Form 425 ION Acquisition Corp 2 Filed by: ION Acquisition Corp 2 Ltd.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 24, 2021

ION ACQUISITION CORP 2 LTD.

(Exact name of registrant as specified in its charter)

| Cayman Islands | 333-252440 | N/A | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

89 Medinat Hayehudim Street

Herzliya 4676672, Israel

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: +972 (9) 970-3620

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one Class A ordinary share, par value $0.0001 per share, and one-eighth of one redeemable warrant | IACB.U | The New York Stock Exchange | ||

| Class A ordinary shares, par value $0.0001 per share | IACB | The New York Stock Exchange | ||

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 | IACB WS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into Material Definitive Agreements.

Merger Agreement

On June 24, 2021, ION Acquisition Corp 2 Ltd., a Cayman Islands exempted company (“ION”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Inspire Merger Sub 1, Inc., a Delaware corporation and a direct, wholly owned subsidiary of ION (“Merger Sub 1”), Inspire Merger Sub 2, LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of ION (“Merger Sub 2” and, together with Merger Sub 1, the “Merger Subs”), and Innovid, Inc., a Delaware corporation (“Innovid”).

Pursuant to the Merger Agreement and subject to the terms and conditions set forth therein, ION will migrate to and domesticate as a Delaware corporation (the “Domestication”) prior to the consummation of the Mergers (as defined below) (the “Closing”), and Merger Sub 1 will merge with and into Innovid (the “First Merger” and, the effective time of such First Merger, the “First Effective Time”), with Innovid continuing as the surviving company of the First Merger (the “Surviving Corporation”). The Surviving Corporation will then merge with and into Merger Sub 2 (the “Second Merger” and, together with the First Merger, the “Mergers”; the effective time of such Second Merger, the “Second Effective Time”), with Merger Sub 2 continuing as the surviving entity of the Second Merger (the “Surviving Entity”), and ION will change its name to “Innovid Corp.” (the “Company”). As a result of the Merger and the other transactions contemplated by the Merger Agreement (the “Transactions” or the “Business Combination”), the Surviving Entity will remain a direct, wholly-owned subsidiary of the Company. The Merger Agreement and the Transactions have been approved by the board of directors of each of ION and Innovid.

Pursuant to the Merger Agreement, immediately prior to the Domestication, each issued and outstanding Class B ordinary share, par value $0.0001 per share, of ION (“ION Class B Shares”) will be automatically converted, on a one-for-one basis, into one (1) Class A ordinary share, par value $0.0001 per share, of ION (“ION Class A Shares”) in accordance with the terms of ION’s organizational documents. Immediately following such conversion, upon the Domestication, (i) each then issued and outstanding ION Class A Share will automatically be converted, on a one-for-one basis, into a share of common stock of ION (after the Domestication) (“ION Domesticated Common Stock”), (ii) each issued and outstanding warrant to purchase one (1) ION Class A Share at a price of $11.50 per share (“ION Warrants”) will automatically be converted into one corresponding warrant to acquire one (1) share of ION Domesticated Common Stock (“ION Domesticated Warrant”) and (iii) each then issued and outstanding unit representing one (1) ION Class A Share and one-eighth (1/8) of an ION Warrant will be automatically converted into one (1) unit of ION (after the Domestication) representing one (1) ION Domesticated Common Stock and one-eighth (1/8) of an ION Domesticated Warrant. No fractional Ion Domesticated Warrants will be issued in connection with such conversion such that if a holder of such units would be entitled to receive a fractional Domesticated Acquiror Warrant, the number of Domesticated Acquiror Warrants to be issued to such holder upon such conversion will be rounded down to the nearest whole number of Domesticated Acquiror Warrants.

The Transactions are targeted to be consummated in the fourth quarter of 2021, after receipt of the required approval by the shareholders of ION (the “ION Shareholder Approval”)the required approval by the stockholders of Innovid (the “Innovid Stockholder Approval”) and the fulfillment of certain other terms and conditions set forth in the Merger Agreement.

Representations and Warranties

The Merger Agreement contains representations and warranties of Innovid and its subsidiaries relating to, among other things, proper organization and qualification; subsidiaries; capitalization; due authorization, performance and enforceability against Innovid of the Merger Agreement and the requisite shareholder approval; absence of conflicts; governmental consents and filings; compliance with laws and possession of requisite governmental permits, approvals and orders; financial statements; absence of undisclosed liabilities; absence of certain changes; litigation and proceedings; company benefit plans; labor matters; real and tangible property; tax matters; environmental matters; broker’s fees; intellectual property and informational technology security; privacy and data security; material contracts; broker’s fees; insurance; related party transactions; TID U.S. Business status; international trade and anti-corruption; top customers and top suppliers; and government loans.

The Merger Agreement contains representations and warranties of ION and its subsidiaries, including each of the Merger Subs, relating to, among other things, proper organization and qualification; capitalization; due authorization; performance and enforceability against ION of the Merger Agreement; absence of conflicts; required consents and filings; compliance with laws and possession of requisite governmental permits, approvals and orders; reports filed with the Securities and Exchange Commission (“SEC”), financial statements, and compliance with the Sarbanes-Oxley Act; litigation and proceedings; business activities; New York Stock Exchange (“NYSE”) listing; absence of undisclosed liabilities; trust account; tax matters; board approval and the requisite shareholder approval; related party transactions; absence of certain changes; status under the Investment Company Act of 1940, as amended, and the Jumpstart Our Business Startups Act of 2012; broker’s fees and the PIPE Investment (as defined below).

1

Covenants

The Merger Agreement includes customary covenants of the parties with respect to efforts to satisfy conditions to the consummation of the Transactions and for Innovid to conduct its business in the ordinary course through the Closing subject to certain restrictions, including to prevent leakage. The Merger Agreement also contains additional covenants of the parties, including, among others, (i) a covenant providing for ION and Innovid to cooperate in the preparation of the Registration Statement on Form S-4 required to be prepared in connection with the Merger (the “Registration Statement”), (ii) covenants requiring ION to duly call and give notice of, convene and hold a meeting of its shareholders, as promptly as reasonably practicable following the date that the Registration Statement is declared effective by the SEC under the Securities Act of 1933, as amended (the “Securities Act” and, such effective date, the “Registration Statement Effective Date”), and in any event, within thirty (30) Business Days after the Registration Statement Effective Date, (iii) covenants requiring the board of directors of ION to recommend to the shareholders of ION the adoption and approval of the ION transaction proposals contemplated by the Merger Agreement; (iv) covenants requiring the board of directors of the Company to recommend to the shareholders of the Company the adoption and approval of the ION transaction proposals contemplated by the Merger Agreement; and (v) covenants prohibiting ION and Innovid from, among other things, directly or indirectly, soliciting, initiating, entering into or continuing discussions, negotiations or transactions with, or encouraging or responding to any inquiries or proposals by, or providing any information to, any person concerning, any alternative business combination. The board of directors of ION would be entitled to change its recommendation to ION’s shareholders under certain circumstances unrelated to an alternative business combination, including after compliance with certain procedural requirements.

The Merger Agreement also includes certain covenants in respect of director and officer indemnification coverage, including obtaining “tail” directors’ and officers’ liability insurance policies in respect of acts or omissions of current and former directors, officers, and employees of ION, the Company, and each of their respective subsidiaries occurring prior to the First Effective Time.

Conditions to Closing

In addition, the consummation of the Transactions is conditioned upon the satisfaction of certain customary closing conditions, including among other things:

| ● | the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976; |

| ● | receipt of the Innovid Stockholder Approval and the ION Shareholder Approval; |

| ● | ION having at least $5,000,001 of net tangible assets immediately after the First Effective Time; |

| ● | the absence of any provision of any applicable legal requirement and any temporary, preliminary or permanent restraining order prohibiting, enjoining or making illegal the consummation of the Transactions; |

| ● | the approval for listing on the NYSE of ION Domesticated Common Stock to be issued in connection with the Closing, subject only to official notice of issuance thereof; and |

| ● | effectiveness of the Registration Statement in accordance with the provisions of the Securities Act, the absence of any stop order issued by the SEC which remains in effect with respect to the Registration Statement, and the absence of any proceeding seeking such a stop order having been threatened or initiated by the SEC which remains pending. |

The obligation of Innovid to consummate the Transactions are also conditioned upon, among other things:

| ● | the accuracy of the representations and warranties of ION (subject to certain materiality standards set forth in the Merger Agreement); |

| ● | material compliance by ION with its pre-closing covenants and agreements; |

| ● | delivery of an executed Investor Rights Agreement; |

| ● | the freely usable cash contained in ION’s trust account (after giving effect to ION shareholder redemptions and the payment of deferred underwriting commissions and taxes), together with the aggregate amount of proceeds from the PIPE Investment (as defined below) funded and remaining with ION (“Available Closing Cash”) equaling or exceeding $250,000,000 (“Minimum Cash Condition”); |

| ● | delivery to Innovid of written resignations of certain officers and directors of ION; and |

| ● | consummation of the Domestication in accordance with the Merger Agreement. |

2

The obligations of ION and the Merger Subs to consummate the Transactions are also conditioned upon, among other things:

| ● | the accuracy of the representations and warranties of Innovid (subject to certain materiality standards set forth in the Merger Agreement); |

| ● | material compliance by Innovid with its pre-closing covenants and agreements; and |

| ● | the absence of any change, event, state of facts, development or occurrence since the date of the Merger Agreement that, individually or in the aggregate, has or would reasonably be expected to have a material adverse effect on the business, assets, financial conditions, or results of operations of Innovid (subject to certain customary exceptions). |

Governance

After the consummation of the Transactions, (i) the current officers of Innovid will remain officers of the Company, (ii) the board of directors of Innovid will be a three (3) tiered classified board divided into three classes, designated as Class I, II and III, and (iii) one (1) person designated by ION will be elected and appointed as a director of Class II of the board of directors of the Company (which class will not be subject to re-election until the second annual meeting of the stockholders of the Company following the consummation of the Transactions).

Termination

The Merger Agreement may be terminated:

| ● | by mutual written consent of ION and Innovid; |

| ● | by either ION or Innovid, if the First Effective Time has not occurred by 11:59 p.m., New York City time, on December 24, 2021 (the “Termination Date”); provided, however, that if the SEC has not declared the Proxy Statement/Registration Statement effective on or prior to November 30, 2021, the Termination Date shall be automatically extended to February 24, 2022; provided, further, that the right to terminate the Merger Agreement will not be available to any Party whose material breach of any provision of therein caused or resulted in the failure of the First Merger to be consummated by such time; |

| ● | by either ION or Innovid, if a governmental entity has issued an order or decree or has taken any other action, in any case having the effect of permanently restraining, enjoining or otherwise prohibiting the Transactions, including the Mergers, which order, decree or other action is final and nonappealable; |

| ● | by either ION or Innovid, if, ION fails to obtain the ION Shareholder Approval upon vote taken thereon at the ION shareholder meeting (or at a meeting of its shareholders following any adjournment or postponement thereof); |

| ● | by Innovid, if ION has breached or failed to perform any of its covenants or representations and warranties or other agreements contained in the Merger Agreement in any material respect and has not cured such breach within the time periods provided for in the Merger Agreement; |

| ● | by ION, if Innovid has breached or failed to perform any of its covenants or representations and warranties or other agreements contained in the Merger Agreement in any material respect and has not cured such breach within the time periods provided for in the Merger Agreement; or |

| ● | by ION, by written notice to Innovid, if the Innovid Stockholder Approval has not have been obtained within five (5) Business Days after the Registration Statement Effective Date, except that ION will have no right to terminate at any time following the delivery to ION or its representatives on its behalf of the Innovid Stockholder Approval, even if the Innovid Stockholder Approval is delivered following such five (5) Business Days period after the Registration Statement Effective Date. |

3

A copy of the Merger Agreement will be filed by amendment on Form 8-K/A to this Current Report on Form 8-K (this “Current Report”) within four (4) business days of the date hereof as Exhibit 2.1, and the foregoing description of the Merger Agreement and the Merger does not purport to be complete and is qualified in its entirety by reference thereto. The Merger Agreement contains representations, warranties and covenants that the respective parties made to each other as of the date of the Merger Agreement or other specific dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the respective parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating the Merger Agreement. The Merger Agreement will be filed to provide investors with information regarding its terms. It is not intended to provide any other factual information about the parties to the Merger Agreement. In particular, the representations, warranties, covenants and agreements contained in the Merger Agreement, which were made only for purposes of the Merger Agreement and as of specific dates, were solely for the benefit of the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties (including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts) and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors, security holders and reports and documents filed with the SEC. Investors and security holders are not third-party beneficiaries under Merger Agreement and should not rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations of the actual state of facts or condition of any party to the Merger Agreement. In addition, the representations, warranties, covenants and agreements and other terms of the Merger Agreement may be subject to subsequent waiver or modification. Moreover, information concerning the subject matter of the representations and warranties and other terms may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in ION’s public disclosures.

Investor Rights Agreement

The Merger Agreement contemplates that, at the closing, certain ION equityholders and certain Innovid equityholders (collectively “Holders”) will enter into an investor rights agreement (the “Investor Rights Agreement”), pursuant to which, among other things, the Company will agree to indemnify ION Holdings 2, LP (the “Sponsor”) and certain Sponsor related persons from certain liabilities arising out of the Sponsor’s control, management, and the business of ION or services provided to ION prior to the signing of the Investor Rights Agreement and any liabilities incurred in connection with any Transaction agreement, including the Merger Agreement, related to the Business Combination subject to certain limitations.

Pursuant to the Investors Rights Agreement the Company also agrees it will file a registration statement within 30 days of the Effective Time to register for resale under the Securities Act of (a) any outstanding Company Common Stock or warrants to purchase Company Common Stock (including any Company Common Stock issued or issuable upon the exercise of any such warrant) held by a Holder immediately following the closing (including Company Common Stock distributable pursuant to the Merger Agreement), (b) any Company Common Stock that may be acquired by Holders upon the exercise of a warrant or other right to acquire Company Common Stock held by a Holder immediately following the closing or (c) any Company Common Stock or warrants to purchase Company Common Stock (including any Company Common Stock issued or issuable upon the exercise of any such warrant) of the Company owned by a Holder or otherwise acquired following the date of the Investor Rights Agreement. The Investor Rights Agreement also permits underwritten takedowns and provides for customary “piggyback” registration rights.

The rights granted under the Investors’ Rights Agreement supersede any prior registration, qualification, or similar rights of the parties with respect to their Innovid securities or ION securities, and all such prior agreements shall be terminated.

The foregoing description of the Investors’ Rights Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Investors’ Rights Agreement, a form of which is attached as Exhibit F to the Merger Agreement.

Sponsor Support Agreement

Concurrently with the execution and delivery of the Merger Agreement, ION, Innovid, the Sponsor, and certain members of the board of directors and management team of ION (the “Insiders”) have entered into a Sponsor Support Agreement (the “Sponsor Support Agreement”) pursuant to which the Sponsor and each Insider has agreed, among other things, to: (i) vote all ION Class A shares, ION Class B shares and any other equity securities of ION (all such shares “Covered Shares”) that it owns, in favor of the Business Combination and related proposals, (ii) appear at an ION shareholder meeting to establish a quorum for the purpose of approving the ION transaction proposals; (iii) vote (or execute and return an action by written consent) in favor of the ION transaction proposals; (iv) vote all Covered Shares in favor of the ION transaction proposals, including the approval of the Business Combination and the other Transactions; (v) vote all Covered Shares against (A) any other business combination transaction other than the Business Combination contemplated by the Merger Agreement or any other action that would reasonably be expected to (1) materially frustrate the purposes of the Transactions (including consummation thereof) or adversely affect, impede, or delay the Transactions, (2) result in a breach of any covenant, representation, or warranty of ION under the Merger Agreement or cause any of the conditions to Closing set forth in the Merger Agreement to not be fulfilled, or (3) result in a breach of any covenant, representation, or warranty of the Sponsor or the Insiders under the Sponsor Support Agreement and (B) any change in business, management or board of directors of ION or any recapitalization, reorganization, liquidation or winding up of ION (other than in connection with the Business Combination); and (vi) not redeem any Covered Shares in connection with the ION Shareholder Approval.

4

The Sponsor Support Agreement also provides that the Private Placement Warrants held by the Sponsor after the Closing will be locked-up until 30 days after the date of the Closing. Additionally, the Sponsor Support Agreement provides that ION Class A Shares, ION Class B Shares or other equity securities of ION held by the Sponsor and the Insiders after the Closing will be locked-up until the earlier of (i) the one year anniversary of the Closing date, (ii) the date on which the volume-weighted average price of shares of the Company equals or exceeds $12.00 per share for any twenty (20) trading days within any thirty (30) trading day period commencing at least one hundred fifty (150) days following the Closing, or (iii) the date on which the Company completes a liquidation, merger, share exchange or other similar transaction that results in all of the Company shareholders having the right to exchange their shares of the Company for cash, securities or other property (the earlier of (i), (ii), and (iii), the “Lock-Up Termination Date”). Further, ION, the Sponsor, and the Insiders have agreed to use reasonable best efforts not to solicit or engage in discussions or negotiations or other agreement concerning any alternative business transaction (other than the Business Combination).

The foregoing description of the Sponsor Support Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Sponsor Support Agreement, a form of which is attached as Exhibit D to the Merger Agreement.

Innovid Stockholder Support Agreements

Concurrently with the execution and delivery of the Merger Agreement, Innovid, ION and certain Innovid stockholders entered into Company Stockholder Support Agreements (“Innovid Stockholder Support Agreements”), pursuant to which each of those Innovid stockholders have generally agreed, among other things, to: (i) vote all shares of Innovid Common Stock and Innovid Preferred Stock (all such shares “Covered Shares”) that it owns, in favor of the Business Combination, (ii) appear at an Innovid stockholder meeting to establish a quorum for the purpose of approving the transaction proposals; (iii) vote (or execute and return an action by written consent) in favor of the transaction proposals; (iv) vote all Covered Shares in favor of the transaction proposals, including the approval of the Merger and the other Transactions; (v) vote all Covered Shares against (A) any other business combination other than the Business Combination contemplated by the Merger Agreement or any other action or agreement that would reasonably be expected to (1) materially frustrate the purposes of or impede the Transactions (including consummation thereof) or adversely affect, impede, or delay the Transactions, or (2) result in a breach of any covenant, representation, or warranty of Innovid under the Merger Agreement or cause any of the conditions to Closing set forth in the Merger Agreement to not be fulfilled and (B) any change in business, management or board of directors of Innovid or any recapitalization, reorganization, liquidation or winding up of Innovid (other than in connection with the Business Combination); and (vi) not redeem any Covered Shares in connection with the Innovid Stockholder Approval. One of the Innovid Stockholder Support Agreements (the “Additional Stockholder Support Agreement”) further provides for (i) a limited right to terminate the agreement in the case of a material modification, amendment, or waiver of the Merger Agreement that reduces or alters the consideration payable to the applicable Innovid stockholder, violates the termination provisions in the Merger Agreement, is adverse to the applicable Innovid stockholder (or its Covered Shares) in an adverse and disproportionate manner relative to other Innovid stockholders (or the Covered Shares held by such other Innovid stockholders), or results in the consummation of the Mergers when the Minimum Cash Condition is not met; (ii) certain rights to receive an allocation schedule setting forth the consideration payable to the applicable Innovid stockholder (including a minimum amount of such consideration payable in the event of the consummation of the Mergers); (iii) restrictions on certain amendments to the Merger Agreement that has any of the effects described in the foregoing subclause (ii) as it relates to the applicable Innovid stockholder (or its Covered Shares); and (iv) rights to secondary sale amounts in favor of certain holders of Innovid Preferred Stock in accordance with a mutually agreed upon schedule based on the Available Closing Cash levels of ION.

The Innovid Stockholder Support Agreements also provide that the ION Domesticated Common Stock held by Innovid stockholders immediately following the First Effective Time will be locked-up for the earlier of (i) one hundred eighty (180) days following the Closing; or (ii) the Lock-Up Termination Date (as defined above) except that the Additional Stockholder Support Agreement provides for a lock-up period of one hundred eighty (180) days following the Closing. Further, Innovid and the Innovid stockholders parties to the Innovid Stockholder Support Agreements have generally agreed not to solicit or engage in discussions or negotiations or other agreement concerning any alternative business transaction (other than the Business Combination).

The foregoing descriptions of the Innovid Stockholder Support Agreements do not purport to be complete and are qualified in their entirety by the terms and conditions of the applicable Innovid Stockholder Support Agreements, forms of which are attached as Exhibit C to the Merger Agreement.

Subscription Agreements

In connection with the of the Merger Agreement, ION entered into certain subscription agreements, each dated June 24, 2021 (the “Subscription Agreements”), with certain accredited and institutional investors, pursuant to which such investors have subscribed to purchase an aggregate of 15,000,000 shares of ION Class A Common Stock (together, the “Subscriptions”), for a purchase price of $10.00 per share, for an aggregate purchase price of $150,000,000, to be issued immediately prior to or substantially concurrently with the closing (the “PIPE Investment”). The obligations of each party to consummate the Subscriptions are conditioned upon, among other things, customary closing conditions and the consummation of the transactions contemplated by the Merger Agreement.

In addition, on June 24, 2021, ION agreed to terminate the previously disclosed ION forward purchase agreements dated January 26, 2021 (the “Forward Purchase Agreements”), between ION and a number of the forward purchase investors (the “FPA Subscribers”), pursuant to which the FPA Subscribers confirmed their intent to purchase, and ION agreed to sell to the FPA Subscribers, an aggregate of 5,0000,000 shares of ION Class A Common Stock for a purchase price of $10.00 per unit and an aggregate of $50 million.

Pursuant to the Subscription Agreements, ION agreed that, within 30 business days following the closing of the Business Combination, ION will file with the Securities and Exchange Commission (“SEC”) a registration statement registering the resale of the PIPE Shares and the New Class A Common Stock and (the “Registration Statement”), and will use its commercially reasonable efforts to have the Registration Statement declared effective as soon as practicable after the filing thereof, but no later than the earlier of (i) the 60th calendar day (or 120th calendar day if the SEC notifies ION that it will “review” the Registration Statement) following the closing and (ii) the 10th business day after the date ION is notified (orally or in writing, whichever is earlier) by the SEC that the Registration Statement will not be “reviewed” or will not be subject to further review.

5

A copy of the form of the Subscription Agreement will be filed by amendment on Form 8-K/A to this Current Report within four (4) business days of the date hereof as Exhibit 10.1 and the foregoing description of the Subscription Agreements does not purport to be complete and is qualified in its entirety by reference thereto.

Secondary Share Purchase Agreements

The Merger Agreement contemplates that, at the closing, ION (the “Buyer”) will purchase and one or more Company Stockholders (the “Sellers”) will sell in accordance with the share purchase agreement (the “Purchase and Sale Agreement”) an aggregate amount of shares determined by the Company and for an aggregate purchase price determined by the Company (“Secondary Sale Amount”). The Secondary Sale Amount will be determined by the Company based on the amount of cash ION has on hand at the closing for the transaction minus $150,000,000; provided, however if the amount equals or is less than $150,000,000, the Secondary Sale Amount shall equal zero. The closing of the Secondary Purchases is conditioned upon, among other things, the consummation of the transactions.

The foregoing description of the Purchase and Sale Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Sponsor Support Agreements, a form of which is attached as Exhibit M to the Merger Agreement.

Item 1.02 Termination of a Material Definitive Agreement.

The description of the termination of the Forward Purchase Agreements set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K with respect to the issuance of ION Class A Common Stock pursuant to the Subscription Agreements is incorporated by reference into this Item 3.02. The shares of ION Class A Common Stock to be issued in connection with the transactions contemplated by the Subscription Agreements will not be registered under the Securities Act, and will be issued in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

Item 7.01 Regulation FD Disclosure.

On June 24, 2021, Innovid issued a press release announcing that it has executed the Merger Agreement. A copy of the press release is furnished hereto as Exhibit 99.1.

Furnished as Exhibit 99.2 hereto is an investor presentation, dated May 2021, prepared by Innovid and ION regarding the Business Combination and presented in connection with the marketing of the PIPE Investment. A copy of the transcript of a pre-recorded investor presentation is furnished as Exhibit 99.3 hereto.

The information in this Item 7.01 and Exhibits 99.1, 99.2 and 99.3 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of ION under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information in this Item 7.01 and Exhibits 99.1, 99.2 and 99.3 attached hereto.

Important Information About the Business Combination and Where to Find It

In connection with the proposed Business Combination, ION intends to file a registration statement on Form S-4 with the U.S. Securities and Exchange Commission, which will include a proxy statement/prospectus and certain other related documents, which will be both the proxy statement to be distributed to holders of shares of ION’s Class A common stock in connection with ION’s solicitation of proxies for the vote by ION’s stockholders with respect to the Business Combination and other matters as may be described in the definitive proxy statement, as well as the prospectus relating to the offer and sale of the securities of ION to be issued in the Business Combination. ION’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus included in the Registration Statement and the amendments thereto and the definitive proxy statement/prospectus and documents incorporated by reference therein filed in connection with the Business Combination, as these materials will contain important information about the parties to the Business Combination Agreement, ION and the Business Combination. After the Registration Statement is declared effective, the definitive proxy statement/prospectus will be mailed to ION’s stockholders as of a record date to be established for voting on the Business Combination and other matters as may be described in the Registration Statement. Stockholders will also be able to obtain copies of the proxy statement/prospectus and other documents filed with the SEC that will be incorporated by reference in the proxy statement/prospectus, without charge, once available, at the SEC’s web site at www.sec.gov, or by directing a request to: ION Acquisition Corp 2 Ltd., 89 Medinat Hayehudim Street, Herzliya 4676672, Israel, Attention: Secretary, +972 (9) 970-3620.

6

Participants in the Solicitation

ION and its directors and executive officers may be deemed participants in the solicitation of proxies from ION’s shareholders with respect to the Business Combination. A list of the names of those directors and executive officers and a description of their interests in ION is contained in ION’s registration statement on Form S-1, which was filed with the SEC on February 10, 2021 and is available free of charge at the SEC’s website at www.sec.gov, or by directing a request to ION Acquisition Corp 2 Ltd., 89 Medinat Hayehudim Street, Herzliya 4676672, Israel, Attention: Secretary, +972 (9) 970-3620. Additional information regarding the interests of such participants will be contained in the Registration Statement when available.

Innovid and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of ION in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be contained in the Registration Statement when available.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Innovid’s and ION’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, ION’s and Innovid’s expectations with respect to future performance and anticipated financial impacts of the Business Combination, the satisfaction of the closing conditions to the Business Combination, and the timing of the completion of the Business Combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside ION’s and Innovid’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement or could otherwise cause the Business Combination to fail to close; (ii) the outcome of legal proceedings that have or may be instituted against ION and Innovid; (iii) the inability to complete the Business Combination, including due to failure to obtain the requisite approval of shareholders or other conditions to closing in the Merger Agreement; (iv) the receipt of an unsolicited offer from another party for an alternative business transaction that could interfere with the Business Combination; (v) the inability to obtain or maintain the listing of the common stock of the post-acquisition company on The New York Stock Exchange following the Business Combination; (vi) the risk that the announcement and consummation of the Business Combination disrupts current plans and operations; (vii) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably and retain its key employees; (viii) costs related to the Business Combination; (ix) changes in applicable laws or regulations; (x) the possibility that ION, Innovid or the combined company may be adversely affected by other economic, business, competitive and/or factors such as the COVID-19 pandemic; and (xi) other risks and uncertainties indicated from time to time in the proxy statement/prospectus relating to the Business Combination, including those under “Risk Factors” in the Registration Statement, and in ION’s other filings with the SEC. ION cautions that the foregoing list of factors is not exclusive. ION cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. ION does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act, or an exemption therefrom.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Press Release, dated June 24, 2021 | |

| 99.2 | Investor Presentation, dated June 2021 | |

| 99.3 | Transcript of Investor Presentation |

7

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ION ACQUISITION CORP 2 LTD. | |||

| By: | /s/ Anthony Reich | ||

| Name: | Anthony Reich | ||

| Title: | Chief Financial Officer | ||

| Date: | June 24, 2021 | ||

8

Exhibit 99.1

Innovid, a Global Leader In Connected TV Ad Delivery and Measurement, to Become Publicly Listed at an Implied $1.3 Billion Valuation via a Merger with ION Acquisition Corp. 2 Ltd.

Total raised to be approximately $403 million including proceeds from ION Acquisition Corp 2 and a PIPE from Fidelity Management and Research Company LLC, Baron Capital Group, funds associated with ION, and others

| ● | Innovid is going public via a merger with ION Acquisition Corp. 2 Ltd. (NYSE: IACB), a publicly traded special purpose acquisition company, or SPAC, with $253M in trust. |

| ● | The transaction implies a pro forma valuation of approximately $1.3 billion for Innovid |

| ● | Innovid has also secured approximately $150 million of PIPE financing anchored by top-tier institutional investors including Fidelity Management and Research Company LLC, Baron Capital Group and others including funds affiliated with ION and Phoenix Insurance. |

| ● | The company has spent the past decade focused on developing critical technology infrastructure for the creation, delivery, and measurement of TV ads across connected TV (CTV), mobile TV and desktop TV. |

| ● | Existing investors including Goldman Sachs, Sequoia Capital, Newspring, Genesis Partners and Vintage will remain shareholders under the proposed structure. |

| ● | Innovid plans to extend its technology edge through expanding integrations with leading CTV publishers across international markets, the launch of additional personalized CTV ad formats, and the introduction of progressive identity solutions with the goal of advancing the underlying technology infrastructure supporting the TV advertising ecosystem’s shift from linear to digital. |

| ● | Innovid’s founders have been together since the company’s inception, over a decade ago, and continue to serve on the management team. |

| ● | The transaction is expected to close in Q4 of 2021 |

New York, NY – June 24, 2021 – Innovid, the world’s largest independent ad delivery and measurement platform for connected TV, today announced it has entered into a definitive merger agreement with ION Acquisition Corp. 2 Ltd. (NYSE: IACB), a special purpose acquisition company. The combined company will operate under the Innovid name and will trade on a US national exchange. The transaction is expected to close in Q4 of 2021.

Founded in 2008, Innovid is a leading independent software platform that provides critical technology infrastructure for the creation, delivery, and measurement of TV ads across CTV, mobile TV and desktop TV. As the only ad server purpose-built for TV, Innovid developed the first and still the most advanced CTV SDK on the market. Innovid’s SDK powers personalized and interactive experiences in CTV through direct integrations across over 50 apps, providing the infrastructure layer behind the advertising shown by some of the biggest names in streaming including Roku (ROKU) and Hulu. The company has spent the past decade focused on building deep relationships across the CTV and OTT industry. Through this focus Innovid has achieved a growing list of industry firsts and key milestones including: the first and only ACR integration with Roku, the first and only buy-side ad server w/MRC certification for CTV measurement, the first and only platform delivering ads into NBCU’s Peacock, as well as serving the first and only interactive Super Bowl ad. The company has also actively worked to connect the different parts of the TV ad-tech ecosystem by launching a consortium with leading independent programmatic platforms The Trade Desk (TTD), Magnite (MGNI), and others to power advanced creative buying at scale across CTV. As the $200 billion dollar TV industry continues to shift to CTV, the company is positioned to take a leadership role in a significant and high growth market.

Additionally, over the past few years, Innovid has expanded its offering to encompass independent global ad serving, data-driven personalization, and new forms of measurement designed to connect all channels in a clean, comparable, and privacy-compliant manner. This offering gives marketers the option to consolidate CTV advertising with desktop TV, mobile TV, display, social and more, through Innovid’s proprietary omni-channel solutions. Furthermore, the open platform boasts a slew of workflows and integrations to seamlessly integrate ad delivery and optimization with preferred external providers. Of note, Innovid does not transact media and therefore has zero media buying conflicts, enabling it to work as a truly independent company across the entire advertising ecosystem.

Innovid at scale:

| ● | Innovid serves a global client base of brands, agencies, and publishers through offices across the Americas, Europe, and Asia Pacific, delivering ads across a growing global footprint. |

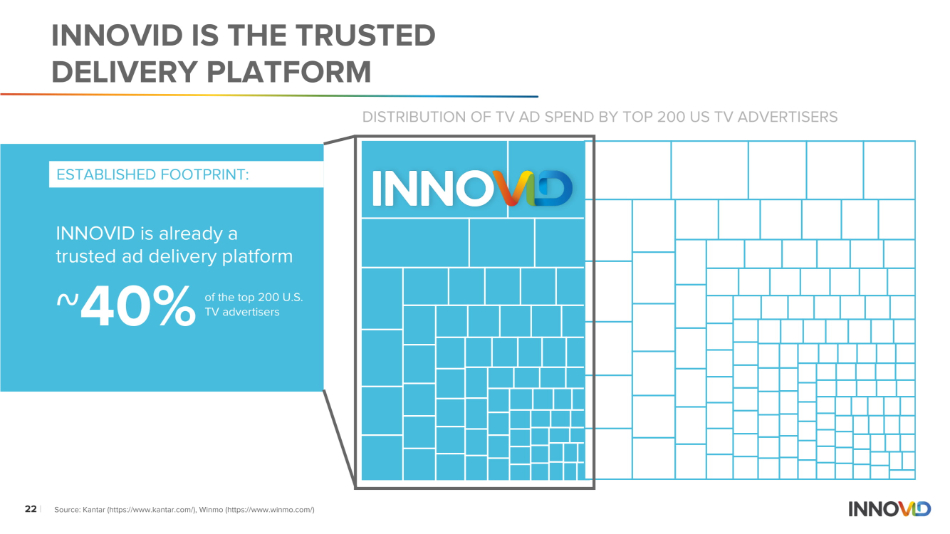

| ● | Innovid currently serves over 40% of the top 200 U.S. TV advertisers, providing technology infrastructure to enable the creation, delivery, and measurement of TV ads across CTV, mobile TV and desktop TV. |

| ● | The Innovid ad serving platform grew impression delivery across CTV devices by more than 70% year-to-date 2021 over the same period in 2020. |

| ● | Named a leader in the Forrester Wave: Creative Ad Tech, Q4 2020 report, the technology powers the generation of personalized ad permutations as well as ad delivery across a footprint spanning over 75 million connected homes. |

2

“Innovid is entering an exciting new chapter of growth as a public company, a major milestone that corresponds with rising adoption and demands for streaming television.” said Zvika Netter, Co-Founder and CEO at Innovid. “The rapid shift of viewership from linear TV to streaming has driven marketers to make CTV a strategic investment focus. Our technology was purpose-built for TV which has allowed us to win in the marketplace and contributed to our rapid growth to date.”

Mr. Netter continued, “As a public company, we expect that we will be able to build on our leading market position, accelerate the growth of our business, and remain the independent platform trusted by the world’s largest TV advertisers. We are proud to have built an independent and neutral software platform to allow advertisers to create, deliver and measure digital TV ads and aim to continue to provide the industry a market leading and transparent offering independent of the large technology walled-garden players who dominate many other parts of the digital world.”

Gilad Shany, CEO of ION said, “We believe Innovid has built an exceptional platform for digital TV advertisers to assist them as they transition $200 billion of TV advertising budgets to the world of digital TV. We are excited to partner in bringing Innovid to the public markets to provide the appropriate capital structure and shareholder base to enable Innovid to lead this market as an independent company. We were looking to merge with an exceptional company with roots in the Israeli hi-tech ecosystem and Innovid’s incredible achievements speak for themselves. The combination of long-term partnerships built by the company throughout the CTV and OTT industry, their strong relationships with the largest TV advertisers in the world, unique ad serving technology and focus on a usage-based software business model, allows Innovid to provide significant value to the digital TV advertising ecosystem while also achieving attractive unit economics as the company grows. With many years of growth ahead as users continue the shift from linear to digital TV, we look forward to joining Zvika and the team for an exciting journey and incredible business opportunities.”

Transaction Overview

Innovid has entered into a definitive agreement to merge with ION Acquisition Corp. 2 Ltd., for an implied pro forma aggregate equity valuation of approximately $1.3 billion. The transaction is supported by approximately $150 million of PIPE financing anchored by top-tier institutional investors including Fidelity Management and Research Company LLC, Baron Capital Group, Vintage and others including funds affiliated with ION and Phoenix Insurance.

The proposed transaction is expected to be completed in Q4 2021, subject to approval by the shareholders of ION, and satisfaction of other customary closing conditions.

3

Advisors

Evercore LLC acted as sole financial and capital markets advisor to Innovid and also acted as a placement agent on the PIPE. Latham & Watkins LLP and FWMK Law Offices acted as legal counsel to Innovid.

Morgan Stanley acted as sole financial advisor to ION and also acted as lead placement agent to ION on the PIPE. White & Case LLP and Goldfarb Seligman & Co. acted as legal counsel to ION. Debevoise & Plimpton LLP acted as legal counsel to the placement agents.

Kost Forer, Gabbay & Kasierer, a member of Ernst & Young Global Limited, is acting as independent auditor.

Forward-Looking Statements Legend

This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Innovid Inc. (“Innovid”) and Ion Acquisition Corp 2 Ltd. (“Ion”), including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by Innovid and the markets in which it operates, and Innovid’ projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: Innovid’s ability to maintain and expand relationships with advertisers; the decrease and/or changes in CTV audience viewership behavior; the failure to make the right investment decisions or the failure to innovate and develop new solutions that are adopted by advertisers and/or partners; Innovid’s estimates of market opportunity, forecasts of market growth and projections of future financial performance; Innovid’s sales and marketing efforts requiring significant investments and long sales cycles; failure to manage growth effectively; the business combination not be satisfied on a timely basis or at all, and other risks and uncertainties indicated from time to time in the proxy statement/prospectus, including those under “Risk Factors” therein, and in Ion’s other filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Innovid and Ion assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Innovid nor Ion gives any assurance that either Innovid or Ion will achieve its expectations.

4

Additional Information and Where to Find It

This document relates to a proposed transaction between Innovid and Ion. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Ion intends to file a registration statement on Form S-4 that will include a proxy statement of Ion and a prospectus of Ion. The proxy statement/prospectus will be sent to all Ion and Innovid stockholders. Ion also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Ion and Innovid are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Ion through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Ion may be obtained, without charge, at the SEC’s website located at www.sec.gov or by directing a request to Ion.

Participants in Solicitation

Ion and Innovid and their respective directors and officers may be deemed to be participants in the solicitation of proxies from Ion’s stockholders in connection with the proposed transaction. Information about Ion’s directors and executive officers and their ownership of Ion’s securities is set forth in Ion’s filings with the SEC. To the extent that holdings of Ion’s securities have changed since the amounts printed in Ion’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/ prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

5

About ION Acquisition Corporation

The Company is a blank check company incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. While the Company may pursue a business combination target in any business or industry, the Company intends to focus on the rapidly growing universe of Israeli companies and entrepreneurs that apply technology and innovation to our everyday lives. The Company is sponsored by ION Holdings 2, LP, an affiliate of ION Asset Management Ltd

About Innovid

Innovid is the only independent omni-channel advertising and analytics platform built for television. We use data to enable the personalization, delivery, and measurement of ads across the widest breadth of channels in the market including TV, video, display, social, audio, and DOOH. Our platform seamlessly connects all media, delivering superior advertising experiences across the audience journey. Innovid serves a global client base of brands, agencies, and publishers through fifteen offices across the Americas, Europe, and Asia Pacific. For more information visit www.innovid.com.

6

Exhibit 99.2

Jun e 2 0 2 1 INVESTOR PR ESEN T A T ION Exhibit 99.2

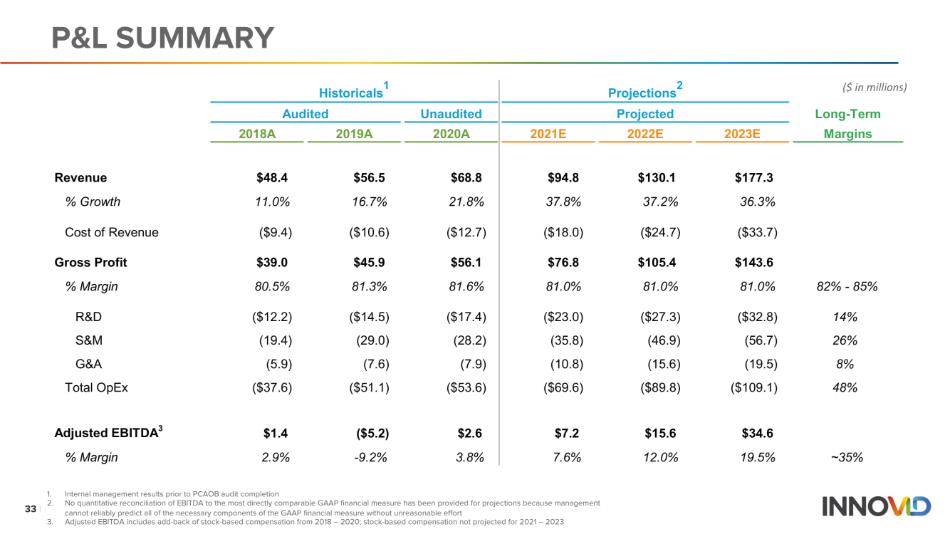

D I S CL A I M E R S This presentation is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Innovid, Inc. (the “Company” or “Innovid”) and ION Acquisition Corp 2 Ltd. (“ION”) and related transactions (collectively, the “Proposed Transactions”) and for no other purpose. This presentation is for information purposes only and is being provided to you solely in your capacity as a potential investor in considering an investment in Innovid. Any reproduction or distribution of this presentation, in whole or in part, or the disclosure of its contents, without the prior consent of Innovid is prohibited. By accepting this presentation, each recipient and its directors, partners, officers, employees, attorney(s), agents and representatives agrees: (i) to maintain the confidentiality of all information that is contained in this presentation and not already in the public domain; and (ii) to return or destroy all copies of this presentation or portions thereof in its possession following the request for the return or destruction of such copies. Fo rwa r d - Lo o k i n g S t a t e m e n t s This presentation includes “forward - looking statements” within the meaning of the federal securities laws, opinions and projections prepared by the Company’s and ION’s management. These forward - looking statements generally are identified by the words “expects,” “will,” “projected,” “continue,” “ increase,” and/or similar expressions that concern the Company’s or ION’s strategy, plans or intentions, but the absence of these words does not mean that a statement is not forward - looking. Such statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are based on management’s belief or interpretation of information currently available. Because forward - looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s or ION’s control. Actual results and condition (financial or otherwise) may differ materially from those indicated in the forward - looking statements. These forward - looking statements are subject to a number of risks and uncertainties that could cause actual results and conditions to differ materially from those indicated in the forward - looking statements, including, but not limited to, the various summary risk factors related to the Proposed Transactions that have been provided to you separately. The list of factors provided separately is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of ION’s final prospectus related to its initial public offering, the Proxy Statement/Registration Statement (as defined below) and other documents filed by ION from time to time with the Securities and Exchange Commission (“SEC”). There may be additional risks that the Company and ION do not presently know or that they currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect the Company’s and ION’s expectations, plans or forecasts of future events and views as of the date of this presentation. Accordingly, you should not place undue reliance upon any such forward - looking statements in this presentation. Neither the Company, ION nor any of their affiliates have any obligation to update this presentation. Ad d i t i on a l I n f o r m a t i o n a n d W h e r e t o F i n d i t In connection with the Proposed Transactions, ION is expected to file with the SEC a registration statement on Form S - 4 containing a preliminary proxy statement/prospectus relating to the Proposed Transactions (the “Proxy Statement/Registration Statement”), and after the registration statement is declared effective, will mail the proxy statement included therein to holders of ION’s ordinary shares in connection with ION’s solicitation of proxies for the vote by the ION shareholders with respect to the Proposed Transactions and other matters as described in the Proxy Statement/Registration Statement. ION urges its shareholders and other interested persons to read, when available, the Proxy Statement/Registration Statement and amendments thereto and documents incorporated by reference therein, as well as other documents filed with the SEC in connection with the transactions, as these materials will contain important information about ION, the Company and the Proposed Transactions. When available, the definitive proxy statement included in the Proxy Statement/Registration Statement will be mailed to ION’s shareholders. Shareholders of ION will also be able to obtain copies of such documents, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: ION Acquisition Corp 2 Ltd., 89 Medinat Hayehudim Street, Herzliya 4676672, Israel. N o R e pr e s e n t a t i o n s a n d W a rr a n t i e s This presentation is for informational purposes only and does not purport to contain all of the information that may be required to evaluate a possible investment decision with respect to Innovid. The recipient agrees and acknowledges that this presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. No representation or warranty, express or implied, is or will be given by Innovid or any of its affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of the Proposed Transactions and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The recipient also acknowledges and agrees that the information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material. Innovid disclaims any duty to update the information contained in this presentation. Par t i c ip a n t s i n S o li c i t a t i o n ION and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of ION’s shareholders in connection with the Proposed Transactions. Shareholders of ION may obtain more detailed information regarding the names, affiliations and interests of ION’s directors and executive officers in ION’s final prospectus for its initial public offering filed with the SEC on April 13, 2021 and in the Proxy Statement/Registration Statement when available. Information concerning the interests of ION’s participants in the solicitation, which may, in some cases, be different than those of ION’s shareholders generally, will be set forth in the Proxy Statement/Registration Statement when it becomes available. 2 |

D I S CL A I M E R S ( c on t ’d ) S t a t e m e n t R e g a r d i n g N o n - G A A P F i n a n c i a l Me a s u r e s The financial information and data contained this presentation is unaudited and does not conform to Regulation S - X promulgated by the SEC. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement, prospectus or other report or document to be filed or furnished by ION, the Company or any entity that is party to the Proposed Transactions with the SEC. Certain financial measures in this presentation are not calculated pursuant to U.S. generally accepted accounting principles (“GAAP”). These non GAAP financial measures are in addition to, and not as a substitute for or superior to measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of these non - GAAP financial measures as compared to their nearest GAAP equivalents. For example, other companies may calculate non - GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of the non - GAAP financial measures herein as tools for comparison. You should review the Company’s audited financial statements, which will be presented in the Proxy Statement/Registration Statement to be filed with the SEC in connection with the Proposed Transactions, and not rely on any single financial measure to evaluate the Company’s business. U s e o f P r o j e c t i o n s This presentation also contains certain financial forecasts, including projected annual revenue, gross profit and Adjusted EBITDA. Innovid's independent auditors have not studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, no independent auditor has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. In this presentation, certain of the above - mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of Innovid's control. While all financial projections, estimates and targets are necessarily speculative, Innovid believes that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. Accordingly, there can be no assurance that the prospective results are indicative of future performance or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. U na u d i t e d Es t i m a t e d R e s u l t s The Company’s preliminary unaudited estimated results contained in this presentation have been prepared in good faith by, and are the responsibility of, management based upon the Company’s internal reporting, and an independent auditing firm has not audited, reviewed, compiled or performed any procedures with respect to the preliminary financial results. Such results are subject to business, economic, regulatory and competitive uncertainties and contingencies and actual results may vary and those variations may be material. As such, Innovid's actual results and financial condition as reflected in the financial statements that will be included in the registration statement on Form S - 4 for the Proposed Transactions may be adjusted or presented differently from the historical financial information herein, and the variations could be material. No Offer or Solicitation; Private Placement This presentation is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of ION or the Company nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. The securities to which this presentation relates have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any other jurisdiction. This presentation relates to securities that Innovid would intend to offer in reliance on exemptions from the registration requirements of the Securities Act and other applicable laws. These exemptions apply to offers and sales of securities that do not involve a public offering. The securities have not been approved or recommended by any federal, state or foreign securities authorities, nor have any of these authorities passed upon the merits of this offering or determined that this presentation is accurate or complete. Any representation to the contrary is a criminal offense. Trademarks This presentation contains trademarks, service marks, trade names, and copyrights of the Company, ION and other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM © or ® symbols, but the Company and ION will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. 3 |

PR E S E N T E R S A N D S E N I O R L E A D E R S H I P Se r i a l en t r e p r ene u r w i t h o v er 28 y e a r s o f e x p e r i e n c e l a u n c h i n g , m a n a g i n g a n d g r o wi ng t e c hn ol o gy c o m p a ni e s Pr i o r t o c o - f o u n d in g I nn o v i d , f o u n d e d a n d s e r v e d a s C E O f o r s e v e r a l t e c hn o l o g y c o m p a ni e s ZVIKA NETTER C E O & CO - F O U N D E R L e a d s f in a n c e , a cc o u n t in g , l e g a l a n d HR f u n c t i o n s a t Innovid Pr i o r t o I nn o v i d , s p e n t e i g h t y e a r s i n f in a n c e r o l e s a t s e v e r a l t e c hn o l o g y c o m p a ni e s a n d f o ur y e a r s a t PwC TANYA ANDREEV - KASPIN CFO C E O o f I O N A c q u is i t i o n C o r p . 1 a n d 2 , Co - C E O o f I O N Ac q u i si ti o n C o r p . 3 , M a n a g in g P a r t n e r o f I O N C r o ss o v e r P a r t n e r s ( I C P) Pr i o r t o c o - f o u n d in g I C P , 1 0 years of experience investing in pu b li c a n d pr i va t e c om pa ni e s w i t h B a r o n C a p i t a l ( N Y ) a nd M a g m a V e n tu r e P a r t n e r s ( TL V ) GI L A D S H A N Y CEO Pr e s i d e n t a n d C O O o f I O N Ac q u i si ti o n C o r p . 1 a n d 2 , C o - C E O and President of ION Acquisition C o r p . 3 CO O o f g r o w t h t e c h c o m p a n i e s Si m il a r W e b & See k i n g A l p ha 8 y e a r s p u b li c & p r i va t e i n v e s t m e n t s , i n c l u d i n g e q u it i es analyst with UBS & venture capital a t J e r u s a l e m G l ob a l V e n t u r e s AVR O M G I L BE R T COO 4 |

AG E N D A Introduction Overview Ab o u t I nn o v i d Go - t o - Mar k e t S t ra t e gy I n v e s t m e n t H i g h li g h t s F i n a n c i a l I nf o r m a t i on G r ow t h St r a t e g y Val u ati o n & Co m p a r a b l e s

INTRODUCTION

I O N – G L O B A L R EA C H , L O N G - T E R M V A L U E Q3 18 I O N C R O SS O V E R P A R T N E R S 2 0 15 S O V E R E I G N W E A L TH F U N D Q4 1 8 I O N T E C H F U N D 2 00 6 I O N I S R A E L F U N D Total AUM: >$2bn Q4 20 I O N A C Q U I S I T I O N C O R P ( S P A C) I A C A ( B C A ) I A C B ( P u b li c ) I A C C (P u blic ) 7 |

I O N I N V E S TM E N T T H E S I S – M A R K E T L E A D I N G EXPOSURE TO CONNECTED TV GROWTH 1 TV ADVERTISING IS A $200B MARKET SHIFTING FROM LINEAR TV TO CTV As “cord cutting” audiences move to CTV, and OTT publishers grow, brand advertising dollars follow 2 MARKET - LEADING INDEPENDENT CTV ADVERTISING PLATFORM Used by >40% of major global advertisers to manage ad campaigns in a fragmented CTV market 3 VISIONARY, FOUNDER - LED, FIRST - TO - MARKET PLAYER WITH DEEP MOAT Proprietary tech to future - proof for CTV roadmap + Unmatched Partner Network (TTD, MGNI, Peacock, Roku, Hulu, etc.) 4 DIFFERENTIATED SOFTWARE COMPANY TO RIDE THE EXPLOSIVE GROWTH OF CTV 80%+ gross margins, 37% Revenue Growth, 94% logo retention + upside from advanced capabilities Source: Dentsu, eMarketer, Kantar (https:// www.kantar.com/), Winmo (https:// www.winmo.com/) Note: $200bn estimate includes 2021 traditional TV ad spend of $169bn and assumes 2021 global CTV ad spend is ~2x US ad spend of $13bn 8 |

OVERVIEW

Source: Dentsu, eMarketer Note: $200bn estimate includes 2021 traditional TV ad spend of $169bn and assumes 2021 global CTV ad spend is ~2x US ad spend of $13bn C T V $1 5 - 20 BILLION $200 BILLION LIN E A R TV THE TV E C O S Y S T E M IS SHIFTING $200 BILLION o f T V a d s pe n d i n g $15 - $20 BILLION o f e s tima te d a d s pe n d i n g on CT V to d a y 10 |

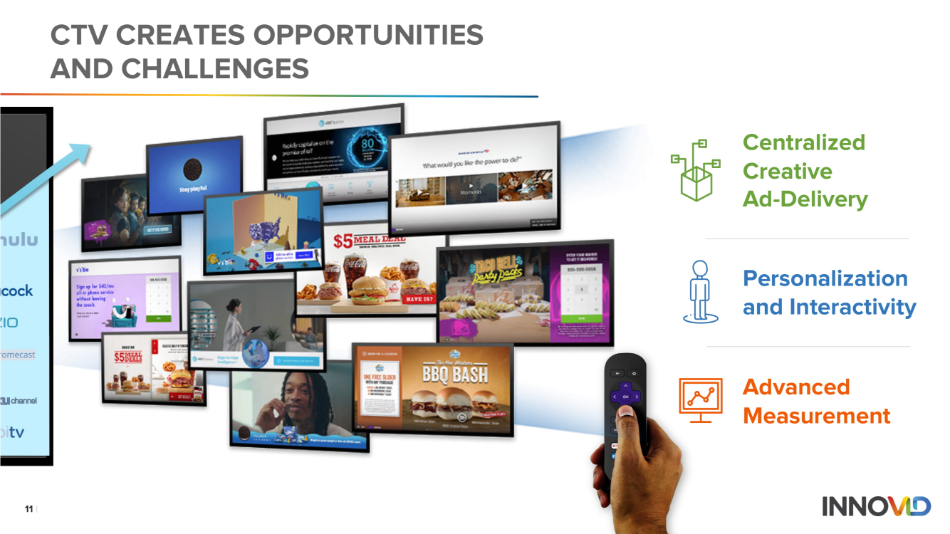

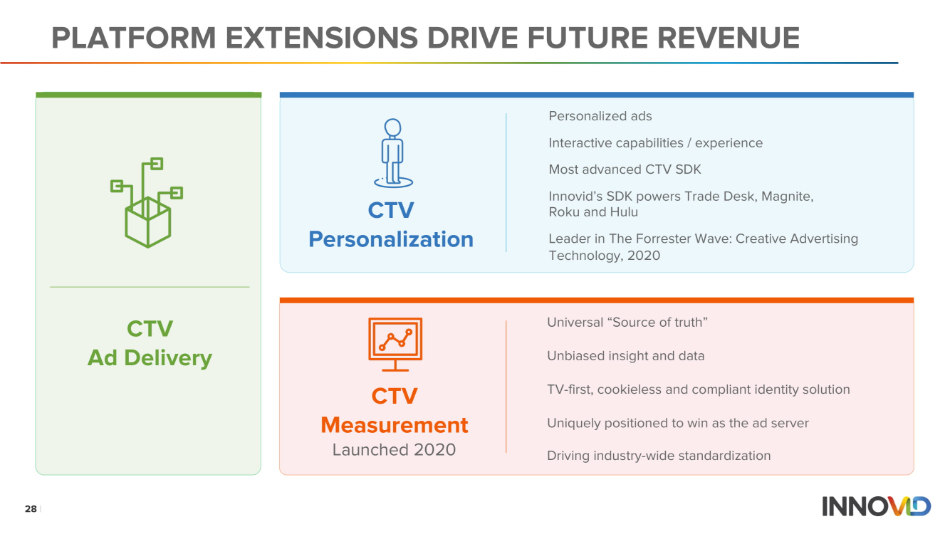

Centralized Creative A d - D e li v e r y Personalization and I n t er a c t i v i t y Advanced Mea s ure m ent 11 | C T V C R E A T E S O PP O R T U N I T I E S AND CHALLENGES

Leading Independent Ad Delivery and Measurement Platform for Connected TV Empowering advertisers to shift investment f r o m li n e a r t o c o nn e c t e d T V

ABOUT INNOVID

P E O PL E - F I R S T: A N A W A R D - W I NN I N G C U L TU R E 14 | INNOVID’S Company Values Ou r s h a r e d v a l u e s un i t e o u r t e a m a n d d r i v e our award - winning company culture Be GENEROUS ~365 Employees N Y C H e a d q u a r t e r s 1 5 O ff i c e s W o r l d w i d e 4.8 99% s t a r r a t i n g CE O a ppr o v a l Be D A R I N G Be UN B E A T A B LE HQ S E L E C T I N V E S T O R S

IN N O V ID = “ IN N O V A T IO N + V ID E O ” F o c u s o n C T V h a s l e d t o a gr o wi n g li s t o f i n d u s t r y f ir s t s a n d k e y m il e s t o n e s : 1 s t M R C c e r t i f i c a t i on fo r C T V m e a s u r e m e n t 1 s t in t e r a c t iv e S u p e r B o w l a d 1 s t C T V a d v e r t i s i n g S D K t o m a r k et E x c l u s iv e R o ku A C R i n t e g r a t i on Na m e d a l e ad e r b y F o rr e s t e r 1 s t a d s e r v i n g i n to Peacock F O C U S E D O N C TV B E F O R E T H E R E W A S C TV 15 | IN V E N T I O N I S IN G R A IN E D I N INN O V ID ’ S DNA x Inse r t i nt e ra c t i v e o b j e c t s i n t o vi d e o c o n t e n t x Video - associated objects x Se r v i n g o b jec t s to be i n s e r t e d to v i de os and t r a c k i ng u s age statistics x Real - time monitoring of s e n t i m e n t w i t h r e s p e c t o f a d e s i r e d p h r as e x An a l y z i n g s e n t i m e n t bas e d o n t e r m ta x o n o m i e s o f U G C 20 0 8 - 1 s t PA T E N T

Media Ec o s y s t e m Measurement Delivery CT V Innovid’s CTV advertiser software platform: x A u t o m a t i c a lly u p l o a ds a n d e n c o de s a d v e r t i s i n g c r e a t i v e t o s t r e a m a ds t o a n y s c r ee n o r de v i c e x M a n a ge s t h e p h y s i c a l de li v e r y o f a ds – c o nn e c t i n g m a r k e t e r s a n d p u bli s h e r s in r e a l - t i m e x Independently measures performance across the w id e s t br e a d t h o f M R C a cc r e di t e d m e t r i c s DELIVERING AND MEASURING ADS A C R O SS A L L M A J O R T V M E D I U M S CT V A d D e li ve r y & M e a s u r e m e n t 16 |

Pu bli s h e r A pp s St r e a m C o n te n t Demand Side Platform (DSP) P r o g r a mm a t i c M e di a B u y i n g Supply Side Platforms (SSP) P r o g r a mm a t i c M e di a S e lli n g Connected TV Devices Con n e c t i n g t h e T V t o t h e I n t e r n e t F r a g m e n t a t i on c o m p li c a t e s a d v e r t i s i n g - w e w o r k w i t h , n o t a ga i n s t , t h e l e a di n g p l a y e r s in t h e t e c hn o l o gy s t a c k PARTNERING ACROSS THE ADTECH ECOSYSTEM INNO V ID INT E G R A T E S AC R O SS A D T E C H : 17 | Measurement Delivery CT V CT V A d D e li ve r y & M e a s u r e m e n t P L A T F O R M S S UPPO R T E D I N C L U D E :

ST R A T E G I C , E X C L U SI V E P A R T N E R S H I PS TO ADVANCE CTV ADVERTISING Leading in CTV innovation as acknowledged by industry - f ir s t a n d e x c l u s i v e r e l a t i o n s h i p s w i t h l e a di n g p r o v id e r s 18 |

GO - TO - MARKET

Source: Kantar (https:// www.kantar.com/), Winmo (https:// www.winmo.com/) OUR GO - TO - MARKET STRATEGY Se lli n g t o b r a n d s , u s e d b y a g e n c ie s Pr i m a r y C T V t e c hn o l o g y pla t f o r m u s e d b y ou r clie n ts Tec hn o l o g y f ee s b a s ed on a d s d e l i v e r ed , n o t m ed i a spend 20 |