Form 425 Chardan NexTech Acquisit Filed by: Chardan NexTech Acquisition 2 Corp.

Filed by Chardan NexTech Acquisition 2 Corp. pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Chardan NexTech Acquisition 2 Corp.

Commission File No.: 001-40730

Dragonfly Energy’s 2022 Analyst & Investor Day Presentation Transcript

8/05/2022

Legal/Disclaimer Introduction

Good morning and welcome to Dragonfly Energy’s Analyst and Investor Day.

Before we begin, we would like to remind everyone that today's session will be recorded. The recording will be available for playback on both the Dragonfly and Chardan NexTech Acquisition 2 Corp. investor relations websites.

Our presentation and discussion today are subject to a number of disclaimers and risk factors, in each case, as they relate to the proposed business combination and U.S. securities laws. For more information regarding these disclaimers and potential risks, we refer those in attendance to the first several pages of the accompanying presentation which is available on the Dragonfly Energy website at dragonflyenergy.com/investors.

We are thrilled to have you here with us today. This is an incredibly exciting time for the Dragonfly team. On May 16th, 2022, Dragonfly and Chardan NexTech Acquisition 2 Corp. entered into a definitive merger agreement. Upon the closing of the transaction, the combined company will be named Dragonfly Energy Holdings, Corp. and its common stock is expected to be listed on the Nasdaq under the new ticker symbol ‘DFLI’.

We will begin today with an overview of Dragonfly Energy, who we are, the products we currently offer and the technology we are developing. We will then highlight our Retail Business, OEM Business, and delve into how our Lithium-Ion Battery Chemistry works and why our products are the ideal replacement for toxic Lead Acid based batteries. From there we'll speak to the new markets we are expanding into. That will be followed by the significant growth and value proposition that drives our financials. Additionally, we'll share information about our Solid-State Technology and the unique patented manufacturing process we have developed. Finally, we will end with a live question and answer session.

Today’s presenters from Dragonfly include Dr. Denis Phares, Chief Executive Officer, Sean Nichols, Chief Operating Officer, and John Marchetti, Chief Financial Officer. You will also hear from Jonas Grossman, Chief Executive Officer of Chardan NexTech Acquisition 2 Corp.

We encourage you to share your questions through the live chat you will see at the bottom of the screen, or email them to [email protected], throughout the presentation. Thank you

| Page 1 |

Opening Video

Voice Over 1:

The future of renewable energy storage ... the next positive, and necessary change, towards a brighter, greener tomorrow. Dragonfly Energy is here to revolutionize the way we store power.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

Dragonfly Energy is more than just a battery company because it really is a technology and innovation company. Our focus is certainly batteries right now in terms of how we innovate. That new battery packs, new battery cell manufacturing processes and the associated products that can be developed.

Really what we're trying to do is solve problems having to do with how we make energy, with how we make electricity, especially in the United States, but globally. What most people don't realize about renewable energy is that we're not actually limited by the cost.

We're limited by the intermittency of renewable energy, of the sun, of the wind. That's why we have to do batteries.

Wade Seaburg, Director of Business Development & Sales – Dragonfly Energy

Dragonfly Energy, to me, is a cutting-edge technology company that's developing energy storage solutions that allow wind and solar to compete with the levelized cost of coal and oil and gas, the ability to stay out there longer, the ability to, as we say, get out there and stay out there. That's ever more in need now than it ever has been.

John Marchetti, Chief Financial Officer – Dragonfly Energy

What’s interesting is, lead acid batteries have been around for 150 years and there really hasn't been much of a change since, you know, AGMs were introduced in the seventies. You look at the replacement opportunity set and it's enormous.

Voice Over 2

Looking towards what was needed in the world of energy and storage, Dragonfly Energy and its consumer brand, Battle Born Batteries, came into the industry with the ideal replacements for traditional lead acid batteries ... and completely changed the way the RV, marine, and off-grid customers powered their lifestyles.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

What we do at Dragonfly Energy today is we assemble battery packs. We market them to consumers and OEMs for different applications through our Battle Born batteries and through the Dragonfly site. Alongside of that, we offer full systems. We offer inverters and solar charge controllers, solar panels, everything that goes along with it. The reason that we do this is it gives us a better look at the industry so we can understand how things are evolving in the energy industry.

We're on the front lines of micro off grid systems, basically what I would call them, in mobile power solutions and fixed buildings as well. Now what we've done is we're driving that conversation toward actual larger scale applications, whether it's emergency backup power or industrial power, we've developed a deep understanding for and become experts at over the years. We can apply this to larger systems. And that's where our new battery technology will come into play. We will start to do these larger systems and displace lead acid and even displace other types of lithium battery that are in play today.

| Page 2 |

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

What excites me most about what Dragonfly is working on is I'm a scientist at heart, and through Dragonfly I have the opportunity to deploy technology that I'm developing to basically solve problems that need to be solved, particularly when it comes to electricity production.

It gives us the opportunity to deploy technology that we're developing in-house that will make a positive impact on the world.

Ryan Hopkins, Director of Engineering & Automation – Dragonfly Energy

Honestly, we want to be the number one battery supplier for clean energy systems. That is really what makes Dragonfly Energy special. The most exciting thing about Dragonfly Energy is knowing that at the end of every day, I've done something that moves us closer to a greener and more sustainable future.

Dr. Vick Singh, Director of Research & Development – Dragonfly Energy

I think it's that combination of having revenue and a strong brand and product line to fund innovative and, you know, potentially world changing technology that makes it different than most battery companies, if not any battery company out there.

Voice Over 3

With the research and development Dragonfly Energy has been able to do since the very beginning, we're not just entering the world of solid-state technology but are focusing on such a technology that the world has never seen before--one that the world of renewables and energy storage is in desperate need of.

John Marchetti, Chief Financial Officer – Dragonfly Energy

Most other solid-state technology companies are all focused on the electric vehicle market. There is really none other than I can think of off the top of my head that are solely focused on the storage market. What Dragonfly is really focused on from a solid-state perspective is so unique and it allows, I think, for a tremendous opportunity because it's an area of the market that I think is wildly important and has largely gone underrepresented as we've been focusing more and more as an industry and as a society on EV.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

It's not just the Holy Grail for electric vehicles. It actually is a critical solution to the widespread deployment of lithium ion batteries, where in one case, you might worry about flammability with a liquid electrolyte, but if it's solid, that problem goes away.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

There is no renewable energy grid. And in order to do that, you need a very safe, cost effective battery solution. And our solid-state battery is going to be made here in the United States. It's going to be very cost effective in manufacturing, and it's going to be non-flammable.

You can't get safer than that. So now you'll be able to put this in every building in America and in many other countries too. That's the difference for us. The solid-state battery technology that we're developing is a real game changer for us and for the planet.

Voice Over 4

Dragonfly Energy, revolutionizing energy storage to build a greener future.

| Page 3 |

Denis Phares, Chief Executive Officer – Dragonfly Energy

Welcome to Dragonfly Energy Corp.’s Analyst Day. I am Dr. Denis Phares, CEO of Dragonfly Energy. Thank you to everyone for joining us.

Dragonfly Energy is a company born to make a significant and positive impact on the environment. Since the very beginning, it has been my mission to advance renewable energy technologies and change the way we look at green energy storage, an area that has virtually stagnated the advancement of widespread renewable energy adoption. And now, here we are–developing and advancing revolutionary technology to make meaningful change.

During today’s Analyst Day, we’ll be hearing from many members of our executive team as we dive deeper into Dragonfly Energy, where we’ve been, and what we envision for the future. We will speak about how we got to where we are today, bringing our current technology to the market and completely flipping the industry upside down, displacing lead-acid batteries for consumers and rapidly growing in OEM markets. I will break down, specifically, how our line of lithium-ion batteries work and the pride we’ve had as a company designing and assembling them right here in the USA. And lastly, but most importantly, you will hear about Dragonfly Energy’s R&D efforts, robust patent profile, and our ultimate goal of revolutionizing grid storage with an All-Solid-State-Battery.

On May 16, 2022, Dragonfly Energy announced our intention to publicly list on Nasdaq through a business combination with Chardan NexTech Acquisition 2 Corp. This is a very exciting time for our company. We believe this transaction will better position the company to grow and advance further on our journey.

With that, I would like to express our team’s enthusiasm about this partnership with Chardan NexTech Acquisition 2 Corp. We believe we absolutely found the right partner to help us deliver on our goals.

To start us off, it is my pleasure to introduce Jonas Grossman of Chardan NexTech Acquisition 2 Corp.

Jonas Grossman, Chief Executive Officer – Chardan NexTech Acquisition 2 Corp.

Thank you, Denis.

I’m Jonas Grossman, CEO and Director of Chardan NexTech Acquisition 2 Corp. I’m thrilled to be here today for Dragonfly Energy’s first analyst day.

By way of background, Chardan NexTech Acquisition 2 is Chardan’s 7th managed SPAC and represents one of 15 Chardan sponsored or co-sponsored SPAC’s over the course of the past two decades. Chardan is uniquely positioned as one of the most active participants in the SPAC space having served as sponsor, underwriter and advisor across more than 130 transactions. This gives us extraordinary insights into what makes for a great SPAC target.

When we launched Chardan NexTech 2, we sought a target with disruptive technology that would yield a long-term benefit to society. In Dragonfly Energy, we believe we have found the company that fits this search. Dragonfly is a leading energy storage company whose cutting-edge technology is enabling the replacement of lead-acid batteries and facilitating the creation of next generation solid state batteries to address tomorrow’s energy storage needs.

Taking this a step further, there are several key points, not only around Dragonfly, but around the energy storage ecosystem as well, which helped formulate our investment thesis:

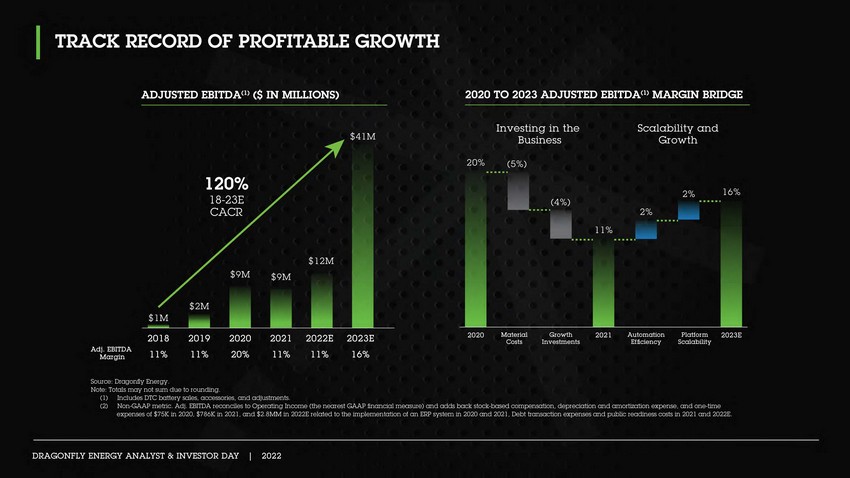

First: Profitable Growth. Dragonfly has grown revenues over 100% annually over the past three years to $78 million in revenue in 2021, enabling 17 quarters of positive adjusted EBITDA since 2017. We expect it to hit over $250 million in revenue in 2023 with adjusted EBITDA of $41 million.

Second: Attractive Valuation. We believe the merger valuation represents a compelling entry point for investors with 2023 projected revenue and EBITDA at approximately 20% and 40% respective discounts to comps.

Third: Large Addressable Markets. The company’s existing and relevant adjacent markets represent a total addressable annual market opportunity of approximately $85 billion.

| Page 4 |

Fourth: Technology. Over the past nine years, the company has developed what we believe has the potential to be a highly disruptive, proprietary, patented solid-state technology that will enable renewables to be cost competitive with fossil fuels. We expect the commercialization of this technology to occur in 2024 and it is not represented in our forecasted numbers. Some call solid state the Holy Grail in battery technology. We agree. If the company executes on this, we see tremendous upside that, again, is not in our base case forecast.

Fifth: Sustainability. I hope one key takeaway from this Analyst Day is that folks recognize that Dragonfly Energy is razor focused on delivering environmentally impactful solutions for energy storage. At Chardan, we also have a mission to partner with companies that will generate compelling returns to shareholders through delivering long term benefits to society.

Sixth: Visionary Leadership. The management team at Dragonfly has a proven track record of execution and success. With a unique approach of combining a commercial product launch while investing heavily in internal R&D as a young company, the team has shown itself to be immensely creative.

Seventh: Strategic Investment. On July 12th, THOR Industries, the largest manufacturer of recreational vehicles in the world, announced a $15mm investment in Dragonfly and a commitment to move towards an exclusive supply relationship across its over 140 brands. THOR represents over 40% of the RV market. This strategic relationship underpins Dragonfly’s distinct leadership position in the RV space. We believe they will replicate this success across other adjacent verticals in the years to come.

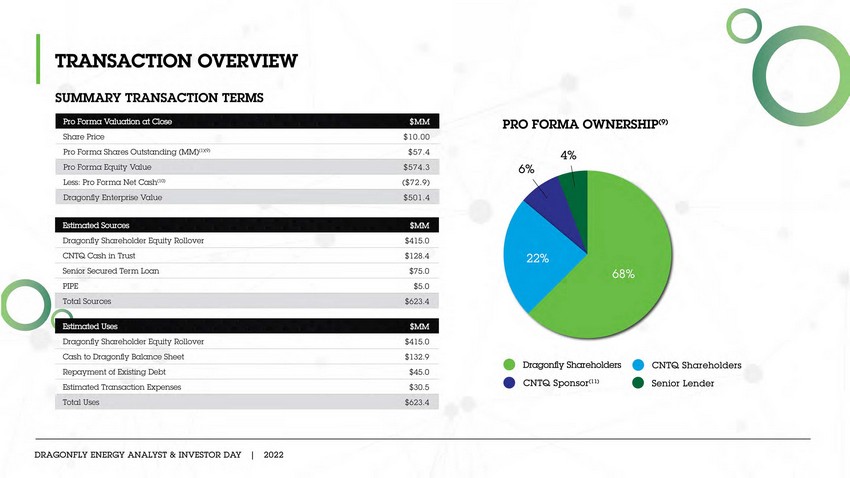

For some background on the transaction, Chardan NexTech Acquisition 2 Corp. completed its $126.5 million initial public offering on August 13th, 2021, and it trades on the Nasdaq under the symbol ‘CNTQ’. As Denis mentioned, on May 16th, 2022 we entered into a definitive business combination with Dragonfly Energy Corporation, where upon closing, the combined company is expected to be listed on the Nasdaq under the new ticker DFLI.

Dragonfly Energy’s pro forma enterprise value is estimated to be $501 million. In addition, embedded within the transaction is a strong incentive earn-out structure, with an additional 40 million shares to be released to existing Dragonfly shareholders pending the achievement of meaningful financial and share price thresholds. The first earn-out milestone is delivering at least $250 million in revenue and $35 million in operating income for the 2023 calendar year. The second two milestones are share based performance above $22.50 and $32.50 per share representing strong returns for investors in the deal. All Dragonfly shareholders are expected to roll-over 100% of their equity.

| Page 5 |

In addition to the approximately $128 million of cash-in-trust (subject to stockholder redemptions), the transaction is supported by an additional $245 million of capital, comprised of a $75 million senior secured term loan maturing in 2026 led by Energy Impact Partners (refinancing existing debt and bringing approximately $30 million in new capital to Dragonfly and $5 million dollars from Chardan in the form of a $5 million equity pipe investment at $10. Chardan has also committed to a $150 million equity facility to be available post-close. The transaction is expected to close in the second half of 2022 with proceeds to be used to fund the acceleration of Dragonfly’s existing business, the commercialization of its all solid-state technology and the repayment of debt.

I’d like to thank you all for joining us today and express my excitement to have Dragonfly Energy take you along their journey.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

The growth of Dragonfly Energy was really due to the fact that we put out a product that satisfied the needs of a lot of consumers. For us, it was the RV business. Basically, folks hated their lead acid batteries.

We knew that we put out a product that basically addressed the issues that lead acid batteries created. You know, when you mix that with a rapidly growing industry like the RV business, you know, strap yourself in.

Voice Over 1:

So how does a small battery company in Reno, NV take on industry titan? By identifying a problem and developing a solution that is powerful, safe, and reliable. And that's exactly what Dragonfly Energy did.

Through relationships with influential customers and industry-leading OEMs, organic grassroots campaigns, and shedding light on the pitfalls and dangers of traditional lead acid batteries, we completely flipped the industry upside down. Since 2018, we've sold over 175,000 of the most popular deep cycle lithium-ion batteries on the market and rapidly grew the Dragonfly Energy and Battle Born Batteries brands.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

I think people got really excited about the products that we offer because they really changed the life they were living. I think that in our being an off-grid power and marine solutions, you know, getting rid of lead acid batteries was a real pain point for people.

They didn't realize there was anything better out there. Once they started tuning into that, you know, it was it was an exciting opportunity for us to grow the company and also change their experience with the activities they were doing with our batteries.

John Marchetti, Chief Financial Officer – Dragonfly Energy

Understanding what it is that customers are ultimately trying to solve for is how then you're going to design the product I think.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

You know, we started this company from the ground up, we started as a base and so on, you know, one or two batteries a day and now we sell thousands. It's you know, it's been an exciting opportunity to see the company grow.

The brands are well received not only as our products are one of the best out there. Also, the customer service, the customer experience that we bring to the table really makes a big difference. And people decide to purchase from us. They get the support that they need.

John Marchetti, Chief Financial Officer – Dragonfly Energy

What's really unique, I think, is the way the Battle Born brand itself took off.

| Page 6 |

Josh Miller, OEM Product Manager – Dragonfly Energy

Now we are fielding hundreds of calls a day from various verticals, various end users in markets that you wouldn't have dreamt of that want to utilize what we do best.

Voice Over 2:

For years, the RV industry was limited in where it could go and what customers could do, using outdated and dangerous technology. Dragonfly Energy's consumer brand, Battle Born Batteries, was an early mover and was at the forefront of the industry's transition from lead acid to lithium ion and remains one of the highest rated and most reliable lineups of LiFePO4 products on the market.

Non-toxic, lighter weight, longer lasting, and safer, these batteries have not only improved customer experiences, but have powered their lifestyles.

Voice Over Comments

| ● | Switching over to lithium has been a game changer for me. |

| ● | This day i'm amazed at the power you get from them |

| ● | We moved to lithium ion because we could store 3 times as much energy for half the weight |

| ● | And you can just trust you're not gonna run out of battery |

| ● | If you can choose just one word, it’s about freedom |

| ● | Its true man, lead is dead |

| ● | I’m able to power 3 house, 2 garages and a full-blown machine shop completely off the grid |

| ● | It has given me a competitive advantage using battle born batteries |

| ● | This is one of the few companies I've ever dealt with that all their promises came true |

| ● | It’s a win-win when you go with battle born batteries |

| ● | Battle born is awesome |

Josh Miller, OEM Product Manager – Dragonfly Energy

I mean, at the end of the day, when we get customers to talk about, can I do this?

The answer is uniformly yes. I mean, you can absolutely change the way that you camp, the lifestyle and leisure in the way that you do it with the addition of what Dragonfly and Battle Born have brought to it.

John Marchetti, Chief Financial Officer – Dragonfly Energy

And ultimately, again, it kind of comes full circle to that's where being a battery technology company and not a battery importer makes a big difference by being able to take that feedback from customers and turn that around into product development is a is something that I think is pretty unique to us in the industry.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

The way we approached the RV industry was very, very well planned. We wanted to educate early adopters about the benefits of the technology and drive the business back to the dealerships while at the same time educating the OEMs.

And that was the reason for the dual branding situation. And we positioned ourselves on both sides of the market. Now they're meeting in the middle and it's been very successful. And I'd say that, you know, we have full penetration in that market based on our techniques and tactics.

| Page 7 |

There's not anyone out there that has an RV or is an RV manufacturer that hasn't heard of our products.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

Battle Born is definitely the market leader in RVs, and we need to continue that momentum. And you never rest on your laurels. We never have. I mean, we don't intend to and we're going to go far beyond, you know, the technology that we have now.

We're going to continue to expand. We're going to continue to automate. And, you know, that's going to not just allow us to remain the market leader in RVs, but we're going to become the market leader in adjacent markets as well.

The lead-acid battery replacement market is enormous, and we intend to lead that charge in replacing lead acid batteries.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

We have solved a significant problem in consumer energy storage within the off-grid, RV, and marine markets already. We’re overcoming hurdles in the industrial energy storage industry. And tomorrow, Dragonfly Energy is creating a solution for distributed or micro-grid storage. There has been, and is, a toxic lead-acid problem in every one of these sectors and providing a replacement to make a significant, positive impact is our ultimate vision.

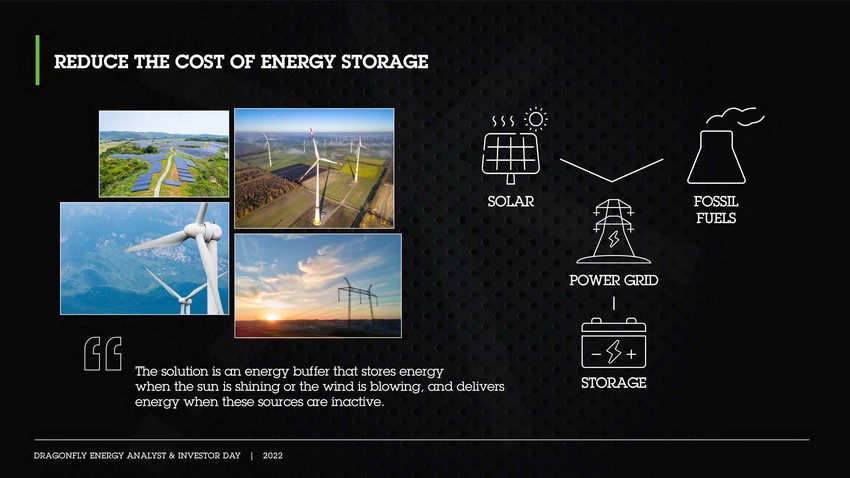

Dragonfly Energy is a lithium-ion battery technology company and from the beginning, the mission of the Company has been to reduce the cost of energy storage. The costs of renewable energy sources like solar and wind are low enough that they are already cost competitive with generating electricity from burning fossil fuels. However, the intermittency of these sources complicates their widespread deployment onto the electrical grid. The solution is an energy buffer that stores energy when the sun is shining or the wind is blowing, and delivers energy when these sources are inactive. We wanted to make a battery that, when combined with the costs of renewable energy, was still cost competitive with fossil fuels, while being easily distributed, and facilitating the smart grid of the future.

Between where we stand today and the ultimate goal of revolutionizing grid storage, there are numerous markets that would benefit from existing lithium-ion battery technology. A significant portion of these markets rely on traditional lead acid batteries.

As a technology company, we are focused on bringing future solutions to the market to solve these critical environmental and infrastructural issues. But what truly differentiates us from the majority of tech companies out there is that we are already revenue generating today with products that also help solve environmental issues! This strong brand of products we designed for both the DTC and OEM markets provided us the opportunity to fund our own R&D while continuing to grow in our existing businesses. This R&D will allow us to develop groundbreaking technology that will help make an even bigger positive impact on the environment and further our mission of storing intermittent renewable energy to displace the use of fossil fuels.

We began this by establishing our headquarters in Reno, Nevada. This was by design, as there is a lot of lithium in the ground here available for our future use, as well as a lot of solar and wind. We went to market with two brands; the first brand, Dragonfly Energy, was reserved for our Original Equipment Manufacturing, or OEM, customers. And the second was a direct-to-consumer, or DTC, retail line of deep cycle lithium-ion battery storage systems that we branded Battle Born Batteries, named after the battle born state of Nevada.

The lead-acid markets we initially targeted, which included RV, marine and off-grid solar, were ripe for a change. The Battle Born brand took off quickly as we informed our customers about the benefits of switching from lead acid to lithium-ion, which not only included safety benefits, but provided additional power and improved performance. And our customers loved it.

| Page 8 |

Along with the technology we had brought to the market came the need for upgrades to the electrical system in general, including accessories like chargers and inverters. And for many applications we wound up selling accessory products to aid in the transition from harmful lead acid batteries to our replacement solutions. Dragonfly Energy and Battle Born Batteries became large resellers of accessories, and we are full system integrators.

We also brought on Wakespeed® Offshore, acquiring their assets and intellectual property portfolio and strengthening our advanced technology offering for our customers and manufacturing partners.

Our products were tested and proven to perform in intense DIY applications like overland and marine, and we developed a strong reputation for reliability and durability. It was thanks to this reputation, that OEMs knew they could trust our product, and in turn, that skyrocketed as well. Dragonfly Energy entered partnerships with major RV manufacturers, such as Keystone RV and Airstream, making our lithium-ion batteries available to the masses, both through dealerships across the country and as factory standard and installed equipment.

OEM Business & Testimonials

Voice Over - Intro

We've built trust with DIY-ers, sailing enthusiasts, both on and off-road adventurers. Our proven track record in the aftermarket has led us here--to partnerships with some of the industry's leading OEMs. Through strategic OEM Partnerships, our Battle Born and Dragonfly Energy batteries are now available to the masses through dealerships across the country and as factory standard and installed equipment.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

I think the Battle Born brand gave the industry a shot in the arm. Battle Born came out focusing on the aftermarket. And all of a sudden everyone had a lithium ion battery on their RV and it didn't come from the factory. And that's when the OEM customers started to realize that this is what the customers actually want. So we need to start thinking about how to get this on the line.

Wade Seaburg, Director of Business Development & Sales – Dragonfly Energy

Our customer base has really embraced the power that lithium is able to give to them over traditional LEAD-ACID batteries, as we've proven it in the direct to consumer marketplace. We've grabbed the attention of the OEMs. once we got Airstream, that iconic brand, right?

Then we landed Keystone as an early adopter and one of their big solar packages. And we had landed Tiffin Motorhomes and we landed a number of other RV companies and had a big OEM footprint.

Then we knew we were hitting that sweet spot.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

We work closely with a number of customers, especially Keystone RV, who, you know, in terms of innovation… Keystone RV did something that really hadn't been done before, which is put batteries on the line in shipping to dealerships with batteries on, you know, on the RVs.

| Page 9 |

And they put Dragonfly batteries on the RV. So we gave the aftermarket a shot in the arm and we changed how RVs are built in Elkhart.

Jeff Runels, President & CEO – Keystone RV

Any time you partner was with anyone you want to use the best and Dragonfly's already got such a great new industry. We actually had customers who were referring us to them, and so that's a really good indicator. One of the things we always talk about is our customers drive what we do, and so that's kind of how the relationship started. You know, they're able to help us not only develop and innovate, but also market. And so it's just worked really well.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

That relationship has grown tremendously. Now we're the exclusive lithium [battery] supplier for Keystone RV, which was a great opportunity for us. It's, you know, because of that initial relationship, we run an old-fashioned business.

We actually care about the people we deal with and that that goes a long way in the relationships that we built.

Josh Miller, OEM Product Manager – Dragonfly Energy

We value the relationship that we've had with Keystone because we also realize when that big gorilla starts to do stuff, the rest of the OEM space takes notice.

And so when those guys start to break down these preconceived ideas that you can't ship units with batteries and they're doing it and doing it successfully and the dealers are really happy, then everybody's going to come chasing and they're already that far ahead.

Wade Seaburg, Director of Business Development & Sales – Dragonfly Energy

That says a lot about our product, right, from a quality perspective of the ability to fulfill the demand. I mean, Keystone makes that many units and we're going to be able to fulfill that demand, and still have capacity for all of our other customers and growth because we're not stopping there. Right. We're pursuing lots of other verticals, material handling, the rail market…the marine market - we're getting more entrenched there. Any place where a lead acid deep cycle battery is used today is a great application for our batteries.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

Our OEM business is really important to us. It gives us credibility. It's the type of business that you can't just get by basically importing a product and slapping the sticker on. We get scrutinized. You get an OEM customer to buy our product.

They will come out and visit our factory. They will ensure that we are able to deliver. We cannot miss a delivery because then they're out of production. To get OEM business means that you know. We're one of the big boys.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

I think as the company matures, you know, as the market matures, we're going to be installing more and more lithium at factories. The aftermarket for RV is still huge. It's 11 million RVs on the road in America today. So our OEM relationships are paramount for this company as we grow those to continue to grow the company and diversify the sales pipeline.

| Page 10 |

So we have a unique ability to develop strong OEM partnerships, and you look back at the way our relationships with Keystone RV and Airstream have developed over the years, it got so strong, it garnered the attention of their parent company Thor Industries. They came to visit Dragonfly Energy because they are excited about what we are doing. As a matter of fact, they’re so excited about what we’re doing they made a $15 million investment a few weeks back into Dragonfly Energy, because they believe in our ability to not only change an industry but change the course of the planet.

Whiteboard Video: Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

To really understand where we are as a company and where we're headed in terms of the technology. Let's take a step back and talk about the fundamentals of lithium ion batteries.

A lithium ion battery is an electrochemical cell that consists of a cathode and an anode.

The cathode is a piece of aluminum foil with some type of lithium salt coated on top of it. In our case, this lithium salt is lithium iron phosphate or L I F E P O 4. The anode, which is the negative side of the battery, is comprised of a piece of copper foil with graphite coated on it.

Graphite is C6 and in between there's a thin plastic separator, typically polyethylene, polypropylene, and this entire structure is filled in with a liquid. This liquid electrolyte has a lot of lithium ions inside of it (Li+). Now when you charge this for the very first time, you're basically pumping electrons from the cathode to the anode.

And when the electron comes off of the cathode, the lithium iron phosphate becomes a lithium ion, plus the electron that gets pumped out, plus iron phosphate. And that's what's left behind on the cathode.

The lithium ion that came out basically migrates through the electrolyte towards the anode or the graphite on the negative side and recombines with the electron that's been pumped through the charger and now the lithium ion plus the electron reacts with the graphite to form a lithiate graphite. And when this cycle is complete and then the battery is fully charged. As the battery discharges, the reverse reaction happens. The lithiate graphite becomes graphite with the lithium ion and an electron. The electron is discharged through the load and then re combines with the lithium ion that has migrated the opposite direction through the electrolyte and then reacts with the iron phosphate to reform lithium ion phosphate.

At that point, the battery is discharged.

A lead acid battery is also an electric chemical cell. In its discharged state both the anode and the cathode are composed of lead sulfate and the electrolyte is sulfuric acid. And within the electrolyte, protons or hydrogen ions are allowed to move back and forth between the electrodes. As the battery is charged, we're pumping once again electrons from one side to the other. And on the cathode what's formed is lead oxide and on the anode pure lead metal is formed and the electrolyte becomes very rich in sulfuric acid. So you can see that in a lead acid battery, there's quite a bit of both lead and sulfuric acid that are required in order for this electrochemical cell to function.

Well lead is highly toxic and sulfuric acid is highly corrosive.

There’re a couple fundamental differences between how a lithium ion battery works and how a lead acid battery works, even though they're both electrochemical cells.

| Page 11 |

So, because of these fundamental differences between our lithium ion batteries and lead acid batteries, our batteries are safer, longer lasting, lighter, more reliable.

And that's why we say for deep cycle applications, LEAD is a dead.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

I am Sean Nichols, the COO here at Dragonfly Energy, where I lead our Operations, Sales, Marketing and go-to-market functions.

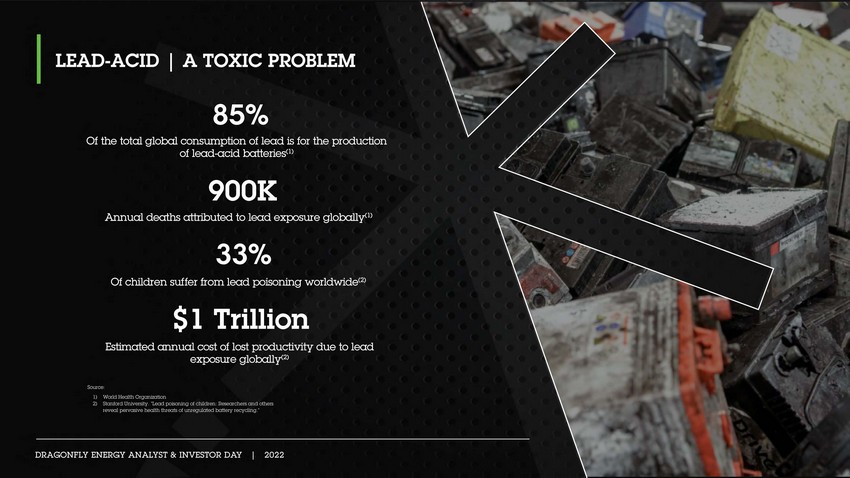

For many years, we’ve been saying that ‘lead is dead’ because traditional lead-acid batteries are an environmental nightmare!

Are you aware that nearly 900,000 die each year on this planet due to lead exposure?

And 1/3 of children on this planet are suffering from lead poisoning...

and $1 trillion in costs is estimated to be lost in productivity each year due to lead exposure.

And today, approximately 85% of the lead that's consumed globally is used to make lead-acid batteries.

Lead is toxic and the world is suffering because of it. But we’ve had enough and know that it doesn’t have to be that way. Dragonfly Energy is here, with our cutting-edge technology, to displace lead-acid batteries, offering a superior solution to this antiquated technology through our conventional lithium iron phosphate-based batteries, and enabling the widespread conversion to green, renewable energy.

Unlike lead-acid, our lithium-ion batteries are environmentally safe and non-toxic. They last 10 times longer than the incumbent technology and provide two to three times the amount of power in the same amount of space. These batteries are one fifth the weight, a significant advantage in almost every application. You can charge these batteries up to five times faster than lead-acid, and there's literally zero maintenance. These batteries are impressively powerful.

Our customer needs and satisfaction have been a key driver of our innovation. We were the very first company to launch cold temperature charging protection in our battery management systems. This was essential to helping our customers protect their investment in our batteries. We took that concept a step further and made a proprietary internally heated battery, which has become the standard with our OEM RV partners, and we have several other technology and product innovations planned over the coming quarters. Today, our customers recognize that these batteries cycle thousands of times more than the incumbent lead-acid technology, and we have strong brand recognition and are known for our product quality, reliability, and strong customer service.

Now, let’s take a few moments to discuss our proven go to market strategy. We utilized a dual branding strategy, launching Dragonfly for the OEM market, and Battle Born Batteries on the direct-to-consumer side.

Through our namesake brand, Dragonfly, on the OEM side we have built strong brand partnerships with some of the largest RV companies in the world including Thor Industries through their Keystone and Airstream brands, as well as the REV Group through Midwest Automotive and Renegade. In fact, we recently announced that Keystone entered into an exclusive agreement to provide Dragonfly Energy batteries as standard or optional OEM equipment on every Keystone RV. In addition, Dragonfly batteries will be sold for aftermarket purchase exclusively through authorized Keystone RV dealers and service centers.

| Page 12 |

On the DTC side, through our Battle Born Batteries brand, we work with some of the largest dealers and resellers in the industries that we focus on today, which include RV, marine and off-grid markets. And the aftermarket opportunity in marine and RV is huge. For example, there were over 11 million RVs on the road in America as of 2021, and lithium-ion, as a whole, has only penetrated roughly 10% of that market. The penetration in the marine market by lithium-ion is even lower. So, there remains a tremendous growth potential over the near-term in the existing markets we serve.

And we are expanding into new areas, entering the industrial equipment and solar integration markets, as well as focusing on work trucks, and emergency and backup standby power markets; with plans to later move to telecom and data centers.

New Markets Video w/ Testimonials

Voice Over 1

For decades, lead acid batteries have been the go-to technology for energy storage across a number of industries, but there has been a large gap in technological advancements and these industries struggle because of that. The need for safe, efficient, and cost-effective energy storage is a pain point for markets across the board, and Dragonfly Energy is here to take storage to the next level.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

There are a lot of markets right now that are still dominated by lead acid batteries. It's the go to technology for deep cycle storage right now. We are going to displace that. We are talking data centers and railroads and forklifts and, you know, emergency vehicles.

The list goes on and on. Ultimately, this is a, you know, tens of billions of dollars in terms of accessible market.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

Every single one of those markets are a target for us now with our well-known UL listed product. We want to go to those markets and expand this business and push lead acid out as a solution. Along the way we're going to continue to build our footprint and our expertise so when we have our solid-state battery cells ready to go to market, we'll have the right products developed from day one.

Wade Seaburg, Director of Business Development & Sales – Dragonfly Energy

The other markets that we're looking at, they've never included a battery in their builds. Like if you look at material handling and you look at work trucks, they've never included a battery in that build. That battery's always been put in after the fact at the dealer at the point of use.

And it's because of deficiencies that are inherent with lead acid technology. The shelf life is bad, and they're toxic. So, OEMs that are building the piece of equipment don't want to keep them and their factory floor.

Well, lithium checks all the boxes and it allows that OEM to be able to put the battery in the vehicle at the time of manufacturing.

You know, security is a big issue now, right? There’re whole businesses around putting a camera up in the sky. Well, there has to be powered in some way. And so now we put lithium batteries into those applications and that use case just got extremely better for the tenant.

| Page 13 |

Now we've expanded into the industrial solar side of our business and everywhere where you see a solar panel up, up on a pole, on top of pole or side of pole, mount with a little box that has a battery buried in it and a controller for a timer, for a radar detector, for a license plate reader, for a camera, whatever the appliances that's being powered by the battery and by the solar panel, we are able to build a much better return on investment and business case for lithium batteries than ever before.

The possibilities are endless and with our engineering team behind it, innovating and developing those custom solutions for OEMs, that's where we really shine and that's something that we have that our competitors don't.

Voice Over 2

The future is wide open for what Dragonfly Energy can do with its advanced technology and now is the time to enter those markets, bringing solutions to the table that will completely change the way we look at energy storage ... the way we power lives.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

Everything that we've done to date has set the stage specifically for this kind of expansion. We grew so fast and this is basically just a continuation of our growth.

Josh Miller, OEM Product Manager – Dragonfly Energy

Here's what our current set of batteries can do for you. Here's what our future set of batteries could do for you. And ultimately, what do we need to do to provide solutions to end markets that you almost didn't realize existed?

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

I consider these new markets a stepping stone to grid storage. You know, ultimately, we're trying to revolutionize the grid, which is a literally $1,000,000,000,000 market. So how do we get there? Will we displace lead acid batteries in all these markets on the way to making the battery that will ultimately be present in every home?

Whiteboard - Storage vs EV Video

Dragonfly Energy is very unique in its focus of lithium ion batteries on storage. Typically, lithium ion batteries are thought of as an electric vehicle battery, but electric vehicle batteries are actually quite different.

They're different in their requirements. They're different in their performance. And I want to talk a little bit about the differences between our lithium ion batteries and electric vehicle lithium ion batteries.

On our lithium-ion batteries, the cathode, which is a lithium compound coated on aluminum foil, is composed of lithium iron phosphate or L F P.

An EV battery requires much more energy density and, therefore, cathode compounds that are more energy dense, typically NMC with heavy cobalt and nickel.

The energy density of an NMC cell makes it very well suited for propulsion or an electric vehicle battery.

A liquid electrolyte inside a battery is organic and reacts strongly with oxygen, and one thing that's critical to note in this chemistry is the oxygen bond, which is much looser in NMC than in LFP.

| Page 14 |

This is where you could get thermal runaway, or an explosion, when that oxygen reacts with that liquid electrolyte at high temperature, something more likely to happen in an NMC cell than a much safer LFP cell.

A couple other things to note:

| - | is that since NMC operates at a higher voltage, it reacts more with the electrolyte at the cathode and therefore ages the battery more as well. It's less stable at the cathode. |

| - | And finally, since LFP is a larger molecule in general, it can last a lot longer as it swells and shrinks when the lithium ion goes in and out upon charge and discharge. |

So while nickel and cobalt based cathodes create really good electric vehicle batteries, our focus on lithium ion phosphate provides us with a chemistry that's very well suited towards the storage applications that are critical for our markets.

Dr. Vick Singh, Director of Research & Development – Dragonfly Energy

As our sales grew in the RV, marine and off-grid sectors, we were able to fund our R&D efforts that focused on cell manufacturing innovation. We have a robust patent portfolio, with over 40 granted and pending patents. We have continued to innovate and we have focused our patented manufacturing processes on creating an All-Solid-State-Battery. In pursuit of this we have already begun construction of our solid-state cell pilot line, with a goal to start cell manufacturing here in the U.S. over the next 12 to 18 months. And it is worth noting that our future aspirations are not related to electric vehicles. We are focused longer-term on grid storage. We want to make a storage battery that will facilitate the adoption of a smart grid, with a battery deployed in every home or business, on or off the grid. These new storage batteries require low manufacturing costs, long cycle life, and non-flammability, which are all characteristics of our patented All-Solid-State-Battery technology and manufacturing processes. This is fundamentally different than an EV battery which requires fast charge times and extremely high energy density.

Between where we stand today and the ultimate goal of revolutionizing grid storage, there are a lot of markets which are still largely dominated by lead-acid batteries, including telecom, data centers, emergency vehicles, work trucks, forklifts, solar integration projects, and more. Today we are recognized as not only the experts in lithium-ion batteries, but on entire lithium battery systems. The markets we are in now, which include the RV, marine and the off grid solar storage markets, are not small, with a combined $12 billion-dollar annual U.S. TAM. When you combine all the markets that are poised to displace lead-acid with lithium-ion in the markets we are focused on, the potential U.S. TAM is expected to expand to a much larger $85 billion by 2025.

Today, Dragonfly is ready to not only further deploy its technology but is also poised to enter some downstream vertical markets, markets which would benefit from the implementation of our future solutions.

John Marchetti, Chief Financial Officer – Dragonfly Energy

As both Denis and Sean have highlighted, Dragonfly has established itself as a leading provider of lithium-ion battery solutions across a wide variety of storage applications. Not only are we a technology and brand leader in these markets, but we bring a well-established track record of strong revenue growth and profitability, setting us apart from many of our competitors and peers.

In 2021, Dragonfly delivered $78 million in revenue and Adjusted EBITDA of $8.7 million, both representing an 80%+ CAGR since 2018 and our fourth straight year of profitability. We have had a strong start to the year, with first quarter revenue of $18.3 million, an increase of 17% year-over-year, putting us on track to meet our fiscal 2022 forecasts.

| Page 15 |

And I want to stress that the key drivers to our growth projections for both 2022 and 2023 are the expansion of our existing OEM business and the acceleration of our direct-to-consumer segment given the investments we are making. Our current forecasts do not include the expected benefits of the solid-state cell technology that we are continuing to develop and which we expect to begin commercializing in 2024.

So, let me take a few minutes to discuss our OEM and DTC growth expectations in a little more detail.

In terms of our OEM business, 2022 represents a significant inflection point that the industry has been working toward for many years as historically RVs were delivered to dealers with no batteries on them at all. This practice is now changing with many OEMs offering batteries as either a standard or optional feature on a number of models. For our 2022 and 2023 OEM forecasts specifically, growth is tied to increased traction with legacy customers, these are relationships that we have today, not customers that we need bring on board in order to meet these projections. Additionally, our forecast includes more than a dozen OEM customers that are supplying us with visibility into their build forecasts which gives us a high level of confidence in our projections. And lastly, we are experiencing growth in aftermarket sales through the various OEM dealer networks where our batteries are being stocked for after-market RV service and lead-acid replacement.

And I just want to spend a moment and highlight how the recent announcement with THOR gives us even more confidence in our 2023 OEM projections. THOR is the largest RV manufacturer in the world and represents approximately 42% of the US Market, not to mention the global opportunity. Today we do business with 3 of the 17 brands or approximately one-third of THOR’s US revenue. So, this deal opens up the remaining 2/3 of

THOR’s US revenue, not to mention the more than 3,500 strong dealership network. So very excited about the opportunity in front of us with THOR.

On the direct-to-consumer or DTC side of the business, there are a number of factors contributing to our growth expectations:

First, we expect increased penetration within existing markets in line with historical performance and the trend of lithium-ion batteries increasingly replacing lead acid batteries. Second, we are increasing our sales and marketing investments targeting new adjacent markets such as solar integration, work truck and industrial equipment, where lead acid batteries are the incumbent storage technology, as these markets are ripe for our value proposition, and third, we will be introducing new battery products later this year and in early 2023, such as new form factors, higher voltages and other product features, to address both new and existing market opportunities.

Lastly, DTC revenue growth is also expected to benefit from increased accessory sales as customers are increasingly demanding more sophisticated systems, rather than simple drop-in replacements, and we further develop our full-system design expertise, and expand our accessory and product offerings to include a more comprehensive listing of third-party components.

While 2022 is a year of significant investment for the company, we do expect to continue to grow profitably and we forecast a return to a mid-teen adjusted EBITDA margin in 2023 as our investments drive faster growth and, combined with our automation efforts, provides us with increased scale and expense absorption.

Similar to most companies we have seen higher logistics and freight costs but we have controlled material costs and protected ourselves from supply disruptions through a combination of long-term supply agreements and the establishment of a buffer inventory where we now carry at least 6 months of critical components. Our pricing for these key materials are locked in through the remainder of 2022 and while we expect some variability in our gross margin due to the mix between OEM and DTC, we expect it to remain in the range of 35% - 40% through 2023, in-line with our historical performance.

| Page 16 |

So, in summary, Dragonfly has a well-established track record of growth and success. And the company boasts a strong, clear path to future growth sourced from our existing business, as well as additional up-side expected to be provided by our All-Solid-State-Battery technology, which we expect will materialize over the longer term.

Whiteboard - Solid State

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

So now that we've talked about a liquid electrolyte and the flammability associated with that liquid electrolyte, let's talk about an alternative to that. Let's talk about a solid electrolyte and how that can be made into a much safer battery.

There is the cathode, either LFP or NMC, and then the anode, which has graphite. We don't actually need a liquid separator here at all ... as the electrolyte itself, which is solid, allows transport of lithium ions back and forth between anode and cathode, acting as the separator.

There are a couple candidates for solid electrolytes. At Dragonfly Energy, we've focused on a composite

electrolyte that has both ceramic and polymers, and we've done this for two reasons.

One, the ceramic itself can't burn, allowing for as safe a system as possible.

And two, it optimizes the conductivity to achieve our desired charge and discharge rate for deep cycle storage applications, much shorter discharge rates than what you'll see in electric vehicles.

In making traditional lithium-ion electrodes, you would have a slurry, made up of NMC or LFP particles, a binder, and a solvent to dissolve that binder that is painted onto this roll of aluminum foil. The foil is introduced into a drying oven where the solvent, or NMP, slowly evaporates, leaving the binder behind and LFP or NMC stuck to the foil.

This drying oven is huge and the NMP solvent is toxic and has to be reclaimed, making the process very time consuming and expensive. That’s what we’ve replaced.

So what we do that's different is, instead of making a slurry, we have a dry powder coating process where we have an aerosolized dry powder that's composed of both the binder and the electrode material, which could be LFP or NMC.

That powder is dry coated onto the foil, and can actually be done simultaneously on both sides.

Then, after a pressing step, what we have is an electrode that's ready for assembly into a cell without any drying needed.

What we discovered through this process is that as we're coating the electrode, we can coat a composite electrolyte directly on top of the electrode. So now we have a layer of electrolyte on the electrode.

And since we're powder coating, we're growing these layers one particle at a time.

| Page 17 |

Now what we have is a very intimate interface, a high surface area interface between the electrode and the electrolyte. This interface is critical in the operation of the battery, getting the lithium ion out of the electrode and into the electrolyte.

This patented technology is what we do really well here, and it's what makes us different. And because it's chemistry agnostic, this can be used and licensed for a wide variety of chemistries and, therefore, applications.

So while we are super excited about the solid state technology, we're not developing any new electrode materials, we're not developing any new electrolyte materials, but we are inventing the processes that are required to make these cells on a mass scale. We're inventing scalable processes that will allow us to feasibly produce solid state storage batteries in the US.

Solid State Technology and Manufacturing

Voice Over 1

The driving force behind solid state batteries has been electric vehicles, but Dragonfly Energy is focusing on something different—energy storage.

Dr. Vick Singh, Director of Research & Development – Dragonfly Energy

Dragonfly's solid-state technology is really unique because it attacks a problem that's, you know, very focused on one thing and one thing only. And that's it will be nonflammable. We want a battery that doesn't need to charge necessarily in 15 minutes and discharge in Extreme C rates. For that electricity to be cheap, it's much more important for that cell to actually last a very, very long time.

The innovative product that Dragonfly's really trying to bring to market is a non-flammable, solid state battery that can last thousands and thousands of cycles. So, it only adds a couple of cents to the levelized cost of electricity over the lifetime of that pack.

John Marchetti, Chief Financial Officer – Dragonfly Energy

You think about what we're ultimately trying to enable, right. As a company, the vision is to really allow for as much... solar, wind, renewable energy sources to be put onto the overall grid. And in order to do that, you've got to solve the problem of intermittency, right?

The wind isn't always blowing, the sun isn't always shining. All of those kinds of things. The challenge then becomes, well, how do you store enough energy so that when the wind isn’t blowing and the sun isn’t shining, you've got it there to pull from.

But what you need for a really resilient grid is to have distributed storage, right? Have storage at every home, have storage at every business, have storage at every, you know, building. And in order to enable that, you have to have a battery that's 100% safe. And you've got to have a battery that's cheap enough that over its lifetime can then lower the cost of storage, enough that when you combine it with that generation of renewable energy can compete with fossil fuels.

What we're doing is very unique is that nobody's really focused on that. I like to call it the last mile piece of storage.

| Page 18 |

Voice Over 2

Last mile storage has been a missing piece to the puzzle, the piece that allows us to store renewable energy and then use it in its entirety to power our lives--at home, at work, anywhere. Dragonfly Energy is not only working to solve that problem but is making the actual cells to do so.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

When it comes to making our own battery cells, it's not just an idea. We actually are already designing and building equipment to use on the pilot line itself. We've got a team of automation experts, in-house robotics experts that are helping us develop this equipment in rapid pace.

When you're developing a new type of lithium battery, there is a process that has to be followed. First you go to lab scale, then you build an analytical lab or use someone else's to analyze the material you have, what they call a prototype lab where you can maybe scale up some smaller size cells to make sure you're making the right stuff and then eventually you need a pilot line, which is actually a full production, maybe not full scale size, but full production line where you can actually produce the product that you want to use.

Then once you produce that, you can do longevity testing. So I think that pilot line is an important component in the timeline in creating a new lithium battery. And so right now we are in the process of building out the facilities to launch a pilot line at our headquarters facilities in Reno, Nevada.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

It's a critical step for us because this is the first time we're really scaling the process. And we're doing it in a way that the cells that come off the pilot line will be salable.

Voice Over 3

The patented process we continue to develop here at Dragonfly Energy has opened doors for us and this new technology. It's designed to be more efficient than anything else on the market and it's cost effective, making widespread implementation possible.

Ryan Hopkins, Director of Engineering & Automation – Dragonfly Energy

Our patented solid-state cell manufacturing technology is very exciting. Two reasons one, manufacturing footprint is a lot smaller. What takes other traditional cell manufacturers, really large-scale buildings and size, we're able to do it in roughly a quarter to a third of the entire size of what traditional cell manufacturers do.

That gives us the ability to one, manufacture for cheaper cost, higher quality product. And it also we were able to get higher efficiencies out of these cells. If we automate, it's one for me so we can have consistency and two for speed. We're looking at having rates that are much faster than traditional cell manufacturing. That's really exciting because that means in a smaller footprint, we're able to get more batteries off the end of the line. We have a sealing process. A packaging process. And all of these are completely automated and essentially hands free. We do that so we can maintain high quality and sustainability and consistency of all of our products.

For our solid-state pilot line, we’re really hoping to accomplish the initial fully automated or fully scalable manufacturing line for solid state cells.

People have made solid state cells on research levels for small lab type batteries. We're taking this to manufacturing and industry level, and that is really critical.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

So ultimately, when you want to compete on the world stage, it's important to have not just a good product, a better product, a unique product, but you also need a cost-effective product. So, it's important to ensure that the manufacturing process lends itself to a low-cost solution, and we’ve really focused on that when it comes to automating the process. We're looking at, you know, low yield, low operating costs, low capital equipment costs that all goes into the cost of the product.

Voice Over 4

And the ultimate goal is to do it all right here in the state of Nevada. To vertically integrate and use materials from our home state to fully manufacture lithium ion batteries here in the United States.

Dr. Vick Singh, Director of Research & Development – Dragonfly Energy

We're a Nevada company and our goal is to vertically integrate in the state of Nevada. That by definition onshores lithium ion battery cell production to the United States. Here in Nevada, we have a lot of lithium in the ground, which is a very strong position to take advantage of the resources we have right here in the state, create jobs and lower the cost of our product ultimately, because it'll all be vertically integrated within one United State. We've partnered with some mining companies, we've signed an MOU with Ioneer so that we are prepared to have a lithium source to produce LFP for our own cells.

| Page 19 |

Wade Seaburg, Director of Business Development & Sales – Dragonfly Energy

What excites me the most is the vertical integration and the ability for us to take lithium that's mined in the state of Nevada, turn it into a battery cell that is the next generation of battery tech. We are going down a path that nobody else has done, and we're going to take raw materials that are straight out of the earth underneath our feet. And we're going to be able to use that to better our lives and to create a more sustainable world.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

We started designing our own battery packs and assembling them here in the States many years ago. But our mission all along was to actually make the cells here in America. And we are very close to being able to execute that mission.

And that's why this opportunity to put our company in the public markets gives us the chance to really move that and accelerate that mission so we can deliver this product to the market. Non-flammable US-made solid-state battery.

The Future of Dragonfly

Voice Over - Intro

The sun,

the wind,

water…

Power is all around us, and we're here to ensure using that power is possible ...

all of it. (Pause)

…even long after it's stopped producing.

What's to come is bright and sustainable when we can harness the power of renewables.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

The future of Dragonfly Energy is revolutionizing the grid.

Dr. Vick Singh, Director of Research & Development – Dragonfly Energy

We have a lot of new infrastructure and tools coming in that are going to help us advance our mission. So we've got new labs being built. We've got prototype and pilot lines coming online.

| Page 20 |

Ryan Hopkins, Director of Engineering & Automation – Dragonfly Energy

The fact that we can get safe, higher energy density, energy storage solutions opens up the realm for cleaner energy production, leveling out the grid, fixing a lot of our energy problems that we've been dealing with for decades.

Wade Seaburg, Director of Business Development & Sales – Dragonfly Energy

I see our future as a distributed network of storage across this country and across the world.

To stabilize the grid, now that you have reliable and safe storage, to be able to harness the power of the sun, be able to harness the power of wind, to be able to bridge that gap when those maybe aren't shining as brightly or not blowing as powerfully.

We're now able to bridge that gap with safe and reliable storage that we can bring to the rest of the world.

John Marchetti, Chief Financial Officer – Dragonfly Energy

It comes back to that idea of we are a battery technology company, you know, today we do a design, we do assembly, we do all that work. And then ultimately over time, we're going to be fully vertically integrated.

And I think that's what's really, really exciting about the opportunity at Dragonfly.

Sean Nichols, Chief Operations Officer – Dragonfly Energy

The future here at Dragonfly Energy is powerful. We've been on a mission to displace lead acid batteries, and now we're on a mission to replace coal. And that's a bright future for us. We have an opportunity to really change the course of this planet when it comes to climate change.

And I think that our whole entire team is really focused on that mission. And they want to make a difference.

Dr. Denis Phares, Chief Executive Officer – Dragonfly Energy

In conclusion, Dragonfly represents a unique ESG-focused technology opportunity. First, we went to market early and became profitable quickly. Second, we demonstrated the ability to displace an incumbent technology in lead acid batteries, and are poised to displace another in fossil fuel burning power plants. Third, our solid-state technology is chemistry agnostic and centers on manufacturing processes rather than new materials. And finally, we are the only battery company in the market looking to solely produce a solid-state storage battery geared towards grid storage, rather than an EV battery in a market that is flooded with competition.

Electric Vehicles are great, but once widely adopted, they will add significant stress to our grid – and risk becoming the last mile of a storage solution. So if we don’t solve the grid issue, we’ll find that they end up doing more damage than good. And solving the grid issue, means providing a solution to properly harness the power of our renewable energy. That’s Solid State…. That makes us truly unique in the Lithium ion battery space and provides an incredible opportunity to be the clear leader in the marketplace.

With our technology, we are the only company driving toward a Cleaner, Greener tomorrow.

Thank you all for your time today and we look forward to keeping you informed of our progress over the coming quarters and years. I will now turn the call over to the operator.

| Page 21 |

Operator: Transition Line to Q&A Section

Thank you. With that, we will now begin the live Q&A portion of the call. Participants can submit questions using the interactive question box on the lower portion of your screen, or email us at [email protected]. We will take a moment to compile the list.

Forward-Looking Statements

This communication contains certain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, including certain financial forecasts and projections. All statements other than statements of historical fact contained in this communication, including statements as to the transactions contemplated by the business combination and related agreements, future results of operations and financial position, revenue and other metrics, planned products and services, business strategy and plans, objectives of management for future operations of Dragonfly, market size and growth opportunities, competitive position and technological and market trends, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,” “could,” “would,” “continue,” “forecast” or the negatives of these terms or variations of them or similar expressions. All forward-looking statements are subject to risks, uncertainties, and other factors (some of which are beyond the control of Dragonfly or CNTQ) which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. All forward-looking statements are based upon estimates, forecasts and assumptions that, while considered reasonable by CNTQ and its management, and Dragonfly and its management, as the case may be, are inherently uncertain and many factors may cause the actual results to differ materially from current expectations which include, but are not limited to: 1) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive merger agreement with respect to the business combination; 2) the outcome of any legal proceedings that may be instituted against Dragonfly, CNTQ, the combined company or others following the announcement of the business combination and the transactions contemplated thereby; 3) the inability to complete the business combination due to the failure to obtain approval of the stockholders of CNTQ, or to satisfy other conditions to closing the business combination; 4) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination; 5) the ability to meet Nasdaq's listing standards following the consummation of the business combination; 6) the risk that the business combination disrupts current plans and operations of Dragonfly as a result of the announcement and consummation of the business combination; 7) the inability to recognize the anticipated benefits of the business combination; 8) ability of Dragonfly to successfully increase market penetration into its target markets; 9) the addressable markets that Dragonfly intends to target do not grow as expected; 10) the loss of any key executives; 11) the loss of any relationships with key suppliers including suppliers in China; 12) the loss of any relationships with key customers; 13) the inability to protect Dragonfly’s patents and other intellectual property; 14) the failure to successfully optimize solid state cells or to produce commercially viable solid state cells in a timely manner or at all, or to scale to mass production; 15) costs related to the business combination; 16) changes in applicable laws or regulations; 17) the possibility that Dragonfly or the combined company may be adversely affected by other economic, business and/or competitive factors; 18) Dragonfly’s estimates of its growth and projected financial results for 2022 and 2023 and meeting or satisfying the underlying assumptions with respect thereto; 19) the risk that the business combination may not be completed in a timely manner or at all, which may adversely affect the price of CNTQ’s securities; 20) the risk that the transaction may not be completed by CNTQ’s business combination deadline (as may be extended pursuant to CNTQ’s governing documents); 21) the impact of the novel coronavirus disease pandemic, including any mutations or variants thereof and the Russian/Ukrainian conflict, and any resulting effect on business and financial conditions; 22) inability to complete the PIPE investment, the term loan and equity line (ChEF) in connection with the business combination; 23) the potential for events or circumstances that result in Dragonfly’s failure to timely achieve the anticipated benefits of Dragonfly’s customer arrangements with Thor; and 24) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in CNTQ’s Form S-1 (File Nos. 333-252449 and 333-253016), Annual Report on Form 10-K for the year ended December 31, 2021, Quarterly Report on Form 10-Q for the three months ended March 31, 2022 and registration statement on Form S-4 (File No. 333-266273) filed with the SEC on July 22, 2022, which is subject to change and will include a document that serves as a prospectus and proxy statement of CNTQ, referred to as a proxy statement/prospectus and other documents filed by CNTQ from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither CNTQ nor Dragonfly gives any assurance that either CNTQ or Dragonfly or the combined company will achieve its expected results. Neither CNTQ nor Dragonfly undertakes any duty to update these forward-looking statements, except as otherwise required by law. For additional information, see “Risk Considerations” in the investor presentation, filed on a Current Report on Form 8-K by CNTQ with the SEC and available at www.sec.gov.

| Page 22 |

Additional Information and Where to Find It

This communication relates to the definitive proxy statement filed by CNTQ with the Securities and Exchange Commission (the “SEC”) on July 22, 2022 (the “Definitive Proxy Statement”). The Definitive Proxy Statement was mailed to all CNTQ stockholders on or around July 22, 2022. Before making any voting decision, investors and security holders of CNTQ are urged to read the Definitive Proxy Statement and all other relevant documents filed or that will be filed with the SEC because they contain important information. a proposed transaction between CNTQ and Dragonfly. CNTQ filed a registration statement on Form S-4 (File No. 333-266273) with the SEC on July 22, 2022, which is subject to change and includes a document that serves as a prospectus and proxy statement of CNTQ, referred to as a proxy statement/prospectus. The definitive proxy statement/prospectus will be sent to all CNTQ stockholders. CNTQ has also filed other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of CNTQ are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction because they contain important information about the proposed transaction.

Investors and security holders are able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by CNTQ through the website maintained by the SEC at www.sec.gov.

The documents filed by CNTQ with the SEC also may be obtained by contacting Chardan NexTech Acquisition 2 Corp. at 17 State Street, 21st Floor, New York, New York 10004, or by calling (646) 465-9001.

NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS COMMUNICATION, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS COMMUNICATION. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE.

Participants in the Solicitation