Form 497K ALPS ETF Trust

RIVERFRONT DYNAMIC US DIVIDEND ADVANTAGE ETF |

ALPS ETF TRUST |

|

NYSE Arca Ticker: RFDA |

Summary Prospectus March 31, 2023, as supplemented June 1, 2023 |

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at https://www.alpsfunds.com/products/etf/RFDA. You can also get this information at no cost by calling 866.759.5679, by sending an e-mail request to [email protected], or by contacting your financial intermediary. The Fund’s prospectus and statement of additional information, each dated March 31, 2023, along with the Fund’s most recent annual report dated November 30, 2022 are incorporated by reference into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

INVESTMENT OBJECTIVE

The Fund seeks to provide capital appreciation and dividend income.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

Management Fees |

0.52% |

Other Expenses |

0.00% |

Total Annual Fund Operating Expenses |

0.52% |

Example

The following example is intended to help you compare the cost of investing in the Fund with the costs of investing in other funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then hold or redeem all of your Shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same each year.

|

One |

Three |

Five |

Ten |

Although your actual costs may be higher or lower, based on these assumptions your costs would be: |

$53 |

$167 |

$291 |

$652 |

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended November 30, 2022, the Fund’s portfolio turnover rate was 104% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGIES

Under normal market conditions, the Fund will seek to achieve its investment objective by investing at least 65% of its net assets in a portfolio of equity securities of publicly traded U.S. companies with the potential for dividend income. Equity securities include common stocks and common or preferred shares of real estate investment trusts (“REITs”).

In selecting the Fund’s portfolio securities, RiverFront Investment Group, LLC, the Fund’s sub-adviser (“RiverFront” or the “Sub-Adviser”), assembles a portfolio of eligible securities based on several core attributes, including, but not limited to, value, quality and momentum. The Sub-Adviser will consider multiple proprietary factors within each core attribute, such as the price-to-book value of a security when determining value, a company’s cash as a percentage of the company’s market capitalization when determining quality and a security’s three month relative price change when determining momentum. Additionally, within a given sector, security selection will emphasize companies offering a meaningful dividend yield premium over alternative investments within that sector. The Sub-Adviser then assigns each qualifying security a score based on its core attributes, including its dividend yield, and selects the individual securities with the highest scores for investment. In doing so, the Sub-Adviser utilizes its proprietary optimization process to maximize the percentage of high-scoring securities included in the portfolio in accordance with sector and risk factor (e.g., beta, quality, volatility) limitations, subject to the Sub-Adviser’s fundamental active overlay. The Sub-Adviser will also consider the market capitalization of the companies in which the Fund may invest, the potential for dividend income, and the trading volume of a company’s shares in the secondary market. The strategy is largely quantitative and rules-based, but also includes multiple parameters over which the Sub-Adviser may exercise discretion (including, but not limited to, the number of holdings and the weightings of particular holdings) in connection with its active management of the Fund.

The Fund may invest in small-, mid- and large-capitalization companies. The Fund will normally invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in securities of U.S. issuers. The Fund considers a “U.S. issuer” to be one (i) domiciled or with a principal place of business or primary securities trading market in the United States, or (ii) that derives more than 50% of its total revenues or profits from the United States. The Fund may invest significantly in companies involved in the financial services sector.

The Fund may also invest in other exchange-traded funds (“ETFs”) and/or closed-end funds which invest in equity securities.

1 |

RIVERFRONT DYNAMIC US DIVIDEND ADVANTAGE ETF

PRINCIPAL INVESTMENT RISKS

Investors should consider the following risk factors and special considerations associated with investing in the Fund, which may cause you to lose money. The following principal risk factors have been identified for the Fund. See also the sections “Additional Information about the Fund’s Principal Investment Risks” and “Additional Risk Considerations” for additional information about the Fund’s risk factors.

Equity Risk. The values of equity securities, such as common stocks and preferred stock, may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, inflation (or expectations for inflation), changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. Equity securities generally have greater price volatility than fixed-income securities.

Investment Risk. An investment in the Fund is subject to investment risk, including the possible loss of the entire principal amount that you invest.

Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. The values of equity securities, such as common stocks and preferred stock, may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic, political and social conditions, inflation (or expectations for inflation), deflation (or expectations for deflation), changes in the general outlook for corporate earnings, global demand for particular products or resources, market instability, debt crises and downgrades, embargoes, tariffs, sanctions and other trade barriers, regulatory events, other governmental trade or market control programs and related geopolitical events, changes in interest or currency rates, recessions, supply chain disruptions or adverse investor sentiment generally. Equity securities generally have greater price volatility than fixed-income securities. In addition, the value of the Fund’s investments may be negatively affected by the occurrence of global events such as war, terrorism, environmental disasters, natural disasters or events, country instability, and infectious disease epidemics or pandemics.

Issuer-Specific Risk. The value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole.

Quantitative Methodology Risk. The Sub-Adviser uses certain quantitative methodologies to help assess the criteria of issuers to be included in the Fund’s portfolio, including information that may be based on assumptions and estimates. Neither the Fund, the Adviser nor the Sub-Adviser can offer assurances that the quantitative methodology will provide an accurate assessment of included issuers.

Small- and Mid-Capitalization Company Risk. Smaller and mid-size companies often have a more limited track record, narrower markets, less liquidity, more limited managerial and financial resources and a less diversified product offering than larger, more established companies. As a result, their performance can be more volatile, which may increase the volatility of the Fund’s portfolio.

Dividend-Paying Stock Risk. The Fund’s emphasis on dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and underperform the market. Also, a company may reduce or eliminate its dividend. An issuer of a security may also be unable or unwilling to make dividend payments when due and the related risk that the value of a security may decline because of concerns about the issuer’s ability to make such payments.

Financial Services Sector Risk. The financial services sector is subject to extensive government regulation, can be subject to relatively rapid change due to increasingly blurred distinctions between service segments, and can be significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Real Estate Investment Risk. The Fund is subject to the risks associated with investing in real estate, which may include, but are not limited to, possible declines in the value of real estate, adverse changes in national, state or local real estate conditions; obsolescence of properties; changes in the availability, cost and terms of mortgage funds (including changes in interest rates), the impact of changes in environmental laws, overbuilding in a real estate company’s market, and environmental problems. The real estate sector is particularly sensitive to economic downturns and changes to interest rates.

REIT Investment Risk. In addition to risks related to investments in real estate generally, investing in REITs involves certain other risks related to their structure and focus, which include, but are not limited to, management risk, non-diversification risk, financing risk, cash flow dependency risk, default risk, self-liquidation risk, mortgage financing and interest rate risks, and, in many cases, relatively small market capitalization, which may result in less market liquidity and greater price volatility. REITs are also subject to the risk that the real estate market may experience an economic downturn generally, which may have a material effect on the real estate in which the REITs invest and their underlying portfolio securities. REITs are also subject to unique federal tax requirements. Dividends received by the Fund from REITs generally will not constitute qualified dividend income.

Management Risk. The Fund is subject to management risk because it is an actively managed portfolio. In managing the Fund’s portfolio securities, the Sub-Adviser will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these will produce the desired results.

Asset Allocation Program Risk. The Sub-Adviser specializes in managing asset allocation portfolios, which invest in various investment vehicles, including the Fund and other ETFs, to obtain targeted amounts of exposure to different asset classes. As the manager of the Fund and the portfolios, the Sub-Adviser is likely to encounter conflicts of interest. For example, the Sub-Adviser may need to reduce its asset allocation portfolios’ exposure to an asset class to which the portfolios obtain exposure by investing in the Fund. Under such circumstances, the Sub-Adviser would liquidate some or all of the portfolios’ investments in the Fund, which could adversely affect the Fund.

2 |

Fluctuation of Net Asset Value. The NAV of the Fund’s Shares will generally fluctuate with changes in the market value of the Fund’s holdings. The market prices of the Shares will generally fluctuate in accordance with changes in NAV as well as the relative supply of and demand for the Shares on the NYSE Arca, Inc. (the “NYSE Arca”). The Sub-Adviser cannot predict whether the Shares will trade below, at or above their NAV.

Growth Investment Risk. Growth stocks tend to be more volatile than certain other types of stocks and their prices usually fluctuate more dramatically than the overall stock market. A stock with growth characteristics can have sharp price declines due to decreases in current or expected earnings.

Liquidity Risk. The Fund may invest in equity securities that may have limited liquidity despite being listed on a securities exchange. Equity securities that are less liquid or that trade less can be more difficult or more costly to buy, or to sell, compared to other more liquid or active investments.

Momentum Investing Risk. The Fund may employ in part a “momentum” style methodology that emphasizes selecting securities that have had higher recent price performance compared to other securities. The Fund may be subject to more risk because securities in which the Fund invests based on momentum may be more volatile than a broad cross-section of securities or the returns on securities that have previously exhibited price momentum are less than returns on other styles of investing or the overall stock market.

Value Investing Risk. Value securities may present risks in addition to the general risks associated with investing in securities. These securities are selected on the basis of an issuer’s business and economic fundamentals or a security’s current credit profile, relative to current market practice. Investing in value stocks carries the risk that the market will not recognize a stock’s potential value for a long time, or that a stock judged to be undervalued may actually be appropriately valued.

Portfolio Turnover Risk. The Fund may trade all or a significant portion of the securities in its portfolio in seeking to achieve its investment objective. A high portfolio turnover rate may increase transaction costs, including brokerage commissions, on the sale of the securities and on reinvestment in other securities, which may increase the Fund’s expenses. Frequent trading may also cause adverse tax consequences for investors in the Fund due to an increase in short-term capital gains.

FUND PERFORMANCE

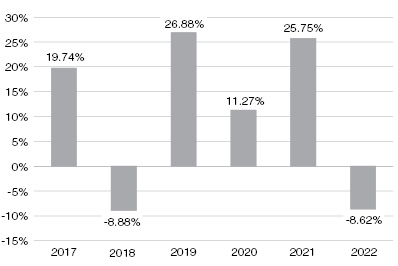

The following bar chart and table provide an indication of the risks of investing in the Fund by showing how the Fund’s average annual returns for a certain time period compare with the average annual returns of the Fund’s benchmark index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Total return figures assume reinvestment of dividends and capital gains distributions and include the effect of the Fund’s recurring expenses. Updated performance information is available online at www.alpsfunds.com or by calling 866.759.5679.

Annual Total Returns (calendar year ended 12/31)

Highest Quarterly Return |

20.27% |

June 30, 2020 |

Lowest Quarterly Return |

-22.17% |

March 31, 2020 |

The after-tax returns presented in the table below are calculated using highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold Shares of the Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Average Annual Total Returns

For periods ended December 31, 2022

|

1 Year |

5 Year |

Since |

Return Before Taxes |

-8.62% |

8.13% |

10.41% |

Return After Taxes on Distributions |

-9.45% |

7.47% |

9.77% |

Return After Taxes on Distributions and Sale of Fund Shares |

-4.65% |

6.24% |

8.22% |

S&P 500® Index* (reflects no deduction for fees, expenses or taxes) |

-18.11% |

9.42% |

11.57% |

|

* |

Index performance shown in the table is the total return, which assumes reinvestment of any dividends and distributions during the time periods shown. |

INVESTMENT ADVISER AND SUB-ADVISER

ALPS Advisors, Inc. is the investment adviser to the Fund (“ALPS Advisors” or the “Adviser”). RiverFront is the Sub-Adviser to the Fund.

3 |

RIVERFRONT DYNAMIC US DIVIDEND ADVANTAGE ETF

PORTFOLIO MANAGERS

Adam Grossman, CFA, Global Equity CIO and Co-Head of the Investment Committee, and Chris Konstantinos, CFA, Director of Investments and Chief Investment Strategist, are the co-portfolio managers of the Fund. Mr. Grossman and Mr. Konstantinos have served as portfolio managers of the Fund since its inception in June 2016.

PURCHASE AND REDEMPTION OF SHARES

Individual Shares of the Fund may only be purchased and sold in secondary market transactions through a broker or dealer at a market price. Shares of the Fund are listed for trading on NYSE Arca under the trading symbol RFDA, and because Shares will trade at market prices rather than NAV, Shares of the Fund may trade at a price greater than NAV (i.e., a premium) or less than NAV (i.e., a discount).

An investor may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Shares of the Fund (bid) and the lowest price a seller is willing to accept for Shares (ask) when buying or selling Shares in the secondary market (the “bid/ask spread”).

Recent information, including information about the Fund’s NAV, market price, premiums and discounts, and the bid/ask spreads, is included on the Fund’s website at www.alpsfunds.com.

TAX INFORMATION

The Fund’s distributions are taxable and will generally be taxed as ordinary income or capital gains.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Shares through a broker-dealer or other financial intermediary, the Adviser, Sub-Adviser or other related companies may pay the intermediary for the sale of Shares or related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- u-blox Secures Significant Project Wins in the Robotic Lawnmower Market With its High-Precision Positioning Technology

- Trakx launches a new product: Trakx USDc Earn CTI powered by OpenTrade

- UAB Partnerystės projektai keturi 2023 audited annual report

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share