Form 497AD AETOS LONG/SHORT STRATEG

Aetos At-A-Glance Founded 2001 Leadership Anne Casscells Co-President & Chief Investment

Officer Michael Klein Co-President & Chief Risk Officer Locations New York, New York Menlo Park, California fund HIGHLIGHTS Inception September 1, 2002 Diversification # of Managers2: 17 # of Sub-Strategies: 4 Beta to Market

Indices1,3 US Aggregate Bond Index: 0.13 MSCI ACWI: 0.28 Geography Global AETOS FUND INFORMATION Aetos SEC-Registered 1940 Act Commingled Hedge Fund of Funds Long/Short Strategies Fund Multi-Strategy Arbitrage Fund Distressed

Investment Strategies Fund Performance and Statistics (since inception through October 31, 2022)1 Firm Overview Aetos Alternatives Management, LP (“Aetos”) is an independent firm that manages assets on behalf of institutional clients. Since

the firm’s inception, Aetos has been a leader in constructing fully customized hedge fund solutions for a broad range of institutional clients. Hedge fund solutions are offered primarily through 1) customized separate accounts and 2) commingled

fund portfolios invested in strategy-specific Aetos 1940 Act SEC-registered funds. FUND Overview The Aetos Long/Short Strategies Fund is an SEC-registered 1940 Act Commingled Hedge Fund of Funds. The Fund allocates its assets among a select

group of managers across a variety of long/short strategies designed to produce an attractive risk-adjusted return, largely independent of the benchmarks associated with traditional asset classes. The Fund is intended to be a vehicle by which

investors can access a portfolio of high-quality long/short strategies, constructed and monitored using disciplined processes. Historical Performance (since inception)1 Aetos Long/Short Strategies Fund 1 Data as of October 31, 2022. The

Aetos Long/Short Strategies Fund (the “Fund”) is an SEC-registered 1940 Act closed-end fund that is a component of Aetos’ commingled diversified absolute return investment asset allocation models. This information is being provided to

prospective investors that have expressed an interest in seeing the investment performance of one or more of the individual Aetos Funds in the models. The Fund returns do not represent the returns of the models as a whole or of any specific

client account. The performance figures shown are net of assumed investment advisory and performance fees of 0.75% of assets annually and 5% of profits above the three-month Treasury bill return, respectively, subject to a high-water mark.

Certain clients investing in accordance with the model may have a different fee arrangement. To the extent actual fees charged to a client differ from the fees shown herein, such client’s returns would vary accordingly. The performance figures

may include returns that are preliminary, unaudited, and estimated based on the most recent information provided by underlying fund managers and are subject to change. The returns also reflect Fund level expenses, some of which have been waived

and/or reimbursed by the Investment Adviser. Returns would have been lower without such waivers and reimbursements. Past performance does not guarantee future results. Investing in hedge funds involves substantial risks, including the risk of

loss of invested capital. Please see Notes and Disclosures section for important additional information. 2 Reflects number of managers in the Aetos Long/Short Strategies Fund as of November 1, 2022 and excludes managers that are under

redemption. 3 Reflects beta since the Aetos Long/Short Strategies Fund’s inception of September 1, 2002 through October 31, 2022. Annualized Returns 1 Year 3 Year 5 Year 10 Year Inception Fund -4.33% 4.44% 3.88% 5.09% 4.56% HFRI

FOF: Composite Index -6.99% 4.34% 3.06% 3.60% 3.55% US Aggregate Bond Index -15.68% -3.77% -0.54% 0.74% 3.07% MSCI ACWI -19.96% 4.85% 5.24% 7.98% 7.56% Volatility (Standard Deviation) - 3 Year 5 Year 10

Year Inception Fund - 9.73% 8.42% 6.86% 6.15% HFRI FOF: Composite Index - 7.28% 6.23% 4.95% 5.22% US Aggregate Bond Index - 5.38% 4.81% 3.95% 3.82% MSCI ACWI - 19.63% 17.32% 14.07% 15.76% Sharpe Ratios - 3 Year 5

Year 10 Year Inception Fund - 0.39 0.32 0.64 0.55 HFRI FOF: Composite Index - 0.51 0.30 0.58 0.45 US Aggregate Bond Index - -0.82 -0.36 0.01 0.50 MSCI ACWI - 0.21 0.23 0.52 0.41

1 Refer to footnote 1 on previous page. 2 Information is subject to change over time, excludes cash and

may not sum to 100% due to

rounding. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year 2022 -1.81% -0.80% 0.06% -0.74% -0.40% -2.16% 2.22% -0.10% -2.24% 1.91% - - -4.08% 2021 -5.99% 5.04% 1.65% 2.99% 0.00% -0.65% 1.05% 0.75% -0.14% 1.59% -2.61% 2.41% 5.79% 2020 -0.50% -2.60% -8.28% 5.96% 2.35% 0.09% 2.39% 2.70% -0.17% -0.63% 4.89% 2.89% 8.60% 2019 4.48% 1.73% 0.99% 2.24% -1.39% 1.96% 1.00% -0.32% -1.39% 1.83% 2.42% 0.92% 15.30% 2018 1.74% -1.89% -0.26% -0.06% 1.76% -0.59% 0.86% 0.37% -0.11% -4.15% -0.69% -1.86% -4.92% 2017 2.05% 0.49% 0.99% 0.68% 1.57% -0.04% 0.98% 0.76% 0.28% 0.73% -0.01% 0.15% 8.96% 2016 -3.88% -2.83% 0.41% -0.26% 3.34% -1.22% 1.97% 0.11% 0.87% -0.90% -0.28% 0.50% -2.36% 2015 -0.46% 2.02% 0.24% -0.81% 1.84% -1.08% 1.99% -1.34% -1.79% 2.85% 0.49% 0.21% 4.11% 2014 -0.74% 2.80% -1.40% -2.00% 2.30% 0.95% -1.10% 1.45% 1.36% 1.49% 1.88% 1.21% 8.37% 2013 2.06% 0.68% 1.97% 0.12% 0.74% 0.44% 1.05% -0.69% 1.67% 1.38% 1.97% 1.24% 13.35% 2012 1.62% 1.12% 0.68% 0.32% -1.30% 0.43% 1.04% 0.27% 0.54% -0.86% 0.32% -0.34% 3.88% 2011 -0.03% 0.40% -0.53% 1.54% -0.35% -0.61% 0.26% -2.89% -2.29% 2.57% -0.24% -0.35% -2.63% 2010 -1.76% 0.77% 1.68% 0.24% -2.86% -1.48% 1.37% -0.14% 2.95% 1.16% 0.04% 2.13% 4.02% 2009 1.00% -0.81% -0.32% -1.09% 3.15% -0.31% 1.29% 0.90% 1.53% -1.38% 2.11% 0.00% 6.14% 2008 -3.13% 1.92% -1.48% 0.68% 2.93% -0.37% -0.48% -0.63% -9.54% -2.53% -0.73% -0.19% -13.25% 2007 2.12% 0.42% 1.40% 1.71% 1.95% 0.69% 1.37% -1.79% 0.98% 1.91% 0.24% 0.91% 12.52% 2006 2.46% 0.07% 1.62% 1.31% -1.31% 0.13% 0.31% 0.96% -0.10% 0.87% 1.90% 1.02% 9.58% 2005 -0.02% 1.68% 0.44% -0.70% 1.09% 1.03% 1.18% 0.85% 1.03% -1.45% 1.06% 1.93% 8.38% 2004 2.09% 1.01% -0.32% -1.46% -0.21% 0.29% -0.24% -0.28% 1.03% 1.02% 1.88% 1.06% 5.97% 2003 -1.02% -0.63% -0.27% 1.86% 1.73% 1.36% 1.03% 1.11% -0.25% 1.65% 1.10% 0.98% 8.92% 2002 - - - - - - - - -1.08% 0.53% -0.31% 1.00% 0.13% Aetos

LONG/SHORT STRATEGIES FUND Historical Monthly Performance (net of fees)1 HISTORICAL EXPOSURES (quarterly over past 5 years) SUB-STRATEGY ALLOCATIONS (as of November 1, 2022)2 GEOGRAPHIC EXPOSURE (as of September 30, 2022)2

Aetos At-A-Glance Founded 2001 Leadership Anne Casscells Co-President & Chief Investment

Officer Michael Klein Co-President & Chief Risk Officer Locations New York, New York Menlo Park, California Portfolio HIGHLIGHTS Inception September 1, 2002 Diversification # of Managers2: 29 # of Strategies: 7 Beta to Market

Indices1,3 US Aggregate Bond Index: 0.11 MSCI ACWI: 0.22 Geography Global AETOS FUND INFORMATION Aetos SEC-Registered 1940 Act Commingled Hedge Fund of Funds Long/Short Strategies Fund Multi-Strategy Arbitrage Fund Distressed

Investment Strategies Fund Performance and Statistics (since inception through October 31, 2022)1 Firm Overview Aetos Alternatives Management, LP (“Aetos”) is an independent firm that manages assets on behalf of institutional clients. Since

the firm’s inception, Aetos has been a leader in constructing fully customized hedge fund solutions for a broad range of institutional clients. Hedge fund solutions are offered primarily through 1) customized separate accounts and 2) commingled

fund portfolios invested in strategy-specific Aetos 1940 Act SEC-registered funds. PORTFOLIO Overview The Aetos Growth Portfolio is a tactically allocated model portfolio comprised of allocations to the strategy-specific Aetos SEC-registered

1940 Act Commingled Hedge Funds of Funds: 1) Aetos Long/Short Strategies Fund, 2) Aetos Multi-Strategy Arbitrage Fund and 3) Aetos Distressed Investment Strategies Fund. The Portfolio is designed to provide institutional investors with

attractive risk-adjusted returns and low betas to traditional markets and is relatively concentrated by manager yet diversified by strategy. Historical Performance (since inception)1 Annualized Returns 1 Year 3 Year 5 Year 10

Year Inception Portfolio -3.49% 4.03% 3.42% 4.30% 4.50% HFRI FOF: Composite Index -6.99% 4.34% 3.06% 3.60% 3.55% US Aggregate Bond Index -15.68% -3.77% -0.54% 0.74% 3.07% MSCI

ACWI -19.96% 4.85% 5.24% 7.98% 7.56% Volatility (Standard Deviation) - 3 Year 5 Year 10 Year Inception Portfolio - 7.25% 5.98% 4.71% 4.56% HFRI FOF: Composite Index - 7.28% 6.23% 4.95% 5.22% US Aggregate Bond

Index - 5.38% 4.81% 3.95% 3.82% MSCI ACWI - 19.63% 17.32% 14.07% 15.76% Sharpe Ratios - 3 Year 5 Year 10 Year Inception Portfolio - 0.47 0.37 0.76 0.73 HFRI FOF: Composite Index - 0.51 0.30 0.58 0.45 US Aggregate

Bond Index - -0.82 -0.36 0.01 0.50 MSCI ACWI - 0.21 0.23 0.52 0.41 Aetos Growth Portfolio 1 Data as of October 31, 2022. The Aetos Growth Portfolio (the “Portfolio”) is an asset allocation model offered by Aetos since September

2002 to clients seeking a diversified absolute return investment program. The Portfolio consists of investments in the Aetos Funds—including the Aetos Long/Short Strategies Fund, Aetos Multi-Strategy Arbitrage Fund and Aetos Distressed

Investment Strategies Fund (and each of the Aetos Capital Market Neutral Strategies Fund and Aetos Capital Opportunities Fund when included in the Portfolio)—weighted in accordance with allocations determined by Aetos and in effect during the

periods shown. The Portfolio returns are of the model only and do not represent the returns of any specific client account. An actual client investing in accordance with the Aetos Growth Portfolio during the time periods shown would have had

allocations to the Aetos Funds that differed from those of the Portfolio for a variety of reasons, including that differences in the relative performance of the Aetos Funds during such periods would have shifted the client’s allocations to the

Aetos Funds away from those of the Portfolio. In addition, an actual client account may have experienced cash flows that could have resulted in further differences from the Portfolio. Accordingly, it is important that the Portfolio performance

not be understood as the actual performance of client accounts when making an investment decision. The performance figures shown are net of assumed investment advisory and performance fees of 0.75% of assets annually and 5% of profits above the

three-month Treasury bill return, respectively, subject to a high-water mark. Certain clients investing in accordance with the model may have a different fee arrangement. To the extent actual fees charged to a client differ from the fees shown

herein, such client’s returns would vary accordingly. The performance figures may include returns that are preliminary, unaudited, and estimated based on the most recent information provided by underlying fund managers and are subject to

change. The returns also reflect Fund level expenses, some of which have been waived and/or reimbursed by the Investment Adviser. Returns would have been lower without such waivers and reimbursements. Past performance does not guarantee future

results. Investing in hedge funds involves substantial risks, including the risk of loss of invested capital. Please see Notes and Disclosures section for important additional information. 2 Reflects number of managers in the Aetos Growth

Portfolio as of November 1, 2022 and excludes managers that are under redemption, except for one manager that still comprises a material allocation in the Aetos Distressed Investment Strategies Fund. 3 Reflects beta since the Aetos Growth

Portfolio’s inception of September 1, 2002 through October 31, 2022.

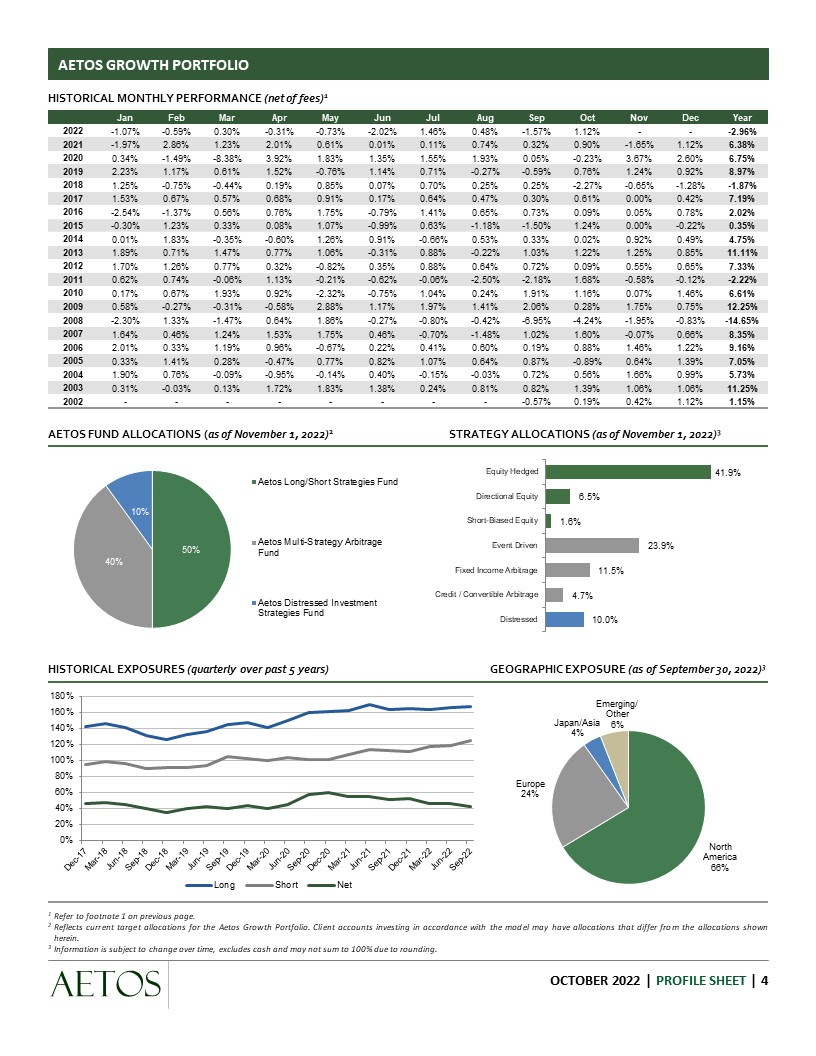

1 Refer to footnote 1 on previous page. 2 Reflects current target allocations for the Aetos Growth

Portfolio. Client accounts investing in accordance with the model may have allocations that differ from the allocations shown herein. 3 Information is subject to change over time, excludes cash and may not sum to 100% due to

rounding. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year 2022 -1.07% -0.59% 0.30% -0.31% -0.73% -2.02% 1.46% 0.48% -1.57% 1.12% - - -2.96% 2021 -1.97% 2.86% 1.23% 2.01% 0.61% 0.01% 0.11% 0.74% 0.32% 0.90% -1.65% 1.12% 6.38% 2020 0.34% -1.49% -8.38% 3.92% 1.83% 1.35% 1.55% 1.93% 0.05% -0.23% 3.67% 2.60% 6.75% 2019 2.23% 1.17% 0.61% 1.52% -0.76% 1.14% 0.71% -0.27% -0.59% 0.76% 1.24% 0.92% 8.97% 2018 1.25% -0.75% -0.44% 0.19% 0.85% 0.07% 0.70% 0.25% 0.25% -2.27% -0.65% -1.28% -1.87% 2017 1.53% 0.67% 0.57% 0.68% 0.91% 0.17% 0.64% 0.47% 0.30% 0.61% 0.00% 0.42% 7.19% 2016 -2.54% -1.37% 0.56% 0.76% 1.75% -0.79% 1.41% 0.65% 0.73% 0.09% 0.05% 0.78% 2.02% 2015 -0.30% 1.23% 0.33% 0.08% 1.07% -0.99% 0.63% -1.18% -1.50% 1.24% 0.00% -0.22% 0.35% 2014 0.01% 1.83% -0.35% -0.60% 1.26% 0.91% -0.66% 0.53% 0.33% 0.02% 0.92% 0.49% 4.75% 2013 1.89% 0.71% 1.47% 0.77% 1.06% -0.31% 0.88% -0.22% 1.03% 1.22% 1.25% 0.85% 11.11% 2012 1.70% 1.26% 0.77% 0.32% -0.82% 0.35% 0.88% 0.64% 0.72% 0.09% 0.55% 0.65% 7.33% 2011 0.62% 0.74% -0.06% 1.13% -0.21% -0.62% -0.06% -2.50% -2.18% 1.68% -0.58% -0.12% -2.22% 2010 0.17% 0.67% 1.93% 0.92% -2.32% -0.75% 1.04% 0.24% 1.91% 1.16% 0.07% 1.46% 6.61% 2009 0.58% -0.27% -0.31% -0.58% 2.88% 1.17% 1.97% 1.41% 2.06% 0.28% 1.75% 0.75% 12.25% 2008 -2.30% 1.33% -1.47% 0.64% 1.86% -0.27% -0.80% -0.42% -6.95% -4.24% -1.95% -0.83% -14.65% 2007 1.64% 0.46% 1.24% 1.53% 1.75% 0.46% -0.70% -1.48% 1.02% 1.60% -0.07% 0.66% 8.35% 2006 2.01% 0.33% 1.19% 0.96% -0.67% 0.22% 0.41% 0.60% 0.19% 0.88% 1.46% 1.22% 9.16% 2005 0.33% 1.41% 0.28% -0.47% 0.77% 0.82% 1.07% 0.64% 0.87% -0.89% 0.64% 1.39% 7.05% 2004 1.90% 0.76% -0.09% -0.95% -0.14% 0.40% -0.15% -0.03% 0.72% 0.56% 1.66% 0.99% 5.73% 2003 0.31% -0.03% 0.13% 1.72% 1.83% 1.38% 0.24% 0.81% 0.82% 1.39% 1.06% 1.06% 11.25% 2002 - - - - - - - - -0.57% 0.19% 0.42% 1.12% 1.15% AETOS

GROWTH PORTFOLIO Historical Monthly Performance (net of fees)1 AETOS FUND ALLOCATIONS (as of November 1, 2022)2 Strategy Allocations (as of November 1, 2022)3 HISTORICAL EXPOSURES (quarterly over past 5 years) GEOGRAPHIC EXPOSURE (as of

September 30, 2022)3

Aetos At-A-Glance Founded 2001 Leadership Anne Casscells Co-President & Chief Investment

Officer Michael Klein Co-President & Chief Risk Officer Locations New York, New York Menlo Park, California Portfolio HIGHLIGHTS Inception April 1, 2007 Diversification # of Managers2: 29 # of Strategies: 7 Beta to Market

Indices1,3 US Aggregate Bond Index: 0.12 MSCI ACWI: 0.24 Geography Global AETOS FUND INFORMATION Aetos SEC-Registered 1940 Act Commingled Hedge Fund of Funds Long/Short Strategies Fund Multi-Strategy Arbitrage Fund Distressed

Investment Strategies Fund Performance and Statistics (since inception through October 31, 2022)1 Firm Overview Aetos Alternatives Management, LP (“Aetos”) is an independent firm that manages assets on behalf of institutional clients. Since

the firm’s inception, Aetos has been a leader in constructing fully customized hedge fund solutions for a broad range of institutional clients. Hedge fund solutions are offered primarily through 1) customized separate accounts and 2) commingled

fund portfolios invested in strategy-specific Aetos 1940 Act SEC-registered funds. PORTFOLIO Overview The Aetos Prime Portfolio is a tactically allocated model portfolio comprised of allocations to the strategy-specific Aetos SEC-registered

1940 Act Commingled Hedge Funds of Funds: 1) Aetos Long/Short Strategies Fund, 2) Aetos Multi-Strategy Arbitrage Fund and 3) Aetos Distressed Investment Strategies Fund. The Portfolio is designed to provide institutional investors with

attractive risk-adjusted returns and low betas to traditional markets and is relatively concentrated by manager yet diversified by strategy. Historical Performance (since inception)1 Annualized Returns 1 Year 3 Year 5 Year 10

Year Inception Portfolio -3.64% 4.10% 3.48% 4.44% 3.45% HFRI FOF: Composite Index -6.99% 4.34% 3.06% 3.60% 2.05% US Aggregate Bond Index -15.68% -3.77% -0.54% 0.74% 2.70% MSCI

ACWI -19.96% 4.85% 5.24% 7.98% 5.00% Volatility (Standard Deviation) - 3 Year 5 Year 10 Year Inception Portfolio - 7.57% 6.31% 4.99% 5.14% HFRI FOF: Composite Index - 7.28% 6.23% 4.95% 5.55% US Aggregate Bond

Index - 5.38% 4.81% 3.95% 3.84% MSCI ACWI - 19.63% 17.32% 14.07% 16.77% Sharpe Ratios - 3 Year 5 Year 10 Year Inception Portfolio - 0.46 0.36 0.75 0.52 HFRI FOF: Composite Index - 0.51 0.30 0.58 0.23 US Aggregate

Bond Index - -0.82 -0.36 0.01 0.50 MSCI ACWI - 0.21 0.23 0.52 0.25 Aetos Prime Portfolio 1 Data as of October 31, 2022. The Aetos Prime Portfolio (the “Portfolio”) is an asset allocation model offered by Aetos since April 2007 to

clients seeking a diversified absolute return investment program. The Portfolio consists of investments in the Aetos Funds—including the Aetos Long/Short Strategies Fund, Aetos Multi-Strategy Arbitrage Fund and Aetos Distressed Investment

Strategies Fund (and the Aetos Capital Opportunities Fund when included in the Portfolio)—weighted in accordance with allocations determined by Aetos and in effect during the periods shown. The Portfolio returns are of the model only and do not

represent the returns of any specific client account. An actual client investing in accordance with the Aetos Prime Portfolio during the time periods shown would have had allocations to the Aetos Funds that differed from those of the Portfolio

for a variety of reasons, including that differences in the relative performance of the Aetos Funds during such periods would have shifted the client’s allocations to the Aetos Funds away from those of the Portfolio. In addition, an actual

client account may have experienced cash flows that could have resulted in further differences from the Portfolio. Accordingly, it is important that the Portfolio performance not be understood as the actual performance of client accounts when

making an investment decision. The performance figures shown are net of assumed investment advisory and performance fees of 0.75% of assets annually and 5% of profits above the three-month Treasury bill return, respectively, subject to a

high-water mark. Certain clients investing in accordance with the model may have a different fee arrangement. To the extent actual fees charged to a client differ from the fees shown herein, such client’s returns would vary accordingly. The

performance figures may include returns that are preliminary, unaudited, and estimated based on the most recent information provided by underlying fund managers and are subject to change. The returns also reflect Fund level expenses, some of

which have been waived and/or reimbursed by the Investment Adviser. Returns would have been lower without such waivers and reimbursements. Past performance does not guarantee future results. Investing in hedge funds involves substantial risks,

including the risk of loss of invested capital. Please see Notes and Disclosures section for important additional information. 2 Reflects number of managers in the Aetos Prime Portfolio as of November 1, 2022 and excludes managers that are

under redemption, except for one manager that still comprises a material allocation in the Aetos Distressed Investment Strategies Fund. 3 Reflects beta since the Aetos Prime Portfolio’s inception of April 1, 2007 through October 31, 2022.

1 Refer to footnote 1 on previous page. 2 Reflects current target allocations for the Aetos Prime

Portfolio. Client accounts investing in accordance with the model may have allocations that differ from the allocations shown herein. 3 Information is subject to change over time, excludes cash and may not sum to 100% due to rounding. Aetos

PRIME PORTFOLIO Historical Monthly Performance (net of

fees)1 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year 2022 -1.21% -0.61% 0.30% -0.38% -0.69% -2.05% 1.53% 0.39% -1.68% 1.25% - - -3.18% 2021 -2.57% 3.25% 1.31% 2.19% 0.63% -0.07% 0.29% 0.73% 0.25% 0.99% -1.79% 1.33% 6.58% 2020 0.20% -1.64% -8.39% 4.23% 1.89% 1.12% 1.68% 1.99% 0.02% -0.30% 3.89% 2.60% 6.88% 2019 2.58% 1.27% 0.65% 1.65% -0.86% 1.26% 0.73% -0.31% -0.73% 0.91% 1.39% 0.89% 9.79% 2018 1.32% -0.93% -0.37% 0.14% 1.01% -0.04% 0.71% 0.30% 0.17% -2.57% -0.67% -1.40% -2.37% 2017 1.61% 0.64% 0.62% 0.66% 0.99% 0.13% 0.68% 0.52% 0.30% 0.61% 0.00% 0.39% 7.35% 2016 -2.75% -1.64% 0.55% 0.64% 2.01% -0.83% 1.52% 0.57% 0.77% -0.06% 0.01% 0.73% 1.42% 2015 -0.33% 1.37% 0.30% -0.06% 1.19% -1.00% 0.86% -1.21% -1.55% 1.48% 0.08% -0.18% 0.91% 2014 -0.11% 2.02% -0.52% -0.82% 1.43% 0.96% -0.71% 0.68% 0.48% 0.26% 1.07% 0.60% 5.43% 2013 1.90% 0.70% 1.56% 0.68% 1.04% -0.19% 0.92% -0.30% 1.14% 1.26% 1.40% 0.92% 11.58% 2012 1.67% 1.21% 0.75% 0.35% -0.88% 0.37% 0.92% 0.59% 0.73% -0.05% 0.50% 0.50% 6.83% 2011 0.48% 0.67% -0.18% 1.20% -0.22% -0.63% 0.02% -2.59% -2.25% 1.84% -0.50% -0.18% -2.38% 2010 -0.17% 0.72% 1.84% 0.80% -2.39% -0.87% 1.07% 0.12% 2.05% 1.16% 0.08% 1.62% 6.10% 2009 0.62% -0.31% -0.36% -0.83% 2.80% 0.91% 1.86% 1.28% 1.91% 0.12% 1.83% 0.58% 10.85% 2008 -2.35% 1.35% -1.53% 0.69% 1.93% -0.15% -0.93% -0.37% -7.01% -3.73% -1.60% -0.72% -13.79% 2007 - - - 1.60% 1.78% 0.42% -0.66% -1.50% 1.12% 1.70% -0.10% 0.61% 5.03% HISTORICAL

EXPOSURES (quarterly over past 5 years) GEOGRAPHIC EXPOSURE (as of September 30, 2022)3 AETOS FUND ALLOCATIONS (as of November 1, 2022)2 Strategy Allocations (as of November 1, 2022)3

Aetos At-A-Glance Founded 2001 Leadership Anne Casscells Co-President & Chief Investment

Officer Michael Klein Co-President & Chief Risk Officer Locations New York, New York Menlo Park, California Portfolio HIGHLIGHTS Inception September 1, 2002 Diversification # of Managers2: 29 # of Strategies: 7 Beta to Market

Indices1,3 US Aggregate Bond Index: 0.12 MSCI ACWI: 0.21 Geography Global AETOS FUND INFORMATION Aetos SEC-Registered 1940 Act Commingled Hedge Fund of Funds Long/Short Strategies Fund Multi-Strategy Arbitrage Fund Distressed

Investment Strategies Fund Performance and Statistics (since inception through October 31, 2022)1 Firm Overview Aetos Alternatives Management, LP (“Aetos”) is an independent firm that manages assets on behalf of institutional clients. Since

the firm’s inception, Aetos has been a leader in constructing fully customized hedge fund solutions for a broad range of institutional clients. Hedge fund solutions are offered primarily through 1) customized separate accounts and 2) commingled

fund portfolios invested in strategy-specific Aetos 1940 Act SEC-registered funds. PORTFOLIO Overview The Aetos Balanced Portfolio is a tactically allocated model portfolio comprised of allocations to the strategy-specific Aetos

SEC-registered 1940 Act Commingled Hedge Funds of Funds: 1) Aetos Long/Short Strategies Fund, 2) Aetos Multi-Strategy Arbitrage Fund and 3) Aetos Distressed Investment Strategies Fund. The Portfolio is designed to provide institutional

investors with attractive risk-adjusted returns and low betas to traditional markets and is relatively concentrated by manager yet diversified by strategy. Historical Performance (since inception)1 Annualized Returns 1 Year 3 Year 5

Year 10 Year Inception Portfolio -3.34% 3.95% 3.36% 4.15% 4.27% HFRI FOF: Composite Index -6.99% 4.34% 3.06% 3.60% 3.55% US Aggregate Bond Index -15.68% -3.77% -0.54% 0.74% 3.07% MSCI

ACWI -19.96% 4.85% 5.24% 7.98% 7.56% Volatility (Standard Deviation) - 3 Year 5 Year 10 Year Inception Portfolio - 6.97% 5.69% 4.46% 4.46% HFRI FOF: Composite Index - 7.28% 6.23% 4.95% 5.22% US Aggregate Bond

Index - 5.38% 4.81% 3.95% 3.82% MSCI ACWI - 19.63% 17.32% 14.07% 15.76% Sharpe Ratios - 3 Year 5 Year 10 Year Inception Portfolio - 0.47 0.38 0.77 0.69 HFRI FOF: Composite Index - 0.51 0.30 0.58 0.45 US Aggregate

Bond Index - -0.82 -0.36 0.01 0.50 MSCI ACWI - 0.21 0.23 0.52 0.41 Aetos Balanced Portfolio 1 Data as of October 31, 2022. The Aetos Balanced Portfolio (the “Portfolio”) is an asset allocation model offered by Aetos since September

2002 to clients seeking a diversified absolute return investment program. The Portfolio consists of investments in the Aetos Funds—including the Aetos Long/Short Strategies Fund, Aetos Multi-Strategy Arbitrage Fund and Aetos Distressed

Investment Strategies Fund (and the Aetos Capital Market Neutral Strategies Fund when included in the Portfolio)—weighted in accordance with allocations determined by Aetos and in effect during the periods shown. The Portfolio returns are of

the model only and do not represent the returns of any specific client account. An actual client investing in accordance with the Aetos Balanced Portfolio during the time periods shown would have had allocations to the Aetos Funds that differed

from those of the Portfolio for a variety of reasons, including that differences in the relative performance of the Aetos Funds during such periods would have shifted the client’s allocations to the Aetos Funds away from those of the Portfolio.

In addition, an actual client account may have experienced cash flows that could have resulted in further differences from the Portfolio. Accordingly, it is important that the Portfolio performance not be understood as the actual performance of

client accounts when making an investment decision. The performance figures shown are net of assumed investment advisory and performance fees of 0.75% of assets annually and 5% of profits above the three-month Treasury bill return,

respectively, subject to a high-water mark. Certain clients investing in accordance with the model may have a different fee arrangement. To the extent actual fees charged to a client differ from the fees shown herein, such client’s returns

would vary accordingly. The performance figures may include returns that are preliminary, unaudited, and estimated based on the most recent information provided by underlying fund managers and are subject to change. The returns also reflect

Fund level expenses, some of which have been waived and/or reimbursed by the Investment Adviser. Returns would have been lower without such waivers and reimbursements. Past performance does not guarantee future results. Investing in hedge funds

involves substantial risks, including the risk of loss of invested capital. Please see Notes and Disclosures section for important additional information. 2 Reflects number of managers in the Aetos Balanced Portfolio as of November 1, 2022 and

excludes managers that are under redemption, except for one manager that still comprises a material allocation in the Aetos Distressed Investment Strategies Fund. 3 Reflects beta since the Aetos Balanced Portfolio’s inception of September 1,

2002 through October 31, 2022.

1 Refer to footnote 1 on previous page. 2 Reflects current target allocations for the Aetos Balanced

Portfolio. Client accounts investing in accordance with the model may have allocations that differ from the allocations shown herein. 3 Information is subject to change over time, excludes cash and may not sum to 100% due to

rounding. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year 2022 -0.94% -0.56% 0.29% -0.24% -0.77% -1.99% 1.39% 0.58% -1.46% 0.99% - - -2.74% 2021 -1.37% 2.47% 1.14% 1.84% 0.59% 0.08% -0.06% 0.76% 0.40% 0.82% -1.52% 0.91% 6.17% 2020 0.48% -1.33% -8.37% 3.61% 1.77% 1.57% 1.42% 1.86% 0.09% -0.16% 3.46% 2.60% 6.61% 2019 1.88% 1.06% 0.57% 1.39% -0.65% 1.02% 0.69% -0.23% -0.46% 0.60% 1.09% 0.95% 8.16% 2018 1.17% -0.56% -0.50% 0.24% 0.69% 0.17% 0.69% 0.21% 0.34% -1.97% -0.63% -1.17% -1.36% 2017 1.45% 0.71% 0.53% 0.70% 0.83% 0.22% 0.61% 0.41% 0.30% 0.61% -0.01% 0.45% 7.02% 2016 -2.33% -1.11% 0.57% 0.88% 1.50% -0.75% 1.31% 0.73% 0.70% 0.24% 0.09% 0.82% 2.62% 2015 -0.26% 1.09% 0.36% 0.23% 0.94% -0.98% 0.40% -1.15% -1.46% 0.99% -0.08% -0.27% -0.23% 2014 0.12% 1.64% -0.18% -0.38% 1.09% 0.86% -0.60% 0.38% 0.17% -0.23% 0.77% 0.38% 4.06% 2013 1.88% 0.73% 1.39% 0.87% 1.07% -0.44% 0.85% -0.15% 0.93% 1.17% 1.10% 0.78% 10.63% 2012 1.75% 1.35% 0.79% 0.30% -0.75% 0.32% 0.84% 0.70% 0.71% 0.24% 0.59% 0.80% 7.91% 2011 0.83% 0.82% 0.14% 1.03% -0.20% -0.61% -0.19% -2.34% -2.02% 1.46% -0.72% -0.01% -1.88% 2010 0.66% 0.60% 2.02% 1.10% -2.20% -0.51% 1.00% 0.40% 1.64% 1.14% 0.03% 1.21% 7.26% 2009 0.44% -0.11% -0.25% -0.34% 2.98% 1.63% 2.18% 1.54% 2.32% 0.55% 1.58% 0.96% 14.27% 2008 -1.73% 1.09% -1.49% 0.58% 1.76% -0.39% -0.69% -0.44% -6.91% -5.33% -2.56% -1.07% -16.19% 2007 1.53% 0.35% 1.13% 1.37% 1.63% 0.30% -2.10% -1.34% 0.93% 1.45% -0.11% 0.52% 5.74% 2006 1.84% 0.50% 0.91% 0.92% -0.38% 0.45% 0.52% 0.46% 0.28% 0.74% 1.32% 1.28% 9.17% 2005 0.46% 1.21% 0.26% -0.34% 0.66% 0.72% 0.99% 0.38% 0.75% -0.75% 0.44% 1.29% 6.23% 2004 1.58% 0.61% -0.03% -0.71% -0.17% 0.30% -0.23% 0.03% 0.51% 0.28% 1.45% 0.87% 4.55% 2003 0.79% 0.19% 0.31% 1.43% 1.98% 1.10% -0.20% 0.63% 1.10% 1.09% 1.05% 0.92% 10.87% 2002 - - - - - - - - -0.42% 0.16% 0.55% 1.10% 1.39% Aetos

Balanced PORTFOLIO Historical Monthly Performance (net of fees)1 AETOS FUND ALLOCATIONS (as of November 1, 2022)2 Strategy Allocations (as of November 1, 2022)3 HISTORICAL EXPOSURES (quarterly over past 5 years) GEOGRAPHIC EXPOSURE (as of

September 30, 2022)3

NOTES and Disclosures Investing in hedge funds and other alternatives investment strategies involves

substantial risks, including the risk of loss of invested capital. These risks remain substantial, notwithstanding the risk management practices Aetos employs in selecting and monitoring investments. Alternative investments are typically made

through investments in illiquid, unregulated investment funds that employ sophisticated investment techniques, often involving derivatives and leverage. Prospective investors should obtain independent advice with respect to the investment,

financial, legal, tax, accounting, regulatory and other aspects of an investment in the strategies offered by Aetos. For a more complete description of the risks associated with an investment with Aetos, please see Part 2 of Form ADV of Aetos

Alternatives Management, LP, which is available upon request from your Aetos contact and on the SEC website. Aetos Alternatives Management is an SEC-registered investment adviser and serves as investment adviser to SEC-registered 1940 Act

funds. Such registrations do not imply in any manner whatsoever that Aetos or the Aetos Funds have been sponsored, recommended, or approved, or that their abilities or qualifications have in any respect been passed upon by the United States or

any agency or any office thereof. Prospective investors should consider the investment objectives, risks, and the charges and expenses of the Aetos Funds carefully before investing. A free copy of the prospectus containing this and other

information may be obtained by calling 212-201-2500. Please read the prospectus carefully before investing. Indices have been provided by Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P.

and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any

information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages

arising in connection therewith. Indices are not actively managed, do not reflect any deduction for fees, expenses or taxes, and investors cannot invest directly in an unmanaged index. The volatility, investment holdings and other

characteristics of the indices presented may be materially different from those of investments made by Aetos referenced herein. The indices shown have not been selected as appropriate benchmarks to compare to the performance of those of

investments made by Aetos; rather they are provided to allow for comparisons to the performance of well-known and widely recognized indices. Bloomberg US Aggregate Bond Index: Index designed to broadly measure the performance of the investment

grade, US dollar-denominated, fixed-rate taxable bond market. The Bloomberg US Aggregate Bond Index includes Treasury securities, government-related and corporate securities, MBS, ABS, and CMBS with maturities of no less than one year. HFRI

Fund of Funds Composite Index: Index that includes fund of funds that invest with multiple managers through funds or managed accounts. Fund of funds design diversified portfolios of managers with the objective of significantly lowering the risk

(volatility) of investing with an individual manager. MSCI ACWI: Index designed to measure developed and emerging market equity performance. The MSCI ACWI consists of 47 country indexes comprising 23 developed and 24 emerging market country

indexes. TERMS Minimum Investment $1 million Subscription Frequency Monthly Redemption Frequency Quarterly with 90 days’ notice after 1 year lock-up period Fund Structures Onshore and offshore vehicles Auditor PricewaterhouseCoopers

LLP Administrator HedgeServ Limited Legal Counsel Clifford Chance LLP (onshore), Maples and Calder LLP (offshore) Custodian JP Morgan Chase Bank Aetos Commingled offerings Aetos Contact Information John Stimpson Managing Director,

Co-Head of Client Relations and Business Development 875 Third Avenue, 6th Floor New York, NY 10022 ( 212.201.2560 * [email protected] Elizabeth Leung Managing Director, Co-Head of Client Relations and Business Development 875 Third

Avenue, 6th Floor New York, NY 10022 ( 212.201.2562 * [email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Form 8.3 - Balanced Commercial Property Trust Limited

- E Source Announces Presence at CS Week Conference 48, Celebrates Client Wins

- FUNDAMENTAL INVENTIONS ENABLE THE BEST PPA AND MOST PORTABLE EFPGA/DSP/SDR/AI IP FOR ADAPTABLE SOCS

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share