Form 425 European Sustainable Filed by: Ads-Tec Energy Public Ltd Co

Filed by Ads-Tec Energy Public Ltd Co

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company:

European Sustainable Growth Acquisition Corp.

(Commission File No. 001-39917)

Commission File No. for related Registration Statement: 333-260312

M itarbeiterkür z el ADS - TEC Energy Investor Presentation Oct obe r 2021

M itarbeiterkür z el Disclaimer This investor presentation (this “Investor Presentation”) has been prepared by ads - tec Energy GmbH (collectively comprising the operating subsidiaries of ads - tec Energy GmbH referred to herein as the “Company”)) and European Sustainable Growth Acquisition Corp. (“EUSG” or the “SPAC”) in connection with the proposed business combination (the “Business Combination”) of EUSG and the Company. This Investor Presentation is for informational purposes only and does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of the SPAC or the Company, or their respective affiliates, which offer may only be made at the time a qualified offeree receives definitive offering documents and other materials (collectively, the “Offering Materials”). Without limiting the generality of the foregoing, this Investor Presentation does not constitute an invitation or inducement of any sort to any person in any jurisdiction in which such an invitation or inducement is not permitted or where the SPAC and the Company are not qualified to make such invitation or inducement. In the event of any conflict between this Investor Presentation and information contained in the Offering Materials, the information in the Offering Materials will control and supersede the information contained in this Investor Presentation. No person has been authorized to make any statement concerning the SPAC or the Company other than as will be set forth in the Offering Materials, and any representation or information not contained therein may not be relied upon. Cautionary Language Regarding Forward - Looking Statements This Investor Presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as “may,” “might,” “will,” “would,” “could,” “should,” “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward - looking statements, which include estimated financial information, involve known and unknown risks, uncertainties and other factors. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward - looking statements. These factors include, without limitation, • the risk that the proposed Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of the securities of the SPAC or the Company; • the risk that the proposed Business Combination may not be completed by the 24 - month deadline to which the SPAC is subject and the potential failure to obtain an extension of the deadline if sought by the SPAC; • the failure to satisfy conditions to the consummation of the proposed Business Combination, including the adoption of a business combination agreement (the “BCA”) by the shareholders of the SPAC and the Company; • the lack of a third - party valuation in determining whether or not to pursue the proposed Business Combination; • the occurrence of any event, change or other circumstance that could give rise to the termination of the BCA; • the effect of the announcement or pendency of the proposed Business Combination on the Company’s business relationships, performance and business generally; • risks that the proposed Business Combination disrupts current plans and operations of the Company; • the outcome of any legal proceedings that may be instituted against the Company or the SPAC related to the BCA or the proposed Business Combination; • the ability to maintain the listing of the SPAC’s securities on Nasdaq; • the volatility of the price of the SPAC’s and the post - combination company’s securities; • the ability to implement business plans, forecasts and other expectations after the completion of the proposed Business Combination, and identify and realize additional opportunities; • the risk of downturns and the possibility of rapid change in the highly competitive industry in which the Company operates; • the risk that the Company and its current and future collaborators are unable to successfully develop and commercialize the Company’s products or services, or experience significant delays in doing so; • the risk that the post - combination company may not achieve or sustain profitability; • the risk that the post - combination company will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; and • the risk that the post - combination company experiences difficulties in managing its growth and expanding operations. You should (also) carefully consider the risks and uncertainties described on pages 19 and 20 of this presentation Forward - looking statements are based on current expectations, estimates, projections, targets, opinions and/or beliefs of the SPAC and the Company or, when applicable, of one or more third - party sources. No representation or warranty is made with respect to the reasonableness of any estimates, forecasts, illustrations, prospects or returns, which should be regarded as illustrative only. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the SPAC’s registration statement on Form S - 1 (the “Registration Statement”) and the proxy statement/prospectus discussed below and other documents filed by the SPAC from time to time with the U.S. Securities and Exchange Commission (“SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements. You are cautioned not to place undue reliance upon any forward - looking statements, which, unless otherwise indicated herein, speak only as of the date of this Investor Presentation. Neither the SPAC nor the Company commits to update or revise the forward - looking statements set forth herein, whether as a result of new information, future events or otherwise, except as may be required by law. Use of Projections This Investor Presentation contains financial forecasts or projections (collectively “Projections”) prepared by the Company. The Company’s independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to the Projections for the purpose of their inclusion in this Investor Presentation and, accordingly, neither the SPAC nor the Company expresses an opinion or provides any other form of assurance with respect thereto for the purpose of this Investor Presentation. These Projections should not be relied upon as being necessarily indicative of future results. The Projections are provided solely for illustrative purposes, reflect the current beliefs of the Company as of the date hereof, and are based on a variety of assumptions and estimates about, among others, future operating results, market conditions and transaction costs, all of which may differ from the assumptions on which the Projections are based. The Company does not assume any obligation to update the Projections or information, data, models, facts or assumptions underlying the foregoing in this Investor Presentation. There are numerous factors related to the markets in general or the implementation of any operational strategy that cannot be fully accounted for with respect to the Projections. Any targets or estimates are therefore subject to a number of important risks, qualifications, limitations and exceptions that could materially and adversely affect the combined company’s performance. Moreover, actual events are difficult to project and often depend upon factors that are beyond the control of the SPAC and the Company. The performance projections and estimates are subject to the ongoing COVID - 19 pandemic, and have the potential to be revised to take into account further adverse effects of the COVID - 19 pandemic on the future performance of the SPAC and the Company. Projected returns and estimates are based on an assumption that public health, economic, market, and other conditions will improve; however, there can be no assurance that such conditions will improve within the time period or to the extent estimated by the SPAC and the Company. The full impact of the COVID - 19 pandemic on future performance is particularly uncertain and difficult to predict, therefore actual results may vary materially and adversely from the Projections included herein. Presentation of Financial Information The Company’s financial statement have been prepared in accordance with International Financial Reporting Standards (“IFRS”), which may not be comparable to financial statements prepared in accordance with US generally accepted accounting principles. Disclaimer (1/3) 2

M itarbeiterkür z el Use of Non - GAAP Financial Measures This Investor Presentation includes certain financial measures not presented in accordance with IFRS, including, but not limited to, EBITDA and certain ratios and other metrics derived therefrom. These non - IFRS financial measures are not measures of financial performance in accordance with IFRS and may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under IFRS. You should be aware that the Company’s presentation of these measures may not be comparable to similarly - titled measures used by other companies, including those peers whose measures are presented in this Investor Presentation. The Company believes these non - IFRS measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company also believes that the use of these non - IFRS financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends, and in comparing the Company’s financial measures with other similar companies, many of which present similar non - IFRS financial measures to investors. These non - IFRS financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - IFRS financial measures. Please refer to any footnotes where presented in this Investor Presentation, as well as to the table on the final page, for a reconciliation of these measures to what the Company believes are the most directly comparable measure evaluated in accordance with IFRS. This Investor Presentation also includes certain projections of non - IFRS financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable IFRS financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable IFRS measures and no reconciliation of the forward - looking non - IFRS financial measures are included in this Investor Presentation. Certain monetary amounts, percentages and other figures included in this Investor Presentation have been subject to rounding adjustments. Certain other amounts that appear in this Investor Presentation may not sum due to rounding. Use of Trademarks and Other Intellectual Property All registered or unregistered service marks, trademarks and trade names referred to in this Investor Presentation are the property of their respective owners, and the use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and trade names. Third - party logos included herein may represent past customers, present customers or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or businesses. There is no guarantee that either the SPAC or the Company will work, or continue to work, with any of the firms or businesses whose logos are included herein in the future. General This Investor Presentation is strictly confidential and may not be copied, reproduced, redistributed or passed on, in whole or in part, or disclosed, directly or indirectly, to any other person or published or for any purpose without the express written approval of the SPAC and the Companies. This Investor Presentation may not be reproduced or used for any other purpose. By accepting this Investor Presentation, the recipient agrees that it will, and will cause its representatives and advisors to, use this Investor Presentation, as well as any information derived by the recipient from this Investor Presentation, only for initial due diligence regarding the SPAC and the Company in connection with (i) the proposed Business Combination and (ii) the SPAC’s proposed private offering of public equity (“PIPE Offering”) to a limited number of investors and for no other purpose and will not, and will cause their representatives and advisors not to, divulge this Investor Presentation to any other party. The delivery of this Investor Presentation shall not, under any circumstances, create any implication that the Investor Presentation is correct in all respects, including as of any time subsequent to the date hereof, and the SPAC and the Company do not undertake any obligation to update such information at any time after such date. Neither the SPAC nor the Company nor any of their respective affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of this Investor Presentation and nothing contained herein should be relied upon as a promise or representation as to past or future performance of the SPAC, the Companies or any other entity referenced herein. An investment through the PIPE Offering entails a high degree of risk and no assurance can be given that investors will receive a return on their capital and investors could lose part or all of their investment. Each recipient acknowledges and agrees that it is receiving this Investor Presentation only for the purposes stated above and subject to all applicable confidentiality obligations as well as securities laws, including without limitation the U.S. federal securities laws and the EU Market Abuse Regulation, prohibiting any person who has received material, non - public information/inside information from purchasing or selling securities of the SPAC or the Company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities Participants in the Solicitation The SPAC and its directors and executive officers may be deemed participants in the solicitation of proxies from its stockholders with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in the SPAC is contained in the Registration Statement, which was filed with the SEC and is available free of charge at the SEC’s website at www.sec.gov. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the proposed Business Combination when available. The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of the SPAC in connection with the proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination will be included in the proxy statement/prospectus for the proposed Business Combination when available. UK Disclaimer UK In the United Kingdom, this Investor Presentation is only being distributed to and is only directed at persons who are qualified investors within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 (Prospectus Regulation) as incorporated into the law of the United Kingdom (UK) by the Prospectus (Amendment etc.) (EU Exit) Regulations 2019 (SI 2019/1234) and supplemented by Financial Services (Miscellaneous Amendments) (EU Exit) Regulations 2020 (SI 2020/628) who are (i) the investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "Order"), or (iii) persons falling within Article 49(2)(a) to (d) of the Order (high net worth companies, unincorporated associations, etc.) (all such persons together being referred to as "Relevant Persons"). This Investor Presentation is directed only at Relevant Persons and must not be acted on or relied upon by persons who are not Relevant Persons. Any investment or investment activity to which this Investor Presentation relates is available only to Relevant Persons and will be engaged in only with Relevant Persons. The securities described herein have not been and are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any person in the UK, except in circumstances which will not result in an offer of securities to the public in the UK within the meaning of Part VI of the Financial Services and Market Act 2000. EEA Disclaimer In member states of the European Economic Area (the “EEA”), this Investor Presentation is directed exclusively at persons who are "qualified investors" within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 (Prospectus Regulation). Disclaimer (2/3) 3

M itarbeiterkür z el Disclaimer (3/3) 4 No Offer or Solicitation This communication is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed business combination or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Additional Information about the Business Combination and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed business combination, ads - tec Energy plc, an Irish public limited company duly incorporated under the laws of Ireland and a wholly owned subsidiary of EUSG (“Irish Holdco”), filed a registration statement on Form F - 4, which includes the preliminary prospectus of Irish Holdco and a preliminary proxy statement of EUSG, with the SEC on October 18, 2021. Irish Holdco and EUSG will file other relevant materials with the SEC in connection with the proposed business combination. Investors and security holders of EUSG are urged to read the proxy statement/prospectus and the other relevant materials before making any voting or investment decision with respect to the proposed business combination because they will contain important information about the business combination and the parties to the business combination. After the registration statement has been declared effective by the SEC, EUSG will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders. INVESTORS AND SHAREHOLDERS OF EUSG ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION, WHICH ARE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. Investors and shareholders will be able to obtain free copies of the materials filed by Irish Holdco and EUSG with the SEC at the SEC’s website at www.sec.gov. Participants in the Solicitation Irish Holdco, EUSG, Bosch Thermotechnik GmbH, ADS - TEC Holding GmbH, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of EUSG in connection with the proposed transaction. You can find more information about EUSG’s directors and executive officers in EUSG’s initial public offering prospectus, which was filed with the SEC on January 22, 2021, and its Forms 10 - Q filed with the SEC. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests is included in the proxy statement/prospectus on file with the SEC. Shareholders, potential investors and other interested persons should read the proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

M itarbeiterkür z el 5 ADS - TEC Energy Thijs Hovers C o - CEO EUSG Pieter Taselaar C o - CEO EUS G , Director Elaine Weidman Grunewald Director – ESG B a z mi H usain Senio r Ad v i s o r La r s Thunell Chairman, Director K aran Trehan President, Director ADS - TEC Energy / EUSG Key People Aaron Greenberg Project Manager, Officer Wilco Jiskoot Director Thomas Speidel Founder & Chief Executive Officer 20+ years experience Hakan Konyar Chief Operating Officer 24 years experience European Sustainable Growth Acquisition Corp. (EUSG) Thorsten Ochs Chief Technology Officer 20+ years experience John Neville Chief Sales Officer 30+ yrs experience Robert Vogt Ch i e f F i nan c ial O ff i c e r 14 years experience David Vieau Head of Strategic Market Development 30+ years experience

M itarbeiterkür z el 6 Sources: EV - Database.org, company data Notes: (1) Illustrative selection, model specifications and figures based on EV - database.org; (2) Expected for 2021; (3) Maximum overhead charging rate for 35 foot Proterra ZX5 bus; (4) Available grid power and capability of car provided; (5) Assuming a power consumption of 40kW per 100 miles; (6) Calculated for 10kW charging power; (7) Calculated with 50kW charging power; (8) Calculated for 250 kW charging power (output & car capability provided). BEV models & max. charging power (1) Porsche Taycan 270kW Tesla Model 3 Perf. 250kW Polestar 2 Long Range 150kW VW iD.4 1 st 126kW Ford Mach - E GT 150kW Hyundai IONIQ 5 LR AWD 232 kW Audi E - tron 150kW Ult ra - fa s t ( >150kW) Battery - buffered DC charging Integrated battery buffer Up to 3 2 0 kW po w er output to car, truck, van Standard low power grid connection (30 - 110kW) Continuous b a tt e ry c h a rg i ng Level 1 (≤1.9 k W ) ~21 hrs ~10 mins Level 2 (3 . 7 - 22 k W ) ~4 h r s (6) (8) FC (>5 0 k W ) ~50 m i n s (7) Charging time (4) How long do 40 KWh (~100 miles ) t a ke to charge? (5) F - 150 Lightning Pro 150kW (2) Ford & SK plan to invest $11.4bn by 2025 for a new electric truck plant and 3 new battery factories Proterra ZX5+ 35ft / 12m bus 355kW (3) Electric Vehicles vs. Charging Solutions

M itarbeiterkür z el 7 Regardless of available grid performance Ultra - Fast Charging: Recharging in Minutes vs. Hours Mobile ChargeTrailer (3,200kW) Si m ul ta neou s c harging option of 10 cars Fully mobile power charger Suitable for high - traffic routes and events of EVs 1,200x1,300x2,400 mm 47x51x94 inches Up to 85’’ ad v e rt is ing display up to two DC outlets Battery capacity up to ~ 200 kWh ChargePost (300kW) Semi - mobile / no c on s tru c t i o n needed Low power grid connection Deplo y m en t expected 2H 22 Up to 320 kW DC charging power ChargeBox (320kW) 400 x 400 x 2 , 700 mm 16 x 16 x 106 inches CBX can be built at a distance of up to 100 meters from dispenser 1,300x1,300x1,400 mm 51x51x55 inches (1) Source: Company information. Note: (1) Plus foundation and underground cabling.

M itarbeiterkür z el Key USPs of ADS - TEC Energy’s ChargePost (1) ChargePost: Semi - Mobile Charging Solution 8 Semi - mobile, ultra - fast DC charging Easy connection at limited voltage grids Up to 85 inch advertising display for additional revenue streams Installed in days vs. months Allows for multiple revenue streams Partner discussions validate the need for a semi - mobile, ultra - fast charging solution Source: Company information. Note: (1) ADS - TEC’s ChargePost available from 2H22.

M itarbeiterkür z el EV Macro Trends 9 2.2 2.9 3.9 5.3 6.9 8.9 1.6 1.9 2.2 2.7 3.5 4.5 3 .8 4 .7 6 .1 8 .0 10 .4 13 .3 2 0 20 2 0 21 2 0 22 2 0 23 2 0 24 2 0 25 23% 32% CAGR ’20 – ‘25 Total cumulative passenger EV sales (2) (million of EVs) Stimulating demand for EVs $0 $10 $20 $30 2020 2022 2024 2026 2028 2030 EV Battery Price EV price (Vehicle + Powertrain) ICE Price EV cost arriving at an inflexion point US medium car segment EVs price vs ICE price (1) ($000s) $40 Traditional OEMs (3) New EV OEMs (3) Sources: Bloomberg NEF Notes: (1) Average internal combustion engine (ICE) price based on the US medium car segment; (2) BEVs and PHEVs passenger vehicle fleets; (3) Selected OEMs, does not represent an exhaustive overview.

M itarbeiterkür z el • Target of 50% new EV sales share in 2030, with numerous consumer incentives • $15bn investment for national network of 500,000 charging stations • 45 states and Democrats offering EV and infrastructure incentives (tax credits) • Target to reduce emissions 55% by 2030; zero emissions new cars by 2035 • 20 countries will have electrification or ban ICEs in 10 - 15 years • ~€1.0bn investment for the development of the public EV charging infrastructure in Germany by 2025 Despite the COVID - 19 pandemic & semiconductor shortages, EV registrations have quickly increased supporting ADS - TEC’s growth agenda. Transportation core part of government climate agendas United States Europe EV growth accelerates • Annual sales EVs to reach double digit millions between 2026 and 2030 • Demand to increase 30% year 2020 - 2025 in US & Europe • Between 2/3 global car sales electric by 2040 , to 100% passenger vehicles in 15 years • Global sales of EV increased by 160% to 2.6 million units in the first half of 2021 compared to last year Sources: Company information, Whitehouse Government, Edison Electric Institute (EEI), Deloitte report – “Electric vehicles; Setting course for 2030”, EVBox – “Charging infrastructure incentives in Europe 2021”, KPMG Research 10 Strong Market Tailwinds in the Global EV Market

M itarbeiterkür z el 11 Increasing the availability of charging stations 1 • US currently has 43k public EV stations and 120k ports (DOE), unevenly distributed • Less than 10% households have access within ¼ mile from home • Main reason users avoid EV purchase is range anxiety (1) : − 58% of d r i v er s f ea r w i l l r un out of po w e r ; − 49% f ear low availability of charging • Charging times vary from less than 20min to 20hrs • Power grids not designed to meet power requirements of EVs • Anything over 50kW generally requires peak demand charges • Grid upgrades require significant, long term investment Improving charging speed convenience to counter range anxiety 2 3 Overcoming grid limitations and boosting grid capabilities Charging infrastructure needs to expand quickly to meet demand ( ~$32bn global market in EV charging stations by 2028) EV Charging Bottlenecks ~ 80 % ~ 15 % < 5 % Close gap in # L3 (DCFC) chargers % in circulation L1 L2 L3 / DCFC Sources: “Biden wants 500,000 EV charging stations. Here’s where they should go,” Axios, Access to Electric Vehicle Charging in the United States, Mobiliyze.ai, “Americans Cite Range Anxiety, Cost as Largest Barriers for New EV Purchases: Study,” “EV rollout will require huge investments in strained U.S. power grids,” Reuters

M itarbeiterkür z el • Oil & gas companies setting net - zero - emission targets : Shell’s ambition to be net zero emission by 2050 BP intends to reduce its carbon footprint in exploration and production by 35% to 40% by 2030 • World’s largest oil companies sold over $198bn of assets (2015 - 2020) & are projected to sell additional $100bn in oil and gas assets over the next years • Denmark cancelled all upcoming North Sea licensing rounds in anticipation of ending oil and gas production in the North Sea by 2050 • EBITDA multiples increase by 15 - 20 % in past 2 years for renewable and biofuel pure companies • Clear trend of divestment of oil and gas assets, particularly refineries, and acquisition of renewable energy companies (e.g. acquisition of ubitricity by Royal Dutch Shell) • With an investment budget of more than $348bn in 2021 (RBC analysts), the oil majors invest in EV charging either because they can or must as it is mandated Oil & Gas Building a resilient core business 12 Automotive industry Decarbonization & Policy agenda main drivers Volvo plans to raise ~$3bn via IPO to propel its EV future • Auto OEM investments in EVs soared 41% in past year , to $330bn through 2025 • Price parity with ICE expected in 2024 To build $11.4 billion mega campuses for EV car production in Tennessee & Detroit • All - electric Taycan outsells flagship 911 car in first 9 - months of 2021 • Macan and Boxster models to go full electric Elon Musk provides innovation insights on VW internal conference All - electric luxury saloon Mercedes EQS released, setting the standard Major Oil & Gas / Automotive Companies Rethink Strategy as world transitions to low - carbon future Sources: Shell, BP, Bloomberg NEF, Reuters, RBC, UBS, Company press releases.

M itarbeiterkür z el ADS - TEC Energy Key Advantages 13 Battery buffer enables quick charge within minutes up to 320kW even on lower power Charge in minutes not hours No grid upgrades required No expensive and time intensive grid expansion necessary – avoiding expensive demand power Small, compact footprint with low noise Ideal for real - estate, parking garages, city deployments Turn grid challenges into grid assets Flexibility of distributed intelligent ecosystem platform contributes to a stable energy supply & allows for decentralized energy platforms Source: Company information

M itarbeiterkür z el • ADS - TEC Energy’s B2B platform will go horizontally across several large sectors to deploy state - of - the - art battery buffered charging • Our customers will then target vertical segments, incl.: » Multi - Family: shared Ultra - Fast charger is preferred over large numbers of level two AC chargers » Retail: Retailers have short visit times beneficial to Ultra - Fast charging » Municipal: private - public partnerships take advantage of long - term cost savings of EVs and requires a network of Ultra - Fast EV chargers » Fleets: will charge “on the go” requiring topping up on route using Ultra - Fast charging Ut i li ti es Oil & Gas CPOs (2) Regional S p e cia l ty 14 Early validation of key markets drives acceleration of ADS - TEC’s North American launch Cumulative ultra - fast public & commercial connectors (#) (1) 1 , 037k 2030 311k 2020 Reta i l M u ni c i p al Flee t s M ul t i - F am il y Source: Bloomberg NEF. Notes: (1) Global number of EV Chargers in circulation excluding China; (2) Charge Point Operators. “Charging - on - the - go” will be relevant to all segments and locations

M itarbeiterkür z el 15 July 2021 R o a d s h o w ▪ ADS - TEC has identified and s u cc e ss f u ll y approa c hed ta rge t customers across horizontal landscape, including: o Multifamily residential o Oil & Gas o Retail o F i nan c ial in s t i tut i o n s & banks o Municipalities o Regional Specialty o CPOs o OEMs Expanding Market Segments x ▪ ADS - TEC has significantly a cc elera te d i ts s trate gi c gro w th plan and entered the U.S. a year earlier than originally planned due to the market opportunities identified ▪ Currently identifying site options for a second assembly plant ▪ Apparent strong visibility at Depa rt m en t o f T ran s po rtat i on event in Washington, DC E ntered the US Market x x x Key New Customers & Repeat Business x Selected new contracts Repeat business from blue - chip auto OEM customer New agreement with Large European Energy supplier New ‘As a Service’ & smart city business models ▪ Strengthened and expanded with well - experienced executive hire: ▪ Hired a new global CSO & Ramp - up of a US sales team laying the foundation for future growth ▪ White Paper published addressing barriers to EV scale up Expanding the ADS - TEC team x S u cc e ssf u l en t r y into US Source: Company information Actions Taken by ADS - TEC

M itarbeiterkür z el $54m $59m $57m $38m $26m $25m $24m $14m $8m $6m $6m Player of Existing Scale: Combining DC With Grid’s Limitations 16 Boosting grid performance with integrated battery Players in the EV charging value chain (Revenue 2020A) (1) $146m $80m Ultra fast C h a rg e r s pec i f i cat ions c harg ing enab led by battery usage Battery integrated x x Required grid power (for max. output, kW) (2) 30 350 350 350 350 (4) 50 22 100 22 350 350 175 n.a. Power output (kW) 320 7 – 350 7 - 350 50 - 350 11 - 350 11 - 50 <22 7 - 100 7 – 22 (3) 50 - 350 50 - 350 7 - 175 <50 Sources: CapIQ, investor presentations, company information. Notes: (1) FY20A figures converted to USD ($) using EUR/USD exchange rate of 1.1422, NOK/EUR exchange rate of 0.1161; (2) Illustrative figures based on the assumption that without a battery buffer, a like - for - like power input to power output is required (assuming 100% efficiency); (3) Recently unveiled non - battery based 350kW charger with expected launch in 2022; (4) Network consists of 3rd party hardware chargers (i.e. EVBox).

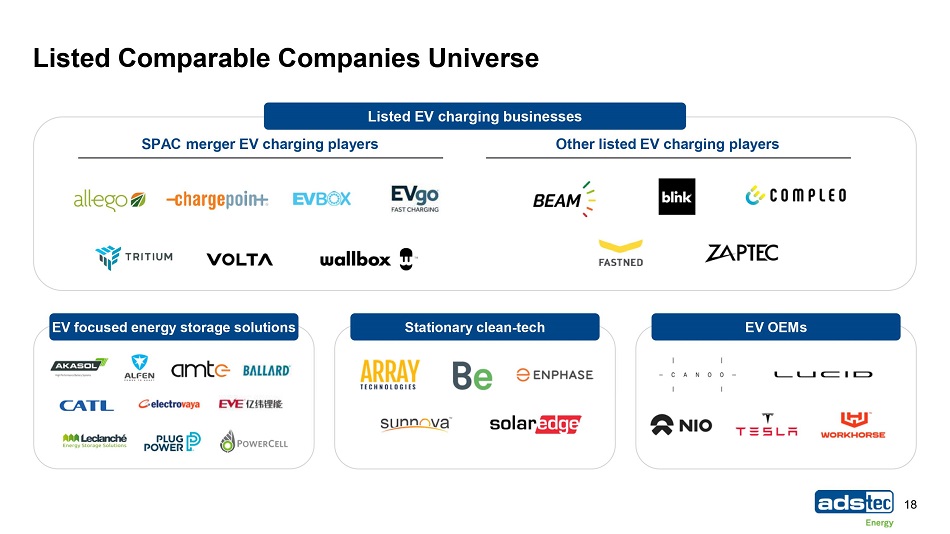

M itarbeiterkür z el Valuation Metrics 17 1 . 5 x 4 . 0 x 5 . 5 x 5 . 5 x 5 . 1 x 4 . 3 x 0 . 9 x 3 . 6 x 3 . 6 x 7 . 6 x 4 . 5 x 2 . 5 x A p er t a E V OE M s 2023 2024 2023 2024 EV charging de - SPAC peers 2023 2024 Other listed EV charging peers 2023 2024 Stationary clean - tech 2023 2024 EV / Revenues (2) 6 . 3 x 24 . 9 x 19 . 7 x 27 . 7 x 20 . 1 x 24 . 8 x 2 . 7 x 8 . 7 x 15 . 1 x 26 . 9 x 15 . 7 x 16 . 8 x A p er t a EV / EBITDA (2) 2024 2025 2024 2025 EV charging de - SPAC peers 2024 2025 Other listed EV charging peers 2024 2025 EV focused energy storage solutions 2024 2025 Stationary clean - tech 2024 2025 EV OEMs Illu s t ra ti v e EV / revenue range 4x – 7x re v e nu e Pro forma EV $356m 2023E revenue (1) $233m 2023 2024 (3) EV focused energy storage solutions Sources: CapIQ data as per 22/10/2021, investor presentations. Notes: (1) Projections constitute forward - looking statements that are subject to inherent uncertainty and rely in part on historical financials that are subject to change; (2) Median figures displayed, multiples calculated on calendarized December year end figures. Broker forecast used where available for listed peers. Allego, EvBox, Tritium and Wallbox based on management reported forecasts. Refer to page 18 for the list of peers included; (3) Akasol, EVE Energy and PowerCell excluded due to unavailable broker estimates for FY24E.

M itarbeiterkür z el 18 EV O E M s S t at i onary c l ea n - t ech EV focused energy storage solutions Listed EV charging businesses SPAC merger EV charging players Other listed EV charging players Listed Comparable Companies Universe

M itarbeiterkür z el The following list of risk factors is provided to certain sophisticated institutional investors in connection with a potential investment in European Sustainable Growth Acquisition Corp (“EUSG”), or a newly formed holding company, as part of a proposed business combination between the Company and EUSG pursuant to which the combined company will become a publicly traded company (the “Business Combination”). References to “we,” “us” or “our” are to the Company and, following the Business Combination, refer to the combined company. The list of risk factors has not been prepared for any other purpose. Investing in the combined company’s common shares to be issued in connection with the Business Combination involves a high degree of risk. Investors should carefully consider the risks and uncertainties inherent in an investment including those described below, and conduct their own due diligence investigation, before making an investment decision. If we cannot address any of the following risks and uncertainties effectively, or any other risks and difficulties that may arise in the future, our business, financial condition or results of operations could be materially and adversely affected. The risks described below are not the only ones we face. The following list of risks is not exhaustive, and additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business, financial condition or results of operations. Risks relating to our business will be disclosed in future documents filed or furnished with the US Securities and Exchange Commission (“SEC”), including the documents filed or furnished in connection with the proposed Business Combination. The risks presented in such filings will be consistent with those that would be required for a public company in their SEC filings and may differ significantly from, and will be more extensive than, those presented below. Risks Related to Our Business and Industry • The COVID - 19 pandemic, and any future outbreak or other public health emergency, could materially affect our business, liquidity, financial condition and operating results. • We may experience significant fluctuations in our operating results and rates of growth. • If we are unable to manage our growth or execute our growth strategies effectively, our business and prospects may be materially and adversely affected. • We face intense competition and could fail to gain, or could lose, market share if we are unable to compete effectively. • Our failure to quickly identify and adapt to changing industry conditions may have a material and adverse effect on us. • We may be unable to prevent unlawful or fraudulent activities in our operations, and we could be liable for such fraudulent or unlawful activities. • Any significant interruptions or delays in IT service or any undetected errors or design faults in IT systems could result in limited capacity, reduced demand, processing delays and loss of customers, suppliers or marketplace merchants and a reduction of commercial activity. • Any failure to adapt to technological developments or industry trends could harm our business. • Our success depends in large part on our ability to attract and retain high quality management and operating personnel, and if we are unable to attract, retain and motivate well qualified employees, our business could be negatively impacted. • We may from time to time pursue acquisitions, which could have an adverse impact on our business, as could the integration of the businesses following acquisition. • Exchange rate fluctuations may negatively affect our results of operations. Risks Related to Legal, Regulatory and Tax Matters • Our operations are subject to a variety of laws and regulations, and we expect that the extent of regulation applicable to us and our operations will increase over time and that we will be subject to new laws and new regulations. • We may become subject to additional laws or regulations or changes to existing laws or regulations, or changes in the interpretation of existing or new laws or regulations, any of which could impact the way we conduct our business. • We are subject to increasingly stringent environmental regulations. • We may not be able to adequately protect our intellectual property rights or may be accused of infringing intellectual property rights of third parties. • We may be unable to continue the use of our domain names or prevent third parties from acquiring and using domain names that infringe upon, are similar to or otherwise decrease the value of our brands, trademarks, or service marks. • Employment laws in German are relatively stringent and their application in a more aggressive manner by the German state could negatively impact our activity. • We may be subject to litigation, tax proceedings or regulatory proceedings which could result in significant liability. • We may be subject to product liability claims if people or property are harmed by the products sold on our platform. • Some of our potential losses may not be covered by insurance. We may not be able to obtain or maintain adequate insurance coverage. • We may be exposed to enforcement for violating anti - corruption laws, anti - money laundering laws and other similar laws and regulations. • Changes in tax treatment of companies engaged in e - commerce may adversely affect the commercial use of our sites and our financial results. • We may experience fluctuations in our tax obligations and effective tax rate, which could materially and adversely affect our operating results. 19 Risk factors (1/2)

M itarbeiterkür z el Risk Related to the Business Combination • We have not yet entered into a definitive agreement for the Business Combination and, when we do, the completion of the Business Combination will be subject to a number of conditions and if those conditions are not satisfied or waived, the Business Combination may not be completed. • Resales of the shares of common stock included in the stock consideration could depress the market price of the combined company’s common stock. • The exercise of discretion by the EUSG directors and officers in agreeing to changes to the terms of or waivers of closing conditions in the Business Combination Agreement may result in a conflict of interest when determining whether such changes to the terms of the Business Combination Agreement or waivers of conditions are appropriate and in the best interests of the stockholders of the combined company. • A market for the combined company’s securities may not continue, which would adversely affect the liquidity and price of the combined company’s securities. • If the Business Combination’s benefits do not meet the expectations of investors, stockholders or financial analysts, the market price of EUSG’s securities may decline. • Both EUSG and the Company will incur significant transaction costs in connection with the Business Combination. • The ability to successfully effect the Business Combination and following the consummation of the Business Combination, the combined company’s ability to successfully operate the business thereafter will be largely dependent upon the efforts of certain key personnel of the Company. The loss of such key personnel could negatively impact the operations and financial results of the combined business. • If the Business Combination’s benefits do not meet the expectations of investors or securities analysts, the market price of EUSG securities or, following the consummation of the Business Combination, the combined company’s securities, may decline. • Delays in completing the Business Combination may substantially reduce the expected benefits of the Business Combination. • Subsequent to the completion of the Business Combination, the combined company may be required to take write - downs or write - offs, restructuring and impairment or other charges that could have a significant negative effect on its financial condition, results of operations and the combined company’s common share price, which could cause you to lose some or all of your investment. • There can be no assurance that the combined company’s common shares will be approved for listing on the Nasdaq or that the combined company will be able to comply with the continued listing standards of the Nasdaq. • There can be no assurance as to the timing of the commencement, or completion, of the SEC review of the proxy statement/prospectus relating to the Business Combination, which in turn will determine the timing of the closing of the Business Combination. • Regulatory investigations or legal proceedings in connection with the Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Business Combination. • Changes in laws or regulations, or a failure to comply with existing or future laws and regulations, may adversely affect our business, financial condition and results of operations. Risk Related to Owning the Combined Company’s Shares • A market for the combined company’s common shares may not develop or be sustained, which would adversely affect the liquidity and price of the combined company’s common shares. • Sales of a substantial number of the combined company’s common shares in the public market, including those issued upon exercise of warrants or options, could cause our share price to decline. • The combined company’s future ability to pay cash dividends to shareholders is subject to the discretion of its board of directors and will be limited by its ability to generate sufficient earnings and cash flows. • There can be no assurance that the combined company will not be a passive foreign investment company for any taxable year, which could subject U.S. shareholders to significant adverse U.S. federal income tax consequences. Risks Related to Being a Public Company • The combined company will incur increased costs as a result of operating as a public company, and its management will devote substantial time to new compliance initiatives. • If our estimates or judgments relating to our critical accounting standards prove to be incorrect, or such standards change over time, our results of operations could be adversely affected. • We expect to be a “foreign private issuer” and intend to follow certain home country corporate governance practices. As a foreign private issuer, we will have different disclosure and other requirements than U.S. domestic registrants. Our shareholders may therefore not have the same protections afforded to shareholders of companies that are subject to all Nasdaq corporate governance requirements. We may lose our foreign private issuer status in the future, which could result in significant additional expense and the need to present our financial statements in accordance with US GAAP. • We could in the future need to disclose, and be required to remediate, material weaknesses or significant deficiencies in our internal control over financial reporting. • We will be a “foreign private issuer” within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. Risk factors (2/2) 20

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Invitation to UPM’s webcast and conference call on Q1 2024 interim report

- Get Up To 15% Flat Discount on Video Promotion Website on VideoIpsum

- Chow Tai Fook Jewellery Celebrates 95-Year Anniversary and Embarks on Brand Transformation Journey

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share