Form 497K ADVISORS SERIES TRUST

Poplar Forest Partners Fund

| Class A | PFPFX | ||||||||||

| Institutional Class | IPFPX | ||||||||||

Summary Prospectus

January 28, 2023

Before you invest, you may want to review the Poplar Forest Partners Fund’s (the “Partners Fund” or the “Fund”) Statutory Prospectus and Statement of Additional Information (“SAI”), which contain more information about the Partners Fund and its risks. The current Statutory Prospectus and SAI dated January 28, 2023, are incorporated by reference into this Summary Prospectus. You can find the Partners Fund’s Statutory Prospectus, SAI and other information about the Fund online at www.poplarforestfunds.com/resources. You can also get this information at no cost by calling 1-877-522-8860 or by sending an e-mail request to compliance@poplarforestllc.com.

Investment Objective

The Poplar Forest Partners Fund (the “Partners Fund”) seeks to achieve long-term growth of capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell Class A shares and Institutional Class shares of the Partners Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Fund’s Class A shares. Certain financial intermediaries also may offer variations in Fund sales charges to their customers as described in Appendix A to the statutory Prospectus. More information about these and other discounts is available from your financial professional and in the “Shareholder Information” section on page 21 of the Fund’s statutory Prospectus, the “More About Class A Shares” section on page 33 of the Fund’s statutory Prospectus, the “Breakpoints/Volume Discounts and Sales Charge Waivers” section on page 34 of the Fund’s Statement of Additional Information (“SAI”), and Appendix A to the Statutory Prospectus.

SHAREHOLDER FEES (fees paid directly from your investment) | Class A | Institutional Class | ||||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.00% | None | ||||||

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||

| Management Fees | 0.83% | 0.83% | ||||||

| Distribution and Service (Rule 12b-1) Fees | 0.25% | None | ||||||

| Other Expenses | 0.21% | 0.21% | ||||||

Total Annual Fund Operating Expenses(1) | 1.29% | 1.04% | ||||||

| Less: Fee Waiver and/or Expense Reimbursement | -0.09% | -0.09% | ||||||

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement(1) | 1.20% | 0.95% | ||||||

(1) Poplar Forest Capital LLC (the “Adviser”) has contractually agreed to waive a portion or all of its management fees and pay Fund expenses (excluding acquired fund fees and expenses (“AFFE”), interest expense, taxes, extraordinary expenses, Rule 12b-1 fees, shareholder servicing fees, and other class-specific expenses) in order to limit the Total Annual Fund Operating Expenses to 0.95% of average daily net assets of the Fund (the “Expense Cap”). The Expense Cap will remain in effect through at least January 27, 2024, and may be terminated only by the Fund’s Board of Trustees (the “Board”). The Adviser may request recoupment of previously waived fees and paid expenses from the Fund for 36 months from the date they were waived or paid, subject to the Expense Cap at the time such amounts were waived or at the time of recoupment, whichever is lower.

Example. This Example is intended to help you compare the cost of investing in the Partners Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your

shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (taking into account the Expense Cap only in the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Class A | $616 | $880 | $1,164 | $1,971 | ||||||||||

| Institutional Class | $97 | $322 | $565 | $1,263 | ||||||||||

Portfolio Turnover. The Partners Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 30.29% of the average value of its portfolio.

Principal Investment Strategy

The Partners Fund seeks to deliver superior, risk-adjusted returns over full market cycles, by investing primarily in the common stocks of underappreciated companies and industries. A full market cycle is deemed to be a multi-year period including a period of material increase in the U.S. stock market (a “bull market”) and a period of material decline in the U.S. stock market (a “bear market”). The Fund generally focuses on 25 to 35 companies with (i) an investment grade debt rating, (ii) a history of paying common stock dividends, and (iii) a market capitalization among the top 1,000 companies in the United States.

The Partners Fund is managed using a long-term approach to security selection. Investments will generally be made with an intended investment horizon of three years, although individual investments may be held for shorter or longer time periods.

The Adviser evaluates investment opportunities using bottom up, fundamental analysis, paying particular attention to the following factors:

1.expected future profits;

2.expected sustainable revenue and/or asset growth;

3.expected cash investment needed to support expected growth;

4.normalized earnings and free cash flow after considering Items 1 through 3 above; and

5.valuation relative to normalized earnings and free cash flow after giving consideration to growth potential and financial strength.

The Partners Fund may also invest up to 25% of its net assets in government and corporate debt securities of any maturity. Of this 25%, no more than 10% of the Fund’s net assets will be invested in investment grade corporate debt and no more than 5% of the Fund’s net assets will be invested in non-investment grade (i.e., “junk” bonds) corporate debt. The Fund also may invest up to 20% of its net assets in foreign equity securities. Additionally, up to 10% of the Fund’s net assets may be invested in a combination of convertible securities, options on stocks, warrants and rights and other non-money market fund investment companies.

Principal Investment Risks

By itself, the Fund is not a complete, balanced investment plan. The Fund cannot guarantee that it will achieve its investment objectives. Losing all or a portion of your investment is a risk of investing in the Fund. The following risks are considered principal and could affect the value of your investment in the Fund:

•General Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. Securities in the Fund’s portfolio may underperform in comparison to securities in general financial markets, a particular financial market or other asset classes due to a number of factors, including: inflation (or expectations for inflation); interest rates; global demand for particular products or resources; natural disasters or events; pandemic diseases; terrorism; regulatory events; and government controls. U.S. and

2

international markets have experienced significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including the impact of COVID-19 as a global pandemic, which has resulted in a public health crisis, disruptions to business operations and supply chains, stress on the global healthcare system, growth concerns in the U.S. and overseas, staffing shortages and the inability to meet consumer demand, and widespread concern and uncertainty. The global recovery from COVID-19 is proceeding at slower than expected rates due to the emergence of variant strains and may last for an extended period of time. Continuing uncertainties regarding interest rates, rising inflation, political events, rising government debt in the U.S. and trade tensions also contribute to market volatility. As a result of continuing political tensions and armed conflicts, including the war between Ukraine and Russia, the U.S. and the European Union imposed sanctions on certain Russian individuals and companies, including certain financial institutions, and have limited certain exports and imports to and from Russia. The war has contributed to recent market volatility and may continue to do so.

•Management Risk. If the Adviser’s investment strategies do not produce the expected results, the value of the Partners Fund could decrease.

•Equity Securities Risk. The price of equity securities may rise or fall because of economic or political changes or changes in a company’s financial condition, sometimes rapidly or unpredictably. These price movements may result from factors affecting individual companies, sectors or industries selected for the Fund’s portfolio or the securities market as a whole, such as changes in economic or political conditions.

•Value-Style Investing Risk. Value stocks can perform differently from the market as a whole and from other types of stocks. Value stocks may be purchased based upon the belief that a given security may be out of favor; that belief may be misplaced or the security may stay out of favor for an extended period of time.

•Large-Sized Companies Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. In addition, large-cap companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

•Medium-Sized Companies Risk. Investing in securities of medium-sized companies may involve greater risk than investing in larger, more established companies because they can be subject to greater share price volatility than larger, more established companies.

•Foreign Securities Risk. Foreign securities can be more volatile than domestic (U.S.) securities. Securities markets of other countries are generally smaller than U.S. securities markets. Many foreign securities may also be less liquid than U.S. securities, which could affect the Fund’s investments.

•Debt Securities Risk. The following risks are associated with the Partners Fund’s investment in debt securities.

◦Prepayment and Extension Risk. The risk that the securities may be paid off earlier (prepayment) or later (extension) than expected. Either situation could cause securities to pay lower-than-market rates of interest, which could hurt the Fund’s yield or share price.

◦Interest Rate Risk. The Fund’s investments in fixed income securities will change in value based on changes in interest rates. If rates increase, the value of these investments generally declines. Securities with greater interest rate sensitivity and longer maturities generally are subject to greater fluctuations in value.

◦Credit Risk. The risk of loss on an investment due to the deterioration of an issuer’s financial strength. Such a deterioration of financial strength may result in a reduction of the credit rating of the issuer’s securities and may lead to the issuer’s inability to honor its contractual obligations, including making timely payment of interest and principal.

◦High-Yield Securities Risk. Debt securities that are rated below investment grade (i.e., “junk bonds”) are subject to additional risk factors due to the speculative nature of these securities, such as increased possibility of default liquidation of the security, and changes in value based on public perception of the issuer.

•Convertible Securities Risk. Convertible securities are subject to the risks of both debt securities and equity securities. The values of convertible securities tend to decline as interest rates rise and, due to the conversion feature, tend to vary with fluctuations in the market value of the underlying common or preferred stock.

•Investment Company Risk. When the Fund invests in an exchange-traded fund (“ETF”) or mutual fund, it will bear additional expenses based on its pro rata share of the ETF’s or mutual fund’s operating expenses, including the potential duplication of management fees. The risk of owning an ETF or mutual fund generally reflects the risks of

3

owning the underlying securities the ETF or mutual fund holds. The Fund also will incur brokerage costs when it purchases ETFs.

•Options Risk. Options on securities may be subject to greater fluctuations in value than an investment in the underlying securities. Purchasing and writing put and call options are highly specialized activities and entail greater than ordinary investment risks.

The Partners Fund may be appropriate for investors who:

•are pursuing long-term growth of capital;

•want to add an investment with appreciation potential to diversify their investment portfolio; and

•can accept the greater risks of investing in a portfolio with significant common stock holdings.

Performance

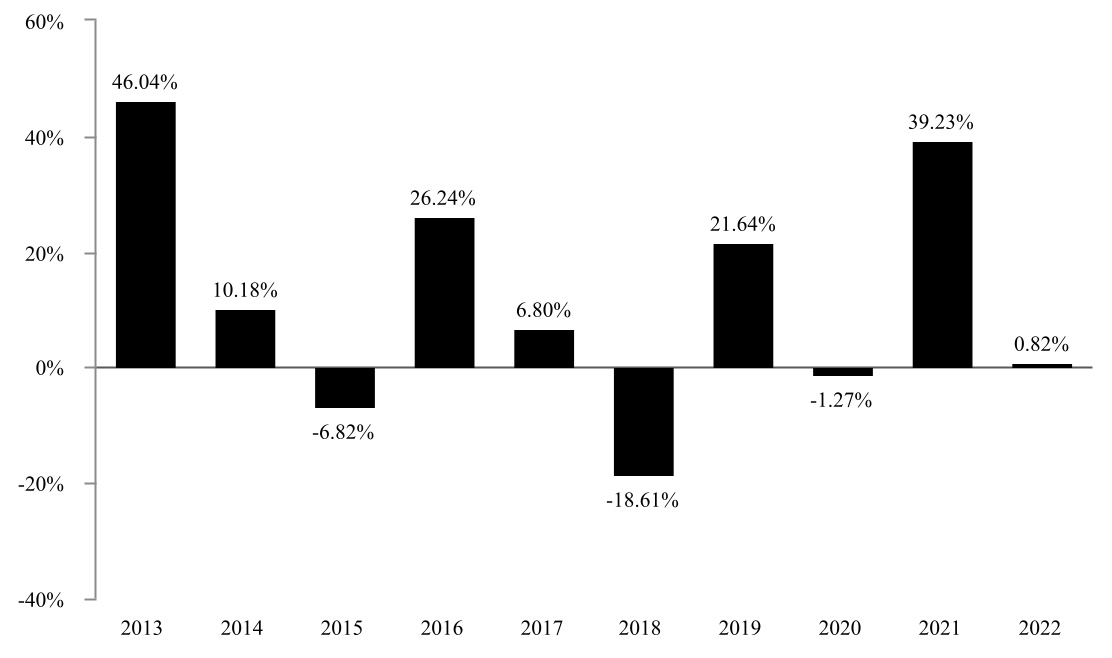

The following information provides some indication of the risks of investing in the Partners Fund. The bar chart shows the Fund’s Institutional Class shares’ annual return from year to year. The table shows how the Fund’s average annual returns for the 1-year, 5-year, 10-year and since inception periods compare with broad measures of market performance. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at http://poplarforestfunds.com/poplar-forest-partners-fund/ within the Fund documents or by calling the Fund toll-free at 1‑877‑522‑8860.

Calendar Year Returns as of December 31 – Institutional Class

During the period of time shown in the bar chart, the highest return for a calendar quarter was 23.33% (quarter ended December 31, 2020) and the lowest return for a calendar quarter was -34.55% (quarter ended March 31, 2020).

4

Average Annual Total Returns (for the periods ended December 31, 2022) | 1 Year | 5 Years | 10 Years | Since Inception (12/31/2009) | ||||||||||

| Institutional Class | ||||||||||||||

| Return Before Taxes | 0.82% | 6.53% | 10.74% | 10.28% | ||||||||||

| Return After Taxes on Distributions | -0.57% | 4.82% | 9.34% | 9.16% | ||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 1.49% | 4.88% | 8.61% | 8.44% | ||||||||||

| Class A | ||||||||||||||

| Return Before Taxes | -4.47% | 5.18% | 9.89% | 9.57% | ||||||||||

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | -18.11% | 9.42% | 12.56% | 12.17% | ||||||||||

Russell 1000® Value Index (reflects no deduction for fees, expenses or taxes) | -7.54% | 6.67% | 10.29% | 10.42% | ||||||||||

The after-tax returns were calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold shares of the Partners Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). After-tax returns are shown only for the Institutional Class; after-tax returns for Class A will vary to the extent it has different expenses. The Return After Taxes on Distributions and Sale of Fund Shares is higher than other return figures when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

Management

Investment Adviser. Poplar Forest Capital LLC is the Fund’s investment adviser.

Portfolio Managers. J. Dale Harvey (CEO and Chief Investment Officer) and Derek Derman (Co-Portfolio Manager and Research Analyst) are the portfolio managers principally responsible for the day-to-day management of the Partners Fund. Mr. Harvey has managed the Fund since its inception on December 31, 2009 and Derek Derman has managed the Fund since March 2022.

Purchase and Sale of Fund Shares

You may purchase, exchange, or redeem Partners Fund shares on any business day by written request via mail (Poplar Forest Partners Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201-0701), by telephone at 1‑877‑522‑8860, or through a financial intermediary. You may also purchase or redeem Fund shares by wire transfer. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the intermediary directly. The minimum initial and subsequent investment amounts are shown below.

| Types of Accounts | To Open Your Account | To Add to Your Account | |||||||||

| Class A | |||||||||||

| Regular Accounts | $25,000 | $1,000 | |||||||||

| IRAs (Traditional, Roth, SEP, and SIMPLE IRAs) | $5,000 | $1,000 | |||||||||

| Institutional Class | |||||||||||

| All Accounts | $100,000 | $1,000 | |||||||||

Tax Information

The Partners Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you invest through a tax-deferred arrangement, such as a 401(k) plan or an IRA. Distributions on investments made through tax-deferred arrangements may be taxed later upon withdrawal of assets from those accounts.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Partners Fund through a broker-dealer or other financial intermediary, the Fund and/or the Adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of

5

interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

6

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Non-Grain Oriented Electrical Steel Market to Reach USD 27.09 Billion by 2031, Driven by Surging Demand for Electricity and Electric Vehicles

- Stabilis Solutions Announces First Quarter 2024 Conference Call and Webcast Date

- ParaZero Received Purchase Order from Draganfly for Advanced Safety Technology Integration into Commander 3XL Drones

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share