Form 497K ALLIED ASSET ADVISORS

| Summary Prospectus September 30, 2021 Trading Symbol: IMANX | ||||

Before you invest, you may want to review the Fund’s statutory prospectus and statement of additional information, which contain more information about the Fund and its risks. The current statutory prospectus and statement of additional information dated September 30, 2021 are incorporated by reference into this Summary Prospectus. You can find the Fund’s statutory prospectus, statement of additional information, reports to shareholders, and other information about the Fund online at http://www.investaaa.com/downloads.html. You can also get this information at no cost by calling the Fund toll-free at 1-888-FUNDS-85 (1-888-386-3785) or by sending an email request to info@investaaa.com.

Summary Section | ||

Investment Objective

The Fund seeks growth of capital while adhering to Islamic principles.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

| Shareholder Fees (fees paid directly from your investment) | ||||||||

| Maximum sales charge (load) imposed on purchases | None | |||||||

| Maximum deferred sales charge (load) | None | |||||||

| Maximum sales charge (load) imposed on reinvested dividends | None | |||||||

| Redemption fee | None | |||||||

| Exchange fee | None | |||||||

| Maximum account fee | None | |||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||

| Management Fees | 1.00% | |||||||

| Distribution (Rule 12b-1) Fees | None | |||||||

| Other Expenses | 0.29% | |||||||

| Total Annual Fund Operating Expenses | 1.29% | |||||||

Example:

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s net operating expenses remain the same. Although your actual cost may be higher or lower, based on these assumptions, your costs, whether or not you redeemed your shares, would be:

| 1 Year | 3 Years | 5 Years | 10 Years | ||||||||

| $131 | $409 | $708 | $1,556 | ||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for Fund shares held in a taxable account. These costs, which are not reflected in Annual Fund

1

Operating Expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, ended May 31, 2021, the Fund’s portfolio turnover rate was 106.6% of the average value of its portfolio.

Principal Investment Strategies

The Fund seeks to achieve its investment objective by investing in common stocks and equity-related securities of domestic and foreign issuers that meet Islamic principles and whose prices the Fund’s investment advisor, Allied Asset Advisors, Inc. (the “Advisor”), anticipates will increase over the long term. Islamic principles generally preclude investments in certain businesses (e.g., alcohol, pornography and gambling) and investments in interest bearing debt obligations or businesses that derive interest income as their primary source of income. The Fund may invest in companies of all market capitalizations. Any uninvested cash will be held in non-interest bearing deposits or invested in a manner following Islamic principles. There can be no guarantee that the Fund will achieve its investment objective.

Among the securities that meet Islamic principles, the Advisor will determine a security’s attractiveness for purchase based on a number of factors, including its anticipated value, record of earnings growth, and possible turn around, among other things. The Advisor may invest in “growth” or “value” stocks, but it anticipates that a majority of its investments will be of the growth type. The Fund may sell portfolio securities at any time when, in the Advisor’s judgment, their price has reached the intended target, their fundamentals have deteriorated, or there are better investment opportunities. The Fund normally does not invest in emerging markets securities except for those traded on U.S. exchanges.

Principal Investment Risks

The principal risks of investing in the Fund are listed below. As with any mutual fund, you may lose money by investing in the Fund. Each risk summarized below is considered a “principal risk” of investing in the Fund, regardless of the order in which it appears.

Equity Securities Risk: The value of the Fund’s shares will fluctuate with changes in the value of the equity securities in which it invests. Equity securities prices fluctuate for several reasons, including changes in investors’ perceptions of the financial condition of an issuer or the general condition of the relevant equity market, such as market volatility, or when political or economic events affecting an issuer occur.

Market Risk: The return on and value of your investment in the Fund will fluctuate in response to stock market movements. Stocks and other equity securities are subject to market risks and fluctuations in value due to changes in earnings, economic conditions and other factors beyond the control of the Fund.

Management Risk: The Fund’s ability to achieve its investment objective depends on the ability of the Advisor to correctly identify economic trends and select stocks, particularly in volatile stock markets. Your investment in the Fund varies with the success and failure of the Advisor’s investment strategies and the Advisor’s selection of the Fund’s portfolio securities. If the Advisor’s strategies do not produce the expected results, your investment could decline in value. It is possible that the Islamic principles restrictions placed on investments and reflected in the principal investment strategies may result in the Fund not performing as well as mutual funds that are not subject to such restrictions.

Growth Stock Risk: The prices of growth stocks may be based largely on expectations of future earnings, and their prices can decline rapidly and significantly in reaction to negative news. Growth stocks may underperform value stocks and stocks in other broad style categories (and the stock market as a whole) over any period of time and may shift in and out of favor with investors generally, sometimes rapidly, depending on changes in market, economic, and other factors.

Value Stock Risk: Value stocks may continue to be undervalued by the market for extended periods, including the entire period during which the stock is held by the Fund, or the events that would cause the

2

stock price to increase may not occur as anticipated or at all. Moreover, a stock that appears to be undervalued actually may be appropriately priced at a low level.

Market Capitalization Risk: Exposure to stocks of mid and/or small capitalization companies may cause the Fund to be more vulnerable to adverse general market or economic developments because such securities may be less liquid and subject to greater price volatility than those of larger, more established companies. Stocks of mid and/or small capitalization companies may be subject to more abrupt or erratic market movements than those of larger, more established companies or the market averages in general. Such companies may have limited product lines, markets or financial resources, and they may be dependent on a limited management group.

Recent Market Events Risk: U.S. and international markets have experienced significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including the impact of the coronavirus (COVID-19) as a global pandemic, which has resulted in public health issues, growth concerns in the U.S. and overseas, layoffs, rising unemployment and reduced consumer spending. The effects of COVID-19 may lead to a substantial economic downturn or recession in the U.S. and global economies, the recovery from which is uncertain and may last for an extended period of time. As a result of this significant volatility, many of the risks discussed herein associated with an investment in the Fund may be increased.

Foreign Securities Risk: The Fund’s investments in securities of non-U.S. companies (“foreign securities”) involve risks relating to adverse political, social and economic developments abroad, as well as risks resulting from the differences between the regulations to which U.S. and non-U.S. companies and markets are subject, including changes in foreign exchange rates. Non-U.S. markets may also be less liquid and more volatile than U.S. markets.

Preferred Stock Risk: The equity-related securities in which the Fund invests may include preferred stocks. Preferred stocks are generally subordinated to bonds and other debt instruments in a company’s capital structure and therefore will be subject to greater credit risk than those debt instruments.

Systems and Cybersecurity Risk: The Fund and the Advisor are susceptible to operational risks through breaches in cybersecurity. A breach in cybersecurity refers to both intentional and unintentional events that may cause the affected party to lose proprietary information, suffer data corruption or lose operational capacity. Such events could cause the Fund to incur regulatory penalties, reputational damage, additional compliance costs associated with corrective measures and/or financial loss. Cybersecurity breaches may involve unauthorized access to the Fund’s digital information systems through “hacking” or malicious software coding but may also result from outside attacks such as denial-of-service attacks through efforts to make network services unavailable to intended users. In addition, cybersecurity breaches of the issuers of securities in which the Fund invests or the Fund’s third-party service providers, such as its administrator, transfer agent, or custodian, as applicable, can also subject the Fund to many of the same risks associated with direct cybersecurity breaches.

Portfolio Turnover Risk: High portfolio turnover may result in the Fund paying higher levels of transaction costs and may generate greater tax liabilities for shareholders. Portfolio turnover risk may cause the Fund’s performance to be less than expected.

Concentrated Ownership Risk: The North American Islamic Trust, Inc. (“NAIT”), an affiliate of the Advisor, owns a substantial portion of the shares of the Fund. As a result of such concentrated ownership, a substantial redemption of the Fund’s shares by NAIT could significantly reduce the Fund’s assets under management. While the Fund maintains certain cash and/or cash equivalents to meet redemption requests, a redemption by NAIT may exceed these holdings and may cause the Fund to sell securities that it might

3

otherwise hold. However, the Fund reserves the right to redeem in-kind to meet redemption requests that represent a large percentage of the Fund’s net assets in order to minimize the effect of large redemptions on the Fund and its remaining shareholders. For more information about NAIT, please refer to Management of the Fund.

Operational Risk: The Fund is exposed to operational risks arising from a number of factors, including, but not limited to, human error, processing and communication errors, errors of the Fund’s service providers, counterparties or other third parties, failed or inadequate processes and technology or systems failures. The Fund and the Advisor seek to reduce these operational risks through controls and procedures. However, these measures do not address every possible risk and may be inadequate to address significant operational risks.

Performance

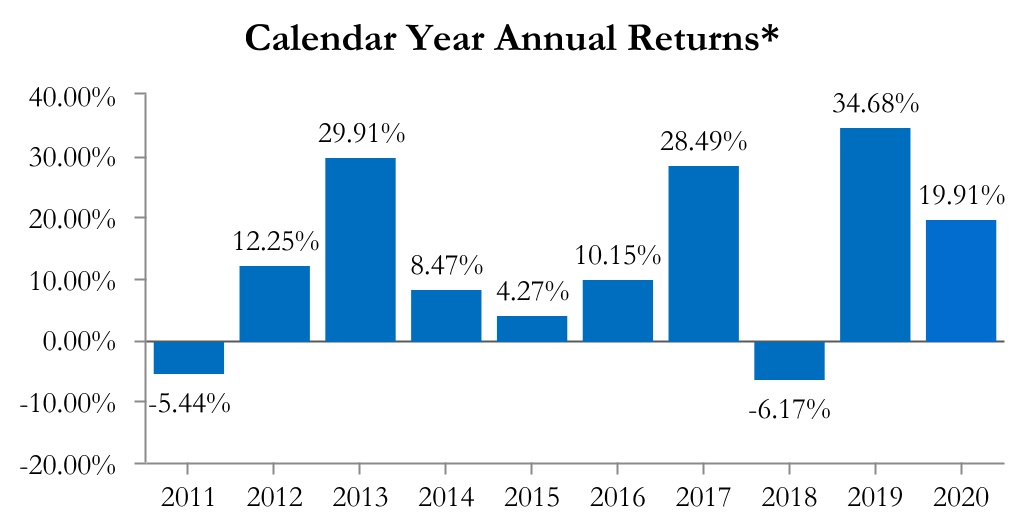

The following performance information indicates some of the risks of investing in the Fund by showing the variability of the Fund’s return. The bar chart illustrates how the Fund’s total return has varied from year to year. The table illustrates the Fund’s average annual total return over time compared with a broad-based securities market index. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.investaaa.com and by calling 1-888-FUNDS-85.

*The Fund’s calendar year-to-date return as of June 30, 2021 was 8.14%.

During the periods shown in the bar chart, the Fund’s highest quarterly return was 18.40% for the quarter ended March 31, 2019 and the lowest quarterly return was -21.67% for the quarter ended March 31, 2020.

Average Annual Total Returns for the Periods ended December 31, 2020

4

1 Year | 5 Years | 10 Years | |||||||||

| Iman Fund | |||||||||||

| Return Before Taxes | 19.91% | 16.49% | 12.83% | ||||||||

| Return After Taxes on Distributions | 19.17% | 14.11% | 11.12% | ||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 12.34% | 12.64% | 10.12% | ||||||||

Dow Jones Islamic MarketTM World Index (reflects no deduction for fees, expenses or taxes) | 28.19% | 15.91% | 11.09% | ||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. Furthermore, the after-tax returns shown are not relevant to those who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs.

Management

Investment Advisor

Allied Asset Advisors, Inc.

Portfolio Manager

Bassam Osman, Chairman of the Advisor, has been the portfolio manager of the Fund since 2000.

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares any business day by written request via mail (Iman Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701), by wire transfer, by telephone at 1-888-FUNDS-85 (1-888-386-3785), or through a financial intermediary. Investors who wish to purchase or redeem Fund shares through a broker-dealer should contact the broker-dealer directly. The minimum initial and subsequent investment amounts are shown below.

| Minimum Investments | To Open Your Account | To Add to Your Account | ||||||

| Regular accounts | $250 | $50 | ||||||

| IRA accounts (Traditional, Roth, SEP and Simple IRAs) | $100 | $50 | ||||||

| Coverdell Education Savings Accounts | $100 | $50 | ||||||

Tax Information

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Advisor and its related companies may compensate the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s web site for more information.

5

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- CVW CleanTech Announces Full Year 2023 Results

- Ameresco Awarded Energy Savings Performance Contract to Upgrade Energy Efficiency & Modernize Historic Building in Columbia County, Oregon

- Vizsla Copper Completes Acquisition of Universal Copper

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share