Form 497K BLACKROCK FUNDS

NOVEMBER 28, 2022

|

Summary Prospectus |

BlackRock FundsSM | Investor A and Institutional Shares

| • | BlackRock Short Obligations Fund |

| Investor A: BASOX • Institutional: BISOX |

Before you invest, you may want to review the Fund’s

prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus (including amendments and supplements), reports to shareholders and other information about the Fund, including the Fund’s

statement of additional information, online at http://www.blackrock.com/cash. You can also get this information at no cost by calling (800) 441-7762 or by sending an e-mail request to

[email protected], or from your financial professional. The Fund’s prospectus and statement of

additional information, both dated November 28, 2022, as amended and supplemented from time to time, are incorporated by reference into (legally made a part of) this Summary Prospectus.

This

Summary Prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or

disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary is a criminal offense.

Not FDIC Insured • May Lose Value • No Bank

Guarantee

Summary Prospectus

Key Facts About BlackRock Short Obligations Fund

Investment Objective

The investment objective of BlackRock Short Obligations Fund

(“Short Obligations Fund” or the “Fund”), a series of BlackRock FundsSM (the “Trust”), is to seek current income consistent with preservation

of capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if

you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to your financial professional or your selected securities dealer, broker, investment adviser, service

provider or industry professional (including BlackRock Advisors, LLC (“BlackRock”) and its affiliates) (each, a “Financial Intermediary”), which are not reflected in the table and example below. More information about

these fees and expenses is available from your Financial Intermediary and in the “Details About the Share Classes” and the “Intermediary-Defined Sales Charge Waiver Policies” sections on pages 22 and A-1, respectively, of the

Fund’s prospectus and in the “Purchase of Shares” section on page II-90 of Part II of the Fund’s Statement of Additional Information.

| Shareholder

Fees (fees paid directly from your investment) |

Investor

A Shares |

Institutional

Shares | ||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None | ||

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) | None 1 | None | ||

| Annual

Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Investor

A Shares |

Institutional

Shares | ||

| Management Fee2 | 0.24% | 0.24% | ||

| Distribution and/or Service (12b-1) Fees | 0.25% | None | ||

| Other Expenses | 0.12% | 0.12% | ||

| Total Annual Fund Operating Expenses | 0.61% | 0.36% | ||

| Fee Waivers and/or Expense Reimbursements2,3 | (0.01)% | (0.01)% | ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements2,3 | 0.60% | 0.35% |

| 1 | There is no contingent deferred sales charge (“CDSC”) on Investor A Shares purchased directly. However, a CDSC of up to 1.00% may apply to certain redemptions of the Fund’s Investor A Shares purchased in an exchange transaction for Investor A Shares of a fund advised by BlackRock or its affiliates where no initial sales charge was paid at the time of purchase of such fund (each, an “Investor A Load-Waived BlackRock Fund”) as part of an investment of $1,000,000 (lesser amounts may apply depending on the Investor A Load-Waived BlackRock Fund) or more. The Investor A Shares CDSC is only charged upon redemptions of Investor A Shares within 18 months after you originally acquired such Investor A Shares of the Investor A Load-Waived BlackRock Fund (a shorter holding period may apply depending on the Investor A Load-Waived BlackRock Fund), unless you qualify for a waiver. There is no CDSC charged on redemptions if you have owned your Investor A Shares for more than 18 months (or for a shorter holding period as applicable) as measured from your original purchase of Investor A Shares that you exchanged into Investor A Shares of the Fund or if you purchase Investor A Shares of the Fund not through an exchange. |

| 2 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 35, BlackRock has contractually agreed to waive the management fee with respect to any portion of the Fund’s assets estimated to be attributable to investments in other equity and fixed-income mutual funds and exchange-traded funds managed by BlackRock or its affiliates that have a contractual management fee, through June 30, 2024. In addition, BlackRock has contractually agreed to waive its management fees by the amount of investment advisory fees the Fund pays to BlackRock indirectly through its investment in money market funds managed by BlackRock or its affiliates, through June 30, 2024. The contractual agreements may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

| 3 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 35, BlackRock has contractually agreed to waive and/or reimburse fees and/or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements (excluding Dividend Expense, Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) to 0.60% (for Investor A Shares) and 0.35% (for Institutional Shares) of average daily net assets through June 30, 2024. The contractual agreements may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

Example:

This Example is intended to help you compare the cost of investing in the

Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your

investment has a 5%

2

return each year and that the Fund’s operating expenses remain the

same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor A Shares1 | $61 | $194 | $339 | $761 |

| Institutional Shares | $36 | $115 | $201 | $455 |

1 These expense figures do not reflect the imposition of the CDSC which may be deducted upon the redemption of Investor A Shares of the

Fund received in an exchange transaction for Investor A Shares of an Investor A Load-Waived BlackRock Fund as described in the applicable prospectuses. No CDSC is deducted upon the redemption of Investor A Shares of the Fund that are not acquired by

exchange.

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual

fund operating expenses or in the Example, affect the Fund’s performance. For the fiscal year ended July 31, 2022, the Fund’s portfolio turnover rate was 36% of the average value of its portfolio.

Principal Investment Strategies of the Fund

Under normal market conditions, Short Obligations Fund will

invest in U.S. dollar-denominated investment grade and short-term fixed and floating rate debt securities maturing in three years or less (with certain exceptions) and will maintain a dollar-weighted average maturity of 180 days or less and a

dollar-weighted average life of 365 days or less.

To

achieve its investment objective, the Fund may invest in corporate securities, mortgage- and asset-backed securities, and money market instruments, including government, U.S. and foreign bank and commercial obligations, obligations issued by or on

behalf of states, territories and possessions of the United States, the District of Columbia and their respective authorities, agencies, instrumentalities and political subdivisions and derivative securities such as beneficial interests in municipal

trust certificates and partnership trusts, and repurchase agreements.

The Fund may invest in variable and floating rate instruments

and when-issued and delayed delivery securities.

The

Fund invests a significant portion of its assets in securities issued by financial services companies, including banks, broker-dealers and insurance companies, and repurchase agreements secured by such obligations.

Investment grade securities purchased by the Fund (or the

issuers of such securities) will carry a rating of BBB-, or equivalent, or higher by at least one nationally recognized statistical rating organization (“NRSRO”) and short-term investments (or the issuers of such securities) will carry a

rating in the highest two rating categories of at least one NRSRO (e.g., A-2, P-2 or F2 or better by Standard & Poor’s Ratings Services, Moody’s Investors Service, Inc., or Fitch Ratings Inc., respectively), or if such investments

are unrated, determined to be of comparable quality by BlackRock, at the time of investment.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your

investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar

investments. The following is a summary description of the principal risks of investing in the Fund. The relative significance of each risk factor below may change over time and you should review each risk factor carefully.

| ■ | Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. |

| ■ | Interest Rate Risk — Interest rate risk is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter-term securities. Due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. Very low or negative interest rates may magnify interest rate risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. The Fund may be subject to a greater risk of rising interest rates due to the recent period of historically low interest rates. The Federal Reserve has recently begun to raise the federal funds rate as part of its efforts to address rising inflation. There is a risk that interest rates will continue to rise, which will likely drive down the prices of bonds and other fixed-income securities. |

3

| Changing interest rates may have unpredictable effects on markets, may result in heightened market volatility and may detract from the Fund’s ability to achieve its investment objective. | |

| ■ | Financial Services Industry Risk — Because the Fund invests a significant portion of its assets in the financial services industry, the Fund will be more susceptible to any economic, business, political or other developments which generally affect this industry sector. As a result, the Fund will be exposed to a large extent to the risks associated with that industry, such as government regulation, the availability and cost of capital funds, consolidation and general economic conditions. Financial services companies are also exposed to losses if borrowers and other counterparties experience financial problems and/or cannot repay their obligations. |

| When interest rates go up, the value of securities issued by many types of financial services companies generally goes down. In many countries, financial services and the companies that provide them are regulated by governmental entities, which can increase costs for new services or products and make it difficult to pass increased costs on to consumers. In certain areas, deregulation of financial services companies has resulted in increased competition and reduced profitability for certain companies. | |

| The profitability of many types of financial services companies may be adversely affected in certain market cycles, including periods of rising interest rates, which may restrict the availability and increase the cost of capital, and declining economic conditions, which may cause credit losses due to financial difficulties of borrowers. Because many types of financial services companies are vulnerable to these economic cycles, the Fund’s investments may lose value during such periods. | |

| ■ | Extension Risk — When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these securities to fall. |

| ■ | Foreign Exposure Risk — Securities issued or supported by foreign entities, including foreign banks and corporations, may involve additional risks and considerations. Extensive public information about the foreign issuer may not be available, and unfavorable political, economic or governmental developments in the foreign country involved could affect the payment of principal and interest. |

| ■ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

| An outbreak of an infectious coronavirus (COVID-19) that was first detected in December 2019 developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. Although vaccines have been developed and approved for use by various governments, the duration of the pandemic and its effects cannot be predicted with certainty. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time. | |

| ■ | Mortgage- and Asset-Backed Securities Risks — Mortgage- and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables held in trust. Mortgage- and asset-backed securities are subject to credit, interest rate, prepayment and extension risks. These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities. |

| ■ | Municipal Securities Risks — Municipal securities risks include the ability of the issuer to repay the obligation, the relative lack of information about certain issuers of municipal securities, and the possibility of future legislative changes which could affect the market for and value of municipal securities. These risks include: |

| General Obligation Bonds Risks — Timely payments depend on the issuer’s credit quality, ability to raise tax revenues and ability to maintain an adequate tax base. | |

| Revenue Bonds Risks — These payments depend on the money earned by the particular facility or class of facilities, or the amount of revenues derived from another source. |

4

| Private Activity Bonds Risks — Municipalities and other public authorities issue private activity bonds to finance development of industrial facilities for use by a private enterprise. The private enterprise pays the principal and interest on the bond, and the issuer does not pledge its full faith, credit and taxing power for repayment. | |

| Moral Obligation Bonds Risks — Moral obligation bonds are generally issued by special purpose public authorities of a state or municipality. If the issuer is unable to meet its obligations, repayment of these bonds becomes a moral commitment, but not a legal obligation, of the state or municipality. | |

| Municipal Notes Risks — Municipal notes are shorter term municipal debt obligations. If there is a shortfall in the anticipated proceeds, the notes may not be fully repaid and the Fund may lose money. | |

| Municipal Lease Obligations Risks — In a municipal lease obligation, the issuer agrees to make payments when due on the lease obligation. Although the issuer does not pledge its unlimited taxing power for payment of the lease obligation, the lease obligation is secured by the leased property. | |

| Tax-Exempt Status Risk — The Fund and its investment manager will rely on the opinion of issuers’ bond counsel and, in the case of derivative securities, sponsors’ counsel, on the tax-exempt status of interest on municipal bonds and payments under derivative securities. Neither the Fund nor its investment manager will independently review the bases for those tax opinions, which may ultimately be determined to be incorrect and subject the Fund and its shareholders to substantial tax liabilities. | |

| ■ | Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the Fund may have to invest the proceeds in securities with lower yields. |

| ■ | Repurchase Agreements Risk— If the other party to a repurchase agreement defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security and the market value of the security declines, the Fund may lose money. |

| ■ | Treasury Obligations Risk — Direct obligations of the U.S. Treasury have historically involved little risk of loss of principal if held to maturity. However, due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. |

| ■ | U.S. Government Obligations Risk — Certain securities in which the Fund may invest, including securities issued by certain U.S. Government agencies and U.S. Government sponsored enterprises, are not guaranteed by the U.S. Government or supported by the full faith and credit of the United States. |

| ■ | Variable and Floating Rate Instrument Risk — Variable and floating rate securities provide for periodic adjustment in the interest rate paid on the securities. These securities may be subject to greater illiquidity risk than other fixed income securities, meaning the absence of an active market for these securities could make it difficult for the Fund to dispose of them at any given time. |

| ■ | When-Issued and Delayed Settlement Transactions Risk — When-issued and delayed delivery securities involve the risk that the security the Fund buys will lose value prior to its delivery. There also is the risk that the security will not be issued or that the other party to the transaction will not meet its obligation. If this occurs, the Fund may lose both the investment opportunity for the assets it set aside to pay for the security and any gain in the security’s price. |

Performance Information

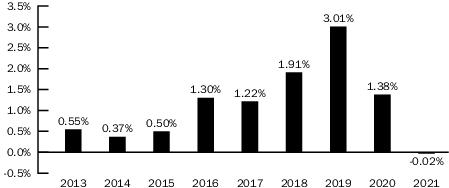

Investor A Shares of the Fund commenced operations on March 9,

2018 and Institutional Shares of the Fund commenced operations on July 9, 2013. As a result, the returns in the table for Investor A Shares, prior to commencement of operations on March 9, 2018, and the returns in the bar chart and table for

Institutional Shares, prior to commencement of operations on July 9, 2013, are based on the Fund’s Class K Shares (designated BlackRock Shares prior to September 1, 2015), adjusted to reflect the fees and expenses applicable to Investor A

Shares and Institutional Shares, respectively.

The

information shows you how the performance for the Fund has varied for the periods since inception and provides some indication of the risks of investing in the Fund. The bar chart shows the returns for Institutional Shares of the Fund for the

complete calendar years since the commencement of the Fund’s operations. The table compares the Fund’s performance to that of the ICE BofA 6-Month U.S. Treasury Bill Index. To the extent that dividends and distributions have been paid by

the Fund, the performance for the Fund in the chart and table assumes reinvestment of the dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. The table includes

all applicable fees. If BlackRock and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. Updated information on the Fund’s performance, including its current

net asset value, can be obtained by visiting www.blackrock.com/cash or can be obtained by phone at (800) 882-0052.

5

Institutional Shares

ANNUAL TOTAL RETURNS

BlackRock Short Obligations Fund

As of 12/31

As of 12/31

During the periods shown

in the bar chart, the highest return for a quarter was 1.53% (quarter ended June 30, 2020) and the lowest return for a quarter was -0.44% (quarter ended March 31, 2020). The year-to-date return as of September 30, 2022 was -0.40%.

| For

the periods ended 12/31/21 Average Annual Total Returns |

1 Year | 5 Years | Since

Inception (November 15, 2012) |

| BlackRock Short Obligations Fund — Institutional Shares | |||

| Return Before Taxes | (0.02)% | 1.50% | 1.12% |

| Return After Taxes on Distributions | (0.13)% | 0.88% | 0.66% |

| Return After Taxes on Distributions and Sale of Fund Shares | (0.01)% | 0.88% | 0.65% |

| BlackRock Short Obligations Fund — Investor A Shares | |||

| Return Before Taxes | (0.25)% | 1.26% | 0.86% |

| ICE

BofA 6-Month U.S. Treasury Bill Index1 (Reflects no deduction for fees, expenses or taxes) |

0.09% | 1.31% | 0.85% |

1 On March 1, 2021 the Fund began to track the 4pm pricing variant of ICE BofA 6-Month U.S. Treasury Bill Index (the

“Index”). Historical index data prior to March 1, 2021 is for the 3pm pricing variant of the Index. Index data on and after March 1, 2021 is for the 4pm pricing variant of the Index.

After-tax returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not

relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Institutional Shares only, and the after-tax returns for Investor A Shares will

vary.

Investment Manager

The Fund’s investment manager is BlackRock Advisors,

LLC(previously defined as “BlackRock”). The Fund’s sub-adviser is BlackRock International Limited (the “Sub-Adviser”). Where applicable, “BlackRock” refers also to the Sub-Adviser.

Portfolio Managers

| Name | Portfolio

Manager of the Fund Since |

Title |

| Eric Hiatt, CFA, FRM | 2013-2020; 2022 | Managing Director of BlackRock, Inc. |

| Bradford Glessner, CFA | 2022 | Director of BlackRock, Inc. |

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund each day the New

York Stock Exchange is open. To purchase or sell shares you should contact your Financial Intermediary, or, if you hold your shares through the Fund, you should contact the Fund by phone at (800) 441-7762, by mail (c/o BlackRock Funds, P.O. Box

9819, Providence, Rhode Island

6

02940-8019), or by the Internet at www.blackrock.com/cash. The Fund’s

initial and subsequent investment minimums generally are as follows, although the Fund may reduce or waive the minimums in some cases:

| Investor A Shares | Institutional Shares | |

| Minimum

Initial Investment |

$1,000

for all accounts except: • $50, if establishing an Automatic Investment Plan (“AIP”). • There is no investment minimum for employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs). • There is no investment minimum for certain fee-based programs. |

There

is no minimum initial investment for: • Employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs), state sponsored 529 college savings plans, collective trust funds, investment companies or other pooled investment vehicles, unaffiliated thrifts and unaffiliated banks and trust companies, each of which may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares. • Clients of Financial Intermediaries that: (i) charge such clients a fee for advisory, investment consulting, or similar services or (ii) have entered into an agreement with the Fund’s distributor to offer Institutional Shares through a no-load program or investment platform. • Clients investing through a self-directed IRA brokerage account program sponsored by a retirement plan record-keeper, provided that such program offers only mutual fund options and that the program maintains an account with the Fund on an omnibus basis.$2 million for individuals and “Institutional Investors,” which include, but are not limited to, endowments, foundations, family offices, local, city, and state governmental institutions, corporations and insurance company separate accounts who may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares.$1,000 for: • Clients investing through Financial Intermediaries that offer such shares on a platform that charges a transaction based sales commission outside of the Fund. • Tax-qualified accounts for insurance agents that are registered representatives of an insurance company’s broker-dealer that has entered into an agreement with the Fund’s distributor to offer Institutional Shares, and the family members of such persons. |

| Minimum

Additional Investment |

$50 for all accounts (with the exception of certain employer-sponsored retirement plans which may have a lower minimum). | No subsequent minimum. |

Tax Information

The Fund’s dividends and distributions may be subject to

U.S. federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a qualified tax-exempt plan described in section 401(a) of the Internal Revenue Code of 1986, as amended,

in which case you may be subject to U.S. federal income tax when distributions are received from such tax-deferred arrangements.

7

Payments to Broker/Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through a Financial

Intermediary, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by

influencing the Financial Intermediary and your individual financial professional to recommend the Fund over another investment.

Ask your individual financial professional or visit your

Financial Intermediary’s website for more information.

8

[This page intentionally left blank]

[This page intentionally left blank]

[This page intentionally left blank]

INVESTMENT COMPANY ACT FILE # 811-05742

SPRO-SO-INST-1122

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- UPDATE: LifeWallet Announces a Comprehensive Settlement with a Group of Affiliated Property & Casualty Insurers

- Cumulus Announces Selected Preliminary Operating Results for First Quarter 2024

- The AGC Group Makes Donations to Help Victims of Eastern Taiwan Earthquake

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share