Form 485BPOS Advisers Investment Trus

| Pre‑Effective Amendment No. | ☐ | |

| Post-Effective Amendment No. 106 | ☒ |

| (Check appropriate box or boxes.) | ☒ |

| ☐ | Immediately upon filing pursuant to paragraph (b) |

| ☒ | On |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) |

| ☐ | On (date) pursuant to paragraph (a)(1) |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | On (date) pursuant to paragraph (a)(2) of Rule 485. |

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

| 1 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 15 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 |

| Back Cover |

| Class I Shares | ||||

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) |

||||

| Maximum deferred sales charge (load) (as a percentage of amount redeemed)) |

||||

| Redemption fee (as a percentage of amount redeemed) |

||||

| Class I Shares | ||||

| Management Fee |

% | |||

| Distribution (Rule 12b‑1) Fees |

||||

| Other Expenses |

% | |||

| Total Annual Fund Operating Expenses |

% | |||

| Fee Waivers and/or Reimbursements1 |

( |

)% | ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Reimbursement |

% | |||

| 1 | Vontobel Asset Management, Inc. (the “Adviser”) has contractually agreed to waive fees and/or reimburse expenses to the extent that Total Annual Fund Operating Expenses (exclusive of brokerage and other transaction expenses relating to the purchase or sale of portfolio investments, interest, taxes, short sale dividends and financing costs associated with the use of the cash proceeds on securities sold short, litigation and indemnification expenses, expenses associated with the investments in underlying investment companies and extraordinary expenses (as determined under generally accepted principles)) exceed 0.65% for Class I Shares until |

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class I Shares |

$ | $ | $ | $ | ||||||||||||

| |

% | |||||||

| |

( |

)% |

| * | |

| Class I Shares | 1 Year | Since Inception* |

||||||

| Before Taxes |

- |

|||||||

| After Taxes on Distributions |

- |

|||||||

| After Taxes on Distributions and Sale of Fund Shares |

- |

|||||||

| S&P 500 Index (reflects no deduction for fees and expenses)^ |

- |

|||||||

| * | |

| ^ | |

| Name | Title | Served on the Fund Since | ||

| Matthew Benkendorf |

CIO Quality Growth/ Managing | Inception: March 27, 2018 | ||

| Director/ Portfolio Manager | ||||

| Edwin Walczak |

Managing Director/ Portfolio | Inception: March 27, 2018 | ||

| Manager | ||||

| Chul Chang |

Executive Director/ Portfolio | June 30, 2020 | ||

| Manager |

| Minimum Initial Investment |

$ | 1,000,000 | ||

| Minimum Additional Investment: |

None |

| Fund | Management Fee | |

| Vontobel U.S. Equity Institutional Fund |

0.50% on the first $500 million | |

| 0.45% on assets over $500 million |

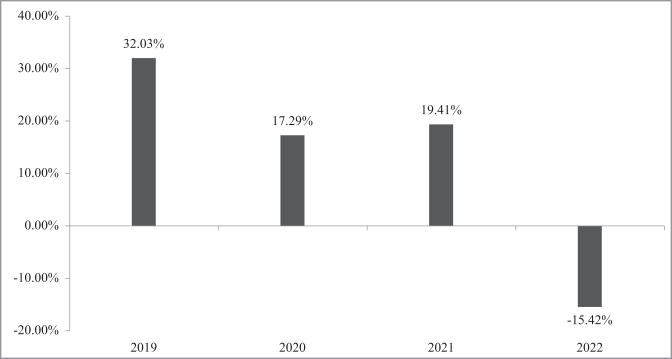

| Calendar Year | Composite Return (Net of Fees) |

Composite Return (Gross of Fees) |

S&P 500 Index | |||||||||

| 2022 |

‑15.17 | % | ‑14.95 | % | ‑18.11 | % | ||||||

| 2021 |

19.95 | % | 20.26 | % | 28.71 | % | ||||||

| 2020 |

17.30 | % | 17.63 | % | 18.40 | % | ||||||

| 2019 |

31.79 | % | 32.16 | % | 31.49 | % | ||||||

| 2018 |

0.10 | % | 0.39 | % | -4.38 | % | ||||||

| 2017 |

26.63 | % | 27.09 | % | 21.83 | % | ||||||

| 2016 |

10.08 | % | 10.52 | % | 11.96 | % | ||||||

| 2015 |

6.82 | % | 8.55 | % | 1.38 | % | ||||||

| 2014 |

8.37 | % | 10.16 | % | 13.69 | % | ||||||

| 2013 |

28.63 | % | 30.60 | % | 32.39 | % | ||||||

| 2012 |

16.71 | % | 18.51 | % | 16.00 | % | ||||||

| 2011 |

9.24 | % | 11.04 | % | 2.11 | % | ||||||

| 2010 |

12.77 | % | 14.85 | % | 15.06 | % | ||||||

| 2009 |

20.81 | % | 23.10 | % | 26.46 | % | ||||||

| 2008 |

-29.36 | % | -27.88 | % | -37.00 | % | ||||||

| 2007 |

-4.45 | % | -2.67 | % | 5.49 | % | ||||||

| 2006 |

12.27 | % | 13.93 | % | 15.79 | % | ||||||

| Average Annual Returns | Composite Return (Net of Fees) |

Composite Return (Gross of Fees) |

Benchmark1 | |||||||||

| 1 year ended December 31, 2022 |

‑15.17 | % | ‑14.95 | % | ‑18.11 | % | ||||||

| 5 years ended December 31, 2022 |

9.51 | % | 9.80 | % | 9.42 | % | ||||||

| 10 years ended December 31, 2022 |

12.57 | % | 13.35 | % | 12.56 | % | ||||||

| 1 | The composite’s gross rates of return are presented before the deduction of investment management fees, other investment-related fees, and after the deduction of foreign withholding taxes, brokerage commissions, and transaction costs. An investor’s actual return will be |

| reduced by investment advisory fees. The composite’s net rates of return are presented after the deduction of all fees, including sales loads if any, such as: investment management fees, brokerage commissions, transaction costs, other investment-related fees, and foreign withholding taxes. Such investment management fees are actual fees, and do not contain any performance-based fee components. Effective January 2016, the net returns reflect daily accruing of fees based on each account’s investment management fee schedule. Prior to 2016, the net returns were calculated using actual fees recorded on a cash basis, net of total expense ratio for pooled vehicles. Results portrayed reflect the reinvestment of dividends and other earnings. Past investment returns are no guarantee of future results. The inception date of the U.S. Equity Composite is April 5, 1990. The comparison to an index is provided for informational purposes only and should not be used as the basis for making an investment. There may be significant differences between the composite and the index, including but not limited to the risk profile, liquidity, volatility, and asset composition. The S&P 500 Index is an unmanaged index consisting of securities listed on exchanges in the United States. The benchmark is used for comparative purposes only and generally reflects the risk or investment style of the investments in the composite. The index is calculated on a total return basis with dividends reinvested, but does not reflect fees, brokerage commissions, or other investment expenses, and is expressed in U.S. dollars. The Adviser claims compliance with the Global Investment Performance Standards (GIPS®). The Adviser has been independently verified for the periods from January 1, 2001 through December 31, 2020. The verification reports and performance examination reports are available upon request. |

| • | The account number (if issued) and Fund name; |

| • | The amount of the transaction, in dollar amount or number of shares; |

| • | For redemptions and exchanges (other than online, telephone or wire redemptions), the signature of all account owners exactly as they are registered on the account; |

| • | Required signature guarantees, if applicable; and |

| • | Other supporting legal documents and certified resolutions that might be required in the case of estates, corporations, trusts and other entities or forms of ownership. Call 866‑252‑5393 (toll free) or 312‑630‑6583 for more information about documentation that may be required of these entities. |

| • | charge a fee for its services; |

| • | act as the shareholder of record of the shares; |

| • | set different minimum initial and additional investment requirements; |

| • | impose other charges, commissions, or restrictions; |

| • | designate intermediaries to accept purchase and sale orders on the Fund’s behalf; or |

| • | impose an earlier cut‑off time for purchase and redemption requests. |

| • | Complete a New Account Application and send it to: |

| • | Wire funds for your purchase. A wire will be considered made when the money is received and the purchase is accepted by the Fund. Any delays that may occur in receiving money, including delays that may occur in processing by the bank, are not the responsibility of the Fund or the Transfer Agent. Wires must be received prior to 4:00 p.m. ET to receive the current day’s NAV. |

| • | Only the listed street address should be used for overnight delivery, and not the P.O. Box address. Please note that receipt by the US Post Office does not constitute delivery to or receipt by the Fund or the Transfer Agent. |

| • | Call 866‑252‑5393 (toll free) or 312‑630‑6583 on days the Fund is open for business or provide a subsequent purchase Letter of Instruction or for instructions on adding to your existing account by wire. |

| • | Complete the “Choose Your Dividend and Capital Gain Distributions” section on the New Account Application. |

| • | Reinvestments can only be directed to an existing Fund account. |

| • | Send a written request to: |

| 1. | The number of shares or the dollar amount to be redeemed; |

| 2. | The Fund account number; and |

| 3. | The signatures of all account owners signed in the exact name(s) and any special capacity in which they are registered. |

| • | A Medallion Signature Guarantee (see below) generally is required but may be waived in certain (limited) circumstances if: |

| 1. | The proceeds are to be sent elsewhere than the address of record, or |

| 2. | The redemption is requested in writing and the amount is greater than $100,000. |

| • | Only the listed street address should be used for overnight delivery, and not the P.O. Box address. Please note that receipt by the US Post Office does not constitute delivery to or receipt by the Fund or the Transfer Agent. |

| • | Call the Transfer Agent at 866‑252‑5393 (toll free) or 312‑630‑6583 for instructions. |

| • | The minimum amount that may be redeemed by this method is $250. |

| • | Call 866‑252‑5393 (toll free) or 312‑630‑6583 to use the telephone privilege. |

| • | If your account is already opened and you wish to add the telephone privilege, send a written request to: |

| • | The written request to add the telephone privilege must be signed by each owner of the account and must be accompanied by signature guarantees. |

| • | Only the listed street address should be used for overnight delivery, and not the P.O. Box address. Please note that receipt by the US Post Office does not constitute delivery to or receipt by the Fund or the Transfer Agent. |

| • | the redemption is requested in writing and the amount redeemed is greater than $100,000; |

| • | information on your investment application has been changed, including the name(s) or the address on your account or the name or address of a payee, within 30 days of your redemption request; |

| • | proceeds or shares are being sent/transferred from a joint account to an individual’s account; or |

| • | proceeds are being sent via wire or ACH and bank instructions have been added or changed within 30 days of your redemption request. |

| Vontobel U.S. Equity Institutional Fund | Year Ended September 30, 2022 |

Year Ended September 30, 2021 |

Year Ended September 30, 2020 |

Year Ended September 30, 2019 |

Period Ended September 30, 2018(a) |

|||||||||||||||

| Net asset value, beginning of year |

$ | 16.24 | $ | 13.77 | $ | 12.35 | $ | 11.16 | $ | 10.00 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income(b) |

0.08 | 0.05 | 0.07 | 0.09 | 0.05 | |||||||||||||||

| Net realized and unrealized gains (losses) from investments and foreign currency |

(2.29 | ) | 2.81 | 1.58 | 1.17 | 1.11 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

(2.21 | ) | 2.86 | 1.65 | 1.26 | 1.16 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Less distributions paid: |

||||||||||||||||||||

| From net investment income |

(0.06 | ) | (0.04 | ) | (0.09 | ) | (0.07 | ) | — | |||||||||||

| From net realized gains |

(1.58 | ) | (0.35 | ) | (0.14 | ) | — | — | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total distributions paid |

(1.64 | ) | (0.39 | ) | (0.23 | ) | (0.07 | ) | — | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Change in net asset value |

(3.85 | ) | 2.47 | 1.42 | 1.19 | 1.16 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value, end of year |

$ | 12.39 | $ | 16.24 | $ | 13.77 | $ | 12.35 | $ | 11.16 | ||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total return(c) |

(15.76 | %) | 21.18 | % | 13.47 | % | 11.46 | % | 11.60 | % | ||||||||||

| Ratios/Supplemental data: |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$ | 19,347 | $ | 24,003 | $ | 19,816 | $ | 15,921 | $ | 11,427 | ||||||||||

| Ratio of net expenses to average net assets(d) |

0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | 0.65 | % | ||||||||||

| Ratio of net investment income to average net assets(d) |

0.51 | % | 0.34 | % | 0.54 | % | 0.82 | % | 0.84 | % | ||||||||||

| Ratio of gross expenses to average net assets(d) |

2.74 | % | 2.61 | % | 3.33 | % | 3.15 | % | 2.93 | % | ||||||||||

| Portfolio turnover rate(c) |

50.11 | % | 43.97 | % | 57.97 | % | 27.31 | % | 20.78 | % | ||||||||||

| (a) | For the period from March 27, 2018, commencement of operations, to September 30, 2018. |

| (b) | Net investment income (loss) for the period ended was calculated using the average shares outstanding method. |

| (c) | Not annualized for periods less than one year. |

| (d) | Annualized for periods less than one year. |

| • | Information we receive from you on applications or other forms (e.g. your name, address, date of birth, social security number and investment information); |

| • | Information about your transactions and experiences with us and our affiliates (e.g. your account balance, transaction history and investment selections); and |

| • | Information we obtain from third parties regarding their brokerage, investment advisory, custodial or other relationship with you (e.g. your account number, account balance and transaction history. |

VONTOBEL U.S. EQUITY INSTITUTIONAL FUND

Class I Shares (Ticker: VTUIX)

A series of Advisers Investment Trust

STATEMENT OF ADDITIONAL INFORMATION

January 28, 2023

This Statement of Additional Information (“SAI”) is not a prospectus. It should be read in conjunction with the prospectus for the Vontobel U.S. Equity Institutional Fund (the “Fund”) dated January 28, 2023. A copy of the prospectus can be obtained at no charge by writing to the transfer agent, Vontobel U.S. Equity Institutional Fund, c/o The Northern Trust Company, P.O. Box 4766, Chicago, Illinois 60680-4766, or by calling 866-252-5393 (toll free) or 312-630-6583. The Fund’s prospectus is incorporated by reference into this SAI.

TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 13 | ||||

| 14 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| A-1 |

i

Description of the Trust and the Fund

Advisers Investment Trust (the “Trust”) is a Delaware statutory trust operating under a Fourth Amended and Restated Agreement and Declaration of Trust (the “Trust Agreement”) dated March 10, 2022. The Trust was formerly an Ohio business trust, which commenced operations on December 20, 2011. On March 31, 2017, the Trust was converted to a Delaware statutory trust. The Trust is an open-end investment company. The Trust Agreement permits the Board of Trustees (“Trustees” or “Board”) to authorize and issue an unlimited number of shares of beneficial interest of separate series. This Statement of Additional Information relates to the Vontobel U.S. Equity Institutional Fund (the “Fund”), a series of the Trust. The investment adviser to the Fund is Vontobel Asset Management, Inc. (the “Adviser” or “Vontobel”). The Fund is a diversified fund.

The Fund does not issue share certificates. All shares are held in non-certificated form registered on the books of the Fund and the transfer agent for the account of the shareholder. Each share of a series represents an equal proportionate interest in the assets and liabilities belonging to that series and is entitled to such dividends and distributions out of income belonging to the series as are declared by the Trustees. The shares do not have cumulative voting rights or any preemptive or conversion rights, and the Trustees have the authority from time to time to divide or combine the shares of any series into a greater or lesser number of shares of that series so long as the proportionate beneficial interest in the assets belonging to that series and the rights of the shareholders of any other series are in no way affected. In case of any liquidation of a series, the shareholders of the series being liquidated will be entitled to receive, as a class, a distribution out of the assets, net of the liabilities, belonging to that series. Expenses attributable to any series are borne by that series. Any general expenses of the Trust not readily identifiable as belonging to a particular series are allocated by or under the direction of the Trustees in such manner as the Trustees determine to be fair and equitable. No shareholder is liable to further calls or to assessment by the Trust without his or her express consent.

Any Trustee of the Trust may be removed by vote of the shareholders holding not less than two-thirds of the outstanding shares of the Trust. The Trust does not hold an annual meeting of shareholders. When matters are submitted to shareholders for a vote, each shareholder is entitled to one vote for each whole share he or she owns and fractional votes for fractional shares he or she owns. All shares of the Fund have equal voting and liquidation rights. The Trust Agreement can be amended by the Trustees, except that any amendment that adversely affects the rights of shareholders must be approved by the shareholders affected. All shares of the Fund are subject to involuntary redemption if the Trustees determine to liquidate the Fund. An involuntary redemption will create a capital gain or a capital loss, which may have tax consequences about which you should consult your tax adviser.

For information concerning the purchase and redemption of shares of the Fund, see “How to Purchase Shares” and “How to Redeem Shares” in the Prospectus. For a description of the methods used to determine the share price and value of the Fund’s assets, see “Pricing Your Shares” in the Prospectus and “Determination of Share Price” in this Statement of Additional Information.

Additional Information About the Fund’s Investments

Investment Strategies and Risks

All principal investment strategies and risks of the Fund are discussed in the Prospectus. This section contains a more detailed discussion of some of the investments the Fund may make, some of the techniques the Fund may use, and the risks related to those techniques and investments. Additional non-principal strategies and risks also are discussed here.

Equity Securities

Equity securities consist of common stock, preferred stock, securities convertible into common and preferred stock, rights, warrants, income trusts, and Master Limited Partnerships (“MLP”). Common stocks, the most familiar type, represent an equity (ownership) interest in a corporation. Preferred stocks represent an equity interest in an issuer that pays dividends at a specified rate and that has precedence over common stock in the payment of dividends or in the event of issuer liquidation or bankruptcy. Warrants are options to purchase equity securities at a specified price for a specific time period. Rights are similar to warrants, but normally have a short duration and are distributed by the issuer to its shareholders. Convertible securities are bonds, debentures, notes, preferred stocks that may be converted or exchanged into shares of the underlying common stock at a stated exchange ratio. Income trusts and MLP units are equity investments and may lack diversification as such trusts are primarily invested in oil and gas, pipelines, and other infrastructures whereas MLPs are primarily engaged in the transportation, storage, processing, refining, marketing, exploration, productions, and mining of minerals and natural

1

resources. Although equity securities have a history of long-term growth in value, their prices fluctuate based on changes in a company’s financial condition and on overall market and economic conditions.

Investments in equity securities are subject to inherent market risks and fluctuations in value due to earnings, economic conditions, and other factors beyond the control of the Adviser. As a result, the return and net asset value (“NAV”) of the Fund will fluctuate. Securities in the Fund’s portfolio may not increase as much as the market as a whole and some undervalued securities may continue to be undervalued for long periods of time. Although profits in some Fund holdings may be realized quickly, it is not expected that most investments will appreciate rapidly.

Depositary Receipts

The Fund may invest in sponsored and unsponsored American Depositary Receipts (“ADRs”), Global Depositary Receipts (“GDRs”) and European Depositary Receipts (“EDRs”), which are receipts issued by a bank or trust company evidencing ownership of underlying securities issued by a foreign issuer. ADRs, in sponsored form, are designed for use in the U.S. securities markets. EDRs are the European equivalent of ADRs and are designed to attract investment capital from the European region. GDRs are designed to raise capital in the U.S. and foreign securities markets. The underlying shares of depositary receipts are held in trust by a custodian bank or similar financial institution in the issuer’s home country. Depositary receipts are alternatives to directly purchasing the underlying foreign securities in their national markets and currencies. A sponsoring company provides financial information to the bank and may subsidize administration of the ADR, EDR, or GDR. Unsponsored ADRs, EDRs, and GDRs may be created by a broker-dealer or depository bank without the participation of the foreign issuer. Holders of these unsponsored depositary receipts generally bear all the costs of the ADR, EDR, or GDR facility, whereas foreign issuers typically bear certain costs in a sponsored depositary receipt. The bank or trust company depositary of an unsponsored depositary receipt may be under no obligation to distribute shareholder communications received from the foreign issuer or to pass through voting rights. Unsponsored depositary receipts may carry more risk than sponsored depositary receipts because of the absence of financial information provided by the underlying company. Many of the risks described below regarding foreign securities apply to investments in ADRs, EDRs, and GDRs.

Foreign and Emerging Markets Investments

Investing in foreign securities generally represents a greater degree of risk than investing in domestic securities, due to possible exchange controls or exchange rate fluctuations, limits on repatriation of capital, less publicly available information as a result of accounting, auditing, and financial reporting standards different from those used in the U.S., more volatile markets, potentially less securities regulation, less favorable tax provisions, political or economic instability, war, or expropriation. As a result of its investments in foreign securities, the Fund may receive interest or dividend payments, or the proceeds of the sale or redemption of such securities, in the foreign currencies in which such securities are denominated.

The Fund may invest in countries or regions with relatively low gross national product per capita compared to the world’s major economies, and in countries or regions with the potential for rapid economic growth (emerging markets). The Adviser includes within its definition of an emerging market country, any country: (i) having an “emerging stock market” as defined by the International Finance Corporation; (ii) with low-to-middle-income economies according to the International Bank for Reconstruction and Development (the “World Bank”); or (iii) listed in World Bank publications as developing.

The risks of investing in foreign securities may be intensified in the case of investments in emerging markets. Securities of many issuers in emerging markets may be less liquid and more volatile than securities of comparable domestic issuers. Emerging markets also may have different clearance and settlement procedures, and in certain markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. Delays in settlement could result in temporary periods when a portion of the assets of the Fund are uninvested and no return is earned thereon. Securities prices in emerging markets can be significantly more volatile than in the more developed nations of the world, reflecting the greater uncertainties of investing in less established markets and economies. The economies of countries with emerging markets may be predominantly based on only a few industries, may be highly vulnerable to changes in local or global trade conditions, and may suffer from extreme and volatile debt burdens or inflation rates. Local securities markets may trade a small number of securities and may be unable to respond effectively to increases in trading volume, potentially making prompt liquidation of substantial holdings difficult or impossible at times. Securities of issuers located in countries with emerging markets may have limited marketability and may be subject to more abrupt or erratic price movements.

Certain emerging markets may require governmental approval for the repatriation of investment income, capital, or the proceeds of sales of securities by foreign investors. In addition, if deterioration occurs in an emerging market’s balance of payments or for other reasons, a country could impose temporary restrictions on foreign capital remittances. The Fund could be adversely affected by delays in, or a refusal to grant, any required governmental approval for repatriation of capital, as well as by the application to the Fund of any restrictions on investments.

2

Investments in certain foreign emerging market debt obligations may be restricted or controlled to varying degrees. These restrictions or controls may at times preclude investment in certain foreign emerging market debt obligations and increase the expenses of the Fund.

In a June 2016 referendum, citizens of the United Kingdom (“UK”) voted to leave the European Union (“EU”). In March 2017, the UK formally notified the European Council of its intention to withdraw from the EU, which triggered a two-year period of negotiations on the terms of the departure. The UK and the EU reached a trade agreement on December 31, 2020, which became effective on May 1, 2021. The full impact of the UK’s departure from the EU and nature of the future relationship between the UK and the EU remains uncertain. Until the economic effects of the UK’s departure become clearer, and while a period of political, regulatory and commercial uncertainty continues, there remains a risk that the UK’s departure from the EU may negatively impact the value of investments held by the Fund. The departure of one or more other countries from the EU.

Foreign Currency and Foreign Currency Forward Contracts, Futures, and Options

When investing in foreign securities, the Fund usually effects currency exchange transactions on a spot (i.e., cash) basis at the spot rate prevailing in the foreign exchange market. The Fund will incur expenses in converting assets from one currency to another.

Forward Contracts. The Fund may enter into foreign currency forward contracts for the purchase or sale of a fixed quantity of a foreign currency at a future date (“forward contracts”) for hedging purposes, either to “lock-in” the U.S. dollar purchase price of the securities denominated in a foreign currency or the U.S. dollar value of interest and dividends to be paid on such securities, or to hedge against the possibility that the currency of a foreign country in which the Fund has investments may suffer a decline against the U.S. dollar, as well as for non-hedging purposes. The Fund may also enter into a forward contract on one currency in order to hedge against risk of loss arising from fluctuations in the value of a second currency (“cross hedging”). Forward contracts are traded over-the-counter, and not on organized commodities or securities exchanges. As a result, such contracts operate in a manner distinct from exchange-traded instruments, and their use involves certain risks beyond those associated with transactions in futures contracts or options traded on an exchange, including counterparty credit risk.

Only a limited market, if any, currently exists for hedging transactions relating to currencies in many emerging market countries, or to securities of issuers domiciled or principally engaged in business in emerging market countries, in which the Fund may invest. This may limit the Fund’s ability to effectively hedge its investments in those emerging markets.

Foreign Currency Futures. Generally, foreign currency futures provide for the delivery of a specified amount of a given currency, on the settlement date, for a pre-negotiated price denominated in U.S. dollars or other currency. Foreign currency futures contracts would be entered into for the same reason and under the same circumstances as forward contracts. The Adviser will assess such factors as cost spreads, liquidity, and transaction costs in determining whether to utilize futures contracts or forward contracts in its foreign currency transactions and hedging strategy.

Purchasers and sellers of foreign currency futures contracts are subject to the same risks that apply to the buying and selling of futures generally. The Fund must accept or make delivery of the underlying foreign currency, through banking arrangements, in accordance with any U.S. or foreign restrictions or regulations regarding the maintenance of foreign banking arrangements by U.S. residents and may be required to pay any fees, taxes, or charges associated with such delivery which are assessed in the issuing country.

Foreign Currency Options. The Fund may purchase and write options on foreign currencies for purposes similar to those involved with investing in forward contracts. For example, in order to protect against declines in the dollar value of portfolio securities which are denominated in a foreign currency, or to protect against potential declines in its portfolio securities that are denominated in foreign currencies.

The value of a foreign currency option depends upon the value of the underlying currency relative to the U.S. dollar. As a result, the price of the option position may vary with changes in the value of either or both currencies and have no relationship to the investment merits of a foreign security, including foreign securities held in a “hedged” investment portfolio. Because foreign currency transactions occurring in the interbank market involve substantially larger amounts than those that may be involved in the use of foreign currency options, investors may be disadvantaged by having to deal in an odd lot market (generally consisting of transactions of less than $1 million) for the underlying foreign currencies at prices that are less favorable than for round lots.

As in the case of other kinds of options, the use of foreign currency options constitutes only a partial hedge, and the Fund could be required to purchase or sell foreign currencies at disadvantageous exchange rates, thereby incurring losses. The

3

purchase of an option on a foreign currency may not necessarily constitute an effective hedge against fluctuations in exchange rates and, in the event of rate movements adverse to the Fund’s position, the Fund may forfeit the entire amount of the premium plus related transaction costs.

Options on foreign currencies written or purchased by the Fund may be traded on U.S. or foreign exchanges or over the counter. There is no systematic reporting of last sale information for foreign currencies traded over the counter or any regulatory requirement that quotations available through dealers or other market sources be firm or revised on a timely basis.

Available quotation information is generally representative of very large transactions in the interbank market and thus may not reflect relatively smaller transactions (i.e., less than $1 million) where rates may be less favorable. The interbank market in foreign currencies is a global, around-the-clock market. To the extent that the U.S. options markets are closed while the markets for the underlying currencies remain open, significant price and rate movements may take place in the underlying markets that are not reflected in the options market.

Foreign Currency Warrants. The Fund may invest in foreign currency warrants that entitle the holder to receive from the issuer an amount of cash (generally, for warrants issued in the United States, in U.S. dollars) that is calculated pursuant to a predetermined formula and based on the exchange rate between a specified foreign currency and the U.S. dollar as of the exercise date of the warrant. Foreign currency warrants generally are exercisable upon their issuance and expire as of a specified date and time.

Foreign currency warrants are severable from the debt obligations with which they may be offered, and may be listed on exchanges. Foreign currency warrants may be exercisable only in certain minimum amounts, and an investor wishing to exercise warrants who possesses less than the minimum number required for exercise may be required either to sell the warrants or to purchase additional warrants, thereby incurring additional transaction costs. Upon exercise of warrants, there may be a delay between the time the holder gives instructions to exercise and the time the exchange rate relating to exercise is determined, thereby affecting both the market and cash settlement values of the warrants being exercised. The expiration date of the warrants may be accelerated if the warrants should be delisted from an exchange or if their trading should be suspended permanently, which would result in the loss of any remaining “time value” of the warrants (i.e., the difference between the current market value and the exercise value of the warrants), and, if the warrants were “out-of-the-money,” in a total loss of the purchase price of the warrants. The initial public offering price of foreign currency warrants is generally considerably in excess of the price that a commercial user of foreign currencies might pay in the interbank market for a comparable option involving significantly larger amounts of foreign currencies. Foreign currency warrants are subject to significant foreign exchange risk, including risks arising from complex political or economic factors.

Principal Exchange Rate Linked Securities. The Fund may invest in principal exchange rate linked securities. Principal exchange rate linked securities (or “PERLS”) are debt obligations the principal on which is payable at maturity in an amount that may vary based on the exchange rate between the U.S. dollar and a particular foreign currency at or about that time. The return on “standard” principal exchange rate linked securities is enhanced if the foreign currency to which the security is linked appreciates against the U.S. dollar, and is adversely affected by increases in the foreign exchange value of the U.S. dollar; “reverse” PERLS are like the “standard” securities, except that their return is enhanced by increases in the value of the U.S. dollar and adversely impacted by increases in the value of foreign currency. Interest payments on the securities are generally made in U.S. dollars at rates that reflect the degree of foreign currency risk assumed or given up by the purchaser of the notes (i.e., at relatively higher interest rates if the purchaser has assumed some of the foreign exchange risk, or relatively lower interest rates if the issuer has assumed some of the foreign exchange risk, based on the expectations of the current market). PERLS may in limited cases be subject to acceleration of maturity (generally, not without the consent of the holders of the securities), which may have an adverse impact on the value of the principal payment to be made at maturity.

Performance Indexed Paper. The Fund may invest in performance indexed paper. Performance indexed paper (or “PIP”) is U.S. dollar-denominated commercial paper the yield of which is linked to certain foreign exchange rate movements. The yield to the investor on performance indexed paper is established at maturity as a function of spot exchange rates between the U.S. dollar and a designated currency, as of or about a specified time (generally, the index maturity two days prior to maturity). The yield to the investor will be within a range stipulated at the time of purchase of the obligation, generally with a guaranteed minimum rate of return that is below, and a potential maximum rate of return that is above, market yields on U.S. dollar-denominated commercial paper, with both the minimum and maximum rates of return on the investment corresponding to the minimum and maximum values of the spot exchange rate two business days prior to maturity.

Additional Risk Factors. As a result of its investments in foreign securities, the Fund may receive interest or dividend payments, or the proceeds of the sale or redemption of such securities, in the foreign currencies in which such securities are denominated. In that event, the Fund may convert such currencies into dollars at the then current exchange rate. Under certain circumstances, however, such as where the Adviser believes that the applicable rate is unfavorable at the time the

4

currencies are received or the Adviser anticipates, for any other reason, that the exchange rate will improve, the Fund may hold such currencies for an indefinite period of time. In addition, the Fund may be required to receive delivery of the foreign currency underlying forward foreign currency contracts it has entered into. This could occur, for example, if an option written by the Fund is exercised or the Fund is unable to close out a forward contract. The Fund may hold foreign currency in anticipation of purchasing foreign securities.

The Fund may also elect to take delivery of the currencies’ underlying options or forward contracts if, in the judgment of the Adviser, it is in the best interest of the Fund to do so. In such instances as well, the Fund may convert the foreign currencies to dollars at the then current exchange rates, or may hold such currencies for an indefinite period of time.

While the holding of currencies will permit the Fund to take advantage of favorable movements in the applicable exchange rate, it also exposes the Fund to risk of loss if such rates move in a direction adverse to the Fund’s position. Such losses could reduce any profits or increase any losses sustained by the Fund from the sale or redemption of securities, and could reduce the dollar value of interest or dividend payments received. In addition, the holding of currencies could adversely affect the Fund’s profit or loss on currency options or forward contracts, as well as its hedging strategies.

Geographic Concentration

The possibility that the Fund may concentrate its investments in a single country or region may make the Fund susceptible to economic, political, regulatory, or other events or conditions affecting companies within such country or region. As a result, the Fund may be more volatile than a more geographically diversified strategy.

Options

The Fund may invest in covered put and covered call options and write covered put and covered call options on securities in which it may invest directly and that are traded on registered domestic securities exchanges. The writer of a call option, who receives a premium, has the obligation, upon exercise of the option, to deliver the underlying security against payment of the exercise price during the option period. The writer of a put, who receives a premium, has the obligation to buy the underlying security, upon exercise, at the exercise price during the option period.

There are numerous risks associated with transactions in options. The principal factors affecting the market value of an option include supply and demand, interest rates, the current market price of the underlying index or security in relation to the exercise price of the option, the actual or perceived volatility of the underlying index or security, and the time remaining until the expiration date. The premium received for an option written by the Fund is recorded as an asset of the Fund and its obligation under the option contract as an equivalent liability. The Fund then adjusts over time the liability as the market value of the option changes. The value of each written option will be marked to market daily.

A decision as to whether, when and how to write call options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events.

Options on securities indices are similar to options on securities except that, rather than the right to take or make delivery of securities at a specified price, an option on a securities index gives the holder the right to receive, upon exercise of the option, an amount of cash if the closing level of the securities index upon which the option is based is greater than, in the case of a call, or less than, in the case of a put, the exercise price of the option. This amount of cash is equal to the difference between the closing price of the index and the exercise price of the option expressed in dollars times a specified multiple. The writer of the option is obligated, in return for the premium received, to make delivery of this amount. Unlike options on securities, all settlements are in cash, and gain or loss depends on price movements in the securities market generally (or in a particular industry or segment of the market) rather than price movements in individual securities.

Because the exercise of index options is settled in cash, sellers of index call options cannot provide in advance for their potential settlement obligations by acquiring and holding the underlying securities. When a call option sold by the Fund is exercised or closed out, the Fund may be required to sell portfolio securities or to deliver portfolio securities to the option purchaser to satisfy its obligations when it would not otherwise choose to do so, or the Fund may choose to sell portfolio securities to realize gains to offset the losses realized upon option exercise. Such sales or delivery would involve transaction costs borne by the Fund and may also result in realization of taxable capital gains, including short-term capital gains taxed at ordinary income tax rates, and may adversely impact the Fund’s after-tax returns.

Other Derivatives

The Fund also will be subject to credit risk with respect to the counterparties to any over-the-counter derivatives contracts purchased by the Fund. If a counterparty becomes bankrupt or otherwise fails to perform its obligations under a derivative

5

contract, the Fund may experience significant delays in obtaining any recovery under the derivative contract in a bankruptcy or other reorganization proceeding. The Fund may obtain only a limited recovery or may obtain no recovery in such circumstances.

Options on securities, futures contracts, and options on currencies may be traded on foreign exchanges. Such transactions may not be regulated as effectively as similar transactions in the United States, may not involve a clearing mechanism and related guarantees, and are subject to the risk of governmental actions affecting trading in, or the prices of, foreign securities. The value of such positions also could be adversely affected by (1) other complex foreign political, legal and economic factors, (2) lesser availability than in the United States of data on which to make trading decisions, (3) delays in the Adviser’s ability to act upon economic events occurring in foreign markets during non-business hours in the United States, (4) the imposition of different exercise and settlement terms and procedures and margin requirements than in the United States, and

(5) lesser trading volume.

The Fund is a “limited derivative user” as defined in Rule 18f-4 under the 1940 Act. This means the Fund’s derivatives exposure will not exceed 10% of its net assets. The Fund has adopted written policies and procedures reasonably designed to manage its derivatives risk. The procedures require the Adviser to monitor the Fund’s derivatives exposure and take action if the Fund’s derivatives exposure exceeds 10% of net assets. Investment in derivatives is not part of the Fund’s principal investment strategy.

A notice claiming an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act, as amended (“CEA”), and the rules of the Commodity Futures Trading Commission (“CFTC”) promulgated thereunder, with respect to the Adviser’s operations with respect to the Fund has been filed with the National Futures Association. Accordingly, the Adviser is not currently subject to registration or regulation as a commodity pool operator.

Other Investment Companies

The Fund may invest in securities issued by other investment companies, including shares of money market funds, exchange traded funds (“ETFs”), open-end and closed-end investment companies, real estate investment trusts, and passive foreign investment companies.

ETFs are typically not actively managed. Rather, an ETF’s objective is to track the performance of a specified index. Therefore, securities may be purchased, retained, and sold by ETFs at times when an actively managed trust would not do so. As a result, the Fund may have a greater risk of loss (and a correspondingly greater prospect of gain) from changes in the value of the securities that are heavily weighted in the index than would be the case if the ETF were not fully invested in such securities. Because of this, an ETF’s price can be volatile. In addition, the results of an ETF will not match the performance of the specified index due to reductions in the ETF’s performance attributable to transaction and other expenses, including fees paid by the ETF to service providers.

The Fund may invest in shares of closed-end funds that are trading at a discount to NAV or at a premium to NAV. There can be no assurance that the market discount on shares of any closed-end fund purchased by the Fund will ever decrease. In fact, it is possible that this market discount may increase and the Fund may suffer realized or unrealized capital losses due to further decline in the market price of the securities of such closed-end funds, thereby adversely affecting the NAV of the Fund’s shares. Similarly, there can be no assurance that any shares of a closed-end fund purchased by the Fund at a premium will continue to trade at a premium or that the premium will not decrease subsequent to a purchase of such shares by the Fund. Also, there may be a limited secondary market for shares of closed-end funds.

Closed-end funds may issue senior securities (including preferred stock and debt obligations) for the purpose of leveraging the closed-end fund’s common shares in an attempt to enhance the current return to such closed-end fund’s common shareholders. The Fund’s investment in the common shares of closed-end funds that are financially leveraged may create an opportunity for greater total return on its investment, but at the same time may be expected to exhibit more volatility in market price and NAV than an investment in shares of investment companies without a leveraged capital structure.

Shares of closed-end funds and ETFs (except, in the case of ETFs, for “aggregation units” of 50,000 shares) are not individually redeemable but are traded on securities exchanges. The prices of such shares are based upon, but not necessarily identical to, the value of the securities held by the issuer. There is no assurance that the requirements of the securities exchange necessary to maintain the listing of shares of any closed-end fund or ETF will continue to be met.

Some of the countries in which the Fund may invest, may not permit, or may place economic restrictions on, direct investment by outside investors. Investments in such countries may be permitted only through foreign government-approved or government-authorized investment vehicles, which may include other investment companies. These funds may also invest in other investment companies that invest in foreign securities. Investing through such vehicles may involve frequent or

6

layered fees or expenses and may also be subject to limitation under the 1940 Act. Under the 1940 Act, the Fund may invest up to 10% of its assets in shares of investment companies and up to 5% of its assets in any one investment company as long as the Fund does not own more than 3% of the voting stock of any one investment company. As a shareholder of another investment company, the Fund would bear, along with other shareholders, its pro rata portion of the other investment company’s expenses, including advisory fees. Those expenses would be in addition to the advisory and other expenses that the Fund bears directly in connection with its own operations.

Illiquid Securities

The Fund may invest up to 15% of its net assets in illiquid securities. Illiquid securities are any investment that the Adviser reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. Illiquid securities may be subject to the potential for delays on resale and uncertainty in valuation for an indefinite period of time. The Fund might be unable to dispose of illiquid securities promptly or at reasonable prices and might thereby experience difficulty in satisfying redemption requests from shareholders.

Illiquid securities may include, among other things, (i) private placements or restricted securities (i.e. Rule 144A securities and Section 4(2) commercial paper) subject to contractual or legal restrictions on resale because they have not been registered under the Securities Act of 1933, as amended (the “Securities Act”)); (ii) securities that are otherwise not readily marketable (e.g., because trading in the security is suspended or because market makers do not exist or will not entertain bids or offers) (iii) repurchase agreements, reverse repurchase agreements, and time deposits that do not provide for payment to the Fund within seven days after notice or which have a term greater than seven days; and (iv) private equity investments.

A large institutional market exists for certain securities that are not registered under the Securities Act, including foreign securities. The fact that there are contractual or legal restrictions on resale to the general public or to certain institutions may not be indicative of the liquidity of such investments. Rule 144A under the Securities Act allows such a broader institutional trading market for securities otherwise subject to restrictions on resale to the general public. Rule 144A establishes a “safe harbor” from the registration requirements of the Securities Act for resale of certain securities to qualified institutional buyers. Rule 144A has produced enhanced liquidity for many restricted securities, and market liquidity for such securities may continue to expand as a result of this regulation.

Under procedures adopted by the Trust’s Board, the Adviser has designated a Liquidity Committee to assess the liquidity risk of each individual Fund based on factors specific to that fund. In making this determination, the Adviser’s Liquidity Committee will consider, as it deems appropriate under the circumstances and among other factors: (i) the Fund’s investment strategy and liquidity of portfolio investments during both normal and reasonably foreseeable stressed conditions, including whether the investment strategy is appropriate for an open-end fund; (ii) the extent to which the strategy involves a relatively concentrated portfolio or large positions in particular issuers; (iii) the use of borrowings for investment purposes (whether from a bank or through financing transactions such as repurchase agreements and short sales); (iv) the use of derivatives; short-term and long-term cash flow projections during both normal and reasonably foreseeable stressed conditions; and (v) holdings of cash and cash equivalents, as well as borrowing arrangements and other funding sources.

The Trust procedures require the Adviser’s Liquidity Committee to classify the liquidity of portfolio investments (including derivative positions) based on the number of days in which the Adviser reasonably expects the investment would be convertible to cash (or sold or disposed of, but not necessarily settled) in current market conditions without significantly changing the market value of the investment, taking into account relevant market, trading and investment-specific considerations. In making this determination, the Liquidity Committee may consider the following factors, if applicable, in addition to other factors determined by the Adviser as relevant to a Fund: (i) existence of an active market for the asset, including whether the asset is listed on an exchange, as well as the number, diversity, and quality of market participants; (ii) frequency of trades or quotes for the asset and average daily trading volume of the asset (regardless of whether the asset is a security traded on an exchange); (iii) volatility of trading prices for the asset; (iv) bid-ask spreads for the asset; (v) whether the asset has a relatively standardized and simple structure; (vi) for fixed income securities, maturity and date of issue; (vii) restrictions on trading of the asset and limitations on transfer of the asset; (viii) the size of the Fund’s position in the asset relative to the asset’s average daily trading volume and, as applicable, the number of units of the asset outstanding; and (ix) relationship of the asset to another portfolio asset.

Although the Adviser’s Liquidity Committee monitors the liquidity of the securities held in the portfolio, the Board of Trustees oversees and retains ultimate responsibility for the Adviser’s liquidity determinations.

7

Certificates of Deposit and Bankers’ Acceptances

Certificates of deposit are receipts issued by a depository institution in exchange for the deposit of funds. The issuer agrees to pay the amount deposited plus interest to the bearer of the receipt on the date specified on the certificate. The certificate usually can be traded in the secondary market prior to maturity. Bankers’ acceptances typically arise from short-term credit arrangements designed to enable businesses to obtain funds to finance commercial transactions. Generally, an acceptance is a time draft drawn on a bank by an exporter or an importer to obtain a stated amount of funds to pay for specific merchandise. The draft is then “accepted” by a bank that, in effect, unconditionally guarantees to pay the face value of the instrument on its maturity date. The acceptance may then be held by the accepting bank as an earning asset or it may be sold in the secondary market at the going rate of discount for a specific maturity. Although maturities for acceptances can be as long as 270 days, most acceptances have maturities of six months or less. Time deposits are non-negotiable receipts issued by a bank in exchange for the deposit of funds. Like certificates of deposits, time deposits earn a specified rate of interest over a definite period of time; however, it cannot be traded in the secondary market. Time deposits with a withdrawal penalty or that mature in more than seven days are considered to be illiquid securities.

Commercial Paper

The Fund may purchase commercial paper. Commercial paper consists of short-term (usually from one to 270 days) unsecured promissory notes issued by corporations in order to finance current operations. The Fund may only invest in commercial paper rated at least “Prime-2” or better by Moody’s or rated “A-2” or better by S&P or, if the security is unrated, the Adviser determines that it is of equivalent quality.

Convertible Securities

Convertible securities include fixed income securities that may be exchanged or converted into a predetermined number of shares of the issuer’s underlying common stock at the option of the holder during a specified period. Convertible securities may take the form of convertible preferred stock, convertible bonds or debentures, units consisting of “usable” bonds and warrants, or a combination of the features of several of these securities. Convertible securities are senior to common stocks in an issuer’s capital structure, but are usually subordinated to similar non-convertible securities. While providing a fixed-income stream (generally higher in yield than the income derivable from common stock but lower than that afforded by a similar nonconvertible security), a convertible security also gives an investor the opportunity, through its conversion feature, to participate in the capital appreciation of the issuing company depending upon a market price advance in the convertible security’s underlying common stock.

Preferred Stock

Preferred stocks, like some debt obligations, are generally fixed-income securities. Shareholders of preferred stocks normally have the right to receive dividends at a fixed rate when and as declared by the issuer’s board of directors, but do not participate in other amounts available for distribution by the issuing corporation. Dividends on the preferred stock may be cumulative, and all cumulative dividends usually must be paid prior to shareholders of common stock receiving any dividends. Because preferred stock dividends must be paid before common stock dividends, preferred stocks generally entail less risk than common stocks. Upon liquidation, preferred stocks are entitled to a specified liquidation preference, which is generally the same as the par or stated value, and are senior in right of payment to common stock. Preferred stocks are, however, equity securities in the sense that they do not represent a liability of the issuer and, therefore, do not offer as great a degree of protection of capital or assurance of continued income as investments in corporate debt securities. Preferred stock dividends are not guaranteed and management can elect to forego the preferred dividend, resulting in a loss to the Fund. Preferred stocks are generally subordinated in right of payment to all debt obligations and creditors of the issuer, and convertible preferred stocks may be subordinated to other preferred stock of the same issue. Preferred stocks lack voting rights and the Adviser may incorrectly analyze the security, resulting in a loss to the Fund.

Rights

Rights are usually granted to existing shareholders of a corporation to subscribe to shares of a new issue of common stock before it is issued to the public. The right entitles its holder to buy common stock at a specified price. Rights have similar features to warrants, except that the life of a right is typically much shorter, usually a few weeks. The risk of investing in a right is that the right may expire prior to the market value of the common stock exceeding the price fixed by the right.

8

Warrants

Warrants are securities that are usually issued with a bond or preferred stock but may trade separately in the market. A warrant allows its holder to purchase a specified amount of common stock at a specified price for a specified time. The risk of investing in a warrant is that the warrant may expire prior to the market value of the common stock exceeding the price fixed by the warrant. The Fund does not invest in warrants but may receive them pursuant to a corporate event involving one of its portfolio holdings. In addition, the percentage increase or decrease in the market price of a warrant may tend to be greater than the percentage increase or decrease in the market price of the optioned common stock.

Real Estate Investment Trusts

The Fund may invest in Real Estate Investment Trusts (“REITs”). REITs are pooled investment vehicles that invest primarily in income producing real estate or real estate related loans or interests. REITs generally are classified as equity REITs, mortgage REITs, or hybrid REITs. An equity REIT, which owns properties, generates income from rental and lease properties. Mortgage REITs invest the majority of their assets in real estate mortgages and derive income from the collection of interest payments. Hybrid REITs are designed to strike a balance between equity investments and mortgage-backed investments and derive their income from the collection of rents, the realization of capital gains from the sale of properties, and from the collection of interest payments on outstanding mortgages held within the trust.

The value of real estate securities in general and REITs in particular, will depend on the value of the underlying properties or the underlying loans or interests. The value of these securities will rise and fall in response to many factors, including economic conditions, the demand for rental property, and interest rates. In particular, the value of these securities may decline when interest rates rise and will also be affected by the real estate market and by the management of the underlying properties. REITs may be more volatile and/or more illiquid than other types of equity securities. The Fund, though not invested directly in real estate, still is subject to the risks associated with investing in real estate, which include:

| • | possible declines in the value of real estate; |

| • | risks related to general and local economic conditions; |

| • | possible lack of availability of mortgage funds; |

| • | overbuilding; |

| • | changes in interest rates; and |

| • | environmental problems. |

Investing in REITs involves certain risks in addition to those risks associated with investing in the real estate industry in general, which include:

| • | dependency upon management skills; |

| • | limited diversification; |

| • | the risks of financing projects; |

| • | heavy cash flow dependency; |

| • | default by borrowers; |

| • | self-liquidation; |

| • | possibility of failing to maintain exemptions from the 1940 Act; and |

| • | in many cases, relatively small market capitalization, which may result in less market liquidity and greater price volatility. |

Stapled Securities

Interests in REITs may be structured as stapled securities. A stapled security consists of two or more securities that are combined to form one security such that the individual securities cannot be traded separately. For example, an interest in a portfolio of real estate properties (a REIT) may be combined with an interest in the operating company that manages the portfolio of those properties. Investors in stapled securities are subject to the risks inherent with each security that makes up the stapled security.

9

When Issued Securities

The Fund may from time to time purchase securities on a “when-issued,” delayed delivery, or forward commitment basis, generally in connection with an underwriting or other offering. The price of such securities, which may be expressed in yield terms, is fixed at the time the commitment to purchase is made, but delivery and payment for the when-issued securities take place at a later date, beyond normal settlement dates, generally from 15 to 45 days after the transaction. The Fund will segregate the liquid securities or cash in an amount at least equal to these commitments. Typically, income may not accrue on securities the Fund has committed to purchase prior to the time delivery of the securities is made, although the Fund may earn income on securities it has segregated.

When purchasing a security on a when-issued, delayed delivery, or forward commitment basis, the Fund assumes the rights and risks of ownership of the security, including the risk of price and yield fluctuations, and takes such fluctuations into account when determining its NAV. Because the Fund is not required to pay for the security until the delivery date, these risks are in addition to the risks associated with the Fund’s other investments. If the Fund remains substantially fully invested at a time when when-issued, delayed delivery, or forward commitment purchases are outstanding, the purchases may result in a form of leverage.

When the Fund has sold a security on a when-issued, delayed delivery, or forward commitment basis, the Fund does not participate in future gains or losses with respect to the security. If the other party to a transaction fails to deliver or pay for the securities, the Fund could miss a favorable price or yield opportunity or could suffer a loss. The Fund may dispose of or renegotiate a transaction after it is entered into, and may sell when-issued, delayed delivery, or forward commitment securities before they are delivered, which may result in a capital gain or loss. There is no percentage limitation on the extent to which the Fund may purchase or sell securities on a when-issued, delayed delivery, or forward commitment basis.

Short-Term Funding Agreements and Guaranteed Investment Contracts

To enhance yield, the Fund may make limited investments in short-term funding agreements issued by banks and highly rated U.S. insurance companies. Short-term funding agreements issued by insurance companies are sometimes referred to as Guaranteed Investment Contracts (“GICs”), while those issued by banks are referred to as Bank Investment Contracts (“BICs”). Pursuant to such agreements, the Fund makes cash contributions to a deposit account at a bank or insurance company. The bank or insurance company then credits to the Fund on a monthly basis guaranteed interest at either a fixed, variable, or floating rate. These contracts are general obligations of the issuing bank or insurance company (although they may be the obligations of an insurance company separate account) and are paid from the general assets of the issuing entity.

The Fund will purchase short-term funding agreements only from banks and insurance companies which, at the time of purchase, are rated in one of the three highest rating categories and have assets of $1 billion or more. Generally, there is no active secondary market in short-term funding agreements. Therefore, short-term funding agreements may be considered by the Fund to be illiquid investments. To the extent that a short-term funding agreement is determined to be illiquid, such agreements will be acquired by the Fund only if, at the time of purchase, no more than 15% of the Fund’s net assets will be invested in short-term funding agreements and other illiquid securities.

Repurchase Agreements

To maintain liquidity, the Fund may enter into repurchase agreements (agreements to purchase U.S. Treasury notes and bills, subject to the seller’s agreement to repurchase them at a specified time and price) with well-established registered securities dealers or banks.

A repurchase agreement is a transaction in which the Fund purchases a security and, at the same time, the seller (normally a commercial bank or broker-dealer) agrees to repurchase the same security (and/or a security substituted for it under the repurchase agreement) at an agreed-upon price and date in the future. The resale price is in excess of the purchase price, as it reflects an agreed-upon market interest rate effective for the period of time during which the Fund holds the securities.

Repurchase agreements may be viewed as a type of secured lending. The purchaser maintains custody of the underlying securities prior to their repurchase; thus the obligation of the bank or dealer to pay the repurchase price on the date agreed to is, in effect, secured by such underlying securities. If the value of such securities is less than the repurchase price, the other party to the agreement is required to provide additional collateral so that all times the collateral is at least 102% of the repurchase price.

The majority of these transactions run from day to day and not more than seven days from the original purchase. However, the maturities of the securities subject to repurchase agreements are not subject to any limits and may exceed one year. The securities will be marked to market every business day so that their value is at least equal to the amount due from the seller, including accrued interest. The Fund’s risk is limited to the ability of the seller to pay the agreed-upon sum on the delivery date.

10

Although repurchase agreements carry certain risks not associated with direct investments in securities, the Fund intends to enter into repurchase agreements only with banks and dealers believed by the Adviser to present minimum credit risks in accordance with guidelines established by the Board of Trustees.

Credit Linked Notes

There are particular risks associated with investments in credit linked notes. Firstly, a credit linked note is a debt instrument which assumes both credit risk of the relevant reference entity (or entities) and the issuer of the credit linked note. There is also a risk associated with the coupon payment—if a reference entity in a basket of credit linked notes suffers a credit event, the coupon will be re-set and paid on the reduced nominal amount. Both the residual capital and coupon will then be exposed to further credit events. In extreme cases, the entire capital may be lost. There is also the risk that a note issuer may default.

Securities Lending

The Fund may, subject to guidelines adopted by the Board of Trustees, lend securities from its portfolio to brokers, dealers, and financial institutions deemed creditworthy and receive, as collateral, cash or cash equivalents which at all times while the loan is outstanding will be maintained in amounts equal to at least 100% of the current market value of the loaned securities. Any cash collateral will be invested in short-term securities that will increase the current income of the Fund lending its securities. The Fund will have the right to regain record ownership of loaned securities to exercise beneficial rights such as voting rights and subscription rights. While a securities loan is outstanding, the Fund is to receive an amount equal to any dividends, interest or other distributions with respect to the loaned securities. The Fund may pay reasonable fees to persons unaffiliated with the Trust for services in arranging such loans.

Even though securities lending usually does not impose market risks on the lending Fund, as with any extension of credit, there are risks of delay in recovery of the loaned securities and in some cases loss of rights in the collateral should the borrower of the securities fail financially. In addition, the value of the collateral taken as security for the securities loaned may decline in value or may be difficult to convert to cash in the event that the Fund must rely on the collateral to recover the value of the securities. Moreover, if the borrower of the securities is insolvent, under current bankruptcy law, the Fund could be ordered by a court not to liquidate the collateral for an indeterminate period of time. If the borrower is the subject of insolvency proceedings and the collateral held might not be liquidated, the result could be a material adverse impact on the liquidity of the lending Fund.

The Fund will not lend securities having a value in excess of 33 1/3% of its assets, including collateral received for loaned securities (valued at the time of any loan).

Temporary Defensive Position

From time to time, the Fund may take temporary defensive positions that are inconsistent with the Fund’s principal investment strategies, in attempting to respond to adverse market, economic, political, or other conditions. For example, the Fund may hold all or a portion of its assets in money market instruments (high quality income securities with maturities of less than one year), securities of money market funds, or U.S. Government repurchase agreements. The Fund may also invest in such investments at any time to maintain liquidity or pending selection of investments in accordance with its policies. As a result, the Fund may not achieve its investment objective.

Fund Operations

Operational Risk. An investment in the Fund, like any fund, can involve operational risks arising from factors such as processing errors, human errors, inadequate or failed internal or external processes, failures in systems and technology, changes in personnel, and errors caused by third-party service providers. The occurrence of any of these failures, errors, or breaches could result in a loss of information, regulatory scrutiny, reputational damage, or other events, any of which could have a material adverse effect on the Fund. While the Fund seeks to minimize such events through controls and oversight, there may still be failures that could cause losses to the Fund.

Information Security Risk. The Fund, and its service providers, may be prone to operational and information security risks resulting from cyber-attacks. Cyber-attacks include, among other behaviors, stealing or corrupting data maintained online or digitally, denial of service attacks on websites, the unauthorized release of confidential information, or various other forms of cyber security breaches. Cyber-attacks affecting the Fund or its investment adviser, custodian, transfer agent, fund accounting agent, financial intermediaries, and other third-party service providers may adversely impact the Fund. For instance, cyber-attacks may interfere with the processing of shareholder transactions, impact the Fund’s ability to calculate its NAVs, cause the release of private shareholder information or confidential business information, impede security trading,

11

or subject the Fund to regulatory fines, financial losses, and/or cause reputational damage. The Fund may also incur additional costs for cyber security risk management purposes. Similar types of cyber security risks are also present for issues or securities in which the Fund may invest, which could result in material adverse consequences for such issuers and may cause the Fund’s investment in such companies to lose value.

Investment Restrictions

Fundamental Investment Limitations. The investment limitations described below have been adopted by the Trust with respect to the Fund and are fundamental (“Fundamental”), i.e., they may not be changed without the affirmative vote of a majority of the outstanding shares of the Fund. As used in the Prospectus and the Statement of Additional Information, the term “majority” of the outstanding shares of the Fund means the lesser of: (1) 67% or more of the outstanding shares of the Fund present at a meeting, if the holders of more than 50% of the outstanding shares of the Fund are present or represented at such meeting or (2) more than 50% of the outstanding shares of the Fund. Other investment practices, which may be changed by the Board of Trustees without the approval of shareholders to the extent permitted by applicable law, regulation, or regulatory policy, are considered non-fundamental (“Non-Fundamental”).

| 1. | Borrowing Money. The Fund will not borrow money, except: (a) from a bank, provided that immediately after such borrowing there is an asset coverage of 300% for all borrowings of the Fund or (b) from a bank or other persons for temporary purposes only, provided that such temporary borrowings are in an amount not exceeding 5% of the Fund’s total assets at the time when the borrowing is made. This limitation does not preclude the Fund from entering into reverse repurchase transactions, provided that the Fund has asset coverage of 300% for all borrowings and reverse repurchase commitments of the Fund. |

| 2. | Senior Securities. The Fund will not issue senior securities. This limitation is not applicable to activities that may be deemed to involve the issuance or sale of a senior security by the Fund, provided that the Fund’s engagement in such activities is consistent with or permitted by the 1940 Act, the rules and regulations promulgated thereunder or interpretations of the SEC or its staff. |

| 3. | Underwriting. The Fund will not act as underwriter of securities issued by other persons. This limitation is not applicable to the extent that, in connection with the disposition of portfolio securities (including restricted securities), the Fund may be deemed an underwriter under certain federal securities laws. |