Form 425 Data Knights Acquisition Filed by: Data Knights Acquisition Corp.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2022

Data Knights Acquisition Corp.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-40386 | 86-2076743 | |

| (Commission File Number) | (IRS Employer Identification No.) |

Unit G6, Frome Business Park, Manor Road

Frome

United Kingdom, BA11 4FN

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code 011-44 203 833 4000

_________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant | DKDCU | The Nasdaq Stock Market LLC | ||

| Class A Common Stock, $0.0001 par value per share | DKDC | The Nasdaq Stock Market LLC | ||

| Redeemable Warrants, each exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share | DKDCW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. | Regulation FD Disclosure. |

Merger Agreement

On April 25, 2022, Data Knights Acquisition Corp., a Delaware corporation (the “Company”), Data Knights Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Data Knights, LLC, the Company’s sponsor (the “Sponsor”), entered into a definitive Agreement and Plan of Merger (the “Merger Agreement”) with OneMedNet Corporation, Inc., a Delaware corporation (“OneMedNet”), and Paul Casey, as seller representative (“Casey”, and together with the Company, Merger Sub, the Sponsor and OneMedNet, the “Parties”) pursuant to which MergerSub will merge with and into OneMedNet and OneMedNet will become a wholly-owned subsidiary of the Company (the “Business Combination”).

Furnished as Exhibit 99.1 hereto and incorporated into this Item 7.01 by reference is an investor presentation that the Company has prepared for use in connection with various meetings and conferences with certain investors in connection with the Merger Agreement, the Business Combination and the related transactions.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Additional Information and Where to Find It

As previously disclosed, the Company intends to file the Prospectus and Proxy Statement with the SEC, which Prospectus and Proxy Statement will be delivered to its stockholders once definitive. This document does not contain all the information that should be considered concerning the Business Combination and the other Stockholder Approval Matters and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination and the other Stockholder Approval Matters. The Company’s stockholders and other interested persons are advised to read, when available, the Prospectus and Proxy Statement and the amendments thereto and other documents filed in connection with the Business Combination and other Stockholder Approval Matters, as these materials will contain important information about the Company, OneMedNet, the Business Combination and the other Stockholder Approval Matters. When available, the Prospectus and Proxy Statement and other relevant materials for the Business Combination and other Stockholder Approval Matters will be mailed to stockholders of the Company as of a record date to be established for voting on the Business Combination and the other Stockholder Approval Matters. Stockholders will also be able to obtain copies of the Prospectus and Proxy Statement and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Data Knights Acquisition Corp., Unit G6, Frome Business Park, Manor Road, Frome, BA11 4FN, United Kingdom.

No Offer or Solicitation

This Current Report on Form 8-K is for informational purposes only and is not intended to and shall not constitute a proxy statement or the solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination or any related transactions and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Participants in Solicitation

The Company and its directors and executive officers may be deemed participants in the solicitation of proxies from the Company’s stockholders with respect to the Business Combination and related matters. A list of the names of those directors and executive officers and a description of their interests in the Company is contained in the Company’s Registration Statement on Form S-1, as filed on March 9, 2021, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to Data Knights Acquisition Corp., Unit G6, Frome Business Park, Manor Road, Frome, BA11 4FN, United Kingdom. Additional information regarding the interests of such participants will be contained in the Prospectus and Proxy Statement when available.

OneMedNet and its directors, managers, and executive officers may also be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the Business Combination and related matters. A list of the names of such parties and information regarding their interests in the Business Combination and related matters will be included in the Prospectus and Proxy Statement when available.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations, and intentions with respect to future operations, products, and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited to, statements regarding the Target’s industry and market sizes, future opportunities for the Company and the Target, the Company’s and the Target’s estimated future results and the transactions contemplated by the Merger Agreement, including the implied enterprise value, the expected transaction and ownership structure and the likelihood and ability of the Parties to successfully consummate the transactions contemplated by the Merger Agreement. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements.

In addition to factors previously disclosed in the Company’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (i) the risk that the transactions contemplated by the Merger Agreement may not be completed in a timely manner or at all, which may adversely affect the price of the Company’s securities; (ii) the risk that the transactions contemplated by the Merger Agreement may not be completed by the Company’s Business Combination deadline and the potential failure to obtain an extension of the Business Combination deadline if sought by the Company; (iii) the failure to satisfy the conditions to the consummation of the transactions contemplated by the Merger Agreement, including the adoption of the Merger Agreement by the stockholders of the Company, the satisfaction of the minimum cash amount following redemptions by the Company’s public stockholders and the receipt of certain governmental and regulatory approvals; (iv) the lack of a third-party valuation in determining whether or not to pursue the transactions contemplated by the Merger Agreement; (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; (vi) the effect of the announcement or pendency of the transactions contemplated by the Merger Agreement on the Target’s business relationships, performance and business generally; (vii) risks that the transactions contemplated by the Merger Agreement disrupt current plans and operations of the Target; (viii) the outcome of any legal proceedings that may be instituted against the Target or the Company related to the Merger Agreement or the transactions contemplated thereby; (ix) the ability to maintain the listing of the Company’s securities on Nasdaq Capital Market; (x) the price of the Company’s securities, including following the Closing, may be volatile due to a variety of factors, including changes in the competitive and regulated industries in which the Target operates, variations in performance across competitors, changes in laws and regulations affecting the Target’s business and changes in the capital structure; (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the transactions contemplated by the Merger Agreement, and identify and realize additional opportunities; (xii) the risk of downturns and the possibility of rapid change in the highly competitive industry in which the Target operates, and the risk of changes in applicable law, rules, regulations and regulatory guidance that could adversely impact the Target’s operations; (xiii) the risk that the Target and its current and future collaborators are unable to successfully develop and commercialize the Target’s products or services, or experience significant delays in doing so; (xiv) the risk that the Target may not achieve or sustain profitability; (xv) the risk that the Target will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; and (xvi) the risk that the Target experiences difficulties in managing its growth and expanding operations.

Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth herein speaks only as of the date hereof in the case of information about the Company and the Target or the date of such information in the case of information from persons other than the Company or the Target, and we disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this communication. Forecasts and estimates regarding the Target’s industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected, and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. | Description |

| 99.1 | Investor Presentation dated May 20, 2022 |

| 104 | Cover Page Interactive Data File (Embedded within the Inline XBRL document and included in Exhibit) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DATA KNIGHTS ACQUISITION CORP. | ||

| Date: May 20, 2022 | By: | /s/ Barry Anderson |

| Barry Anderson | ||

| Chief Executive Officer | ||

Exhibit 99.1

Extracting and Refining Medical Real World Data P AUL C ASEY CEO J EFFREY Y U , MD F OUNDER & C HAIRMAN APRIL 2022 1

‹#› C o nfi de ntial — N o t f or Di str ibuti on This presentation is for information purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between OneMedNet Corporation (“OneMedNet”) and Data Knights Acquisition Corp (“Data Knights”) . The information contained herein does not purport to be all - inclusive, and none of OneMedNet , Data Knights, or any of their respective affiliates, or any of their control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein and, by accepting this presentation, you confirm that you are not relying upon the information contained herein to make any decision. This Presentation is for informational purposes only and is not intended to and shall not constitute a proxy statement or the soli cit ation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination or any related transactions and is not intended to and shall not constit ute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be an y sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such ju ris diction. Forward - Looking Statements This document includes certain statements, estimates, targets, forward - looking statements and projections (collectively, “forward - looking statements”) that reflect assumptions made by OneMedNet concerning anticipated future performance of OneMedNet and its industry. Such forward - looking statements are based on significant assumptions and subjective judgments concerning anticipated results, which are inherently subject to risks, variability and contingencies, many of which are beyond OneMedNet’s control. Factors that could cause actual results to differ from these forward - looking statement include, but are not limited to, general economic conditions, the availability and terms of financing, the effects and uncertainties created by the ongoing COVID - 19 pandemic, OneMedNet’s limited operating history, changes in regulatory requirements and governmental incentives, competition, and other risks and uncertainties associated with OneMedNet’s research and development activities and commercial production and sales. Such forward - looking statements may be identified by the use of words like “anticipate”, “believe”, “estimate”, “expect”, “intend”, “may”, “plan”, “will”, “should”, “seek” and similar expressions and include any financial projections or estimates or pro forma financial information set forth herein. You are cautioned that any such forward - looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward - looking statements. Neither Data Knights nor OneMedNet undertake any duty to update these forward - looking statements, or the other information contained in this presentation. Neither Data Knights nor OneMedNet makes any representation or warranty, express or implied, as to the accuracy or completeness of this document or any other information (whether written or oral) that has been or will be provided to you. Nothing contained herein or in any other oral or written information provided to you is, nor shall be relied upon as, a promise or representation of any kind by Data Knights or OneMedNet. Without limitation of the foregoing, Data Knights and OneMedNet expressly disclaim any representation regarding any projections concerning future operating results or any other forward - looking statement contained herein or that otherwise has been or will be provided to you. Neither Data Knights nor OneMedNet shall be liable to you or any prospective investor or any other person for any information contained herein or that otherwise has been or will be provided to you, or any action heretofore or hereafter taken or omitted to be taken, in connection with this potential transaction. C o nfi de ntial — N o t f or Di str ibuti on Disclaimer 2

‹#› C o nfi de ntial — N o t f or Di str ibuti on Why Real World Data is Needed Because Clinical Trials Are Very Artificial Very Limited Need REAL Data from the REAL World October 2018 FDA Mandates the Use of Imaging Real World Data January 2020 China FDA Publishes Real World Data Guidelines If COVID - 19 has taught us anything it is that diseases evolve quickly We enable life sciences companies to bring safer, more effective cures, vaccines, medical devices and artificial intelligence to market faster at a lower cost 3

‹#› C o nfi de ntial — N o t f or Di str ibuti on Management 4 Data Knights Acquisition Corp. OneMedNet Barry Anderson Firdauz Edmin Mokhtar Jeffrey Yu Paul Casey Thomas Kosasa Erkan Aykuz Chairman & CEO CFO F o un d er / Chair man /CMO CEO & Board Director Board Director Board Director +15 years experience in business development strategy +20 years experience in corporate finance; CPA, Malaysian Institute of Accountant 28 Years of Healthcare IT Experience; Tiger 21 Member Orlando Investor in startups & a mentor to CEOs & founders 20 Year Healthcare IT Experience; CTO at Agfa Healthcare Renowned Ob/Gyn/Fertility medical specialist

‹#› C o nfi de ntial — N o t f or Di str ibuti on Transaction Overview OneMedNet is preparing to go public through a SPAC Merger with Data Knights Acquisition Corp. ● OneMedNet is a pioneer in medical image sharing and exchange technologies. OneMedNet has provid ed medical image sharing anywhere around the world over the Internet since 2010. • Founded in 2009 by Entrepreneur, Radiologist, and Nuclear Medicine physician Jeffrey Yu • Extensive imaging experience from years of image sharing experience, including the entire country of Ireland • Laser focused on the rapidly growing RWD Market • Ahead of the curve when it comes to providing fast and secure access to curated medical images ● Data Knights Acquisition Corp. (“Data Knights”) is a Special Purpose Acquisition Corporation (“SPAC”) • Initially capitalized with $117.3 million in cash in May 2021 trading under the ticker DKDCU in Nasdaq • Management team collectively has over 20 years of experience in business development and management roles • Currently seeking a commitment via PIPE ● Data Knights anticipates entering into a business combination agreement w ith OneMedNet in Q2. • Pre - money valuation of $ 200 M on OneMedNet – implies a discount to peer trading levels • Pro - forma ownership of ~50.9% existing OneMedNet shareholders, ~39.8% SPAC public shareholders, ~ 9.3 % SPAC sponsor shareholders • No minimum cash on closing requirement 5

‹#› C o nfi de ntial — N o t f or Di str ibuti on SPAC Cash in Trust $117.3M Cash to Balance Sheet $113.2M Seller Rollover Equity $ 200M Seller Rollover Equity $200M PIPE Investment Pending Transaction Expenses $4.02M Total Sources $ 317.3M Total Uses $317.3M Share Pric e $10.00 Pro Forma Shares Outstanding 39.32 Equity Value $393.2M + Debt - - C ash $113.2M Equity Value $279.9M Transaction Overview Sources, uses & pro forma ownership Uses Sources Pro Forma Valuation Illustrative Pro Forma Ownership 6 Note: (1) the amount from the various sources of cash may change based on (i) the amount of public stockholder redemptions prior to cl osing (ii) investor interest in the acquisition and (iii) the then current markets for equity and debt financing (2) Assumes PIPE funds of $0 (3) Assumes pre - transaction valuation of target company at $200,000,000 (4) Deferred IPO fees, does not include additional fees from service providers for PIPE or closing (such as legal, audit, and fi nancial advisors) (5) Assumes that there are no new awards under any new Surviving Company equity incentive plan. Assumes that there are no ad jus tments to the transaction consideration. (6) Assuming a redemption price of $10.00 per share (7) Assumes public investors redemptions of 0% (8) Warrants exercised on cashless basis at $18 market price 50.86% 9.34% 39.80% existing OneMedNet shareholders SPAC sponsor shareholders SPAC public shareholders

‹#› C o nfi de ntial — N o t f or Di str ibuti on Clinical Trials and Research > $404 B RWE $12B Market Overview Total Addressable Market ● Biopharma and medical device companies require insight - rich, high - quality patient data to fuel their development of novel therap eutics and devices. ● OneMedNet addresses multiple aspects of these requirements, playing at the nexus of three market opportunities: Clinical Trials ● Scientific studies of the safety and efficacy of a new medical drug or other treatment conducted on human volunteers. ● Leverage Real - World Evidence to evaluate the effects of these therapies on health related biomedical or behavioral outcomes ● Clinical evidence about the usage and potential benefits/risks of products derived from Real - World Data analysis Real - World Data (RWD) ● RWD harmonizes siloed data by ingesting large quantities of structured and unstructured data and creating a comprehensive, longitudinal view or “sole source of truth ” Sources: 1. CB Insights 2. Markets and Markets 3. Grand View Research 4. Health Catalyst Prospectus RWD $10B Real - World Evidence (RWE) 7

‹#› C o nfi de ntial — N o t f or Di str ibuti on Clinical Trial Market Real World - Evidence The Real - World Data Market size was valued at $47.0B in 2021, expected to grow at CAGR of 5.8% from 2022 to 2030 2020 TAM is estimated at $37.2B, expected to grow to $62.6B by 2028 with a 7.6% CAGR 2021 TAM is estimated at $10.4B, expected to grow to $164.B by 2024 with a 16.5% CAGR “Clinical trials heavily depend on RWD and RWE to guide study design and optimize patient recruitment and retention, which make up 61% of the total trial cycle time…” Sources: 1. Grand View Research 2. Markets and Markets 3. CB Insights Market Overview 8 Total Addressable Market

‹#› C o nfi de ntial — N o t f or Di str ibuti on $61M 2026 Bookings iRWD ONLY Provider of Regulatory Grade Imaging Real World Data (iRWD) on Demand 65M+ Studies High barriers to entry: Largest volume and geographic coverage of regulatory grade data and secret sauce indexing and data curation techniques/technology Leading Modality & IT Vendor Validated by blue - chip strategic partners Global footprint - built to scale 42 Countries 200+ C u st o mers Strong momentum and clear path to scale with profitability driven by recurring revenue $4.6 2022 Bookings Investment Highlights 9

‹#› C o nfi de ntial — N o t f or Di str ibuti on Largest Volume and Diversity of Regulatory Grade Data Radiology Cardiology Orthopedics Neurology Oncology Woman’s Health Dentistry Pathology Ophthalmology OneMedNet has the knowledge, tools, and experience to access and harmonize complete patient profiles across fragmented data silos. OneMedNet curate s information to the most stringent multi - level stratified requirements while providing unmatched data accuracy and ensuring the security and privacy of protected health information. Moreover, OneMedNet delivers this curated data fast and efficiently to address the rapidly growing needs of image analysis and researchers. 65M+ Patient Studies 20M MORE SOON! 10

‹#› C o nfi de ntial — N o t f or Di str ibuti on Key Differentiators Regulatory Grade Our imaging results serve as proof of effectiveness for regulatory agencies, meeting requirements for quality and diversity On Demand Our powerful indexing platform access and harmonizes complete patient profiles across fragmented data silos, delivering images and records o n demand Expertly Curated We curate to the most stringent multi - level stratified requirements, providing unmatched data accuracy and completeness Disrupting a $404B Market 11

‹#› C o nfi de ntial — N o t f or Di str ibuti on Competitive Advantages 65M Medical Imaging Studies ● Many contain full longitudinal record ( orders, images, reports, EMR data ) ● 20M more coming soon through new data partnerships ● On track for critical mass of 100M studies Highly Qualified Curation Staff ● Interpreted sophisticated requirements of the buyer ● Accurately fill complex orders quickly ● Embedding learnings into the platform as AI & ML Patent Portfolio ● Covers foundational technologies ● Data brokerage ● Data transport OneMedNet’s iRWD is already being used by leading imaging core labs, AI companies, biopharma and device manufacturers for regulatory clearances and approvals 12

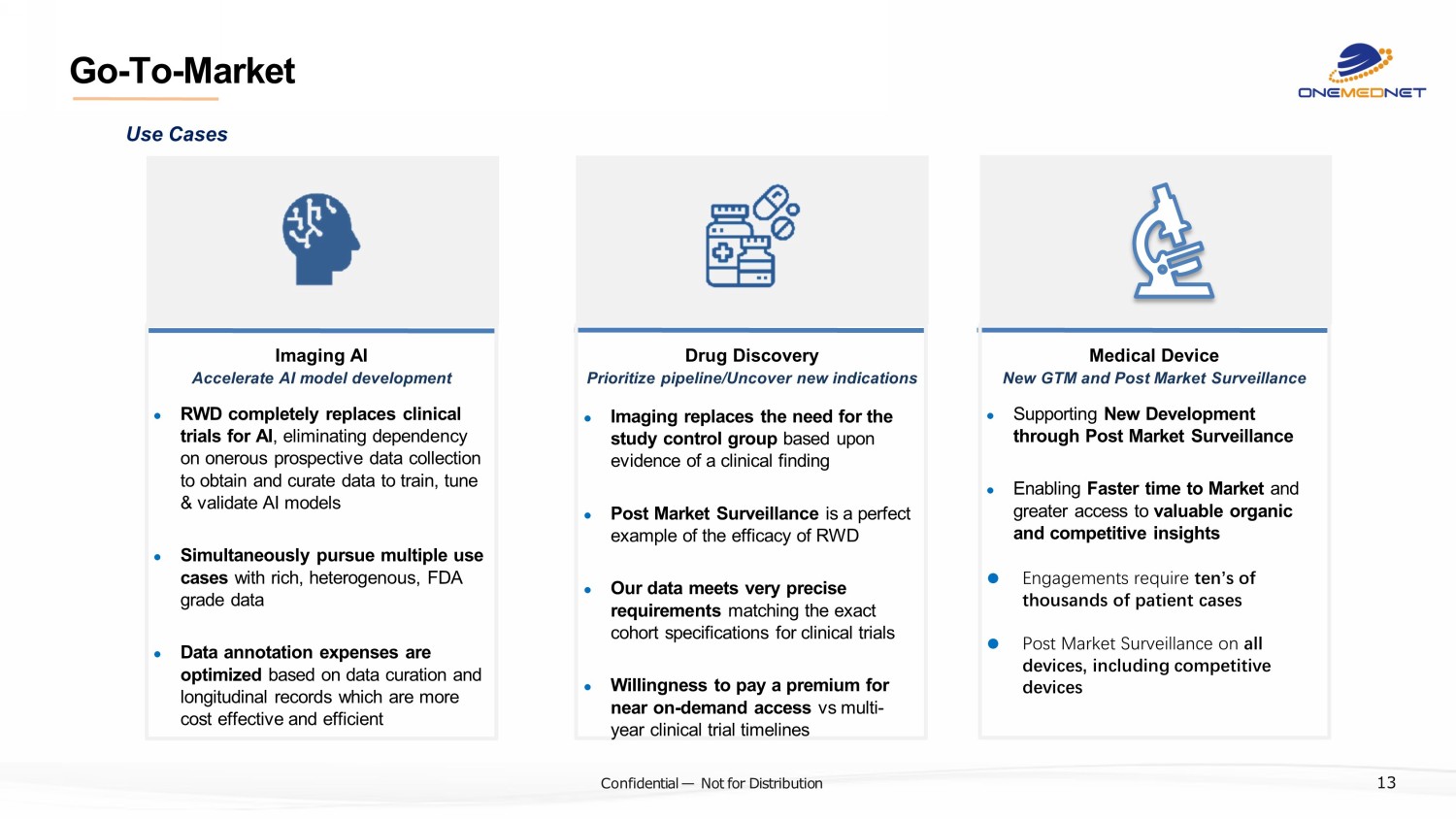

‹#› C o nfi de ntial — N o t f or Di str ibuti on Go - To - Market ? Imaging AI ● RWD completely replaces clinical trials for AI , eliminating dependency on onerous prospective data collection to obtain and curate data to train, tune & validate AI models ● Simultaneously pursue multiple use cases with rich, heterogenous, FDA grade data ● Data annotation expenses are optimized based on data curation and longitudinal records which are more cost effective and efficient Accelerate AI model development Drug Discovery ● Imaging replaces the need for the study control group based upon evidence of a clinical finding ● Post Market Surveillance is a perfect example of the efficacy of RWD ● Our data meets very precise requirements matching the exact cohort specifications for clinical trials ● Willingness to pay a premium for near on - demand access vs multi - year clinical trial timelines Prioritize pipeline/Uncover new indications Medical Device ● Supporting New Development through Post Market Surveillance ● Enabling Faster time to Market and greater access to valuable organic and competitive insights ● Engagements require ten’s of thousands of patient cases ● Post Market Surveillance on all devices, including competitive devices New GTM and Post Market Surveillance Use Cases 13

‹#› C o nfi de ntial — N o t f or Di str ibuti on 14 Regulatory Grade Raw Data Claims Add Clinical Records (EMR) Add Imaging + Reports Add Genotype (Genomic Data) Data Richness Add Pathology Add Longitudinal (Patient Data Over Time) Data Specificity / Curation $ Real - World Data Market Value

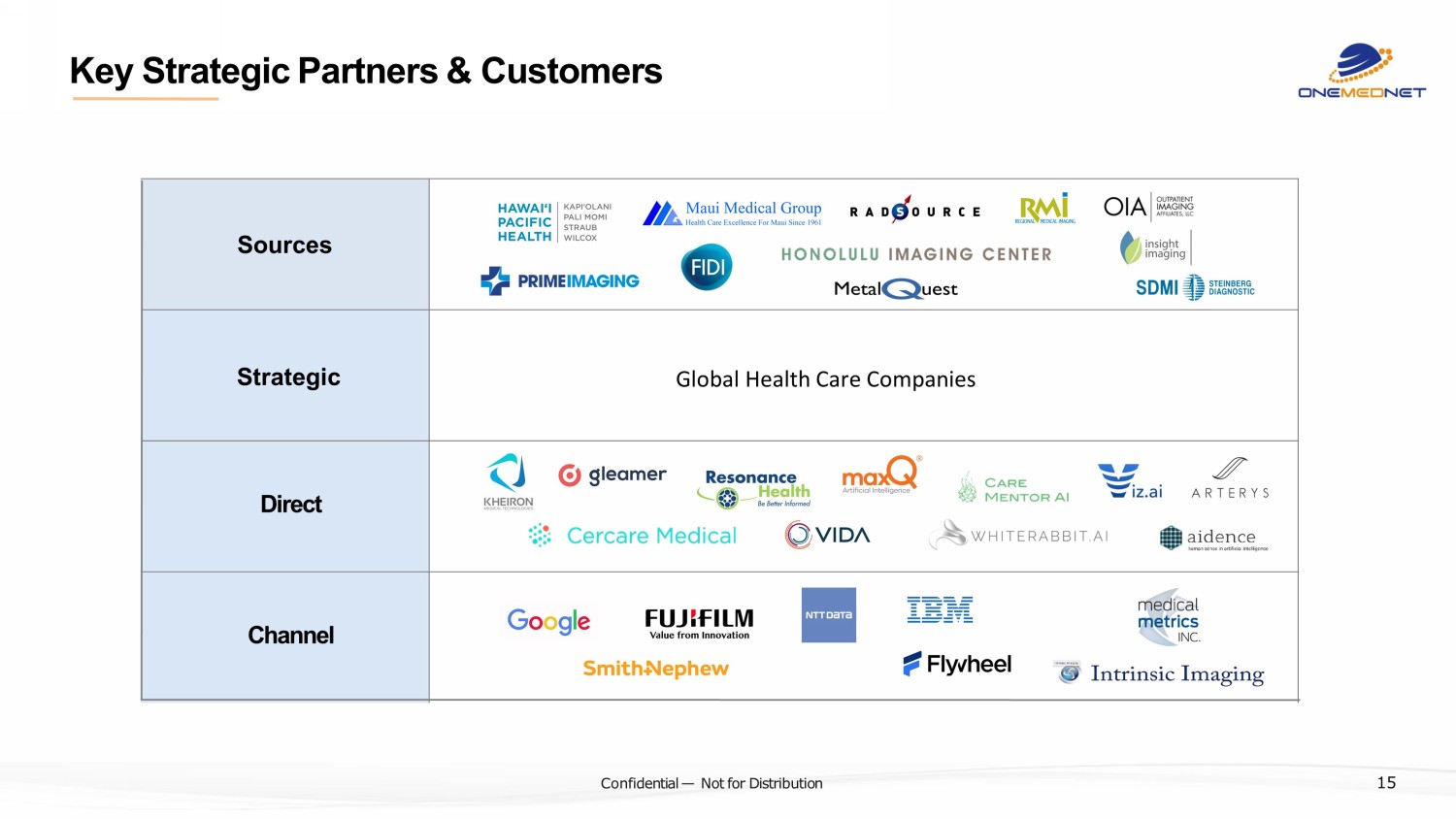

‹#› C o nfi de ntial — N o t f or Di str ibuti on Key Strategic Partners & Customers Sources Strategic Direct Channel 15 Global Health Care Companies

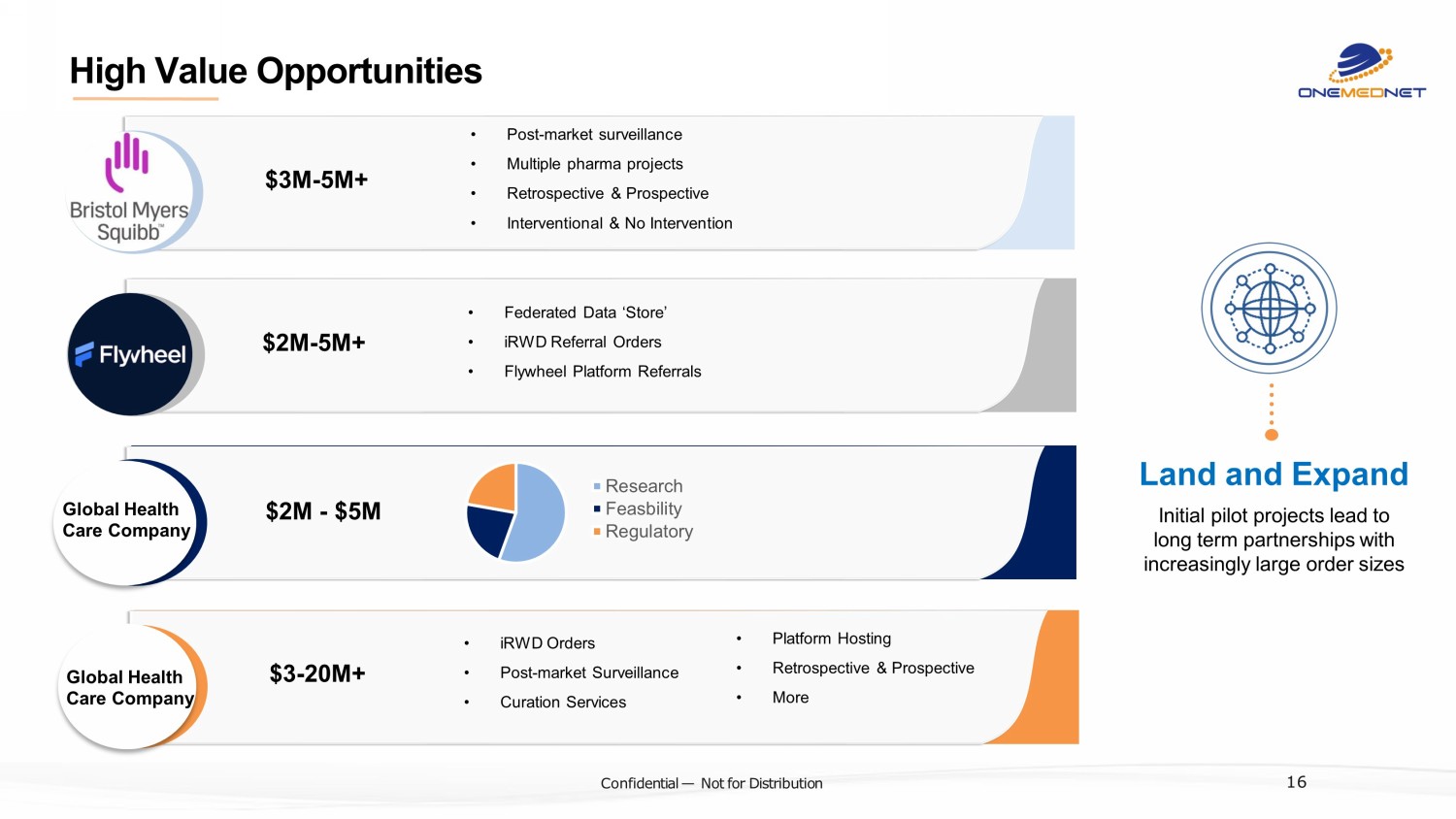

‹#› C o nfi de ntial — N o t f or Di str ibuti on $3M - 5M+ $2M - 5M+ • Post - market surveillance • Multiple pharma projects • Retrospective & Prospective • Interventional & No Intervention • Federated Data ‘Store’ • iRWD Referral Orders • Flywheel Platform Referrals High Value Opportunities Land and Expand Initial pilot projects lead to long term partnerships with increasingly large order sizes 16 $2M - $5M Research Feasbility Regulatory Global Health Care Company $3 - 20M+ • iRWD Orders • Post - market Surveillance • Curation Services • Platform Hosting • Retrospective & Prospective • More Global Health Care Company

‹#› C o nfi de ntial — N o t f or Di str ibuti on Opportunity Review C ompany A - Training Data Project In Negotiation $3,000,000 Company A - New AI Sourcing Partner (training data) In Negotiation $1,000,000 Company A - CTPA for PE rule in/out, Puneet In Negotiation $135,000 Company A - Liver CT for Sasa In Negotiation $125,000 Company A - Chest CT Feasibility for Sasa In Negotiation $125,000 Company A - CT w/ Calcium Score, Puneet In Negotiation $75,000 Company A - Whole body PET/CT - Vijay In Negotiation $16,500 Company A - Dual Energy Spine CT for Eli In Negotiation $25,000 Company A - Additional Opportunities Various Stages TBD Total $4,501,500 Opportunity Stage Amount Closed to date : $559k • Competitive Win (R&D), now incumbent • Open Opportunities: (19) • $4.5M In Negotiation • Expansion to 6 additional BU’s ~ at $18M in 2022 • Multiple in - roads • ~ 10 individual product groups • DTI (Digital Technology Innovation) preferred vendor • M&A / Strategic Partnerships teams 2022 Top Opportunities Near Term Opportunity $2M - $5M 17 Global Health Care Company A

‹#› C o nfi de ntial — N o t f or Di str ibuti on Validated by Key Strategic Partners 29 Case Study: Global Health Care Company A Land - and - Expand Validation Data Low to average Volume Detailed data collection protocols Expert clinical data curation Price: $$$ Training Data High volume Minimal data requirements Minimal clinical data curation Price: $ Feasibility Data Average volume Some require clinical data curation Price: $$ 18 Land and Expand Looking for a single Big Data partner Data Specificity / Curation and Price New R&D Dept for AI / DL Oct 2020 Expansion To Multiple BUs 2021 Goal 1 BILLION CT/MR/ CR Studies Company A

‹#› C o nfi de ntial — N o t f or Di str ibuti on Company B - Post Market Surveillance Prospecting $1,000,000 Company B - Real World Surveillance Prospecting $1,000,000 Company B - Post Market Surveillance POC Evaluating $250,000 Company B - Data Innovation team (POC) Evaluating $250,000 Company B - Pharma/RSNA - POC Evaluating $100,000 Company B - Upper Extremity CT’s Negotiating $4,950 Total $2,604,950 Opportunity Stage Amount Open Opportunities: • Very substantial opportunity; the scoping is occurring now • Device : • Small order for US project • EU project in process • Post - market surveillance opportunity • Requires audit • Pharma: • Pharma and AI • Real World & Integrated Evidence 2022 Top Opportunities Near Term Opportunity $2M - $5M 19 Opportunity Review Global Health Care Company B

‹#› C o nfi de ntial — N o t f or Di str ibuti on Key Differentiators Google developed a breast cancer mammography imaging AI algorithm, promoting a study on the performance on their AI as diagnostic breast cancer more accurately than radiologists’ Scientists took the study to task, including the use of restrictive data access procedures Consequently, Google hired a leading imaging Core Lab to conduct a study that would stand up to peer review and regulatory approvals Background The Imaging Core Lab turned to OneMedNet for imaging real - world data meeting the stringent data quality and data diversity standards of regulatory bodies This reflects a market opportunity with big tech players such as Google & IBM to complement their large data assets with high quality, regulatory - grade images Outcome Case Study: Regulatory Grade - Data with Google 20

‹#› C o nfi de ntial — N o t f or Di str ibuti on 21 BEAM connects the entire country of Ireland Change Healthcare has deployed OneMedNet’s BEAM into ALL public and private hospitals of Ireland connecting the entire country’s healthcare system into a single network (43 public and 25 private hospitals) Change is pursuing similar networks in the UK, France and with large health systems in the US Change Healthcare is merging with Optum, with an opportunity to have OneMedNet enrich their claims and electronic health record patient data with imaging RWD from Change’s imaging customers Flywheel and OneMedNet have signed a definitive agreement for OneMedNet to provide iRWD to Flywheel’s customers Flywheel provides the leading image management platform to Pharma and Device companies. OneMedNet is Intrinsic/WCG’s go to partner for iRWD Intrinsic Imaging is the leading global Imaging Core Lab and their parent WCG is involved in over 90% of clinical trials and over 90% of FDA approvals. Blackford analysis refers their AI partners to OneMedNet for iRWD for training, validation, and regulatory approvals Blackford is the leading global Imaging AI Marketplace Multi - year contracts leveraging OneMedNet iRWD to drive their imaging AI model and device development + +Others 21 Validated by Key Strategic Partners Case Studies: Extensive network of strategic partnerships provides long - term competitive advantage

‹#› C o nfi de ntial — N o t f or Di str ibuti on Validated by Key Strategic Partners Case Study: Channel Strategy with Flywheel Flywheel provides an imaging centric platform for research, academic and pharma to mine and analyze clinical trail data • Flywheel is partnering with OneMedNet to infuse medical imaging into a data marketplace that connects data providers with multiple customer segments • Blended subscription and transactional model , creating both ARR and volume - based licenses • Collaboration locks in clients into a data ‘ecosystem ’ with a one - stop - shop for RWD, maximizing the value of the shared platform • Relationship has already yielded a $500k opportunity with leading Pharma company (close Q4 2021) and additional pipeline deals including several leading Device companies. 22

‹#› C o nfi de ntial — N o t f or Di str ibuti on Mature Pipeline or iRWD Deals 41 Imaging AI 32 Med Device 22 Pharma & CRO 135 Deals in PIPELINE $21.9M year 1 ACV Growing Deal Size Pharmaceutical Device Imaging AI Clinical Research Org. Healthcare Providers 23

‹#› C o nfi de ntial — N o t f or Di str ibuti on Native and Partner Data Coverage 24 Data Available via OneMedNet Data Sites Under Development

‹#› C o nfi de ntial — N o t f or Di str ibuti on OneMedNet Board Jeffrey Yu F o un d er / Chair man/CMO OneMedNet ● Founder & Chairman: Kineticor ● CTO: The Queens Health System ● Chief of Radiology / Diagnostics Queens Health System ● Tiger 21 Member Orlando ● Mallinckrodt Institute of Radiology ● Residency Diagnostic Radiology ● Fellowship Nuclear Medicine ● Graduate UC Berkeley, Wash U, and Bowman Grey ● 28 Years of Healthcare IT Experience Paul Casey CEO & Board Director OneMedNet ● Former President CEO & Board Member of Hawaiian Airlines a US publicly - traded company. ● Former Board Member of TZ Limited an Australian publicly - traded company ● VP International and Asia Pacific Continental Airlines ● Investor in startups ● Mentor to CEOs & founders ● Investor in commercial real estate in the US ● President & CEO: Lyniate ● EVP: Change Healthcare ● President, Imaging Solutions: McKesson Change Healthcare ● President & CEO: Vital Images (Toshiba) ● CTO: Agfa Healthcare ● 20 Year Healthcare IT Experience ● Executive MBA INSEAD ● Naval Academy and Postgraduate School Erkan Aykuz Board Director OneMedNet ● Renowned Ob/Gyn/Fertility specialist ● Founder: ABC Stores of Hawaii ● Board of Trustees: Pan Pacific Surgical ● FDA Consultant Maternal / Reproductive Health ● Past member Hawaii Board Med Examiners & FDA ● Professor Endocrinology University of Hawaii ● Harvard Medical School ● Residency Obstetrics & Gynecology ● Fellowship Reproductive Endocrinology Thomas Kosasa Board Director OneMedNet 25

‹#› C o nfi de ntial — N o t f or Di str ibuti on Enterprise Value / Revenue Valuation Benchmarking 29 15.17x 18.95x 20.02x 14.64x 26.33x 15.66x 30.14x 11.36x 13.01x 14.33x NA 20.24x 12.90x 11.02x Avg. 20.13x Avg. 13.81x Enterprise Value: $200 M 23.26X 10.75X Source: FactSet Fundamentals, FactSet Estimates. Marketdata as of 03/21 /2022. Multiples over 99x and below 0x are marked as ‘NM’. Multiples where data is not available considered ’NA’.

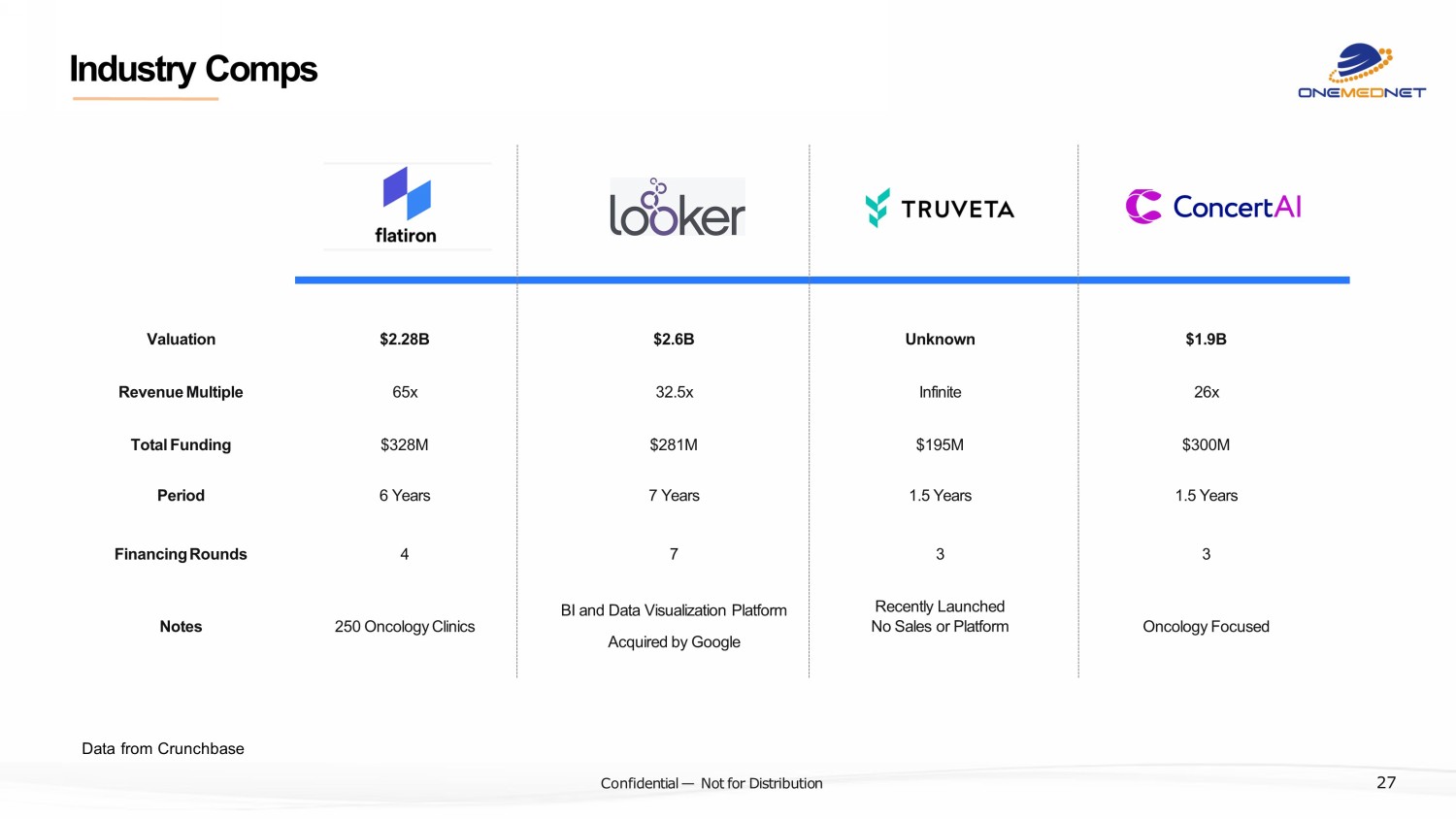

‹#› C o nfi de ntial — N o t f or Di str ibuti on Industry Comps Data from Crunchbase 27 $2.28B Valuation $2.6B Unknown $1.9B $328M Total Funding $281M $195M $300M 65x Revenue Multiple 32.5x Infinite 26x 6 Years Period 7 Years 1.5 Years 1.5 Years 250 Oncology Clinics Notes BI and Data Visualization Platform Acquired by Google Recently Launched No Sales or Platform Oncology Focused 4 Financing Rounds 7 3 3

THANK YOU 28

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Hempacco Co (HPCO) Receives Nasdaq Non-compliance Notice

- Amneal Pharmaceuticals (AMRX) Announces U.S. FDA Approval of Over-the-Counter Naloxone Hydrochloride Nasal Spray for Emergency Treatment of an Opioid Overdose

- SensaSure Technologies and Verde Bio Holdings Provide Update on Pending Merger

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share