Form 425 Pathfinder Acquisition Filed by: Pathfinder Acquisition Corp

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 17, 2021

PATHFINDER ACQUISITION CORPORATION

(Exact

name of registrant as specified in its charter)

| Cayman Islands | 001-40074 | 98-1575384 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

| 1950

University Avenue Suite 350 Palo Alto, CA |

94303 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (650) 321-4910

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-fifth of one redeemable warrant | PFDRU | The Nasdaq Stock Market LLC | ||

| Class A ordinary shares included as part of the units | PFDR | The Nasdaq Stock Market LLC | ||

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 | PFDRW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

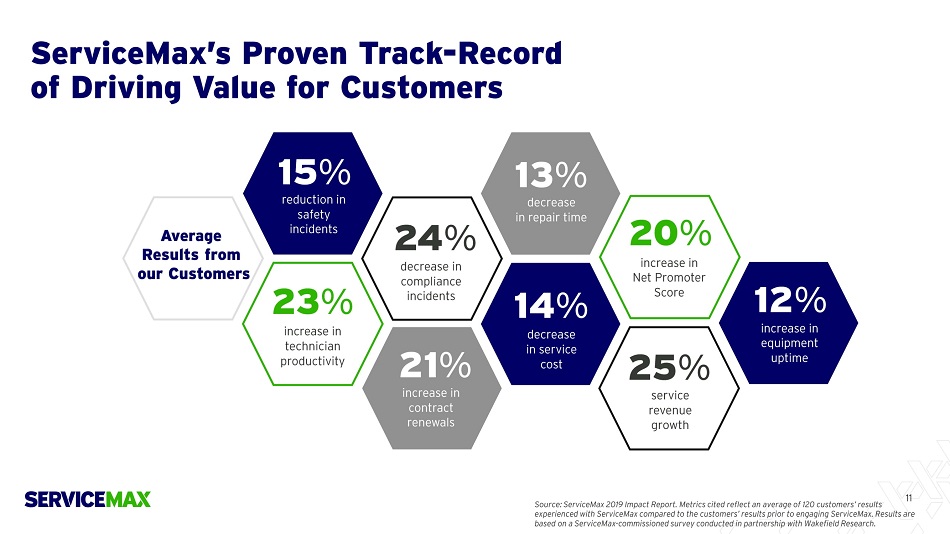

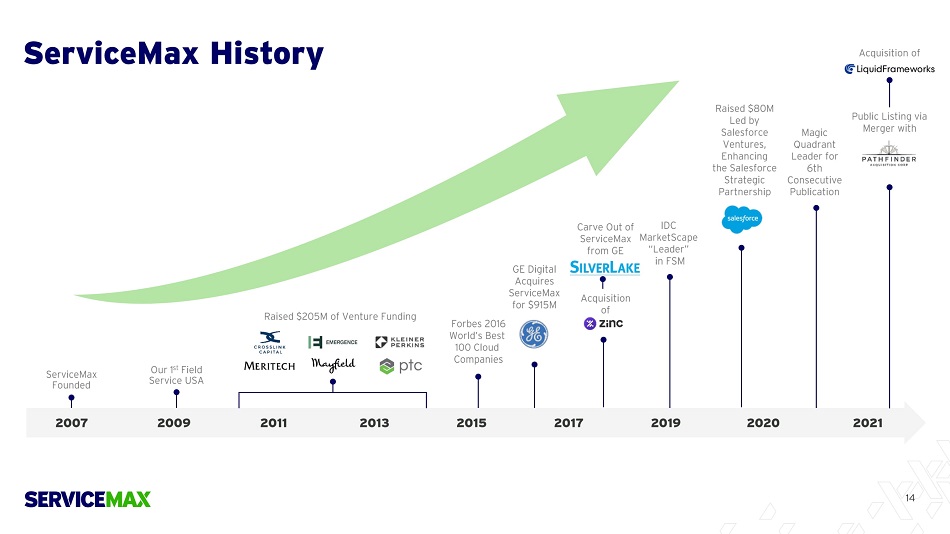

Attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”), and incorporated into this Item 7.01 by reference, are slides from an Analyst Day presentation held by ServiceMax, Inc., a Delaware corporation (“ServiceMax”), on September 17, 2021. Presentation slides will be available on the website of Pathfinder Acquisition Corporation (“Pathfinder”): www.pathfinderacquisition.com.

The foregoing is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Additional Information

In connection with the proposed transaction, Pathfinder filed a registration statement on Form S-4 with the SEC that include a prospectus with respect to the securities to be issued in connection with the proposed transaction and a proxy statement with respect to the shareholder meeting of Pathfinder to vote on the proposed transaction. Shareholders of Pathfinder and other interested persons are encouraged to read the preliminary proxy statement/prospectus, and when available, the definitive proxy statement/prospectus, as well as other documents filed with the SEC because these documents will contain important information about Pathfinder, ServiceMax and the proposed transaction. After the registration statement is declared effective, the definitive proxy statement/prospectus to be included in the registration statement will be mailed to shareholders of Pathfinder as of a record date to be established for voting on the proposed transaction. Shareholders of Pathfinder will also be able to obtain a copy of the S-4, including the proxy statement/prospectus, and when available, the definitive proxy statement/prospectus, and other documents filed with the SEC without charge, by directing a request to: Pathfinder Acquisition Corporation, 1950 University Avenue, Suite 350, Palo Alto, California 94303. The preliminary and definitive proxy statement/prospectus to be included in the registration statement, once available, can also be obtained, without charge, at the SEC’s website (www.sec.gov).

Participants in the Solicitation

Pathfinder and ServiceMax and their respective directors and executive officers may be considered participants in the solicitation of proxies with respect to the potential transaction described in this communication under the rules of the SEC. Information about the directors and executive officers of Pathfinder and their ownership is set forth in Pathfinder’s filings with the SEC, including the final prospectus filed by Pathfinder on February 18, 2021 relating to Pathfinder’s initial public offering and in its subsequent periodic reports and other filings with the SEC. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the Pathfinder shareholders in connection with the potential transaction is set forth in the registration statement containing the preliminary proxy statement/prospectus filed with the SEC. These documents are available free of charge at the SEC’s website at www.sec.gov or by directing a request to: Pathfinder Acquisition Corporation, 1950 University Avenue, Suite 350, Palo Alto, California 94303.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and does not constitute an offer to sell or a solicitation of an offer to buy any securities of Pathfinder or ServiceMax, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

1

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of section 27A of the Securities Act and Section 21E of the Exchange Act that are based on beliefs and assumptions and on information currently available to Pathfinder and ServiceMax. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “target,” “seek” or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. Any statements that refer to expectations, projections or other characterizations of future events or circumstances, including strategies or plans as they relate to the proposed transaction, are also forward-looking statements. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although each of Pathfinder and ServiceMax believes that it has a reasonable basis for each forward-looking statement contained in this Current Report on Form 8-K, each of Pathfinder and ServiceMax caution you that these statements are based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. Forward-looking statements in this Current Report on Form 8-K include, but are not limited to, statements regarding the proposed transaction, including the timing and structure of the transaction, the proceeds of the transaction and the benefits of the transaction. Neither Pathfinder nor ServiceMax can assure you that the forward-looking statements in this Current Report on Form 8-K will prove to be accurate. These forward-looking statements are subject to a number of risks and uncertainties, including, among others, changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the business combination or that the approval of the shareholders of ServiceMax or Pathfinder is not obtained; the failure to realize the anticipated benefits of the business combination; risks relating to the uncertainty of the projected financial information with respect to ServiceMax; risks related to the timing and achievement of expected business milestones; the effects of competition on ServiceMax’s business; the risk that the business combination disrupts current plans and operations of Pathfinder and ServiceMax as a result of the announcement and consummation of the business combination; the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and retain its management and key employees; risks relating ServiceMax’s history of no revenues and net losses; risks relating to ServiceMax’s intellectual property portfolio; the amount of redemption requests made by Pathfinder's public shareholders; the ability of Pathfinder, ServiceMax or the combined company to issue equity or equity-linked securities or obtain debt financing in connection with the business combination or in the future and other risks and uncertainties, including those included under the heading “Risk Factors” in the registration statement on Form S-4 filed by Pathfinder with the SEC and those included under the heading “Risk Factors” in the final prospectus filed by Pathfinder on February 18, 2021 relating to Pathfinder’s initial public offering and in its subsequent periodic reports and other filings with the SEC. The forward-looking statements in this Current Report on Form 8-K represent the views of Pathfinder and ServiceMax as of the date of this Current Report on Form 8-K. Subsequent events and developments may cause that view to change. However, while Pathfinder and ServiceMax may elect to update these forward-looking statements at some point in the future, there is no current intention to do so, except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing the views of Pathfinder or ServiceMax as of any date subsequent to the date of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit Number |

Description | |

| 99.1 | Analyst Day Presentation, dated September 17, 2021 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 17, 2021

| PATHFINDER ACQUISITION CORPORATION | ||

| By: | /s/ Lance Taylor | |

| Name: | Lance Taylor | |

| Title: | Chief Financial Officer | |

3

Exhibit 99.1

x x x x x x x x x x x x

▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪

▪ ▪ ▪

▪ ▪ ▪

▪ ▪ ▪

▪ ▪ ▪

▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪ ▪

▪ ▪ ▪ ▪ ▪ ▪

$22.5 $23.7 $24.7 $ 2 5 . 8 $27.5 $ 5 .1 $4.3 $4.1 $4.3 $4.7 $ 2 7.6 $28.0 $28.8 $30.0 $32 .2 Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 $80.8 $92.9 $21.7 $17.8 $102 .5 $ 1 1 0 .7 FY20 FY21

x x x x x x x x

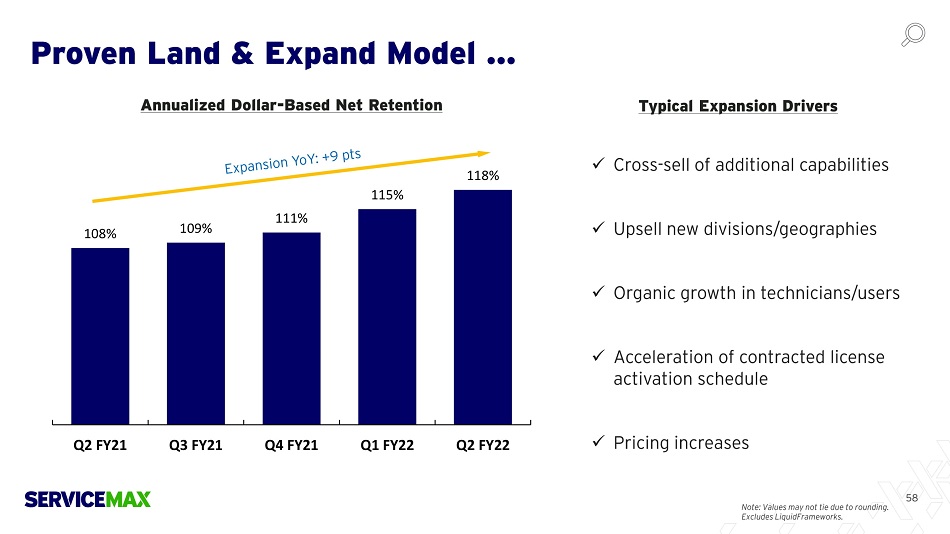

1 0 8% 109% 111% 115% 118% Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 x x x x x

$57 $67 5 6 % 60% FY20 FY21 $16 $18 $19 $20 $21 7 3 % 7 5 % 7 6 % 76% 78% Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 $16 $17 $18 $19 $22 59% 61% 64% 6 5 % 68% Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22 $56 $69 70% 74% FY20 FY21

41% 46% 48% 42% 37 % 22% 22% 2 3 % 26% 23% 11% 13% 13% 1 5 % 15% 74% 81% 8 4 % 84% 7 5 % Q2 FY 2 1 Q3 FY 2 1 Q4 FY 2 1 Q1 FY 2 2 Q2 FY 2 2 60% 47% 29% 24% 15% 14% 104% 84% FY20 FY21

( $49) ( $17) ( 48 %) ( 1 5%) FY20 FY21 ( $49) ( $2 6 ) (48%) (24%) FY20 FY21 ( $4) ( $6) ( $6) ( $6) ( $3) (15%) (20%) (20%) (19%) (8%) Q2 FY 2 1 Q3 FY 2 1 Q4 FY 2 1 Q1 FY 2 2 Q2 FY 2 2 ( $9) ( $1 ) ( $3) Q1 FY22 $4 ( $5) (32%) ( 4%) (11%) 1 2 % ( 1 6%) Q2 FY21 Q3 FY21 Q4 FY21 Q2 FY22

x x x

F Y 2 0 A Growt $103 $111 $130 $155 $188 56 % 60 % 67 % 69 % 71% Memo: Subscription Margin 70% 74% 77% 79% 80% FY20A Margin $57 $67 $86 $107 $134 F Y 2 1 A F Y 2 2 E F Y 2 3 E F Y 2 4 E M argi n ( 49 % ) ( 18 % ) ( 16 % ) 1% 12% ( $50) ( $20) ( $20) $2 $22 F Y 2 0 A F Y 2 1 A F Y 2 2 E F Y 2 3 E F Y 2 4 E

• • • • • •

x x x x x x x x x x x x

• • • • • • •

• • • •

($mm) Q 2 FY 202 1 Q 3 FY 202 1 Q 4 FY 202 1 Q 1 FY 202 2 Q 2 FY 202 2 FY2020 FY2021 GAAP Revenue $27.2 $27.6 $28.4 $30.0 $32.2 $86.9 $109.1 + Fair Value Adjustment to Acquired Unearned Revenue (1) 0.4 0.4 0.4 - - 15.7 1.6 Adj. Revenue $27.6 $28.0 $28.8 $30.0 $32.2 $102.5 $110.7 % YoY Growth 9.3% 7.7% 10.0% 14.0% 16.7% - 8.0% GAAP Subscription Revenue $22.1 $23.3 $24.3 $25.8 $27.5 $65.1 $91.3 + Fair Value Adjustment to Acquired Unearned Revenue (1) 0.4 0.4 0.4 - - 15.7 1.6 Adj. Subscription Revenue $22.5 $23.7 $24.7 $25.8 $27.5 $80.8 $92.9 % YoY Growth 13.9% 13.6% 17.2% 17.0% 22.1% - 15.0% GAAP Gross Profit $10.7 $11.4 $12.7 $14.0 $16.5 $20.3 $44.0 + Fair Value Adjustment to Acquired Unearned Revenue (1) 0.4 0.4 0.4 - - 15.7 1.6 + Amortization of Acquired Intangibles 5.2 5.2 5.2 5.2 5.2 20.7 20.7 + Stock - Based Compensation 0.0 0.0 0.0 0.1 0.1 0.1 0.2 + Other Non - Recurring Costs - - - 0.1 - 0.6 0.1 Adj. Gross Profit $16.3 $17.0 $18.3 $19.4 $21.8 $57.4 $66.5 % Adj. Gross Margin 59.0% 60.8% 63.5% 64.7% 67.6% 55.9% 60.1% GAAP Subscription Gross Profit $10.8 $12.1 $13.2 $14.5 $16.2 $20.0 $46.5 + Fair Value Adjustment to Acquired Unearned Revenue (1) 0.4 0.4 0.4 - - 15.7 1.6 + Amortization of Acquired Intangibles 5.2 5.2 5.2 5.2 5.2 20.7 20.7 + Stock - Based Compensation 0.0 0.0 0.0 0.0 0.0 0.0 (0.0) + Other Non - Recurring Costs - - - - - 0.1 (0.0) Adj. Subscription Gross Profit $16.4 $17.7 $18.8 $19.7 $21.4 $56.4 $68.8 % Adj. Subscription Gross Margin 72.9% 74.6% 76.0% 76.5% 77.8% 69.8% 74.0%

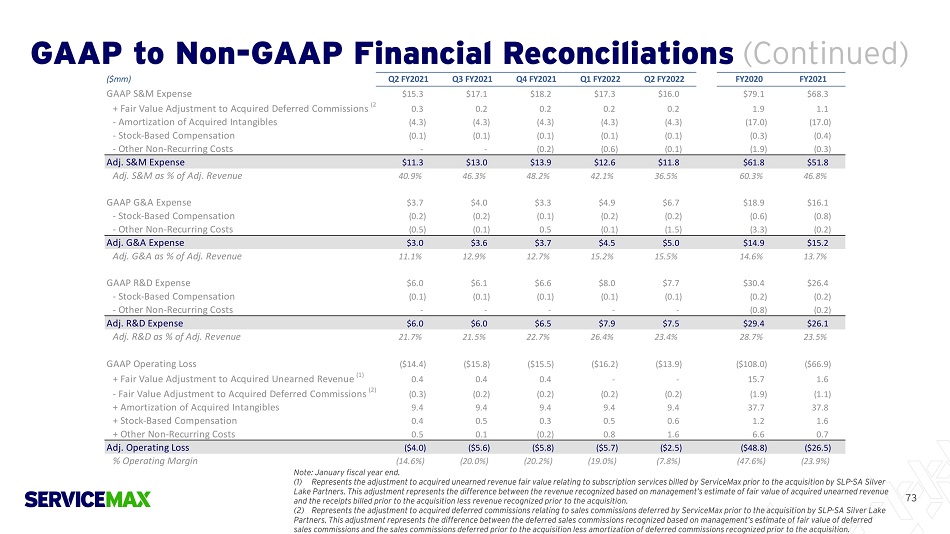

($mm) Q2 FY2021 Q3 FY2021 Q4 FY2021 Q1 FY2022 Q2 FY2022 FY2020 FY2021 GAAP S&M Expense $15.3 $17.1 $18.2 $17.3 $16.0 $79.1 $68.3 + Fair Value Adjustment to Acquired Deferred Commissions (2 0.3 0.2 0.2 0.2 0.2 1.9 1.1 - Amortization of Acquired Intangibles (4.3) (4.3) (4.3) (4.3) (4.3) (17.0) (17.0) - Stock - Based Compensation (0.1) (0.1) (0.1) (0.1) (0.1) (0.3) (0.4) - Other Non - Recurring Costs - - (0.2) (0.6) (0.1) (1.9) (0.3) Adj. S&M Expense $11.3 $13.0 $13.9 $12.6 $11.8 $61.8 $51.8 Adj. S&M as % of Adj. Revenue 40.9% 46.3% 48.2% 42.1% 36.5% 60.3% 46.8% GAAP G&A Expense $3.7 $4.0 $3.3 $4.9 $6.7 $18.9 $16.1 - Stock - Based Compensation (0.2) (0.2) (0.1) (0.2) (0.2) (0.6) (0.8) - Other Non - Recurring Costs (0.5) (0.1) 0.5 (0.1) (1.5) (3.3) (0.2) Adj. G&A Expense $3.0 $3.6 $3.7 $4.5 $5.0 $14.9 $15.2 Adj. G&A as % of Adj. Revenue 11.1% 12.9% 12.7% 15.2% 15.5% 14.6% 13.7% GAAP R&D Expense $6.0 $6.1 $6.6 $8.0 $7.7 $30.4 $26.4 - Stock - Based Compensation (0.1) (0.1) (0.1) (0.1) (0.1) (0.2) (0.2) - Other Non - Recurring Costs - - - - - (0.8) (0.2) Adj. R&D Expense $6.0 $6.0 $6.5 $7.9 $7.5 $29.4 $26.1 Adj. R&D as % of Adj. Revenue 21.7% 21.5% 22.7% 26.4% 23.4% 28.7% 23.5% GAAP Operating Loss ($14.4) ($15.8) ($15.5) ($16.2) ($13.9) ($108.0) ($66.9) + Fair Value Adjustment to Acquired Unearned Revenue (1) 0.4 0.4 0.4 - - 15.7 1.6 - Fair Value Adjustment to Acquired Deferred Commissions (2) (0.3) (0.2) (0.2) (0.2) (0.2) (1.9) (1.1) + Amortization of Acquired Intangibles 9.4 9.4 9.4 9.4 9.4 37.7 37.8 + Stock - Based Compensation 0.4 0.5 0.3 0.5 0.6 1.2 1.6 + Other Non - Recurring Costs 0.5 0.1 (0.2) 0.8 1.6 6.6 0.7 Adj. Operating Loss ($4.0) ($5.6) ($5.8) ($5.7) ($2.5) ($48.8) ($26.5) % Operating Margin (14.6%) (20.0%) (20.2%) (19.0%) (7.8%) (47.6%) (23.9%)

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Sony/Apollo bid for Paramount could be worth as much as $29 billion - Source

- SMC Announces Marketing Agreement with Plato Technologies. Inc.

- KDDI Corp. (9433:JP) (KDDIY) PT Lowered to JPY4,520 at HSBC

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share