As filed with the Securities and

Exchange Commission on June 24, 2021

1933 Act Registration

No. 033-70742

1940 Act Registration No. 811-08090

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

POST-EFFECTIVE AMENDMENT NO. 223

And

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

AMENDMENT NO. 226

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST

(Exact Name of Registrant as Specified in

Charter)

Jayson R. Bronchetti, President

1301 South Harrison Street

Fort Wayne, Indiana 46802

(Address of Principal Executive Offices)

Registrant’s Telephone Number, Including Area Code: (260) 455-2000

Ronald A. Holinsky, Esquire

Lincoln Financial Group

150 N. Radnor-Chester Road

Radnor, PA 19087

(Name and Address of Agent for Service)

Copies of all communications to:

Robert A. Robertson, Esquire

Dechert, LLP

2010 Main Street, Suite 500

Irvine, CA 92614

It is proposed that this filing will become effective:

[] immediately upon filing pursuant to paragraph (b)

[ ] on __________________pursuant to paragraph (b)

[ ] 60 days after filing pursuant to paragraph (a)(1)

[ ] on pursuant to paragraph (a)(1)

[X ] 75 days after filing pursuant to paragraph (a)(2)

[ ] on __________________ pursuant to paragraph (a)(2) of Rule 485

If appropriate, check the following box:

[_] This post-effective amendment designates a new effective date for a previously

filed post-effective amendment.

Title of Securities Being Registered:

Shares of Beneficial Interest.

Lincoln

Variable Insurance Products Trust

Lincoln Nasdaq-100

Buffer Fund Dec

Standard and Service Class

1301 South Harrison Street

Fort Wayne, Indiana 46802

Prospectus [September 7], 2021

Lincoln Nasdaq-100 Buffer Fund Dec (the “Fund”) is a series of the

Lincoln Variable Insurance Products Trust (the “Trust”). Shares of the Fund are

currently offered only to separate accounts that fund variable annuity and variable life insurance contracts (“variable accounts”) of The Lincoln National Life Insurance Company, its affiliates, and third-party insurance companies. You cannot purchase shares of the Fund directly. This prospectus discusses the information about the Fund that you should know before investing.

As with all mutual funds, the Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

We

have not authorized any dealer, salesperson, or any other person to give any information, or to make any representation, other than what this prospectus states.

•

The Fund has characteristics unlike traditional investment products and will not be suitable for all investors. Carefully read this prospectus before determining whether the Fund may be a suitable investment.

•

The Fund seeks, over a specified annual period (an “Outcome Period”), to

provide returns that track those of the Invesco QQQ TrustSM, Series 1 (“Underlying

ETF”) up to a cap, while providing a buffer against losses. There is no guarantee that the Fund will successfully achieve its investment

objective.

•

The

Fund’s initial Outcome Period is the one-year period from [December 17],

2021 to [December 16], 2022.

•

Buffer: The Fund seeks to provide a buffer against the first 12% of Underlying ETF price decreases over each Outcome

Period before the deduction of Fund expenses (the “Buffer”). The Fund, and therefore investors, will bear all Underlying ETF losses exceeding 12%. There is no guarantee the Fund will successfully buffer against Underlying ETF price decreases. The Buffer is designed to have its full effect only for investors who hold Fund shares for an entire Outcome

Period.

•

Cap: For each Outcome Period, Fund performance is subject to a specified upside return cap that represents the maximum percentage return the Fund can achieve during the Outcome Period before the deduction of Fund expenses (the “Cap”). The Cap is set on the first day of an Outcome Period and may increase or decrease from one Outcome Period to the next. If the Underlying ETF experiences returns over an Outcome Period in excess of the Cap, the Fund, and therefore investors, will not experience those excess gains.

•

The Fund is designed to produce predetermined investment outcomes relative to the

performance of an Underlying ETF. The defined outcomes sought by the Fund include the Buffer and Cap (“Outcomes”) based upon the performance of the Underlying

ETF over an Outcome Period. There is no guarantee that the Outcomes for any Outcome Period will be realized. A shareholder may lose its entire investment.

•

The Fund’s strategy is designed to produce specific Outcomes which

may only be realized if you are holding shares of the Fund on the first day of the Outcome Period and hold them continuously through the last day of the

Outcome Period. It should not be expected that the Outcomes

will be provided at any point prior to the end of an Outcome Period. The Outcomes are measured

from the Fund’s net asset value (the per share value of the Fund’s assets (“NAV”)) on the first day of the Outcome Period. The Fund does not track

the Underlying ETF except over an entire Outcome Period, and the Fund’s NAV will not increase or decrease at the same rate as the Underlying ETF during an Outcome

Period.

•

Outcomes are Before Fund Expenses: The Buffer and the Cap are calculated before Fund expenses. Thus, maximum Fund performance over an Outcome

Period is expected to be lower than the Cap by the amount of such Fund expenses, and Fund performance over an Outcome Period will be exposed to losses beyond the Buffer in

the amount of such Fund expenses. The Fund’s prospectus includes further detail on Fund expenses.

•

If you purchase shares after an Outcome Period has begun or redeem shares prior to an

Outcome Period’s conclusion, you may experience investment returns very different from those that the Fund seeks to provide. If the Fund has experienced high levels

of either gains or losses since the beginning of the Outcome Period, there may be little to no ability to achieve gains or benefit from the Buffer for the remainder of the Outcome Period. Please note in

particular:

•

An investor purchasing shares after the Fund has increased in

value during an Outcome Period would not benefit from the Buffer until the Fund’s value has decreased to its value at the commencement of the

Outcome Period. Such an investor also would have less potential for gains before the Cap is reached. An investor purchasing shares after the Fund

has increased in value to a level near to the Cap for an Outcome Period would have little or no ability to achieve gains but would remain

susceptible to downside risks.

•

An investor purchasing shares after the Fund has decreased in

value would have less protection from the Buffer. An investor purchasing shares after the Fund has decreased in value beyond the Buffer would gain

no benefit from the Buffer.

•

Because the Buffer is designed to be in effect only at the end of an Outcome Period, an investor who sells Fund shares before the end of an Outcome Period may not experience the full effect of the Buffer.

•

After the conclusion of an Outcome Period, another one-year Outcome Period will begin. Each

Outcome Period will have a new Cap which may be higher or lower than the current Cap.

•

The Fund’s website, lincolnfinancial.com/definedoutcomefunds, provides important information on

a daily basis that will assist you in determining whether to buy shares, including the current Outcome Period start and end dates, the remaining Cap and Buffer, and the potential outcomes of an investment in the Fund. Investors considering purchasing or selling shares should visit the website to understand the potential investment outcomes at the end of the current Outcome Period.

INVESTOR SUITABILITY

You should consider this investment

only if all of the following factors

apply to you:

•

you fully understand the risks inherent in an investment in the Fund;

•

you desire to invest in a product with a return that depends upon the performance of the

Invesco QQQ TrustSM, Series 1 over a full Outcome Period;

•

you are willing to hold shares for the duration of the Outcome Period in order to achieve

the Outcomes that the Fund seeks to provide;

•

you fully understand that investments made when the Fund is at or near to the Cap may have

limited to no upside;

•

you

seek the protection of a 12% Buffer on Invesco QQQ TrustSM, Series

1 losses for an investment held for the duration of the entire Outcome Period and understand that there is no guarantee that the Fund will be successful in its attempt to

provide protection through the Buffer;

•

you are willing to forego any gains in excess of the Cap;

•

you are willing to be exposed to the downside performance of the Invesco QQQ TrustSM, Series 1 beyond the 12% Buffer;

•

you understand that the Fund’s investment strategies are not expected to provide for

dividends to the Fund;

•

you

fully understand that investments made after an Outcome Period has begun may not fully benefit from the Buffer;

•

you are willing to accept the risk of losing your entire investment; and

•

you have visited the Fund’s website and understand the investment Outcomes available

to you based upon the time of your purchase.

Lincoln Nasdaq-100 Buffer Fund Dec

(Standard and Service Class)

Summary

Investment Objective

The Fund seeks, over a specified annual period (an “Outcome Period”), to provide

returns that track those of the Invesco QQQ TrustSM, Series 1 up to a cap, while providing a buffer against losses.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. This table does not reflect any variable contract expenses. You may pay other fees, such as brokerage commissions and

other fees to financial intermediaries, which are not reflected in the tables and examples below. If variable contract expenses were included, the expenses shown would be higher.

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment)

| |

|

|

| |

|

|

Distribution and/or Service (12b-1) Fees |

|

|

| |

|

|

Acquired Fund Fees and Expenses2 (AFFE) |

|

|

Total Annual Fund Operating Expenses |

|

|

| |

|

|

Total Annual Fund Operating Expenses (After Fee Waiver) |

|

|

1

Other Expenses are based on estimates for the current fiscal year.

2

AFFE is based on estimated amounts for the current fiscal year.

3

Lincoln Investment Advisors Corporation (the “Adviser”) has contractually agreed

to waive the following portion of its advisory fee: 0.23% on the first $50 million of the Fund’s average daily net assets; and 0.00% of the Funds average daily net

assets in excess of $50 million. The agreement will continue through at least June 30, 2022 and cannot be terminated before that date without the mutual agreement of the Fund’s Board of Trustees and the Adviser.

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example illustrates the hypothetical expenses that you would incur over the time periods indicated if you invest $10,000 in the Fund’s shares. The example also assumes that the Fund provides a return of 5% a year and that operating expenses remain the same. This example reflects the net operating expenses with fee waiver for the one-year contractual period and the total operating expenses without fee waiver for the remaining time periods shown below. Your actual costs may be higher or lower than this example. This example does not reflect any variable contract expenses. If variable contract expenses were included, the expenses shown would be higher. The results apply whether or not you redeem your investment at the end of the given period.

Lincoln Nasdaq-100 Buffer Fund Dec1

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. Because the Fund is newly organized, the portfolio turnover rate is not yet available. The Fund intends to turn over all of its options holdings on at least an annual basis.

Principal Investment Strategies

The Fund seeks, over each Outcome Period, to provide returns that track those of the Invesco QQQ TrustSM, Series 1 (the “Underlying ETF”), up to a cap, while providing a buffer against losses. The Fund employs a defined outcome strategy, sub-advised by Milliman Financial Risk Management LLC, which seeks to produce pre-determined investment outcomes based on the performance of the Underlying ETF’s market price over a one-year period (“Outcomes”), subject to the specified cap for gains and with the benefit of a buffer for losses. Due to the unique mechanics of the Fund’s strategy, the return an investor can expect to receive from an investment in the Fund has characteristics that are distinct from many other investment vehicles.

The Fund, under normal circumstances, invests at least 80% of its assets in options that reference the Underlying ETF or, in an underlying fund which tracks the same index as that tracked by the Underlying ETF. The Fund invests approximately half of its assets in FLexible EXchange® Options (“FLEX Options”) and approximately half of its assets in the LVIP SSGA Nasdaq-100 Index Fund (the “Underlying Fund”).

The Fund’s initial Outcome Period is the one-year period from [December 17], 2021 to [December 16], 2022. The pre-determined Outcomes sought by

the Fund, which include the buffer and cap discussed below, are based upon the performance of the Underlying ETF’s market price during the Outcome Period. The Fund

will not receive or benefit from any dividend payments made by the Underlying ETF.

Buffer: The Fund seeks to provide a buffer against the first 12% of Underlying ETF price decreases over each Outcome Period, before the deduction of Fund expenses (the “Buffer”), which after Fund expenses is approximately 11.15% for the Standard Class and 10.80% for the Service Class. The Fund, and therefore investors, will bear all Underlying ETF losses exceeding 12%. There is no guarantee the Fund will successfully buffer against Underlying ETF price decreases. The Buffer is designed to have its full effect only for investors who continually hold Fund shares for an entire Outcome Period. The Buffer is discussed in further detail below.

Cap: For each Outcome Period, Fund performance is subject to a specified upside return cap that represents the maximum percentage return the Fund can achieve during the Outcome Period before the deduction of Fund expenses (the “Cap”). The Cap is set on the first day of an Outcome Period based on the cost of providing the Buffer and may increase or decrease from one Outcome Period to the next.

If the Underlying ETF experiences gains over an Outcome Period, the strategy seeks to provide investment returns that track the performance of the Underlying ETF, up to the Cap. If the Underlying ETF experiences returns over an Outcome Period in excess of the Cap, the Fund will not experience those excess gains. The Cap (before Fund expenses) is reduced by the Fund’s expenses. The Cap is expected to change from one Outcome Period to the next. The Cap is discussed in further detail below.

The Fund’s website, lincolnfinancial.com/definedoutcomefunds, provides important Fund information on a daily basis, including

information about the Cap and Buffer, current Outcome Period start and end dates, and information relating to the remaining potential Outcomes of an investment in the Fund. Investors considering purchasing shares should visit the website for the latest information.

2Lincoln Nasdaq-100 Buffer Fund Dec

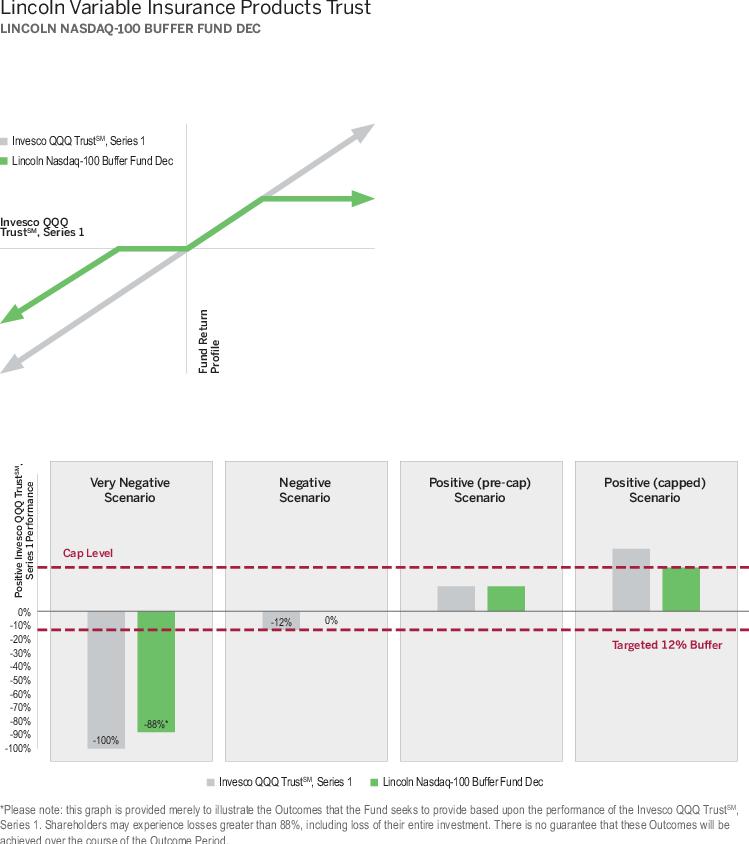

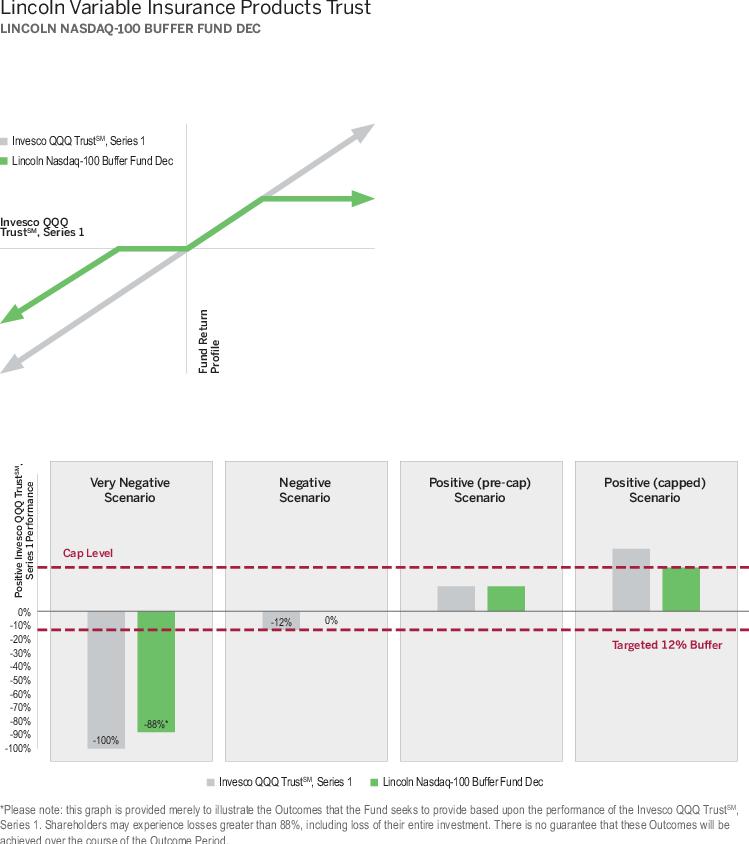

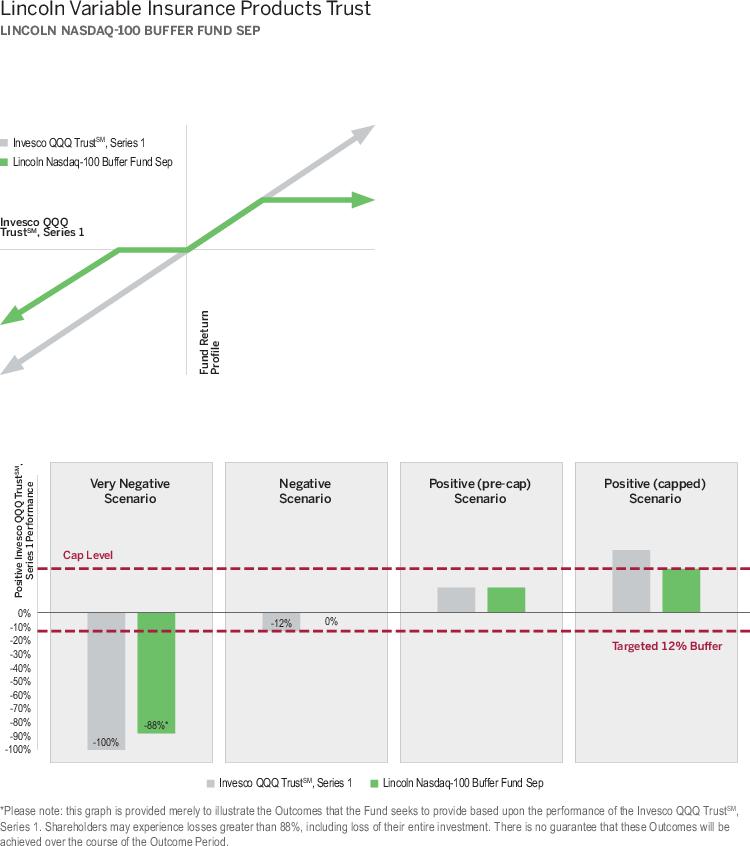

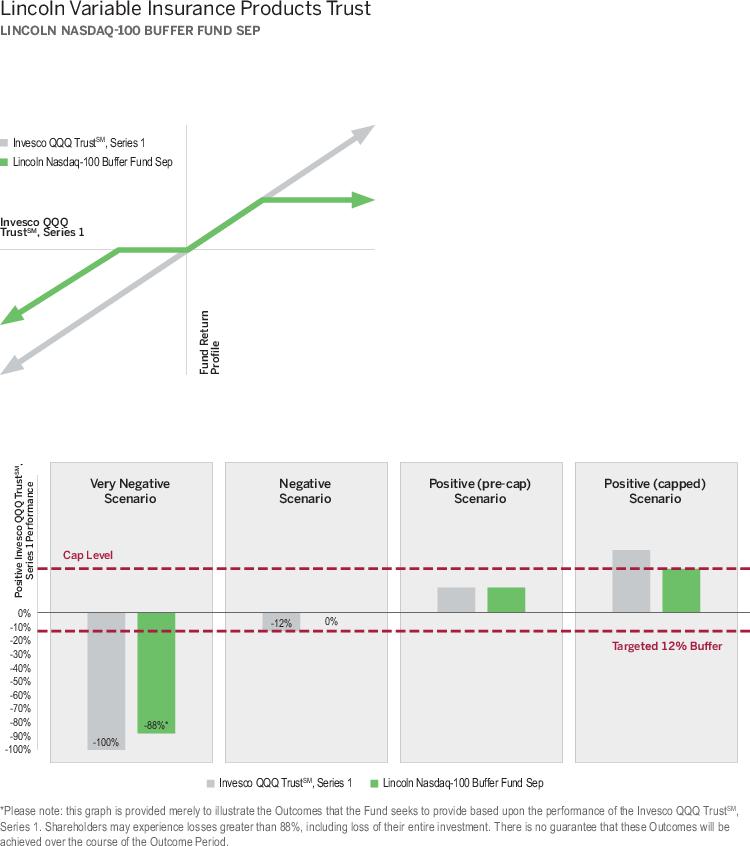

The two

hypothetical graphical illustrations provided below are designed to illustrate the Outcomes based upon the hypothetical performance of the Underlying ETF

for a shareholder that holds shares for the entirety of an Outcome Period. There is no guarantee that the Fund will be successful in its attempt to provide

the Outcomes for an Outcome Period. The returns that the Fund seeks to provide do not include the

costs associated with purchasing shares of the Fund and the expenses incurred by the Fund.

Lincoln Nasdaq-100 Buffer

Fund Dec3

Use of FLEX Options. The Fund invests approximately 50% of

its net assets in FLEX Options, the value of which is derived from the performance of the underlying reference asset, the Underlying ETF. FLEX Options are exchange-traded

options contracts with uniquely customizable terms. FLEX Options are set to expire on the last day of the Outcome Period, at which time the Fund will invest in a new set of FLEX Options for the next Outcome Period. An option contract is an agreement between a buyer and seller that gives the purchaser of the option the right to buy or sell a particular reference asset at a specified future date at an agreed upon price.

Investment Strategy of the Buffer. The Fund pursues its

objective by purchasing and selling call and put FLEX Options to create layers within the Fund’s portfolio. One layer is designed to buffer the Fund from losses, while

another layer is designed to produce returns that track those of the Underlying ETF for an Outcome Period, up to the Cap.

The Buffer layer of FLEX Options is designed to buffer the Fund from losses of up to

12% if the Underlying ETF experiences a loss at the end of an Outcome Period.

There is no guarantee that the Fund will be successful in its attempt to provide buffered returns. The Buffer is operative only against the first 12% of Underlying ETF losses at the end an Outcome Period. If

the Underlying ETF has decreased in value by more than 12% at the end of an Outcome Period, the Fund, and therefore investors, will experience those losses.

The Underlying ETF tracking layer of FLEX Options is designed to work alongside the Fund’s investment in the Underlying Fund to produce returns that track those of the Underlying ETF for an Outcome Period if the Underlying ETF has experienced gains during that Outcome Period. This gain is subject to the Cap, a maximum investment return level, which is

discussed below.

Outcome Periods. The Outcomes sought by the Fund are based

upon the Fund’s NAV on the first day of an Outcome Period. An Outcome Period begins on the day the FLEX Options are entered into and ends on the day they expire. Each

FLEX Option’s value is ultimately derived from the performance of the Underlying ETF during the Outcome Period. Because the terms of the FLEX Options do not change, the Cap and Buffer both relate to the Fund’s NAV on the first day of the Outcome Period. To achieve the Outcomes for an Outcome Period, an investor must be holding

shares for the entire Outcome Period. A shareholder that purchases shares after the commencement of an Outcome Period will likely have purchased shares at a

different NAV than the NAV upon which the Outcomes are based and may experience investment Outcomes very different from those sought by the Fund over the

entire Outcome Period. A shareholder that redeems shares prior to the end of an Outcome Period may also experience investment Outcomes very different from those sought by the Fund.

There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes.

The value of FLEX Options is derived from the performance of the underlying reference asset, the Underlying ETF. However, because a component of an option’s value is the time remaining until its expiration, during the Outcome Period, the Fund’s NAV will not directly correlate on a day-to-day basis with the returns experienced by the Underlying ETF, though as a FLEX Option approaches its expiration date, its value typically increasingly moves with the value of the Underlying ETF. While the Fund generally anticipates that its NAV will move in the same direction as the Underlying ETF (meaning that the Fund’s NAV will increase if the Underlying ETF experiences gains and that the Fund’s NAV will decrease if the Underlying ETF experiences losses), the Fund’s NAV may not increase or decrease at the same rate as the Underlying ETF. Similarly, the amount of time remaining until the end of the Outcome Period also affects the impact of the Buffer on the Fund’s NAV, which may not be in full effect prior to the end of the Outcome Period. The Fund’s strategy is designed to produce the Outcomes upon the

expiration of the FLEX Options on the last day of the Outcome Period and it should not be expected that the Outcomes will be provided at any point prior to

that time. Taken together, this means that at the midpoint of the Outcome Period, if the

Underlying ETF has decreased in value by 12%, the Fund’s NAV can be expected to have decreased in value (because the Buffer is not yet in full effect), but by less

than 12% (because the Fund’s NAV will not correlate one-to-one with the Underlying ETF and the Fund’s NAV tends not to participate fully in either Underlying ETF

gains or losses).

Cap on Potential

Upside Returns. Unlike other investment products, the potential returns an investor can receive from an investment in the Fund are subject to an upside return Cap. This means that if the Underlying ETF

experiences gains for the Outcome Period beyond the level of the Cap, the Fund will not experience those excess gains. Therefore, regardless of the

performance of the Underlying ETF, the Cap (after Fund expenses) is the maximum return an investor can achieve from an investment in the Fund for an Outcome Period.

The Cap will change for each Outcome Period based upon prevailing market conditions at

the beginning of an Outcome Period. The Cap may increase or decrease from one Outcome Period to the next. The Cap, and the Fund’s position relative to it, should be

considered before investing in the Fund. If the Fund has already increased in

value to a level near to the Cap, an investor purchasing shares at that price has limited or no potential gains available for the remainder of the Outcome

Period but remains vulnerable to significant downside risks.

Buffer. The Buffer is operative only against the first 12%

of Underlying ETF losses for an Outcome Period; however, there is no guarantee that the Fund will be successful in its attempt to provide buffered returns. If the

Underlying ETF has decreased in value by more than 12% during an Outcome Period, the Fund will experience all further losses. The Buffer is calculated prior to taking into

account Fund expenses, such as Fund management fees equal to 0.55% of the Fund’s daily net assets, transaction fees, and any other expenses incurred by the Fund. If an investor purchases shares during an Outcome Period, and

the Fund has already decreased in value during that Outcome Period, that investor may not fully benefit from the Buffer for the remainder of the Outcome

Period, but will have increased gains available prior to reaching the Cap. Conversely, during the Outcome Period, if the Fund has already

4Lincoln Nasdaq-100 Buffer Fund Dec

increased in value, then a shareholder investing at that time may experience losses

prior to gaining the protection offered by the Buffer. While the Fund seeks to

limit losses by 12% for shareholders who hold shares for an entire Outcome Period, there is no guarantee it will successfully do so. Notwithstanding the Buffer, a

shareholder that purchases shares at the beginning of an Outcome Period or during an Outcome Period may lose its entire investment. An investment in the Fund is only

appropriate for shareholders willing to bear those losses.

Fund Rebalance. The Fund is a continuous investment vehicle.

It does not terminate and distribute its assets at the conclusion of each Outcome Period. On the termination date of an Outcome Period, the Fund will invest in a new set of

FLEX Options, which will provide a new Cap, and another Outcome Period will commence.

Approximately one week prior to the end of an Outcome Period, the Fund will file a

prospectus supplement, which will alert existing shareholders that an Outcome Period is approaching its conclusion and disclose the anticipated ranges for the Cap for the

next Outcome Period. Following the close of business on the last day of an Outcome Period, the Fund will file a prospectus supplement that discloses the Fund’s final Cap for the next Outcome Period.

The Fund’s website, lincolnfinancial.com/definedoutcomefunds, provides information relating to the Outcomes, including the Fund’s

position relative to the Cap and Buffer, of an investment in the Fund on a daily basis.

The Underlying Fund

The Underlying Fund seeks to achieve its objective by investing in the securities that comprise the Nasdaq-100® Index (the “Index”). The Underlying Fund, under normal market conditions, invests at least 80% of its assets in the securities of issuers included in the Index. The Underlying Fund attempts to replicate the Index by investing all, or substantially all, of its assets in the stocks that comprise the Index, holding each stock in approximately the same proportion as its weighting in the Index. The Underlying Fund may not invest in every security in the Index if it is not practical to do so (such as when transaction costs are too high, there is a liquidity issue, or there is a pending corporate action).

The Index includes the common stocks of the 100 largest domestic and international

non-financial companies on the broader Nasdaq Composite Index based on market capitalization. The Index reflects companies across major industry groups including computer

hardware and software, telecommunications, retail/wholesale trade and biotechnology. As of March 15, 2021, the market capitalization range of the companies comprising the Index was $5.4 billion to $2 trillion. The Index typically is rebalanced quarterly and reconstituted annually. The Fund will reinvest Underlying Fund dividends and distributions in additional Underlying Fund shares.

The Underlying Fund employs a passive investment approach called “indexing”, by which the Underlying Fund’s Sub-Adviser attempts to approximate, before fees and expenses, the performance of the Index over the long term. The Underlying Fund’s Sub-Adviser invests in the equity securities comprising the Index, in approximately the same proportions as they are represented in the Index. Equity securities may include common stocks, preferred stocks, depository receipts, or other securities convertible into common stock. The Underlying Fund’s Sub-Adviser may sell securities that are represented in the Index, or purchase securities that are not yet represented in the Index, prior to or after their removal or addition to the Index.

The Underlying Fund may purchase or sell index futures contracts, or options on those futures, or engage in other transactions involving the use of derivatives, to provide equity exposure to the Underlying Fund’s cash position while maintaining cash balances for liquidity, or for other purposes that assist in replicating the Underlying Fund's investment performance of the Index. The Underlying Fund’s return may not match the return of the Index.

The Underlying Fund intends to be diversified in approximately the same proportion as the Index. The Underlying Fund may become “non-diversified,” as defined by the Investment Company Act of 1940 solely as a result of a change in relative market capitalization or index weighting of one or more constituents of the Index. As a “non-diversified” fund, the Underlying Fund can invest a greater percentage of its assets in a limited number of issuers or in any one issuer. Shareholder approval will not be sought if the Underlying Fund shifts from diversified to non-diversified solely due to a change in the relative market capitalization or index weightings of one or more constituents of the Index.

The Underlying Fund will concentrate its investments in a particular industry or group

of industries to the extent the Index is concentrated. The Index, at times, may be significantly concentrated in the information technology sector.

Principal Risks

All mutual funds carry risk. Accordingly, loss of money is a risk of investing in the Fund.

Because the Fund invests certain of its assets in shares of an Underlying Fund, the Fund indirectly owns the investments made by the Underlying Fund. By investing in the

Fund, therefore, you indirectly assume the same types of risks as investing directly in the Underlying Fund. In addition, the Fund will indirectly pay a proportional share of the fees and expenses of the Underlying Fund. The Fund's ability to achieve its investment objective depends, in large part, on the Underlying Fund's ability to meet its investment objective, as well as the performance of the FLEX Options. The following risks reflect the Fund's principal risks, which include the principal risks of the FLEX Options and the Underlying Fund.

•

Buffered Loss Risk. There can be no guarantee that the Fund will be successful in its

strategy to provide buffer protection

Lincoln Nasdaq-100 Buffer Fund Dec5

against Underlying ETF

losses if the Underlying ETF has decreased at the end of an Outcome Period. In the event an investor purchases shares after the commencement of an Outcome Period, the Buffer

that the Fund seeks to provide may not be available. The Fund does not provide principal protection and an investor may experience significant losses on its investment,

including the loss of its entire investment.

•

Capped Upside Return Risk. The Fund’s strategy seeks to provide returns only up to the Cap. In the event that the Underlying ETF

has gains in excess of the Cap during an Outcome Period, the Fund will not participate in those gains beyond the Cap. In the event an investor purchases shares after the

commencement of an Outcome Period and the Fund has risen in value to a level near to the Cap, there may be little or no ability for that investor to experience an investment

gain.

•

Outcome Period Risk. The Fund’s investment strategy is designed to deliver returns that track the Underlying ETF only if shares are bought at the beginning of an Outcome Period and held until the end of the Outcome Period. If an investor purchases or sells shares during an Outcome Period, the returns realized by the investor may not be those that the Fund seeks to achieve. In addition, the Cap may change from one Outcome Period to the next and is unlikely to remain the same for consecutive Outcome Periods.

•

FLEX Options Risk. The Fund may experience substantial downside from specific FLEX Option positions, and certain FLEX Option

positions may expire worthless. In addition, the FLEX Options are subject to the following risks:

Valuation Risk. The value of the FLEX Options will be affected by, among

others, changes in the value of the Underlying ETF, changes in interest rates, changes in the actual and implied volatility of the Underlying ETF and the remaining time

until the FLEX Options expire. The value of the FLEX Options does not increase or decrease at the same rate as the level of the Underlying ETF (although they generally move in the same direction).

Liquidity Risk. In the event that trading in the FLEX Options is limited or absent, the value of the Fund’s FLEX Options may decrease. There is no guarantee that a liquid secondary trading market will exist for the FLEX Options.

Counterparty Risk. Counterparty risk is the risk an issuer, guarantor or counterparty of a security in the Fund is unable or unwilling to meet its obligation on the security. The Fund will utilize FLEX Options issued and guaranteed for settlement by the Options Clearing Corporation (the “OCC”). Although guaranteed for settlement by the OCC, FLEX Options are still subject to counterparty risk with the OCC and may be less liquid than more traditional standardized exchange-traded

options.

Correlation Risk. The FLEX Options held by the Fund will be exercisable at

the strike price only on their expiration date. Prior to the expiration date, the value of the FLEX Options will be determined based upon market quotations or using other

recognized pricing methods, consistent with the Fund’s valuation policy. Because a component of the FLEX Option’s value will be affected by, among other things, changes in the value of the Underlying ETF, changes in interest rates, changes in the actual and implied volatility of the Underlying ETF and the remaining time until the FLEX Options expire, the value of the Fund’s FLEX Options positions is not anticipated to increase or decrease at the same rate as the Underlying ETF, and it is possible they may move in different directions, and as a result, the Fund’s NAV may not increase or decrease at the same rate as the Underlying ETF. Similarly, the components of the option’s value are anticipated to impact the effect of the Buffer on the Fund’s NAV, which may not be in full effect prior to the end of the Outcome Period. The Fund’s strategy is designed to produce the Outcomes upon the expiration of the FLEX Options on the last business day of the Outcome Period, and it should not be expected that the Outcomes will be provided at any point other than the end of the Outcome Period.

•

Market Risk. The value of portfolio investments may decline. As a result, your investment in the Fund may decline in value and you could lose money.

•

Issuer Risk. The prices of, and the income generated by, portfolio securities may decline in response to various factors directly related to the issuers of such securities.

•

Fund of Funds Risk. The Fund bears all risks of an Underlying Fund’s investment strategies, including the risk that an Underlying Fund may not meet its investment objective which may negatively affect the Fund’s performance. In addition, the Fund indirectly will pay a proportional share of the fees and expenses of an Underlying Fund.

•

Tracking Error Risk. The Underlying Fund's performance may deviate substantially from the performance of the index it tracks as a

result of cash flows, fund expenses, imperfect correlation between the Underlying Fund's investments and the index’s components, and other factors. While attempting to

replicate the index return, the Underlying Fund may invest in fewer than all of the securities in the index and in some securities not included in the index, potentially

increasing the risk of divergence between the Underlying Fund’s return and that of the index.

•

Investment Objective Risk. Certain circumstances under which the Fund might not achieve its objective include, but are not limited, to

(i) if the Fund disposes of FLEX Options, (ii) if the Fund is unable to maintain the optimal balance of FLEX Options in the Fund’s portfolio, (iii) significant accrual

of Fund expenses in connection with effecting the Fund’s principal investment strategies or (iv) adverse tax law changes affecting the treatment of FLEX

Options.

•

Exchange-Traded Fund (“ETF”) Risk. ETFs generally reflect the risks of owning the underlying securities they hold, although lack of liquidity in

ETF shares could result in the price of the ETF being more volatile.

•

Authorized Participation Concentration Risk. Only an authorized participant may engage in creation or redemption transactions directly with the Underlying

ETF. The Fund has a limited number of institutions that may act as authorized participants on an agency basis (i.e., on behalf of other market participants). To the extent that authorized participants

exit the business or are

6Lincoln Nasdaq-100 Buffer Fund Dec

unable to proceed with

creation and/or redemption orders with respect to the Underlying ETF and no other authorized participant is able to step forward to create or redeem creation units, shares

may be more likely to trade at a premium or discount to NAV and possibly face trading halts and/or delisting.

•

Active Markets Risk. Although the shares are listed for trading on an exchange, there can be no assurance that an active trading

market for the shares will develop or be maintained. shares trade on an exchange at market prices that may be below, at or above the Underlying ETF’s NAV. Securities,

including the shares, are subject to market fluctuations and liquidity constraints that may be caused by such factors as economic, political, or regulatory developments,

changes in interest rates, and/or perceived trends in securities prices. shares of the Underlying ETF could decline in value or underperform other investments.

•

Fluctuation of Net Asset Value Risk. The Underlying ETF’s shares trade on an exchange at their market price rather than their NAV. The

market price may be at, above or below the Underlying ETF’s NAV. Differences in market price and NAV may be due, in large part, to the fact that supply and demand

forces at work in the secondary trading market for shares will be closely related to, but not identical to, the same forces influencing the prices of the holdings of the

Underlying ETF trading individually or in the aggregate at any point in time. These differences can be especially pronounced during times of market volatility or stress.

During these periods, the demand for shares may decrease considerably and cause the market price of shares to deviate significantly from the Underlying ETF’s NAV.

•

Market Maker Risk. If the Underlying ETF has lower average daily trading volumes, it may rely on a small number of third-party

market makers to provide a market for the purchase and sale of shares. Any trading halt or other problem relating to the trading activity of these market makers could result in a dramatic change in the spread between the Underlying ETF’s NAV and the price at which the shares are trading on an exchange, which could result in a decrease in value of the shares. In addition, decisions by market makers or authorized participants to reduce their role or step away from these activities in times of market stress could inhibit the effectiveness of the arbitrage process in maintaining the relationship between the underlying values of the Underlying ETF’s portfolio securities and the Underlying ETF’s market price. This reduced effectiveness could result in shares trading at a discount to NAV and also in greater than normal intra-day bid-ask spreads for shares.

•

Trading Issues Risk. Although the shares are listed for trading on an exchange, there can be no assurance that an active trading

market for such shares will develop or be maintained. Trading in shares on an exchange may be halted due to market conditions or for reasons that, in the view of the exchange, make trading in shares inadvisable. In addition, trading in shares on an exchange is subject to trading halts caused by extraordinary market volatility pursuant to exchange “circuit breaker” rules. Market makers are under no obligation to make a market in the shares, and authorized participants are not obligated to submit purchase or redemption orders for creation units. There can be no assurance that the requirements of an exchange necessary to maintain the listing of the Underlying ETF will continue to be met or will remain unchanged. Initially, due to the small asset size of the Underlying ETF, it may have difficulty maintaining its listings on an exchange.

•

Passive Management Risk. Index funds invest in the securities of an index rather than actively selecting among securities. With an

indexing strategy there is no attempt to manage volatility, use defensive strategies, or reduce the effects of any long-term period of poor investment

performance.

•

Concentration Risk. Investments that are concentrated in particular industries, sectors or

types of investments may be subject to greater risks of adverse developments in such areas of focus than investments that are spread among a wider variety of industries, sectors or investments.

•

Information Technology Sector Risk. Market or economic factors impacting information technology companies could have a major effect on the value

of the Fund’s investments. The value of stocks of information technology companies is particularly vulnerable to rapid changes in technology product cycles, rapid

product obsolescence, government regulation and competition.

•

Preferred Securities Risk. Preferred securities are subject to issuer-specific and market risks applicable generally to equity

securities. The value of preferred stock also can be affected by prevailing interest rates. Preferred securities may pay fixed or adjustable rates of return. In addition, a company’s preferred securities generally pay dividends only after the company makes required payments to holders of its bonds and other debt.

•

Convertible Securities Risk. Convertible securities share investment characteristics of both fixed income and equity securities. The value

of these securities may vary more with fluctuations in the value of the underlying common stock than with fluctuations in interest rates. The value of convertible securities

also may be less volatile than the underlying common stock. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of

similar quality. The Fund could lose money if the issuer of a convertible security is unable to meet its financial obligations or goes bankrupt.

•

Futures Risk. A futures contract is considered a derivative because it derives its value from the price of the underlying security or financial index. The prices of futures contracts can be volatile, and futures contracts may be illiquid. In addition, there may be imperfect or even negative correlation between the price of the futures contracts and the price of the underlying securities. Losses on futures contracts may exceed the amount invested.

•

Non-Diversification Risk. When a mutual fund is non-diversified, it may invest a greater percentage of its assets in a particular

issuer than a diversified fund. Therefore, a fund’s value may decrease because of a single investment or a small number of investments.

•

Natural Disaster/Epidemic Risk. Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis, and other

severe weather-related phenomena generally, and widespread disease and illness, including pandemics and epidemics (such as the novel coronavirus), have been and can be

highly disruptive to economies and markets.

Lincoln Nasdaq-100 Buffer

Fund Dec7

•

Liquidity Risk. Liquidity risk is the risk that the Fund cannot meet requests to redeem Fund-issued shares without significantly diluting the remaining investors’ interest in the Fund. This may result when portfolio holdings may be difficult to value and may be difficult to sell, both at the time or price desired. Liquidity risk also may result from increased shareholder redemptions in the Fund.

Fund Performance

The Fund will commence operations on or about June 18, 2021. Once the Fund has at

least one full calendar year of performance, a bar chart and performance table will be included in the prospectus. Please note that the Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

Investment Adviser and Sub-Adviser

Investment Adviser: Lincoln Investment Advisors Corporation

(“LIAC”)

Investment Sub-Adviser: Milliman Financial

Risk Management LLC (“Milliman”)

Portfolio

Managers

Milliman Portfolio Managers |

|

|

| |

Principal and Director of Global Trading |

|

| |

|

|

Purchase and Sale of Fund Shares

Fund shares are available as underlying investment options for variable life

insurance and variable annuity products issued by The Lincoln National Life Insurance Company (“Lincoln Life”), Lincoln Life & Annuity Company of New York

(“LNY”), and unaffiliated insurance companies. These insurance companies are the record owners of the separate accounts holding the Fund’s shares. You do

not buy, sell or exchange Fund shares directly – you choose investment options through your variable annuity contract or variable life insurance policy. The insurance companies then cause the separate accounts to purchase and redeem Fund shares according to the investment options you choose. Fund shares also may be available for investment by certain funds of the Lincoln Variable Insurance Products Trust.

Tax Information

In general, Contract owners are taxed only on underlying Fund amounts they withdraw from their variable accounts. Contract owners should consult their Contract Prospectus for more information on the federal income tax consequences to them regarding their indirect investment in the Fund. Contract owners also may wish to consult with their own tax advisors as to the tax consequences of investments in variable contracts and the Fund, including application of state and local taxes.

Payments to Broker-Dealers and other Financial

Intermediaries

Shares of the Fund are available only through the

purchase of variable contracts issued by certain life insurance companies. Parties related to the Fund (such as the Fund's principal underwriter or investment adviser) may

pay such insurance companies (or their related companies) for the sale of Fund shares and related services. These payments may create a conflict of interest and may

influence the insurance company to include the Fund as an investment option in its variable contracts. Such insurance companies (or their related companies) may pay broker-dealers or other financial intermediaries (such as banks) for the sale and retention of variable contracts that offer Fund shares. These payments may create a conflict of interest by influencing the broker-dealers or other financial intermediaries to recommend variable contracts that offer Fund shares. The prospectus or other disclosure documents for the variable contracts may contain additional information about these payments, if any. Ask your salesperson or visit your financial intermediary's website for more information.

8Lincoln

Nasdaq-100 Buffer Fund Dec

Additional Information about the Fund

Investment Objective and Principal Investment Strategies

The Fund’s investment objective is to seek, over a specified annual period (an “Outcome Period”), to provide returns that track those of the Invesco QQQ TrustSM, Series 1 (the “Underlying ETF”), up to a cap, while providing a buffer against losses. The investment objective is non-fundamental and may be changed without shareholder approval.

The Fund employs a defined outcome strategy, sub-advised by Milliman Financial Risk Management LLC, which seeks to produce pre-determined investment outcomes based on the performance of the Underlying ETF’s market price over a one-year period (“Outcomes”), subject to the specified cap for gains and with the benefit of a buffer for losses. Due to the unique mechanics of the Fund’s strategy, the return an investor can expect to receive from an investment in the Fund has characteristics that are distinct from many other investment vehicles.

The Fund, under normal circumstances, invests at least 80% of its assets in options that reference the Underlying ETF or, in an underlying fund which tracks the same index as that tracked by the Underlying ETF. The Fund invests approximately half of its assets in FLexible EXchange® Options (“FLEX Options”) and approximately half of its assets in the LVIP SSGA Nasdaq-100 Index Fund (the “Underlying Fund”).

The Fund’s initial Outcome Period is the one-year period from [December 17], 2021 to [December 16], 2022. The pre-determined Outcomes sought by

the Fund, which include the buffer and cap discussed below, are based upon the performance of the Underlying ETF’s market price during the Outcome Period. The Fund

will not receive or benefit from any dividend payments made by the Underlying ETF.

Buffer: The Fund seeks to provide a buffer against the first 12% of Underlying ETF price decreases over each Outcome Period, before the deduction of Fund expenses (the “Buffer”), which after Fund expenses is approximately 11.15% for the Standard Class and 10.80% for the Service Class. The Fund, and therefore investors, will bear all Underlying ETF losses exceeding 12%. There is no guarantee the Fund will successfully buffer against Underlying ETF price decreases. The Buffer is designed to have its full effect only for investors who continually hold Fund shares for an entire Outcome Period. The Buffer is discussed in further detail below.

Cap: For each Outcome Period, Fund performance is subject to a specified upside return cap that represents the maximum percentage return the Fund can achieve during the Outcome Period before the deduction of Fund expenses (the “Cap”). The Cap is set on the first day of an Outcome Period based on the cost of providing the Buffer and may increase or decrease from one Outcome Period to the next.

If the Underlying ETF experiences gains over an Outcome Period, the strategy seeks to provide investment returns that track the performance of the Underlying ETF, up to the Cap. If the Underlying ETF experiences returns over an Outcome Period in excess of the Cap, the Fund will not experience those excess gains. The Cap (before Fund expenses) is reduced by the Fund’s expenses. The Cap is expected to change from one Outcome Period to the next. The Cap is discussed in further detail below.

The Fund’s website, lincolnfinancial.com/definedoutcomefunds, provides important Fund information on a daily basis, including

information about the Cap and Buffer, current Outcome Period start and end dates, and information relating to the remaining potential Outcomes of an investment in the Fund. Investors considering purchasing shares should visit the website for the latest information.

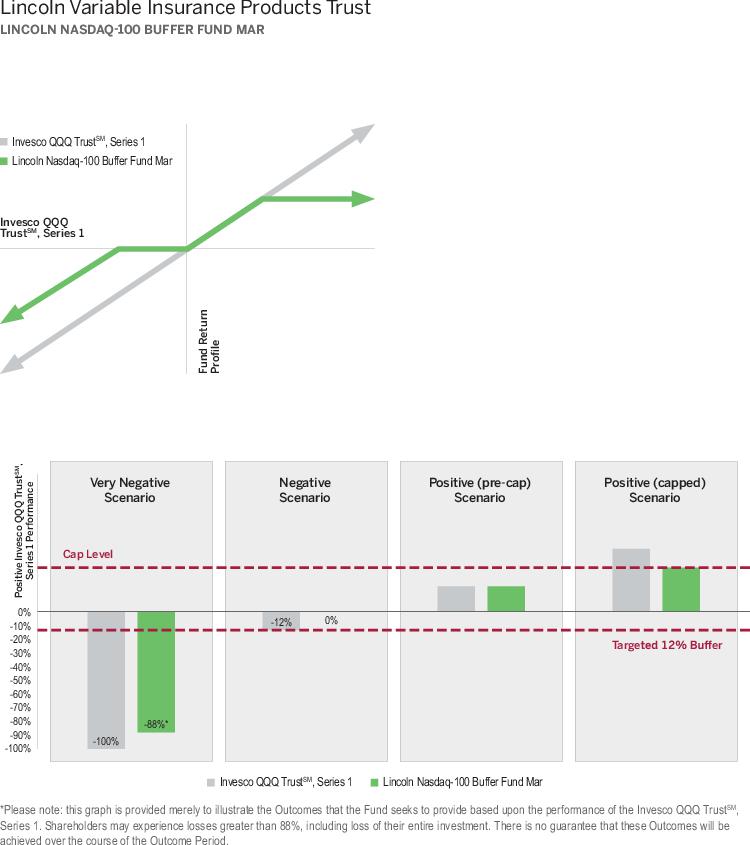

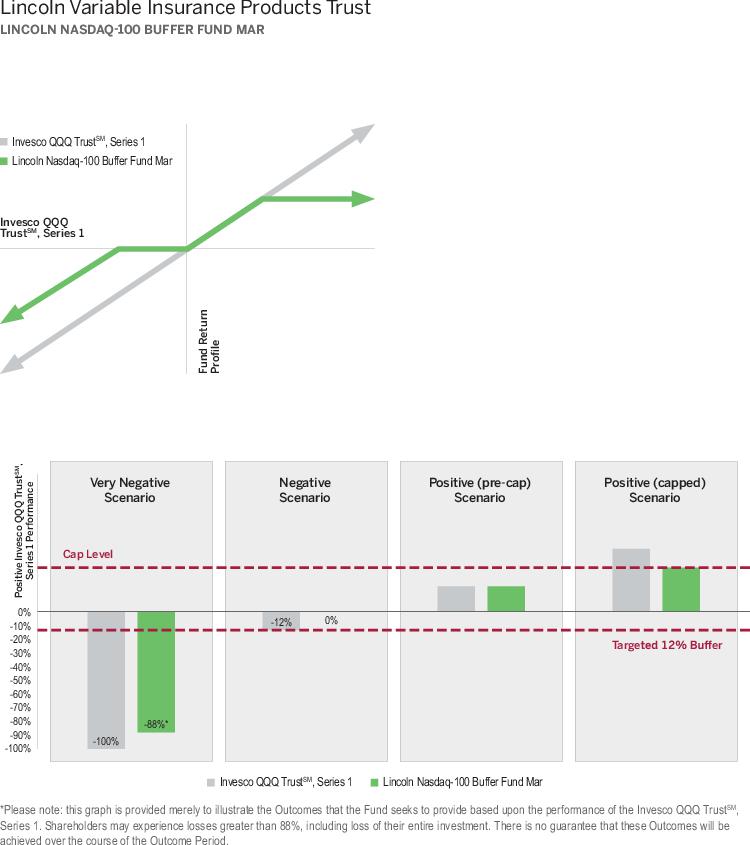

The two hypothetical graphical illustrations provided below are designed to illustrate the Outcomes based upon the hypothetical performance of the Underlying ETF for a shareholder that holds shares for the entirety of an Outcome Period. There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes for an Outcome

Period. The returns that the Fund seeks to provide do not include the costs associated with

purchasing shares of the Fund and the expenses incurred by the Fund.

Use of FLEX Options. The Fund invests approximately 50% of

its net assets in FLEX Options, the value of which is derived from the performance of the underlying reference asset, the Underlying ETF. FLEX Options are exchange-traded

options contracts with uniquely customizable terms. FLEX Options are set to expire on the last day of the Outcome Period, at which time the Fund will invest in a new set of FLEX Options for the next Outcome Period. An option contract is an agreement between a buyer and seller that gives the purchaser of the option the right to buy or sell a particular reference asset at a specified future date at an agreed upon price.

Investment Strategy of the Buffer. The Fund pursues its

objective by purchasing and selling call and put FLEX Options to create layers within the Fund’s portfolio. One layer is designed to buffer the Fund from losses, while

another layer is designed to produce returns that track those of the Underlying ETF for an Outcome Period, up to the Cap.

The Buffer layer of FLEX Options is designed to buffer the Fund from losses of up to

12% if the Underlying ETF experiences a loss at the end of an Outcome Period.

There is no guarantee that the Fund will be successful in its attempt to provide buffered returns. The Buffer is operative only against the first 12% of Underlying ETF losses at the end an Outcome Period. If

the Underlying ETF has decreased in value by more than 12% at the end of an Outcome Period, the Fund, and therefore investors, will experience those losses.

The Underlying ETF tracking layer of FLEX Options is designed to work alongside the Fund’s investment in the Underlying Fund to produce returns that track those of the Underlying ETF for an Outcome Period if the Underlying ETF has experienced gains during that Outcome Period. This gain is subject to the Cap, a maximum investment return level, which is

discussed below.

Outcome Periods. The Outcomes sought by the Fund are based

upon the Fund’s NAV on the first day of an Outcome Period. An Outcome Period begins on the day the FLEX Options are entered into and ends on the day they expire. Each

FLEX Option’s value is ultimately derived from the performance of the Underlying ETF during the Outcome period. Because the terms of the FLEX Options do not change, the Cap and Buffer both relate to the Fund’s NAV on the first day of the Outcome Period. To achieve the Outcomes for an Outcome Period, an investor must be holding

shares for the entire Outcome Period. A shareholder that purchases shares after the commencement of an Outcome Period will likely have purchased shares at a

different NAV than the NAV upon which the Outcomes are based and may experience investment Outcomes very different from those sought by the Fund over the

entire Outcome Period. A shareholder that redeems shares prior to the end of an Outcome Period may also experience investment Outcomes very different from those sought by the Fund.

There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes.

The value of FLEX Options is derived from the performance of the underlying reference asset, the Underlying ETF. However, because a component of an option’s value is the time remaining until its expiration, during the Outcome Period, the Fund’s NAV will not directly correlate on a day-to-day basis with the returns experienced by the Underlying ETF, though as a FLEX Option approaches its expiration date, its value typically increasingly moves with the value of the Underlying ETF. While the Fund generally anticipates that its NAV will move in the same direction as the Underlying ETF (meaning that the Fund’s NAV will increase if the Underlying ETF experiences gains and that the Fund’s NAV will decrease if the Underlying ETF experiences losses), the Fund’s NAV may not increase or decrease at the same rate as the Underlying ETF. Similarly, the amount of time remaining until the end of the Outcome Period also affects the impact of the Buffer on the Fund’s NAV, which may not be in full effect prior to the end of the Outcome Period. The Fund’s strategy is designed to produce the Outcomes upon the

expiration of the FLEX Options on the last day of the Outcome Period and it should not be expected that the Outcomes will be provided at any point prior to

that time. Taken together, this means that at the midpoint of the Outcome Period, if the

Underlying ETF has decreased in value by 12%, the Fund’s NAV can be expected to have decreased in value (because the Buffer is not yet in full effect), but by less

than 12% (because the Fund’s NAV will not correlate one-to-one with the Underlying ETF and the Fund’s NAV tends not to participate fully in either Underlying ETF

gains or losses).

Cap on Potential

Upside Returns. Unlike other investment products, the potential returns an investor can receive from an investment in the Fund are subject to an upside return Cap. This means that if the Underlying ETF

experiences gains for the Outcome Period beyond the level of the Cap, the Fund will not experience those excess gains. Therefore, regardless of the

performance of the Underlying ETF, the Cap (after Fund expenses) is the maximum return an investor can achieve from an investment in the Fund for an Outcome Period.

The Cap will change for each Outcome Period based upon prevailing market conditions at

the beginning of an Outcome Period. The Cap may increase or decrease from one Outcome Period to the next. The Cap, and the Fund’s position relative to it, should be

considered before investing in the Fund. If the Fund has already increased in

value to a level near to the Cap, an investor purchasing shares at that price has limited or no potential gains available for the remainder of the Outcome

Period but remains vulnerable to significant downside risks.

Buffer. The Buffer is operative only against the first 12%

of Underlying ETF losses for an Outcome Period; however, there is no guarantee that the Fund will be successful in its attempt to provide buffered returns. If the

Underlying ETF has decreased in value by more than 12% during an Outcome Period, the Fund will experience all further losses. The Buffer is calculated prior to taking into

account Fund expenses, such as Fund management fees equal to 0.55% of the Fund’s daily net assets, transaction fees, and any other expenses incurred by the Fund. If an investor purchases shares during an Outcome Period, and

the Fund has already decreased in value during that Outcome Period, that investor may not fully benefit from the Buffer for the remainder of the Outcome

Period, but will have increased gains available prior to reaching the Cap. Conversely, during the Outcome Period, if the Fund has already

increased

in value, then a shareholder investing at that time may experience losses prior to gaining the protection offered by the Buffer. While the Fund seeks to limit losses by 12% for shareholders who hold shares for an entire Outcome Period, there is no guarantee it will successfully do so. Notwithstanding the Buffer, a shareholder that purchases shares at the beginning of an Outcome Period or during an Outcome Period may lose its entire investment. An investment in the Fund is only appropriate for shareholders willing to bear those losses.

Fund Rebalance. The Fund is a continuous investment vehicle.

It does not terminate and distribute its assets at the conclusion of each Outcome Period. On the termination date of an Outcome Period, the Fund will invest in a new set of

FLEX Options, which will provide a new Cap, and another Outcome Period will commence.

Approximately one week prior to the end of an Outcome Period, the Fund will file a

prospectus supplement, which will alert existing shareholders that an Outcome Period is approaching its conclusion and disclose the anticipated ranges for the Cap for the

next Outcome Period. Following the close of business on the last day of an Outcome Period, the Fund will file a prospectus supplement that discloses the Fund’s final Cap for the next Outcome Period.

The Fund’s website, lincolnfinancial.com/definedoutcomefunds, provides information relating to the Outcomes, including the Fund’s

position relative to the Cap and Buffer, of an investment in the Fund on a daily basis.

The Underlying Fund

The Underlying Fund seeks to achieve its objective by investing in the securities that comprise the Nasdaq-100® Index (the “Index”). The Underlying Fund, under normal market conditions, invests at least 80% of its assets in the securities of issuers included in the Index. The Underlying Fund attempts to replicate the Index by investing all, or substantially all, of its assets in the stocks that comprise the Index, holding each stock in approximately the same proportion as its weighting in the Index. The Underlying Fund may not invest in every security in the Index if it is not practical to do so (such as when transaction costs are too high, there is a liquidity issue, or there is a pending corporate action).

The Index includes the common stocks of the 100 largest domestic and international

non-financial companies on the broader Nasdaq Composite Index based on market capitalization. The Index reflects companies across major industry groups including computer

hardware and software, telecommunications, retail/wholesale trade and biotechnology. As of March 15, 2021, the market capitalization range of the companies comprising the Index was $5.4 billion to $2 trillion. The Index typically is rebalanced quarterly and reconstituted annually. The Fund will reinvest Underlying Fund dividends and distributions in additional Underlying Fund shares.

The Underlying Fund employs a passive investment approach called “indexing”, by which the Underlying Fund’s Sub-Adviser attempts to approximate, before fees and expenses, the performance of the Index over the long term. The Underlying Fund’s Sub-Adviser invests in the equity securities comprising the Index, in approximately the same proportions as they are represented in the Index. Equity securities may include common stocks, preferred stocks, depository receipts, or other securities convertible into common stock. The Underlying Fund’s Sub-Adviser may sell securities that are represented in the Index, or purchase securities that are not yet represented in the Index, prior to or after their removal or addition to the Index.

The Underlying Fund may purchase or sell index futures contracts, or options on those futures, or engage in other transactions involving the use of derivatives, to provide equity exposure to the Underlying Fund’s cash position while maintaining cash balances for liquidity, or for other purposes that assist in replicating the Underlying Fund's investment performance of the Index. The Underlying Fund’s return may not match the return of the Index.

The Underlying Fund intends to be diversified in approximately the same proportion as the Index. The Underlying Fund may become “non-diversified,” as defined by the Investment Company Act of 1940 solely as a result of a change in relative market capitalization or index weighting of one or more constituents of the Index. As a “non-diversified” fund, the Underlying Fund can invest a greater percentage of its assets in a limited number of issuers or in any one issuer. Shareholder approval will not be sought if the Underlying Fund shifts from diversified to non-diversified solely due to a change in the relative market capitalization or index weightings of one or more constituents of the Index.

The Underlying Fund will concentrate its investments in a particular industry or group

of industries to the extent the Index is concentrated. The Index, at times, may be significantly concentrated in the information technology sector.

*

Nasdaq®

and NASDAQ-100® Indexes are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Lincoln Investment Advisors Corporation. The Fund has not been passed on by the Corporations as to their legality or suitability. The Fund is not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear

no liability with respect to the Fund.

The Fund’s Board of Trustees may change the Fund’s investment strategies

or policies in the interest of shareholders without a shareholder vote, unless those strategies or policies are designated as fundamental. The Fund may change its policy of

investing at least 80% of its net assets in FLEX Options that reference the Invesco QQQ TrustSM, Series 1 or, in an underlying fund which tracks the same index as that tracked by the Invesco QQQ TrustSM, Series 1, only upon 60 days' notice to shareholders.

Principal Risks

All mutual funds carry risk. Accordingly, loss of money is a risk of investing in the

Fund. Because the Fund invests certain of its assets in shares of an Underlying Fund, the Fund

indirectly owns the investments made by the Underlying Fund. By investing in the Fund, therefore, you indirectly assume the same types of risks as investing directly in the

Underlying Fund. In addition, the Fund will indirectly pay a proportional share of the fees and expenses of the Underlying Fund. The Fund's ability to achieve its investment

objective depends, in large part, on the Underlying Fund's ability to meet its investment objective, as well as the performance of the FLEX Options. The following risks reflect the Fund's principal risks, which include the principal risks of the FLEX Options and the Underlying Fund.

Buffered Loss Risk. There can be no guarantee that the Fund will be successful

in its strategy to provide buffer protection against Underlying ETF losses if the Underlying ETF has decreased at the end of an Outcome Period. A shareholder may lose their

entire investment. The Fund’s strategy seeks to deliver returns that track the Underlying ETF (up to the Cap), while limiting downside losses, if shares are bought on the day on which the Fund enters into the FLEX Options and held until those FLEX Options expire at the end of each Outcome Period. In the event an investor purchases shares after the date on which the FLEX Options were entered into or sells shares prior to the expiration of the FLEX Options, the Buffer that the Fund seeks to provide may not be available. The Fund does not provide principal protection and an investor may experience significant losses on its investment, including the loss of its entire investment.

Capped Upside Return Risk. The Fund’s strategy seeks to provide returns that are subject to the Cap. In the event that the Underlying ETF has gains in excess of the Cap for the Outcome Period, the Fund will not participate in those gains beyond the Cap. The Fund’s strategy seeks to deliver returns that track those of the Underlying ETF if shares are bought on the day on which the Fund enters into the FLEX Options and held until those FLEX Options expire at the end of the Outcome Period. In the event an investor purchases shares after the date on which the FLEX Options were entered into and the Fund has risen in value to a level near to the Cap, there may be little or no ability for that investor to experience an investment gain on its shares. A new Cap is established at the beginning of each Outcome Period and is dependent on prevailing market conditions. The Cap may therefore change from one Outcome Period to the next and is unlikely to remain the same for consecutive Outcome Periods. The Fund is exposed to operational risk arising from human error in the calculation of the Cap. The Fund seeks to reduce this risk through controls and procedures; however, these measures may be inadequate to address such risk.

Outcome Period Risk. The Fund’s investment strategy is designed to

deliver returns that track the Underlying ETF if shares are bought on the day on which the Fund enters into the FLEX Options and held until those FLEX Options expire at the

end of the Outcome Period. In the event an investor purchases shares after the date on which the FLEX Options were entered into or sells shares prior to the expiration of the FLEX Options, the returns realized by the investor may not be those that the Fund seeks to achieve.

FLEX Options Risk. The Fund may experience substantial downside from specific FLEX Option positions and certain FLEX Option

positions may expire worthless. In addition, the FLEX Options are subject to the following risks:

Valuation Risk. The value of the FLEX Options will be affected by, among others, changes in the value of the Underlying ETF, changes in interest rates, changes in the actual and implied volatility of the Underlying ETF and the remaining time until the FLEX Options expire. The value of the FLEX Options does not increase or decrease at the same rate as the level of the Underlying ETF (although they generally move in the same direction). However, as a FLEX Option approaches its expiration date, its value typically increasingly moves with the value of the Underlying ETF. Also, during periods of reduced market liquidity or in the absence of readily available market quotations, or when there is reduced availability of reliable objective pricing data for the FLEX Options, the ability of the Fund to value the FLEX Options becomes more difficult. In these situations, the judgment of the Fund’s investment adviser may play a greater role in the valuation of such holdings. Consequently, while these determinations will be made in good faith, it may nevertheless be more difficult for the Fund to accurately assign a daily value.

Liquidity Risk. In the event that trading in the FLEX Options is limited or

absent, the value of the Fund’s FLEX Options may decrease. There is no guarantee that a liquid secondary trading market will exist for the FLEX Options. The trading in

FLEX Options may be less deep and liquid than the market for certain other securities. FLEX Options may be less liquid than certain non-customized options. In a less liquid market for the FLEX Options, terminating the FLEX Options may require the payment of a premium or acceptance of a discounted price and may take longer to complete. In a less liquid market for the FLEX Options, the liquidation of a large number of options may more significantly impact the price. A less liquid trading market may adversely impact the value of the FLEX Options and the value of your investment.

Counterparty Risk. Counterparty risk is the risk an issuer, guarantor or

counterparty of a security in the Fund is unable or unwilling to meet its obligation on the security. The Fund will utilize FLEX Options issued and guaranteed for settlement

by the Options Clearing Corporation (the “OCC”). Although guaranteed for settlement by the OCC, FLEX Options are still subject to counterparty risk with the

OCC and may be less liquid than more traditional standardized exchange-traded options. As a result, the ability of the Fund to meet its objective depends on the OCC being able to meet its obligations. In the unlikely event that the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the Fund could suffer significant losses. The Fund bears the risk that the OCC will be unable or unwilling to perform its obligations under the FLEX Options contracts.

Correlation Risk. The FLEX Options held by the Fund will be exercisable at the strike price only on their expiration date. Prior to the expiration date, the value of the FLEX Options will be determined based upon market quotations or using other recognized pricing methods, consistent with the Fund’s valuation policy. Because a component of the FLEX Option’s value will be affected by, among other things, changes in the value of the Underlying ETF, changes in interest rates, changes in the actual and implied volatility of the Underlying ETF and the remaining time until the FLEX Options expire, the value of the Fund’s FLEX Options positions is not anticipated to increase or decrease at the same rate as the Underlying ETF, and it is possible they may move in different directions, and as a result, the Fund’s NAV may not increase or decrease at the same rate as the Underlying ETF. Similarly, the components of the option’s value are anticipated to impact the effect of the Buffer on the Fund’s NAV, which may not be in full effect prior to the end of the Outcome Period. The Fund’s strategy is designed to produce the Outcomes upon the expiration of the FLEX Options on the last business day of the Outcome Period, and it should not be expected that the Outcomes will be provided at any point other than the end of the Outcome Period.

Market Risk. The value of portfolio investments may decline. As a result, your

investment in the Fund may decline in value and you could lose money. A decline in value could result from, among other things, a negative development of: the issuer of the

security, an industry, a sector of the economy, or the overall securities market.

Issuer Risk. The prices of, and the income generated by, portfolio securities may decline in response to various factors directly related to the issuers of such securities. These factors may include reduced demand for an issuer’s goods or services, poor management performance, major litigation related to the issuer, changes in government regulations affecting the issuer or its competitive environment, and strategic initiatives such as mergers, acquisitions or dispositions.

Fund of Funds Risk. The Fund bears all risks of an Underlying Fund’s

investment strategies, including the risk that an Underlying Fund may not meet its investment objective, which may negatively affect the Fund’s performance. The Fund

does not control the investments of Underlying Funds, which may have different investment objectives and may engage in investment strategies that the Fund would not engage in directly. Aggregation of Underlying Fund holdings may result in indirect concentration of assets in a particular industry or group of industries, or in a single issuer, which may increase Fund volatility. In addition, the Fund indirectly will pay a proportional share of the fees and expenses of an Underlying Fund, including management, administration and custodian fees of an Underlying Fund.

Tracking Error Risk. The Underlying Fund attempts to track the performance of

the index it tracks. The performance of the Underlying Fund may deviate substantially from the index it tracks. Various factors may affect the Underlying Fund’s

ability to achieve perfect correlation, such as cash flows, fund expenses, imperfect correlation between the Underlying Fund’s investments and those of the index, rounding of share prices, changes to the index and regulatory policies, and costs in buying and selling securities. To the extent that the Underlying Fund employs a sampling technique to construct the Underlying Fund's portfolio, the Underlying Fund may invest in fewer than all of the securities in the index and in some securities not included in the Index, potentially increasing the risk of divergence between the Underlying Fund’s return and that of the index. In addition, the Underlying Fund may not be fully invested at times, either as a result of cash flows into or out of the Underlying Fund or reserves of cash held by the Underlying Fund to meet redemptions. The representative sample of securities in the Index that are actually held by the Underlying Fund may vary from time to time. In addition, the Underlying Fund’s investment approach, which attempts to track the performance of the index before fees and expenses, may perform differently than other mutual funds that focus on a particular market segment or invest in other asset classes.

Investment Objective Risk. Certain circumstances under which the Fund might not achieve its objective include, but are not limited, to

(i) if the Fund disposes of FLEX Options, (ii) if the Fund is unable to maintain the optimal balance of FLEX Options in the Fund’s portfolio, (iii) significant accrual

of Fund expenses in connection with effecting the Fund’s principal investment strategies or (iv) adverse tax law changes affecting the treatment of FLEX

Options.

Exchange-Traded Fund (“ETF”)

Risk. ETFs generally reflect the risks of owning the underlying securities they hold, although lack of liquidity in ETF shares could result in the price of the ETF being more volatile. Certain ETF track the performance of an index. An imperfect correlation between an ETF’s portfolio securities and those in its index, rounding of prices, the timing of cash flows, the ETF’s size, changes to the index and regulatory requirements may cause tracking error, the divergence of an ETF’s performance from that of its underlying index.

Authorized Participation Concentration Risk. Only an authorized participant

may engage in creation or redemption transactions directly with the Underlying ETF. The Fund has a limited number of institutions that may act as authorized participants on

an agency basis (i.e., on behalf of other market participants). To the extent that authorized participants exit the business or are unable to proceed with creation and/or redemption orders with respect to the Underlying ETF and no other authorized participant is able to step forward to create or redeem creation units, shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts and/or delisting.

Active Markets Risk. Although the shares are listed for trading on an

exchange, there can be no assurance that an active trading market for the shares will develop or be maintained. shares trade on an exchange at market prices that may be

below, at or above the Underlying ETF’s NAV. Securities, including the shares, are subject to market fluctuations and liquidity constraints that may be caused by such factors as economic, political, or regulatory developments, changes in interest rates, and/or perceived trends in securities prices. shares of the Underlying ETF could decline in value or underperform other investments.

Fluctuation of Net Asset Value Risk. The Fund’s shares trade on an exchange at their market price rather than their NAV. The market price

may be at, above or below the Underlying ETF’s NAV. Differences in market price and NAV may be due, in large part, to the fact that supply and demand forces at work in