Form 497K Arrow Investments Trust

|

ARROW DWA TACTICAL: INTERNATIONAL ETF DWCR 1-877-ARROW-FD (1-877-277-6933) www.ArrowFunds.com |

Summary Prospectus |

December 1, 2022 |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. The Fund’s prospectus and Statement of Additional Information dated December 1, 2022, are incorporated by reference into this Summary Prospectus. You can obtain these documents and other information about the Fund online at www.ArrowFunds.com. You can also obtain these documents at no cost by calling 1-877-277-6933 or by sending an email request to [email protected]. Shares of the Fund are listed and traded on Cboe BZX Exchange, Inc. (the “Exchange”).

Investment Objective

The Arrow DWA Tactical: International ETF (the “Fund”) seeks long-term capital appreciation by tracking the investment results of the Dorsey Wright Country and Stock Momentum Index (the “Index”).

Fees and Expenses

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. Investors may pay other fees, such as brokerage commissions and other fees to financial intermediaries, on their purchases and sales of shares in the secondary market, which are not reflected in the table or the example below.

|

Shareholder Fees (fees paid directly from your investment) |

None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| Management Fees | 0.70% |

| Distribution and/or Service (12b-1) Fees | None |

| Other Expenses | 1.13% |

| Foreign Custody Transaction Expense | 0.11% |

| Remaining Other Expenses | 1.02% |

| Acquired Fund Fees and Expenses(1) | 0.07% |

| Total Annual Fund Operating Expenses | 1.90% |

| Fee Waiver(2) | (0.77)% |

| Total Annual Fund Operating Expenses After Fee Waiver | 1.13% |

| (1) | Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies. The operating expenses in this fee table will not correlate to the expense ratio in the Fund’s financial highlights because the financial statements include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in other investment companies |

| (2) | Arrow Investment Advisors, LLC (the Advisor”) has contractually agreed to waive its fees and/or reimburse expenses of the Fund until December 31, 2023 to ensure that the Fund’s Total Annual Fund Operating Expenses After Fee Waiver and/or Reimbursement (exclusive of any front-end or contingent deferred sales loads, taxes, leverage interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, dividend expense on securities sold short, underlying fund fees and expenses, foreign custody transaction costs and foreign account set up fees and extraordinary expenses such as litigation) will not exceed 0.95%. These fee waivers and expense reimbursements are subject to possible recoupment from the Fund in future years on a rolling three-year basis (within the three years after the fees have been waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limit or the expense limit in place at the time of waiver. This agreement may be terminated by the Fund’s Board of Trustees on 60 days’ written notice. |

| 1 |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds.

This Example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. This Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. This example does not reflect the brokerage commissions that you may pay to buy and sell Shares. Although your actual costs may be higher or lower, your costs, based on these assumptions, would be:

| 1 YEAR | 3 YEARS | 5 YEARS | 10 YEARS |

| $115 | $522 | $955 | $2,160 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it purchases and sells securities (or “turns over” its portfolio). A higher portfolio turnover will cause the Fund to incur additional transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, may affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 164% of the average value of its portfolio.

Principal Investment Strategies

Under normal circumstances, substantially all of the Fund’s total assets is invested in the component securities of the Index and investments that have economic characteristics that are substantially identical to the economic characteristics of such component securities (e.g., depositary receipts, exchange traded instruments). Strictly in accordance with its guidelines and mandated procedures of the index provider, the index selection methodology consists of long positions in the equity markets of foreign countries exhibiting relatively strong momentum characteristics among the foreign universe. The foreign universe will be composed of countries from the developed and emerging markets, excluding the United States. There is no consideration given to the allocation among developed and emerging markets; the strategy of the Index will allocate among them depending on global price trends.

In general, momentum is the tendency of an investment to exhibit persistence in its relative performance; a “momentum style” of investing emphasizes investing in securities that have had better performance compared to other securities. The Index selects at least ten countries with the highest relative strength among the universe of 41 foreign countries on a quarterly basis. The countries identified are given equal weight. For each country identified, between five to ten equity securities with the highest relative strength within that country are selected. The securities identified are equally weighted.

The Index looks at a company’s location and economic ties in determining its country designation. Relative strength investing involves buying securities that have appreciated in price more than the other securities in the country universe and holding those securities until they underperform. The strategy is entirely based on market movement of the countries and relative strength of the securities within those countries, and there is no company fundamental data involved in the analysis. The process is systematic and is repeated quarterly.

The Advisor expects that, over time, the correlation between the Fund’s performance and that of the Index, before fees and expenses, will be 95% or higher. The Fund may concentrate its investments in a particular industry or group of industries to the extent that the Index concentrates in an industry or group of industries.

The Fund generally uses a “replication” strategy to seek to achieve its investment objective, meaning the Fund invests in all of the component securities of the Index in the same approximate proportions as in the Index, but may, when the Advisor believes it is in the best interests of the Fund, use a “representative sampling” strategy, meaning the Fund may invest in a sample of the securities in the Index whose risk, return and other characteristics closely resemble the risk, return and other characteristics of the Index as a whole. The Fund may also invest its assets in cash and cash equivalents, other investment companies, as well as securities and other instruments not included in the Index but which the Advisor believes will help the Fund track the Index. For example, the Fund may invest in securities that are not components of the Index to reflect various corporate actions and other changes to the Index (such as reconstitutions, additions and deletions).

| 2 |

Principal Investment Risks

As with all funds, there is the risk that you could lose money through your investment in the Fund. Many factors affect the Fund’s net asset value, price of shares, and performance. The following describes the risks the Fund bears with respect to its investments. As with any fund, there is no guarantee that the Fund will achieve its objective.

- Asset Class Risk. Securities in the Index or in the Fund’s portfolio may underperform in comparison to the general securities markets or other asset classes.

- Concentration Risk. The Fund may focus its investments in securities of a particular industry to the extent the Index does. Economic, legislative or regulatory developments may occur that significantly affect the industry. This may cause the Fund’s net asset value (“NAV”) to fluctuate more than that of a fund that does not focus in a particular industry.

- Early Close/Trading Halt Risk. An exchange or market may close or issue trading halts on specific securities, or the ability to buy or sell certain securities or financial instruments may be restricted, which may prevent the Fund from buying or selling certain securities or financial instruments. In these circumstances, the Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and may incur substantial trading losses.

- Emerging Markets Risk. In addition to all of the risks of investing in foreign developed markets and emerging market securities involve risks attendant to less mature and stable governments and economies, such as lower trading volume, trading suspension, security price volatility, repatriation restrictions, government confiscation, inflation, deflation, currency devaluation and adverse government regulations of industries or markets. As a result of these risks, the prices of emerging market securities tend to be more volatile than the securities of issuers located in developed markets.

- Equity Securities Risk. Equity securities are susceptible to general stock market fluctuations and to volatile increases and decreases in value. The equity securities held by the Fund may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors affecting securities markets generally, the equity securities of a particular sector, or a particular company.

- ETF Structure Risks. The Fund is structured as an exchange traded fund (“ETF”) and as a result is subject to the special risks, including:

| o | Not Individually Redeemable. Shares of the Fund (“Shares”) are not individually redeemable and may be redeemed by the Fund at NAV only in large blocks known as “Creation Units.” There can be no assurance that there will be sufficient liquidity in Shares in the secondary market to permit assembly of a Creation Unit. In addition, investors may incur brokerage and other costs in connection with assembling a Creation Unit. |

| o | Trading Issues. Trading in Shares on Cboe may be halted due to market conditions or for reasons that, in the view of Cboe, make trading in Shares inadvisable, such as extraordinary market volatility. There can be no assurance that Shares will continue to meet the listing requirements of Cboe. An active trading market for the Fund’s shares may not be developed or maintained. If the securities in the Fund’s portfolio are traded outside a collateralized settlement system, the number of financial institutions that can act as authorized participants (“Authorized Participants”) that can post collateral on an agency basis is limited, which may limit the market for the Fund’s shares. |

- Foreign Investment Risk. Returns on investments in foreign securities could be more volatile than, or trail the returns on, investments in U.S. securities. Exposures to foreign securities entail special risks, including risks due to: (i) differences in information available about foreign issuers; (ii) differences in investor protection standards in other jurisdictions; (iii) capital controls risks, including the risk of a foreign jurisdiction imposing restrictions on the ability to repatriate or transfer currency or other assets; (iv) political, diplomatic and economic risks; (v) regulatory risks; and (vi) foreign market and trading risks, including the costs of trading and risks of settlement in foreign jurisdictions. In addition, the Fund’s investments in securities denominated in other currencies could decline due to changes in local currency relative to the value of the U.S. dollar, which may affect the Fund’s returns.

- Geographic Concentration Risk. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is more likely to be impacted by events or conditions affecting that country or region.

- Index Risk. Unlike many investment companies, the Fund does not utilize an investing strategy that seeks returns in excess of the Index. Therefore, it would not necessarily sell a security unless that security is removed from the Index, even if that security generally is underperforming.

- Management Risk. As the Fund may not fully replicate the Index, it is subject to the risk that investment management strategy may not produce the intended results.

| 3 |

- Market and Geopolitical Risk. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, climate change and climate related events, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years may result in market volatility and may have long term effects on both the U.S. and global financial markets. The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, has had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

- Market Price Variance Risk. The market prices of Shares will fluctuate in response to changes in NAV and supply and demand for Shares and will include a “bid-ask spread” charged by the exchange specialists, market makers or other participants that trade the particular security. There may be times when the market price and the NAV vary significantly. This means that Shares may trade at a discount to NAV.

o In times of market stress, market makers may step away from their role of market making in shares of ETFs and in executing trades, which can lead to differences between the market value of Fund shares and the Fund’s net asset value.

| o | The market price for the Fund’s shares may deviate from the Fund’s net asset value, particularly during times of market stress, with the result that investors may pay significantly more or significantly less for Fund shares than the Fund’s net asset value, which is reflected in the bid and ask price for Fund shares or in the closing price. |

o When all or a portion of an ETF’s underlying securities trade in a market that is closed when the market for the Fund’s shares is open, there may be changes from the last quote of the closed market and the quote from the Fund’s domestic trading day, which could lead to differences between the market value of the Fund’s shares and the Fund’s net asset value.

o In stressed market conditions, the market for the Fund’s shares may become less liquid in response to the deteriorating liquidity of the Fund’s portfolio. This adverse effect on the liquidity of the Fund’s shares may, in turn, lead to differences between the market value of the Fund’s shares and the Fund’s net asset value.

- Momentum Risk. The price and performance momentum of a security can change or may not continue, and securities with high relative performance may not continue to have such relative performance.

- Non-Correlation Risk. The Fund’s return may not match the return of the Index for a number of reasons, including: the Fund incurs operating expenses not applicable to the Index, and incurs costs in buying and selling securities; the Fund may not be fully invested at times; the performance of the Fund and the Index may vary due to asset valuation differences and differences between the Fund’s portfolio and the Index resulting from legal restrictions, cost or liquidity constraints and; if used, representative sampling may cause the Fund’s tracking error to be higher than would be the case if the Fund purchased all of the securities in the Index.

- Passive Investment Risk. The Fund is not actively managed and may be affected by a general decline in market segments related to the Index. The Fund invests in securities included in, or representative of securities included in, the Index, regardless of their investment merits. The Fund does not take defensive positions under any market conditions, including conditions that are adverse to the performance of the Fund, unless such defensive positions are also taken by the Index.

- Portfolio Turnover Risk. Portfolio turnover refers to the rate at which the securities held by the Fund are replaced. The higher the rate, the higher the transactional and brokerage costs associated with the turnover, which may reduce the Fund’s return unless the securities traded can be bought and sold without corresponding commission costs. Active trading of securities may also increase the Fund’s realized capital gains or losses, which may affect the taxes you pay as the Fund shareholder.

- Sampling Risk. The Fund’s use of a representative sampling approach, if used, could result in its holding a smaller number of securities than are in the Index. As a result, an adverse development with an issuer of securities held by the Fund could result in a greater decline in NAV than would be the case if the Fund held all of the securities in the Index. To the extent the assets in the Fund are smaller, these risks will be greater.

- Small and Medium Capitalization Stock Risk. The value of a small or medium capitalization company stocks or ETFs that invests in stocks of small and medium capitalization companies may be subject to more abrupt or erratic market movements than those of larger, more established companies or the market averages in general.

- Tracking Error Risk. Tracking error is the divergence of the Fund’s performance

from that of the Index. Tracking error may occur because of imperfect correlation between the Fund’s holdings of portfolio securities

and those in the Index, pricing differences, the Fund’s holding of cash, differences on timing of the accrual of dividends, changes

to the Index or the need to meet various regulatory requirements. This risk may be heightened during times of increased market volatility

or other unusual market conditions. Tracking error also may result because the Fund incurs fees and expenses, while the Index does not.

| 4 |

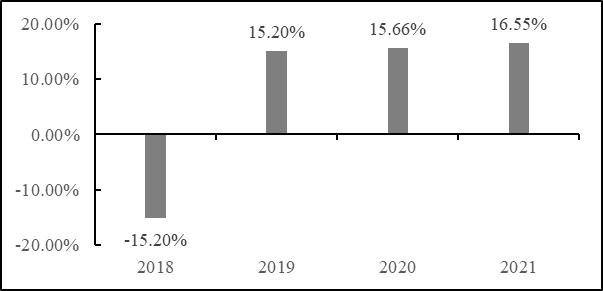

Fund Performance

The bar chart and performance table below show the variability of the Fund’s return, which is some indication of the risks of investing in the Fund. The bar chart shows performance of the Fund’s shares for each full calendar year since the Fund’s inception. The performance table compares the performance of the Fund’s shares over time to the performance of a broad market index and supplementary indexes. You should be aware that the Fund’s past performance (before and after taxes) may not be an indication of how the Fund will perform in the future. Updated performance information will be available at no cost by visiting www.ArrowFunds.com or by calling 1-877-277-6933 (1-877-ARROW-FD).

Total Return

(Years ended December 31):

| Best Quarter | 6/30/2020 | 22.72% |

| Worst Quarter | 3/30/2020 | (26.35)% |

The year-to-date return as of the most recent calendar quarter, which ended September 30, 2022, was (30.33)%.

Average Annual Total Returns

(as of December 31, 2021)

|

One Year |

Since Inception* | |

| Return Before Taxes | 16.55% | 7.17% |

| Return after Taxes on Distributions | 16.02% | 6.82% |

| Return after Taxes on Distributions and Sale of Fund Shares | 10.19% | 5.57% |

|

Dorsey Wright Country and Stock Momentum Index(1) (reflects no deduction for fees, expenses or taxes) |

19.33% | 10.50% |

|

MSCI ACWI Ex US Index(2) (reflects no deduction for fees, expenses or taxes) |

7.82% | 5.70% |

|

MSCI Emerging Markets Investable Market Index(3) (reflects no deduction for fees, expenses or taxes) |

0.06% | 4.92% |

| * | Commencement of trading was December 28, 2017 |

| (1) | Dorsey Wright Country and Stock Momentum Total Return Index is constructed pursuant to Dorsey, Wright & Associates proprietary methodology. The index has a relative strength focus that looks for the 10 strongest performing countries among a universe of 41 countries. Once the country is identified, the index methodology is designed to identify 10 companies that demonstrate powerful relative strength characteristics within that country. The Fund and the index are equally weighted and rebalanced and reconstituted quarterly. Investors cannot invest directly in an index. |

| (2) | The MSCI ACWI ex USA Index USD captures large and mid cap representation across 22 of 23 Developed Markets countries (excluding the US) and 26 Emerging Markets countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. Investors cannot invest directly in an index. |

| (3) | The MSCI Emerging Markets Investable Market Index (IMI) USD captures large, mid and small cap representation across 27 Emerging Markets (EM) countries. The index covers approximately 99% of the free float-adjusted market capitalization in each country. Investors cannot invest directly in an index. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred arrangements such as an individual retirement account (“IRA”) or other tax-advantaged accounts.

| 5 |

Management of the Fund

Investment Advisor: Arrow Investment Advisors, LLC (the “Advisor”).

Portfolio Managers: The Fund is team managed by the following individuals:

| Name | Title with Advisor | When Began Managing Fund |

| Joseph Barrato | Portfolio Manager | 2017 |

| Jonathan S. Guyer | Portfolio Manager | 2017 |

| Amit Gutt | Portfolio Manager | 2020 |

Purchase and Redemption of Fund Shares

The Fund will issue and redeem Shares at NAV only in large blocks of 50,000 Shares (each block of Shares is called a “Creation Unit”) to authorized participants who have entered into agreements with the Fund’s distributor. Creation Units are issued and redeemed for cash and/or in-kind for securities. Individual Shares of the Fund may only be purchased and sold in secondary market transactions through a broker dealer. Except when aggregated in Creation Units, the Shares are not redeemable securities of the Fund. Shares of the Fund are listed for trading on Cboe and trade at market prices rather than NAV. Shares of the Fund may trade at a price that is greater than, at, or less than NAV. An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares of the Fund (bid) and the lowest price a seller is willing to accept for Shares of the Fund (ask) when buying or selling Shares in the secondary market. Recent information on the Fund’s NAV, market price, premiums and discounts, and bid-ask spreads is available at www.ArrowFunds.com.

Tax Information

The Fund’s distributions are generally taxable as ordinary income or capital gains. A sale of Shares may result in capital gain or loss.

Payments to Broker-Dealers and Other Financial Intermediaries

Investors purchasing shares in the secondary market through a brokerage account or with the assistance of a broker may be subject to brokerage commissions and charges. If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 6 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Correction to Company announcement – No. 23 / 2024

- Clarification of Details Regarding Oceansix's Engagement with RB Milestone Group LLC

- Phish Live at Sphere: Moment Factory Harnesses Sphere's Next-Generation Technologies to Reimagine Concert Experience

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share