Form 497K AQR Funds

AQR Global Equity Fund

Fund Summary — January 29, 2023

Ticker: Class N/AQGNX — Class I/AQGIX — CLASS R6/AQGRX

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund, including the statement of additional information, online at https://funds.aqr.com/fund-documents. You can also get this information at no cost by calling (866) 290-2688 or by sending an email to [email protected]. The Fund’s

prospectus and

statement of additional information, each dated January 29, 2023, as amended and supplemented from time to time, and the Fund’s most recent

shareholder report, dated September 30, 2022, are all incorporated by reference to this summary prospectus.

Investment Objective

The AQR

Global Equity Fund (the “Fund”) seeks long-term capital appreciation.

Fees and Expenses of the Fund

This

table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial

intermediaries, which are not reflected in the tables and examples below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the

value of your investment)

| |

Class N |

Class I |

Class R6 |

| Management Fee |

0.60% |

0.60% |

0.60% |

| Distribution (12b-1) Fee |

0.25% |

None |

None |

| Other Expenses |

|

|

|

| Interest Expense |

0.01% |

0.01% |

0.01% |

| All Other Expenses |

0.21% |

0.21%

|

0.11% |

| Total Other Expenses |

0.22% |

0.22% |

0.12% |

| Acquired Fund Fees and Expenses1

|

0.01% |

0.01% |

0.01% |

| Total Annual Fund Operating Expenses |

1.08% |

0.83% |

0.73% |

| Less: Expense Reimbursements2

|

0.01% |

0.01% |

0.01% |

| Total Annual Fund Operating Expenses after Expense Reimbursements |

1.07% |

0.82% |

0.72% |

1 Acquired Fund Fees and Expenses reflect the expenses incurred indirectly by the Fund as a result of the

Fund's investments in underlying money market mutual funds, exchange-traded funds or other pooled investment vehicles.

2 The

Adviser has contractually agreed to reimburse operating expenses of the Fund in an amount

sufficient to limit certain Specified Expenses at no more than 0.20% for Class N Shares and Class I Shares and 0.10% for Class R6 Shares. "Specified Expenses" for this purpose

include all Fund operating expenses other than management fees and 12b-1 fees and exclude interest, taxes, dividends on short sales, borrowing costs, acquired fund fees and expenses, interest expense relating to short sales, expenses related to class action claims, contingent expenses related to tax reclaim receipts and extraordinary expenses. This agreement (the “Expense Limitation Agreement”) will continue at least through January 28, 2024. The Expense Limitation Agreement may be

terminated with the consent of the Board of Trustees, including a majority of the Non-Interested Trustees of the Trust. The Adviser

is entitled to recapture any expenses reimbursed during the thirty-six month period following the end of the month during which the

Adviser reimbursed expenses, provided that the amount recaptured may not cause the Specified

Expenses attributable to a share class of the Fund during a year in which a repayment is made to exceed either of (i) the applicable limits in effect at the time of the

reimbursement and (ii) the applicable limits in effect at the time of recapture.

Example: This Example is intended to help you compare the cost of investing in the Fund with

the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares

at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same and takes into

account the effect of the Expense

AQR Funds–Summary Prospectus2

Limitation Agreement through January 28, 2024, as discussed in Footnote No. 2 to the Fee Table. Although

your actual costs may be higher or lower, based on these assumptions your costs would

be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class N Shares |

$109 |

$342 |

$595 |

$1,316 |

| Class I Shares |

$84 |

$264 |

$460 |

$1,024 |

| Class R6 Shares |

$74 |

$232 |

$405 |

$906 |

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns

over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the

example, affect the Fund’s performance. During the fiscal year ended September 30, 2022, the Fund’s portfolio turnover rate was 123% of the average value of its

portfolio.

Principal Investment Strategies of the

Fund

The Fund seeks to outperform, after expenses, the MSCI World Index (the

Global Equity Benchmark) while seeking to control its tracking error relative

to this benchmark. While the Adviser expects that the Fund’s targeted annualized

forecasted tracking error will typically range between 3-5% relative to the Global Equity Benchmark; the Adviser may, on occasion, tactically

target a level of tracking error outside of this range. The actual or realized tracking error level for longer or shorter periods may be materially higher or lower depending on market conditions, sector positioning, securities selection and other

factors. Higher tracking error generally indicates higher market risk. Actual or realized tracking error can and will differ from the forecasted or target tracking error described above.

Generally, the Fund will invest in instruments of companies located in a number of different countries

throughout the world, one of which will be the United States. Under normal circumstances, the Fund will invest at least 40% of its assets in non-U.S. companies. Notwithstanding the previous sentence, if the weighting of non-U.S. companies in the Global

Equity Benchmark drops below 45%, the Fund may invest a lower amount in non-U.S. companies,

which will normally be such that the minimum level for non-U.S. companies will be 5% below the weighting of non-U.S. companies in the Global Equity Benchmark as of the end of the prior business day (or, if such information is unavailable, the most recently published composition).

The Fund will allocate its assets among various regions and countries, including the United States (but in no less than three different countries outside of the U.S.).

The

Adviser uses a set of value, momentum and other factors to generate an investment portfolio

based on the Adviser’s global asset allocation models and security selection procedures. The Adviser believes that a better risk-adjusted return may be achievable by applying both value and momentum strategies

simultaneously.

•Value strategies favor

securities that appear cheap based on fundamental measures. Examples of value measures include using price-to-earnings and price-to-book ratios for choosing individual equities and

countries, and purchasing power parity for choosing currencies.

•Momentum strategies favor securities with measures of strong recent performance. Examples of momentum measures

include simple price momentum for choosing individual equities and countries, and foreign exchange rate momentum for selecting currencies.

•In addition to these two

main strategies, the Adviser may use a number of additional quantitative strategies based on

the Adviser’s proprietary research. These may include, but are not limited to, quality

strategies (which favor stable companies in good business health, including those with strong profitability and stable earnings) and sentiment strategies (which favor companies favored by high-conviction investors or companies whose management is acting in shareholder-friendly

ways).

In seeking to achieve its investment objective, the Fund may enter into both

“long” and “short” positions in equities and currencies using derivative instruments. The owner of a “long” position in a derivative instrument

will benefit from an increase in the price of the underlying investment. The owner of a “short” position in a derivative instrument will benefit from a decrease in the price of the underlying investment.

Generally, the Fund will invest at least 80% of its net assets (including any borrowings for investment purposes) in equity and equity-related instruments (including, but not limited to, exchange-traded funds, equity index futures, equity index swaps,

swaps on equity index futures, depositary receipts and real estate investment trusts or securities with similar characteristics). The Fund will invest in companies with a broad range of market capitalizations. The Fund has no market capitalization

constraints. The Fund invests primarily in securities comprising the Global Equity

Benchmark and also invests to some extent in securities outside the Global Equity Benchmark which the Adviser deems to have similar investment characteristics to the securities comprising the Global Equity Benchmark. The Fund may invest in or use rights, warrants, equity swaps, financial futures contracts, swaps on futures contracts,

forward foreign currency contracts and other types of derivative instruments in seeking to achieve its investment objective. A portion of the Fund’s assets may be held in

cash or cash equivalents including, but not limited to, money market instruments, interests in short-term investment funds or shares of money market or short-term bond funds. However, under normal market conditions net economic exposure to the equity markets

(i.e. the total value of equity positions plus the net notional value of equity derivatives) will generally equal at least 95% of the Fund’s net assets.

AQR Funds–Summary Prospectus3

The Adviser believes that the management of transaction costs should be considered when determining whether an investment is

attractive. Transaction costs include commissions, bid-ask spreads, market impact and time delays (time between decision and implementation when a market may move in favor of or

against the Fund). The Adviser considers expected transaction costs both in its forecasting model and optimization process to seek to ensure that trades for the Fund

will remain attractive after transaction costs are reflected.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in

the Fund or your investment may not perform as well as other similar investments. The Fund is not a complete investment program and

should be considered only as one part of an investment portfolio. The Fund is more appropriate for long-term investors who can bear the risk of

short-term NAV fluctuations, which at times, may be significant and rapid, however, all investments long- or short-term are subject to risk of

loss. The following is a summary description of certain risks of investing in the Fund. The order of the below

risk factors does not indicate the significance of any particular risk factor.

Common Stock Risk: The Fund may invest in, or have exposure to, common stocks. Common stocks are subject to

greater fluctuations in market value than certain other asset classes as a result of such factors as a company’s business performance, investor perceptions, stock market trends and general economic conditions.

Counterparty Risk: The Fund may enter into various types of derivative contracts. Many of these derivative

contracts will be privately negotiated in the over-the-counter market. These contracts also involve exposure to credit risk, since contract performance depends in part on the financial condition of the counterparty. If a privately negotiated over-the-counter contract calls for payments by the Fund, the Fund must be prepared to make such payments when due. In addition, if a

counterparty’s creditworthiness declines, the Fund may not receive payments owed under the contract, or such payments may be delayed under such circumstances and the value of agreements with such counterparty can be expected to decline,

potentially resulting in losses to the Fund.

Currency Risk: Currency risk is the risk that changes in currency exchange rates will negatively affect

securities denominated in, and/or receiving revenues in, foreign currencies. The liquidity and trading value of foreign currencies could be affected by global economic factors, such as inflation, interest rate levels, and trade balances among countries, as well as the actions of sovereign governments and central banks. Adverse changes in currency exchange rates (relative to the U.S.

dollar) may erode or reverse any potential gains from the Fund’s investments in securities denominated in a foreign currency or may widen existing losses.

Derivatives Risk: In general, a derivative contract typically involves leverage, i.e., it provides exposure to potential gain or loss from a change in the level of the market price of the underlying security, currency or commodity (or a basket or index) in a notional amount that exceeds the amount of cash or assets required to establish or maintain the derivative contract.

Adverse changes in the value or level of the underlying asset or index, which the Fund may not directly own, can result in a loss to the Fund substantially greater than the amount invested in the derivative itself. The use of derivative instruments also exposes the Fund to additional risks and transaction costs. These instruments come in many varieties and have a wide range

of potential risks and rewards, and may include, as further described in the section entitled “Principal Investment Strategies of the Fund,” futures contracts, swaps

and forward foreign currency contracts. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate perfectly with the overall

securities markets.

Foreign Investments Risk: Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund

will lose money. These risks include:

•The Fund generally holds its foreign instruments and cash in foreign banks and securities depositories, which may be

recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight.

•Changes in foreign currency

exchange rates can affect the value of the Fund’s portfolio.

•The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to

such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position.

•The governments of certain countries may prohibit or impose substantial restrictions on foreign investments in their

capital markets or in certain industries.

•Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the

same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws.

•Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities

not typically associated with settlement and clearance of U.S. investments.

•The regulatory, financial reporting, accounting, recordkeeping and auditing standards of foreign countries may differ, in

some cases significantly, from U.S. standards.

Forward and Futures Contract Risk: The successful use of forward and futures contracts draws upon the Adviser’s skill and experience with respect to such instruments and is subject to special risk considerations. The primary

risks associated with the use of forward and futures contracts, which may adversely affect the Fund’s NAV and total

return, are (a) the imperfect correlation between the change in market value of the instruments held by

the Fund and the price of the forward or

AQR Funds–Summary Prospectus4

futures contract; (b) possible lack of a liquid secondary market for a forward or futures contract and

the resulting inability to close a forward or futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other

economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to

sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do

so.

High Portfolio Turnover Risk: The investment techniques and strategies utilized by the Fund, including investments made on a shorter-term basis or in

derivative instruments or instruments with a maturity of one year or less at the time of acquisition, may result in frequent portfolio trading and high portfolio turnover. High

portfolio turnover rates will cause the Fund to incur higher levels of brokerage fees and commissions, which may reduce performance, and may cause higher levels of current tax liability to shareholders in the Fund.

Investment in Other Investment Companies Risk: As with other investments, investments in other investment

companies, including exchange-traded funds (“ETFs”), are subject to market and manager risk. In addition, if the Fund acquires shares of investment companies, shareholders bear both their proportionate share of expenses in the Fund (including management and

advisory fees) and, indirectly, the expenses of the investment companies. The Fund may invest in money market mutual funds. An investment in a money market mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market mutual funds that invest in U.S. government securities seek to preserve the value of the Fund’s investment at $1.00 per share, it

is possible to lose money by investing in a stable NAV money market mutual fund. Moreover, prime money market mutual funds are required to use floating NAVs that do not preserve the value

of the Fund’s investment at $1.00 per share. Investments in real estate investment trusts or securities with similar characteristics that pool investors’ capital to

purchase or finance real estate investments also involve certain unique risks, including concentration risk (by geography or property type) and interest rate risk (i.e., in a rising interest rate

environment, the stock prices of real estate-related investments may decline and the borrowing costs of these companies may increase).

Leverage Risk: As

part of the Fund’s principal investment strategy, the Fund will make investments in futures contracts, forward contracts, swaps and other derivative instruments. These

derivative instruments provide the economic effect of financial leverage by creating additional investment exposure to the underlying instrument, as well as the potential for

greater loss. If the Fund uses leverage through purchasing derivative instruments, the Fund

has the risk that losses may exceed the net assets of the Fund. The net asset value of the

Fund while employing leverage will be more volatile and sensitive to market movements.

Manager Risk: If the Adviser makes poor investment decisions, it will negatively affect the Fund’s investment

performance.

Market Risk: Market risk is the risk that the markets on which the Fund’s investments trade will increase or decrease in value.

Prices may fluctuate widely over short or extended periods in response to company, market or economic news. Markets also tend to move in cycles, with periods of rising and falling

prices. Recently, there have been inflationary price movements and rising interest rates. If there is a general decline in the securities and other markets, your investment in the

Fund may lose value, regardless of the individual results of the securities and other instruments in which the Fund invests.

Mid-Cap Securities Risk: The Fund may invest in, or have exposure to, the securities of mid-cap companies. The prices of securities of mid-cap

companies generally are more volatile than those of large capitalization companies and are more likely to be adversely affected than large-cap companies by changes in earnings

results and investor expectations or poor economic or market conditions, including those experienced during a recession.

Model and Data

Risk: Given the complexity of the investments and strategies of the Fund, the Adviser relies heavily on quantitative models and information and traditional and non-traditional data supplied or made available by

third parties (“Models and Data”). Models and Data are used to construct sets of transactions and investments, to provide risk management insights, and to assist in hedging the Fund’s investments.

When Models and Data prove to be incorrect or incomplete, including because data is stale, missing or unavailable, any

decisions made in reliance thereon expose the Fund to potential risks. Similarly, any hedging based on faulty Models and Data may prove to be unsuccessful. Some of the models used by the Adviser for the Fund are predictive in nature. The use of predictive models has inherent risks. Because predictive models are

usually constructed based on historical data supplied by third parties or otherwise, the success of relying on such models may depend on the accuracy and reliability of the supplied historical data. The Fund bears the risk that the quantitative models used by the Adviser will not be successful in selecting companies for investment or in determining the weighting of investment positions that

will enable the Fund to achieve its investment objective.

All models rely on correct data inputs. If incorrect data is entered into even a well-founded model, the resulting information

will be incorrect. However, even if data is inputted correctly, “model prices” will often differ substantially from market prices, especially for instruments with complex characteristics, such as derivative instruments.

The Adviser currently makes

use of non-traditional data, also known as “alternative data” (e.g., data related to consumer transactions or other behavior, social media sentiment, and internet

search and traffic data). There can be no assurance that using alternative data will result in positive performance. Alternative data is often less structured than

traditional data sets and usually has less history, making it more complicated (and riskier) to incorporate into quantitative models. Alternative

AQR

Funds–Summary Prospectus5

data providers often have less robust information technology infrastructure, which can result in data sets

being suspended, delayed, or otherwise unavailable. In addition, as regulators have increased scrutiny of the use of alternative data in making investment decisions, the changing regulatory landscape could result in legal, regulatory, financial and/or reputational risk.

The Fund is unlikely to be successful unless the assumptions underlying the models are realistic and

either remain realistic and relevant in the future or are adjusted to account for changes in the overall market environment. If such assumptions are inaccurate or become inaccurate and are not promptly adjusted, it is likely that profitable trading signals will not be

generated, and major losses may result.

The

Adviser, in its sole discretion, will continue to test, evaluate and add new models, which

may result in the modification of existing models from time to time. There can be no assurance that model modifications will enable the Fund to achieve its investment objective.

Momentum Style Risk: Investing in or having exposure to securities with positive momentum entails investing

in securities that have had above-average recent returns. These securities may be more volatile than a broad cross-section of securities. In addition, there may be periods during which the investment performance of the Fund while using a momentum strategy may

suffer.

Short Sale Risk: The Fund may take a short position in a derivative instrument, such as a future, forward or swap. A short position in a

derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying instrument, which could cause the Fund to suffer a (potentially

unlimited) loss. Short sales also involve transaction and financing costs that will reduce potential Fund gains and increase potential Fund losses.

Small-Cap Securities Risk: Investments in or exposure to the securities of companies with smaller market capitalizations involve higher risks in some

respects than do investments in securities of larger companies. For example, prices of such securities are often more volatile than prices of large capitalization securities. In

addition, due to thin trading in some such securities, an investment in these securities may be less liquid (i.e., harder to sell) than that of larger capitalization securities. Smaller capitalization companies also fail more often than larger companies and may have more limited management and

financial resources than larger companies.

Swap Agreements Risk: Swap agreements involve the risk that the party with whom the Fund has entered into

the swap will default on its obligation to pay the Fund. Additionally, certain unexpected market events or significant adverse market movements could result in the Fund not holding enough assets to be able to meet its obligations under the agreement. Such

occurrences may negatively impact the Fund’s ability to implement its principal investment strategies and could result in losses to the Fund.

Value Style Risk:

Investing in or having exposure to “value” securities presents the risk that the securities may never reach what the Adviser believes are their full market values, either because the market fails to recognize what the

Adviser considers to be the security’s true value or because the Adviser misjudged that value. In addition, there may be periods during which the investment performance of the Fund while using a value strategy may suffer.

Volatility Risk: The Fund may have investments that appreciate or decrease significantly in value over

short periods of time. This may cause the Fund’s net asset value per share to experience significant increases or declines in value over short periods of time, however, all investments long- or short-term are subject to risk of loss.

Performance Information

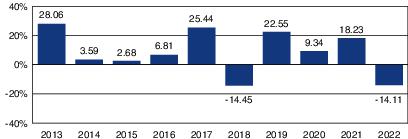

The performance information below shows summary performance information for the Fund in a bar chart and an average annual total returns table. The

information shows you how the Fund’s performance has varied year by year and provides some indication of the risks of investing in the Fund.

The Fund’s past performance (before and after taxes), as provided by the bar

chart and performance table that follows, is not an indication of future results. Updated

information on the Fund’s performance, including its current NAV

per share, can be obtained by visiting https://funds.aqr.com.

Class I

Shares—Total Returns

The bar chart below provides an illustration of how the

Fund’s performance has varied in each of the indicated calendar years.

AQR Funds–Summary Prospectus6

| Highest Quarterly Return |

Lowest Quarterly Return | ||

| 20.18% |

6/30/20 |

-24.06% |

3/31/20 |

Average Annual Total Returns as of December 31, 2022

The following table compares the Fund’s average annual total returns for Class I Shares, Class N Shares and Class R6 Shares as of December 31, 2022 to the MSCI World Index. You cannot invest directly in an index. The table includes all applicable fees and sales charges.

| |

One

Year |

Five

Year |

Ten

Year |

Since

Inception |

Share Class

Inception

Date |

| AQR Global Equity Fund—Class I |

|

|

|

|

|

| Return Before Taxes |

-14.11% |

3.08% |

7.83% |

- |

12/31/2009 |

| Return After Taxes on Distributions |

-14.98% |

1.94% |

4.97% |

- |

|

| Return After Taxes on Distributions and Sale of Fund Shares |

-7.75% |

2.34% |

5.42% |

- |

|

| MSCI World Index (reflects no

deductions for fees, expenses or

taxes) |

-18.14% |

6.14% |

8.85% |

- |

|

| AQR Global Equity Fund—Class N |

|

|

|

|

|

| Return Before Taxes |

-14.41% |

2.79% |

7.53% |

- |

12/31/2009 |

| MSCI World Index (reflects no

deductions for fees, expenses or

taxes) |

-18.14% |

6.14% |

8.85% |

- |

|

| AQR Global Equity Fund—Class R6 |

|

|

|

|

|

| Return Before Taxes |

-14.09% |

3.16% |

- |

5.97%* |

01/08/2014 |

| MSCI World Index (reflects no

deductions for fees, expenses or

taxes) |

-18.14% |

6.14% |

- |

7.12%* |

|

* Since inception performance is shown for Class R6 since it does not have 10 years of performance history.

After-tax returns are calculated using the historical highest individual marginal tax rates and do not

reflect the impact of state and local taxes. In some cases, the return after taxes on distributions and sale of

Fund shares may exceed the return before taxes and the return after taxes on distributions due to an assumed benefit from any losses on a sale of Fund shares at the end of the measurement period. Actual after-tax returns depend on an investor’s tax situation and may differ from

those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. After-tax returns are for Class I Shares only. After-tax

returns for other classes will vary.

Investment Manager

The Fund’s investment manager is AQR Capital Management, LLC.

Portfolio Managers

| Name |

Portfolio Manager

of the Fund Since |

Title |

| Clifford S. Asness, Ph.D., M.B.A. |

December 31, 2009 |

Managing and Founding Principal of the Adviser |

| John M. Liew, Ph.D., M.B.A. |

December 31, 2009 |

Founding Principal of the Adviser |

| Jordan Brooks, Ph.D., M.A. |

January 1, 2022 |

Principal of the Adviser |

| Andrea Frazzini, Ph.D., M.S. |

January 1, 2020 |

Principal of the Adviser |

| John. J. Huss |

January 1, 2022 |

Principal of the Adviser |

| Lars N. Nielsen, M.Sc. |

January 1, 2020 |

Principal of the Adviser |

Important Additional Information

PURCHASE AND SALE OF FUND SHARES

You may purchase or redeem Class N Shares, Class I Shares and Class R6 Shares of the Fund, as

applicable, each day the NYSE is open. To purchase or redeem shares you should contact your

financial intermediary, or, if you hold your shares through the Fund, you should contact the Fund by phone at (866) 290-2688 or by mail (c/o AQR Funds, P.O. Box 2248, Denver, CO 80201-2248). The Fund’s initial and subsequent investment minimums for Class N Shares, Class I Shares and

Class R6 Shares, as applicable, generally are as follows.

AQR

Funds–Summary Prospectus7

| |

Class N Shares |

Class I Shares |

Class R6 Shares |

| Minimum Initial Investment |

$1,000,000* |

$5,000,000* |

$50,000,000* |

| Minimum Subsequent Investment |

None |

None |

None |

* Reductions apply to certain eligibility groups. See “Investing With the AQR Funds” in the

Fund’s prospectus.

Tax Information

The Fund’s dividends and distributions may be subject to federal income taxes and may be taxed as ordinary income or

capital gains, unless you are a tax-exempt investor or are investing through a retirement plan, in which case you may be subject to federal income tax upon withdrawal from such tax deferred arrangements.

Payments to Broker/Dealers and other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary, the Fund

and/or the Adviser or its

affiliates may pay the intermediary for the sale of Fund shares and other services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your individual financial professional to

recommend the Fund over another investment. Ask your individual financial professional or visit your financial intermediary’s website for more information.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- HSBC Bank Plc - Form 8.5 (EPT/RI) - Wincanton plc

- Russell Wilson Cements his Commitment to Performance Excellence by Joining INDIBA as an Ambassador

- Nothing Introduces Ear and Ear (a) along with new ChatGPT Integrations

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share