Form 425 Exterran Corp Filed by: Enerflex Ltd.

Filed by Enerflex Ltd. pursuant to Rule 425 under the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: Exterran Corporation Commission File No. 001-36875 Enerflex and Exterran to Combine, Creating a Premier Integrated Global Provider of Energy Infrastructure January 24, 2022 ALL FIGURES HEREIN PRESENTED IN US DOLLARS UNLESS OTHERWISE NOTED

Advisories This presentation contains forward-looking information within the meaning of applicable Canadian securities laws and within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to the respective management expectations about future events, results of operations and the future performance (both operational and financial) and business prospects of Enerflex Ltd. (Enerflex), Exterran Corporation (Exterran), or the surviving entity resulting from the combination (transaction) of a direct wholly owned subsidiary of Enerflex with Exterran (the combined entity). All statements other than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “future”, “plan”, “contemplate”, “continue”, “estimate”, “expect”, “intend”, “propose”, “might”, “may”, “will”, “shall”, “project”, “should”, “could”, “would”, “believe”, “predict”, “forecast”, “pursue”, “potential”, “objective” and “capable” and similar expressions are intended to identify forward-looking information. In particular, this presentation includes (without limitation) forward- looking information pertaining to: the anticipated financial performance of the combined entity, including the acceleration of its growth of recurring gross revenues and the contribution of different segments and their respective business drivers to such accelerated growth; the expected run rate synergies and efficiencies to be achieved as a result of the transaction and the quantum and timing associated therewith; the dual listing of Enerflex common shares on the Toronto Stock Exchange and the New York Stock Exchange or NASDAQ Inc., as applicable, to be effective upon transaction close, and the expectation that such dual listing will improve market liquidity; expected pro forma EBITDA and free cash flow; Enerflex’s anticipated prioritization of balance sheet strength, sustainable shareholder returns and disciplined growth; expectations regarding the combined entity’s enterprise value and Adjusted EBITDA; the pro forma outlook in relation to EBITDA, committed capital expenditures, works-in-progress and free cash flow; accelerated free cash flow and the expected timing thereof resulting from reductions in overhead and operational efficiencies; pro forma geographic exposure and the expected revenues associated therewith; the pro forma entity’s expanded depth and technical expertise in natural gas and energy transition solutions, and expanded product lines in three distinct markets and the growth prospects thereof; the allocation of future capital expenditures, including the amount and nature thereof; business prospects and strategy; expansion and growth of the business and operations, including position in the energy service markets; expectations regarding future dividends; the 3-year revolving credit facility and up to 5-year bridge loan facility and the combined entity’s related targets of net debt to EBITDA and the timing thereof; the bridge loan facility providing financing to backstop an anticipated issuance of new debt securities and the timing thereof; the committed financing being sufficient to fully repay existing Enerflex and Exterran notes and revolving credit facilities, provide for capital expenditures and other ordinary course capital needs, and provide significant liquidity for the pro forma business; the priorities of the combined entity in 2023 following capital project commitments in 2022; the combined entity’s expected commitment to environmental, social and governance matters; the combined entity’s ability to deliver sustainable solutions and support a global transition toward a lower carbon future; the constitution of the Board of Directors of the combined entity as at closing of the transaction; the receipt of all necessary approvals including the approval of the Enerflex shareholders and Exterran shareholders and the timing associated therewith; and the successful completion of the transaction and the anticipated closing date. This forward-looking information is based on assumptions, estimates and analysis made by Enerflex and its perception of trends, current conditions and expected developments, as well as other factors that are believed by Enerflex to be reasonable and relevant in the circumstances and in light of the transaction. All forward-looking information in this presentation is subject to important risks, uncertainties, and assumptions, which are difficult to predict and which may affect Enerflex’s operations, including, without limitation: the satisfaction of closing conditions to the transaction in a timely manner, if at all; receipt of all necessary regulatory and/or competition approvals on terms acceptable to Enerflex and Exterran; the impact of economic conditions including volatility in the price of oil, gas, and gas liquids, interest rates and foreign exchange rates; industry conditions including supply and demand fundamentals for oil and gas, and the related infrastructure including new environmental, taxation and other laws and regulations; business disruptions resulting from the ongoing COVID-19 pandemic; the ability to continue to build and improve on proven manufacturing capabilities and innovate into new product lines and markets; increased competition; insufficient funds to support capital investments required to grow the business; the lack of availability of qualified personnel or management; political unrest; and other factors, many of which are beyond the control of Enerflex. Readers are cautioned that the foregoing list of assumptions and risk factors should not be construed as exhaustive. While Enerflex believes that there is a reasonable basis for the forward-looking information and statements included in this presentation, as a result of such known and unknown risks, uncertainties and other factors, actual results, performance, or achievements could differ and such differences could be material from those expressed in, or implied by, these statements. The forward-looking information included in this presentation should not be unduly relied upon as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to: the completion and related timing for completion of the transaction; the ability of Enerflex and Exterran to timely receive any necessary regulatory, shareholder, stock exchange, lender, or other third-party approvals to satisfy the closing conditions of the transaction; interloper risk; the ability to complete the transaction on the terms contemplated by Enerflex and Exterran or at all; the ability of the combined entity to realize the anticipated benefits of, and synergies from, the transaction and the timing and quantum thereof; consequences of not completing the transaction, including the volatility of the share prices of Enerflex and Exterran, negative reactions from the investment community and the required payment of certain costs related to the transaction; actions taken by government entities or others seeking to prevent or alter the terms of the transaction; potential undisclosed liabilities unidentified during the due diligence process; the accuracy of the pro forma financial information of the combined entity; the interpretation of the transaction by tax authorities; the success of business integration and the time required to successfully integrate; the focus of management's time and attention on the transaction and other disruptions arising from the transaction; the ability to maintain desirable financial ratios; the ability to access various sources of debt and equity capital, generally, and on acceptable terms, if at all; the ability to utilize tax losses in the future; the ability to maintain relationships with partners and to successfully manage and operate integrated businesses; risks associated with technology and equipment, including potential cyberattacks; the occurrence of unexpected events such as pandemics, war, terrorist threats and the instability resulting therefrom; risks associated with existing and potential future lawsuits, shareholder proposals and regulatory actions; and those factors referred to under the heading Risk Factors in Enerflex's annual information form and Exterran’s Form 10-K, each for the year ended December 31, 2020, and in Enerflex’s management’s discussion and analysis and Exterran’s Form 10-Q, each for the three and nine months ended September 30, 2021, located on SEDAR and EDGAR respectively. In addition, the effects and impacts of the ongoing COVID-19 pandemic, the rapid decline in global energy prices and the length of time to significantly reduce the global threat of COVID-19 on Enerflex’s, Exterran’s, and the combined entity’s respective businesses, the global economy and markets are unknown and cannot be reasonably estimated at this time and could cause actual results to differ materially from the forward-looking statements contained in this presentation. 2

Advisories The forward-looking information contained herein is expressly qualified in its entirety by the above cautionary statement. The forward-looking information included in this presentation is made as of the date of this presentation and, other than as required by law, Enerflex disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. This presentation and its contents should not be construed, under any circumstances, as investment, tax or legal advice. All figures in US dollars unless otherwise indicated. Future-Oriented Financial Information This presentation contains information that may constitute future-oriented financial information or financial outlook information (FOFI) about Enerflex, Exterran and the combined entity’s prospective financial performance, financial position or cash flows, all of which is subject to the same assumptions, risk factors, limitations and qualifications as set forth above. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may provide to be imprecise or inaccurate and, as such, undue reliance should not be placed on FOFI. Enerflex, Exterran or the combined entity’s actual results, performance and achievements could differ materially from those expressed in, or implied by, FOFI. Enerflex and Exterran have included FOFI in this presentation in order to provide readers with a more complete perspective on the combined entity’s future operations and management’s current expectations regarding the combined entity’s future performance. Readers are cautioned that such information may not be appropriate for other purposes. FOFI contained herein was made as of the date of this presentation. Unless required by application laws, Enerflex and Exterran do not undertake any obligation to publicly update or revise any FOFI statements, whether as a result of new information, future events, or otherwise. No Offer or Solicitation This presentation is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find It In connection with the proposed transaction, Enerflex and Exterran will file relevant materials with the Securities and Exchange Commission (“SEC”), including a Registration Statement containing a proxy statement/prospectus on appropriate form of registration statement regarding each of Enerflex and Exterran, respectively, and an information circular regarding Exterran. After the Registration Statement has become effective, the definitive proxy statement/prospectus will be mailed to Exterran stockholders. The information circular will be mailed to Enerflex shareholders. Both the definitive proxy statement/prospectus and information circular will contain important information about the proposed transaction and related matters. INVESTORS AND SHAREHOLDERS ARE URGED AND ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS AND INFORMATION CIRCULAR, AS APPLICABLE, CAREFULLY WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. The definitive proxy statement, the preliminary proxy statement, the information circular, and other relevant materials in connection with the transaction (when they become available) and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC's website, at www.sec.gov and with SEDAR may be obtained free of charge from the SEDAR website at www.sedar.com. The documents filed by Enerflex with the SEC and SEDAR may also be obtained free of charge at Enerflex’s investor relations website at https://www.enerflex.com/investors/index.php. Alternatively, these documents, when available, can be obtained free of charge from Enerflex upon written request to Enerflex Ltd., Attn: Investor Relations, Suite 904, 1331 Macleod Trail SE, Calgary, Alberta, Canada T2G 0K3 or by calling +1.403.387.6377. The documents filed by Exterran with the SEC may also be obtained free of charge at Exterran’s investor relations website at https://www.exterran.com/EXTN. Alternatively, these documents, when available, can be obtained free of charge from Exterran upon written request to [email protected] or by calling +1.281.836.7000. Participants in the Solicitation Enerflex, Exterran and their respective directors and executive officers may be deemed, under SEC rules, to be participants in the solicitation of proxies from Exterran’s shareholders in connection with the transaction. Information about Exterran’s directors and executive officers and their ownership of Exterran’s ’s securities is set forth in Exterran’s definitive proxy statement on Schedule 14A filed with the SEC on March 17, 2021 and may also be obtained free of charge at Enerflex’s investor relations website at https://www.enerflex.com/investors/index.php. Alternatively, these documents can be obtained free of charge from Exterran upon written request to [email protected] or by calling +1.281.836.7000. You may obtain information about Enerflex’s executive officers and directors in Enerflex's Annual Information Form, which was filed with SEDAR on February 24, 2021. These documents may be obtained free of charge from the SEDAR website at www.sedar.com and may also be obtained free of charge at Enerflex’s investor relations website at https://www.enerflex.com/investors/index.php. Alternatively, these documents can be obtained free of charge from Enerflex upon written request to Enerflex Ltd., Attn: Investor Relations, Suite 904, 1331 Macleod Trail SE, Calgary, Alberta, Canada T2G 0K3 or by calling +1 403.387.6377. Additional information regarding the interests of all such Exterran directors and officers in the proposed transaction will be included in the proxy statement relating to such transaction when it is filed with the SEC. 3

Advisories (Cont’d) Non-IFRS Measures: Financial measures in this presentation do not have a standardized meaning as prescribed by generally accepted accounting principles in Canada, which are International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. These non-IFRS measures include Adjusted EBITDA, net debt and free cash flow. These non-IFRS measures may not be comparable to similar measures presented by other issuers. These measures have been described and presented in order to provide shareholders, potential investors and analysts with additional measures for assessing the performance of Enerflex, Exterran and, where applicable, the pro forma expectations of the combined entity, as applicable, and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Adjusted gross margin is a non-IFRS measure defined as gross margin excluding the impact of depreciation and amortization. The historical costs of assets may differ if they were acquired though acquisition or constructed, resulting in differing depreciation. Adjusted gross margin is useful to present the operating performance of the business before the impact of depreciation that may not be comparable across assets. Adjusted EBITDA is a non-IFRS measure defined as net earnings or loss before finance costs, taxes, depreciation, depletion, amortization, non-cash impairments or impairment reversals on non-current assets, unrealized gains or losses on mark to market commodity transactions, equity-settled share-based compensation, other income/expenses, and certain items that are considered unique in nature, including restructuring costs and transaction costs. Management of Enerflex and Exterran believe that Adjusted EBITDA is a useful supplemental measure to evaluate the results of each issuer’s principal business activities prior to consideration of how those activities are financed and the impacts of foreign exchange, taxation, depreciation, depletion and amortization, and other non-cash charges that add volatility to financial results (such as impairment expenses, share-based compensation, and other transactions that are unique in nature). A quantitative reconciliation of this non-IFRS measure is incorporated by reference herein and can be found on page 3 under the heading “Adjusted EBITDA” of Enerflex’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2021 and 2020, which is available under Enerflex’s profile at www.sedar.com Net debt is a non-IFRS measure defined as short- and long-term debt less cash and cash equivalents. Net debt is a commonly used non-IFRS measures to assess overall indebtedness and capital structure. Net debt is a non-IFRS measure to assess overall indebtedness and capital structure. See page 15 under the heading “Non-IFRS Measures” of Enerflex’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2021 and 2020, which is available under Enerflex’s profile at www.sedar.com. Free cash flow is a non-IFRS measure defined as cash from operating activities in a period adjusted for changes in non-cash working capital, non-cash items (including interest expense and current tax expense) and non-normal course inflows (including proceeds on the disposition of property, plant and equipment (“PP&E”) and rental equipment), less cash items (interest paid, cash taxes paid, work-in-progress related to finance leases, additions to PP&E, maintenance capital expenditures, growth capital expenditures, and dividends) and non-normal course outflows. Free cash flow is a non-IFRS measure used in to assist in measuring a company’s ability to finance its capital programs and meet its financial obligations. A quantitative reconciliation of this non-IFRS measure is incorporated by reference herein and can be found on page 16 under the heading “Free Cash Flow” of Enerflex’s Management’s Discussion and Analysis for the three and nine months ended September 30, 2021 and 2020, which is available under Enerflex’s profile at www.sedar.com. 4

Strategic Rationale Creates a Premier Integrated Global Provider of Energy Infrastructure • Geographic balance with ~25-35% of revenues from each of North America, the Middle East, and Latin America • Accesses a larger, more diverse opportunity set for global energy infrastructure and energy transition solutions Accelerates Growth of Recurring Revenues • Approximately doubles EBITDA, with > 50% CFPS accretion and ~50% EPS* accretion for Enerflex shareholders • Accelerates Asset Ownership strategy, with > 70% of the combined entity’s pro forma gross margin from recurring sources, strengthening its margin profile and reducing cyclicality Significantly Improves Efficiencies • Consolidation drives significant operational and SG&A synergies • Targeting at least US$40 million of annual run-rate synergies within 12 – 18 months after closing Enhanced Size and Scale • Meaningfully enhanced scale with pro forma 2023e EBITDA of US$360 - $400 million, inclusive of synergies • Significant free cash flow in 2023+ provides capital allocation flexibility. Enerflex will prioritize: balance sheet strength, sustainable shareholder returns, and disciplined growth Long-Term Stable Capital Structure • Fully committed debt capital structure of US$600 million revolving credit facility and US$925 million High Yield Bridge/Unsecured Notes supports full repayment of existing notes and revolving credit facilities • Targeting 2.5x-3.0x net debt to EBITDA within 12 – 18 months of closing Commitment to Sustainability • Combined entity’s business lines, including water and energy transition solutions, reinforce its commitment to sustainability • Products support a global transition toward a lower carbon future 5 * EPS accretion subject to final purchase price allocation upon closing.

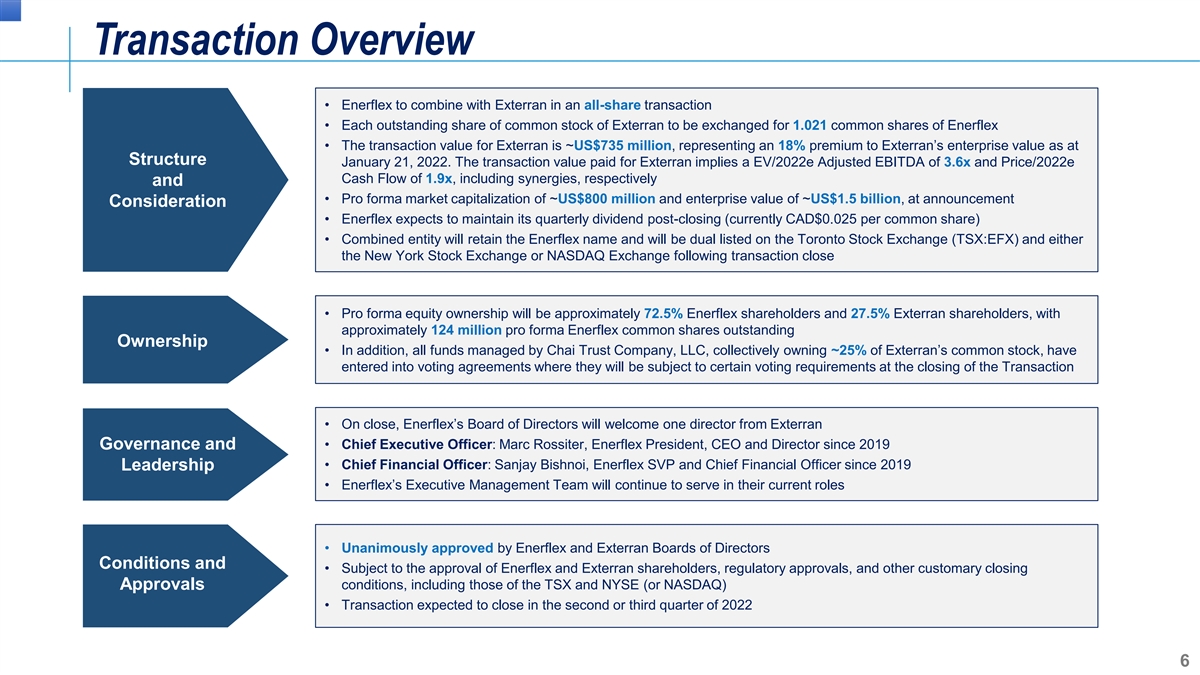

Transaction Overview • Enerflex to combine with Exterran in an all-share transaction • Each outstanding share of common stock of Exterran to be exchanged for 1.021 common shares of Enerflex • The transaction value for Exterran is ~US$735 million, representing an 18% premium to Exterran’s enterprise value as at Structure January 21, 2022. The transaction value paid for Exterran implies a EV/2022e Adjusted EBITDA of 3.6x and Price/2022e Cash Flow of 1.9x, including synergies, respectively and • Pro forma market capitalization of ~US$800 million and enterprise value of ~US$1.5 billion, at announcement Consideration • Enerflex expects to maintain its quarterly dividend post-closing (currently CAD$0.025 per common share) • Combined entity will retain the Enerflex name and will be dual listed on the Toronto Stock Exchange (TSX:EFX) and either the New York Stock Exchange or NASDAQ Exchange following transaction close • Pro forma equity ownership will be approximately 72.5% Enerflex shareholders and 27.5% Exterran shareholders, with approximately 124 million pro forma Enerflex common shares outstanding Ownership • In addition, all funds managed by Chai Trust Company, LLC, collectively owning ~25% of Exterran’s common stock, have entered into voting agreements where they will be subject to certain voting requirements at the closing of the Transaction • On close, Enerflex’s Board of Directors will welcome one director from Exterran • Chief Executive Officer: Marc Rossiter, Enerflex President, CEO and Director since 2019 Governance and • Chief Financial Officer: Sanjay Bishnoi, Enerflex SVP and Chief Financial Officer since 2019 Leadership • Enerflex’s Executive Management Team will continue to serve in their current roles • Unanimously approved by Enerflex and Exterran Boards of Directors Conditions and • Subject to the approval of Enerflex and Exterran shareholders, regulatory approvals, and other customary closing Approvals conditions, including those of the TSX and NYSE (or NASDAQ) • Transaction expected to close in the second or third quarter of 2022 6

Enhanced Presence in Key Growth Regions Highly complementary business lines and expanded offerings across key growth regions • Focused on four key geographies: North America, Middle East/Africa, Asia Pacific, and Latin America. Each region expected to present opportunities for growth in coming years • Balanced geographic revenue exposure with ~25-35% from each of North America, the Middle East, and Latin America • Middle East and Latin American cash flows largely underwritten by long-term take-or-pay contracts with NOCs and IOCs that require assets to sustain production and fund fiscal spending (2) Pro Forma Revenue Mix by Geography, TTM Q3 2021 Asia Canada Pacific 11% 8% Middle East USA 4 Key Geographies 27% US$977MM 28% 75+ Operating locations Relative Natural Gas Production Latin (1) Growth Forecast, 2020 – 2050 America 26% (1) Source: U.S. Energy Information Administration, International Energy Outlook 2021. 7 (2) Corporate disclosure, 9 months ended Sept 30, 2021.

Operationally Advantaged Pro forma Enerflex has expanded depth and technical expertise in both natural gas and energy transition solutions Pro Forma Business Lines Energy Infrastructure Any solution on a leased basis, including water treatment and energy transition solutions Engineered Systems Modular gas handling and low-carbon solutions for CO , 2 biofuels, and electricity. Expanded capabilities in cryogenic, oil processing, and water treatment applications Integrated Turnkey (“ITK”) Turnkey Engineered Systems, with local construction and installation After-Market Services Installation, commissioning, O&M, and parts and global support for all products 8

Expanded Product Lines Target Multiple End Markets Combined entity’s deep expertise in modular equipment benefits three distinct markets each with significant growth prospects Natural Gas Energy Transition Water ü All produced gas requires compression and ü Modular solutions will benefit the energy transitionü Water processing for recycling processing ü Evolving markets will target CCUS, bioenergy, ü De-Sanding ü Global gas production growth remains resilient hydrogen, and electrification ü De-Oiling North American Market Assessment (2021-50) Natural Gas Production Supply Growth (2020 – 2030) DNV, BP Rapid Sky, IEA SDS Scenario = Relative Enerflex TAM Natural gas supply, EJ/Yr 162 BP 160 158 DNV 156 154 IEA SDS 152 150 148 146 144 2021 2023 2025 2027 2029 2020 2030 9 Source: IEA; DNV GL Energy Transition Outlook; BP Energy Outlook. Enerflex analysis.

Accelerated Growth of Recurring Margin Balanced contribution across recurring segments and manufacturing enhances resiliency Gross Margin % Business Drivers US$500 - $600 million Demand for new natural ~20-30% Engineered Systems / 10 – 20% gas, water, and energy Product Sales transition infrastructure ~15-20% After-Market Services 20 – 25% Installed base of equipment Long term take or pay ~70% contracts with NOCs & from IOCs Energy Infrastructure recurring ~55-60% (BOOM, ECO & Contract sources 55 – 65% Compression) Contract Compression driven by growth and maintenance of produced natural gas volumes 2022e Pro Forma Adj. Gross (1) Margin 10 (1) Adjusted Gross Margin is a non-IFRS measure defined as gross margin excluding the impact of depreciation and amortization. See appendix for historical reconciliation to amounts presented in Enerflex’s MD&A.

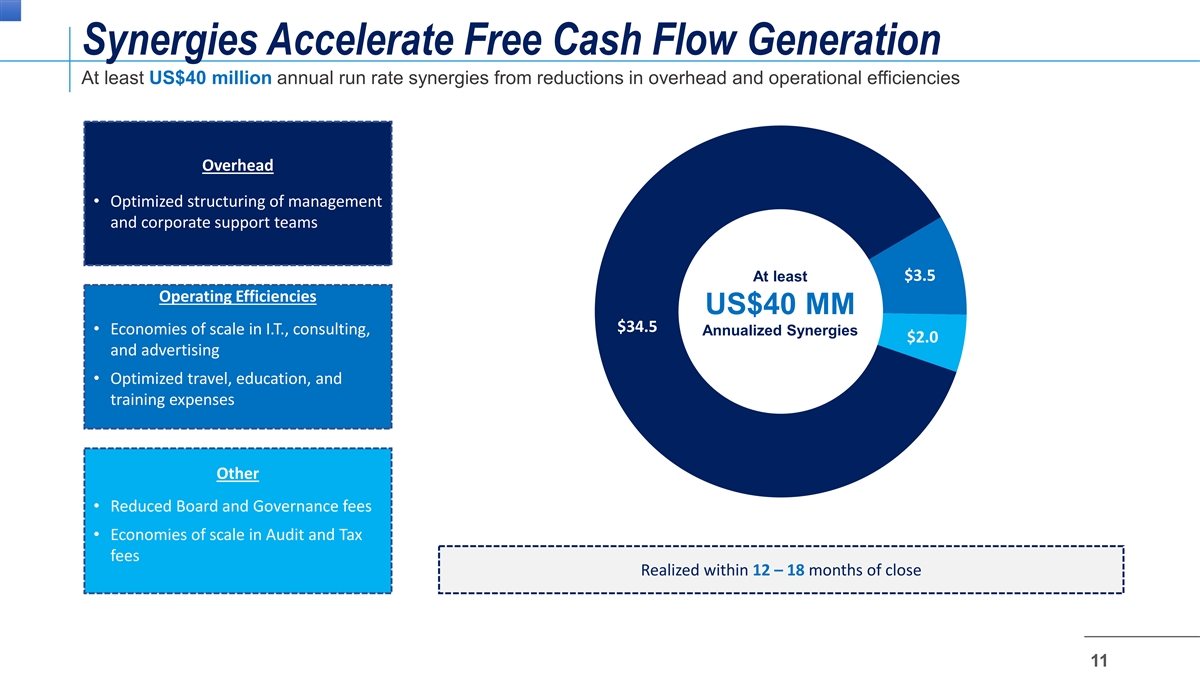

Synergies Accelerate Free Cash Flow Generation At least US$40 million annual run rate synergies from reductions in overhead and operational efficiencies Overhead • Optimized structuring of management and corporate support teams At least $3.5 Operating Efficiencies US$40 MM $34.5 • Economies of scale in I.T., consulting, Annualized Synergies $2.0 and advertising • Optimized travel, education, and training expenses Other • Reduced Board and Governance fees • Economies of scale in Audit and Tax fees Realized within 12 – 18 months of close 11

Enhanced Scale and Improved Capital Markets Relevance The combined entity benefits from improved size and scale, increasing its relevance to capital markets All Values in US$MM (1) (1) (2) Enterprise Value Enterprise Value vs. LTM Adjusted EBITDA $5,000 $4,000 $3,000 $4,000 GEI $2,000 USAC $1,000 $3,000 AROC $0 GEI USAC AROC SES Pro NESR BDGI SES Forma (2) $2,000 LTM Adjusted EBITDA, including combination synergies Pro Forma NESR $400 $1,000 BDGI $300 $200 $0 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $100 LTM EBITDA $0 USAC AROC GEI Pro SES NESR BDGI Forma Dual TSX and NYSE (or NASDAQ) listings expected to improve market liquidity Enerflex Exterran Synergies (1) Source: Bloomberg. Includes market capitalization as of January 21, 2022 and net debt as at September 30, 2021. 12 (2) Source: Bloomberg. Illustrates contribution of expected annual cost savings. Enterprise Value

Capital Structure Long-term, stable capital structure with ample liquidity 09/30/2021 Capital Structure (1) In USD millions Enerflex Exterran Pro Forma Secured Debt • US$600 million 3-year secured Revolving ABL 33 - - Credit Facility Credit Facility Committed - 650 600 (2) • Favourable covenant structure Drawn - 226 - Undrawn - 424 600 • US$925 million High Yield Bridge / Total Secured Debt 33 226 - iri Unsecured Notes Unsecured Debt Credit Facility • Committed US$925 million 5-year Bridge Committed 573 - - facility provides financing to backstop an Drawn 31 - - Undrawn 542 - - anticipated issuance of new debt securities Private Placement Notes 212 - - prior to close Senior Unsecured Notes Existing - 350 - • Committed financing is sufficient to fully repay New Issuance - - 925 existing Enerflex and Exterran notes and Total Unsecured Debt 243 350 925 revolving credit facilities and support putting in Total Debt 276 576 925 place a new capital structure, provide for Cash $81 $58 $212 capital expenditures and other ordinary Net Debt 195 518 713 course capital needs, and provide significant Total Debt / LTM Adj. EBITDA 2.3x 4.0x 3.5x liquidity for the pro forma business Total Debt / LTM Adj. EBITDA (incl. annual synergies) 3.0x Net Debt / LTM Adj. EBITDA 1.6x 3.6x 2.7x Net Debt / LTM Adj. EBITDA (incl. annual synergies) 2.3x (1) Illustrative pro forma capital structure represents Enerflex and Exterran indebtedness as at September 30, 2021, excludes transaction, financing and integration costs; Reflects FX of 0.79x USD/CAD as at September 30, 2021. 13 (2) Bank-adjusted total net debt to EBITDA covenant of 4.5x to step down to 4.0x by the fourth quarter of 2023.

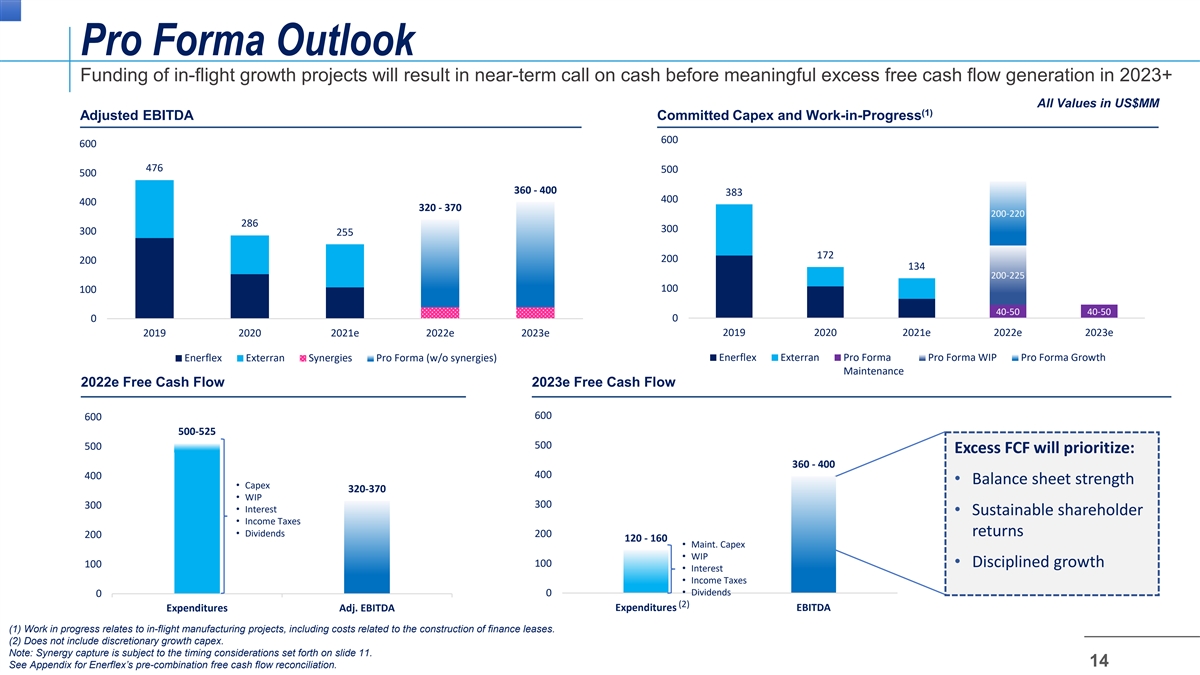

Pro Forma Outlook Funding of in-flight growth projects will result in near-term call on cash before meaningful excess free cash flow generation in 2023+ All Values in US$MM (1) Adjusted EBITDA Committed Capex and Work-in-Progress 600 600 476 500 500 360 - 400 383 400 400 320 - 370 200-220 286 300 300 255 172 200 200 134 200-225 100 100 40-50 40-50 0 0 2019 2020 2021e 2022e 2023e 2019 2020 2021e 2022e 2023e Enerflex Exterran Synergies Pro Forma (w/o synergies) Enerflex Exterran Pro Forma Pro Forma WIP Pro Forma Growth Maintenance 2022e Free Cash Flow 2023e Free Cash Flow 600 600 500-525 500 500 Excess FCF will prioritize: 360 - 400 400 400 • Balance sheet strength • Capex 320-370 • WIP 300 300 • Interest • Sustainable shareholder • Income Taxes • Dividends returns 200 200 120 - 160 • Maint. Capex • WIP 100 100 • Disciplined growth • Interest • Income Taxes 0 • Dividends 0 (2) Expenditures Adj. EBITDA Expenditures EBITDA (1) Work in progress relates to in-flight manufacturing projects, including costs related to the construction of finance leases. (2) Does not include discretionary growth capex. Note: Synergy capture is subject to the timing considerations set forth on slide 11. 14 See Appendix for Enerflex’s pre-combination free cash flow reconciliation.

Go Forward Capital Allocation Philosophy Following 2022’s capital project commitments, capital allocation in 2023+ will prioritize: balance sheet strength, sustainable shareholder returns, and growth Capital Allocation Principles Maintain ample liquidity, targeting Net Debt / EBITDA of 2.5x - 3.0x within 12 - 18 months of closing • Protect the balance sheet by achieving leverage target and Pay sustainable base dividend maintaining ample liquidity Investment in product lines and capabilities, including for energy • Sustainable dividend transition • Disciplined growth focused If Net Debt / EBITDA above targets: If Net Debt / EBITDA below targets: 1 2 on full-cycle earnings and return of capital to Balance sheet shareholders Balance sheet Increased shareholder returns (dividend, share buybacks) Shareholder returns (base dividend) Investment Investment 15 Free Cash Flow Committed After Dividend (2023+) Capital (2022)

Committed to Sustainability Enerflex’s pro forma business lines together with its environmental, social, and governance processes reinforce its commitments to corporate sustainability Environmental Social Governance Ø Core products support a global Ø Track record of leadership in transition toward lower carbon Ø Highly experienced Board of protecting employee health fuel sources Directors and safety Ø Innovative Energy Transition and Ø Commitment to long-term Ø Board and management Water solutions mitigate shareholder value creation prioritizing of diversity in environmental impact via: Ø Executive compensation tied to gender, ethnicity, race, national • CCUS corporate performance, including origin, and geography. • Bioenergy ESG factors Ø Global commitment to an • Hydrogen Ø Board-level oversight of ESG inclusive and diverse work • Electric drive compression performance and programs environment, professional • Produced water reuse and development opportunities, recycling and fair hiring and labor standards 16

Positioned for Success Combination enhances shareholder value PREMIER GLOBAL BALANCED & PREDICTABLE OPTIMIZED EFFICIENCY & PLATFORM EARNINGS LOWER COST OF BUSINESS Focused on four key ~70/30 split of Expect ~US$40 million growth regions, expanded recurring vs. of annual run-rate product lines, excellence in manufacturing margins synergies modular energy solutions pro forma VALUE COMMITTED TO FINANCIAL CREATION SUSTAINABILITY FLEXIBILITY Ample liquidity, ~Doubling of EBITDA and Combined cultures and targeting 2.5x - 3.0x > 50% CFPS accretion. business lines bank-adjusted net debt Meaningful excess free reinforce commitment to EBITDA within 12 – cash flow in 2023+ to sustainability 18 months of closing 17

18

Appendix Non-IFRS Financial Measures 19

Enerflex – Gross Margin Profile by Product Line 20

Enerflex – Historical Free Cash Flow Reconciliation TTM Q3 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Cash provided by operating activities 134,795 134,208 69,024 64,611 104,173 91,792 179,251 242,868 54,169 220,248 157,546 Net change in non-cash working capital and other 48,243 15,531 (28,929) (61,053) (55,251) (41,385) 9,736 38,208 (221,749) 32,776 (3,328) 86,552 118,677 97,953 125,664 159,424 133,177 169,515 204,660 275,918 187,472 160,874 Add back: Net finance costs 7,011 5,661 5,518 9,771 15,310 14,056 12,727 19,145 18,578 22,493 19,522 Current income tax expense 17,293 22,435 23,256 45,949 32,097 20,742 27,525 20,871 31,720 (6,872) (10,658) Proceeds on the disposal of property, plant and equipment 22,853 9,205 115 117 Proceeds on the disposal of rental equipment 6,935 4,454 3,121 1,490 Deduct: Net interest paid (8,525) (6,356) (5,408) (8,999) (13,657) (13,116) (11,957) (18,373) (18,398) (22,374) (21,137) Net cash taxes (paid) received (25,642) (16,723) (26,801) (34,667) (39,839) (15,089) (31,580) (2,273) (29,434) (13,259) (10,882) Expenditure related to finance leases (23,132) Additions to property, plant and equipment (16,920) (46,322) (9,874) (5,070) Additions to rental equipment: Growth (102,960) (208,978) (110,820) (38,589) Maintenance (12,365) (8,090) (13,059) (10,476) Dividends paid (9,266) (18,606) (21,798) (23,499) (26,804) (26,921) (30,066) (33,676) (37,548) (24,212) (7,175) Net capital spending 33,993 (32,706) (17,365) (32,401) (166,318) 4,244 (13,159) Free cash flow 101,416 72,382 55,355 81,818 (39,787) 117,093 123,005 87,897 (8,895) 12,731 54,884 Free cash flow before net capital spending 67,423 105,088 72,720 114,219 126,531 112,849 136,164 190,354 240,836 143,248 107,412 21

Investor Relations Contacts For Enerflex inquiries: Stefan Ali Vice President, Strategy and Investor Relations Enerflex Ltd. [email protected] +1-403-717-4953 For Exterran inquiries: Blake Hancock Vice President of Finance – FP&A, Investor Relations, and Corporate Development Exterran Corporation [email protected] +1-281-854-3043 22

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- New Induction Heating System Revolutionizes Metal Processing with Enhanced Efficiency and Stress Relief Capabilities

- Salesforge Gains Pre-Seed Funding of $500K to Create a Future-Proof AI Co-Pilot in B2B Sales

- Marqeta Partners with OakNorth to Offer Commercial Cards in the UK, Embracing Growing Small and Medium-Sized Business Demand for Better Banking Tools

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share