Form 497K BLACKROCK INDEX FUNDS,

APRIL 30, 2021

|

Summary Prospectus |

BlackRock Index Funds, Inc. | Investor and Institutional Shares

| • | iShares MSCI EAFE International Index Fund |

| Investor A: MDIIX • Institutional: MAIIX |

Before you invest, you may want to review the Fund’s

prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus (including amendments and supplements), reports to shareholders and other information about the Fund, including the Fund’s

statement of additional information, online at http://www.blackrock.com/prospectus. You can also get this information at no cost by calling (800) 441-7762 or by sending an e-mail request to

[email protected], or from your financial professional. The Fund’s prospectus and

statement of additional information, both dated April 30, 2021, as amended and supplemented from time to time, are incorporated by reference into (legally made a part of) this Summary Prospectus.

This

Summary Prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or

disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary is a criminal offense.

Not FDIC Insured • May Lose Value • No Bank

Guarantee

Summary Prospectus

Key Facts About iShares MSCI EAFE International Index

Fund

Investment Objective

The investment objective of iShares MSCI EAFE International

Index Fund (“MSCI EAFE International Index Fund”or the “Fund”), a series of BlackRock Index Funds, Inc. (the “Corporation”), is to match the performance of the MSCI EAFE Index (Europe, Australasia, Far East) (the

“MSCI EAFE Index” or the “Underlying Index”) in U.S. dollars with net dividends as closely as possible before the deduction of Fund expenses.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if

you buy, hold and sell shares of MSCI EAFE International Index Fund. You may pay other fees, such as brokerage commissions and other fees to your financial professional or your selected securities dealer, broker,

investment adviser, service provider or industry professional (including BlackRock Advisors, LLC (“BlackRock”) and its affiliates) (each, a “Financial Intermediary”), which are not reflected in the table and example

below.

| Annual

Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Investor

A Shares |

Institutional

Shares | ||

| Management Fee1 | 0.01% | 0.01% | ||

| Distribution and/or Service (12b-1) Fees | 0.25% | None | ||

| Other Expenses2,4 | 0.08% 3 | 0.08% | ||

| Administration Fees2 | 0.08% 3 | 0.08% | ||

| Independent Expenses4 | — | — | ||

| Total Annual Fund Operating Expenses | 0.34% 3 | 0.09% | ||

| Fee Waivers and/or Expense Reimbursements1,4 | — | — | ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements1,4 | 0.34% | 0.09% |

| 1 | As described in the “Management of the Funds” section of the Fund’s prospectus beginning on page 40, BlackRock has contractually agreed to waive the management fee with respect to any portion of the Fund’s assets estimated to be attributable to investments in other equity and fixed-income mutual funds and exchange-traded funds managed by BlackRock or its affiliates that have a contractual management fee, through June 30, 2023. In addition, BlackRock has contractually agreed to waive its management fees by the amount of investment advisory fees the Fund pays to BlackRock indirectly through its investment in money market funds managed by BlackRock or its affiliates, through June 30, 2023. The contractual agreements may be terminated upon 90 days’ notice by a majority of the non-interested directors of the Corporation or by a vote of a majority of the outstanding voting securities of the Fund. |

| 2 | Administration Fees have been restated to reflect current fees. |

| 3 | Total Annual Fund Operating Expenses do not correlate to the ratios of expenses to average net assets given in the Fund’s most recent annual report, which do not include the restatement of the Administration Fees to reflect current fees. |

| 4 | Independent Expenses consist of the Fund’s allocable portion of the fees and expenses of the independent directors of the Corporation, counsel to such independent directors and the independent registered public accounting firm that provides audit services to the Fund. BlackRock has contractually agreed to reimburse, or provide offsetting credits to, the Fund for Independent Expenses through June 30, 2031. After giving effect to such contractual arrangements, Independent Expenses will be 0.00%. Such contractual arrangements may not be terminated prior to July 1, 2031 without the consent of the Board of Directors of the Corporation. |

Example:

This Example is intended to help you compare the cost of investing in the

Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your

investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor A Shares | $35 | $109 | $191 | $431 |

| Institutional Shares | $ 9 | $ 29 | $ 51 | $115 |

2

Portfolio Turnover:

MSCI EAFE International Index Fund pays transaction costs, such as

commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs,

which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, MSCI EAFE International Index Fund’s portfolio turnover rate was 8% of the average value of

its portfolio.

Principal Investment Strategies of the

Fund

MSCI EAFE International Index Fund employs a

“passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the MSCI EAFE Index. The Fund will be substantially invested in securities in the MSCI

EAFE Index, and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the MSCI EAFE Index. The

Fund may change its target index if Fund management believes a different index would better enable the Fund to match the performance of the market segment represented by the current index.

MSCI EAFE International Index Fund invests in a statistically

selected sample of equity securities included in the MSCI EAFE Index and in derivative instruments linked to the MSCI EAFE Index. Equity securities include common stock, preferred stock and securities or other instruments whose price is linked to

the value of common stock. The Fund will, under normal circumstances, invest in all of the countries represented in the MSCI EAFE Index. The Fund may not, however, invest in all of the companies within a country represented in the MSCI EAFE Index,

or in the same weightings as in the MSCI EAFE Index.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your

investment in MSCI EAFE International Index Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment

may not perform as well as other similar investments. The following is a summary description of the principal risks of investing in the Fund. The order of the below risk factors does not indicate the significance of any particular risk factor.

| ■ | Equity Securities Risk — Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. |

| ■ | Foreign Securities Risk — Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. These risks include: |

| ■ | The Fund generally holds its foreign securities and cash in foreign banks and securities depositories, which may be recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight. |

| ■ | Changes in foreign currency exchange rates can affect the value of the Fund’s portfolio. |

| ■ | The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position. |

| ■ | The governments of certain countries, or the U.S. Government with respect to certain countries, may prohibit or impose substantial restrictions through capital controls and/or sanctions on foreign investments in the capital markets or certain industries in those countries, which may prohibit or restrict the ability to own or transfer currency, securities, derivatives or other assets. |

| ■ | Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws. |

| ■ | Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities not typically associated with settlement and clearance of U.S. investments. |

| ■ | The Fund’s claims to recover foreign withholding taxes may not be successful, and if the likelihood of recovery of foreign withholding taxes materially decreases, due to, for example, a change in tax regulation or approach in the foreign country, accruals in the Fund’s net asset value for such refunds may be written down partially or in full, which will adversely affect the Fund’s net asset value. |

3

| ■ | The European financial markets have recently experienced volatility and adverse trends due to concerns about economic downturns in, or rising government debt levels of, several European countries. These events may spread to other countries in Europe. These events may affect the value and liquidity of certain of the Fund’s investments. |

| ■ | Index Fund Risk — An index fund has operating and other expenses while an index does not. As a result, while the Fund will attempt to track the MSCI EAFE Index as closely as possible, it will tend to underperform the index to some degree over time. If an index fund is properly correlated to its stated index, the fund will perform poorly when the index performs poorly. |

| ■ | Index-Related Risk — There is no guarantee that the Fund’s investment results will have a high degree of correlation to those of the Underlying Index or that the Fund will achieve its investment objective. Market disruptions or high volatility, other unusual market circumstances and regulatory restrictions could have an adverse effect on the Fund’s ability to adjust its exposure to the required levels in order to track the Underlying Index. Errors in index data, index computations or the construction of the Underlying Index in accordance with its methodology may occur from time to time and may not be identified and corrected by the index provider for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. Unusual market conditions may cause the index provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition. |

| ■ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

| A recent outbreak of an infectious coronavirus has developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time. | |

| ■ | Passive Investment Risk — Because BlackRock does not select individual companies in the index that the Fund tracks, the Fund may hold securities of companies that present risks that an investment adviser researching individual securities might seek to avoid. |

Performance Information

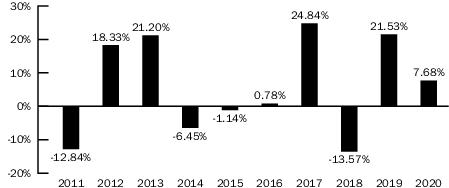

The information shows how the Fund’s performance has

varied year by year and provides some indication of the risks of investing in the Fund. The table compares the Fund’s performance to that of the MSCI EAFE Index. To the extent that dividends and distributions have been paid by the Fund, the

performance information for the Fund in the chart and table assumes reinvestment of the dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. The table includes

all applicable fees. If BlackRock and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. Updated information on the Fund’s performance, including its current

net asset value, can be obtained by visiting www.blackrock.com or can be obtained by phone at (800) 882-0052.

4

Investor A Shares

ANNUAL TOTAL RETURNS

MSCI EAFE International Index Fund

As of 12/31

As of 12/31

During the ten-year

period shown in the bar chart, the highest return for a quarter was 16.10% (quarter ended June 30, 2020) and the lowest return for a quarter was -23.37% (quarter ended March 31, 2020).

| For

the periods ended 12/31/20 Average Annual Total Returns |

1 Year | 5 Years | 10 Years |

| iShares MSCI EAFE International Index Fund — Investor A Shares | |||

| Return Before Taxes | 7.68% | 7.31% | 5.10% |

| Return After Taxes on Distributions | 7.40% | 6.78% | 4.55% |

| Return After Taxes on Distributions and Sale of Fund Shares | 5.01% | 5.81% | 4.01% |

| iShares MSCI EAFE International Index Fund — Institutional Shares | |||

| Return Before Taxes | 8.03% | 7.59% | 5.39% |

| MSCI

EAFE Index (Europe, Australasia, Far East) (Reflects no deduction for fees, expenses or taxes) |

7.82% | 7.45% | 5.51% |

After-tax returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not

relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Investor A Shares only, and the after-tax returns for Institutional Shares will

vary.

Investment Manager

MSCI EAFE International Index Fund’s investment manager

is BlackRock Advisors, LLC (previously defined as “BlackRock”). MSCI EAFE International Index Fund’s sub-adviser is BlackRock Fund Advisors (the “Sub-Adviser”). Where applicable, “BlackRock” refers also to

the Sub-Adviser.

Portfolio Managers

| Name | Portfolio

Manager of the Fund Since |

Title |

| Alan Mason | 2014 | Managing Director of BlackRock, Inc. |

| Suzanne Henige, CFA | 2020 | Director of BlackRock, Inc. |

| Jennifer Hsui, CFA | 2016 | Managing Director of BlackRock, Inc. |

| Amy Whitelaw | 2019 | Managing Director of BlackRock, Inc. |

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund each day the New

York Stock Exchange is open. To purchase or sell shares you should contact your Financial Intermediary, or, if you hold your shares through the Fund, you should contact the Fund by phone at (800) 441-7762, by mail (c/o BlackRock Funds, P.O. Box

9819, Providence, Rhode Island

5

02940-8019), or by the Internet at www.blackrock.com. The Fund’s

initial and subsequent investment minimums generally are as follows, although the Fund may reduce or waive the minimums in some cases:

| Investor A Shares | Institutional Shares | |

| Minimum

Initial Investment |

$1,000

for all accounts except: • $50, if establishing an Automatic Investment Plan. • There is no investment minimum for employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs). • There is no investment minimum for certain fee-based programs. |

There

is no minimum initial investment for: • Employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs), state sponsored 529 college savings plans, collective trust funds, investment companies or other pooled investment vehicles, unaffiliated thrifts and unaffiliated banks and trust companies, each of which may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares. • Clients of Financial Intermediaries that: (i) charge such clients a fee for advisory, investment consulting, or similar services or (ii) have entered into an agreement with the Fund’s distributor to offer Institutional Shares through a no-load program or investment platform. • Clients investing through a self-directed IRA brokerage account program sponsored by a retirement plan record-keeper, provided that such program offers only mutual fund options and that the program maintains an account with the Fund on an omnibus basis. $2 million for individuals and “Institutional Investors,” which include, but are not limited to, endowments, foundations, family offices, local, city, and state governmental institutions, corporations and insurance company separate accounts who may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares.$1,000 for: • Clients investing through Financial Intermediaries that offer such shares on a platform that charges a transaction based sales commission outside of the Fund. • Tax-qualified accounts for insurance agents that are registered representatives of an insurance company’s broker-dealer that has entered into an agreement with the Fund’s distributor to offer Institutional Shares, and the family members of such persons. |

| Minimum

Additional Investment |

$50 for all accounts (with the exception of certain employer-sponsored retirement plans which may have a lower minimum). | No subsequent minimum. |

Tax Information

The Fund’s dividends and distributions may be subject to

U.S. federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a qualified tax-exempt plan described in section 401(a) of the Internal Revenue Code of 1986, as amended,

in which case you may be subject to U.S. federal income tax when distributions are received from such tax-deferred arrangements.

6

Payments to Broker/Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through a Financial

Intermediary, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by

influencing the Financial Intermediary and your individual financial professional to recommend the Fund over another investment.

Ask your individual financial professional or visit your

Financial Intermediary’s website for more information.

7

INVESTMENT COMPANY ACT FILE # 811-7899

SPRO-INDEX2-0421

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Danske Bank A/S, transactions by persons discharging managerial responsibilities

- NEXEN Tire hosts ‘2024 Purple Summit Korea’

- SalMar – Integrated annual report 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share