Form 497 BAIRD FUNDS INC

1

TABLE OF CONTENTS

| BAIRD SMALL/MID CAP GROWTH FUND | |||||

| SMALL/MID CAP GROWTH COMPOSITE | |||||

| BACK COVER | |||||

| Summary Section | ||

| Baird MidCap Fund | ||

Investment Objective

The investment objective of the Baird MidCap Fund (the “Fund”) is to provide long-term growth of capital.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Shareholder Fees

(fees paid directly from your investment)

None

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

Investor Class Shares | Institutional Class Shares | |||||||

| Management Fees | 0.75% | 0.75% | ||||||

Distribution and Service (12b-1) Fees | 0.25% | None | ||||||

| Other Expenses | 0.07% | 0.07% | ||||||

| Total Annual Fund Operating Expenses | 1.07% | 0.82% | ||||||

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Investor Class Shares | $109 | $340 | $590 | $1,306 | ||||||||||

| Institutional Class Shares | $84 | $262 | $455 | $1,014 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in total annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 47% of the average value of its portfolio.

Principal Investment Strategies

The Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in the equity securities of U.S. and foreign mid-capitalization companies, principally common stocks, preferred stocks, securities convertible into common stocks and American Depositary Receipts (“ADRs”) that are traded on major U.S. exchanges. Although the Fund principally invests in U.S. companies, the Fund may invest up to 15% of its total assets in equity securities (consisting of common stocks, ordinary shares and ADRs) of foreign companies. The Fund defines mid-capitalization companies as those companies with a market capitalization within the range of companies in the Russell Midcap® Growth Index at the time of investment.

When analyzing equity securities to be purchased by the Fund, Robert W. Baird & Co. Incorporated (the “Advisor”) emphasizes a company’s growth prospects. The Fund’s investments are selected using a variety of both quantitative techniques and fundamental research in seeking to maximize the Fund’s expected return while controlling risk.

The Fund seeks a portfolio comprised of companies which reflect “PRIME” growth factors. These factors are analyzed as part of the Advisor’s investment process and are represented in the following ways:

•Durable Profitability. Companies with attractive margins and favorable margin trends can drive superior earnings growth.

•Sustainable Revenue Growth. Solid barriers to entry, favorable pricing and demonstrated product/service track record can aid top-line prospects.

•Favorable Industry dynamics.

•Management strength and integrity is a critical element of a high quality company. Growth, profitability and shareholder returns provide insight into management effectiveness. The Advisor seeks companies with management that position their company’s balance sheet to be a source of strength.

2

•Understanding market Expectations of a company is important in assessing risk/return opportunities.

The Advisor believes an analysis of these PRIME factors yields insights to the competitive strength of a business model.

The Advisor applies the following strategies when purchasing securities for the Fund’s portfolio:

•Intentionally avoiding short-term trading strategies and rapid shifts in industry positions.

•Setting sector limits at the greater of 30% of the Fund’s total assets or double the weighting of the Russell Midcap® Growth Index in any one sector, as defined by such index.

•Typically holding the securities of fewer than 60 companies with exposure to at least 20 industries.

•Seeking securities whose growth prospects, in the Advisor’s opinion, are not reflected in their current stock prices.

•Limiting the size of any one new position. No security will represent more than 5% of the Fund’s total assets at the time of purchase.

• Leveraging key tools, such as the Advisor’s proprietary tier-board, which provides a visual representation of portfolio positions and enables discussion on relative weights of underlying positions.

The Advisor may sell a security due to achievement of valuation targets, significant change in the initial investment premise or fundamental deterioration.

Principal Risks

Please be aware that you may lose money by investing in the Fund. The following is a summary description of certain risks of investing in the Fund.

Stock Market Risks

Stock prices vary and may fall, thus reducing the value of the Fund’s investments. Certain stocks selected for the Fund’s portfolio may decline in value more than the overall stock market. The U.S. and international markets have recently experienced extreme price volatility and reduced liquidity. Continuing market problems may have adverse effects on the Fund.

3

Growth-Style Investing Risks

Because the Fund focuses on growth-style stocks, its performance may at times be better or worse than the performance of funds that focus on other types of stocks or that have a different investment style. Growth stocks are often characterized by high price-to-earnings ratios, which may be more volatile than stocks with lower price-to-earnings ratios.

Management Risks

The Advisor’s judgments about the attractiveness, value and potential appreciation of particular companies’ stocks may prove to be incorrect. Such errors could result in a negative return to the Fund and a loss to you.

Equity Securities Risks

Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This change may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors or companies in which the Fund invests.

Common Stock Risks

Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Holders of common stocks are generally subject to greater risk than holders of preferred stocks and debt obligations of the same issuer because common stockholders generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors.

Mid-Capitalization Risks

Mid-capitalization stocks are often more volatile and less liquid than investments in larger companies. The frequency and volume of trading in securities of mid-size companies may be substantially less than is typical of larger companies. Therefore, the securities of mid-size companies may be subject to greater and more abrupt price fluctuations. In addition, mid-size companies may lack the management experience, financial resources and product diversification of larger companies, making them more susceptible to market pressures and business failure.

Foreign Securities Risks

Securities of foreign issuers and ADRs are subject to certain inherent risks, such as political or economic instability of the country of issue and government policies, tax rates, withholding of foreign taxes, prevailing interest rates and credit conditions that may differ from those affecting domestic corporations. Securities of foreign issuers and ADRs may also be subject to currency fluctuations and controls and greater fluctuation in price than the securities of domestic corporations. Foreign companies generally are subject to different auditing and financial reporting standards than those applicable to domestic companies.

The United Kingdom (UK) withdrew from the European Union (EU) on January 31, 2020 following a June 2016 referendum referred to as “Brexit.” Although the UK and

4

EU agreed to a trade deal in December 2020, certain post-EU arrangements, such as those relating to the offering of cross-border financial services and sharing of cross-border data, have yet to be reached and the EU’s willingness to grant equivalency to the UK remains uncertain. There is significant market uncertainty regarding Brexit’s ramifications, and the range of possible political, regulatory, economic and market outcomes is difficult to predict. The uncertainty surrounding the UK’s economy, and its legal, political, and economic relationship with the remaining member states of the EU, may cause considerable disruption in securities markets, including decreased liquidity and increased volatility, as well as currency fluctuations in the British pound’s exchange rate against the U.S. dollar.

Recent Market Events

U.S. and international markets have experienced significant periods of volatility in recent months and years due to a number of economic, political, social and global macro factors including the impact of the coronavirus (COVID-19) global pandemic, which has resulted in a global health crisis, business interruptions, growth concerns in the U.S. and overseas, layoffs, rising unemployment claims, changed travel and social behaviors, reduced consumer spending, and fiscal, monetary and other government policy responses. The impact of the COVID-19 pandemic may last for an extended period of time.

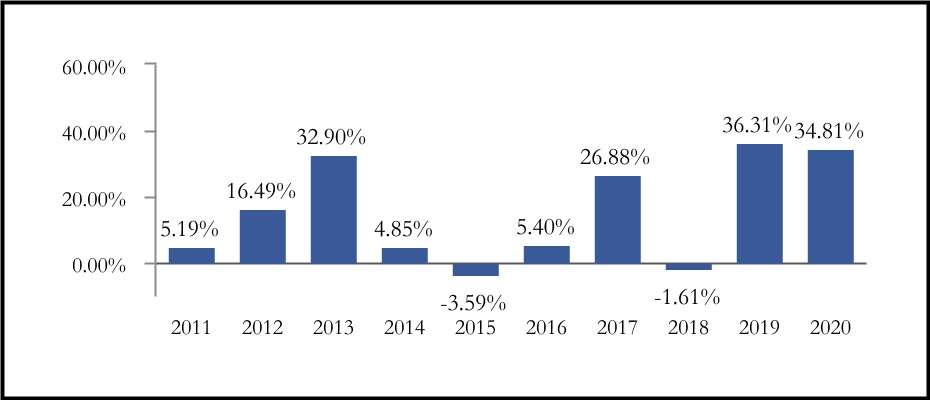

Performance

The performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for one, five and ten years and since inception period compare with those of a broad measure of market performance. Past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.bairdfunds.com or by calling the Fund toll-free at 1-866-442-2473.

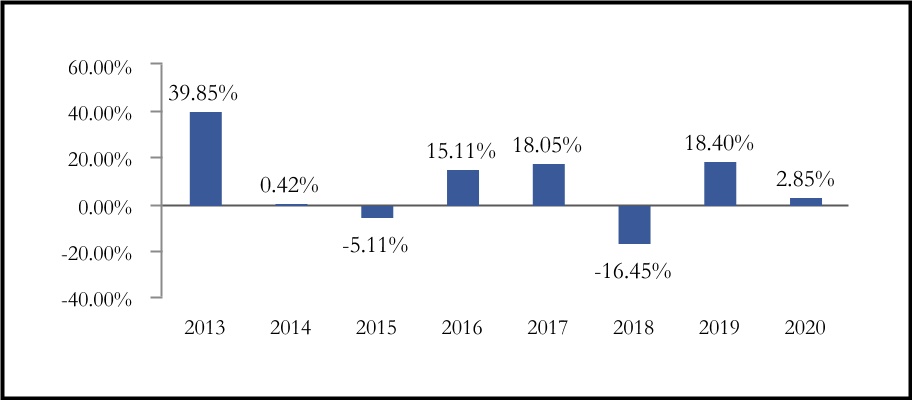

Calendar Year Returns for Institutional Class Shares

5

| Best quarter: | 2nd quarter 2020 | 29.44 | % | |||||

| Worst quarter: | 1st quarter 2020 | -19.30 | % | |||||

| Average Annual Total Returns as of December 31, 2020 | ||||||||||||||

| 1 Year | 5 Years | 10 Years | Since Inception (12/29/00) | |||||||||||

| Institutional Class | ||||||||||||||

| Return Before Taxes | 34.81% | 19.31% | 14.81% | 9.41% | ||||||||||

| Return After Taxes on Distributions | 31.76% | 17.88% | 13.91% | 8.63% | ||||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 22.29% | 15.42% | 12.28% | 7.85% | ||||||||||

| Investor Class | ||||||||||||||

| Return Before Taxes | 34.32% | 18.98% | 14.52% | 9.14% | ||||||||||

Russell MidCap® Growth Index (reflects no deduction for fees, expenses or taxes) | 35.59% | 18.66% | 15.04% | 8.91% | ||||||||||

After‑tax returns are shown only for Institutional Class shares, and the after‑tax returns for Investor Class shares will vary. After‑tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after‑tax returns depend on your tax situation and may differ from those shown. After‑tax returns are not relevant if you hold your shares through a tax‑deferred account, such as a 401(k) plan or an individual retirement account.

Investment Advisor

Robert W. Baird & Co. Incorporated is the Fund’s investment advisor.

Portfolio Managers

| Name | Portfolio Manager of the Fund Since | Title | ||||||

| Charles F. Severson, CFA | 2000 | Senior Portfolio Manager for Baird Equity Asset Management and Managing Director of the Advisor | ||||||

| Kenneth M. Hemauer, CFA | 2010 | Senior Portfolio Manager for Baird Equity Asset Management and Managing Director of the Advisor | ||||||

6

For important information about the purchase and sale of Fund shares, tax information and financial intermediary compensation, please turn to “Purchase and Sale of Fund Shares, Taxes and Financial Intermediary Compensation” on page 44.

7

| Baird Small/Mid Cap Growth Fund | ||

Investment Objective

The investment objective of the Baird Small/Mid Cap Growth Fund (the “Fund”) is to provide long-term growth of capital.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Shareholder Fees

(fees paid directly from your investment)

None

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

Investor Class Shares | Institutional Class Shares | |||||||

| Management Fees | 0.75% | 0.75% | ||||||

Distribution and Service (12b-1) Fees | 0.25% | None | ||||||

| Other Expenses | 0.68% | 0.68% | ||||||

| Total Annual Fund Operating Expenses | 1.68% | 1.43% | ||||||

Less: Fee Waiver/Expense Reimbursement(1) | -0.58% | -0.58% | ||||||

| Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement | 1.10% | 0.85% | ||||||

(1)Robert W. Baird & Co. Incorporated (the “Advisor”) has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.10% of average daily net assets for the Investor Class shares and 0.85% of average daily net assets for the Institutional Class shares. The Advisor’s expense reimbursement agreement includes fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. If such excluded expenses were incurred, Fund expenses would be higher. The Advisor is entitled to recoup the fees waived and/or expenses reimbursed within a three-year period from the time the expenses were incurred, provided that the aggregate amount actually paid by the Fund toward the operating expenses in any month (taking into account the recoupment) will not cause the Fund to exceed the lesser of: (1) the expense cap in place at the time of the fee waiver and/or expense reimbursement; or (2) the expense cap in place at the time of the recoupment. The agreement will continue in effect at least through April 30, 2022 and may only be terminated prior to the end of this term by or with the consent of the Board of Directors.

8

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Please note that the one-year numbers below are based on the Fund’s net expenses resulting from the fee waiver/expense reimbursement agreement described above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Investor Class Shares | $112 | $473 | $858 | $1,939 | ||||||||||

| Institutional Class Shares | $87 | $395 | $726 | $1,663 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in total annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 65% of the average value of its portfolio.

Principal Investment Strategies

The Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in the equity securities of U.S. and foreign small- and mid-capitalization companies, principally common stocks and American Depositary Receipts (“ADRs”) that are traded on major U.S. exchanges. Although the Fund principally invests in U.S. companies, the Fund may invest up to 15% of its total assets in equity securities (consisting of common stocks, ordinary shares and ADRs) of foreign companies. The Fund defines small- and mid-capitalization companies as those companies with a market capitalization within the range of companies in the Russell 2500® Growth Index at the time of investment.

When analyzing equity securities to be purchased by the Fund, the Advisor emphasizes a company’s growth prospects. The Fund’s investments are selected using a variety of both quantitative techniques and fundamental research in seeking to maximize the Fund’s expected return while controlling risk.

The Fund seeks a portfolio comprised of companies which reflect “PRIME” growth factors. These factors are analyzed as part of the Advisor’s investment process and are represented in the following ways:

9

•Durable Profitability. Companies with attractive margins and favorable margin trends can drive superior earnings growth.

•Sustainable Revenue Growth. Solid barriers to entry, favorable pricing and demonstrated product/service track records can aid top-line prospects.

•Favorable Industry dynamics.

•Management strength and integrity is a critical element of a high quality company. Growth, profitability and shareholder returns provide insight into management effectiveness. The Advisor seeks companies with management that position their company’s balance sheet to be a source of strength.

•Understanding market Expectations of a company is important in assessing risk/return opportunities.

The Advisor believes an analysis of these PRIME factors yields insights into the competitive strength of a business model.

The Advisor applies the following strategies when purchasing securities for the Fund’s portfolio:

•Typically holding the securities of fewer than 70 companies with exposure to approximately 20 industries.

•Seeking securities whose growth prospects, in the Advisor’s opinion, are not reflected in their current stock prices.

•Limiting the size of any one new position. No security will represent more than 5% of the Fund’s total assets at the time of purchase.

The Advisor may sell a security when the price meets or exceeds the Advisor’s targeted valuation or price range for the security, when a significant change occurs that adversely affects the Advisor’s premise or reasons for investing in the security or when the company experiences a fundamental deterioration in its business, financial condition or results, or growth prospects.

Principal Risks

Please be aware that you may lose money by investing in the Fund. The following is a summary description of certain risks of investing in the Fund.

Stock Market Risks

Stock prices vary and may fall, thus reducing the value of the Fund’s investments. Certain stocks selected for the Fund’s portfolio may decline in value more than the overall stock market. The U.S. and international markets have recently experienced

10

extreme price volatility and reduced liquidity. Continuing market problems may have adverse effects on the Fund.

Growth-Style Investing Risks

Because the Fund focuses on growth-style stocks, its performance may at times be better or worse than the performance of funds that focus on other types of stocks or that have a different investment style. Growth stocks are often characterized by high price-to-earnings ratios, which may be more volatile than stocks with lower price-to-earnings ratios.

Management Risks

The Advisor’s judgments about the attractiveness, value and potential appreciation of particular companies’ stocks may prove to be incorrect. Such errors could result in a negative return to the Fund and a loss to you.

Equity Securities Risks

Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This change may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors or companies in which the Fund invests.

Common Stock Risks

Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Holders of common stocks are generally subject to greater risk than holders of preferred stocks and debt obligations of the same issuer because common stockholders generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors.

Small- and Mid-Capitalization Risks

Small- and mid-capitalization stocks are often more volatile and less liquid than investments in larger companies. The frequency and volume of trading in securities of small- and mid-size companies may be substantially less than is typical of larger companies. Therefore, the securities of small- and mid-size companies may be subject to greater and more abrupt price fluctuations. In addition, small- and mid-size companies may lack the management experience, financial resources and product diversification of larger companies, making them more susceptible to market pressures and business failure. Small- and mid-size companies in which the Fund may invest may be in the early stages of development and may not yet be profitable. These risks may be more pronounced for small-capitalization companies than for mid-capitalization companies.

Small Fund Risk

There can be no assurance that the Fund will grow to or maintain an economically viable size.

11

Foreign Securities Risks

Securities of foreign issuers and ADRs are subject to certain inherent risks, such as political or economic instability of the country of issue and government policies, tax rates, withholding of foreign taxes, prevailing interest rates and credit conditions that may differ from those affecting domestic corporations. Securities of foreign issuers and ADRs may also be subject to currency fluctuations and controls and greater fluctuation in price than the securities of domestic corporations. Foreign companies generally are subject to different auditing and financial reporting standards than those applicable to domestic companies.

The United Kingdom (UK) withdrew from the European Union (EU) on January 31, 2020 following a June 2016 referendum referred to as “Brexit.” Although the UK and EU agreed to a trade deal in December 2020, certain post-EU arrangements, such as those relating to the offering of cross-border financial services and sharing of cross-border data, have yet to be reached and the EU’s willingness to grant equivalency to the UK remains uncertain. There is significant market uncertainty regarding Brexit’s ramifications, and the range of possible political, regulatory, economic and market outcomes is difficult to predict. The uncertainty surrounding the UK’s economy, and its legal, political, and economic relationship with the remaining member states of the EU, may cause considerable disruption in securities markets, including decreased liquidity and increased volatility, as well as currency fluctuations in the British pound’s exchange rate against the U.S. dollar.

Recent Market Events

U.S. and international markets have experienced significant periods of volatility in recent months and years due to a number of economic, political, social and global macro factors including the impact of the coronavirus (COVID-19) global pandemic, which has resulted in a global health crisis, business interruptions, growth concerns in the U.S. and overseas, layoffs, rising unemployment claims, changed travel and social behaviors, reduced consumer spending, and fiscal, monetary and other government policy responses. The impact of the COVID-19 pandemic may last for an extended period of time.

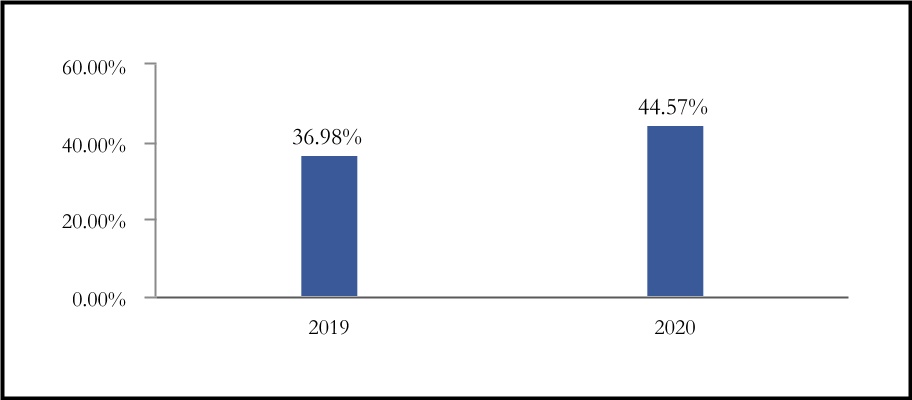

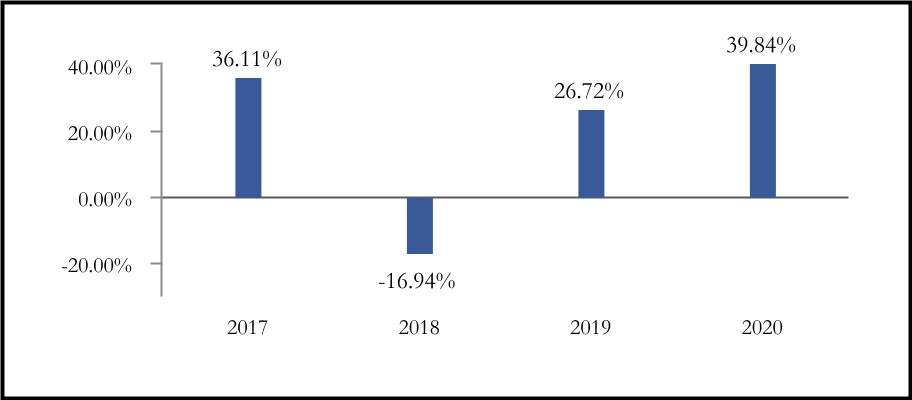

Performance

The performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance for the past two calendar years and by showing how the Fund’s average annual returns for one year and since inception period compare with those of a broad measure of market performance. Past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.bairdfunds.com or by calling the Fund toll-free at 1-866-442-2473.

12

Calendar Year Returns for Institutional Class Shares

| Best quarter: | 2nd quarter 2020 | 33.43 | % | |||||

| Worst quarter: | 1st quarter 2020 | -18.52 | % | |||||

| Average Annual Total Returns as of December 31, 2020 | ||||||||

| 1 Year | Since Inception (10/31/18) | |||||||

| Institutional Class | ||||||||

Return Before Taxes | 44.57% | 30.23% | ||||||

Return After Taxes on Distributions | 43.73% | 29.88% | ||||||

Return After Taxes on Distributions and Sale of Fund Shares | 26.65% | 23.72% | ||||||

| Investor Class | ||||||||

Return Before Taxes | 43.89% | 29.75% | ||||||

Russell 2500® Growth Index (reflects no deduction for fees, expenses or taxes) | 40.47% | 27.48% | ||||||

After‑tax returns are shown only for Institutional Class shares, and the after‑tax returns for Investor Class shares will vary. After‑tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after‑tax returns depend on your tax situation and may differ from those shown. After‑tax returns are not relevant if you hold your shares through a tax‑deferred account, such as a 401(k) plan or an individual retirement account.

Investment Advisor

Robert W. Baird & Co. Incorporated is the Fund’s investment advisor.

13

Portfolio Manager

| Name | Portfolio Manager of the Fund Since | Title | ||||||

| Jonathan Good | 2018 | Portfolio Manager for Baird Equity Asset Management and Director of the Advisor | ||||||

For important information about the purchase and sale of Fund shares, tax information and financial intermediary compensation, please turn to “Purchase and Sale of Fund Shares, Taxes and Financial Intermediary Compensation” on page 44.

14

| Baird Small/Mid Cap Value Fund | ||

Investment Objective

The investment objective of the Baird Small/Mid Cap Value Fund (the “Fund”) is to provide long-term capital appreciation.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Shareholder Fees

(fees paid directly from your investment)

None

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

Investor Class Shares | Institutional Class Shares | |||||||

| Management Fees | 0.75% | 0.75% | ||||||

Distribution and Service (12b-1) Fees | 0.25% | None | ||||||

| Other Expenses | 0.90% | 0.90% | ||||||

| Total Annual Fund Operating Expenses | 1.90% | 1.65% | ||||||

Less: Fee Waiver/Expense Reimbursement(1) | -0.80% | -0.80% | ||||||

| Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement | 1.10% | 0.85% | ||||||

(1)Robert W. Baird & Co. Incorporated (the “Advisor”) has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.10% of average daily net assets for the Investor Class shares and 0.85% of average daily net assets for the Institutional Class shares. The Advisor’s expense reimbursement agreement includes the fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. If such excluded expenses were incurred, Fund expenses would be higher. The Advisor is entitled to recoup the fees waived and/or expenses reimbursed within a three-year period from the time the expenses were incurred, provided that the aggregate amount actually paid by the Fund toward the operating expenses in any month (taking into account the recoupment) will not cause the Fund to exceed the lesser of: (1) the expense cap in place at the time of the fee waiver and/or expense reimbursement; or (2) the expense cap in place at the time of the recoupment. The agreement will continue in effect at least through April 30, 2022 and may only be terminated prior to the end of this term by or with the consent of the Board of Directors.

15

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Please note that the one-year numbers below are based on the Fund’s net expenses resulting from the expense reimbursement agreement described above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Investor Class Shares | $112 | $519 | $952 | $2,157 | ||||||||||

| Institutional Class Shares | $87 | $442 | $822 | $1,887 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in total annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 84% of the average value of its portfolio.

Principal Investment Strategies

The Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in a diversified portfolio of common stocks of companies with small-to-medium market capitalizations. The Advisor defines such companies as those with a maximum market capitalization of $17 billion at the time of investment. Although the Fund invests principally in U.S. companies, the Fund may invest up to 15% of its total assets in equity securities (consisting of common stocks, ordinary shares and American Depositary Receipts (“ADRs”)) of foreign companies that are traded on U.S. exchanges. The Advisor seeks to identify industries and business models that it believes are priced at a discount to their true value because they are currently out of favor with the market or have earnings or profit potential that may be underestimated by Wall Street analysts. The Advisor seeks to purchase securities of small-to-medium capitalization companies believed to have favorable valuation characteristics and opportunities for increased growth. The Advisor primarily considers the following factors:

•Valuation – Low price/earnings, price/book and price/cash flow ratios. These characteristics are evaluated based upon a proprietary analysis of forecasted levels of profitability.

16

•Balance Sheet Strength – Above average projected net margins, returns on equity, returns on assets, free cash flow generation, and revenue and earnings growth rates; trends in balance sheet items, including inventories and accounts receivable and payable, are also scrutinized.

•Product Offering/Market Position – The company offers a valuable product or service and has a good market position within a viable industry.

•Accounting Policies and Management – The company possesses sound financial and accounting policies and has a high quality management team with a track record of success.

The Advisor also considers environmental, social and governance (ESG) factors in selecting investments for the Fund. As a long-term, buy and hold investor, the Advisor includes ESG considerations as part of its overall investment decision-making. The Advisor believes ESG factors vary across companies, industries, and sectors and therefore does not apply exclusionary ESG screens in selecting investments for the Fund.

The Advisor will typically sell a security held by the Fund when the investment thesis changes, the company’s fundamentals deteriorate, the Advisor identifies portfolio structure or risk management needs and/or the security’s valuation relative to its peer group is no longer attractive.

Principal Risks

Please be aware that you may lose money by investing in the Fund. The following is a summary description of certain risks of investing in the Fund.

Stock Market Risks

Stock prices vary and may fall, thus reducing the value of the Fund’s investments. Certain stocks selected for the Fund’s portfolio may decline in value more than the overall stock market. The U.S. and international markets have recently experienced extreme price volatility and reduced liquidity. Continuing market problems may have adverse effects on the Fund.

Value-Style Investing Risks

Because the Fund focuses on value-style stocks, its performance may at times be worse than the performance of funds that focus on other types of stocks or that have a different investment style. Value-style investing may go out of favor with investors, negatively impacting the Fund’s growth and performance. Value stocks may also fail to appreciate as much as anticipated, and their intrinsic value may not be recognized by the broader market.

17

Management Risks

The Advisor’s judgments about the attractiveness, value and potential appreciation of particular companies’ stocks may prove to be incorrect. Such errors could result in a negative return to the Fund and a loss to you.

Equity Securities Risks

Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This change may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors or companies in which the Fund invests.

Common Stock Risks

Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Holders of common stocks are generally subject to greater risk than holders of preferred stocks and debt obligations of the same issuer because common stockholders generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors.

Small-to-Medium Market Capitalization Risks

Stocks of companies with small and medium market capitalizations involve a higher degree of risk than investments in the broad-based equities market. Small- to mid-capitalization stocks are often more volatile and less liquid than investments in larger companies, and are more likely to be adversely affected by poor economic or market conditions. In addition, small- to mid-capitalization companies may lack the management experience, financial resources and product diversification of larger companies, making them more susceptible to market pressures and business failure.

Financial Sector Risks

The Fund may invest a relatively large percentage of its assets in the financial sector given its weighting in the Fund’s benchmark and, therefore, the Fund’s performance may be adversely affected by volatility in financial and credit markets. Financial services companies (e.g., banks and insurance companies) are subject to extensive government regulation, interest rate risk, credit losses and price competition, among other factors.

Small Fund Risk

There can be no assurance that the Fund will grow to or maintain an economically viable size.

ESG Considerations Risk

Consideration of ESG factors in the investment process may cause the Advisor to forgo opportunities to invest in certain companies or to gain exposure to certain industries or regions and, therefore, carries the risk that, under certain market conditions, the Fund may underperform funds that do not consider such factors. There are not universally accepted ESG factors and the Advisor will consider them in its discretion.

18

Foreign Securities Risks

Securities of foreign issuers and ADRs are subject to certain inherent risks, such as political or economic instability of the country of issue and government policies, tax rates, withholding of foreign taxes, prevailing interest rates and credit conditions that may differ from those affecting domestic corporations. Securities of foreign issuers and ADRs may also be subject to currency fluctuations and controls and greater fluctuation in price than the securities of domestic corporations. Foreign companies generally are subject to different auditing and financial reporting standards than those applicable to domestic companies.

The United Kingdom (UK) withdrew from the European Union (EU) on January 31, 2020 following a June 2016 referendum referred to as “Brexit.” Although the UK and EU agreed to a trade deal in December 2020, certain post-EU arrangements, such as those relating to the offering of cross-border financial services and sharing of cross-border data, have yet to be reached and the EU’s willingness to grant equivalency to the UK remains uncertain. There is significant market uncertainty regarding Brexit’s ramifications, and the range of possible political, regulatory, economic and market outcomes is difficult to predict. The uncertainty surrounding the UK’s economy, and its legal, political, and economic relationship with the remaining member states of the EU, may cause considerable disruption in securities markets, including decreased liquidity and increased volatility, as well as currency fluctuations in the British pound’s exchange rate against the U.S. dollar.

Recent Market Events

U.S. and international markets have experienced significant periods of volatility in recent months and years due to a number of economic, political, social and global macro factors including the impact of the coronavirus (COVID-19) global pandemic, which has resulted in a global health crisis, business interruptions, growth concerns in the U.S. and overseas, layoffs, rising unemployment claims, changed travel and social behaviors, reduced consumer spending, and fiscal, monetary and other government policy responses. The impact of the COVID-19 pandemic may last for an extended period of time.

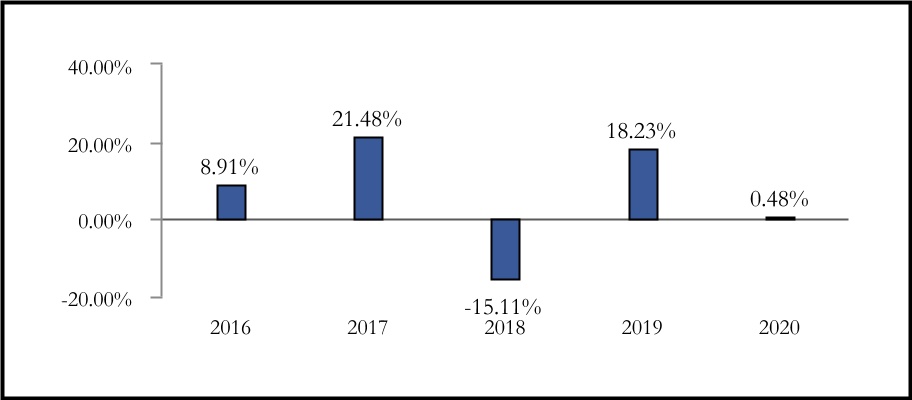

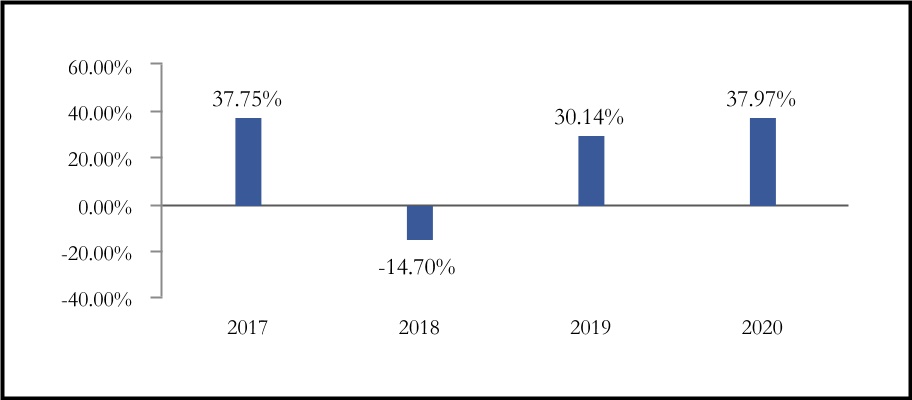

Performance

The performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for one and five years and since inception period compare with those of a broad measure of market performance. Past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.bairdfunds.com or by calling the Fund toll-free at 1-866-442-2473.

19

Calendar Year Returns for Institutional Class Shares

| Best quarter: | 4th quarter 2020 | 24.29 | % | |||||

| Worst quarter: | 1st quarter 2020 | -28.00 | % | |||||

| Average Annual Total Returns as of December 31, 2020 | |||||||||||

| 1 Year | 5 Years | Since Inception (11/30/15) | |||||||||

| Institutional Class | |||||||||||

| Return Before Taxes | 0.48% | 5.94% | 4.85% | ||||||||

| Return After Taxes on Distributions | 0.31% | 5.77% | 4.68% | ||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 0.41% | 4.63% | 3.77% | ||||||||

| Investor Class | |||||||||||

| Return Before Taxes | 0.15% | 5.64% | 4.56% | ||||||||

Russell 2500® Value Index (reflects no deduction for fees, expenses or taxes) | 4.88% | 9.43% | 8.26% | ||||||||

After‑tax returns are shown only for Institutional Class shares, and the after‑tax returns for Investor Class shares will vary. After‑tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after‑tax returns depend on your tax situation and may differ from those shown. After‑tax returns are not relevant if you hold your shares through a tax‑deferred account, such as a 401(k) plan or an individual retirement account.

The Return After Taxes on Distributions and Sale of Fund Shares may be higher than other return figures when a capital loss occurs upon the redemption of Fund shares and provides an assumed tax benefit that increases the after‑tax return.

20

Investment Advisor

Robert W. Baird & Co. Incorporated is the Fund’s investment advisor.

Portfolio Manager

| Name | Portfolio Manager of the Fund Since | Title | ||||||

| Michelle E. Stevens, CFA | 2015 | Senior Portfolio Manager for Baird Equity Asset Management and Managing Director of the Advisor | ||||||

For important information about the purchase and sale of Fund shares, tax information and financial intermediary compensation, please turn to “Purchase and Sale of Fund Shares, Taxes and Financial Intermediary Compensation” on page 44.

21

| Baird SmallCap Value Fund | ||

Investment Objective

The investment objective of the Baird SmallCap Value Fund (the “Fund”) is to provide long-term capital appreciation.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Shareholder Fees

(fees paid directly from your investment)

None

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

Investor Class Shares | Institutional Class Shares | |||||||

| Management Fees | 0.85% | 0.85% | ||||||

Distribution and Service (12b-1) Fees | 0.25% | None | ||||||

| Other Expenses | 0.79% | 0.79% | ||||||

| Total Annual Fund Operating Expenses | 1.89% | 1.64% | ||||||

Less: Fee Waiver/Expense Reimbursement(1) | -0.69% | -0.69% | ||||||

| Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement | 1.20% | 0.95% | ||||||

(1)Robert W. Baird & Co. Incorporated (the “Advisor”) has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.20% of average daily net assets for the Investor Class shares and 0.95% of average daily net assets for the Institutional Class shares. The Advisor’s expense reimbursement agreement includes the fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. If such excluded expenses were incurred, Fund expenses would be higher. The Advisor is entitled to recoup the fees waived and/or expenses reimbursed within a three-year period from the time the expenses were incurred provided that the aggregate amount actually paid by the Fund toward the operating expenses in any month (taking into account the recoupment) will not cause the Fund to exceed the lesser of: (1) the expense cap in place at the time of the fee waiver and/or expense reimbursement; or (2) the expense cap in place at the time of the recoupment. The agreement will continue in effect at least through April 30, 2022 and may only be terminated prior to the end of this term by or with the consent of the Board of Directors.

22

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Please note that the one-year numbers below are based on the Fund’s net expenses resulting from the expense reimbursement agreement described above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Investor Class Shares | $122 | $527 | $957 | $2,155 | ||||||||||

| Institutional Class Shares | $97 | $450 | $827 | $1,886 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in total annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 61% of the average value of its portfolio.

Principal Investment Strategies

The Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in a diversified portfolio of common stocks of companies with small market capitalizations. The Advisor defines such companies as those with a maximum market capitalization of $8 billion at the time of investment. Although the Fund invests principally in U.S. companies, the Fund may invest up to 15% of its total assets in equity securities (consisting of common stocks, ordinary shares and American Depositary Receipts (“ADRs”)) of foreign companies that are traded on U.S. exchanges. The Advisor seeks to identify industries and business models that it believes are priced at a discount to their true value because they are currently out of favor with the market or have earnings or profit potential that may be underestimated by Wall Street analysts. The Advisor seeks to purchase small-cap securities believed to have favorable valuation characteristics and opportunities for increased growth.

The Advisor also considers environmental, social and governance (ESG) factors in selecting investments for the Fund. As a long-term, buy and hold investor, the Advisor includes ESG considerations as part of its overall investment decision-making. The Advisor believes ESG factors vary across companies, industries, and sectors and therefore does not apply exclusionary ESG screens in selecting investments for the Fund.

23

The Advisor will typically sell a security held by the Fund when the investment thesis changes, the company’s fundamentals deteriorate, the Advisor identifies portfolio structure or risk management needs and/or the security’s valuation relative to its peer group is no longer attractive.

Principal Risks

Please be aware that you may lose money by investing in the Fund. The following is a summary description of certain risks of investing in the Fund.

Stock Market Risks

Stock prices vary and may fall, thus reducing the value of the Fund’s investments. Certain stocks selected for the Fund’s portfolio may decline in value more than the overall stock market. The U.S. and international markets have recently experienced extreme price volatility and reduced liquidity. Continuing market problems may have adverse effects on the Fund.

Value-Style Investing Risks

Because the Fund focuses on value-style stocks, its performance may at times be worse than the performance of funds that focus on other types of stocks or that have a different investment style. Value-style investing may go out of favor with investors, negatively impacting the Fund’s growth and performance. Value stocks may also fail to appreciate as much as anticipated, and their intrinsic value may not be recognized by the broader market.

Management Risks

The Advisor’s judgments about the attractiveness, value and potential appreciation of particular companies’ stocks may prove to be incorrect. Such errors could result in a negative return to the Fund and a loss to you.

Equity Securities Risks

Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This change may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors or companies in which the Fund invests.

Common Stock Risks

Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Holders of common stocks are generally subject to greater risk than holders of preferred stocks and debt obligations of the same issuer because common stockholders generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors.

Small Market Capitalization Risks

Stocks of companies with small market capitalizations involve a higher degree of risk than investments in the broad-based equities market. Small-capitalization stocks are

24

often more volatile and less liquid than investments in larger companies, and are more likely to be adversely affected by poor economic or market conditions. In addition, small-capitalization companies may lack the management experience, financial resources and product diversification of larger companies, making them more susceptible to market pressures and business failure.

Financial Sector Risks

The Fund may invest a relatively large percentage of its assets in the financial sector given its weighting in the Fund’s benchmark and, therefore, the Fund’s performance may be adversely affected by volatility in financial and credit markets. Financial services companies are subject to extensive government regulation, interest rate risk, credit losses and price competition, among other factors.

Small Fund Risk

There can be no assurance that the Fund will grow to or maintain an economically viable size.

ESG Considerations Risk

Consideration of ESG factors in the investment process may cause the Advisor to forgo opportunities to invest in certain companies or to gain exposure to certain industries or regions and, therefore, carries the risk that, under certain market conditions, the Fund may underperform funds that do not consider such factors. There are not universally accepted ESG factors and the Advisor will consider them in its discretion.

Foreign Securities Risks

Securities of foreign issuers and ADRs are subject to certain inherent risks, such as political or economic instability of the country of issue and government policies, tax rates, withholding of foreign taxes, prevailing interest rates and credit conditions that may differ from those affecting domestic corporations. Securities of foreign issuers and ADRs may also be subject to currency fluctuations and controls and greater fluctuation in price than the securities of domestic corporations. Foreign companies generally are subject to different auditing and financial reporting standards than those applicable to domestic companies.

The United Kingdom (UK) withdrew from the European Union (EU) on January 31, 2020 following a June 2016 referendum referred to as “Brexit.” Although the UK and EU agreed to a trade deal in December 2020, certain post-EU arrangements, such as those relating to the offering of cross-border financial services and sharing of cross-border data, have yet to be reached and the EU’s willingness to grant equivalency to the UK remains uncertain. There is significant market uncertainty regarding Brexit’s ramifications, and the range of possible political, regulatory, economic and market outcomes is difficult to predict. The uncertainty surrounding the UK’s economy, and its legal, political, and economic relationship with the remaining member states of the EU, may cause considerable disruption in securities markets, including decreased liquidity and increased volatility, as well as currency fluctuations in the British pound’s exchange rate against the U.S. dollar.

25

Recent Market Events

U.S. and international markets have experienced significant periods of volatility in recent months and years due to a number of economic, political, social and global macro factors including the impact of the coronavirus (COVID-19) global pandemic, which has resulted in a global health crisis, business interruptions, growth concerns in the U.S. and overseas, layoffs, rising unemployment claims, changed travel and social behaviors, reduced consumer spending, and fiscal, monetary and other government policy responses. The impact of the COVID-19 pandemic may last for an extended period of time.

Performance

The performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for one and five years and since inception period compare with those of a broad measure of market performance. Past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.bairdfunds.com or by calling the Fund toll-free at 1-866-442-2473.

Calendar Year Returns for Institutional Class Shares

| Best quarter: | 4th quarter 2020 | 27.62 | % | |||||

| Worst quarter: | 1st quarter 2020 | -27.11 | % | |||||

26

| Average Annual Total Returns as of December 31, 2020 | |||||||||||

| 1 Year | 5 Years | Since Inception (5/1/12) | |||||||||

| Institutional Class | |||||||||||

| Return Before Taxes | 2.85% | 6.69% | 7.73% | ||||||||

| Return After Taxes on Distributions | 1.56% | 5.96% | 7.14% | ||||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 2.58% | 5.20% | 6.18% | ||||||||

| Investor Class | |||||||||||

| Return Before Taxes | 2.54% | 6.43% | 7.46% | ||||||||

Russell 2000® Value Index (reflects no deduction for fees, expenses or taxes) | 4.63% | 9.65% | 9.56% | ||||||||

After‑tax returns are shown only for Institutional Class shares, and the after‑tax returns for Investor Class shares will vary. After‑tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after‑tax returns depend on your tax situation and may differ from those shown. After‑tax returns are not relevant if you hold your shares through a tax‑deferred account, such as a 401(k) plan or an individual retirement account.

The Return After Taxes on Distributions and Sale of Fund Shares may be higher than other return figures when a capital loss occurs upon the redemption of Fund shares and provides an assumed tax benefit that increases the after‑tax return.

Investment Advisor

Robert W. Baird & Co. Incorporated is the Fund’s investment advisor.

Portfolio Manager

| Name | Portfolio Manager of the Fund Since | Title | ||||||

| Michelle E. Stevens, CFA | 2012 | Senior Portfolio Manager for Baird Equity Asset Management and Managing Director of the Advisor | ||||||

For important information about the purchase and sale of Fund shares, tax information and financial intermediary compensation, please turn to “Purchase and Sale of Fund Shares, Taxes and Financial Intermediary Compensation” on page 44.

27

| Chautauqua International Growth Fund | ||

Investment Objective

The investment objective of the Chautauqua International Growth Fund (the “Fund”) is to provide long‑term capital appreciation.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Shareholder Fees

(fees paid directly from your investment)

Investor Class Shares | Institutional Class Shares | |||||||

Redemption Fee (as a percentage of amount redeemed, for shares held 90 days or less) | 2.00% | 2.00% | ||||||

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

Investor Class Shares | Institutional Class Shares | |||||||

| Management Fees | 0.75% | 0.75% | ||||||

| Distribution and Service (12b‑1) Fees | 0.25% | None | ||||||

| Other Expenses | 0.15% | 0.15% | ||||||

| Total Annual Fund Operating Expenses | 1.15% | 0.90% | ||||||

Less: Fee Waiver/Expense Reimbursement(1) | -0.10% | -0.10% | ||||||

| Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement | 1.05% | 0.80% | ||||||

(1)Robert W. Baird & Co. Incorporated (the “Advisor”) has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.05% of average daily net assets for the Investor Class shares and 0.80% of average daily net assets for the Institutional Class shares. The Advisor’s expense reimbursement agreement includes the fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. If such excluded expenses were incurred, Fund expenses would be higher. The Advisor is entitled to recoup the fees waived and/or expenses reimbursed within a three‑year period from the time the expenses were incurred provided that the aggregate amount actually paid by the Fund toward the operating expenses in any month (taking into account the recoupment) will not cause the Fund to exceed the lesser of: (1) the expense cap in place at the time of the fee waiver and/or expense reimbursement; or (2) the expense cap

28

in place at the time of the recoupment. The agreement will continue in effect at least through April 30, 2022 and may only be terminated prior to the end of this term by or with the consent of the Board of Directors.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Please note that the one‑year numbers below are based on the Fund’s net expenses resulting from the expense reimbursement agreement described above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Investor Class Shares | $107 | $355 | $623 | $1,389 | ||||||||||

| Institutional Class Shares | $82 | $277 | $489 | $1,099 | ||||||||||

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in total annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 31% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests primarily in equity securities of non‑U.S. companies with medium to large market capitalizations (i.e., those typically with market capitalizations in excess of U.S. $5 billion at the time of purchase). Equity securities in which the Fund may invest include common stocks, preferred stocks, depositary shares and receipts, rights, warrants and exchange-traded funds (“ETFs”). Under normal market conditions, the Fund will invest at least 65% of its total assets at the time of purchase in non‑U.S. companies. The Fund will normally be diversified among at least three countries other than the U.S. The Fund invests in developed markets and emerging markets. In evaluating potential investments, the Advisor considers companies with growth characteristics that the Advisor believes are likely to benefit from current macro‑economic and global trends and possess sustainable competitive advantages. The Fund will normally hold the securities of a limited number (generally 25 to 35) of companies. While the Fund may invest in U.S. companies as a part of its investment

29

strategy, the Fund may invest up to 100% of its assets in non-U.S. companies and may at times have little or no investment in U.S. companies.

In determining whether a company is a U.S. or non-U.S. company, the Advisor considers a number of factors, including the company’s jurisdiction of incorporation or organization, the location of the company’s corporate or operational headquarters or principal place of business, the location of the principal trading market for the company’s common stock, the location(s) of a majority of the company’s assets or production of its goods and services, and the locations of the primary sources of the company’s revenues or profits.

The Advisor believes that environmental, social and governance (ESG) factors can have a material effect on investment returns. The Advisor seeks to understand pertinent ESG topics that are relevant to individual companies that are being considered for investment in the Fund. Examples include, but are not limited to, corporate governance structure, climate change, supply chain integrity, labor practices and human resource management.

The Fund may invest in ETFs. For example, the Fund may invest cash temporarily in ETFs until individual securities are identified for purchase or until the Fund is able to purchase securities in a particular country or region.

The Advisor will typically sell or reduce a position to mitigate specific risk, to take advantage of better opportunities, to avoid country risks, when the Advisor believes that valuations are high relative to changes in the company’s fundamentals, or when operational performance does not meet the Advisor’s expectations.

Principal Risks

Please be aware that you may lose money by investing in the Fund. The following is a summary description of certain risks of investing in the Fund.

Stock Market Risks

Stock prices vary and may fall, thus reducing the value of the Fund’s investments. Certain stocks selected for the Fund’s portfolio may decline in value more than the overall stock market. International markets have recently experienced extreme price volatility and reduced liquidity. Continuing market problems may have adverse effects on the Fund.

Growth‑Style Investing Risks

Because the Fund focuses on growth‑style stocks, its performance may at times be better or worse than the performance of funds that focus on other types of stocks or that have a different investment style. Growth stocks are often characterized by high price‑to‑earnings ratios, which may be more volatile than stocks with lower price‑to‑earnings ratios.

30

Limited Holdings Risks

Although it is diversified, the Fund may invest a relatively high percentage of assets in a focused number of issuers, which may result in increased volatility.

Management Risks

The Advisor’s judgments about the attractiveness, value and potential appreciation of particular companies’ stocks may prove to be incorrect. Such errors could result in a negative return to the Fund and a loss to you.

Equity Securities Risks

Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This change may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors or companies in which the Fund invests.

Common Stock Risks

Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Holders of common stocks are generally subject to greater risk than holders of preferred stocks and debt obligations of the same issuer because common stockholders generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors.

Currency Risks

The value of foreign investments held by the Fund may be significantly affected by changes in foreign currency exchange rates. Generally, when the U.S. dollar rises in value against a foreign currency, an investment in that foreign currency loses value because it is worth fewer U.S. dollars. The foreign currency exchange market can be highly volatile for a variety of reasons. For example, changes in monetary policy, macro-economic factors, currency conversion expenses, restrictions, exchange control regulation, devaluation and political developments may have a significant impact on the value of any investments denominated in that currency.

Medium and Large Capitalization Risks

Stocks of companies with certain market capitalization may perform differently from the equities markets generally. At times, medium and large capitalization stocks may underperform as compared to small capitalization stocks. Larger, more established companies may be unable to respond to new competitive challenges such as changes in consumer tastes or innovative smaller competitors. Moreover, medium capitalization stocks may perform differently from large capitalization stocks, as medium capitalization stocks may be less liquid and more volatile than large capitalization stocks.

Foreign Securities Risks

Securities of foreign issuers and ADRs are subject to certain inherent risks, such as political or economic instability of the country of issue and government policies, tax

31

rates, withholding of foreign taxes, prevailing interest rates and credit conditions that may differ from those affecting domestic corporations. Securities of foreign issuers and ADRs may also be subject to currency fluctuations and controls and greater fluctuation in price than the securities of domestic corporations. Foreign companies generally are subject to different auditing and financial reporting standards than those applicable to domestic companies.

The United Kingdom (UK) withdrew from the European Union (EU) on January 31, 2020 following a June 2016 referendum referred to as “Brexit.” Although the UK and EU agreed to a trade deal in December 2020, certain post-EU arrangements, such as those relating to the offering of cross-border financial services and sharing of cross-border data, have yet to be reached and the EU’s willingness to grant equivalency to the UK remains uncertain. There is significant market uncertainty regarding Brexit’s ramifications, and the range of possible political, regulatory, economic and market outcomes is difficult to predict. The uncertainty surrounding the UK’s economy, and its legal, political, and economic relationship with the remaining member states of the EU, may cause considerable disruption in securities markets, including decreased liquidity and increased volatility, as well as currency fluctuations in the British pound’s exchange rate against the U.S. dollar.

Emerging Market Risks

Investments in emerging markets can involve risks in addition to and greater than those generally associated with investing in more developed foreign markets. The extent of economic development, political stability, market depth, infrastructure, capitalization, and regulatory oversight can be less than in more developed markets. Emerging market economies can be subject to greater social, economic, regulatory, and political uncertainties, including interruptions in trading. All of these factors can make emerging market securities more volatile and potentially less liquid than securities issued in more developed markets.

Region, Country, Sector Risks

The Fund may invest a higher percentage of its total assets in a particular country, region or sector of international markets, which may have a significant impact on the Fund’s overall portfolio.

ETF Risks

You will indirectly bear fees and expenses charged by the ETFs in which the Fund invests, in addition to the Fund’s direct fees and expenses. Accordingly, your cost of investing in the Fund will generally be higher than the cost of investing directly in the ETF. The market price of ETF shares may trade at a discount to their net asset value or an active trading market for ETF shares may not develop or be maintained. ETFs in which the Fund invests typically will not be able to replicate exactly the performance of the underlying assets they track.

32

Valuation Risks

The prices provided by the Fund’s pricing services or independent dealers or the fair value determinations made by the valuation committee of the Advisor may be different from the prices used by other mutual funds or from the prices at which securities are actually bought or sold. The prices of certain securities provided by pricing services may be subject to frequent and significant change, and will vary depending on the information that is available.

ESG Considerations Risk

Consideration of ESG factors in the investment process may cause the Advisor to forgo opportunities to invest in certain companies or to gain exposure to certain industries or regions and, therefore, carries the risk that, under certain market conditions, the Fund may underperform funds that do not consider such factors. There are not universally accepted ESG factors and the Advisor will consider them in its discretion.

Recent Market Events

U.S. and international markets have experienced significant periods of volatility in recent months and years due to a number of economic, political, social and global macro factors including the impact of the coronavirus (COVID-19) global pandemic, which has resulted in a global health crisis, business interruptions, growth concerns in the U.S. and overseas, layoffs, rising unemployment claims, changed travel and social behaviors, reduced consumer spending, and fiscal, monetary and other government policy responses. The impact of the COVID-19 pandemic may last for an extended period of time.

Performance

The performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for one year and since inception period compare with those of a broad measure of market performance. Past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.bairdfunds.com or by calling the Fund toll-free at 1-866-442-2473.

33

Calendar Year Returns for Institutional Class Shares

| Best quarter: | 2nd quarter 2020 | 25.57 | % | |||||

| Worst quarter: | 4th quarter 2018 | -16.88 | % | |||||

| Average Annual Total Returns as of December 31, 2020 | ||||||||

| 1 Year | Since Inception (4/15/16) | |||||||

| Institutional Class | ||||||||

| Return Before Taxes | 39.84% | 14.81% | ||||||

| Return After Taxes on Distributions | 39.65% | 14.21% | ||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 23.77% | 11.68% | ||||||

| Investor Class | ||||||||

| Return Before Taxes | 39.37% | 14.52% | ||||||

MSCI ACWI ex USA Index (reflects no deductions for fees, expenses or taxes) | 10.65% | 9.16% | ||||||

After‑tax returns are shown only for Institutional Class shares, and the after‑tax returns for Investor Class shares will vary. After‑tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your actual after‑tax returns depend on your tax situation and may differ from those shown. After‑tax returns are not relevant if you hold your shares through a tax‑deferred account, such as a 401(k) plan or an individual retirement account.

Investment Advisor

Robert W. Baird & Co. Incorporated is the Fund’s investment advisor.

34

Portfolio Managers

| Name | Portfolio Manager of the Fund Since | Title | ||||||

| Brian Beitner, CFA | 2016 | Portfolio Manager of the Fund, Partner of the Advisor’s Chautauqua Capital Management Division, and Managing Director of the Advisor | ||||||

| Jesse A. Flores, CFA | 2020 | Portfolio Manager of the Fund, Partner of the Advisor’s Chautauqua Capital Management Division, and Director of the Advisor | ||||||

| Haicheng Li, CFA | 2020 | Portfolio Manager of the Fund, Managing Partner of the Advisor’s Chautauqua Capital Management Division, and Director of the Advisor | ||||||

| Nathaniel R. Velarde | 2020 | Portfolio Manager of the Fund, Partner of the Advisor’s Chautauqua Capital Management Division, and Director of the Advisor | ||||||

For important information about the purchase and sale of Fund shares, tax information and financial intermediary compensation, please turn to “Purchase and Sale of Fund Shares, Taxes and Financial Intermediary Compensation” on page 44.

35

| Chautauqua Global Growth Fund | ||

Investment Objective

The investment objective of the Chautauqua Global Growth Fund (the “Fund”) is to provide long‑term capital appreciation.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below.

Shareholder Fees

(fees paid directly from your investment)

Investor Class Shares | Institutional Class Shares | |||||||

Redemption Fee (as a percentage of amount redeemed, for shares held 90 days or less) | 2.00% | 2.00% | ||||||

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

Investor Class Shares | Institutional Class Shares | |||||||

| Management Fees | 0.75% | 0.75% | ||||||

| Distribution and Service (12b‑1) Fees | 0.25% | None | ||||||

| Other Expenses | 0.29% | 0.29% | ||||||

| Total Annual Fund Operating Expenses | 1.29% | 1.04% | ||||||

Less: Fee Waiver/Expense Reimbursement(1) | -0.24% | -0.24% | ||||||

| Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement | 1.05% | 0.80% | ||||||

(1)Robert W. Baird & Co. Incorporated (the “Advisor”) has contractually agreed to waive management fees and/or reimburse other expenses in order to limit the Fund’s total annual fund operating expenses to 1.05% of average daily net assets for the Investor Class shares and 0.80% of average daily net assets for the Institutional Class shares. The Advisor’s expense reimbursement agreement includes the fees and expenses incurred by the Fund in connection with the Fund’s investments in other investment companies (to the extent, in the aggregate, such expenses exceed 0.0049% of the Fund’s net assets) and interest expense, but excludes taxes, brokerage commissions and extraordinary expenses. If such excluded expenses were incurred, Fund expenses would be higher. The Advisor is entitled to recoup the fees waived and/or expenses reimbursed within a three‑year period from the time the expenses were incurred; provided that the aggregate amount actually paid by the Fund toward the operating expenses in any month (taking into account the recoupment) will not cause the Fund to exceed the lesser of: (1) the expense cap in place at the time of the fee waiver and/or expense reimbursement or (2) the expense cap

36