Form 425 Pathfinder Acquisition Filed by: Pathfinder Acquisition Corp

Filed by Pathfinder Acquisition Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12 under the

Securities Exchange Act of 1934

Subject Company: Pathfinder Acquisition Corporation

Commission File No. 001-40074

Date: January 30, 2023

The below presentation was used by Movella, Inc. (“Movella”) in a presentation to certain individuals on January 30, 2023, in connection with Movella’s previously disclosed proposed business combination with Pathfinder Acquisition Corporation.

1

Investor Presentation WINTER 2023

Disclaimer This information contained in this presentation is confidential information regarding Movella Inc (“Movella” or the “Company” ) and Pathfinder Acquisition Corporation (“Pathfinder”). Such information is being provided on a strictly confidential basis and may not be published, reproduced, copied or disclosed to any other party without the prior written approval of Movella. The information contained h erein does not purport to be all-inclusive and this presentation is made solely for informational purposes and delivered to assist interested parties in making their own evaluation with respect to investing in a proposed business combination (the “Business Combination”) between Pathfi nder and Movella, and no representation or warranty, express or implied, is made by Movella or any of its representatives as to the information contained in these materials or disclosed during any related presentation or discussions. By accepting this presentation, each recipient a cknowledges that it will be solely responsible for making its own investigations, including all costs and expenses incurred in c onnection with such investigations or its investment, if any, and forming its own view as to the condition and prospects of such investment, and the accuracy an d completeness of the statements contained herein. This presentation should not be considered a recommendation by Movella, Pathf inder, or its respective affiliates, advisors or representatives to invest in Pathfinder or Movella, and recipients interested in investing are recomm ended to seek their own independent financial, legal and other advice from persons authorized and specializing, as necessary, in investments of the kind in question and should rely solely on their own judgment, review, and analysis in evaluating the investment. Recipients should be aware that any investment activity exposes them to risk of losing some or all of their investment. Cautionary Note Regarding Forward-Looking Statements This presentation contains statements which describe future expectations, plans, results or strategies and can often be ident ified by the use of terminology such as “may,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect,” “anticipate,” “sho uld,” “could,” “potential,” “projection,” “forecast,” “plan,” “trend,” “assumption,” “opportunity,” or similar terminology. Statements other than histori cal facts, including, but not limited to, those concerning (i) the proposed Business Combination, (ii) the Francisco Partners Fin ancing and any the private placement of securities in connection with the Business Combination, (iii) market conditions, (iv) the revenues, earnings, performance (performance or otherwise), strategies, prospects, anticipated product development timing, market opportunities, and other aspects of the businesses of the Company or (v) trends, consumer or customer preferences or other similar concepts with respect to Pathfinde r, the Company or the proposed Business Combination, are based upon management’s current expectations, assumptions and estimates , and are not guarantees of future results or the timing thereof and should not be relied upon as such. Actual results may differ materiall y from those contemplated in these statements due to a variety of risks and uncertainties related to the business of Movella and Pathfinder, including, but not limited to, (1) changes in domestic and foreign business, market, financial, political, and legal conditions, (2) the inabili ty of the parties to successfully or timely negotiate and consummate the proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed Business Combination, (3) that approval of stockholders is not obtained, (4) failure to rea lize the anticipated benefits of the proposed Business Combination, (5) risks relating to the uncertainty of the projected financial information of the Com pany, (6) the effects of competition on the Company’s business, (7) the amount of redemption requests made by Pathfinder’s publi c stockholders, (8) the ability of Pathfinder or the combined company to issue equity or equity-linked securities in connection with the proposed Business Combination or in the future, (9) the impact of the global COVID-19 pandemic, and (10) other risks discussed in Pathfinder’s Registration Statement on Form S-1 (File No. 333-252498) under the heading “Risk Factors” and other documents that Pathfinder has filed or will file with the Secur ities and Exchange Commission. These forward-looking statements are based upon management’s current expectations, assumptions and estimates, and are not guarantees of future results or the timing thereof and should not be relied upon as such. Neither Pathfinder nor the Comp any commits to update or revise the forward looking statements set forth herein, whether as a result of new information, future events or otherwise, except as may be required by law. Performance, Statistics and Use of Non-GAAP Financial Measures Past performance is not indicative of future results. This presentation includes certain management estimates or predictions that are not intended to predict the Company’s or Pathfinder’s future results, including expected future revenue and revenue gro wth, expected gross profit margins, expected operating expenses, expected EBITDA, EBITDA Profitability and EBITDA Margin. No representation is made as t o the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modeling or back -testing or any other information contained herein. Unless otherwise specified herein, performance figures included herein are presented on a forwa rd-looking, pro forma basis giving effect to the Business Combination and do not reflect any events subsequent to the date hereo f. These estimates have been developed based on a variety of estimates and assumptions about future events that rely significantly on management’s ju dgment and that, while presented with numerical specificity and considered reasonable by management, are inherently subject to s ignificant business, economic, competitive, regulatory and other uncertainties and contingencies, all of which are difficult to predict and many o f which are beyond the Company’s, Pathfinder’s or any other person’s control, and on estimates and assumptions with respect to f uture business decisions that are subject to change. Some of the data contained herein is derived from information provided by Pathfinder or the Company and various third -party sources and is included herein for illustrative purposes only. The delivery of this presentation shall not under any circumstance s, create any implication that the presentation is correct in all respects, including as of any time subsequent to the date hereof, and Pathfinder and the C ompany do not undertake any obligation to update such information at any time after such date. Certain information in this prese ntation may be based upon information from third-party sources which we consider reliable, but neither Pathfinder nor the Company represents that such information is accurate, complete or sufficient for any purpose and it should not be relied upon as such. There is no guarantee that these estimates or predictions will be ultimately realized or that the Company or Pathfinder will achieve the results reflected therein. As a re sult, you should not rely on these estimates or predictions. Neither the Company’s independent auditors, nor the independent reg istered public accounting firm of Pathfinder have audited, reviewed, compiled or performed any procedures with respect to the projections for purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance wi th respect thereto for the purpose of this presentation. This presentation includes certain financial measures of Movella not presented in accordance with generally accepted accounti ng principles in the U.S. (“GAAP”), including, but not limited to, gross profit, operating expenses, operating income, EBITDA, EBITDA Margin and EBITDA Profitability in each case presented on a non-GAAP basis. A non-GAAP reconciliation is provided on slide 34 hereto. These non-GAAP measures of financial performance may exclude items that are significant in understanding and assessing the Company’s f inancial results. Therefore, these measures should not be considered in isolation or as an alternative to revenue, gross profit or net income or other mea sures of profitability, liquidity or performance under GAAP. You should be aware that the Company’s presentation of these measur es may not be comparable to similarity-titled measures used by other companies. The Company believes these non-GAAP measures of financial results provide useful information to management and investors regardi ng certain financial and business trends relating to the Company’s financial condition and results of operations. The Company believes that the usage of those non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results an d trends in comparing the Company’s financial measures with those of similar companies, many of which present similar non -GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by ma nagement about which expense and income items are excluded or included in determining these non-GAAP financial measures. This presentation has been provided solely for information purposes and does not constitute investment, legal, tax or other a dvice and nor is it to be relied upon in making an investment decision. The information contained in this presentation is provid ed only as of the date on which this presentation is made and is subject to change. Neither Pathfinder nor Movella is under any obligation to update or other wise revise the information after the date of presentation. None of the Company, Pathfinder, or their respective affiliates, adv isors or representatives shall have any liability whatsoever for any loss arising from any use of this presentation or its contents or otherwise arising in connection with this presentation.

Disclaimer (cont’d) Additional Information and Where To Find It In connection with the transaction, Pathfinder filed a registration statement on Form S-4 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”), which includes a preliminary proxy statement to be distributed to holders of Pathfinder’s ordinary shares in connection with Pathfinder’s solicitation of proxies for the vote by Pathfinder’s shareholders with respect to the transac tion and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securi ties to be issued to Movella’s shareholders in connection with the transaction. On January 13, 2023, the SEC declared the Registration Statement effective, and on January 18, 2023, Pathfinder commenced mai ling the definitive proxy statement to holders of its ordinary shares as of the record date established for voting on the transaction. Investors and security holders and other interested parties are urged to read the proxy statement/prospectus, any amendments thereto and any other documents filed with the SEC carefully and in their entirety when they become available because they will contain important information about Pathfinder, Movella, and the transaction. Investors and security holders may obtain free copies of the Registration Statement, preliminary proxy statement/prospectus and definitive proxy statement/prospectus (when ava ilable) and other documents filed with the SEC by Pathfinder through the website maintained by the SEC at http://www.sec.gov. The documents fil ed by Pathfinder with the SEC also may be obtained free of charge at Pathfinder’s website at www.pathfinderacquisition.com or up on written request to Pathfinder at 1950 University Avenue, Suite 350, Palo Alto, CA 94303. Trademarks This presentation contains trademarks and tradenames of Movella and of other parties, and are the property of their respectiv e owners. Third-party logos included herein may represent past customers, present customers or may be provided simply for illustrat ive purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no g uarantee that either Pathfinder or the Company will work, or continue to work, with any of the firms or businesses whose logos a re included herein in the future. Participants in Solicitation Pathfinder and Movella and their respective directors and certain of their respective executive officers and other members of management and employees may be considered participants in the solicitation of proxies with respect to the transaction. Informa tion about the directors and executive officers of Pathfinder is set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitati on of the shareholders of Pathfinder and a description of their direct and indirect interests in Pathfinder, by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the transaction when they become available. Shareholders, potential investors and other interested persons should read the proxy statement/prospectus carefully when it b ecomes available before making any voting or investment decisions. When available, these documents can be obtained free of charg e from the sources indicated above. Distribution, No Offer or Solicitation The distribution of this presentation may also be restricted by law, and persons into whose possession this presentation come s should inform themselves about and observe any such restrictions. You acknowledge that you are (a) aware that the United State s securities laws prohibit any person who has material, non-public information concerning a company from purchasing or selling securities of such company o r from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934, as amended, and the rules and re gulations promulgated thereunder (collectively, the “Exchange Act”), and that you will neither use, nor cause any third party to use this presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b -5 thereunder. By accepting this presentation, you agree that you will, and will cause your representatives and advisors to, use this presen tation, as well as any information derived by you from this presentation, only for initial due diligence regarding Pathfinder an d the Company in connection with (a) the proposed Business Combination and (b) any proposed private offering of securities to a limited number of investors th at qualify as QIBs and Institutional Accredited Investors (each as defined below) and for no other purpose and you will not, and you will cause your representatives and advisors not to, divulge this presentation to any other party. This presentation may not be reproduced or used for any other purpose. No securities commission or securities regulatory authority in the United States or any other jurisdiction has in any way pas sed upon the merits of the Business Combination if it occurs or the accuracy or adequacy of this presentation. This presentation is being distributed to selected recipients only and is not intended for distribution to, or use by any per son or entity in, any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Neithe r this presentation nor any part or copy of it may be taken or transmitted into the United States or published, released, disclosed or distributed, directly or i ndirectly, in the United States, except to a limited number of qualified institutional buyers (“QIBs”), as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), or institutional “accredited investors” (“Institutional Accredited Investors”) within the mea ning of Regulation D under the Securities Act. This presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendat ion to purchase any security of Pathfinder, the Company or any of their respective affiliates. You should not construe the contents of this presentation as l egal, tax, accounting or investment advice or a recommendation, and you should consult your own counsel and tax and financial ad visors as to legal and related matters concerning the matters described herein, and by accepting this presentation, you confirm that you are not relying upo n the information contained herein to make any decision.

Introduction

Movella Digitizes Movement Movella is a leading full-stack provider of sensors, software, and analytics that enable the digitization of movement. Our products, services and solutions enable a wide range of existing and emerging high-growth markets by sensing, capturing, and transforming movement data into meaningful and actionable insights. Our Vision: To move humanity forward by bringing meaning to movement. 5

The Explosive Potential of Movement Digitization Critical for Next-Gen Entertainment, Gaming, and Live Mass-Market Potential for New Metaverse Streaming Applications Social Media Applications Enable New Frontier of Monetizable Actionable Movement Insights for Digital “Motion IP” for Content Creators Health & Sports Applications 6

Visionary and Experienced Leadership with Compelling Partnership with Leading Technology Investors 7

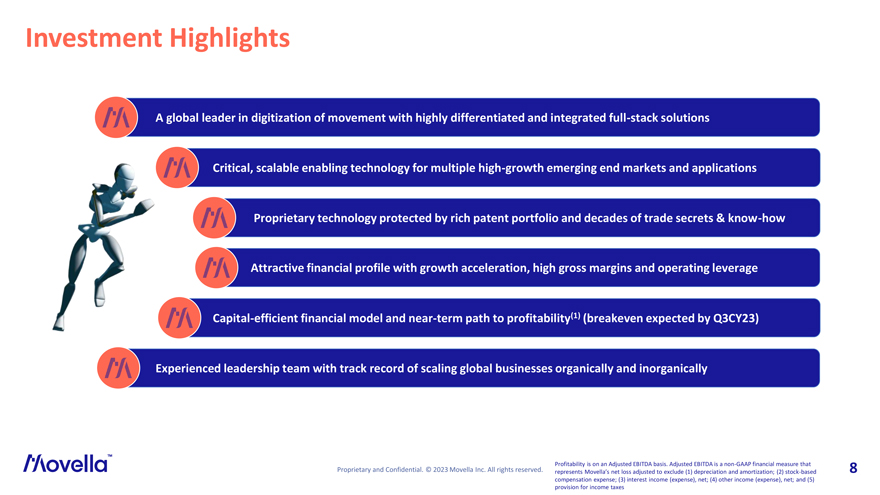

Investment Highlights A global leader in digitization of movement with highly differentiated and integrated full-stack solutions Critical, scalable enabling technology for multiple high-growth emerging end markets and applications Proprietary technology protected by rich patent portfolio and decades of trade secrets & know-how Attractive financial profile with growth acceleration, high gross margins and operating leverage Capital-efficient financial model and near-term path to profitability(1) (breakeven expected by Q3CY23) Experienced leadership team with track record of scaling global businesses organically and inorganically Profitability is on an Adjusted EBITDA basis. Adjusted EBITDA is a non-GAAP financial measure that 8 represents Movella’s net loss adjusted to exclude (1) depreciation and amortization; (2) stock-based compensation expense; (3) interest income (expense), net; (4) other income (expense), net; and (5) provision for income taxes

Company Overview

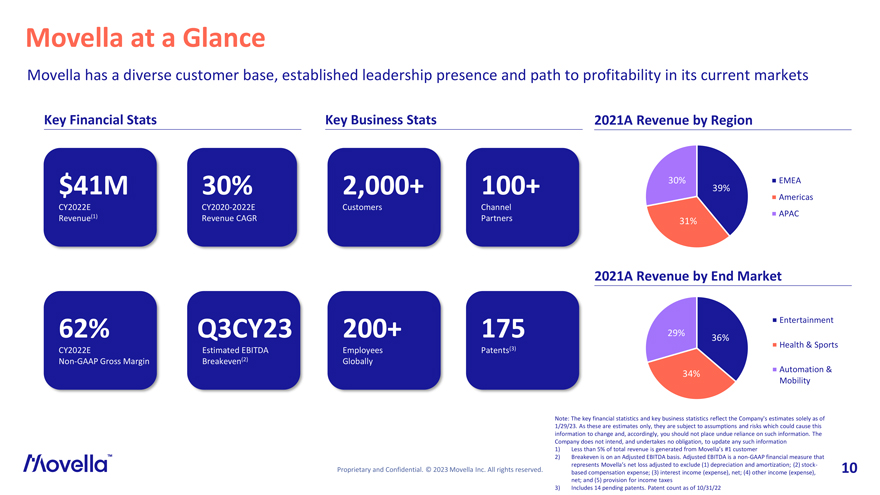

Movella at a Glance Movella has a diverse customer base, established leadership presence and path to profitability in its current markets Key Financial Stats Key Business Stats 2021A Revenue by Region CY2022E Revenue Growth $41M 30% 2,000+ 100+ 30% 39% EMEA Americas CY2022E CY2020-2022E Customers Channel APAC Revenue(1) Revenue CAGR Partners 31% 2021A Revenue by End Market Entertainment 62% Q3CY23 200+ 175 29% 36% Health & Sports CY2022E Estimated EBITDA Employees Patents(3) Non-GAAP Gross Margin Breakeven(2) Globally Automation & 34% Mobility Note: The key financial statistics and key business statistics reflect the Company’s estimates solely as of 1/29/23. As these are estimates only, they are subject to assumptions and risks which could cause this information to change and, accordingly, you should not place undue reliance on such information. The Company does not intend, and undertakes no obligation, to update any such information 1) Less than 5% of total revenue is generated from Movella’s #1 customer 2) Breakeven is on an Adjusted EBITDA basis. Adjusted EBITDA is a non-GAAP financial measure that represents Movella’s net loss adjusted to exclude (1) depreciation and amortization; (2) stock- 10 based compensation expense; (3) interest income (expense), net; (4) other income (expense), net; and (5) provision for income taxes 3) Includes 14 pending patents. Patent count as of 10/31/22

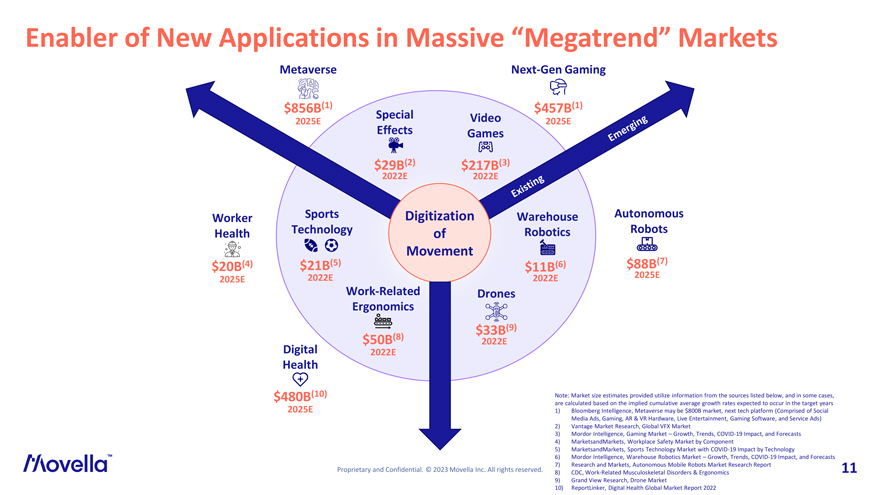

Enabler of New Applications in Massive “Megatrend” Markets Metaverse Next-Gen Gaming $856B(1) $457B(1) Special Video 2025E Effects 2025E Games $29B(2) $217B(3) 2022E 2022E Worker Sports Digitization Warehouse Autonomous Health Technology of Robotics Robots Movement $20B(4) $21B(5) (6) $88B(7) $11B 2022E 2022E 2025E 2025E Work-Related Drones Ergonomics $33B(9) $50B(8) 2022E Digital 2022E Health $480B(10) Note: Market size estimates provided utilize information from the sources listed below, and in some cases, 2025E are calculated based on the implied cumulative average growth rates expected to occur in the target years 1) Bloomberg Intelligence, Metaverse may be $800B market, next tech platform (Comprised of Social Media Ads, Gaming, AR & VR Hardware, Live Entertainment, Gaming Software, and Service Ads) 2) Vantage Market Research, Global VFX Market 3) Mordor Intelligence, Gaming Market – Growth, Trends, COVID-19 Impact, and Forecasts 4) MarketsandMarkets, Workplace Safety Market by Component 5) MarketsandMarkets, Sports Technology Market with COVID-19 Impact by Technology 6) Mordor Intelligence, Warehouse Robotics Market – Growth, Trends, COVID-19 Impact, and Forecasts 7) Research and Markets, Autonomous Mobile Robots Market Research Report 11 8) CDC, Work-Related Musculoskeletal Disorders & Ergonomics 9) Grand View Research, Drone Market 10) ReportLinker, Digital Health Global Market Report 2022

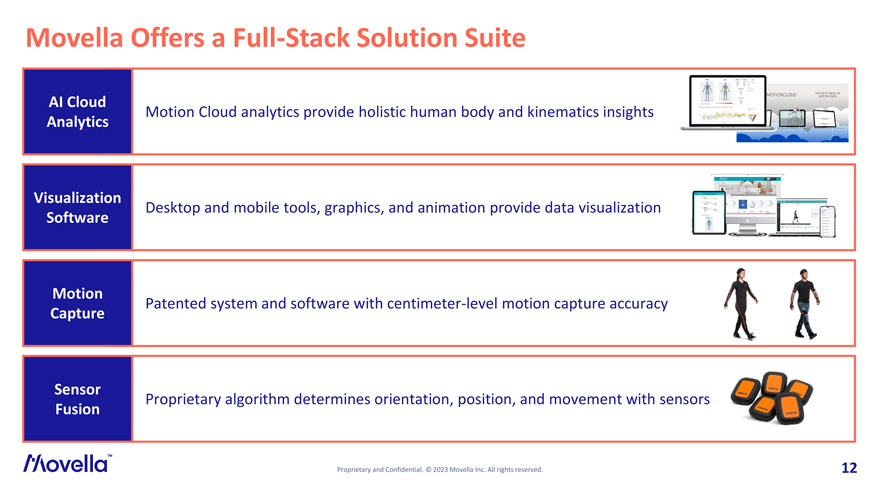

Movella Offers a Full-Stack Solution Suite AI Cloud Motion Cloud analytics provide holistic human body and kinematics insights Analytics Visualization Desktop and mobile tools, graphics, and animation provide data visualization Software Motion Patented system and software with centimeter-level motion capture accuracy Capture onsumers experience mixed reality Sensor Proprietary algorithm determines orientation, position, and movement with sensors Fusion 12

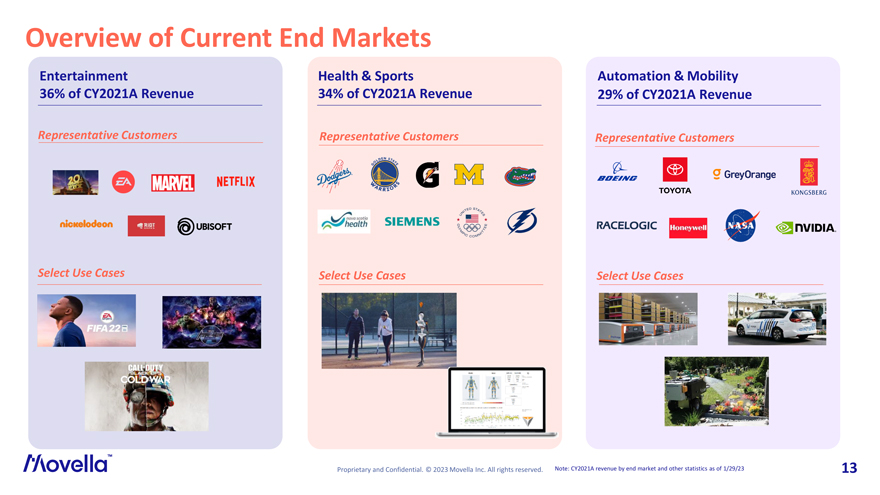

Overview of Current End Markets Entertainment Health & Sports Automation & Mobility 36% of CY2021A Revenue 34% of CY2021A Revenue 29% of CY2021A Revenue Representative Customers Representative Customers Representative Customers Select Use Cases Select Use Cases Select Use Cases Note: CY2021A revenue by end market and other statistics as of 1/29/23 13

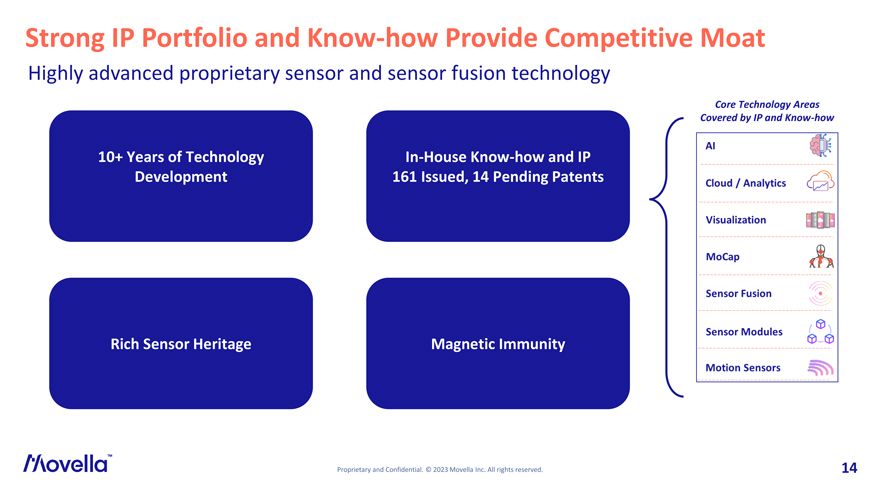

Strong IP Portfolio and Know-how Provide Competitive Moat Highly advanced proprietary sensor and sensor fusion technology Core Technology Areas Covered by IP and Know-how 10+ Years of Technology In-House Know-how and IP Development 161 Issued, 14 Pending Patents Rich Sensor Heritage Magnetic Immunity 14

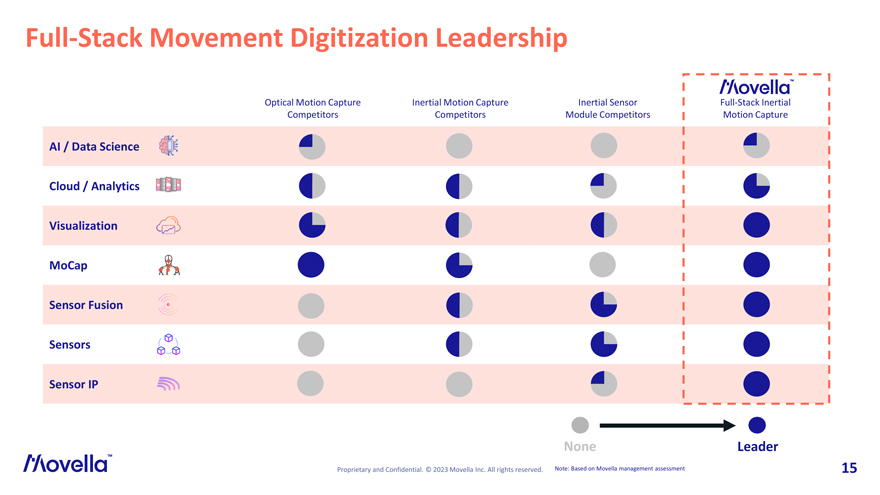

Full-Stack Movement Digitization Leadership Optical Motion Capture Inertial Motion Capture Inertial Sensor Full-Stack Inertial Competitors Competitors Module Competitors Motion Capture AI / Data Science Cloud / Analytics Visualization MoCap Sensor Fusion Sensors Sensor IP None Leader Note: Based on Movella management assessment 15

Growth Strategy Driven by Multiple Growth Vectors Growth of Established Channel / International Ramp of Newer New Products Expansion Products Markets(1) Selectively pursue acquisitions across all growth vectors 1) New Markets growth vector is not accounted for in revenue projections 16

Financial Summary

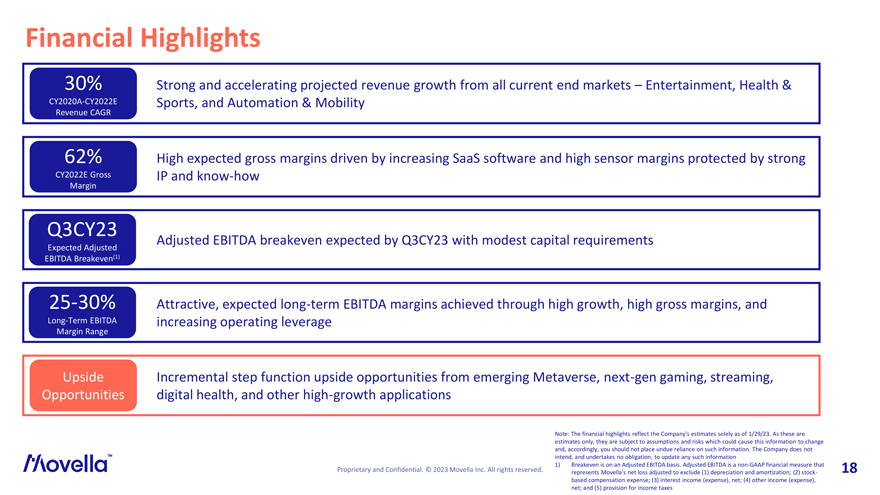

Financial Highlights 30% Strong and accelerating projected revenue growth from all current end markets – Entertainment, Health & CY2020A-CY2022E Sports, and Automation & Mobility Revenue CAGR 62% High expected gross margins driven by increasing SaaS software and high sensor margins protected by strong CY2022E Gross IP and know-how Margin Q3CY23 Adjusted EBITDA breakeven expected by Q3CY23 with modest capital requirements Expected Adjusted EBITDA Breakeven(1) 25-30% Attractive, expected long-term EBITDA margins achieved through high growth, high gross margins, and Long-Term EBITDA increasing operating leverage Margin Range Upside Incremental step function upside opportunities from emerging Metaverse, next-gen gaming, streaming, Opportunities digital health, and other high-growth applications Note: The financial highlights reflect the Company’s estimates solely as of 1/29/23. As these are estimates only, they are subject to assumptions and risks which could cause this information to change and, accordingly, you should not place undue reliance on such information. The Company does not intend, and undertakes no obligation, to update any such information 1) Breakeven is on an Adjusted EBITDA basis. Adjusted EBITDA is a non-GAAP financial measure that 18 represents Movella’s net loss adjusted to exclude (1) depreciation and amortization; (2) stock-based compensation expense; (3) interest income (expense), net; (4) other income (expense), net; and (5) provision for income taxes

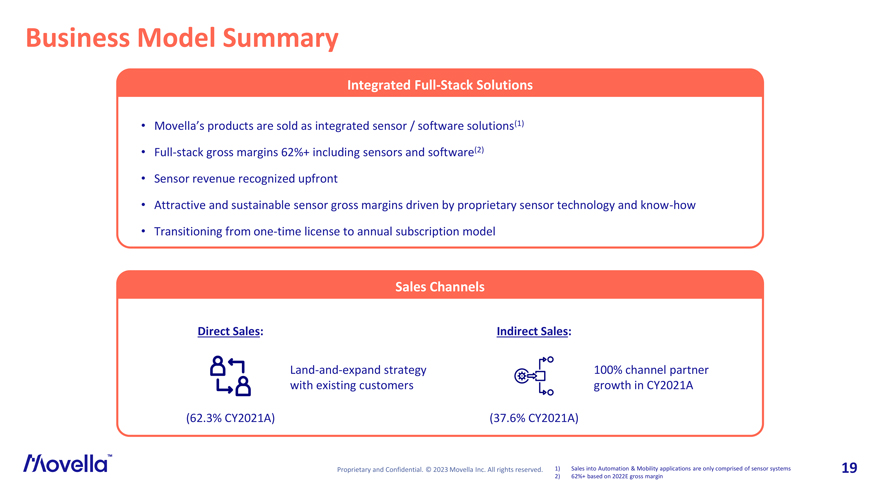

Business Model Summary Integrated Full-Stack Solutions • Movella’s products are sold as integrated sensor / software solutions(1) • Full-stack gross margins 62%+ including sensors and software(2) • Sensor revenue recognized upfront • Attractive and sustainable sensor gross margins driven by proprietary sensor technology and know-how • Transitioning from one-time license to annual subscription model Sales Channels Direct Sales: Indirect Sales: Land-and-expand strategy 100% channel partner with existing customers growth in CY2021A (62.3% CY2021A) (37.6% CY2021A) 1) Sales into Automation & Mobility applications are only comprised of sensor systems 19 2) 62%+ based on 2022E gross margin

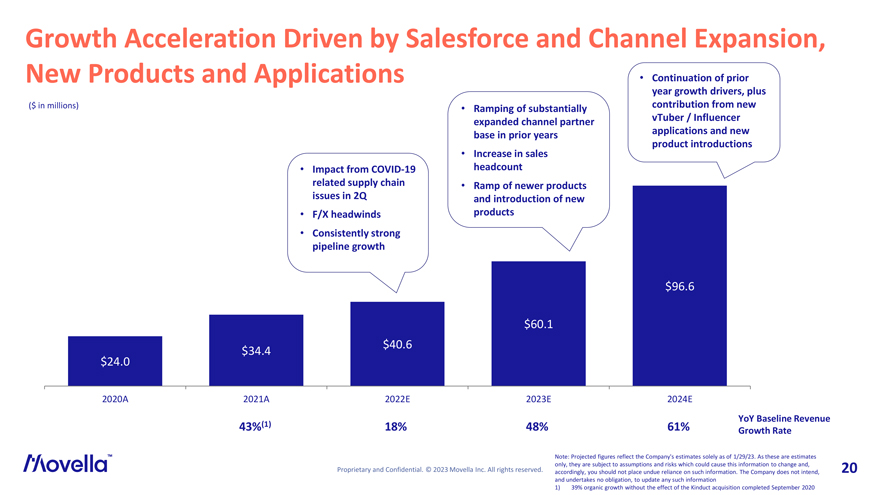

Growth Acceleration Driven by Salesforce and Channel Expansion, New Products and Applications • Continuation of prior year growth drivers, plus ($ in millions) contribution from new • Ramping of substantially vTuber / Influencer expanded channel partner applications and new base in prior years product introductions • Increase in sales • Impact from COVID-19 headcount related supply chain • Ramp of newer products issues in 2Q and introduction of new • F/X headwinds products • Consistently strong pipeline growth $96.6 $60.1 $40.6 $34.4 $24.0 2020A 2021A 2022E 2023E 2024E YoY Baseline Revenue 43%(1) 18% 48% 61% Growth Rate Note: Projected figures reflect the Company’s estimates solely as of 1/29/23. As these are estimates only, they are subject to assumptions and risks which could cause this information to change and, 20 accordingly, you should not place undue reliance on such information. The Company does not intend, and undertakes no obligation, to update any such information 1) 39% organic growth without the effect of the Kinduct acquisition completed September 2020

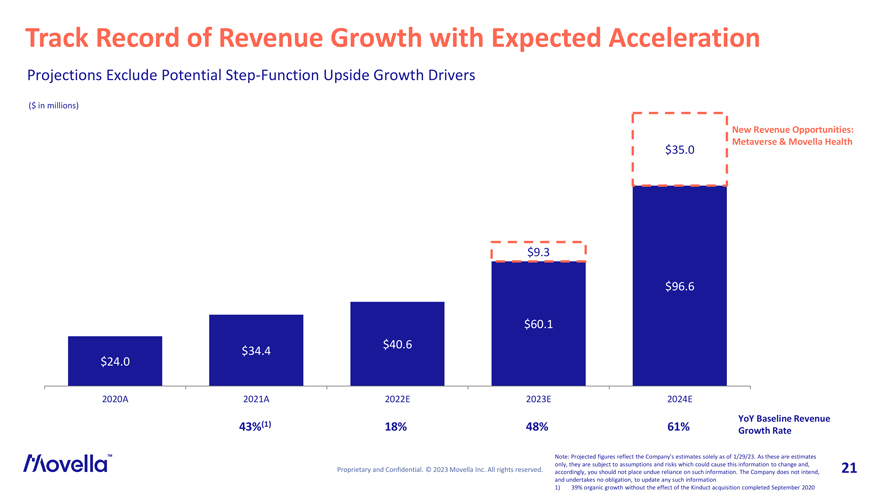

Track Record of Revenue Growth with Expected Acceleration Projections Exclude Potential Step-Function Upside Growth Drivers ($ in millions) New Revenue Opportunities: Metaverse & Movella Health $35.0 $9.3 $96.6 $60.1 $40.6 $34.4 $24.0 2020A 2021A 2022E 2023E 2024E YoY Baseline Revenue 43%(1) 18% 48% 61% Growth Rate Note: Projected figures reflect the Company’s estimates solely as of 1/29/23. As these are estimates only, they are subject to assumptions and risks which could cause this information to change and, 21 accordingly, you should not place undue reliance on such information. The Company does not intend, and undertakes no obligation, to update any such information 1) 39% organic growth without the effect of the Kinduct acquisition completed September 2020

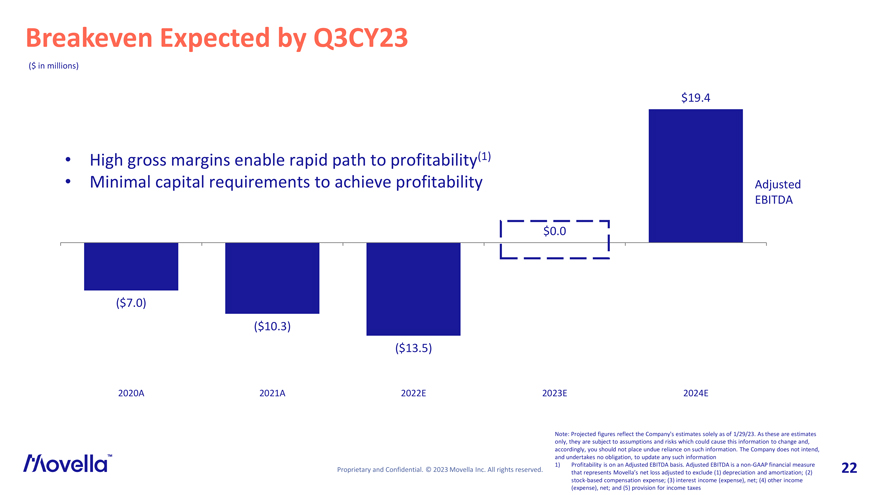

Breakeven Expected by Q3CY23 ($ in millions) $19.4 • High gross margins enable rapid path to profitability(1) • Minimal capital requirements to achieve profitability Adjusted EBITDA $0.0 ($7.0) ($10.3) ($13.5) 2020A 2021A 2022E 2023E 2024E Note: Projected figures reflect the Company’s estimates solely as of 1/29/23. As these are estimates only, they are subject to assumptions and risks which could cause this information to change and, accordingly, you should not place undue reliance on such information. The Company does not intend, and undertakes no obligation, to update any such information 1) Profitability is on an Adjusted EBITDA basis. Adjusted EBITDA is a non-GAAP financial measure 22 that represents Movella’s net loss adjusted to exclude (1) depreciation and amortization; (2) stock-based compensation expense; (3) interest income (expense), net; (4) other income (expense), net; and (5) provision for income taxes

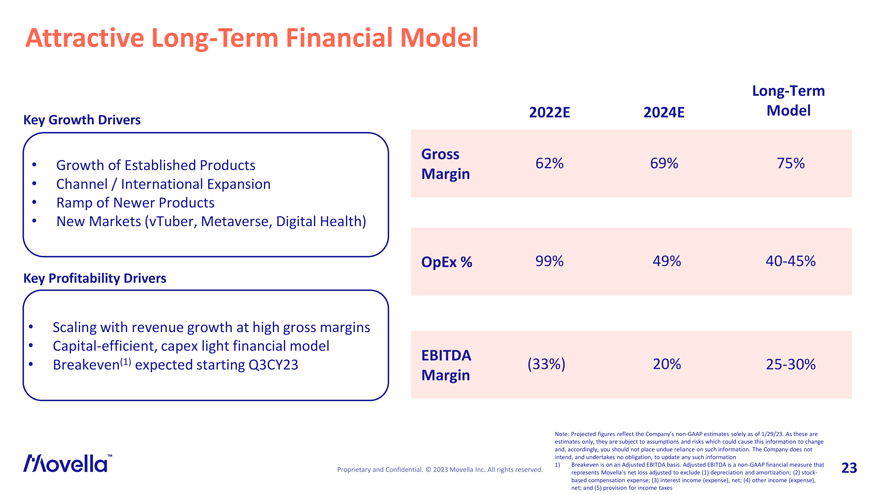

Attractive Long-Term Financial Model Long-Term 2022E 2024E Model Key Growth Drivers Gross • Growth of Established Products 62% 69% 75% Margin • Channel / International Expansion • Ramp of Newer Products • New Markets (vTuber, Metaverse, Digital Health) OpEx % 99% 49% 40-45% Key Profitability Drivers • Scaling with revenue growth at high gross margins • Capital-efficient, capex light financial model EBITDA • Breakeven(1) expected starting Q3CY23 (33%) 20% 25-30% Margin Note: Projected figures reflect the Company’s non-GAAP estimates solely as of 1/29/23. As these are estimates only, they are subject to assumptions and risks which could cause this information to change and, accordingly, you should not place undue reliance on such information. The Company does not intend, and undertakes no obligation, to update any such information 1) Breakeven is on an Adjusted EBITDA basis. Adjusted EBITDA is a non-GAAP financial measure that 23 represents Movella’s net loss adjusted to exclude (1) depreciation and amortization; (2) stock-based compensation expense; (3) interest income (expense), net; (4) other income (expense), net; and (5) provision for income taxes

Investment Highlights A global leader in digitization of movement with highly differentiated and integrated full-stack solutions Critical, scalable enabling technology for multiple high-growth emerging end markets and applications Proprietary technology protected by rich patent portfolio and decades of trade secrets & know-how Attractive financial profile with growth acceleration, high gross margins and operating leverage Capital-efficient financial model and near-term path to profitability(1) (breakeven expected by Q3CY23) Experienced leadership team with track record of scaling global businesses organically and inorganically Profitability is on an Adjusted EBITDA basis. Adjusted EBITDA is a non-GAAP financial measure that 24 represents Movella’s net loss adjusted to exclude (1) depreciation and amortization; (2) stock-based compensation expense; (3) interest income (expense), net; (4) other income (expense), net; and (5) provision for income taxes

Appendix

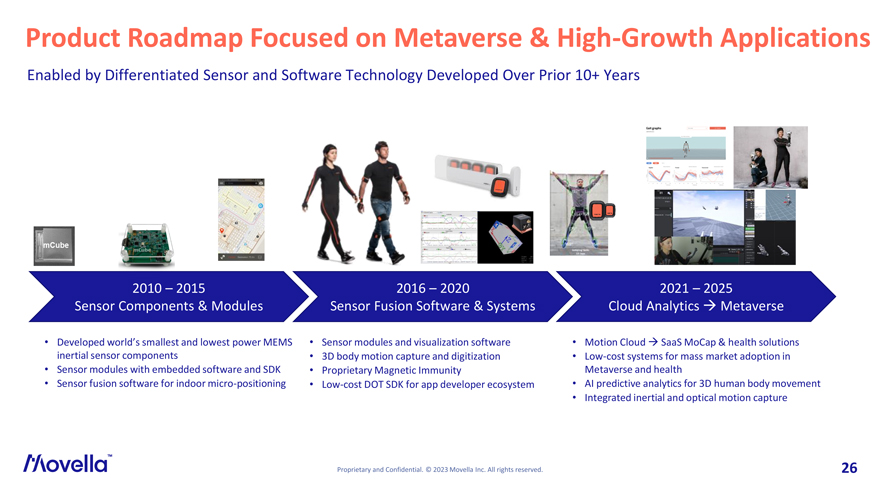

Product Roadmap Focused on Metaverse & High-Growth Applications Enabled by Differentiated Sensor and Software Technology Developed Over Prior 10+ Years 2010 – 2015 2016 – 2020 2021 – 2025 Sensor Components & Modules Sensor Fusion Software & Systems Cloud Analytics ? Metaverse • Developed world’s smallest and lowest power MEMS • Sensor modules and visualization software • Motion Cloud ?SaaS MoCap & health solutions inertial sensor components • 3D body motion capture and digitization • Low-cost systems for mass market adoption in • Sensor modules with embedded software and SDK • Proprietary Magnetic Immunity Metaverse and health • Sensor fusion software for indoor micro-positioning • Low-cost DOT SDK for app developer ecosystem • AI predictive analytics for 3D human body movement • Integrated inertial and optical motion capture 26

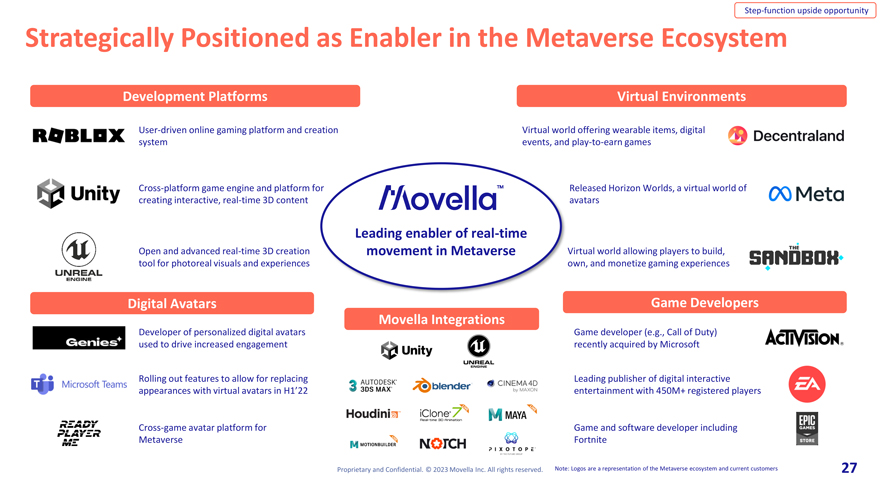

Step-function upside opportunity Strategically Positioned as Enabler in the Metaverse Ecosystem Development Platforms Virtual Environments User-driven online gaming platform and creation Virtual world offering wearable items, digital system events, and play-to-earn games Cross-platform game engine and platform for Released Horizon Worlds, a virtual world of creating interactive, real-time 3D content avatars Leading enabler of real-time Open and advanced real-time 3D creation movement in Metaverse Virtual world allowing players to build, tool for photoreal visuals and experiences own, and monetize gaming experiences Digital Avatars Game Developers Movella Integrations Developer of personalized digital avatars Game developer (e.g., Call of Duty) used to drive increased engagement recently acquired by Microsoft Rolling out features to allow for replacing Leading publisher of digital interactive appearances with virtual avatars in H1’22 entertainment with 450M+ registered players Cross-game avatar platform for Game and software developer including Metaverse Fortnite Note: Logos are a representation of the Metaverse ecosystem and current customers 27

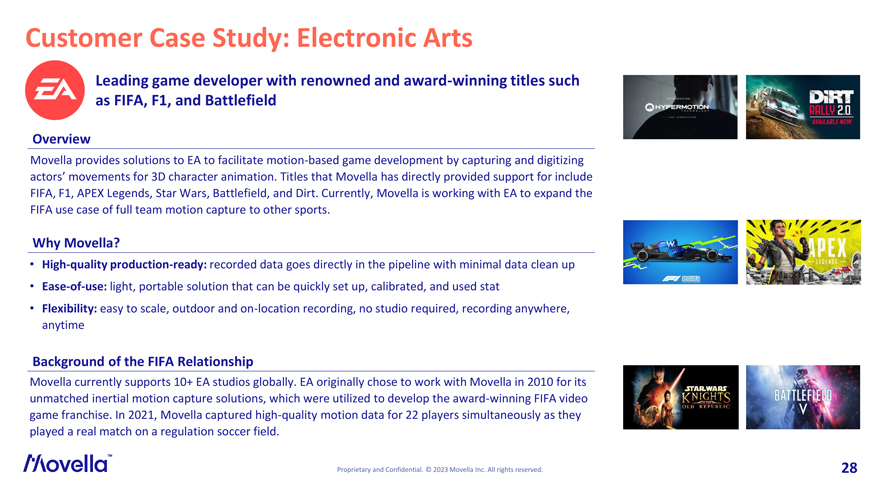

Customer Case Study: Electronic Arts Leading game developer with renowned and award-winning titles such as FIFA, F1, and Battlefield Overview Movella provides solutions to EA to facilitate motion-based game development by capturing and digitizing actors’ movements for 3D character animation. Titles that Movella has directly provided support for include FIFA, F1, APEX Legends, Star Wars, Battlefield, and Dirt. Currently, Movella is working with EA to expand the FIFA use case of full team motion capture to other sports. Why Movella? • High-quality production-ready: recorded data goes directly in the pipeline with minimal data clean up • Ease-of-use: light, portable solution that can be quickly set up, calibrated, and used stat • Flexibility: easy to scale, outdoor and on-location recording, no studio required, recording anywhere, anytime Background of the FIFA Relationship Movella currently supports 10+ EA studios globally. EA originally chose to work with Movella in 2010 for its unmatched inertial motion capture solutions, which were utilized to develop the award-winning FIFA video game franchise. In 2021, Movella captured high-quality motion data for 22 players simultaneously as they played a real match on a regulation soccer field. 28

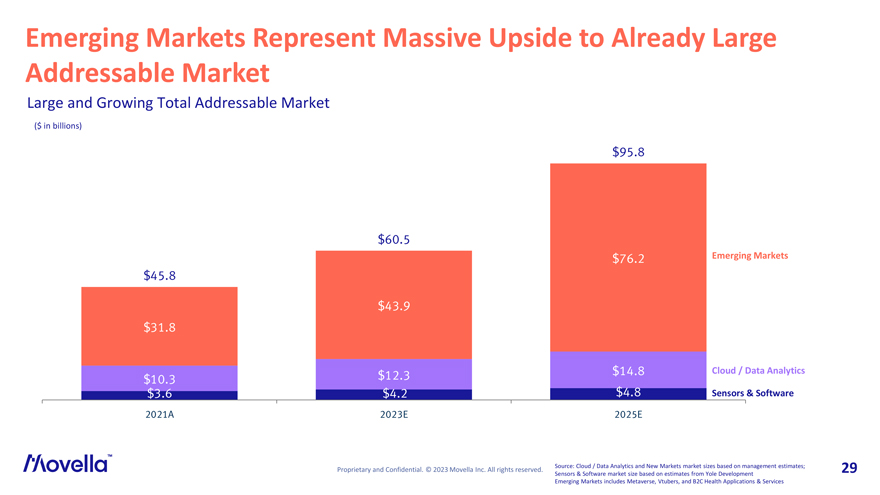

Emerging Markets Represent Massive Upside to Already Large Addressable Market Large and Growing Total Addressable Market ($ in billions) $95.8 $60.5 $76.2 Emerging Markets $45.8 $43.9 $31.8 $12.3 $14.8 Cloud / Data Analytics $10.3 $3.6 $4.2 $4.8 Sensors & Software 2021A 2023E 2025E Source: Cloud / Data Analytics and New Markets market sizes based on management estimates; 29 Sensors & Software market size based on estimates from Yole Development Emerging Markets includes Metaverse, Vtubers, and B2C Health Applications & Services

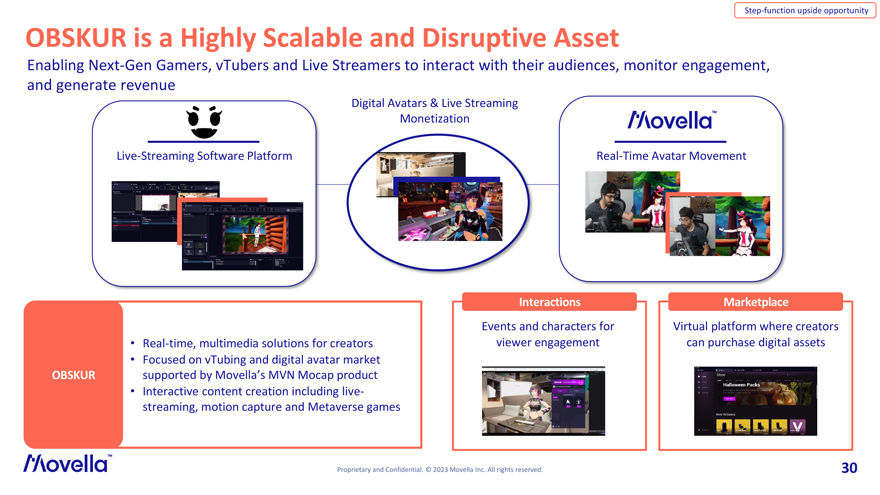

Step-function upside opportunity OBSKUR is a Highly Scalable and Disruptive Asset Enabling Next-Gen Gamers, vTubers and Live Streamers to interact with their audiences, monitor engagement, and generate revenue Digital Avatars & Live Streaming Monetization Live-Streaming Software Platform Real-Time Avatar Movement Interactions Marketplace Events and characters for Virtual platform where creators • Real-time, multimedia solutions for creators viewer engagement can purchase digital assets • Focused on vTubing and digital avatar market OBSKUR supported by Movella’s MVN Mocap product • Interactive content creation including live-streaming, motion capture and Metaverse games Capital purposefully utilized to maximi h 30

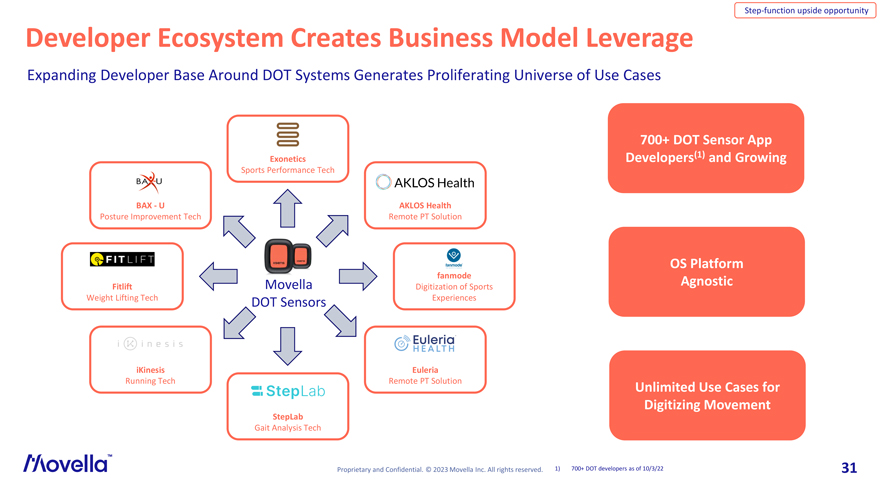

Step-function upside opportunity Developer Ecosystem Creates Business Model Leverage Expanding Developer Base Around DOT Systems Generates Proliferating Universe of Use Cases 700+ DOT Sensor App (1) Exonetics Developers and Growing Sports Performance Tech BAX - U AKLOS Health Posture Improvement Tech Remote PT Solution OS Platform fanmode Agnostic Fitlift Movella Digitization of Sports Weight Lifting Tech DOT Sensors Experiences iKinesis Euleria Running Tech Remote PT Solution Unlimited Use Cases for Digitizing Movement StepLab Gait Analysis Tech 1) 700+ DOT developers as of 10/3/22 31

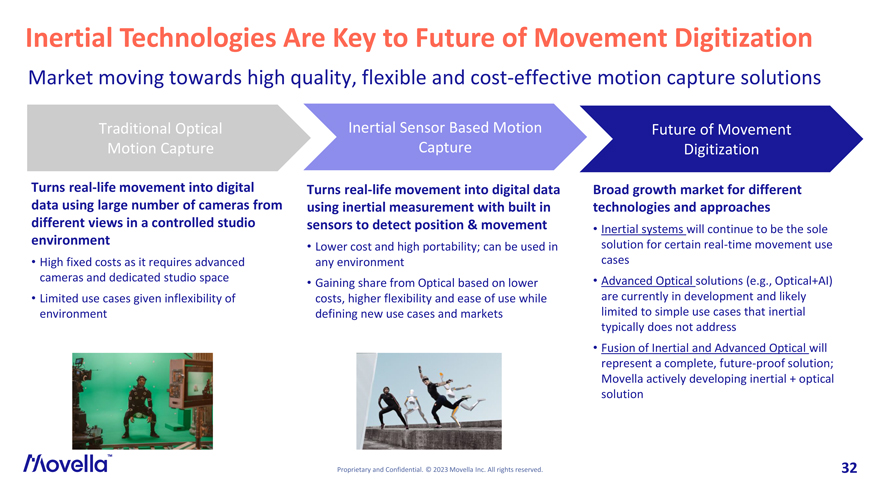

Inertial Technologies Are Key to Future of Movement Digitization Market moving towards high quality, flexible and cost-effective motion capture solutions Traditional Optical Inertial Sensor Based Motion Future of Movement Motion Capture Capture Digitization Turns real-life movement into digital Turns real-life movement into digital data Broad growth market for different data using large number of cameras from using inertial measurement with built in technologies and approaches different views in a controlled studio sensors to detect position & movement • Inertial systems will continue to be the sole environment solution for certain real-time movement use • Lower cost and high portability; can be used in • High fixed costs as it requires advanced any environment cases cameras and dedicated studio space • Advanced Optical solutions (e.g., Optical+AI) • Gaining share from Optical based on lower • Limited use cases given inflexibility of costs, higher flexibility and ease of use while are currently in development and likely environment defining new use cases and markets limited to simple use cases that inertial typically does not address • Fusion of Inertial and Advanced Optical will represent a complete, future-proof solution; Movella actively developing inertial + optical solution 32

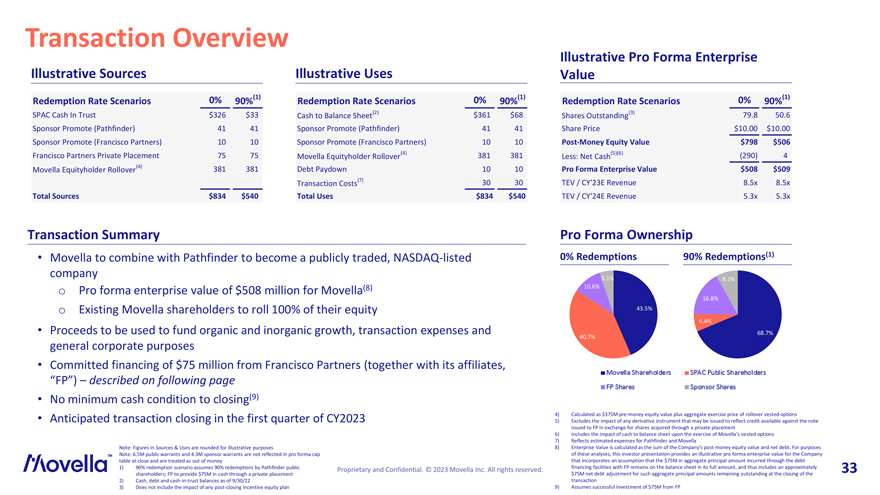

Transaction Overview Illustrative Pro Forma Enterprise Illustrative Sources Illustrative Uses Value 0% 90%(1) 0% 90%(1) 0% 90%(1) Redemption Rate Scenarios Redemption Rate Scenarios Redemption Rate Scenarios SPAC Cash In Trust $326 $33 (2) $361 $68 (3) 79.8 50.6 Cash to Balance Sheet Shares Outstanding Sponsor Promote (Pathfinder) 41 41 Sponsor Promote (Pathfinder) 41 41 Share Price $10.00 $10.00 Sponsor Promote (Francisco Partners) 10 10 Sponsor Promote (Francisco Partners) 10 10 Post-Money Equity Value $798 $506 Francisco Partners Private Placement 75 75 (4) 381 381 (5)(6) (290) 4 Movella Equityholder Rollover Less: Net Cash (4) 381 381 Debt Paydown 10 10 Pro Forma Enterprise Value $508 $509 Movella Equityholder Rollover (7) 30 30 TEV / CY’23E Revenue 8.5x 8.5x Transaction Costs Total Sources $834 $540 Total Uses $834 $540 TEV / CY’24E Revenue 5.3x 5.3x Transaction Summary Pro Forma Ownership • Movella to combine with Pathfinder to become a publicly traded, NASDAQ-listed 0% Redemptions 90% Redemptions(1) company 5.1% 8.1% o Pro forma enterprise value of $508 million for Movella(8) 10.6% 16.8% o Existing Movella shareholders to roll 100% of their equity 43.5% • 6.4% Proceeds to be used to fund organic and inorganic growth, transaction expenses and 40.7% 68.7% general corporate purposes • Committed financing of $75 million from Francisco Partners (together with its affiliates, “FP”) – described on following page • No minimum cash condition to closing(9) • Anticipated transaction closing in the first quarter of CY2023 4) Calculated as $375M pre-money equity value plus aggregate exercise price of rollover vested options 5) Excludes the impact of any derivative instrument that may be issued to reflect credit available against the note issued to FP in exchange for shares acquired through a private placement 6) Includes the impact of cash to balance sheet upon the exercise of Movella’s vested options 7) Reflects estimated expenses for Pathfinder and Movella Note: Figures in Sources & Uses are rounded for illustrative purposes 8) Enterprise Value is calculated as the sum of the Company’s post-money equity value and net debt. For purposes Note: 6.5M public warrants and 4.3M sponsor warrants are not reflected in pro forma cap of these analyses, this investor presentation provides an illustrative pro forma enterprise value for the Company table at close and are treated as out of money that incorporates an assumption that the $75M in aggregate principal amount incurred through the debt 1) 90% redemption scenario assumes 90% redemptions by Pathfinder public financing facilities with FP remains on the balance sheet in its full amount, and thus includes an approximately 33 shareholders; FP to provide $75M in cash through a private placement $75M net debt adjustment for such aggregate principal amounts remaining outstanding at the closing of the 2) Cash, debt and cash-in-trust balances as of 9/30/22 transaction 3) Does not include the impact of any post-closing incentive equity plan 9) Assumes successful investment of $75M from FP

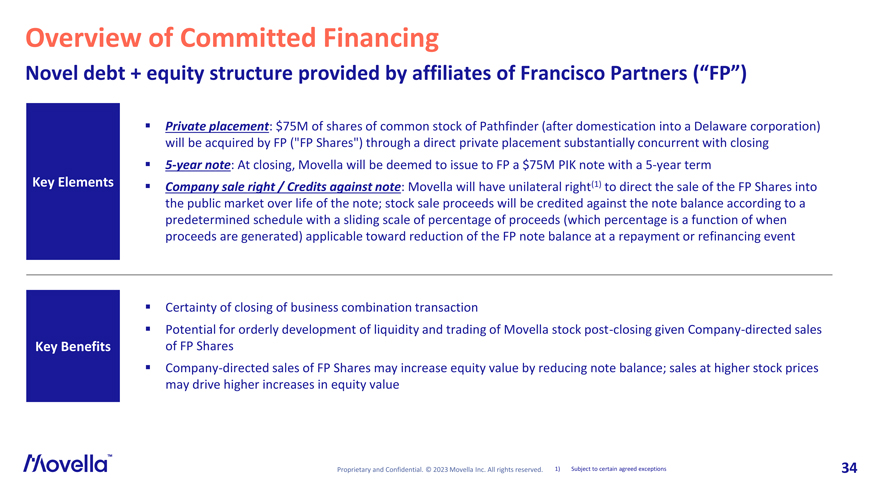

Overview of Committed Financing Novel debt + equity structure provided by affiliates of Francisco Partners (“FP”) ◾ Private placement: $75M of shares of common stock of Pathfinder (after domestication into a Delaware corporation) will be acquired by FP (“FP Shares”) through a direct private placement substantially concurrent with closing◾ 5-year note: At closing, Movella will be deemed to issue to FP a $75M PIK note with a 5-year term Key Elements◾ Company sale right / Credits against note: Movella will have unilateral right(1) to direct the sale of the FP Shares into the public market over life of the note; stock sale proceeds will be credited against the note balance according to a predetermined schedule with a sliding scale of percentage of proceeds (which percentage is a function of when proceeds are generated) applicable toward reduction of the FP note balance at a repayment or refinancing event ◾ Certainty of closing of business combination transaction ◾ Potential for orderly development of liquidity and trading of Movella stock post-closing given Company-directed sales Key Benefits of FP Shares ◾ Company-directed sales of FP Shares may increase equity value by reducing note balance; sales at higher stock prices may drive higher increases in equity value 1) Subject to certain agreed exceptions 34

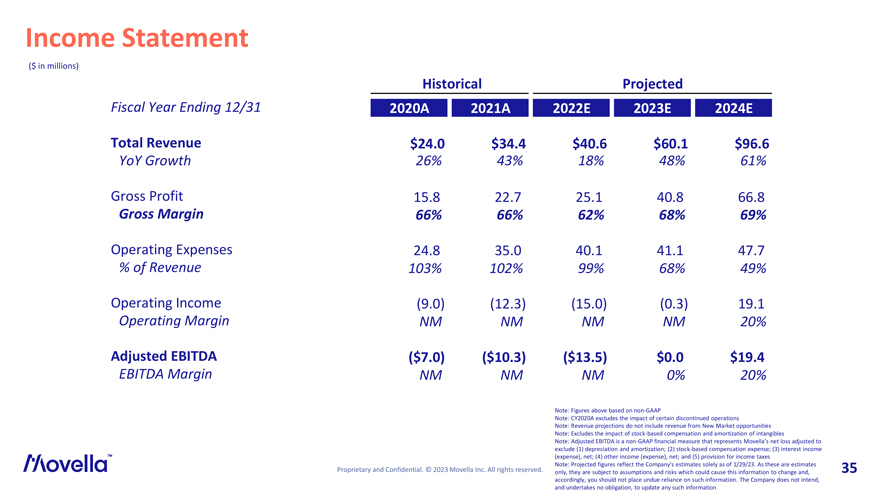

Income Statement ($ in millions) Historical Projected Fiscal Year Ending 12/31 2020A 2021A 2022E 2023E 2024E Total Revenue $24.0 $34.4 $40.6 $60.1 $96.6 YoY Growth 26% 43% 18% 48% 61% Gross Profit 15.8 22.7 25.1 40.8 66.8 Gross Margin 66% 66% 62% 68% 69% Operating Expenses 24.8 35.0 40.1 41.1 47.7 % of Revenue 103% 102% 99% 68% 49% Operating Income (9.0) (12.3) (15.0) (0.3) 19.1 Operating Margin NM NM NM NM 20% Adjusted EBITDA ($7.0) ($10.3) ($13.5) $0.0 $19.4 EBITDA Margin NM NM NM 0% 20% Note: Figures above based on non-GAAP Note: CY2020A excludes the impact of certain discontinued operations Note: Revenue projections do not include revenue from New Market opportunities Note: Excludes the impact of stock-based compensation and amortization of intangibles Note: Adjusted EBITDA is a non-GAAP financial measure that represents Movella’s net loss adjusted to exclude (1) depreciation and amortization; (2) stock-based compensation expense; (3) interest income (expense), net; (4) other income (expense), net; and (5) provision for income taxes Note: Projected figures reflect the Company’s estimates solely as of 1/29/23. As these are estimates 35 only, they are subject to assumptions and risks which could cause this information to change and, accordingly, you should not place undue reliance on such information. The Company does not intend, and undertakes no obligation, to update any such information

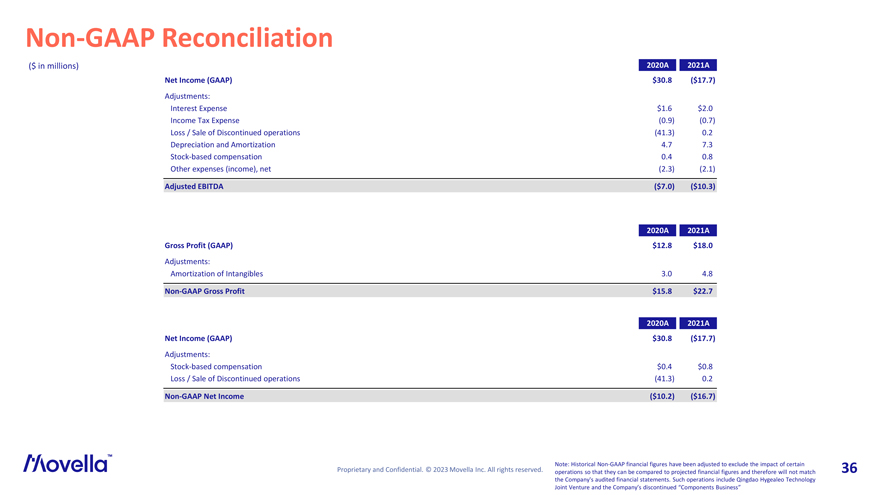

Non-GAAP Reconciliation ($ in millions) 2020A 2021A Net Income (GAAP) $30.8 ($17.7) Adjustments: Interest Expense $1.6 $2.0 Income Tax Expense (0.9) (0.7) Loss / Sale of Discontinued operations (41.3) 0.2 Depreciation and Amortization 4.7 7.3 Stock-based compensation 0.4 0.8 Other expenses (income), net (2.3) (2.1) Adjusted EBITDA ($7.0) ($10.3) 2020A 2021A Gross Profit (GAAP) $12.8 $18.0 Adjustments: Amortization of Intangibles 3.0 4.8 Non-GAAP Gross Profit $15.8 $22.7 2020A 2021A Net Income (GAAP) $30.8 ($17.7) Adjustments: Stock-based compensation $0.4 $0.8 Loss / Sale of Discontinued operations (41.3) 0.2 Non-GAAP Net Income ($10.2) ($16.7) Note: Historical Non-GAAP financial figures have been adjusted to exclude the impact of certain 36 operations so that they can be compared to projected financial figures and therefore will not match the Company’s audited financial statements. Such operations include Qingdao Hygealeo Technology Joint Venture and the Company’s discontinued “Components Business”

Risk Factors Certain Risk Related to Pathfinder and Movella and the Business Combination All references to the “Company,” “we,” “us,” “our” or “Movella” refer to the business of Movella Inc. and its subsidiaries, t aken as a whole, unless the context otherwise requires. The risks noted below are not exhaustive and are qualified in their entirety by disclosures contained in future documents filed or furnished by the Company, Pathfinder Acquisition Corporation ( “Pathfinder”), and, after consummation of the proposed business combination and the related transactions contemplated among the parties (including the proposed financing by Francisco Partners (“FP”)) (collectively, the “Business Combination”), the combined company (the “combined company” or “NewCo”), or others, including FP, with the U.S. Securities and Exchange Commission (the “SEC”). The risks presented in such filings will include risks with respect to the business and sec urities of the Company, Pathfinder, and Newco, as well as risks related to the Business Combination and any related financing, and may differ significantly from and be more extensive than those presented below. Certain risks related to Pathf inder, Movella, and the Business Combination include the following: • Pathfinder’s and Movella’s ability to complete the Business Combination, including the FP financing, during the anticipated t imeframe or at all, including as a result of any changes in SEC regulations or policies related to business combinations involving SPACs that could adversely affect Pathfinder’s and Movella’s ability to negotiate and complete the Business Combina tion; • Movella’s success in retaining or recruiting, or changes required in, officers, key employees, or directors following the Bus iness Combination; • The funds in the trust account being available to Pathfinder or the combined company; • Pathfinder’s or the combined company’s ability to obtain additional financing to complete the Business Combination; • Pathfinder’s public securities’ liquidity and trading and those of the combined company; • The lack of a market for Pathfinder’s or the combined company’s securities; • The use of funds not held in the trust account or available to Pathfinder from interest income on the trust account balance a nd the trust account not being subject to claims of third parties; • The impact of the COVID-19 pandemic, macroeconomic conditions, and geopolitical crises; • The number of Pathfinder shareholders voting against the business combination proposal; • The occurrence of any event, change or other circumstances that could give rise to the termination of the definitive merger a greement; • The ability to achieve and maintain the listing of the combined company’s shares on a national securities exchange following the Business Combination; • Changes adversely affecting the businesses in which Movella is engaged, including the risk that the Business Combination disr upts current plans and operations of the Company as a result of the announcement or the consummation of the Business Combination; • Management of growth and Movella’s ability to execute on its business strategy and plans; • The result of future financing efforts; • Risks related to regulatory matters, including trade policy and tariffs and laws and regulations related to anti -corruption, cyber security and privacy; • Risks related to broad market acceptance of Movella’s current or future products and technology and Movella’s ability to succ essfully commercialize any anticipated products in a timely manner or at all, as well as Movella’s ability to accurately anticipate customer adoption rates and demand for its products and technologies; • Movella’s future financial performance, including the risk that Movella’s financial results and business metrics are likely t o fluctuate on a quarterly and annual basis; • Market opportunity estimates and growth forecasts are subject to significant uncertainty and are based on assumptions and est imates that may not prove to be accurate; • Risks related to Movella’s ability to retain and expand its customer base, the lack of long -term and binding commitments with customers, and its ability to compete effectively; • Risks related to international operations and related regulatory risks; • Risks related to our intellectual property, including our ability to protect our IP portfolio and risks related potential cla ims by third parties; • Movella’s failure to raise additional capital or generate the significant capital necessary to maintain and expand its operat ions, and risks related to Movella’s ability to continue as a “going concern”; • Movella’s ability implement and maintain sufficient internal control over financial reporting and disclosure controls and pro cedures, and its ability to report its financial results in an accurate and timely manner; • Fluctuations in the stock price of the combined company’s securities; • Any projections will not have been prepared with a view toward compliance with published guidelines of the American Institute of Certified Public Accountants, and have not been compiled or examined by any registered public accountants nor any other independent expert or outside party; • Risks related to the limited public company experience among Movella’s management team and risks related to Movella’s ability to operate as a public company and comply with applicable law and regulations and corporate governance matters applicable to public companies, including those required by the SEC and applicable stock exchange; • Certain of Pathfinder’s and Movella’s directors and officers and significant stakeholders may have interests in the Business Combination different from the interests of Pathfinder’s or Movella’s shareholders; • The exercise of discretion by directors and officers Pathfinder or Movella in agreeing to changes to the terms, or waivers of closing conditions, in the definitive agreements with respect to the Business Combination and potential conflicts of interest o f SPAC’s sponsor, directors and officers; • Costs related to the Business Combination and the increased costs of being a public company following the consummation of the Business Combination; and • Other risks described under the heading “Risk Factors” in Pathfinder’s Annual Report on Form 10 -K for the year ended December 31, 2021 and Pathfinder’s registration statement on Form S-1 (File No. 333-252498). 37

No Offer or Solicitation

This presentation is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential Business Combination between Movella and Pathfinder. This presentation does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities of Pathfinder or Movella, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Participants in the Solicitation

Pathfinder and Movella and their respective directors and certain of their respective executive officers and other members of management and employees may be considered participants in the solicitation of proxies with respect to the Business Combination. Information about the directors and executive officers of Pathfinder is set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation of the shareholders of Pathfinder and a description of their direct and indirect interests in Pathfinder, by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Business Combination when they become available. Shareholders, potential investors and other interested persons should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. When available, these documents can be obtained free of charge from the sources indicated above.

Additional Information and Where To Find It

In connection with the Business Combination, Pathfinder has filed a registration statement on Form S-4 (File No. 333-268068) (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”), which includes a preliminary proxy statement to be distributed to holders of Pathfinder’s ordinary shares in connection with Pathfinder’s solicitation of proxies for the vote by Pathfinder’s shareholders with respect to the Business Combination and other matters as described in the Registration Statement, as well as the prospectus

38

relating to the offer of the securities to be issued to Movella’s shareholders in connection with the Business Combination. On January 13, 2023, the SEC declared the Registration Statement effective and Pathfinder commenced mailing the definitive proxy statement/prospectus on January 18, 2023 to holders of its ordinary shares as of January 13, 2023, the record date to be established for voting on the Business Combination. AAC filed a supplement to the definitive proxy statement/prospectus with the SEC on January 18, 2023. Investors and security holders and other interested parties are urged to read the proxy statement/prospectus, any amendments thereto and any other documents filed with the SEC carefully and in their entirety when they become available because they will contain important information about Pathfinder, Movella, and the Business Combination. Investors and security holders may obtain free copies of the Registration Statement, preliminary proxy statement/prospectus, definitive proxy statement/prospectus and other documents filed with the SEC by Pathfinder through the website maintained by the SEC at http://www.sec.gov. The documents filed by Pathfinder with the SEC also may be obtained free of charge at Pathfinder’s website at www.pathfinderacquisition.com or upon written request to Pathfinder at 1950 University Avenue, Suite 350, Palo Alto, CA 94303.

Cautionary Statement Regarding Forward Looking Statements

This presentation contains “forward-looking statements” regarding Pathfinder, Movella, and the combined company. Statements in this presentation that are not historical in nature may constitute forward-looking statements. In addition, any statements that refer to Pathfinder’s, Movella’s, or the combined company’s future expectations, beliefs, plans, objectives, financial conditions, assumptions, performance, projections, forecasts, or estimates, including with respect to financial or other performance or valuation metrics or market size or opportunity, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of Pathfinder’s or Movella’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. The words “anticipate,” “believe,” “continue,” “could,” “enable,” “estimate,” “expect,” “extend,” “future,” “intend,” “may,” “might,” “opportunity,” “outlook,” “plan,” “position,” “possible,” “potential,” “predict,” “project,” “see,” “seem,” “should,” “will,” “would,” and similar expressions, or the negative of such expressions, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this presentation include, but are not limited to, statements regarding the following: Pathfinder’s or Movella’s management team’s expectations, hopes, beliefs, intentions or strategies regarding the future; the anticipated timing of the closing of the Business Combination and the transactions contemplated thereby; the statements relating to the Francisco Partners financing, including the funds to be provided in connection therewith.

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond Pathfinder’s or Movella’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Although each of Pathfinder and Movella believes that it has a reasonable basis for each forward-looking statement contained in this presentation, each of Pathfinder and Movella caution you that these statements are based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. These risks and uncertainties include, but are not limited to, the following: (i) Pathfinder’s and Movella’s ability to complete the Business Combination, including the Francisco Partners financing, during the anticipated timeframe or at all; (ii) Movella’s success in retaining or recruiting, or changes required in, officers, key employees, or directors following the Business Combination; (iii) the funds in the trust account being available to Pathfinder or the combined company; (iv) Pathfinder’s or the combined company’s ability to obtain additional financing to complete the Business Combination; (v) Pathfinder’s public securities’ liquidity and trading and those of the combined company; (vi) the lack of a market for Pathfinder’s or the combined company’s securities; (vii) the use of funds not held in the trust account or available to Pathfinder from interest income on the trust account balance; (viii) the trust account not being subject to claims of third parties; (ix) general economic conditions and Movella’s financial performance; (x) the impact of the COVID-19 pandemic, macroeconomic conditions, and geopolitical crises; (xi) the number of Pathfinder shareholders voting against the business combination proposal; (xii) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive merger agreement; (xiii) the ability to achieve and maintain the listing of the combined company’s shares on a national securities exchange following the business combination; (xiv) changes adversely affecting the businesses in which Movella is engaged; (xv) management of growth;

39

(xvi) Movella’s ability to execute on its business strategy and plans; (xvii) the result of future financing efforts; and (xviii) risks related to regulatory matters, as well as the factors described under the heading “Risk Factors” in Pathfinder’s Annual Report on Form 10-K for the year ended December 31, 2021, Pathfinder’s registration statement on Form S-1 (File No. 333-252498), the registration statement on Form S-4 discussed above, and other documents filed by Pathfinder from time to time with the SEC.

If any of these risks materialize or the underlying assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Pathfinder nor Movella presently know or that Pathfinder and Movella currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Pathfinder’s and Movella’s expectations, plans or forecasts of future events and views as of the date of this presentation. Pathfinder and Movella anticipate that subsequent events and developments will cause Pathfinder’s and Movella’s assessments to change. However, while Pathfinder and Movella may elect to update these forward-looking statements at some point in the future, Pathfinder and Movella specifically disclaim any obligation to do so, except to the extent required by applicable law. These forward-looking statements should not be relied upon as representing Pathfinder’s and Movella’s assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements.

40

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Nordstrom (JWN) CEO Erik Nordstrom Reports 7.45% Stake, Seeks to Finance Potential Deal with Debt/Equity

- VirTra, Inc. (VTSI) Awarded $5.9M Prototype Contract from U.S. Army IVAS Prime Contractor Microsoft

- New York Community Bancorp (NYCB) Appoints Craig Gifford as CFO

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share