Form 497K Advisors' Inner Circle

The Advisors’ Inner Circle Fund III

Mesirow Small Company Fund

(Formerly, Mesirow Small Company

Sustainability Fund)

(Institutional Shares: MSVIX)

(Investor Shares: MSVVX)

Summary Prospectus

January 28, 2023

Investment Adviser:

Mesirow Institutional Investment Management, Inc.

Before you invest, you may want to review the Fund’s complete prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at https://www.mesirow.com/mutual-funds. You can also get this information at no cost by calling 833-MESIROW (833-637-4769), by sending an e-mail request to [email protected], or by asking any financial intermediary that offers shares of the Fund. The Fund’s prospectus and statement of additional information, both dated January 28, 2023, as they may be amended from time to time, are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above. |

Investment Objective

The Mesirow Small Company Fund (the “Small Company Fund” or the “Fund”) seeks to provide long-term capital appreciation with less volatility than the U.S. small company market.

Fund Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees (fees paid directly from your investment)

Institutional and Investor Shares |

|

Redemption Fee (as a percentage of amount redeemed, if shares redeemed have been held for less than 90 days) |

1.00% |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Institutional |

Investor |

|

Management Fees |

0.75% |

0.75% |

Distribution and/or Service (12b-1) Fees |

None |

0.25% |

Other Expenses1 |

2.22% |

2.36% |

Shareholder Servicing Fees |

0.15% |

0.15% |

Other Operating Expenses |

2.07% |

2.21% |

Total Annual Fund Operating Expenses |

2.97% |

3.36% |

Less Fee Reductions and/or Expense Reimbursements1 |

(1.99)% |

(2.13)% |

Total Annual Fund Operating Expenses After Fee Reductions and/or Expense Reimbursements |

0.98% |

1.23% |

|

1 |

Other Expenses have been restated to reflect the implementation of a 0.15% Shareholder Servicing Fee. |

|

2 |

Mesirow Institutional Investment Management, Inc. (“MIIM”) has contractually agreed to waive fees and/or to reimburse expenses to the extent necessary to keep Total Annual Fund Operating Expenses (excluding interest, taxes, brokerage commissions, class specific expenses (e.g., Distribution and/or Service (12b-1) Fees) other than Shareholder Servicing Fees incurred by the Fund under the Amended and Restated Shareholder Services Plan adopted by the Trust (as defined below), research expenses relating to the securities that are purchased and sold by the Fund, dividend and interest expenses on securities sold short, acquired fund fees and expenses, other expenditures which are capitalized in accordance with generally |

1

accepted accounting principles, and non-routine expenses (collectively, “excluded expenses”)) from exceeding 0.98% of the average daily net assets of the Fund’s Institutional Shares and Investor Shares until January 31, 2024 (the “contractual expense limit”). In addition, MIIM may receive from the Fund the difference between the Total Annual Fund Operating Expenses (not including excluded expenses) and the contractual expense limit to recoup all or a portion of the prior fee waivers or expense reimbursements MIIM or Mesirow Financial Investment Management, Inc., the Fund’s previous investment adviser and an affiliate of MIIM, made during the rolling three-year period preceding the date of the recoupment if at any point Total Annual Fund Operating Expenses (not including excluded expenses) are below the contractual expense limit (i) at the time of the fee waiver and/or expense reimbursement and (ii) at the time of the recoupment. This agreement may be terminated: (i) by the Board of Trustees (the “Board”) of The Advisors’ Inner Circle Fund III (the “Trust”), for any reason at any time; or (ii) by MIIM, upon ninety (90) days’ prior written notice to the Trust, effective as of the close of business on January 31, 2024.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses (including one year of capped expenses in each period) remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

Institutional Shares |

$100 |

$730 |

$1,387 |

$3,148 |

Investor Shares |

$125 |

$834 |

$1,566 |

$3,505 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in total annual fund operating expenses or in the example, affect the Fund’s performance. During its most recent fiscal year, the Fund’s portfolio turnover rate was 109% of the average value of its portfolio.

2

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in securities of small companies. This investment policy may be changed by the Fund upon 60 days’ prior written notice to shareholders.

The Fund considers small companies to be those with market capitalizations within the range of the market capitalizations of companies in the Russell 2500 Index at the time of purchase, and exchange-traded funds (“ETFs”) that aim to replicate or produce returns that generally correspond to small company indexes. The market capitalization range of the Russell 2500 Index was approximately $6 million to $20.3 billion as of September 30, 2022, and may change over time. At any given time, the Fund may own a diversified group of stocks in several industries. The Fund invests mainly in common stocks, but it may also invest in ETFs.

MIIM employs a relative value philosophy to identify companies that MIIM believes have attractive valuations and a high probability for accelerated earnings and cash flow growth compared to their peers. MIIM evaluates broad themes and market developments that it believes can be exploited through portfolio construction and rigorous fundamental research to identify investments that are best positioned to take advantage of catalysts and trends that may positively change the earnings potential and cash flow growth of a target company. MIIM believes that earnings and cash flow growth are the principal drivers of investment performance, particularly when accompanied by visible, quantifiable catalysts that have not been fully recognized by the investment community.

Further, MIIM considers environmental, social and governance (“ESG”) factors within its fundamental assessment of macro, sector and company specific trends, as may be modified over time. Factors taken into consideration may include (but are not limited to): environmental factors such as the management of natural resources, carbon related issues, waste and recycling; social factors such as diversity and inclusion at the board of directors level, workplace policies, child labor and human rights; and governance factors such as board composition, share class structure and shareholder voting rights. MIIM believes that certain ESG factors have the potential to reduce the cost of capital, materially lower operating costs or increase the profitability of a company, which may, in turn, lead to higher investment returns by the Fund if it invests in such company. MIIM also believes incorporating such ESG factors may contribute

3

to better investment returns by reducing the overall risk profile of the Fund’s portfolio holdings.

MIIM continuously monitors and evaluates investments held by the Fund to discern changes in trends, modify investment outlooks, and adjust valuations accordingly. MIIM attempts to mitigate excess risk through ownership of what it considers a well-diversified portfolio with broad representation across market industries and sectors. MIIM seeks to actively encourage management of the Fund’s portfolio companies to improve their ESG factors with the goal of producing better investment results and positive environmental and societal outcomes. From time to time, the Fund may focus its investments in a particular sector or sectors of the economy. MIIM will liquidate an investment based on several factors, including asset valuation, changes in prospective attributes, and purchases of alternative investments with potentially higher returns. MIIM generally will not immediately sell a stock merely due to market appreciation outside the Fund’s target capitalization range if it believes the company has growth potential.

Due to its investment strategy, the Fund may buy and sell securities frequently. This may result in higher transaction costs and more capital gains tax liabilities than a fund with a buy and hold strategy.

The Fund may invest in cash or money market instruments for the purpose of meeting redemption requests or making other anticipated cash payments.

Principal Risks

As with all mutual funds, there is no guarantee that the Fund will achieve its investment objective. You could lose money by investing in the Fund. A Fund share is not a bank deposit and it is not insured or guaranteed by the FDIC or any government agency. The principal risk factors affecting shareholders’ investments in the Fund are set forth below.

Equity Market Risk — The risk that stock prices will fall over short or extended periods of time. In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Fund

4

invests, which in turn could negatively impact the Fund’s performance and cause losses on your investment in the Fund.

Small Companies Risk — Small companies in which the Fund invests may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, small companies may have limited product lines, markets and financial resources and may depend upon a relatively small management group. Therefore, stocks of small companies may be more volatile than those of larger companies. Stocks of small companies may be traded over-the-counter or listed on an exchange.

Sector Emphasis Risk — The securities of companies in the same business sector, if comprising a significant portion of the Fund’s portfolio, may in some circumstances react negatively to market conditions, interest rates and economic, regulatory or financial developments and adversely affect the value of the portfolio to a greater extent than if such securities comprised a lesser portion of the Fund’s portfolio or the Fund’s portfolio was diversified across a greater number of industry sectors.

Style Risk — Relative value investing focuses on companies with stocks that appear undervalued in light of factors such as the company’s earnings, book value, revenues or cash flow. If MIIM’s assessment of market conditions, or a company’s value or prospects for exceeding earnings expectations, is wrong, the Fund could suffer losses or produce poor performance relative to other funds.

Investment Strategy Risk — The risk that the Fund’s investment strategy may underperform other segments of the equity markets or the equity markets as a whole.

ESG Risk — The Fund’s integration of ESG criteria may exclude securities of certain issuers for non-financial reasons. Therefore, the Fund may forgo opportunities to buy certain securities when it might otherwise be advantageous to do so, or may sell securities for ESG reasons when it might be otherwise disadvantageous for it to do so. Accordingly, the Fund may underperform other funds that do not utilize an investment strategy that incorporates ESG criteria.

Liquidity Risk — The risk that certain securities may be difficult or impossible to sell at the time and the price that the seller would like. The seller may have to lower the price, sell other securities instead or forego an investment opportunity, any of which could have a negative effect on Fund management or performance.

5

Valuation Risk — The risk that a security may be difficult to value. The Fund may value certain securities at a price higher than the price at which they can be sold.

Portfolio Turnover Risk — The Fund is subject to portfolio turnover risk because it may buy and sell investments frequently. Such a strategy often involves higher expenses, including brokerage commissions, and may increase the amount of capital gains (in particular, short-term gains) realized by the Fund. Shareholders may pay tax on such capital gains.

Exchange-Traded Funds (ETFs) Risk — The risks of owning shares of an ETF generally reflect the risks of owning the underlying securities in which the ETF invests, although lack of liquidity in an ETF could result in its value being more volatile than the underlying portfolio securities. When the Fund invests in an ETF, in addition to directly bearing the expenses associated with its own operations, it will bear a pro rata portion of the ETF’s expenses.

Money Market Instruments Risk — The value of money market instruments may be affected by changing interest rates and by changes in the credit ratings of the investments. An investment in a money market fund is not a bank deposit and is not insured or guaranteed by any bank, the FDIC or any other government agency. A money market fund’s sponsor has no legal obligation to provide financial support to the fund, and there should be no expectation that the sponsor will provide financial support to the fund at any time. Certain money market funds float their net asset value while others seek to preserve the value of investments at a stable net asset value (typically, $1.00 per share). An investment in a money market fund, even an investment in a fund seeking to maintain a stable net asset value per share, is not guaranteed and it is possible for the Fund to lose money by investing in these and other types of money market funds. If the liquidity of a money market fund’s portfolio deteriorates below certain levels, the money market fund may suspend redemptions (i.e., impose a redemption gate) and thereby prevent the Fund from selling its investment in the money market fund or impose a fee of up to 2% on amounts the Fund redeems from the money market fund (i.e., impose a liquidity fee). These measures may result in an investment loss or prohibit the Fund from redeeming shares when MIIM would otherwise redeem shares. Money market funds and the securities they invest in are subject to comprehensive regulations. The enactment of new legislation or regulations, as well as changes in interpretation and

6

enforcement of current laws, may affect the manner of operation, performance and/or yield of money market funds.

Performance Information

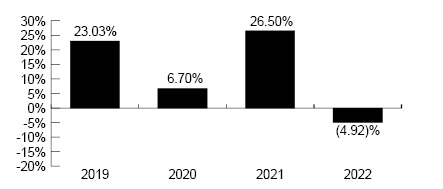

The bar chart and the performance table below illustrate the risks and volatility of an investment in the Fund by showing changes in the Fund’s Institutional Shares performance from year to year and by showing how the Fund’s average annual total returns for 1 year and since inception compare with those of a broad measure of market performance. Of course, the Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future.

Updated performance information is available by calling 833-MESIROW (833-637-4769) or on the Internet at www.mesirow.com.

BEST QUARTER |

WORST QUARTER |

30.92% |

(32.67)% |

(12/31/2020) |

(3/31/2020) |

Average Annual Returns for Periods Ended December 31, 2022

This table compares the Fund’s average annual total returns for the periods ended December 31, 2022 to those of an appropriate broad-based index.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After tax returns are shown for Institutional Shares only. After tax returns for Investor Shares will vary.

7

Returns after taxes on distributions and sale of Fund shares may be higher than before-tax returns when a net capital loss occurs upon the redemption of Fund shares.

Mesirow Small Company Fund |

1 Year |

Since Inception (12/19/2018) |

Fund Returns Before Taxes |

|

|

Institutional Shares |

(4.92)% |

11.21% |

Investor Shares |

(5.12)% |

11.18% |

Fund Returns After Taxes |

|

|

Institutional Shares |

(5.59)% |

8.31% |

Fund Returns After Taxes on Distributions and Sale of Fund Shares |

|

|

Institutional Shares |

(2.47)% |

7.89% |

Russell 2000 Index (reflects no deduction for fees, expenses or taxes) |

(20.44)% |

8.23% |

Investment Adviser

Mesirow Institutional Investment Management, Inc.

Portfolio Managers

Kathryn A. Vorisek, Senior Managing Director and Portfolio Manager, has managed the Fund since its inception in 2018.

Leo Harmon, CFA, CAIA, Senior Managing Director, Chief Investment Officer and Portfolio Manager, has managed the Fund since its inception in 2018.

John Nelson, CFA, Managing Director and Portfolio Manager, has managed the Fund since 2023.

Eric Jacobsohn, CFA, Managing Director and Portfolio Manager, has managed the Fund since 2023.

Purchase and Sale of Fund Shares

You may generally purchase or redeem shares on any day that the New York Stock Exchange (“NYSE”) is open for business.

To purchase Institutional Shares of the Fund for the first time, you must invest at least $100,000. To purchase Investor Shares of the Fund for

8

the first time, you must invest at least $5,000. There is no minimum for subsequent investments.

The Fund may accept investments of smaller amounts in its sole discretion.

If you own your shares directly, you may redeem your shares by contacting the Fund directly by mail at: Mesirow Funds P.O. Box 219009, Kansas City, MO 64121-9009 (Express Mail Address: Mesirow Funds, c/o SS&C Global Investor & Distribution Solutions, Inc., 430 West 7th Street, Kansas City, MO 64105) or telephone at 833-MESIROW (833-637-4769).

If you own your shares through an account with a broker or other financial intermediary, contact that broker or financial intermediary to redeem your shares. Your broker or financial intermediary may charge a fee for its services in addition to the fees charged by the Fund.

Tax Information

The Fund intends to make distributions that may be taxed as qualified dividend income, ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement accounts (“IRAs”), in which case your distribution will be taxed when withdrawn from the tax-deferred account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s web site for more information.

9

MES-SM-003-0600

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- SPACEMOBILE ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against AST SpaceMobile, Inc. and Encourages Investors to Contact the Firm

- POWERFLEET ALERT: Bragar Eagel & Squire, P.C. is Investigating PowerFleet, Inc. on Behalf of PowerFleet Stockholders and Encourages Investors to Contact the Firm

- Power Knot Wins 2024 Innovation Award of Excellence at Restaurants Canada

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share