Form 425 CBRE Acquisition Holding Filed by: CBRE Acquisition Holdings, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 28, 2021

CBRE ACQUISITION HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-39798 | 85-3448396 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

| 2100 McKinney Avenue Suite 1250 Dallas, Texas |

75201 | |

| (Address of principal executive offices) | (Zip code) |

(214) 979-6100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| SAILSM (Stakeholder Aligned Initial Listing) securities, each consisting of one share of Class A Common Stock, $0.0001 par value, and one-fourth of one redeemable warrant | CBAH.U | New York Stock Exchange | ||

| Class A Common Stock included as part of the SAILSM securities | CBAH | New York Stock Exchange | ||

| Warrants included as part of the SAILSM securities, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.00 | CBAH WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference is the investor presentation to be used by CBRE Acquisition Holdings, Inc., a Delaware corporation (“CBAH”) in making presentations to certain analysts and existing and potential stockholders of CBAH on September 28, 2021. Such exhibit and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Additional Information

In connection with the Proposed Transaction (as defined below), CBAH filed with the Securities and Exchange Commission (the “SEC”) on August 11, 2021 and amended on September 23, 2021 a registration statement on Form S-4 (the “Registration Statement”) that includes a proxy statement for the stockholders of CBAH that also constitutes a prospectus with respect to the shares of CBAH common stock to be offered and sold to the stockholders of Altus Power, Inc., a Delaware corporation (“Altus Power”). CBAH urges investors, stockholders and other interested persons to read, when available, the preliminary proxy statement/prospectus as well as other documents filed with the SEC because these documents will contain important information about CBAH, Altus Power and the Proposed Transactions. After the Registration Statement is declared effective, the definitive proxy statement/prospectus to be included in the Registration Statement will be mailed to stockholders of CBAH as of a record date to be established for voting on the Proposed Transactions. Stockholders will also be able to obtain a

copy of the proxy statement/prospectus, without charge by directing a request to: CBRE Acquisition Holdings, Inc., 2100 McKinney Avenue, Suite 1250, Dallas, TX 75201. The preliminary and definitive proxy statement/prospectus to be included in the Registration Statement, once available, can also be obtained, without charge, at the SEC’s website (www.sec.gov).

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the planned business combination between Altus Power and CBAH (the “Business Combination”) and the other transactions contemplated by the business combination agreement entered into by Altus Power and CBAH (the “Business Combination Agreement”) and shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Participants in the Solicitation

CBAH, Altus Power and certain of their respective directors and officers may be deemed participants in the solicitation of proxies of CBAH’s stockholders with respect to the approval of the Business Combination. CBAH and Altus Power urge investors, stockholders and other interested persons to read the Registration Statement, including the preliminary proxy statement/prospectus and amendments thereto and the definitive proxy statement/prospectus and exhibits thereto, as well as other documents filed with the SEC in connection with the Business Combination, as these materials will contain important information about Altus Power, CBAH and the Business Combination. Information regarding CBAH’s directors and officers and a description of their interests in CBAH is contained in the Registration Statement.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “could”, “continue”, “expect”, “estimate”, “may”, “plan”, “outlook”, “future” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements, which involve risks and uncertainties, relate to the use of proceeds for the new credit facility and analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable and may also relate to CBAH’s and Altus Power’s future prospects, developments and business strategies. In particular, such forward-looking statements include statements concerning the timing of the Business Combination, the business plans, objectives, expectations and intentions of CBAH once the Business Combination and the other transactions contemplated thereby (the “Proposed Transactions”) and change of name are complete (“New Altus”), and New Altus’s estimated and future results of operations, business strategies, competitive position, industry environment and potential growth opportunities. These statements are based on CBAH’s or Altus Power’s management’s current expectations and beliefs, as well as a number of assumptions concerning future events.

Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside CBAH’s or Altus Power’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement; (2) the inability to complete the Proposed Transactions due to the failure to obtain approval of the stockholders of CBAH or Altus Power or other conditions to closing in the Business Combination Agreement; (3) the ability of New Altus to meet NYSE’s listing standards (or the standards of any other securities exchange on which securities of the public entity are listed) following the Business Combination; (4) the inability to complete the private placement of common stock of CBAH to certain institutional accredited investors; (5) the risk that the announcement and consummation of the Proposed Transactions disrupts Altus Power’s current plans and operations; (6) the ability to recognize the

anticipated benefits of the Proposed Transactions, which may be affected by, among other things, competition, the ability of New Altus to grow and manage growth profitably, maintain relationships with customers, business partners, suppliers and agents and retain its management and key employees; (7) costs related to the Proposed Transactions; (8) changes in applicable laws or regulations and delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals required to complete the Proposed Transactions; (9) the possibility that Altus Power and New Altus may be adversely affected by other economic, business, regulatory and/or competitive factors; (10) the impact of COVID-19 on Altus Power’s and New Altus’s business and/or the ability of the parties to complete the Proposed Transactions; (11) the outcome of any legal proceedings that may be instituted against CBAH, Altus Power, New Altus or any of their respective directors or officers, following the announcement of the Proposed Transactions; and (12) the failure to realize anticipated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions and purchase price and other adjustments.

Additional factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements can be found in the Registration Statement and CBAH’s proxy statement/prospectus when available. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. You are cautioned not to place undue reliance upon any forward-looking statements,

which speak only as of the date made, and CBAH and Altus Power undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, changes in expectations, future events or otherwise.

This communication is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in CBAH and is not intended to form the basis of an investment decision in CBAH. All subsequent written and oral forward-looking statements concerning CBAH and Altus Power, the Proposed Transactions or other matters and attributable to CBAH and Altus Power or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

Non-GAAP Financial Measure and Related Information

The exhibit to this Current Report on Form 8-K references EBITDA and EBITDA margin, which are financial measures that are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures do not have a standardized meaning, and the definition of EBITDA used by Altus Power may be different from other, similarly named non-GAAP measures used by others. In addition, such financial information is unaudited and does not conform to SEC Regulation S-X and as a result such information may be presented differently in future filings by Altus Power with the SEC.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Exhibit | |

| 99.1 | Investor Presentation, dated September 28, 2021. | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: September 28, 2021

| CBRE ACQUISITION HOLDINGS, INC. | ||

| By: | /s/ Cash J. Smith | |

| Name: | Cash J. Smith | |

| Title: | Chief Financial Officer | |

Analyst Day Presentation Leading the Clean Energy Transition September 2021 World-Class Sponsorship Shoppers World 1.7 MW Solar System New Marlborough 2.0 MWh Storage System Exhibit 99.1

Disclaimer DISCLAIMER AND FORWARD LOOKING STATEMENTS This presentation (this "Presentation") is being delivered to you by CBRE Acquisition Holdings, Inc. (“CBAH”) and Altus Power, Inc. (“Altus Power”) for use by CBAH and Altus Power in connection with their proposed business combination (the "Transaction"). This Presentation was prepared for informational purposes only. This Presentation is for strategic discussion purposes only and does not constitute an offer to purchase nor a solicitation of an offer to sell shares of CBAH or any successor entity, nor does it constitute the solicitation of an offer to buy any securities, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed business combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdictions. This Presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. No representation, express or implied, is or will be given by CBAH or Altus Power or any of their respective affiliates and advisors as to the accuracy or completeness of the information contained herein, or any other written or oral information made available in the course of an evaluation of the Transaction. No Representations and Warranties This Presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. The recipient agrees and acknowledges that this Presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. No representation or warranty, express or implied, is or will be given by CBAH or Altus Power or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this Presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of the Transaction and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The recipient also acknowledges and agrees that the information contained in this Presentation is preliminary in nature and is subject to change, and any such changes may be material. CBAH and Altus Power disclaim any duty to update the information contained in this Presentation. Forward-Looking Statements This Presentation may contain certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding Altus Power's and it's management teams' expectations, hopes, beliefs, intentions or strategies regarding the future. The words "anticipate", "believe", "budget", "continue", "could", "estimate", "expect", "forecast", "intends", "may", "might", "plan", "possible", "potential", "predict", "project", "should", "will", "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are based on CBAH's and Altus Power's current expectations and beliefs concerning future developments and their potential effects on CBAH or Altus Power or any successor entity. There can be no assurance that the future developments affecting CBAH or Altus Power or any successor entity will be those that they have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond CBAH's and Altus Power's control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Trademarks All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong to their respective owners and CBAH's and Altus Power's uses thereof do not imply an affiliation with, or endorsement by the owners of such trademarks, copyrights, logos and other intellectual property. Solely for convenience, trademarks and trade names referred to in this Presentation may appear with the ® or ™ symbols, but such references are not intended to indicate, in any way, that such names and logos are trademarks or registered trademarks of CBAH or Altus Power. Industry and Market Data In this Presentation, CBAH and Altus Power rely on and refer to publicly available information and statistics regarding market participants in the sectors in which Altus Power competes and other industry data. Any comparison of Altus Power to the industry or to any of its competitors is based on this publicly available information and statistics and such comparisons assume the reliability of the information available to CBAH and Altus Power. CBAH and Altus Power obtained this information and these statistics from third-party sources, including reports by market research firms and company filings. While CBAH and Altus Power believe such third-party information is reliable, there can be no assurances as to the accuracy or completeness of the indicated information. Neither CBAH nor Altus Power has independently verified the information provided by the third party sources. Accordingly, none of CBAH nor Altus Power nor any of their respective affiliates or advisors makes any representations as to the accuracy or completeness of these data.

Disclaimer Financial Information The financial information contained in this Presentation has been taken from or prepared based on the historical financial statements of Altus Power for the periods presented. This Presentation includes non-GAAP financial measures. Altus Power believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Altus Power's financial condition and results of operations. Altus Power's management uses certain of these non-GAAP measures to compare Altus Power's performance to that of prior periods for trend analyses and for budgeting and planning purposes. These non-GAAP measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Altus Power also believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Altus Power. Other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, Altus Power's non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Use of Projections This Presentation also contains certain financial forecasts. Neither CBAH’s nor Altus Power's independent auditors have studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, have not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. In this Presentation, certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of CBAH's and Altus Power's control. While all financial projections, estimates and targets are necessarily speculative, CBAH and Altus Power believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. Accordingly, there can be no assurance that the prospective results are indicative of future performance of the combined company after the Transaction or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Participation in Solicitation CBAH and Altus Power and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of CBAH’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination in CBAH's filings with the SEC, including CBAH’s registration statement on Form S-1, which was originally filed with the SEC on December 7, 2020, its registration statement on Form S-4, which was originally filed with the SEC on August 11, 2021, and its most recent annual report on Form 10-K. Investors and security holders of CBAH and Altus Power are urged to read the proxy statement/prospectus and other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed business combination. Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about CBAH and Altus Power through the website maintained by the SEC at www.sec.gov.

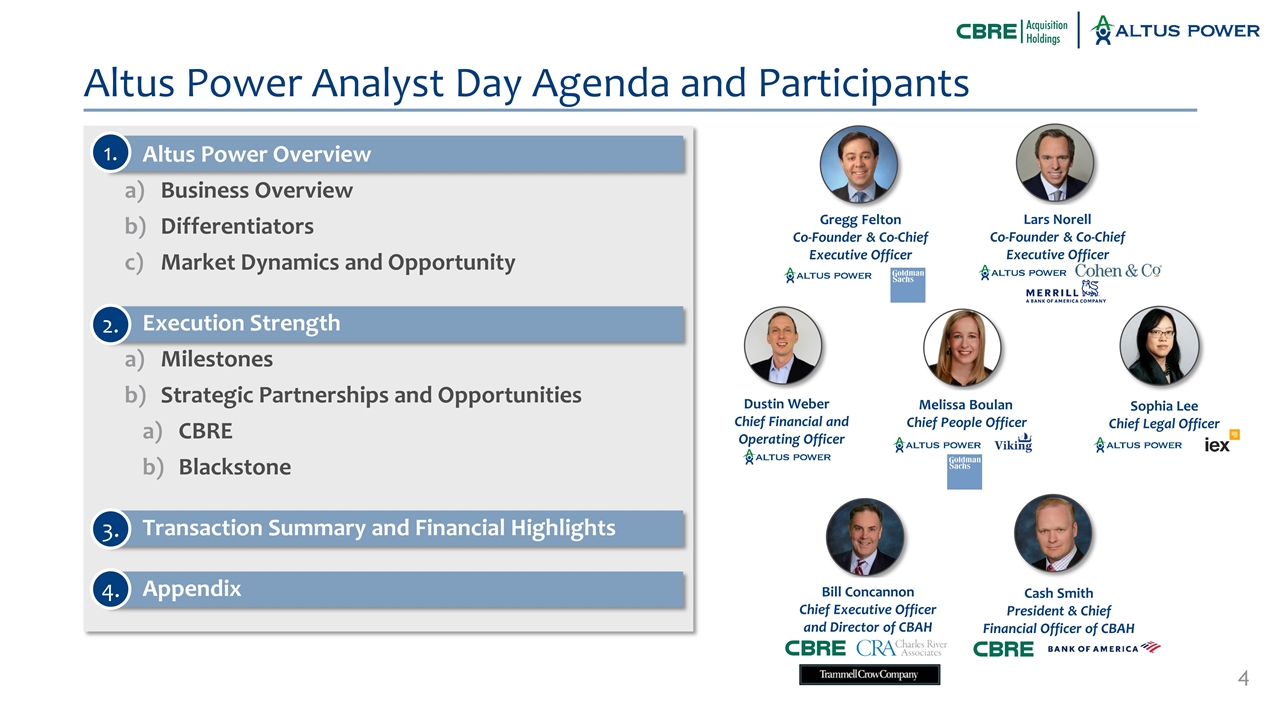

Altus Power Analyst Day Agenda and Participants Gregg Felton Co-Founder & Co-Chief Executive Officer Lars Norell Co-Founder & Co-Chief Executive Officer Bill Concannon Chief Executive Officer and Director of CBAH Cash Smith President & Chief Financial Officer of CBAH Dustin Weber Chief Financial and Operating Officer Melissa Boulan Chief People Officer Sophia Lee Chief Legal Officer Altus Power Overview Business Overview Differentiators Market Dynamics and Opportunity Execution Strength Milestones Strategic Partnerships and Opportunities CBRE Blackstone Transaction Summary and Financial Highlights Appendix 1. 2. 3. 4.

Altus Power Overview

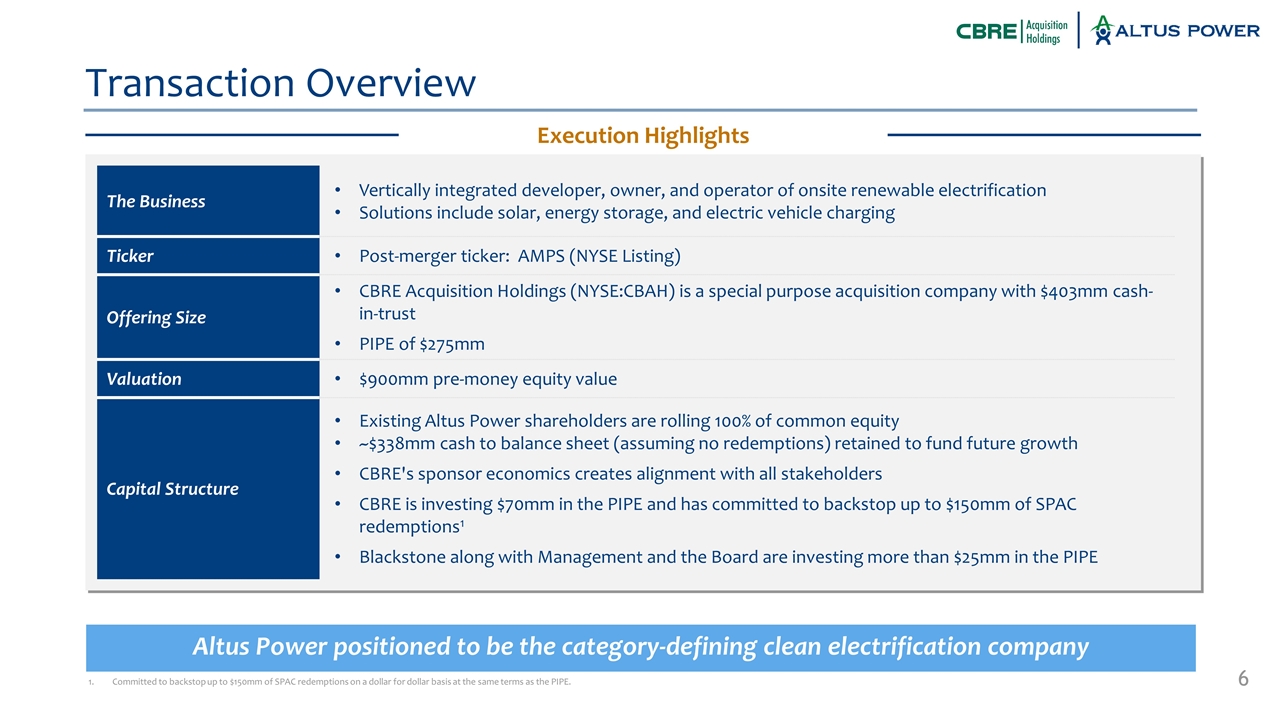

The Business Vertically integrated developer, owner, and operator of onsite renewable electrification Solutions include solar, energy storage, and electric vehicle charging Ticker Post-merger ticker: AMPS (NYSE Listing) Offering Size CBRE Acquisition Holdings (NYSE:CBAH) is a special purpose acquisition company with $403mm cash-in-trust PIPE of $275mm Valuation $900mm pre-money equity value Capital Structure Existing Altus Power shareholders are rolling 100% of common equity ~$338mm cash to balance sheet (assuming no redemptions) retained to fund future growth CBRE's sponsor economics creates alignment with all stakeholders CBRE is investing $70mm in the PIPE and has committed to backstop up to $150mm of SPAC redemptions1 Blackstone along with Management and the Board are investing more than $25mm in the PIPE Transaction Overview Execution Highlights Altus Power positioned to be the category-defining clean electrification company Committed to backstop up to $150mm of SPAC redemptions on a dollar for dollar basis at the same terms as the PIPE.

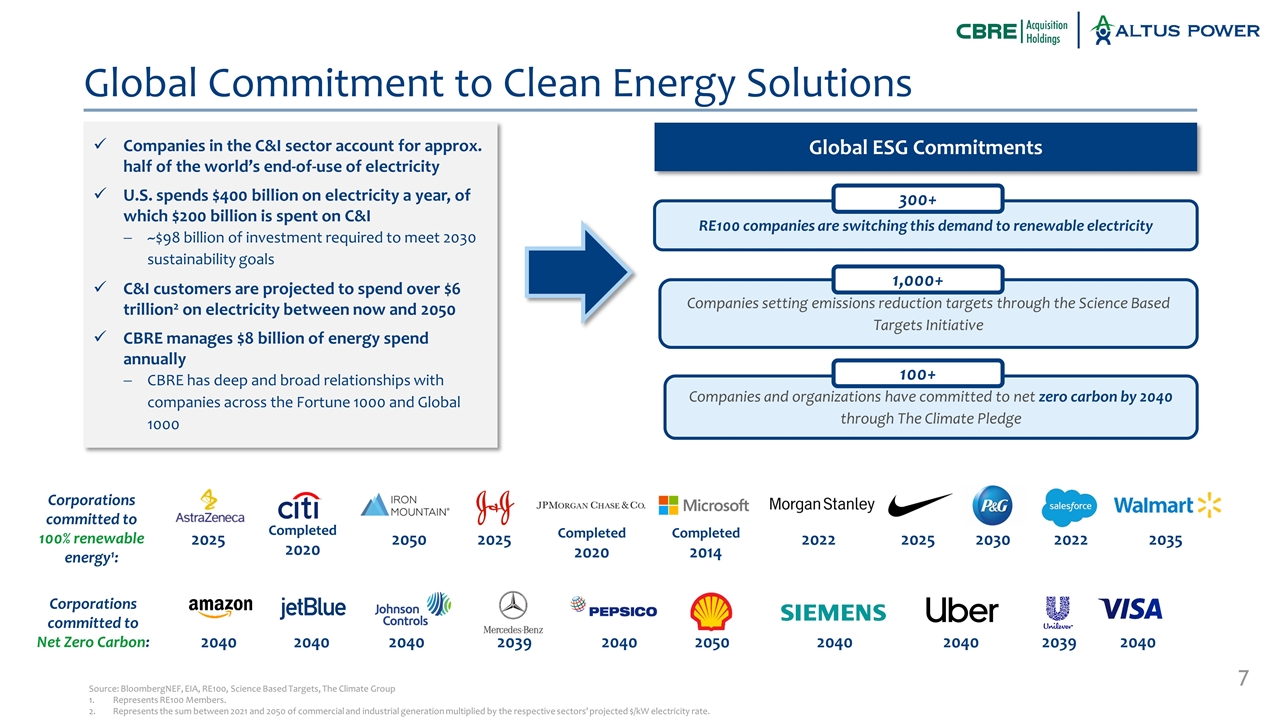

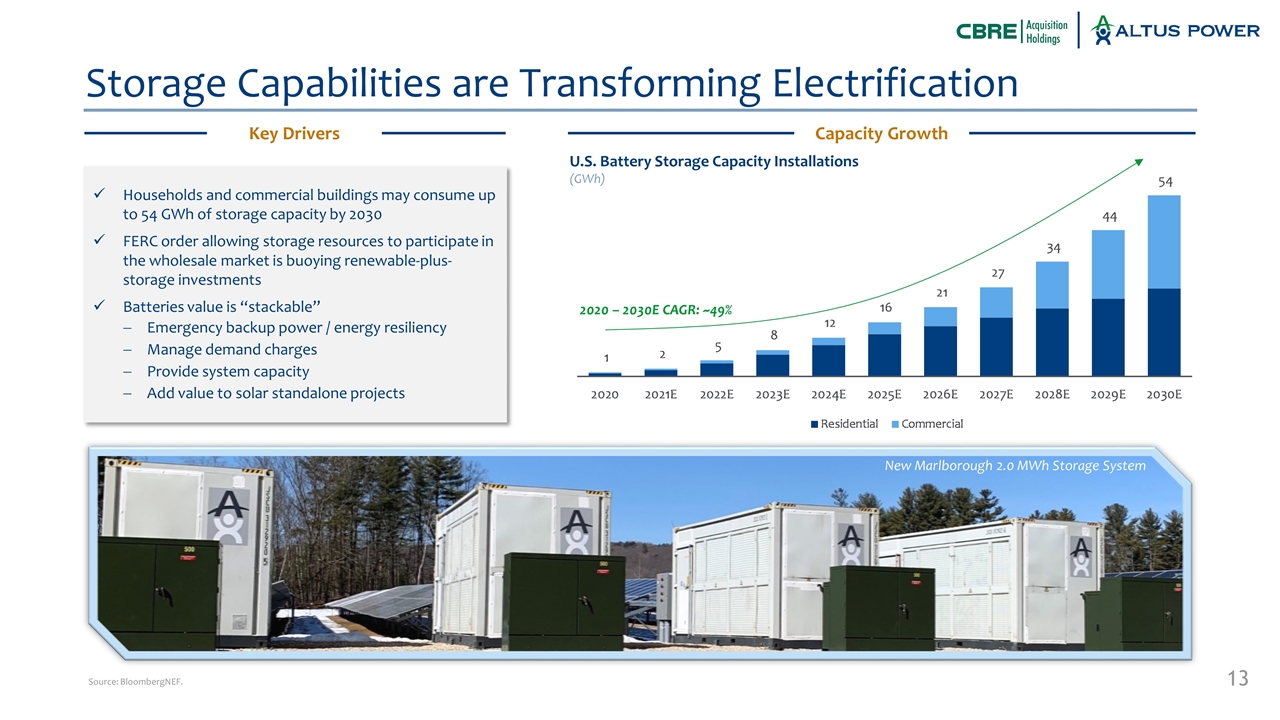

Companies in the C&I sector account for approx. half of the world’s end-of-use of electricity U.S. spends $400 billion on electricity a year, of which $200 billion is spent on C&I ~$98 billion of investment required to meet 2030 sustainability goals C&I customers are projected to spend over $6 trillion2 on electricity between now and 2050 CBRE manages $8 billion of energy spend annually CBRE has deep and broad relationships with companies across the Fortune 1000 and Global 1000 Global Commitment to Clean Energy Solutions Companies and organizations have committed to net zero carbon by 2040 through The Climate Pledge 100+ RE100 companies are switching this demand to renewable electricity 2025 2025 2025 2035 Completed 2014 Completed 2020 2022 2050 2030 2022 Completed 2020 Companies setting emissions reduction targets through the Science Based Targets Initiative 2040 2040 2040 2039 2040 2050 2040 2040 2039 2040 Massive future growth expected in corporate demand for renewable energy Growth in companies committing to 100% renewable energy Only 5% of C&I solar market is penetrated U.S. cumulative installed C&I solar capacity expected to grow ~290% to 48 GW by 2030 Technology improvements expected to enable solar to capture 65% of the total corporate renewable market through 2030 CBRE has deep and broad relationships with companies across the Fortune 1000 and Global 1000 Households and commercial buildings may consume up to 54 GWh of storage capacity by 2030 FERC order allowing storage resources to participate in the wholesale market is buoying renewable-plus-storage investments Batteries value is “stackable” Emergency backup power / energy resiliency Manage demand charges Provide system capacity Add value to solar standalone projects Corporations committed to 100% renewable energy1: Corporations committed to Net Zero Carbon: 300+ 1,000+ Source: BloombergNEF, EIA, RE100, Science Based Targets, The Climate Group Represents RE100 Members. Represents the sum between 2021 and 2050 of commercial and industrial generation multiplied by the respective sectors’ projected $/kW electricity rate. Global ESG Commitments

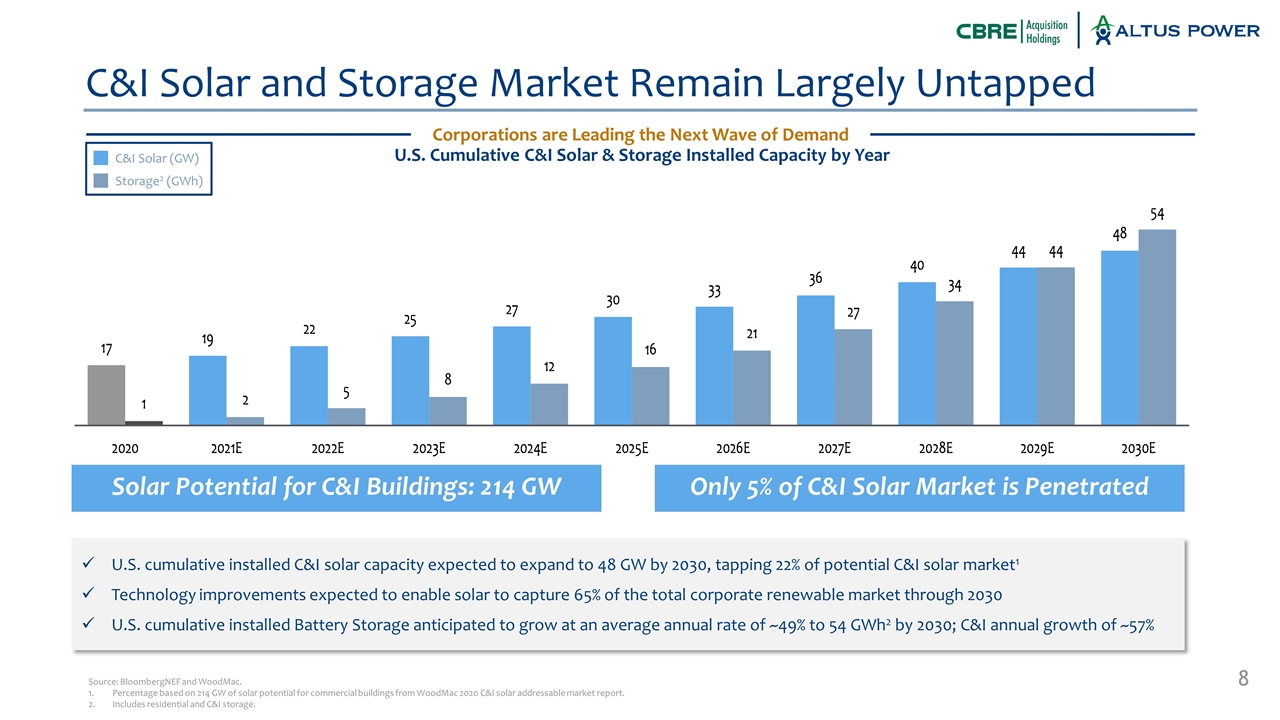

C&I Solar and Storage Market Remain Largely Untapped U.S. cumulative installed C&I solar capacity expected to expand to 48 GW by 2030, tapping 22% of potential C&I solar market1 Technology improvements expected to enable solar to capture 65% of the total corporate renewable market through 2030 U.S. cumulative installed Battery Storage anticipated to grow at an average annual rate of ~49% to 54 GWh2 by 2030; C&I annual growth of ~57% Source: BloombergNEF and WoodMac. Percentage based on 214 GW of solar potential for commercial buildings from WoodMac 2020 C&I solar addressable market report. Includes residential and C&I storage. Corporations are Leading the Next Wave of Demand https://ihsmarkit.com/research-analysis/corporate-us-renewable-procurement-outlook-optimism.html U.S. Cumulative C&I Solar & Storage Installed Capacity by Year Tom’s comparison in WoodMac C&I Solar (GW) Storage2 (GWh) Solar Potential for C&I Buildings: 214 GW Only 5% of C&I Solar Market is Penetrated

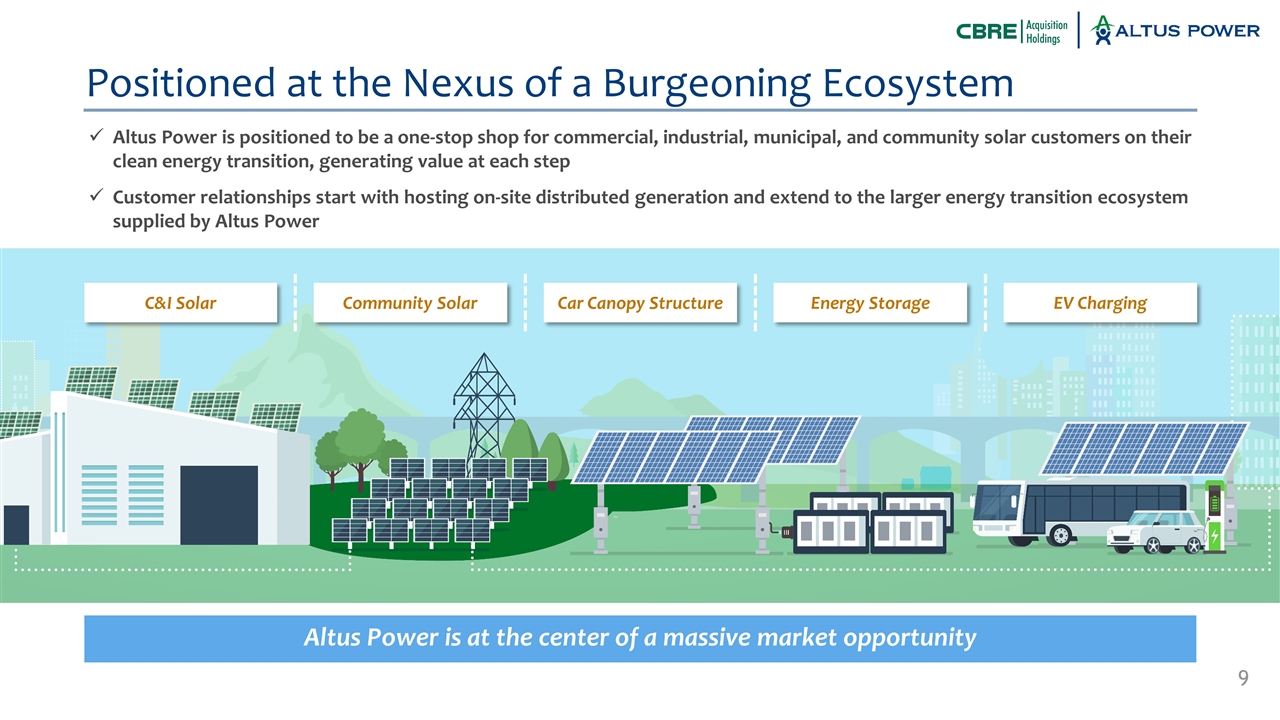

Positioned at the Nexus of a Burgeoning Ecosystem Altus Power is positioned to be a one-stop shop for commercial, industrial, municipal, and community solar customers on their clean energy transition, generating value at each step Customer relationships start with hosting on-site distributed generation and extend to the larger energy transition ecosystem supplied by Altus Power Community Solar EV Charging Energy Storage C&I Solar Car Canopy Structure Altus Power is at the center of a massive market opportunity

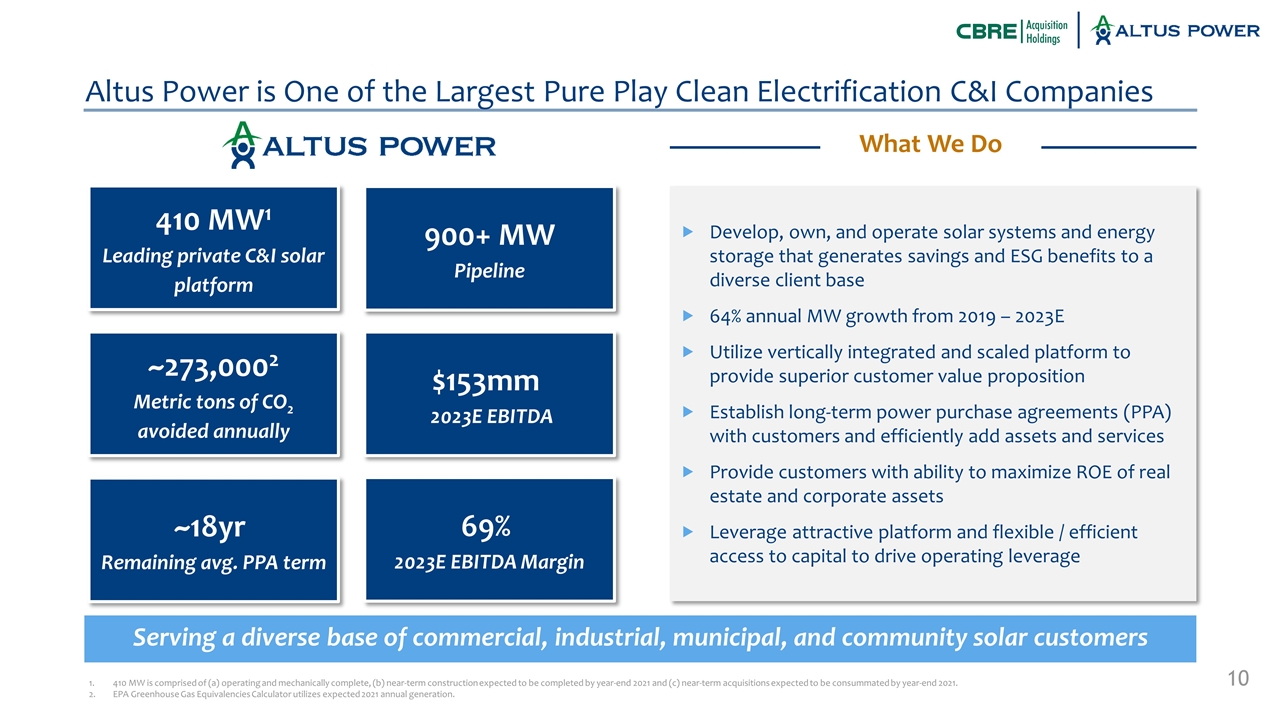

Altus Power is One of the Largest Pure Play Clean Electrification C&I Companies 410 MW is comprised of (a) operating and mechanically complete, (b) near-term construction expected to be completed by year-end 2021 and (c) near-term acquisitions expected to be consummated by year-end 2021. EPA Greenhouse Gas Equivalencies Calculator utilizes expected 2021 annual generation. Develop, own, and operate solar systems and energy storage that generates savings and ESG benefits to a diverse client base 64% annual MW growth from 2019 – 2023E Utilize vertically integrated and scaled platform to provide superior customer value proposition Establish long-term power purchase agreements (PPA) with customers and efficiently add assets and services Provide customers with ability to maximize ROE of real estate and corporate assets Leverage attractive platform and flexible / efficient access to capital to drive operating leverage 410 MW1 Leading private C&I solar platform 900+ MW Pipeline 69% 2023E EBITDA Margin ~273,0002 Metric tons of CO2 avoided annually ~18yr Remaining avg. PPA term $153mm 2023E EBITDA What We Do Serving a diverse base of commercial, industrial, municipal, and community solar customers

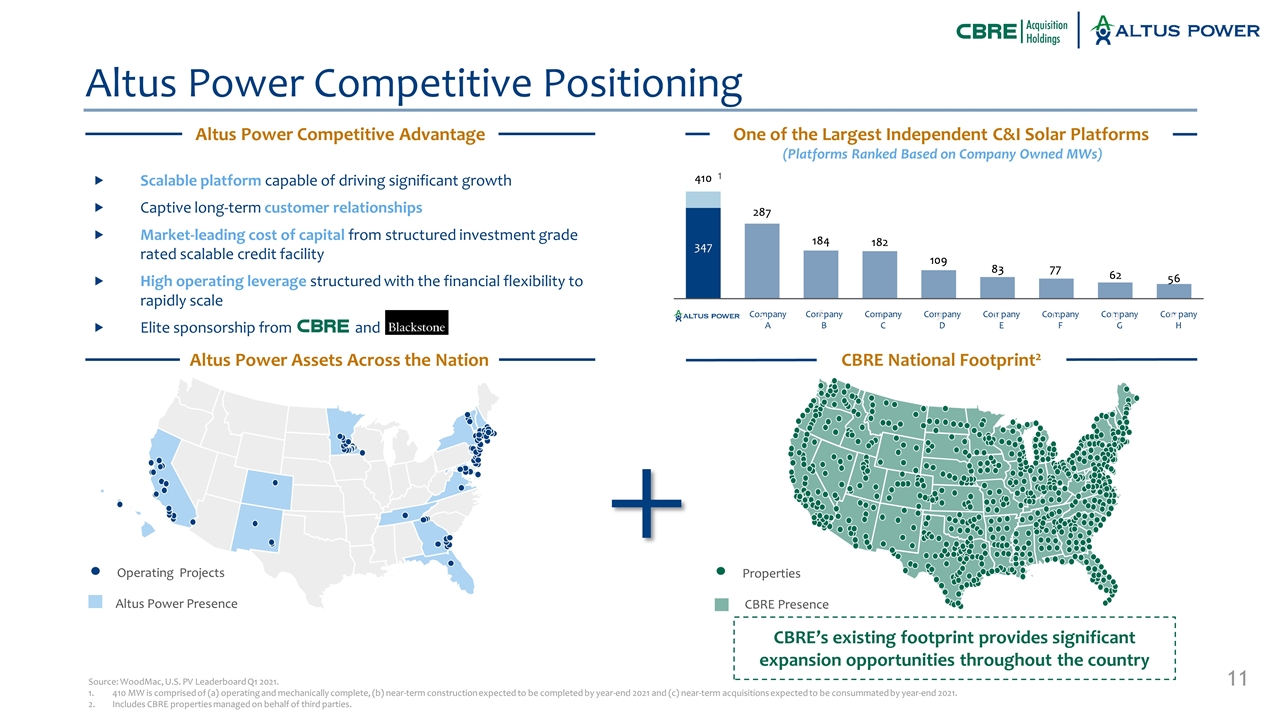

Altus Power Competitive Positioning CBRE National Footprint2 Altus Power Assets Across the Nation Source: WoodMac, U.S. PV Leaderboard Q1 2021. 410 MW is comprised of (a) operating and mechanically complete, (b) near-term construction expected to be completed by year-end 2021 and (c) near-term acquisitions expected to be consummated by year-end 2021. Includes CBRE properties managed on behalf of third parties. Operating Projects Altus Power Presence CBRE’s existing footprint provides significant expansion opportunities throughout the country One of the Largest Independent C&I Solar Platforms (Platforms Ranked Based on Company Owned MWs) 1 Company A Company B Company C Company D Company E Company F Company G Company H Scalable platform capable of driving significant growth Captive long-term customer relationships Market-leading cost of capital from structured investment grade rated scalable credit facility High operating leverage structured with the financial flexibility to rapidly scale Elite sponsorship from and Altus Power Competitive Advantage Properties CBRE Presence

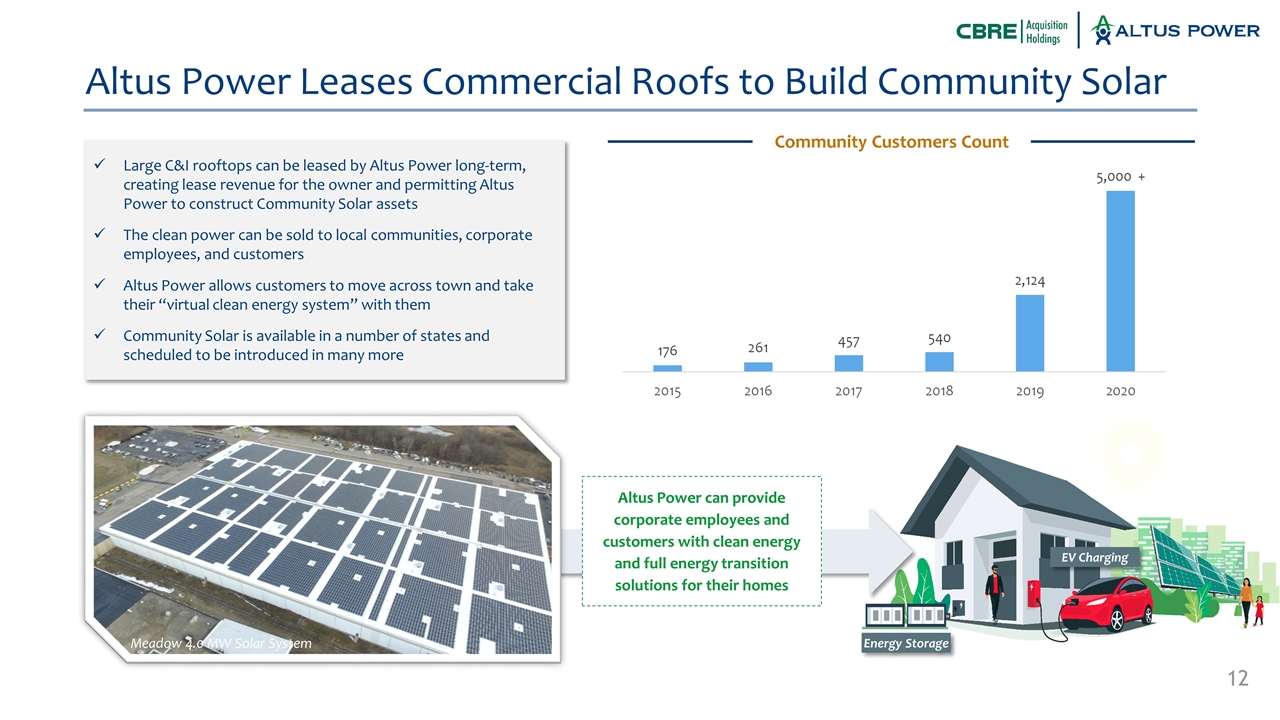

Altus Power Leases Commercial Roofs to Build Community Solar Large C&I rooftops can be leased by Altus Power long-term, creating lease revenue for the owner and permitting Altus Power to construct Community Solar assets The clean power can be sold to local communities, corporate employees, and customers Altus Power allows customers to move across town and take their “virtual clean energy system” with them Community Solar is available in a number of states and scheduled to be introduced in many more Community Customers Count Altus Power can provide corporate employees and customers with clean energy and full energy transition solutions for their homes Energy Storage EV Charging Meadow 4.0 MW Solar System

U.S. Battery Storage Capacity Installations (GWh) Households and commercial buildings may consume up to 54 GWh of storage capacity by 2030 FERC order allowing storage resources to participate in the wholesale market is buoying renewable-plus-storage investments Batteries value is “stackable” Emergency backup power / energy resiliency Manage demand charges Provide system capacity Add value to solar standalone projects Source: BloombergNEF. 2020 – 2030E CAGR: ~49% Key Drivers Capacity Growth Storage Capabilities are Transforming Electrification New Marlborough 2.0 MWh Storage System

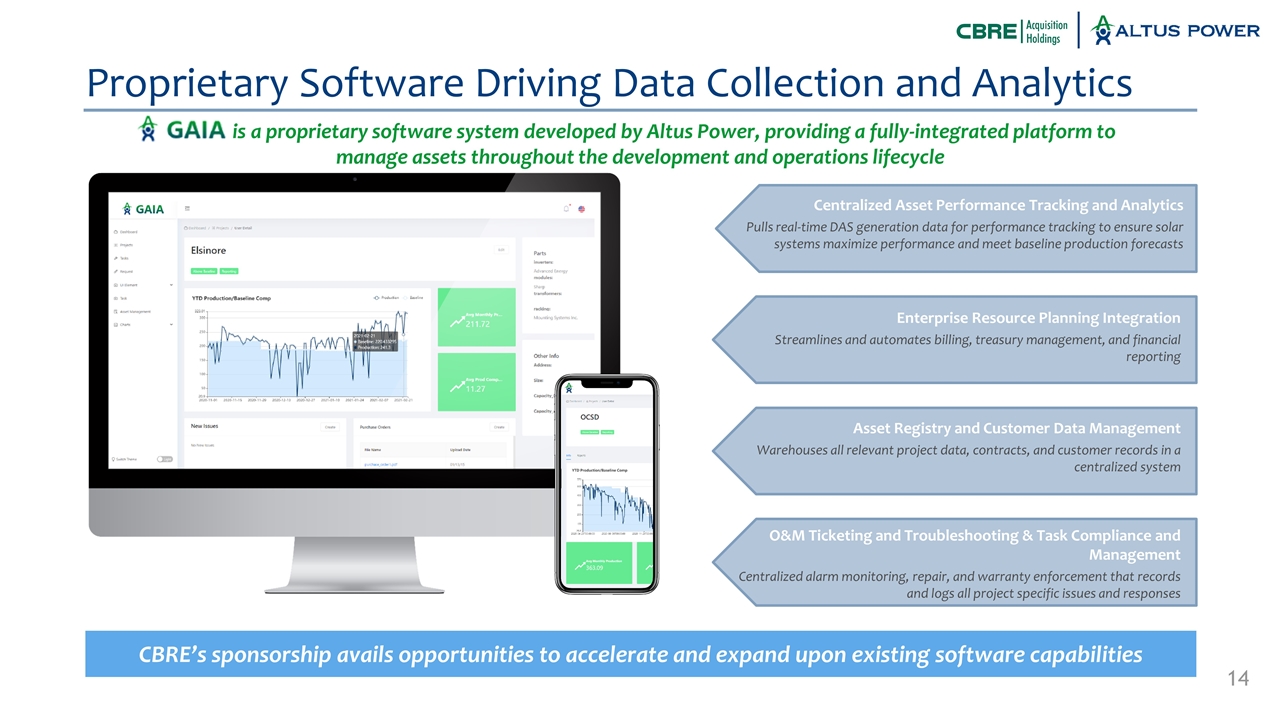

Proprietary Software Driving Data Collection and Analytics is a proprietary software system developed by Altus Power, providing a fully-integrated platform to manage assets throughout the development and operations lifecycle Centralized Asset Performance Tracking and Analytics Pulls real-time DAS generation data for performance tracking to ensure solar systems maximize performance and meet baseline production forecasts Enterprise Resource Planning Integration Streamlines and automates billing, treasury management, and financial reporting Asset Registry and Customer Data Management Warehouses all relevant project data, contracts, and customer records in a centralized system O&M Ticketing and Troubleshooting & Task Compliance and Management Centralized alarm monitoring, repair, and warranty enforcement that records and logs all project specific issues and responses CBRE’s sponsorship avails opportunities to accelerate and expand upon existing software capabilities

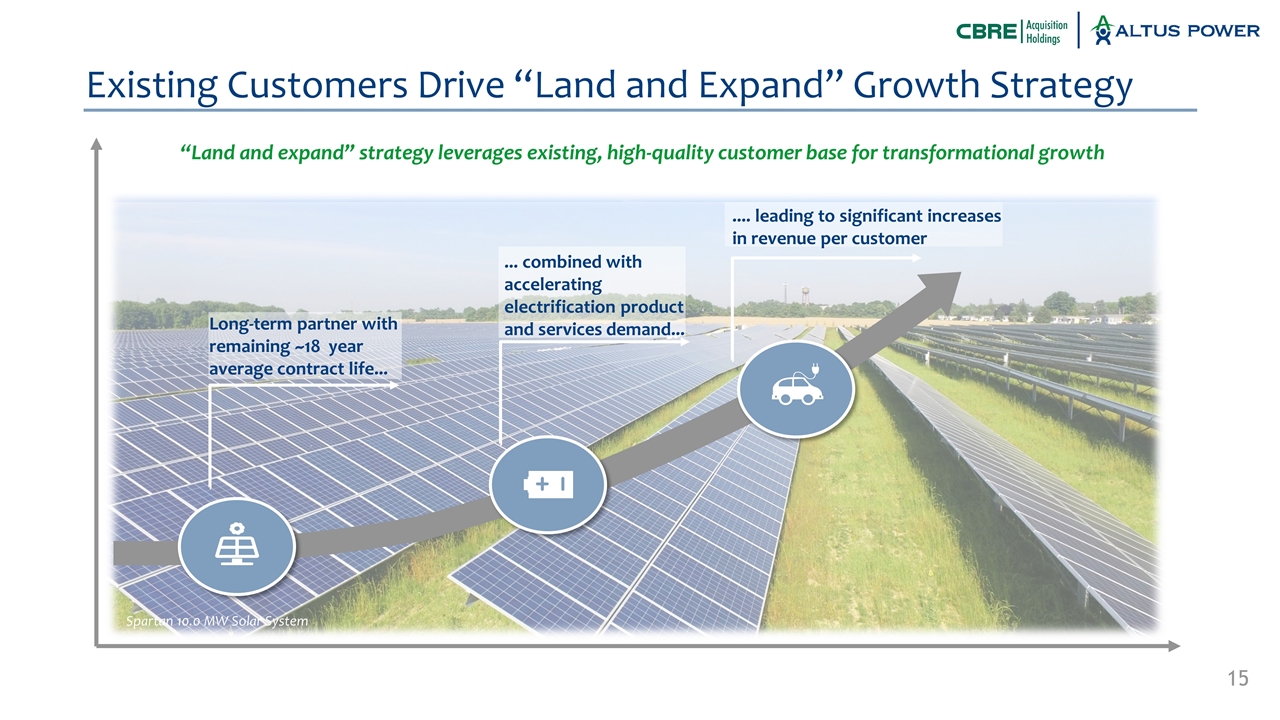

Existing Customers Drive “Land and Expand” Growth Strategy “Land and expand” strategy leverages existing, high-quality customer base for transformational growth Long-term partner with remaining ~18 year average contract life... ... combined with accelerating electrification product and services demand... .... leading to significant increases in revenue per customer Spartan 10.0 MW Solar System

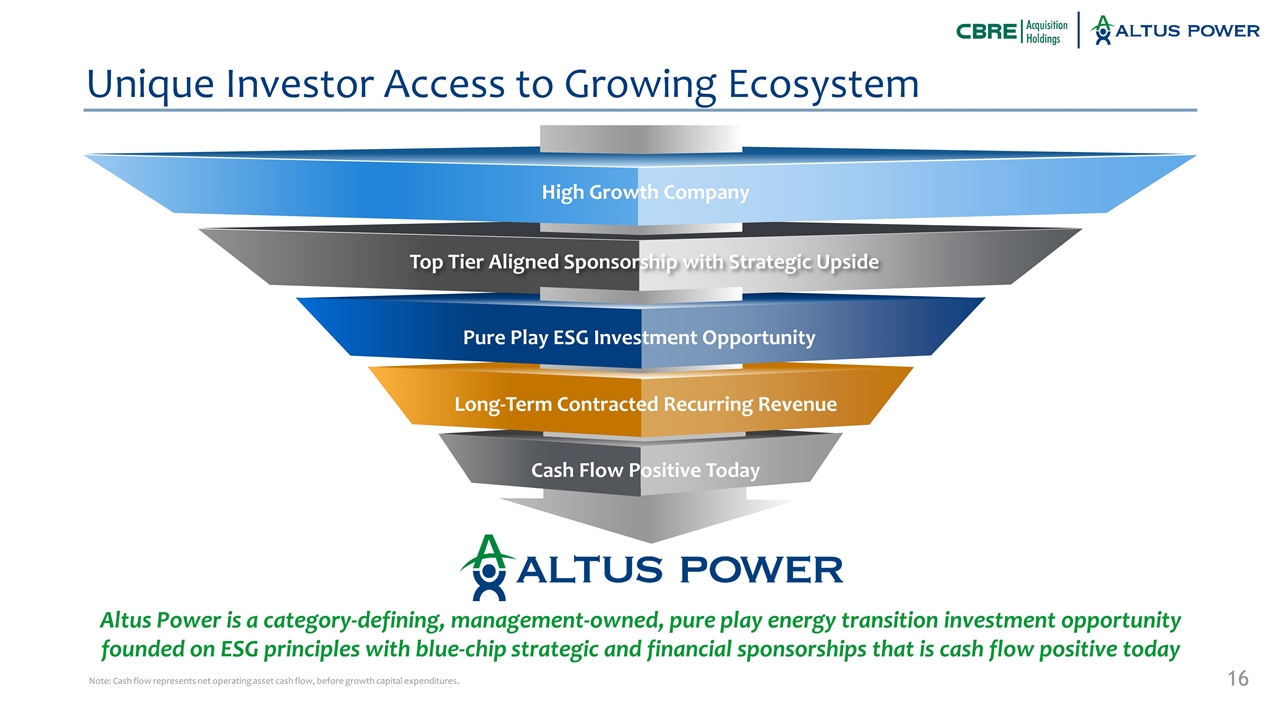

Unique Investor Access to Growing Ecosystem High Growth Company Top Tier Aligned Sponsorship with Strategic Upside Cash Flow Positive Today Pure Play ESG Investment Opportunity Long-Term Contracted Recurring Revenue Altus Power is a category-defining, management-owned, pure play energy transition investment opportunity founded on ESG principles with blue-chip strategic and financial sponsorships that is cash flow positive today Note: Cash flow represents net operating asset cash flow, before growth capital expenditures.

Execution Strength

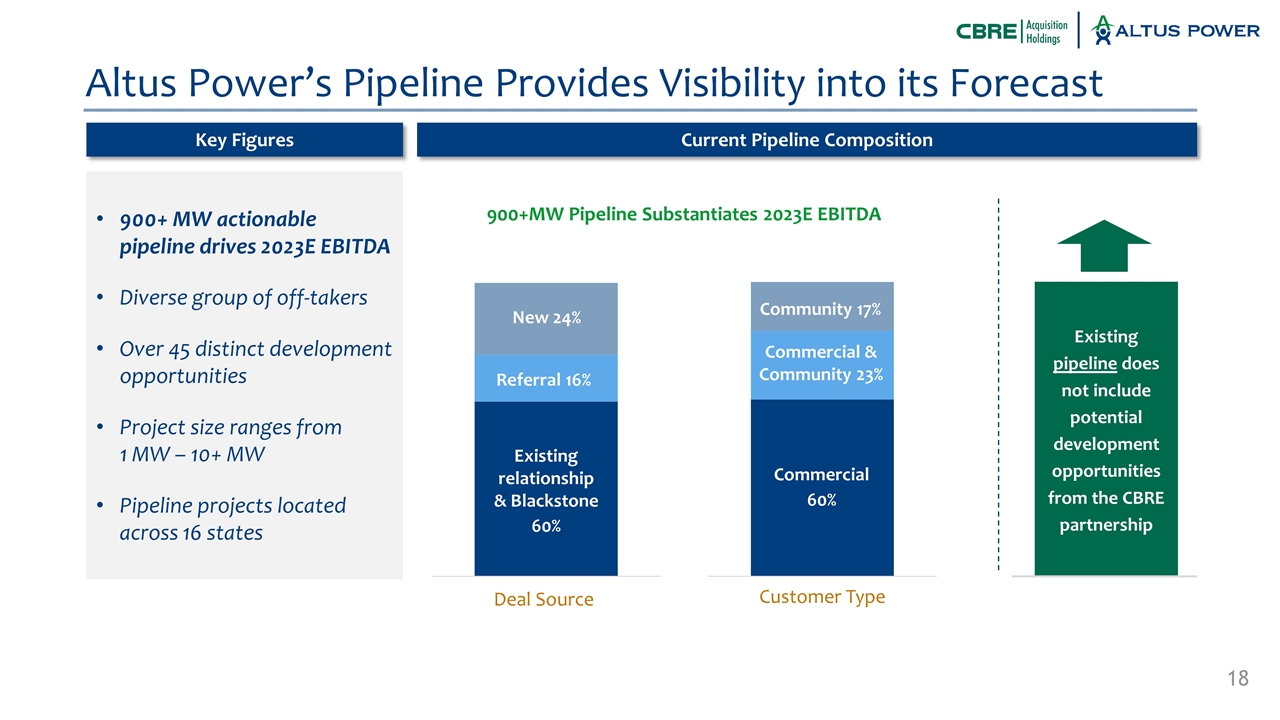

Altus Power’s Pipeline Provides Visibility into its Forecast 900+ MW actionable pipeline drives 2023E EBITDA Diverse group of off-takers Over 45 distinct development opportunities Project size ranges from 1 MW – 10+ MW Pipeline projects located across 16 states Current Pipeline Composition Key Figures Deal Source Existing relationship & Blackstone 60% Referral 16% New 24% Customer Type Commercial 60% Commercial & Community 23% Community 17% 900+MW Pipeline Substantiates 2023E EBITDA Existing pipeline does not include potential development opportunities from the CBRE partnership

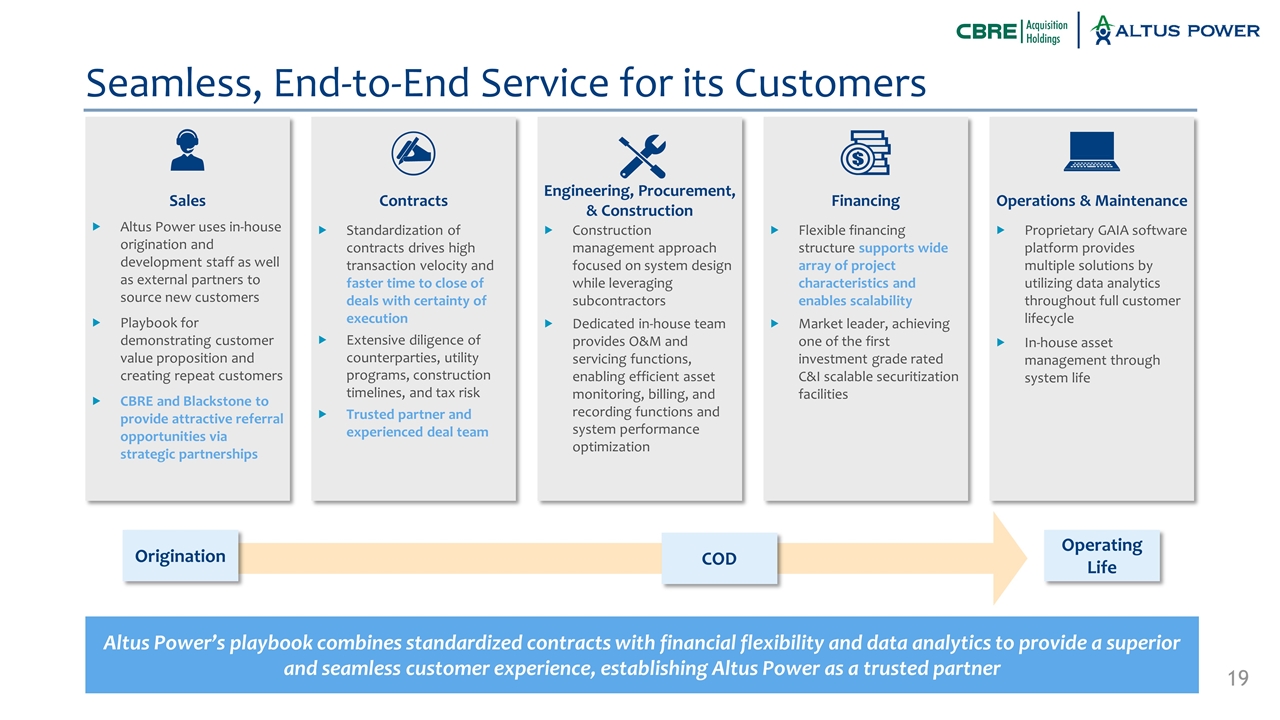

Seamless, End-to-End Service for its Customers Altus Power’s playbook combines standardized contracts with financial flexibility and data analytics to provide a superior and seamless customer experience, establishing Altus Power as a trusted partner Altus Power uses in-house origination and development staff as well as external partners to source new customers Playbook for demonstrating customer value proposition and creating repeat customers CBRE and Blackstone to provide attractive referral opportunities via strategic partnerships Origination Standardization of contracts drives high transaction velocity and faster time to close of deals with certainty of execution Extensive diligence of counterparties, utility programs, construction timelines, and tax risk Trusted partner and experienced deal team Construction management approach focused on system design while leveraging subcontractors Dedicated in-house team provides O&M and servicing functions, enabling efficient asset monitoring, billing, and recording functions and system performance optimization Flexible financing structure supports wide array of project characteristics and enables scalability Market leader, achieving one of the first investment grade rated C&I scalable securitization facilities Proprietary GAIA software platform provides multiple solutions by utilizing data analytics throughout full customer lifecycle In-house asset management through system life COD Operating Life Sales Contracts Financing Operations & Maintenance Engineering, Procurement, & Construction

Continued Execution Since Deal Announcement Altus Power, Inc. Acquires 79 MW Of Operating Solar Power Generation Assets And Expands Into 17th State, TN Market-leading clean electrification company acquires portfolio from private equity funds managed by True Green Capital Management. Altus Power, Inc. Upsizes Blackstone Senior Funding Facility to $503 million Altus Power upsize reduces cost of capital while extending the facility’s term, supporting growing portfolio of C&I solar projects. https://patch.com/connecticut/stamford/altus-power-opens-new-office-harbor-point https://altuspower.com/altus-power-inc-a-market-leading-clean-electrification-company-acquires-79-mw-of-operating-solar-power-generation-assets/ https://altuspower.com/altus-power-inc-a-market-leading-clean-electrification-company-upsizes-senior-funding-facility-to-503-million-and-reduces-cost-of-capital-supporting-growing-portfolio-of-commercial-and-industria/ Altus Power, Inc. Closes First Sale Leaseback Financing Structure With a $42 million Fifth Third Facility Altus Power, Inc. Signs Lease For New Headquarters in Stamford, CT Altus Power announces the opening of their new 33,000 square foot office with Building and Land Technology to accommodate growth and expansion. Continued Asset Growth & Geographic Expansion ~30% Diversity of Financing Alternatives Upsizing & Extension of Existing Financing Facilities TN Growth of Company Footprint #17 Installed MW Growth Source: Altus Power Press Release. Source: Altus Power Press Release. Altus Power Headquarters Stamford, CT On Track to Meet 2021 EBITDA Target

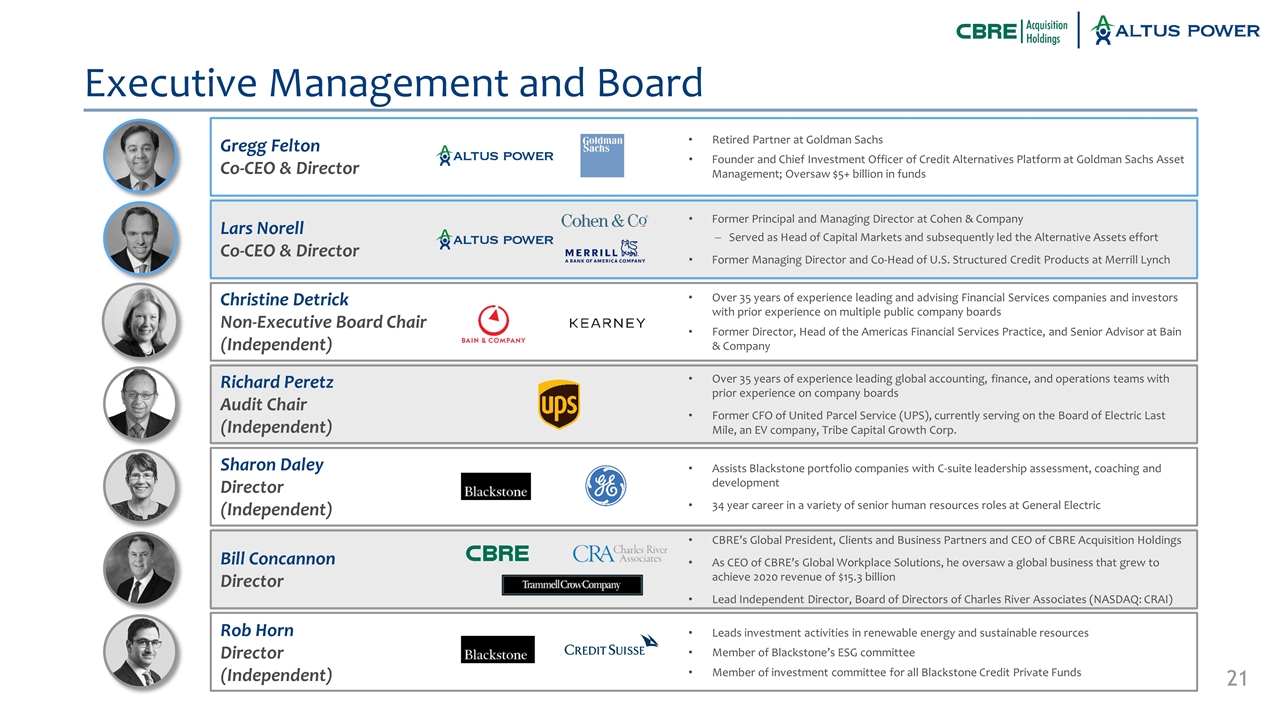

Gregg Felton Co-CEO & Director Retired Partner at Goldman Sachs Founder and Chief Investment Officer of Credit Alternatives Platform at Goldman Sachs Asset Management; Oversaw $5+ billion in funds Lars Norell Co-CEO & Director Former Principal and Managing Director at Cohen & Company Served as Head of Capital Markets and subsequently led the Alternative Assets effort Former Managing Director and Co-Head of U.S. Structured Credit Products at Merrill Lynch Christine Detrick Non-Executive Board Chair (Independent) Over 35 years of experience leading and advising Financial Services companies and investors with prior experience on multiple public company boards Former Director, Head of the Americas Financial Services Practice, and Senior Advisor at Bain & Company Richard Peretz Audit Chair (Independent) Over 35 years of experience leading global accounting, finance, and operations teams with prior experience on company boards Former CFO of United Parcel Service (UPS), currently serving on the Board of Electric Last Mile, an EV company, Tribe Capital Growth Corp. Sharon Daley Director (Independent) Assists Blackstone portfolio companies with C-suite leadership assessment, coaching and development 34 year career in a variety of senior human resources roles at General Electric Bill Concannon Director CBRE’s Global President, Clients and Business Partners and CEO of CBRE Acquisition Holdings As CEO of CBRE’s Global Workplace Solutions, he oversaw a global business that grew to achieve 2020 revenue of $15.3 billion Lead Independent Director, Board of Directors of Charles River Associates (NASDAQ: CRAI) Rob Horn Director (Independent) Leads investment activities in renewable energy and sustainable resources Member of Blackstone’s ESG committee Member of investment committee for all Blackstone Credit Private Funds Executive Management and Board

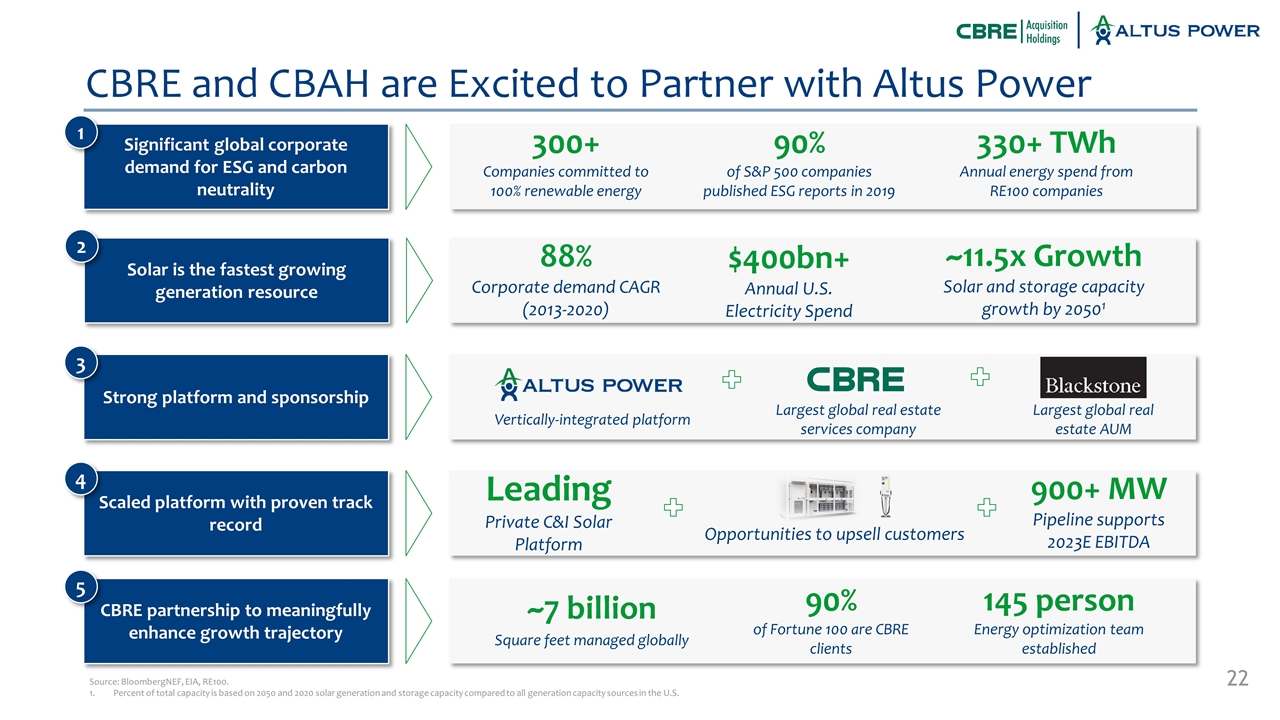

Source: BloombergNEF, EIA, RE100. Percent of total capacity is based on 2050 and 2020 solar generation and storage capacity compared to all generation capacity sources in the U.S. CBRE and CBAH are Excited to Partner with Altus Power Significant global corporate demand for ESG and carbon neutrality 1 Solar is the fastest growing generation resource 2 Strong platform and sponsorship 3 Scaled platform with proven track record 4 CBRE partnership to meaningfully enhance growth trajectory 5 88% Corporate demand CAGR (2013-2020) 11% Solar penetration (today) Vertically-integrated platform Largest global real estate AUM Largest global real estate services company Leading Private C&I Solar Platform $400bn+ Annual U.S. Electricity Spend Opportunities to upsell customers ~7 billion Square feet managed globally 145 person Energy optimization team established 90% of Fortune 100 are CBRE clients 900+ MW Pipeline supports 2023E EBITDA 300+ Companies committed to 100% renewable energy 90% of S&P 500 companies published ESG reports in 2019 330+ TWh Annual energy spend from RE100 companies ~11.5x Growth Solar and storage capacity growth by 20501

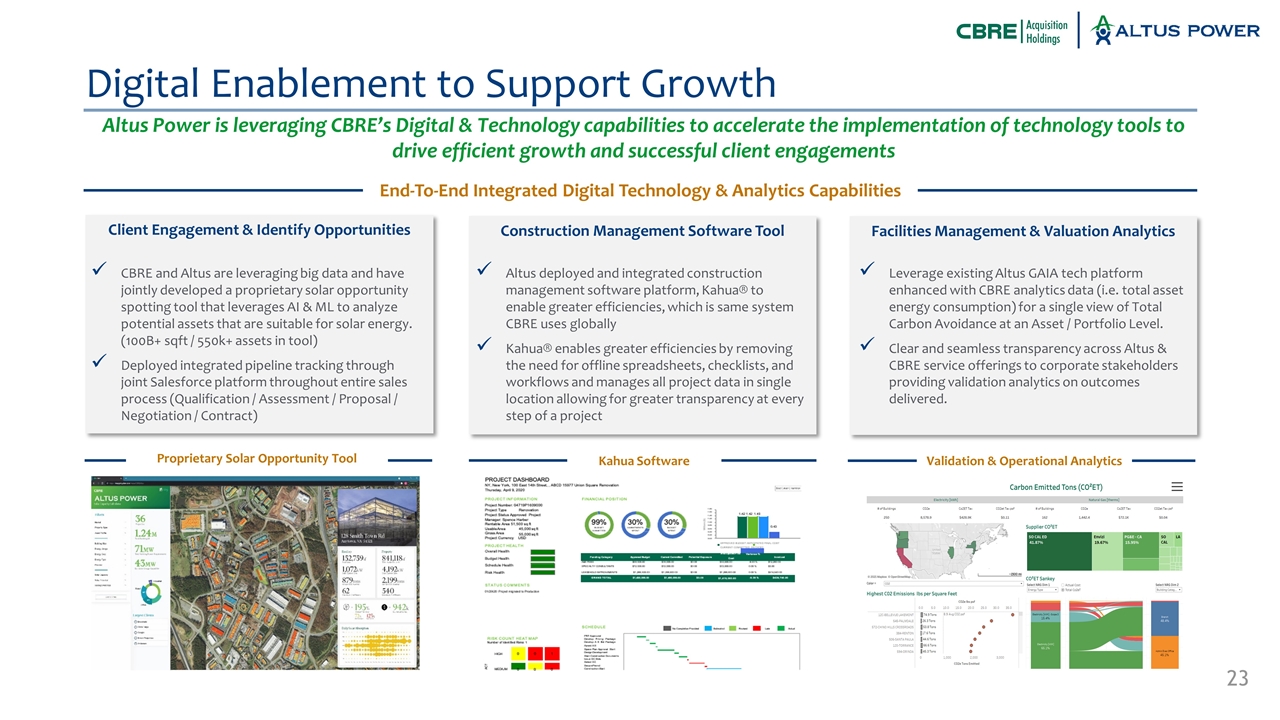

Client Engagement & Identify Opportunities Construction Management Software Tool Facilities Management & Valuation Analytics Integrated Technology & Analytics Business Case Development & Lease Negotiation Project Management & Construction Client Engagement & Identify Opportunities Facilities Management & Equipment Maintenance CBRE and Altus are leveraging big data and have jointly developed a proprietary solar opportunity spotting tool that leverages AI & ML to analyze potential assets that are suitable for solar energy. (100B+ sqft / 550k+ assets in tool) Deployed integrated pipeline tracking through joint Salesforce platform throughout entire sales process (Qualification / Assessment / Proposal / Negotiation / Contract) End-To-End Integrated Digital Technology & Analytics Capabilities Proprietary Solar Opportunity Tool Kahua Software Validation & Operational Analytics Altus deployed and integrated construction management software platform, Kahua® to enable greater efficiencies, which is same system CBRE uses globally Kahua® enables greater efficiencies by removing the need for offline spreadsheets, checklists, and workflows and manages all project data in single location allowing for greater transparency at every step of a project Leverage existing Altus GAIA tech platform enhanced with CBRE analytics data (i.e. total asset energy consumption) for a single view of Total Carbon Avoidance at an Asset / Portfolio Level. Clear and seamless transparency across Altus & CBRE service offerings to corporate stakeholders providing validation analytics on outcomes delivered. Altus Power is leveraging CBRE’s Digital & Technology capabilities to accelerate the implementation of technology tools to drive efficient growth and successful client engagements Digital Enablement to Support Growth

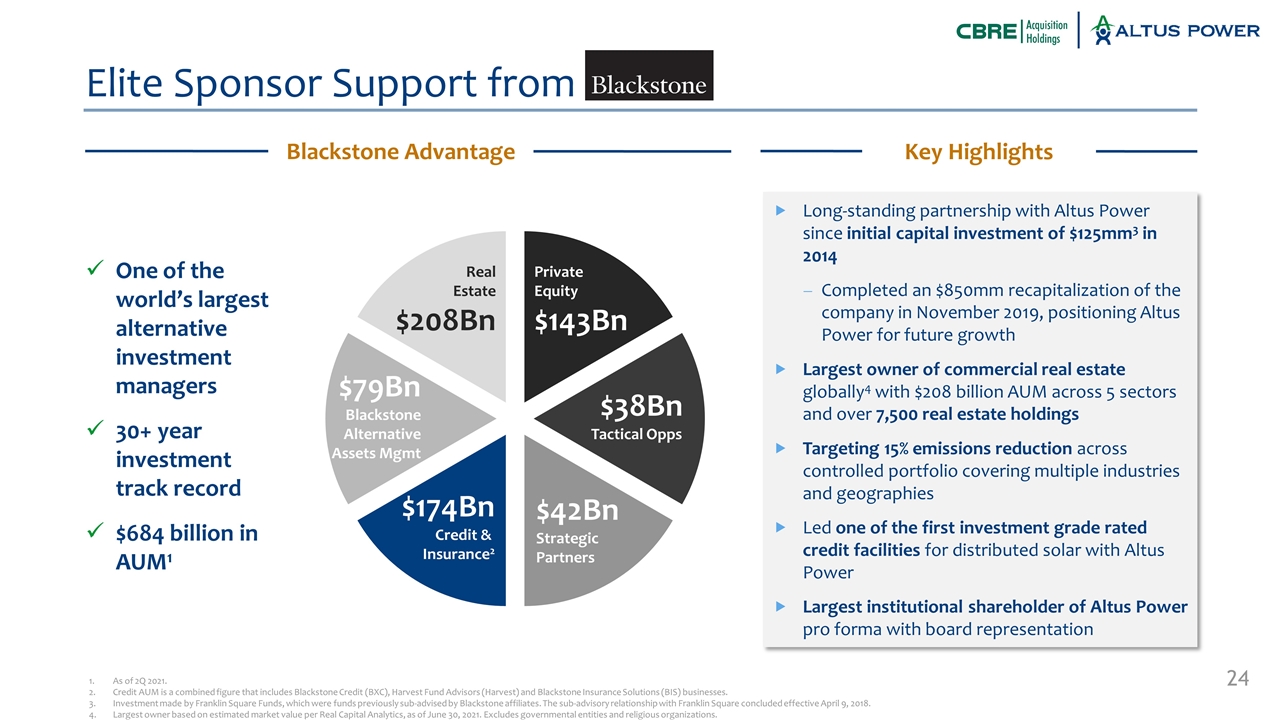

Elite Sponsor Support from Long-standing partnership with Altus Power since initial capital investment of $125mm3 in 2014 Completed an $850mm recapitalization of the company in November 2019, positioning Altus Power for future growth Largest owner of commercial real estate globally4 with $208 billion AUM across 5 sectors and over 7,500 real estate holdings Targeting 15% emissions reduction across controlled portfolio covering multiple industries and geographies Led one of the first investment grade rated credit facilities for distributed solar with Altus Power Largest institutional shareholder of Altus Power pro forma with board representation Real Estate $208Bn Private Equity $143Bn $38Bn Tactical Opps $42Bn Strategic Partners $79Bn Blackstone Alternative Assets Mgmt $174Bn Credit & Insurance2 Key Highlights One of the world’s largest alternative investment managers 30+ year investment track record $684 billion in AUM1 As of 2Q 2021. Credit AUM is a combined figure that includes Blackstone Credit (BXC), Harvest Fund Advisors (Harvest) and Blackstone Insurance Solutions (BIS) businesses. Investment made by Franklin Square Funds, which were funds previously sub-advised by Blackstone affiliates. The sub-advisory relationship with Franklin Square concluded effective April 9, 2018. Largest owner based on estimated market value per Real Capital Analytics, as of June 30, 2021. Excludes governmental entities and religious organizations. Blackstone Advantage

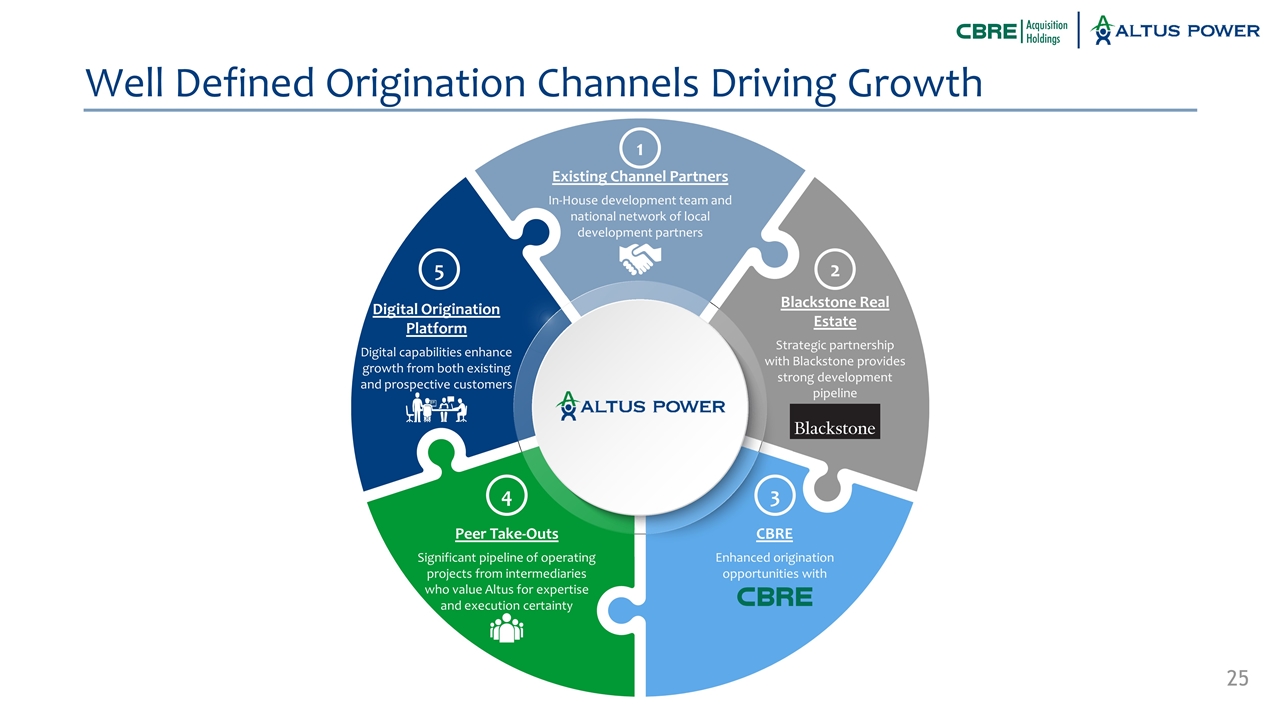

Enhanced origination opportunities with CBRE Well Defined Origination Channels Driving Growth Enhanced origination opportunities with CBRE and Blackstone Digital Origination Platform Digital capabilities enhance growth from both existing and prospective customers Existing Channel Partners In-House development team and national network of local development partners Blackstone Real Estate Strategic partnership with Blackstone provides strong development pipeline CBRE Enhanced origination opportunities with Peer Take-Outs Significant pipeline of operating projects from intermediaries who value Altus for expertise and execution certainty 5 4 3 2 1

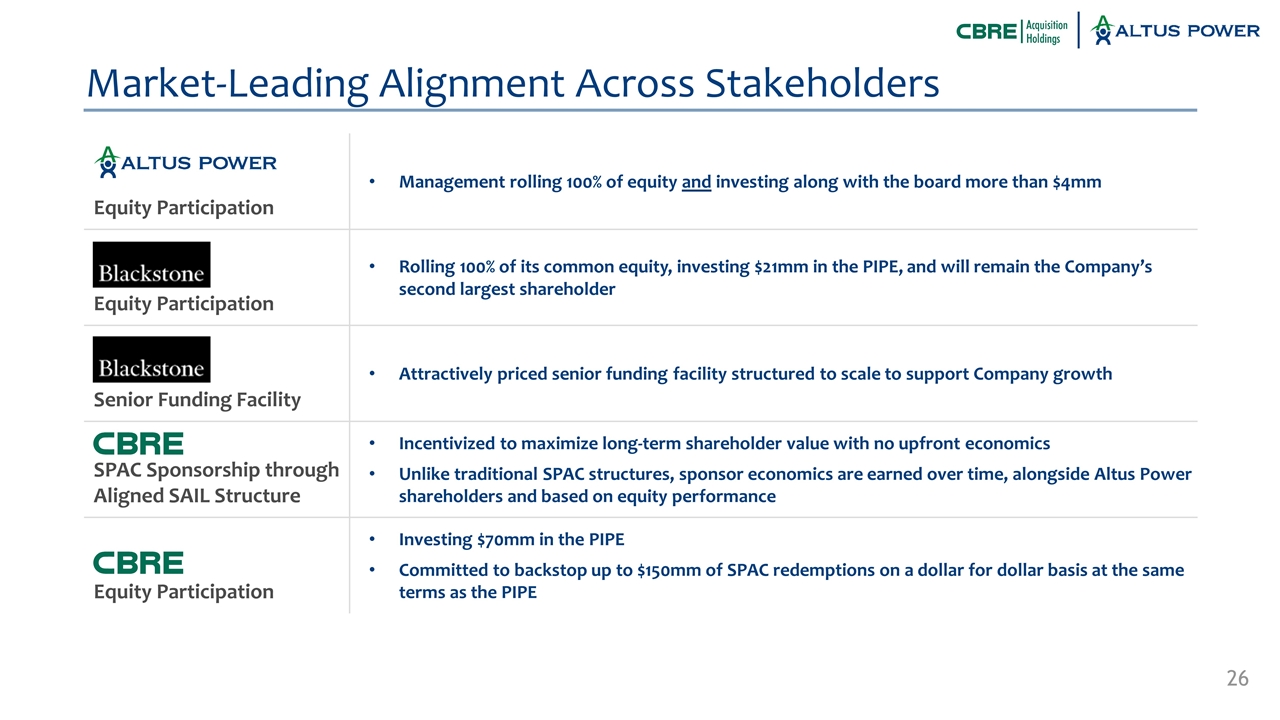

Market-Leading Alignment Across Stakeholders Equity Participation Management rolling 100% of equity and investing along with the board more than $4mm Equity Participation Rolling 100% of its common equity, investing $21mm in the PIPE, and will remain the Company’s second largest shareholder Senior Funding Facility Attractively priced senior funding facility structured to scale to support Company growth SPAC Sponsorship through Aligned SAIL Structure Incentivized to maximize long-term shareholder value with no upfront economics Unlike traditional SPAC structures, sponsor economics are earned over time, alongside Altus Power shareholders and based on equity performance Equity Participation Investing $70mm in the PIPE Committed to backstop up to $150mm of SPAC redemptions on a dollar for dollar basis at the same terms as the PIPE Meadow 4.0 MW Solar System

Transaction Summary and Financial Highlights

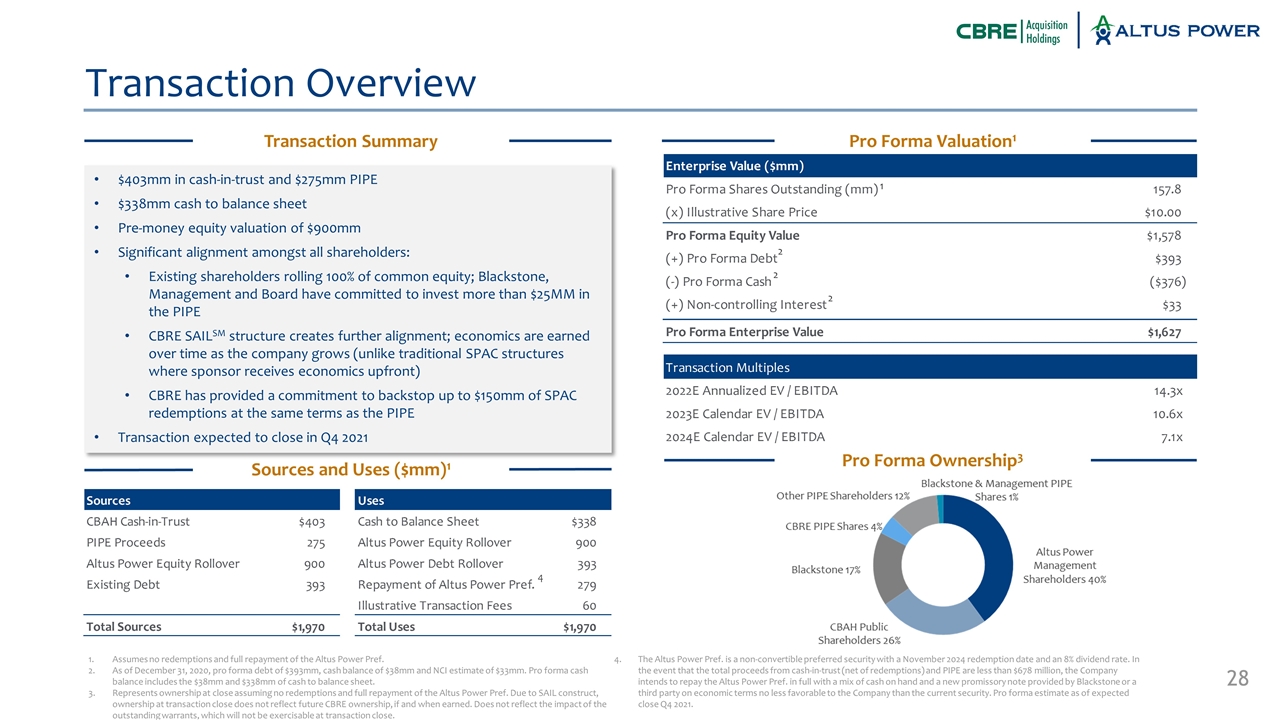

Sources and Uses ($mm)1 Transaction Overview Transaction Summary Pro Forma Valuation1 Pro Forma Ownership3 Assumes no redemptions and full repayment of the Altus Power Pref. As of December 31, 2020, pro forma debt of $393mm, cash balance of $38mm and NCI estimate of $33mm. Pro forma cash balance includes the $38mm and $338mm of cash to balance sheet. Represents ownership at close assuming no redemptions and full repayment of the Altus Power Pref. Due to SAIL construct, ownership at transaction close does not reflect future CBRE ownership, if and when earned. Does not reflect the impact of the outstanding warrants, which will not be exercisable at transaction close. The Altus Power Pref. is a non-convertible preferred security with a November 2024 redemption date and an 8% dividend rate. In the event that the total proceeds from cash-in-trust (net of redemptions) and PIPE are less than $678 million, the Company intends to repay the Altus Power Pref. in full with a mix of cash on hand and a new promissory note provided by Blackstone or a third party on economic terms no less favorable to the Company than the current security. Pro forma estimate as of expected close Q4 2021. 2 2 1 2 $403mm in cash-in-trust and $275mm PIPE $338mm cash to balance sheet Pre-money equity valuation of $900mm Significant alignment amongst all shareholders: Existing shareholders rolling 100% of common equity; Blackstone, Management and Board have committed to invest more than $25MM in the PIPE CBRE SAILSM structure creates further alignment; economics are earned over time as the company grows (unlike traditional SPAC structures where sponsor receives economics upfront) CBRE has provided a commitment to backstop up to $150mm of SPAC redemptions at the same terms as the PIPE Transaction expected to close in Q4 2021 4

Financial Highlights Long-term contracted revenues Existing EBITDA positive business supported by long-term contracted revenues 20-year standard contract term with recontracting mechanism 80%+ investment grade1 quality counterparties; Zero commercial customer defaults in Altus Power’s operating history Low customer acquisition cost Blackstone and CBRE strategic partnerships offer immediate access to a large, diversified customer base seeking clean energy National developer base with local expertise in sourcing new customers Repeat customers and strong referral network Robust growth profile Strong, identified 2022 and 2023 pipeline Partnerships that yield systematic growth Sponsorship through CBRE and Blackstone offer their vast resources (portfolio companies, technologies, relationships, etc.) Scalable financing structure Flexible, competitive, and scalable credit facilities through Blackstone Insurance and Fifth Third Tax equity relationships and partnerships, ready for additional deployment New products complimenting core solar offerings Energy storage augments the traditional solar offering, improving the customer value proposition and creating a larger addressable market Electric vehicle charging is expected to grow significantly over the next 10 years, and the industry is focusing on clean charging Investment grade includes 680+ prime FICO borrower. Representative of 347 MWs. Where Moody’s rating is not available, S&P equivalent rating is taken. May include related party, affiliate or Moody's risk shadow rating, at the time of underwriting.

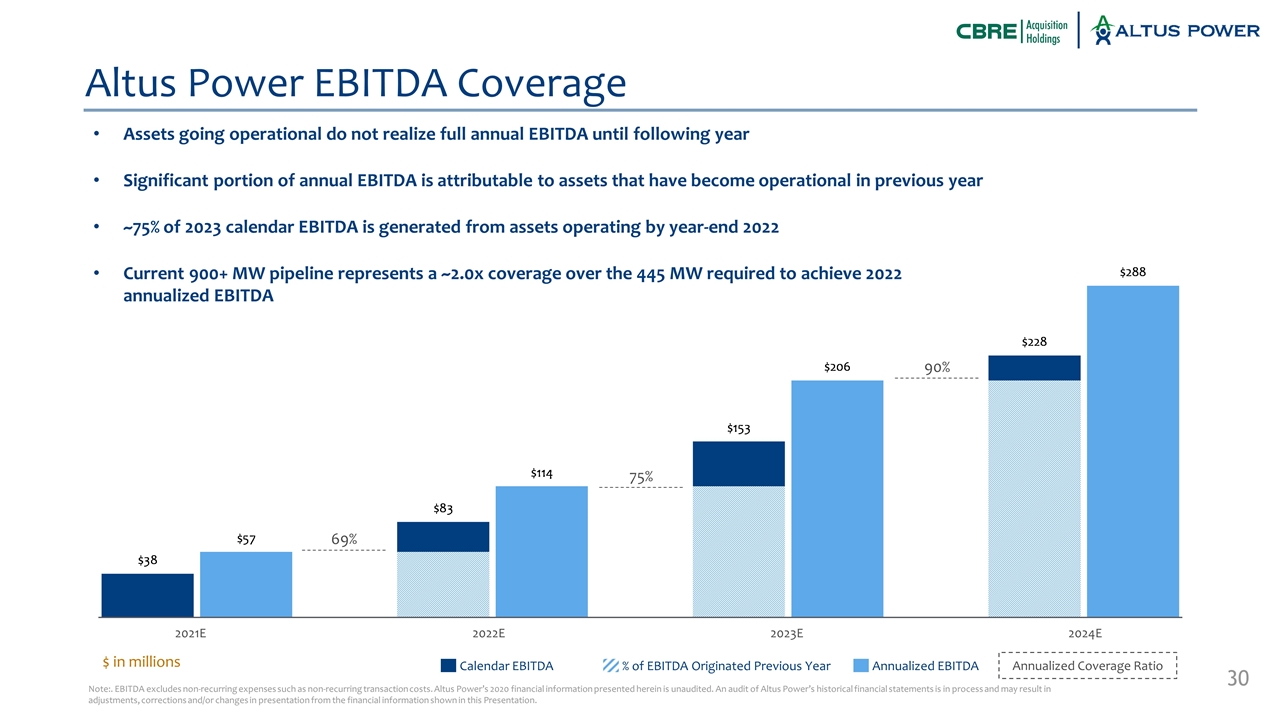

Altus Power EBITDA Coverage Assets going operational do not realize full annual EBITDA until following year Significant portion of annual EBITDA is attributable to assets that have become operational in previous year ~75% of 2023 calendar EBITDA is generated from assets operating by year-end 2022 Current 900+ MW pipeline represents a ~2.0x coverage over the 445 MW required to achieve 2022 annualized EBITDA Annualized Coverage Ratio Calendar EBITDA Annualized EBITDA % of EBITDA Originated Previous Year 75% 90% $ in millions 69% Note:. EBITDA excludes non-recurring expenses such as non-recurring transaction costs. Altus Power’s 2020 financial information presented herein is unaudited. An audit of Altus Power’s historical financial statements is in process and may result in adjustments, corrections and/or changes in presentation from the financial information shown in this Presentation. 2021E 2022E 2023E 2024E

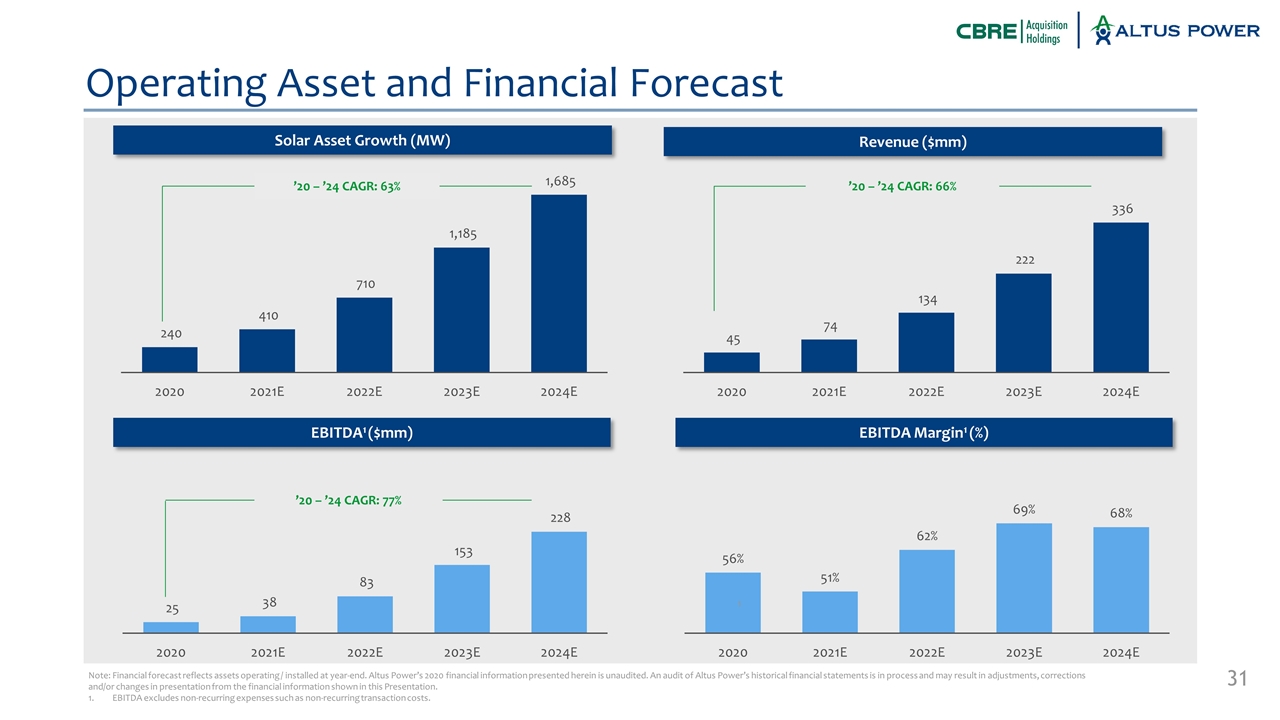

Operating Asset and Financial Forecast Solar Asset Growth (MW) Note: Financial forecast reflects assets operating / installed at year-end. Altus Power’s 2020 financial information presented herein is unaudited. An audit of Altus Power’s historical financial statements is in process and may result in adjustments, corrections and/or changes in presentation from the financial information shown in this Presentation. EBITDA excludes non-recurring expenses such as non-recurring transaction costs. ’20 – ’24 CAGR: 63% EBITDA1 ($mm) Revenue ($mm) ’20 – ’24 CAGR: 66% ’20 – ’24 CAGR: 77% EBITDA Margin1 (%) 1

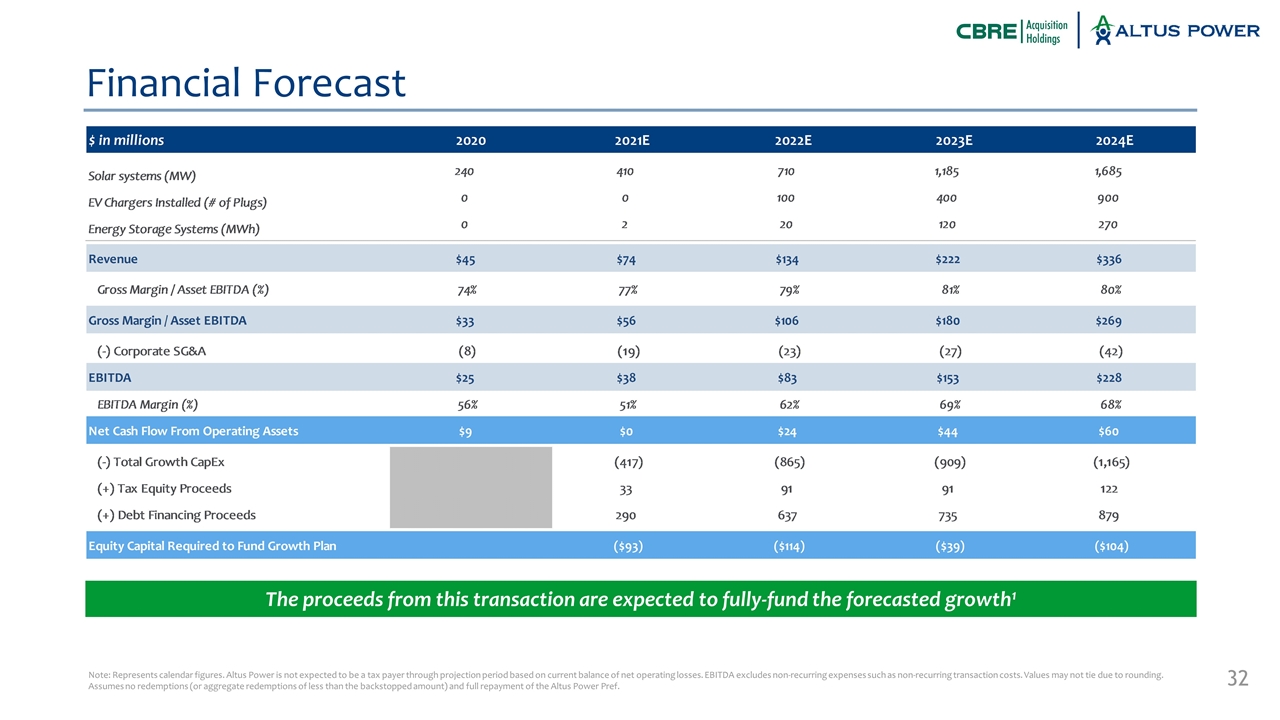

Financial Forecast Note: Represents calendar figures. Altus Power is not expected to be a tax payer through projection period based on current balance of net operating losses. EBITDA excludes non-recurring expenses such as non-recurring transaction costs. Values may not tie due to rounding. Assumes no redemptions (or aggregate redemptions of less than the backstopped amount) and full repayment of the Altus Power Pref. The proceeds from this transaction are expected to fully-fund the forecasted growth1

Appendix

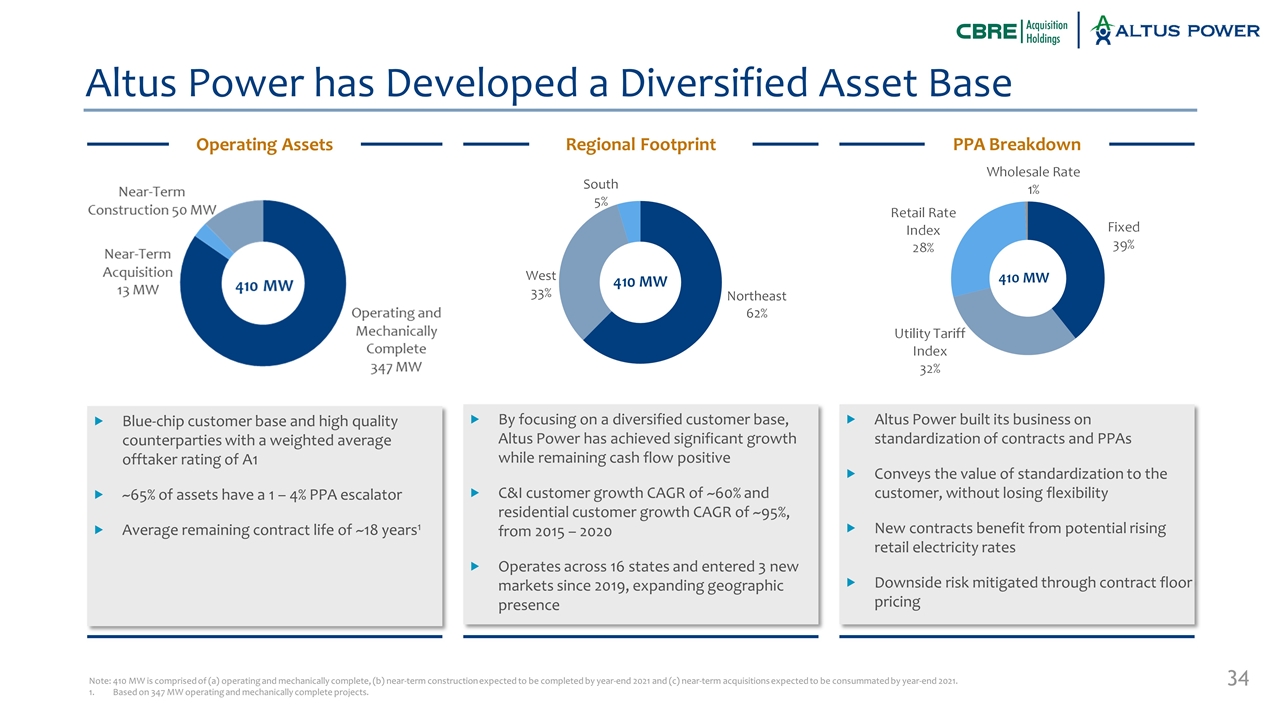

Altus Power has Developed a Diversified Asset Base Blue-chip customer base and high quality counterparties with a weighted average offtaker rating of A1 ~65% of assets have a 1 – 4% PPA escalator Average remaining contract life of ~18 years1 By focusing on a diversified customer base, Altus Power has achieved significant growth while remaining cash flow positive C&I customer growth CAGR of ~60% and residential customer growth CAGR of ~95%, from 2015 – 2020 Operates across 16 states and entered 3 new markets since 2019, expanding geographic presence Altus Power built its business on standardization of contracts and PPAs Conveys the value of standardization to the customer, without losing flexibility New contracts benefit from potential rising retail electricity rates Downside risk mitigated through contract floor pricing Operating Assets PPA Breakdown Regional Footprint Note: 410 MW is comprised of (a) operating and mechanically complete, (b) near-term construction expected to be completed by year-end 2021 and (c) near-term acquisitions expected to be consummated by year-end 2021. Based on 347 MW operating and mechanically complete projects.

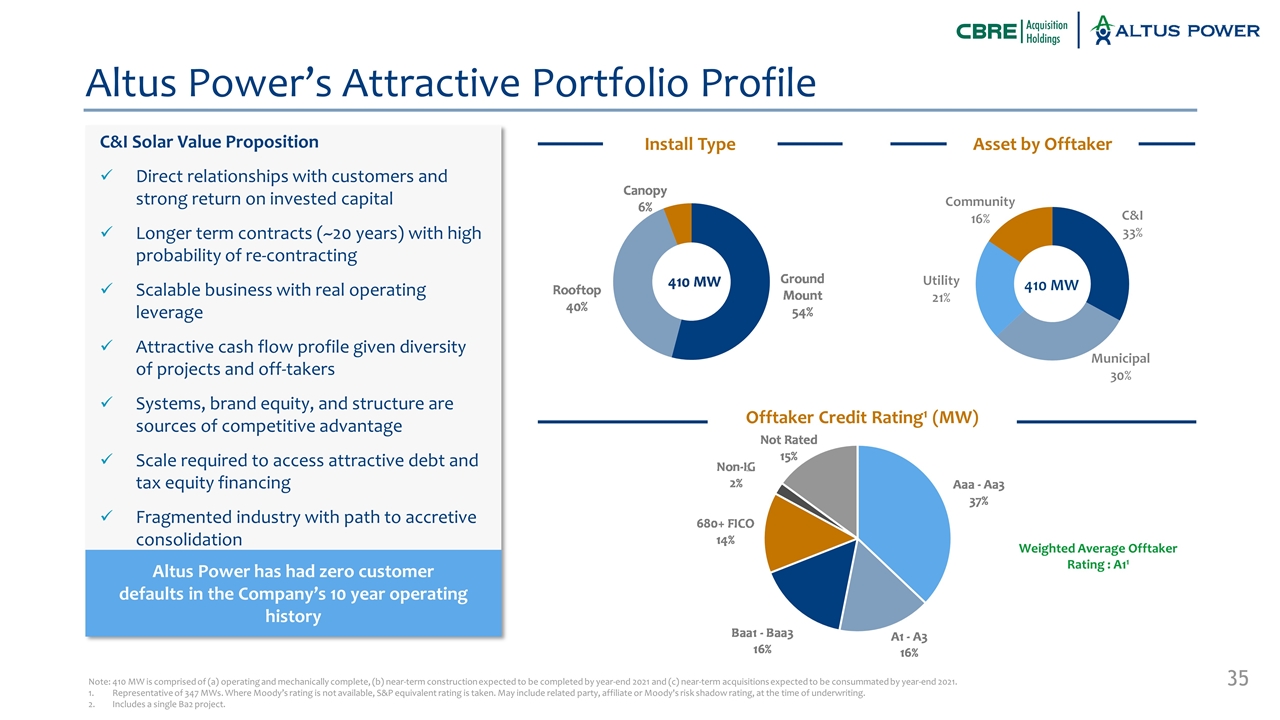

Altus Power’s Attractive Portfolio Profile C&I Solar Value Proposition Direct relationships with customers and strong return on invested capital Longer term contracts (~20 years) with high probability of re-contracting Scalable business with real operating leverage Attractive cash flow profile given diversity of projects and off-takers Systems, brand equity, and structure are sources of competitive advantage Scale required to access attractive debt and tax equity financing Fragmented industry with path to accretive consolidation Altus Power has had zero customer defaults in the Company’s 10 year operating history Note: 410 MW is comprised of (a) operating and mechanically complete, (b) near-term construction expected to be completed by year-end 2021 and (c) near-term acquisitions expected to be consummated by year-end 2021. Representative of 347 MWs. Where Moody’s rating is not available, S&P equivalent rating is taken. May include related party, affiliate or Moody's risk shadow rating, at the time of underwriting. Includes a single Ba2 project. 2 Weighted Average Offtaker Rating : A11 Install Type Asset by Offtaker Offtaker Credit Rating1 (MW)

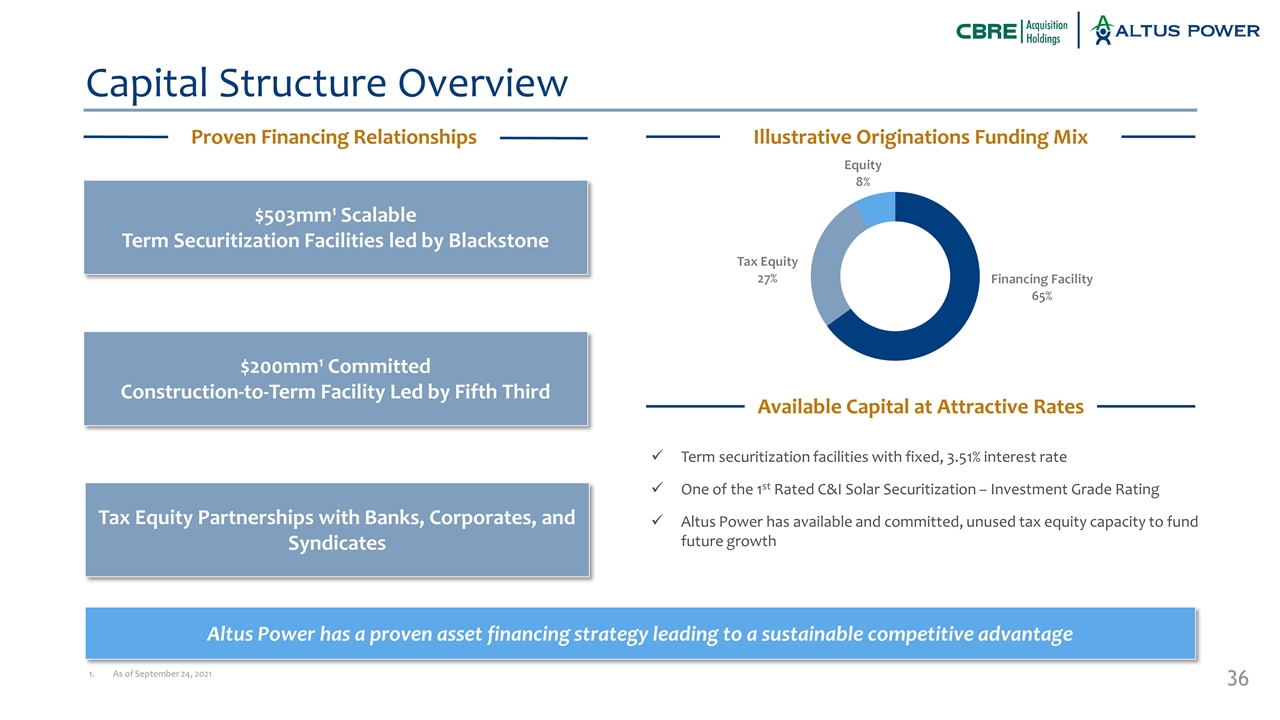

Altus Power has a proven asset financing strategy leading to a sustainable competitive advantage Tax Equity Partnerships with Banks, Corporates, and Syndicates $200mm1 Committed Construction-to-Term Facility Led by Fifth Third $503mm1 Scalable Term Securitization Facilities led by Blackstone Capital Structure Overview Proven Financing Relationships Term securitization facilities with fixed, 3.51% interest rate One of the 1st Rated C&I Solar Securitization – Investment Grade Rating Altus Power has available and committed, unused tax equity capacity to fund future growth Available Capital at Attractive Rates Illustrative Originations Funding Mix As of September 24, 2021

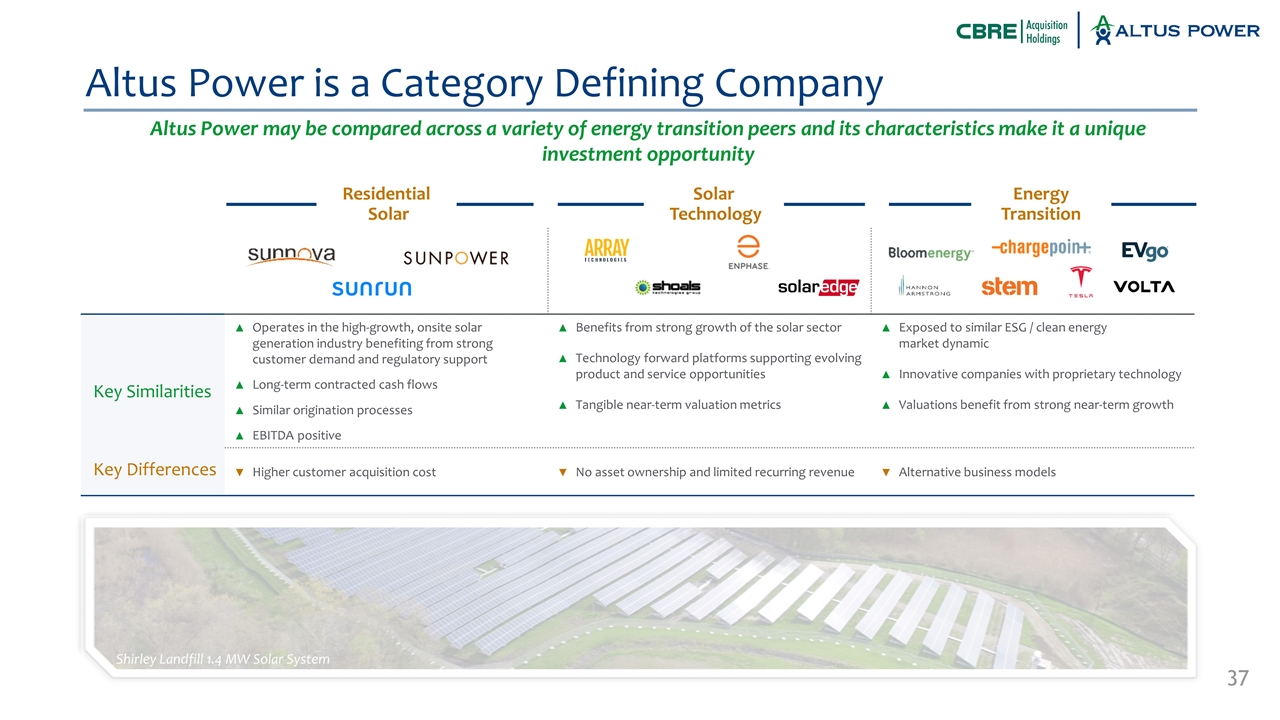

Operates in the high-growth, onsite solar generation industry benefiting from strong customer demand and regulatory support Long-term contracted cash flows Similar origination processes EBITDA positive Benefits from strong growth of the solar sector Technology forward platforms supporting evolving product and service opportunities Tangible near-term valuation metrics Exposed to similar ESG / clean energy market dynamic Innovative companies with proprietary technology Valuations benefit from strong near-term growth Higher customer acquisition cost No asset ownership and limited recurring revenue Alternative business models Altus Power is a Category Defining Company Residential Solar Energy Transition Solar Technology Altus Power may be compared across a variety of energy transition peers and its characteristics make it a unique investment opportunity Key Similarities Key Differences Shirley Landfill 1.4 MW Solar System

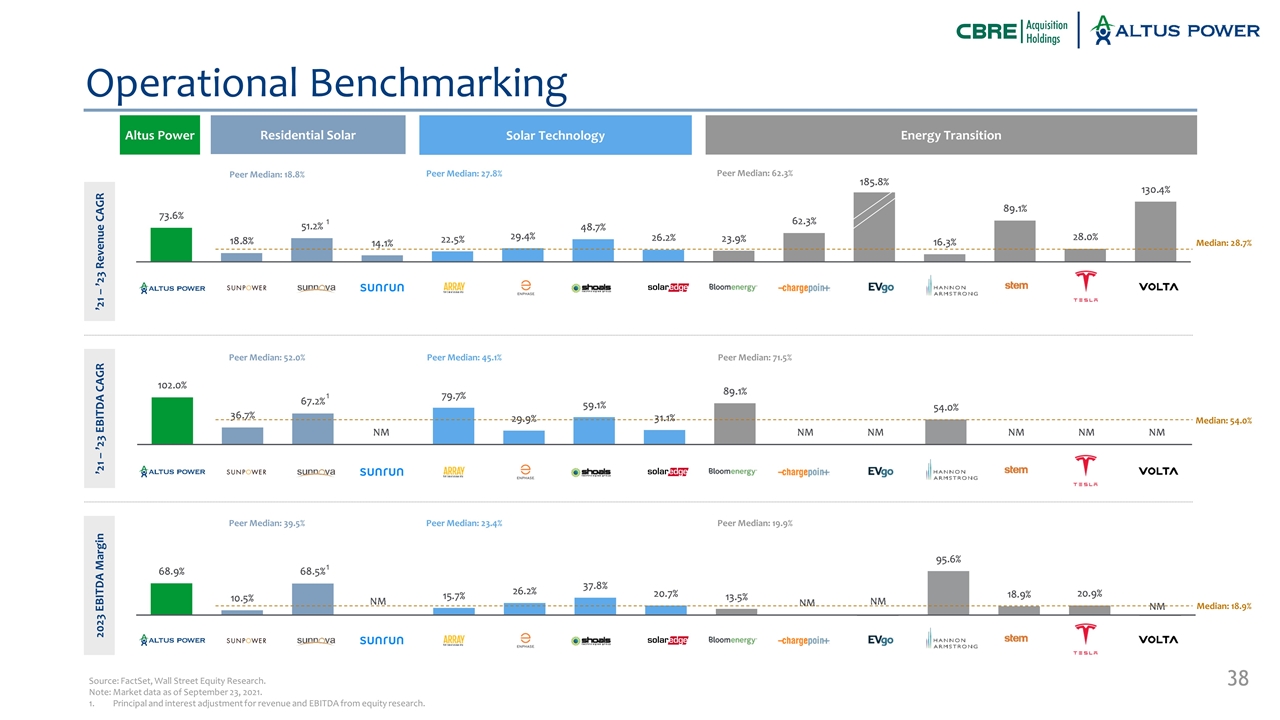

Operational Benchmarking ’21 – ’23 Revenue CAGR ’21 – ’23 EBITDA CAGR Peer Median: 27.8% Peer Median: 62.3% Peer Median: 18.8% Peer Median: 45.1% Peer Median: 71.5% Peer Median: 52.0% Altus Power 2023 EBITDA Margin Peer Median: 39.5% Peer Median: 23.4% Peer Median: 19.9% Residential Solar Solar Technology Energy Transition 1 Median: 28.7% Median: 54.0% Median: 18.9% Source: FactSet, Wall Street Equity Research. Note: Market data as of September 23, 2021. Principal and interest adjustment for revenue and EBITDA from equity research. 1 1

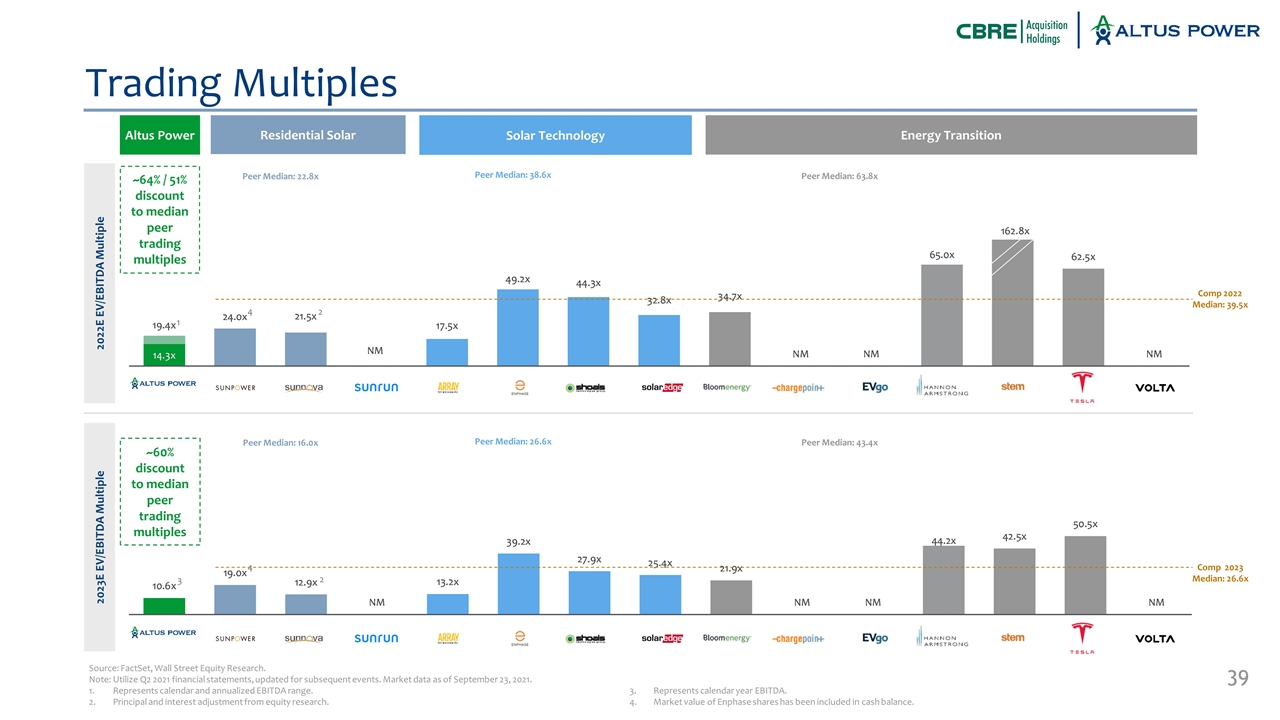

Trading Multiples 2022E EV/EBITDA Multiple 2023E EV/EBITDA Multiple 2 Peer Median: 22.8x Peer Median: 38.6x Peer Median: 63.8x Peer Median: 16.0x Peer Median: 26.6x Peer Median: 43.4x ~60% discount to median peer trading multiples Comp 2022 Median: 39.5x Comp 2023 Median: 26.6x 2 ~64% / 51% discount to median peer trading multiples 1 3 Residential Solar Solar Technology Energy Transition Altus Power 4 Source: FactSet, Wall Street Equity Research. Note: Utilize Q2 2021 financial statements, updated for subsequent events. Market data as of September 23, 2021. Represents calendar and annualized EBITDA range. Principal and interest adjustment from equity research. Represents calendar year EBITDA. Market value of Enphase shares has been included in cash balance. 4

Key Risks Unless the context otherwise suggests, all references to the “Company,” “we,” “us” or “our” refer to the business and operations of CBRE Acquisition Holdings, Inc. and its subsidiaries (the “SPAC”) following the potential business combination with Altus Power, Inc. (“Altus Power”) (the “Transaction”). The risks presented below are certain of the general risks related to the business of the Company, and such list is not exhaustive. The list below is qualified in its entirety by disclosures contained in future documents filed or furnished by the Company with the United States Securities and Exchange Commission (“SEC”), including the documents filed or furnished in connection with the Transaction. The risks presented in such filings will be consistent with those that would be required for a public company in its SEC filings, including with respect to the business and securities of the Company and the Transaction, and may differ significantly from and be more extensive than those presented below. The risks described below are not the only ones we face. Additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business, financial condition or results of operations. You should review the investor presentation and perform your own due diligence prior to making an investment in the Company. Business and Operational Risks Our growth strategy depends on the widespread adoption of solar power technology. If we cannot compete successfully against other solar and energy companies, we may not be successful in developing our operations and our business may suffer. With respect to providing electricity on a price-competitive basis, solar systems face competition from traditional regulated electric utilities, from less-regulated third party energy service providers and from new renewable energy companies. A material reduction in the retail price of traditional utility-generated electricity or electricity from other sources could harm our business, financial condition, results of operations and prospects. Due to the limited number of suppliers in our industry, the acquisition of any of these suppliers by a competitor or any shortage, delay, quality issue, price change, or duties or other limitation in our ability to obtain components or technologies we use could result in adverse effects. Although our business has benefited from the declining cost of solar panels, our financial results may be harmed now that the cost of solar panels has stabilized and could increase in the future, due to increases in the cost of solar panels and tariffs on imported solar panels imposed by the U.S. government. Our market is characterized by rapid technological change, which requires us to continue to develop new products and product innovations. Any delays in such development could adversely affect market adoption of our products and our financial results. Developments in alternative technologies may materially adversely affect demand for our offerings. The operation and maintenance of our facilities are subject to many operational risks, the consequences of which could have a material adverse effect on our business, financial condition, results of operations and prospects. Our business, financial condition, results of operations and prospects could suffer if we do not proceed with projects under development or are unable to complete the construction of, or capital improvements to, facilities on schedule or within budget. We face risks related to project siting, financing, construction, permitting, governmental approvals and the negotiation of project development agreements that may impede their development and operating activities. Our business is subject to risks associated with construction, such as cost overruns and delays, and other contingencies that may arise in the course of completing installations, such as union requirements, and such risks may increase in the future as we expand the scope of such services with other parties. We may not be able to effectively manage our growth. We may not realize the anticipated benefits of future acquisitions, and integration of these future acquisitions which may disrupt our business and management. Our business is concentrated in certain markets, putting us at risk of region-specific disruptions. Our growth depends in part on the success of our relationships with third parties. We have incurred operating losses before income taxes and may be unable to achieve or sustain profitability in the future.

Key Risks (cont’d) We are not currently regulated as an electric utility under applicable law in the jurisdictions in which we operate, but we may be subject to regulation as an electric utility in the future. Failure to hire and retain a sufficient number of employees and service providers in key functions would constrain our growth and our ability to timely complete customers’ projects and successfully manage customer accounts. Our business, financial condition, results of operations and prospects could be materially adversely affected by work strikes or stoppages and increasing personnel costs. If we are unable to retain and recruit qualified technicians and advisors, or if our board of directors, key executives, key employees or consultants discontinue their employment or consulting relationship with us, it may delay our development efforts or otherwise harm our business. The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members and officers. We may be materially adversely affected by negative publicity. Problems with product quality or performance may cause us to incur warranty expenses, damage our market reputation and prevent us from maintaining or increasing our market share. Our business, financial condition, results of operations and prospects can be materially adversely affected by weather conditions, including, but not limited to, the impact of severe weather. Our results of operations may fluctuate from quarter to quarter, which could make our future performance difficult to predict and could cause our results of operations for a particular period to fall below expectations, resulting in a decline in the price of our common stock. Our results of operations have been and will continue to be adversely impacted by the COVID-19 pandemic, and the duration and extent to which it will impact our results of operations remains uncertain. Adverse economic conditions may have negative consequences on our business, results of operations and financial condition. Threats of terrorism and catastrophic events that could result from terrorism, cyberattacks or individuals and/or groups attempting to disrupt our business, or the businesses of third parties, may materially adversely affect our business, financial condition, results of operations and prospects. Our ability to obtain insurance and the terms of any available insurance coverage could be materially adversely affected by international, national, state or local events and company-specific events, as well as the financial condition of insurers. As an emerging growth company within the meaning of the Securities Act, we will utilize certain modified disclosure requirements, and we cannot be certain if these reduced requirements will make our common stock less attractive to investors. We may need to raise additional funds and these funds may not be available when needed. Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited. If we fail to maintain an effective system of internal control over financial reporting and other business practices, and of board-level oversight, we may not be able to report our financial results accurately or prevent and detect fraud and other improprieties. Consequently, investors could lose confidence in our financial reporting, and this may decrease the trading price of our stock. We have material weaknesses in our internal control over financial reporting. If we are unable to remediate these material weaknesses, or otherwise fail to maintain an effective system of internal control over financial reporting, this may result in material misstatements of our consolidated financial statements or cause us to fail to meet our periodic reporting obligations. As a privately-held company, we were not required to evaluate our internal control over financial reporting in a manner that meets the standards of publicly traded companies required by Section 404 of the Sarbanes-Oxley Act. Our historical financial results may not be indicative of what our actual financial position or results of operations would have been if we were a public company. Our reported financial results may be affected, and comparability of our financial results with other companies in our industry may be impacted, by changes in the accounting principles generally accepted in the U.S. Litigation and Regulatory Risks Our business, financial condition, results of operations and prospects may be materially adversely affected by the extensive regulation of our business.

Key Risks (cont’d) Any reductions or modifications to, or the elimination of, governmental incentives or policies that support solar energy, including, but not limited to, tax laws, policies and incentives, RPS or feed-in-tariffs, or the imposition of additional taxes or other assessments on solar energy, could result in, among other items, the lack of a satisfactory market for the development and/or financing of new solar energy projects, our abandoning the development of solar energy projects, a loss of our investments in solar energy projects and reduced project returns, any of which could have a material adverse effect on our business, financial condition, results of operations and prospects. The absence of net energy metering and related policies to offer competitive pricing to our customers in our current markets, and changes to net energy metering policies may significantly reduce demand for electricity from our solar energy systems. Our business depends in part on the regulatory treatment of third-party-owned solar energy systems. Existing electric utility industry regulations, and changes to regulations, may present technical, regulatory and economic barriers to the purchase and use of solar energy offerings that may significantly reduce demand for our solar energy offerings. Regulatory decisions that are important to us may be materially adversely affected by political, regulatory and economic factors. Compliance with occupational safety and health requirements and best practices can be costly, and noncompliance with such requirements may result in potentially significant monetary penalties, operational delays and adverse publicity. A failure to comply with laws and regulations relating to our interactions with current or prospective customers could result in negative publicity, claims, investigations and litigation, and adversely affect our financial performance. We have previously been, and may in the future be, named in legal proceedings, become involved in regulatory inquiries or be subject to litigation in the future, all of which are costly, distracting to our core business and could result in an unfavorable outcome or a material adverse effect on our business, financial condition, results of operations or the market price for our common stock. We may be subject to claims arising from the operations of our various businesses for periods prior to the dates we acquired them. Product liability claims against us could result in adverse publicity and potentially significant monetary damages. Changes in tax laws, guidance or policies, including but not limited to changes in corporate income tax rates, as well as judgments and estimates used in the determination of tax-related asset and liability amounts, could materially adversely affect our business, financial condition, results of operations and prospects. Intellectual Property and Data Privacy Risks If we are unsuccessful in developing and maintaining our proprietary technology, including our Gaia software, our ability to attract and retain solar partners could be impaired, our competitive position could be harmed and our revenue could be reduced. Our business may be harmed if we fail to properly protect our intellectual property, and we may also be required to defend against claims or indemnify others against claims that our intellectual property infringes on the intellectual property rights of third parties. We use open source software, which may require that we release the source code of certain software subject to open source licenses or subject us to possible litigation or other actions that could adversely affect our business. Failure to comply with the terms of underlying open source software licenses could restrict our ability to provide our offerings. If we experience a significant disruption in our information technology systems, fail to implement new systems and software successfully or if we experience cyber security incidents or have a deficiency in cybersecurity, our business could be adversely affected. Any security breach or unauthorized disclosure or theft of personal information we gather, store and use, or other hacking and phishing attacks on our systems, could harm our reputation, subject us to claims or litigation and have an adverse impact on our business. Our business is subject to complex and evolving laws and regulations regarding privacy and data protection. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, increased cost of operations or otherwise harm our business. Risks Relating to Projections We may not successfully implement our business model. Certain estimates of market opportunity and forecasts of market growth may prove to be inaccurate.

Key Risks (cont’d) Our projections are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding future legislation and changes in regulations, both inside and outside of the U.S. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations. Our relationship with CBRE is new and developing an may not result in profitable long-term contracts with their referred clients. Risks Relating to the Business Combination Uncertainties about the Business Combination during the pre-closing period may cause third parties to delay or defer decisions concerning Altus or its subsidiaries or seek to change existing arrangements. Risks Relating to Our Financial Statements A significant portion of our activities are conducted through variable interest entities, and changes to accounting guidance, policies or interpretations thereof could cause us to materially change the presentation of our financial statements. Risks Related to Ownership of Our Securities Concentration of ownership among existing executive officers, directors and their affiliates may prevent new investors from influencing significant corporate decisions. Our stock price will be volatile, and you may not be able to sell shares at or above the price at closing. Anti-takeover provisions contained in our governing documents and applicable laws could impair a takeover attempt. Warrants will become exercisable for our common stock, which would increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders. Our stakeholder aligned initial listing ("SAILSM") structure could result in a substantial number of shares being issued to our sponsor, which could cause significant dilution to a potential investor.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- TransUnion (TRU) Provides Update on Operations Reorganization

- Equity Bancshares (EQBK) PT Raised to $38 at Piper Sandler

- Hibbett (HIBB) soars 18% on deal to sell to JD Sports for $1.08 billion

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share