Form 497K BLACKROCK FUNDS

SEPTEMBER 28, 2022

|

Summary Prospectus |

BlackRock FundsSM | Investor and Institutional Shares

| • | BlackRock Commodity Strategies Fund |

| Investor A: BCSAX • Investor C: BCSCX • Institutional: BICSX |

Before you invest, you may want to review the Fund’s

prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus (including amendments and supplements), reports to shareholders and other information about the Fund, including the Fund’s

statement of additional information, online at http://www.blackrock.com/prospectus. You can also get this information at no cost by calling (800) 441-7762 or by sending an e-mail request to

[email protected], or from your financial professional. The Fund’s prospectus and statement of

additional information, both dated September 28, 2022, as amended and supplemented from time to time, are incorporated by reference into (legally made a part of) this Summary Prospectus.

This

Summary Prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission and the Commodity

Futures Trading Commission have not approved or disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary is a criminal offense.

Not FDIC Insured • May Lose Value • No Bank

Guarantee

Summary Prospectus

Key Facts About BlackRock Commodity Strategies Fund

Investment Objective

The investment objective of BlackRock Commodity Strategies

Fund (the “Fund”), a series of BlackRock FundsSM (the “Trust”), is to seek total return.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if

you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to your financial professional or your selected securities dealer, broker, investment adviser, service

provider or industry professional (including BlackRock Advisors, LLC (“BlackRock”) and its affiliates) (each, a “Financial Intermediary”), which are not reflected in the table and example below. You may qualify for

sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in the fund complex advised by BlackRock or its affiliates. More information about these and other discounts is available from your Financial

Intermediary and in the “Details About the Share Classes” and the “Intermediary-Defined Sales Charge Waiver Policies” sections on pages 33 and A-1, respectively, of the Fund’s prospectus and in the “Purchase of

Shares” section on page II-89 of Part II of the Fund’s Statement of Additional Information (the “SAI”).

| Shareholder

Fees (fees paid directly from your investment) |

Investor

A Shares |

Investor

C Shares |

Institutional

Shares | |||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.25% | None | None | |||

| Maximum Deferred Sales Charge (Load) (as a percentage of offering price or redemption proceeds, whichever is lower) | None 1 | 1.00% 2 | None | |||

| Annual

Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Investor

A Shares |

Investor

C Shares |

Institutional

Shares | |||

| Management Fee3 | 0.60% | 0.60% | 0.60% | |||

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | None | |||

| Other Expenses4 | 0.28% | 0.21% | 0.22% | |||

| Miscellaneous Other Expenses | 0.28% | 0.21% | 0.22% | |||

| Other Expenses of the Subsidiary4 | — | — | — | |||

| Total Annual Fund Operating Expenses | 1.13% | 1.81% | 0.82% | |||

| Fee Waivers and/or Expense Reimbursements3,5 | (0.16)% | (0.09)% | (0.10)% | |||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements3,5 | 0.97% | 1.72% | 0.72% |

| 1 | A contingent deferred sales charge (“CDSC”) of 1.00% is assessed on certain redemptions of Investor A Shares made within 18 months after purchase where no initial sales charge was paid at time of purchase as part of an investment of $1,000,000 or more. |

| 2 | There is no CDSC on Investor C Shares after one year. |

| 3 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 48, BlackRock has contractually agreed to waive the management fee with respect to any portion of the Fund’s assets estimated to be attributable to investments in other equity and fixed-income mutual funds and exchange-traded funds managed by BlackRock or its affiliates that have a contractual management fee, through June 30, 2024. In addition, BlackRock has contractually agreed to waive its management fees by the amount of investment advisory fees the Fund pays to BlackRock indirectly through its investment in money market funds managed by BlackRock or its affiliates, through June 30, 2024. The contractual agreements may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

| 4 | The Other Expenses of the BlackRock Cayman Commodity Strategies Fund, Ltd. (the “Subsidiary”) were less than 0.01% for the most recent fiscal year. |

| 5 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 48, BlackRock has contractually agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements (excluding Dividend Expense, Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) as a percentage of average daily net assets to 0.97% (for Investor A Shares), 1.72% (for Investor C Shares) and 0.72% (for Institutional Shares) through June 30, 2024. The contractual agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

2

Example:

This Example is intended to help you compare the cost of investing in the

Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your

investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor A Shares | $619 | $850 | $1,100 | $1,814 |

| Investor C Shares | $275 | $561 | $ 972 | $1,941 |

| Institutional Shares | $ 74 | $252 | $ 445 | $1,004 |

You would pay the following expenses if you did not redeem

your shares:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Investor C Shares | $175 | $561 | $972 | $1,941 |

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual

fund operating expenses or in the Example, affect the Fund’s performance.

During the most recent fiscal year, the Fund’s portfolio turnover rate was 91% of the average value of its portfolio.

During the most recent fiscal year, the Fund’s portfolio turnover rate was 91% of the average value of its portfolio.

Principal Investment Strategies of the Fund

The Fund utilizes two strategies and under normal

circumstances expects to invest approximately 50% of its total assets in each strategy; provided, however, that from time to time, Fund management may alter the weightings if it deems it prudent to do so based on market conditions, trends or

movements or other similar factors.

One strategy focuses

on investments in commodity-linked derivatives. To meet coverage and collateral requirements associated with these derivative investments, and to invest excess cash, the Fund holds a portion of its portfolio in investment-grade short-term

fixed-income securities. The other strategy focuses on equity investments in commodity-related companies, including, but not limited to, companies operating in the mining, energy and agricultural sectors. The Fund invests in equity securities of

such companies in order to complement the commodity exposures achieved through investments in commodity-linked derivatives. Taken together, these two strategies offer broad exposure to global commodities market trends across asset classes,

industries, sectors, and regions.

Commodities are assets

that have tangible properties, such as oil and other energy products, metals, and agricultural products. Commodity-linked derivative instruments include, but are not limited to, commodity-linked notes, swap agreements, commodity options, futures and

options on futures, that provide exposure to the investment returns of the commodities markets, without investing directly in physical commodities.

Commodity-related companies include, but are not limited to,

companies in commodities, natural resources and energy businesses and in associated businesses and companies that provide services or have exposure to such businesses (collectively, the “Commodities Sector”). These companies include,

without limitation, companies engaged in the exploration, ownership, production, refinement, processing, transportation, distribution or marketing of commodities, companies that use commodities extensively in their products and companies that

provide technology and services to commodity-related companies. This includes companies that are engaged in businesses such as integrated oil, oil and gas exploration and production, energy services and technology, chemicals and oil products, coal

and other consumable fuel, gold and precious metals, metals and minerals, forest products, agricultural chemicals and services, farm land, alternative energy sources, environmental services and agricultural products (including crop growers, owners

of plantations, and companies that produce and process foods), as well as related transportation companies, equipment manufacturers, service providers and engineering, procurement and construction (“EPC”) companies.

The Fund may make investments directly or through investments

in the Subsidiary, a wholly-owned subsidiary of the Fund formed in the Cayman Islands. The Subsidiary is managed by BlackRock and has the same investment objective as the Fund. The assets of the Subsidiary are subject to the same investment

restrictions and limitations, and follow the same compliance policies and procedures, as the Fund, except that the Subsidiary does not invest in equity

3

securities of commodity-related companies, and may invest without limitation

in commodity-linked derivative instruments. The Fund will not invest more than 25% of its total assets (measured at the time of investment) in the Subsidiary.

The Fund manages the term structure of its commodity-linked

derivative positions and has the flexibility to gain exposure to futures maturities which differ from those in the Fund’s benchmark, the Bloomberg Commodity Index Total

ReturnSM. This is done in an effort to achieve efficient investment results and minimize any adverse effects on returns caused by commodity term structures.

Equity securities held by the Fund may include common stocks,

preferred stocks, convertible securities, warrants, depositary receipts, and other instruments whose price is linked to the value of common stock, and equity interests in master limited partnerships. In addition, the Fund may also invest in

fixed-income instruments (of any credit quality and any duration) of commodity-related companies.

There are no restrictions on investment in terms of geography

or market capitalization. As such, the Fund may invest in both U.S. and non-U.S. companies, including companies located in emerging markets, and in securities denominated in both U.S. dollars and foreign currencies.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your

investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as

other similar investments. The following is a summary description of the principal risks of investing in the Fund. The relative significance of each risk factor below may change over time and you should review each risk factor carefully.

| ■ | Commodities Investment Risk — Investing in commodity-linked derivative instruments and equity securities of commodity-related companies may subject the Fund to greater volatility than investments in traditional securities. The commodities markets have experienced periods of extreme volatility. Similar future market conditions may result in rapid and substantial valuation increases or decreases in the Fund’s holdings. |

| The commodities markets may fluctuate widely based on a variety of factors. Movements in commodity investment prices are outside of the Fund’s control and may not be anticipated by Fund management. Price movements may be influenced by, among other things: governmental, agricultural, trade, fiscal, monetary and exchange control programs and policies; changing market and economic conditions; market liquidity; weather and climate conditions; changing supply and demand relationships and levels of domestic production and imported commodities; the availability of local, intrastate and interstate transportation systems; energy conservation; the success of exploration projects; changes in international balances of payments and trade; domestic and foreign rates of inflation; currency devaluations and revaluations; domestic and foreign political and economic events; domestic and foreign interest rates and/or investor expectations concerning interest rates; foreign currency/exchange rates; domestic and foreign governmental regulation and taxation; war, acts of terrorism and other political upheaval and conflicts; governmental expropriation; investment and trading activities of mutual funds, hedge funds and commodities funds; changes in philosophies and emotions of market participants. The frequency and magnitude of such changes cannot be predicted. | |

| The commodity markets are subject to temporary distortions and other disruptions due to, among other factors, lack of liquidity, the participation of speculators, and government regulation and other actions. U.S. futures exchanges and some foreign exchanges limit the amount of fluctuation in futures contract prices which may occur in a single business day (generally referred to as “daily price fluctuation limits”). The maximum or minimum price of a contract as a result of these limits is referred to as a “limit price.” If the limit price has been reached in a particular contract, no trades may be made beyond the limit price. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at disadvantageous times or prices. | |

| ■ | Equity Securities Risk — Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. |

| ■ | Derivatives Risk — The Fund’s use of derivatives may increase its costs, reduce the Fund’s returns and/or increase volatility. Derivatives involve significant risks, including: |

| Leverage Risk — The Fund’s use of derivatives can magnify the Fund’s gains and losses. Relatively small market movements may result in large changes in the value of a derivatives position and can result in losses that greatly exceed the amount originally invested. | |

| Market Risk — Some derivatives are more sensitive to interest rate changes and market price fluctuations than other securities. The Fund could also suffer losses related to its derivatives positions as a result of unanticipated |

4

| market movements, which losses are potentially unlimited. Finally, BlackRock may not be able to predict correctly the direction of securities prices, interest rates and other economic factors, which could cause the Fund’s derivatives positions to lose value. | |

| Counterparty Risk — Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will be unable or unwilling to fulfill its contractual obligation, and the related risks of having concentrated exposure to such a counterparty. | |

| Illiquidity Risk — The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately. | |

| Operational Risk — The use of derivatives includes the risk of potential operational issues, including documentation issues, settlement issues, systems failures, inadequate controls and human error. | |

| Legal Risk — The risk of insufficient documentation, insufficient capacity or authority of counterparty, or legality or enforceability of a contract. | |

| Volatility and Correlation Risk — Volatility is defined as the characteristic of a security, an index or a market to fluctuate significantly in price within a short time period. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate with the overall securities markets. | |

| Valuation Risk — Valuation for derivatives may not be readily available in the market. Valuation may be more difficult in times of market turmoil since many investors and market makers may be reluctant to purchase complex instruments or quote prices for them. | |

| Hedging Risk — Hedges are sometimes subject to imperfect matching between the derivative and the underlying security, and there can be no assurance that the Fund’s hedging transactions will be effective. The use of hedging may result in certain adverse tax consequences. | |

| Tax Risk — Certain aspects of the tax treatment of derivative instruments, including swap agreements and commodity-linked derivative instruments, are currently unclear and may be affected by changes in legislation, regulations or other legally binding authority. Such treatment may be less favorable than that given to a direct investment in an underlying asset and may adversely affect the timing, character and amount of income the Fund realizes from its investments. | |

| Regulatory Risk — Derivative contracts are subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) in the United States and under comparable regimes in Europe, Asia and other non-U.S. jurisdictions. Under the Dodd-Frank Act, with respect to uncleared swaps, swap dealers are required to collect variation margin from the Fund and may be required by applicable regulations to collect initial margin from the Fund. Both initial and variation margin may be comprised of cash and/or securities, subject to applicable regulatory haircuts. Shares of investment companies (other than certain money market funds) may not be posted as collateral under applicable regulations. In addition, regulations adopted by global prudential regulators that are now in effect require certain bank-regulated counterparties and certain of their affiliates to include in certain financial contracts, including many derivatives contracts, terms that delay or restrict the rights of counterparties, such as the Fund, to terminate such contracts, foreclose upon collateral, exercise other default rights or restrict transfers of credit support in the event that the counterparty and/or its affiliates are subject to certain types of resolution or insolvency proceedings. The implementation of these requirements with respect to derivatives, as well as regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of other derivatives, may increase the costs and risks to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund. | |

| Risks Specific to Certain Derivatives Used by the Fund |

Commodity-Linked Derivatives — The value of a commodity-linked derivative investment typically is based upon the price movements of a commodity, a commodity futures contract or commodity index, or some other readily measurable economic

variable. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, volatility of the underlying benchmark, changes in interest rates, or factors affecting a particular industry or commodity, such

as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. The value of commodity-linked derivatives will rise or fall in response to changes in the underlying commodity or

related index. Investments in commodity-linked derivatives may be subject to greater volatility than non-derivative based investments. A highly liquid secondary market may not exist for certain commodity-linked derivatives, and there can be no

assurance that one will develop.

Commodity-linked derivatives also may be

subject to credit and interest rate risks that in general affect the values of fixed-income securities. Therefore, at maturity, the Fund may receive more or less principal than it

5

originally invested. The Fund might receive interest

payments that are more or less than the stated coupon interest payments.

In connection with the Fund’s direct

and indirect investments in commodity-linked derivatives, the Fund will attempt to manage its counterparty exposure so as to limit its exposure to any one counterparty. However, due to the limited number of entities that may serve as counterparties

(and which the Fund believes are creditworthy) at any one time the Fund may enter into swap agreements with a limited number of counterparties and may invest in commodity-linked notes issued by a limited number of issuers that will act as

counterparties, which may increase the Fund’s exposure to counterparty credit risk. There can be no assurance that the Fund will be able to limit exposure to any one counterparty at all times.

Commodity-Linked Notes — Commodity-linked notes involve substantial risks, including the risk of loss of a significant portion of their principal value. In addition to commodity risk and general derivatives risk, they may be subject to

additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities.

Futures

— Futures are standardized, exchange-traded contracts that obligate a purchaser to take delivery, and a seller to make delivery, of a specific amount of an asset at a specified future date at a specified price. The primary risks associated

with the use of futures contracts and options are: (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract or option; (b) the possible lack of a liquid secondary

market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the investment adviser’s inability to predict

correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; and (e) the possibility that the counterparty will default in the performance of its obligations.

Swaps

— Swap agreements, including total return swaps that may be referred to as contracts for difference, are two-party contracts entered into for periods ranging from a few weeks to more than one year. In a standard “swap” transaction,

two parties agree to exchange the returns (or differentials in rates of return) earned or realized on particular predetermined investments or instruments, which can be adjusted for an interest factor. Swap agreements involve the risk that the party

with whom the Fund has entered into the swap will default on its obligation to pay the Fund and the risk that the Fund will not be able to meet its obligations to pay the other party to the agreement. Swap agreements may also involve the risk that

there is an imperfect correlation between the return on the Fund’s obligation to its counterparty and the return on the referenced asset. In addition, swap agreements are subject to market and illiquidity risk, leverage risk and hedging

risk.

Forward Foreign Currency

Exchange Contracts — Forward foreign currency exchange transactions are OTC contracts to purchase or sell a specified amount of a specified currency or multinational currency unit at a price and future date set

at the time of the contract. Forward foreign currency exchange contracts do not eliminate fluctuations in the value of non-U.S. securities but rather allow the Fund to establish a fixed rate of exchange for a future point in time. This strategy can

have the effect of reducing returns and minimizing opportunities for gain.

| ■ | Commodities Regulatory Risk — Commodity-related companies are subject to significant federal, state and local government regulation in virtually every aspect of their operations, including how facilities are constructed, maintained and operated, environmental and safety controls, and the prices they may charge for the products and services they provide. The Commodity Futures Trading Commission (the “CFTC”) and the U.S. commodities exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the imposition of higher margin requirements, the establishment of daily limits and the suspension of trading. Any of these actions, if taken, could adversely affect the returns of the Fund by limiting or precluding investment decisions the Fund might otherwise make. |

| The CFTC and the U.S. commodities exchanges impose limits referred to as “speculative position limits” on the maximum net long or net short speculative positions that any person may hold or control in any particular futures, options contracts or swaps traded on U.S. commodities exchanges. In October 2020, the CFTC adopted new speculative position limits with respect to futures and options on futures on many physical commodities, including energy, metals and agricultural commodities (the “core referenced futures contracts”), and on economically equivalent swaps. The new position limits include an exemption from limits for bona fide hedging transactions or positions. The compliance dates for the CFTC’s new federal speculative position limits are January 1, 2022 for the core referenced futures contracts and January 1, 2023 for economically equivalent swaps. As a consequence of these new position limits, the size or duration of positions available to the Fund may be severely limited. | |

| Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), swaps and other financial derivative products are subject to increased regulatory oversight and may in the future become subject to further increased regulatory oversight. BlackRock cannot predict the effects of any new governmental regulation that may be implemented on the ability of the Fund to use swaps or any other financial derivative product, |

6

| including commodity-linked derivatives, and there can be no assurance that any new governmental regulation will not adversely affect the Fund’s ability to achieve its investment objectives. | |

| In addition, the Internal Revenue Service (the “IRS”) (i) will no longer issue private letter rulings on the tax treatment of a mutual fund investment in commodity-linked derivatives if the ruling would depend on whether the investment is a security under the Investment Company Act of 1940, as amended (the “Investment Company Act”) and (ii) issued proposed regulations that, if finalized in current form, would specify that a subpart F income inclusion for U.S. federal income tax purposes would be treated as qualifying income only to the extent that the Subsidiary makes distributions out of its earnings and profits in the same taxable year. See “—Subsidiary Risk” below. | |

| ■ | Precious Metal and Related Securities Risk — Prices of precious metals and of precious metal related securities historically have been very volatile. The high volatility of precious metal prices may adversely affect the financial condition of companies involved with precious metals. The production and sale of precious metals by governments or central banks or other larger holders can be affected by various economic, financial, social and political factors, which may be unpredictable and may have a significant impact on the prices of precious metals. Other factors that may affect the prices of precious metals and securities related to them include changes in inflation, the outlook for inflation and changes in industrial and commercial demand for precious metals. |

| ■ | Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. |

| ■ | Emerging Markets Risk — Emerging markets are riskier than more developed markets because they tend to develop unevenly and may never fully develop. Investments in emerging markets may be considered speculative. Emerging markets are more likely to experience hyperinflation and currency devaluations, which adversely affect returns to U.S. investors. In addition, many emerging securities markets have far lower trading volumes and less liquidity than developed markets. |

| ■ | Foreign Securities Risk — Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. These risks include: |

| ■ | The Fund generally holds its foreign securities and cash in foreign banks and securities depositories, which may be recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight. |

| ■ | Changes in foreign currency exchange rates can affect the value of the Fund’s portfolio. |

| ■ | The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position. |

| ■ | The governments of certain countries, or the U.S. Government with respect to certain countries, may prohibit or impose substantial restrictions through capital controls and/or sanctions on foreign investments in the capital markets or certain industries in those countries, which may prohibit or restrict the ability to own or transfer currency, securities, derivatives or other assets. |

| ■ | Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws. |

| ■ | Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities not typically associated with settlement and clearance of U.S. investments. |

| ■ | The Fund’s claims to recover foreign withholding taxes may not be successful, and if the likelihood of recovery of foreign withholding taxes materially decreases, due to, for example, a change in tax regulation or approach in the foreign country, accruals in the Fund’s net asset value for such refunds may be written down partially or in full, which will adversely affect the Fund’s net asset value. |

| ■ | Interest Rate Risk — Interest rate risk is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter-term securities. Due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. Very low or negative interest rates may magnify interest rate risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, may result in heightened market volatility and may detract from the Fund’s ability to achieve its investment objective. |

7

| ■ | Leverage Risk — Some transactions may give rise to a form of economic leverage. These transactions may include, among others, derivatives, and may expose the Fund to greater risk and increase its costs. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet the applicable requirements of the Investment Company Act, and the rules thereunder. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage. |

| ■ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

| An outbreak of an infectious coronavirus (COVID-19) that was first detected in December 2019 developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. Although vaccines have been developed and approved for use by various governments, the duration of the pandemic and its effects cannot be predicted with certainty. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time. | |

| ■ | Mid Cap Securities Risk — The securities of mid cap companies generally trade in lower volumes and are generally subject to greater and less predictable price changes than the securities of larger capitalization companies. |

| ■ | Sector Risk — Sector risk is the risk that the Fund’s concentration in the securities of companies in a specific market sector or industry will cause the Fund to be more exposed to the price movements

of companies in and developments affecting that sector than a more broadly diversified fund. Because the Fund invests primarily in one sector, there is the risk that the Fund will perform poorly during a downturn in that sector. |

| The Fund’s investments will be concentrated in a group of industries that make up the Commodities Sector. Because the Fund is focused in specific industries, it may present more risks than if it were broadly diversified over numerous industries and sectors of the economy. A downturn in the Commodities Sector would have a larger impact on the Fund than on an investment company that does not concentrate in the industries or businesses in the Commodities Sector. The industries and businesses in the Commodities Sector in which the Fund will concentrate its investments can be significantly affected by the supply of and demand for specific products and services, exploration and production spending, government regulation, world events and economic conditions. The Commodities Sector can also be significantly affected by events relating to international political developments, energy conservation, the success of exploration projects, commodity prices, and tax and government regulations. The stock prices of commodity-related companies may also experience greater price volatility than other types of common stocks. Securities issued by commodity-related companies are sensitive to changes in the prices of, and in supply and demand for, the indicated commodities. The value of securities issued by commodity-related companies may be affected by changes in overall market movements, changes in interest rates, or factors affecting a particular industry or commodity, such as weather, embargoes, tariffs, policies of commodity cartels and international economic, political and regulatory developments. Fund management’s judgments about trends in the prices of these securities and commodities may prove to be incorrect. At times, the performance of securities of companies in the Commodities Sector will lag behind the performance of other industries or the broader market as a whole. | |

| ■ | Small Cap and Emerging Growth Securities Risk — Small cap or emerging growth companies may have limited product lines or markets. They may be less financially secure than larger, more established companies. They may depend on a more limited management group than larger capitalized companies. |

| ■ | Subsidiary Risk — By investing in the Subsidiary, the Fund is indirectly exposed to the risks associated with the Subsidiary’s investments. The commodity-related instruments held by the Subsidiary are generally similar to those that are permitted to be held by the Fund and are subject to the same risks that apply to similar investments if held directly by the Fund. There can be no assurance that the investment objective of the Subsidiary will be achieved. The Subsidiary is not registered under the Investment Company Act, and, unless otherwise noted in this prospectus, is not subject to all the investor protections of the Investment Company Act. However, the Fund wholly owns and controls the Subsidiary, and the Fund and the Subsidiary are both managed by BlackRock, making it unlikely that the Subsidiary will take action contrary to the interests of the Fund and its shareholders. The Board |

8

| has oversight responsibility for the investment activities of the Fund, including its investment in the Subsidiary, and the Fund’s role as sole shareholder of the Subsidiary. The Subsidiary is subject to the same investment restrictions and limitations, and follows the same compliance policies and procedures, as the Fund, except that the Subsidiary does not invest in equity securities of commodity-related companies, and may invest without limitation in commodity-linked derivative instruments. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Fund and/or the Subsidiary to operate as described in this prospectus and the SAI and could adversely affect the Fund. |

Performance Information

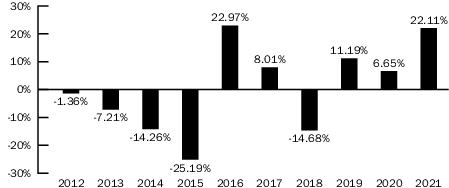

The information shows you how the Fund’s performance has

varied for the periods since inception and provides some indication of the risks of investing in the Fund. The table compares the Fund’s performance to that of the Bloomberg Commodity Index Total ReturnSM. To the extent that dividends and distributions have been paid by the Fund, the performance information for the Fund in the chart and table assumes reinvestment of the dividends

and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. Sales charges are not reflected in the bar chart. If they were, returns would be less than those shown. However, the

table includes all applicable fees and sales charges. If BlackRock and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. Updated information on the Fund’s

performance, including its current net asset value, can be obtained by visiting http://www.blackrock.com or can be obtained by phone at (800) 882-0052.

Investor A Shares

ANNUAL TOTAL RETURNS

BlackRock Commodity Strategies Fund

As of 12/31

As of 12/31

During the ten-year

periods shown in the bar chart, the highest return for a quarter was 16.37% (quarter ended June 30, 2020) and the lowest return for a quarter was -23.31% (quarter ended March 31, 2020). The year-to-date return as of June 30, 2022 was 8.21%.

| For

the periods ended 12/31/21 Average Annual Total Returns |

1 Year | 5 Years | 10 Years |

| BlackRock Commodity Strategies Fund — Investor A Shares | |||

| Return Before Taxes | 15.70% | 4.80% | (0.91)% |

| Return After Taxes on Distributions | 14.67% | 4.36% | (1.13)% |

| Return After Taxes on Distributions and Sale of Fund Shares | 9.44% | 3.60% | (0.75)% |

| BlackRock Commodity Strategies Fund — Investor C Shares | |||

| Return Before Taxes | 20.19% | 5.15% | (0.96)% |

| BlackRock Commodity Strategies Fund — Institutional Shares | |||

| Return Before Taxes | 22.44% | 6.21% | (0.13)% |

| Bloomberg

Commodity Index Total ReturnSM (Reflects no deduction for fees, expenses or taxes) |

27.11% | 3.66% | (2.85)% |

After-tax returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not

relevant to investors who hold their shares through

9

tax-deferred arrangements, such as 401(k) plans or individual retirement

accounts. After-tax returns are shown for Investor A Shares only, and the after-tax returns for Investor C and Institutional Shares will vary.

Investment Manager

The Fund’s investment manager is BlackRock Advisors, LLC

(previously defined as “BlackRock”). The Fund’s sub-adviser is BlackRock International Limited (the “Sub-Adviser”). Where applicable, “BlackRock” refers also to the Sub-Adviser.

Portfolio Managers

| Name | Portfolio

Manager of the Fund Since |

Title |

| Alastair Bishop | 2017 | Managing Director of BlackRock, Inc. |

| Hannah Johnson, CFA | 2016 | Director of BlackRock, Inc. |

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund each day the New

York Stock Exchange is open. To purchase or sell shares, you should contact your Financial Intermediary, or, if you hold your shares through the Fund, you should contact the Fund by phone at (800) 441-7762, by mail (c/o BlackRock Funds, P.O. Box

9819, Providence, Rhode Island 02940-8019), or by the Internet at www.blackrock.com. The Fund’s initial and subsequent investment minimums generally are as follows, although the Fund may reduce or waive the minimums in some cases:

10

| Investor A and Investor C Shares | Institutional Shares | |

| Minimum

Initial Investment |

$1,000

for all accounts except: • $50, if establishing an Automatic Investment Plan. • There is no investment minimum for employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs). • There is no investment minimum for certain fee-based programs. |

There

is no minimum initial investment for: • Employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs), state sponsored 529 college savings plans, collective trust funds, investment companies or other pooled investment vehicles, unaffiliated thrifts and unaffiliated banks and trust companies, each of which may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares. • Clients of Financial Intermediaries that: (i) charge such clients a fee for advisory, investment consulting, or similar services or (ii) have entered into an agreement with the Fund’s distributor to offer Institutional Shares through a no-load program or investment platform. • Clients investing through a self-directed IRA brokerage account program sponsored by a retirement plan record-keeper, provided that such program offers only mutual fund options and that the program maintains an account with the Fund on an omnibus basis.$2 million for individuals and “Institutional Investors,” which include, but are not limited to, endowments, foundations, family offices, local, city, and state governmental institutions, corporations and insurance company separate accounts who may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares.$1,000 for: • Clients investing through Financial Intermediaries that offer such shares on a platform that charges a transaction based sales commission outside of the Fund. • Tax-qualified accounts for insurance agents that are registered representatives of an insurance company’s broker-dealer that has entered into an agreement with the Fund’s distributor to offer Institutional Shares, and the family members of such persons. |

| Minimum

Additional Investment |

$50 for all accounts (with the exception of certain employer-sponsored retirement plans which may have a lower minimum). | No subsequent minimum. |

Tax Information

The Fund’s dividends and distributions may be subject to

U.S. federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a qualified tax-exempt plan described in section 401(a) of the Internal Revenue Code of 1986, as amended,

in which case you may be subject to U.S. federal income tax when distributions are received from such tax-deferred arrangements.

Payments to Broker/Dealers and Other Financial

Intermediaries

If you purchase shares of the Fund through a Financial

Intermediary, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by

influencing the Financial Intermediary and your individual financial professional to recommend the Fund over another investment.

11

Ask your individual financial professional or visit your

Financial Intermediary’s website for more information.

12

[This page intentionally left blank]

[This page intentionally left blank]

[This page intentionally left blank]

INVESTMENT COMPANY ACT FILE # 811-05742

SPRO-CS-0922

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- First Northern Bank Promotes Human Resources Director to Chief Human Resources Officer

- Dollet Announces Partnership with Leading Crypto Projects

- T2M Global Introduces Revolutionary Plastic Heat Exchanger (P-HEX) Technology to Combat Wasted Heat and Drive Economic Growth

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share