Form 497 DEUTSCHE DWS INTERNATION

Prospectus

March 1, 2022, as revised May 16, 2022

|

DWS Emerging Markets Equity Fund | ||||||||||||

|

CLASS/TICKER |

A |

SEKAX |

T |

SEKTX |

C |

SEKCX |

R6 |

SEKRX |

INST |

SEKIX |

S |

SEMGX |

|

|

|

|

DWS Emerging Markets Fixed Income Fund | ||||||||||

|

CLASS/TICKER |

A |

SZEAX |

T |

SZETX |

C |

SZECX |

INST |

SZEIX |

S |

SCEMX |

|

|

|

|

DWS ESG Global Bond Fund | ||||||||||

|

CLASS/TICKER |

A |

SZGAX |

T |

SZGTX |

C |

SZGCX |

INST |

DGBIX |

S |

SSTGX |

|

|

|

|

DWS Global Macro Fund | ||||||||||||||

|

CLASS/TICKER |

A |

DBISX |

T |

DBIUX |

C |

DBICX |

R |

DBITX |

R6 |

DBIWX |

INST |

MGINX |

S |

DBIVX |

|

|

|

|

DWS Global Small Cap Fund | ||||||||||||

|

CLASS/TICKER |

A |

KGDAX |

T |

KGDTX |

C |

KGDCX |

R6 |

KGDZX |

INST |

KGDIX |

S |

SGSCX |

|

|

|

|

DWS Latin America Equity Fund | ||||||||||

|

CLASS/TICKER |

A |

SLANX |

T |

SLAUX |

C |

SLAPX |

INST |

SLARX |

S |

SLAFX |

(Class T shares are not available for purchase)

As with all mutual funds, the Securities and Exchange Commission (SEC) does not approve or disapprove these shares or determine whether the information in this prospectus is truthful or complete. It is a criminal offense for anyone to inform you otherwise.

Table of Contents

|

| |

|

1 | |

|

1 | |

|

2 | |

|

2 | |

|

5 | |

|

6 | |

|

6 | |

|

6 | |

|

7 | |

|

| |

|

8 | |

|

8 | |

|

9 | |

|

9 | |

|

12 | |

|

13 | |

|

13 | |

|

13 | |

|

14 | |

|

| |

|

15 | |

|

15 | |

|

16 | |

|

17 | |

|

20 | |

|

21 | |

|

21 | |

|

22 | |

|

22 |

|

| |

|

23 | |

|

23 | |

|

24 | |

|

25 | |

|

29 | |

|

30 | |

|

30 | |

|

30 | |

|

30 | |

|

| |

|

32 | |

|

32 | |

|

33 | |

|

33 | |

|

36 | |

|

36 | |

|

37 | |

|

37 | |

|

37 | |

|

| |

|

38 | |

|

38 | |

|

39 | |

|

39 | |

|

42 | |

|

43 | |

|

43 | |

|

44 | |

|

44 |

|

| |

|

45 | |

|

45 | |

|

50 | |

|

55 | |

|

61 | |

|

67 | |

|

72 | |

|

77 | |

|

78 | |

|

80 |

|

| |

|

82 | |

|

Institutional Class and Class S Shares |

89 |

|

89 | |

|

90 | |

|

91 | |

|

91 | |

|

92 | |

|

92 | |

|

92 | |

|

93 | |

|

93 | |

|

99 | |

|

100 | |

|

100 | |

|

103 | |

|

134 | |

|

134 | |

|

151 | |

|

152 | |

|

152 |

Your investment in a fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, entity or person.

|

|

A |

T |

C |

R6 |

INST |

S |

|

Maximum sales charge (load)

imposed on purchases, as %

of offering price |

|

|

|

|

|

|

|

Maximum deferred sales

charge (load), as % of

redemption proceeds1

|

|

|

|

|

|

|

|

Account Maintenance Fee

(annually, for fund account

balances below $10,000 and

subject to certain exceptions) |

$ |

|

$ |

|

|

$ |

|

|

A |

T |

C |

R6 |

INST |

S |

|

Management fee |

|

|

|

|

|

|

|

Distribution/service (12b-1)

fees |

|

|

|

|

|

|

|

Other expenses |

|

|

|

|

|

|

|

Acquired funds fees and

expenses |

|

|

|

|

|

|

|

Total annual fund operating

expenses |

|

|

|

|

|

|

|

Fee waiver/expense reim-

bursement |

|

|

|

|

|

|

|

Total annual fund operating

expenses after fee waiver/

expense reimbursement |

|

|

|

|

|

|

1Investments of $1,000,000 or more may be eligible to buy Class A shares without a sales charge (load), but may be subject to a contingent deferred sales charge of 1.00% if redeemed within 12 months of the original purchase date and 0.50% if redeemed within the following six months.

| Prospectus March 1, 2022, as revised May 16, 2022 | 1 | DWS Emerging Markets Equity Fund |

|

Years |

A |

T |

C |

R6 |

INST |

S |

|

1 |

$ |

$ |

$ |

$ |

$ |

$ |

|

3 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

Years |

A |

T |

C |

R6 |

INST |

S |

|

1 |

$ |

$ |

$ |

$ |

$ |

$ |

|

3 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

Prospectus March 1, 2022, as revised May 16, 2022

2

DWS Emerging Markets Equity Fund

Prospectus March 1, 2022, as revised May 16, 2022

3

DWS Emerging Markets Equity Fund

Prospectus March 1, 2022, as revised May 16, 2022

4

DWS Emerging Markets Equity Fund

|

|

|

|

|

|

|

|

|

|

|

|

Prospectus March 1, 2022, as revised May 16, 2022

5

DWS Emerging Markets Equity Fund

(For periods ended 12/31/2021 expressed as a %)

|

|

Class

Inception |

1

Year |

5

Years |

10

Years |

|

Class A before tax |

|

- |

|

|

|

After tax on distribu-

tions |

|

- |

|

|

|

After tax on distribu-

tions and sale of fund

shares |

|

- |

|

|

|

Class T before tax |

|

- |

|

|

|

Class C before tax |

|

- |

|

|

|

INST Class before tax |

|

- |

|

|

|

Class S before tax |

|

- |

|

|

|

MSCI Emerging Markets

Index (reflects no deduc-

tion for fees or

expenses) |

|

- |

|

|

|

|

Class

Inception |

1

Year |

Since

Inception |

|

Class R6 before tax |

|

- |

|

|

MSCI Emerging Markets

Index (reflects no deduc-

tion for fees or

expenses) |

|

- |

|

Management

Investment Advisor

DWS Investment Management Americas, Inc.

Subadvisor

DWS Investments Hong Kong Limited

Portfolio Manager(s)

Sean Taylor, Chief Investment Officer APAC. Lead Portfolio Manager of the fund. Began managing the fund in 2014.

Purchase and Sale of Fund Shares

Minimum Initial Investment ($)

|

|

Non-IRA |

IRAs |

UGMAs/

UTMAs |

Automatic

Investment

Plans |

|

A T C |

1,000 |

500 |

1,000 |

500 |

|

R6 |

None |

N/A |

N/A |

N/A |

|

INST |

1,000,000 |

N/A |

N/A |

N/A |

|

S |

2,500 |

1,000 |

1,000 |

1,000 |

For participants in all group retirement plans for Class A, T, C and S shares, and in certain fee-based and wrap programs approved by the Advisor for Class A, C and S shares, there is no minimum initial investment and no minimum additional investment. For Section 529 college savings plans, there is no minimum initial investment and no minimum additional investment for Class S shares and Class R6 shares. The minimum initial investment for Class S shares may be waived for eligible intermediaries that have agreements with DDI to offer Class S shares in their brokerage platforms when such Class S shares are held in omnibus accounts on such brokerage platforms. In certain instances, the minimum initial investment may be waived for Institutional Class shares. For more information regarding available Institutional Class investment minimum waivers, see “Institutional Class Shares – Investment Minimum” in the “Choosing a Share Class” section of the prospectus. There is no minimum additional investment for Institutional Class and Class R6 shares. The minimum additional investment in all other instances is $50.

To Place Orders

|

Mail |

All Requests |

DWS

PO Box 219151

Kansas City, MO 64121-9151 |

|

Expedited Mail |

DWS

210 West 10th Street

Kansas City, MO 64105-1614 | |

|

Web Site |

dws.com | |

|

Telephone |

(800) 728-3337, M – F 8 a.m. – 7 p.m. ET | |

|

TDD Line |

(800) 972-3006, M – F 8 a.m. – 7 p.m. ET | |

The fund is generally open on days when the New York Stock Exchange is open for regular trading. Initial investments must be sent by mail. You can make additional investments or sell shares of the fund on any business day by visiting our Web site, by mail, or by telephone; however you may have to elect certain privileges on your initial account application. If you are working with a financial representative, contact your financial representative for assistance with buying or selling fund shares. A financial representative separately may impose its own policies and procedures for buying and selling fund shares.

Class T shares are closed to new purchases, except in connection with the reinvestment of dividends or other distributions where Class T shares have been issued. Class R6 shares are generally available only to certain qualifying plans and programs, which may have their own policies or instructions for buying and selling fund shares. Institutional Class shares are generally available only to qualified institutions. Class S shares are available through certain intermediary relationships with financial services firms, or can be purchased by establishing an account directly with the fund’s transfer agent.

Tax Information

The fund's distributions are generally taxable to you as ordinary income or capital gains, except when your investment is in an IRA, 401(k), or other tax-advantaged investment plan. Any withdrawals you make from such tax- advantaged investment plans, however, may be taxable to you.

Prospectus March 1, 2022, as revised May 16, 2022

6

DWS Emerging Markets Equity Fund

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund, the Advisor, and/or the Advisor’s affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

No such payments are made with respect to Class R6 shares. To the extent the fund makes such payments with respect to another class of its shares, the expense is borne by the other share class.

Prospectus March 1, 2022, as revised May 16, 2022

7

DWS Emerging Markets Equity Fund

DWS Emerging Markets Fixed Income Fund

Investment Objective

The fund seeks to provide high current income and, secondarily, long-term capital appreciation.

Fees and Expenses

These are the fees and expenses you may pay when you buy, hold and sell shares. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts in Class A shares if you and your immediate family invest, or agree to invest in the future, at least $100,000 in DWS funds. You may qualify for sales charge discounts if you invest at least $250,000 in Class T shares in the fund. More information about these and other discounts and waivers is available from your financial representative and in Choosing a Share Class (p. 82), Sales Charge Waivers and Discounts Available Through Intermediaries (Appendix B, p. 152) and Purchase and Redemption of Shares in the fund’s Statement of Additional Information (SAI) (p. II-15).

SHAREHOLDER FEES (paid directly from your investment)

|

|

A |

T |

C |

INST |

S |

|

Maximum sales charge (load)

imposed on purchases, as % of

offering price |

4.50 |

2.50 |

None |

None |

None |

|

Maximum deferred sales charge

(load), as % of redemption

proceeds1

|

None |

None |

1.00 |

None |

None |

|

Account Maintenance Fee (annually,

for fund account balances below

$10,000 and subject to certain

exceptions) |

$20 |

None |

$20 |

None |

$20 |

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a % of the value of your investment)

(expenses that you pay each year as a % of the value of your investment)

|

|

A |

T |

C |

INST |

S |

|

Management fee |

0.59 |

0.59 |

0.59 |

0.59 |

0.59 |

|

Distribution/service (12b-1) fees |

0.24 |

0.25 |

1.00 |

None |

None |

|

Other expenses2

|

0.57 |

0.54 |

0.66 |

0.37 |

0.53 |

|

Total annual fund operating

expenses |

1.40 |

1.38 |

2.25 |

0.96 |

1.12 |

|

Fee waiver/expense reimbursement |

0.27 |

0.25 |

0.37 |

0.08 |

0.24 |

|

Total annual fund operating

expenses after fee waiver/expense

reimbursement |

1.13 |

1.13 |

1.88 |

0.88 |

0.88 |

1Investments of $1,000,000 or more may be eligible to buy Class A shares without a sales charge (load), but may be subject to a contingent deferred sales charge of 0.85% if redeemed within 12 months of the original purchase date and 0.50% if redeemed within the following six months.

2”Other expenses“ for Class T are based on estimated amounts for the current fiscal year.

The Advisor has contractually agreed through February 28, 2023 to waive its fees and/or reimburse fund expenses to the extent necessary to maintain the fund’s total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and acquired fund fees and expenses) at ratios no higher than 1.13%, 1.13%, 1.88%, 0.88% and 0.88% for Class A, Class T, Class C, Institutional Class and Class S, respectively. The agreement may only be terminated with the consent of the fund’s Board.

EXAMPLE

This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses (including one year of capped expenses in each period) remain the same. Class C shares generally convert automatically to Class A shares after 8 years. The information

| Prospectus March 1, 2022, as revised May 16, 2022 | 8 | DWS Emerging Markets Fixed Income Fund |

presented in the Example for Class C reflects the conversion of Class C shares to Class A shares after 8 years. See ”Class C Shares“ in the ”Choosing a Share Class“ section of the prospectus for more information. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Years |

A |

T |

C |

INST |

S |

|

1 |

$560 |

$362 |

$291 |

$90 |

$90 |

|

3 |

848 |

652 |

668 |

298 |

332 |

|

5 |

1,157 |

963 |

1,171 |

523 |

594 |

|

10 |

2,032 |

1,845 |

2,341 |

1,171 |

1,342 |

You would pay the following expenses if you did not redeem your shares:

|

Years |

A |

T |

C |

INST |

S |

|

1 |

$560 |

$362 |

$191 |

$90 |

$90 |

|

3 |

848 |

652 |

668 |

298 |

332 |

|

5 |

1,157 |

963 |

1,171 |

523 |

594 |

|

10 |

2,032 |

1,845 |

2,341 |

1,171 |

1,342 |

PORTFOLIO TURNOVER

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may mean higher taxes if you are investing in a taxable account. These costs are not reflected in annual fund operating expenses or in the expense example, and can affect the fund's performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 36% of the average value of its portfolio.

Principal Investment Strategies

Main Investments. Under normal circumstances, the fund invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in high yield bonds (also known as “junk bonds”) and other debt securities issued by governments and corporations in emerging market countries (i.e., the issuer is traded mainly in an emerging market, is organized under the laws of an emerging market country or is a company with more than half of its business in emerging markets) or the return on which is derived primarily from emerging markets.

The fund considers “emerging markets” to include, but not to be limited to: (i) the countries or markets that are part of the JP Morgan Emerging Markets Bond (EMBI) Global Diversified Index; or (ii) the countries or markets that are classified as “emerging market and developing economies” by the International Monetary Fund (“IMF”) (World Economic Outlook); or (iii) countries listed as low or middle (both lower middle and higher middle) income by the World Bank, if a country is an emerging market and

if such country is not listed in the JP Morgan EMBI Global Diversified Index and if it is not classified as an “emerging market and developing economy” by the IMF.

The fund may invest without limit in investment-grade debt securities and in junk bonds, which are those below the fourth credit grade (grade BB/Ba and below) and may include debt securities not currently paying interest and debt securities in default.

The fund invests at least 50% of total assets in US dollar-denominated securities.

Management process. Portfolio management typically considers a number of factors, including economic and currency outlooks, possible interest rate movements, capital flows, debt levels, inflation trends, credit quality of issuers, security characteristics and changes in supply and demand within global bond markets. Portfolio management may consider financially material Environmental, Social and Governance (ESG) factors in its fundamental analysis. In evaluating ESG issues, portfolio management refers to internal securities specific ESG ratings, internal and external ESG research and other factors.

Portfolio management may also adjust the duration (a measure of sensitivity to interest rate movements) of the fund’s portfolio, depending on its outlook for interest rates.

Derivatives. Portfolio management generally may use futures contracts or options, which are types of derivatives (contracts whose value are based on, for example, indices, currencies or securities) as a hedge against anticipated changes in interest rates, fixed income markets or currency markets, for duration management (i.e., reducing or increasing the sensitivity of the fund's portfolio to interest rate changes), or for non-hedging purposes to seek to enhance potential gains. In addition, portfolio management generally may use forward currency contracts (i) to hedge the fund's exposure to changes in foreign currency exchange rates on its foreign currency denominated portfolio holdings; (ii) to facilitate transactions in foreign currency denominated securities; or (iii) for non-hedging purposes to seek to enhance potential gains.

The fund may also use other types of derivatives (i) for hedging purposes; (ii) for risk management; (iii) for non-hedging purposes to seek to enhance potential gains; or (iv) as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions.

Securities lending. The fund may lend securities (up to one-third of total assets) to approved institutions, such as registered broker-dealers, banks and pooled investment vehicles.

Main Risks

There are several risk factors that could hurt the fund’s performance, cause you to lose money or cause the fund’s performance to trail that of other investments. The fund may not achieve its investment objective, and is not

Prospectus March 1, 2022, as revised May 16, 2022

9

DWS Emerging Markets Fixed Income Fund

intended to be a complete investment program. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Credit risk. The fund's performance could be hurt if an issuer of a debt security suffers an adverse change in financial condition that results in the issuer not making timely payments of interest or principal, a security downgrade or an inability to meet a financial obligation. Credit risk is greater for lower-rated securities.

Because the issuers of high yield debt securities, or junk bonds (debt securities rated below the fourth highest credit rating category), may be in uncertain financial health, the prices of their debt securities can be more vulnerable to bad economic news, or even the expectation of bad news, than investment-grade debt securities. Credit risk for high yield securities is greater than for higher-rated securities.

Because securities in default generally have missed one or more payments of interest and/or principal, an investment in such securities has an increased risk of loss. Issuers of securities in default have an increased likelihood of entering bankruptcy or beginning liquidation procedures which could impact the fund's ability to recoup its investment. Securities in default may be illiquid or trade in low volumes and thus may be difficult to value.

Market disruption risk. Geopolitical and other events, including war, terrorism, economic uncertainty, trade disputes, public health crises and related geopolitical events have led, and in the future may lead, to disruptions in the US and world economies and markets, which may increase financial market volatility and have significant adverse direct or indirect effects on the fund and its investments. Market disruptions could cause the fund to lose money, experience significant redemptions, and encounter operational difficulties. Although multiple asset classes may be affected by a market disruption, the duration and effects may not be the same for all types of assets.

Russia's recent military incursions in Ukraine have led to, and may lead to additional sanctions being levied by the United States, European Union and other countries against Russia. Russia's military incursion and the resulting sanctions could adversely affect global energy and financial markets and thus could affect the value of the fund's investments, even beyond any direct exposure the fund may have to Russian issuers or the adjoining geographic regions. The extent and duration of the military action, sanctions and resulting market disruptions are impossible to predict, but could be substantial. Any such disruptions caused by Russian military action or resulting sanctions may magnify the impact of other risks described in this “MAIN RISKS” section.

Other recent market disruption events include the pandemic spread of the novel coronavirus known as COVID-19, and the significant uncertainty, market volatility,

decreased economic and other activity, increased government activity, including economic stimulus measures, and supply chain disruptions that it has caused. The full effects, duration and costs of the COVID-19 pandemic are impossible to predict, and the circumstances surrounding the COVID-19 pandemic will continue to evolve, including the risk of future increased rates of infection due to low vaccination rates and/or the lack of effectiveness of current vaccines against new variants. The pandemic has affected and may continue to affect certain countries, industries, economic sectors, companies and investment products more than others, may exacerbate existing economic, political, or social tensions and may increase the probability of an economic recession or depression. The fund and its investments may be adversely affected by the effects of the COVID-19 pandemic, and the pandemic may result in the fund and its service providers experiencing operational difficulties in coordinating a remote workforce and implementing their business continuity plans, among others. The disruptions caused by the COVID-19 pandemic may magnify the impact of each of the other risks described in this “MAIN RISKS” section and may increase volatility in one or more markets in which the fund invests leading to the potential for greater losses for the fund.

Interest rate risk. When interest rates rise, prices of debt securities generally decline. The longer the duration of the fund’s debt securities, the more sensitive the fund will be to interest rate changes. (As a general rule, a 1% rise in interest rates means a 1% fall in value for every year of duration.) Recent and potential future changes in monetary policy made by central banks or governments are likely to affect the level of interest rates. Rising interest rates may prompt redemptions from the fund, which may force the fund to sell investments at a time when it is not advantageous to do so, which could result in losses. The fund may be subject to a greater risk of rising interest rates following periods of low rates, including the current low rate period. In addition, in response to the COVID-19 pandemic, as with other serious economic disruptions, governmental authorities and regulators have enacted significant fiscal and monetary policy changes, including providing direct capital infusions into companies, creating new monetary programs and lowering interest rates considerably. If these actions are modified or reversed or are ineffective in achieving their desired outcomes, the fund could be adversely affected by periods of heightened volatility and uncertainty.

London Interbank Offered Rate (LIBOR), the benchmark rate for certain floating rate securities, has been phased out as of the end of 2021 for most maturities and currencies, although certain widely used US Dollar LIBOR rates are expected to continue to be published through June 2023 to assist with the transition. The fund or the instruments in which the fund invests may be adversely affected by the phase out by, among other things, increased volatility or illiquidity. There remains uncertainty regarding the

Prospectus March 1, 2022, as revised May 16, 2022

10

DWS Emerging Markets Fixed Income Fund

future use of LIBOR and the nature of any replacement reference rate and, accordingly, it is difficult to predict the impact to the fund of the transition away from LIBOR.

Prepayment and extension risk. When interest rates fall, issuers of high interest debt obligations may pay off the debts earlier than expected (prepayment risk), and the fund may have to reinvest the proceeds at lower yields. When interest rates rise, issuers of lower interest debt obligations may pay off the debts later than expected (extension risk), thus keeping the fund’s assets tied up in lower interest debt obligations. Ultimately, any unexpected behavior in interest rates could increase the volatility of the fund’s share price and yield and could hurt fund performance. Prepayments could also create capital gains tax liability in some instances.

High yield debt securities risk. High yield debt securities, or junk bonds, are generally regarded as speculative with respect to the issuer’s continuing ability to meet principal and interest payments. High yield debt securities’ total return and yield may generally be expected to fluctuate more than the total return and yield of investment-grade debt securities. A real or perceived economic downturn or an increase in market interest rates could cause a decline in the value of high yield debt securities, result in increased redemptions and/or result in increased portfolio turnover, which could result in a decline in net asset value of the fund, reduce liquidity for certain investments and/or increase costs. High yield debt securities are often thinly traded and can be more difficult to sell and value accurately than investment-grade debt securities as there may be no established secondary market. Investments in high yield debt securities could increase liquidity risk for the fund. In addition, the market for high yield debt securities can experience sudden and sharp volatility which is generally associated more with investments in stocks.

Foreign investment risk. The fund faces the risks inherent in foreign investing. Adverse political, economic or social developments, as well as US and foreign government actions such as the imposition of tariffs, economic and trade sanctions or embargoes, could undermine the value of the fund’s investments, prevent the fund from realizing the full value of its investments or prevent the fund from selling securities it holds. Financial reporting standards for companies based in foreign markets differ from those in the US. Additionally, foreign securities markets generally are smaller and less liquid than US markets. To the extent that the fund invests in non-US dollar denominated foreign securities, changes in currency exchange rates may affect the US dollar value of foreign securities or the income or gain received on these securities. In addition, because non-US markets may be open on days when the fund does not price its shares, the value of the securities in the fund’s portfolio may change on days when shareholders will not be able to purchase or sell the fund’s shares.

Emerging markets risk. Foreign investment risks are greater in emerging markets than in developed markets. Investments in emerging markets are often considered speculative.

Regional focus risk. Focusing investments in a single country or few countries, or regions, involves increased currency, political, regulatory and other risks. Market swings in such a targeted country, countries or regions are likely to have a greater effect on fund performance than they would in a more geographically diversified fund.

Currency risk. Changes in currency exchange rates may affect the value of the fund’s investments and the fund’s share price. To the extent the fund seeks to hedge part or all of its foreign currency exposure, the fund may not be successful in hedging against currency changes. The fund’s US dollar share price may go down if the value of the local currency of the non−US markets in which the fund invests depreciates against the US dollar. This is true even if the local currency value of securities in the fund’s holdings goes up. Furthermore, the fund’s use of forward currency contracts may eliminate some or all of the benefit of an increase in the value of a foreign currency versus the US dollar. The value of the US dollar measured against other currencies is influenced by a variety of factors. These factors include: interest rates, national debt levels and trade deficits, changes in balances of payments and trade, domestic and foreign interest and inflation rates, global or regional political, economic or financial events, monetary policies of governments, actual or potential government intervention, global energy prices, political instability and government monetary policies and the buying or selling of currency by a country’s government. Currency exchange rates can be volatile and can change quickly and unpredictably, thereby impacting the value of the fund’s investments.

Non-diversification risk. The fund is classified as non-diversified under the Investment Company Act of 1940, as amended. This means that the fund may invest in securities of relatively few issuers. Thus, the performance of one or a small number of portfolio holdings can affect overall performance.

Derivatives risk. Risks associated with derivatives may include the risk that the derivative is not well correlated with the security, index or currency to which it relates; the risk that derivatives may result in losses or missed opportunities; the risk that the fund will be unable to sell the derivative because of an illiquid secondary market; the risk that a counterparty is unwilling or unable to meet its obligation; and the risk that the derivative transaction could expose the fund to the effects of leverage, which could increase the fund's exposure to the market and magnify potential losses.

Prospectus March 1, 2022, as revised May 16, 2022

11

DWS Emerging Markets Fixed Income Fund

Security selection risk. The securities in the fund’s portfolio may decline in value. Portfolio management could be wrong in its analysis of industries, companies, economic trends, ESG factors, the relative attractiveness of different securities or other matters.

Pricing risk. If market conditions make it difficult to value some investments, the fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value determined for an investment could be different from the value realized upon such investment’s sale. As a result, you could pay more than the market value when buying fund shares or receive less than the market value when selling fund shares.

Liquidity risk. In certain situations, it may be difficult or impossible to sell an investment and/or the fund may sell certain investments at a price or time that is not advantageous in order to meet redemption requests or other cash needs. Unusual market conditions, such as an unusually high volume of redemptions or other similar conditions could increase liquidity risk for the fund, and in extreme conditions, the fund could have difficulty meeting redemption requests.

Securities lending risk. Securities lending involves the risk that the fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The fund could also lose money in the event of a decline in the value of the collateral provided for the loaned securities, or a decline in the value of any investments made with cash collateral or even a loss of rights in the collateral should the borrower of the securities fail financially while holding the securities.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the fund.

Operational and technology risk. Cyber-attacks, disruptions or failures that affect the fund’s service providers or counterparties, issuers of securities held by the fund, or other market participants may adversely affect the fund and its shareholders, including by causing losses for the fund or impairing fund operations. For example, the fund’s or its service providers’ assets or sensitive or confidential information may be misappropriated, data may be corrupted and operations may be disrupted (e.g., cyber-attacks, operational failures or broader disruptions may cause the release of private shareholder information or confidential fund information, interfere with the processing of shareholder transactions, impact the ability to calculate the fund’s net asset value and impede trading). Market

events and disruptions also may trigger a volume of transactions that overloads current information technology and communication systems and processes, impacting the ability to conduct the fund’s operations.

While the fund and its service providers may establish business continuity and other plans and processes that seek to address the possibility of and fallout from cyber-attacks, disruptions or failures, there are inherent limitations in such plans and systems, including that they do not apply to third parties, such as fund counterparties, issuers of securities held by the fund or other market participants, as well as the possibility that certain risks have not been identified or that unknown threats may emerge in the future and there is no assurance that such plans and processes will be effective. Among other situations, disruptions (for example, pandemics or health crises) that cause prolonged periods of remote work or significant employee absences at the fund’s service providers could impact the ability to conduct the fund’s operations. In addition, the fund cannot directly control any cybersecurity plans and systems put in place by its service providers, fund counterparties, issuers of securities held by the fund or other market participants.

Past Performance

How a fund's returns vary from year to year can give an idea of its risk; so can comparing fund performance to overall market performance (as measured by an appropriate market index).Past performance may not indicate future results. All performance figures below assume that dividends and distributions were reinvested. For more recent performance figures, go to dws.com (the Web site does not form a part of this prospectus) or call the telephone number included in this prospectus.

Class T had not commenced investment operations as of the date of this prospectus. The performance figures for Class T shares are based on the historical performance of the fund’s Class S shares adjusted to reflect the higher expenses and applicable sales charges of Class T.

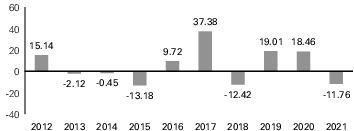

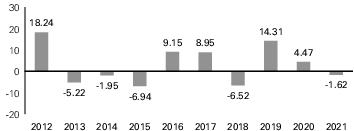

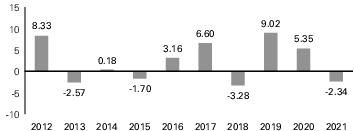

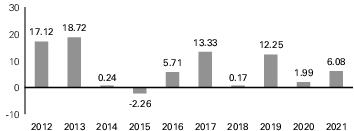

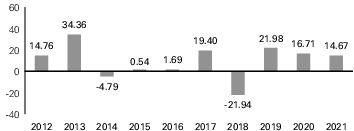

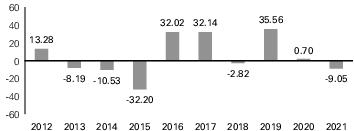

CALENDAR YEAR TOTAL RETURNS (%) (Class A)

These year-by-year returns do not include sales charges, if any, and would be lower if they did. Returns for other classes were different and are not shown here.

|

|

Returns |

Period ending |

|

Best Quarter |

17.54% |

June 30, 2020 |

|

Worst Quarter |

-17.97% |

March 31, 2020 |

Prospectus March 1, 2022, as revised May 16, 2022

12

DWS Emerging Markets Fixed Income Fund

Average Annual Total Returns

(For periods ended 12/31/2021 expressed as a %)

(For periods ended 12/31/2021 expressed as a %)

After-tax returns (which are shown only for Class A and would be different for other classes) reflect the historical highest individual federal income tax rates, but do not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares held in an IRA, 401(k) or other tax-advantaged investment plan.

|

|

Class

Inception |

1

Year |

5

Years |

10

Years |

|

Class A before tax |

6/18/2001 |

-6.05 |

2.70 |

2.46 |

|

After tax on distribu-

tions |

|

-7.70 |

1.00 |

0.80 |

|

After tax on distribu-

tions and sale of fund

shares |

|

-3.55 |

1.32 |

1.16 |

|

Class T before tax |

|

-4.08 |

3.09 |

2.67 |

|

Class C before tax |

6/18/2001 |

-2.24 |

2.88 |

2.17 |

|

INST Class before tax |

3/3/2008 |

-1.27 |

3.94 |

3.27 |

|

Class S before tax |

12/31/1993 |

-1.37 |

3.88 |

3.19 |

|

JP Morgan EMBI Global

Diversified Index

(reflects no deduction for

fees, expenses or taxes) |

|

-1.80 |

4.65 |

5.28 |

Management

Investment Advisor

DWS Investment Management Americas, Inc.

Subadvisor

DWS International GmbH

Portfolio Manager(s)

Nicolas Schlotthauer, CEFA, Head of Investment Strategy Fixed Income. Portfolio Manager of the fund. Began managing the fund in 2017.

Joergen Hartmann, CFA, Senior Portfolio Manager Fixed Income. Portfolio Manager of the fund. Began managing the fund in 2018.

Roland Gabert, Portfolio Manager Fixed Income. Portfolio Manager of the fund. Began managing the fund in 2018.

Purchase and Sale of Fund Shares

Minimum Initial Investment ($)

|

|

Non-IRA |

IRAs |

UGMAs/

UTMAs |

Automatic

Investment

Plans |

|

A T C |

1,000 |

500 |

1,000 |

500 |

|

INST |

1,000,000 |

N/A |

N/A |

N/A |

|

S |

2,500 |

1,000 |

1,000 |

1,000 |

For participants in all group retirement plans for Class A, T, C and S shares, and in certain fee-based and wrap programs approved by the Advisor for Class A, C and S shares, there is no minimum initial investment and no minimum additional investment. For Section 529 college savings plans, there is no minimum initial investment and no minimum additional investment for Class S shares. The minimum initial investment for Class S shares may be waived for eligible intermediaries that have agreements with DDI to offer Class S shares in their brokerage platforms. In certain instances, the minimum initial investment may be waived for Institutional Class shares. For more information regarding available Institutional Class investment minimum waivers, see “Institutional Class Shares – Investment Minimum” in the “Choosing a Share Class” section of the prospectus. There is no minimum additional investment for Institutional Class shares. The minimum additional investment in all other instances is $50.

To Place Orders

|

Mail |

All Requests |

DWS

PO Box 219151

Kansas City, MO 64121-9151 |

|

Expedited Mail |

DWS

210 West 10th Street

Kansas City, MO 64105-1614 | |

|

Web Site |

dws.com | |

|

Telephone |

(800) 728-3337, M – F 8 a.m. – 7 p.m. ET | |

|

TDD Line |

(800) 972-3006, M – F 8 a.m. – 7 p.m. ET | |

The fund is generally open on days when the New York Stock Exchange is open for regular trading. Initial investments must be sent by mail. You can make additional investments or sell shares of the fund on any business day by visiting our Web site, by mail, or by telephone; however you may have to elect certain privileges on your initial account application. If you are working with a financial representative, contact your financial representative for assistance with buying or selling fund shares. A financial representative separately may impose its own policies and procedures for buying and selling fund shares.

Class T shares are closed to new purchases, except in connection with the reinvestment of dividends or other distributions where Class T shares have been issued. Institutional Class shares are generally available only to qualified institutions. Class S shares are available through certain intermediary relationships with financial services firms, or can be purchased by establishing an account directly with the fund’s transfer agent.

Tax Information

The fund's distributions are generally taxable to you as ordinary income or capital gains, except when your investment is in an IRA, 401(k), or other tax-advantaged investment plan. Any withdrawals you make from such tax- advantaged investment plans, however, may be taxable to you.

Prospectus March 1, 2022, as revised May 16, 2022

13

DWS Emerging Markets Fixed Income Fund

Payments to Broker-Dealers and

Other Financial Intermediaries

Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund, the Advisor, and/or the Advisor’s affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

Prospectus March 1, 2022, as revised May 16, 2022

14

DWS Emerging Markets Fixed Income Fund

DWS ESG Global Bond Fund

Investment Objective

The fund seeks total return, with an emphasis on current income; capital appreciation is a secondary goal.

Fees and Expenses

These are the fees and expenses you may pay when you buy, hold and sell shares. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts in Class A shares if you and your immediate family invest, or agree to invest in the future, at least $100,000 in DWS funds. You may qualify for sales charge discounts if you invest at least $250,000 in Class T shares in the fund. More information about these and other discounts and waivers is available from your financial representative and in Choosing a Share Class (p. 82), Sales Charge Waivers and Discounts Available Through Intermediaries (Appendix B, p. 152) and Purchase and Redemption of Shares in the fund’s Statement of Additional Information (SAI) (p. II-15).

SHAREHOLDER FEES (paid directly from your investment)

|

|

A |

T |

C |

INST |

S |

|

Maximum sales charge (load)

imposed on purchases, as % of

offering price |

4.50 |

2.50 |

None |

None |

None |

|

Maximum deferred sales charge

(load), as % of redemption

proceeds1

|

None |

None |

1.00 |

None |

None |

|

Account Maintenance Fee (annually,

for fund account balances below

$10,000 and subject to certain

exceptions) |

$20 |

None |

$20 |

None |

$20 |

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a % of the value of your investment)

(expenses that you pay each year as a % of the value of your investment)

|

|

A |

T |

C |

INST |

S |

|

Management fee |

0.31 |

0.31 |

0.31 |

0.31 |

0.31 |

|

Distribution/service (12b-1) fees |

0.21 |

0.25 |

1.00 |

None |

None |

|

Other expenses2

|

0.66 |

0.63 |

0.79 |

0.65 |

0.66 |

|

Total annual fund operating

expenses |

1.18 |

1.19 |

2.10 |

0.96 |

0.97 |

|

Fee waiver/expense reimbursement |

0.23 |

0.24 |

0.40 |

0.26 |

0.27 |

|

Total annual fund operating

expenses after fee waiver/expense

reimbursement |

0.95 |

0.95 |

1.70 |

0.70 |

0.70 |

1Investments of $1,000,000 or more may be eligible to buy Class A shares without a sales charge (load), but may be subject to a contingent deferred sales charge of 0.85% if redeemed within 12 months of the original purchase date and 0.50% if redeemed within the following six months.

2”Other expenses“ for Class T are based on estimated amounts for the current fiscal year.

The Advisor has contractually agreed through February 28, 2023 to waive its fees and/or reimburse fund expenses to the extent necessary to maintain the fund’s total annual operating expenses (excluding certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and acquired funds fees and expenses) at ratios no higher than 0.95%, 0.95%, 1.70%, 0.70% and 0.70% for Class A, Class T, Class C, Institutional Class and Class S, respectively. The agreement may only be terminated with the consent of the fund’s Board.

EXAMPLE

This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses (including one year of capped expenses in each period) remain the same. Class C shares generally convert automatically to Class A shares after 8 years. The information

| Prospectus March 1, 2022, as revised May 16, 2022 | 15 | DWS ESG Global Bond Fund |

presented in the Example for Class C reflects the conversion of Class C shares to Class A shares after 8 years. See ”Class C Shares“ in the ”Choosing a Share Class“ section of the prospectus for more information. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Years |

A |

T |

C |

INST |

S |

|

1 |

$543 |

$345 |

$273 |

$72 |

$72 |

|

3 |

786 |

595 |

619 |

280 |

282 |

|

5 |

1,049 |

865 |

1,092 |

506 |

510 |

|

10 |

1,798 |

1,636 |

2,163 |

1,154 |

1,165 |

You would pay the following expenses if you did not redeem your shares:

|

Years |

A |

T |

C |

INST |

S |

|

1 |

$543 |

$345 |

$173 |

$72 |

$72 |

|

3 |

786 |

595 |

619 |

280 |

282 |

|

5 |

1,049 |

865 |

1,092 |

506 |

510 |

|

10 |

1,798 |

1,636 |

2,163 |

1,154 |

1,165 |

PORTFOLIO TURNOVER

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may mean higher taxes if you are investing in a taxable account. These costs are not reflected in annual fund operating expenses or in the expense example, and can affect the fund's performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 47% of the average value of its portfolio.

Principal Investment Strategies

Main investments. Under normal circumstances, the fund invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in bonds of issuers from around the world, including the United States, that meet the Advisor’s sustainability criteria at the time of investment. The fund may, at the discretion of portfolio management, invest up to 20% of net assets in investments that do not meet such sustainability criteria. The fund can buy many types of income producing securities of any stated maturity, among them US and foreign government bonds, corporate bonds and mortgage- and asset-backed securities. The fund is typically invested in at least three different countries, which may include emerging markets.

The fund may invest up to 35% of net assets in junk bonds, which are those below the fourth credit grade (i.e. grade BB/Ba and below), and may include debt securities not currently paying interest or in default. The fund will

normally have investment exposure to foreign securities, foreign currencies and other foreign investments equal to at least 40% of the fund’s assets.

Management process. In choosing investments for the fund, portfolio management uses a proprietary environmental, social and governance (ESG) issuer rating as well as fundamental security analysis.

The ESG rating used by the Advisor to meet the Advisor’s sustainability criteria is DWS’s ESG Quality Assessment rating. This rating is generated by a DWS proprietary ESG tool that evaluates and rates an issuer’s performance across a variety of ESG assessment categories, primarily on the basis of data obtained from multiple third-party ESG data providers and public sources. An additional DWS internal review process allows for changes to the ESG rating. An internal review may occur, for example, if it is deemed that information is not reflected in the existing ESG rating because new information or insights have emerged that the ESG data providers have not yet processed. Examples of information that may be considered in such internal assessments include, but are not limited to, the announcement of new (or withdrawal from previously announced) climate-related commitments, or the resolution of legacy (or involvement in new) controversies. Portfolio management may use its discretion in considering application of internal assessments on a given rating.

A DWS ESG Quality Assessment rating is provided for both corporate and sovereign issuers. For corporate issuers, the DWS ESG Quality Assessment seeks to identify ESG leaders and laggards within industry and region-specific peer groups in terms of overall ESG performance (best-in-class approach). Issuers within the same industry and region-specific peer group are rated on a scale of A (leader) to F (laggard). Issuers with a rating of C or above are deemed to meet the Advisor’s sustainability criteria. In calculating the DWS ESG Quality Assessment rating, the DWS proprietary ESG tool utilizes a proprietary methodology to evaluate ESG scores from multiple third-party data providers across a broad range of ESG-related issues to arrive at a consensus overall quality ranking intended to reflect which companies may be positioned better, and which companies may be more exposed to unmanaged future ESG risks, relative to their peers. The broad range of ESG-related issues covered include, among others, assessments of an issuer’s carbon emissions including its own emissions and those of its products and services, land use and biodiversity, climate change strategy and vulnerability, product safety and quality, employee management issues including equal opportunities and non-discrimination, freedom of association and right to collective bargaining and occupational health and safety, community relations, human rights issues related to supply chain, business ethics and anti-corruption, and corporate governance matters including executive pay, board diversity and board independence. For asset-backed and similar securities,

Prospectus March 1, 2022, as revised May 16, 2022

16

DWS ESG Global Bond Fund

the DWS ESG Quality Assessment rating assigned to the issuing agency or entity is used unless an explicit ESG assessment is available from an outside party for the specific asset-backed or similar security. For example, certain mortgage-backed securities are assessed by independent third parties who consider the sustainable impact of the underlying loans such as providing support for affordable housing to low-to-moderate income families or projects that include environmental impact features. For sovereign issuers, the DWS ESG Quality Assessment rating evaluates countries based on traditional indicators including governmental policies and actions on issues such as climate change and natural resources, social conditions, basic needs, institutional strength, and rule of law, in addition to an assessment of political and civil freedom.

In its fundamental analysis, portfolio management typically considers a number of factors when buying and selling securities, including economic and currency outlooks, possible interest rate movements, capital flows, debt levels, inflation trends, credit quality of issuers, security characteristics and changes in supply and demand within the global bond markets. As part of this fundamental analysis, portfolio management may also consider ESG factors other than the DWS Quality Assessment rating, where such ESG factors are deemed to be financially material. These ESG factors may include other separate specialized ratings generated by the ESG tool. Examples of these specialized ratings include the DWS Climate Transition Risk Rating, DWS Norm Rating and DWS Sustainable Development Goals Rating, as well as ratings for involvement in controversial sectors and involvement in controversial weapons.

Portfolio management may also adjust the duration (a measure of sensitivity to interest rate movements) of the fund’s portfolio, depending on its outlook for interest rates.

Derivatives. Portfolio management generally may use futures contracts and interest rate swap contracts, which are types of derivatives (contracts whose value is based on, for example, indices, currencies or securities) to gain exposure to different parts of the yield curve while managing overall duration. Portfolio management generally may also use credit default swaps (a contract whose value is based on, for example, indices, currencies or securities) to seek to increase the fund’s income, to gain exposure to a bond issuer’s credit quality characteristics without directly investing in the bond, or to hedge the risk of default on bonds held in the fund’s portfolio. Portfolio management generally may also use options, to seek to enhance potential gains by increasing or decreasing the fund’s exposure to a particular sector or market or as a substitute for direct investment. In addition, portfolio management may generally use forward currency contracts (i) to hedge exposure to changes in foreign currency exchange rates on foreign currency denominated portfolio holdings; (ii) to facilitate transactions in foreign currency denominated securities; or (iii) for non-hedging

purposes to seek to enhance potential gains. While portfolio management may periodically hedge exposure to changes in foreign currency exchange rates depending on its current market views, it does not intend to hedge all non-US currency exposure back to the US dollar.

The fund may also use other types of derivatives (i) for hedging purposes; (ii) for risk management; (iii) for non-hedging purposes to seek to enhance potential gains; or (iv) as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions. Derivatives used by the fund do not receive a DWS ESG Quality Assessment rating and are not otherwise evaluated using ESG criteria.

Securities lending. The fund may lend securities (up to one-third of total assets) to approved institutions, such as registered broker-dealers, banks and pooled investment vehicles.

Main Risks

There are several risk factors that could hurt the fund’s performance, cause you to lose money or cause the fund’s performance to trail that of other investments. The fund may not achieve its investment objective, and is not intended to be a complete investment program. An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

Credit risk. The fund's performance could be hurt if an issuer of a debt security suffers an adverse change in financial condition that results in the issuer not making timely payments of interest or principal, a security downgrade or an inability to meet a financial obligation. Credit risk is greater for lower-rated securities.

Because the issuers of high yield debt securities, or junk bonds (debt securities rated below the fourth highest credit rating category), may be in uncertain financial health, the prices of their debt securities can be more vulnerable to bad economic news, or even the expectation of bad news, than investment-grade debt securities. Credit risk for high yield securities is greater than for higher-rated securities.

Because securities in default generally have missed one or more payments of interest and/or principal, an investment in such securities has an increased risk of loss. Issuers of securities in default have an increased likelihood of entering bankruptcy or beginning liquidation procedures which could impact the fund's ability to recoup its investment. Securities in default may be illiquid or trade in low volumes and thus may be difficult to value.

Market disruption risk. Geopolitical and other events, including war, terrorism, economic uncertainty, trade disputes, public health crises and related geopolitical events have led, and in the future may lead, to disruptions in the US and world economies and markets, which may increase financial market volatility and have significant

Prospectus March 1, 2022, as revised May 16, 2022

17

DWS ESG Global Bond Fund

adverse direct or indirect effects on the fund and its investments. Market disruptions could cause the fund to lose money, experience significant redemptions, and encounter operational difficulties. Although multiple asset classes may be affected by a market disruption, the duration and effects may not be the same for all types of assets.

Russia's recent military incursions in Ukraine have led to, and may lead to additional sanctions being levied by the United States, European Union and other countries against Russia. Russia's military incursion and the resulting sanctions could adversely affect global energy and financial markets and thus could affect the value of the fund's investments, even beyond any direct exposure the fund may have to Russian issuers or the adjoining geographic regions. The extent and duration of the military action, sanctions and resulting market disruptions are impossible to predict, but could be substantial. Any such disruptions caused by Russian military action or resulting sanctions may magnify the impact of other risks described in this “MAIN RISKS” section.

Other recent market disruption events include the pandemic spread of the novel coronavirus known as COVID-19, and the significant uncertainty, market volatility, decreased economic and other activity, increased government activity, including economic stimulus measures, and supply chain disruptions that it has caused. The full effects, duration and costs of the COVID-19 pandemic are impossible to predict, and the circumstances surrounding the COVID-19 pandemic will continue to evolve, including the risk of future increased rates of infection due to low vaccination rates and/or the lack of effectiveness of current vaccines against new variants. The pandemic has affected and may continue to affect certain countries, industries, economic sectors, companies and investment products more than others, may exacerbate existing economic, political, or social tensions and may increase the probability of an economic recession or depression. The fund and its investments may be adversely affected by the effects of the COVID-19 pandemic, and the pandemic may result in the fund and its service providers experiencing operational difficulties in coordinating a remote workforce and implementing their business continuity plans, among others. The disruptions caused by the COVID-19 pandemic may magnify the impact of each of the other risks described in this “MAIN RISKS” section and may increase volatility in one or more markets in which the fund invests leading to the potential for greater losses for the fund.

Interest rate risk. When interest rates rise, prices of debt securities generally decline. The longer the duration of the fund’s debt securities, the more sensitive the fund will be to interest rate changes. (As a general rule, a 1% rise in interest rates means a 1% fall in value for every year of duration.) Recent and potential future changes in monetary policy made by central banks or governments are likely to affect the level of interest rates. Rising interest rates may prompt redemptions from the fund, which may force the

fund to sell investments at a time when it is not advantageous to do so, which could result in losses. The fund may be subject to a greater risk of rising interest rates following periods of low rates, including the current low rate period. In addition, in response to the COVID-19 pandemic, as with other serious economic disruptions, governmental authorities and regulators have enacted significant fiscal and monetary policy changes, including providing direct capital infusions into companies, creating new monetary programs and lowering interest rates considerably. If these actions are modified or reversed or are ineffective in achieving their desired outcomes, the fund could be adversely affected by periods of heightened volatility and uncertainty.

London Interbank Offered Rate (LIBOR), the benchmark rate for certain floating rate securities, has been phased out as of the end of 2021 for most maturities and currencies, although certain widely used US Dollar LIBOR rates are expected to continue to be published through June 2023 to assist with the transition. The fund or the instruments in which the fund invests may be adversely affected by the phase out by, among other things, increased volatility or illiquidity. There remains uncertainty regarding the future use of LIBOR and the nature of any replacement reference rate and, accordingly, it is difficult to predict the impact to the fund of the transition away from LIBOR.

Prepayment and extension risk. When interest rates fall, issuers of high interest debt obligations may pay off the debts earlier than expected (prepayment risk), and the fund may have to reinvest the proceeds at lower yields. When interest rates rise, issuers of lower interest debt obligations may pay off the debts later than expected (extension risk), thus keeping the fund’s assets tied up in lower interest debt obligations. Ultimately, any unexpected behavior in interest rates could increase the volatility of the fund’s share price and yield and could hurt fund performance. Prepayments could also create capital gains tax liability in some instances.

High yield debt securities risk. High yield debt securities, or junk bonds, are generally regarded as speculative with respect to the issuer’s continuing ability to meet principal and interest payments. High yield debt securities’ total return and yield may generally be expected to fluctuate more than the total return and yield of investment-grade debt securities. A real or perceived economic downturn or an increase in market interest rates could cause a decline in the value of high yield debt securities, result in increased redemptions and/or result in increased portfolio turnover, which could result in a decline in net asset value of the fund, reduce liquidity for certain investments and/or increase costs. High yield debt securities are often thinly traded and can be more difficult to sell and value accurately than investment-grade debt securities as there may be no established secondary market. Investments in high yield debt securities could increase liquidity risk for the

Prospectus March 1, 2022, as revised May 16, 2022

18

DWS ESG Global Bond Fund

fund. In addition, the market for high yield debt securities can experience sudden and sharp volatility which is generally associated more with investments in stocks.

ESG investing risk. Investing primarily in investments that meet ESG criteria carries the risk that the fund may forgo otherwise attractive investment opportunities or increase or decrease its exposure to certain types of issuers and, therefore, may underperform funds that do not consider ESG factors. The ESG research and ratings used by the Advisor are based on information that is publicly available and/or provided by the companies themselves or by third parties. Such information may be unavailable or unreliable and, with respect to information provided by third parties, may be based on criteria that differs among data providers. The reliability and comparability of the data will affect the proprietary ratings utilized by the Advisor. The ESG ratings utilized by the Advisor are based on peer group comparisons, which may result in a favorable rating for an issuer that might not have received a favorable rating if compared to a broader universe of issuers. Additionally, investors can differ in their views of what constitutes positive or negative ESG characteristics. As a result, the fund may invest in issuers that do not reflect the beliefs and values with respect to ESG of any particular investor.

Foreign investment risk. The fund faces the risks inherent in foreign investing. Adverse political, economic or social developments, as well as US and foreign government actions such as the imposition of tariffs, economic and trade sanctions or embargoes, could undermine the value of the fund’s investments, prevent the fund from realizing the full value of its investments or prevent the fund from selling securities it holds. In June 2016, citizens of the United Kingdom approved a referendum to leave the European Union (EU) and in March 2017, the United Kingdom initiated the formal process of withdrawing from the EU. On January 31, 2020, the United Kingdom officially withdrew from the EU pursuant to a withdrawal agreement, providing for a transition period in which the United Kingdom negotiated and finalized a trade deal with the EU, the EU-UK Trade and Cooperation Agreement (the Trade Agreement). As a result, as of January 1, 2021 the United Kingdom is no longer part of the EU customs union and single market, nor is it subject to EU policies and international agreements. Among other things, the Trade Agreement provides for zero tariffs and zero quotas on all goods that comply with appropriate rules of origin and establishes the treatment and level of access the United Kingdom and EU have agreed to grant each other’s service suppliers and investors. In addition to trade in goods and services and investment, the Trade Agreement also covers digital trade, intellectual property, public procurement, aviation and road transport, energy, fisheries, social security coordination, law enforcement and judicial cooperation in criminal matters, thematic cooperation and participation in EU programs. Even with the Trade Agreement in place, the United Kingdom’s withdrawal from the EU may create

new barriers to trade in goods and services and to cross-border mobility and exchanges, including with respect to trade in financial services which is not comprehensively addressed in the Trade Agreement and remains subject to negotiation between the United Kingdom and the EU. The long-term impact of the United Kingdom’s withdrawal from the EU is still unknown and could have adverse economic and political effects on the United Kingdom, the EU and its member countries, and the global economy, including financial markets and asset valuations.

Financial reporting standards for companies based in foreign markets differ from those in the US. Additionally, foreign securities markets generally are smaller and less liquid than US markets. To the extent that the fund invests in non-US dollar denominated foreign securities, changes in currency exchange rates may affect the US dollar value of foreign securities or the income or gain received on these securities. In addition, because non-US markets may be open on days when the fund does not price its shares, the value of the securities in the fund’s portfolio may change on days when shareholders will not be able to purchase or sell the fund’s shares.

Emerging markets risk. Foreign investment risks are greater in emerging markets than in developed markets. Investments in emerging markets are often considered speculative.

Currency risk. Changes in currency exchange rates may affect the value of the fund’s investments and the fund’s share price. To the extent the fund seeks to hedge part or all of its foreign currency exposure, the fund may not be successful in hedging against currency changes. The fund’s US dollar share price may go down if the value of the local currency of the non−US markets in which the fund invests depreciates against the US dollar. This is true even if the local currency value of securities in the fund’s holdings goes up. Furthermore, the fund’s use of forward currency contracts may eliminate some or all of the benefit of an increase in the value of a foreign currency versus the US dollar. The value of the US dollar measured against other currencies is influenced by a variety of factors. These factors include: interest rates, national debt levels and trade deficits, changes in balances of payments and trade, domestic and foreign interest and inflation rates, global or regional political, economic or financial events, monetary policies of governments, actual or potential government intervention, global energy prices, political instability and government monetary policies and the buying or selling of currency by a country’s government. Currency exchange rates can be volatile and can change quickly and unpredictably, thereby impacting the value of the fund’s investments.

Regional focus risk. Focusing investments in a single country or few countries, or regions, involves increased currency, political, regulatory and other risks. Market

Prospectus March 1, 2022, as revised May 16, 2022

19

DWS ESG Global Bond Fund

swings in such a targeted country, countries or regions are likely to have a greater effect on fund performance than they would in a more geographically diversified fund.

Derivatives risk. Risks associated with derivatives may include the risk that the derivative is not well correlated with the security, index or currency to which it relates; the risk that derivatives may result in losses or missed opportunities; the risk that the fund will be unable to sell the derivative because of an illiquid secondary market; the risk that a counterparty is unwilling or unable to meet its obligation; and the risk that the derivative transaction could expose the fund to the effects of leverage, which could increase the fund's exposure to the market and magnify potential losses.

Security selection risk. The securities in the fund’s portfolio may decline in value. Portfolio management could be wrong in its analysis of industries, companies, economic trends, the relative attractiveness of different securities or other matters.

Pricing risk. If market conditions make it difficult to value some investments, the fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value determined for an investment could be different from the value realized upon such investment’s sale. As a result, you could pay more than the market value when buying fund shares or receive less than the market value when selling fund shares.

Liquidity risk. In certain situations, it may be difficult or impossible to sell an investment and/or the fund may sell certain investments at a price or time that is not advantageous in order to meet redemption requests or other cash needs. Unusual market conditions, such as an unusually high volume of redemptions or other similar conditions could increase liquidity risk for the fund, and in extreme conditions, the fund could have difficulty meeting redemption requests.

Securities lending risk. Securities lending involves the risk that the fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The fund could also lose money in the event of a decline in the value of the collateral provided for the loaned securities, or a decline in the value of any investments made with cash collateral or even a loss of rights in the collateral should the borrower of the securities fail financially while holding the securities.

Counterparty risk. A financial institution or other counterparty with whom the fund does business, or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the fund.