Form 425 PCSB Financial Corp Filed by: BROOKLINE BANCORP INC

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 23, 2022

BROOKLINE BANCORP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 0-23695 | 04-3402944 | ||

| (State or other jurisdiction | (Commission File No.) | (I.R.S. employer | ||

| of incorporation) | Identification No.) |

| 131 Clarendon Street, Boston, Massachusetts | 02116 | |

| (Address of principal executive offices) | (Zip Code) |

(617) 425-4600

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, par value of $0.01 per share | BRKL | Nasdaq Global Select Market |

Indicate by check mark if the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

Merger Agreement

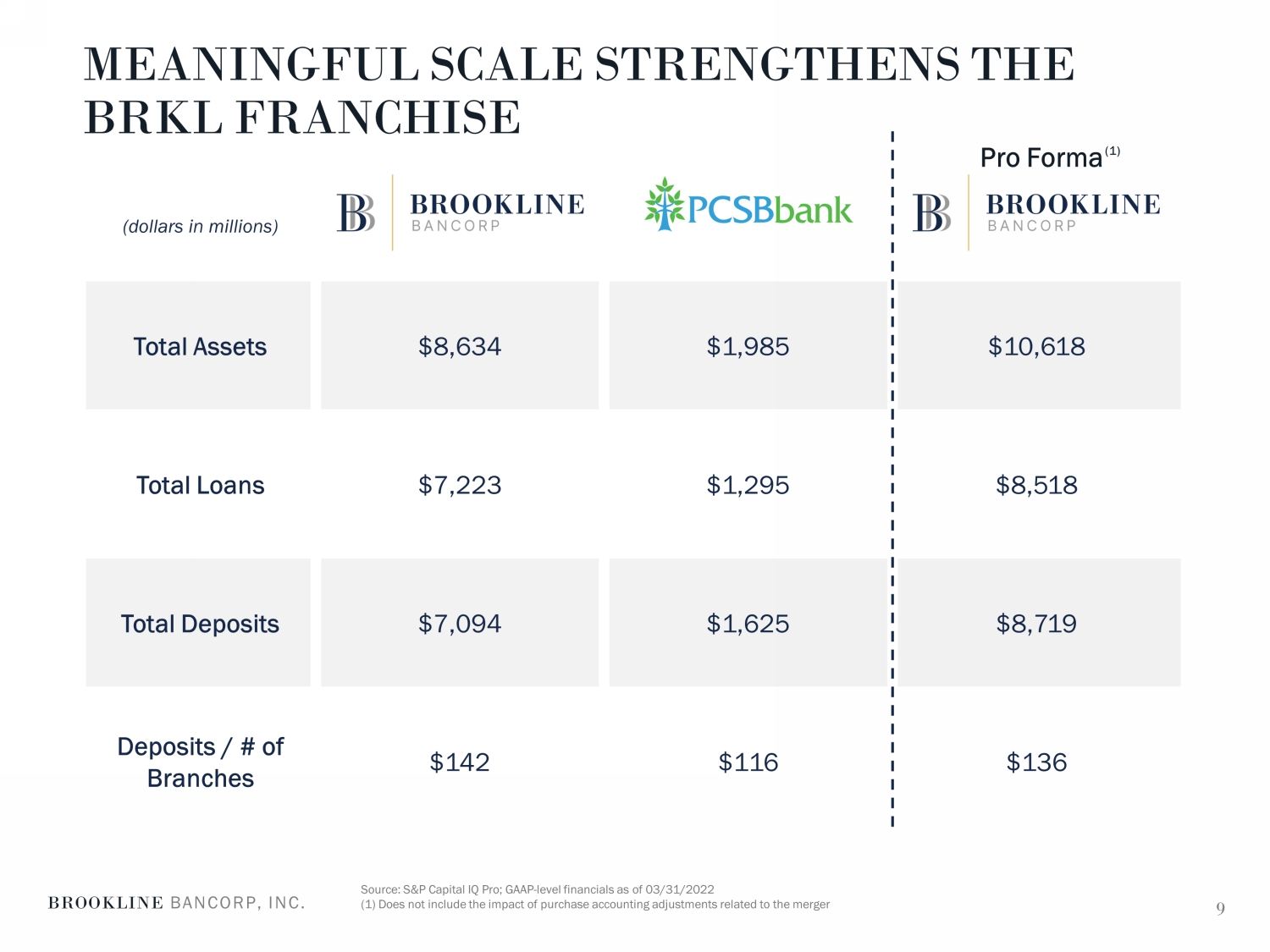

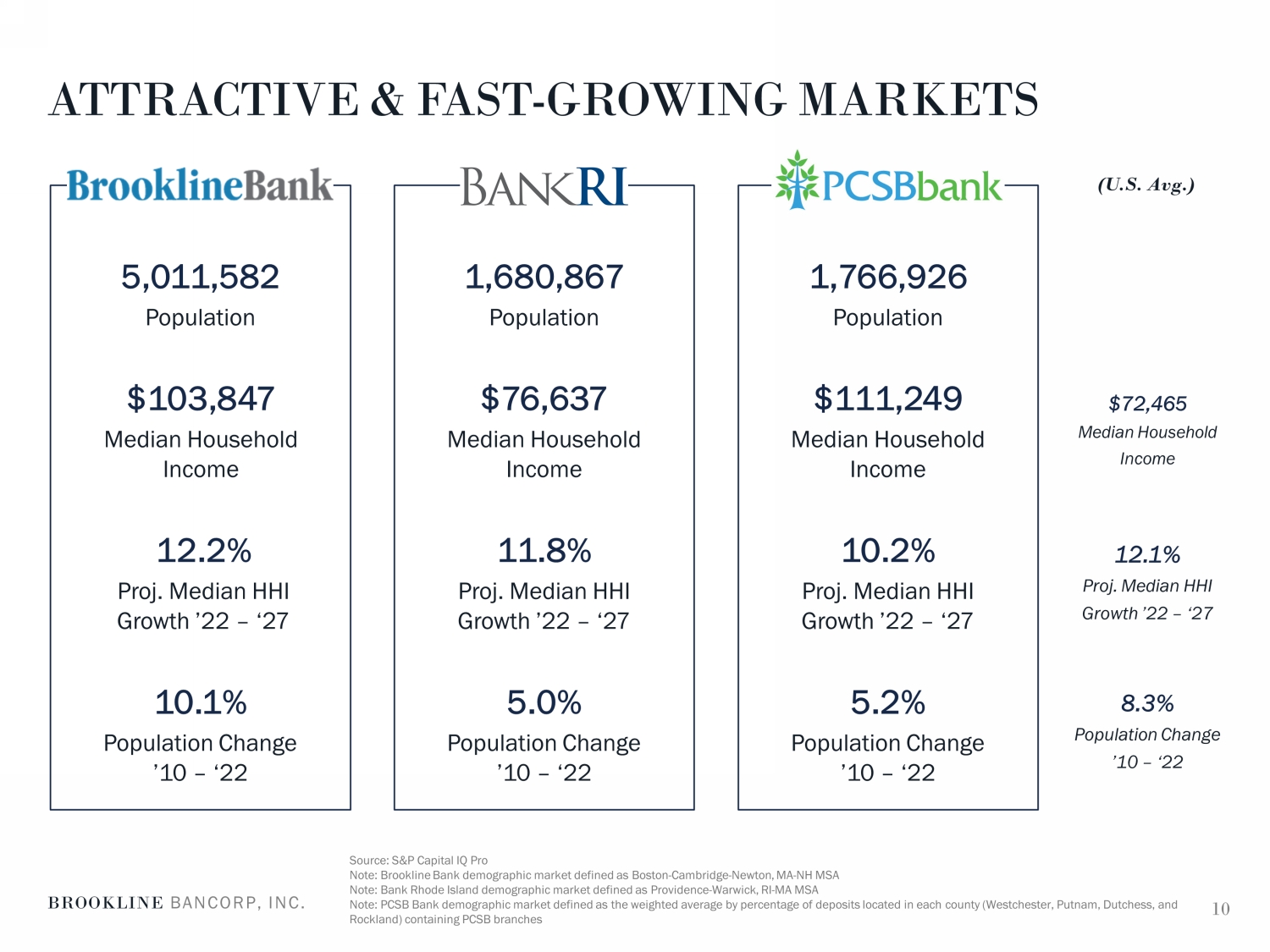

On May 23, 2022, Brookline Bancorp, Inc. (“Brookline”), the holding company of Brookline Bank and Bank Rhode Island, and PCSB Financial Corporation (“PCSB”), the holding company of PCSB Bank, entered into an Agreement and Plan of Merger (the “Merger Agreement”). Pursuant to the Merger Agreement, PCSB will merge with and into Brookline, with Brookline as the surviving corporation (the “Merger”). Following the Merger, PCSB Bank will operate as a separate bank subsidiary of Brookline.

Pursuant to the terms of the Merger Agreement, at the effective time of the Merger, each stockholder of PCSB will receive, for each share of PCSB common stock, at the holder’s election, either $22.00 in cash consideration or 1.3284 shares of Brookline common stock for each share of PCSB common stock, subject to allocation procedures to ensure that 60% of the outstanding shares of PCSB common stock will be converted to Brookline common stock. In addition, Brookline will add one PCSB director to the Brookline Board of Directors.

The Merger Agreement contains customary representations, warranties and covenants of PCSB and Brookline, including covenants by PCSB to conduct its business in the ordinary course during the interim period between the execution of the Merger Agreement and the consummation of the Merger and not to engage in certain kinds of transactions during such period. PCSB has also agreed not to solicit proposals relating to alternative business combination transactions or, subject to certain exceptions that permit PCSB’s Board of Directors to comply with its fiduciary duties, enter into discussions concerning, or furnish information in connection with, any proposals for alternative business combination transactions. The Merger Agreement provides each of PCSB and Brookline with specified termination rights. If the Merger is not consummated under specified circumstances, including if PCSB terminates the Merger Agreement for a Superior Proposal (as defined in the Merger Agreement), PCSB has agreed to pay Brookline a termination fee in the amount of approximately $12 million.

The consummation of the Merger is subject to customary closing conditions, including the receipt of regulatory approvals and approval by PCSB’s stockholders. The Merger is currently expected to be completed in the second half of 2022.

The Merger Agreement has been unanimously approved by the Boards of Directors of each of PCSB and Brookline.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and the terms of which are incorporated herein by reference.

The Merger Agreement has been included to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about Brookline or PCSB. The Merger Agreement contains customary representations, warranties and covenants that Brookline and PCSB made to each other as of specific dates. The assertions embodied in those representations, warranties and covenants were made solely for purposes of the Merger Agreement between Brookline and PCSB and may be subject to important qualifications and limitations agreed to by Brookline and PCSB in connection with negotiating its terms, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Merger Agreement. Moreover, the representations and warranties are subject to a contractual standard of materiality that may be different from what may be viewed as material to stockholders, and may have been used to allocate risk between Brookline and PCSB rather than establishing matters as facts. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in Brookline’s or PCSB’s public disclosures. For the foregoing reasons, no person should rely on the representations and warranties as statements of factual information at the time they were made or otherwise.

Voting Agreements

Simultaneously with the execution of the Merger Agreement, the members of PCSB’s Board of Directors and certain executive officers of PCSB have entered into voting agreements with Brookline (collectively, the “PCSB Voting Agreements”) pursuant to which such individuals have agreed, among other things, to vote their respective shares of PCSB common stock in favor of the approval of the Merger Agreement at a special meeting of PCSB’s stockholders to be held for the purpose of approving the Merger Agreement.

The persons signing the PCSB Voting Agreements currently beneficially own an aggregate of approximately 5% of the outstanding PCSB common stock. The foregoing description of the PCSB Voting Agreements does not purport to be complete and is qualified in its entirety by reference to the form of PCSB Voting Agreement, which is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities nor a solicitation of any vote or approval with respect to the proposed transaction or otherwise. No offering of securities shall be made except by means of a prospectus meeting the requirements of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and otherwise in accordance with applicable law.

Important Additional Information and Where To Find It

In connection with the proposed transaction, Brookline will file a registration statement on Form S-4 with the SEC, which will contain the proxy statement of PCSB and a prospectus of Brookline, as well as other relevant documents concerning the proposed transaction. Stockholders of PCSB and Brookline are encouraged to read the registration statement, including the proxy statement/prospectus that will be part of the registration statement, and the other relevant materials filed with the SEC when they become available, as well as any amendments or supplements to those documents, because they will contain important information about the proposed transaction, PCSB and Brookline. After the registration statement is filed with the SEC, the proxy statement/prospectus and other relevant documents will be mailed to PCSB stockholders and will be available for free on the SEC’s website (www.sec.gov). The proxy statement/prospectus will also be made available for free by contacting Carl M. Carlson, Brookline’s Co-President and Chief Financial Officer, at (617)-425-5331 or Jeffrey M. Helf, PCSB's Chief Financial Officer, at (914) 248-7272. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Participants in Solicitation

PCSB and certain of its directors and executive officers may be deemed to participate in the solicitation of proxies from the stockholders of PCSB in connection with the proposed transaction. Information about the directors and executive officers of PCSB and their ownership of PCSB common stock is set forth in the proxy statement for its 2021 annual meeting of stockholders, as filed with the SEC on Schedule 14A on September 24, 2021. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available. Free copies of this document when available may be obtained as described in the preceding paragraph.

Forward-Looking Statements

Certain of the statements made in this report may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” and “estimate,” and similar expressions, are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking, including statements about the benefits to Brookline or PCSB of the proposed merger, Brookline’s and PCSB’s future financial and operating results and their respective plans, objectives, and intentions. All forward-looking statements are subject to risks, uncertainties, and other factors that may cause the actual results, performance, or achievements of Brookline and PCSB to differ materially from any results, performance, or achievements expressed or implied by such forward-looking statements. Such risks, uncertainties, and other factors include, among others, (1) the risk that the cost savings and any revenue synergies from the proposed merger may not be realized or take longer than anticipated to be realized, (2) the risk that the cost savings and any revenue synergies from recently completed mergers may not be realized or may take longer than anticipated to realize, (3) disruption from the proposed merger, or recently completed mergers, with customer, supplier, or employee relationships, (4) the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger agreement, (5) the failure to obtain necessary shareholder or regulatory approvals for the merger, (6) the possibility that the amount of the costs, fees, expenses, and charges related to the merger may be greater than anticipated, including as a result of unexpected or unknown factors, events, or liabilities, (7) the failure of the conditions to the merger to be satisfied, (8) the risk of successful integration of the two companies’ businesses, including the risk that the integration of PCSB’s operations with those of Brookline will be materially delayed or will be more costly or difficult than expected, (9) the risk of expansion into new geographic or product markets, (10) reputational risk and the reaction of the parties’ customers to the merger, (11) the risk of potential litigation or regulatory action related to the merger, (12) the dilution caused by Brookline’s issuance of additional shares of its common stock in the merger, and (13) general competitive, economic, political, and market conditions. Additional factors which could affect the forward-looking statements can be found in Brookline’s annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, or PCSB’s annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at http://www.sec.gov. Brookline and PCSB disclaim any obligation to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events, or otherwise.

| Item 7.01 | Regulation FD Disclosure |

An investor presentation containing additional information regarding the Merger is included in this report as Exhibit 99.2. The investor presentation is being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities under that Section. Furthermore, the information contained in Exhibit 99.2 shall not be deemed to be incorporated by reference into the filings of Brookline under the Securities Act of 1933.

| Item 8.01. | Other Events |

On March May 24, 2022, Brookline and PCSB issued a joint press release announcing that they had entered into the Merger Agreement. A copy of the joint press release is attached as Exhibit 99.3 to this Current Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits |

| Number | Description | |

| 2.1 | Agreement and Plan of Merger dated as of May 23, 2022 by and between Brookline Bancorp, Inc. and PCSB Financial Corporation. | |

| 99.1 | Form of PCSB Voting Agreement | |

| 99.2 | Investor Presentation dated May 24, 2022 | |

| 99.3 | Joint Press Release dated May 24, 2022 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 24, 2022 | BROOKLINE BANCORP, INC. | |

| By: | /s/ Marissa S. Martin | |

| Marissa S. Martin | ||

| General Counsel | ||

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

by and between

Brookline Bancorp, Inc.

and

PCSB Financial Corporation

Dated as of May 23, 2022

| Article I - THE MERGER | 1 | |

| 1.1 | The Merger | 1 |

| 1.2 | Effective Time | 1 |

| 1.3 | Effects of the Merger | 2 |

| 1.4 | Closing | 2 |

| 1.5 | Certificate of Incorporation and Bylaws | 2 |

| 1.6 | Directors of the Surviving Corporation | 2 |

| 1.7 | Officers of the Surviving Corporation | 2 |

| 1.8 | Company Bank | 3 |

| 1.9 | Tax Consequences | 3 |

| Article II - MERGER CONSIDERATION; ELECTION AND EXCHANGE PROCEDURES | 3 | |

| 2.1 | Merger Consideration | 3 |

| 2.2 | Rights as Stockholders; Stock Transfers | 3 |

| 2.3 | Fractional Shares | 4 |

| 2.4 | Election Procedures | 4 |

| 2.5 | Exchange Procedures | 6 |

| 2.6 | Anti-Dilution Provisions | 8 |

| 2.7 | Options and Other Stock-Based Awards | 8 |

| 2.8 | Withholding Rights | 9 |

| 2.9 | No Dissenters’ Rights | 9 |

| 2.10 | Reservation of Right to Revise Structure | 9 |

| Article III - REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 9 | |

| 3.1 | Making of Representations and Warranties | 9 |

| 3.2 | Organization, Standing and Authority | 10 |

| 3.3 | Capitalization | 10 |

| 3.4 | Subsidiaries | 11 |

| 3.5 | Corporate Power | 12 |

| 3.6 | Corporate Authority | 12 |

| 3.7 | Non-Contravention | 12 |

| 3.8 | Articles of Incorporation; Bylaws; Corporate Records | 13 |

| 3.9 | Compliance with Laws | 13 |

| 3.10 | Litigation; Regulatory Action | 14 |

| 3.11 | SEC Documents; Financial Reports and Regulatory Reports | 15 |

| 3.12 | Absence of Certain Changes or Events | 16 |

| 3.13 | Taxes and Tax Returns | 17 |

| 3.14 | Employee Benefit Plans | 19 |

| 3.15 | Labor Matters | 23 |

| 3.16 | Insurance | 24 |

| 3.17 | Environmental Matters | 25 |

| 3.18 | Intellectual Property | 26 |

| 3.19 | Privacy and Protection of Personal Information | 28 |

| 3.20 | Material Agreements; Defaults | 30 |

| 3.21 | Property and Leases | 31 |

ii

| 3.22 | Inapplicability of Takeover Laws | 33 |

| 3.23 | Regulatory Capitalization | 33 |

| 3.24 | Loans; Nonperforming and Classified Assets | 33 |

| 3.25 | Deposits | 37 |

| 3.26 | Investment Securities | 37 |

| 3.27 | Investment Management and Related Activities | 37 |

| 3.28 | Derivative Transactions | 37 |

| 3.29 | Repurchase Agreements | 38 |

| 3.30 | Deposit Insurance | 38 |

| 3.31 | CRA, Anti-money Laundering and Customer Information Security | 38 |

| 3.32 | Transactions with Affiliates | 40 |

| 3.33 | Brokers; Fairness Opinion | 40 |

| 3.34 | Intended Tax Treatment | 40 |

| Article IV - REPRESENTATIONS AND WARRANTIES OF BUYER | 40 | |

| 4.1 | Making of Representations and Warranties | 40 |

| 4.2 | Organization, Standing and Authority | 41 |

| 4.3 | Capitalization | 41 |

| 4.4 | Corporate Power | 42 |

| 4.5 | Corporate Authority | 42 |

| 4.6 | Non-Contravention | 42 |

| 4.7 | Corporate Records; Certificate of Incorporation; Bylaws | 43 |

| 4.8 | Compliance with Laws | 43 |

| 4.9 | Litigation; Regulatory Action | 44 |

| 4.10 | SEC Documents; Financial Reports; and Regulatory Reports | 44 |

| 4.11 | Absence of Certain Changes or Events | 45 |

| 4.12 | Employee Benefit Plans | 46 |

| 4.13 | Regulatory Capitalization | 47 |

| 4.14 | CRA, Anti-money Laundering and Customer Information Security | 47 |

| 4.15 | Taxes and Tax Returns | 48 |

| 4.16 | Labor Matters | 48 |

| 4.17 | Insurance | 48 |

| 4.18 | Environmental Matters | 48 |

| 4.19 | Privacy and Protection of Personal Information | 49 |

| 4.20 | Loans | 50 |

| 4.21 | Brokers | 50 |

| Article V - COVENANTS RELATING TO CONDUCT OF BUSINESS | 51 | |

| 5.1 | Company Forbearances | 51 |

| 5.2 | Buyer Forbearances | 55 |

| Article VI - ADDITIONAL AGREEMENTS | 55 | |

| 6.1 | Company Stockholder Approval | 55 |

| 6.2 | Registration Statement | 56 |

| 6.3 | Press Releases | 57 |

| 6.4 | Access; Information | 57 |

| 6.5 | No Solicitation | 58 |

| 6.6 | Takeover Laws | 61 |

| 6.7 | Shares Listed | 61 |

| 6.8 | Regulatory Applications; Filings; Consents | 61 |

| 6.9 | Indemnification; Directors’ and Officers’ Insurance | 62 |

| 6.10 | Employees and Benefit Plans | 63 |

| 6.11 | Notification of Certain Matters | 65 |

| 6.12 | Financial Statements and Other Current Information | 65 |

| 6.13 | Confidentiality Agreement | 66 |

| 6.14 | Certain Tax Matters | 66 |

| 6.15 | Certain Litigation | 66 |

| 6.16 | Section 16 Votes | 66 |

| 6.17 | Tax Treatment | 66 |

| 6.18 | ESOP Matters | 67 |

| Article VII - CONDITIONS TO CONSUMMATION OF THE MERGER | 68 | |

| 7.1 | Conditions to Each Party’s Obligations to Effect the Merger | 68 |

| 7.2 | Conditions to the Obligations of Buyer | 68 |

| 7.3 | Conditions to the Obligations of the Company | 69 |

| Article VIII - TERMINATION | 70 | |

| 8.1 | Termination | 70 |

| 8.2 | Effect of Termination and Abandonment | 71 |

| Article IX - MISCELLANEOUS | 72 | |

| 9.1 | Standard | 72 |

| 9.2 | Survival | 73 |

| 9.3 | Certain Definitions | 73 |

| 9.4 | Waiver; Amendment | 81 |

| 9.5 | Expenses | 81 |

| 9.6 | Notices | 81 |

| 9.7 | Understanding; No Third Party Beneficiaries | 82 |

| 9.8 | Confidential Supervisory Information | 82 |

| 9.9 | Assignability; Binding Effect | 82 |

| 9.10 | Headings; Interpretation | 82 |

| 9.11 | Counterparts | 83 |

| 9.12 | Governing Law | 83 |

| 9.13 | Specific Performance | 83 |

| 9.14 | Severability | 83 |

| 9.15 | Delivery by Facsimile or Electronic Transmission | 83 |

AGREEMENT AND PLAN OF MERGER, dated as of May 23, 2022 (this “Agreement”), by and between Brookline Bancorp, Inc., a Delaware corporation (“Buyer”), and PCSB Financial Corporation, a Maryland corporation (the “Company”).

RECITALS

WHEREAS, the respective Boards of Directors of Buyer and the Company have determined that it is in the best interests of their respective corporations and stockholders to enter into this Agreement and to consummate the strategic business combination provided for herein;

WHEREAS, Buyer and the Company intend to effect a merger (the “Merger”) of the Company with and into Buyer in accordance with this Agreement and the Maryland General Corporation Law (the “MGCL”) and the Delaware General Corporation Law (the “DGCL”) with Buyer to be the surviving entity in the Merger;

WHEREAS, as a condition to the willingness of Buyer to enter into this Agreement, each of the directors and certain executive officers of the Company has entered into a Voting Agreement, dated as of the date hereof, with Buyer (each, a “Voting Agreement”), pursuant to which each stockholder has agreed, among other things, to vote such stockholder’s shares of common stock, par value $0.01 per share, of the Company (“Company Common Stock”) in favor of the approval of this Agreement and the transactions contemplated hereby, upon the terms and subject to the conditions set forth in the Voting Agreement;

WHEREAS, the parties intend the Merger to qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and that this Agreement shall constitute a “plan of reorganization” for purposes of Sections 354 and 361 of the Code; and

WHEREAS, the parties desire to make certain representations, warranties and agreements in connection with the Merger and also to prescribe certain conditions to the Merger.

NOW, THEREFORE, in consideration of the mutual covenants, representations, warranties and agreements contained herein, and intending to be legally bound hereby, the parties agree as follows:

Article I - THE MERGER

1.1 The Merger. Subject to the terms and conditions of this Agreement, in accordance with the MGCL and the DGCL, and in reliance upon the representations, warranties and covenants set forth herein, at the Effective Time, the Company shall merge with and into Buyer, the separate corporate existence of the Company shall cease and Buyer shall survive and continue its corporate existence under its Certificate of Incorporation, Bylaws and the laws of the State of Delaware (Buyer, as the surviving corporation in the Merger, being sometimes referred to herein as the “Surviving Corporation”).

1.2 Effective Time. On or before the Closing Date, as promptly as practicable after all of the conditions set forth in Article VII shall have been satisfied or, if permissible, waived by the party entitled to the benefit of the same, Buyer and the Company shall execute and cause to be filed with the Secretary of State of the State of Delaware a certificate of merger in a form reasonably satisfactory to Buyer and the Company, in accordance with the DGCL, and execute and cause to be filed with the State of Maryland Department of Assessments and Taxation a certificate of merger in a form reasonably satisfactory to Buyer and the Company, in accordance with the MGCL. The Merger shall become effective on the date and at the time specified therein (the “Effective Time”).

1.3 Effects of the Merger. At the Effective Time, the effect of the Merger shall be as provided herein and as provided in the applicable provisions of the MGCL and the DGCL.

1.4 Closing. The transactions contemplated by this Agreement shall be consummated at a closing (the “Closing”) that will take place by mail, electronic delivery, or, with the mutual consent of the parties, at the offices of Goodwin Procter LLP, 100 Northern Avenue, Boston, Massachusetts 02210, (a) at 9:00 a.m. (Eastern Time) on a date to be specified by the parties, which shall be no later than five Business Days after all of the conditions to the Closing set forth in Article VII (other than conditions to be satisfied at the Closing, which shall be satisfied or waived at the Closing) have been satisfied or waived in accordance with the terms hereof (the “Baseline Closing Date”), (b) at the election of Buyer, on the last Business Day of the month in which the Baseline Closing Date occurs, or (c) if the Baseline Closing Date occurs in the second half of a fiscal quarter of Buyer, at the election of Buyer, on the last Business Day of such fiscal quarter (such day hereinafter referred to as the “Closing Date”). Notwithstanding the foregoing, the Closing may take place at such other place, time or date as may be mutually agreed upon in writing by Buyer and the Company.

1.5 Certificate of Incorporation and Bylaws. The Certificate of Incorporation of Buyer, as in effect immediately prior to the Effective Time, shall be the Certificate of Incorporation of the Surviving Corporation, until thereafter amended as provided therein and in accordance with applicable law. The Bylaws of Buyer, as in effect immediately prior to the Effective Time, shall be the Bylaws of the Surviving Corporation, until thereafter amended as provided therein and in accordance with applicable law.

1.6 Directors of the Surviving Corporation. The directors of Buyer immediately prior to the Effective Time shall be the directors of the Surviving Corporation, each of whom shall serve in accordance with the Certificate of Incorporation and Bylaws of the Surviving Corporation; provided, however, that, upon and subject to the occurrence of the Effective Time, Buyer shall expand the size of its Board of Directors to consist of 15 directors, including one director of the Company, who shall be a member of the Board of Directors of the Company as of immediately prior to the Effective Time and shall qualify as an “independent director” with respect to Buyer under the listing standards of the Nasdaq Stock Market LLC (“Nasdaq”) and the applicable rules of the SEC, as selected by Buyer in its sole discretion (the “Company Board Designee”), to fill such newly-created vacancy and hold office until his or her successor is duly elected and qualified or until their earlier death, resignation or removal.

1.7 Officers of the Surviving Corporation. The officers of Buyer immediately prior to the Effective Time shall be the officers of the Surviving Corporation, each to hold office in accordance with the Certificate of Incorporation and Bylaws of the Surviving Corporation.

2

1.8 Company Bank. The Board of Directors of PCSB Bank (the “Company Bank”) immediately after the Effective Time shall consist of the current directors of the Company Bank; provided, however, the Company Board Designee shall resign as a director of the Company Bank immediately prior to the Effective Time. The Board of Directors of the Company Bank shall receive the compensation set forth in Schedule 1.8 of the Company Disclosure Schedule.

1.9 Tax Consequences. It is intended that the Merger shall qualify as a “reorganization” under Section 368(a) of the Code, and that this Agreement shall constitute a “plan of reorganization” for purposes of Sections 354 and 361 of the Code.

Article II

- MERGER CONSIDERATION;

ELECTION AND EXCHANGE PROCEDURES

2.1 Merger Consideration. Subject to the provisions of this Agreement, at the Effective Time, automatically by virtue of the Merger and without any action on the part of Buyer, the Company, any stockholder of the Company or any stockholder of Buyer:

(a) Each share of common stock, par value $0.01 per share, of Buyer (“Buyer Common Stock”) that is issued and outstanding immediately prior to the Effective Time shall remain outstanding following the Effective Time and shall be unchanged by the Merger.

(b) Each share of Company Treasury Stock immediately prior to the Effective Time and any Suspense Shares remitted to the Company prior to the Effective Time for purposes of repayment of the ESOP Loan as contemplated by Section 6.18, shall be canceled and retired and shall cease to exist, and no payment shall be made with respect thereto.

(c) Each share of Company Common Stock issued and outstanding immediately prior to the Effective Time (other than Treasury Stock and any Suspense Shares) shall become and be converted into, as provided in and subject to the limitations set forth in this Agreement, the right to receive at the election of the holder thereof as provided in Section 2.4 either (i) $22.00 in cash, without interest (the “Cash Consideration”), or (ii) 1.3284 shares (the “Exchange Ratio”) of Buyer Common Stock (the “Stock Consideration”). The Cash Consideration and the Stock Consideration are sometimes referred to herein collectively as the “Merger Consideration.”

2.2 Rights as Stockholders; Stock Transfers. All shares of Company Common Stock, when converted as provided in Section 2.1(c), shall no longer be outstanding and shall automatically be cancelled and retired and shall cease to exist and, except as to Treasury Stock and any Suspense Shares, each Certificate previously evidencing such shares shall thereafter represent only the right to receive, for each such share of Company Common Stock, the Merger Consideration and, if applicable, any cash in lieu of fractional shares of Buyer Common Stock in accordance with Section 2.3. At the Effective Time, holders of Company Common Stock shall cease to be, and shall have no rights as, stockholders of the Company, other than the right to receive the Merger Consideration and cash in lieu of fractional shares of Buyer Common Stock as provided under this Article II. After the Effective Time, there shall be no transfers on the stock transfer books of the Company of shares of Company Common Stock, other than transfers of Company Common Stock that have occurred prior to the Effective Time.

3

2.3 Fractional Shares. Notwithstanding any other provision hereof, no fractional shares of Buyer Common Stock and no certificates or scrip therefor, or other evidence of ownership thereof, will be issued in the Merger. In lieu thereof, Buyer shall pay to each holder of a fractional share of Buyer Common Stock an amount of cash (without interest) determined by multiplying the fractional share interest to which such holder would otherwise be entitled by the average of the daily closing prices of Buyer Common Stock on Nasdaq during the regular session (as reported in The Wall Street Journal or, if not reported therein, in another authoritative source) for the ten consecutive trading days ending on the fifth Business Day immediately prior to the Closing Date, rounded to the nearest whole cent (the “Buyer Stock Price”).

2.4 Election Procedures.

(a) An election form and other appropriate and customary transmittal materials (which shall specify that delivery shall be effected, and risk of loss and title to Certificates shall pass, only upon proper delivery of such Certificates to a bank or trust company designated by Buyer and reasonably satisfactory to the Company (the “Exchange Agent”)) in such form as the Company and Buyer shall mutually agree (the “Election Form”), shall be mailed no less than 20 Business Days prior to the anticipated Closing Date or such other date as the Company and Buyer shall mutually agree (the “Mailing Date”) to each holder of record of Company Common Stock as of five Business Days prior to the Mailing Date. Each Election Form shall permit the holder of record of Company Common Stock (or in the case of nominee record holders, the beneficial owner through proper instructions and documentation) to (i) elect to receive the Cash Consideration for all or a portion of such holder’s shares (a “Cash Election”), (ii) elect to receive the Stock Consideration for all or a portion of such holder’s shares (a “Stock Election”), or (iii) make no election with respect to the receipt of the Cash Consideration or the Stock Consideration (a “Non-Election”); provided, however, that, notwithstanding any other provision of this Agreement to the contrary, 60 percent (60%) of the shares of Company Common Stock issued and outstanding immediately prior to Effective Date (which shall not exceed 16,350,000) (the “Stock Conversion Number”) shall be converted into the Stock Consideration and the remaining shares of Company Common Stock shall be converted into the Cash Consideration. A record holder acting in different capacities or acting on behalf of other Persons in any way will be entitled to submit an Election Form for each capacity in which such record holder so acts with respect to each Person for which it so acts. Shares of Company Common Stock as to which a Cash Election has been made are referred to herein as “Cash Election Shares.” Shares of Company Common Stock as to which a Stock Election has been made are referred to herein as “Stock Election Shares.” Shares of Company Common Stock as to which no election has been made (or as to which an Election Form is not properly completed and returned in a timely fashion) are referred to herein as “Non-Election Shares.” The aggregate number of shares of Company Common Stock with respect to which a Stock Election has been made is referred to herein as the “Stock Election Number.”

(b) To be effective, a properly completed Election Form shall be received by the Exchange Agent on or before 5:00 p.m., Eastern Time, on the 25th day following the Mailing Date (or such other time and date as mutually agreed upon by the parties (which date shall be publicly announced by Buyer as soon as practicable prior to such date)) (the “Election Deadline”), accompanied by the Certificate(s) as to which such Election Form is being made or by an appropriate guarantee of delivery of such Certificate(s), as set forth in the Election Form, from a member of any registered national securities exchange or a commercial bank or trust company in the United States (provided, however, that such Certificate(s) are in fact delivered to the Exchange Agent by the time required in such guarantee of delivery; failure to deliver shares of Company Common Stock covered by such guarantee of delivery within the time set forth on such guarantee shall be deemed to invalidate any otherwise properly made election, unless otherwise determined by Buyer, in its sole discretion). If a holder of Company Common Stock either (i) does not submit a properly completed Election Form in a timely fashion or (ii) revokes the holder’s Election Form prior to the Election Deadline (without later submitting a properly completed Election Form prior to the Election Deadline), the shares of Company Common Stock held by such holder shall be designated Non-Election Shares. Subject to the terms of this Agreement and of the Election Form, the Exchange Agent shall have reasonable discretion to determine whether any election, revocation or change has been properly or timely made and to disregard immaterial defects in any Election Form, and any good faith decisions of the Exchange Agent regarding such matters shall be binding and conclusive. Neither Buyer nor the Exchange Agent shall be under any obligation to notify any Person of any defect in an Election Form.

4

(c) The allocation among the holders of shares of Company Common Stock of rights to receive the Cash Consideration and the Stock Consideration will be made as set forth in this Section 2.4(c).

(i) If the Stock Election Number exceeds the Stock Conversion Number, then all Cash Election Shares and all Non-Election Shares shall be converted into the right to receive the Cash Consideration, and, subject to Section 2.3 hereof, each holder of Stock Election Shares will be entitled to receive the Stock Consideration in respect of that number of Stock Election Shares held by such holder equal to the product obtained by multiplying (x) the number of Stock Election Shares held by such holder by (y) a fraction, the numerator of which is the Stock Conversion Number and the denominator of which is the Stock Election Number, with the remaining number of such holder’s Stock Election Shares being converted into the right to receive the Cash Consideration;

(ii) If the Stock Election Number is less than the Stock Conversion Number (the amount by which the Stock Conversion Number exceeds the Stock Election Number being referred to herein as the “Shortfall Number”), then all Stock Election Shares shall be converted into the right to receive the Stock Consideration and the Non-Election Shares and the Cash Election Shares shall be treated in the following manner:

(A) if the Shortfall Number is less than or equal to the number of Non-Election Shares, then all Cash Election Shares shall be converted into the right to receive the Cash Consideration and, subject to Section 2.3 hereof, each holder of Non-Election Shares shall receive the Stock Consideration in respect of that number of Non-Election Shares held by such holder equal to the product obtained by multiplying (x) the number of Non-Election Shares held by such holder by (y) a fraction, the numerator of which is the Shortfall Number and the denominator of which is the total number of Non-Election Shares, with the remaining number of such holder’s Non-Election Shares being converted into the right to receive the Cash Consideration; or

5

(B) if the Shortfall Number exceeds the number of Non-Election Shares, then all Non-Election Shares shall be converted into the right to receive the Stock Consideration, and, subject to Section 2.3 hereof, each holder of Cash Election Shares shall receive the Stock Consideration in respect of that number of Cash Election Shares equal to the product obtained by multiplying (x) the number of Cash Election Shares held by such holder by (y) a fraction, the numerator of which is the amount by which (1) the Shortfall Number exceeds (2) the total number of Non-Election Shares and the denominator of which is the total number of Cash Election Shares, with the remaining number of such holder’s Cash Election Shares being converted into the right to receive the Cash Consideration.

2.5 Exchange Procedures.

(a) On or before the Closing Date, for the benefit of the holders of Certificates, (i) Buyer shall cause to be delivered to the Exchange Agent, for exchange in accordance with this Article II, certificates representing the shares of Buyer Common Stock issuable pursuant to this Article II (“New Certificates”) and (ii) Buyer shall deliver, or shall cause to be delivered, to the Exchange Agent an aggregate amount of cash sufficient to pay the aggregate amount of cash payable pursuant to this Article II (including the estimated amount of cash to be paid in lieu of fractional shares of Buyer Common Stock) (such cash and New Certificates, being hereinafter referred to as the “Exchange Fund”).

(b) Not more than five Business Days following the Closing Date, and provided that the Company has delivered, or caused to be delivered, to the Exchange Agent all information which is necessary for the Exchange Agent to perform its obligations as specified herein, the Exchange Agent shall mail to each holder of record of a Certificate or Certificates who has not previously surrendered such Certificate or Certificates with an Election Form, a form of letter of transmittal (which shall specify that delivery shall be effected, and risk of loss and title to the Certificates shall pass, only upon delivery of the Certificates to the Exchange Agent) and instructions for use in effecting the surrender of the Certificates in exchange for the Merger Consideration into which the shares of Company Common Stock represented by such Certificate or Certificates shall have been converted pursuant to Sections 2.1, 2.3 and 2.4 of this Agreement. Upon proper surrender of a Certificate for exchange and cancellation to the Exchange Agent, together with a properly completed letter of transmittal, duly executed, the holder of such Certificate shall be entitled to receive in exchange therefor, as applicable, (i) a New Certificate representing that number of shares of Buyer Common Stock (if any) to which such former holder of Company Common Stock shall have become entitled pursuant to this Agreement, (ii) a check representing that amount of cash (if any) to which such former holder of Company Common Stock shall have become entitled pursuant to this Agreement, and/or (iii) a check representing the amount of cash (if any) payable in lieu of a fractional share of Buyer Common Stock which such former holder has the right to receive in respect of the Certificate surrendered pursuant to this Agreement, and the Certificate so surrendered shall forthwith be cancelled. Until surrendered as contemplated by this Section 2.5(b), each Certificate (other than Certificates representing Treasury Stock and any Suspense Shares) shall be deemed at any time after the Effective Time to represent only the right to receive upon such surrender the Merger Consideration provided in Sections 2.1, 2.3 and 2.4 and any unpaid dividends and distributions thereon as provided in Section 2.5(c). No interest shall be paid or accrued on (x) any cash constituting Merger Consideration (including any cash in lieu of fractional shares) or (y) any such unpaid dividends and distributions payable to holders of Certificates.

6

(c) No dividends or other distributions with a record date after the Effective Time with respect to Buyer Common Stock shall be paid to the holder of any unsurrendered Certificate until the holder thereof shall surrender such Certificate in accordance with this Section 2.5. After the surrender of a Certificate in accordance with this Section 2.5, the record holder thereof shall be entitled to receive any such dividends or other distributions, without any interest thereon, which theretofore had become payable with respect to shares of Buyer Common Stock represented by such Certificate.

(d) The Exchange Agent and Buyer, as the case may be, shall not be obligated to deliver cash and/or a New Certificate or New Certificates representing shares of Buyer Common Stock to which a holder of Company Common Stock would otherwise be entitled as a result of the Merger until such holder surrenders the Certificate or Certificates representing the shares of Company Common Stock for exchange as provided in this Section 2.5, or an appropriate affidavit of loss and indemnity agreement and/or a bond in an amount as may be required in each case by Buyer. If any New Certificates evidencing shares of Buyer Common Stock are to be issued in a name other than that in which the Certificate evidencing Company Common Stock surrendered in exchange therefor is registered, it shall be a condition of the issuance thereof that the Certificate so surrendered shall be properly endorsed or accompanied by an executed form of assignment separate from the Certificate and otherwise in proper form for transfer, and that the Person requesting such exchange pay to the Exchange Agent any transfer or other tax required by reason of the issuance of a New Certificate for shares of Buyer Common Stock in any name other than that of the registered holder of the Certificate surrendered or otherwise establish to the satisfaction of the Exchange Agent that such tax has been paid or is not payable.

(e) Any portion of the Exchange Fund that remains unclaimed by the stockholders of the Company for six months after the Effective Time (as well as any interest or proceeds from any investment thereof) shall be delivered by the Exchange Agent to Buyer. Any stockholders of the Company who have not theretofore complied with Section 2.5(b) shall thereafter look only to the Surviving Corporation for the Merger Consideration deliverable in respect of each share of Company Common Stock such stockholder holds as determined pursuant to this Agreement, in each case without any interest thereon. If outstanding Certificates for shares of Company Common Stock are not surrendered, or the payment for them is not claimed prior to the date on which such shares of Buyer Common Stock or cash would otherwise escheat to or become the property of any governmental unit or agency, the unclaimed items shall, to the extent permitted by abandoned property and any other applicable law, become the property of Buyer (and to the extent not in its possession shall be delivered to it), free and clear of all claims or interest of any Person previously entitled to such property. Neither the Exchange Agent nor any party to this Agreement shall be liable to any holder of shares of Company Common Stock represented by any Certificate for any consideration paid to a public official pursuant to applicable abandoned property, escheat or similar laws. Buyer and the Exchange Agent shall be entitled to rely upon the stock transfer books of the Company to establish the identity of those Persons entitled to receive the Merger Consideration specified in this Agreement, which books shall be conclusive with respect thereto. In the event of a dispute with respect to ownership of any shares of Company Common Stock represented by any Certificate, Buyer and the Exchange Agent shall be entitled to deposit any Merger Consideration represented thereby in escrow with an independent third party and thereafter be relieved with respect to any claims thereto.

7

(f) Buyer (through the Exchange Agent, if applicable) shall be entitled to deduct and withhold from any amounts otherwise payable pursuant to this Agreement to any holder of shares of Company Common Stock such amounts as Buyer is required to deduct and withhold under applicable law. Any amounts so deducted and withheld shall be treated for all purposes of this Agreement as having been paid to the holder of Company Common Stock in respect of which such deduction and withholding was made by Buyer.

2.6 Anti-Dilution Provisions. In the event Buyer or the Company changes (or establishes a record date for changing) the number of, or provides for the exchange of, shares of Buyer Common Stock or Company Common Stock issued and outstanding prior to the Effective Time as a result of a stock split, stock dividend, recapitalization, reclassification, or similar transaction with respect to the outstanding Buyer Common Stock or Company Common Stock and the record date therefor shall be prior to the Effective Time, the Exchange Ratio shall be proportionately and appropriately adjusted; provided, however, that nothing in this Section 2.6 shall be construed to permit the Company to take any action with respect to its securities that is prohibited by the terms of this Agreement; provided, further, that, for the avoidance of doubt, no such adjustment shall be made with regard to the Buyer Common Stock if (i) Buyer issues additional shares of Buyer Common Stock and receives consideration for such shares in a bona fide third party transaction or (ii) Buyer issues employee or director stock grants or similar equity awards or issues and/or withholds shares of Buyer Common Stock upon exercise or settlement of such awards.

2.7 Options and Other Stock-Based Awards.

(a) At the Effective Time, each option to purchase Company Common Stock (collectively, the “Company Stock Options”), whether vested or unvested, which is outstanding immediately prior to the Effective Time and which has not been exercised or canceled prior thereto shall, at the Effective Time, automatically be canceled and, on the Closing Date, Company shall pay to the holder thereof cash in an amount equal to the product of (i) the number of shares of Company Common Stock underlying such Company Stock Option (whether vested or unvested) and (ii) the excess, if any, of $22.00 per share over the exercise price per share of Company Common Stock provided for in such Company Stock Option, which cash payment shall be made without interest and shall be net of all applicable withholding taxes.

(b) As of immediately prior to the Effective Time, all restricted stock awards granted by the Company (collectively, the “Company RSAs”) shall vest in full so as to no longer be subject to any forfeiture or vesting requirements, and all such shares of Company Common Stock shall be considered outstanding shares for all purposes of this Agreement, including but not limited to, the provisions of Section 2.1(c).

8

(c) As of immediately after the Effective Time, the 2018 Equity Incentive Plan (the “Company Equity Plan”) shall terminate and be of no further force and effect. The Company shall take all actions necessary in order to effect the provisions of this Section 2.7, including, without limitation, seeking all necessary approvals and providing any notices required under the Company Equity Plan. The Board of Directors of the Company (the “Company Board”) (or, if appropriate, any committee thereof administering the Company Equity Plan) shall adopt such resolutions or take such other actions as may be required to effect the foregoing.

2.8 Withholding Rights. Buyer (through the Exchange Agent, if applicable) shall be entitled to deduct and withhold from any amounts otherwise payable pursuant to this Agreement to any holder of shares of Company Common Stock or Company Stock Options or Company RSAs such amounts as Buyer is required to deduct and withhold under applicable law. Any amounts so deducted and withheld shall be treated for all purposes of this Agreement as having been paid to the holder of Company Common Stock, Company Stock Options or Company RSAs in respect of which such deduction and withholding was made by Buyer.

2.9 No Dissenters’ Rights. In connection with the Merger and the transactions contemplated by this Agreement, holders of shares of Company Common Stock are not entitled to any rights of an objecting stockholder provided under Title 3, Subtitle 2 of the MGCL, “appraisal”, “dissenters”, rights to receive “fair value” for stock, or any other similar rights under the MCGL or otherwise.

2.10 Reservation of Right to Revise Structure. Buyer may at any time prior to the Effective Time change the method of effecting the business combination contemplated by this Agreement if and to the extent that it deems such a change to be desirable; provided, however, that no such change shall (a) alter or change the type or amount of the consideration to be issued to holders of Company Common Stock as merger consideration as currently contemplated in this Agreement, (b) reasonably be expected to materially impede or delay consummation of the Merger, (c) adversely affect the federal income tax treatment of holders of Company Common Stock in connection with the Merger, or (d) require submission to or approval of the Company’s stockholders after the plan of merger set forth in this Agreement has been approved by the Company’s stockholders. In the event that Buyer elects to make such a change, the parties agree to execute appropriate documents to reflect the change.

Article III - REPRESENTATIONS AND WARRANTIES OF THE COMPANY

3.1 Making of Representations and Warranties.

(a) As a material inducement to Buyer to enter into this Agreement and to consummate the transactions contemplated hereby, the Company hereby makes to Buyer the representations and warranties contained in this Article III, subject to the standards established by Section 9.1.

9

(b) On or prior to the date hereof, the Company has delivered to Buyer a schedule (the “Company Disclosure Schedule”) listing, among other things, items the disclosure of which is necessary or appropriate in relation to any or all of the Company’s representations and warranties contained in this Article III; provided, however, that (i) no such item is required to be set forth on the Company Disclosure Schedule as an exception to a representation or warranty if its absence is not reasonably likely to result in the related representation or warranty being untrue or incorrect under the standards established by Section 9.1 and (ii) the mere inclusion of an item in the Company Disclosure Schedule as an exception to a representation or warranty shall not be deemed an admission by the Company that such item represents a material exception or fact, event or circumstance or that such item would reasonably be expected to result in a Company Material Adverse Effect. Any disclosure made in the Company Disclosure Schedule with respect to a section of Article III shall be deemed to qualify any other section of Article III specifically referenced or cross-referenced or that contains sufficient detail to enable a reasonable Person to recognize the relevance of such disclosure to such other sections.

3.2 Organization, Standing and Authority. The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Maryland. The Company is duly registered as a bank holding company under the Bank Holding Company Act of 1956, as amended (“BHCA”), and the regulations of the Board of Governors of the Federal Reserve System (the “FRB”) promulgated thereunder. The Company Bank is a member in good standing of the Federal Home Loan Bank of New York. The Company is duly qualified to do business and is in good standing in the jurisdictions where its ownership or leasing of property or the conduct of its business requires it to be so qualified, except where the failure to so qualify has not had and would not reasonably be expected to have, individually or in the aggregate, a Company Material Adverse Effect. A complete and accurate list of all such jurisdictions is set forth on Schedule 3.2 of the Company Disclosure Schedule.

3.3 Capitalization.

(a) As of the date hereof, the authorized capital stock of the Company consists solely of 200,000,000 shares of Company Common Stock and 10,000,000 shares of preferred stock, $0.01 par value. As of May 23, 2022, there were (i) 18,703,577 shares of Company Common Stock issued and 15,334,857 shares (including 223,450 shares representing Company RSAs) of Company Common Stock outstanding, (ii) 3,368,720 shares of Treasury Stock, (iii) 1,320,963 shares of Company Common Stock reserved for issuance upon the exercise of outstanding Company Stock Options, and (iv) no shares of Buyer Preferred Stock issued and outstanding. The outstanding shares of Company Common Stock are validly issued, fully paid and nonassessable with no personal liability attaching to the ownership thereof, and subject to no preemptive or similar rights (and were not issued in violation of any preemptive or similar rights). There are no additional shares of the Company’s capital stock authorized or reserved for issuance, the Company does not have any securities (including units of beneficial ownership interest in any partnership or limited liability company) convertible into or exchangeable for any additional shares of stock, any stock appreciation rights, or any other rights to subscribe for or acquire shares of its capital stock issued and outstanding, and the Company does not have, and is not bound by, any commitment to authorize, issue or sell any such shares or other rights. Except for the ESOP and the Voting Agreements, there are no voting trusts, shareholder agreements, proxies or other agreements to which the Company or any Company Subsidiary is a party with respect to the voting, sale or transfer, or registration of any securities or other equity interests of the Company. All of the issued and outstanding shares of Company Common Stock were issued in compliance with applicable securities laws.

10

(b) There are no outstanding obligations of the Company to repurchase, redeem or otherwise acquire any shares of capital stock of, or other equity interests in, the Company or to provide funds to, or make any investment (in the form of a loan, capital contribution or otherwise) in, any Subsidiary of the Company.

(c) Schedule 3.3(c) of the Company Disclosure Schedule sets forth, as of the date hereof, for each Company Stock Option, Company RSA and other Company stock-based award, the name of the grantee, the date of grant, the type of grant, the status of any option grant as qualified or non-qualified under Section 422 of the Code, the number of shares of Company Common Stock subject to each award, the vesting schedule of each award, the number of shares of Company Common Stock that are currently exercisable or vested with respect to such award, the expiration date, and the exercise price per share for each option grant.

3.4 Subsidiaries.

(a) (i) Schedule 3.4(a) of the Company Disclosure Schedule sets forth a complete and accurate list of all of the Company’s Subsidiaries, including the jurisdiction of organization of each such Subsidiary; (ii) except as disclosed in Schedule 3.4(a)(ii) of the Company Disclosure Schedule, the Company owns all of the issued and outstanding equity securities of each Subsidiary the Company owns, directly or indirectly; (iii) no equity securities of any of the Company’s Subsidiaries are, or may become, required to be issued (other than to the Company) by reason of any contractual right or otherwise; (iv) there are no contracts, commitments, understandings or arrangements by which any of such Subsidiaries are or may be bound to sell or otherwise transfer any of its equity securities (other than to the Company or a wholly-owned Subsidiary of the Company); (v) there are no contracts, commitments, understandings or arrangements relating to the Company’s rights to vote or to dispose of such securities; and (vi) all of the equity securities of each such Subsidiary held by the Company, directly or indirectly, are validly issued, fully paid and nonassessable, not subject to preemptive or similar rights and are owned by the Company free and clear of all mortgages, pledges, liens, security interests, conditional and installment sale agreements, encumbrances, charges or other claims of third parties of any kind (collectively, “Liens”).

(b) Except as disclosed in Schedule 3.4(b) of the Company Disclosure Schedule, the Company does not own (other than in a bona fide fiduciary capacity for persons other than those described in 12 U.S.C. § 1841(g)(2) or in satisfaction of a debt previously contracted) beneficially, directly or indirectly, any equity securities or similar interests of any Person, or any interest in a partnership or joint venture of any kind.

(c) Each of the Company’s Subsidiaries has been duly organized and qualified under the laws of the jurisdiction of its organization and is duly qualified to do business and in good standing in the jurisdictions where its ownership or leasing of property or the conduct of its business requires it to be so qualified. A complete and accurate list of all such jurisdictions is set forth on Schedule 3.4(c) of the Company Disclosure Schedule.

11

(d) Each of the Company’s Subsidiaries is engaged solely in activities that are permissible for a subsidiary of a bank holding company and, of the Company’s Subsidiaries that is a Subsidiary of the Company Bank is engaged solely in activities that are permissible for the Company Bank, at locations where the Company Bank may engage in such activities and subject to the same requirements as would apply to such activities if conducted by the Company Bank.

3.5 Corporate Power. Each of the Company and its Subsidiaries has the corporate power and authority to carry on its business as it is now being conducted and to own all of its properties and assets; and the Company has the corporate power and authority to execute and deliver this Agreement, to perform its obligations under this Agreement and to consummate the transactions contemplated hereby, subject to the receipt of the Regulatory Approvals and the Company Stockholder Approval.

3.6 Corporate Authority. This Agreement and the transactions contemplated hereby, subject to the adoption and approval of this Agreement by the affirmative vote of holders of at least a majority of Company Common Stock outstanding and entitled to vote thereon (the “Company Stockholder Approval”), have been authorized by all necessary corporate action of the Company and the Company Board. The Company Board (a) unanimously approved the Merger and this Agreement and determined that this Agreement and the transactions contemplated hereby, including the Merger, are advisable and in the best interests of the holders of Company Common Stock; (b) directed that the Merger be submitted for consideration at a meeting of the stockholders of the Company; and (c) unanimously resolved to recommend that the holders of Company Common Stock vote for the approval of the Merger and the transactions contemplated hereby at a meeting of the stockholders of the Company. The Company has duly executed and delivered this Agreement and, assuming the due authorization, execution and delivery by Buyer, this Agreement is a legal, valid and binding agreement of the Company, enforceable in accordance with its terms (except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and similar laws of general applicability relating to or affecting creditors’ rights or by general principles of equity). The Company Stockholder Approval is the only vote of any class or series of capital stock of the Company required by the MGCL, the Articles of Incorporation of the Company or the Bylaws of the Company to approve this Agreement, the Merger and the transactions contemplated hereby.

3.7 Non-Contravention.

(a) Subject to the receipt of the Regulatory Approvals and the Company Stockholder Approval, and the required filings under federal and state securities laws, and except as set forth on Schedule 3.7(a) of the Company Disclosure Schedule, the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby (including, without limitation, the Merger) by the Company do not and will not (i) constitute a breach or violation of, or a default under, result in a right of termination or the acceleration of any right or obligation under, any law, rule or regulation or any judgment, decree, order, permit, license, credit agreement, indenture, loan, note, bond, mortgage, reciprocal easement agreement, lease, instrument, concession, franchise or other agreement of the Company or any of its Subsidiaries or to which the Company or any of its Subsidiaries, properties or assets is subject or bound; (ii) constitute a breach or violation of, or a default under, the Company’s Articles of Incorporation or Bylaws; or (iii) require the consent or approval of any third party or Governmental Authority under any such law, rule, regulation, judgment, decree, order, permit, license, credit agreement, indenture, loan, note, bond, mortgage, reciprocal easement agreement, lease, instrument, concession, franchise or other agreement.

12

(b) As of the date hereof, the Company has no Knowledge of any reasons relating to the Company or the Company Bank (i) why all of the Regulatory Approvals shall not be procured from the applicable Governmental Authorities having jurisdiction over the transactions contemplated by this Agreement or (ii) why any Burdensome Condition would be imposed.

3.8 Articles of Incorporation; Bylaws; Corporate Records. The Company has made available to Buyer a complete and correct copy of its Articles of Incorporation and the Bylaws or equivalent organizational documents, each as amended to date, of the Company and each of its Subsidiaries. Neither the Company nor any of its Subsidiaries is in violation of any of the terms of its Articles of Incorporation or Bylaws (or equivalent organizational documents). The minute books of the Company and each of its Subsidiaries (whether written or electronic) contain complete and accurate records of all meetings held by, and complete and accurate records of all other corporate actions of, their respective stockholders and boards of directors (including committees of their respective boards of directors).

3.9 Compliance with Laws. Each of the Company and its Subsidiaries:

(a) since January 1, 2019, has been in compliance with all applicable federal, state, local and foreign statutes, laws, regulations, ordinances, rules, judgments, orders or decrees applicable thereto or to the employees conducting its business, including, without limitation, the Truth in Lending Act, the Real Estate Settlement Procedures Act, the Consumer Credit Protection Act, the Equal Credit Opportunity Act, the Fair Credit Reporting Act, the Homeowners Ownership and Equity Protection Act, the Fair Debt Collections Act, CRA, other applicable federal, state, local and foreign laws regulating lending, and all other applicable fair lending laws and other laws relating to discriminatory business practices and record retention (“Finance Laws”). In addition, there is no pending or, to the Knowledge of the Company, threatened charge, action or proceeding by any Governmental Authority that any of the Company and its Subsidiaries has violated, nor any pending or, to the Knowledge of the Company, threatened investigation by any Governmental Authority with respect to possible violations of, any applicable Finance Laws;

(b) has all permits, licenses, authorizations, orders and approvals of, and has made all filings, applications and registrations with, all Governmental Authorities that are required in order to permit them to own or lease their properties and to conduct their businesses as presently conducted; all such permits, licenses, authorizations, orders and approvals are in full force and effect and, to the Knowledge of the Company, no suspension or cancellation of any of them is threatened; and

(c) has received, since January 1, 2019, no notification or communication from any Governmental Authority (i) asserting that the Company or any of its Subsidiaries is not in compliance with any of the statutes, regulations, or ordinances which such Governmental Authority enforces, (ii) threatening to revoke any license, franchise, permit, or governmental authorization, (iii) threatening or contemplating revocation or limitation of, or which would have the effect of revoking or limiting, federal deposit insurance or (iv) failing to approve any proposed acquisition, or stating its intention not to approve acquisitions, proposed to be effected by the Company within a certain time period or indefinitely (nor, to the Knowledge of the Company, do any grounds for any of the foregoing exist).

13

(d) This Section 3.9 shall not require the disclosure of any confidential supervisory information that may not be disclosed by law.

3.10 Litigation; Regulatory Action.

(a) Except as set forth on Schedule 3.10(a), no litigation, claim, suit, investigation or other proceeding before any court, governmental agency or arbitrator is pending against the Company or any of its Subsidiaries, and, to the Knowledge of the Company, (i) no such litigation, claim, suit, investigation or other proceeding has been threatened and (ii) there are no facts which would reasonably be expected to give rise to such litigation, claim, suit, investigation or other proceeding.

(b) Neither the Company nor any of its Subsidiaries nor any of their respective properties is a party to or is subject to any assistance agreement, board resolution, order, decree, supervisory agreement, memorandum of understanding, condition or similar arrangement with, or a commitment letter or similar submission to, any Governmental Authority charged with the supervision or regulation of financial institutions or issuers of securities or engaged in the insurance of deposits (including, without limitation, the FRB, the Federal Deposit Insurance Corporation (“FDIC”) and the New York State Department of Financial Services) or the supervision or regulation of the Company or any of its Subsidiaries. Neither the Company nor any of its Subsidiaries has been subject to any order or directive by, or been ordered to pay any civil money penalty by, or has been since January 1, 2019, a recipient of any supervisory letter from, or since January 1, 2019, has adopted any policies, procedures or board resolutions at the request or suggestion of, any Governmental Authority that currently regulates in any material respect the conduct of its business or that in any manner relates to its capital adequacy, its ability to pay dividends, its credit or risk management policies, its management or its business, other than those of general application that apply to similarly-situated banks or financial holding companies or their subsidiaries.

(c) Neither the Company nor any of its Subsidiaries has been advised by a Governmental Authority that it will issue, or has Knowledge of any facts which would reasonably be expected to give rise to the issuance by any Governmental Authority or has Knowledge that such Governmental Authority is contemplating issuing or requesting (or is considering the appropriateness of issuing or requesting) any such order, decree, agreement, board resolution, memorandum of understanding, supervisory letter, commitment letter, condition or similar submission.

14

3.11 SEC Documents; Financial Reports and Regulatory Reports.

(a) The Company’s Annual Report on Form 10-K, as amended through the date hereof, for the fiscal year ended June 30, 2021 (the “Company Form 10-K”), and all other reports, registration statements, definitive proxy statements or information statements required to be filed or furnished by the Company or any of its Subsidiaries subsequent to April 17, 2017 under the Securities Act, or under Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (collectively, the “Company SEC Documents”), with the Securities and Exchange Commission (“SEC”), and all of the Company SEC Documents filed with the SEC after the date hereof, in the form filed or to be filed, (i) complied or will comply as to form in all material respects with the applicable requirements under the Securities Act or the Exchange Act, as the case may be, and (ii) did not and will not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements made therein, in light of the circumstances under which they were made, not misleading; and each of the statements of financial condition contained in or incorporated by reference into any such Company SEC Document (including the related notes and schedules thereto) fairly presents and will fairly present the financial position of the entity or entities to which such statement of financial condition relates as of its date, and each of the statements of operations and changes in stockholders’ equity and cash flows or equivalent statements in such Company SEC Documents (including any related notes and schedules thereto) fairly presents and will fairly present the results of operations, changes in stockholders’ equity and changes in cash flows, as the case may be, of the entity or entities to which such statement relates for the periods to which it relates, in each case in accordance with GAAP consistently applied during the periods involved, except in each case as may be noted therein, subject to normal year-end audit adjustments in the case of unaudited financial statements. Except for those liabilities that are fully reflected or reserved against in the most recent audited consolidated statement of financial condition of the Company and its Subsidiaries contained in the Company Form 10-K (the “Company Balance Sheet”) and, except for liabilities reflected in Company SEC Documents filed prior to the date hereof or incurred in the ordinary course of business consistent with past practices or in connection with this Agreement, since June 30, 2018, neither the Company nor any of its Subsidiaries has any liabilities or obligations of any nature (whether accrued, absolute, contingent or otherwise) required by GAAP to be set forth on its consolidated statement of financial condition or in the notes thereto.

(b) The Company and each of its Subsidiaries, officers and directors are in compliance with, and have complied, with (i) the applicable provisions of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and the related rules and regulations promulgated under such act and the Exchange Act and (ii) the applicable listing and corporate governance rules and regulations of Nasdaq. The Company (iii) has established and maintained disclosure controls and procedures and internal control over financial reporting (as such terms are defined in paragraphs (e) and (f), respectively, of Rule 13a-15 under the Exchange Act) as required by Rule 13a-15 under the Exchange Act, and (iv) has disclosed based on its most recent evaluations, to its outside auditors and the audit committee of the Company Board (A) all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting (as defined in Rule 13a-15(f) of the Exchange Act) which are reasonably likely to adversely affect the Company’s ability to record, process, summarize and report financial data and (B) any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal control over financial reporting.

15

(c) Since July 1, 2019, the Company and its Subsidiaries have duly filed with the FRB, the FDIC, the New York State Department of Financial Services and any other applicable Governmental Authority, in correct form the reports required to be filed under applicable laws and regulations and such reports were complete and accurate and in compliance with the requirements of applicable laws and regulations.

3.12 Absence of Certain Changes or Events. Except as set forth on Schedule 3.12 of the Company Disclosure Schedule or in the Company SEC Documents (excluding any risk factors or other forward-looking information) filed or furnished prior to the date hereof, or as otherwise expressly permitted or expressly contemplated by this Agreement, since June 30, 2021, there has not been (i) any change or development in the business, operations, assets, liabilities, condition (financial or otherwise), results of operations, cash flows or properties of the Company or any of its Subsidiaries which has had, or would reasonably be expected to have, individually or in the aggregate, a Company Material Adverse Effect; (ii) any change by the Company or any of its Subsidiaries in its accounting methods, principles or practices, other than changes required by applicable law or GAAP or regulatory accounting as concurred in by the Company’s independent registered public accounting firm; (iii) any entry by the Company or any of its Subsidiaries into any contract or commitment of (A) more than $100,000 or (B) $50,000 per annum with a term of more than one year, other than loans and loan commitments in the ordinary course of business consistent with past practice; (iv) any declaration, setting aside or payment of any dividend or distribution in respect of any capital stock of the Company or any of its Subsidiaries or any redemption, purchase or other acquisition of any of its securities, other than in the ordinary course of business consistent with past practice; (v) any action not in the ordinary course of business with respect to the compensation or employment of directors, officers or employees of the Company or any of its Subsidiaries, (vi) any Tax election made or changed, any annual accounting period changed, any accounting method adopted or changed, any amended Tax Return filed, any Tax Return not timely filed, any closing agreement entered into, any liability with respect to Taxes settled or compromised, any adjustment of any Tax attribute agreed to, any right to claim a refund of Taxes surrendered, any extension or waiver of the limitation period applicable to any Tax claim or assessment consented to, or any other similar action taken by the Company or any of its Subsidiaries relating to the filing of any Tax Return or the payment of any Tax; (v) any material change in the credit policies or procedures of the Company or any of its Subsidiaries, the effect of which was or is to make any such policy or procedure less restrictive in any respect; (vi) any material acquisition or disposition of any assets or properties, or any contract for any such acquisition or disposition entered into, other than loans and loan commitments; or (vii) any material lease of real or personal property entered into, other than in connection with foreclosed property or in the ordinary course of business consistent with past practice.

16

3.13 Taxes and Tax Returns. For purposes of this Section 3.13, any reference to the Company or its Subsidiaries shall be deemed to include a reference to the Company’s predecessors or the predecessors of its Subsidiaries, respectively, except where inconsistent with the language of this Section 3.13. Except as set forth on Schedule 3.13 of the Company Disclosure Schedule:

(a) Each of the Company and its Subsidiaries has (i) timely filed (or there has been timely filed on its behalf) with the appropriate Governmental Authorities all Tax Returns required to be filed by it (giving effect to all extensions) and such Tax Returns are true, correct and complete in all material respects; and (ii) timely paid in full (or there has been timely paid in full on its behalf) all Taxes required to have been paid by it.