Form 425 COVA Acquisition Corp. Filed by: COVA Acquisition Corp.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 26, 2022

COVA ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-40012 | 98-1572360 | ||

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer | ||

| incorporation or organization) | Identification No.) |

| 530 Bush Street, Suite 703 | ||

| San Francisco, California | 94108 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (415) 800-2289

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name

of each exchange on | ||

| Units, each consisting of one Class A Ordinary Share, $0.0001 par value, and one-half of one redeemable warrant | COVAU | The Nasdaq Stock Market LLC | ||

| Class A Ordinary Shares included as part of the units | COVA | The Nasdaq Stock Market LLC | ||

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 | COVAW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry Into A Material Definitive Agreement. |

The Merger Agreement

On May 26, 2022, COVA Acquisition Corp., a Cayman Islands exempted company (“COVA”), ECARX Holdings Inc., a Cayman Islands exempted company (the “Company” or “ECARX”), Ecarx Temp Limited, a Cayman Islands exempted company and wholly owned subsidiary of ECARX (“Merger Sub 1”), and Ecarx&Co Limited, a Cayman Islands exempted company and wholly owned subsidiary of ECARX ( “Merger Sub 2”) entered into the Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which, among other things, (a) Merger Sub 1 will merge with and into COVA (the “First Merger”), with COVA surviving the First Merger as a wholly owned subsidiary of ECARX (such company, as the surviving entity of the First Merger, “Surviving Entity 1”), and (b) immediately following the First Merger and as part of the same overall transaction as the First Merger, Surviving Entity 1 will merge with and into Merger Sub 2 (the “Second Merger,” and together with the First Merger, the “Mergers”), with Merger Sub 2 surviving the Second Merger as a wholly owned subsidiary of ECARX (such company, as the surviving entity of the Second Merger, “Surviving Entity 2”) (the transactions contemplated by the Merger Agreement, including the Mergers, collectively, the “Business Combination”). Capitalized terms in this summary of the Merger Agreement not otherwise defined herein shall have the meanings ascribed to them in the Merger Agreement.

The Business Combination

Pursuant to the Merger Agreement, immediately prior to the First Effective Time on the Closing Date, (i) the Seventh Amended and Restated Memorandum and Articles of Association of ECARX (the “Amended Company Articles”) shall be adopted and become effective; (ii) each of the preferred shares of ECARX that is issued and outstanding immediately prior to such time shall be re-designated and re-classified into one ordinary share of ECARX (the “Preferred Share Conversion”); (iii) immediately after the Preferred Share Conversion, (x) issued and outstanding ordinary shares of ECARX (other than the Co-Founder Shares (as defined in the Merger Agreement)) and certain authorized but unissued ordinary share of ECARX shall each be re-designated into one Class A ordinary shares of ECARX, par value of US$0.000005 per share (“ECARX Class A Ordinary Shares”), where each ECARX Class A Ordinary Share shall entitle its holder to one (1) vote on all matters subject to vote at general meetings of ECARX, (y) issued and outstanding Co-Founder Shares and certain authorized but unissued ordinary shares shall each be re-designated as one Class B ordinary shares of ECARX, par value of US$0.000005 per share (“ECARX Class B Ordinary Shares” and collectively with ECARX Class A Ordinary Shares, “ECARX Ordinary Shares”), where each ECARX Class B Ordinary Share shall entitle its holder to ten (10) votes on all matters subject to vote at general meetings of ECARX, and (z) certain authorized but unissued ordinary shares of ECARX shall each be re-designated as shares of par value of US$0.000005 each of such class or classes (however designated) as the board of directors of ECARX may determine in accordance with the Amended Company Articles (actions set forth in clause (iii) are referred to as the “Re-designation”); and (iv) each authorized issued and unissued ECARX Ordinary Share immediately prior to the First Effective Time shall be recapitalized by way of a repurchase in exchange for issuance of such number of ECARX Ordinary Shares equal to the Recapitalization Factor (as defined below) as described further in the Merger Agreement. Actions set forth in clauses (i) through (iv) above are collectively referred to as the “Capital Restructuring.” The “Recapitalization Factor” is a number determined by dividing the Price per Share by $10.00. “Price per Share” is defined in the Merger Agreement as the amount equal to $3,400,000,000 divided by such amount equal to (a) the aggregate number of ECARX shares (i) that are issued and outstanding immediately prior to the Re-designation and (ii) that are issuable upon the exercise of all ECARX options and other equity securities of ECARX that are issued and outstanding immediately prior to the Re-designation (whether or not then vested or exercisable, as applicable), minus (b) the ECARX shares held by ECARX or any of its subsidiaries (if applicable) as treasury shares.

In addition, pursuant to the Merger Agreement, at the First Effective Time: (i) each of COVA’s units (“Units”) (each consisting of one COVA Public Share (as defined below) and one-half of one COVA public warrant (the “COVA Public Warrants”)) issued and outstanding immediately prior to the First Effective Time shall be automatically separated and the holder thereof shall be deemed to hold one COVA Public Share and one-half of one COVA Public Warrant; provided, that, no fractional COVA Public Warrants shall be issued in connection with such separation such that if a holder of such Units would be entitled to receive a fractional COVA Public Warrant upon such separation, the number of COVA Public Warrants to be issued to such holder upon such separation will be rounded down to the nearest whole number of COVA Public Warrants and no cash will be paid in lieu of such fractional COVA Public Warrants; (ii) immediately following the separation of each Unit, each Class A ordinary share, par value $0.0001 per share, of COVA (“COVA Public Shares”) and each Class B ordinary share, par value $0.0001 per share, of COVA (“Founder Shares” collectively with COVA Public Shares, “COVA Shares”) (excluding COVA Public Shares that are held by COVA shareholders that validly exercise their redemption rights, COVA Shares that are held by COVA shareholders that exercise and perfect their relevant dissenters’ rights and COVA treasury shares) issued and outstanding immediately prior to the First Effective Time shall be cancelled and cease to exist and each holder thereof shall be entitled to receive one newly issued ECARX Class A Ordinary Share; and (iii) each whole warrant of COVA outstanding immediately prior to the First Effective Time shall cease to be a warrant with respect to COVA Public Shares and be assumed by ECARX and converted into a warrant to purchase one ECARX Class A Ordinary Share (“ECARX Warrants”), subject to substantially the same terms and conditions prior to the First Effective Time.

Pursuant to the Merger Agreement, (i) each ordinary share, par value US$0.000005 per share, of Merger Sub 1 that is issued and outstanding immediately prior to the First Effective Time shall continue existing and constitute the only issued and outstanding share capital of Surviving Entity 1, (ii) each ordinary share of Surviving Entity 1 that is issued and outstanding immediately prior to the Second Effective Time will be automatically cancelled and cease to exist without any payment therefor, and (iii) each ordinary share, par value US$0.000005 per share, of Merger Sub 2 issued and outstanding immediately prior to the Second Effective Time shall remain outstanding and continue existing and constitute the only issued and outstanding share capital of Surviving Entity 2 and shall not be affected by the Second Merger.

Representations and Warranties

The Merger Agreement contains representations and warranties of ECARX, its subsidiaries, including Merger Sub 1 and Merger Sub 2, and COVA, relating to, among other things, their ability to enter into the Merger Agreement and their outstanding capitalization. In the Merger Agreement, ECARX also made certain other customary representations and warranties to COVA, including among others, representations and warranties related to the following: compliance with laws; tax matters; financial statements; absence of changes; actions; liabilities; material contracts and commitments; title, properties; intellectual property rights; labor and employee matters.

The representations and warranties are, in certain cases, subject to specified exceptions and materiality, Company Material Adverse Effect and SPAC Material Adverse Effect, knowledge and other qualifications contained in the Merger Agreement and may be further modified and limited by the Disclosure Letters to the Merger Agreement.

The representations and warranties made in the Merger Agreement will not survive the consummation of the Mergers.

Covenants

The Merger Agreement includes customary covenants of the parties with respect to operation of their respective businesses prior to consummation of the Business Combination and efforts to satisfy conditions to the consummation of the Business Combination. The Merger Agreement also contains additional covenants of the parties, including, among others, (i) a covenant providing for COVA and ECARX to cooperate in the preparation of the Registration Statement on Form F-4 required to be prepared and filed with the SEC in connection with the Mergers, (ii) covenants requiring COVA to establish a record date for, duly call and give notice of, convene and hold an extraordinary general meeting of the COVA shareholders as promptly as practicable following the date that the Registration Statement is declared effective by the SEC under the Securities Act of 1933, as amended (the “Securities Act”), (iii) covenants requiring ECARX to establish a record date for, duly call and give notice of, convene and hold an extraordinary general meeting of the ECARX shareholders as promptly as practicable following the date that the Registration Statement is declared effective by the SEC under the Securities Act, and (iv) covenants prohibiting COVA and ECARX from, among other things, soliciting or negotiating with third parties regarding alternative transactions and agreeing to certain related restrictions and ceasing discussions regarding alternative transactions.

Conditions to the Consummation of the Transaction

Consummation of the transactions contemplated by the Merger Agreement is subject to customary closing conditions, including approval of the Business Combination by the shareholders of COVA and ECARX. The Merger Agreement also contains other conditions, including, among others: (i) the accuracy of representations and warranties to various standards, from no materiality qualifier to a material adverse effect qualifier, (ii) the bringdown to Closing of a representation that no material adverse effect has occurred (both for COVA and ECARX); (iii) material compliance with pre-closing covenants, (iv) the delivery of customary closing certificates, (v) the absence of a legal prohibition on consummating the Transactions, (vi) ECARX’s listing application with Nasdaq being approved, (vii) COVA having at least US$5,000,001 of net tangible assets remaining after taking into account redemptions by COVA shareholders; and (viii) (a) all amounts in the trust account established for the purpose of holding the net proceeds of COVA’s initial public offering as of immediately prior to the Closing, plus (b) cash proceeds that will be funded prior to, concurrently with, or immediately after, the Closing to the Company in connection with the purchase of equity securities of the Company by investors on or prior to the Closing Date pursuant to a subscription or similar agreement executed by such investors and the Company after the date hereof, plus (c) proceeds in the form of cash or securities that have been funded or issued or will be funded or issued prior to, concurrently with, or immediately after, the Closing to the Company in connection with the Permitted Financing, minus (d) the aggregate amount payable to COVA shareholders exercising their redemption rights, in the aggregate equaling no less than $100,000,000.

Termination

The Merger Agreement may be terminated under customary and limited circumstances prior to the closing of the Business Combination, including, but not limited to: (i) by mutual written consent of COVA and ECARX, (ii) by either COVA or ECARX if the Business Combination is not consummated on or prior to the 300th day after the date of the Merger Agreement, (iii) by either COVA or ECARX if there is a final and nonappealable order issued by a Governmental Authority prohibiting the Business Combination, (iv) by ECARX if the board of directors of COVA (“COVA Board”) shall have failed to include a statement to the effect that COVA Board has unanimously recommended that COVA’s shareholders vote in favor of the Transaction Proposals at the duly convened meeting of COVA’s shareholders (such statement, the “COVA Board Recommendation”) in the proxy statement distributed to COVA’s shareholders or shall have withheld, withdrawn, qualified, amended or modified, or publicly proposed or resolved to withhold, withdraw, qualify, amend or modify, the COVA Board Recommendation, (v) by COVA if there is any breach of any representation, warranty, covenant or agreement on the part of ECARX set forth in the Merger Agreement, such that the conditions to COVA’s obligations to consummate the Transactions would not be satisfied at the Closing, and such breach cannot be or has not been cured within 60 days following receipt by ECARX of notice from COVA of such breach; provided that COVA shall not have the right to terminate the Merger Agreement pursuant to this paragraph if it is then in material breach of any of its representations, warranties, covenants or agreements set forth in the Merger Agreement, (vi) by ECARX if there is any breach of any representation, warranty, covenant or agreement on the part of COVA set forth in the Merger Agreement, such that the conditions to ECARX’s obligation to consummate the Transactions would not be satisfied at the closing, and such breach cannot be or has not been cured within 60 days following receipt by COVA of notice from ECARX of such breach; provided that ECARX shall not have the right to terminate the Merger Agreement pursuant to this paragraph if it is then in material breach of any of its representations, warranties, covenants or agreements set forth in the Merger Agreement, (vii) by COVA if the Business Combination and other related proposals are not approved by ECARX’s shareholders at the duly convened meeting of ECARX shareholders, and (viii) by ECARX if the Business Combination and other related proposals are not approved by COVA’s shareholders at the duly convened meeting of COVA’s shareholders.

The foregoing description of the Merger Agreement and the Business Combination does not purport to be complete and is qualified in its entirety by the terms and conditions of the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The Merger Agreement contains representations, warranties and covenants that the respective parties made to each other as of the date of such agreement or other specific dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the respective parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating the Merger Agreement. The Merger Agreement has been included to provide investors with information regarding its terms. It is not intended to provide any other factual information about the parties to the Merger Agreement. In particular, the representations, warranties, covenants and agreements contained in the Merger Agreement, which were made only for purposes of the Merger Agreement and as of specific dates, were solely for the benefit of the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties (including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts) and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors and reports and documents filed with the U.S. Securities and Exchange Commission (the “SEC”). Investors should not rely on the representations, warranties, covenants and agreements, or any descriptions thereof, as characterizations of the actual state of facts or condition of any party to the Merger Agreement. In addition, the representations, warranties, covenants and agreements and other terms of the Merger Agreement may be subject to subsequent waiver or modification. Moreover, information concerning the subject matter of the representations and warranties and other terms may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in COVA’s public disclosures.

Other Agreements

Strategic Investment Agreements

Concurrently with the execution of the Merger Agreement, ECARX entered into a strategic investment agreement with Luminar Technologies, Inc. (“Luminar”), pursuant to which Luminar agreed to subscribe for and purchase ECARX Class A Ordinary Shares at $10.00 per share for an aggregate investment amount of $15,000,000, payable in a certain number of shares of Class A common stock, par value $0.0001 per share, of Luminar or, at Luminar's election, in cash. Concurrently with the execution of the Merger Agreement, ECARX entered into a strategic investment agreement with Geely Investment Holding Ltd. (“Geely”), pursuant to which Geely agreed to subscribe for and purchase ECARX Class A Ordinary Shares at $10.00 per share for an aggregate purchase price of $20,000,000 (together with the strategic investment by Luminar, the “Strategic Investments”). Pursuant the Strategic Investment Agreements, the obligations of the parties to consummate the Strategic Investments are subject to the satisfaction or waiver of certain customary closing conditions of the respective parties, including, among others, (i) all conditions precedent under the Merger Agreement having been satisfied or waived (other than those to be satisfied at the closing of the Business Combination) and the Business Combination having been consummated, (ii) the accuracy of representations and warranties in all material respects and (iii) material compliance with covenants.

The Strategic Investment Agreements are filed as Exhibit 10.4 and Exhibit 10.5 to this Current Report on Form 8-K and the foregoing description of the Strategic Investment Agreements is qualified in its entirety by reference thereto.

Sponsor Support Agreement

Concurrently with the execution of the Merger Agreement, COVA, COVA Acquisition Sponsor LLC (the “Sponsor”) and ECARX entered into the Sponsor Support Agreement and Deed, pursuant to which Sponsor has agreed, among other things and subject to the terms and conditions set forth therein: (a) in connection with the Closing, to surrender to COVA such number of Founder Shares equal to the quotient obtained by dividing the aggregate amount payable with respect to all redeeming COVA Shares by $10.00, without consideration therefor, in the event that the amounts in the Trust Account immediately prior to the Closing (after deducting the SPAC Shareholder Redemption Amount) is less than $210 million, provided that the number of Founder Shares so surrendered shall not exceed 30% of the aggregate number of Founder Shares held by Sponsor as of immediately prior to the consummation of the Mergers (b) to vote in favor of the transactions contemplated in the Merger Agreement and the other Transaction Proposals, (c) to waive the anti-dilution rights it held in respect of the Founder Shares under the Amended and Restated Memorandum and Articles of Association of COVA, (d) to appear at the extraordinary general meeting for purposes of constituting a quorum, (e) to vote against any proposals that would materially impede the transactions contemplated in the Merger Agreement and the other Transaction Proposals, (f) not to redeem any COVA Shares held by Sponsor, (g) not to amend that certain letter agreement between COVA, Sponsor and certain other parties thereto, dated as of February 4, 2021, (h) not to transfer any COVA Shares held by Sponsor, subject to certain exceptions, (i) to unconditionally and irrevocably waive the dissenters’ rights pursuant to the Cayman Act in respect to all COVA Shares held by Sponsor with respect to the First Merger, to the extent applicable, and (j) for a period after the Closing specified therein, not to transfer ECARX Ordinary Shares, ECARX Warrants, and ECARX Class A Ordinary Shares received upon the exercise of any ECARX Warrants, if any, subject to certain exceptions.

The foregoing description of the Sponsor Support Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Sponsor Support Agreement, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.1 and the terms of which are incorporated by reference herein.

ECARX Shareholder Support Agreement

Concurrently with the execution of the Merger Agreement, COVA, ECARX and certain of the shareholders of ECARX entered into the ECARX Shareholder Support Agreement and Deed, pursuant to which certain shareholders holding sufficient number, type and classes of the issued and outstanding ECARX Shares to approve the transactions contemplated by the Merger Agreement have agreed, among other things: (a) to vote in favor of the transactions contemplated by the Merger Agreement, (b) to appear at the ECARX shareholders’ meeting in person or by proxy for purposes of counting towards a quorum, (c) to vote against any proposals that would or would be reasonably likely to in any material respect impede the transactions contemplated by the Merger Agreement, (d) not to transfer any ECARX shares held by such shareholder, subject to certain exceptions, and (e) for a period after the Closing specified therein, not to transfer certain ECARX shares held by such shareholder, if any, subject to certain exceptions.

The foregoing description of the ECARX Shareholder Support Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the ECARX Shareholder Support Agreement, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.2 and the terms of which are incorporated by reference herein.

Registration Rights Agreement

The Merger Agreement contemplates that, at the Closing, ECARX, COVA, Sponsor and certain shareholders of ECARX will enter into a registration rights agreement, to be effective as of the Closing, pursuant to which, among other things, ECARX will agree to undertake certain resale shelf registration obligations in accordance with the Securities Act and Sponsor and certain shareholders of ECARX will be granted customary demand and piggyback registration rights.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Registration Rights Agreement, a form of which is included as Exhibit C to the Merger Agreement, filed as Exhibit 2.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Assignment, Assumption and Amendment Agreement

At the Closing, COVA, ECARX and Continental Stock Transfer & Trust Company (“Continental”) will enter into the Assignment, Assumption and Amendment Agreement pursuant to which, among other things, COVA will assign all of its rights, interests and obligations in its existing warrant agreement with Continental (the “Warrant Agreement”) to ECARX, and the Warrant Agreement will be amended to change all references to COVA to ECARX and so that each warrant will represent the right to receive one whole ECARX Class A Ordinary Share.

The foregoing description of the Assignment, Assumption and Amendment Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Assignment, Assumption and Amendment Agreement, a form of which is included as Exhibit H to the Merger Agreement, filed as Exhibit 2.1 to this Current Report on Form 8-K, and incorporated herein by reference.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

On May 26, 2022, COVA issued a promissory note (the “Note”) in the amount of up to $2,000,000 to the Sponsor. The Note bears no interest and is repayable in full upon the earlier to occur of (i) the consummation of COVA’s initial business combination and (ii) the winding up of COVA. The Note also provides that up to $1,000,000 of the Note may be converted into a number of warrants, at a price of $1.00 per warrant, at the option of the Sponsor and at any time prior to payment in full of the outstanding principal amount of the Note. Such warrants would be identical to the private placement warrants issued to the Sponsor at COVA’s initial public offering.

The Note was issued pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act.

A copy of the Note is attached as Exhibit 10.3 to this Current Report on Form 8-K and is incorporated herein by reference. The disclosure set forth in this Item 2.03 is intended to be a summary only and is qualified in its entirety by reference to the Note.

|

Item 3.02 |

Unregistered Sales of Equity Securities. |

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein. The ECARX Class A Ordinary Shares to be offered and sold in connection with the Strategic Investment Agreements, and in connection with any subsequent equity financing and permitted financing between the date hereof and the closing of the Mergers, have not been registered under the Securities Act in reliance upon the exemption provided in Section 4(a)(2) thereof.

| Item 7.01 | Regulation FD Disclosure. |

On May 26, 2022 COVA issued a press release announcing the execution of the Merger Agreement. The press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

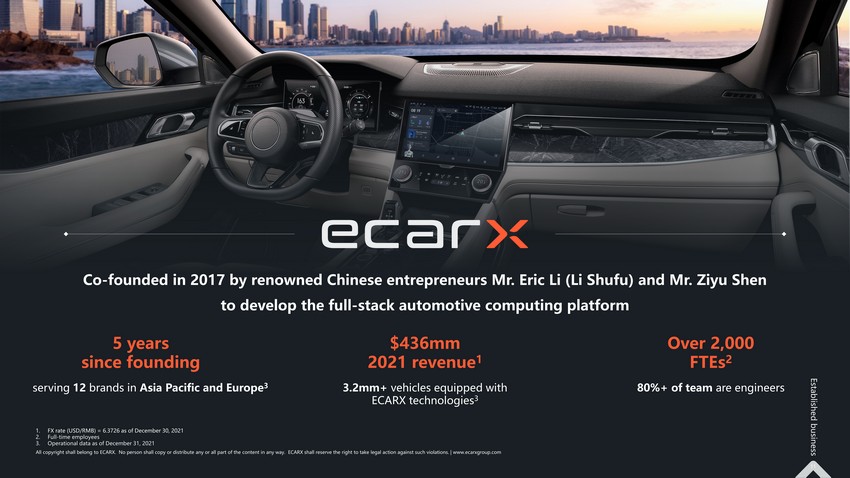

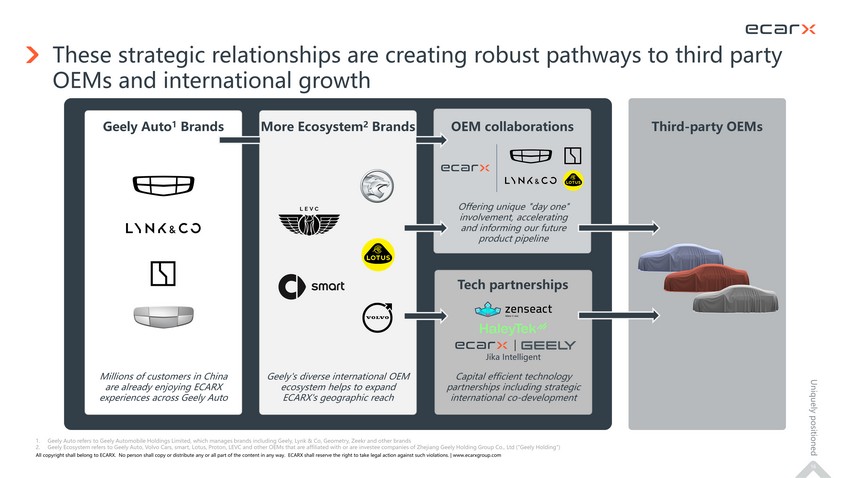

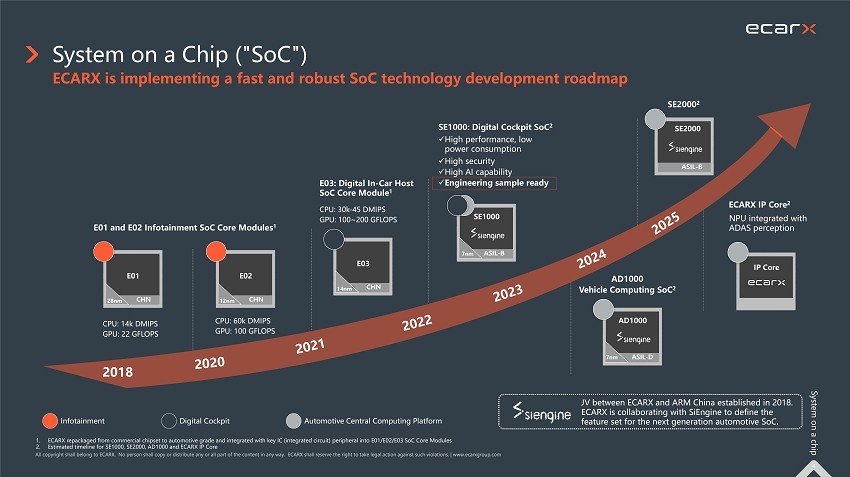

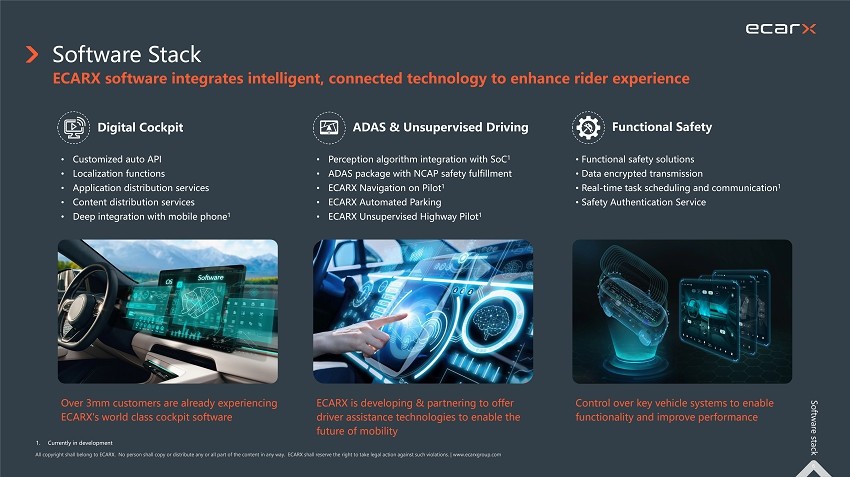

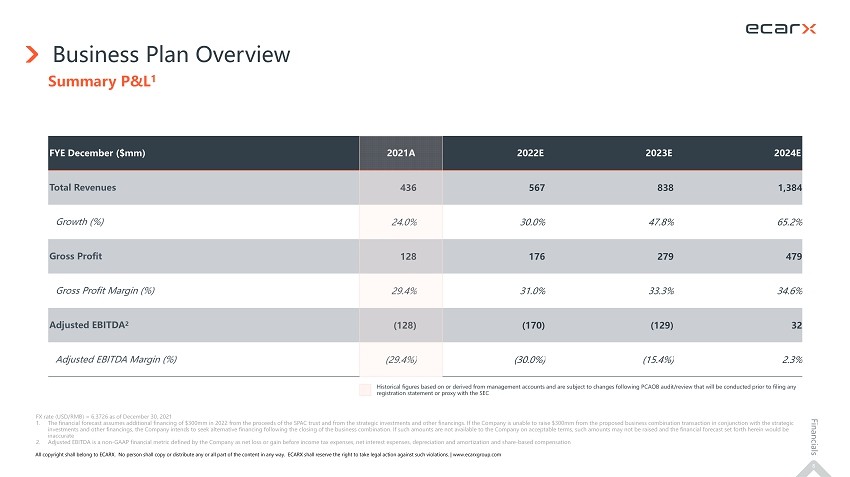

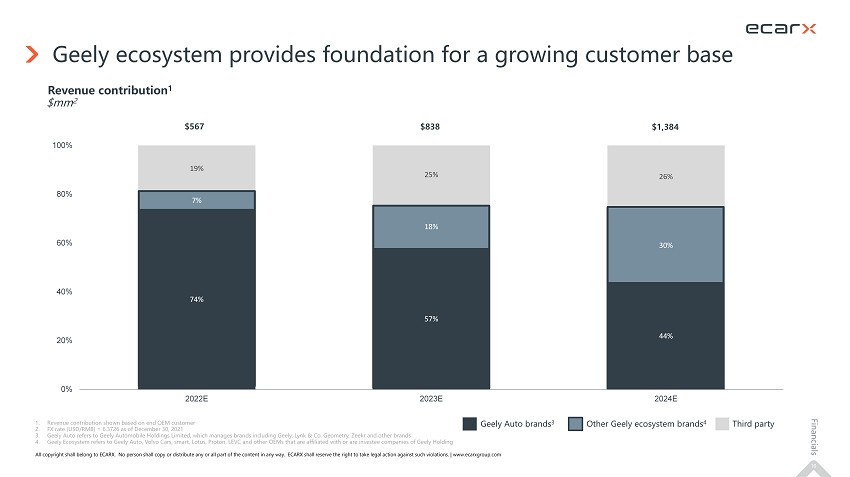

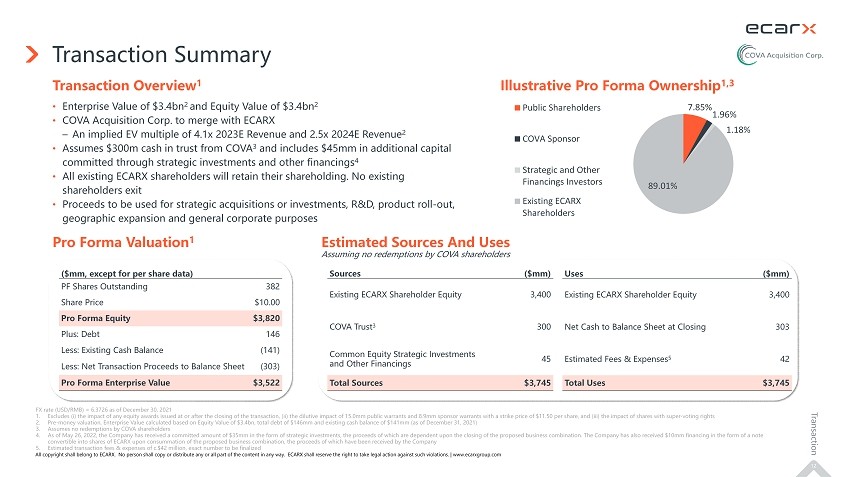

Furnished as Exhibit 99.2 hereto and incorporated into this Item 7.01 by reference is an investor presentation that COVA and ECARX have prepared for use in connection with the Merger Agreement.

The foregoing (including Exhibits 99.1 and 99.2) is being furnished pursuant to Item 7.01 and shall not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing of COVA under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report will not be deemed an admission as to the materiality of any of the information in this Item 7.01, including Exhibits 99.1 and 99.2.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that are based on beliefs and assumptions and on information currently available to COVA and ECARX, and also contains certain financial forecasts and projections.

All statements other than statements of historical fact contained in this Current Report, including, but not limited to, statements as to future results of operations and financial position, ECARX’s plans for new product development and geographic expansion, objectives of management for future operations of ECARX, projections of market opportunity and revenue growth, competitive position, technological and market trends, the sources and uses of cash from the proposed transaction, the anticipated enterprise value of the combined company following the consummation of the proposed transaction, anticipated benefits of the proposed transaction and expectations related to the terms of the proposed transaction, are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “target,” “seek” or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. These statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of COVA and ECARX, which involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by these forward-looking statements. Any such estimates, assumptions, expectations, forecasts, views or opinions, whether or not identified in this Current Report, should be regarded as preliminary and for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Although each of COVA and ECARX believes that it has a reasonable basis for each forward-looking statement contained in this Current Report, each of COVA and ECARX caution you that these statements are based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. In addition, there will be risks and uncertainties described in the proxy statement/prospectus on Form F-4 relating to the proposed transaction, which is expected to be filed by ECARX with the SEC and other documents filed by COVA or ECARX from time to time with the SEC. These filings may identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements in this Current Report include statements regarding the proposed transaction, including the timing and structure of the transaction, the proceeds of the transaction and the benefits of the transaction. Neither COVA nor ECARX can assure you that the forward-looking statements in this Current Report will prove to be accurate. These forward-looking statements are subject to a number of risks and uncertainties, including the ability to complete the business combination due to the failure to obtain approval from COVA shareholders or satisfy other closing conditions in the Merger Agreement, the occurrence of any event that could give rise to the termination of the Merger Agreement, the ability to recognize the anticipated benefits of the business combination, the amount of redemption requests made by COVA public shareholders, costs related to the transaction, the impact of the global COVID-19 pandemic, the risk that the transaction disrupts current plans and operations as a result of the announcement and consummation of the transaction, the outcome of any potential litigation, government or regulatory proceedings and other risks and uncertainties, including those to be included under the heading “Risk Factors” in the registration statement on Form F-4 to be filed by ECARX with the SEC and those included under the heading “Risk Factors” in the final prospectus of COVA dated February 4, 2021 and in its subsequent filings with the SEC. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by COVA or ECARX, their respective directors, officers or employees or any other person that COVA or ECARX will achieve their objectives and plans in any specified time frame, or at all. The forward-looking statements in this Current Report represent the views of COVA and ECARX as of the date of this Current Report. Subsequent events and developments may cause those views to change. However, while COVA and ECARX may update these forward-looking statements in the future, COVA and ECARX specifically disclaim any obligation to do so, except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing the views of COVA and ECARX as of any date subsequent to the date of this Current Report. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Important Additional Information Regarding the Transaction Will Be Filed With the SEC

In connection with the proposed transaction, ECARX will file a registration statement on Form F-4 with the SEC that will include a prospectus with respect to ECARX’s securities to be issued in connection with the proposed transaction and a proxy statement with respect to the shareholder meeting of COVA to vote on the proposed transaction. Shareholders of COVA and other interested persons are encouraged to read, when available, the preliminary proxy statement/prospectus as well as other documents to be filed with the SEC because these documents will contain important information about COVA and ECARX and the proposed transaction. After the registration statement is declared effective, the definitive proxy statement/prospectus to be included in the registration statement will be mailed to shareholders of COVA as of a record date to be established for voting on the proposed transaction. Once available, shareholders of COVA will also be able to obtain a copy of the Form F-4, including the proxy statement/prospectus, and other documents filed with the SEC without charge, by directing a request to: COVA Acquisition Corp., 530 Bush Street, Suite 703, San Francisco, California 94108. The preliminary and definitive proxy statement/prospectus to be included in the registration statement, once available, can also be obtained, without charge, at the SEC’s website (www.sec.gov).

Participants in the Solicitation

COVA and ECARX and their respective directors and executive officers may be considered participants in the solicitation of proxies with respect to the potential transaction described in this Current Report under the rules of the SEC. Information about the directors and executive officers of COVA and their ownership is set forth in COVA’s filings with the SEC. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of COVA’s shareholders in connection with the potential transaction will be set forth in the registration statement containing the preliminary proxy statement/prospectus when it is filed with the SEC. These documents are available free of charge at the SEC’s website at www.sec.gov or by directing a request to COVA Acquisition Corp., 530 Bush Street, Suite 703, San Francisco, California 94108.

No Offer or Solicitation

This Current Report is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and does not constitute an offer to sell or a solicitation of an offer to buy any securities of COVA or ECARX, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

|

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

| * | Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). COVA hereby undertakes to furnish supplementally a copy of any omitted schedule to the SEC upon its request; provided, however, that COVA may request confidential treatment for any such schedules so furnished. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 26, 2022 | COVA ACQUISITION CORP. | |

| By: | /s/ Jun Hong Heng | |

| Name: | Jun Hong Heng | |

| Title: | Chief Executive Officer | |

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

by and among

ECARX Holdings Inc.,

Ecarx Temp Limited,

Ecarx&Co Limited

and

COVA Acquisition Corp.

dated as of May 26, 2022

TABLE OF CONTENTS

Page

| Article I | ||

| CERTAIN DEFINITIONS | ||

| Section 1.1. | Definitions | 4 |

| Section 1.2. | Construction | 24 |

| Article II | ||

| TRANSACTIONS; CLOSING | ||

| Section 2.1. | Pre-Closing Actions | 25 |

| Section 2.2. | The Mergers | 28 |

| Section 2.3. | Effect of the Mergers on Issued Securities of SPAC, Merger Sub 1 and Merger Sub 2 | 29 |

| Section 2.4. | Closing Deliverables | 31 |

| Section 2.5. | Cancellation of SPAC Equity Securities and Disbursement of Merger Consideration | 32 |

| Section 2.6. | Further Assurances | 33 |

| Section 2.7. | Dissenter’s Rights | 33 |

| Section 2.8. | Withholding | 34 |

| Article III | ||

| REPRESENTATIONS AND WARRANTIES OF THE COMPANY | ||

| Section 3.1. | Organization, Good Standing and Qualification | 34 |

| Section 3.2. | Subsidiaries | 35 |

| Section 3.3. | Capitalization of the Company | 35 |

| Section 3.4. | Capitalization of Subsidiaries | 36 |

| Section 3.5. | Authorization | 37 |

| Section 3.6. | Consents; No Conflicts | 38 |

| Section 3.7. | Compliance with Laws; Consents; Permits | 38 |

| Section 3.8. | Tax Matters | 41 |

| Section 3.9. | Financial Statements | 42 |

| Section 3.10. | Absence of Changes | 43 |

| Section 3.11. | Actions | 43 |

| Section 3.12. | Undisclosed Liabilities | 43 |

| Section 3.13. | Material Contracts and Commitments | 43 |

| Section 3.14. | Title; Properties | 44 |

| Section 3.15. | Intellectual Property Rights and Data | 46 |

| Section 3.16. | Privacy and Cybersecurity | 49 |

| Section 3.17. | Labor and Employee Matters | 51 |

| Section 3.18. | Brokers | 52 |

| Section 3.19. | Environmental Matters | 52 |

| Section 3.20. | Insurance | 52 |

| Section 3.21. | Company Related Parties | 53 |

| Section 3.22. | Proxy/Registration Statement | 53 |

| Section 3.23. | No Additional Representations or Warranties | 53 |

| Article IV | ||

| REPRESENTATIONS AND WARRANTIES OF SPAC | ||

| Section 4.1. | Organization, Good Standing, Corporate Power and Qualification | 53 |

| Section 4.2. | Capitalization and Voting Rights | 54 |

| Section 4.3. | Corporate Structure; Subsidiaries | 55 |

| Section 4.4. | Authorization | 55 |

| Section 4.5. | Consents; No Conflicts | 56 |

| Section 4.6. | Tax Matters | 57 |

| Section 4.7. | Financial Statements | 58 |

| Section 4.8. | Absence of Changes | 58 |

| Section 4.9. | Actions | 59 |

| Section 4.10. | Brokers | 59 |

| Section 4.11. | Proxy/Registration Statement | 59 |

| Section 4.12. | SEC Filings | 59 |

| Section 4.13. | Trust Account | 60 |

| Section 4.14. | Investment Company Act; JOBS Act | 60 |

| Section 4.15. | Business Activities | 60 |

| Section 4.16. | Nasdaq Quotation | 61 |

| Section 4.17. | SPAC Related Parties | 61 |

| Section 4.18. | No Additional Representations or Warranties | 61 |

| Article V | ||

| COVENANTS OF THE COMPANY | ||

| Section 5.1. | Conduct of Business | 61 |

| Section 5.2. | Access to Information | 64 |

| Section 5.3. | Company Listing | 65 |

| Section 5.4. | Company Equity Incentive Plan | 65 |

| Section 5.5. | Acquisition Proposals and Alternative Transactions | 65 |

| Section 5.6. | D&O Indemnification and Insurance | 66 |

| Section 5.7. | Post-Closing Board of Directors of the Company | 67 |

| Section 5.8. | Notice of Developments | 67 |

| Section 5.9. | Financials | 68 |

| Section 5.10. | No Trading | 68 |

| Section 5.11. | Shareholder Lock-Up | 68 |

| Section 5.12. | VIE Restructuring | 68 |

ii

| Article VI | ||

| COVENANTS OF SPAC | ||

| Section 6.1. | Conduct of Business | 69 |

| Section 6.2. | Access to Information | 70 |

| Section 6.3. | Acquisition Proposals and Alternative Transactions | 70 |

| Section 6.4. | Nasdaq Listing | 71 |

| Section 6.5. | SPAC Public Filings | 71 |

| Section 6.6. | Section 16 Matters | 71 |

| Article VII | ||

| JOINT COVENANTS | ||

| Section 7.1. | Regulatory Approvals; Other Filings | 71 |

| Section 7.2. | Proxy/Registration Statement; SPAC Shareholders’ Meeting and Approvals; Company Shareholders’ Approval | 72 |

| Section 7.3. | Support of Transaction | 77 |

| Section 7.4. | Tax Matters | 77 |

| Section 7.5. | Shareholder Litigation | 77 |

| Section 7.6. | Subsequent Equity Financing and Permitted Financing | 78 |

| Article VIII | ||

| CONDITIONS TO OBLIGATIONS | ||

| Section 8.1. | Conditions to Obligations of Each Party | 78 |

| Section 8.2. | Additional Conditions to Obligations of SPAC | 79 |

| Section 8.3. | Additional Conditions to Obligations of the Company, Merger Sub 1 and Merger Sub 2 | 80 |

| Section 8.4. | Frustration of Conditions | 80 |

| Article IX | ||

| TERMINATION/EFFECTIVENESS | ||

| Section 9.1. | Termination | 80 |

| Section 9.2. | Effect of Termination | 82 |

| Article X | ||

| MISCELLANEOUS | ||

| Section 10.1. | Trust Account Waiver | 82 |

| Section 10.2. | Waiver | 82 |

iii

| Section 10.3. | Notices | 83 |

| Section 10.4. | Assignment | 84 |

| Section 10.5. | Rights of Third Parties | 84 |

| Section 10.6. | Expenses | 84 |

| Section 10.7. | Governing Law | 84 |

| Section 10.8. | Consent to Jurisdiction | 85 |

| Section 10.9. | Headings; Counterparts | 85 |

| Section 10.10. | Disclosure Letters | 86 |

| Section 10.11. | Entire Agreement | 86 |

| Section 10.12. | Amendments | 86 |

| Section 10.13. | Publicity | 86 |

| Section 10.14. | Confidentiality | 87 |

| Section 10.15. | Severability | 87 |

| Section 10.16. | Enforcement | 87 |

| Section 10.17. | Non-Recourse | 87 |

| Section 10.18. | Non-Survival of Representations, Warranties and Covenants | 88 |

| Section 10.19. | Conflicts and Privilege | 88 |

Exhibits

| Exhibit A | Sponsor Support Agreement |

| Exhibit B | Company Support Agreement |

| Exhibit C | Registration Rights Agreement |

| Exhibit D | Form of First Plan of Merger |

| Exhibit E | Form of Second Plan of Merger |

| Exhibit F | Form of A&R Company Charter |

| Exhibit G | Material Terms of Company 2022 Equity Incentive Plan |

| Exhibit H | Form of Assignment, Assumption and Amendment Agreement |

| Exhibit I | Strategic Investment Agreement |

| Exhibit J | VIE Restructuring Plan |

| Exhibit K | Strategic Investment Agreement |

Schedules

SPAC Disclosure Letter

Company Disclosure Letter

iv

INDEX OF DEFINED TERMS

| A&R Company Charter | 2.1(a) |

| Action | 1.1 |

| Affiliate | 1.1 |

| Aggregate Proceeds | 1.1 |

| Agreement | Preamble |

| AI Technologies | 1.1 |

| Anti-Corruption Laws | 3.7(d) |

| Anti-Money Laundering Laws | 1.1 |

| Assignment, Assumption and Amendment Agreement | Recitals |

| Audited Financial Statements | 3.9(a) |

| Authorization Notice | 2.2(c)(i) |

| Benefit Plan | 1.1 |

| Business Combination | 1.1 |

| Business Data | 1.1 |

| Business Day | 1.1 |

| CAC | 8.2(c) |

| Capital Restructuring | 2.1(d)(ii) |

| Cayman Act | Recitals |

| Closing | 2.2(a) |

| Closing Date | 2.2(a) |

| Code | 1.1 |

| Co-Founder Shares | 1.1 |

| Company | Preamble |

| Company 2022 Equity Incentive Plan | 5.4 |

| Company Acquisition Proposal | 1.1 |

| Company AI Policies | 3.15(h) |

| Company Board | Recitals |

| Company Board Recommendation | 7.2(c)(ii) |

| Company Charter | 1.1 |

| Company Class A Ordinary Shares | 1.1 |

| Company Class B Ordinary Shares | 1.1 |

| Company Closing Statement | 2.4(a)(ii) |

| Company Contract | 1.1 |

| Company Directors | 5.7 |

| Company Disclosure Letter | III |

| Company Financial Statements | 3.9(a) |

| Company IP | 1.1 |

| Company Lease | 3.14(c) |

| Company Material Adverse Effect | 1.1 |

| Company Material Lease | 3.14(c) |

| Company Options | 1.1 |

| Company Ordinary Shares | 1.1 |

| Company Product | 1.1 |

| Company Shareholder | 1.1 |

v

| Company Shareholders’ Approval | 1.1 |

| Company Shareholders’ Meeting | 7.2(c)(i) |

| Company Shares | 1.1 |

| Company Source Code | 3.15(j) |

| Company Support Agreement | Recitals |

| Company Transaction Expenses | 1.1 |

| Company Warrant | 2.3(d) |

| Competing SPAC | 1.1 |

| Consent Party | Recitals |

| Contract | 1.1 |

| Control | 1.1 |

| Controlled | 1.1 |

| Controlling | 1.1 |

| Copyleft License | 1.1 |

| COVID-19 | 1.1 |

| COVID-19 Measures | 1.1 |

| CSRC | 8.2(c) |

| Cybersecurity Laws | 1.1 |

| Data Secutity Laws | 1.1 |

| Disclosure Letter | 1.1 |

| Dissenting SPAC Shareholders | 2.7(a) |

| Dissenting SPAC Shares | 2.7(a) |

| DTC | 1.1 |

| Encumbrance | 1.1 |

| Enforceability Exceptions | Section 3.5(a) |

| Environmental Laws | 1.1 |

| Equity Securities | 1.1 |

| ERISA | 1.1 |

| ERISA Affiliate | 1.1 |

| ESOP | 1.1 |

| Event | 1.1 |

| Exchange Act | 1.1 |

| Exchange Agent | 2.5(a) |

| First Effective Time | 2.2(a) |

| First Merger | Recitals |

| First Merger Filing Documents | 2.2(a) |

| First Plan of Merger | 1.1 |

| Fully-Diluted Company Shares | 1.1 |

| GAAP | 1.1 |

| Government Official | 1.1 |

| Governmental Authority | 1.1 |

| Governmental Order | 1.1 |

| Group | 1.1 |

| Group Companies | 1.1 |

| Group Company | 1.1 |

| Indebtedness | 1.1 |

vi

| Intellectual Property | 1.1 |

| Intended Tax Treatment | 7.4 |

| Interim Period | 5.1 |

| Intervening Event | 1.1 |

| Intervening Event Notice | 7.2(b)(ii) |

| Intervening Event Notice Period | 7.2(b)(ii) |

| Investment Company Act | 1.1 |

| Investors Rights Agreement | 1.1 |

| IP Contributor | 3.15(b) |

| IPO | 10.1 |

| IT Systems | 3.16(g) |

| Knowledge of SPAC | 1.1 |

| Knowledge of the Company | 1.1 |

| Law | 1.1 |

| Leased Real Property | 1.1 |

| Liabilities | 1.1 |

| Major Customers | 1.1 |

| Major Suppliers | 1.1 |

| Management Accounts | 3.9(b) |

| Material Contracts | 1.1 |

| Material Permit | 3.7(g) |

| Merger Consideration | 1.1 |

| Merger Sub 1 | Preamble |

| Merger Sub 2 | Preamble |

| Merger Subs | Preamble |

| Mergers | Recitals |

| Nasdaq | 4.16 |

| NDA | 1.1 |

| Non-Recourse Parties | 10.17 |

| Non-Recourse Party | 10.17 |

| OFAC | 1.1 |

| Open Source Software | 1.1 |

| Ordinary Course | 1.1 |

| Ordinary Shares | 1.1 |

| Organizational Documents | 1.1 |

| Orrick | 10.19 |

| Owned IP | 1.1 |

| Parties | Preamble |

| Party | Preamble |

| Patents | 1.1 |

| Permitted Encumbrances | 1.1 |

| Permitted Financing | 1.1 |

| Permitted Financing Agreement | 1.1 |

| Permitted Financing Proceeds | 1.1 |

| Person | 1.1 |

| Personal Data | 1.1 |

vii

| PRC | 1.1 |

| Preferred Share Conversion | 2.1(b) |

| Preferred Shares | 1.1 |

| Price per Share | 1.1 |

| Privacy Laws | 1.1 |

| Privacy Obligation | 1.1 |

| Privacy Policy | 1.1 |

| Process | 1.1 |

| Processed | 1.1 |

| Processing | 1.1 |

| Prohibited Person | 1.1 |

| Proxy Statement | 1.1 |

| Proxy/Registration Statement | 7.2(a)(i) |

| Recapitalization | 2.1(d)(i) |

| Recapitalization Factor | 1.1 |

| Redeeming SPAC Shares | 1.1 |

| Re-designation | 2.1(c) |

| Registered IP | 1.1 |

| Registrable Securities | 1.1 |

| Registration Rights Agreement | Recitals |

| Regulatory Approvals | 7.1(a) |

| Regulatory Opinion | 8.2(c) |

| Related Party | 1.1 |

| Remaining Trust Fund Proceeds | 2.4(b)(iv) |

| Representatives | 1.1 |

| Required Governmental Authorizations | 1.1 |

| Required Shareholders’ Approval | 1.1 |

| Requisite Shareholder Consent | 1.1 |

| restraint | 8.1(f) |

| Sanctioned Territory | 1.1 |

| Sanctions | 1.1 |

| Sarbanes-Oxley Act | 1.1 |

| SEC | 1.1 |

| Second Effective Time | 2.2(b) |

| Second Merger | Recitals |

| Second Merger Filing Documents | 2.2(b) |

| Second Plan of Merger | 1.1 |

| Securities Act | 1.1 |

| Security Incident | 1.1 |

| Series A Preferred Shares | 1.1 |

| Series A+ Preferred Shares | 1.1 |

| Series A++ Preferred Shares | 1.1 |

| Series Angel Preferred Shares | 1.1 |

| Series B Preferred Shares | 1.1 |

viii

| Shareholder Litigation | 7.5 |

| SPAC | Preamble |

| SPAC Accounts Date | 1.1 |

| SPAC Acquisition Proposal | 1.1 |

| SPAC Board | Recitals |

| SPAC Board Recommendation | 7.2(b)(ii) |

| SPAC Change in Recommendation | 7.2(b)(ii) |

| SPAC Charter | 1.1 |

| SPAC Class A Ordinary Shares | 1.1 |

| SPAC Class B Conversion | 2.3(a) |

| SPAC Class B Ordinary Shares | 1.1 |

| SPAC Closing Statement | 2.4(a)(i) |

| SPAC D&O Indemnified Parties | 5.6(a) |

| SPAC D&O Insurance | 5.6(b) |

| SPAC D&O Tail | 5.6(b) |

| SPAC Disclosure Letter | IV |

| SPAC Financial Statements | 4.7(a) |

| SPAC Material Adverse Effect | 1.1 |

| SPAC Ordinary Shares | 1.1 |

| SPAC Preference Shares | 1.1 |

| SPAC SEC Filings | 4.12 |

| SPAC Securities | 1.1 |

| SPAC Shareholder | 1.1 |

| SPAC Shareholder Redemption Amount | 1.1 |

| SPAC Shareholder Redemption Right | 1.1 |

| SPAC Shareholders' Approval | 1.1 |

| SPAC Shareholders' Meeting | 7.2(b)(i) |

| SPAC Shares | 1.1 |

| SPAC Transaction Expenses | 1.1 |

| SPAC Unit | 1.1 |

| SPAC Warrant | 1.1 |

| Sponsor | Recitals |

| Sponsor Group | 10.19 |

| Sponsor Shares Forfeiture | Recitals |

| Sponsor Support Agreement | Recitals |

| Strategic Investment Agreements | Recitals |

| Subsequent Equity Financing | 1.1 |

| Subsequent Equity Financing Proceeds | 1.1 |

| Subsequent Equity Subscription Agreements | 1.1 |

| Subsidiary | 1.1 |

| Surviving Entity 1 | Recitals |

| Surviving Entity 2 | Recitals |

| Tax | 1.1 |

| Tax Returns | 1.1 |

| Taxes | 1.1 |

| Terminating Company Breach | 9.1(e) |

ix

| Terminating SPAC Breach | 9.1(f) |

| Third Party Data | 1.1 |

| Trade Control Laws | 1.1 |

| Trade Secrets | 1.1 |

| Trademarks | 1.1 |

| Training Data | 1.1 |

| Transaction Document | 1.1 |

| Transaction Documents | 1.1 |

| Transaction Proposals | 1.1 |

| Transactions | 1.1 |

| Trust Account | 10.1 |

| Trust Agreement | 4.13 |

| Trustee | 4.13 |

| U.S. | 1.1 |

| under common Control with | 1.1 |

| Union | 1.1 |

| Unit Separation | 2.3(a) |

| VIE Restructuring | 1.1 |

| VIE Restructuring Agreement | 1.1 |

| Warrant Agreement | 1.1 |

| Written Objection | 2.2(c) |

x

AGREEMENT AND PLAN OF MERGER

This Agreement and Plan of Merger, dated as of May 26, 2022 (this “Agreement”), is made and entered into by and among (i) ECARX Holdings Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands (the “Company”), (ii) Ecarx Temp Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands and a direct wholly owned subsidiary of the Company (“Merger Sub 1”), (iii) Ecarx&Co Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands and a direct wholly owned subsidiary of the Company (“Merger Sub 2”, and together with Merger Sub 1, the “Merger Subs”), and (iv) COVA Acquisition Corp., an exempted company limited by shares incorporated under the laws of the Cayman Islands (“SPAC”). Each of the Company, Merger Sub 1, Merger Sub 2 and SPAC are individually referred to herein as a “Party” and, collectively, as the “Parties.”

RECITALS

WHEREAS, SPAC is a blank check company and was formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses;

WHEREAS, each of the Merger Subs is a newly incorporated Cayman Islands exempted company limited by shares, wholly owned by the Company, and was formed for the purpose of effectuating the Mergers (as defined below);

WHEREAS, immediately following the Capital Restructuring (as defined below), upon the terms and subject to the conditions set forth in this Agreement and in accordance with the applicable provisions of the Companies Act (As Revised) of the Cayman Islands (the “Cayman Act”), at the Closing (as defined below), Merger Sub 1 will merge with and into SPAC (the “First Merger”), with SPAC being the surviving company (as defined in the Cayman Act) and becoming a wholly owned subsidiary of the Company (SPAC is hereinafter referred to for the periods from and after the First Effective Time as “Surviving Entity 1”);

WHEREAS, immediately following the consummation of the First Merger, upon the terms and subject to the conditions set forth in this Agreement and in accordance with the applicable provisions of the Cayman Act, Surviving Entity 1 will merge with and into Merger Sub 2 (the “Second Merger” and together with the First Merger, collectively, the “Mergers”), with Merger Sub 2 being the surviving company (as defined in the Cayman Act) and remaining a wholly owned subsidiary of the Company (Merger Sub 2 is hereinafter referred to for the periods from and after the Second Effective Time as the “Surviving Entity 2”);

| 1 |

WHEREAS, the Company has received, concurrently with the execution and delivery of this Agreement, a Sponsor Support Agreement and Deed in the form attached hereto as Exhibit A (the “Sponsor Support Agreement”) signed by the Company, SPAC, COVA Acquisition Sponsor LLC, a Cayman Islands limited liability company (“Sponsor”), pursuant to which, among other things, and subject to the terms and conditions set forth therein, Sponsor agrees (a) that if immediately prior to the Closing the amounts in the Trust Account (after deducting the SPAC Shareholder Redemption Amount) are less than $210 million, it will surrender to SPAC such number of SPAC Class B Ordinary Shares equal to the quotient obtained by dividing the SPAC Shareholder Redemption Amount by $10.00, without consideration therefor; provided that the number of SPAC Class B Ordinary Shares so surrendered shall not under any circumstances exceed thirty percent (30%) of the aggregate number of SPAC Class B Ordinary Shares held by Sponsor as of the date hereof (the “Sponsor Shares Forfeiture”); (b) to vote all SPAC Shares held by Sponsor in favor of (i) the Transactions and (ii) the other Transaction Proposals; (c) to waive the anti-dilution rights of the holders of SPAC Class B Ordinary Shares under the SPAC Charter; (d) to appear at the SPAC Shareholders’ Meeting in person or by proxy for purposes of counting towards a quorum; (e) to vote all SPAC Shares held by Sponsor against any proposals that would or would be reasonably likely to materially impede the Transactions or any other Transaction Proposal; (f) not to redeem any SPAC Shares held by Sponsor in connection with the Transactions; (g) not to amend that certain letter agreement between SPAC, Sponsor and certain other parties thereto, dated as of February 4, 2021 (other than any terms set forth therein that are amended and restated in accordance with the Sponsor Support Agreement); (h) not to transfer any SPAC Securities held by Sponsor, subject to certain exceptions; (i) to unconditionally and irrevocably waive the dissenters’ rights pursuant to the Cayman Act in respect to all SPAC Shares held by Sponsor with respect to the First Merger, to the extent applicable; and (j) not to transfer Company Ordinary Shares, Company Warrants, or Company Ordinary Shares received upon the exercise of any Company Warrants, if any, during the respective periods as set forth therein, subject to certain exceptions;

WHEREAS, SPAC has received concurrently with the execution and delivery of this Agreement, a Shareholder Support Agreement and Deed in the form attached hereto as Exhibit B (the “Company Support Agreement”) signed by the Company, SPAC and Company Shareholders holding sufficient number, type and classes of Company Shares to obtain the Company Shareholders’ Approval (each such Company Shareholder, a “Consent Party”), pursuant to which, among other things, and subject to the terms and conditions set forth therein, each Consent Party agrees (a) to vote all of such Consent Party’s Company Shares in favor of the Transactions, (b) to, if applicable, appear at the Company Shareholders’ Meeting in person or by proxy for purposes of counting towards a quorum, (c) to vote all Company Shares held by such Consent Party against any proposals that would or would be reasonably likely to materially impede the Transactions, (d) not to transfer any Company Shares held by such Company Shareholders, subject to certain exceptions, and (e) for the period after the Closing specified therein, not to transfer certain Company Shares held by such Company Shareholders, if any, subject to certain exceptions;

WHEREAS, at the Closing, the Company, Sponsor, SPAC and certain Company Shareholders shall enter into a registration rights agreement in substantially the form attached hereto as Exhibit C (the “Registration Rights Agreement”);

WHEREAS, at the Closing, the Company, SPAC and the warrant agent thereunder shall enter into an assignment, assumption and amendment agreement in substantially the form attached hereto as Exhibit H (the “Assignment, Assumption and Amendment Agreement”) pursuant to which, among other things, (i) SPAC will assign to the Company all of its rights, interests, and obligations in and under the Warrant Agreement, and (ii) the Warrant Agreement will be amended (a) to change all references to Warrants (as such term is defined therein) to Company Warrants (and all references to Ordinary Shares (as such term is defined therein) underlying such warrants to Company Class A Ordinary Shares) and (b) to cause each outstanding Company Warrant to represent the right to receive, from the Closing, one whole Company Class A Ordinary Share;

| 2 |

WHEREAS, on or before the date of this Agreement, certain strategic investor has agreed to make a private investment in the Company to purchase an aggregate of 2,000,000 Company Class A Ordinary Shares in the aggregate cash amount of $20,000,000 at a price per share equal to $10.00 on the Closing Date and substantially concurrent with the Closing (but after the consummation of the Capital Restructuring), pursuant to a Strategic Investment Agreement in substantially the form attached hereto as Exhibit I;

WHEREAS, on or before the date of this Agreement, certain strategic investor has agreed to make a private investment in the Company to purchase an aggregate of 1,500,000 Company Class A Ordinary Shares at a price per share equal to $10.00 on the Closing Date and substantially concurrent with the Closing (but after the consummation of the Capital Restructuring), and as consideration, to issue and sell to the Company certain number of shares of Class A common stock of such strategic investor with an aggregate value of $15,000,000 or, at such strategic investor’s election, pay cash in the aggregate amount of $15,000,000, pursuant to a Strategic Investment Agreement in substantially the form attached hereto as Exhibit K (together with the Strategic Investment Agreement in the preceding paragraph, collectively, the “Strategic Investment Agreements”);

WHEREAS, the board of directors of SPAC (the “SPAC Board”) has unanimously (a) determined that (x) it is fair to, advisable and in the best interests of SPAC to enter into this Agreement and to consummate the Mergers and the other Transactions, and (y) the Transactions constitute a “Business Combination” as such term is defined in the SPAC Charter, (b) (i) approved and declared advisable this Agreement and the execution, delivery and performance hereof, the Mergers and the other Transactions, and (ii) approved and declared advisable the First Plan of Merger, the Second Plan of Merger, the Sponsor Support Agreement, the Assignment, Assumption and Amendment Agreement, the Company Support Agreement, the Registration Rights Agreement, each other Transaction Document to which SPAC is a party and the execution, delivery and performance thereof, (c) resolved to recommend the adoption of this Agreement, the First Plan of Merger and the Second Plan of Merger by the shareholders of SPAC, and (d) directed that this Agreement, the First Plan of Merger and the Second Plan of Merger be submitted to the shareholders of SPAC for their approval at the SPAC Shareholders’ Meeting;

WHEREAS, (a) the sole director of Merger Sub 1 has (i) determined that it is desirable and in the commercial interests of Merger Sub 1 to enter into this Agreement and to consummate the First Merger and the other Transactions, (ii) approved and declared desirable this Agreement and the First Plan of Merger and the execution, delivery and performance of this Agreement and the First Plan of Merger and the consummation of the Transactions and (b) the Company, in its capacity as the sole shareholder of Merger Sub 1, has approved the First Plan of Merger by a written resolution;

| 3 |

WHEREAS, (a) the sole director of Merger Sub 2 has (i) determined that it is desirable and in the commercial interests of Merger Sub 2 to enter into this Agreement and to consummate the Second Merger and the other Transactions, (ii) approved and declared desirable this Agreement and the Second Plan of Merger and the execution, delivery and performance of this Agreement and the Second Plan of Merger and the consummation of the Transactions and (b) the Company, in its capacity as the sole shareholder of Merger Sub 2 and in its capacity as the sole shareholder of Surviving Entity 1 at the time of the Second Merger, respectively, has approved the Second Plan of Merger by a written resolution; and

WHEREAS, the board of directors of the Company (the “Company Board”) has (a) determined that this Agreement and the other Transaction Documents to which the Company is a party and the consummation of the Transactions would be in the best interests of the Company, (b) (i) authorized and approved the execution, delivery and performance by the Company of this Agreement and the other Transaction Documents to which the Company is a party and the consummation of the Transactions, and (iii) resolved to direct this Agreement be submitted to the shareholders of the Company for adoption.

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth in this Agreement and intending to be legally bound hereby, the Company, Merger Sub 1, Merger Sub 2 and SPAC agree as follows:

Article I

CERTAIN DEFINITIONS

Section 1.1. Definitions. As used herein, the following terms shall have the following meanings:

“Action” means any charge, claim, action, complaint, petition, prosecution, investigation, appeal, suit, litigation, arbitration or other similar proceeding initiated or conducted by a mediator, arbitrator or Governmental Authority, whether administrative, civil, regulatory or criminal, and whether at law or in equity, or otherwise under any applicable Law;

“Affiliate” means, with respect to any Person, any other Person which, directly or indirectly, Controls, is Controlled by or is under common Control with such Person. In the case of a Person which is a fund or which is directly or indirectly Controlled by a fund, the term “Affiliate” also includes (a) any of the general partners of such fund, (b) the fund manager managing such fund, any other person which, directly or indirectly, Controls such fund or such fund manager, or any other funds managed by such fund manager and (c) trusts (excluding the Trust Account for all purposes other than for the sole purpose of the release of the proceeds of the Trust Account in accordance with this Agreement and the Trust Agreement) Controlled by or for the benefit of any Person referred to in (a) or (b);

“Aggregate Proceeds” means, without duplication, an amount equal to (a) all amounts in the Trust Account immediately prior to the Closing (after deducting the SPAC Shareholder Redemption Amount) plus (b) Permitted Financing Proceeds plus (c) Subsequent Equity Financing Proceeds.

“Anti-Money Laundering Laws” means all financial recordkeeping and reporting requirements and all money laundering related Laws and any related or similar Law issued, administered or enforced by any Governmental Authority and applicable to the Group Companies.

| 4 |

“AI Technologies” means any and all deep learning, machine learning, and other artificial intelligence technologies, including any and all: (a) proprietary algorithms, software, or systems that make use of or employ neural networks, statistical learning algorithms (such as linear and logistic regression, support vector machines, random forests, or k-means clustering), or reinforcement learning; and (b) proprietary embodied artificial intelligence and related hardware or equipment.

“Benefit Plan” means any “employee benefit plan” (as such term is defined in Section 3(3) of ERISA, whether or not subject to ERISA) and compensation or benefit plan, program, policy, practice, Contract or other arrangement, including any compensation, severance, termination pay, deferred compensation, retirement, profit sharing, incentive, bonus, health, welfare, performance awards, equity or equity-based compensation (including stock option, equity purchase, equity ownership and restricted stock unit), disability, death benefit, life insurance, fringe benefits, indemnification, retention or stay-bonus, transaction or change-in control agreement, or other compensation or benefits, whether written, unwritten or otherwise, that is sponsored, maintained, contributed to or required to be contributed to by the Company or its ERISA Affiliates for the benefit of any current or former employee, director or officer or individual contractor of the Company and its Subsidiaries, in each case other than any statutory benefit plan mandated by Law;

“Business Combination” has the meaning given in the SPAC Charter;

“Business Data” means confidential or proprietary data, databases, data compilations and data collections (including customer databases, Training Data and Third-Party Data), and technical, business and other information and data, including Personal Data collected, used, stored, shared, distributed, transferred, disclosed, destroyed, disposed of or otherwise Processed by or on behalf of the Company or any of its Subsidiaries;

“Business Day” means a day on which commercial banks are open for business in New York, U.S., the Cayman Islands and the PRC, except a Saturday, Sunday or public holiday (gazetted or ungazetted and whether scheduled or unscheduled);

“Co-Founder Shares” means all of the Company Shares held by Mr. Ziyu Shen and 20,520,820 Company Shares held by Mr. Shufu Li immediately prior to the Re-designation;

“Code” means the United States Internal Revenue Code of 1986, as amended;

“Company Acquisition Proposal” means (a) any, direct or indirect, acquisition by any third party, in one transaction or a series of transactions, of the Company or of more than 20% of the consolidated total assets, Equity Securities or businesses of the Company and its Controlled Affiliates taken as a whole (whether by merger, consolidation, scheme of arrangement, business combination, reorganization, recapitalization, purchase or issuance of Equity Securities, purchase of assets, tender offer or otherwise) other than the Transactions; (b) any direct or indirect acquisition by any third party, in one transaction or a series of transactions, of voting Equity Securities representing more than 20%, by voting power, of (x) the Company (whether by merger, consolidation, recapitalization, purchase or issuance of Equity Securities, tender offer or otherwise) or (y) the Company’s Controlled Affiliates which comprise more than 20% of the consolidated total assets, revenues or earning power of the Company and its Controlled Affiliates taken as a whole other than the Transactions, (c) any direct or indirect acquisition by any third party, in one transaction or a series of transactions, of more than 20% of the consolidated total assets, revenues or earning power of the Company and its Controlled Affiliates taken as a whole, other than by SPAC or its Affiliates or pursuant to the Transactions or (d) the issuance by the Company of more than 20% of its voting Equity Securities as consideration for the assets or securities of a third party (whether an entity, business or otherwise), except in any such case as permitted under Section 5.1(c) or Section 5.1(d);

| 5 |

“Company Charter” means the Sixth Amended and Restated Memorandum and Articles of Association of the Company, adopted pursuant to a special resolution passed on December 27, 2021;

“Company Class A Ordinary Shares” means class A ordinary shares of the Company, par value $0.000005 per share, as further described in the A&R Company Charter;

“Company Class B Ordinary Shares” means class B ordinary shares of the Company, par value $$0.000005 per share, as further described in the A&R Company Charter;

“Company Contract” means any Contract to which a Group Company is a party or by which a Group Company is bound and for which performance of substantive obligations is ongoing;

“Company IP” means, collectively: (a) all Owned IP and (b) all other Intellectual Property that has been licensed to the Group Companies under a valid and enforceable written agreement, or any valid and enforceable written agreement under which the Company is the beneficiary of a covenant not to sue, or any other agreement not to assert claims involving Intellectual Property (or any rights therein) or that is otherwise used in, held for use in, or necessary to the Company’s conduct of its business.

| 6 |

“Company Material Adverse Effect” means any Event that has had, or would reasonably be expected to have, individually or in the aggregate, a material adverse effect on (i) the business, assets and liabilities, results of operations or financial condition of the Company and its Subsidiaries, taken as a whole or (ii) the ability of the Company, any of its Subsidiaries or either Merger Sub to consummate the Transactions; provided, however, that in no event would any of the following, alone or in combination, be deemed to constitute, or be taken into account in determining whether there has been or will be, a “Company Material Adverse Effect”: (a) any change in applicable Laws or GAAP or any interpretation thereof following the date of this Agreement, (b) any change in interest rates or economic, political, business or financial market conditions generally, (c) the taking or refraining from taking of any action required to be taken or refrained from being taken under this Agreement, (d) any natural disaster (including hurricanes, storms, tornados, flooding, earthquakes, volcanic eruptions or similar occurrences), epidemic or pandemic (including any COVID-19 Measures or any change in such COVID-19 Measures or interpretations following the date of this Agreement), acts of nature or change in climate, (e) any acts of terrorism or war, the outbreak or escalation of hostilities, geopolitical conditions, local, national or international political conditions, riots or insurrections, (f) any failure in and of itself of the Company and any of its Subsidiaries to meet any projections or forecasts, provided, however, that the exception in this clause (f) shall not prevent or otherwise affect a determination that any change, effect or development underlying such change has resulted in or contributed to a Company Material Adverse Effect, (g) any Events generally applicable to the industries or markets in which the Company or any of its Subsidiaries operate, (h) any action taken by, or at the written request of, SPAC, (i) the announcement of this Agreement and consummation of the Transactions, including any termination of, reduction in or similar adverse impact (but in each case only to the extent attributable to the announcement of this Agreement or consummation of the Transactions) on the Company’s and its Subsidiaries’ relationships with any customers, suppliers, employees or Governmental Authorities (provided that this clause (i) shall not apply to any representations or warranty to the extent the purpose of such representation or warranty is to address the consequences resulting from this Agreement or the consummation of the Transaction) or (j) any Events that are cured by the Company prior to the Closing; provided, however, that in the case of each of clauses (a), (b), (d), (e) and (g), any such Event to the extent it disproportionately affects the Company or any of its Subsidiaries relative to other similarly situated participants in the industries and geographies in which such Persons operate shall not be excluded from the determination of whether there has been, or would reasonably be expected to be, a Company Material Adverse Effect, but only to the extent of the incremental disproportionate effect on the Company and its Subsidiaries, taken as a whole, relative to such similarly situated participants;

“Company Options” means all outstanding options exercisable to purchase Company Shares pursuant to the ESOP or otherwise, as adjusted to give effect to the Re-designation and Recapitalization;

“Company Ordinary Shares” means, collectively, Company Class A Ordinary Shares and Company Class B Ordinary Shares;

“Company Product” means each of the products and services that have been (i) developed and are scheduled for release within the twelve (12) months after the date hereof or (ii) marketed, distributed, licensed, sold, offered, or otherwise provided or made available, in each case, by any of the Group Companies, including with respect to (i) and (ii) products and services of any of the Group Companies that employ or make use of AI Technologies, including all versions of all of the foregoing.

“Company Shareholder” means any holder of any issued and outstanding Ordinary Shares, Preferred Shares or Company Ordinary Shares, as applicable, as of any determination time prior to the First Effective Time;

“Company Shares” means, collectively, the Ordinary Shares and the Preferred Shares;