Form 485APOS BLACKROCK LIQUIDITY FUND

As filed with the Securities and Exchange Commission on May 19, 2022

1933 Act Registration No. 2-47015

1940 Act Registration No. 811-2354

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | ☒ | |

| Pre-Effective Amendment No. | :=¨ | |

| Post-Effective Amendment No. 138 | ☒ | |

| and | ||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

☒ | |

BLACKROCK LIQUIDITY FUNDS

(Exact Name of Registrant As Specified In Charter)

100 Bellevue Parkway Wilmington, Delaware 19809

(Address of Principal Executive Offices)

Registrant’s Telephone Number: (800) 441-7450

John M. Perlowski

BLACKROCK LIQUIDITY FUNDS

55 East 52nd Street

New York, New York 10055

(Name and Address of Agent for Service)

Copies to:

| Counsel for the Fund:

Jesse C. Kean, Esq. Sidley Austin LLP 787 Seventh Avenue New York, New York 10019-6018 |

Janey Ahn, Esq. BlackRock Advisors, LLC 55 East 52nd Street New York, New York 10055 |

It is proposed that this filing will become effective (check appropriate box)

| ☐ | Immediately upon filing pursuant to paragraph (b) |

| ☐ | On (date) pursuant to paragraph (b) |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) |

| ☒ | On August 1, 2022 pursuant to paragraph (a)(1) |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | On (date) pursuant to paragraph (a)(2) of Rule 485 |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

Title of Securities Being Registered: Shares of Beneficial Interest.

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 19, 2022

| ||

|

[ ], 2022 | |

|

|

Prospectus

|

BlackRock Liquidity Funds | Stern Brothers Shares

| • | BlackRock Liquid Federal Trust Fund |

Stern Brothers Shares: [ ]

| • | FedFund |

Stern Brothers Shares: [ ]

This Prospectus contains information you should know before investing, including information about risks.

Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| Fund Overview |

Key facts and details about the Funds, including investment objective, principal investment strategies, principal risk factors, fee and expense information, and historical performance information | |||||

| Key Facts About BlackRock Liquid Federal Trust Fund | 3 | |||||

| Key Facts About FedFund | 8 | |||||

| Details About the Funds |

Information about how each Fund invests, including investment objective, investment processes, principal strategies and risk factors | |||||

| How Each Fund Invests | 13 | |||||

| Investment Risks | 15 | |||||

| Account Information |

Information about account services, shareholder transactions, and distribution and other payments | |||||

| Valuation of Fund Investments and Price of Fund Shares | 18 | |||||

| Purchase of Shares | 18 | |||||

| Redemption of Shares | 20 | |||||

| Additional Purchase and Redemption Information | 21 | |||||

| Distribution and Shareholder Servicing Payments | 22 | |||||

| Dividends and Distributions | 22 | |||||

| Federal Taxes | 22 | |||||

| State and Local Taxes | 23 | |||||

| Management of the Funds |

Information About BlackRock | |||||

| BlackRock | 24 | |||||

| Conflicts of Interest | 25 | |||||

| Master/Feeder Structure | 26 | |||||

| Financial Highlights |

Financial Performance of the Funds | 27 | ||||

| General Information |

Certain Fund Policies | 29 | ||||

| Glossary |

Glossary of Investment Terms | 30 | ||||

| For More Information |

Funds and Service Providers | 31 | ||||

| How to Contact BlackRock Liquidity Funds | Inside Back Cover |

| Additional Information | Back Cover |

Fund Overview

Key Facts About BlackRock Liquid Federal Trust Fund

Investment Objective

The investment objective of BlackRock Liquid Federal Trust Fund (the “Fund”), a series of BlackRock Liquidity Funds (the “Trust”), is to seek current income as is consistent with liquidity and stability of principal.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell Stern Brothers Shares of BlackRock Liquid Federal Trust Fund. You may pay other fees, such as brokerage commissions and other fees to your financial professional or your selected securities dealer, broker, investment adviser, service provider or industry professional (including BlackRock Advisors, LLC (“BlackRock”) and its affiliates) (each, a “Financial Intermediary”), which are not reflected in the table and example below.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Stern Brothers Shares | ||

| Management Fee |

[ ]% | |

| Distribution (12b-1) Fees |

[ ] | |

| Miscellaneous/Other Expenses1 |

[ ]% | |

|

| ||

| Total Annual Fund Operating Expenses |

[ ]% | |

| Fee Waivers and/or Expense Reimbursements2 |

[ ]% | |

|

| ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements1 |

[ ]% | |

|

| ||

| 1 | Miscellaneous/Other Expenses are based on estimated amounts. |

| 2 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 24, BlackRock, the Fund’s investment manager, has contractually agreed to waive fees and/or reimburse ordinary operating expenses in order to keep combined Management Fees and Miscellaneous/Other Expenses (excluding Dividend Expense, Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) from exceeding 0.17% of average daily net assets through June 30, 2024. The agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

| Stern Brothers Shares |

$[ ] | $[ ] | $[ ] | $[ ] | ||||

Principal Investment Strategies of the Fund

BlackRock Liquid Federal Trust Fund invests 100% of its total assets in cash, U.S. Treasury bills, notes and other obligations issued or guaranteed as to principal and interest by the U.S. Government or by its agencies or instrumentalities, the interest

3 - BlackRock Liquid Federal Trust Fund

income on which, under current federal law, generally may not be subject to state income tax. The Fund invests in securities maturing in 397 days or less (with certain exceptions) and the portfolio will have a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of 120 days or less. The Fund may invest in variable and floating rate instruments, and transact in securities on a when-issued, delayed delivery or forward commitment basis.

The Fund will invest, under normal circumstances, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in U.S. Treasury bills, notes and other obligations issued or guaranteed as to principal and interest by the U.S. Government or by its agencies or instrumentalities, the interest income on which, under current federal law, generally may not be subject to state income tax. This policy is a non-fundamental policy of the Fund and the Fund will not change the policy without providing shareholders with at least 60 days’ prior notice of any change in the policy.

The securities purchased by the Fund are subject to the quality, diversification, and other requirements of Rule 2a-7 under the Investment Company Act of 1940, as amended (the “1940 Act”), and other rules of the Securities and Exchange Commission. The Fund will only purchase securities that present minimal credit risk as determined by BlackRock, the Fund’s investment manager, pursuant to guidelines approved by the Trust’s Board of Trustees.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. The following is a summary description of principal risks of investing in the Fund. The order of the below risk factors does not indicate the significance of any particular risk factor.

| ◾ | Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. |

| ◾ | Income Risk — Income risk is the risk that the Fund’s yield will vary as short-term securities in its portfolio mature and the proceeds are reinvested in securities with different interest rates. |

| ◾ | Interest Rate Risk — Interest rate risk is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter-term securities. Due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. Very low or negative interest rates may magnify interest rate risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, may result in heightened market volatility and may detract from the Fund’s ability to achieve its investment objective. |

| ◾ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

A recent outbreak of an infectious coronavirus has developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. Because the Fund invests in short-term instruments these events have caused some instruments to have declining yields, which may impair the results of the Fund if these conditions persisted. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

4 - BlackRock Liquid Federal Trust Fund

| ◾ | Stable Net Asset Value Risk — The Fund may not be able to maintain a stable net asset value (“NAV”) of $1.00 per share at all times. If the Fund fails to maintain a stable NAV (or if there is a perceived threat of such a failure), the Fund, along with other money market funds, could be subject to increased redemption activity. |

| ◾ | Trading Risk — In selling securities prior to maturity, the Fund may realize a price higher or lower than that paid to acquire such securities, depending upon whether interest rates have decreased or increased since their acquisition. In addition, shareholders in a state that imposes an income or franchise tax should determine through consultation with their own tax advisors whether the Fund’s interest income, when distributed by the Fund, will be considered by the state to have retained exempt status, and whether the Fund’s capital gain and other income, if any, when distributed, will be subject to the state’s income or franchise tax. |

| ◾ | Treasury Obligations Risk — Direct obligations of the U.S. Treasury have historically involved little risk of loss of principal if held to maturity. However, due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. |

| ◾ | U.S. Government Obligations Risk — Certain securities in which the Fund may invest, including securities issued by certain U.S. Government agencies and U.S. Government sponsored enterprises, are not guaranteed by the U.S. Government or supported by the full faith and credit of the United States. |

| ◾ | Variable and Floating Rate Instrument Risk — Variable and floating rate securities provide for periodic adjustment in the interest rate paid on the securities. These securities may be subject to greater illiquidity risk than other fixed income securities, meaning the absence of an active market for these securities could make it difficult for the Fund to dispose of them at any given time. |

| ◾ | When-Issued and Delayed Delivery Securities and Forward Commitments Risk — When-issued and delayed delivery securities and forward commitments involve the risk that the security the Fund buys will lose value prior to its delivery. There also is the risk that the security will not be issued or that the other party to the transaction will not meet its obligation. If this occurs, the Fund may lose both the investment opportunity for the assets it set aside to pay for the security and any gain in the security’s price. |

5 - BlackRock Liquid Federal Trust Fund

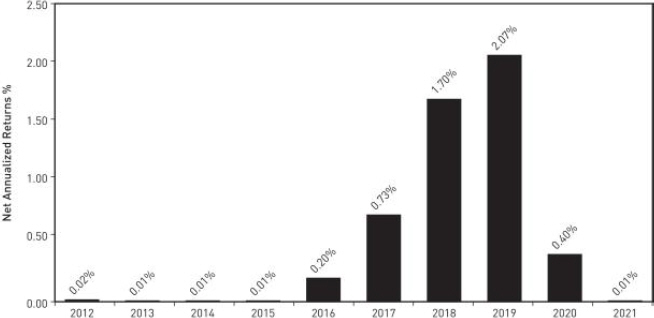

Performance Information

Stern Brothers Shares do not have a full calendar year of performance history as of the date of this prospectus. As a result, the chart, the table and the seven-day yield shown below give you a picture of the performance for Institutional Shares of the Fund, which are not offered in this prospectus. The performance of the Fund’s Stern Brothers Shares would be substantially similar to Institutional Shares because Stern Brothers Shares and Institutional Shares are invested in the same portfolio of securities and performance would only differ to the extent that Stern Brothers Shares and Institutional Shares have different expenses. The actual returns of Stern Brothers Shares would have been approximately the same as those of Institutional Shares because Stern Brothers Shares have the same expenses as Institutional Shares.

The information shows you how BlackRock Liquid Federal Trust Fund’s performance has varied year by year and provides some indication of the risks of investing in the Fund. As with all such investments, past performance is not an indication of future results. The table includes all applicable fees. If BlackRock and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. The Fund is a money market fund managed pursuant to the requirements of Rule 2a-7 under the 1940 Act. Updated information on the Fund’s performance can be obtained by visiting www.blackrock.com/cash or can be obtained by phone at (800) 441-7450.

BlackRock Liquid Federal Trust Fund

Institutional Shares

ANNUAL TOTAL RETURNS

As of 12/31

During the ten-year period shown in the bar chart, the highest return for a quarter was 0.57% (quarter ended June 30, 2019) and the lowest return for a quarter was 0.00% (quarter ended September 30, 2021).

6 - BlackRock Liquid Federal Trust Fund

For the periods ended 12/31/21

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years | ||||

| BlackRock Liquid Federal Trust Fund—Institutional Shares |

0.01% | 0.98% | 0.51% | |||

| 7-Day Yield As of December 31, 2021 | ||||||

| BlackRock Liquid Federal Trust Fund—Institutional Shares |

0.03% | |||||

Current Yield: You may obtain the Fund’s current 7-day yield by calling (800) 441-7450 or by visiting the Fund’s website at www.blackrock.com/cash.

Investment Manager

BlackRock Liquid Federal Trust Fund’s investment manager is BlackRock Advisors, LLC (previously defined as “BlackRock”).

Purchase and Sale of Fund Shares

Stern Brothers Shares are only available for purchase by clients of Stern Brothers & Co. and its affiliates.

To open an account with the Fund, contact Stern Brothers & Co. by telephone (646-969-7882) or by e-mail at [email protected].

You may purchase or sell shares without paying a sales charge. You may generally purchase or redeem shares of the Fund each day on which the New York Stock Exchange and the Federal Reserve Bank of Philadelphia are open for business. To purchase or sell shares of the Fund, purchase orders and redemption orders must be transmitted to the Fund’s office in Wilmington, Delaware by telephone (800-441-7450; in Delaware 302-797-2350), through the Fund’s internet-based order entry program, or by such other electronic means as the Fund agrees to in its sole discretion. The initial and subsequent investment minimums generally are as follows, although the Fund’s officers may reduce or waive the minimums in some cases:

| Stern Brothers Shares | ||

| Minimum Initial Investment |

$3 million for institutions. | |

| Minimum Additional Investment |

No subsequent minimum. |

Tax Information

Dividends and distributions paid by BlackRock Liquid Federal Trust Fund may be subject to federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a retirement plan, in which case you may be subject to federal income tax when you withdraw or receive distributions from such tax-deferred arrangements.

Payments to Broker/Dealers and Other Financial Intermediaries

If you purchase shares of BlackRock Liquid Federal Trust Fund through a broker-dealer or other Financial Intermediary, such as Stern Brothers & Co., the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other Financial Intermediary and your individual financial professional to recommend the Fund over another investment.

Ask your individual financial professional or visit your Financial Intermediary’s website for more information.

7 - BlackRock Liquid Federal Trust Fund

Fund Overview

Investment Objective

The investment objective of FedFund (the “Fund”), a series of BlackRock Liquidity Funds (the “Trust”), is to seek current income as is consistent with liquidity and stability of principal.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell Stern Brothers Shares of FedFund. You may pay other fees, such as brokerage commissions and other fees to your financial professional or your selected securities dealer, broker, investment adviser, service provider or industry professional (including BlackRock Advisors, LLC (“BlackRock”) and its affiliates) (each, a “Financial Intermediary”), which are not reflected in the table and example below.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Stern Brothers Shares | ||

| Management Fee |

[ ]% | |

| Distribution (12b-1) Fees |

[ ] | |

| Miscellaneous/Other Expenses1 |

[ ]% | |

|

| ||

| Total Annual Fund Operating Expenses |

[ ]% | |

| Fee Waivers and/or Expense Reimbursements2 |

[ ]% | |

|

| ||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements2 |

[ ]% | |

|

| ||

| 1 | Miscellaneous/Other Expenses are based on estimated amounts. |

| 2 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 24, BlackRock, the Fund’s investment manager, has contractually agreed to waive fees and/or reimburse ordinary operating expenses in order to keep combined Management Fees and Miscellaneous/Other Expenses (excluding Dividend Expense, Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) from exceeding 0.17% of average daily net assets through June 30, 2024. The agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

| Stern Brothers Shares |

$[ ] | $[ ] | $[ ] | $[ ] | ||||

Principal Investment Strategies of the Fund

FedFund invests at least 99.5% of its total assets in cash, U.S. Treasury bills, notes and other obligations issued or guaranteed as to principal and interest by the U.S. Government, its agencies or instrumentalities, and repurchase agreements secured by such

8 - FedFund

obligations or cash. The yield of the Fund is not directly tied to the federal funds rate. The Fund invests in securities maturing in 397 days or less (with certain exceptions) and the portfolio will have a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of 120 days or less. The Fund may invest in variable and floating rate instruments, and transact in securities on a when-issued, delayed delivery or forward commitment basis.

The Fund will invest, under normal circumstances, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in U.S. Treasury bills, notes and other obligations issued or guaranteed as to principal and interest by the U.S. Government, its agencies or instrumentalities, and repurchase agreements secured by such obligations. This policy is a non-fundamental policy of the Fund and the Fund will not change the policy without providing shareholders with at least 60 days’ prior notice of any change in the policy.

The securities purchased by the Fund are subject to the quality, diversification, and other requirements of Rule 2a-7 under the Investment Company Act of 1940, as amended (the “1940 Act”), and other rules of the Securities and Exchange Commission. The Fund will only purchase securities that present minimal credit risk as determined by BlackRock, the Fund’s investment manager, pursuant to guidelines approved by the Trust’s Board of Trustees.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. The following is a summary description of principal risks of investing in the Fund. The order of the below risk factors does not indicate the significance of any particular risk factor.

| ◾ | Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. |

| ◾ | Income Risk — Income risk is the risk that the Fund’s yield will vary as short-term securities in its portfolio mature and the proceeds are reinvested in securities with different interest rates. |

| ◾ | Interest Rate Risk — Interest rate risk is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter-term securities. Due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. Very low or negative interest rates may magnify interest rate risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, may result in heightened market volatility and may detract from the Fund’s ability to achieve its investment objective. |

| ◾ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

A recent outbreak of an infectious coronavirus has developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. Because the Fund invests in short-term instruments these events have caused some instruments to have declining yields, which may impair the results of the Fund if these conditions persisted. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

9 - FedFund

| ◾ | Repurchase Agreements Risk — If the other party to a repurchase agreement defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security and the market value of the security declines, the Fund may lose money. |

| ◾ | Stable Net Asset Value Risk — The Fund may not be able to maintain a stable net asset value (“NAV”) of $1.00 per share at all times. If the Fund fails to maintain a stable NAV (or if there is a perceived threat of such a failure), the Fund, along with other money market funds, could be subject to increased redemption activity. |

| ◾ | Treasury Obligations Risk — Direct obligations of the U.S. Treasury have historically involved little risk of loss of principal if held to maturity. However, due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. |

| ◾ | U.S. Government Obligations Risk — Certain securities in which the Fund may invest, including securities issued by certain U.S. Government agencies and U.S. Government sponsored enterprises, are not guaranteed by the U.S. Government or supported by the full faith and credit of the United States. |

| ◾ | Variable and Floating Rate Instrument Risk — Variable and floating rate securities provide for periodic adjustment in the interest rate paid on the securities. These securities may be subject to greater illiquidity risk than other fixed income securities, meaning the absence of an active market for these securities could make it difficult for the Fund to dispose of them at any given time. |

| ◾ | When-Issued and Delayed Delivery Securities and Forward Commitments Risk — When-issued and delayed delivery securities and forward commitments involve the risk that the security the Fund buys will lose value prior to its delivery. There also is the risk that the security will not be issued or that the other party to the transaction will not meet its obligation. If this occurs, the Fund may lose both the investment opportunity for the assets it set aside to pay for the security and any gain in the security’s price. |

10 - FedFund

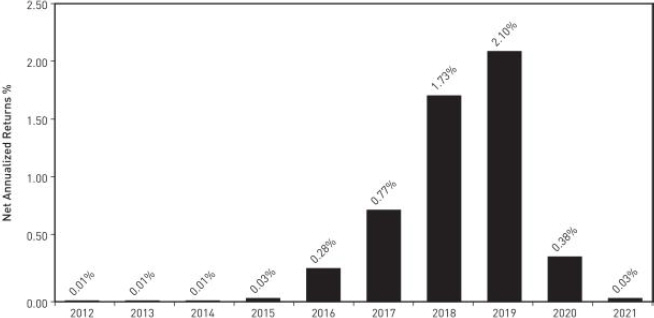

Performance Information

Stern Brothers Shares of FedFund do not have a full calendar year of performance history as of the date of this prospectus. As a result, the chart, the table and the seven-day yield shown below give you a picture of the performance for Institutional Shares of the Fund, which are not offered in this prospectus. The performance of the Fund’s Stern Brothers Shares would be substantially similar to Institutional Shares because Stern Brothers Shares and Institutional Shares are invested in the same portfolio of securities and performance would only differ to the extent that Stern Brothers Shares and Institutional Shares have different expenses. The actual returns of Stern Brothers Shares would have been approximately the same as those of Institutional Shares because Stern Brothers Shares have the same expenses as Institutional Shares.

The information shows you how FedFund’s performance has varied year by year and provides some indication of the risks of investing in the Fund. As with all such investments, past performance is not an indication of future results. The table includes all applicable fees. If BlackRock and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. The Fund is a money market fund managed pursuant to the requirements of Rule 2a-7 under the 1940 Act. Updated information on the Fund’s performance can be obtained by visiting www.blackrock.com/cash or can be obtained by phone at (800) 441-7450.

FedFund

Institutional Shares

ANNUAL TOTAL RETURNS

As of 12/31

During the ten-year period shown in the bar chart, the highest return for a quarter was 0.57% (quarter ended June 30, 2019) and the lowest return for a quarter was 0.00% (quarter ended September 30, 2015).

11 - FedFund

For the periods ended 12/31/21

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years | ||||

| FedFund—Institutional Shares |

0.03% | 1.00% | 0.53% | |||

| 7-Day Yield As of December 31, 2021 | ||||||

| FedFund—Institutional Shares |

0.03% | |||||

Current Yield: You may obtain the Fund’s current 7-day yield by calling (800) 441-7450 or by visiting the Fund’s website at www.blackrock.com/cash.

Investment Manager

FedFund’s investment manager is BlackRock Advisors, LLC (previously defined as “BlackRock”).

Purchase and Sale of Fund Shares

Stern Brothers Shares are only available for purchase by clients of Stern Brothers & Co. and its affiliates.

To open an account with the Fund, contact the Stern Brothers & Co. by telephone (646-969-7882) or by e-mail at [email protected].

You may purchase or sell shares without paying a sales charge. You may generally purchase or redeem shares of FedFund each day on which the New York Stock Exchange and the Federal Reserve Bank of Philadelphia are open for business. To purchase or sell shares of the Fund, purchase orders and redemption orders must be transmitted to the Fund’s office in Wilmington, Delaware by telephone (800-441-7450; in Delaware 302-797-2350), through the Fund’s internet-based order entry program, or by such other electronic means as the Fund agrees to in its sole discretion. The initial and subsequent investment minimums generally are as follows, although the Fund’s officers may reduce or waive the minimums in some cases:

| Stern Brothers Shares | ||

| Minimum Initial Investment |

$3 million for institutions. | |

| Minimum Additional Investment |

No subsequent minimum. |

Tax Information

Dividends and distributions paid by FedFund may be subject to federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a retirement plan, in which case you may be subject to federal income tax when you withdraw or receive distributions from such tax-deferred arrangements.

Payments to Broker/Dealers and Other Financial Intermediaries

If you purchase shares of FedFund through a broker-dealer or other Financial Intermediary, such as Stern Brothers & Co., the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other Financial Intermediary and your individual financial professional to recommend the Fund over another investment.

Ask your individual financial professional or visit your Financial Intermediary’s website for more information.

12 - FedFund

Details About the Funds

Included in this prospectus are sections that tell you about your shareholder rights, buying and selling shares, management information, and shareholder features of BlackRock Liquid Federal Trust Fund and FedFund, each a government money market fund under Rule 2a-7 (the “Funds”). Each Fund is a series of BlackRock Liquidity Funds (the “Trust”).

| ◾ | Each Fund will maintain a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of 120 days or less. For a discussion of dollar-weighted average maturity and dollar-weighted average life, please see the Glossary on page 30. |

| ◾ | Pursuant to Rule 2a-7, each Fund is subject to a “general liquidity requirement” that requires that each Fund hold securities that are sufficiently liquid to meet reasonably foreseeable shareholder redemptions in light of its obligations under Section 22(e) of the Investment Company Act of 1940, as amended (the “1940 Act”) regarding share redemptions and any commitments the Fund has made to shareholders. To comply with this general liquidity requirement, BlackRock Advisors, LLC (“BlackRock”) must consider factors that could affect the Fund’s liquidity needs, including characteristics of the Fund’s investors and their likely redemptions. Depending upon the volatility of its cash flows (particularly shareholder redemptions), this may require a Fund to maintain greater liquidity than would be required by the daily and weekly minimum liquidity requirements discussed below. |

| ◾ | No Fund will acquire any illiquid security (i.e., securities that cannot be sold or disposed of in the ordinary course of business within seven days at approximately the value ascribed to them by the Fund) if, immediately following such purchase, more than 5% of the Fund’s total assets are invested in illiquid securities. |

| ◾ | No Fund will acquire any security other than a daily liquid asset unless, immediately following such purchase, at least 10% of its total assets would be invested in daily liquid assets, and no Fund will acquire any security other than a weekly liquid asset unless, immediately following such purchase, at least 30% of its total assets would be invested in weekly liquid assets. For a discussion of daily liquid assets and weekly liquid assets, please see the Glossary on page 30. |

| ◾ | Each Fund seeks to maintain a net asset value (“NAV”) of $1.00 per share. |

The Trust’s Board of Trustees (the “Board”) has chosen not to subject the Funds to liquidity fees or redemption gates due to declines in a Fund’s weekly liquid assets. If the Board changes this policy with respect to liquidity fees or redemption gates, such change would become effective only after shareholders are provided with advance notice of the change.

Investment Objectives

Each Fund seeks current income as is consistent with liquidity and stability of principal. The investment objective of each Fund may be changed by the Board without shareholder approval.

Investment Process

Each Fund invests in securities maturing within 397 days or less from the date of purchase, with certain exceptions. For example, certain government securities held by a Fund may have remaining maturities exceeding 397 days if such securities provide for adjustments in their interest rates not less frequently than every 397 days.

The securities purchased by a Fund are also subject to the quality, diversification, and other requirements of Rule 2a-7 under the 1940 Act, and other rules of the Securities and Exchange Commission (the “SEC”). Each Fund will purchase securities (or issuers of such securities) that are Eligible Securities that present minimal credit risk as determined by BlackRock pursuant to guidelines approved by the Board. For a discussion of Eligible Securities, please see the Glossary.

Principal Investment Strategies

Each Fund’s principal investment strategies are described under the heading “Principal Investment Strategies of the Fund” in each Fund’s “Key Facts” section included in “Fund Overview.”

13

Principal Investments

The section below describes the particular types of securities in which a Fund principally invests. Each Fund may, from time to time, make other types of investments and pursue other investment strategies in support of its overall investment goal. These supplemental investment strategies are described in the Statement of Additional Information (the “SAI”). The SAI also describes the Funds’ policies and procedures concerning the disclosure of portfolio holdings.

Repurchase Agreements. FedFund. The Fund may enter into repurchase agreements. Repurchase agreements are similar in certain respects to collateralized loans, but are structured as a purchase of securities by FedFund, subject to the seller’s agreement to repurchase the securities at a mutually agreed upon date and price. Under a repurchase agreement, the seller is required to furnish collateral at least equal in value or market price to the amount of the seller’s repurchase obligation. Collateral for FedFund’s repurchase agreements may include cash and obligations issued by the U.S. Government or its agencies or instrumentalities.

FedFund may transfer uninvested cash balances into a single joint account at FedFund’s custodian bank, the daily aggregate balance of which will be invested in one or more repurchase agreements.

U.S. Government Obligations. All Funds. Each Fund may purchase obligations issued or guaranteed by the U.S. Government or its agencies, authorities, instrumentalities and sponsored enterprises, and related custodial receipts.

U.S. Treasury Obligations. All Funds. Each Fund may invest in direct obligations of the U.S. Treasury. Each Fund may also invest in Treasury receipts where the principal and interest components are traded separately under the Separate Trading of Registered Interest and Principal of Securities (“STRIPS”) program.

Variable and Floating Rate Instruments. All Funds. Each Fund may purchase variable or floating rate notes, which are instruments that provide for adjustments in the interest rate on certain reset dates or whenever a specified interest rate index changes, respectively.

When-Issued, Delayed Delivery and Forward Commitment Transactions. All Funds. Each Fund may transact in securities on a when-issued, delayed delivery or forward commitment basis. Each Fund expects that commitments to purchase securities on a when-issued, delayed delivery or forward commitment basis will not exceed 25% of the value of its total assets absent unusual market conditions. No Fund intends to purchase securities on a when-issued, delayed delivery or forward commitment basis for speculative purposes but only in furtherance of its investment objective. No Fund receives income from securities purchased on a when-issued, delayed delivery or forward commitment basis prior to delivery of such securities.

Other Investments

In addition to the principal investments described above, each Fund (except as noted below) may also invest or engage in the following investments/strategies:

Borrowing. All Funds. During periods of unusual market conditions, each Fund is authorized to borrow money from banks or other lenders on a temporary basis to the extent permitted by the 1940 Act, the rules and regulations thereunder and any applicable exemptive relief. The Funds will borrow money when BlackRock believes that the return from securities purchased with borrowed funds will be greater than the cost of the borrowing. Such borrowings may be secured or unsecured. No Fund will purchase portfolio securities while borrowings in excess of 5% of such Fund’s total assets are outstanding.

Illiquid Investments. All Funds. No Fund will invest more than 5% of the value of its respective total assets in illiquid securities that it cannot sell in the ordinary course within seven days at approximately current value.

Investment Company Securities. All Funds. Each Fund may invest in securities issued by other open-end or closed-end investment companies, including affiliated investment companies, as permitted by the 1940 Act. A pro rata portion of the other investment companies’ expenses may be borne by the Fund’s shareholders. These investments may include, as consistent with a Fund’s investment objective and policies, certain variable rate demand securities issued by closed-end funds, which invest primarily in portfolios of taxable or tax-exempt securities.

Reverse Repurchase Agreements. FedFund. The Fund may enter into reverse repurchase agreements. The Fund is permitted to invest up to one-third of its total assets in reverse repurchase agreements. Investments in reverse repurchase agreements and securities lending transactions (described below) will be aggregated for purposes of this investment limitation.

14

Securities Lending. FedFund. The Fund may lend its securities with a value of up to one-third of its total assets (including the value of the collateral for the loan) to qualified brokers, dealers, banks and other financial institutions for the purpose of realizing additional net investment income through the receipt of interest on the loan. Investments in reverse repurchase agreements (described above) and securities lending transactions will be aggregated for purposes of this investment limitation.

Risk is inherent in all investing. You could lose money by investing in a Fund. Although each Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in a Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Funds’ sponsor has no legal obligation to provide financial support to a Fund, and you should not expect that the sponsor will provide financial support to a Fund at any time.

The following is a description of certain risks of investing in the Funds. The order of the below risk factors does not indicate the significance of any particular risk factor.

Principal Risks of Investing in the Funds

Credit Risk. All Funds. Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Income Risk. All Funds. The Fund’s yield will vary as the short-term securities in its portfolio mature and the proceeds are reinvested in securities with different interest rates.

Interest Rate Risk. All Funds. Interest rate risk is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter-term securities. Due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. Very low or negative interest rates may magnify interest rate risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, may result in heightened market volatility and may detract from the Fund’s ability to achieve its investment objective.

Market Risk and Selection Risk. All Funds. Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money.

A recent outbreak of an infectious coronavirus has developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. Because the Fund invests in short-term instruments these events have caused some instruments to have declining yields, which may impair the results of the Fund if these conditions persisted. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

Repurchase Agreements Risk. FedFund. If the other party to a repurchase agreement defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security and the market value of the security declines, the Fund may lose money.

Stable Net Asset Value Risk. All Funds. The Fund may not be able to maintain a stable NAV of $1.00 per share at all times. If the Fund fails to maintain a stable NAV (or if there is a perceived threat of such a failure), the Fund, along with other money market funds, could be subject to increased redemption activity.

15

Trading Risk. BlackRock Liquid Federal Trust Fund. In selling securities prior to maturity, the Fund may realize a price higher or lower than that paid to acquire such securities, depending upon whether interest rates have decreased or increased since their acquisition. In addition, shareholders in a state that imposes an income or franchise tax should determine through consultation with their own tax advisors whether the Fund’s interest income, when distributed by the Fund, will be considered by the state to have retained exempt status, and whether the Fund’s capital gain and other income, if any, when distributed, will be subject to the state’s income or franchise tax.

Treasury Obligations Risk. All Funds. Direct obligations of the U.S. Treasury have historically involved little risk of loss of principal if held to maturity. However, due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund.

U.S. Government Obligations Risk. All Funds. Not all U.S. Government securities are backed by the full faith and credit of the United States. Obligations of certain agencies, authorities, instrumentalities and sponsored enterprises of the U.S. Government are backed by the full faith and credit of the United States (e.g., the Government National Mortgage Association); other obligations are backed by the right of the issuer to borrow from the U.S. Treasury (e.g., the Federal Home Loan Banks) and others are supported by the discretionary authority of the U.S. Government to purchase an agency’s obligations. Still others are backed only by the credit of the agency, authority, instrumentality or sponsored enterprise issuing the obligation. No assurance can be given that the U.S. Government would provide financial support to any of these entities if it is not obligated to do so by law.

Variable and Floating Rate Instrument Risk. All Funds. Variable and floating rate securities provide for periodic adjustment in the interest rate paid on the securities. Certain of these securities may be subject to greater illiquidity risk than other fixed income securities, meaning the absence of an active market for these securities could make it difficult for the Fund to dispose of them at any given time.

When-Issued and Delayed Delivery Securities and Forward Commitments Risk. All Funds. When-issued and delayed delivery securities and forward commitments involve the risk that the security the Fund buys will lose value prior to its delivery. There also is the risk that the security will not be issued or that the other party to the transaction will not meet its obligation. If this occurs, the Fund may lose both the investment opportunity for the assets it set aside to pay for the security and any gain in the security’s price.

Other Risks of Investing in the Funds

Each Fund (except as noted below) may also be subject to certain other non-principal risks associated with its investments and investment strategies, including:

Borrowing Risk. All Funds. Borrowing may exaggerate changes in the NAV of Fund shares and in the return on the Fund’s portfolio. Borrowing will cost the Fund interest expense and other fees. The costs of borrowing may reduce the Fund’s return. Borrowing may cause the Fund to liquidate positions when it may not be advantageous to do so to satisfy its obligations.

Cyber Security Risk. All Funds. Failures or breaches of the electronic systems of the Fund, the Fund’s adviser, distributor, and other service providers, or the issuers of securities in which the Fund invests have the ability to cause disruptions and negatively impact the Fund’s business operations, potentially resulting in financial losses to the Fund and its shareholders. While the Fund has established business continuity plans and risk management systems seeking to address system breaches or failures, there are inherent limitations in such plans and systems. Furthermore, the Fund cannot control the cyber security plans and systems of the Fund’s service providers or issuers of securities in which the Fund invests.

Expense Risk. All Funds. Fund expenses are subject to a variety of factors, including fluctuations in the Fund’s net assets. Accordingly, actual expenses may be greater or less than those indicated. For example, to the extent that the Fund’s net assets decrease due to market declines or redemptions, the Fund’s expenses will increase as a percentage of Fund net assets. During periods of high market volatility, these increases in the Fund’s expense ratio could be significant.

Illiquid Investments Risk. All Funds. The Fund’s illiquid investments may reduce the returns of the Fund because it may be difficult to sell the illiquid investments at an advantageous time or price. The Fund may be unable to pay redemption proceeds within the time period stated in this prospectus because of unusual market conditions, an unusually high volume of redemption requests, or other reasons.

16

Investment in Other Investment Companies Risk. All Funds. As with other investments, investments in other investment companies, including exchange-traded funds, are subject to market and selection risk. In addition, if the Fund acquires shares of investment companies, including ones affiliated with the Fund, shareholders bear both their proportionate share of expenses in the Fund (including management and advisory fees) and, indirectly, the expenses of the investment companies (to the extent not offset by BlackRock through waivers). To the extent the Fund is held by an affiliated fund, the ability of the Fund itself to hold other investment companies may be limited.

Reverse Repurchase Agreements Risk. FedFund. Reverse repurchase agreements involve the sale of securities held by the Fund with an agreement to repurchase the securities at an agreed-upon price, date and interest payment. Reverse repurchase agreements involve the risk that the other party may fail to return the securities in a timely manner or at all. The Fund could lose money if it is unable to recover the securities and the value of the collateral held by the Fund, including the value of the investments made with cash collateral, is less than the value of the securities. These events could also trigger adverse tax consequences for the Fund. In addition, reverse repurchase agreements involve the risk that the interest income earned in the investment of the proceeds will be less than the interest expense.

Securities Lending Risk. FedFund. Securities lending involves the risk that the borrower may fail to return the securities in a timely manner or at all. As a result, the Fund may lose money and there may be a delay in recovering the loaned securities. The Fund could also lose money if it does not recover the securities and/or the value of the collateral falls, including the value of investments made with cash collateral. These events could trigger adverse tax consequences for the Fund.

17

Account Information

Valuation of Fund Investments and Price of Fund Shares

The price you pay when you purchase or redeem a Fund’s shares is the NAV next determined after confirmation of your order. The Funds calculates the NAV as follows:

| NAV = | (Value of Assets of a Share Class) – (Liabilities of the Share Class)

| |

| Number of Outstanding Shares of the Share Class |

Each Fund’s NAV per share is calculated by JPMorgan Chase Bank, N.A. (“JPM”) on each day on which the New York Stock Exchange (“NYSE”) and the Federal Reserve Bank of Philadelphia are open for business (a “Business Day”). Generally, trading in U.S. Government securities, short-term debt securities and money market instruments is substantially completed each day at various times prior to the close of business on the NYSE. The value of each security used in computing the NAV of a Fund’s shares is determined as of such times.

In computing the NAV, each Fund use the amortized cost method of valuation as described in the SAI under “Additional Purchase and Redemption Information.”

The NAV of BlackRock Liquid Federal Trust Fund is determined on each Business Day as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time).

The NAV of FedFund normally is determined on each Business Day as of 6:00 p.m. (Eastern time).

The Funds reserve the right to advance the time for accepting purchase or redemption orders on any day when the NYSE, bond markets (as recommended by The Securities Industry and Financial Markets Association (“SIFMA”)) or the Federal Reserve Bank of Philadelphia closes early1, trading on the NYSE is restricted, an emergency arises or as otherwise permitted by the SEC. See “Purchase of Shares” and “Redemption of Shares” for further information. In addition, the Board may, for any Business Day, decide to change the time as of which a Fund’s NAV is calculated in response to new developments such as altered trading hours, or as otherwise permitted by the SEC.

In the event the NYSE does not open for business because of an emergency or other unanticipated event, the Funds may, but are not required to, open for purchase or redemption transactions if the Federal Reserve wire payment system is open. To learn whether a Fund is open for business during an emergency or an unanticipated NYSE closing, please call (800) 441-7450.

Stern Brothers Shares are available only to clients of Stern Brothers & Co. and its affiliates. If you are no longer a client of Stern Brothers & Co., you are not eligible to hold Stern Brothers Shares and any Stern Brothers Shares you hold will be converted to Institutional Shares of the Fund, which are not offered in this prospectus.

To open an account with a Fund, contact Stern Brothers & Co. by telephone (646-969-7882) or by e-mail at [email protected].

After an account is established, purchase orders for shares are accepted only on Business Days and must be transmitted to the Fund’s office in Wilmington, Delaware by telephone (800-441-7450; in Delaware 302-797-2350), through the Fund’s internet-based order entry program, or by such other electronic means as the Fund agrees to in its sole discretion with you or your financial professional or your selected securities dealer, broker, investment adviser, service provider or industry professional (including BlackRock and its affiliates) (each, a “Financial Intermediary”).

| 1 | SIFMA currently recommends an early close for the bond markets on the following dates: April 14, May 27, July 1, November 25, December 23 and December 30, 2022. The NYSE will close early on November 25, 2022. |

18

Your purchase order must be received in proper form by the Funds or BNY Mellon Investment Servicing (US) Inc. (“BNY Mellon”), the Funds’ transfer agent, prior to the deadlines noted below to receive that NAV. However, a Fund may also honor a purchase order if the Fund can verify that the purchase order was submitted to a Financial Intermediary that is an authorized agent of the Fund before the applicable deadline.

Your Financial Intermediary may charge you a fee and may offer additional account services than those described in this prospectus. Additionally, your Financial Intermediary may have procedures for placing orders for Stern Brothers Shares that differ from those of the Funds, such as different investment minimums or earlier trading deadlines. Please contact your Financial Intermediary directly for more information and details.

In order to invest, a completed account application form must be submitted to, and processed by, your Financial Intermediary or the Funds’ transfer agent and an account number assigned. You may be asked to provide information to verify your identity when opening an account.

Payment for Stern Brothers Shares of a Fund may be made only in federal funds or other immediately available funds. You may be charged for any costs incurred by a Fund or its service providers, including any costs incurred to recompute a Fund’s NAV, in connection with a purchase order that has been placed but for which the Fund has not received full payment by the close of the federal funds wire (normally 6:45 p.m. Eastern time) on the day the purchase order was placed. This payment deadline may be extended by one Business Day where a purchase order is processed through certain electronic platforms where same-day cash settlement is impracticable. The Funds will notify a shareholder or Financial Intermediary if its purchase order or payment was not received by an applicable deadline.

Each Fund reserves the right to suspend or discontinue the offer and sale of its shares and reject or cancel any purchase order for any reason.

Each Fund will open for business and begin accepting purchase orders at 7:30 a.m. (Eastern time) on any Business Day. The chart below outlines the deadlines for receipt of purchase orders for the Funds’ Stern Brothers Shares.

| Fund | Deadline (Eastern time) | |||

| BlackRock Liquid Federal Trust Fund1 |

2:30 p.m. | |||

| FedFund2 |

5:00 p.m. | |||

| 1 | Purchase orders for Shares of BlackRock Liquid Federal Trust Fund placed after 2:25 p.m. Eastern time will not be transmitted by the Fund’s internet-based order entry program. Account holders may transmit their trades during the next time window when internet-based trading resumes. The Fund also reserves the right to limit the amount of such orders or to reject an order for any reason. |

| 2 | Purchase orders for Shares of FedFund placed after 4:30 p.m. Eastern time will not be transmitted by the Fund’s internet-based order entry program. Account holders may transmit their trades during the next time window when internet-based trading resumes. The Fund also reserves the right to limit the amount of such orders or to reject an order for any reason. |

Orders received after the applicable deadline for any Fund on any Business Day (or, if the Fund closes early, at such closing time) will generally be executed on the next Business Day.

Notwithstanding the foregoing, on any day that the principal bond markets close early (as recommended by SIFMA) or the Federal Reserve Bank of Philadelphia or the NYSE closes early, a Fund may advance the time on that day by which a purchase order must be placed so that it will be effected and begin to earn dividends that day. Typically, the deadline for purchases of BlackRock Liquid Federal Trust Fund is advanced to 2:00 p.m. on days before and sometimes after holiday closings.

Contact the Funds’ office at (800) 441-7450 for specific information.

The minimum initial investment by an institution for Stern Brothers Shares is $3 million. There is no minimum subsequent investment. The Funds’ officers, at their discretion, may reduce the minimum initial investment for Stern Brothers Shares for specific institutions whose aggregate relationship with the Fund is substantially equivalent to this $3 million minimum and warrants this reduction.

Stern Brothers Shares of the Funds are sold without a sales charge. Financial Intermediaries purchasing or holding Stern Brothers Shares of the Funds for their customer accounts may charge customers fees for cash management and other services provided in connection with their accounts. A customer should, therefore, consider the terms of its account with a

19

Financial Intermediary before purchasing Stern Brothers Shares of the Funds. A Financial Intermediary purchasing Stern Brothers Shares of a Fund on behalf of its customers is responsible for transmitting orders to the Fund in accordance with its customer agreements.

Certain accounts may be eligible for an automatic investment or redemption privilege, commonly called a “sweep,” under which amounts necessary to decrease or increase the account balance to a predetermined dollar amount at the end of each day are invested in or redeemed from the Fund as of the end of the day. Each investor desiring to use this privilege should consult its bank for details.

Shares of the Funds are only registered for sale in the United States and certain of its territories. Consequently, the Funds generally do not accept investments from non-U.S. residents.

Redemption orders must be transmitted to the Funds’ office in Wilmington, Delaware in the manner described under “Purchase of Shares.”

Each Fund will open for business and begin accepting redemption orders at 7:30 a.m. (Eastern time) on any Business Day. The deadline for receipt of redemption orders for the Fund’s Stern Brothers Shares is outlined in the chart below.

If redemption orders are received by BNY Mellon on a Business Day by the established deadlines, payment for redeemed Fund shares will typically be wired in federal funds on that same day.

Orders received after the applicable deadline for the Fund on any Business Day (or, if the Fund closes early, at such closing time) will generally be executed on the next Business Day.

If you purchased shares through a Financial Intermediary, that entity may have its own earlier deadlines for the receipt of the redemption order.

Where a redemption order is processed through certain electronic platforms where same-day cash settlement is impracticable, payment for redeemed shares will generally be delayed by one Business Day.

A Fund may suspend the right of redemption or postpone the date of payment under the conditions described under “Additional Purchase and Redemption Information” below.

| Fund | Deadline (Eastern time) | |||

| BlackRock Liquid Federal Trust Fund1 |

2:30 p.m. | |||

| FedFund2 |

5:00 p.m. | |||

| 1 | Redemption orders for Shares of BlackRock Liquid Federal Trust Fund placed after 2:25 p.m. Eastern time will not be transmitted by the Fund’s internet-based order entry program. Account holders may transmit their trades during the next time window when internet-based trading resumes. Shareholders placing orders through a Financial Intermediary are responsible for making certain that their Financial Intermediary communicates the order to the Fund’s office no later than the stated deadline. The Fund reserves the right to limit the amount of such orders that will be paid on the same day. |

| 2 | Redemption orders for Shares of FedFund placed after 4:30 p.m. Eastern time will not be transmitted by the Fund’s internet-based order entry program. Account holders may transmit their trades during the next time window when internet-based trading resumes. Shareholders placing orders through a Financial Intermediary are responsible for making certain that their Financial Intermediary communicates the order to the Fund’s office no later than the stated deadline. The Fund reserves the right to limit the amount of such orders that will be paid on the same day. |

Notwithstanding the foregoing, on any day that the principal bond markets close early (as recommended by SIFMA) or the Federal Reserve Bank of Philadelphia or the NYSE closes early, a Fund may advance the time on that day by which a redemption order must be placed so that it will be effected that day.

Typically, the deadline for redemption of BlackRock Liquid Federal Trust Fund is advanced to 2:00 p.m. on days before and sometimes after holiday closings. Contact the Funds’ office at (800) 441-7450 for specific information.

The Funds shall have the right to redeem shares in any Stern Brothers Shares account if the value of the account is less than $100,000, after 60 days’ prior written notice to the shareholder. If during the 60-day period the shareholder increases the

20

value of its Stern Brothers Shares account to $100,000 or more, no such redemption shall take place. If a shareholder’s Stern Brothers Shares account falls below an average of $100,000 in any particular calendar month, the account may be charged a service fee with respect to that month. Any such redemption shall be effected at the NAV next determined after the redemption order is entered.

In addition, a Fund may redeem Stern Brothers Shares involuntarily under certain special circumstances described in the SAI under “Additional Purchase and Redemption Information.” A Financial Intermediary redeeming shares of a Fund on behalf of its customers is responsible for transmitting orders to such Fund in accordance with its customer agreements.

Under normal and stressed market conditions, each Fund typically expects to meet redemption requests by using cash or cash equivalents in its portfolio or by selling portfolio assets to generate additional cash.

Additional Purchase and Redemption Information

Upon receipt of a proper redemption request submitted in a timely manner and otherwise in accordance with the redemption procedures set forth in this prospectus, the Fund will redeem the requested shares and make a payment to you in satisfaction thereof no later than the Business Day following the redemption request.

A Fund may postpone and/or suspend redemption and payment beyond one Business Day only as follows:

| a. | For any period during which there is a non-routine closure of the Federal Reserve wire system or applicable Federal Reserve Banks; |

| b. | For any period (1) during which the NYSE is closed other than customary week-end and holiday closings or (2) during which trading on the NYSE is restricted; |

| c. | For any period during which an emergency exists as a result of which (1) disposal of securities owned by the Fund is not reasonably practicable or (2) it is not reasonably practicable for the Fund to fairly determine the NAV of shares of the Fund; |

| d. | For any period during which the SEC has, by rule or regulation, deemed that (1) trading shall be restricted or (2) an emergency exists; |

| e. | For any period that the SEC may by order permit for your protection; or |

| f. | For any period during which the Fund, as part of a necessary liquidation of the Fund, has properly postponed and/or suspended redemption of shares and payment in accordance with federal securities laws (as discussed below). |

If the Board, including a majority of the non-interested Trustees, determines either that (1) a Fund has invested, at the end of a business day, less than 10% of its total assets in weekly liquid assets, or (2) a Fund’s calculated NAV per share has deviated from $1.00 or such deviation is likely to occur; then the Board, subject to certain conditions, may in the case of a Fund that the Board has determined to liquidate irrevocably, suspend redemptions and payment of redemption proceeds in order to facilitate the permanent liquidation of the Fund in an orderly manner. A Fund, prior to suspending redemptions, will notify the SEC of its decision to liquidate and suspend redemptions. If this were to occur, it would likely result in a delay in your receipt of your redemption proceeds.

Market timing is an investment technique involving frequent short-term trading of mutual fund shares designed to exploit market movements or inefficiencies in the way a mutual fund prices its shares. The Board has not adopted a market timing policy for each Fund because the Funds seek to maintain a stable NAV of $1.00 per share and generally the Funds’ shares are used by investors for short-term investment or cash management purposes. There can be no assurances, however, that a Fund may not, on occasion, serve as a temporary or short-term investment vehicle for those who seek to market time funds offered by other investment companies.

Under certain circumstances, if no activity occurs in an account within a time period specified by state law, a shareholder’s shares in the Fund may be transferred to that state.

21

Distribution and Shareholder Servicing Payments

Other Payments by BlackRock

From time to time, BlackRock, the Fund’s distributor or their affiliates may pay a portion of the fees for administrative, networking, recordkeeping, sub-transfer agency, sub-accounting and shareholder services at its or their own expense and out of its or their profits. BlackRock, the Fund’s distributor and their affiliates may also compensate affiliated and unaffiliated Financial Intermediaries, such as Stern Brothers & Co., for the sale and distribution of shares of the Funds. These payments would be in addition to the Fund payments described in this prospectus and may be a fixed dollar amount, may be based on the number of customer accounts maintained by the Financial Intermediary, may be based on a percentage of the value of shares sold to, or held by, customers of the Financial Intermediary or may be calculated on another basis. The aggregate amount of these payments by BlackRock, the Fund’s distributor and their affiliates may be substantial and, in some circumstances, may create an incentive for a Financial Intermediary, its employees or associated persons to recommend or sell shares of the Funds to you.

Please contact your Financial Intermediary for details about payments it may receive from the Funds or from BlackRock, the Funds’ distributor or their affiliates. For more information, see the SAI.

Each Fund declares dividends daily and distributes substantially all of its net investment income to shareholders monthly. Shares begin accruing dividends on the day the purchase order for the shares is effected and continue to accrue dividends through the day before such shares are redeemed. Unless they are reinvested, dividends are paid monthly generally by wire transfer within five Business Days after the end of the month or within five Business Days after a redemption of all of a shareholder’s shares of a particular class.

Shareholders may elect to have their dividends reinvested in additional full and fractional shares of the same class of shares with respect to which such dividends are declared. Reinvested dividends receive the same tax treatment as dividends paid in cash. Reinvested dividends are available for redemption on the following Business Day. Reinvestment elections, and any revocations thereof, must be made in writing to the Fund at 100 Bellevue Parkway, Wilmington, Delaware 19809 and will become effective after its receipt by the Fund with respect to dividends paid.

Distributions paid by the Funds will generally be taxable to shareholders. Each Fund expects that all, or virtually all, of its distributions will consist of ordinary income that is not eligible for the reduced rates applicable to qualified dividend income. You will be subject to income tax on these distributions regardless of whether they are paid in cash or reinvested in additional shares. The one major exception to these tax principles is that distributions on shares held in an individual retirement account (“IRA”) (or other tax-qualified plan) will not be currently taxable.

Distributions derived from taxable interest income or capital gains on portfolio securities, if any, will be subject to federal income taxes and will generally be subject to state and local income taxes. If you redeem shares of a Fund, you generally will be treated as having sold your shares and any gain on the transaction may be subject to tax.

Each Fund will be required in certain cases to withhold and remit to the United States Treasury a percentage of taxable ordinary income or capital gain dividends paid to any non-corporate shareholder who (1) has failed to provide a correct tax identification number, (2) is subject to back-up withholding by the IRS for failure to properly include on his or her return payments of taxable interest or dividends, or (3) has failed to certify to the Fund that he or she is not subject to back-up withholding or that he or she is an “exempt recipient.” Backup withholding is not an additional tax. Any amount withheld generally may be allowed as a refund or a credit against a shareholder’s federal income tax liability provided the required information is timely provided to the IRS.

A 3.8% Medicare tax is imposed on the net investment income (which includes, but is not limited to, interest, dividends and net gain from investments) of U.S. individuals with income exceeding $200,000, or $250,000 if married filing jointly, and of trusts and estates. Net investment income does not include exempt-interest dividends received from a Fund.