Form 497 FAIRHOLME FUNDS INC

FAIRHOLME FUNDS

No-load, non-diversified funds

THE FAIRHOLME FUND (FAIRX)

Seeking long-term growth of capital

THE FAIRHOLME FOCUSED INCOME FUND (FOCIX)

Seeking current income

THE FAIRHOLME ALLOCATION FUND (FAAFX)

Seeking long-term total return

PROSPECTUS

March 29, 2019

(As amended August 9, 2019)

Managed by

FAIRHOLME CAPITAL MANAGEMENT

The Securities and Exchange Commission has not approved or

disapproved these securities or passed on the accuracy or adequacy of

this prospectus. Any representation to the contrary is a criminal offense.

Beginning March 29, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund or your financial intermediary electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling the Fund at (866) 202-2263.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with a Fund, you can call the Fund at (866) 202-2263. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all funds held with Fairholme Funds, Inc.

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| Payments to Broker-Dealers and Other Financial Intermediaries |

7 | |||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| Payments to Broker-Dealers and Other Financial Intermediaries |

12 | |||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| Payments to Broker-Dealers and Other Financial Intermediaries |

17 | |||

| ADDITIONAL INFORMATION ABOUT THE FUNDS’ INVESTMENTS AND RISKS |

18 | |||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| Back Cover | ||||

2

(“The Fairholme Fund”)

The Fairholme Fund’s investment objective is long-term growth of capital.

The following table describes the fees and expenses you may pay if you buy and hold shares of The Fairholme Fund. You may be required to pay commissions and/or other forms of compensation to a broker for transactions in shares of The Fairholme Fund, which are not reflected in the tables or the Example below.

| SHAREHOLDER FEES | ||||

| (Fees Paid Directly From Your Investment) | ||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

None | |||

| Maximum Deferred Sales Charge (Load) (as a percentage of amount redeemed) |

None | |||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and Other Distributions (as a percentage of amount reinvested) |

None | |||

| Redemption Fee Paid to the Fund (as a percentage of amount redeemed within 60 days of purchase, if applicable) |

2.00% | |||

| ANNUAL FUND OPERATING EXPENSES | ||||

| (Expenses That You Pay Each Year As A Percentage Of The Value Of Your Investment In The Fairholme Fund) |

||||

| Management Fees |

1.00% | |||

| Distribution (12b-1) Fees |

None | |||

| Other Expenses |

0.00% | |||

|

|

|

|||

| Total Annual Fund Operating Expenses(a) |

1.00% | |||

| (a) | This table does not reflect the application of the management fee waiver discussed in the section of the Prospectus entitled “Investment Management,” pursuant to which the Manager (defined below) has agreed to waive, on a voluntary basis, a portion of the management fee of The Fairholme Fund to the extent necessary to limit the management fee paid to the Manager by The Fairholme Fund to an annual rate of 0.80% of the daily average net asset value of The Fairholme Fund (“Undertaking”). This Undertaking may be terminated by the Manager upon 60 days’ written notice to The Fairholme Fund. |

For more information about the management fee, see the “Investment Management” section of the Prospectus.

Example

This Example is intended to help you compare the cost of investing in The Fairholme Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in The Fairholme Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that The Fairholme Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $102* | $318 | $552 | $1,225 | |||

| * | The amount shown does not reflect the application of the Undertaking. |

The Fairholme Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when The Fairholme Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect The Fairholme Fund’s performance. During the most recent fiscal year, The Fairholme Fund’s portfolio turnover rate was 16.29% of the average value of its portfolio.

3

Principal Investment Strategies

Fairholme Capital Management, L.L.C. (the “Manager”), the investment adviser to The Fairholme Fund, attempts, under normal circumstances, to achieve The Fairholme Fund’s investment objective by investing in a focused portfolio of equity and fixed-income securities. The proportion of The Fairholme Fund’s assets invested in each type of asset class will vary from time to time based upon the Manager’s assessment of general market and economic conditions. The Fairholme Fund may invest in, and may shift frequently among, asset classes and market sectors.

The equity securities in which The Fairholme Fund may invest include common and preferred stock (including convertible preferred stock), partnership interests, business trust shares, depository receipts, rights and warrants to subscribe for the purchase of equity securities, and interests in real estate investment trusts (“REITs”).

The fixed-income securities in which The Fairholme Fund may invest include U.S. corporate debt securities, non-U.S. corporate debt securities, bank debt (including bank loans and participations), U.S. Government and agency debt securities (including U.S. Treasury bills), short-term debt obligations of foreign governments and foreign money market instruments.

The Fairholme Fund may also invest in “special situations,” which are situations when the securities of a company are expected to appreciate over time due to company-specific developments rather than general business conditions or movements of the market as a whole.

The Manager uses fundamental analysis to identify certain attractive characteristics of companies. Such characteristics may include: high free cash flow yields in relation to market values and risk-free rates; sensible capital allocation policies; strong competitive positions; solid balance sheets; liquidity and leverage; stress-tested owner/managers; participation in stressed industries having reasonable prospects for recovery; potential for long-term growth; significant tangible assets in relation to enterprise values; high returns on invested equity and capital; and the production of essential services and products. The Manager defines free cash flow as the cash a company would generate annually from operations after all cash outlays necessary to maintain the business in its current condition.

Although The Fairholme Fund normally holds a focused portfolio of equity and fixed-income securities, The Fairholme Fund is not required to be fully invested in such securities and may maintain a significant portion of its total assets in cash and securities generally considered to be cash equivalents. In certain market conditions, the Manager may determine that it is appropriate for The Fairholme Fund to hold a significant cash position for an extended period of time.

The Fairholme Fund may also use other investment strategies and invest its assets in other types of investments, which are described in the section in this Prospectus entitled “Additional Information about the Funds’ Investments and Risks,” and in The Fairholme Fund’s Statement of Additional Information (“SAI”).

Principal Risks of Investing in The Fairholme Fund

General Risks. All investments are subject to inherent risks, and an investment in The Fairholme Fund is no exception. Accordingly, you may lose money by investing in The Fairholme Fund. Markets can trade in random or cyclical price patterns, and prices can fall over time. The value of The Fairholme Fund’s investments will fluctuate as markets fluctuate and could decline over short- or long-term periods.

Equity Risk. The Fairholme Fund is subject to the risk that stock and other equity security prices may fall over short or extended periods of time. Historically, the equity markets have moved in cycles, and the value of The Fairholme Fund’s equity securities may fluctuate drastically from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response. These factors contribute to price volatility.

Small- to Medium-Capitalization Risk. Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small- to mid-cap companies may have additional risks because, among other things, these companies have limited product lines, markets or financial resources.

Focused Portfolio and Non-Diversification Risks. The Fairholme Fund may have more volatility and is considered to have more risk than a fund that invests in securities of a greater number of issuers because changes in the value of a single issuer’s security may have a more significant effect, either negative or positive, on The Fairholme Fund’s net asset value (“NAV”). To the extent that The Fairholme Fund invests its assets in the securities of fewer issuers, The Fairholme Fund will be subject to greater risk of loss if any of those securities decreases in value or becomes impaired. To the extent that The Fairholme Fund’s investments are focused in a particular issuer, region, country, market, industry, asset class or other category, The Fairholme Fund may be susceptible to loss due to adverse occurrences affecting that issuer, region, country, market, industry, asset class or other category.

Industry/Sector Risk. To the extent The Fairholme Fund invests or maintains a significant portion of its assets in one or more issuers in a particular industry or industry sector, The Fairholme Fund will be subject to a greater degree to the risks particular to

4

that industry or industry sector. Market or economic factors affecting issuers in that industry, group of related industries or sector could have a major effect on the value of The Fairholme Fund’s investments and NAV. The securities of an issuer in the real estate sector comprise a significant portion of The Fairholme Fund’s assets. This investment exposes The Fairholme Fund to the risks of the real estate related sector generally and of that issuer, including risks relating to real estate investments and development in Northwest Florida, hospitality, and forestry. In this regard, the securities of a single real estate related issuer or a group of real estate issuers may underperform the market as a whole due to legislative or regulatory changes, adverse market conditions and/or increased competition affecting the real estate sector.

Special Situation Risk. Investments in special situations may involve greater risks when compared to The Fairholme Fund’s other strategies due to a variety of factors. Mergers, reorganizations, liquidations or recapitalizations may fail or not be completed on the terms originally contemplated, and expected developments may not occur in a timely manner, or at all.

Cash Position Risk. To the extent that The Fairholme Fund holds large positions in cash or cash equivalents, there is a risk of lower returns and potential lost opportunities to participate in market appreciation.

Interest Rate Risk. Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations, but increasing interest rates may have an adverse effect on the value of The Fairholme Fund’s investment portfolio as a whole, as investors and markets adjust expected returns relative to such increasing rates.

Credit Risk. The Fairholme Fund’s investments are subject to credit risk. An issuer’s credit quality depends on its ability to pay interest on and repay its debt and other obligations. Defaulted securities (or those expected to default) are subject to additional risks in that the securities may become subject to a plan or reorganization that can diminish or eliminate their value. The credit risk of a security may also depend on the credit quality of any bank or financial institution that provides credit enhancement for the security. Changes in economic, tax and regulatory policies, interest rates, inflation rates and government instability, war or other political or economic actions or factors may have an adverse effect on the investments of The Fairholme Fund. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations. The Manager does not rely solely on third party credit ratings to select The Fairholme Fund’s portfolio securities.

Illiquid Investments Risk. The Fairholme Fund’s investments are subject to illiquid investments risk. This is the risk that the market for a security or other investment cannot accommodate an order to buy or sell the security or other investment in the desired timeframe, possibly preventing The Fairholme Fund from selling these securities at an advantageous price. This risk includes the risk that legal or contractual restrictions on the resale of a security may affect The Fairholme Fund’s ability to sell the security when deemed appropriate or necessary by the Manager. Derivatives and securities involving substantial market and credit risk tend to involve greater illiquid investments risk, and, in certain circumstances, illiquid investments risk may be greater for a particular security as a result of, among other things, changes in the markets relating to that security, increased selling of the security by market participants or increases in the size of the holding relative to other fund holdings or to the issuer’s total issuance. Over recent years illiquid investments risk has increased because the capacity of dealers in the secondary market for fixed-income securities to make markets in these securities has decreased, even as the overall bond market has grown significantly, due to, among other things, structural changes, additional regulatory requirements and capital and risk restraints that have led to reduced inventories. Illiquid investments risk may be higher in a rising interest rate environment, when the value and liquidity of fixed-income securities generally decline. This risk also includes the risk that trading on an exchange may be halted because of market conditions.

Control and Substantial Positions Risk. The Fairholme Fund may invest in the securities of a company for the purpose of affecting the management or control of the company or may have or acquire a substantial position in the securities of a company, subject to applicable legal restrictions with respect to the investment. Such an investment imposes additional risks for The Fairholme Fund other than a possible decline in the value of the investment. These additional risks include: the application of statutory, regulatory and other requirements to The Fairholme Fund, or to the Manager and its affiliates, could restrict activities contemplated by The Fairholme Fund, or by the Manager and its affiliates, with respect to a portfolio company or limit the time and the manner in which The Fairholme Fund is able to dispose of its holdings or hedge such holdings; The Fairholme Fund, or the Manager and its affiliates, may be required to obtain relief from the Securities and Exchange Commission (the “SEC”) or its staff prior to engaging in certain activities with respect to a portfolio company that could be deemed a joint arrangement under the Investment Company Act of 1940, as amended (the “1940 Act”); The Fairholme Fund may incur substantial expenses and costs when taking control or other substantial positions in a company, including paying market prices for securities whose value The Fairholme Fund is required to discount when computing the NAV of The Fairholme Fund’s shares, and there is no guarantee that such expenses and costs can be recouped; and The Fairholme Fund could be exposed to various legal claims by governmental entities, or by a portfolio company, its security holders and its creditors, arising from,

5

among other things, The Fairholme Fund’s status as an insider or control person of a portfolio company or from the Manager’s designation of directors to serve on the board of directors of a portfolio company.

An investment in The Fairholme Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Further discussion about other risks of investing in The Fairholme Fund may be found in the section in this Prospectus entitled “Additional Information about the Funds’ Investments and Risks,” and in The Fairholme Fund’s SAI.

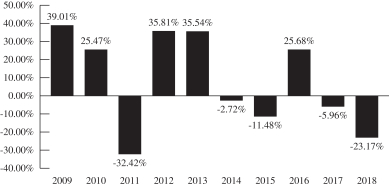

The bar chart and table set out below show The Fairholme Fund’s historical performance and provide some indication of the risks of investing in The Fairholme Fund by showing changes in The Fairholme Fund’s performance from year to year and by showing how The Fairholme Fund’s average annual total returns for 1-, 5-, and 10-year periods and since inception compare to the performance of the S&P 500 Index. The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. The S&P 500 Index assumes reinvestment of all dividends and distributions. Because indices cannot be invested in directly, these index returns do not reflect a deduction for fees, expenses or taxes. The Fairholme Fund’s past performance (before and after taxes) may not be an indication of how The Fairholme Fund will perform in the future. Updated performance information for The Fairholme Fund may be obtained by calling 1-866-202-2263.

Annual Returns for The Fairholme Fund for the Last 10 Calendar Years

| Best Quarter - 2nd Qtr 2009: +32.74% | Worst Quarter - 3rd Qtr 2011: -25.47% | |

Average Annual Total Returns for The Fairholme Fund (for the periods ended December 31, 2018)

| Portfolio Returns | 1 Year | 5 Years | 10 Years |

Since Inception (12/29/1999) | ||||||||||

| Return Before Taxes |

-23.17% | -4.80% | 5.43% | 7.99% | ||||||||||

| Return After Taxes on Distributions |

-23.83% | -7.68% | 3.43% | 6.71% | ||||||||||

| Return After Taxes on Distributions and Sale of The Fairholme Fund Shares |

-13.69% | -3.39% | 4.53% | 6.89% | ||||||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

-4.38% | 8.49% | 13.12% | 4.89% | ||||||||||

The theoretical “after-tax” returns shown in the table are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Your actual “after-tax” returns depend on your personal tax situation and may differ from the returns shown above. Also, “after-tax” return information is not relevant to shareholders who hold The Fairholme Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). The “after-tax” returns shown in the table reflect past tax effects and are not predictive of future tax effects.

The average annual total return after taxes on distributions and sale of The Fairholme Fund shares for the 1-year, 5-year, 10-year, and Since Inception periods are higher than the average annual total return after taxes on distributions for the same periods because of realized losses that would have been sustained upon the sale of The Fairholme Fund shares immediately after such 1-year, 5-year, 10-year, and Since Inception periods. In addition to the assumptions in the preceding paragraph, the calculation for the average annual total return after taxes on distributions and sale of The Fairholme Fund shares assumes that an

6

investor would have been able to immediately utilize the full realized loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisors regarding their personal tax situations.

Fairholme Capital Management, L.L.C., the Manager, provides investment advisory services to The Fairholme Fund.

Bruce R. Berkowitz, Chief Investment Officer of the Manager, and the President and a Director of Fairholme Funds, Inc. (the “Company”), has been The Fairholme Fund’s lead portfolio manager since The Fairholme Fund’s inception. Mr. Berkowitz is responsible for the day-to-day management of The Fairholme Fund’s portfolio.

Purchase and Sale of The Fairholme Fund Shares

Purchases of shares of The Fairholme Fund are subject to the following minimum investment amounts (which may be waived by the Manager in its discretion):

| Minimum Investment To Open Account |

$10,000 for Regular Accounts |

$6,000 for IRAs | ||

|

Minimum Subsequent Investment (Non-Automatic Investment Plan Members) |

$1,000 for Regular Accounts and IRAs | |||

|

Minimum Subsequent Investment (Automatic Investment Plan Members) |

$250 per month minimum ($100 per month minimum for The Fairholme Fund shareholders who became AIP members prior to September 1, 2008) | |||

Shareholders eligible to purchase shares of The Fairholme Fund may do so through their financial intermediaries or by contacting The Fairholme Fund: (i) by telephone at 1-866-202-2263; or (ii) by mail addressed to c/o BNY Mellon Investment Servicing (US) Inc., P.O. Box 9692, Providence, RI 02940-9692; or (iii) by overnight delivery addressed to c/o BNY Mellon Investment Servicing (US) Inc., 4400 Computer Drive, Westborough, MA 01581-1722.

The Fairholme Fund reserves the right to limit the sale of shares to new investors and existing shareholders at any time. The Fairholme Fund may reject any order to purchase shares, and may withdraw the offering of shares at any time to any or all investors.

Shareholders may redeem shares of The Fairholme Fund through their financial intermediaries or by contacting The Fairholme Fund: (i) by telephone at 1-866-202-2263; (ii) by mail addressed to c/o BNY Mellon Investment Servicing (US) Inc., P.O. Box 9692, Providence, RI 02940-9692; or (iii) by overnight delivery addressed to c/o BNY Mellon Investment Servicing (US) Inc., 4400 Computer Drive, Westborough, MA 01581-1722.

Tax Information for The Fairholme Fund

The Fairholme Fund intends to make distributions that may be taxed as ordinary income or capital gains.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of The Fairholme Fund through a broker-dealer or other financial intermediary (such as a bank), The Fairholme Fund and its related companies may pay the intermediary for certain administrative and shareholder servicing functions. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary to recommend The Fairholme Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

7

THE FAIRHOLME FOCUSED INCOME FUND

(“The Income Fund”)

The Income Fund seeks current income.

The following table describes the fees and expenses you may pay if you buy and hold shares of The Income Fund. You may be required to pay commissions and/or other forms of compensation to a broker for transactions in shares of The Income Fund, which are not reflected in the tables or the Example below.

| SHAREHOLDER FEES | ||||

| (Fees Paid Directly From Your Investment) | ||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

None | |||

| Maximum Deferred Sales Charge (Load) (as a percentage of amount redeemed) |

None | |||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and Other Distributions (as a percentage of amount reinvested) |

None | |||

| ANNUAL FUND OPERATING EXPENSES | ||||

| (Expenses That You Pay Each Year As A Percentage Of The Value Of Your Investment In The Income Fund) |

||||

| Management Fees |

1.00% | |||

| Distribution (12b-1) Fees |

None | |||

| Other Expenses |

0.01% | |||

|

|

|

|||

| Total Annual Fund Operating Expenses(a) |

1.01% | |||

| (a) | This table does not reflect the application of the management fee waiver discussed in the section of the Prospectus entitled “Investment Management,” pursuant to which the Manager (defined below) has agreed to waive, on a voluntary basis, a portion of the management fee of The Income Fund to the extent necessary to limit the management fee paid to the Manager by The Income Fund to an annual rate of 0.80% of the daily average net asset value of The Income Fund (“Undertaking”). This Undertaking may be terminated by the Manager upon 60 days’ written notice to The Income Fund. |

For more information about the management fee, see the “Investment Management” section of the Prospectus. “Other Expenses” include acquired fund fees and expenses, which are incurred indirectly by The Income Fund as a result of The Income Fund’s investing in securities issued by one or more investment companies, including money market funds. Please note that the Total Annual Fund Operating Expenses in the table above may not correlate to the Ratio of Net Expenses to Average Net Assets found within the “Financial Highlights” section of this Prospectus.

Example

This Example is intended to help you compare the cost of investing in The Income Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in The Income Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that The Income Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $103* | $322 | $558 | $1,236 | |||

| * | The amount shown does not reflect the application of the Undertaking. |

The Income Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when The Income Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect The Income Fund’s performance. During the most recent fiscal year, The Income Fund’s portfolio turnover rate was 45.78% of the average value of its portfolio.

8

Principal Investment Strategies

Fairholme Capital Management, L.L.C. (the “Manager”), the investment adviser to The Income Fund, attempts, under normal circumstances, to achieve The Income Fund’s investment objective by investing in a focused portfolio of cash distributing securities. To maintain maximum flexibility, the securities in which The Income Fund may invest include corporate bonds and other corporate debt securities of issuers in the U.S. and foreign countries, bank debt (including bank loans and participations), government and agency debt securities of the U.S. and foreign countries (including U.S. Treasury bills), convertible bonds and other convertible securities, and equity securities, including preferred and common stock of issuers in the U.S. and foreign countries, and interests in real estate investment trusts (“REITs”). The Income Fund’s portfolio securities may be rated by one or more nationally recognized statistical rating organizations (“NRSROs”), such as Moody’s Investors Service, Inc. (“Moody’s”) or S&P Global Ratings (“S&P”), or may be unrated. The Manager may invest in securities for The Income Fund without regard to maturity or the rating of the issuer of the security. The Income Fund may invest without limit in lower-rated securities (or “junk bonds”). Lower-rated securities are those rated below “Baa” by Moody’s or below “BBB” by S&P or that have comparable ratings from other NRSROs or, if unrated, are determined to be comparable to lower-rated debt securities by the Manager.

Although The Income Fund normally holds a focused portfolio of securities, The Income Fund is not required to be fully invested in such securities and may maintain a significant portion of its total assets in cash and securities generally considered to be cash equivalents. In certain market conditions, the Manager may determine that it is appropriate for The Income Fund to hold a significant cash position for an extended period of time.

The Income Fund may also use other investment strategies and invest its assets in other types of investments, which are described in the section in this Prospectus entitled “Additional Information about the Funds’ Investments and Risks,” and in The Income Fund’s Statement of Additional Information (“SAI”).

Principal Risks of Investing in The Income Fund

General Risks. All investments are subject to inherent risks, and an investment in The Income Fund is no exception. Accordingly, you may lose money by investing in The Income Fund. Markets can trade in random or cyclical price patterns, and prices can fall over time. The value of The Income Fund’s investments will fluctuate as markets fluctuate and could decline over short-or long-term periods.

Focused Portfolio and Non-Diversification Risks. The Income Fund may have more volatility and is considered to have more risk than a fund that invests in securities of a greater number of issuers because changes in the value of a single issuer’s securities may have a more significant effect, either negative or positive, on the net asset value (“NAV”) of The Income Fund. To the extent that The Income Fund invests its assets in the securities of fewer issuers, The Income Fund will be subject to greater risk of loss if any of those securities decreases in value or becomes impaired. To the extent that The Income Fund’s investments are focused in a particular issuer, region, country, market, industry, asset class or other category, The Income Fund may be susceptible to loss due to adverse occurrences affecting that issuer, region, country, market, industry, asset class or other category.

High Yield Security Risk. Investments in fixed-income securities that are rated below investment grade by one or more NRSROs or that are unrated and are deemed by the Manager to be of similar quality (“high yield securities”) may be subject to greater risk of loss of principal and interest than investments in higher-rated fixed-income securities. High yield securities are also generally considered to be subject to greater market risk than higher-rated securities.

Credit Risk. The Income Fund’s investments are subject to credit risk. An issuer’s credit quality depends on its ability to pay interest on and repay its debt and other obligations. Defaulted securities (or those expected to default) are subject to additional risks in that the securities may become subject to a plan or reorganization that can diminish or eliminate their value. The credit risk of a security may also depend on the credit quality of any bank or financial institution that provides credit enhancement for the security. Changes in economic, tax and regulatory policies, interest rates, inflation rates and government instability, war or other political or economic actions or factors may have an adverse effect on the investments of The Income Fund. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations. The Manager does not rely solely on third party credit ratings to select The Income Fund’s portfolio securities.

Cash Position Risk. To the extent that The Income Fund holds large positions in cash or cash equivalents, there is a risk of lower returns and potential lost opportunities to participate in market appreciation.

Interest Rate Risk. Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by

9

higher income from new investments. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations, but increasing interest rates may have an adverse effect on the value of The Income Fund’s investment portfolio as a whole, as investors and markets adjust expected returns relative to such increasing rates.

Illiquid Investments Risk. The Income Fund’s investments are subject to illiquid investments risk. This is the risk that the market for a security or other investment cannot accommodate an order to buy or sell the security or other investment in the desired timeframe, possibly preventing The Income Fund from selling these securities at an advantageous price. This risk includes the risk that legal or contractual restrictions on the resale of a security may affect The Income Fund’s ability to sell the security when deemed appropriate or necessary by the Manager. Derivatives and securities involving substantial market and credit risk tend to involve greater illiquid investments risk. Over recent years illiquid investments risk has increased because the capacity of dealers in the secondary market for fixed-income securities to make markets in these securities has decreased, even as the overall bond market has grown significantly, due to, among other things, structural changes, additional regulatory requirements and capital and risk restraints that have led to reduced inventories. Illiquid investments risk may be higher in a rising interest rate environment, when the value and liquidity of fixed-income securities generally decline, and, in certain circumstances, illiquid investments risk may be greater for a particular security as a result of, among other things, changes in the markets relating to that security, increased selling of the security by market participants or increases in the size of the holding relative to other fund holdings or to the issuer’s total issuance. Market turbulence and volatility in the U.S. and non-U.S. financial markets may increase the risks associated with an investment in The Income Fund. This risk also includes the risk that trading on an exchange may be halted because of market conditions.

Equity Risk. The Income Fund is subject to the risk that stock and other equity security prices may fall over short or extended periods of time. Historically, the equity markets have moved in cycles, and the value of The Income Fund’s equity securities may fluctuate drastically from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response. These factors contribute to price volatility.

Small- to Medium-Capitalization Risk. Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small- to mid-cap companies may have additional risks because, among other things, these companies have limited product lines, markets or financial resources.

Control and Substantial Positions Risk. The Income Fund may invest in the securities of a company for the purpose of affecting the management or control of the company or may have or acquire a substantial position in the securities of a company, subject to applicable legal restrictions with respect to the investment. Such an investment imposes additional risks for The Income Fund other than a possible decline in the value of the investment. These additional risks include: the application of statutory, regulatory and other requirements to The Income Fund, or to the Manager and its affiliates, could restrict activities contemplated by The Income Fund, or by the Manager and its affiliates, with respect to a portfolio company or limit the time and the manner in which The Income Fund is able to dispose of its holdings or hedge such holdings; The Income Fund, or the Manager and its affiliates, may be required to obtain relief from the Securities and Exchange Commission (the “SEC”) or its staff prior to engaging in certain activities with respect to a portfolio company that could be deemed a joint arrangement under the Investment Company Act of 1940, as amended (the “1940 Act”); The Income Fund may incur substantial expenses and costs when taking control or other substantial positions in a company, including paying market prices for securities whose value The Income Fund is required to discount when computing the NAV of The Income Fund’s shares, and there is no guarantee that such expenses and costs can be recouped; and The Income Fund could be exposed to various legal claims by governmental entities, or by a portfolio company, its security holders and its creditors, arising from, among other things, The Income Fund’s status as an insider or control person of a portfolio company or from the Manager’s designation of directors to serve on the board of directors of a portfolio company.

An investment in The Income Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Further discussion about other risks of investing in The Income Fund may be found in the section in this Prospectus entitled “Additional Information about the Funds’ Investments and Risks,” and in The Income Fund’s SAI.

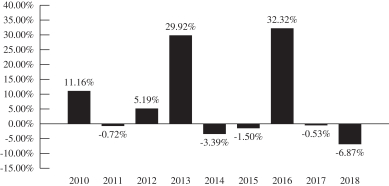

The bar chart and table set out below show The Income Fund’s historical performance, and provide some indication of the risks of investing in The Income Fund by showing changes in The Income Fund’s performance from year to year and by showing how The Income Fund’s average annual total returns for the 1- and 5-year periods and since inception compare to the performance of the Bloomberg Barclays U.S. Aggregate Bond Index. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, and includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities (agency and non-agency). Because indices cannot be invested in directly, these index returns do not reflect a deduction for fees, expenses or

10

taxes. The Income Fund’s past performance (before and after taxes) may not be an indication of how The Income Fund will perform in the future. Updated performance information for The Income Fund may be obtained by calling 1-866-202-2263.

Annual Returns of The Income Fund for the Last 9 Calendar Years

| Best Quarter - 2nd Qtr 2013: +15.79% | Worst Quarter - 4th Qtr 2015: -9.66% | |

Average Annual Total Returns for The Income Fund (for the periods ended December 31, 2018)

| Portfolio Returns | 1 Year | 5 Years | Since Inception (12/31/2009) | |||||||

| Return Before Taxes |

-6.87% | 3.13% | 6.48% | |||||||

| Return After Taxes on Distributions |

-8.37% | 1.05% | 4.14% | |||||||

| Return After Taxes on Distributions and Sale of The Income Fund Shares |

-3.91% | 1.67% | 4.25% | |||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

0.01% | 2.52% | 3.21% | |||||||

The theoretical “after-tax” returns shown in the table are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Your actual “after-tax” returns depend on your personal tax situation and may differ from the returns shown above. Also, “after-tax” return information is not relevant to shareholders who hold shares of The Income Fund through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). The “after-tax” returns shown in the table reflect past tax effects and are not predictive of future tax effects.

The average annual total return after taxes on distributions and sale of The Income Fund shares for the 1-year, 5-year, and Since Inception periods are higher than the average annual total return after taxes on distributions for the same periods because of realized losses that would have been sustained upon the sale of The Income Fund shares immediately after such 1-year, 5-year, and Since Inception periods. In addition to the assumptions in the preceding paragraph, the calculation for the average annual total return after taxes on distributions and sale of The Income Fund shares assumes that an investor would have been able to immediately utilize the full realized loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisors regarding their personal tax situations.

Fairholme Capital Management, L.L.C., the Manager, provides investment advisory services to The Income Fund.

Bruce R. Berkowitz, Chief Investment Officer of the Manager, and the President and a Director of Fairholme Funds, Inc. (the “Company”), has been The Income Fund’s lead portfolio manager since The Income Fund’s inception. Mr. Berkowitz is responsible for the day-to-day management of The Income Fund’s portfolio.

11

Purchase and Sale of The Income Fund Shares

Purchases of shares of The Income Fund are subject to the following minimum investment amounts (which may be waived by the Manager in its discretion):

| Minimum Investment To Open Account |

$10,000 for Regular Accounts |

$6,000 for IRAs | ||

|

Minimum Subsequent Investment (Non-Automatic Investment Plan Members) |

$1,000 for Regular Accounts and IRAs | |||

| Minimum Subsequent Investment (Automatic Investment Plan Members) |

$250 per month minimum | |||

Shareholders eligible to purchase shares of The Income Fund may do so through their financial intermediaries or by contacting The Income Fund: (i) by telephone at 1-866-202-2263; or (ii) by mail addressed to c/o BNY Mellon Investment Servicing (US) Inc., P.O. Box 9692, Providence, RI 02940-9692; or (iii) by overnight delivery addressed to c/o BNY Mellon Investment Servicing (US) Inc., 4400 Computer Drive, Westborough, MA 01581-1722.

The Income Fund reserves the right to limit the sale of shares to new investors and existing shareholders at any time. The Income Fund may reject any order to purchase shares, and may withdraw the offering of shares at any time to any or all investors.

Shareholders may redeem shares of The Income Fund through their financial intermediaries or by contacting The Income Fund: (i) by telephone at 1-866-202-2263; (ii) by mail addressed to c/o BNY Mellon Investment Servicing (US) Inc., P.O. Box 9692, Providence, RI 02940-9692; or (iii) by overnight delivery addressed to c/o BNY Mellon Investment Servicing (US) Inc., 4400 Computer Drive, Westborough, MA 01581-1722.

Tax Information for The Income Fund

The Income Fund intends to make distributions that may be taxed as ordinary income or capital gains.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of The Income Fund through a broker-dealer or other financial intermediary (such as a bank), The Income Fund and its related companies may pay the intermediary for certain administrative and shareholder servicing functions. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary to recommend The Income Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

12

(“The Allocation Fund”)

The Allocation Fund seeks long-term total return.

The following table describes the fees and expenses you may pay if you buy and hold shares of The Allocation Fund. You may be required to pay commissions and/or other forms of compensation to a broker for transactions in shares of The Allocation Fund, which are not reflected in the tables or the Example below.

| SHAREHOLDER FEES | ||||

| (Fees Paid Directly From Your Investment) | ||||

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

None | |||

| Maximum Deferred Sales Charge (Load) (as a percentage of amount redeemed) |

None | |||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and Other Distributions (as a percentage of amount reinvested) |

None | |||

| Redemption Fee Paid to the Fund (as a percentage of amount redeemed within 60 days of purchase, if applicable) |

2.00% | |||

| ANNUAL FUND OPERATING EXPENSES | ||||

| (Expenses That You Pay Each Year As A Percentage Of The Value Of Your Investment In The Allocation Fund) |

||||

| Management Fees |

1.00% | |||

| Distribution (12b-1) Fees |

None | |||

| Other Expenses |

0.01% | |||

|

|

|

|||

| Total Annual Fund Operating Expenses(a) |

1.01% | |||

| (a) | This table does not reflect the application of the management fee waiver discussed in the section of the Prospectus entitled “Investment Management,” pursuant to which the Manager (defined below) has agreed to waive, on a voluntary basis, a portion of the management fee of The Allocation Fund to the extent necessary to limit the management fee paid to the Manager by The Allocation Fund to an annual rate of 0.80% of the daily average net asset value of The Allocation Fund (“Undertaking”). This Undertaking may be terminated by the Manager upon 60 days’ written notice to The Allocation Fund. |

For more information about the management fee, see the “Investment Management” section of the Prospectus. “Other Expenses” include acquired fund fees and expenses, which are incurred indirectly by The Allocation Fund as a result of investing in securities of one or more investment companies, including money market funds. Please note that the Total Annual Fund Operating Expenses in the table above may not correlate to the Ratio of Net Expenses to Average Net Assets found within the “Financial Highlights” section of this Prospectus.

Example

This Example is intended to help you compare the cost of investing in The Allocation Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in The Allocation Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that The Allocation Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||

| $103* | $322 | $558 | $1,236 | |||

| * | The amount shown does not reflect the application of the Undertaking. |

13

The Allocation Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when The Allocation Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect The Allocation Fund’s performance. During the most recent fiscal year, The Allocation Fund’s portfolio turnover rate was 23.52% of the average value of its portfolio.

Principal Investment Strategies

The Allocation Fund seeks long-term total return from capital appreciation and income. Fairholme Capital Management, L.L.C. (the “Manager”), the investment adviser to The Allocation Fund, attempts, under normal circumstances, to achieve The Allocation Fund’s investment objective by investing opportunistically in a focused portfolio of investments in the equity, fixed-income and cash and cash-equivalent asset classes. The proportion of The Allocation Fund’s portfolio invested in each asset class will vary from time to time based on the Manager’s assessment of relative fundamental values of securities and other investments in the class, the attractiveness of investment opportunities within each asset class, general market and economic conditions, and expected future returns of investments.

The Allocation Fund may invest in any, all or none of the targeted asset classes at any given time. There is no limitation on the amount of The Allocation Fund’s portfolio that may be allocated to any one of these asset classes. The Allocation Fund may maintain a significant portion of its assets in cash and cash-equivalent securities and investments. In certain market conditions, the Manager may determine that it is appropriate for The Allocation Fund to hold a significant cash position for an extended period of time.

In addition, The Allocation Fund may invest in securities and other investments without regard to the jurisdictions in which the issuers of the securities are organized or situated and without regard to the market capitalizations or sectors of the issuers. The Allocation Fund may also invest in securities without regard to maturity or the rating of the issuer of the security. The Allocation Fund may invest, for example, without limit in lower-rated securities (or “junk bonds”), which are those securities rated below “Baa” by Moody’s Investors Service, Inc. (“Moody’s”) or below “BBB” by S&P Global Ratings (“S&P”) or that have comparable ratings from other nationally recognized statistical rating organizations (“NRSROs”) or, if unrated, are determined to be comparable to lower-rated debt securities by the Manager.

The Allocation Fund may also use other investment strategies and invest its assets in other types of investments, which are described in the section in this Prospectus entitled “Additional Information about the Funds’ Investments and Risks,” and in The Allocation Fund’s Statement of Additional Information (“SAI”).

Principal Risks of Investing in The Allocation Fund

General Risks. All investments are subject to inherent risks, and an investment in The Allocation Fund is no exception. Accordingly, you may lose money by investing in The Allocation Fund. Markets can trade in random or cyclical price patterns, and prices can fall over time. The value of The Allocation Fund’s investments will fluctuate as markets fluctuate and could decline over short-or long-term periods.

Allocation Risk. The allocation of investments among the different asset classes, such as equity or fixed-income asset classes, may have a more significant effect on The Allocation Fund’s net asset value (“NAV”) when one of these classes is performing more poorly than others.

Equity Risk. The Allocation Fund is subject to the risk that stock and other equity security prices may fall over short or extended periods of time. Historically, the equity markets have moved in cycles, and the value of The Allocation Fund’s equity securities may fluctuate drastically from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response. These factors contribute to price volatility.

Focused Portfolio and Non-Diversification Risks. The Allocation Fund may have more volatility and is considered to have more risk than a fund that invests in securities of a greater number of issuers because changes in the value of a single issuer’s security may have a more significant effect, either negative or positive, on The Allocation Fund’s NAV. To the extent that The Allocation Fund invests its assets in the securities of fewer issuers, The Allocation Fund will be subject to greater risk of loss if any of those securities decreases in value or becomes impaired. To the extent that The Allocation Fund’s investments are focused in a particular issuer, region, country, market, industry, asset class or other category, The Allocation Fund may be susceptible to loss due to adverse occurrences affecting that issuer, region, country, market, industry, asset class or other category.

Interest Rate Risk. Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of existing investments in fixed-income securities tends to fall and this decrease in value may not be offset by

14

higher income from new investments. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations, but increasing interest rates may have an adverse effect on the value of The Allocation Fund’s investment portfolio as a whole, as investors and markets adjust expected returns relative to such increasing rates.

Cash Position Risk. To the extent that The Allocation Fund holds large positions in cash or cash equivalents, there is a risk of lower returns and potential lost opportunities to participate in market appreciation.

Credit Risk. The Allocation Fund’s investments are subject to credit risk. An issuer’s credit quality depends on its ability to pay interest on and repay its debt and other obligations. Defaulted securities (or those expected to default) are subject to additional risks in that the securities may become subject to a plan or reorganization that can diminish or eliminate their value. The credit risk of a security may also depend on the credit quality of any bank or financial institution that provides credit enhancement for the security. Changes in economic, tax and regulatory policies, interest rates, inflation rates and government instability, war or other political or economic actions or factors may have an adverse effect on the investments of The Allocation Fund. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations. The Manager does not rely solely on third party credit ratings to select The Allocation Fund’s portfolio securities.

Small- to Medium-Capitalization Risk. Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small- to mid-cap companies may have additional risks because, among other things, these companies have limited product lines, markets or financial resources.

Prepayment Risk. The Allocation Fund’s investments may be subject to prepayment risk. Prepayment risk occurs when the issuer of a security can repay principal prior to the security’s maturity. Securities subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. In addition, the potential impact of prepayment features on the price of a security can be difficult to predict and result in greater volatility.

Inflation Risk. This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of The Allocation Fund’s assets can decline as can the value of The Allocation Fund’s distributions. This risk increases as The Allocation Fund invests a greater portion of its assets in fixed-income securities with longer maturities.

Illiquid Investments Risk. Illiquid investments risk exists when particular investments are difficult to purchase or sell, possibly preventing The Allocation Fund from selling out of these illiquid securities at an advantageous price. Derivatives and securities involving substantial market and credit risk tend to involve greater illiquid investments risk. A fund may face illiquid investments risk as a result of, among other factors, low trading volumes, legal or contractual restrictions on resale, substantial redemptions of the fund’s shares and, with respect to fixed-income securities, rising interest rates. In certain circumstances, illiquid investments risk may be greater for a particular security as a result of, among other things, changes in the markets relating to that security, increased selling of the security by market participants or increases in the size of the holding relative to other fund holdings or to the issuer’s total issuance. In addition, over recent years illiquid investments risk has increased because the capacity of dealers in the secondary market for fixed-income securities to make markets in these securities has decreased, even as the overall bond market has grown significantly, due to, among other things, structural changes, additional regulatory requirements and capital and risk restraints that have led to reduced inventories. Illiquid investments risk may be higher in a rising interest rate environment, when the value and liquidity of fixed-income securities generally decline.

REITs Risk. The Allocation Fund may invest in real estate investment trusts (“REITs”), including equity REITs and mortgage REITs. Equity REITs invest directly in real property while mortgage REITs invest in mortgages on real property. REITs may be subject to certain risks associated with the direct ownership of real property, including declines in the value of real estate, risks related to general and local economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses, and variations in rental income. REITs are dependent upon management skills, are not diversified, and are subject to heavy cash flow dependency, default by borrowers, and self-liquidation. REITs (especially mortgage REITs) are also subject to interest rate risks. When interest rates decline, the value of a REIT’s investment in fixed-rate obligations can be expected to rise. Conversely, when interest rates rise, the value of a REIT’s investment in fixed-rate obligations can be expected to decline. Mortgage REITs may be affected by the quality of any credit extended to them.

Control and Substantial Positions Risk. The Allocation Fund may invest in the securities of a company for the purpose of affecting the management or control of the company or may have or acquire a substantial position in the securities of a company, subject to applicable legal restrictions with respect to the investment. Such an investment imposes additional risks for The Allocation Fund other than a possible decline in the value of the investment. These additional risks include: the application of statutory, regulatory and other requirements to The Allocation Fund, or to the Manager and its affiliates, could restrict activities contemplated by The Allocation Fund, or by the Manager and its affiliates, with respect to a portfolio company or limit the time and the manner in which The Allocation Fund is able to dispose of its holdings or hedge such holdings; The Allocation

15

Fund, or the Manager and its affiliates, may be required to obtain relief from the Securities and Exchange Commission (the “SEC”) or its staff prior to engaging in certain activities with respect to a portfolio company that could be deemed a joint arrangement under the Investment Company Act of 1940, as amended (the “1940 Act”); The Allocation Fund may incur substantial expenses and costs when taking control or other substantial positions in a company, including paying market prices for securities whose value The Allocation Fund is required to discount when computing the NAV of The Allocation Fund’s shares, and there is no guarantee that such expenses and costs can be recouped; and The Allocation Fund could be exposed to various legal claims by governmental entities, or by a portfolio company, its security holders and its creditors, arising from, among other things, The Allocation Fund’s status as an insider or control person of a portfolio company or from the Manager’s designation of directors to serve on the board of directors of a portfolio company.

An investment in The Allocation Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Further discussion about other risks of investing in The Allocation Fund may be found in the section in this Prospectus entitled “Additional Information about the Funds’ Investments and Risks,” and in The Allocation Fund’s SAI.

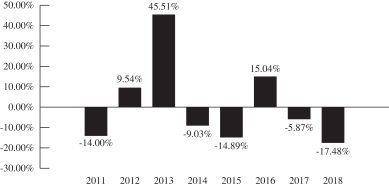

The bar chart and table set out below show The Allocation Fund’s historical performance, and provide some indication of the risks of investing in The Allocation Fund by showing changes in The Allocation Fund’s performance from year to year and by showing how The Allocation Fund’s average annual total returns for the 1- and 5-year periods and since inception compare to the performance of the Bloomberg Barclays U.S. Aggregate Bond Index and the S&P 500 Index. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, and includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities and commercial mortgage-backed securities (agency and non-agency). The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. The S&P 500 Index assumes reinvestment of all dividends and distributions. Because indices cannot be invested in directly, these index returns do not reflect a deduction for fees, expenses or taxes. The Allocation Fund’s past performance (before and after taxes) may not be an indication of how The Allocation Fund will perform in the future. Updated performance information for The Allocation Fund may be obtained by calling 1-866-202-2263.

Annual Returns for The Allocation Fund for the Last 8 Calendar Years

| Best Quarter - 1st Qtr 2012: +18.37% | Worst Quarter - 3rd Qtr 2011: -18.96% | |

Average Annual Total Returns for The Allocation Fund (for the period ended December 31, 2018)

| Portfolio Returns | 1 Year | 5 Years |

Since Inception (12/31/10) | |||||||

| Return Before Taxes |

-17.48% | -7.10% | -0.66% | |||||||

| Return After Taxes on Distributions |

-17.80% | -8.84% | -1.84% | |||||||

| Return After Taxes on Distributions and Sale of The Allocation Fund Shares |

-10.29% | -5.15% | -0.45% | |||||||

| Bloomberg Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes) |

0.01% | 2.52% | 2.80% | |||||||

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) |

-4.38% | 8.49% | 11.32% | |||||||

16

The theoretical “after-tax” returns shown in the table are calculated using the highest historical individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Your actual “after-tax” returns depend on your personal tax situation and may differ from the returns shown above. Also, “after-tax” return information is not relevant to shareholders who hold The Allocation Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”). The “after-tax” returns shown in the table reflect past tax effects and are not predictive of future tax effects.

The average annual total return after taxes on distributions and sale of The Allocation Fund shares for the 1-year, 5-year, and Since Inception periods are higher than the average annual total return after taxes on distributions for the same periods because of realized losses that would have been sustained upon the sale of The Allocation Fund shares immediately after such 1-year, 5-year, and Since Inception periods. In addition to the assumptions in the preceding paragraph, the calculation for the average annual total return after taxes on distributions and sale of The Allocation Fund shares assumes that an investor would have been able to immediately utilize the full realized loss to reduce his or her federal tax liability. However, actual individual tax results may vary and investors should consult their tax advisors regarding their personal tax situations.

Fairholme Capital Management, L.L.C., the Manager, provides investment advisory services to The Allocation Fund.

Bruce R. Berkowitz, Chief Investment Officer of the Manager, and the President and a Director of Fairholme Funds, Inc. (the “Company”), has been The Allocation Fund’s lead portfolio manager since The Allocation Fund’s inception. Mr. Berkowitz is responsible for the day-to-day management of The Allocation Fund’s portfolio.

Purchase and Sale of The Allocation Fund Shares

Purchases of shares of The Allocation Fund are subject to the following minimum investment amounts (which may be waived by the Manager in its discretion):

| Minimum Investment To Open Account |

$10,000 for Regular Accounts |

$6,000 for IRAs | ||

|

Minimum Subsequent Investment (Non-Automatic Investment Plan Members) |

$1,000 for Regular Accounts and IRAs | |||

| Minimum Subsequent Investment (Automatic Investment Plan Members) |

$250 per month minimum | |||

Shareholders eligible to purchase shares of The Allocation Fund may do so through their financial intermediaries or by contacting The Allocation Fund: (i) by telephone at 1-866-202-2263; (ii) by mail addressed to c/o BNY Mellon Investment Servicing (US) Inc., P.O. Box 9692, Providence, RI 02940-9692; or (iii) by overnight delivery addressed to c/o BNY Mellon Investment Servicing (US) Inc., 4400 Computer Drive, Westborough, MA 01581-1722.

The Allocation Fund reserves the right to limit the sale of shares to new investors and existing shareholders at any time. The Allocation Fund may reject any order to purchase shares, and may withdraw the offering of shares at any time to any or all investors.

Shareholders may redeem shares of The Allocation Fund through their financial intermediaries or by contacting The Allocation Fund: (i) by telephone at 1-866-202-2263; (ii) by mail addressed to c/o BNY Mellon Investment Servicing (US) Inc., P.O. Box 9692, Providence, RI 02940-9692; or (iii) by overnight delivery addressed to c/o BNY Mellon Investment Servicing (US) Inc., 4400 Computer Drive, Westborough, MA 01581-1722.

Tax Information for The Allocation Fund

The Allocation Fund intends to make distributions that may be taxed as ordinary income or capital gains.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of The Allocation Fund through a broker-dealer or other financial intermediary (such as a bank), The Allocation Fund and its related companies may pay the intermediary for certain administrative and shareholder servicing functions. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary to recommend The Allocation Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

17

ABOUT THE FUNDS’ INVESTMENTS AND RISKS

This section of the Prospectus provides additional information about the investment practices and related risks, including principal and non-principal strategies and risks, of The Fairholme Fund, The Income Fund, and The Allocation Fund (each a “Fund” and together, the “Funds”).

Investment Objective and Investment Strategies

The Fairholme Fund’s investment objective is long-term growth of capital. The Fairholme Fund’s investment objective is fundamental and may be changed only with the approval of a majority of the outstanding voting securities of the Fund as defined in the 1940 Act.

The Manager attempts, under normal circumstances, to achieve The Fairholme Fund’s investment objective by investing in a focused portfolio of equity and fixed-income securities. The proportion of The Fairholme Fund’s assets invested in each type of asset class will vary from time to time based upon the Manager’s assessment of general market and economic conditions. The Fairholme Fund may invest in, and may shift frequently among, the asset classes and market sectors.

The equity securities in which The Fairholme Fund may invest include common and preferred stock (including convertible preferred stock), partnership interests, business trust shares, interests in REITs, rights and warrants to subscribe for the purchase of equity securities, and depository receipts. The Fairholme Fund may invest in equity securities without regard to the jurisdictions in which the issuers of the securities are organized or situated and without regard to the market capitalizations or sectors of such issuers.

The fixed-income securities in which The Fairholme Fund may invest include U.S. corporate debt securities, non-U.S. corporate debt securities, bank debt (including bank loans and participations), U.S. Government and agency debt securities (including U.S. Treasury bills), short-term debt obligations of foreign governments, and foreign money market instruments. Except for its investments in short-term debt obligations of foreign governments, The Fairholme Fund may invest in fixed-income securities regardless of the maturity or the rating of the issuer of the security. The Fairholme Fund’s investments in short-term debt obligations of foreign governments will generally have a maturity of six months or less and a credit rating of “A” or better by S&P Global Ratings (“S&P”) or a similar rating by another NRSRO.

The Manager uses fundamental analysis to identify certain attractive characteristics of companies. Such characteristics may include: high free cash flow yields in relation to market values and risk-free rates; sensible capital allocation policies; strong competitive positions; solid balance sheets; stress-tested owners/managers; participation in stressed industries having reasonable prospects for recovery; potential for long-term growth; significant tangible assets in relation to enterprise values; high returns on invested equity and capital; and the production of essential services and products. The Manager defines free cash flow as the cash a company would generate annually from operations after all cash outlays necessary to maintain the business in its current condition.

The Fairholme Fund also may invest in “special situations” to achieve its objective. A special situation arises when the securities of a company are expected to appreciate over time due to company-specific developments rather than general business conditions or movements of the market as a whole. Such developments and situations include liquidations, reorganizations, recapitalizations, mergers, management changes, and technological developments. Investments in special situations may include equity securities or fixed-income securities, such as corporate debt, which may be in a distressed position as a result of economic or company specific developments. “Special situation” investments may include high yield fixed-income securities (or “junk bonds”) (i.e., securities that are rated below investment grade by S&P or by another NRSRO or similar unrated securities).

Subject to applicable legal restrictions, The Fairholme Fund may invest in securities of an issuer for the purpose of affecting the management or control of the issuer or may have or acquire a substantial position in the securities of an issuer, although it is not the intention of The Fairholme Fund or the Manager to unilaterally control any issuer. The Fairholme Fund may obtain a controlling or other substantial position in a public or private company.

Although The Fairholme Fund normally holds a focused portfolio of equity and fixed-income securities, The Fairholme Fund is not required to be fully invested in such securities and may maintain a significant portion of its total assets in cash and securities generally considered to be cash equivalents, including U.S. Government securities, money market funds, commercial paper, repurchase agreements, and other high quality money market instruments. From time to time, cash and cash reserves may also include foreign securities, including short-term obligations of foreign governments or other high quality foreign money market instruments. The Fairholme Fund believes that a certain amount of liquidity in The Fairholme Fund’s portfolio is desirable both to meet operating requirements and to take advantage of new investment opportunities. Under adverse market conditions or

18

when The Fairholme Fund is unable to find sufficient investments meeting its criteria, cash and cash reserves may comprise a significant percentage of The Fairholme Fund’s total assets, a situation which may exist for extended periods of time. When The Fairholme Fund holds a significant portion of assets in cash and cash reserves, it may not meet its investment objective.

The Fairholme Fund may also use other investment strategies and may invest its assets in other types of investments, which are described in the SAI.

Risks of Investing in The Fairholme Fund

General Risks. All investments are subject to inherent risks, and investments in The Fairholme Fund are no exception. Accordingly, you may lose money by investing in The Fairholme Fund. When you sell your shares, they may be worth less than what you paid for them because the value of The Fairholme Fund’s investments will fluctuate, reflecting day-to-day changes in market conditions, interest rates, and numerous other factors.

Market Risk. Markets can trade in random or cyclical price patterns, and prices can fall over time. Asset prices change daily as a result of many factors, including developments affecting the condition of individual companies, the sector or industries in which they operate, and the market in general. The value of The Fairholme Fund’s investments will fluctuate as markets fluctuate and could decline over short- or long-term periods.

Equity Risk. The Fairholme Fund is subject to the risk that stock and other equity security prices may fall over short or extended periods of time. Historically, the equity markets have moved in cycles, and the value of The Fairholme Fund’s equity securities may fluctuate significantly from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response. These factors contribute to price volatility.