Form 497K BARON INVESTMENT FUNDS

Baron Fifth Avenue Growth Fund

Investment Goal

The investment goal of Baron Fifth Avenue Growth Fund (the “Fund”) is capital appreciation through investments primarily in securities of large-sized growth companies.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you would pay if you bought and held shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| Management Fee |

Distribution (12b-1) Fee |

Other Expenses |

Total Annual Fund Operating Expenses |

Expense Reimbursements |

Total Annual Fund Operating Expenses After Expense Reimbursements1 |

|||||||||||||||||||

| BARON FIFTH AVENUE GROWTH FUND |

||||||||||||||||||||||||

| Retail Shares |

0.70% | 0.25% | 0.08% | 1.03% | (0.03 | )% | 1.00% | |||||||||||||||||

| Institutional Shares |

0.70% | 0.00% | 0.06% | 0.76% | (0.01 | )% | 0.75% | |||||||||||||||||

| R6 Shares |

0.70% | 0.00% | 0.06% | 0.76% | (0.01 | )% | 0.75% | |||||||||||||||||

| 1 | BAMCO, Inc. (“BAMCO” or the “Adviser”) has agreed that, pursuant to a contract with an 11-year term terminating on August 29, 2033, it will reimburse certain expenses of the Fund, limiting net annual operating expenses (portfolio transaction costs, interest, dividend, acquired fund fees and expenses and extraordinary expenses are not subject to the operating expense limitation) to 1.00% of average daily net assets of Retail Shares, 0.75% of average daily net assets of Institutional Shares and 0.75% of average daily net assets of R6 shares. Only the Board of Trustees of the Fund may terminate the expense reimbursement agreement prior to its termination date. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same, giving effect to the expense reimbursement agreement described above.

| 1 | www.BaronFunds.com | |

Baron Fifth Avenue Growth Fund

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| YEAR | 1 | 3 | 5 | 10 | ||||||||||||

| BARON FIFTH AVENUE GROWTH FUND |

||||||||||||||||

| Retail Shares |

$ | 102 | $ | 318 | $ | 552 | $ | 1,225 | ||||||||

| Institutional Shares |

$ | 77 | $ | 240 | $ | 417 | $ | 930 | ||||||||

| R6 Shares |

$ | 77 | $ | 240 | $ | 417 | $ | 930 | ||||||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for Fund shareholders. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended September 30, 2022, the Fund’s portfolio turnover rate was 37.41% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund is a diversified fund that invests primarily in equity securities in the form of common stock of U.S. large-sized growth companies. The Adviser defines large-sized companies as those, at the time of purchase, with market capitalizations no smaller than the top 85th percentile by total market capitalization of the Russell 1000 Growth Index at June 30, or companies with market capitalizations above $10 billion, whichever is smaller. The Adviser seeks to invest in businesses it believes have significant opportunities for growth, sustainable competitive advantages, exceptional management, and an attractive valuation.

Principal Risks of Investing in the Fund

General Stock Market. Fund losses may be incurred due to declines in one or more markets in which Fund investments are made. These declines may be the result of, among other things, political, regulatory, market, economic or social developments affecting the relevant market(s). In addition, turbulence as has recently been experienced, caused, among other reasons, by increased inflation, tightening monetary policy and interest rate increases by the US Federal Reserve or similar international bodies, and reduced liquidity in financial markets may continue to negatively affect many issuers, which could have an adverse effect on your Fund investment. Global economies and financial markets are increasingly interconnected,

| 1-800-99BARON | 2 | |

Baron Fifth Avenue Growth Fund

and conditions and events in one country, region or financial market, such as Russia’s invasion of Ukraine in February 2022 and the world-wide response to it, have and may continue to adversely impact issuers and markets worldwide. The coronavirus disease 2019 (COVID-19) global pandemic and the aggressive responses taken by many governments or voluntarily imposed by private parties, including closing borders, restricting travel and imposing prolonged quarantines or similar restrictions, as well as the closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

Growth Investing. Growth stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. Growth stocks tend to be more expensive relative to their earnings or assets compared to other types of stocks. As a result, because growth stocks tend to be sensitive to changes in their earnings and to increasing interest rates and inflation, they tend to be more volatile than other types of stocks. In response, growth investing as an investment style may go out of favor with investors.

Large-Cap Companies. Because the Fund invests primarily in large-cap company securities, it may underperform other funds during periods when the Fund’s securities are out of favor.

Technology. Technology companies, including internet-related and information technology companies, as well as companies propelled by new technologies, may present the risk of rapid change and product obsolescence, and their successes may be difficult to predict for the long term. Some technology companies may be newly formed and have limited operating history and experience. Technology companies may also be adversely affected by changes in governmental policies, competitive pressures and changing demand. The securities of these companies may also experience significant price movements caused by disproportionate investor optimism or pessimism, with little or no basis in the companies’ fundamentals or economic conditions.

Consumer Discretionary Sector Risk. The consumer discretionary sector may be affected by changes in domestic and international economies, exchange and interest rates, inflation, competition, consumers’ disposable income, consumer preferences, social trends and marketing campaigns.

| 3 | www.BaronFunds.com | |

Baron Fifth Avenue Growth Fund

Performance

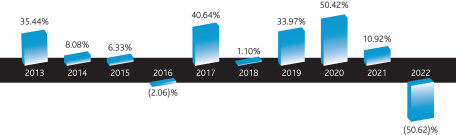

The following bar chart and table provide some indication of the risks of investing in the Fund (Retail Shares) by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for 1, 5 and 10 years and since inception compare with those of two broad measures of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available online at www.BaronFunds.com/performance or by calling 1-800-99BARON (1-800-992-2766).

Year by Year Total Return (%) as of December 31 of Each Year (Retail Shares)

| Best Quarter: | 06/30/20: 37.82% |

| Worst Quarter: | 06/30/22: (30.60)% |

Average Annual Total Returns (for periods ended 12/31/22)

The following table shows the Fund’s Retail Shares’ annual returns and long-term performance (before and after taxes) and the change in value of broad-based market indexes over various periods ended December 31, 2022. The table also shows the average annual returns of the Fund’s Institutional Shares and R6 Shares, but it does not show after-tax returns.

After-tax returns are calculated using the highest individual federal marginal income tax rate in effect at the time of each distribution and assumed sale, but they do not include the impact of state and local taxes.

Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund’s shares in a tax-deferred account (including a 401(k) or IRA or Coverdell account), or to investors that are tax-exempt.

| 1-800-99BARON | 4 | |

Baron Fifth Avenue Growth Fund

Average Annual Total Returns for the periods ended December 31, 2022

| 1 year | 5 years | 10 years | Since Inception |

|||||||||||||

| BARON FIFTH AVENUE GROWTH FUND |

||||||||||||||||

| Retail

Shares |

||||||||||||||||

| Return before taxes |

(50.62 | )% | 2.22% | 9.12% | 6.87% | |||||||||||

| Return after taxes on distributions |

(50.62 | )% | 1.91% | 8.95% | 6.62% | |||||||||||

| Return after taxes on distributions and sale of Fund shares |

(29.97 | )% | 1.86% | 7.59% | 5.79% | |||||||||||

| Institutional

Shares* |

||||||||||||||||

| Return before taxes |

(50.49 | )% | 2.48% | 9.39% | 7.06% | |||||||||||

| R6

Shares* |

||||||||||||||||

| Return before taxes |

(50.53 | )% | 2.46% | 9.39% | 7.06% | |||||||||||

| Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) |

(29.14 | )% | 10.96% | 14.10% | 10.05% | |||||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

(18.11 | )% | 9.42% | 12.56% | 9.04% | |||||||||||

| * | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares, and prior to May 29, 2009 is based on the Retail Shares. The Retail Shares have a distribution fee, but Institutional Shares and R6 Shares do not. If the annual returns for the Institutional Shares and R6 Shares prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

The Russell 1000® Growth Index is an unmanaged index of larger-cap growth companies. The S&P 500 Index is an unmanaged index of larger-cap companies.

Management

Investment Adviser. BAMCO is the investment adviser of the Fund.

Portfolio Manager. Alex Umansky has been the portfolio manager of the Fund since November 1, 2011.

| 5 | www.BaronFunds.com | |

Baron Fifth Avenue Growth Fund

Purchase and Sale of Fund Shares

Shares may be purchased only on days that the New York Stock Exchange is open for trading.

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| Retail Shares |

$2,000 | No Minimum | No Maximum | |||

| Baron Automatic Investment Plan |

$500 (with subsequent minimum investments of $50 per month until your investment has reached $2,000.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

$2,000 | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| Institutional Shares |

$1,000,000 (Employees of the Adviser and its affiliates and Trustees of the Baron Funds® and employer sponsored retirement plans (qualified and nonqualified) are not subject to the eligibility requirements for Institutional Shares.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

| 1-800-99BARON | 6 | |

Baron Fifth Avenue Growth Fund

| Minimum Initial Investment |

Minimum Subsequent Investment |

Maximum Subsequent Investment | ||||

| R6 Shares |

$5,000,000 (There is no minimum initial investment for qualified retirement plans; however, the shares must be held through plan-level or omnibus accounts held on the books of the Fund.) | No Minimum | No Maximum | |||

| Baron Funds® website purchases |

You may not make an initial purchase through the Baron Funds® website. | $10 | $6,500 for retirement accounts and $250,000 for non-retirement accounts. | |||

You Can Purchase or Redeem Shares By:

| 1. | Mailing a request to Baron Funds®, P.O. Box 219946, Kansas City, MO 64121-9946 or by overnight mail to: Baron Funds®, 430 West 7th Street, Kansas City, MO 64105-1514; |

| 2. | Wire (Purchase Only); |

| 3. | Calling 1-800-442-3814; |

| 4. | Visiting the Baron Funds® website www.BaronFunds.com; or |

| 5. | Through a broker, dealer or other financial intermediary that may charge you a fee. |

The Fund is not for short-term traders who intend to purchase and then sell their Fund shares within a 90 day period. If the Adviser reasonably believes that a person is not a long-term investor, it will attempt to prohibit that person from making additional investments in the Fund.

Tax Information

Distributions of the Fund’s net investment income (other than “qualified dividend income”) and distributions of net short-term capital gains will be taxable to you as ordinary income. Distributions of the Fund’s net capital gains reported as capital gain dividends by the Fund will be taxable to you as long-term capital gains, regardless of the length of time you have held shares of the Fund. If you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, you may be subject to federal income tax on withdrawals from tax-deferred arrangement at a later date.

| 7 | www.BaronFunds.com | |

Baron Fifth Avenue Growth Fund

Financial Intermediary Compensation

If you purchase Retail or Institutional Shares of the Fund through a broker, dealer or other financial intermediary (such as a bank or financial adviser), the Fund, Baron Capital, Inc., the Fund’s distributor, BAMCO or their affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker, dealer or other financial intermediary, including your salesperson, to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 1-800-99BARON | 8 | |

JAN23

SUMPROFIFTHAVE 1/27/2023

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Calliditas Announces Positive NefIgArd Open Label Extension Results

- CGG: Availability of the preparatory documents for the Combined General Meeting

- Breakdown of debtors, Realkredit Danmark A/S

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share