Form 497K AMG FUNDS

|

Summary Prospectus |

May 1, 2022 (As revised December 9, 2022) |

| AMG GW&K Municipal Enhanced Yield Fund | ||

| | ||

| Class N: GWMNX |

Class I: GWMEX |

Class Z: GWMZX |

Before you invest, you

may want to review the Fund’s prospectus and statement of additional information, which contain more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information, reports to shareholders and other information about the Fund online at

https://www.amgfunds.com/resources/order_literature.html. You can also get this information at no cost by calling 1-800-548-4539 or by sending an e-mail request to [email protected]. The current prospectus and statement of additional information, dated May 1, 2022, as revised or supplemented from time to time, are incorporated by reference into this summary prospectus.

https://www.amgfunds.com/resources/order_literature.html. You can also get this information at no cost by calling 1-800-548-4539 or by sending an e-mail request to [email protected]. The current prospectus and statement of additional information, dated May 1, 2022, as revised or supplemented from time to time, are incorporated by reference into this summary prospectus.

Investment Objective

The investment objective of the AMG GW&K Municipal Enhanced Yield Fund (the “Fund”) is

to provide investors with a high level of current income that is exempt from federal income

tax. Capital appreciation is also an objective, but is secondary to income.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions

and other fees to financial intermediaries, which are not reflected in the tables and

examples below.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

| |

Class N |

Class I |

Class Z |

| Management Fee |

0.45% |

0.45% |

0.45%

|

| Distribution and Service (12b-1)

Fees |

0.25% |

None |

None |

| Other Expenses |

0.35% |

0.25% |

0.20%

|

| Total Annual Fund Operating

Expenses |

1.05% |

0.70% |

0.65%

|

| Fee Waiver and Expense Reimbursements1 |

(0.06)% |

(0.06)% |

(0.06)% |

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursements1 |

0.99% |

0.64% |

0.59% |

1AMG Funds LLC (the “Investment Manager”) has contractually agreed, through at

least May 1, 2025, to waive management fees and/or pay or reimburse the Fund’s expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursements (exclusive of taxes, interest (including interest incurred in

connection with bank and custody overdrafts and in connection with securities sold short), shareholder servicing fees, distribution and service (12b-1) fees, brokerage commissions and other transaction costs, dividends payable with

respect to securities sold short, acquired fund fees and expenses, and extraordinary expenses) of the Fund to the annual rate of 0.59% of the Fund’s average daily net assets (this annual rate or such other annual rate that may be in

effect from time to time, the “Expense Cap”), subject to later reimbursement by the Fund in certain circumstances. In general, for a period of up to 36 months after the date any amounts are paid, waived or reimbursed by the Investment Manager, the

Investment Manager may recover such amounts from the Fund, provided that such repayment would not cause the Fund’s Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursements (exclusive of the items noted

in the parenthetical above) to exceed either (i) the Expense Cap in effect at the time such amounts were paid, waived or reimbursed, or (ii) the Expense Cap in effect at the time of such repayment by the Fund. The contractual

expense limitation may only be terminated in the event the Investment Manager or a successor ceases to be the investment manager of the Fund or a successor fund, by mutual agreement between the Investment Manager and the AMG

Funds Board of Trustees or in the event of the Fund’s liquidation unless the Fund is reorganized or is a party to a merger

in which

the surviving entity is successor to the accounting and performance information of the Fund.

Expense Example

This Example will help you compare the cost of investing in the Fund to the cost of investing in other mutual funds. The Example makes certain assumptions. It assumes

that you invest $10,000 as an initial investment in the Fund for the time periods indicated

and then redeem all of your shares at the end of those periods. It also assumes that your investment has a 5% total return each year and the Fund’s operating expenses remain the same. The Example includes the

Fund’s contractual expense limitation through May 1, 2025. Although your actual costs may be higher or lower, based on the above assumptions, your costs would be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class N |

$101 |

$319 |

$565 |

$1,269 |

| Class I |

$65

|

$209 |

$375 |

$856 |

| Class Z |

$60

|

$193 |

$347 |

$796 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate

may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the

Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 61% of the average value of its portfolio.

Principal Investment Strategies

In pursuing its investment objective, which is a fundamental policy that may not be changed without shareholder approval, the Fund, under normal circumstances,

invests at least 80% of its net assets, plus the amount of any borrowings for investment

purposes, in U.S. dollar-denominated fixed income securities that are exempt from federal

income tax. This policy is also fundamental and may not be changed without shareholder

approval. In addition, up to 50% of the Fund’s net assets, plus the amount of any

borrowings for investment purposes, may be invested in securities that are subject to the federal alternative minimum tax.

The Fund may

invest up to 35% of its total assets in unrated securities, and may invest up to 50% of its total assets in unrated securities and below investment grade securities (commonly known as “junk bonds” or

“high yield securities”). Below

SUM028-1222

AMG GW&K Municipal Enhanced Yield Fund SUMMARY PROSPECTUS

investment grade

securities are rated below Baa3 by Moody’s Investors Service, Inc. (“Moody’s”) or below BBB- by S&P Global Ratings (“S&P”) or similarly rated by another nationally recognized statistical

rating organization, or unrated but determined by GW&K Investment Management, LLC, the subadviser to the Fund (“GW&K” or the “Subadviser”), to be of comparable credit

quality. In cases where the credit ratings agencies have assigned different credit ratings to the same security, the security will be considered to have the higher credit rating. The Fund may continue to hold securities that are

downgraded in credit rating subsequent to their purchase if GW&K believes it would be

advantageous to do so. The Fund may invest in bonds of any maturity or duration and does not expect to target any specific range of maturity or duration. The Fund’s average weighted portfolio maturity and duration will

vary from time to time depending on the Subadviser’s views on the direction of interest

rates.

Although

the Fund seeks to be diversified by geography and across sectors of the municipal bond market, the Fund may at times invest a significant portion of its assets in a particular state or region or in a particular

sector due to market conditions. GW&K may also allocate a significant portion of the Fund to a specific segment of the municipal bond yield. In particular, the Fund often favors bonds with more than

10 years to maturity that offer higher yields.

Within limits, the Fund also may use certain derivatives (e.g., futures, options), which are investments whose value is determined by underlying securities, indices or

reference rates.

Principal Risks

There is the risk that you may lose money on your investment. All investments carry a certain amount of risk, and the Fund cannot guarantee that it will achieve its

investment objective. An investment in the Fund is not a deposit or obligation of any bank,

is not endorsed or guaranteed by any bank, and is not insured by the Federal Deposit

Insurance Corporation (“FDIC”) or any other government

agency.

Below are some of the risks of investing in the Fund. The risks are presented in an order intended to

facilitate readability and their order does not imply that the realization of one risk is more likely to occur than another risk or likely to have a greater adverse impact than another risk. The

significance of any specific risk to an investment in the Fund will vary over time,

depending on the composition of the Fund’s portfolio, market conditions, and other

factors. You should read all of the risk information presented below carefully, because any one or more of these risks may result in losses to the Fund.

Debt Securities Risk—the value of a debt security changes in response to various factors, including, for example, market-related factors, such as changes in interest

rates or changes in the actual or perceived ability of an issuer to meet its obligations.

Investments in debt securities are subject to, among other risks, credit risk, interest rate risk, extension risk, prepayment risk and liquidity risk.

Municipal Market Risk—factors unique to the municipal bond market may negatively affect the value of municipal

bonds.

Interest Rate Risk—fixed coupon payments (cash flows) of bonds and debt securities may become less competitive with the market in periods of rising interest

rates and cause bond prices to decline. During periods of increasing interest rates, the Fund

may experience high levels of volatility and shareholder redemptions, and may have to sell

securities at times when it would otherwise not do so, and at unfavorable prices, which could

reduce the returns of the Fund.

Credit and Counterparty Risk—the issuer of bonds or other debt securities or a counterparty to a derivatives contract may be unable or unwilling, or may be

perceived as unable or unwilling, to make timely interest, principal or settlement payments or otherwise honor its obligations.

Liquidity Risk—the Fund may not be able to dispose of particular investments, such as illiquid securities, readily at favorable times or prices or the Fund

may have to sell them at a loss.

Changing Distribution Level Risk—the Fund will normally receive income which may include interest, dividends and/or capital gains, depending upon its

investments. The distribution amount paid by the Fund will vary and generally depends on the

amount of income the Fund earns (less expenses) on its portfolio holdings, and capital

gains or losses it recognizes. A decline in the Fund’s income or net capital gains arising from its investments may reduce its distribution level.

Derivatives Risk—the use of derivatives involves costs, the risk that the value of derivatives may not correlate perfectly with their underlying assets, rates or

indices, liquidity risk, and the risk of mispricing or improper valuation. The use of derivatives may not succeed for various reasons, and the complexity and rapidly changing structure of derivatives

markets may increase the possibility of market losses.

Extension Risk—during periods of rising interest rates, a debtor may pay back a bond or other fixed income security slower than expected or required, and the

value of such security may fall.

High Yield

Risk—below investment grade debt securities and unrated securities of similar credit

quality (commonly known as “junk bonds” or “high yield securities”) may be subject to greater levels of interest rate, credit, liquidity, and market risk than higher-rated securities. These

securities are considered predominately speculative with respect to the issuer’s continuing ability to make principal and interest payments.

Inflation/Deflation Risk—inflation risk is the risk that the value of assets or income from investments will be worth less

in the future. Inflation rates may change frequently and drastically as a result of various

factors and the Fund’s investments may not keep pace with inflation, which may result in losses to Fund investors or adversely affect the real value of shareholders’ investments in the Fund. Recently,

there have been signs of inflationary price movements. As such, fixed income securities

markets may experience heightened levels of interest rate volatility and liquidity risk.

Deflation risk is the risk that the prices throughout the economy decline over time – the opposite of inflation. Deflation may have an adverse effect on the creditworthiness of issuers and may make

issuer default more likely, which may result in a decline in the value of the Fund’s portfolio.

2 AMG Funds

AMG GW&K Municipal Enhanced Yield Fund SUMMARY PROSPECTUS

Management

Risk—because the Fund is an actively managed investment portfolio, security selection

or focus on securities in a particular style, market sector or group of companies may cause

the Fund to incur losses or underperform relative to its benchmarks or other funds with a

similar investment objective. There can be no guarantee that the Subadviser’s investment techniques and risk analysis will produce the desired result.

Market Risk—market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of factors, including economic, political, or market

conditions, or other factors including terrorism, war, natural disasters and the spread of

infectious illness or other public health issues, including epidemics or pandemics such as the COVID-19 outbreak, or in response to events that affect particular industries or companies.

Prepayment

Risk—a debtor may exercise its right to pay back a bond or other debt security

earlier than expected or required during periods of decreasing interest rates.

Reinvestment Risk—the Fund may have difficulty reinvesting payments from debtors and may receive lower rates than from its original investments.

Sector

Risk—issuers and companies that are in similar industry sectors may be similarly

affected by particular economic or market events; to the extent the Fund has substantial

holdings within a particular sector, the risks associated with that sector increase. A portion of the Fund's assets may be invested in fixed income securities that would tend to respond similarly to

particular economic or political developments or the interest on which is based on revenues or otherwise related to similar types of projects. An example would be securities of issuers whose

revenues are paid from similar types of projects, such as health care (including hospitals) or transportation.

Performance

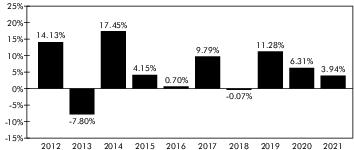

The

following performance information illustrates the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s performance compares to that of a broad-based

securities market index. As always, past performance of the Fund (before and after taxes)

is not an indication of how the Fund will perform in the future. Effective October 1, 2016, outstanding Investor Class and Institutional Class shares of the Fund were renamed Class N and Class I shares, respectively. To obtain

updated performance information please visit www.amgfunds.com or call

800.548.4539.

Calendar Year Total Returns as of 12/31/21 (Class I)

Best Quarter: 6.39% (1st Quarter 2014)

Worst Quarter: -7.09% (2nd Quarter 2013)

Worst Quarter: -7.09% (2nd Quarter 2013)

| Average Annual Total Returns as of 12/31/21 | ||||

| AMG GW&K Municipal Enhanced Yield Fund |

1 Year |

5 Years |

10 Years |

Since

Inception1 |

| Class I Return

Before Taxes |

3.94%

|

6.17% |

5.75% |

— |

| Class I Return

After Taxes on Distributions |

3.53%

|

5.96% |

5.28% |

— |

| Class I Return

After Taxes on Distributions and Sale of

Fund Shares |

3.42%

|

5.41% |

5.04% |

— |

| Class N Return

Before Taxes |

3.59%

|

5.80% |

5.32% |

— |

| Class Z Return

Before Taxes |

3.99%

|

— |

— |

6.11% |

| Bloomberg U.S. Municipal Bond BAA Index

(reflects no deduction for

fees, expenses, or taxes) |

4.85% |

5.97% |

5.01% |

5.80% |

1Class Z and Index performance shown reflects performance since the inception date of the

Fund's Class Z shares on February 24, 2017.

After-tax returns are calculated using the

historical highest individual federal marginal income tax rates and do not reflect the

impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-advantaged

arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

After-tax returns are shown for Class I shares only, and after-tax returns for Class

N and Class Z shares will vary.

Portfolio Management

Investment Manager

AMG Funds

LLC

Subadviser

GW&K Investment Management, LLC

Portfolio Managers

Nancy G. Angell, CFA

Partner and Co-Director of Fixed Income of GW&K; Portfolio Manager of the Fund since 12/05.

Partner and Co-Director of Fixed Income of GW&K; Portfolio Manager of the Fund since 12/05.

3 AMG Funds

AMG GW&K Municipal Enhanced Yield Fund SUMMARY PROSPECTUS

John B. Fox, CFA

Partner and Co-Director of Fixed Income of GW&K; Portfolio Manager of the Fund since 12/05.

Partner and Co-Director of Fixed Income of GW&K; Portfolio Manager of the Fund since 12/05.

Martin R. Tourigny, CFA

Partner of GW&K; Portfolio Manager of the Fund since 12/05.

Partner of GW&K; Portfolio Manager of the Fund since 12/05.

Brian T. Moreland, CFA

Partner of GW&K; Portfolio Manager of the Fund since 10/06.

Partner of GW&K; Portfolio Manager of the Fund since 10/06.

Kara M. South, CFA

Principal of GW&K; Portfolio Manager of the Fund since 07/22.

Principal of GW&K; Portfolio Manager of the Fund since 07/22.

Buying and Selling Fund Shares

Initial Investment Minimum

Class N

Regular Account:

$2,000

Individual Retirement Account: $1,000

Individual Retirement Account: $1,000

Class I

Regular Account:

$100,000

Individual Retirement Account: $25,000

Individual Retirement Account: $25,000

Class Z*

Regular Account: $5,000,000

Individual Retirement Account: $50,000

Individual Retirement Account: $50,000

Additional Investment Minimum

Class N and Class I (all accounts): $100

Class Z (all accounts): $1,000

Class Z (all accounts): $1,000

*Individual

retirement accounts may only invest in Class Z shares by purchasing shares directly from the Fund.

TRANSACTION POLICIES

You may purchase or sell your shares of the Fund any day that the New York Stock Exchange is open for business, either through your registered investment professional

or directly with

the Fund. Shares may be purchased, sold or exchanged by mail at the address listed below, by phone at

800.548.4539, online at www.amgfunds.com, or by bank wire (if bank wire instructions are on

file for your account).

AMG Funds

c/o BNY Mellon Investment Servicing (US) Inc.

P.O. Box 9769

Providence, RI 02940-9769

c/o BNY Mellon Investment Servicing (US) Inc.

P.O. Box 9769

Providence, RI 02940-9769

Tax Information

The Fund intends to make distributions of exempt-interest dividends, which are generally not taxable to you for federal income tax purposes but may be subject to

the federal alternative minimum tax. A portion of the Fund’s distributions may not

qualify as exempt-interest dividends; such distributions will generally be taxable to you

as ordinary income or capital gains, except when your investment is in an IRA, 401(k), or other tax-advantaged investment plan.

Payments to Broker-Dealers and Other

Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the

Fund and its related companies, including the Investment Manager, AMG Distributors, Inc.

(the “Distributor”) and the Subadviser, may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other

intermediary and your salesperson to recommend the Fund over another investment. Ask your

salesperson or visit your financial intermediary’s website for more information.

4 AMG Funds

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Trulioo 24/7 Support Empowers Top APAC Region Companies to Expand Into New Markets, Achieve Compliance and Accelerate Customer Onboarding

- Seven New Hotels, Including Hotel Maya Long Beach, Sign with UNITE HERE Local 11, Raising the Total to 41 Agreements

- TANDEM ALERT: Bragar Eagel & Squire, P.C. is Investigating Tandem Diabetes Care, Inc. on Behalf of Long-Term Stockholders and Encourages Investors to Contact the Firm

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share