fund may experience a substantial or complete loss on any investment.

Credit Risk. Fixed income securities are subject to varying degrees of credit risk, which are often reflected in credit ratings. The value of an issuer’s securities held by the Fund may decline in response to adverse developments with respect to the issuer or if the issuer or any guarantor is, or is perceived to be unwilling or unable to pay or perform in a timely fashion. The Fund could be delayed or hindered in its enforcement of rights against an issuer, guarantor or counterparty. Subordinated securities (meaning securities

that rank below other securities with respect to payments and/or claims on the issuer’s assets) are more likely to suffer a credit loss than non-subordinated securities of the same issuer and will be disproportionately affected by a default, downgrade or perceived decline in creditworthiness. The Fund may experience a substantial or complete loss on any investment.

Interest Rate Risk. As with most fixed income funds, the income on and value of your shares in the Fund will fluctuate along with interest rates. When interest rates rise, the market prices of the debt securities the Fund owns usually decline. When interest rates fall, the prices of these securities usually increase. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. Interest rates have been historically low, so the Fund faces a heightened risk that rates may rise.

Liquidity Risk. Liquidity risk exists when particular investments are or become difficult or impossible to purchase or sell. Markets may become illiquid when, for example, there are few, if any, interested buyers or sellers or when dealers are unwilling or unable to make a market for certain securities. As a general matter, dealers recently have been less willing to make markets for fixed income securities. During times of market turmoil, there have been, and may be, no buyers for entire asset classes, including U.S. Treasury securities. The Fund’s investments in illiquid securities may reduce the return of the Fund because it may be unable to sell such illiquid securities at an advantageous time or price. Illiquid securities may also be difficult to value.

Duration Risk. The longer the maturity of a fixed income security, the more its price will vary as levels of interest rates change. The Fund can hold securities with long-dated maturities. Duration is a measure of how sensitive a security or portfolio is to moves in interest rates. If and when the Fund’s duration is significantly longer than that of its benchmark index, the Fund’s portfolio is likely to be more volatile when market interest rates move materially.

The remaining principal risks are presented in alphabetical order. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears.

Active Management Risk. The Advisor is an active manager, and the Fund’s investments may differ from the benchmark. The value of your investment may go down if the Advisor’s judgment about the attractiveness or value of, or market trends affecting, a particular security, industry, sector or region, or about market movements, is incorrect or does not produce the desired results, or if there are imperfections, errors or limitations in the models, tools or data used by the Advisor.

Currency Risk. Because the Fund invests in securities denominated in foreign currencies, the U.S. dollar values of its investments fluctuate as a result of changes in foreign exchange rates. Such changes will also affect the Fund’s income.

Foreign Securities Risk. Investing in securities of foreign issuers or issuers with significant exposure to foreign

| Summary Prospectus January 28, 2023 | 2 of 8 | Brandes Investment Trust |

markets involves additional risks. Foreign markets can be less liquid, less regulated, less transparent and more volatile than U.S. markets. The value of the fund’s foreign investments may decline, sometimes rapidly or unpredictably, because of factors affecting the particular issuer as well as foreign markets and issuers generally, such as unfavorable or unsuccessful government actions, reduction of government or central bank support, wars, tariffs and trade disruptions, political or financial instability, social unrest or other adverse economic or political developments. Changes in currency rates and exchange control regulations, and the imposition of sanctions, confiscations, trade restrictions, and other government restrictions by the United States and/or other governments may adversely affect the value of the Fund’s investments in foreign securities. These risks can be elevated in emerging markets. Investments in emerging markets are generally more volatile than investments in developed foreign markets.

Mortgage- and Asset-Backed Securities Risk. Mortgage- and asset-backed securities may decline in value when defaults on the underlying mortgages or assets occur and may exhibit additional volatility in periods of changing interest rates. When interest rates decline, the prepayment of mortgages or assets underlying such securities may require the Fund to reinvest that money at lower prevailing interest rates, resulting in reduced returns. When interest rates rise, prepayments may decline, resulting in longer-than-anticipated maturities.

Non-Investment Grade (High Yield Bond) Securities Risk. Below investment grade debt securities are speculative and involve a greater risk of default and price change due to changes in the issuer’s creditworthiness. The market prices of these debt securities may fluctuate more than the market prices of investment grade debt securities and may decline significantly in periods of general economic difficulty. These securities may be difficult or impossible to sell during periods of uncertainty or market turmoil.

Recent Events. The COVID-19 pandemic, Russia’s invasion of Ukraine, and higher inflation have resulted in extreme volatility in the financial markets, economic downturns around the world, and severe losses, particularly to some sectors of the economy and individual issuers. Financial markets remain volatile and disrupted, and the liquidity of many instruments remains reduced. There continue to be significant disruptions to business operations, including business closures; strained healthcare systems; disruptions to supply chains and employee availability; large fluctuations in consumer demand; and widespread uncertainty regarding the long-term effects of the pandemic. Government intervention into the economies and financial markets around the world has resulted in high levels of public debt. These circumstances may continue to adversely affect economies and markets, and also may continue to adversely affect the value and liquidity of the Fund’s investments and negatively impact the Fund’s performance.

U.S. Government Obligations Risk. Securities issued by the U.S. Treasury and certain U.S. government agencies are backed by the full faith and credit of the U.S. government. While this guarantee should ensure the timely repayment of all principal and interest, it does not mean that the market value of such securities cannot be adversely impacted by changes in interest rates, similar to non-U.S. government-issued fixed income securities. Securities issued by certain other U.S. government-related entities, principally Fannie Mae and Freddie Mac, are often categorized as U.S. government obligations, but do not enjoy the full backing of the U.S. government.

Value Style Risk. The value style of investing has caused the Fund’s performance to deviate from the performance of market benchmarks and other managers for substantial periods of time and may do so in the future.

Performance

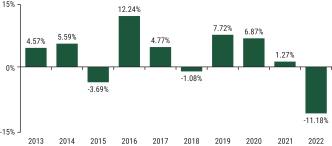

The following information shows you how the Fund has performed and provides some indication of the risks of investing in the Fund by showing how its performance has varied from year to year. The bar chart shows changes in the yearly performance of the Fund for the past ten years. The table below compares the Fund’s total return over time to a broad-based index and to a secondary benchmark which provides an additional market comparison. The chart and table assume reinvestment of dividends and distributions. Of course, past performance, before and after taxes, does not indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.brandesfunds.com. Performance does not reflect the fees charged in the wrap program.

Year-by-Year Total Returns as of December 31, for Class I Shares

| Best Quarter | 2Q 2016 | 5.11% | ||

| Worst Quarter | 2Q 2022 | -6.86% |

| Summary Prospectus January 28, 2023 | 3 of 8 | Brandes Investment Trust |

Average Annual Total Returns For periods ended December 31, 2022

(Returns reflect applicable sales charges)

| Brandes Separately Managed Account Reserve Trust |

1 Year | 5 Year | 10 Year | |||||||||

| Return Before Taxes | -11.18% | 0.48% | 2.51% | |||||||||

| Return After Taxes on Distributions |

-12.64% | -1.10% | 0.64% | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

-6.60% | -0.26% | 1.12% | |||||||||

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) | -13.01% | 0.02% | 1.06% | |||||||||

| Bloomberg U.S. Intermediate Credit Index (reflects no deduction for fees, expenses or taxes) | -9.10% | 1.08% | 1.76% | |||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who are exempt from tax or hold their Fund shares through tax-advantaged accounts such as 401(k) plans or individual retirement accounts.

The “Return After Taxes on Distributions and Sale of Fund Shares” is higher than other return figures when a capital loss occurs upon the redemption of Fund shares.

Management

Investment Advisor. Brandes Investment Partners, L.P.

| Portfolio Managers | Position with Advisor |

Managed the Fund Since: | ||

| Charles S. Gramling, CFA | Director, Fixed Income and Fixed Income Investment Committee Member | 2007 | ||

| David J. Gilson, CFA | Senior Fixed Income Analyst and Fixed Income Investment Committee Member | 2007 | ||

| Timothy M. Doyle, CFA | Fixed Income Portfolio Manager and Fixed Income Investment Committee Member | 2012 |

Purchase and Sale of Fund Shares

In most cases, purchase and redemption orders are effected based on instructions from the wrap program advisor (in its capacity as investment advisor or sub-advisor to the applicable wrap account) to the broker-dealer who executes trades for the account. The sponsor or broker-dealer acting on behalf of an eligible client must submit a purchase or redemption order to the Transfer Agent, by

telephone at 1-800-395-3807, either directly or through an appropriate clearing agency. The Fund has no maximum or minimum initial investment requirements.

Tax Information

The Fund’s distributions are taxed as ordinary income or capital gains, unless you are investing through a tax-advantaged account, such as a 401(k) plan or an individual retirement account. Distributions on investments made through tax-advantaged accounts, such as 401(k) plans or IRAs, may be taxed later upon withdrawal of assets from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| Summary Prospectus January 28, 2023 | 4 of 8 | Brandes Investment Trust |

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Sasken and JOYNEXT forge strategic partnership to accelerate innovation and expand global footprint

- GPTBots.AI Unveils Asia’s First “On-premise AI Bot Platform”

- Mercantile Bank Corporation Declares Regular Cash Dividend

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share