Form 425 Cerberus Telecom Acquisi Filed by: Cerberus Telecom Acquisition Corp.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 12, 2021

CERBERUS TELECOM ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-39647 | 98-1556740 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) | ||

| 875 Third Avenue New York, NY |

10022 | |||

| (Address of principal executive offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (212) 891-2100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

| Units, each consisting of Class A Ordinary Share, $0.0001 par value, and one-third of one redeemable warrant | CTAC.U | The New York Stock Exchange | ||

| Class A Ordinary Shares included as part of the units | CTAC | The New York Stock Exchange | ||

| Warrants, included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 | CTAC WS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 12, 2021, Cerberus Telecom Acquisition Corp. (“CTAC”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among CTAC, King Pubco, Inc. (“Pubco”), a Delaware corporation and wholly owned subsidiary of Cerberus Telecom Acquisition Holdings, LLC (the “Sponsor”), an affiliate of CTAC, King Corp Merger Sub, Inc. (“Corp Merger Sub”), a Delaware corporation and direct, wholly owned subsidiary of the Sponsor, King LLC Merger Sub, LLC (“LLC Merger Sub”), a Delaware limited liability company and direct, wholly owned subsidiary of Pubco, and Maple Holdings Inc. (“KORE”), a Delaware corporation.

Pursuant to the Merger Agreement, the parties thereto will enter into a business combination transaction (the “Business Combination”) pursuant to which, among other things, (i) on the day immediately prior to the Closing Date (as defined in the Merger Agreement), CTAC will merge with and into LLC Merger Sub, a subsidiary of Pubco (the “Pubco Merger”), with LLC Merger Sub being the surviving entity of the Pubco Merger and Pubco as parent of the surviving entity, (ii) on the Closing Date and immediately prior to the First Merger (as defined below), Sponsor will contribute 100% of its equity interests in Corp Merger Sub to Pubco (the “Corp Merger Sub Contribution”), as a result of which Corp Merger Sub will become a wholly owned subsidiary of Pubco, (iii) following the Corp Merger Sub Contribution, Corp Merger Sub will merge with and into KORE (the “First Merger”), with KORE being the surviving corporation of the First Merger; and (iv) immediately following the First Merger and as part of the same overall transaction as the First Merger, KORE will merge with and into LLC Merger Sub (the “Second Merger” and, together with the First Merger, being collectively referred to as the “Mergers” and, together with the other transactions contemplated by the Merger Agreement, the “Transactions” and the closing of the Transactions, the “Closing”), with LLC Merger Sub being the surviving entity of the Second Merger and Pubco being the sole member of LLC Merger Sub.

The Business Combination is expected to be consummated after receipt of the required approval by the stockholders of CTAC and the satisfaction or waiver of certain other conditions, as summarized below.

Merger Agreement

Closing Merger Consideration

As a result of the First Merger, among other things, all shares of common stock, preferred stock, warrants and options of KORE, in each case, outstanding immediately prior to the effective time of the First Merger, will be cancelled in exchange, except in the case of certain options, for the right to receive a portion of the “Closing Cash Consideration” and/or the “Closing Share Consideration”. The “Closing Cash Consideration” shall be comprised of (i) the aggregate amount of cash payable in respect of KORE’s Series A, A-1 and Series B preferred stock pursuant to the governing documents of KORE (which amount shall be determined as of the Closing Date and shall not exceed $268,345,812, assuming the Closing occurs prior to the termination date of the Merger Agreement), (ii) $4,075,000 payable to certain holders of KORE’s stock options and (iii) $1,050,000 payable to certain employees of KORE pursuant to the KORE Wireless Long-Term Cash Incentive Plan. The “Closing Share Consideration” shall be comprised of $346,000,000 in shares of common stock of Pubco, at $10.00 per share, par value $0.0001 per share (“Pubco Common Stock”), with 432,500 of such shares of common stock being payable to certain holders of KORE’s stock options, and the balance being payable to holders of KORE’s common stock, Series C preferred stock and warrants.

Representations and Warranties

The Merger Agreement contains customary representations and warranties of the parties thereto, which will terminate and be of no further force and effect as of the consummation of the Second Merger.

Covenants

The Merger Agreement contains customary covenants of the parties, including, among others, covenants with respect to (i) the operation of the parties’ respective businesses prior to consummation of the Transactions, (ii) CTAC and KORE’s efforts to satisfy conditions to consummate the Transactions, (iii) CTAC and KORE ceasing discussions regarding any alternative transactions, (iv) CTAC preparing and filing a registration statement on Form S-4 with the SEC and taking certain other actions to obtain the requisite approval of CTAC’s stockholders to vote in favor of certain matters (the “CTAC Stockholder Matters”), including the adoption of the Merger Agreement, approval of the Transactions, the amendment and restatement of Pubco’s certificate of incorporation and certain other matters at a special meeting called therefor (the “Special Meeting”), (v) the protection of, and access to, confidential information of the parties, (vi) the parties’ efforts to obtain necessary approvals from governmental agencies and (vii) delivery by KORE of its 2019 and 2020 PCAOB-compliant audited financial statements within 15 business days following the date of the Merger Agreement (the “Audited Financial Statements”).

Conditions to Closing

The consummation of the Transactions is subject to customary closing conditions for special purpose acquisition companies such as CTAC, including, among others, (i) the following conditions in favor of KORE and CTAC: (a) approval of the Transactions by CTAC’s shareholders, (b) approval of the Transactions by KORE’s stockholders, (c) the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and approval of the Transactions from The New Zealand Overseas Investment Office and The Treasurer of the Commonwealth of Australia, (d) no order, statute, rule or regulation enjoining or prohibiting the consummation of the Transactions being in force, (e) CTAC having at least $5,000,001 of net tangible assets as of the Closing, (f) the aggregate amount of (x) (A) cash held by CTAC in its trust account (after reduction for the aggregate amount of cash payable in respect of CTAC stockholder redemptions), plus (B) the amounts received by CTAC upon consummation of the PIPE Investment, plus (y) freely available cash of KORE, being an aggregate amount of no less than $345,000,000 and (g) the registration statement filed in respect of the Transactions shall have become effective; (ii) the following conditions in favor of CTAC: (a) no default or event of default under KORE’s existing credit facility and (b) customary bringdown conditions; and (iii) customary bringdown conditions in favor of KORE.

Termination

The Merger Agreement may be terminated at any time prior to the Closing (i) by mutual written consent of CTAC and KORE, (ii) by either CTAC or KORE (a) if the Transactions are not consummated on or before September 12, 2021, (b) if a governmental entity shall have issued an order or taken any other action that is final and nonappealable and permanently enjoins or prohibits the Pubco Merger or the Mergers, (c) in the event of certain uncured breaches by the other party, (iii) by CTAC or KORE if, at the Special Meeting, the Transactions and the other CTAC Stockholder Matters shall fail to be approved by requisite holders of CTAC’s outstanding shares, (iv) by CTAC, if KORE does not deliver the Company Stockholder Approval (as defined in the Merger Agreement) within 48 hours after the CTAC registration statement on Form S-4 is declared effective by the U.S. Securities and Exchange Commission (the “SEC”), or (v) by CTAC, if the Audited Financial Statements (x) have not been delivered to CTAC within 15 business days following the date of the Merger Agreement, (y) are not accompanied by an unqualified opinion from KORE’s auditor and/or (z) with respect to KORE and its subsidiaries taken as a whole, differ in any material and adverse respect from the unaudited 2019 and 2020 financial statements previously delivered to CTAC.

Related Agreements

Investor Rights Agreement

The Merger Agreement contemplates that, at the Closing, Pubco, the Sponsor, certain stockholders of KORE and the other parties thereto will enter into an Investor Rights Agreement, (the “Investor Rights Agreement”) setting forth the parties’ rights and obligations with respect to the designation, removal and replacement of directors of Pubco and the registration for resale of certain shares of Pubco Common Stock and other equity securities of Pubco that are held by the parties thereto from time to time.

Subscription Agreements

On March 12, 2021, concurrently with the execution of the Merger Agreement, CTAC entered into subscription agreements (the “Subscription Agreements”) with certain investors (collectively, the “PIPE Investors”), pursuant to, and on the terms and subject to the conditions of which, the PIPE Investors have collectively subscribed for 22,500,000 shares of Pubco Common Stock for an aggregate purchase price equal to $225,000,000 (the “PIPE Investment”). The PIPE Investment will be consummated substantially concurrently with the Closing.

The Subscription Agreements for the PIPE Investors provide for certain registration rights. In particular, CTAC is required to, as soon as practicable but no later than 15 calendar days following the Closing, submit to or file with the SEC a registration statement registering the resale of such shares. Additionally, CTAC is required to use its commercially reasonable efforts to have the registration statement declared effective as soon as practicable after the filing thereof. Upon the reasonable request of a PIPE Investor, CTAC must use commercially reasonable efforts to keep the registration statement continuously effective with respect to such PIPE Investor until the earliest of: (a) the date such PIPE Investor no longer holds any registrable shares, (b) the date all registrable shares held by such PIPE Investor may be sold without restriction under Rule 144 and (c) two years from the date of effectiveness of the registration statement.

The Subscription Agreements will terminate with no further force and effect upon the earliest to occur of: (i) three business days after the termination of the Merger Agreement in accordance with its terms, (ii) the mutual written agreement of the parties to such Subscription Agreement, or (iii) the failure to close by December 12, 2021.

Transaction Support Agreement

In connection with the execution of the Merger Agreement, CTAC entered into a transaction support agreement (the “Transaction Support Agreement”) with the Sponsor and KORE. Pursuant to the Transaction Support Agreement, the Sponsor agreed, among other things, (i) to vote all equity securities of CTAC in favor of the Transactions, (ii) not to transfer or sell any of such equity securities, (iii) not to solicit or engage in discussions with respect to an alternative business combination transaction, and (iv) to waive anti-dilution protections with respect to its Class B Ordinary Shares of CTAC. The Transaction Support Agreement will terminate in its entirety, and be of no further force or effect, upon a valid termination of the Merger Agreement.

KORE Holders Support Agreement

In connection with the execution of the Merger Agreement, CTAC entered into a support agreement (the “KORE Holders Support Agreement”) with KORE and certain stockholders of KORE (the “Requisite KORE Stockholders”). Pursuant to KORE Holders Support Agreement, the Requisite KORE Stockholders agreed to, among other things, vote to adopt and approve, as soon as reasonably practicable (and in any event within forty-eight (48) hours) after the registration statement is declared effective and delivered or otherwise made available to stockholders, the Merger Agreement and all other documents and transactions contemplated thereby, in each case, subject to the terms and conditions of KORE Holders Support Agreement. KORE Stockholders also agreed, among other things, to refrain from (i) transferring their covered shares prior to the termination of the KORE Holders Support Agreement and (ii) joining any class actions with respect to any claim against CTAC. In addition, certain stockholders agreed to exercise their drag-along rights in connection with the Transactions, subject to the terms and conditions of KORE Holders Support Agreement. The KORE Holders Support Agreement will terminate in its entirety, and be of no further force or effect, upon the valid termination of the Merger Agreement.

The foregoing descriptions of the Merger Agreement, Investor Rights Agreement, Subscription Agreements, Transaction Support Agreement and KORE Holders Support Agreement and the transactions contemplated thereunder are not complete and are qualified in their entirety by reference to the respective agreements (as may, from time-to-time, be amended or supplemented in accordance with their terms), copies of which are hereby filed as Exhibits 2.1, 10.1, 10.2, 10.3, and 10.4 to this Current Report on Form 8-K and incorporated herein by reference. The aforementioned agreements and the foregoing descriptions thereof have been included to provide investors and stockholders with information regarding the terms of such agreements, do not purport to be complete, and are qualified in their entirety by the full text of the respective agreements (either in final (for documents executed as of the date

hereof) or substantially final (for documents which are unexecuted as of the date hereof) form. They are not intended to provide any other factual information about the parties to the respective agreements. The respective representations, warranties and covenants contained in such agreements were made only as of specified dates for the purposes of each such agreement, were solely for the benefit of the parties to each such agreement and may be subject to qualifications and limitations agreed upon by such parties. In particular, in reviewing the respective representations, warranties and covenants contained in each such agreement and discussed in the respective foregoing description, it is important to bear in mind that such representations, warranties and covenants were negotiated with the principal purpose of allocating risk between the parties, rather than establishing matters as facts. Such representations, warranties and covenants may also be subject to a contractual standard of materiality different from those generally applicable to stockholders and reports and documents filed with the SEC, and, with respect to the Merger Agreement, are also qualified in important part by a confidential disclosure schedule delivered by KORE to CTAC in connection with the Merger Agreement. Investors and stockholders are not third-party beneficiaries under the Merger Agreement or other foregoing agreements except as expressly contemplated therein. Accordingly, investors and stockholders should not rely on such representations, warranties and covenants as characterizations of the actual state of facts or circumstances described therein. Information concerning the subject matter of such representations, warranties and covenants may change after the date of the Merger Agreement and each such other agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure set forth above in Item 1.01 of this Current Report is incorporated by reference herein. The shares of Pubco common stock to be issued in connection with the Subscription Agreements will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

Item 7.01 Regulation FD Disclosure.

On March 12, 2021, CTAC and KORE, issued a press release (the “Press Release”) announcing the Transactions. The Press Release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

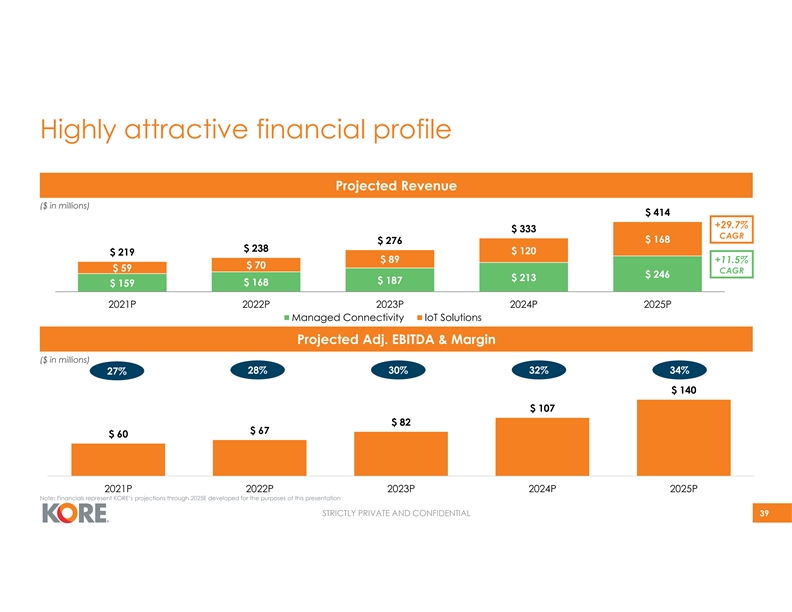

Attached as Exhibit 99.2 and incorporated by reference herein is an investor presentation dated March 12, 2021, that will be used by CTAC in meetings with certain of its shareholders as well as other persons with respect to the proposed Transactions, as described in this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of CTAC under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report will not be deemed an admission as to the materiality of any information of the information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

The Exhibit Index is incorporated by reference herein.

Additional Information and Where to Find It

This Current Report on Form 8-K relates to a proposed transaction between CTAC and KORE. This Current Report on Form 8-K does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. CTAC intends to file a registration statement on Form S-4 with the SEC, which will include a document that serves as a prospectus and proxy statement of CTAC, referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to

all CTAC shareholders. CTAC also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of CTAC are urged to read the registration statement and the related proxy statement/prospectus (including all amendments and supplements thereto) and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by CTAC through the website maintained by the SEC at www.sec.gov.

The documents filed by CTAC with the SEC also may be obtained free of charge at CTAC’s website at www.cerberusacquisition.com or upon written request to Cerberus Telecom Acquisition Corp., 875 Third Avenue, New York, NY 10022.

Participants in Solicitation

CTAC and its directors and executive officers may be deemed to be participants in the solicitation of proxies from CTAC’s shareholders in connection with the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the business combination will be contained in the proxy statement/prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between CTAC and KORE, including statements regarding the anticipated benefits of the transaction, the anticipated terms and timing of the transaction, the services offered by KORE and the markets in which it operates, and future financial condition, operational metrics, market opportunity, market share and performance of KORE and expected financial impacts of the transaction (including future revenue, pro forma enterprise value and cash balance), the satisfaction of closing conditions to the transaction, the PIPE transaction, and the level of redemptions of CTAC’s public shareholders. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are projections and other statements about future events that are based on current expectations and assumptions and are not predictions of actual performance, and, as a result, are subject to risks and uncertainties. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of factor probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of CTAC and KORE. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of CTAC’s securities, (ii) the risk that the transaction may not be completed by CTAC’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by CTAC, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the approval of the merger agreement by the shareholders of CTAC, the satisfaction of the minimum trust account amount following redemptions by CTAC’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the business combination, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (vi) the effect of the announcement or pendency of the transaction on KORE business relationships, performance, and business generally, (vii) risks that the proposed transaction disrupts current plans and operations of KORE, (viii) the outcome of any legal proceedings that may be instituted against KORE or against CTAC related to the merger agreement or the proposed transaction, (ix) the ability to maintain the listing of CTAC’s securities on The New York Stock Exchange, (x) the price of CTAC’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which CTAC plans to operate, variations in performance across competitors, changes in laws and regulations affecting KORE’s business and changes in the combined capital

structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities, and (xii) risks relating to the uncertainty of the projected financial and operational information with respect to KORE. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of CTAC’s registration statement on Form S-4 discussed above when available and other documents filed by CTAC from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither CTAC nor KORE presently know or that CTAC and KORE currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. CTAC and KORE anticipate that subsequent events and developments will cause CTAC’s and KORE’s assessments to change. Readers are cautioned not to put undue reliance on forward-looking statements, and CTAC and KORE assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither CTAC nor KORE gives any assurance that either CTAC or KORE will achieve its expectations. Accordingly, undue reliance should not be placed upon the forward-looking statements.

EXHIBIT INDEX

| * Schedules omitted pursuant to Item 601(a)(5) of Regulation S-K. CTAC agrees to furnish supplementally a copy of any omitted schedule to the Securities and Exchange Commission upon request. | ||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CERBERUS TELECOM ACQUISITION CORP. | ||||||

| Dated: March 12, 2021 | ||||||

| By: | /s/ Michael Palmer | |||||

| Name: Michael Palmer | ||||||

| Title: Authorized Signatory | ||||||

Exhibit 2.1

Execution Version

CONFIDENTIAL

AGREEMENT AND PLAN OF MERGER

by and among

CERBERUS TELECOM ACQUISITION CORP.,

KING PUBCO, INC.,

KING CORP MERGER SUB, INC.,

KING LLC MERGER SUB, LLC

AND

MAPLE HOLDINGS INC.

dated as of

March 12, 2021

TABLE OF CONTENTS

| ARTICLE I CERTAIN DEFINITIONS |

3 | |||||

| Section 1.01 |

Definitions | 3 | ||||

| Section 1.02 |

Construction | 17 | ||||

| Section 1.03 |

Knowledge | 18 | ||||

| Section 1.04 |

Equitable Adjustments | 18 | ||||

| ARTICLE II THE MERGERS |

18 | |||||

| Section 2.01 |

The Mergers | 18 | ||||

| Section 2.02 |

Effective Times | 19 | ||||

| Section 2.03 |

Effect of the Pubco Merger | 19 | ||||

| Section 2.04 |

Effect of the Mergers | 20 | ||||

| Section 2.05 |

Governing Documents | 21 | ||||

| Section 2.06 |

Directors/Managers and Officers of Pubco, the Surviving Corporation and the Surviving Entity | 21 | ||||

| ARTICLE III TOTAL PRE-CLOSING HOLDER CONSIDERATION; CONVERSION OF SECURITIES; MERGER CONSIDERATION |

21 | |||||

| Section 3.01 |

Total Pre-Closing Holder Consideration | 21 | ||||

| Section 3.02 |

Effect of First Merger on Company Stock and Warrants | 22 | ||||

| Section 3.03 |

Merger Consideration | 24 | ||||

| Section 3.04 |

Exchange Agent | 25 | ||||

| Section 3.05 |

Effect of Second Merger | 26 | ||||

| Section 3.06 |

Treatment of Company Options | 26 | ||||

| Section 3.07 |

Withholding Rights | 26 | ||||

| Section 3.08 |

Dissenting Shares | 26 | ||||

| ARTICLE IV CLOSING TRANSACTIONS |

27 | |||||

| Section 4.01 |

Closing | 27 | ||||

| Section 4.02 |

Closing Statements | 27 | ||||

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

29 | |||||

| Section 5.01 |

Corporate Organization of the Company | 29 | ||||

| Section 5.02 |

Subsidiaries | 29 | ||||

| Section 5.03 |

Due Authorization | 30 | ||||

| Section 5.04 |

No Conflict | 30 | ||||

| Section 5.05 |

Governmental Authorities; Consents | 30 | ||||

| Section 5.06 |

Current Capitalization | 31 | ||||

| Section 5.07 |

Capitalization of Subsidiaries | 31 | ||||

| Section 5.08 |

Financial Statements | 32 | ||||

| Section 5.09 |

Undisclosed Liabilities | 32 | ||||

| Section 5.10 |

Litigation and Proceedings | 33 | ||||

| Section 5.11 |

Compliance with Laws | 33 | ||||

| Section 5.12 |

Contracts; No Defaults | 34 | ||||

| Section 5.13 |

Company Benefit Plans | 35 | ||||

| Section 5.14 |

Labor Matters | 37 | ||||

| Section 5.15 |

Taxes | 38 | ||||

| Section 5.16 |

Insurance | 39 | ||||

| Section 5.17 |

Permits | 40 | ||||

| Section 5.18 |

Personal Property and Assets | 40 | ||||

| Section 5.19 |

Real Property | 40 | ||||

| Section 5.20 |

Intellectual Property and IT Security | 41 | ||||

| Section 5.21 |

Environmental Matters | 43 | ||||

| Section 5.22 |

Absence of Changes | 43 | ||||

| Section 5.23 |

Brokers’ Fees | 44 | ||||

| Section 5.24 |

Business Relationships | 44 | ||||

| Section 5.25 |

Related Party Transactions | 44 | ||||

| Section 5.26 |

Information Supplied | 45 | ||||

| Section 5.27 |

Regulatory Compliance | 45 | ||||

| ARTICLE VI REPRESENTATIONS AND WARRANTIES OF ACQUIROR PARTIES |

46 | |||||

| Section 6.01 |

Corporate Organization | 46 | ||||

| Section 6.02 |

Due Authorization | 46 | ||||

| Section 6.03 |

No Conflict | 47 | ||||

| Section 6.04 |

Litigation and Proceedings | 47 | ||||

| Section 6.05 |

Governmental Authorities; Consents | 48 | ||||

| Section 6.06 |

Financial Ability; Trust Account | 48 | ||||

| Section 6.07 |

Brokers’ Fees | 49 | ||||

| Section 6.08 |

SEC Reports; Financial Statements; Sarbanes-Oxley Act; Undisclosed Liabilities | 49 | ||||

| Section 6.09 |

Business Activities | 50 | ||||

| Section 6.10 |

Tax Matters | 51 | ||||

| Section 6.11 |

Capitalization | 52 | ||||

| Section 6.12 |

NYSE Listing | 53 | ||||

| Section 6.13 |

PIPE Investment | 53 | ||||

| Section 6.14 |

Related Party Transactions | 54 | ||||

| Section 6.15 |

Investment Company Act | 54 | ||||

| Section 6.16 |

Registration Statement, Proxy Statement and Proxy Statement/Registration Statement | 54 | ||||

| ARTICLE VII COVENANTS OF THE COMPANY |

54 | |||||

| Section 7.01 |

Conduct of Business | 54 | ||||

| Section 7.02 |

Inspection | 57 | ||||

| Section 7.03 |

No Claim Against the Trust Account | 58 | ||||

| Section 7.04 |

Code Section 280G | 58 | ||||

| Section 7.05 |

FIRPTA | 59 | ||||

| Section 7.06 |

Company Stockholder Approval | 59 | ||||

| Section 7.07 |

Affiliate Agreements | 59 | ||||

| Section 7.08 |

Financing Cooperation | 60 | ||||

| Section 7.09 |

R&W Insurance | 60 | ||||

| Section 7.10 |

Investor Rights Agreement | 61 | ||||

| Section 7.11 |

2020 Audited Financial Statements | 61 | ||||

- ii -

| ARTICLE VIII COVENANTS OF ACQUIROR |

61 | |||||

| Section 8.01 |

Indemnification and Insurance | 61 | ||||

| Section 8.02 |

Conduct of Acquiror During the Interim Period | 63 | ||||

| Section 8.03 |

PIPE Investment | 64 | ||||

| Section 8.04 |

Inspection | 65 | ||||

| Section 8.05 |

Acquiror NYSE Listing | 65 | ||||

| Section 8.06 |

Acquiror Public Filings | 65 | ||||

| Section 8.07 |

Section 16 Matters | 65 | ||||

| Section 8.08 |

Pubco Board of Directors, Committees and Officers | 66 | ||||

| Section 8.09 |

Incentive Equity Plan | 66 | ||||

| Section 8.10 |

Compensation Matters | 66 | ||||

| Section 8.11 |

Qualification as an Emerging Growth Company | 66 | ||||

| Section 8.12 |

Investor Rights Agreement | 66 | ||||

| ARTICLE IX |

67 | |||||

| JOINT COVENANTS |

67 | |||||

| Section 9.01 |

Support of Transaction | 67 | ||||

| Section 9.02 |

Proxy Statement/Registration Statement; Acquiror Special Meeting | 67 | ||||

| Section 9.03 |

Exclusivity | 70 | ||||

| Section 9.04 |

Tax Matters | 71 | ||||

| Section 9.05 |

Confidentiality; Publicity | 72 | ||||

| Section 9.06 |

Cooperation; Further Assurances | 72 | ||||

| Section 9.07 |

Employee Matters | 73 | ||||

| Section 9.08 |

HSR Act and Regulatory Approvals | 74 | ||||

| Section 9.09 |

Post-Closing Transaction Expenses | 75 | ||||

| ARTICLE X CONDITIONS TO OBLIGATIONS |

75 | |||||

| Section 10.01 |

Conditions to Obligations of All Parties | 75 | ||||

| Section 10.02 |

Additional Conditions to Obligations of Acquiror Parties | 76 | ||||

| Section 10.03 |

Additional Conditions to the Obligations of the Company | 77 | ||||

| Section 10.04 |

Frustration of Conditions | 77 | ||||

| ARTICLE XI TERMINATION/EFFECTIVENESS |

77 | |||||

| Section 11.01 |

Termination | 77 | ||||

| Section 11.02 |

Effect of Termination | 78 | ||||

| ARTICLE XII MISCELLANEOUS |

79 | |||||

| Section 12.01 |

Waiver | 79 | ||||

| Section 12.02 |

Notices | 79 | ||||

| Section 12.03 |

Assignment | 81 | ||||

| Section 12.04 |

Rights of Third Parties | 81 | ||||

| Section 12.05 |

Expenses | 81 | ||||

| Section 12.06 |

Governing Law | 81 | ||||

| Section 12.07 |

Captions; Counterparts | 81 | ||||

| Section 12.08 |

Schedules and Exhibits | 81 | ||||

| Section 12.09 |

Entire Agreement | 82 | ||||

| Section 12.10 |

Amendments | 82 | ||||

| Section 12.11 |

Severability | 82 | ||||

| Section 12.12 |

Jurisdiction; WAIVER OF TRIAL BY JURY | 82 | ||||

- iii -

| Section 12.13 |

Enforcement | 82 | ||||

| Section 12.14 |

Non-Recourse | 83 | ||||

| Section 12.15 |

Nonsurvival of Representations, Warranties and Covenants | 83 | ||||

| Section 12.16 |

Acknowledgments | 83 | ||||

| Section 12.17 |

Provisions Respecting Representation of the Acquiror and Company | 84 |

EXHIBITS

| Exhibit A | – | Company Holder Support Agreement | ||

| Exhibit B | – | Sponsor Support Agreement | ||

| Exhibit C | – | Form of Pubco Charter | ||

| Exhibit D | – | Form of Pubco Bylaws | ||

| Exhibit E | – | Form of Investor Rights Agreement |

- iv -

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”) is made and entered into as of March 12, 2021, by and among Cerberus Telecom Acquisition Corp. (“Acquiror”), a Cayman Islands exempted company, King Pubco, Inc. (“Pubco”), a Delaware corporation and wholly owned subsidiary of Cerberus Telecom Acquisition Holdings, LLC (the “Sponsor”), King Corp Merger Sub, Inc. (“Corp Merger Sub”), a Delaware corporation and direct, wholly owned subsidiary of the Sponsor, King LLC Merger Sub, LLC (“LLC Merger Sub”), a Delaware limited liability company and direct, wholly owned subsidiary of Pubco, and Maple Holdings Inc. (the “Company”), a Delaware corporation. Acquiror, Pubco, Corp Merger Sub, LLC Merger Sub and the Company are collectively referred to herein as the “Parties” and individually as a “Party.” Capitalized terms used and not otherwise defined herein have the meanings set forth in Section 1.01.

RECITALS

WHEREAS, Acquiror is a blank check company incorporated in the Cayman Islands and formed to acquire one or more operating businesses through a Business Combination (as defined below);

WHEREAS, Pubco is a newly formed wholly owned direct subsidiary of the Sponsor;

WHEREAS, LLC Merger Sub is a newly formed wholly owned direct subsidiary of Pubco;

WHEREAS, on the day immediately prior to the Closing Date and on the terms and subject to the conditions of this Agreement and in accordance with the Companies Act (As Revised) of the Cayman Islands (the “Companies Act”) and the Limited Liability Company Act of the State of Delaware (as amended, “DLLCA”) and other applicable Laws, Acquiror will merge with and into LLC Merger Sub (the “Pubco Merger”), with LLC Merger Sub being the surviving entity of the Pubco Merger, as a result of which, among other things, (i) each class A ordinary share of Acquiror, par value $0.0001 (“Acquiror Class A Shares”) outstanding immediately prior to the Pubco Merger shall no longer be outstanding and shall automatically be converted into the right of the holder thereof to receive a share of common stock, par value $0.0001 (“Pubco Common Stock”) of Pubco on identical terms, (ii) each class B ordinary share of Acquiror, par value $0.0001 (“Acquiror Class B Share”) outstanding immediately prior to the Pubco Merger shall no longer be outstanding and shall automatically be converted into the right of the holder thereof to receive a share of Pubco Common Stock on identical terms, and (iii) each outstanding warrant (“Acquiror Warrant”) to purchase Acquiror Class A Shares outstanding immediately prior to the Pubco Merger will become a warrant of Pubco (“Pubco Warrant”) exercisable for shares of Pubco Common Stock on identical terms

WHEREAS, for U.S. federal income tax purposes (and for purposes of any applicable state or local Income Tax that follows the U.S. federal income tax treatment of the Pubco Merger), each of the Parties intends that (i) the Pubco Merger qualify as a “reorganization” within the meaning of Section 368(a)(1)(F) of the Code and the Treasury Regulations thereunder to which Acquiror and Pubco are parties under Section 368(b) of the Code and (ii) this Agreement be and hereby is, adopted as a “plan of reorganization” for purposes of Section 368 of the Code and Treasury Regulations Section 1.368-2(g);

WHEREAS, on the Closing Date (as defined below) and immediately prior to the First Merger (as defined below) and on terms and subject to the conditions of a contribution agreement between Sponsor and Pubco in the form to be agreed to by Acquiror and the Company, Sponsor will contribute 100% of its equity interests in Corp Merger Sub to Pubco (the “Corp Merger Sub Contribution”), as a result of which Corp Merger Sub will become a wholly owned subsidiary of Pubco;

WHEREAS, following the Corp Merger Sub Contribution, on the terms and subject to the conditions of this Agreement and in accordance with the General Corporation Law of the State of Delaware (as amended, the “DGCL”), the DLCCA and other applicable Laws, the Parties intend to enter into a business combination transaction by which: (i) Corp Merger Sub will merge with and into the Company (the “First Merger”), with the Company being the surviving corporation of the First Merger (the Company, in its capacity as the surviving corporation of the First Merger, is sometimes referred to as the “Surviving Corporation”); and (ii) immediately following the First Merger and as part of the same overall transaction as the First Merger, the Surviving Corporation will merge with and into LLC Merger Sub (the “Second Merger” and, together with the First Merger, the “Mergers”), with LLC Merger Sub being the surviving entity of the Second Merger (LLC Merger Sub, in its capacity as the surviving entity of the Second Merger, is sometimes referred to as the “Surviving Entity”);

WHEREAS, as a condition and inducement to Acquiror’s willingness to enter into this Agreement, simultaneously with the execution and delivery of this Agreement, the Requisite Company Stockholders have each executed and delivered to Acquiror a Company Holders Support Agreement, a copy of which is attached as Exhibit A hereto, pursuant to which the Requisite Company Stockholders have agreed to, among other things, provide their written consent to adopt and approve, upon the effectiveness of the Registration Statement, this Agreement and the other documents contemplated hereby and the transactions contemplated hereby and thereby, in each case, to which the Company is a party;

WHEREAS, for U.S. federal income tax purposes (and for purposes of any applicable state or local Income Tax that follows the U.S. federal income tax treatment of the Mergers), each of the Parties intends that (i) the First Merger and the Second Merger, taken together, will constitute an integrated transaction that qualifies as a “reorganization” within the meaning of Section 368(a) of the Code and the Treasury Regulations thereunder to which Pubco and the Company are parties under Section 368(b) of the Code, and (ii) this Agreement be, and hereby is, adopted as a “plan of reorganization” for the purposes of Section 368 of the Code and Treasury Regulations Section 1.368-2(g);

WHEREAS, the board of directors of the Company has unanimously (i) determined that it is in the best interests of the Company and the stockholders of the Company, and declared it advisable, to enter into this Agreement providing for the Mergers, (ii) approved this Agreement and the Transactions to which the Company is a party, including the Mergers, on the terms and subject to the conditions of this Agreement, and (iii) adopted a resolution recommending that this Agreement and the Transactions to which the Company is a party, including the First Merger, be approved and adopted by the stockholders of the Company;

WHEREAS, the board of directors of Acquiror has unanimously (i) determined that it is in the best interests of Acquiror and the Acquiror Shareholders, and declared it advisable, to enter into this Agreement providing for the Pubco Merger and the Mergers, (ii) approved this Agreement, the Plan of Merger and the Transactions, including the Pubco Merger and the Mergers, on the terms and subject to the conditions of this Agreement, and (iii) adopted a resolution recommending that this Agreement, the Plan of Merger and the Transactions, including the Pubco Merger and the Mergers, be approved and adopted by the Acquiror Shareholders (the “Acquiror Board Recommendation”);

WHEREAS, in furtherance of the Mergers and in accordance with the terms hereof, Acquiror shall provide an opportunity to Acquiror Shareholders to have their outstanding shares of Acquiror Class A Shares redeemed on the terms and subject to the conditions set forth in this Agreement and Acquiror’s Governing Documents in connection with obtaining the Acquiror Shareholder Approval (as defined below);

WHEREAS, as a condition and inducement to the Company’s willingness to enter into this Agreement, concurrently with the execution and delivery of this Agreement, the Sponsor, the Company, Acquiror and Pubco have entered into the Sponsor Support Agreement, a copy of which is attached as Exhibit B hereto;

- 2 -

WHEREAS, on or prior to the date hereof, Acquiror has obtained commitments from certain investors for a private placement of shares of Pubco Common Stock (the “PIPE Investment”) pursuant to the terms of one or more subscription agreements (each, a “Subscription Agreement”), pursuant to which, among other things, such investors have agreed to subscribe for and purchase, and Acquiror has agreed to issue and sell to such investors, an aggregate number of shares of Pubco Common Stock set forth in the Subscription Agreements in exchange for an aggregate purchase price of $225,000,000 on the Closing Date, on the terms and subject to the conditions set forth therein;

WHEREAS, immediately prior to the closing of the PIPE Investment, Pubco shall (i) subject to obtaining the Acquiror Shareholder Approval, amend and restate the certificate of incorporation of Pubco to be substantially in the form of Exhibit C attached hereto (the “Pubco Charter”), and (ii) amend and restate the bylaws of Acquiror to be substantially in the form of Exhibit D attached hereto (the “Pubco Bylaws”); and

WHEREAS, at the Closing, the Sponsor, Pubco, the Company, certain of the Pre-Closing Holders and certain other parties will enter into an Investor Rights Agreement, substantially in the form of Exhibit E attached hereto (as amended, restated, modified, supplemented or waived from time to time, the “Investor Rights Agreement”).

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth in this Agreement and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the Parties hereby agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

Section 1.01 Definitions. For purposes of this Agreement, the following capitalized terms have the following meanings:

“2020 Audited Financial Statements” has the meaning specified in Section 7.11.

“Acquiror” has the meaning specified in the preamble hereto.

“Acquiror Arrangements” has the meaning specified in Section 7.04.

“Acquiror Board Recommendation” has the meaning specified in the recitals hereto.

“Acquiror Class A Shares” has the meaning specified in the recitals hereto.

“Acquiror Class A Unit” has the meaning specified in Section 6.12.

“Acquiror Class B Shares” has the meaning specified in the recitals hereto.

“Acquiror Closing Statement” has the meaning specified in Section 4.02(a).

“Acquiror Counsel” has the meaning specified in Section 12.17(a).

“Acquiror Cure Period” has the meaning specified in Section 11.01(c).

- 3 -

“Acquiror Disclosure Letter” has the meaning specified in the introduction to Article VI.

“Acquiror Group” has the meaning specified in Section 12.17(a).

“Acquiror Parties” means Acquiror, Pubco, Corp Merger Sub and LLC Merger Sub.

“Acquiror Party Representations” means the representations and warranties of Acquiror, Pubco, Corp Merger Sub and LLC Merger Sub expressly and specifically set forth in Article VI of this Agreement, as qualified by the Acquiror Disclosure Letter. For the avoidance of doubt, the Acquiror Party Representations are solely made by each of Acquiror, Pubco, Corp Merger Sub and LLC Merger Sub.

“Acquiror Preferred Shares” means the preference shares, par value $0.0001 per share, of Acquiror.

“Acquiror Privileged Communications” has the meaning specified in Section 12.17(a).

“Acquiror Shareholder Approval” has the meaning specified in Section 6.02(b).

“Acquiror Shareholder Matters” has the meaning specified in Section 9.02(a)(v).

“Acquiror Shareholder Redemption” has the meaning specified in Section 9.02(a)(v).

“Acquiror Shareholders” means the holders of shares of Acquiror Shares.

“Acquiror Shares” means the Acquiror Class A Shares and the Acquiror Class B Shares.

“Acquiror Tail” has the meaning specified in Section 8.01(b).

“Acquiror Transaction Expenses” means (i) all fees, costs and expenses of Acquiror incurred prior to and through the Closing Date in connection with the negotiation, preparation and execution of this Agreement, the other Transaction Agreements, the performance and compliance with all Transaction Agreements and conditions contained herein to be performed or complied with by Acquiror at or before Closing, and the consummation of the Transactions, including the fees, costs, expenses and disbursements of counsel, accountants, advisors, underwriters and consultants of Acquiror, 100% of any filing fees payable to the Antitrust Division of the United States Department of Justice or the United States Federal Trade Commission under the HSR Act or Regulatory Law authorities of any other jurisdiction in connection with the Transactions, the cost of the Acquiror Tail to be obtained pursuant to Section 8.01 and 100% of the Transfer Taxes, in each case, whether paid or unpaid prior to the Closing.

“Acquiror Warrant” has the meaning specified in the recitals hereto.

“Acquisition Intended Income Tax Treatment” has the meaning specified in Section 9.04(b).

“Acquisition Transaction” has the meaning specified in Section 9.03(a).

“Action” means any claim, action, suit, assessment, arbitration or legal, judicial or administrative proceeding (whether at law or in equity) or arbitration.

“Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, through one or more intermediaries or otherwise. The term “control” means the ownership of a majority of the voting securities of the applicable Person or the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of the applicable Person, whether through ownership of voting securities, by

- 4 -

Contract or otherwise, and the terms “controlled” and “controlling” have meanings correlative thereto; provided that, in no event shall the Company or any of the Company’s Subsidiaries be considered an Affiliate of any portfolio company (other than the Company and its Subsidiaries) of any investment fund or account affiliated with, managed or controlled by, any direct or indirect equityholder of the Company nor shall any portfolio company (other than the Company and its Subsidiaries) of any investment fund or account affiliated with any equityholder of the Company be considered to be an Affiliate of the Company or any of its Subsidiaries; provided further, that in no event shall Acquiror or any of Acquiror’s Subsidiaries be considered an Affiliate of any portfolio company (other than Acquiror and its Subsidiaries) of any investment fund or account affiliated with, managed or controlled by, any direct or indirect equityholder of Acquiror nor shall any portfolio company (other than Acquiror and its Subsidiaries) of any investment fund or account affiliated with any equityholder of Acquiror (including Sponsor and its affiliates) be considered to be an Affiliate of Acquiror or any of its Subsidiaries.

“Affiliate Agreements” has the meaning specified in Section 5.25.

“Agreement” has the meaning specified in the preamble hereto.

“Allocation Schedule” has the meaning specified in Section 4.02(b).

“Alternative PIPE Financing” has the meaning specified in Section 8.03(b).

“Alternative Subscription Agreement” has the meaning specified in Section 8.03(b).

“Anti-Corruption Laws” means any or all of: (a) the U.S. Foreign Corrupt Practices Act (FCPA); (b) the UK Bribery Act 2010; and (c) any other applicable Laws related to combating bribery or corruption.

“Antitrust Division” has the meaning specified in Section 9.08(a).

“Articles of Association” means the amended and restated memorandum and articles of association of Acquiror adopted by Acquiror on October 21, 2020.

“Available Closing Acquiror Cash” means an amount equal to (i) all amounts in the Trust Account (after reduction for the aggregate amount of payments required to be made in connection with the Acquiror Shareholder Redemption), plus (ii) the aggregate amount of cash that has been funded to and remains with Acquiror pursuant to the Subscription Agreements as of immediately prior to the Closing.

“Business Combination” has the meaning ascribed to such term in the Articles of Association.

“Business Combination Proposal” has the meaning specified in Section 9.03(b)

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York, New York or Alpharetta, Georgia are authorized or required by Law to close.

“Certificates” has the meaning specified in Section 3.03(c).

“Change in Recommendation” has the meaning specified in Section 9.02(a)(vi).

“Closing” has the meaning specified in Section 4.01.

“Closing Cash Consideration” means the aggregate amount of cash payable in respect of (i) the Company A and B Preferred Stock in accordance with the Company’s Governing Documents, (ii) the Option Cash Consideration pursuant to Section 3.06, and (iii) the First LTIP Payment, in each case, as set forth on the Company Closing Statement.

- 5 -

“Closing Date” has the meaning specified in Section 4.01.

“Closing Merger Consideration” means the Closing Cash Consideration plus the Closing Share Consideration.

“Closing Share Consideration” means the number of shares (rounded to the nearest whole share) of Pubco Common Stock determined by dividing (a) an equity value equal to $346,000,000, by (b) $10.00.

“Code” means the Internal Revenue Code of 1986, as amended.

“Companies Act” has the meaning specified in the recitals hereto.

“Company” has the meaning specified in the preamble hereto.

“Company A and B Preferred Stock” means, collectively, the Series A Preferred Stock, the Series A-1 Preferred Stock and the Series B Preferred Stock.

“Company Bank Accounts” has the meaning specified in Section 3.03(b).

“Company Benefit Plan” has the meaning specified in Section 5.13(a).

“Company Closing Statement” has the meaning specified in Section 4.02(b).

“Company Common Stock” means the shares of common stock, par value $0.01 per share, of the Company.

“Company Credit Agreement” means the credit agreement dated as of December 21, 2018 among KORE Wireless, Maple Intermediate Holdings Inc., UBS AG, Stamford Branch, the lenders party thereto, and the other loan parties thereto, as amended, restated, amended and restated, supplemented or otherwise modified from time to time prior to the date hereof.

“Company Cure Period” has the meaning specified in Section 11.01(b).

“Company Disclosure Letter” has the meaning specified in the introduction to Article V.

“Company Employees” has the meaning specified in Section 5.13(a).

“Company Holders Support Agreement” means that certain Support Agreement, dated as of the date hereof, by and among the Requisite Company Stockholders, Acquiror and the Company, as amended or modified from time to time.

“Company Incentive Plans” means that certain Maple Holdings Inc. 2014 Equity Incentive Plan, as amended.

“Company Option” means an option to acquire shares of Company Common Stock granted under the Company Incentive Plan.

- 6 -

“Company Preferred Stock” means, collectively, the shares of preferred stock, par value $0.01 per share, of the Company, which shares have been designated as: (i) Series A Preferred Stock (the “Series A Preferred Stock)”, (ii) Series A-1 Preferred Stock (the “Series A-1 Preferred Stock”), (iii) Series B Preferred Stock (the “Series B Preferred Stock”) and (iv) Series C Convertible Preferred Stock (the “Series C Convertible Preferred Stock”).

“Company Representations” means the representations and warranties of the Company expressly and specifically set forth in Article V of this Agreement, as qualified by the Company Disclosure Letter. For the avoidance of doubt, the Company Representations are solely made by the Company.

“Company Software” has the meaning specified in Section 5.20(f).

“Company Stock” means the Company Common Stock and the Company Preferred Stock.

“Company Stockholder Approval” means the approval of this Agreement and the Transactions, including the First Merger and the transactions contemplated thereby and the making of any filings, notices or information statements in connection with the foregoing, by the affirmative vote or written consent of the holders of at least a majority of the voting power of the outstanding Company Common Stock in accordance with the terms and subject to the conditions of the Company’s Governing Documents and applicable Law.

“Company Subsidiary Securities” has the meaning specified in Section 5.07(b).

“Company Tail” has the meaning specified in Section 8.01(b).

“Company Transaction Expenses” means all unpaid, whether accrued for or otherwise, fees, costs and expenses of the Company and its Subsidiaries incurred or accrued prior to and through the Closing Date in connection with the negotiation, preparation and execution of this Agreement, the other Transaction Agreements, the performance and compliance with all Transaction Agreements and conditions contained herein to be performed or complied with at or before Closing, and the consummation of the Transactions, including, but not limited to, (i) the fees, costs, expenses and disbursements of counsel, accountants, advisors and consultants of the Company and its Subsidiaries, (ii) any retention bonuses and transaction bonuses, including incentive program payments paid or payable to employees, directors or independent contractors of the Company or its Subsidiaries by or at the direction of the Company in connection with the Closing (including, in each case, the employer portion of any payroll or employment Taxes related to such amounts), and including the employer portion of any payroll or employment Taxes related to the Option Consideration, and (iii) the cost of the Company Tail to be obtained pursuant to Section 8.01; provided, however, that “Company Transaction Expenses” shall not include any (i) retention, severance or transaction payments or other payments pursuant to arrangements entered into by Acquiror or any of its Affiliates (or the Company at the direction of the Acquiror or any of its Affiliates) that is effect on or after the Closing Date, and (ii) the Second LTIP Payment.

“Company Warrants” means the warrants issued by the Company to purchase Company Common Stock.

“Compliance Laws” means Sanctions Laws, Anti-Corruption Laws and Export Control Laws.

“Confidentiality Agreement” has the meaning specified in Section 12.09.

“Continuing Employee” has the meaning specified in Section 9.07(a).

“Contracts” means any legally binding contracts, agreements, subcontracts and leases, whether written or oral, and all material amendments, written modifications and written supplements thereto.

- 7 -

“Corp Merger Sub” has the meaning specified in the preamble hereto.

“Corp Merger Sub Contribution” has the meaning specified in the recitals hereto.

“Counsel” means each of Acquiror Counsel and Seller Counsel.

“COVID-19” means SARS-CoV-2 or COVID-19, any evolution or variations existing as of or following the date hereof, or any other epidemics, pandemics or disease outbreaks.

“COVID-19 Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester or any other Law, Governmental Order, Action, directive, pronouncement, guidelines or recommendations by any Governmental Authority (including the Centers for Disease Control and Prevention and the World Health Organization) in connection with, related to or in response to COVID-19, including, but not limited to, the Coronavirus Aid, Relief, and Economic Security Act and the Families First Coronavirus Response Act, or any changes thereto.

“D&O Tail” has the meaning specified in Section 8.01(b).

“DGCL” has the meaning specified in the recitals hereto.

“Disclosure Letter” means, as applicable, the Company Disclosure Letter or the Acquiror Disclosure Letter.

“Dissenting Shares” has the meaning specified in Section 3.08.

“DLLCA” has the meaning specified in the recitals hereto.

“Domestication Intended Income Tax Treatment” has the meaning specified in Section 9.04(b).

“Effect” has the meaning specified in the definition of “Material Adverse Effect”.

“Enforceability Exceptions” has the meaning specified in Section 5.03.

“Environmental Laws” means any applicable Laws relating to pollution or protection of the environment, including all those relating to the use, storage, emission, disposal or release of Hazardous Materials, each as in effect as of the date hereof.

“Equity Securities” means, with respect to any Person, any share, share capital, capital stock, partnership, membership, joint venture or similar interest in such Person (including any stock appreciation, phantom stock, profit participation or similar rights), and any option, warrant, right or security (including debt securities) convertible, exchangeable or exercisable therefor.

“ERISA” has the meaning specified in Section 5.13(a).

“ERISA Affiliate” means any trade or business (whether or not incorporated) (i) under common control within the meaning of Section 4001(b)(1) of ERISA with the Company or any of its Subsidiaries or (ii) which together with the Company or any of its Subsidiaries is treated as a single employer under Section 414(t) of the Code.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Exchange Agent” has the meaning specified in Section 3.03(a).

- 8 -

“Exchange Agent Agreement” means a paying and exchange agent agreement, in form and substance reasonably acceptable to Acquiror and the Company.

“Excluded Shares” has the meaning specified in Section 3.02(a)(i).

“Export Control Laws” means any or all of (a) the U.S. Export Administration Regulations and all other Laws adopted by Governmental Authorities of the United States and other countries relating to import and export controls and (b) the anti-boycott regulations administered by the U.S. Department of Commerce and the U.S. Department of the Treasury.

“Final Prospectus” has the meaning specified in Section 6.06(a).

“FIRPTA Documentation” has the meaning specified in Section 7.05.

“First Certificate of Merger” has the meaning specified in Section 2.02(b).

“First Effective Time” has the meaning specified in Section 2.02(b).

“First LTIP Payment” means an amount not to exceed $1,050,000.

“First Merger” has the meaning specified in the recitals hereto.

“Fraud” means actual and intentional fraud under Delaware common law with a specific intent to deceive brought against a Party to the extent based on the making of any representation or warranty by such Party in Article V or Article VI and any certificates delivered pursuant to this Agreement (in each case, as applicable).

“FTC” has the meaning specified in Section 9.08(a).

“GAAP” means United States generally accepted accounting principles, consistently applied.

“Governing Documents” means the legal document(s) by which any Person (other than an individual) establishes its legal existence or which govern its internal affairs, in each case as amended, restated, modified or supplemented from time to time. For example, the “Governing Documents” of a corporation are its certificate of incorporation and by-laws, the “Governing Documents” of a limited partnership are its limited partnership agreement and certificate of limited partnership, the “Governing Documents” of a limited liability company are its operating agreement and certificate of formation and the “Governing Documents” of an exempted company are its memorandum and articles of association.

“Governmental Authority” means any federal, state, provincial, municipal, local or foreign government, governmental authority including any supranational authority such as the European Union, regulatory or administrative agency, governmental commission, department, board, bureau, agency or instrumentality, court or tribunal.

“Governmental Order” means any order, judgment, injunction, decree, writ, stipulation, determination or award, in each case, entered by or with any Governmental Authority.

“Hazardous Material” means any material, substance or waste that is listed, regulated, or otherwise defined as “hazardous,” “toxic,” or “radioactive”, or as a “pollutant” or “contaminant” or words of similar intent or meaning, under applicable Environmental Laws as in effect as of the date hereof, including petroleum, petroleum by-products, asbestos or asbestos-containing material, polychlorinated biphenyls, flammable or explosive substances, or pesticides, in each case, which are regulated under Environmental Law and as to which liability may be imposed pursuant to Environmental Law.

- 9 -

“Healthcare Information Laws” has the meaning specified in Section 5.11(b).

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder.

“Incentive Equity Plan” has the meaning specified in Section 8.09.

“Income Tax” means any Tax imposed upon or measured by net income or gain (however denominated).

“Indebtedness” means, with respect to any Person, all (i) indebtedness for borrowed money of such Person or indebtedness issued by such Person in substitution or exchange for borrowed money, (ii) indebtedness evidenced by any note, bond, debenture or other debt security, in each case, as of such time of such Person, (iii) that portion of the obligations with respect to capital leases in accordance with GAAP, (iv) the net settlement value of all interest rate or currency swaps, collars, caps, and similar hedging obligations or other derivative agreements and (v) all reimbursement or other obligations with respect to letters of credit, bank guarantees, bankers acceptances or similar instruments, in each case, solely to the extent drawn.

“Indemnitee Affiliates” has the meaning specified in Section 8.01(c).

“Intellectual Property” means all worldwide intellectual property and proprietary rights, existing now or in the future, in any jurisdiction, whether registered or unregistered, including, but not limited to rights in and to (a) patents, published, or unpublished patent applications (and any patents that issue as a result of those patent applications), including the right to file other or further applications, inventions (whether or not patentable or whether or not reduced to practice), invention disclosures, and industrial designs, together with all parents, improvements, reissues, continuations, continuations-in-part, revisions, divisional, extensions and re-examinations, (b) copyrights and rights in works of authorship and copyrightable subject matter, together with any moral rights related thereto, including all rights of authorship, use, publication, reproduction, distribution, and performance, transformation and ownership and all registrations and applications for registration of such copyrights, together with all other interests accruing by reason of international copyright conventions, rights of endorsement, publicity and personality of individuals, (c) trade secrets, know-how and confidential information, (d) trademarks, trade names, logos, service marks, trade dress, business names (including any fictitious or “dba” names), Internet domain names, designs, emblems, signs, insignia, slogans, symbols, all translations, adaptations, derivations and combinations of the foregoing and other similar designations of source or origin and general intangibles of like nature, whether or not registrable as a trademark in any given country, together with the goodwill of the business symbolized by or associated with any of the foregoing, and registrations and applications for registration of the foregoing, (e) rights in Software, (f) technical data, and databases, compilations and collections of technical data as well as analyses and other work product derived from technical data, (g) any registrations or applications for registration for any of the foregoing, including any provisional, divisions, continuations, continuations-in-part, renewals, reissuances, re-examinations and extensions (as applicable) and (h) all claims, causes of action, rights to sue for past, present and future infringement or unconsented use of any of the foregoing, the right to file applications and obtain registrations, and all products, proceeds, rights of recovery and revenues arising from or relating to any and all of the foregoing.

“Intentional Breach” means, with respect to any covenant or agreement in this Agreement, an action or omissions (including a failure to cure circumstances) taken or omitted to be taken that the breaching Party intentionally takes (or intentionally fails to take) and knows (or reasonably should have known) would, or would reasonably be expected to, cause a material breach of such agreement or covenant.

- 10 -

“Interim Period” has the meaning specified in Section 7.01.

“Investor Rights Agreement” has the meaning specified in the recitals hereto.

“IT Systems” means any information technology and computer systems, servers, networks, databases, websites, computer hardware and equipment used to process, store, generate, analyze, maintain and operate data or information that are owned by, licensed or leased to or otherwise under the control of the Company, including any Software embedded or installed thereon.

“JOBS Act” has the meaning specified in Section 8.11.

“Law” means any statute, law, ordinance, rule, regulation or Governmental Order, in each case, of any Governmental Authority.

“Leased Real Property” has the meaning specified in Section 5.19(b).

“Leases” has the meaning specified in Section 5.19(b).

“Letter of Transmittal” means a letter of transmittal in customary form and containing such provisions as Acquiror and the Company reasonably agree prior to the First Effective Time.

“Licensed Intellectual Property” has the meaning specified in Section 5.20(b).

“Lien” means any mortgage, deed of trust, pledge, hypothecation, encumbrance, easement, license, option, right of first refusal, security interest or other lien of any kind.

“LLC Merger Sub” has the meaning specified in the preamble hereto.

“LTIP” means the KORE Wireless Long-Term Cash Incentive Plan maintained by Kore Wireless Group Inc.

“LTIP Award” means an award of cash-based incentive award payable pursuant to the LTIP.

“M&A Contract” has the meaning specified in Section 5.12(a)(ii).

“Material Adverse Effect” means, with respect to the Company and its Subsidiaries, any effect, occurrence, development, fact, condition or change (“Effect”) that has had, or would reasonably be expected to have, individually or in the aggregate, a material adverse effect on the business, results of operations or financial condition of the Company and its Subsidiaries, taken as a whole; provided, however, that in no event would any of the following, alone or in combination, be deemed to constitute, or be taken into account in determining whether there has been or will be, a “Material Adverse Effect”: (i) any change in applicable Laws or GAAP or any interpretation thereof, (ii) any change in interest rates or economic, political, business, financial, commodity, currency or market conditions generally, (iii) the announcement of this Agreement or any of the Transactions, including the impact thereof on relationships, contractual or otherwise, with customers, suppliers, landlords, licensors, distributors, partners, providers and employees, (iv) any Effect generally affecting any of the industries or markets in which the Company or its Subsidiaries operate or the economy as a whole, (v) any earthquake, hurricane, epidemic, pandemic, tsunami, tornado, flood, mudslide, wild fire or other natural disaster, act of God or other force majeure event, (vi) any national

- 11 -

or international political or social conditions in countries in which, or in the proximate geographic region of which, the Company operates, including the engagement by the United States or such other countries in hostilities or the escalation thereof, whether or not pursuant to the declaration of a national emergency or war, or the occurrence or the escalation of any military or terrorist attack upon the United States or such other country, or any territories, possessions, or diplomatic or consular offices of the United States or such other countries or upon any United States or such other country military installation, equipment or personnel, (vii) any failure of the Company and its Subsidiaries, taken as a whole, to meet any projections, forecasts or budgets; provided that clause (vii) shall not prevent a determination that any Effect not otherwise excluded from this definition of Material Adverse Effect underlying such failure to meet projections or forecasts has resulted in, or would reasonably be expected to result in, a Material Adverse Effect, (viii) COVID-19, any COVID-19 Measures, or the Company’s or any of its Subsidiaries’ compliance therewith, and (ix) the taking of any action expressly required by this Agreement or with the express written consent of Acquiror; provided that, in the case of clauses (i), (ii), (iv), (v) and (vi), such changes may be taken into account to the extent (but only to the extent) that such changes have had a materially disproportionate and adverse impact on the Company and its Subsidiaries, taken as a whole, as compared to other similarly situated competitors or other entities operating in the industries and markets in which the Company and its Subsidiaries operate.

“Material Carriers” has the meaning specified in Section 5.24(c).

“Material Contracts” has the meaning specified in Section 5.12(b).

“Material Customers” has the meaning specified in Section 5.24(a).

“Material Suppliers” has the meaning specified in Section 5.24(b).

“Maximum Consideration” has the meaning specified in Section 3.02(d).

“Mergers” has the meaning specified in the recitals hereto.

“Most Recent Balance Sheet” has the meaning specified in Section 5.08(a).

“NYSE” means the New York Stock Exchange.

“Offer Documents” has the meaning specified in Section 9.02(a)(i).

“Option Cancellation Agreement” means those option cancellation agreements entered into between the Company and holders of Company Options

“Option Cash Consideration” means $4,075,000.

“Option Consideration” means the aggregate amount of cash and stock payable in respect of the Option Cash Consideration and the Option Share Consideration.

“Option Share Consideration” means a portion of the Closing Share Consideration equal to the number of shares (rounded to the nearest whole share) of Pubco Common Stock determined by dividing (a) $4,325,000, by (b) $10.00.

“Owned Intellectual Property” means all Intellectual Property that is owned by the Company or its Subsidiaries.

- 12 -

“Parties” and “Party” have the meanings specified in the preamble hereto.

“Permits” has the meaning specified in Section 5.17.