Form 425 Silver Spike Acquisition Filed by: Eleusis Inc.

Filed by Eleusis Inc.

Pursuant to Rule 425 under the Securities Act of 1933, and

deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934

Subject Company: Silver Spike Acquisition Corp II

Commission File No.: 001-40182

Date: January 20, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): January 20, 2022

SILVER SPIKE ACQUISITION CORP II

(Exact name of registrant as specified in its charter)

|

Cayman Islands

|

001-40182

|

N/A

|

||

|

(State or Other Jurisdiction

|

(Commission File Number)

|

(I.R.S. Employer

|

||

|

of Incorporation)

|

Identification No.)

|

|

660 Madison Avenue Suite 1600

New York, New York

|

10065

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: +1 212-905-4923

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

||

|

Class A ordinary shares, par value $0.0001 per share

|

SPKB

|

The NASDAQ Stock Market LLC

|

||

|

Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

SPKBW

|

The NASDAQ Stock Market LLC

|

||

|

Units, each consisting of one Class A ordinary share and one-fourth of one redeemable warrant

|

SPKBU

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of

1934 (17 CFR 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

The Business Combination Agreement and Plan of Merger

On January 20, 2022, Silver Spike Acquisition Corp II, an exempted company incorporated in the Cayman Islands with limited liability (“Silver Spike” or “SPAC”), entered into

a Business Combination Agreement and Plan of Merger (the “Business Combination Agreement”) by and among Silver Spike, Silver Spike Merger Sub II, Inc., a Delaware corporation and a direct, wholly owned subsidiary of Silver Spike (“Merger Sub 1”),

Eleusis Inc., a Delaware corporation (“HoldCo”), Eclipse Merger Sub, Inc., a Delaware corporation and a direct, wholly owned subsidiary of HoldCo (“Merger Sub 2”), and Eleusis Holdings Limited, a company incorporated under the laws of England and

Wales with company number 10809365 (“Eleusis”).

The Business Combination

Pursuant to the Business Combination Agreement and on the terms and subject to the conditions set forth therein, (i) Silver Spike will merge with and into Merger Sub 1, with

Merger Sub 1 surviving such merger and continuing as a Delaware corporation (“SPAC Successor”) (the “Domestication Merger”), (ii) HoldCo will acquire all of the outstanding shares of Eleusis from Eleusis’s shareholders in exchange for the issuance to

such shareholders of HoldCo stock, (iii) holders of options of Eleusis will roll over such options into replacement options to acquire shares of common stock of HoldCo (“HoldCo Common Stock”), (iv) HoldCo will be recapitalized such that its

authorized and outstanding capital stock will consist solely of HoldCo Common Stock and, prior to the closing of the transactions contemplated by the Business Combination Agreement (the “Closing”), HoldCo will complete a stock split of the HoldCo

Common Stock, and (v) Merger Sub 2 will merge with and into SPAC Successor, with SPAC Successor surviving such merger as a direct, wholly owned subsidiary of HoldCo (the “Business Combination Merger” and, together with the Domestication Merger, the

“Mergers”, and the Mergers, together with the other transactions contemplated by the Business Combination Agreement, the “Business Combination”).

As a result of the Business Combination, each issued and outstanding SPAC Class A Ordinary Share and SPAC Class B Ordinary Share will be cancelled and converted into a share

of HoldCo Common Stock, and subject to the Warrant Agreement, dated as of March 10, 2021, between SPAC and its warrant agent and the Business Combination Agreement, each warrant to acquire one SPAC Class A Ordinary Share (a “SPAC Warrant”) will be

cancelled and converted into a warrant to acquire one share of HoldCo Common Stock. Each unit of SPAC consisting of one SPAC Class A Ordinary Share and one-fourth of a SPAC Warrant that has not previously been separated into the underlying SPAC Class

A Ordinary Share and SPAC Warrant will be separated immediately prior to the Business Combination.

The Business Combination is expected to close in the second or third quarter of 2022, following the receipt of the required approval of Silver Spike’s shareholders and the

fulfillment of other customary closing conditions.

Business Combination Consideration

As a result of the Business Combination, existing equityholders of Eleusis, including holders of Eleusis options (each, an “Eleusis Equityholder”), will receive a number of

shares of HoldCo Common Stock (or restricted stock units, in the case of holders of Eleusis options) determined based on an implied equity value for Eleusis of $350 million, at a value of $10.00 per share of HoldCo Common Stock. In the event that

Eleusis obtains equity financing prior to the Closing as permitted by the Business Combination Agreement, the implied equity value of the HoldCo Common Stock (or restricted stock units) received by Eleusis Equityholders will be increased by the

amount of such financing, at a value of $10.00 per share of Holdco Common Stock.

1

Eleusis Equityholders will also receive a number of earnout shares in connection with the Closing approximately equal to 14% of an adjusted measure of the pro forma value of

HoldCo immediately following the Closing (the “Earnout Shares”), subject to vesting and forfeiture based on achievement of post-closing share price targets, in each case for any 20 trading days within any 30 trading day period commencing on the date

on which the Closing occurs (the “Closing Date”) and ending on the third anniversary of the Closing Date:

| • |

20% of the Earnout Shares will vest if and when the closing trading price of HoldCo Common Stock equals or exceeds $12.50 per share;

|

| • |

30% of the Earnout Shares will vest if and when the closing trading price of HoldCo Common Stock equals or exceeds $15.00 per share; and

|

| • |

50% of the Earnout Shares will vest if and when the closing trading price of HoldCo Common Stock equals or exceeds $17.50 per share.

|

The earn-out shares will be issued and outstanding as of the Closing, and any earn-out shares that have not vested as of the third anniversary of the Closing Date will be

forfeited for no consideration at that time. Holders of earn-out shares will be entitled to exercise the voting rights carried by the earn-out shares while the earn-out shares are subject to vesting conditions and the risk of forfeiture.

The transaction will result in approximately $258 million being contributed to the balance sheet of Eleusis, assuming no redemptions and net of estimated transaction

expenses.

Eleusis’s obligations to complete the Business Combination are contingent upon proceeds of the trust account (net of redemptions) and any financing arrangements being greater

than or equal to $50,000,000 (the “Minimum Cash Condition”). Under the Business Combination Agreement, if Silver Spike fails to meet the Minimum Cash Condition, Eleusis may waive the Minimum Cash Condition.

Sponsor Promote

In the event that the amount of cash available to be released from the trust account of Silver Spike (after giving effect to all payments made as a result of the completion

of all Silver Spike share redemptions) and the net amount of proceeds actually received by HoldCo or Eleusis pursuant to certain financing arrangements is, in the aggregate, between $50,000,000 and $100,000,000, then up to 3.25 million of the SPAC

Class B Ordinary Shares held by Silver Spike Sponsor, LLC (the “Sponsor”) will be forfeited. Additionally, in the event that the Minimum Cash Condition is not satisfied but is waived by Eleusis, the Sponsor will forfeit up to 250,000 of its SPAC

Class B Ordinary Shares at the Closing.

Covenants of the Parties

Each party agreed in the Business Combination Agreement to use commercially reasonable efforts to take all appropriate actions to consummate and make effective, in the most

expeditious manner practicable, the Business Combination. The Business Combination Agreement also contains certain customary covenants by Eleusis and Silver Spike during the period between the signing of the Business Combination Agreement and the

Closing, including the conduct of their respective businesses, obtaining governmental consents, as well as certain customary covenants, such as publicity, some of which may continue after the Closing. Each of the parties also agreed not to solicit or

enter into any alternative competing transactions during the period from the date of the Business Combination Agreement and the Closing. Silver Spike also agreed that it will ensure Silver Spike remains listed as a public company and that Silver

Spike’s ordinary shares remain listed on Nasdaq.

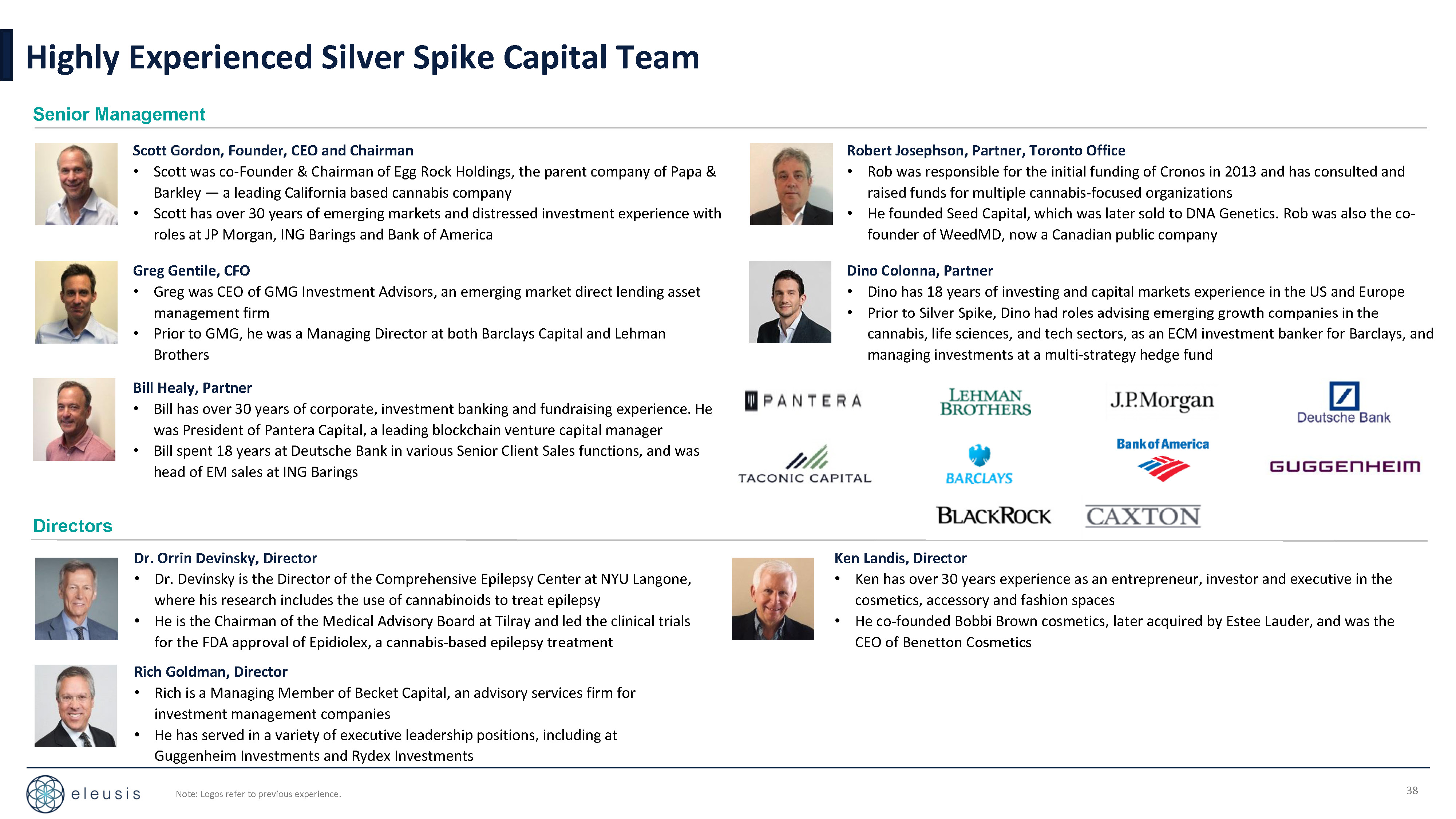

Directors of Holdco

The board of directors of HoldCo as of immediately following the Closing will consist of either seven (7) or nine (9) directors, as determined by Eleusis, of whom two (2)

individuals will be designated by Silver Spike (one of which must be selected from a list of prospective independent directors that is mutually agreed upon by Silver Spike and the other of which will be Scott Gordon), and of whom seven (7)

individuals will be designated by Eleusis. Pursuant to an Investor Rights Agreement (a form of which is attached as an exhibit to the Business Combination Agreement) to be entered into by HoldCo and certain stockholders of HoldCo at the Closing,

Shlomi Raz, the founder and chief executive office of Eleusis, will have certain rights to nominate individuals for election or appointment as directors of HoldCo following the Closing.

2

Closing Conditions

The obligations of the parties to complete the Closing are subject to various conditions, including customary conditions of each party and the following mutual conditions of

the parties, unless waived:

| • |

the approval of the Silver Spike shareholders shall have been obtained;

|

| • |

the Domestication Merger shall have been consummated;

|

| • |

the shares of registration statement on Form S-4 shall have become effective, no stop order shall have been issued by the SEC with respect to the registration statement and no legal

proceeding seeking such stop order shall have been initiated and remain pending;

|

| • |

the absence of any law or governmental order that would enjoin or prohibit the consummation of the Business Combination;

|

| • |

Silver Spike shall have at least $5,000,001 of net tangible assets remaining after giving effect to redemptions and any financing arrangements; and

|

| • |

the HoldCo Common Stock shall have been approved and listed on Nasdaq, subject to official notice of the issuance thereof.

|

In addition, Eleusis’s obligation to complete the Closing is subject to (unless waived by Eleusis) the Minimum Cash Condition.

Termination

The Business Combination Agreement may be terminated under certain customary and limited circumstances, including:

| • |

by written consent of Eleusis and Silver Spike;

|

| • |

by either party if: (i) the consummation of the Mergers is permanently prevented, prohibited, or deemed illegal by the terms of a final, non-appealable governmental order; (ii) Silver

Spike’s shareholders do not approve the transaction proposals at the Silver Spike shareholder meeting (subject to any adjournment or postponement thereof); (iii) the representations, warranties or covenants of the other party are breached

such that there is a failure of the related closing condition (subject to a 30-day cure period); or (iv) the Closing has not occurred on or before seven months following the date of the Merger Agreement;

|

| • |

by Silver Spike if Eleusis incurs indebtedness prior to the Closing other than as permitted by the Business Combination Agreement, in breach of its covenants set forth therein; or

|

| • |

by Eleusis if there is a modification in recommendation by the Silver Spike board of directors.

|

Other General

The Business Combination Agreement contains representations, warranties and covenants that the parties made to each other as of the date of such agreement or other specific

dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the parties and are subject to important qualifications and limitations agreed to by the parties in connection with

negotiating such agreement. The Business Combination Agreement has been filed to provide investors with information regarding its terms. It is not intended to provide any other factual information about Silver Spike, Eleusis, HoldCo or any other

party to the Business Combination Agreement. In particular, the representations, warranties, covenants and agreements contained in the Business Combination Agreement, which were made only for purposes of such agreement and as of specific dates, were

solely for the benefit of the parties to the Business Combination Agreement, may be subject to limitations agreed upon by the contracting parties (including being qualified by confidential disclosures made for the purposes of allocating contractual

risk between the parties to the Business Combination Agreement instead of establishing these matters as facts) and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors and

reports and documents filed with the SEC. Investors should not rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations of the actual state of facts or condition of any party to the Business

Combination Agreement. In addition, the representations, warranties, covenants and agreements and other terms of the Merger Agreement may be subject to subsequent waiver or modification. Moreover, information concerning the subject matter of the

representations and warranties and other terms may change after the date of the Business Combination Agreement, which subsequent information may or may not be fully reflected in Silver Spike’s public disclosures.

3

The foregoing description of the Business Combination Agreement is not complete and is qualified in its entirety by reference to the Business Combination Agreement (including

the form of Investor Rights Agreement and the other exhibits thereto), the form of which is attached as Exhibit 2.1 to this Current Report and incorporated herein by reference.

Deed of Irrevocable Undertaking

Concurrently with the execution of the Business Combination Agreement, Eleusis’s shareholders and holders of convertible notes entered into deeds of irrevocable undertaking

(collectively, the “Deeds of Irrevocable Undertaking”) pursuant to which such shareholders and holders of convertible notes agreed to exchange all of their shares of Eleusis for shares of HoldCo Stock prior to the Closing as contemplated by the

Business Combination Agreement and to take certain other actions in furtherance of the Business Combination and related transactions. Eleusis’s shareholders and holders of convertible notes also agreed, with certain exceptions, to a lock-up

applicable to their shares of HoldCo Common Stock for a period of one year after the Closing, subject to early release if the closing trading price of HoldCo Common Stock equals or exceeds $12.00 for any 20 trading days within any 30 trading day

period starting at least 150 days after Closing Date.

The foregoing description of the Deeds of Irrevocable Undertaking does not purport to be complete and is qualified in its entirety by the terms and conditions of the Deeds of

Irrevocable Undertaking, a representative form of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Sponsor Letter Agreement

Concurrently with the execution of the Business Combination Agreement, the Sponsor entered into a letter agreement (the “Sponsor Letter Agreement”) with Silver Spike, HoldCo

and Eleusis pursuant to which the Sponsor agreed, among other things, to vote all of its Class B ordinary shares, par value $0.0001 per share, of Silver Spike, along with the HoldCo Common Stock into which such shares are converted as a result of the

Business Combination (the “Sponsor Shares”), in favor of the Business Combination and related transactions and to take certain other actions in support of the Business Combination Agreement and related

transactions and, subject to customary exceptions, not to transfer the Sponsor Shares prior to the Closing. The Sponsor also agreed, with certain exceptions, to a lock-up applicable to their shares of HoldCo Common Stock for a period of one year

after the Closing, subject to early release if the closing trading price of HoldCo Common Stock equals or exceeds $12.00 for any 20 trading days within any 30 trading day period starting at least 150 days after Closing Date.

The foregoing description of the Sponsor Letter Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Sponsor Letter

Agreement, a copy of which is filed as Exhibit 10.2 hereto and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On January 20, 2022, Silver Spike and Eleusis issued a joint press release (the “Press Release”) announcing the execution of the Business Combination Agreement.

4

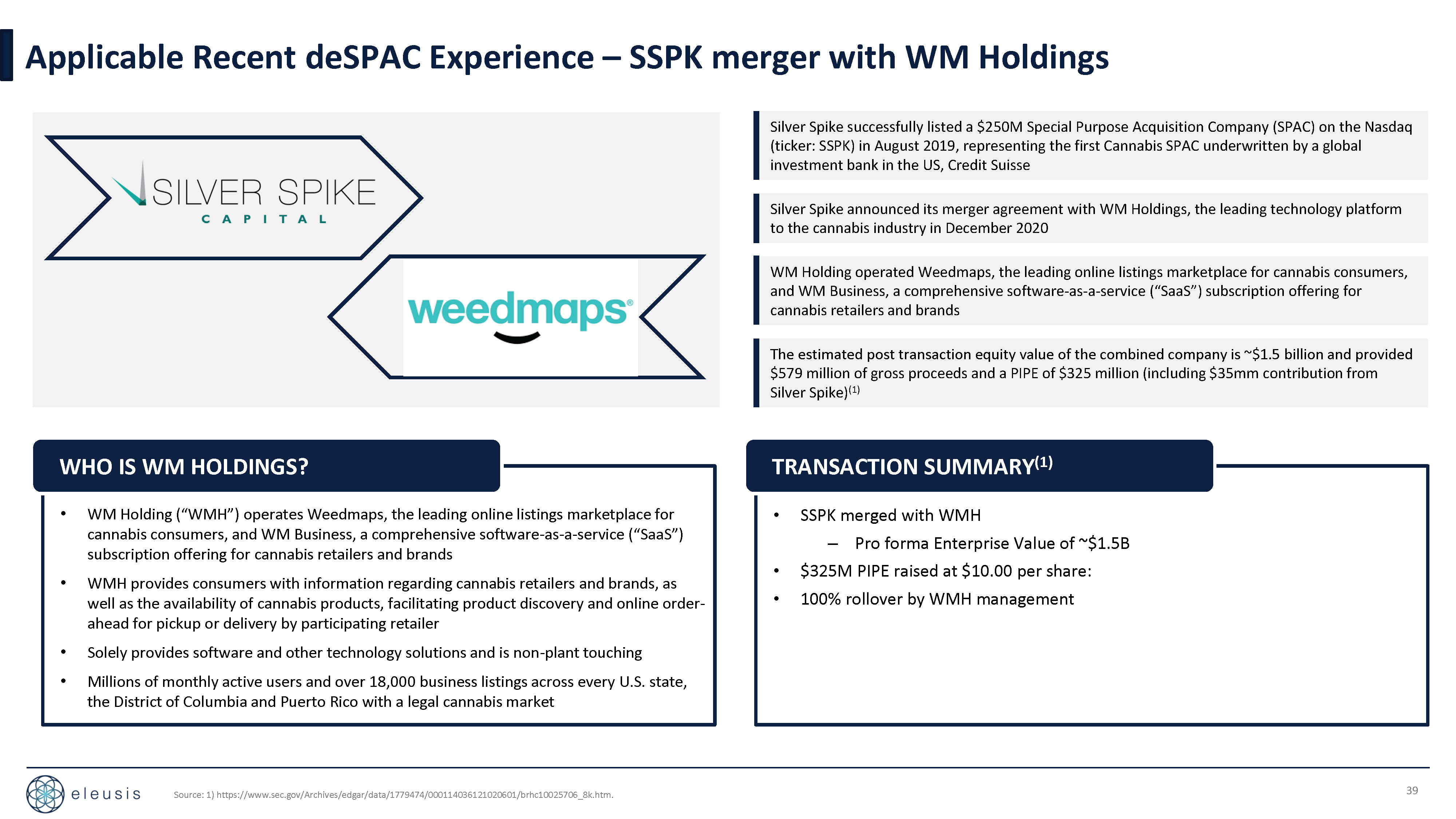

Also on January 20, 2022, Silver Spike and Eleusis released an investor presentation that will be used by Silver Spike, Eleusis and HoldCo with respect to the Business

Combination (the “Investor Presentation”).

Copies of the Press Release and Investor Presentation are furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report and are incorporated by reference herein.

The information in this Item 7.01 and Exhibits 99.1 and 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or otherwise subject to liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in

such filing.

Forward-Looking Statements Legend

This document contains certain “forward-looking statements” within the meaning of the federal securities laws, with respect to the proposed transaction between Eleusis

Holdings Limited (“Eleusis”) and Silver Spike Acquisition Corp II (“Silver Spike”). These forward-looking statements are generally

identified by words such as “anticipate,” “believe,” continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” or the negatives of these words or words of

similar meaning. These forward looking statements include, but are not limited to, statements regarding the benefits of the transaction, the anticipated timing of the transaction, Eleusis’s product candidates and expected markets, and Eleusis's

projected future results. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Such

forward-looking statements are based upon the current beliefs and expectations of the management of each of Silver Spike and Eleusis and are inherently subject to significant business, economic and competitive risks, uncertainties and contingencies.

Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may

adversely affect the price of Silver Spike's securities, (ii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the agreement and plan of merger by the shareholders of Silver Spike, the

satisfaction of the minimum trust account amount following redemptions by Silver Spike's public shareholders and the receipt of certain governmental and regulatory approvals, (iii) the lack of a third party valuation in determining whether or not to

pursue the proposed transaction, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreement and plan of merger, (v) the effect of the announcement or pendency of the transaction on

Eleusis’s business relationships, performance, and business generally, (vi) risks that the proposed transaction disrupts current plans of Eleusis and potential difficulties in Eleusis employee retention as a result of the proposed transaction, (vii)

the outcome of any legal proceedings that may be instituted against Eleusis or against Silver Spike or NewCo related to the agreement and plan of merger or the proposed transaction, (viii) the ability of NewCo's securities to qualify to list on The

Nasdaq Capital Market, (ix) volatility in the price of Silver Spike's securities due to a variety of factors, including changes in the competitive and highly regulated industries in which Eleusis plans to operate, variations in performance across

competitors, changes in laws and regulations affecting Eleusis’s business and changes in the combined capital structure, (x) the impact of the global COVID-19 pandemic, (xi) the enforceability of Eleusis's intellectual property, including its

trademarks, and the potential infringement on the intellectual property rights of others, cyber security risks or potential breaches of data security, (xii) the ability of Eleusis to protect the intellectual property and confidential information of

its customers, (xiii) unexpected costs, charges, or expenses resulting from the proposed business combination, (xiv) evolving legal, regulatory and tax regimes, (xv) the possibility that Eleusis may be adversely affected by other economic, business

and/or competitive factors, (xvi) actions by third parties, including government agencies, and (xvii) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and

realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Silver Spike’s Quarterly Reports

on Form 10-Q, the registration statement on Form S-4 and proxy statement/prospectus included therein discussed below and other documents filed by Silver Spike and NewCo from time to time with the U.S. Securities and Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking statements as a predictor of future results, performance and/or achievements as projected financial information and

other information are based on estimates and assumptions, whether or not identified in this document, that are inherently subject to various significant risks, uncertainties, contingencies and other factors, many of which are difficult to predict and

generally beyond the control of the parties. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Eleusis, NewCo and Silver Spike assume no obligation and do not intend to update or revise these

forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Eleusis, NewCo nor Silver Spike gives any assurance that either Eleusis, NewCo or Silver Spike will achieve its expectations.

5

Additional Information and Where to Find It

This document relates to a proposed transaction between Eleusis and Silver Spike. This document does not constitute an offer to sell or exchange, or the

solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction. Silver Spike and NewCo intend to file a registration statement on Form S-4 that will include a preliminary proxy statement for the solicitation of Silver Spike shareholder approval and prospectuses of Silver Spike and NewCo. The

proxy statement/prospectus will be sent to all Silver Spike stockholders. Silver Spike and NewCo also will file other documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF

SILVER SPIKE ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/ PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that are or

will be filed with the SEC by Silver Spike and NewCo through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Silver Spike and NewCo may be obtained free of charge from their respective websites at

silverspikecap.com or by written request to Silver Spike at 660 Madison Ave, Suite 1600, New York, New York 10065.

Participants in Solicitation

Silver Spike, NewCo and Eleusis and their respective directors and officers may be deemed to be participants in the solicitation of proxies from Silver

Spike’s stockholders in connection with the proposed transaction. Information about Silver Spike’s directors and executive officers and their ownership of Silver Spike’s securities is set forth in Silver Spike’s filings with the SEC. To the extent

that holdings of Silver Spike’s securities have changed since the amounts printed in Silver Spike’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information

regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/ prospectus regarding the proposed transaction when it becomes available. You may

obtain free copies of these documents as described in the preceding paragraph.

6

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

Description

|

|

Business Combination Agreement and Plan of Merger, dated January 20, 2022, by and among Silver Spike Acquisition Corp II, Silver Spike Merger Sub II, Inc., Eleusis Inc., Eclipse Merger

Sub, Inc., and Eleusis Holdings Limited

|

|

|

Form of Deed of Irrevocable Undertaking

|

|

|

Form of Sponsor Support Agreement

|

|

|

Press Release, dated January 20, 2022.

|

|

|

Investor Presentation, dated January 20, 2022.

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

| * |

Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). Silver Spike agrees to furnish supplementally a copy of any omitted

exhibit or schedule to the SEC upon its request.

|

7

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Dated: January 20, 2022

|

SILVER SPIKE ACQUISITION CORP II

|

|||

|

By:

|

/s/ Gregory Gentile

|

||

|

Name:

|

Gregory Gentile |

||

|

Title:

|

CFO |

||

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

AND PLAN OF MERGER

by and among

SILVER SPIKE ACQUISITION CORP II,

SILVER SPIKE MERGER SUB II, INC.

ELEUSIS INC.,

ECLIPSE MERGER SUB, INC.,

and

ELEUSIS HOLDINGS LIMITED

dated as of January 20, 2022

TABLE OF CONTENTS

Page

ARTICLE 1

Certain Definitions

|

Section 1.1.

|

Definitions

|

10

|

|

Section 1.2.

|

Construction

|

36

|

|

Section 1.3.

|

Knowledge

|

37

|

|

Section 1.4.

|

Equitable Adjustments

|

37

|

ARTICLE 2

Domestication; Exchange; Agreement and Plan of Merger

|

Section 2.1.

|

Domestication Merger

|

38

|

|

Section 2.2.

|

Exchange

|

39

|

|

Section 2.3.

|

The Business Combination Merger

|

41

|

|

Section 2.4.

|

Effects of the Mergers

|

41

|

|

Section 2.5.

|

Closing; Merger Effective Time

|

42

|

|

Section 2.6.

|

Closing Deliverables

|

42

|

|

Section 2.7.

|

Governing Documents

|

44

|

|

Section 2.8.

|

Directors and Officers

|

44

|

|

Section 2.9.

|

Company Convertible Notes

|

45

|

|

Section 2.10.

|

Earn-Out Shares.

|

45

|

|

Section 2.11.

|

Incentive Earn-Out Shares.

|

47

|

ARTICLE 3

Effects of The Transactions on Capital Stock and Equity Awards

|

Section 3.1.

|

Conversion of Securities in the Domestication Merger

|

49

|

|

Section 3.2.

|

Initial Exchange Consideration; Conversion of Securities in HoldCo Recapitalization

|

50

|

|

Section 3.3.

|

Conversion of Securities in the Business Combination Merger

|

51

|

|

Section 3.4.

|

Business Combination Merger Exchange Procedures

|

53

|

|

Section 3.5.

|

Treatment of Company Options and Company Restricted Shares

|

54

|

|

Section 3.6.

|

Withholding

|

55

|

|

Section 3.7.

|

SPAC Warrants; SPAC Successor Warrants

|

56

|

1

ARTICLE 4

Representations and Warranties of the Company

|

Section 4.1.

|

Company Organization

|

57

|

|

Section 4.2.

|

Subsidiaries

|

57

|

|

Section 4.3.

|

Due Authorization

|

58

|

|

Section 4.4.

|

No Conflict

|

58

|

|

Section 4.5.

|

Governmental Authorities; Consents

|

59

|

|

Section 4.6.

|

Capitalization of the Company

|

59

|

|

Section 4.7.

|

Capitalization of Subsidiaries

|

61

|

|

Section 4.8.

|

Financial Statements

|

61

|

|

Section 4.9.

|

Undisclosed Liabilities

|

63

|

|

Section 4.10.

|

Litigation and Proceedings

|

63

|

|

Section 4.11.

|

Legal Compliance

|

63

|

|

Section 4.12.

|

Contracts; No Defaults

|

64

|

|

Section 4.13.

|

Company Benefit Plans

|

66

|

|

Section 4.14.

|

Labor Relations; Employees

|

69

|

|

Section 4.15.

|

Taxes

|

70

|

|

Section 4.16.

|

Brokers’ Fees

|

74

|

|

Section 4.17.

|

Insurance

|

74

|

|

Section 4.18.

|

Licenses and Permits

|

74

|

|

Section 4.19.

|

Real Property

|

75

|

|

Section 4.20.

|

Intellectual Property

|

75

|

|

Section 4.21.

|

Privacy and Cybersecurity

|

77

|

|

Section 4.22.

|

Environmental Matters

|

78

|

|

Section 4.23.

|

Absence of Changes

|

79

|

|

Section 4.24.

|

Anti‑Corruption and Anti‑Money Laundering Compliance

|

79

|

|

Section 4.25.

|

Sanctions and International Trade Compliance

|

79

|

|

Section 4.26.

|

Information Supplied

|

80

|

|

Section 4.27.

|

Government Contracts

|

80

|

|

Section 4.28.

|

Transactions with Affiliates

|

80

|

|

Section 4.29.

|

No Additional Representations or Warranties

|

81

|

ARTICLE 5

Representations and Warranties of SPAC

|

Section 5.1.

|

SPAC Organization

|

81

|

|

Section 5.2.

|

Due Authorization

|

82

|

|

Section 5.3.

|

No Conflict

|

83

|

|

Section 5.4.

|

Subsidiaries

|

83

|

|

Section 5.5.

|

Litigation and Proceedings

|

83

|

|

Section 5.6.

|

SEC Filings

|

83

|

|

Section 5.7.

|

Internal Controls; Listing; Financial Statements

|

84

|

|

Section 5.8.

|

Governmental Authorities; Consents

|

85

|

|

Section 5.9.

|

Trust Account

|

86

|

|

Section 5.10.

|

Investment Company Act; JOBS Act

|

86

|

|

Section 5.11.

|

Absence of Changes

|

86

|

|

Section 5.12.

|

No Undisclosed Liabilities

|

87

|

|

Section 5.13.

|

Capitalization of SPAC

|

87

|

|

Section 5.14.

|

Brokers’ Fees

|

88

|

|

Section 5.15.

|

Indebtedness

|

88

|

|

Section 5.16.

|

Taxes

|

88

|

|

Section 5.17.

|

Business Activities

|

90

|

|

Section 5.18.

|

Nasdaq Listing; Securities Registration

|

91

|

|

Section 5.19.

|

Registration Statement, Proxy Statement and Proxy Statement/Registration Statement

|

91

|

|

Section 5.20.

|

No Outside Reliance

|

92

|

|

Section 5.21.

|

No Additional Representation or Warranties

|

92

|

|

Section 5.22.

|

Affiliate Transactions

|

92

|

2

ARTICLE 6

Representations and Warranties of Holdco and Merger Sub 2

|

Section 6.1.

|

Corporate Organization

|

93

|

|

Section 6.2.

|

Certificate of Incorporation and Bylaws

|

93

|

|

Section 6.3.

|

Capitalization

|

93

|

|

Section 6.4.

|

Authority Relative to This Agreement

|

94

|

|

Section 6.5.

|

No Conflict; Required Filings and Consents

|

95

|

|

Section 6.6.

|

Compliance

|

95

|

|

Section 6.7.

|

Board Approval; Vote Required

|

96

|

|

Section 6.8.

|

No Prior Operations of HoldCo or Merger Sub 2

|

96

|

|

Section 6.9.

|

No Indebtedness

|

97

|

|

Section 6.10.

|

Brokers’ Fees

|

97

|

|

Section 6.11.

|

Information Supplied

|

97

|

|

Section 6.12.

|

No Additional Representations or Warranties

|

97

|

ARTICLE 7

Representations and Warranties of Merger Sub 1

|

Section 7.1.

|

Corporate Organization

|

98

|

|

Section 7.2.

|

Certificate of Incorporation and Bylaws

|

98

|

|

Section 7.3.

|

Capitalization

|

98

|

|

Section 7.4.

|

Authority Relative to This Agreement

|

98

|

|

Section 7.5.

|

No Conflict; Required Filings and Consents

|

99

|

|

Section 7.6.

|

Compliance

|

99

|

|

Section 7.7.

|

Board Approval; Vote Required

|

100

|

|

Section 7.8.

|

No Prior Operations of Merger Sub 1

|

100

|

|

Section 7.9.

|

No Indebtedness

|

100

|

|

Section 7.10.

|

Brokers’ Fees

|

100

|

|

Section 7.11.

|

Information Supplied

|

100

|

|

Section 7.12.

|

No Additional Representations or Warranties

|

101

|

ARTICLE 8

Covenants of The Company, Holdco and Merger Sub 2

|

Section 8.1.

|

Conduct of Business

|

101

|

|

Section 8.2.

|

Inspection

|

106

|

|

Section 8.3.

|

Preparation and Delivery of Additional Company Financial Statements

|

107

|

|

Section 8.4.

|

Termination of Certain Agreements

|

107

|

|

Section 8.5.

|

Acquisition Proposals

|

108

|

|

Section 8.6.

|

Shareholder Litigation

|

108

|

|

Section 8.7.

|

Indemnification and Insurance

|

109

|

|

Section 8.8.

|

Actions Under Deed of Irrevocable Undertaking

|

110

|

|

Section 8.9.

|

Registration of HoldCo Shares Issued in the Exchange

|

111

|

3

ARTICLE 9

Covenants of SPAC

|

Section 9.1.

|

Trust Account

|

112

|

|

Section 9.2.

|

No Solicitation by SPAC

|

113

|

|

Section 9.3.

|

SPAC Conduct of Business

|

113

|

|

Section 9.4.

|

Inspection

|

116

|

|

Section 9.5.

|

SPAC Public Filings

|

116

|

|

Section 9.6.

|

Shareholder Litigation

|

117

|

ARTICLE 10

Joint Covenants

|

Section 10.1.

|

Filings with Governmental Authorities

|

117

|

|

Section 10.2.

|

Preparation of Proxy Statement/Registration Statement; Shareholders’ Meeting and Approvals

|

118

|

|

Section 10.3.

|

Support of Transaction

|

121

|

|

Section 10.4.

|

Tax Matters

|

121

|

|

Section 10.5.

|

Section 16 Matters

|

123

|

|

Section 10.6.

|

Form 8-K Filings

|

124

|

|

Section 10.7.

|

Commercially Reasonable Efforts; Further Assurances

|

124

|

|

Section 10.8.

|

Employee Matters

|

124

|

|

Section 10.9.

|

Post-Closing Directors of HoldCo

|

126

|

|

Section 10.10.

|

Securities Listing and De‑Listing

|

127

|

|

Section 10.11.

|

Confidentiality

|

127

|

ARTICLE 11

Conditions to Obligations

|

Section 11.1.

|

Conditions to Obligations of SPAC, SPAC Successor, Merger Sub 1, Holdco, Merger Sub 2, and the Company

|

128

|

|

Section 11.2.

|

Conditions to Obligations of SPAC, SPAC Successor and Merger Sub 1

|

129

|

|

Section 11.3.

|

Conditions to the Obligations of HoldCo, Merger Sub 2 and the Company

|

130

|

|

Section 11.4.

|

Frustration of Conditions

|

132

|

ARTICLE 12

Termination/Effectiveness

|

Section 12.1.

|

Termination

|

132

|

|

Section 12.2.

|

Effect of Termination

|

133

|

4

ARTICLE 13

Miscellaneous

|

Section 13.1.

|

Trust Account Waiver

|

133

|

|

Section 13.2.

|

Waiver

|

134

|

|

Section 13.3.

|

Notices

|

134

|

|

Section 13.4.

|

Assignment

|

135

|

|

Section 13.5.

|

Rights of Third Parties

|

135

|

|

Section 13.6.

|

Expenses

|

135

|

|

Section 13.7.

|

Governing Law

|

136

|

|

Section 13.8.

|

Headings; Counterparts

|

136

|

|

Section 13.9.

|

Company and SPAC Disclosure Letters

|

136

|

|

Section 13.10.

|

Entire Agreement

|

136

|

|

Section 13.11.

|

Amendments

|

137

|

|

Section 13.12.

|

Publicity

|

137

|

|

Section 13.13.

|

Severability

|

137

|

|

Section 13.14.

|

Jurisdiction; Waiver of Jury Trial

|

137

|

|

Section 13.15.

|

Enforcement

|

138

|

|

Section 13.16.

|

Non‑Recourse

|

138

|

|

Section 13.17.

|

Non‑Survival of Representations, Warranties and Covenants

|

139

|

|

Section 13.18.

|

Conflicts and Privilege

|

139

|

INDEX OF EXHIBITS

Exhibit Description

|

Exhibit A

|

Form of Investor Rights Agreement

|

|

|

Exhibit B

|

Form of Deed of Irrevocable Undertaking

|

|

|

Exhibit C

|

SPAC Investor Support Agreement

|

|

|

Exhibit D

|

Form of First Certificate of Merger

|

|

|

Exhibit E

|

Form of Second Amended and Restated HoldCo Certificate of Incorporation

|

|

|

Exhibit F

|

Form of Second Amended and Restated HoldCo Bylaws

|

|

|

Exhibit G

|

Form of Second Certificate of Merger

|

|

|

Exhibit H

|

Form of Amended and Restated Certificate of Incorporation of the Surviving Company

|

|

|

Exhibit I

|

Form of Amended and Restated Bylaws of the Surviving Company

|

|

|

Exhibit J

|

Form of Plan of Merger

|

5

BUSINESS COMBINATION AGREEMENT AND PLAN OF MERGER

This Business Combination Agreement and Plan of Merger, dated as of January 20, 2022 (this “Agreement”), is made and entered into by and among Silver Spike Acquisition Corp II, an exempted company incorporated in the Cayman Islands with limited liability (“SPAC”), Silver Spike Merger Sub II, Inc., a Delaware corporation and a direct, wholly owned subsidiary of SPAC (“Merger Sub 1”), Eleusis Inc., a Delaware corporation (“HoldCo”), Eclipse Merger Sub, Inc., a

Delaware corporation and a direct, wholly owned subsidiary of HoldCo (“Merger Sub 2”), and Eleusis Holdings Limited, a company incorporated under

the laws of England and Wales with company number 10809365 (the “Company”). SPAC, Merger Sub 1, HoldCo, Merger Sub 2 and the Company are sometimes

collectively referred to herein as the “Parties”, and each of them is sometimes individually referred to herein as a “Party”. Certain capitalized terms used herein have the meanings ascribed to them in Section 1.1.

RECITALS

WHEREAS, SPAC is a blank check

company incorporated as a Cayman Islands exempted company and incorporated for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses;

WHEREAS, each of HoldCo, Merger Sub

1 and Merger Sub 2 is an entity newly formed for the purposes of the Transactions;

WHEREAS, at least two (2) Business

Days prior to the Closing Date, upon the terms and subject to the conditions of this Agreement, SPAC will merge with and into Merger Sub 1, with Merger Sub 1 surviving such merger and continuing as a Delaware corporation (“SPAC Successor”), in accordance with the applicable provisions of the DGCL and the Cayman Statute (the “Domestication Merger”);

WHEREAS, at least one (1) day prior

to the date on which the Initial Exchange is consummated, the Company shall take such actions as are necessary or appropriate to cause the Company Convertible Notes to be converted into, exchanged for or otherwise replaced with Company Shares in

accordance with the terms of this Agreement;

WHEREAS, prior to the Initial

Exchange, HoldCo shall adopt and file with the Secretary of State of Delaware an amended and restated certificate of incorporation (the “First Amended and Restated Holdco Certificate of Incorporation”) and adopt amended and

restated bylaws (the “First Amended and Restated Holdco Bylaws”),

which collectively shall, to the maximum extent permitted by the DGCL and other applicable law, have the same terms and provide for the same rights and entitlements as the Organizational Documents of the Company as of immediately prior to the

Initial Exchange;

6

WHEREAS, upon the terms and subject

to the conditions of this Agreement, following the Domestication Merger, SPAC Successor, HoldCo, Merger Sub 2 and the Company will complete a business combination transaction pursuant to which, among other things:

(a) following HoldCo’s adoption

of the First Amended and Restated HoldCo Certificate of Incorporation and the First Amended and Restated Bylaws and at least one (1) Business Day prior to the date on which the HoldCo Recapitalization occurs, (i) HoldCo shall acquire all of the outstanding Company Shares from the Company Shareholders that are the holders thereof solely in exchange for the issuance to such Company Shareholders of

HoldCo Stock on the terms and subject to the conditions contained herein and in the Deed of Irrevocable Undertaking and (ii) the holders of Company Options will

roll over their Company Options into replacement options to acquire shares of HoldCo Common Stock (the foregoing clauses (i) and (ii), together, the “Initial Exchange”) and, as a result of the Initial Exchange, the

Company will become a direct, wholly owned subsidiary of HoldCo;

(b) at least one (1) Business

Day following the date on which the Initial Exchange occurs and prior to the consummation of the Stock Split, in order to facilitate the consummation of the Transactions, HoldCo will be recapitalized on the terms and subject to the conditions set

forth herein such that, immediately prior to the Merger Effective Time, HoldCo’s authorized capital stock shall consist solely of HoldCo Common Stock (the “HoldCo Recapitalization”); and,

(c) following the consummation

of the HoldCo Recapitalization and prior to the Merger Effective Time, HoldCo will complete a stock split of the HoldCo Common Stock on the terms and subject to the conditions set forth herein (the “Stock Split”, and the Stock Split together with the HoldCo Recapitalization and the Initial Exchange, collectively, the “Exchange”); and

(d) following the consummation

of the Exchange, Merger Sub 2 will merge with and into SPAC Successor, with SPAC Successor surviving such merger as a direct, wholly owned subsidiary of HoldCo (the “Business Combination Merger” and, together with the Domestication Merger, the “Mergers”);

WHEREAS, for U.S. federal income tax purposes, the Parties intend that (a) the Domestication Merger qualify as a “reorganization” within the meaning of Section 368(a)(1)(F) of the Internal Revenue Code of

1986, as amended (the “Code”), (b) the Exchange and the

Business Combination Merger, taken together, qualify as a transaction described in Section 351 of the Code, (c) the Business Combination Merger qualify as a “reorganization” within the meaning of Section 368(a) of the Code and (d) this

Agreement be and is adopted as a “plan of reorganization” within the meaning of Sections 354 and 361 of the Code, with respect to each of the Domestication Merger and the Business Combination Merger (collectively, the “Intended U.S. Tax Treatment”);

WHEREAS, each of the Parties intends

that, for UK tax purposes, the Initial Exchange satisfy the requirements of Section 77 of the United Kingdom Finance Act 1986 (the “Intended U.K. Tax

Treatment” and, together with the Intended U.S. Tax Treatment, the “Intended Tax Treatment”);

7

WHEREAS, the SPAC Board has

unanimously (a) determined that the Mergers and the other Transactions are fair to, and in the best interests of, SPAC Shareholders, (b) adopted a resolution approving this Agreement, the Ancillary Agreements, the Mergers and the other Transactions

and (c) subject to the terms herein, recommended the approval and adoption of this Agreement, the Plan of Merger, the Ancillary Agreements, the Mergers and the other Transactions by SPAC Shareholders;

WHEREAS, the Company Board has

unanimously (a) formed the opinion that the Transactions are likely to promote the success of the Company for the benefit of its members as a whole and (b) approved this Agreement, the Ancillary Agreements, the Initial Exchange, the Business

Combination Merger and the other Transactions;

WHEREAS, the HoldCo Board has

unanimously (a) determined that the Transactions are fair to, and in the best interests of, HoldCo and the Company (as the sole stockholder of HoldCo), (b) approved this Agreement, the Ancillary Agreements, the Exchange, the Business Combination

Merger and the other Transactions and (c) recommended the approval of the Initial Exchange, the HoldCo Recapitalization, the Stock Split and the other Transactions by the Company (as the sole stockholder of HoldCo);

WHEREAS, the Merger Sub 1 Board has

unanimously (a) determined that this Agreement, the Ancillary Agreements, the Mergers and the other Transactions are fair to, and in the best interests of, Merger Sub 1 and SPAC (as the sole shareholder of Merger Sub 1), (b) adopted a resolution

approving this Agreement, the Ancillary Agreements, the Mergers and the other Transactions and (c) recommended the approval and adoption of this Agreement and the Mergers by SPAC (as the sole stockholder of Merger Sub 1);

WHEREAS, the Merger Sub 2 Board has

unanimously (a) determined that this Agreement, the Ancillary Agreements, the Business Combination Merger and the other Transactions are fair to, and in the best interests of, Merger Sub 2 and HoldCo (as the sole shareholder of Merger Sub 2), (b)

adopted a resolution approving this Agreement, the Ancillary Agreements, the Business Combination Merger and the other Transactions and (c) recommended the approval and adoption of this Agreement and the Business Combination Merger by HoldCo (as the

sole stockholder of Merger Sub 2);

WHEREAS, as a condition and

inducement to SPAC’s willingness to enter into this Agreement, simultaneously with the execution and delivery of this Agreement, each Person that is a Company Investor as of the time of the execution and delivery of this Agreement has executed and

delivered to HoldCo a Deed of Irrevocable Undertaking pursuant to which such Company Investor has, on the terms and subject to the conditions set forth in the Deed of Irrevocable Undertaking, among other things, (a) agreed to consummate the Exchange, pursuant to which, among other things, such Company Investor will sell, and HoldCo will purchase, such Company Investor’s Company Shares (including the Company

Shares issued in connection with the Company Convertible Note Exchange) in accordance with the terms and conditions set forth herein and in the Deed of Irrevocable Undertaking, (b) agreed to comply with certain transfer restrictions applicable to

its Company Shares, its shares of HoldCo Stock issued pursuant to each of the Initial Exchange, the HoldCo Recapitalization and the Stock Split, (c) agreed to support this Agreement, the Ancillary Agreements to which the Company is or will be a

party and the Transactions, including the Exchange, and (d) agreed to take, or cause to be taken, any actions necessary or advisable to effect the Transactions, including the Exchange;

8

WHEREAS, in connection with the

Exchange and the Business Combination Merger, the Parties desire for HoldCo to register with the SEC to become a publicly traded company;

WHEREAS, in furtherance of the

Mergers and in accordance with the terms hereof, SPAC shall provide an opportunity to SPAC Shareholders to have their outstanding SPAC Ordinary Shares redeemed on the terms and subject to the conditions set forth in this Agreement and SPAC’s

Governing Documents in connection with obtaining SPAC Shareholder Approval;

WHEREAS, as a condition and

inducement to the Company’s willingness to enter into this Agreement, simultaneously with the execution and delivery of this Agreement, the Sponsor has executed and delivered to the Company the SPAC Investor Support Agreement pursuant to which the

Sponsor has agreed to, among other things, (a) support and vote all of its voting shares of SPAC to adopt and approve this Agreement and the other documents contemplated hereby and the Transactions, (b) comply with certain transfer restrictions applicable to its SPAC Securities (and any other equity securities of SPAC, SPAC Successor or HoldCo for which such SPAC Securities are exchanged or into which such SPAC

Securities are converted), on the terms and subject to the conditions set forth in the SPAC Investor Support Agreement and (c) subject to, and conditioned upon the occurrence of, the Closing, waive any adjustment to the conversion ratio set forth

in the SPAC Organizational Documents or any other anti‑dilution or similar protection, in each case, with respect to the SPAC Class B Ordinary Shares (and any other equity securities of SPAC, SPAC Successor or HoldCo for which the SPAC Class B

Ordinary Shares are exchanged or into which the SPAC Class B Ordinary Shares are converted);

WHEREAS, at the Closing, HoldCo, the

Sponsor and certain Company Shareholders shall enter into an Investor Rights Agreement (the “Investor Rights Agreement”) in the form attached

hereto as Exhibit A (with such changes as may be agreed in writing by SPAC and the Company) which shall be effective as of the Closing; and

NOW, THEREFORE, in consideration of

the foregoing and the respective representations, warranties, covenants and agreements set forth in this Agreement and intending to be legally bound hereby, SPAC, HoldCo, Merger Sub 1, Merger Sub 2 and the Company agree as follows:

9

ARTICLE 1

Certain Definitions

Section 1.1. Definitions. As used herein, the following terms shall have the following meanings:

“Acquisition Proposal” means, with

respect to the Company and its Subsidiaries, other than the Transactions and other than the acquisition or disposition of inventory, equipment or other tangible personal property in the ordinary course of business, any offer or proposal relating to,

in a single transaction or series of related transactions: (a) any acquisition or purchase, direct or indirect, of (i) a portion of the business of the Company and its Subsidiaries that comprises 15% or more of their combined net revenues or net

income, (ii) 15% or more of the consolidated assets of the Company and its Subsidiaries taken as a whole (based on the fair market value thereof, as determined in good faith by the Company Board), or (iii) 15% or more of any class of equity or voting

securities of (x) the Company or (y) one or more Subsidiaries of the Company holding assets constituting, individually or in the aggregate, 15% or more of the consolidated assets of the Company and its Subsidiaries, (b) any tender offer (including a

self‑tender offer) or exchange offer that, if consummated, would result in any Person beneficially owning 15% or more of any class of equity or voting securities of (i) the Company or (ii) one or more Subsidiaries of the Company holding assets

constituting, individually or in the aggregate, 15% or more of the consolidated assets of the Company and its Subsidiaries taken as a whole or (c) a merger, consolidation, share exchange, business combination, sale of substantially all the assets,

reorganization, recapitalization, liquidation, dissolution or other similar transaction involving the sale or disposition of (i) the Company or (ii) one or more Subsidiaries of the Company holding assets constituting, individually or in the

aggregate, 15% or more of the consolidated assets of the Company and its Subsidiaries taken as a whole.

“Action” means any claim, action,

suit, audit, examination, assessment, arbitration, mediation or inquiry, or any proceeding or enforcement action, by or before any Governmental Authority.

“Affiliate” means, with respect to

any specified Person, any other Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, whether through one or more intermediaries or otherwise. The term “control” (including the terms

“controlling”, “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting

securities, by Contract or otherwise. For the avoidance of doubt, the Sponsor shall be deemed an Affiliate of SPAC and SPAC Successor, in each case, prior to the Merger Effective Time, for all purposes hereunder.

“Affordable Care Act” has the

meaning specified in Section 4.13(d).

“Agreement” has the meaning

specified in the Preamble hereto.

10

“Agreement End Date” has the meaning

specified in Section 12.1(e).

“Ancillary Agreements” has the

meaning specified in Section 13.10.

“Announcement 8-K” has the meaning

specified in Section 10.6.

“Anti‑Bribery Laws” means the

anti‑bribery provisions of the Foreign Corrupt Practices Act of 1977, as amended, and all other applicable anti‑corruption and bribery Laws (including the UK Bribery Act 2010, and any rules or regulations promulgated thereunder or other Laws of other

countries implementing the OECD Convention on Combating Bribery of Foreign Officials).

“Anti‑Money Laundering Laws” means

all applicable laws or regulations of the United Kingdom, the United States of America, the European Union and its Member States and any jurisdiction applicable to the Company or its Subsidiaries that relate to money laundering, counter‑terrorist

financing or record keeping and reporting requirements relating to money laundering or counter‑terrorist financing.

“Audited Financial Statements” has

the meaning specified in Section 4.8(a).

“At-Risk Sponsor Promote Additional Amount”

means 250,000 shares of SPAC Successor Class A Common Stock; provided that such amount and the At-Risk Sponsor Promote Base Amount will be

reduced pro rata by an aggregate amount equal to the At-Risk Sponsor Promote Offset Amount.

“At-Risk Sponsor Promote Base Amount”

means 3,250,000 shares of SPAC Successor Class A Common Stock; provided that such amount and the At-Risk Sponsor Promote Additional Amount will

be reduced pro rata by an aggregate amount equal to the At-Risk Sponsor Promote Offset Amount.

“At-Risk Sponsor Promote Offset Amount”

means a number of shares of SPAC Successor Class A Common Stock equal to the product of (a) the Interim Financing Discount Sharing Percentage multiplied by (b) the Interim Financing Discount Share Number.

“Business Combination” has the

meaning set forth in Article 1.1 of SPAC’s Governing Documents as in effect on the date hereof.

“Business Combination Merger” has

the meaning set forth in the Recitals.

“Business Combination Proposal”

means any offer, inquiry, proposal or indication of interest (whether written or oral, binding or non‑binding, and other than an offer, inquiry, proposal or indication of interest with respect to the Transactions), relating to a Business Combination.

“Business Day” means a day other

than a Saturday, Sunday or other day on which commercial banks in New York, New York or London, United Kingdom or Governmental Authorities in the Cayman Islands are authorized or required by Law to close.

11

“CARES Act” has the meaning

specified in Section 4.15(q).

“Cayman Merger Documents” has the

meaning specified in Section 2.1.

“Cayman Registrar” means the

Registrar of Companies of the Cayman Islands under the Cayman Statute.

“Cayman Statute” means the Companies

Act (Revised) of the Cayman Islands.

“Class B Conversion Ratio” means the

ratio at which SPAC Successor Class B Common Stock are automatically convertible into SPAC Successor Class A Common Stock pursuant to the SPAC Successor Certificate of Incorporation (for the avoidance of doubt, without giving effect to any adjustment

provision of the SPAC Successor Certificate of Incorporation that would result in such ratio being greater than one-to-one).

“Closing” has the meaning specified

in Section 2.5(a).

“Closing Available Cash” means an amount equal to (a) the amount of cash available to be released from the Trust Account as

of immediately prior to the Closing (net of the SPAC Share Redemption Amount, but without reduction for any amount of cash included in clause (e) of this definition), plus (b) the net amount of cash proceeds actually received or confirmed to be received by HoldCo or the Company as of immediately prior

to the Closing pursuant to any Financing Arrangement (without reduction for any amount of cash included in clause (e) of this definition), plus (c) the minimum net amount of cash proceeds required to be paid or made available to HoldCo or the Company during the period commencing at the Closing and ending on the first

anniversary of the Closing Date pursuant to any Post-Closing Financing Arrangement (taking into account, for purposes of determining such minimum net amount, any terms, conditions or other provisions of such Post-Closing Financing Arrangement that

could limit HoldCo’s or the Company’s right to receive such cash proceeds during such period or otherwise cause the net amount of such cash proceeds actually paid or made available to HoldCo or the Company during such period to vary) (without

reduction for any amount of cash included in clause (e) of this definition), plus (d) the amount of cash (other than Excluded Cash) of SPAC as of immediately prior to the Closing that is held in an account of SPAC outside the Trust Account, minus (e) the amount of cash required to be transferred to, retained by or held in escrow for the benefit of the

counterparty to any Financing Arrangement, minus (f) the

amount by which the aggregate amount of all Transaction Expenses and all SPAC Transaction Expenses exceeds $20,000,000.

“Closing Company Financial Statements”

has the meaning specified in Section 8.3.

“Closing Date” has the meaning

specified in Section 2.5(a).

“Closing Press Release” has the

meaning specified in Section 10.6.

12

“Code” has the meaning specified in

the Recitals hereto.

“Companies Act” means the UK

Companies Act 2006, as amended.

“Company” has the meaning specified

in the Preamble hereto.

“Company Award” shall mean a Company

Option or a Company Restricted Share.

“Company Benefit Plan” has the

meaning specified in Section 4.13(a).

“Company Board” means the board of

directors of the Company.

“Company Convertible Note” means any

outstanding convertible loan note issued by the Company set forth on Section 1.01 of the Company Disclosure Letter.

“Company Convertible Note Exchange”

has the meaning specified in Section 2.9.

“Company Cure Period” has the

meaning specified in Section 12.1(e).

“Company Deferred Share” means an

ordinary share in the capital of the Company with a nominal value of £0.0001 per share, having all the rights and entitlements of a “Deferred Share” pursuant to the Company Organizational Documents.

“Company Designees” has the meaning

specified in Section 10.9.

“Company Disclosure Letter” has the

meaning specified in the introduction to Article 4.

“Company Incentive Plan” means the

Eleusis Holdings Limited 2020 Equity Incentive Plan.

“Company Indemnified Parties” has

the meaning specified in Section 8.7(a).

“Company Investor” means any holder

of any Company Share or Company Convertible Note.

“Company IP” means any and all

Intellectual Property owned (or purported to be owned) by the Company or any of its Subsidiaries.

“Company IT Systems” means any and

all IT Systems that are owned, leased, or licensed by the Company or its Subsidiaries and used (or held for use) in or necessary for the operation of their businesses.

“Company Licensed IP” means any and

all Intellectual Property owned by a third Person and licensed or sublicensed, or purported to be licensed or sublicensed, exclusively to the Company or any of its Subsidiaries or for which the Company or any of its Subsidiaries has obtained, or has

purported to have obtained, a covenant not to be sued or similar right.

13

“Company Material Adverse Effect”

means any event, state of facts, condition, change, development, circumstance, occurrence or effect (collectively, “Events”) that (i) has had, or

would reasonably be expected to have, individually or in the aggregate, a material adverse effect on the business, assets, results of operations or financial condition of the Company and its Subsidiaries, taken as a whole, or (ii) does or would

reasonably be expected to, individually or in the aggregate, prevent, materially delay or materially impede the ability of the Company to consummate the Exchange or the Business Combination Merger; provided, however, that, solely in the case of the foregoing clause (i), in no event would

any of the following, alone or in combination, be deemed to constitute, or be taken into account in determining whether there has been or will be, a “Company

Material Adverse Effect”: (a) any change in applicable Laws or GAAP or any interpretation thereof following the date of this Agreement, (b) any change in interest rates or economic, political, business or financial market conditions

generally, (c) the taking of any action required by this Agreement, (d) any natural disaster (including hurricanes, storms, tornados, flooding, earthquakes, volcanic eruptions or similar occurrences), pandemic, disease outbreak or other public health

emergency (including COVID‑19 and the effect of any abatement thereof or any Permitted Action in response thereto) or change in climate, (e) any acts of terrorism or war, the outbreak or escalation of hostilities, geopolitical conditions, local,

national or international political conditions, (f) any failure of the Company to meet any projections or forecasts (provided that this clause (f)

shall not prevent a determination that any Event not otherwise excluded from this definition of Company Material Adverse Effect underlying such failure to meet projections or forecasts has resulted in a Company Material Adverse Effect), (g) any

Events generally applicable to the industries or markets in which the Company and its Subsidiaries operate (including increases in the cost of products, supplies, materials or other goods purchased from third party suppliers), (h) the announcement of

this Agreement and consummation of the Transactions (it being understood that this clause (h) shall be disregarded for purposes of the representation and warranty set forth in Section 4.4 and the condition to Closing with respect thereto), (i) the

results of any pre-clinical, clinical or post-marketing studies being conducted by or on behalf of the Company or any of its Subsidiaries or any competitor of the Company or any of its Subsidiaries, (j) any action or inaction, including any decision,

recommendation or statement of, or requirement imposed by, any U.S. or foreign patent or trademark office with respect to any patent or trademark application owned or otherwise controlled by the Company or any of its Subsidiaries in the ordinary

course of prosecution of such patent or trademark application or (k) any action taken by, or at the request of, SPAC; provided, further, that any Event referred to in clauses (a), (b), (d), (e) or (g) above may be taken into account in determining if a Company Material Adverse

Effect has occurred to the extent it has a disproportionate and adverse effect on the business, assets, results of operations or financial condition of the Company and its Subsidiaries, taken as a whole, relative to similarly situated companies in

the industry in which the Company and its Subsidiaries conduct their respective operations, but only to the extent of the incremental disproportionate effect on the Company and its Subsidiaries, taken as a whole, relative to similarly situated

companies in the industry in which the Company and its Subsidiaries conduct their respective operations.

14

“Company Option” means an option to

purchase Company Ordinary Shares granted under the Company Incentive Plan.

“Company Ordinary Share” means an

ordinary share in the capital of the Company with a nominal value of £0.0001 per share, having all the rights and entitlements of an “Ordinary Share” pursuant to the Company Organizational Documents.

“Company Ordinary A Share” means an

ordinary share in the capital of the Company with a nominal value of £0.0001 per share, having all the rights and entitlements of an “A Share” pursuant to the Company Organizational Documents.

“Company Ordinary B Share” means an

ordinary share in the capital of the Company with a nominal value of £0.0001 per share, having all the rights and entitlements of an “B Share” pursuant to the Company Organizational Documents.

“Company Ordinary N Share” means an

ordinary share in the capital of the Company with a nominal value of £0.0001 per share, having all the rights and entitlements of an “N Share” pursuant to the Company Organizational Documents.

“Company Organizational Documents”

means the articles of association and bylaws of Company or equivalent organizational documents, as amended, modified or supplemented from time to time.

“Company Preferred Share” means a

series A preferred share in the capital of the Company with a nominal value of £0.0001 per share, having all the rights and entitlements of a “Series A Share” pursuant to the Company Organizational Documents.

“Company Registered Intellectual Property”

has the meaning specified in Section 4.21(a).

“Company Related Party” has the

meaning specified in Section 4.28.

“Company Related Party Transactions”

has the meaning specified in Section 4.28.

“Company Restricted Share” means a

Company Share that, as of immediately prior to the Initial Exchange Effective Time, is subject to a substantial risk of forfeiture within the meaning of Section 83 of the Code and was issued pursuant to the Company Incentive Plan (including as a

result of the exercise of a Company Option issued pursuant to the Company Incentive Plan).

“Company Shareholders” means holders

of Company Shares (including the holders of the Company Shares issued in connection with the Company Convertible Note Exchange).

15

“Company Shares” means,

collectively, the Company Preferred Shares, the Company Ordinary A Shares, the Company Ordinary N Shares, the Company Ordinary B Shares, the Company Ordinary Shares and the Company Deferred Shares.

“Completion 8-K” has the meaning

specified in Section 10.6.

“Confidentiality Agreement” has the

meaning specified in Section 13.10.

“Contracts” means any legally

binding contracts, agreements, subcontracts, leases, and purchase orders.

“COVID‑19” means SARS‑CoV‑2 or

COVID‑19, and any evolutions, variations or mutations thereof or related or associated epidemics, pandemic or disease outbreaks.

“COVID‑19 Measures” means any

quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester, safety or other similar Law, directive, guidelines or recommendations by any Regulatory Authority, in each case implemented or

otherwise having the force of Law in connection with or in response to COVID‑19 and in each case applicable to the Company and/or its Subsidiaries, including the CARES Act and Families First Act.

“CTA 2010” means the United Kingdom

Corporation Tax Act 2010.

“D&O Indemnified Parties” has

the meaning specified in Section 8.7(a).

“Davis Polk” has the meaning

specified in Section 13.18(a).

“Deed of Irrevocable Undertaking” means

any of those certain Deeds of Irrevocable Undertaking entered into prior to the date hereof by the applicable Company Investor and acknowledged and agreed by HoldCo, substantially in the form attached hereto as Exhibit B.

“DGCL” means the Delaware General Corporation Law.

“Disclosure Letter” means, as

applicable, the Company Disclosure Letter or SPAC Disclosure Letter.

“DOL” has the meaning specified in

Section 4.13(a).