Form 425 LAKELAND BANCORP INC Filed by: PROVIDENT FINANCIAL SERVICES INC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 27, 2022 (September 26, 2022)

PROVIDENT FINANCIAL SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-31566 | 42-1547151 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 239 Washington Street |

| Jersey City, New Jersey 07302 |

| (Address of principal executive offices) (Zip Code) |

(732) 590-9200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.01 per share | PFS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

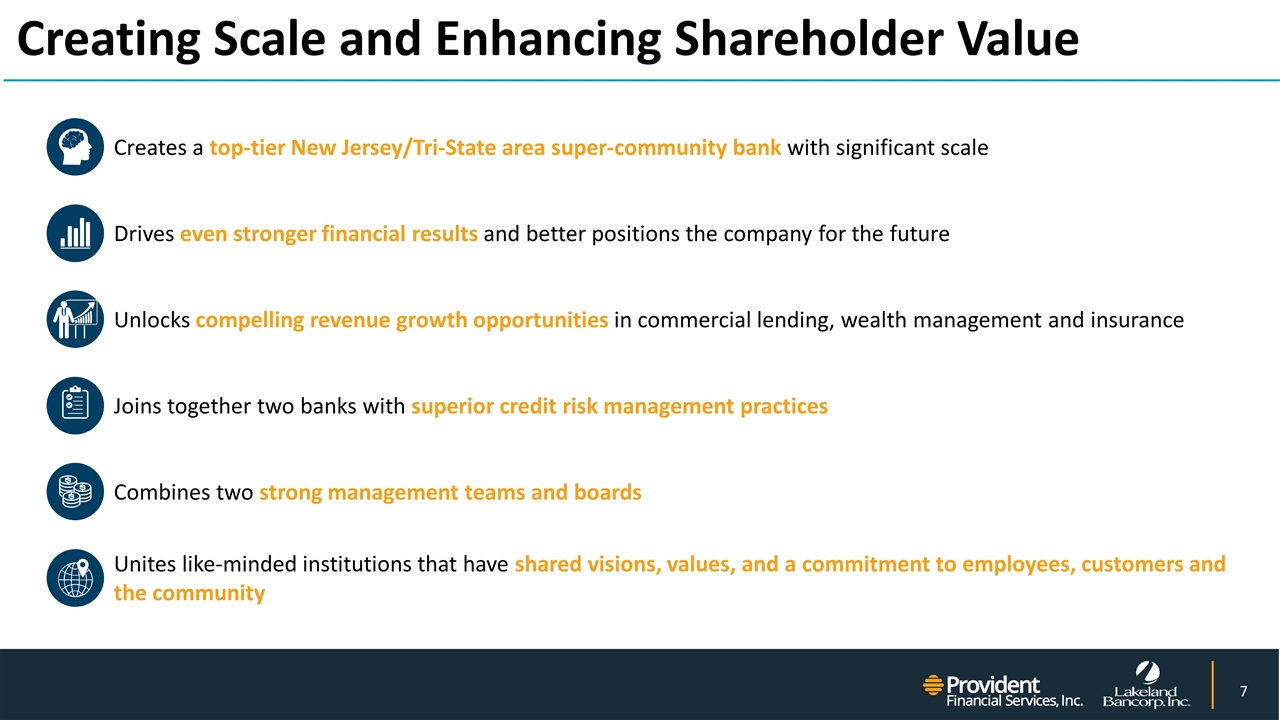

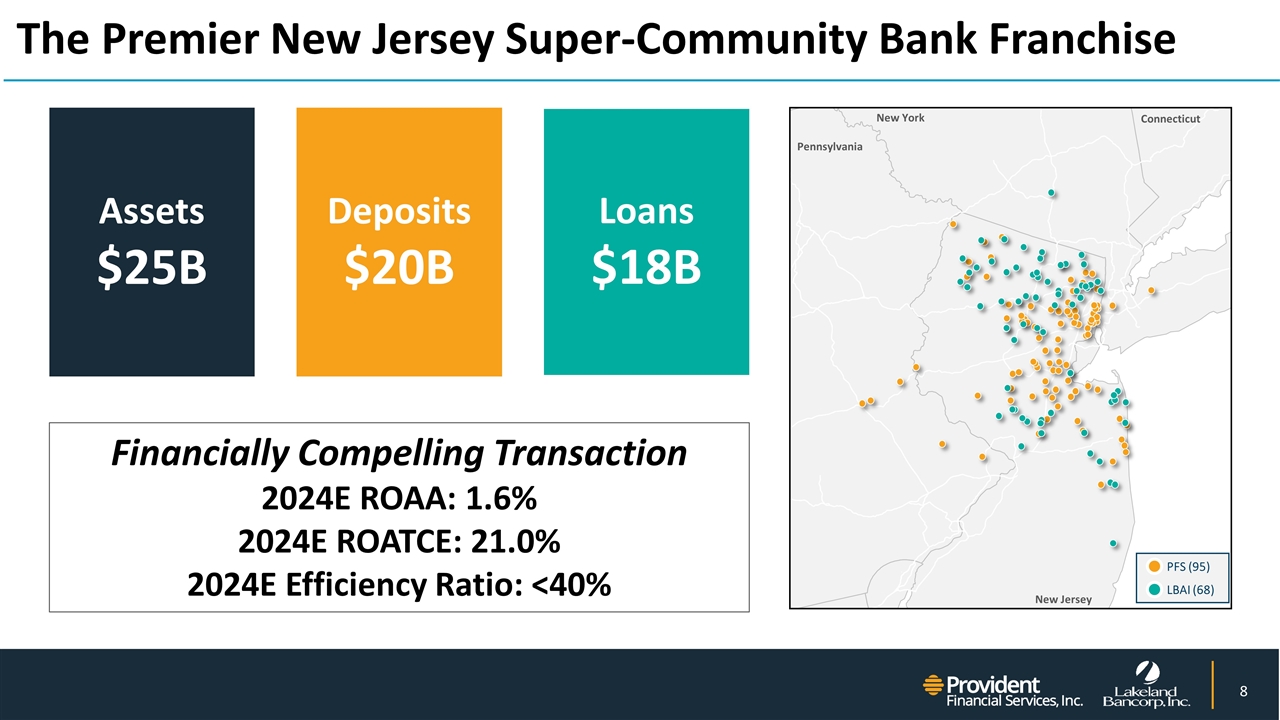

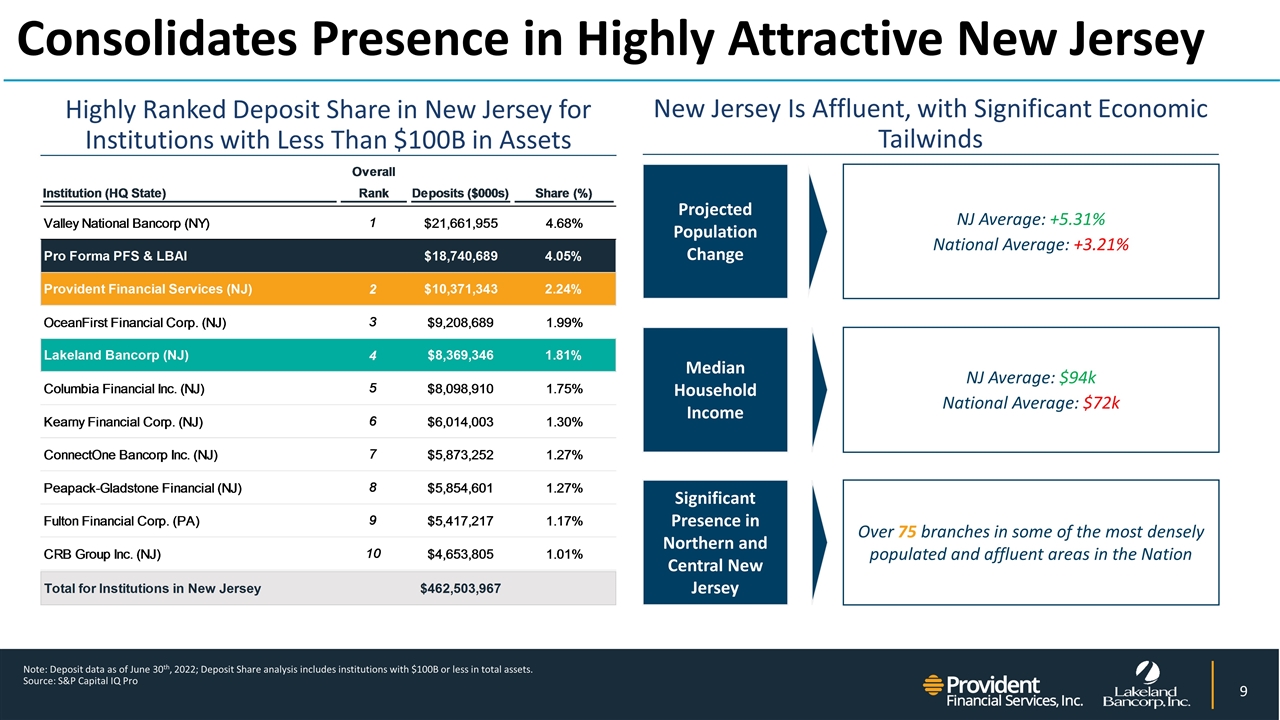

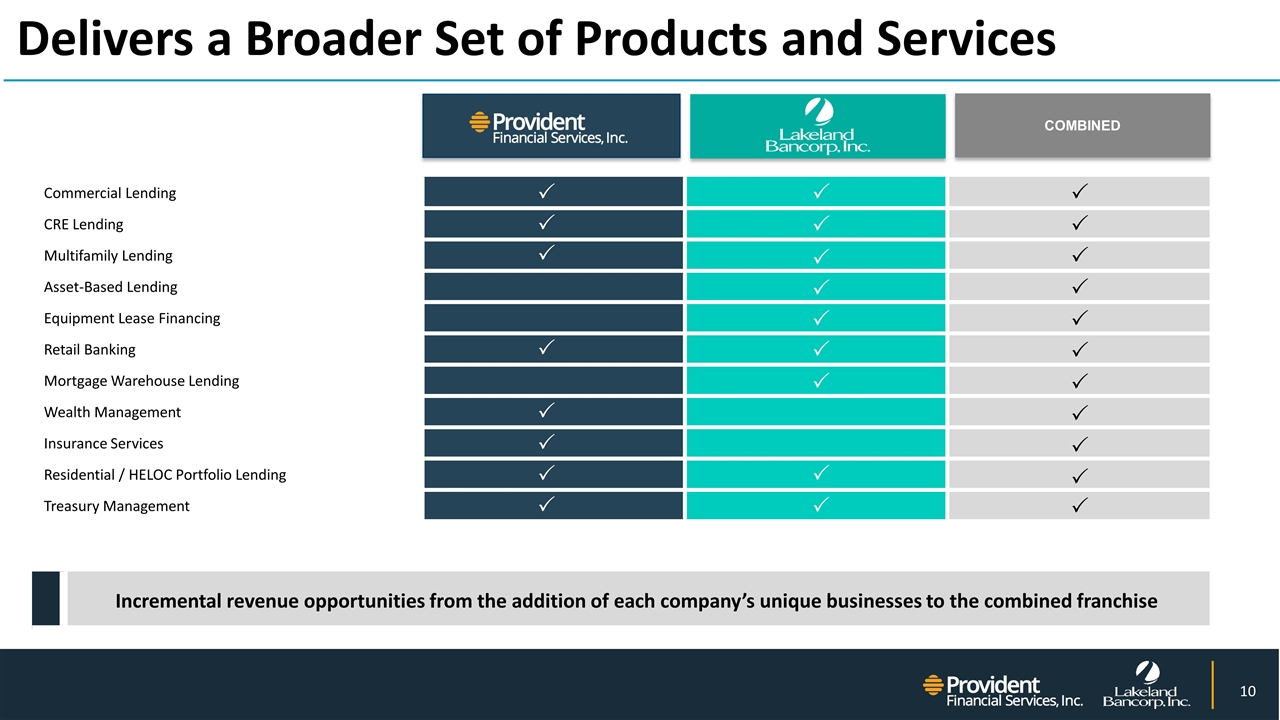

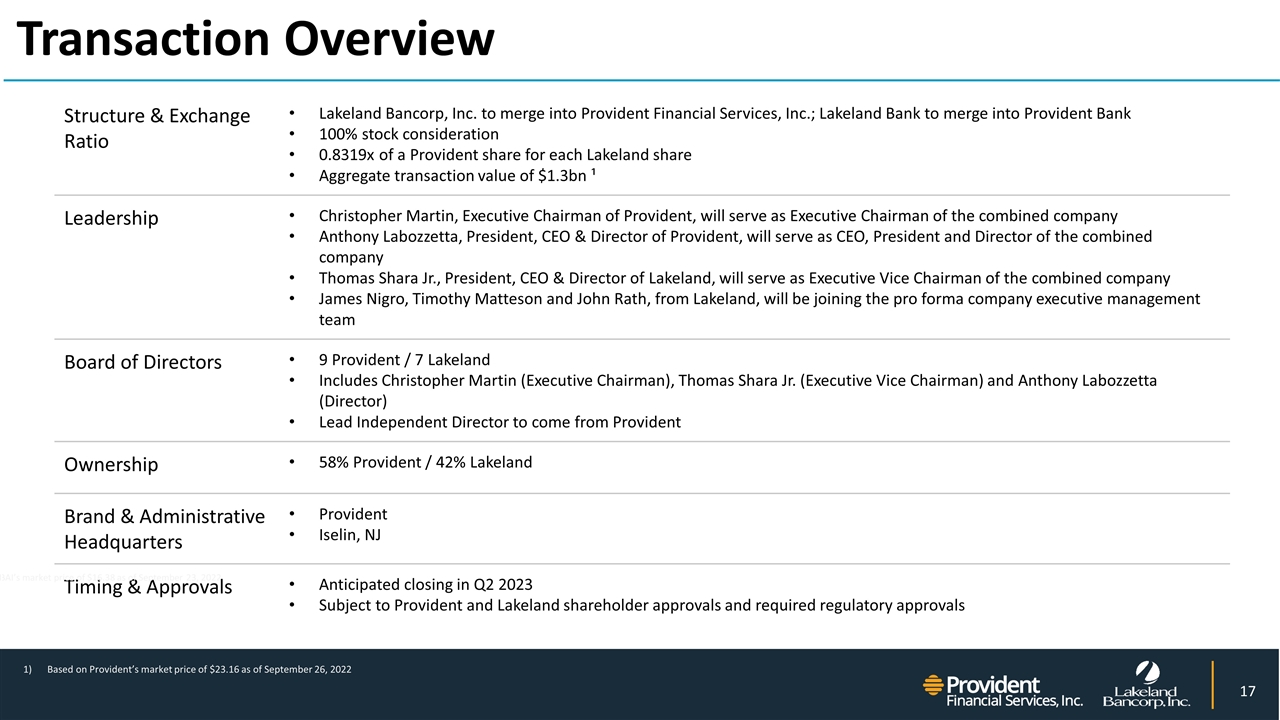

On September 26, 2022, Provident Financial Services, Inc., a Delaware corporation (“Provident”), NL 239 Corp., a Delaware corporation and a direct, wholly owned subsidiary of Provident (“Merger Sub”), and Lakeland Bancorp, Inc., a New Jersey corporation (“Lakeland”), entered into an Agreement and Plan of Merger (the “Merger Agreement”). The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein, Merger Sub will merge with and into Lakeland, with Lakeland as the surviving entity (the “Merger”), and as soon as reasonably practicable following the Merger, Lakeland will merge with and into Provident, with Provident as the surviving entity (the “Holdco Merger”). The Merger Agreement further provides that at a date and time following the Holdco Merger as determined by Provident, Lakeland Bank, a New Jersey state-chartered commercial bank and a wholly owned subsidiary of Lakeland, will merge with and into Provident Bank, a New Jersey state-chartered savings bank and a wholly owned subsidiary of Provident, with Provident Bank as the surviving bank (the “Bank Merger” and, together with the Merger and the Holdco Merger, the “Transaction”). The Merger Agreement was unanimously approved by the board of directors of each of Provident and Lakeland.

Merger Consideration

Upon the terms and subject to the conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each share of common stock, no par value per share, of Lakeland (“Lakeland Common Stock”) outstanding immediately prior to the Effective Time, other than certain shares held by Lakeland or Provident, will be converted into the right to receive 0.8319 of a share (the “Exchange Ratio”) of common stock, par value $0.01 per share, of Provident (“Provident Common Stock”). Holders of Lakeland Common Stock will receive cash in lieu of fractional shares.

Treatment of Lakeland’s Equity Awards

The Merger Agreement provides that, at the Effective Time, except as otherwise agreed between Lakeland and Provident, all Lakeland restricted stock awards and Lakeland restricted stock unit awards under the Lakeland 2018 Omnibus Equity Incentive Plan and the Lakeland 2009 Equity Program outstanding on September 26, 2022 will accelerate in full and fully vest, and be converted into the right for the holder to receive shares of Provident Common Stock in accordance with the Exchange Ratio. Any applicable performance-based vesting conditions will be deemed achieved at “target” level performance at closing.

Certain Governance Matters

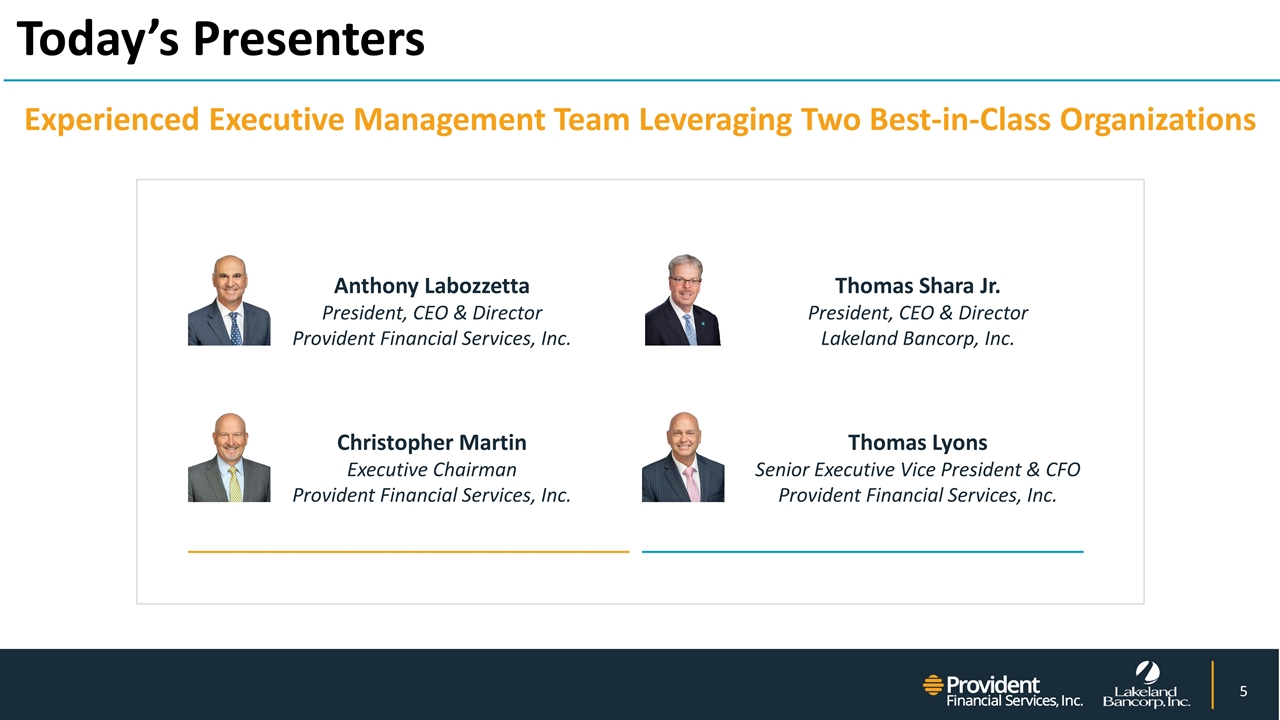

The Merger Agreement provides that, prior to the Effective Time, the board of directors of Provident will take all actions necessary to adopt certain amendments to the bylaws of Provident (the “Provident Bylaw Amendment”) regarding governance matters. Effective as of the Effective Time, and in accordance with the Provident Bylaw Amendment, the number of directors that will comprise the full boards of directors of Provident and Provident Bank will be sixteen, of which (i) nine will be directors of Provident immediately prior to the Effective Time (the “Provident Designated Directors”), which will include Christopher Martin, the current Executive Chairman of the board of directors of Provident and Provident Bank, and Anthony J. Labozzetta, a current director and the President and Chief Executive Officer of Provident and Provident Bank, and such other directors as determined by Provident and (ii) seven will be directors of Lakeland immediately prior to the Effective Time, which will include Thomas J. Shara, a current director and the President and Chief Executive Officer of Lakeland and Lakeland Bank, and such other directors as determined by Lakeland. In addition, effective as of the Effective Time, and in accordance with the Provident Bylaw Amendment, (a) Christopher Martin will serve as the Executive Chairman of the boards of directors of Provident and Provident Bank for a two-year term; (b) Thomas J. Shara will serve as the Executive Vice Chairman of the boards of directors of Provident and Provident Bank for a two-year term; (c) Anthony J. Labozzetta will serve as the President and Chief Executive Officer of Provident and Provident Bank and as a member of the boards of directors of Provident and Provident Bank for a term that ends no earlier than the two-year anniversary of the Effective Time; (d) a Provident Designated Director that is independent of Provident in accordance with applicable stock exchange standards will serve as the Lead Independent Director of the boards of directors of Provident and Provident Bank for a two-year term. The Merger Agreement provides that, following the Transaction, the headquarters of the surviving corporation and the surviving bank will remain located in Iselin, New Jersey and the name of the surviving corporation and the surviving bank will remain Provident Financial Services, Inc. and Provident Bank, respectively.

1

Certain Other Terms and Conditions of the Merger Agreement

The Merger Agreement contains customary representations and warranties from both Provident and Lakeland, and each party has agreed to customary covenants, including, among others, covenants relating to (i) the conduct of its business during the interim period between the execution of the Merger Agreement and the Effective Time, (ii) in the case of Provident, its obligation to call a meeting of its stockholders to approve the issuance of shares of Provident Common Stock pursuant to the Merger Agreement (the “Provident share issuance”) and, subject to certain exceptions, the obligation of its board of directors to recommend that its stockholders approve the Provident share issuance, (iii) in the case of Lakeland, its obligation to call a meeting of its shareholders to approve the Merger Agreement, and, subject to certain exceptions, the obligation of its board of directors to recommend that its shareholders approve the Merger Agreement, and (iv) each party’s non-solicitation obligations related to alternative acquisition proposals. Provident and Lakeland have also agreed to use their reasonable best efforts to prepare and file all applications, notices and other documents to obtain all necessary consents and approvals for consummation of the transactions contemplated by the Merger Agreement.

The completion of the Merger is subject to customary conditions, including (i) approval of the Merger Agreement by the requisite vote of the Lakeland shareholders, (ii) approval of the Provident share issuance by the requisite vote of the Provident stockholders, (iii) authorization for listing on the New York Stock Exchange of the shares of Provident Common Stock to be issued in the Merger, subject to official notice of issuance, (iv) receipt of required regulatory approvals, including the approval of the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation and the New Jersey Department of Banking and Insurance, without the imposition of any condition or restriction that would be reasonably expected to have a material adverse effect on the surviving corporation of the Holdco Merger and its subsidiaries, taken as a whole, after giving effect to the Merger, the Holdco Merger and the Bank Merger, (v) effectiveness of the registration statement on Form S-4 for the Provident Common Stock to be issued in the Merger and (vi) the absence of any order, injunction, decree or other legal restraint preventing the completion of the Merger, the Holdco Merger, the Bank Merger or any of the other transactions contemplated by the Merger Agreement or making the completion of the Merger, the Holdco Merger, the Bank Merger or any of the other transactions contemplated by the Merger Agreement illegal. Each party’s obligation to complete the Merger is also subject to certain additional customary conditions, including (a) subject to certain exceptions, the accuracy of the representations and warranties of the other party, (b) performance in all material respects by the other party of its obligations under the Merger Agreement, (c) receipt by such party of an opinion from its counsel to the effect that the Merger and the Holdco Merger, taken together, will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended, and (d) the execution of a bank merger agreement providing for the Bank Merger by Provident Bank and Lakeland Bank.

The Merger Agreement provides certain termination rights for both Provident and Lakeland and further provides that a termination fee of $50 million will be payable by either Provident or Lakeland, as applicable, upon termination of the Merger Agreement under certain circumstances.

The representations, warranties and covenants of each party set forth in the Merger Agreement have been made only for purposes of, and were and are solely for the benefit of the parties to, the Merger Agreement; may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time, and investors should not rely on them as statements of fact. In addition, such representations and warranties (i) will not survive consummation of the Merger and (ii) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding Provident or Lakeland, their respective affiliates or their respective businesses. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding Provident, Lakeland, their respective affiliates or their respective businesses, the Merger Agreement, the Merger, the Holdco Merger and the Bank Merger that will be contained in, or incorporated by reference into, the Registration Statement on Form S-4 that will include a joint proxy statement of Provident and Lakeland and a prospectus of Provident, as well as in the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings that each of Provident and Lakeland makes with the Securities and Exchange Commission (“SEC”).

2

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 and incorporated herein by reference.

| Item 8.01. | Other Events. |

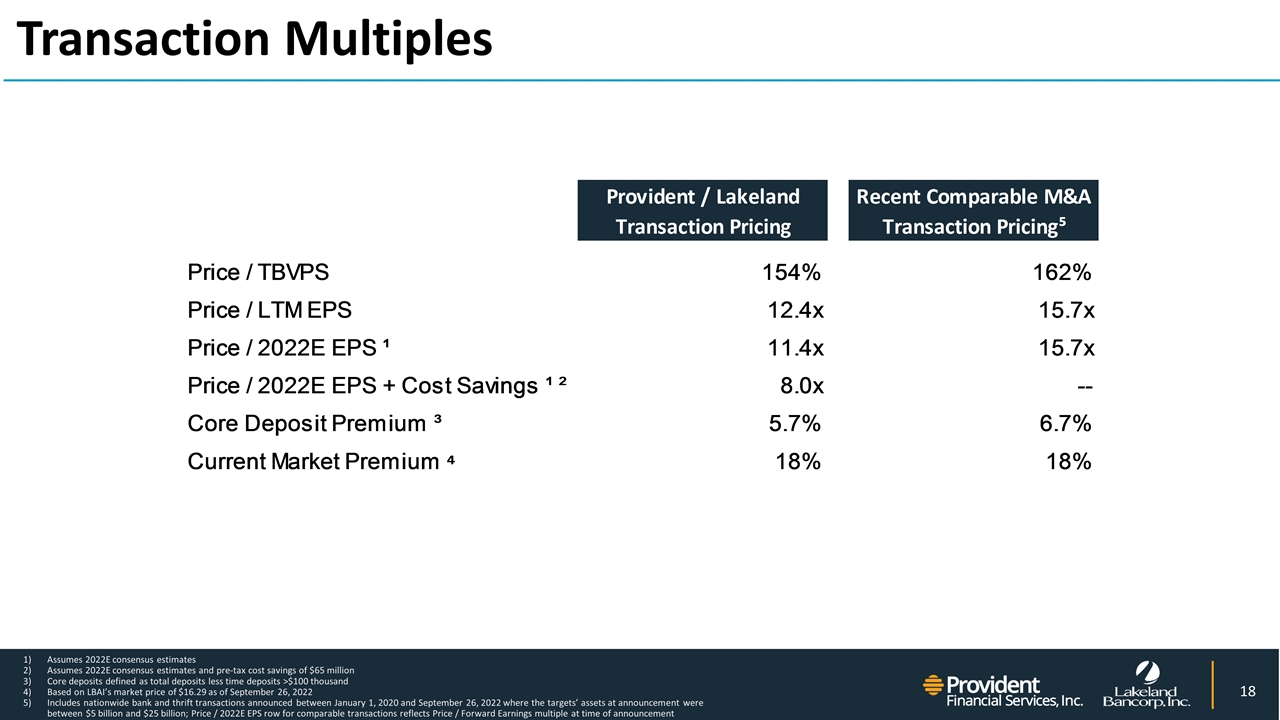

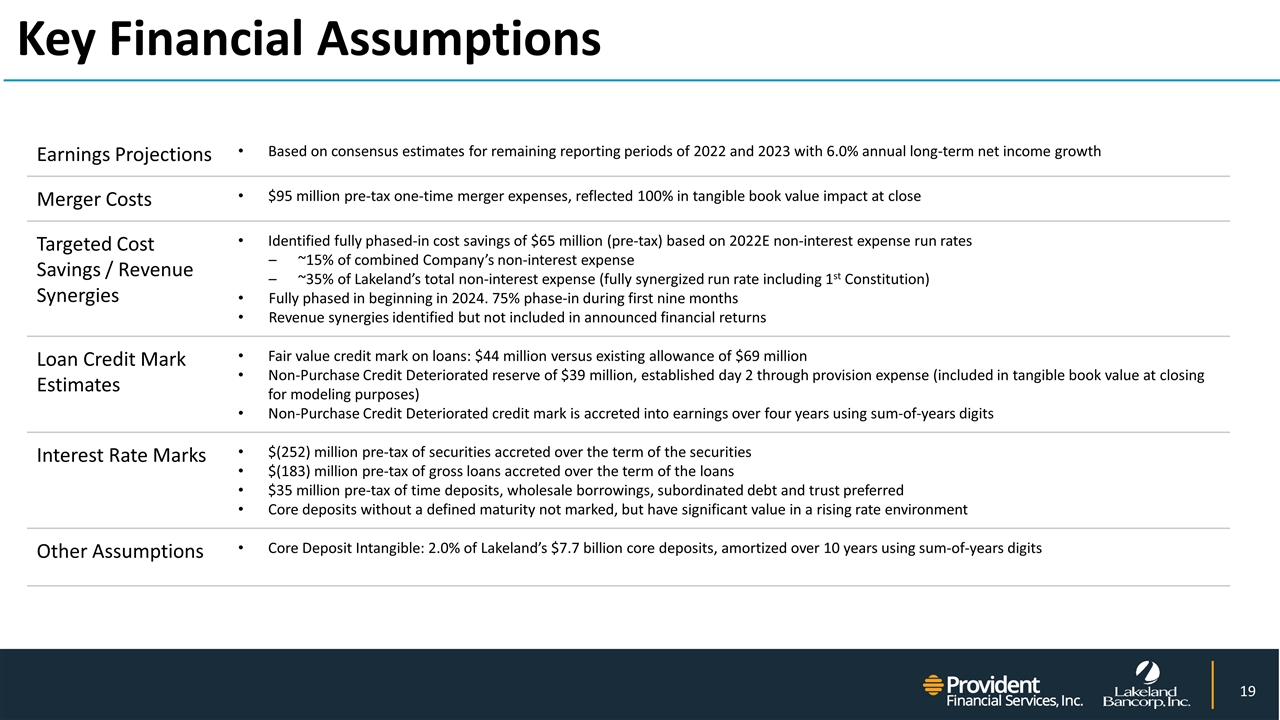

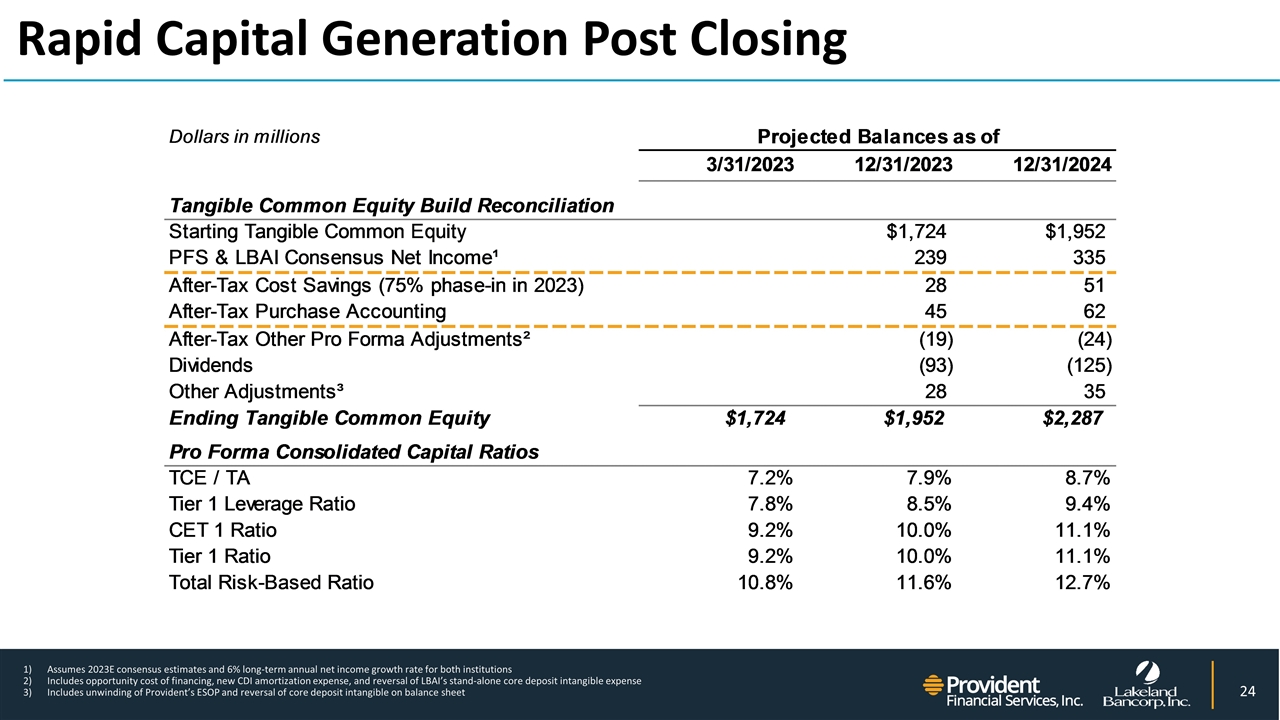

On September 27, 2022, Provident and Lakeland issued a joint press release announcing the execution of the Merger Agreement. A copy of the press release is filed as Exhibit 99.1 hereto and is incorporated herein by reference. In addition, in connection with the announcement of the Merger Agreement, Provident and Lakeland intend to provide supplemental information regarding the proposed transaction in connection with presentations to analysts and investors. A copy of the investor presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit Number |

Description | |

| 2.1 | Agreement and Plan of Merger, dated September 26, 2022, by and among Provident Financial Services, Inc., NL 239 Corp. and Lakeland Bancorp, Inc.* | |

| 99.1 | Joint Press Release, dated September 27, 2022 | |

| 99.2 | Investor Presentation, dated September 27, 2022 | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document). | |

| * | Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule will be furnished to the SEC upon request; provided, however, that the parties may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any document so furnished. |

Forward-Looking Statements

This Current Report on Form 8-K and the exhibits filed herewith include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to Provident’s and Lakeland’s beliefs, goals, intentions, and expectations regarding the proposed transaction, revenues, earnings, earnings per share, loan production, asset quality, and capital levels, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; our ability to achieve our financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies and other anticipated benefits from the proposed transaction; and other statements that are not historical facts.

Forward-looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. These forward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction.

Additionally, forward-looking statements speak only as of the date they are made; Provident and Lakeland do not assume any duty, and do not undertake, to update such forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Furthermore, because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Provident and Lakeland. Such statements are based upon the current beliefs and expectations of the management of Provident and Lakeland and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the Merger Agreement; the outcome of any legal proceedings that may be instituted against Provident or Lakeland; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a

3

timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the ability of Provident and Lakeland to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Provident and Lakeland do business; certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate Lakeland’s operations and those of Provident; such integration may be more difficult, time consuming or costly than expected; revenues following the proposed transaction may be lower than expected; Provident’s and Lakeland’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by Provident’s issuance of additional shares of its capital stock in connection with the proposed transaction; effects of the announcement, pendency or completion of the proposed transaction on the ability of Provident and Lakeland to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; and risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction and other factors that may affect future results of Provident and Lakeland; uncertainty as to the extent of the duration, scope, and impacts of the COVID-19 pandemic on Provident, Lakeland and the proposed transaction; and the other factors discussed in the “Risk Factors” section of each of Provident’s and Lakeland’s Annual Report on Form 10-K for the year ended December 31, 2021, in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of each of Provident’s and Lakeland’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, and other reports Provident and Lakeland file with the SEC.

Additional Information and Where to Find It

In connection with the proposed transaction, Provident will file a registration statement on Form S-4 with the SEC. The registration statement will include a joint proxy statement of Provident and Lakeland, which also constitutes a prospectus of Provident, that will be sent to stockholders of Provident and shareholders of Lakeland seeking certain approvals related to the proposed transaction.

The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SECURITY HOLDERS OF PROVIDENT AND LAKELAND AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PROVIDENT, LAKELAND AND THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain a free copy of the registration statement, including the joint proxy statement/prospectus, as well as other relevant documents filed with the SEC containing information about Provident and Lakeland, without charge, at the SEC’s website (http://www.sec.gov). Copies of documents filed with the SEC by Provident will be made available free of charge in the “SEC Filings” section of Provident’s website, https://investorrelations.provident.bank/, under the heading “SEC Filings.” Copies of documents filed with the SEC by Lakeland will be made available free of charge in the “Investor Relations” section of Lakeland’s website, https://investorrelations.lakelandbank.com/, under the heading “Documents.”

Participants in Solicitation

Provident, Lakeland, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding Provident’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 18, 2022, and certain other documents filed by Provident with the SEC. Information regarding Lakeland’s directors and

4

executive officers is available in its definitive proxy statement, which was filed with the SEC on April 7, 2022, and certain other documents filed by Lakeland with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: September 27, 2022 |

PROVIDENT FINANCIAL SERVICES, INC. | |||||

| By: | /s/ Anthony J. Labozzetta | |||||

| Anthony J. Labozzetta President and Chief Executive Officer | ||||||

Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

by and among

PROVIDENT FINANCIAL SERVICES, INC.,

NL 239 CORP.

and

LAKELAND BANCORP, INC.

Dated as of September 26, 2022

TABLE OF CONTENTS

ARTICLE I

THE MERGER

| 1.1 |

The Merger | 2 | ||||

| 1.2 |

Closing | 2 | ||||

| 1.3 |

Effective Time | 2 | ||||

| 1.4 |

Effects of the Merger | 2 | ||||

| 1.5 |

Conversion of Lakeland Common Stock | 2 | ||||

| 1.6 |

Merger Sub Stock | 3 | ||||

| 1.7 |

Treatment of Lakeland Equity Awards | 3 | ||||

| 1.8 |

Certificate of Incorporation of Interim Surviving Corporation | 4 | ||||

| 1.9 |

Bylaws of Interim Surviving Corporation | 5 | ||||

| 1.10 |

Directors and Officers of Interim Surviving Corporation | 5 | ||||

| 1.11 |

Tax Consequences | 5 | ||||

| 1.12 |

Holdco Merger | 5 | ||||

| 1.13 |

Bank Merger | 6 | ||||

| ARTICLE II

EXCHANGE OF SHARES |

| |||||

| 2.1 |

Provident to Make Merger Consideration Available | 7 | ||||

| 2.2 |

Exchange of Shares | 7 | ||||

| ARTICLE III

REPRESENTATIONS AND WARRANTIES OF LAKELAND |

| |||||

| 3.1 |

Corporate Organization | 10 | ||||

| 3.2 |

Capitalization | 12 | ||||

| 3.3 |

Authority; No Violation | 13 | ||||

| 3.4 |

Consents and Approvals | 14 | ||||

| 3.5 |

Reports | 14 | ||||

| 3.6 |

Financial Statements | 15 | ||||

| 3.7 |

Broker’s Fees | 17 | ||||

| 3.8 |

Absence of Certain Changes or Events | 17 | ||||

| 3.9 |

Legal Proceedings | 17 | ||||

| 3.10 |

Taxes and Tax Returns | 18 | ||||

| 3.11 |

Employees and Employee Benefit Plans | 19 | ||||

| 3.12 |

Compliance with Applicable Law | 22 | ||||

| 3.13 |

Certain Contracts | 24 | ||||

| 3.14 |

Agreements with Regulatory Agencies | 25 | ||||

| 3.15 |

Risk Management Instruments | 25 | ||||

-i-

| 3.16 |

Environmental Matters |

26 | ||||

| 3.17 |

Investment Securities and Commodities |

26 | ||||

| 3.18 |

Real Property |

27 | ||||

| 3.19 |

Intellectual Property |

27 | ||||

| 3.20 |

Related Party Transactions |

28 | ||||

| 3.21 |

State Takeover Laws |

28 | ||||

| 3.22 |

Reorganization |

28 | ||||

| 3.23 |

Opinions |

28 | ||||

| 3.24 |

Lakeland Information |

28 | ||||

| 3.25 |

Loan Portfolio |

29 | ||||

| 3.26 |

Insurance |

30 | ||||

| 3.27 |

Information Security |

30 | ||||

| 3.28 |

Subordinated Indebtedness |

30 | ||||

| 3.29 |

No Investment Advisor Subsidiary; No Broker-Dealer Subsidiary. |

30 | ||||

| ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF PROVIDENT AND MERGER SUB

|

| |||||

| 4.1 |

Corporate Organization |

31 | ||||

| 4.2 |

Capitalization |

32 | ||||

| 4.3 |

Authority; No Violation |

33 | ||||

| 4.4 |

Consents and Approvals |

34 | ||||

| 4.5 |

Reports |

35 | ||||

| 4.6 |

Financial Statements |

36 | ||||

| 4.7 |

Broker’s Fees |

37 | ||||

| 4.8 |

Absence of Certain Changes or Events |

38 | ||||

| 4.9 |

Legal Proceedings |

38 | ||||

| 4.10 |

Taxes and Tax Returns |

38 | ||||

| 4.11 |

Employees and Employee Benefit Plans |

39 | ||||

| 4.12 |

Compliance with Applicable Law |

42 | ||||

| 4.13 |

Certain Contracts |

43 | ||||

| 4.14 |

Agreements with Regulatory Agencies |

45 | ||||

| 4.15 |

Risk Management Instruments |

45 | ||||

| 4.16 |

Environmental Matters |

45 | ||||

| 4.17 |

Investment Securities and Commodities |

46 | ||||

| 4.18 |

Real Property |

46 | ||||

| 4.19 |

Intellectual Property |

46 | ||||

| 4.20 |

Related Party Transactions |

47 | ||||

| 4.21 |

State Takeover Laws |

47 | ||||

| 4.22 |

Reorganization |

47 | ||||

| 4.23 |

Opinions |

47 | ||||

| 4.24 |

Provident Information |

47 | ||||

| 4.25 |

Loan Portfolio |

48 | ||||

| 4.26 |

Insurance |

49 | ||||

| 4.27 |

Information Security |

49 | ||||

-ii-

| ARTICLE V

COVENANTS RELATING TO CONDUCT OF BUSINESS

|

||||||

| 5.1 |

Conduct of Businesses Prior to the Effective Time |

49 | ||||

| 5.2 |

Forbearances |

50 | ||||

| ARTICLE VI

ADDITIONAL AGREEMENTS |

||||||

| 6.1 |

Regulatory Matters |

53 | ||||

| 6.2 |

Access to Information; Confidentiality |

55 | ||||

| 6.3 |

Non-Control |

55 | ||||

| 6.4 |

Shareholders’ Approval and Stockholder Approval |

56 | ||||

| 6.5 |

Legal Conditions to Merger |

57 | ||||

| 6.6 |

Stock Exchange Listing |

58 | ||||

| 6.7 |

Employee Matters |

58 | ||||

| 6.8 |

Indemnification; Directors’ and Officers’ Insurance |

60 | ||||

| 6.9 |

Additional Agreements |

61 | ||||

| 6.10 |

Advice of Changes |

61 | ||||

| 6.11 |

Dividends |

62 | ||||

| 6.12 |

Stockholder or Shareholder Litigation |

62 | ||||

| 6.13 |

Corporate Governance |

62 | ||||

| 6.14 |

Acquisition Proposals |

63 | ||||

| 6.15 |

Public Announcements |

65 | ||||

| 6.16 |

Change of Method |

65 | ||||

| 6.17 |

Restructuring Efforts |

65 | ||||

| 6.18 |

Takeover Statutes |

65 | ||||

| 6.19 |

Treatment of Lakeland Debt |

66 | ||||

| 6.20 |

Exemption from Liability under Section 16(b) |

66 | ||||

| 6.21 |

Specified Order |

66 | ||||

| ARTICLE VII

CONDITIONS PRECEDENT |

||||||

| 7.1 |

Conditions to Each Party’s Obligation to Effect the Merger |

67 | ||||

| 7.2 |

Conditions to Obligations of Provident and Merger Sub |

67 | ||||

| 7.3 |

Conditions to Obligations of Lakeland |

68 | ||||

| ARTICLE VIII

TERMINATION AND AMENDMENT |

||||||

| 8.1 |

Termination |

70 | ||||

| 8.2 |

Effect of Termination |

71 | ||||

-iii-

| ARTICLE IX

GENERAL PROVISIONS |

||||||

| 9.1 |

Nonsurvival of Representations, Warranties and Agreements |

73 | ||||

| 9.2 |

Amendment |

73 | ||||

| 9.3 |

Extension; Waiver |

73 | ||||

| 9.4 |

Expenses |

74 | ||||

| 9.5 |

Notices |

74 | ||||

| 9.6 |

Interpretation |

75 | ||||

| 9.7 |

Counterparts |

76 | ||||

| 9.8 |

Entire Agreement |

76 | ||||

| 9.9 |

Governing Law; Jurisdiction |

76 | ||||

| 9.10 |

Waiver of Jury Trial |

77 | ||||

| 9.11 |

Assignment; Third-Party Beneficiaries |

77 | ||||

| 9.12 |

Specific Performance |

77 | ||||

| 9.13 |

Severability |

78 | ||||

| 9.14 |

Confidential Supervisory Information |

78 | ||||

| 9.15 |

Delivery by Electronic Transmission |

78 | ||||

| 9.16 |

No Other Representations or Warranties |

78 | ||||

| Exhibit A – Form of Provident Bylaw Amendment |

| Exhibit B – Form of Bank Merger Agreement |

-iv-

INDEX OF DEFINED TERMS

| Page | ||||

| Acquisition Proposal |

64 | |||

| affiliate |

75 | |||

| Agreement |

1 | |||

| Bank Merger |

6 | |||

| Bank Merger Agreement |

6 | |||

| Bank Merger Certificates |

6 | |||

| Bank Merger Effective Time |

7 | |||

| BHC Act |

10 | |||

| BOLI |

30 | |||

| Borrower |

29 | |||

| business day |

75 | |||

| CARES Act |

23 | |||

| Certificates of Merger |

2 | |||

| Chosen Courts |

76 | |||

| Closing |

2 | |||

| Closing Date |

2 | |||

| Code |

1 | |||

| Confidentiality Agreement |

55 | |||

| Continuation Period |

58 | |||

| Continuing Employees |

58 | |||

| Controlled Group Liability |

20 | |||

| Delaware Secretary |

2 | |||

| DGCL |

2 | |||

| Effective Time |

2 | |||

| Enforceability Exceptions |

13 | |||

| Environmental Laws |

26 | |||

| ERISA |

19 | |||

| ERISA Affiliate |

21 | |||

| Exchange Act |

16 | |||

| Exchange Agent |

7 | |||

| Exchange Fund |

7 | |||

| Exchange Ratio |

2 | |||

| FDIC |

11 | |||

| Federal Reserve Board |

14 | |||

| GAAP |

10 | |||

| Governmental Entity |

14 | |||

| Holdco Merger |

1 | |||

| Holdco Merger Certificates |

5 | |||

| Holdco Merger Effective Time |

5 | |||

| Intellectual Property |

27 | |||

| Interim Surviving Corporation |

1 | |||

| IRS |

18 | |||

| Joint Proxy Statement |

14 | |||

-v-

| KBW |

17 | |||

| knowledge |

75 | |||

| Lakeland |

1 | |||

| Lakeland 401(k) Plan |

59 | |||

| Lakeland Bank |

6 | |||

| Lakeland Benefit Plans |

19 | |||

| Lakeland Board Recommendation |

56 | |||

| Lakeland Bylaws |

5 | |||

| Lakeland Certificate |

4 | |||

| Lakeland Common Stock |

2 | |||

| Lakeland Contract |

25 | |||

| Lakeland Disclosure Schedule |

9 | |||

| Lakeland Equity Awards |

4 | |||

| Lakeland Indemnified Parties |

60 | |||

| Lakeland Insiders |

66 | |||

| Lakeland Meeting |

56 | |||

| Lakeland Owned Properties |

27 | |||

| Lakeland Preferred Stock |

12 | |||

| Lakeland Qualified Plans |

20 | |||

| Lakeland Real Property |

27 | |||

| Lakeland Regulatory Agreement |

25 | |||

| Lakeland Reports |

15 | |||

| Lakeland Restricted Stock Award |

3 | |||

| Lakeland Restricted Stock Unit Award |

4 | |||

| Lakeland Stock Plans |

4 | |||

| Lakeland Subsidiary |

11 | |||

| Liens |

12 | |||

| Loans |

29 | |||

| Material Adverse Effect |

10 | |||

| Materially Burdensome Regulatory Condition |

54 | |||

| Merger |

1 | |||

| Merger Consideration |

3 | |||

| Merger Sub |

1 | |||

| Merger Sub Bylaws |

31 | |||

| Merger Sub Certificate |

31 | |||

| Merger Sub Common Stock |

3 | |||

| Multiemployer Plan |

20 | |||

| Multiple Employer Plan |

20 | |||

| NASDAQ |

14 | |||

| New Certificates |

7 | |||

| New Jersey DORES |

2 | |||

| NJBCA |

2 | |||

| NJDBI |

14 | |||

| NYSE |

8 | |||

| Old Certificate |

3 | |||

| Pandemic |

11 |

-vi-

| Pandemic Measures |

11 | |||

| PBGC |

20 | |||

| Permitted Encumbrances |

27 | |||

| person |

75 | |||

| Personal Data |

23 | |||

| Piper Sandler |

37 | |||

| Premium Cap |

61 | |||

| Provident |

1 | |||

| Provident 401(k) Plan |

59 | |||

| Provident Bank |

6 | |||

| Provident Benefit Plans |

39 | |||

| Provident Board Recommendation |

56 | |||

| Provident Bylaw Amendment |

6 | |||

| Provident Bylaws |

6 | |||

| Provident Certificate |

6 | |||

| Provident Common Stock |

3 | |||

| Provident Contract |

44 | |||

| Provident Designated Directors |

62 | |||

| Provident Disclosure Schedule |

30 | |||

| Provident Equity Awards |

32 | |||

| Provident ESOP |

32 | |||

| Provident Insiders |

42 | |||

| Provident Meeting |

56 | |||

| Provident Owned Properties |

46 | |||

| Provident Preferred Stock |

32 | |||

| Provident Qualified Plans |

40 | |||

| Provident Real Property |

46 | |||

| Provident Regulatory Agreement |

45 | |||

| Provident Reports |

35 | |||

| Provident Restricted Stock Unit Awards |

32 | |||

| Provident Share Issuance |

14 | |||

| Provident Stock Options |

32 | |||

| Provident Stock Plans |

32 | |||

| Provident Subsidiary |

31 | |||

| Recommendation Change |

56 | |||

| Regulatory Agencies |

14 | |||

| Representatives |

63 | |||

| Requisite Lakeland Vote |

13 | |||

| Requisite Provident Vote |

33 | |||

| Requisite Regulatory Approvals |

54 | |||

| S-4 |

14 | |||

| Sarbanes-Oxley Act |

15 | |||

| SEC |

14 | |||

| Securities Act |

15 | |||

| Security Breach |

23 | |||

| Significant Subsidiaries |

11 |

-vii-

| Specified Order |

25 | |||

| SRO |

14 | |||

| Subsidiary |

11 | |||

| Surviving Bank |

6 | |||

| Surviving Corporation |

1 | |||

| Surviving Entity Plans |

59 | |||

| Takeover Statutes |

28 | |||

| Tax |

19 | |||

| Tax Return |

19 | |||

| Taxes |

19 | |||

| Termination Date |

70 | |||

| Termination Fee |

71 | |||

| Total Borrower Commitment |

29 |

-viii-

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER, dated as of September 26, 2022 (this “Agreement”), by and among Provident Financial Services, Inc., a Delaware corporation (“Provident”), NL 239 Corp., a Delaware corporation and a direct, wholly-owned subsidiary of Provident (“Merger Sub”), and Lakeland Bancorp, Inc., a New Jersey corporation (“Lakeland”).

W I T N E S S E T H:

WHEREAS, the Boards of Directors of Provident, Merger Sub and Lakeland have determined that it is in the best interests of their respective companies and their stockholders and shareholders, as applicable, to consummate the strategic business combination transaction provided for herein, pursuant to which Merger Sub will, subject to the terms and conditions set forth herein, merge with and into Lakeland (the “Merger”), so that Lakeland is the surviving corporation (hereinafter sometimes referred to in such capacity, the “Interim Surviving Corporation”) in the Merger, and, as soon as reasonably practicable following the Merger and as part of a single integrated transaction for purposes of the Internal Revenue Code of 1986, as amended (the “Code”), the Interim Surviving Corporation will, subject to the terms and conditions set forth herein, merge with and into Provident (the “Holdco Merger”), so that Provident is the surviving corporation in the Holdco Merger (hereinafter sometimes referred to in such capacity as the “Surviving Corporation”);

WHEREAS, in furtherance thereof, the respective Boards of Directors of Provident, Merger Sub and Lakeland have approved this Agreement and the transactions contemplated hereby and, in the case of Provident, have resolved to submit the Provident Share Issuance to its stockholders for approval and to recommend that its stockholders approve the Provident Share Issuance and, in the case of Lakeland, have directed that this Agreement be submitted to a vote of its shareholders for approval and have recommended that its shareholders approve this Agreement;

WHEREAS, for federal income tax purposes, it is intended that the Merger and the Holdco Merger, taken together, shall qualify as a “reorganization” within the meaning of Section 368(a) of the Code, and this Agreement is intended to be and is adopted as a plan of reorganization for purposes of Sections 354 and 361 of the Code; and

WHEREAS, the parties desire to make certain representations, warranties and agreements in connection with the transactions contemplated hereby and also to prescribe certain conditions to the transactions contemplated hereby.

NOW, THEREFORE, in consideration of the mutual covenants, representations, warranties and agreements contained herein, and intending to be legally bound hereby, the parties agree as follows:

ARTICLE I

THE MERGER

1.1 The Merger. Subject to the terms and conditions of this Agreement, in accordance with the Delaware General Corporation Law (the “DGCL”) and the New Jersey Business Corporation Act (the “NJBCA”), at the Effective Time, Merger Sub shall merge with and into Lakeland. Lakeland shall be the Interim Surviving Corporation in the Merger, and shall continue its corporate existence under the laws of the State of New Jersey. Upon consummation of the Merger, the separate corporate existence of Merger Sub shall terminate.

1.2 Closing. Subject to the terms and conditions of this Agreement, the closing of the Merger (the “Closing”) will take place (a) by electronic exchange of documents at 10:00 a.m., New York City time, on a date which shall be no later than three (3) business days after all of the conditions set forth in Article VII hereof have been satisfied or waived (other than those conditions that by their nature can only be satisfied at the Closing, but subject to the satisfaction or waiver thereof); provided, however, that if all such conditions are satisfied or waived within the last seven (7) business days of a calendar month, then on the first business day of the succeeding calendar month; or (b) at such other date, time or place as Provident and Lakeland may mutually agree in writing after all of such conditions have been satisfied or waived (other than those conditions that by their nature can only be satisfied at the Closing, but subject to the satisfaction or waiver thereof). The date on which the Closing actually occurs is hereinafter referred to as the “Closing Date”.

1.3 Effective Time. The Merger shall become effective as set forth in the certificate of merger to be filed with the Secretary of State of the State of Delaware (the “Delaware Secretary”) and the certificate of merger to be filed with the New Jersey Department of the Treasury, Division of Revenue and Enterprise Services (the “New Jersey DORES”), respectively, on the Closing Date (the “Certificates of Merger”). The term “Effective Time” shall be the date and time when the Merger becomes effective, as set forth in the Certificates of Merger.

1.4 Effects of the Merger. At and after the Effective Time, the Merger shall have the effects set forth in the applicable provisions of the DGCL, NJBCA and this Agreement.

1.5 Conversion of Lakeland Common Stock. At the Effective Time, by virtue of the Merger and without any action on the part of Provident, Merger Sub, Lakeland or the holder of any securities of Provident or Lakeland:

(a) Subject to Section 2.2(e), each share of the common stock, no par value, of Lakeland (the “Lakeland Common Stock”) issued and outstanding immediately prior to the Effective Time, except for shares of Lakeland Common Stock owned by Lakeland as treasury shares or owned by Lakeland or Provident (in each case other than shares of Lakeland Common Stock (i) held in trust accounts, managed accounts, mutual funds and the like, or otherwise held in a fiduciary or agency capacity that are beneficially owned by third parties or (ii) held, directly or indirectly, by Lakeland or Provident in respect of debts previously contracted), shall be converted into the right to receive 0.8319 of a share (the “Exchange Ratio” and such shares, the “Merger Consideration”) of the common stock, $0.01 par value, of Provident (the “Provident Common Stock”).

-2-

(b) All of the shares of Lakeland Common Stock converted into the right to receive the Merger Consideration pursuant to this Article I shall no longer be outstanding and shall automatically be cancelled and shall cease to exist as of the Effective Time, and each certificate (each, an “Old Certificate,” it being understood that any reference herein to an “Old Certificate” shall be deemed to include reference to book-entry account statements relating to the ownership of shares of Lakeland Common Stock) previously representing any such shares of Lakeland Common Stock shall thereafter represent only the right to receive (i) a New Certificate representing the number of whole shares of Provident Common Stock which such shares of Lakeland Common Stock have been converted into the right to receive, (ii) cash in lieu of fractional shares which the shares of Lakeland Common Stock represented by such Old Certificate have been converted into the right to receive pursuant to this Section 1.5 and Section 2.2(e), without any interest thereon, and (iii) any dividends or distributions which the holder thereof has the right to receive pursuant to Section 2.2, without any interest thereon. If, prior to the Effective Time, the outstanding shares of Provident Common Stock or Lakeland Common Stock shall have been increased, decreased, changed into or exchanged for a different number or kind of shares or securities as a result of a reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split, or other similar change in capitalization, or there shall be any extraordinary dividend or distribution, an appropriate and proportionate adjustment shall be made to the Exchange Ratio to give Provident and the holders of Lakeland Common Stock the same economic effect as contemplated by this Agreement prior to such event; provided, that nothing contained in this sentence shall be construed to permit Lakeland or Provident to take any action with respect to its securities or otherwise that is prohibited by the terms of this Agreement.

(c) Notwithstanding anything in this Agreement to the contrary, at the Effective Time, all shares of Lakeland Common Stock owned by Lakeland as treasury shares or owned by Lakeland or Provident (in each case other than shares of Lakeland Common Stock (i) held in trust accounts, managed accounts, mutual funds and the like, or otherwise held in a fiduciary or agency capacity that are beneficially owned by third parties or (ii) held, directly or indirectly, by Lakeland or Provident in respect of debts previously contracted) shall be cancelled and shall cease to exist and no Provident Common Stock or other consideration shall be delivered in exchange therefor.

1.6 Merger Sub Stock. At and after the Effective Time, each share of common stock of Merger Sub, par value $0.01 per share (“Merger Sub Common Stock”), issued and outstanding immediately prior to the Effective Time shall at the Effective Time be converted into and become one share of common stock, no par value, of the Interim Surviving Corporation.

1.7 Treatment of Lakeland Equity Awards

-3-

(a) Except as otherwise agreed between Lakeland and Provident, at the Effective Time, all outstanding restricted stock awards in respect of a share of Lakeland Common Stock under the Lakeland Stock Plans (each, a “Lakeland Restricted Stock Award”) granted prior to the date hereof shall, automatically and without any required action on the part of the holder thereof, accelerate in full and fully vest and shall be converted into, and become exchanged for the Merger Consideration within five (5) business days after the Effective Time (less applicable Taxes required to be withheld, if any, with respect to such vesting in accordance with Section 2.2(g)); provided, that if such time frame is not operationally feasible, each Lakeland Restricted Stock Unit Award shall be cancelled and converted into the right to receive the Merger Consideration as soon as reasonably practicable after the Effective Time.

(b) Except as otherwise agreed between Lakeland and Provident, at the Effective Time, (i) any vesting conditions applicable to each outstanding time or performance-based restricted stock unit award in respect of a share of Lakeland Common Stock granted under the Lakeland Stock Plans (a “Lakeland Restricted Stock Unit Award”), shall, automatically and without any required action on the part of the holder thereof, accelerate in full and fully vest, with any applicable performance-based vesting condition to be deemed achieved at “target level” (as defined in the applicable Lakeland Stock Plans), and (ii) each Lakeland Restricted Stock Unit Award shall, automatically and without any required action on the part of the holder thereof, be cancelled and converted into the right to receive the Merger Consideration (less applicable Taxes required to be withheld, if any, with respect to such vesting in accordance with Section 2.2(g)) within five (5) business days after the Effective Time; provided, that if such time frame is not operationally feasible, each Lakeland Restricted Stock Unit Award shall be cancelled and converted into the right to receive the Merger Consideration as soon as reasonably practicable after the Effective Time.

(c) At or prior to the Effective Time, Lakeland, the Board of Directors of Lakeland or the compensation committee of the Board of Directors of Lakeland, as applicable, shall adopt any resolutions and take any actions that are necessary to (i) effectuate the treatment of the Lakeland Equity Awards consistent with the provisions of this Section 1.7 and (ii) cause the Lakeland Stock Plans to terminate at or prior to the Effective Time. Lakeland shall take all actions necessary to ensure that from and after the Effective Time, Provident will not be required to deliver shares of Lakeland Common Stock or other capital stock of Lakeland to any person pursuant to or in settlement of Lakeland Equity Awards.

(d) For purposes of this Agreement, the following terms shall have the following meanings:

(i) “Lakeland Equity Awards” means the Lakeland Restricted Stock Awards and the Lakeland Restricted Stock Unit Awards.

(ii) “Lakeland Stock Plans” means the Lakeland 2018 Omnibus Equity Incentive Plan and the Lakeland 2009 Equity Program.

1.8 Certificate of Incorporation of Interim Surviving Corporation. At the Effective Time, the Restated Certificate of Incorporation of Lakeland (the “Lakeland Certificate”), as in effect immediately prior to the Effective Time, shall be the Certificate of Incorporation of the Interim Surviving Corporation until thereafter amended in accordance with applicable law.

-4-

1.9 Bylaws of Interim Surviving Corporation. At the Effective Time, the Amended and Restated Bylaws of Lakeland (the “Lakeland Bylaws”), as in effect immediately prior to the Effective Time, shall be the Bylaws of the Interim Surviving Corporation until thereafter amended in accordance with applicable law.

1.10 Directors and Officers of Interim Surviving Corporation. At the Effective Time, the directors and officers of Merger Sub as of immediately prior to the Effective Time shall, at and after the Effective Time, be the directors and officers, respectively, of the Interim Surviving Corporation, such individuals to serve in such capacities until such time as their respective successors shall have been duly elected or appointed and qualified or until their respective earlier death, resignation or removal from office.

1.11 Tax Consequences. It is intended that the Merger and the Holdco Merger, taken together, shall be treated as an integrated transaction described in Revenue Ruling 2001-46, 2001-2 C.B. 321, and shall qualify as a “reorganization” within the meaning of Section 368(a) of the Code, and that this Agreement is intended to be and is adopted as a plan of reorganization for the purposes of Sections 354 and 361 of the Code.

1.12 Holdco Merger.

(a) General. As soon as reasonably practicable following the Merger and as part of a single integrated transaction for U.S. federal income tax purposes, Provident shall cause the Interim Surviving Corporation to be, and the Interim Surviving Corporation shall be, merged with and into Provident in accordance with the DGCL and the NJBCA. Provident shall be the Surviving Corporation in the Holdco Merger, and shall continue its corporate existence under the laws of the State of Delaware. Upon consummation of the Holdco Merger, the separate corporate existence of the Interim Surviving Corporation shall terminate. Provident and the Interim Surviving Corporation shall enter into a separate agreement and plan of merger to effect the Holdco Merger immediately after the Effective Time.

(b) Holdco Merger Effective Time. Provident and the Interim Surviving Corporation shall cause to be filed a certificate of merger with the Delaware Secretary and a certificate of merger with the New Jersey DORES with respect to the Holdco Merger (together, the “Holdco Merger Certificates”). The Holdco Merger shall become effective at such date and time as specified in the Holdco Merger Certificates in accordance with the relevant provisions of the DGCL and the NJBCA, as applicable, or at such other date and time as shall be provided by applicable law (such date and time hereinafter referred to as the “Holdco Merger Effective Time”).

(c) Effects of the Holdco Merger. At and after the Holdco Merger Effective Time, the Holdco Merger shall have the effects set forth in the applicable provisions of the DGCL, NJBCA and this Agreement.

(d) Cancellation of Interim Surviving Corporation Stock. Each share of common stock, no par value, of the Interim Surviving Corporation, as well as each share of any other class or series of capital stock of the Interim Surviving Corporation, in each case that is issued and outstanding immediately prior to the Holdco Merger Effective Time, shall, at the Holdco Merger Effective Time, solely by virtue and as a result of the Holdco Merger and without any action on the part of any holder thereof, automatically be cancelled and retired for no consideration and shall cease to exist.

-5-

(e) Provident Stock. At and after the Holdco Merger Effective Time, each share of Provident Common Stock issued and outstanding immediately prior to the Holdco Merger Effective Time shall remain an issued and outstanding share of Provident Common Stock and shall not be affected by the Holdco Merger.

(f) Certificate of Incorporation of Surviving Corporation. At the Holdco Merger Effective Time, the Certificate of Incorporation of Provident (the “Provident Certificate”), as in effect immediately prior to the Holdco Merger Effective Time, shall be the certificate of incorporation of the Surviving Corporation until thereafter amended in accordance with its terms and applicable law.

(g) Bylaws of Surviving Corporation. At the Holdco Merger Effective Time, the Amended and Restated Bylaws of Provident (the “Provident Bylaws”) as in effect immediately prior to the Holdco Merger Effective Time (including as amended as set forth in Exhibit A) (such amendment, the “Provident Bylaw Amendment”), shall be the bylaws of the Surviving Corporation until thereafter amended in accordance with their terms and applicable law.

(h) Directors and Officers of the Surviving Corporation. Subject to Section 6.13, at the Holdco Merger Effective Time, the directors and officers of Provident as of immediately prior to the Holdco Merger Effective Time shall, at and after the Holdco Merger Effective Time, be the directors and officers, respectively, of the Surviving Corporation, such individuals to serve in such capacities until such time as their respective successors shall have been duly elected or appointed and qualified or until their respective earlier death, resignation or removal from office.

1.13 Bank Merger. At a date and time following the Holdco Merger as determined by Provident, Lakeland Bank (“Lakeland Bank”), a New Jersey state-chartered commercial bank and a wholly-owned Subsidiary of Lakeland, will merge (the “Bank Merger”) with and into Provident Bank, a New Jersey state-chartered savings bank and a wholly-owned Subsidiary of Provident (“Provident Bank”). Provident Bank shall be the surviving entity in the Bank Merger (the “Surviving Bank”) and, following the Bank Merger, the separate corporate existence of Lakeland Bank shall cease. As soon as practical after the date of this Agreement, or on such later date as Provident and Lakeland may mutually agree, Provident and Lakeland shall cause Provident Bank and Lakeland Bank, respectively, to enter into an agreement and plan of merger in substantially the form set forth in Exhibit B (the “Bank Merger Agreement”). Each of Provident and Lakeland shall approve the Bank Merger Agreement and the Bank Merger as the sole stockholder of Provident Bank and Lakeland Bank, respectively, and Provident and Lakeland shall, and shall cause Provident Bank and Lakeland Bank, respectively, to execute certificates or articles of merger and such other documents and certificates as are necessary to make the Bank Merger effective (“Bank Merger Certificates”) at the Bank Merger Effective Time. The Bank Merger shall become effective promptly following the Holdco Merger Effective Time or at such date and time as specified in the Bank Merger Agreement in accordance with applicable law (such date and time hereinafter referred to as the “Bank Merger Effective Time”).

-6-

ARTICLE II

EXCHANGE OF SHARES

2.1 Provident to Make Merger Consideration Available. At or prior to the Effective Time, Provident shall deposit, or shall cause to be deposited, with an exchange agent designated by Provident and acceptable to Lakeland (the “Exchange Agent”), for the benefit of the holders of Old Certificates, for exchange in accordance with this Article II, (a) certificates or, at Provident’s option, evidence of shares in book-entry form (collectively, referred to herein as “New Certificates”), representing the shares of Provident Common Stock to be issued to holders of Lakeland Common Stock and (b) cash in lieu of any fractional shares (such cash and New Certificates, together with any dividends or distributions with respect thereto, being hereinafter referred to as the “Exchange Fund”), to be issued pursuant to Section 1.5 and paid pursuant to Section 2.2(a).

2.2 Exchange of Shares.

(a) As promptly as practicable after the Effective Time, but in no event later than five (5) business days thereafter, Provident and Lakeland shall cause the Exchange Agent to mail to each holder of record of one or more Old Certificates representing shares of Lakeland Common Stock immediately prior to the Effective Time that have been converted at the Effective Time into the right to receive the Merger Consideration pursuant to Article I, a letter of transmittal (which shall specify that delivery shall be effected, and risk of loss and title to the Old Certificates shall pass, only upon proper delivery of the Old Certificates to the Exchange Agent) and instructions for use in effecting the surrender of the Old Certificates in exchange for New Certificates representing the number of whole shares of Provident Common Stock and any cash in lieu of fractional shares which the shares of Lakeland Common Stock represented by such Old Certificate or Old Certificates shall have been converted into the right to receive pursuant to this Agreement as well as any dividends or distributions to be paid pursuant to Section 2.2(b). Upon proper surrender of an Old Certificate or Old Certificates for exchange and cancellation to the Exchange Agent, together with such properly completed letter of transmittal, duly executed, the holder of such Old Certificate or Old Certificates shall be entitled to receive in exchange therefor, as applicable, (i) a New Certificate representing that number of whole shares of Provident Common Stock to which such holder of Lakeland Common Stock shall have become entitled pursuant to the provisions of Article I and (ii) a check representing the amount of (A) any cash in lieu of fractional shares which such holder has the right to receive in respect of the Old Certificate or Old Certificates surrendered pursuant to the provisions of this Article II and (B) any dividends or distributions which the holder thereof has the right to receive pursuant to Section 2.2(b), and the Old Certificate or Old Certificates so surrendered shall forthwith be cancelled. No interest will be paid or accrued on any cash in lieu of fractional shares or dividends or distributions payable to holders of Old Certificates. Until surrendered as contemplated by this Section 2.2, each Old Certificate shall be deemed at any time after the Effective Time to represent only the right to receive, upon surrender, the number of whole shares of Provident Common Stock which the shares of Lakeland Common Stock represented by such Old Certificate have been converted into the right to receive and any cash in lieu of fractional shares or in respect of dividends or distributions as contemplated by this Section 2.2.

-7-

(b) No dividends or other distributions declared with respect to Provident Common Stock shall be paid to the holder of any unsurrendered Old Certificate until the holder thereof shall surrender such Old Certificate in accordance with this Article II. After the surrender of an Old Certificate in accordance with this Article II, the record holder thereof shall be entitled to receive any such dividends or other distributions, without any interest thereon, which theretofore had become payable with respect to the whole shares of Provident Common Stock which the shares of Lakeland Common Stock represented by such Old Certificate have been converted into the right to receive.

(c) If any New Certificate representing shares of Provident Common Stock is to be issued in a name other than that in which the Old Certificate or Old Certificates surrendered in exchange therefor is or are registered, it shall be a condition of the issuance thereof that the Old Certificate or Old Certificates so surrendered shall be properly endorsed (or accompanied by an appropriate instrument of transfer) and otherwise in proper form for transfer, and that the person requesting such exchange shall pay to the Exchange Agent in advance any transfer or other similar Taxes required by reason of the issuance of a New Certificate representing shares of Provident Common Stock in any name other than that of the registered holder of the Old Certificate or Old Certificates surrendered, or required for any other reason, or shall establish to the satisfaction of the Exchange Agent that such Tax has been paid or is not payable.

(d) After the Effective Time, there shall be no transfers on the stock transfer books of Lakeland of the shares of Lakeland Common Stock that were issued and outstanding immediately prior to the Effective Time. If, after the Effective Time, Old Certificates representing such shares are presented for transfer to the Exchange Agent, they shall be cancelled and exchanged for New Certificates representing shares of Provident Common Stock, cash in lieu of fractional shares and dividends or distributions as provided in this Article II.

(e) Notwithstanding anything to the contrary contained herein, no New Certificates or scrip representing fractional shares of Provident Common Stock shall be issued upon the surrender for exchange of Old Certificates, no dividend or distribution with respect to Provident Common Stock shall be payable on or with respect to any fractional share, and such fractional share interests shall not entitle the owner thereof to vote or to any other rights of a stockholder of Provident. In lieu of the issuance of any such fractional share, Provident shall pay to each former holder of Lakeland Common Stock who otherwise would be entitled to receive such fractional share an amount in cash (rounded to the nearest cent) determined by multiplying (i) the average of the closing-sale prices of Provident Common Stock on the New York Stock Exchange (the “NYSE”) as reported by The Wall Street Journal for the consecutive period of five (5) full trading days ending on the day preceding the Closing Date by (ii) the fraction of a share (after taking into account all shares of Lakeland Common Stock held by such holder immediately prior to the Effective Time and rounded to the nearest thousandth when expressed in decimal form) of Provident Common Stock which such holder would otherwise be entitled to receive pursuant to Section 1.5. The parties acknowledge that payment of such cash consideration in lieu of issuing fractional shares is not separately bargained-for consideration, but merely represents a mechanical rounding off for purposes of avoiding the expense and inconvenience that would otherwise be caused by the issuance of fractional shares.

-8-

(f) Any portion of the Exchange Fund that remains unclaimed by the holders of Lakeland Common Stock for twelve (12) months after the Effective Time shall be paid to the Surviving Corporation. Any former holders of Lakeland Common Stock who have not theretofore complied with this Article II shall thereafter look only to the Surviving Corporation for payment of the shares of Provident Common Stock, cash in lieu of any fractional shares and any unpaid dividends and distributions on the Provident Common Stock deliverable in respect of each former share of Lakeland Common Stock that such holder holds as determined pursuant to this Agreement, in each case, without any interest thereon. Notwithstanding the foregoing, none of Provident, Lakeland, the Surviving Corporation, the Exchange Agent or any other person shall be liable to any former holder of shares of Lakeland Common Stock for any amount delivered in good faith to a public official pursuant to applicable abandoned property, escheat or similar laws.

(g) Provident shall be entitled to deduct and withhold, or cause the Exchange Agent to deduct and withhold, from any cash in lieu of fractional shares of Provident Common Stock, any dividends or distributions payable pursuant to this Section 2.2 or any other consideration otherwise payable pursuant to this Agreement to any holder of Lakeland Common Stock or Lakeland Equity Awards such amounts as it is required to deduct and withhold with respect to the making of such payment under the Code or any provision of Tax law. To the extent that amounts are so withheld by Provident or the Exchange Agent, as the case may be, and paid over to the appropriate Governmental Entity, the withheld amounts shall be treated for all purposes of this Agreement as having been paid to the holder of Lakeland Common Stock or Lakeland Equity Awards in respect of which the deduction and withholding was made by Provident or the Exchange Agent, as the case may be.

(h) In the event any Old Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the person claiming such Certificate to be lost, stolen or destroyed and, if required by Provident or the Exchange Agent, the posting by such person of a bond in such amount as Provident or the Exchange Agent may determine is reasonably necessary as indemnity against any claim that may be made against it with respect to such Certificate, the Exchange Agent will issue in exchange for such lost, stolen or destroyed Certificate the shares of Provident Common Stock and any cash in lieu of fractional shares, and dividends of distributions, deliverable in respect thereof pursuant to this Agreement.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF LAKELAND

Except (a) as disclosed in the disclosure schedule delivered by Lakeland to Provident concurrently herewith (the “Lakeland Disclosure Schedule”); provided, that (i) no such item is required to be set forth as an exception to a representation or warranty if its absence would not result in the related representation or warranty being deemed untrue or incorrect, (ii) the mere inclusion of an item in the Lakeland Disclosure Schedule as an exception to a representation or warranty shall not be deemed an admission by Lakeland that such item represents a material exception or fact, event or circumstance or that such item would reasonably be expected to result

-9-

in a Material Adverse Effect, and (iii) any disclosures made with respect to a section of this Article III shall be deemed to qualify (1) any other section of this Article III specifically referenced or cross-referenced and (2) other sections of this Article III to the extent it is reasonably apparent on its face (notwithstanding the absence of a specific cross-reference) from a reading of the disclosure that such disclosure applies to such other sections or (b) as disclosed in any Lakeland Reports filed by Lakeland after January 1, 2021 and prior to the date hereof (but disregarding risk factor disclosures contained under the heading “Risk Factors,” or disclosures of risks set forth in any “forward-looking statements” disclaimer or any other statements that are similarly nonspecific or cautionary, predictive or forward-looking in nature), Lakeland hereby represents and warrants to Provident and Merger Sub as follows:

3.1 Corporate Organization.

(a) Lakeland is a corporation duly organized, validly existing and in good standing under the laws of the State of New Jersey and is a bank holding company duly registered under the Bank Holding Company Act of 1956, as amended (the “BHC Act”) that has elected to be treated as a financial holding company under the BHC Act. Lakeland has the corporate power and authority to own or lease all of its properties and assets and to carry on its business as it is now being conducted. Lakeland is duly licensed or qualified to do business and in good standing in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned or leased by it makes such licensing, qualification or standing necessary, except where the failure to be so licensed or qualified or to be in good standing would not, either individually or in the aggregate, reasonably be expected to have a Material Adverse Effect on Lakeland. As used in this Agreement, “Material Adverse Effect” means, with respect to Provident, Lakeland or the Surviving Corporation, as the case may be, any effect, change, event, circumstance, condition, occurrence or development that, either individually or in the aggregate, has had or would reasonably be expected to have a material adverse effect on (i) the business, properties, assets, liabilities, results of operations or financial condition of such party and its Subsidiaries taken as a whole (provided, that, with respect to this clause (i), Material Adverse Effect shall not be deemed to include the impact of (A) changes, after the date hereof, in U.S. generally accepted accounting principles (“GAAP”) or applicable regulatory accounting requirements, (B) changes, after the date hereof, in laws, rules or regulations (including the Pandemic Measures) of general applicability to companies in the industries in which such party and its Subsidiaries operate, or interpretations thereof by courts or Governmental Entities, (C) changes, after the date hereof, in global, national or regional political conditions (including the outbreak of war or acts of terrorism) or in economic or market (including equity, credit and debt markets, as well as changes in interest rates) conditions affecting the financial services industry generally and not specifically relating to such party or its Subsidiaries (including any such changes arising out of the Pandemic or any Pandemic Measures), (D) changes, after the date hereof, resulting from hurricanes, earthquakes, tornados, floods or other natural disasters or from any outbreak of any disease or other public health event (including the Pandemic), (E) public disclosure of the execution of this Agreement, public disclosure or consummation of the transactions contemplated hereby (including any effect on a party’s relationships with its customers or employees) (it being understood and agreed that the foregoing in this subclause (E) shall not apply for purposes of the representations and warranties in Sections 3.3(b), 3.4, 3.11(j), 4.3(b), 4.4 or 4.11(j)) or actions expressly required by this Agreement or that are taken with the prior written consent of the other party in contemplation of

-10-

the transactions contemplated hereby, (F) a decline in the trading price of a party’s common stock or the failure, in and of itself, to meet earnings projections or internal financial forecasts (it being understood that the underlying causes of such decline or failure may be taken into account in determining whether a Material Adverse Effect has occurred, except to the extent otherwise excepted by this proviso) or (G) the expenses incurred by Lakeland or Provident in negotiating, documenting, effecting and consummating the transactions contemplated by this Agreement; except, with respect to subclauses (A), (B), (C) or (D) to the extent that the effects of such change are materially disproportionately adverse to the business, properties, assets, liabilities, results of operations or financial condition of such party and its Subsidiaries, taken as a whole, as compared to other companies in the industry in which such party and its Subsidiaries operate) or (ii) the ability of such party to timely consummate the transactions contemplated hereby. As used in this Agreement, “Pandemic” means any outbreaks, epidemics or pandemics relating to SARS-CoV-2 or Covid-19, or any variants, evolutions or mutations thereof, or any other viruses (including influenza), and the governmental and other responses thereto; “Pandemic Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shutdown, closure, sequester or other laws, directives, policies, guidelines or recommendations promulgated by any Governmental Entity, including the Centers for Disease Control and Prevention and the World Health Organization, in each case, in connection with or in response to a Pandemic; “Subsidiary,” when used with respect to any person, means any subsidiary of such person within the meaning ascribed to such term in either Rule 1-02 of Regulation S-X promulgated by the SEC or the BHC Act; and “Significant Subsidiaries” shall have the meaning ascribed to it in Rule 1-02 of Regulation S-X promulgated under the Exchange Act. True and complete copies of the Lakeland Certificate and the Lakeland Bylaws, as in effect as of the date of this Agreement, have previously been made available by Lakeland to Provident.

(b) Each Subsidiary of Lakeland (a “Lakeland Subsidiary”) (i) is duly organized and validly existing under the laws of its jurisdiction of organization, (ii) is duly qualified to do business and, where such concept is recognized under applicable law, in good standing in all jurisdictions (whether federal, state, local or foreign) where its ownership or leasing of property or the conduct of its business requires it to be so qualified and in which the failure to be so qualified would reasonably be expected to have a Material Adverse Effect on Lakeland and (iii) has all requisite corporate power and authority to own or lease its properties and assets and to carry on its business as now conducted. There are no restrictions on the ability of any Subsidiary of Lakeland to pay dividends or distributions except, in the case of a Subsidiary that is a regulated entity, for restrictions on dividends or distributions generally applicable to all such regulated entities. The deposit accounts of each Subsidiary of Lakeland that is an insured depository institution are insured by the Federal Deposit Insurance Corporation (the “FDIC”) through the Deposit Insurance Fund to the fullest extent permitted by law, all premiums and assessments required to be paid in connection therewith have been paid when due, and no proceedings for the termination of such insurance are pending or threatened. There are no Subsidiaries of Lakeland other than Lakeland Bank that have or are required to have deposit insurance. Section 3.1(b) of the Lakeland Disclosure Schedule sets forth a true and complete list of all Subsidiaries of Lakeland as of the date hereof. True and complete copies of the organizational documents of each Lakeland Subsidiary as in effect as of the date of this Agreement have previously been made available by Lakeland to Provident. There is no person whose results of operations, cash flows, changes in stockholders’ equity or financial position are consolidated in the financial statements of Lakeland other than the Lakeland Subsidiaries.

-11-

3.2 Capitalization.