Form 485BPOS VARIABLE ANNUITY ACCOUNT

811-04294

| Pre-Effective Amendment No. ___ | □ |

| Post-Effective Amendment No. 5 | ☒ |

| Amendment No. 360 | ☒ |

400 Robert Street North

| □ | immediately upon filing pursuant to paragraph (b) of Rule 485 |

| ☒ | on September 16, 2021 pursuant to paragraph (b) of Rule 485 |

| □ | 60 days after filing pursuant to paragraph (a)(1) of Rule 485 |

| □ | on (date) pursuant to paragraph (a)(1) of Rule 485 |

| □ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

| • | MultiOption® Advantage Variable Annuity |

| • | MultiOption ® Momentum Variable Annuity |

| • | TOPS® Target RangeTM Portfolio – Class S Shares |

| Fund Name | Investment

Adviser |

Investment

Objective | ||

| Northern Lights Variable Trust (TOPS) | ||||

| TOPS ® Target RangeTM Portfolio | ValMark

Advisers, Inc. Sub-Adviser: Milliman, Inc. |

Seeks to provide capital appreciation with a secondary objective of hedging risk. |

Variable Annuity Contract

Minnesota Life Insurance Company

| (1) | Bathing: Washing oneself by sponge bath; or in either a tub or shower, including the task of getting into or out of the tub or shower. |

| (2) | Continence: The ability to maintain control of bowel and bladder function or, when unable to maintain control of bowel or bladder function, the ability to perform associated personal hygiene (including caring for a catheter or colostomy bag). |

| (3) | Dressing: Putting on and taking off all items of clothing and any necessary braces, fasteners or artificial limbs. |

| (4) | Eating: Feeding oneself by getting food into the body from a receptacle (such as a plate, cup or table) or by a feeding tube or intravenously. |

| (5) | Toileting: Getting to and from the toilet, getting on and off the toilet and performing associated personal hygiene. |

| (6) | Transferring: Moving into or out of a bed, chair or wheelchair. |

| (a) | is the value that is being adjusted immediately prior to the withdrawal, |

| (b) | is the total amount withdrawn, including any applicable charges, and |

| (c) | is the Contract Value immediately prior to the withdrawal. |

|

• Call our service line at 844-878-2199 to speak with one of our customer service representatives. They’re available Monday through Friday from 7:30 a.m. to 4:30 p.m. Central Time during normal business days. |

|

• Purchase Payments,

service requests, and inquiries sent by regular mail should be sent to: Minnesota Life Annuity Services P.O. Box 64628 St. Paul, MN 55164-0628 |

| • All

overnight express mail should be sent to: Annuity Services A3-9999 400 Robert Street North St. Paul, MN 55101-2098 |

| • To receive a current copy of the MultiOption® Momentum Variable Annuity Statement of Additional Information (SAI) without charge, call 844-878-2199, or complete and detach the following and send it to: | |||

| Minnesota

Life Insurance Company Annuity Services P.O. Box 64628 St. Paul, MN 55164-0628 |

|||

| Name

|

|||

| Address

|

|||

| City

|

State

|

Zip

|

|

| Initial Minimum | $25,000 |

| Subsequent payment minimum | $500 |

| Maximum cumulative Purchase Payments (without our prior consent) | $2,000,000 |

| * | Please note: If you intend to use this contract as part of an employer sponsored retirement plan or it is a Qualified Contract, the retirement plan or Qualified Contract may have contribution minimums or maximums that are different than those that apply to this contract. In addition, you will receive no additional benefit from the tax deferral feature of the annuity since the employer sponsored retirement plan (if it is tax qualified) or Qualified Contract is already tax deferred. You should consult your tax advisor to ensure that you meet all of the requirements and limitations, and to be sure this contract is appropriate to your situation. |

| Fixed Account (available only for Fixed Annuity Payments) | Minnesota Life General Account |

| DCA Fixed Account (new Purchase Payments only) | 6 Month Option |

| DCA Fixed Account (new Purchase Payments only) | 12 Month Option |

| Indexed Accounts | Minnesota Life General Account |

| Variable Annuity Account | See the list of Portfolios on the cover page |

| Minimum withdrawal amount | $250 |

| • | Hospital and Medical Care Waiver |

| • | Terminal Condition Waiver |

| • | Premier Protector Death Benefit (Premier Protector or PPDB) Rider |

| • | Return of Purchase Payments Death Benefit (ROPP DB) |

| Sales Load Imposed on Purchases | |

| (as a percentage of Purchase Payments) | None |

| • | Deferred sales charges may apply to withdrawals, partial surrenders and surrenders. (as a percentage of each Purchase Payment) |

| Years Since Purchase Payment | 0-1 | 1-2 | 2-3 | 3-4 | 4-5 | 5 and thereafter |

| Deferred Sales Charge | 8% | 8% | 7% | 6% | 5% | 0% |

| Surrender Fee | None |

| Transfer Fee* | |

| Maximum Charge | $10* |

| * | (We reserve the right to impose a $10 charge for each transfer when transfer requests exceed 12 in a single Contract Year. Currently this fee is waived.) |

| Annual Maintenance Fee** | $50 |

| ** | (Applies only to contracts where the greater of the Contract Value or Purchase Payments, less withdrawals, is less than $75,000 on the Contract Anniversary and at surrender. Does not apply after annuitization.) |

| Mortality and Expense Risk Charge | 0.75% |

| Administrative Charge | 0.15% |

| Total Base Contract Separate Account Annual Expenses (No Optional Riders) | 0.90% |

| Total

Charge: Optional Charge + Base Contract | |

| Base Contract | 0.90% |

| Optional Rider | Maximum

Possible Charge Annual Percentage |

Current

Benefit Charge Annual Percentage |

To

determine the amount to be deducted, the Annual Charge Percentage is multiplied by the: |

The

Benefit Charge is deducted on each: |

| Premier Protector Death Benefit — Charge | 0.90% | 0.90% | Premier

Protector Death Benefit |

Quarterly

Contract Anniversary |

| Enhanced Liquidity Option — Charge | 0.45% | 0.45% | Contract Value | Quarterly

Contract Anniversary |

| Return of Purchase Payments Death Benefit Charge | Return

of Purchase Payments Death Benefit |

Quarterly

Contract Anniversary | ||

| Age at issue 0 – 70: | 0.15% | 0.15% | ||

| Age at issue 71 – 80: | 0.40% | 0.40% |

| Minimum | Maximum | |

| Total

Annual Portfolio Company Operating Expenses (expenses that are deducted from Portfolio assets, including management fees, distribution and/or service (12b-1) fees, and other expenses) |

0.37% | 1.67% |

| If

you surrendered your contract at the end of the applicable time period |

If

you annuitize at the end of the applicable time period or you do not surrender your contract | ||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||

| Maximum Fund Expenses | |||||||||||||||

| Base + PPDB | $1,151 | $1,777 | $2,334 | $3,872 | $ 351 | $1,077 | $1,834 | $3,872 | |||||||

| Minimum Fund Expenses | |||||||||||||||

| Base + PPDB | $1,021 | $1,385 | $ 1,681 | $2,569 | $ 221 | $ 685 | $ 1,181 | $2,569 | |||||||

| Maximum Fund Expenses | |||||||||||||||

| Base + PPDB + Enhanced Liquidity Option | $ 396 | $ 1,210 | $ 2,051 | $4,283 | $396 | $ 1,210 | $ 2,051 | $4,283 | |||||||

| Minimum Fund Expenses | |||||||||||||||

| Base + PPDB + Enhanced Liquidity Option | $ 267 | $ 823 | $ 1,413 | $3,043 | $267 | $ 823 | $ 1,413 | $3,043 | |||||||

| Separate Account Based Charges | |

| Mortality and Expense Risk Charge | 1.20% |

| Administrative Charge | 0.15% |

| Total Base Contract Separate Account Annual Expenses (No Optional Riders) | 1.35% |

| Optional Separate Account Charges | Not Applicable |

| Other Charges | |

| Optional Benefit Charges | Not Applicable |

| Fund Name | Investment

Adviser |

Investment

Objective | ||

| AB Variable Products Series Fund, Inc. | ||||

| Dynamic Asset Allocation Portfolio – Class B Shares* | AllianceBernstein L.P. | Seeks to maximize total return consistent with the Adviser’s determination of reasonable risk. | ||

| AIM

Variable Insurance Funds (Invesco Variable Insurance Funds) |

||||

| Invesco Oppenheimer V.I. International Growth Fund – Series II Shares | Invesco Advisers, Inc. | Seeks capital appreciation. | ||

| Invesco V.I. American Value Fund – Series II Shares | Invesco Advisers, Inc. | Long-term capital appreciation. | ||

| Invesco V.I. Comstock Fund – Series II Shares | Invesco Advisers, Inc. | Seeks capital growth and income through investments in equity securities, including common stocks, preferred stocks and securities convertible into common and preferred stocks. | ||

| Invesco V.I. Equity and Income Fund – Series II Shares | Invesco Advisers, Inc. | Seeks both capital appreciation and current income. | ||

| Invesco V.I. Small Cap Equity Fund – Series II Shares | Invesco Advisers, Inc. | Long-term growth of capital. | ||

| ALPS Variable Investment Trust (Morningstar) | ||||

| Morningstar Aggressive Growth ETF Asset Allocation Portfolio – Class II Shares | ALPS

Advisors, Inc. Sub-Adviser: Morningstar Investment Management LLC |

Seeks to provide investors with capital appreciation. | ||

| Morningstar Balanced ETF Asset Allocation Portfolio – Class II Shares | ALPS

Advisors, Inc. Sub-Adviser: Morningstar Investment Management LLC |

Seeks to provide investors with capital appreciation and some current income. | ||

| Morningstar Conservative ETF Asset Allocation Portfolio – Class II Shares | ALPS

Advisors, Inc. Sub-Adviser: Morningstar Investment Management LLC |

Seeks to provide investors with current income and preservation of capital. | ||

| Morningstar Growth ETF Asset Allocation Portfolio – Class II Shares | ALPS

Advisors, Inc. Sub-Adviser: Morningstar Investment Management LLC |

Seeks to provide investors with capital appreciation. |

| Fund Name | Investment

Adviser |

Investment

Objective | ||

| Morningstar Income and Growth ETF Asset Allocation Portfolio – Class II Shares | ALPS

Advisors, Inc. Sub-Adviser: Morningstar Investment Management LLC |

Seeks to provide investors with current income and capital appreciation. | ||

| American Century Variable Portfolios II, Inc. | ||||

| VP Inflation Protection Fund – Class II Shares | American Century Investment Management, Inc. | The fund pursues long-term total return using a strategy that seeks to protect against U.S. inflation. | ||

| American Funds Insurance Series® | ||||

| Capital World Bond Fund – Class 2 Shares | Capital Research and Management Company | The fund’s investment objective is to provide you, over the long term, with a high level of total return consistent with prudent investment management. Total return comprises the income generated by the fund and the changes in the market value of the fund’s investments. | ||

| Global Growth Fund – Class 2 Shares | Capital Research and Management Company | The fund’s investment objective is to provide long-term growth of capital. | ||

| Global Small Capitalization Fund – Class 2 Shares | Capital Research and Management Company | The fund’s investment objective is to provide long-term growth of capital. | ||

| Growth Fund – Class 2 Shares | Capital Research and Management Company | The fund’s investment objective is to provide growth of capital. | ||

| Growth-Income Fund – Class 2 Shares | Capital Research and Management Company | The fund’s investment objectives are to achieve long-term growth of capital and income. | ||

| International Fund – Class 2 Shares | Capital Research and Management Company | The fund’s investment objective is to provide long-term growth of capital. | ||

| New World Fund® – Class 2 Shares | Capital Research and Management Company | The fund’s investment objective is long-term capital appreciation. | ||

| U.S. Government Securities Fund – Class 2 Shares | Capital Research and Management Company | The fund’s investment objective is to provide a high level of current income consistent with prudent investment risk and preservation of capital. | ||

| BlackRock Variable Insurance Funds, Inc. | ||||

| BlackRock International Index V.I. Fund – Class III Shares | BlackRock Advisors, LLC | Seeks to match the performance of the MSCI EAFE Index (Europe, Australasia, Far East) (the “MSCI EAFE Index” or the “Underlying Index”) in U.S. dollars with net dividends as closely as possible before the deduction of Fund expenses. | ||

| BlackRock Small Cap Index V.I. Fund – Class III Shares | BlackRock Advisors, LLC | Seeks to match the performance of the Russell 2000® Index (the “Russell 2000” or the “Underlying Index”) as closely as possible before the deduction of Fund expenses. | ||

| Fidelity ® Variable Insurance Products Funds | ||||

| Bond Index Portfolio – Service Class 2 Shares | Fidelity

Management & Research Company LLC (FMR) Sub-Adviser: Other investment advisers serve as sub-advisers for the fund. |

Seeks to provide investment results that correspond to the aggregate price and interest performance of the debt securities in the Bloomberg Barclays U.S. Aggregate Bond Index. |

| Fund Name | Investment

Adviser |

Investment

Objective | ||

| Equity-Income Portfolio – Service Class 2 Shares | Fidelity

Management & Research Company LLC (FMR) Sub-Adviser: Other investment advisers serve as sub-advisers for the fund. |

Seeks reasonable income and the potential for capital appreciation. The fund’s goal is to achieve a yield which exceeds the composite yield on the securities comprising the Standard & Poor’s 500SM Index (S&P 500®). | ||

| Mid Cap Portfolio – Service Class 2 Shares | Fidelity

Management & Research Company LLC (FMR) Sub-Adviser: Other investment advisers serve as sub-advisers for the fund. |

Seeks long-term growth of capital. | ||

| Franklin Templeton Variable Insurance Products Trust | ||||

| Franklin Small Cap Value VIP Fund – Class 2 Shares | Franklin Mutual Advisers, LLC | Seeks long-term total return. | ||

| Templeton Developing Markets VIP Fund – Class 2 Shares | Franklin Templeton Investment Management Limited | Seeks long-term capital appreciation. | ||

| Goldman Sachs Variable Insurance Trust | ||||

| Goldman Sachs VIT Global Trends Allocation Fund – Service Shares | Goldman Sachs Asset Management, L.P. | Seeks total return while seeking to provide volatility management. | ||

| Goldman Sachs VIT High Quality Floating Rate Fund – Service Shares | Goldman Sachs Asset Management, L.P. | Seeks to provide a high level of current income, consistent with low volatility of principal. | ||

| Ivy Variable Insurance Portfolios | ||||

| Ivy VIP Asset Strategy – Class II Shares | Ivy Investment Management Company | To seek to provide total return. | ||

| Ivy VIP Balanced – Class II Shares | Ivy Investment Management Company | To seek to provide total return through a combination of capital appreciation and current income. | ||

| Ivy VIP Core Equity – Class II Shares | Ivy Investment Management Company | To seek to provide capital growth and appreciation. | ||

| Ivy VIP Global Growth – Class II Shares | Ivy Investment Management Company | To seek to provide growth of capital. | ||

| Ivy VIP High Income – Class II Shares | Ivy Investment Management Company | To seek to provide total return through a combination of high current income and capital appreciation. | ||

| Ivy VIP International Core Equity – Class II Shares | Ivy Investment Management Company | To seek to provide capital growth and appreciation. | ||

| Ivy VIP Mid Cap Growth – Class II Shares | Ivy Investment Management Company | To seek to provide growth of capital. | ||

| Ivy VIP Natural Resources – Class II Shares | Ivy Investment Management Company | To seek to provide capital growth and appreciation. | ||

| Ivy VIP Science and Technology – Class II Shares | Ivy Investment Management Company | To seek to provide growth of capital. | ||

| Ivy VIP Small Cap Core – Class II Shares | Ivy Investment Management Company | To seek to provide capital appreciation. | ||

| Ivy VIP Small Cap Growth – Class II Shares | Ivy Investment Management Company | To seek to provide growth of capital. | ||

| Ivy VIP Value – Class II Shares | Ivy Investment Management Company | To seek to provide capital appreciation. | ||

| Ivy VIP Pathfinder Moderate – Managed Volatility – Class II Shares* | Ivy

Investment Management Company Sub-Adviser: Securian Asset Management, Inc. |

To seek to provide total return consistent with a moderate level of risk as compared to the other Ivy VIP Pathfinder Managed Volatility Portfolios, while seeking to manage volatility of investment return. |

| Fund Name | Investment

Adviser |

Investment

Objective | ||

| Ivy VIP Pathfinder Moderately Aggressive – Managed Volatility – Class II Shares* | Ivy

Investment Management Company Sub-Adviser: Securian Asset Management, Inc. |

Seeks to provide growth of capital, but also to seek income consistent with a moderately aggressive level of risk as compared to the other Ivy VIP Pathfinder Managed Volatility Portfolios, while seeking to manage volatility of investment return. | ||

| Ivy VIP Pathfinder Moderately Conservative – Managed Volatility – Class II Shares* | Ivy

Investment Management Company Sub-Adviser: Securian Asset Management, Inc. |

Seeks to provide total return consistent with a moderately conservative level of risk as compared to the other Ivy VIP Pathfinder Managed Volatility Portfolios, while seeking to manage volatility of investment return. | ||

| Janus Aspen Series | ||||

| Janus Henderson Balanced Portfolio – Service Shares | Janus Capital Management LLC | Seeks long-term capital growth, consistent with preservation of capital and balanced by current income. | ||

| Janus Henderson Flexible Bond Portfolio – Service Shares | Janus Capital Management LLC | Seeks to obtain maximum total return, consistent with preservation of capital. | ||

| Janus Henderson Forty Portfolio – Service Shares | Janus Capital Management LLC | Seeks long-term growth of capital. | ||

| Janus Henderson Mid Cap Value Portfolio – Service Shares | Janus Capital Management LLC | Seeks capital appreciation. | ||

| Janus Henderson Overseas Portfolio – Service Shares | Janus Capital Management LLC | Seeks long-term growth of capital. | ||

| Legg Mason Partners Variable Equity Trust | ||||

| ClearBridge Variable Small Cap Growth Portfolio – Class II Shares | Legg

Mason Partners Fund Advisor, LLC Sub-Adviser: ClearBridge Investments, LLC |

Seeks long-term growth of capital. | ||

| MFS ® Variable Insurance Trust II | ||||

| MFS ® International Intrinsic Value Portfolio – Service Class | Massachusetts Financial Services Company | To seek capital appreciation. | ||

| Morgan Stanley Variable Insurance Fund, Inc. | ||||

| Emerging Markets Equity Portfolio – Class II Shares | Morgan

Stanley Investment Management Inc. Sub-Adviser: Morgan Stanley Investment Management Company |

Seeks long-term capital appreciation by investing primarily in growth-oriented equity securities of issuers in emerging market countries. | ||

| Neuberger Berman Advisers Management Trust | ||||

| Neuberger Berman AMT Sustainable Equity Portfolio – S Class Shares | Neuberger Berman Investment Advisers LLC | The fund seeks long-term growth of capital by investing primarily in securities of companies that meet the Fund’s financial criteria and social policy. | ||

| Northern Lights Variable Trust (TOPS) | ||||

| TOPS ® Managed Risk Balanced ETF Portfolio – Class 2 Shares* | ValMark

Advisers, Inc. Sub-Adviser: Milliman, Inc. |

Seeks to provide income and capital appreciation with less volatility than the fixed income and equity markets as a whole. |

| Fund Name | Investment

Adviser |

Investment

Objective | ||

| TOPS ® Managed Risk Flex ETF Portfolio* | ValMark

Advisers, Inc. Sub-Adviser: Milliman, Inc. |

Seeks to provide income and capital appreciation with less volatility than the fixed income and equity markets as a whole. | ||

| TOPS ® Managed Risk Growth ETF Portfolio – Class 2 Shares* | ValMark

Advisers, Inc. Sub-Adviser: Milliman, Inc. |

Seeks capital appreciation with less volatility than the equity markets as a whole. | ||

| TOPS ® Managed Risk Moderate Growth ETF Portfolio – Class 2 Shares* | ValMark

Advisers, Inc. Sub-Adviser: Milliman, Inc. |

Seeks capital appreciation with less volatility than the equity markets as a whole. | ||

| PIMCO Variable Insurance Trust | ||||

| PIMCO VIT Global Diversified Allocation Portfolio – Advisor Class Shares* | Pacific Investment Management Company LLC (“PIMCO”) | Seeks to maximize risk-adjusted total return relative to a blend of 60% MSCI World Index 40% Bloomberg Barclays U.S. Aggregate Index. | ||

| PIMCO VIT Low Duration Portfolio – Advisor Class Shares | Pacific Investment Management Company LLC (“PIMCO”) | Seeks maximum total return, consistent with preservation of capital and prudent investment management. | ||

| PIMCO VIT Total Return Portfolio – Advisor Class Shares | Pacific Investment Management Company LLC (“PIMCO”) | Seeks maximum total return, consistent with preservation of capital and prudent investment management. | ||

| Putnam Variable Trust | ||||

| Putnam VT Growth Opportunities Fund – Class IB Shares | Putnam Investment Management, LLC | Seeks capital appreciation. | ||

| Putnam VT International Value Fund – Class IB Shares | Putnam Investment Management, LLC | Seeks growth of capital. Current income is a secondary objective. | ||

| Putnam VT Large Cap Value Fund – Class IB Shares | Putnam Investment Management, LLC | Seeks capital growth and current income. | ||

| Securian Funds Trust | ||||

| SFT Balanced Stabilization Fund* | Securian Asset Management, Inc. | Seeks to maximize risk-adjusted total return relative to its blended benchmark index comprised of 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index (the Benchmark Index). | ||

| SFT Core Bond Fund – Class 2 Shares | Securian Asset Management, Inc. | Seeks as high a level of a long-term total rate of return as is consistent with prudent investment risk. The Portfolio also seeks preservation of capital as a secondary objective. | ||

| SFT Equity Stabilization Fund* | Securian Asset Management, Inc. | Seeks to maximize risk-adjusted total return relative to its blended benchmark index, comprised of 60% S&P 500 Low Volatility Index, 20% S&P BMI International Developed Low Volatility Index and 20% Bloomberg Barclays U.S. 3 Month Treasury Bellwether Index (the Benchmark Index). | ||

| SFT Government Money Market Fund | Securian Asset Management, Inc. | Seeks maximum current income to the extent consistent with liquidity and the preservation of capital. (1) |

| Fund Name | Investment

Adviser |

Investment

Objective | ||

| SFT Index 400 Mid-Cap Fund – Class 2 Shares | Securian Asset Management, Inc. | Seeks investment results generally corresponding to the aggregate price and dividend performance of the publicly traded common stocks that comprise the Standard & Poor’s 400 MidCap Index (the S&P 400). | ||

| SFT Index 500 Fund – Class 2 Shares | Securian Asset Management, Inc. | Seeks investment results that correspond generally to the price and yield performance of the common stocks included in the Standard & Poor’s 500 Composite Stock Price Index (the S&P 500). | ||

| SFT International Bond Fund – Class 2 Shares | Securian

Asset Management, Inc. Sub-Adviser: Brandywine Global Investment Management, LLC |

Seeks to maximize current income, consistent with the protection of principal. | ||

| SFT IvySM Growth Fund | Securian

Asset Management, Inc. Sub-Adviser: Ivy Investment Management Company |

Seeks to provide growth of capital. | ||

| SFT IvySM Small Cap Growth Fund | Securian

Asset Management, Inc. Sub-Adviser: Ivy Investment Management Company |

Seeks to provide growth of capital. | ||

| SFT Real Estate Securities Fund – Class 2 Shares | Securian Asset Management, Inc. | Seeks above average income and long-term growth of capital. | ||

| SFT T. Rowe Price Value Fund | Securian

Asset Management, Inc. Sub-Adviser: T. Rowe Price Associates, Inc. |

Seeks to provide long-term capital appreciation by investing in common stocks believed to be undervalued. Income is a secondary objective. | ||

| SFT Wellington Core Equity Fund – Class 2 Shares | Securian

Asset Management, Inc. Sub-Adviser: Wellington Management Company LLP |

Seeks growth of capital. |

| * | This Fund employs a managed volatility strategy. |

| (1) | Although the SFT Government Money Market Fund seeks to preserve its net asset value at $1.00, per share, it cannot guarantee it will do so. An investment in the SFT Government Money Market Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any government agency. The SFT Government Money Market Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the SFT Government Money Market Fund at any time. In addition, because of expenses incurred by sub-accounts in the Variable Annuity Account, during extended periods of low interest rates, the yield of the sub-account that invests in the SFT Government Money Market Fund may become extremely low and possibly negative. |

| (1) | your application or instructions fail to specify which Portfolios you desire, or is otherwise incomplete, or |

| (2) | you do not consent to our retention of your payment until the application or instructions are made complete and in “good order.” |

| i. | For example, you may request that Minnesota Life hold any amounts received, in a non-interest bearing account, and delay issuing the Contract until the full initial Purchase |

| Payment is received. This election eliminates the possibility of a particular source of funds being allocated to the Indexed Accounts, and subsequent receipt from another source being allocated to the Interim Account. | |

| ii. | Purchase Payments subsequent to your initial payment must be at least $500 regardless of whether it is a Qualified or Non-Qualified Contract. Total Purchase Payments may not exceed $2,000,000 for the benefit of the same Owner or Annuitant except with our consent. For purposes of this limitation, we may aggregate other Minnesota Life annuity contracts with this one. Additional Purchase Payments will not be accepted while either the Owner or Joint Owner qualifies under the hospital and medical care or terminal condition provisions for the waiver of any deferred sales charges. |

| • | the dollar amount of the transfer(s); |

| • | whether the transfers are part of a pattern of transfers that appear designed to take advantage of market inefficiencies; |

| • | whether an underlying Portfolio has requested that we look into identified unusual or frequent activity in a Portfolio; |

| • | the number of transfers in the previous calendar quarter; |

| • | whether the transfers during a quarter constitute more than two “round trips” in a particular Portfolio. A round trip is a purchase into a Portfolio and a subsequent redemption out of the Portfolio, without regard to order. |

| Transaction

Date |

Transaction | DCA

Fixed Account Before Activity |

Purchase

Payments Allocated to DCA Fixed Account |

Transfer

to Selected Sub- Accounts |

DCA

Fixed Account After Activity | |||||

| June 1 | Purchase

Payment |

— | 20,000.00 | — | 20,000.00 | |||||

| July 1 | Monthly

Transfer |

20,032.58 | — | 1,669.38

(=20,032.58/12) |

18,363.20 | |||||

| August 1 | Monthly

Transfer |

18,394.11 | — | 1,672.19

(=18,394.11/11) |

16,721.92 | |||||

| August 15 | Purchase

Payment |

16,734.63 | 10,000.00 | — | 26,734.63 | |||||

| September 1 | Monthly

Transfer |

26,759.30 | — | 2,675.93

(=26,759.30/10) |

24,083.37 |

| • | days on which changes in the value of that Portfolio’s securities will not materially affect the current net asset value of that Portfolio’s shares; |

| • | days during which none of that Portfolio’s shares are tendered for redemption and no order to purchase or sell that Portfolio’s shares is received by that Portfolio; and |

| • | customary national business holidays on which the Exchange is closed for trading. |

| • | the value of that Accumulation Unit on the immediately preceding Valuation Date by, |

| • | the Net Investment Factor for the applicable Sub-Account (described below) for the valuation period just ended. |

| • | the net asset value per share of a Portfolio share held in a Sub-Account of the Variable Annuity Account determined at the end of the current valuation period, plus |

| • | the per share amount of any dividend or capital gain distribution by the Portfolio if the “ex-dividend” date occurs during the current valuation period, divided by, |

| • | the net asset value per share of that Portfolio share determined at the end of the preceding valuation period. |

| (a) | is the value of the Index at the end of the Contract Year, and |

| (b) | is the value of the Index at the beginning of the Contract Year. |

| 1. | The Cap for the Contract Year, if applicable; or |

| 2. | The result of A multiplied by B, where: |

| A | is the Index Change; and |

| B | is the Participation Rate for the Contract Year. |

| • | The value of the S&P 500® Index at the beginning of the Contract Year is 1,000; |

| • | The value of the S&P 500® at the end of the of the Contract Year is 1,075; |

| • | The Cap for the Contract Year is 5.00%, or 0.05; |

| • | No Participation Rate is specified; and |

| • | The Indexed Account value at the end of the Contract Year is $25,000. |

| • | The value of the S&P 500® Index at the beginning of the Contract Year is 1,000; |

| • | The value of the S&P 500® at the end of the of the Contract Year is 1,025; |

| • | The Cap for the Contract Year is 5.00%, or 0.05; |

| • | No Participation Rate is specified; and |

| • | The Indexed Account value at the end of the Contract Year is $25,000. |

| • | The value of the Barclays All Caps Trailblazer 5 Index at the beginning of the Contract Year is 1,000; |

| • | The value of the Barclays All Caps Trailblazer 5 Index at the end of the of the Contract Year is 1,120; |

| • | No Cap is specified; |

| • | The Participation Rate is 85%, or 0.85; and |

| • | The Indexed Account value at the end of the Contract Year is $25,000. |

| • | The value of the S&P 500® Index at the beginning of the Contract Year is 1,000; |

| • | The value of the S&P 500® at the end of the of the Contract Year is 950; |

| • | The Cap for the Contract Year is 5.00%, or 0.05; |

| • | No Participation Rate is specified; and |

| • | The Indexed Account value at the end of the Contract Year is $25,000. |

| • | on withdrawals where a systematic withdrawal program is in place and the smaller amount satisfies the minimum distribution requirements of the Code, or |

| • | when the withdrawal is requested because of an excess contribution to a Qualified Contract. |

| • | no Purchase Payments are made for a period of two or more full Contract Years, and |

| • | the total Purchase Payments made, less any withdrawals and associated charges, are less than $2,000, and |

| • | the Contract Value of the contract is less than $2,000. |

| • | your interest may not be assigned, sold, transferred, discounted or pledged as collateral for a loan or as security for the performance of an obligation or for any other purpose, and |

| • | to the maximum extent permitted by law, benefits payable under the contract shall be exempt from the claims of creditors. |

| • | any period during which the Exchange is closed other than customary weekend and holiday closings, or during which trading on the Exchange is restricted, as determined by the SEC; |

| • | any period during which an emergency exists as determined by the SEC as a result of which it is not reasonably practical to dispose of securities in the Portfolio(s) or to fairly determine the value of the assets of the Portfolio(s); or |

| • | other periods as permitted or ordered by the SEC for the protection of the Owners. |

| Years Since Purchase Payment | DSC | |

| 0-1 | 8% | |

| 1-2 | 8% | |

| 2-3 | 7% | |

| 3-4 | 6% | |

| 4-5 | 5% | |

| 5 and thereafter | 0% |

| • | calculating the number of years each Purchase Payment being withdrawn has been in the contract; |

| • | multiplying each Purchase Payment withdrawn by the appropriate sales charge percentage in the table; and |

| • | adding the DSC from all Purchase Payments so calculated. This amount is then deducted from your Contract Value. |

| • | Amounts withdrawn in any Contract Year that are less than or equal to the annual “free amount”. The free amount is equal to 10% of any Purchase Payments not previously withdrawn and received by us during the current Contract Year plus the greater of: (1) Contract Value less Purchase Payments not previously withdrawn, each as of the most recent Contract Anniversary; or (2) 10% of the sum of Purchase Payments not previously withdrawn and still subject to DSC as of the most recent Contract Anniversary. The free withdrawal does not apply to surrenders. |

| • | The difference, in any Contract Year, between a required minimum distribution due (according to Internal Revenue Service (IRS) rules) on this contract for a single calendar year and any annual “free amount” allowed. However, if you withdraw the required minimum distribution for two calendar years in a single Contract Year, DSC may apply. Amounts withdrawn to satisfy the required minimum distribution will reduce the free amount available for the Contract Year. We may modify or eliminate this right if there is any change to the Code or regulations regarding required minimum distributions, including guidance issued by the IRS. |

| • | Amounts withdrawn to pay the annual maintenance fee or any transfer charge. |

| • | Amounts payable as a death benefit upon the death of the Owner or the Annuitant, if applicable. |

| • | Amounts applied to provide Annuity Payments under an annuity option. |

| • | Amounts withdrawn because of an excess contribution to a tax-qualified contract (including, for example, IRAs). |

| • | A surrender or withdrawal requested any time after the first Contract Anniversary and if you meet the requirements of a qualifying confinement in a hospital or medical care facility as described below. |

| • | A surrender or withdrawal requested any time after the first Contract Anniversary and in the event that you are diagnosed with a terminal condition as described below. |

| • | A surrender or withdrawal requested during the Acceleration Period if you have purchased Premier Protector. |

| • | A surrender or withdrawal requested while the Enhanced Liquidity Option is effective. |

| • | prescribed by a licensed Physician in writing; and |

| • | based on physical limitations which prohibit daily living in a non-institutional setting. |

| • | is diagnosed by a licensed Physician; and |

| • | is expected to result in death within 12 months. |

| • | If you purchase Premier Protector, we will deduct a charge on a quarterly basis for expenses related to this optional benefit. The annual Premier Protector charge is equal to 0.90% of the Premier Protector DB value. Beginning three months after the rider effective date, and every three months thereafter, an amount equal to one quarter of the Premier Protector DB charge (0.225%) will be multiplied by the Premier Protector DB value on that date and will be deducted proportionately from Contract Values allocated to the Variable Annuity Account. See the section of this Prospectus entitled “Death Benefits — Optional Death Benefits” for details on how the Premier Protector DB value is determined. The charge does not apply after annuitization, or in the case of a partial annuitization, to the portion of your contract annuitized. Additionally, the charge does not apply during the Acceleration Period. See the section entitled “Death Benefits — Optional Death Benefit Riders” for details on the Acceleration Period. At rider termination, a portion of the charge for the period of time between the last quarterly charge and the date of termination will be deducted. |

| • | If you purchase the ROPP DB optional death benefit, we will deduct an ROPP DB charge on a quarterly basis for expenses related to this optional benefit. The annual rider charge is based on the issue age of the oldest Owner and will not change for the life of the Contract. If the Owner is not a natural person, the Annuitant will be treated as the Owner for the purposes of determining the rider charge. The annual ROPP DB charge is equal to 0.15% (0.40% for ages 71-80) of the ROPP DB. Beginning three months after the rider effective date, and every three months thereafter, an amount equal to one quarter of the ROPP DB charge (0.0375%, 0.1% for ages 71-80) will be multiplied by the ROPP DB on that date and will be deducted proportionately from Contract Values allocated to the Variable Annuity Account, Indexed Accounts and Guaranteed Interest Accounts. See the section of this Prospectus entitled “Death Benefits — Optional Death |

| Benefit Rider” for details on how the ROPP DB is determined. The charge does not apply after annuitization, or in the case of a partial annuitization to the portion of your Contract annuitized. In the event that the rider terminates prior to the charge being taken for the period, a proportionate amount of the charge will be taken for the period. |

| • | If you purchase the Enhanced Liquidity Option, we will deduct a charge on a quarterly basis for expenses related to this optional benefit. The annual Enhanced Liquidity Option charge is 0.45%. Beginning three months after the Rider Effective Date, and every three months thereafter, unless otherwise terminated, an amount equal to one quarter of the annual rider charge (0.1125%) will be multiplied by the Contract Value and deducted on a proportional basis from Contract Values allocated to the Variable Account, Guaranteed Interest Accounts, and the Indexed Accounts. Before electing this optional rider, please consider whether you value the flexibility to take large withdrawals, or surrender the Contract, without being assessed a deferred sales charge during the 5-year deferred sales charge period. See the section entitled “Other Optional Benefit Riders” for a description of the benefits, limitations, and restrictions of the Enhanced Liquidity Option. |

| a) | the Assumed Investment Return (AIR) and mortality table specified in the contract, |

| b) | the age and gender of the Annuitant and any joint Annuitant, |

| c) | the type of Annuity Payment option you select, and |

| d) | the investment performance of the Portfolios you select. |

| (a) | the value of the Annuity Unit for that Sub-Account for the preceding Valuation Date by; |

| (b) | the Net Investment Factor for that Sub-Account for the Valuation Date for which the Annuity Unit value is being calculated; and by |

| (c) | a factor that neutralizes the Assumed Investment Return. This factor reverses the Assumed Investment Return (AIR) which is used to calculate the initial variable payment and Annuity Units. It substitutes the performance of the underlying Funds in place of the AIR to determine the increase or decrease in the value of the Annuity Units. |

| • | We must receive the written request for an annuity transfer in the home office at least 3 days in advance of the due date of the Annuity Payment subject to the transfer. A transfer request received less than 3 days prior to the Annuity Payment due date will be made as of the next Annuity Payment due date. |

| • | Your transfer must be for the lesser of $1,000 or the entire reserve amount in the applicable Sub-Account. |

| (a) | the Contract Value; or |

| (b) | the total GMSV for the Indexed Accounts plus the Contract Values of the Variable Sub-Accounts and Guaranteed Interest Accounts; or |

| (c) | if you purchased an optional death benefit when your contract was issued, the value due under the selected optional death benefit rider. (See the section entitled “Optional Death Benefit Riders” for details of this calculation.) |

| If: | Then: |

| The

Owner dies; and • there is a surviving Joint Owner; and • the Annuitant is either living or deceased. |

The Joint Owner receives the death benefit |

| The

Owner dies; and • there is no Joint Owner; and • the Annuitant is either living or deceased. |

The designated beneficiary receives the death benefit |

| The

Owner dies; and • there is no Joint Owner and • there is no designated beneficiary (or all of the beneficiaries pre-decease the Owner); and • the Annuitant is either living or deceased |

Owner’s estate receives the death benefit |

| The

Annuitant dies; and • Owner is living |

The Owner may name a new Annuitant |

| The

Annuitant dies; and • the Owner is not a natural person, such as a trust |

The designated beneficiary receives the death benefit |

| The

Annuitant dies; and • the Owner is not a natural person, such as a trust; and • there is no designated beneficiary (or all of the beneficiaries pre-decease the Annuitant) |

The Owner receives the death benefit |

| Optional

Death Benefit Riders |

Optional

Death Benefit Riders it may be Elected With |

| Premier Protector DB | None |

| ROPP | None |

| • | This death benefit is not long term care or nursing home insurance. |

| • | This death benefit may not be elected if, at the time of application, either Owner (or Annuitant in the case of an Owner who is not a natural person): |

| a) | Cannot perform all of the Activities of Daily Living; or |

| b) | Is confined to a nursing home or skilled nursing facility. |

| • | The death benefit may not be accelerated during the one year period following contract issue. |

| • | Withdrawals or surrender of Contract Value during the acceleration period will be subject to taxation in the same manner as any other withdrawal. You may wish to consult your tax advisor before electing to accelerate your benefit. |

| (a) | the date we receive due proof of death; |

| (b) | the date the acceleration period begins; or |

| (c) | the Last Increase Date which is the Contract Anniversary on or following the 85th birthday of the oldest Owner or the oldest Annuitant, in the case of an Owner who is not a natural person. |

| — | Chronic Illness is a permanent condition where the individual is: |

| • | Unable to perform, without substantial assistance from another person, at least two Activities of Daily Living due to loss of functional capacity; or |

| • | Requires substantial supervision to protect the individual from threats to health and safety due to severe cognitive impairment. |

| — | Terminal Illness is a diagnosis expected to result in death within 12 months. |

| (a) | the date we receive due proof of death of either Owner (or either Annuitant in the case of an Owner who is not a natural person); |

| (b) | termination or surrender of the contract; |

| (c) | the Annuity Commencement Date where all remaining amount available has been applied to provide Annuity Payments; |

| (d) | the Contract Value equals zero; or |

| (e) | the date of an ownership change or assignment under the contract unless: |

| • | the new Owner assumes full ownership of the contract and is essentially the same person (this includes but is not limited to the change from individual ownership to a revocable trust for the benefit of such individual Owner or the change from joint ownership to ownership by the surviving spouse when one of them dies); or |

| • | the assignment is for the purposes of effectuating a 1035 exchange of the contract. |

| (a) | the date we receive due proof of death of any remaining Owner who satisfied Accelerated Benefit Eligibility; |

| (b) | the date we receive due proof of death of either Annuitant in the case of an Owner who is not a natural person; |

| (c) | termination or surrender of the contract; |

| (d) | the Annuity Commencement Date where all remaining amount available has been applied to provide Annuity Payments; |

| (e) | the Contract Value equals zero; or |

| (f) | the date of an ownership change or assignment under the contract unless: |

| • | the new Owner assumes full ownership of the contract and is essentially the same person (this includes but is not limited to the change from individual ownership to a revocable trust for the benefit of such individual Owner or the change from joint ownership to ownership by the surviving spouse when one of them dies); or the assignment is for the purposes of effectuating a 1035 exchange of the contract. |

| • | the payment of all death benefits available under the Contract or optional death benefit riders; |

| • | termination or surrender of the Contract; |

| • | the Annuity Commencement Date where all remaining Contract Value has been applied to provide Annuity Payments; |

| • | the Contract Value equals zero; or |

| • | the date of an ownership change or assignment under the Contract unless: (a) the new Owner assumes full ownership of the Contract and is essentially the same person (this includes, but is not limited to, the change from individual ownership to a revocable trust for the benefit of such individual Owner or the change from joint ownership to ownership by the surviving spouse when one of them dies); or (b) the assignment is for the purposes of effectuating a 1035 exchange of the Contract. |

| (a) | the payment of all death benefits available under the contract and/or any attached riders; or |

| (b) | termination or surrender of the Contract; or |

| (c) | the Annuity Commencement Date where all remaining amount available has been applied to provide Annuity Payments; or |

| (d) | the Contract Value equals zero; or |

| (e) | the date on which we receive written notice from you to terminate the rider, provided such date is after all deferred sales charges in your Contract have expired. |

CRI Securities, LLC

| Additional Payment Type | Description or examples of payment |

| Payments for Access or Visibility | Access to registered representatives and/or broker dealers such as one-on-one wholesaler visits or attendance at national/regional sales meetings or similar events; inclusion of our products on a broker-dealer’s “preferred list”; participation in or visibility at national and/or regional conferences; articles in broker-dealer or similar publications promoting our services or products |

| Payments for Gifts & Entertainment | Occasional meals and/or entertainment, tickets to sporting/other events, and other gifts. |

| Payments for Marketing Support | Joint marketing campaigns, broker-dealer event participation/advertising; sponsorship of broker-dealer sales contests or promotions in which participants (including registered representatives) receive prizes such as travel, awards, merchandise or other recognition |

| Payments for Technical Type Support | Sales support through the provision of hardware, software, or links to our websites from broker-dealer websites and other expense allowance or reimbursement |

| Additional Payment Type | Description or examples of payment |

| Payments for Training | Educational, due diligence, sales or training seminars, conferences and programs, sales and service desk training, and/or client or prospect seminar sponsorships. |

| • | where the taxpayer is 59 ½ or older, |

| • | where payment is made on account of the taxpayer’s disability, or |

| • | where payment is made by reason of the death of the Owner, and |

| • | in certain other circumstances. |

| (a) | if an Owner dies on or after the annuity starting date but prior to the time the entire interest in the contract has been distributed, the remaining portion of such interest will be distributed at least as rapidly as under the method of distribution being used as of the date of that Owner’s death; and |

| (b) | if an Owner dies prior to the annuity starting date, the entire interest in the contract must be distributed within five years after the date of the Owner’s death. |

| • | contributions in excess of specified limits; |

| • | distributions prior to age 59 ½ (subject to certain exceptions); |

| • | distributions that do not conform to specified minimum distribution rules; and |

| • | other specified circumstances. |

| • | one of a series of substantially equal annual (or more frequent) payments made: |

| — | over the life or life expectancy of the employee, |

| — | over the joint lives or joint life expectancies of the employee and the employee’s designated beneficiary, or |

| — | for a specified period of ten years or more, |

| • | a required minimum distribution, |

| • | a hardship distribution, or |

| • | the non-taxable portion of a distribution. |

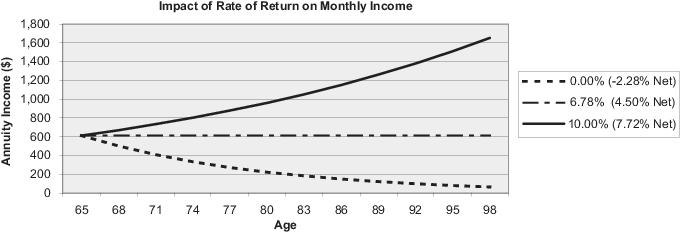

Variable Contribution: $100,000.00

Initial Variable Monthly Income: $612.09

| Monthly Annuity Income Based on Hypothetical Rate of Return | ||||||||

| Beginning of Year | Age | 0.00%

Gross (-2.28% Net) |

6.78%

Gross (4.50% Net) |

10.00%

Gross (7.72% Net) | ||||

|

1 |

65 | $ 612 | $612 | $ 612 | ||||

|

4 |

68 | $ 501 | $612 | $ 670 | ||||

|

7 |

71 | $409 | $612 | $ 734 | ||||

|

10 |

74 | $335 | $612 | $ 804 | ||||

|

13 |

77 | $274 | $612 | $ 881 | ||||

|

16 |

80 | $224 | $612 | $ 965 | ||||

|

19 |

83 | $183 | $612 | $1,057 | ||||

|

22 |

86 | $150 | $612 | $1,158 | ||||

|

25 |

89 | $122 | $612 | $1,268 | ||||

|

28 |

92 | $ 100 | $612 | $1,389 | ||||

|

31 |

95 | $ 82 | $612 | $ 1,521 | ||||

|

34 |

98 | $ 67 | $612 | $1,666 | ||||

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Highest

Anniversary Value |

4%

Increase Value |

Premier

Protector Death Benefit | ||||||||

| Beginning of Year 1 | 72 | — | $100,000 | — | $ 100,000 | $ 100,000 | $ 100,000 | $100,000 | ||||||||

| Beginning of Year 2 | 73 | $ 108,000 | — | — | $ 108,000 | $ 108,000 | $ 104,000 | $108,000 | ||||||||

| Beginning of Year 3 | 74 | $ 119,000 | — | — | $ 119,000 | $ 119,000 | $ 108,160 | $119,000 | ||||||||

| Beginning of Year 4 | 75 | $125,000 | — | — | $125,000 | $125,000 | $ 112,486 | $125,000 | ||||||||

| Beginning of Year 5 | 76 | $ 112,000 | — | — | $ 112,000 | $125,000 | $ 116,986 | $125,000 | ||||||||

| Beginning of Year 6 | 77 | $ 102,000 | — | — | $ 102,000 | $125,000 | $ 121,665 | $125,000 | ||||||||

| Beginning of Year 7 | 78 | $ 121,000 | — | — | $ 121,000 | $125,000 | $126,532 | $126,532 | ||||||||

| Beginning of Year 8 | 79 | $155,000 | — | — | $155,000 | $155,000 | $ 131,593 | $155,000 | ||||||||

| Beginning of Year 9 | 80 | $130,000 | — | — | $130,000 | $155,000 | $136,857 | $155,000 | ||||||||

| Beginning of Year 10 | 81 | $140,000 | — | — | $140,000 | $155,000 | $ 142,331 | $155,000 | ||||||||

| Beginning of Year 11 | 82 | $156,000 | — | — | $156,000 | $156,000 | $148,024 | $156,000 | ||||||||

| Beginning of Year 12 | 83 | $150,000 | — | — | $150,000 | $156,000 | $153,945 | $156,000 | ||||||||

| Beginning of Year 13 | 84 | $165,000 | — | — | $165,000 | $165,000 | $ 160,103 | $165,000 | ||||||||

| Beginning of Year 14 | 85 | $166,000 | — | — | $166,000 | $166,000 | $ 166,507 | $166,507 | ||||||||

| Beginning of Year 15 | 86 | $160,000 | — | — | $160,000 | $166,000 | $ 166,507 | $166,507 | ||||||||

| Beginning of Year 16 | 87 | $ 170,000 | — | — | $ 170,000 | $166,000 | $ 166,507 | $ 166,507 |

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Highest

Anniversary Value |

4%

Increase Value |

Premier

Protector Death Benefit | ||||||||

| Beginning of Year 1 | 67 | — | $100,000 | — | $100,000 | $100,000 | $100,000 | $100,000 |

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Highest

Anniversary Value |

4%

Increase Value |

Premier

Protector Death Benefit | ||||||||

| Beginning of Year 1 | 67 | — | $100,000 | — | $ 100,000 | $ 100,000 | $100,000 | $100,000 | ||||||||

| Activity 6 months later | 67 | $105,000 | $ 20,000 | — | $125,000 | $120,000 | $121,980 | $121,980 |

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Highest

Anniversary Value |

4%

Increase Value |

Premier

Protector Death Benefit | ||||||||

| Beginning of Year 1 | 67 | — | $100,000 | — | $ 100,000 | $ 100,000 | $ 100,000 | $100,000 | ||||||||

| Activity 6 months later | 67 | $ 105,000 | $ 20,000 | — | $125,000 | $120,000 | $ 121,980 | $121,980 | ||||||||

| Beginning of Year 2 | 68 | $130,000 | — | — | $130,000 | $130,000 | $124,396 | $130,000 |

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Highest

Anniversary Value |

4%

Increase Value |

Premier

Protector Death Benefit | ||||||||

| Beginning of Year 1 | 67 | — | $100,000 | — | $ 100,000 | $ 100,000 | $ 100,000 | $100,000 | ||||||||

| Activity 6 months later | 67 | $ 105,000 | $ 20,000 | — | $125,000 | $120,000 | $ 121,980 | $121,980 | ||||||||

| Beginning of Year 2 | 68 | $130,000 | — | — | $130,000 | $130,000 | $124,396 | $130,000 | ||||||||

| Activity 6 months later | 68 | $126,000 | — | $5,000 | $ 121,000 | $ 124,841 | $ 121,825 | $ 124,841 |

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Return

of Purchase Payments DB |

Death

Benefit Payable | |||||||

|

Beginning of Year 1

|

67 | $ 0 | $100,000 | — | $ 100,000 | $100,000 | $ 100,000 | |||||||

|

Beginning of Year 2

|

68 | $ 106,000 | $ 0 | — | $ 106,000 | $100,000 | $ 106,000 | |||||||

|

Beginning of Year 3

|

69 | $ 95,000 | $ 0 | — | $ 95,000 | $100,000 | $ 100,000 | |||||||

|

Beginning of Year 4

|

70 | $ 90,000 | $ 0 | — | $ 90,000 | $100,000 | $ 100,000 | |||||||

|

Beginning of Year 5

|

71 | $ 108,000 | $ 0 | — | $ 108,000 | $100,000 | $ 108,000 | |||||||

|

Beginning of Year 6

|

72 | $ 100,000 | $ 0 | — | $ 100,000 | $100,000 | $ 100,000 | |||||||

|

Beginning of Year 7

|

73 | $156,000 | $ 0 | — | $156,000 | $100,000 | $156,000 | |||||||

|

Beginning of Year 8

|

74 | $160,000 | $ 0 | — | $160,000 | $100,000 | $160,000 | |||||||

|

Beginning of Year 9

|

75 | $125,000 | $ 0 | — | $125,000 | $100,000 | $125,000 | |||||||

|

Beginning of Year 10

|

76 | $ 141,000 | $ 0 | — | $ 141,000 | $100,000 | $ 141,000 | |||||||

|

Beginning of Year 11

|

77 | $160,000 | $ 0 | — | $160,000 | $100,000 | $160,000 | |||||||

|

Beginning of Year 12

|

78 | $155,000 | $ 0 | — | $155,000 | $100,000 | $155,000 | |||||||

|

Beginning of Year 13

|

79 | $163,000 | $ 0 | — | $163,000 | $100,000 | $163,000 | |||||||

|

Beginning of Year 14

|

80 | $140,000 | $ 0 | — | $140,000 | $100,000 | $140,000 | |||||||

|

Beginning of Year 15

|

81 | $155,000 | $ 0 | — | $155,000 | $100,000 | $155,000 | |||||||

|

Beginning of Year 16

|

82 | $165,000 | $ 0 | — | $165,000 | $100,000 | $165,000 |

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Return

of Purchase Payments DB |

Death

Benefit Payable | |||||||

|

Beginning of Year 1

|

67 | — | $100,000 | — | $100,000 | $100,000 | $100,000 |

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Return

of Purchase Payments DB |

Death

Benefit Payable | |||||||

|

Beginning of Year 1

|

67 | — | $100,000 | — | $ 100,000 | $ 100,000 | $ 100,000 | |||||||

|

Activity 6 months later

|

67 | $105,000 | $ 20,000 | — | $125,000 | $120,000 | $125,000 |

| Contract Anniversary | Age | Contract

Value before Activity |

Purchase

Payments Received |

Withdrawal

Amount |

Contract

Value after Activity |

Return

of Purchase Payments DB |

Death

Benefit Payable | |||||||

|

Beginning of Year 1

|

67 | — | $100,000 | — | $ 100,000 | $ 100,000 | $ 100,000 | |||||||

|

Activity 6 months later

|

67 | $105,000 | $ 20,000 | — | $125,000 | $120,000 | $125,000 | |||||||

|

Beginning of Year 2

|

68 | $100,000 | — | — | $ 100,000 | $120,000 | $120,000 | |||||||

|

Activity 6 months later

|

68 | $ 115,000 | — | $5,000 | $ 110,000 | $ 114,783 | $ 114,783 |

(“MINNESOTA LIFE”)

| MOA Momentum | 1 |

| MOA Momentum | 2 |

6300 Lamar Avenue

Shawnee Mission, KS 66202

6600 Rockledge Drive, Sixth Floor

Bethesda, Maryland 20817-1806

29 Sawyer Road

Waltham, MA 02453

570 Ameriprise Financial Center

Minneapolis, MN 55474

200 North Sepulveda Boulevard, Suite 1200

El Segundo, CA 90245

FSC Securities Corporation

2300 Windy Ridge Pkwy, Suite 1000

Atlanta, GA 30339

| MOA Momentum | 3 |

130 Springside Drive, Suite 300

Akron, OK 44333

| T | = | (ERV/P) (1/N) - 1 |

| Where | T | = | average annual total return |

| MOA Momentum | 4 |

| ERV | = | ending redeemable value | |

| P | = | hypothetical initial payment of $1,000 | |

| N | = | number of years |

| [(BASE PERIOD RETURN + 1)365/7] - 1 |

| MOA Momentum | 5 |

| YIELD | = | 2[( a-b/cd + 1)6 - 1] |

| Where | a | = | net investment income earned during the period by the portfolio attributable to the sub-account. |

| b | = | expenses accrued for the period (net of reimbursements) | |

| c | = | the average daily number of sub-account units outstanding during the period that were entitled to receive dividends. | |

| d | = | the unit value of the sub-account units on the last day of the period. |

| MOA Momentum | 6 |

| MOA Momentum | 7 |

| (a) | Audited Financial Statements of Variable Annuity Account for the year ended December 31, 2020, are included in Part B of this filing and consist of the following: |

| 1. | Report of Independent Registered Public Accounting Firm. |

| 2. | Statements of Assets and Liabilities, as of December 31, 2020. |

| 3. | Statements of Operations, year or period ended December 31, 2020. |

| 4. | Statements of Changes in Net Assets, years or periods ended December 31, 2020 and 2019. |

| 5. | Notes to Financial Statements. |

| 1. | Independent Auditor’s Report – Minnesota Life Insurance Company. |

| 2. | Statutory Statements of Admitted Assets, Liabilities and Capital and Surplus – Minnesota Life Insurance Company, as of December 31, 2020 and 2019. |

| 3. | Statutory Statements Operations and Capital Surplus – Minnesota Life Insurance Company, for the years ended December 31, 2020, 2019, and 2018. |

| 4. | Statutory Statements of Cash Flow – Minnesota Life Insurance Company, for the years ended December 31, 2020, 2019, and 2018. |

| 5. | Notes to Statutory Financial Statements – Minnesota Life Insurance Company, for the years ended December 31, 2020, 2019, and 2018. |

| 6. | Schedule of Selected Financial Data – Minnesota Life Insurance Company as of December 31, 2020. |

| 7. | Schedule of Supplemental Investment Risks Interrogatories – Minnesota Life Insurance Company as of December 31, 2020. |

| 8. | Summary Investment Schedule – Minnesota Life Insurance Company as of December 31, 2020. |

| Name

and Principal Business Address |

Position

and Offices with the Depositor | |

| Erich

J. Axmacher Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President, Corporate Compliance Officer & Chief Privacy Officer | |

| Barbara

A. Baumann Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Vice President – Business Services | |

| Michael

P. Boyle Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President – Law | |

| Mary

K. Brainerd 1823 Park Avenue Mahtomedi, MN 55115 |

Director | |

| Kimberly

K. Carpenter Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President – CCO Individual Solutions | |

| Gary

R. Christensen Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Director, Attorney-in-Fact, Senior Vice President, General Counsel and Secretary |

| Name

and Principal Business Address |

Position

and Offices with the Depositor | |

| George

I. Connolly Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Executive Vice President – Individual Solutions | |

| Robert

J. Ehren Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Senior Vice President – Business Services | |

| Kristin

M. Ferguson Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President and Actuary – CFO Individual Solutions | |

| Benjamin

G.S. Fowke III Chairman, President and Chief Executive Officer Xcel Energy, Inc. 414 Nicollet Mall, 401-9 Minneapolis, MN 55401 |

Director | |

| Siddharth

S. Gandhi Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Senior Vice President – Chief Strategy and Enterprise Technology Officer | |

| Sara

H. Gavin President, North America Weber Shandwick 510 Marquette Avenue 13F Minneapolis, MN 55402 |

Director | |

| Mark

J. Geldernick Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Vice President and Chief Risk Officer | |

| Eric

B. Goodman 101 North 7th Street Suite 202 Louisville, KY 40202 |

Director | |

| Christopher

M. Hilger Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Director, Chairman of the Board, President and CEO | |

| Ann

McGarry Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President – Marketing | |

| Susan

M. Munson-Regala Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Vice President and Actuary – Affinity Solutions | |

| Ted

J. Nistler Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President and Treasurer |

| Name

and Principal Business Address |

Position

and Offices with the Depositor | |

| Kent

O. Peterson Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President and Actuary – CFO Retirement Solutions | |

| Trudy

A. Rautio 5000 France Avenue South #23 Edina, MN 55410-2060 |

Director | |

| Robert

L. Senkler 557 Portsmouth Court Naples, FL 34110 |

Director | |

| Bruce

P. Shay Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Executive Vice President | |

| Mark

W. Sievers Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President – Chief Audit Executive | |

| Mary

L. Streed Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Second Vice President – HRBP & Associate Experience | |

| Katia

O. Walsh Chief Strategy and Artificial Intelligence Officer, Global Leadership Team Levi Strauss & Co. 115 Battery Street San Francisco, CA 94111 |

Director | |

| Kevin

F. Warren Commissioner Big Ten Conference 5440 Park Place Rosemont, IL 60018 |

Director | |

| John

A. Yaggy Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Vice President and Controller | |

| Warren

J. Zaccaro Minnesota Life Insurance Company 400 Robert Street North St. Paul, MN 55101 |

Director, Executive Vice President and CFO |

Robert Street Property Management, Inc.

Securian Ventures, Inc.

Securian Asset Management, Inc.

Securian Financial Services, Inc.

Securian Casualty Company

Ochs, Inc.

Lowertown Capital, LLC (Delaware)

Securian Holding Company Canada, Inc. (British Columbia, Canada)

1880 Reinsurance Company (Vermont)

Securian Life Insurance Company

Marketview Properties, LLC

Marketview Properties II, LLC

Marketview Properties III, LLC

Marketview Properties IV, LLC

Oakleaf Service Corporation

Securian AAM Holdings, LLC (Delaware)

Clauson Dealer Services, LLC (Delaware)

CRI Canada Ltd. (British Columbia, Canada)

Canadian Premier General Insurance Company (Ontario, Canada)

Selient, Inc. (Ontario, Canada)

Armour Group Inc.

2602432 Ontario Ltd.

Integrated Warranty Services Inc.

Premium Services Group, Inc.

VA Insurance Services Inc.

Securian Trust Company, N.A.

Spinnaker Holdings, LLC (Delaware)

Bloom Health Services, LLC (Delaware)

| Title of Class | Number of Record Holders | |

| Variable

Annuity Contracts – MultiOption Momentum |

320 |

| (a) | Securian Financial Services, Inc. currently acts as a principal underwriter for the following investment companies: |

Variable Annuity Account

Minnesota Life Variable Life Account

Minnesota Life Individual Variable Universal Life Account

Minnesota Life Variable Universal Life Account

Securian Life Variable Universal Life Account

| (b) | Directors and Officers of Securian Financial Services, Inc: |

| Name

and Principal Business Address |

Positions

and Offices with Underwriter | |

| George

I. Connolly Securian Financial Services, Inc. 400 Robert Street North St. Paul, MN 55101 |

President, Chief Executive Officer and Director | |

| Gary

R. Christensen Securian Financial Services, Inc. 400 Robert Street North St. Paul, MN 55101 |

Director | |

| Warren

J. Zaccaro Securian Financial Services, Inc. 400 Robert Street North St. Paul, MN 55101 |

Director | |

| Jeffrey

D. McGrath Securian Financial Services, Inc. 400 Robert Street North St. Paul, MN 55101 |

Vice President | |

| Kimberly

K. Carpenter Securian Financial Services, Inc. 400 Robert Street North St. Paul, MN 55101 |

Senior Vice President, Chief Compliance Officer and Anti-Money Laundering Compliance Officer | |

| Kjirsten

G. Zellmer Securian Financial Services, Inc. 400 Robert Street North St. Paul, MN 55101 |

Vice President - Strategy and Business Operations | |

| Kristin

M. Ferguson Securian Financial Services, Inc. 400 Robert Street North St. Paul, MN 55101 |

Vice President, Chief Financial Officer, Treasurer and Financial Operations Principal |

| (c) | All commissions and other compensation received by each principal underwriter, directly or indirectly, from the Registrant during the Registrant’s last fiscal year: |

| Name

of Principal Underwriter |

Net

Underwriting Discounts and Commissions |

Compensation

on Redemption or Annuitization |

Brokerage

Commissions |

Other

Compensation | ||||

| Securian Financial Services, Inc. | $20,987,995 | — | — | — |

(Registrant)

(Depositor)

Chairman of the Board,

President and Chief Executive Officer

(Depositor)

Chairman of the Board,

President and Chief Executive Officer

| Signature | Title | Date | ||

| /s/

Christopher M. Hilger Christopher M. Hilger |

Chairman of the Board, President and Chief Executive Officer | September 16, 2021 | ||

| *

Robert L. Senkler |

Director | |||

| *

Mary K. Brainerd |

Director | |||

| *

Gary R. Christensen |

Director | |||

| *

Benjamin G.S. Fowke III |

Director | |||

| *

Sara H. Gavin |

Director | |||

| *

Eric B. Goodman |

Director |

| Signature | Title | Date | ||

| *

Trudy A. Rautio |

Director | |||

| *

Bruce P. Shay |

Director | |||

| *

Katio O. Walsh |

Director | |||

| *

Kevin F. Warren |

Director | |||

| *

Warren J. Zaccaro |

Director | |||

| /s/

Warren J. Zaccaro Warren J. Zaccaro |

Executive Vice President and Chief Financial Officer (chief financial officer) | September 16, 2021 | ||

| /s/

John A. Yaggy John A. Yaggy |

Vice President and Controller (chief accounting officer) | September 16, 2021 | ||

| /s/

Ted J. Nistler Ted J. Nistler |

Second Vice President and Treasurer (treasurer) | September 16, 2021 | ||

| /s/

Gary R. Christensen Gary R. Christensen |

Director, Attorney-in-Fact, Senior Vice President, General Counsel and Secretary | September 16, 2021 |

SECOND AMENDMENT

TO DISTRIBUTION AND

SHAREHOLDER SERVICES AGREEMENT

AMONG NORTHERN LIGHTS VARIABLE TRUST,

AND

MINNESOTA LIFE INSURANCE COMPANY

This Second Amendment is incorporated in and made a part of the Distribution and Shareholder Services Agreement (the “Agreement”) made as of the 10th of June, 2021, by and among Minnesota Life Insurance Company (hereinafter the “Company”), on its own behalf and on behalf of one or more segregated asset accounts of the Company (hereinafter the “Account”) and Northern Lights Variable Trust (hereinafter the “Trust”). The following terms and conditions amend the terms of the Agreement and, in the case of any conflict between the terms and conditions of the Agreement and the terms and conditions of this Addendum, the language of this Addendum shall control and govern. All capitalized and abbreviated terms defined in the Agreement shall have the same definitions apply in this Addendum.

1. Exhibit A of the Agreement is deleted and replaced with the Exhibit A to this Addendum, attached hereto.

IN WITNESS WHEREOF, each of the parties hereto has caused this Second Amendment to the Agreement to be executed in its name and on its behalf by its duly authorized representative as of June 10, 2021:

| Company: |

| MINNESOTA LIFE INSURANCE COMPANY |

| By its authorized officer, |

| /s/ Kristin Ferguson |

| By: |

| Title: |

| Date: |

| Trust: |

| NORTHERN LIGHTS VARIABLE TRUST |

| By its authorized officer, |

| /s/ Stephanie Shearer |

| By: Stephanie Shearer |

| Title: Secretary |

| Date: June 10, 2021 |

1

Exhibit A

| Fund |

Fee | |||

| TOPS® Conservative ETF Portfolio - Class 2 |

0.25 | % | ||

| TOPS® Balanced ETF Portfolio - Class 2 |

0.25 | % | ||

| TOPS® Moderate Growth ETF Portfolio - Class 2 |

0.25 | % | ||

| TOPS® Growth ETF Portfolio - Class 2 |

0.25 | % | ||

| TOPS® Aggressive Growth ETF Portfolio - Class 2 |

0.25 | % | ||

| TOPs® Global Target Range™ Fund – Class S |

0.45 | % | ||

SECOND AMENDMENT

TO PARTICIPATION AGREEMENT

AMONG NORTHERN LIGHTS VARIABLE TRUST,

NORTHERN LIGHTS DISTRIBUTORS, LLC,

VALMARK ADVISERS, INC.,

AND

MINNESOTA LIFE INSURANCE COMPANY

This Second Amendment is incorporated in and made a part of the Fund Participation Agreement (the “Agreement”) made as of the 12th day of August, 2021, by and among Minnesota Life Insurance Company (hereinafter the “Company”), on its own behalf and on behalf of one or more segregated asset accounts of the Company (hereinafter the “Account”), Northern Lights Variable Trust (hereinafter the “Trust”), Northern Lights Distributors, LLC (hereinafter the “Underwriter”) and ValMark Advisers, Inc. (hereinafter the “Adviser”). The following terms and conditions amend the terms of the Agreement and, in the case of any conflict between the terms and conditions of the Agreement and the terms and conditions of this Addendum, the language of this Addendum shall control and govern. All capitalized and abbreviated terms defined in the Agreement shall have the same definitions apply in this Addendum.

1. Schedule A of the Agreement is deleted and replaced with the Schedule A to this Addendum, attached hereto.

IN WITNESS WHEREOF, each of the parties hereto has caused this Second Amendment to the Agreement to be executed in its name and on its behalf by its duly authorized representative as of August 12, 2021:

| Company: |

| MINNESOTA LIFE INSURANCE COMPANY |

| By its authorized officer, |

| /s/ Kristin Ferguson |

| By: Kristin Ferguson |

| Title: 2nd Vice President, CFO & Actuary |

| Date: 8/24/2021 |

| Trust: |

| NORTHERN LIGHTS VARIABLE TRUST |

| By its authorized officer, |

|

|

| By: |

| Title: |

| Date: |

1

| Underwriter: |

| NORTHERN LIGHTS DISTRIBUTORS, INC. |

| By its authorized officer, |

|

|

| By: |

| Title: |

| Date: |

| Advisor: |

| VALMARK ADVISERS, INC. |

| By its authorized officer, |

|

|

| By: |

| Title: |

| Date: |

2

SCHEDULE B

(as amended August 12, 2021)

| Fund |

| TOPS® Conservative ETF Portfolio - Class 2 |

| TOPS® Balanced ETF Portfolio - Class 2 |

| TOPS® Moderate Growth ETF Portfolio - Class 2 |

| TOPS® Growth ETF Portfolio - Class 2 |

| TOPS® Aggressive Growth ETF Portfolio - Class 2 |

| TOPs® Target Range™ Fund – Class S |

400 Robert Street North

St. Paul, MN 55101-2908

www.securian.com

651.665.3500

400 Robert Street North

St. Paul, Minnesota 55101-2908

| 1. | The Account is a separate account of the Company duly created and validly existing pursuant of the laws of the State of Minnesota; and |

| 2. | The issuance and sale of the variable annuity contracts funded by the Account have been duly authorized by the Company and such contracts, when issued in accordance with and as described in the current Prospectus contained in the Registration Statement, and upon compliance with applicable local and federal laws, will be legal and binding obligations of the Company in accordance with their terms. |

September 15, 2021

September 15, 2021

Power of Attorney

| Signature | Title | Date | ||

| /s/

Christopher M. Hilger Christopher M. Hilger |

Chairman of the Board, President and Chief Executive Officer | April 13, 2021 | ||

| /s/

Robert L. Senkler Robert L. Senkler |

Director | April 13, 2021 | ||

| /s/

Mary K. Brainerd Mary K. Brainerd |

Director | April 13, 2021 | ||

| /s/

Gary R. Christensen Gary R. Christensen |

Director | April 13, 2021 | ||

| /s/

Benjamin G.S. Fowke III Benjamin G.S. Fowke III |

Director | April 13, 2021 | ||

| /s/

Sara H. Gavin Sara H. Gavin |

Director | April 13, 2021 |

| Signature | Title | Date | ||

| /s/

Eric B. Goodman Eric B. Goodman |

Director | April 13, 2021 | ||

| /s/