Form 497K AQR Funds

AQR Diversified Arbitrage Fund

Fund Summary — May 1, 2022 (as Amended August 19, 2022)

Ticker: Class N/ADANX —Class I/ADAIX — CLASS R6/QDARX

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, reports to shareholders, and other information about the Fund, including the statement of additional information, online at https://funds.aqr.com/fund-documents. You can also get this information at no cost by calling (866) 290-2688 or by sending an email to [email protected]. The Fund’s

prospectus and

statement of additional information, each dated May 1, 2022, as amended and supplemented from time to time, and the Fund’s most recent

shareholder report, dated December 31, 2021, are all incorporated by reference to this summary prospectus.

Investment Objective

The AQR

Diversified Arbitrage Fund (the “Fund”) seeks long-term absolute (positive) returns.

As

further described under “Details About the AQR Diversified Arbitrage Fund” in the Fund’s prospectus, an “absolute (positive) return” seeks to earn a

positive total return over a reasonable period of time regardless of market conditions or

general market direction.

Fees and Expenses of the Fund

This

table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the

value of your investment)

| |

Class N |

Class I |

Class R6 |

| Management Fee |

1.00% |

1.00% |

1.00% |

| Distribution (12b-1) Fee |

0.25% |

None |

None |

| Other Expenses |

|

|

|

| Dividends and interest on short sales1 and other

interest expense |

0.27% |

0.27% |

0.27% |

| All other expenses |

0.24% |

0.24%

|

0.15% |

| Total Other Expenses |

0.51% |

0.51% |

0.42% |

| Acquired Fund Fees and Expenses2

|

0.02% |

0.02% |

0.02% |

| Total Annual Fund Operating Expenses |

1.78% |

1.53% |

1.44% |

| Less: Expense Reimbursements3

|

0.04% |

0.04% |

0.05% |

| Total Annual Fund Operating Expenses after Expense Reimbursements4 |

1.74% |

1.49% |

1.39% |

1 When a cash dividend is declared on a stock the Fund has sold short, or an interest payment is made on

a bond the Fund has sold short, the Fund is required to pay an amount equal to the dividend or interest payment, as applicable, to the party from which the Fund has borrowed the

stock or bond, and to record the payment as an expense.

2 Acquired Fund Fees and Expenses reflect the expenses incurred indirectly by the Fund as a result of the

Fund's investments in underlying money market mutual funds, exchange-traded funds or other pooled investment vehicles.

3 The

Adviser has contractually agreed to reimburse operating expenses of the Fund in an amount

sufficient to limit certain Specified Expenses at no more than 0.20% for Class N Shares and Class I Shares and 0.10% for Class R6 Shares. "Specified Expenses" for this purpose

include all Fund operating expenses other than management fees and 12b-1 fees and exclude interest, taxes, dividends on short sales, borrowing costs, acquired fund fees and expenses, interest expense relating to short sales, expenses related to class action claims, contingent expenses related to tax reclaim receipts and extraordinary expenses. This agreement (the “Expense Limitation Agreement”) will continue at least through April 30, 2023. The Expense Limitation Agreement may be

terminated with the consent of the Board of Trustees, including a majority of the Non-Interested Trustees of the Trust. The Adviser is entitled to recapture any expenses reimbursed during the thirty-six month period following the

end of the month during which the Adviser reimbursed expenses, provided that the amount

recaptured may not cause the Specified Expenses attributable to a share class of the Fund during a year in which a repayment is made to exceed either of (i) the applicable limits in

effect at the time of the reimbursement and (ii) the applicable limits in effect at the time of recapture.

AQR Funds–Summary Prospectus2

4 Total Annual Fund Operating Expenses after Expense Reimbursements are 1.47% for Class N Shares, 1.22%

for Class I Shares and 1.12% for Class R6 Shares if dividends and interest on short sales and other interest expense are not included.

Example: This Example is intended to help you compare the cost of investing in the Fund with

the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in

the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and

that the Fund’s operating expenses remain the same and takes into account the effect of the Expense Limitation Agreement through April 30, 2023, as discussed in Footnote No. 3 to the Fee Table. Although your actual costs may be higher or lower,

based on these assumptions your costs would be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class N Shares |

$177 |

$556 |

$961 |

$2,091 |

| Class I Shares |

$152 |

$479 |

$830 |

$1,820 |

| Class R6 Shares |

$142 |

$451 |

$782 |

$1,720 |

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells

securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the

example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 518% of the average value of its

portfolio.

Principal Investment Strategies of the

Fund

The Fund seeks to outperform, after expenses, the ICE BofAML US 3-Month Treasury Bill Index while seeking to control its tracking risk relative to this benchmark. The ICE BofAML US 3-Month Treasury Bill Index is designed to measure the performance of a high-quality short-term cash-equivalent investment. An investment in the Fund is more volatile than an

investment in Treasury Bills, and is not backed by the full faith and credit of the U.S. Government.

The Fund uses a number of arbitrage investment strategies employed by hedge funds and proprietary

trading desks of investment banks, including merger arbitrage, convertible arbitrage, and other kinds of arbitrage strategies and corporate event strategies described more fully below. In order to pursue these investment strategies, the Fund invests in a diversified

portfolio of instruments, including equities, convertible securities, debt securities, loans (including unfunded loan commitments), warrants, options, swaps (including credit default swaps and

credit default index swaps), futures contracts, forwards or other types of derivative instruments. The securities in which the Fund invests may be restricted and/or Rule 144A securities. The Sub-Adviser tactically allocates the Fund’s assets across arbitrage and alternative investment strategies with positive

anticipated returns based on market conditions.

The Sub-Adviser will employ hedging strategies with the intent of (i) reducing the risk associated with

each of the arbitrage and corporate event strategies; (ii) keeping the overall

volatility of the Fund’s net asset value low; and (iii) maintaining a low correlation with the overall equity market.

The Fund will also engage extensively in short sales of securities. When the Fund sells a security short, it borrows the

security from a third party and sells it at the then current market price. The Fund is then obligated to buy the security on a later date so that it can return the security to the lender. For arbitrage strategies, the Fund will generally buy securities and simultaneously sell securities short in amounts that are intended to result in an approximately neutral economic exposure to

overall market movements.

The Fund makes use of derivative instruments, which may be used for hedging purposes, as a substitute for investing in

conventional securities and for investment purposes. The Fund will also use derivatives to increase its economic exposure, either long or short, to a particular security, currency or index. Futures and forward contracts are contractual agreements to

buy or sell a particular currency, commodity or financial instrument at a pre-determined price in the future. The Fund’s use of swaps, futures contracts, forward contracts and certain other derivative instruments may have the economic effect of

financial leverage. Financial leverage magnifies exposure to the swings in prices of an asset underlying a derivative instrument and results in increased volatility, which means the Fund will have the potential for greater gains, as well as the potential for greater losses, than if the

Fund did not use derivative instruments that have a leveraging effect. For example, if the

Adviser seeks to gain enhanced exposure to a specific asset through a derivative instrument

providing leveraged exposure to the asset and that derivative instrument increases in value, the gain to the Fund will be magnified. If that investment decreases in value, however, the loss to the Fund will also be magnified. A decline in the Fund’s assets due to losses magnified by the derivative instruments providing leveraged exposure may require the Fund to liquidate portfolio

positions to satisfy its obligations or to meet redemption requests when it may not be advantageous to do so. There is no assurance that the Fund’s use of derivative instruments providing enhanced exposure will enable the Fund to achieve its

investment objective.

The Fund invests in debt securities, which may be of any credit rating, maturity or duration, and which

may include high-yield or “junk” bonds. A portion of the Fund’s assets will be held in cash or cash equivalent investments, including, but not limited to, interests in short-term investment funds, shares of money market or short-term bond funds and/or U.S. Government

securities. In response to adverse market, economic or other conditions, such as the availability of attractive arbitrage and corporate event opportunities (or lack thereof), the Fund may temporarily invest a substantial portion of its assets in such

cash or cash equivalent securities and during such periods the Fund may not achieve its investment objective. The Fund will invest in issuers in foreign countries, which may include emerging market countries.

AQR Funds–Summary Prospectus3

Examples of Arbitrage and Corporate Event Strategies:

Merger Arbitrage:

When engaging in merger arbitrage, the Sub-Adviser buys shares of the “target”

company in a proposed merger or other reorganization between two companies. If the consideration in the transaction consists of stock of the acquirer, the Sub-Adviser will

typically hedge the exposure to the acquirer by shorting the stock of the acquiring company.

Convertible Arbitrage: When employing a convertible arbitrage strategy, the Sub-Adviser invests in convertible securities that are trading at discounts to their fundamental values and attempts to mitigate the various risks associated with investing

in such convertible securities. In some cases, convertible

securities trade at premiums relative to their fundamental values; in such cases the Fund would short sell the

respective convertible security and employ various hedging strategies to mitigate the various risks associated with being short the convertible security.

Corporate

Events: The Sub-Adviser

also employs other arbitrage and corporate event strategies when market opportunities arise. Examples of such investments can include distressed investments, IPOs (Initial Public

Offerings), SEOs (Seasoned Equity Offerings), “price-pressure” trades, “dual-class” arbitrage and “closed-end fund” arbitrage among other

strategies. Additionally, as a part of its corporate events strategy, the Fund will invest in Special Purpose Acquisition Companies (“SPACs”). SPACs, sometimes referred to as “blank check” companies, are publicly traded companies or similar special purpose entities that pool funds to seek potential acquisition opportunities. Unless and until an acquisition is completed, a

SPAC generally invests its assets (less a portion retained to cover expenses) in U.S. Government securities, money market fund securities and cash. The Fund seeks to capture a liquidity premium when these securities (initially a unit comprised of a

share and a right or a warrant) are selling at a discount to their fundamental value.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in

the Fund or your investment may not perform as well as other similar investments. The Fund is not a complete investment program and

should be considered only as one part of an investment portfolio. The Fund is more appropriate for long-term investors who can bear the risk of

short-term NAV fluctuations, which at times, may be significant and rapid, however, all investments long- or short-term are subject to risk of

loss. The following is a summary description of certain risks of investing in the Fund. The order of the below

risk factors does not indicate the significance of any particular risk factor.

Arbitrage or Fundamental Risk: Employing arbitrage and alternative strategies involves the risk that

anticipated opportunities may not play out as planned, resulting in potentially reduced returns or losses to the Fund as it unwinds failed trades.

Below

Investment Grade Securities Risk: Although bonds rated below investment grade (also known as “junk” securities) generally pay higher rates of interest than investment grade bonds, bonds rated below investment grade are high risk,

speculative investments that may cause income and principal losses for the Fund.

Common Stock Risk: The Fund may invest in, or have exposure to, common stocks. Common stocks are subject to

greater fluctuations in market value than certain other asset classes as a result of such factors as a company’s business performance, investor perceptions, stock market trends and general economic conditions.

Convertible Securities Risk: The market value of a convertible security performs like that of a regular debt security; that is, if market interest rates rise, the value of a convertible security usually falls. In addition, convertible securities are subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may

change based on changes in the issuer’s credit rating or the market’s perception of the issuer’s creditworthiness. Since it derives a portion of its value from the common stock into which it may be converted, a convertible security is also subject to the same types of market and issuer risks that apply to the underlying common stock.

Counterparty Risk:

The Fund may enter into various types of derivative contracts. Many of these derivative contracts will be privately negotiated in the over-the-counter market. These contracts also

involve exposure to credit risk, since contract performance depends in part on the financial condition of the counterparty. If a privately negotiated over-the-counter contract

calls for payments by the Fund, the Fund must be prepared to make such payments when due. In addition, if a

counterparty’s creditworthiness declines, the Fund may not receive payments owed under the contract, or such payments may be delayed under such circumstances and the value of agreements with such counterparty can be expected to decline,

potentially resulting in losses to the Fund.

Credit Default Swap Agreements Risk: The Fund may enter into credit default swap agreements or credit default index

swap agreements as a “buyer” or “seller” of credit protection. Credit default swap agreements involve special risks because they may be difficult to value, are highly susceptible to liquidity and credit risk, and generally pay a return to the party that has paid the premium only in the event of an actual default by the issuer of the underlying obligation (as opposed to a credit

downgrade or other indication of financial difficulty).

Credit Risk: Credit risk refers to the possibility that the issuer of a security or the issuer of the

reference asset of a derivative instrument will not be able to make principal and interest payments when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer.

AQR

Funds–Summary Prospectus4

Securities rated in the four highest categories by the rating agencies are considered investment grade but

they may also have some speculative characteristics. Investment grade ratings do not guarantee that the issuer will not default on its payment obligations or that bonds will not otherwise lose value.

Currency Risk: Currency risk is the risk that changes in currency exchange rates will negatively affect

securities denominated in, and/or receiving revenues in, foreign currencies. The liquidity and trading value of foreign currencies could be affected by global economic factors, such as inflation, interest rate levels, and trade balances among countries, as well as the actions of sovereign governments and central banks. Adverse changes in currency exchange rates (relative to the U.S.

dollar) may erode or reverse any potential gains from the Fund’s investments in securities denominated in a foreign currency or may widen existing losses.

Derivatives Risk: In general, a derivative instrument typically involves leverage, i.e., it provides exposure to potential gain or loss from a change in the level of the market price of the underlying security or currency (or a basket or index) in a

notional amount that exceeds the amount of cash or assets required to establish or maintain the derivative instrument. Adverse changes in the value or level of the underlying asset or index, which the Fund may not directly own, can result in a

loss to the Fund substantially greater than the amount invested in the derivative itself. The use of derivative instruments also exposes the Fund to additional risks and transaction costs. These instruments come in many varieties and have a wide range

of potential risks and rewards, and may include, as further described in the section entitled “Principal Investment Strategies of the Fund,” futures contracts, forward

contracts, options (both written and purchased) and swaps. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate perfectly with

the overall securities markets.

Distressed Investments Risk: The Fund may invest in distressed investments, which are issued by companies that are, or might be, involved in

reorganizations or financial restructurings, either out of court or in bankruptcy. The Fund’s investments in distressed securities typically may involve the purchase of

high-yield bonds, bank debt, corporate loans or other indebtedness of such companies. These investments may present a substantial risk of default or may be in default at the

time of investment. The Fund may incur additional expenses to the extent it is required to seek recovery upon a default in the payment of principal or interest on its portfolio holdings. In any reorganization or liquidation proceeding relating to an

investment, the Fund may lose its entire investment or may be required to accept cash or securities with a value less than its original investment. Among the risks inherent in investments in a troubled issuer is that it frequently may be difficult to obtain information as to the true financial condition of the issuer. The Adviser’s or Sub-Adviser’s judgments

about the credit quality of a financially distressed issuer and the relative value of its securities may prove to be wrong.

Emerging Market

Risk: The Fund intends to have exposure to emerging markets. Emerging markets are riskier than more developed

markets because they tend to develop unevenly and may never fully develop. Investments in emerging markets may be considered speculative. Emerging markets are more likely to

experience hyperinflation and currency devaluations, which adversely affect returns to U.S. investors. In addition, many emerging securities markets have far lower trading volumes and less liquidity than developed markets. Emerging markets generally have less stable political systems, less

developed securities settlement procedures and may require the establishment of special custody arrangements. Emerging securities markets generally do not have the level of market efficiency and strict standards in accounting and securities

regulation as developed markets, which could impact the Adviser's ability to evaluate these securities and/or impact Fund performance.

Foreign Investments Risk: Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund

will lose money. These risks include:

•The Fund generally holds its foreign instruments and cash in foreign banks and securities depositories, which may be

recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight.

•Changes in foreign currency

exchange rates can affect the value of the Fund’s portfolio.

•The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to

such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position.

•The governments of certain countries may prohibit or impose substantial restrictions on foreign investments in their

capital markets or in certain industries.

•Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the

same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws.

•Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities

not typically associated with settlement and clearance of U.S. investments.

•The regulatory, financial reporting, accounting, recordkeeping and auditing standards of foreign countries may differ, in

some cases significantly, from U.S. standards.

Forward and Futures Contract Risk: The successful use of forward and futures contracts draws upon the Adviser’s or Sub-Adviser's (as

applicable) skill and experience with respect to such instruments and is subject to special risk considerations. The primary risks associated with the use of forward and futures

contracts, which may adversely affect the Fund’s NAV and total return, are (a) the

imperfect correlation between the change in market value of the instruments held by the Fund and the price of the forward or futures contract; (b) possible lack of a liquid

secondary market for a forward or futures contract and the resulting inability to close a forward or futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Adviser’s or Sub-Adviser's (as

applicable) inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors;

AQR

Funds–Summary Prospectus5

(e) the possibility that the counterparty will default in the performance of its obligations; and

(f) if the Fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the Fund may have to sell securities at a time when it may be disadvantageous to do so.

Hedging Transactions Risk: The Adviser and

Sub-Adviser from time to time employ various hedging techniques. The success of the Fund’s hedging strategy will be subject to the Adviser’s or Sub-Adviser's ability to

correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged. Since the characteristics of many securities change as markets change or time

passes, the success of the Fund’s hedging strategy will also be subject to the

Adviser’s and Sub-Adviser's ability to continually

recalculate, readjust, and execute hedges in an efficient and timely manner. For a variety of reasons, the Adviser or Sub-Adviser may not seek to

establish a perfect correlation between such hedging instruments and the portfolio holdings being hedged. Such imperfect correlation may prevent the Fund from achieving the

intended hedge or expose the Fund to risk of loss. In addition, it is not possible to hedge fully or perfectly against any risk, and hedging entails its own costs (such as trading commissions and fees).

High Portfolio Turnover Risk: The investment techniques and strategies utilized by the Fund, including

investments made on a shorter-term basis or in derivative instruments or instruments with a maturity of one year or less at the time of acquisition, may result in frequent portfolio trading and high portfolio turnover. High portfolio turnover rates will cause the Fund to incur higher levels of brokerage fees and commissions, which may reduce performance, and may cause higher levels of

current tax liability to shareholders in the Fund.

Illiquidity Risk:

The Fund may experience difficulty in selling illiquid investments in a timely manner at the price that it

believes the investments are worth. In addition, market conditions may cause the Fund to experience temporary mark-to-market losses, especially in less liquid positions, even in the absence of any selling of investments by the Fund.

Interest Rate

Risk: Interest rate risk is the risk that prices of fixed income securities generally increase when interest rates decline and decrease when interest rates increase. The Fund may lose money if short-term or long-term interest rates rise

sharply or otherwise change in a manner not anticipated by the Adviser or Sub-Adviser.

Investment in Other Investment Companies Risk: As with other investments, investments in other investment companies, including exchange-traded funds (“ETFs”),

are subject to market and manager risk. In addition, if the Fund acquires shares of investment companies, shareholders bear both their proportionate share of expenses in the Fund

(including management and advisory fees) and, indirectly, the expenses of the investment companies. The Fund may invest in money market mutual funds. An

investment in a money market mutual fund is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other government agency. Although money market mutual

funds that invest in U.S. government securities seek to preserve the value of the Fund’s investment at

$1.00 per share, it is possible to lose money by investing in a stable NAV money market

mutual fund. Moreover, prime money market mutual funds are required to use floating NAVs that do not preserve the value

of the Fund’s investment at $1.00 per share.

IPO and SEO Risk: “IPOs” or “New Issues” are initial public offerings of U.S.

equity securities. “SEOs” are seasoned (i.e., secondary) equity offerings of U.S. equity securities. Securities issued in IPOs are subject to many of the same risks as

investing in companies with smaller market capitalizations (see “Risk Factors — Small-Cap Securities Risk”). Securities issued in IPOs have no trading history, and information about the companies may be available for very limited periods. In

addition, the prices of securities sold in IPOs or SEOs may be highly volatile or may decline shortly after the initial public offering or seasoned equity offering.

Leverage Risk: As part of the Fund’s principal investment strategy, the Fund will make investments in

futures contracts, forward contracts, options and swaps and other derivative instruments. These derivative instruments provide the economic effect of financial leverage by creating additional investment exposure to the underlying instrument, as well as the potential

for greater loss. If the Fund uses leverage through activities such as entering into short

sales or purchasing derivative instruments, the Fund has the risk that losses may exceed the net assets of the Fund. The net asset value of the Fund while employing leverage will be more volatile and sensitive to market

movements.

Litigation and Enforcement Risk: Investing in companies involved in significant restructuring tends to involve increased litigation risk. This risk may be

greater in the event the Fund takes a large position or is otherwise prominently involved on a bankruptcy or creditors’ committee. The expense of asserting claims (or

defending against counterclaims) and recovering any amounts pursuant to settlements or judgments may be borne by the Fund. Further, ownership of companies over certain threshold levels involves additional filing requirements and substantive regulation on such owners, and if the Fund fails to

comply with all of these requirements, the Fund may be forced to disgorge profits, pay fines or otherwise bear losses or other costs from such failure to comply.

Manager Risk: If the

Adviser or Sub-Adviser makes poor investment decisions, it will negatively affect the Fund’s investment performance.

Market Risk: Market risk is the risk that the markets on which the Fund’s investments trade will

increase or decrease in value. Prices may fluctuate widely over short or extended periods in response to company, market or economic news. Markets also tend to move in cycles, with periods of rising and falling prices. If there is a general decline in the securities and other markets, your investment in the Fund may lose value, regardless of the individual results of the securities and other

instruments in which the Fund invests.

AQR Funds–Summary Prospectus6

Mid-Cap Securities

Risk: The Fund may invest in, or have exposure to, the securities of mid-cap companies. The prices of

securities of mid-cap companies generally are more volatile than those of large capitalization companies and are more likely to be adversely affected than large-cap companies by changes in earnings results and investor expectations or poor economic

or market conditions, including those experienced during a recession.

Model and Data

Risk: Given the complexity of the investments and strategies of the Fund, the Adviser relies heavily on quantitative models and information and data supplied or made available by third parties (“Models

and Data”). Models and Data are used to construct sets of transactions and investments, to provide risk management insights, and to assist in hedging the Fund’s investments.

When Models and Data prove to be incorrect or incomplete, including because data is stale, missing or

unavailable, any decisions made in reliance thereon expose the Fund to potential risks. Similarly, any hedging based on faulty Models and Data may prove to be unsuccessful. Some of the models used by the Adviser for the Fund are predictive in nature. The use of predictive models has inherent risks. Because predictive models are

usually constructed based on historical data supplied by third parties or otherwise, the success of relying on such models may depend on the accuracy and reliability of the supplied historical data. The Fund bears the risk that the quantitative models used by the Adviser will not be successful in selecting investments or in determining the weighting of investment positions that will enable

the Fund to achieve its investment objective.

All models rely on correct data inputs. If incorrect data is entered into even a well-founded model, the resulting information

will be incorrect. However, even if data is inputted correctly, “model prices” will often differ substantially from market prices, especially for instruments with complex characteristics, such as derivative instruments.

The Fund is unlikely to be successful unless the assumptions underlying the models are realistic and either remain realistic

and relevant in the future or are adjusted to account for changes in the overall market environment. If such assumptions are inaccurate or become inaccurate and are not promptly adjusted, it is likely that profitable trading signals will not be

generated, and major losses may result.

The

Adviser, in its sole discretion, will continue to test, evaluate and add new models, which

may result in the modification of existing models from time to time. There can be no assurance that model modifications will enable the Fund to achieve its investment objective.

Options Risk: An option is an agreement that, for a premium payment or fee, gives the option holder (the

purchaser) the right but not the obligation to buy (a “call option”) or sell (a “put option”) the underlying asset (or settle for cash an amount based on an underlying asset, rate, or index) at a specified price (the “exercise price”) during a period of time or on a specified date. Investments in options are considered speculative. When the Fund purchases an option, it may lose the

premium paid for it if the price of the underlying security or other assets decreased or remained the same (in the case of a call option) or increased or remained the same (in the case of a put option). If a put or call option purchased by the Fund

were permitted to expire without being sold or exercised, its premium would represent a loss to the Fund. The Fund may also write call and put options, which includes the risk that the underlying instrument appreciates or depreciates sufficiently over the period to offset the net premium received by the Fund for the written option, resulting in a loss to the Fund.

PIPEs Risk: The

Fund may make private investments in public companies whose stocks are quoted on stock exchanges or which trade in the over-the-counter securities market, a type of investment

commonly referred to as a “PIPE” transaction. PIPE transactions will generally result in the Fund acquiring either restricted stock or an instrument convertible into

restricted stock. As with investments in other types of restricted securities, such an investment may be illiquid. The Fund’s ability to dispose of securities acquired in PIPE transactions may depend upon the registration of such securities for resale. Any

number of factors may prevent or delay a proposed registration. Even if the Fund is able to have securities acquired in a PIPE transaction registered or sell such securities through an exempt transaction, the Fund may not be able to sell all the

securities on short notice, and the sale of the securities could lower the market price of the securities.

Restricted Securities Risk: Restricted securities are securities that cannot be offered for public resale unless registered under the applicable

securities laws or that have a contractual restriction that prohibits or limits their resale. Restricted securities may not be listed on an exchange and may have no active trading

market. Restricted securities may include private placement securities that have not been registered under the applicable securities laws. Certain restricted securities can be resold to institutional investors and traded in the institutional market under Rule 144A under the Securities Act of

1933, as amended, and are called Rule 144A securities. Rule 144A securities can be resold to qualified institutional buyers but not to the general public.

Short Sale Risk: The Fund enters into a short sale by selling a security it has borrowed (typically from a

broker or other institution). If the market price of a security increases after the Fund borrows the security, the Fund will suffer a (potentially unlimited) loss when it replaces the borrowed security at the higher price. In certain cases, purchasing a security to cover a

short position can itself cause the price of the security to rise further, thereby exacerbating the loss. In addition, the Fund may not always be able to borrow the security at a particular time or at an acceptable price. The Fund may also take a short

position in a derivative instrument, such as a future, forward or swap. A short position in a derivative instrument involves the risk of a theoretically unlimited increase in the value of the underlying instrument, which could cause the Fund to suffer a

(potentially unlimited) loss. Short sales also involve transaction and financing costs that will reduce potential Fund gains and increase potential Fund losses.

AQR Funds–Summary Prospectus7

Small-Cap Securities Risk: Investments in or exposure to the securities of companies with smaller market capitalizations involve higher risks in some

respects than do investments in securities of larger companies. For example, prices of such securities are often more volatile than prices of large capitalization securities. In

addition, due to thin trading in some such securities, an investment in these securities may be less liquid (i.e., harder to sell) than that of larger capitalization securities. Smaller capitalization companies also fail more often than larger companies and may have more limited management and

financial resources than larger companies.

SPACs Risk: The Fund may invest in stock, warrants, and other securities of special purpose acquisition

companies (“SPACs”) or similar special purpose entities that pool funds to seek potential acquisition opportunities. Unless and until an acquisition is completed, a SPAC generally invests its assets (less a portion retained to cover expenses) in U.S. Government

securities, money market fund securities and cash; if an acquisition that meets the requirements for the SPAC is not completed within a pre-established period of time, the invested funds are returned to the entity’s shareholders. Because

SPACs and similar entities are in essence blank check companies without an operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable acquisition. Some SPACs may pursue acquisitions only within certain industries or regions,

which may increase the volatility of their prices. In addition, these securities, which are typically traded in the over-the-counter market, can in certain

circumstances be considered illiquid and/or be subject to restrictions on resale.

Swap Agreements

Risk: Swap agreements involve the risk that the party with whom the Fund has entered into the swap will default

on its obligation to pay the Fund. Additionally, certain unexpected market events or significant adverse market movements could result in the Fund not holding enough assets to be

able to meet its obligations under the agreement. Such occurrences may negatively impact the Fund’s ability to implement its principal investment strategies and could result

in losses to the Fund.

Volatility Risk: The Fund may have investments that appreciate or decrease significantly in value over

short periods of time. This may cause the Fund’s net asset value per share to experience significant increases or declines in value over short periods of time, however, all investments long- or short-term are subject to risk of loss.

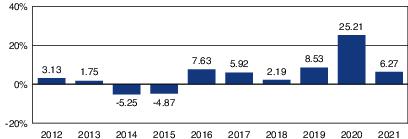

Performance Information

The performance information below shows summary performance information for the Fund in a bar chart and an average annual total returns table. The

information shows you how the Fund’s performance has varied year by year and provides some indication of the risks of investing in the Fund.

The Fund’s past performance (before and after taxes), as provided by the bar

chart and performance table that follows, is not an indication of future results. Updated

information on the Fund’s performance, including its current NAV

per share, can be obtained by visiting https://funds.aqr.com.

Class I

Shares—Total Returns

The bar chart below provides an illustration of how the

Fund’s performance has varied in each of the indicated calendar years.

| Highest Quarterly Return |

Lowest Quarterly Return | ||

| 13.28% |

12/31/20 |

-6.67% |

3/31/20 |

AQR Funds–Summary Prospectus8

Average Annual Total Returns as of December 31, 2021

The following table compares the Fund’s average annual total returns for Class I Shares, Class N Shares and Class R6 Shares for the periods ended December 31, 2021 to the ICE BofAML US 3-Month Treasury Bill

Index. You cannot invest directly in an index. The table includes all applicable fees and sales charges.

| |

One

Year |

Five

Year |

Ten

Year |

Since

Inception |

Share Class

Inception

Date |

| AQR Diversified Arbitrage Fund— Class I |

|

|

|

|

|

| Return Before Taxes |

6.27% |

9.34% |

4.76% |

- |

01/15/2009 |

| Return After Taxes on Distributions |

5.99% |

7.82% |

3.33% |

- |

|

| Return After Taxes on Distributions and Sale of Fund Shares |

3.71% |

6.57% |

3.01% |

- |

|

| ICE BofAML US 3-Month Treasury Bill Index (reflects no deductions for

fees, expenses or taxes) |

0.05% |

1.14% |

0.63% |

- |

|

| AQR Diversified Arbitrage Fund— Class N |

|

|

|

|

|

| Return Before Taxes |

5.99% |

9.07% |

4.51% |

- |

01/15/2009 |

| ICE BofAML US 3-Month Treasury Bill Index (reflects no deductions for

fees, expenses or taxes) |

0.05% |

1.14% |

0.63% |

- |

|

| AQR Diversified Arbitrage Fund— Class R6 |

|

|

|

|

|

| Return Before Taxes |

6.37% |

9.46% |

- |

5.84%* |

09/02/2014 |

| ICE BofAML US 3-Month Treasury Bill Index (reflects no deductions for

fees, expenses or taxes) |

0.05% |

1.14% |

- |

0.83%* |

|

* Since inception performance is shown for Class R6 since it does not have 10 years of performance history.

After-tax returns are calculated using the historical highest individual marginal tax rates and do not

reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax

situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or

individual retirement accounts. After-tax returns are for Class I Shares only. After-tax returns for other

classes will vary.

Investment Manager

The Fund’s investment manager is AQR Capital Management, LLC. AQR Arbitrage, LLC is

the Sub-Adviser of the Fund.

Portfolio Managers

| Name |

Portfolio Manager

of the Fund Since |

Title |

| Ashwin Thapar |

January 1, 2022 |

Principal of the Adviser |

| Robert F. Bryant |

May 1, 2019 |

Principal of the Sub-Adviser |

| Mark L. Mitchell, Ph.D. |

January 15, 2009 |

Principal of the Sub-Adviser |

| Todd C. Pulvino, Ph.D., A.M., M.S. |

January 15, 2009 |

Principal of the Sub-Adviser |

| John Eckert |

May 1, 2022 |

Managing Director of the Sub-Adviser |

Important Additional Information

Purchase and Sale of Fund Shares

You may purchase or redeem Class N Shares, Class I Shares and Class R6 Shares of the Fund, as applicable,

each day the NYSE is open. To purchase or redeem shares you should contact your financial

intermediary, or, if you hold your shares through the Fund, you should contact the Fund by phone at (866) 290-2688 or by mail (c/o AQR Funds, P.O. Box 2248, Denver, CO 80201-2248). The Fund’s initial and subsequent investment minimums for Class N Shares, Class I Shares and

Class R6 Shares, as applicable, generally are as follows.

| |

Class N Shares |

Class I Shares |

Class R6 Shares |

| Minimum Initial Investment |

$1,000,0001

|

$5,000,0001

|

$50,000,0001 |

| Minimum Subsequent Investment |

None |

None |

None |

1 Reductions apply to certain eligibility groups. See “Investing With the AQR Funds” in the

Fund’s prospectus.

AQR Funds–Summary Prospectus9

Tax Information

The Fund’s dividends and distributions may be subject to federal income taxes and may be taxed as

ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a retirement plan, in which case you may be subject to federal income tax upon withdrawal from such tax deferred arrangements.

Payments to Broker/Dealers and other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary, the Fund

and/or the Adviser or its

affiliates may pay the intermediary for the sale of Fund shares and other services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your individual financial professional to

recommend the Fund over another investment. Ask your individual financial professional or visit your financial intermediary’s website for more information.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BrainSell Promotes Kevin Cook to Chief Technology Officer

- Industry Bolsters BDA’s Presence at RISKWORLD 2024

- Celebrating Earth Month: Southern Company NFWF Partnership

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share