Form 424B3 Super Group (SGHC) Ltd

Table of Contents

Filed pursuant to Rule 424(b)(3)

Registration No. 333-268287

PROSPECTUS/OFFER TO EXCHANGE

Super Group (SGHC) Limited

Offer to Exchange Public Warrants to Acquire Ordinary Shares

of

Super Group (SGHC) Limited

for

Ordinary Shares

of

Super Group (SGHC) Limited

and

Consent Solicitation

THE OFFER PERIOD (AS DEFINED BELOW) AND WITHDRAWAL RIGHTS WILL EXPIRE AT 12:01 A.M., EASTERN TIME, ON DECEMBER 12, 2022, OR SUCH LATER TIME AND DATE TO WHICH WE MAY EXTEND.

Terms of the Offer and Consent Solicitation

Until the Expiration Date (as defined below), we are offering to the holders of our outstanding public warrants, (as defined below) to purchase Ordinary Shares, no par value per share (“Ordinary Shares”), of Super Group (SGHC) Limited (the “Company”), the opportunity to receive 0.25 Ordinary Shares in exchange for each of our outstanding public warrants tendered by the holder thereof and exchanged pursuant to the offer (the “Offer”).

The Offer is being made to all holders of our public warrants. Each public warrant holder whose public warrants are exchanged pursuant to the Offer will receive 0.25 Ordinary Shares for each public warrant tendered by such holder and exchanged. No fractional Ordinary Shares will be issued pursuant to the Offer. In lieu of issuing fractional shares to any holder of public warrants who would otherwise have been entitled to receive fractional shares pursuant to the Offer, the Company will round the number of shares to which such holder is entitled, after aggregating all fractions, up to the next whole number of shares.

Concurrently with the Offer, we are also soliciting consents (the “Consent Solicitation”, and together with the Offer, the “Offer and Consent Solicitation”) from holders of (i) public warrants and (ii) private placement warrants (as defined below) (jointly, the “warrants” or each a “warrant”) to amend the Warrant Agreement (as defined below) (the “Warrant Amendment”), which governs all of the warrants, to permit the Company to (i) require that each outstanding public warrant upon the closing of the Offer be converted into 0.225 Ordinary Shares (a ratio 10% less than the exchange ratio applicable to the Offer) and (ii) instruct the warrant agent (as defined below) to cancel each outstanding private placement warrant for no consideration. The Warrant Amendment will permit us to eliminate all of the warrants that remain outstanding after the Offer is completed. Pursuant to the terms of the Warrant Agreement, all except certain specified modifications or amendments require the vote or written consent of holders of at least 50% of the number of then outstanding public warrants and, solely with respect to any amendment to the terms of the private placement warrants or any provision of the Warrant Agreement with respect to the private placement warrants, the vote or written consent of at least 50% of the number of then outstanding private placement warrants and at least 50% of the number of then outstanding public warrants.

The warrants are governed by the warrant agreement, dated as of October 6, 2020 (the “Warrant Agreement”), by and between Sports Entertainment Acquisition Corp. and Continental Stock Transfer & Trust

Table of Contents

Company, as warrant agent. Our Ordinary Shares and public warrants are listed on the New York Stock Exchange (“NYSE”) under the symbols “SGHC” and “SGHC WS,” respectively. As of November 9, 2022, a total of 33,499,986 warrants were outstanding, consisting of 22,499,986 public warrants and 11,000,000 private placement warrants. Pursuant to the Offer, we are offering up to an aggregate of 5,624,997 Ordinary Shares in exchange for the public warrants.

The Offer and Consent Solicitation is made solely upon the terms and conditions in this Prospectus/Offer to Exchange and in the related letter of transmittal and consent (as it may be supplemented and amended from time to time, the “Letter of Transmittal and Consent”). One of the conditions of the Offer and Consent Solicitation is that (i) holders of at least 50% of then outstanding public warrants tender their warrants in the Offer, and thereby consent to the Warrant Amendment, and (ii) holders of at least 50% of the number of then outstanding private placement warrants consent to the Warrant Amendment. Holders of public warrants may not consent to the Warrant Amendment without tendering their public warrants in the Offer and may not tender such warrants without consenting to the Warrant Amendment. The consent to the Warrant Amendment is a part of the Letter of Transmittal and Consent. Holders who tender public warrants for exchange in the Offer will automatically be deemed, without any further action, to have given their consent to approval of the Warrant Amendment (effective upon our acceptance of the tendered warrants). Public warrant holders may revoke their consent at any time prior to the Expiration Date (as defined below) by withdrawing the public warrants tendered in the Offer. Private placement warrant holders that consent to the Warrant Amendment may not revoke their consent. Pursuant to the terms of the Warrant Agreement, all except certain specified modifications or amendments require the vote or written consent of holders of at least 50% of the number of then outstanding public warrants and, solely with respect to any amendment to the terms of the private placement warrants or any provision of the Warrant Agreement with respect to the private placement warrants, the vote or written consent of at least 50% of the number of then outstanding private placement warrants and at least 50% of the number of then outstanding public warrants.

Parties representing approximately 22.5% of the outstanding public warrants have agreed to tender their warrants in the Offer and to consent to the Warrant Amendment in the Consent Solicitation, and approximately 59.5% of the outstanding private placement warrants have agreed to consent to the Warrant Amendment in the Consent Solicitation pursuant to a tender and support agreement (the “Tender and Support Agreement”). Accordingly, if holders of an additional approximately 27.5% of the outstanding public warrants tender their public warrants in the Offer and consent to the Warrant Amendment in the Consent Solicitation and the other conditions described herein are satisfied or waived, then the Offer will be consummated and the Warrant Amendment will be adopted. For additional detail regarding the Tender and Support Agreement, see “Market Information, Dividends and Related Shareholder Matters — Transactions and Agreements Concerning Our Securities — Tender and Support Agreement.” Additionally, conditional on the completion of the Offer and Consent Solicitation, each of the Pre-Closing Holders (as defined in that certain Business Combination Agreement (as defined below)) have agreed to irrevocably and unconditionally waive their respective rights to receive Earnout Shares (as defined in the Business Combination Agreement) arising from the earnout obligation subject to and with effect from completion of the Offer and Consent Solicitation.

The Offer and Consent Solicitation will be open until 12:01 a.m., Eastern Time, on December 12, 2022, or such later time and date to which we may extend (the period during which the Offer and Consent Solicitation is open, giving effect to any withdrawal or extension, is referred to as the “Offer Period,” and the date and time at which the Offer Period ends is referred to as the “Expiration Date”). The Offer and Consent Solicitation is not made to those holders who reside in states or other jurisdictions where an offer, solicitation or sale would be unlawful.

We may withdraw the Offer and Consent Solicitation only if the conditions to the Offer and Consent Solicitation are not satisfied or waived prior to the Expiration Date. Promptly upon any such withdrawal, we will return the tendered public warrants to the public warrant holders and any related consents to the Warrant Amendment will be revoked. One of the conditions of the Offer and Consent Solicitation is that (i) holders of at least 50% of then outstanding public warrants tender their warrants in the Offer, and thereby consent to the Warrant Amendment, and (ii) holders of at least 50% of the number of then outstanding private placement warrants consent to the Warrant Amendment. Pursuant to the terms of the Warrant Agreement, all except certain

Table of Contents

specified modifications or amendments require the vote or written consent of holders of at least 50% of the number of then outstanding public warrants and, solely with respect to any amendment to the terms of the private placement warrants or any provision of the Warrant Agreement with respect to the private placement warrants, the vote or written consent of at least 50% of the number of then outstanding private placement warrants and at least 50% of the number of then outstanding public warrants.

Public warrant holders may tender some or all of their warrants into the Offer. Holders participating in the Offer and Consent Solicitation shall follow the instructions in this Prospectus/Offer to Exchange and the related documents, including the Letter of Transmittal and Consent. Holders of tendered public warrants may withdraw such warrants at any time before the Expiration Date. and retain them on their current terms or amended terms if the Warrant Amendment is approved, by following the instructions in this Prospectus/Offer to Exchange. In addition, tendered warrants that are not accepted by us for exchange by January 10, 2023, may thereafter be withdrawn by public warrant holders until such time as the warrants are accepted by us for exchange. If public warrant holders withdraw the tender of their warrants, their warrants and consent to the Warrant Amendment will be withdrawn as a result. Holders of private placement warrants that consent to the Warrant Amendment may not revoke their consent.

Public warrants not exchanged for Ordinary Shares pursuant to the Offer will remain outstanding subject to their current terms or amended terms if the Warrant Amendment is approved. If the Warrant Amendment is approved, we intend to (i) require the conversion of all outstanding public warrants into Ordinary Shares at a ratio of 0.225 Ordinary Shares per public warrant (a ratio which is 10% less than the exchange ratio applicable to the Offer) and (ii) instruct the warrant agent to cancel all outstanding private placement warrants for no consideration, as provided in the Warrant Amendment. The Warrant Amendment will permit us to eliminate all of the warrants that remain outstanding after the Offer is completed. Our public warrants are currently listed on NYSE under the symbol “SGHC WS”; however, our public warrants will be delisted following the completion of the Offer and Consent Solicitation.

The Offer and Consent Solicitation is conditioned upon the effectiveness of a registration statement on Form F-4 that we filed with the U.S. Securities and Exchange Commission (the “SEC”) regarding the Ordinary Shares issuable upon exchange of the warrants pursuant to the Offer. This Prospectus/Offer to Exchange forms a part of the registration statement.

Our board of directors has approved the Offer and Consent Solicitation. However, neither we nor any of our management, our board of directors, or the information agent or the exchange agent for the Offer and Consent Solicitation is making any recommendation as to whether holders of warrants should tender warrants for exchange in the Offer and, as applicable, consent to the Warrant Amendment in the Consent Solicitation. Each holder of a warrant must make its own decision as to whether to exchange some or all of its warrants and, as applicable, consent to the Warrant Amendment. All questions concerning the terms of the Offer and Consent Solicitation should be directed to the Company.

All questions concerning exchange procedures and requests for additional copies of this Prospectus/Offer to Exchange, the Letter of Transmittal and Consent or the Notice of Guaranteed Delivery should be directed to the information agent:

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Shareholders, Banks and Brokers

Call Toll Free: 888-680-1526

We will amend our offering materials, including this Prospectus/Offer to Exchange, to the extent required by applicable securities laws to disclose any material changes to information previously published, sent or given to warrant holders.

Table of Contents

The securities offered by this Prospectus/Offer to Exchange involve risks. Before participating in the Offer and consenting to the Warrant Amendment, you are urged to read carefully the section titled “Risk Factors” beginning on page 15 of this Prospectus/Offer to Exchange.

Neither the SEC nor any state securities commission or any other regulatory body has approved or disapproved of these securities or determined if this Prospectus/Offer to Exchange is truthful or complete. Any representation to the contrary is a criminal offense.

Through the Offer and Consent Solicitation, we are soliciting consent to the Warrant Amendment. Holders of public warrants who tender their warrants in the Offer will be delivering the consent to the proposed Warrant Amendment, which consent will be effective upon our acceptance of such warrants for exchange.

This Prospectus/Offer to Exchange is dated December 9, 2022.

Table of Contents

| Page | ||||

| ii | ||||

| iii | ||||

| v | ||||

| 1 | ||||

| SUMMARY CONSOLIDATED HISTORICAL AND OTHER FINANCIAL INFORMATION |

11 | |||

| 15 | ||||

| 67 | ||||

| 75 | ||||

| 87 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

120 | |||

| 162 | ||||

| 172 | ||||

| MARKET INFORMATION, DIVIDENDS AND RELATED SHAREHOLDER MATTERS |

174 | |||

| 184 | ||||

| 201 | ||||

| 203 | ||||

| 205 | ||||

| 205 | ||||

| 205 | ||||

| F-1 | ||||

| A-1 | ||||

i

Table of Contents

ABOUT THIS PROSPECTUS/OFFER TO EXCHANGE

This Prospectus/Offer to Exchange is a part of the registration statement that we filed on Form F-4 with the U.S. Securities and Exchange Commission. You should read this Prospectus/Offer to Exchange, including the detailed information regarding the Company, Ordinary Shares and warrants, and the financial statements and the notes included herein and any applicable prospectus supplement.

We have not authorized anyone to provide you with information different from that contained in this Prospectus/Offer to Exchange. If anyone makes any recommendation or representation to you, or gives you any information, you must not rely upon that recommendation, representation or information as having been authorized by us. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should not assume that the information in this Prospectus/Offer to Exchange or any prospectus supplement is accurate as of any date other than the date on the front of those documents. You should not consider this Prospectus/Offer to Exchange to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. Furthermore, you should not consider this Prospectus/Offer to Exchange to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so, or if it is unlawful for you to receive such an offer or solicitation.

Unless the context requires otherwise, in this Prospectus/Offer to Exchange, we use the terms “the Company”, “our company,” “we,” “us,” “our,” and similar references to refer to Super Group (SGHC) Limited and its subsidiaries.

ii

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Prospectus/Offer to Exchange and the documents incorporated herein by reference contain statements that are forward-looking and as such are not historical facts. In addition, any statements that refer to estimates, projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for the Company. Specifically, forward-looking statements may include statements relating to:

| • | operational, economic, political and regulatory risks; |

| • | the potential opportunity for profitability within targeted markets and geographic regions; |

| • | the impact of seasonality effects; |

| • | natural disasters and other business disruptions including outbreaks of epidemic or pandemic disease and their impact on our business; |

| • | failure to retain key personnel or identify performance problems; |

| • | our inability to recognize deferred tax assets and tax loss carry forwards; |

| • | our future operating results fluctuating, failing to match performance or to meet expectations; |

| • | unanticipated changes in our tax obligations; |

| • | our obligations under various laws and regulations; |

| • | the effect of litigation, judgments, orders or regulatory proceedings on our business; |

| • | our ability to successfully expand and launch into new markets; |

| • | global or local economic and political movements; |

| • | our ability to effectively manage our credit risk and collect on our accounts receivable; |

| • | our ability to fulfill our public company obligations; |

| • | any failure of our management information systems and data security; |

| • | our ability to meet our working capital and capital expenditure requirements and obligations; |

| • | our growth strategies; |

| • | our marketing strategies and plans; |

| • | pending acquisitions; |

| • | the recognition of business combinations and acquisitions within our financial results; |

| • | the effectiveness of non-GAAP financial information in evaluating our performance; |

| • | changes in accounting policies applicable to us; |

| • | the development and maintenance of effective internal controls; and |

| • | other risks and uncertainties discussed in the section titled “Risk Factors” in this Prospectus/Offer to Exchange. |

iii

Table of Contents

You should refer to the section of this Prospectus/Offer to Exchange titled “Risk Factors” for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Prospectus/Offer to Exchange will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, statements that “we believe” and other similar statements reflect our belief and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Prospectus/Offer to Exchange, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherent uncertain and investors are cautioned not to unduly rely upon these statements.

You should read this Prospectus/Offer to Exchange and the documents that we reference in this Prospectus/Offer to Exchange and have filed as exhibits to the registration statement, of which this Prospectus/Offer to Exchange is a part, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

iv

Table of Contents

Unless the context otherwise requires, references in this Prospectus/Offer to Exchange to:

“Business Combination” means the transactions contemplated by the Business Combination Agreement.

“Business Combination Agreement” means the Business Combination Agreement, dated as of April 23, 2021, by and among SEAC, SGHC, Super Group, Merger Sub and Sponsor, a copy of which was filed as Exhibit 2.1 to Sports Entertainment Acquisition Corp.’s Current Report on Form 8-K with the SEC on April 26, 2021.

“Class A Shares” means SEAC’s Class A common stock, par value $0.0001.

“Class B Shares” means SEAC’s Class B common stock, par value $0.0001.

“Closing” means the closing of the Business Combination.

“common stock” means Class A Shares and Class B Shares.

“Company” means Super Group.

“Continental” means Continental Stock Transfer & Trust Company.

“DGCL” means the Delaware General Corporation Law as the same may be amended from time to time.

“DTC” means the Depository Trust Company.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Guernsey Companies Law” means the Companies (Guernsey) Law, 2008 (as amended).

“IFRS” means the International Financial Reporting Standards as set forth by the International Accounting Standards Board.

“Information Agent” means Georgeson LLC.

“IPO” means SEAC’s October 6, 2020 initial public offering of units, with each unit consisting of one Class A Share and one-half of one warrant, raising total gross proceeds of approximately $450,000,000.

“Merger Sub” means Super Group (SGHC) Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of the Company.

“NYSE” means the New York Stock Exchange.

“Pre-Closing Holders” means the existing shareholders of SGHC prior to the Closing.

“private placement warrants” means the warrants originally issued to the Sponsor and PJT Partners Holdings LP in a private placement simultaneously with the closing of the IPO as well as in connection with the closing of the partial exercise by the underwriters of their over-allotment option, with each such warrant entitling the holder thereof to purchase one Class A Share at a price of $11.50 per share.

“public warrants” means the 22,499,986 redeemable warrants sold as part of the units in the IPO.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

v

Table of Contents

“SEAC” means Sports Entertainment Acquisition Corp., a Delaware corporation.

“SEAC Founder Holders” means each of Sponsor, Natara Holloway Branch, Timothy Goodell and their permitted transferees.

“SEAC Holders” means SEAC Founder Holders and PJT Partners Holdings LP.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended.

“SGHC” means SGHC Limited, a non-cellular company limited by shares incorporated under the laws of the Island of Guernsey.

“SGHC Post-Closing Holders” means certain shareholders who are officers and employees of SGHC, the Company, Merger Sub and all direct and indirect subsidiaries of SGHC and certain other existing shareholders of SGHC (the “Co-Investors”).

“Sponsor” means Sports Entertainment Acquisition Holdings LLC, a Delaware limited liability company.

“Super Group” means Super Group (SGHC) Limited, a non-cellular company limited by shares incorporated under the laws of the Island of Guernsey, and its subsidiaries when the context requires.

“Super Group Board” means the board of directors of Super Group.

“Super Group Governing Documents” means the Super Group Amended and Restated Memorandum of Incorporation and the Super Group Amended and Restated Articles of Incorporation.

“Super Group Ordinary Shares” or “Ordinary Shares” means the ordinary redeemable shares of Super Group, of no par value.

“Transfer Agent” means Continental Stock Transfer & Trust Company.

“warrants” means the private placement warrants and public warrants.

vi

Table of Contents

The Offer and Consent Solicitation

This summary provides a brief overview of the key aspects of the Offer and Consent Solicitation. Because it is only a summary, it does not contain all of the detailed information contained elsewhere in this Prospectus/Offer to Exchange or in the documents included as exhibits to the registration statement that contains this Prospectus/Offer to Exchange. Accordingly, you are urged to carefully review this Prospectus/Offer to Exchange in its entirety (including all documents filed as exhibits to the registration statement that contains this Prospectus/Offer to Exchange, which exhibits may be obtained by following the procedures set forth herein in the section titled “Where You Can Find Additional Information”).

In this Prospectus/Offer to Exchange, unless otherwise stated, the terms “the Company,” “we,” “us” or “our” refer to Super Group (SGHC) Limited and its subsidiaries.

Summary of the Offer and Consent Solicitation

| The Company |

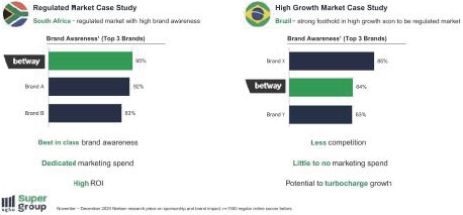

Super Group is a leading global online sports betting and gaming operator. Super Group’s mission is to responsibly provide first-class entertainment to the worldwide online betting and gaming community. Super Group’s strategy for achieving this is built around three key pillars: |

| 1. Expanding its global footprint into as many commercially feasible regulated markets as possible in order to engage with as many customers as it can possibly reach; |

| 2. Increasing awareness of its brands through strategic partnerships and coordinated sponsorship and marketing campaigns; and |

| 3. Utilizing enhanced proprietary data to optimize the confluence of ethical corporate culture, responsible gaming values, value-for-money product offerings and customer-centric service delivery. |

| As of the date of this Prospectus/Offer to Exchange, Super Group subsidiaries are licensed in over 20 jurisdictions and manage approximately 3,800 employees. Over the six months ended June 30, 2022, on average, over 2.6 million customers per month have yielded in excess of €2.5 billion in wagers per month. During the period from January 1, 2022 to June 30, 2022, total wagers amounted to €15.6 billion. Super Group’s business generated €655 million on a consolidated basis of net gaming revenue between January 1, 2022 and June 30, 2022 in different geographic regions, including the Americas, Europe, Africa and the rest of the world, such regions accounting for 46%, 10%, 20% and 24%, respectively, of Super Group’s total revenue in 2022. |

| Corporate Contact Information |

The Company’s registered office in Guernsey is Kingsway House, Havilland Street, St. Peter Port, Guernsey GY1 2QE. The address of the principal executive office of the Company is Super Group (SGHC) Limited, Bordeaux Court, Les Echelons, St. Peter Port, |

1

Table of Contents

| Guernsey, GY1 1AR, and the telephone number of the Company is +44 (0) 14 8182 2939. We maintain a website at https://www.sghc.com where general information about us is available. The information contained on, or that may be accessed through, our website is not part of, and is not incorporated into, this Prospectus/Offer to Exchange or the registration statement of which it forms a part. |

| Warrants that qualify for the Offer |

As of November 9, 2022, we had outstanding an aggregate of 33,499,986 warrants, including 22,499,986 public warrants, each exercisable for one Ordinary Shares at a price of $11.50 per share, subject to adjustments pursuant to the Warrant Agreement. Pursuant to the Offer, we are offering up to an aggregate of 5,624,997 Ordinary Shares in exchange for all of the outstanding public warrants. |

| Under the Warrant Agreement, we may call the public warrants for redemption at our option: |

| • | in whole and not in part; |

| • | at a price of $0.10 per warrant; |

| • | upon not less than 30 days’ prior written notice of redemption (the “30-day redemption period”) to each warrant holder; and |

| • | if, and only if, the reported closing price of our Ordinary Shares equals or exceeds $18.00 per share (as adjusted for share splits, share dividends, reorganizations, recapitalizations and the like) for any 10 trading days within a 20-trading day period ending on the third business day prior to the date on which we send the notice of redemption to the warrant holders, provided that there is an effective registration statement covering the Ordinary Shares issuable upon exercise of the public warrants, and a current prospectus relating thereto, available throughout the 30-day redemption period or the Company has elected to require the exercise of public warrants on a “cashless basis.” |

| The warrants expire on January 27, 2027, subject to certain terms and conditions. |

| Market Price of Our Ordinary Shares |

Our Ordinary Shares and public warrants are listed on NYSE under the symbols “SGHC” and “SGHC WS” respectively. See “Market Information, Dividends and Related Shareholder Matters.” |

| The Offer |

Each public warrant holder who tenders warrants for exchange pursuant to the Offer will receive 0.25 Ordinary Shares for each public warrant so exchanged. No fractional Ordinary Shares will be issued pursuant to the Offer. In lieu of issuing fractional shares to any holder of warrants who would otherwise have been entitled to receive fractional shares pursuant to the Offer, the Company will round the number of shares to which such holder is entitled, after aggregating all fractions, up to the next whole number of shares. One of the |

2

Table of Contents

| conditions of the Offer and Consent Solicitation is that (i) holders of at least 50% of then outstanding public warrants tender their warrants in the Offer, and thereby consent to the Warrant Amendment, and (ii) holders of at least 50% of the number of then outstanding private placement warrants consent to the Warrant Amendment. |

| Holders of the warrants tendered for exchange will not have to pay any of the exercise price for the tendered warrants in order to receive Ordinary Shares in the exchange. The Ordinary Shares issued in exchange for the tendered public warrants will be unrestricted and freely transferable, as long as the holder is not an affiliate of ours and was not an affiliate of ours within the three months prior to the proposed transfer of such shares. |

| The Offer is being made to all public warrant holders except those holders who reside in states or other jurisdictions where an offer, solicitation or sale would be unlawful (or would require further action in order to comply with applicable securities laws). |

| The Consent Solicitation |

If approved, the Warrant Amendment would permit the Company to (i) require that all outstanding public warrants upon the closing of the Offer be converted into Ordinary Shares at a ratio of 0.225 Ordinary Shares per public warrant (a ratio which is10% less than the exchange ratio applicable to the Offer) and (ii) instruct the warrant agent to cancel each outstanding private placement warrant for no consideration. The Warrant Amendment will permit us to eliminate all of the warrants that remain outstanding after the Offer is consummated. |

| The Consent Solicitation is conditioned upon receiving the consent of holders of at least 50% of the then outstanding public warrants (which is the minimum number required to amend the Warrant Agreement with respect to the public warrants), and the consent of at least 50% of the number of then outstanding private placement warrants and at least 50% of the number of then outstanding public warrants (which is the minimum number required to amend the Warrant Agreement with respect to the private placement warrants). |

| Warrant holders participating in the Consent Solicitation are required to consent by executing the Letters of Transmittal and Consent or requesting that their broker or nominee consent on their behalf to an amendment to the Warrant Agreement governing the warrants as set forth in the Warrant Amendment attached as Annex A. |

| Holders of public warrants may not consent to the Warrant Amendment without tendering their public warrants in the Offer and may not tender such warrants without consenting to the Warrant Amendment. Holders who tender public warrants for exchange in the Offer will automatically be deemed, without any further action, to have given their consent to approval of the Warrant Amendment (effective upon our acceptance of the tendered warrants). |

3

Table of Contents

| Purpose of the Offer and Consent Solicitation |

The purpose of the Offer and Consent Solicitation is to attempt to simplify our capital structure, increase our public float and reduce the potential dilutive impact of the warrants, which we believe will provide us with more flexibility for financing our operations and growth opportunities in the future. |

| Additionally, conditional on the completion of the Offer and Consent Solicitation, each of the Pre-Closing Holders have agreed to irrevocably and unconditionally waive their respective rights to receive Earnout Shares arising from the earnout obligation subject to and with effect from completion of the exchange. |

| See “The Offer and Consent Solicitation — Background and Purpose of the Offer and Consent Solicitation.” |

| Offer Period |

The Offer and Consent Solicitation will expire on the Expiration Date, which is 12:01 a.m., Eastern Time, on December 12, 2022, or such later time and date to which we may extend. All warrants tendered for exchange pursuant to the Offer and Consent Solicitation, and all required related paperwork, must be received by the exchange agent by the Expiration Date, as described in this Prospectus/Offer to Exchange. |

| If the Offer Period is extended, we will make a public announcement of such extension by no later than 9:00 a.m., Eastern Time, on the next business day following the Expiration Date as in effect immediately prior to such extension. |

| We may withdraw the Offer and Consent Solicitation only if the conditions of the Offer and Consent Solicitation are not satisfied or waived prior to the Expiration Date. Promptly upon any such withdrawal, we will return the tendered warrants and revoke any consents to the Warrant Amendment. We will announce our decision to withdraw the Offer and Consent Solicitation by disseminating notice by public announcement or otherwise as permitted by applicable law. See “The Offer and Consent Solicitation — General Terms — Offer Period.” |

| Amendments to the Offer and Consent Solicitation |

We reserve the right at any time or from time to time to amend the Offer and Consent Solicitation, including by increasing or (if the conditions to the Offer are not satisfied) decreasing the exchange ratio of Ordinary Shares issued for every public warrant exchanged or by changing the terms of the Warrant Amendment. If we make a material change in the terms of the Offer and Consent Solicitation or the information concerning the Offer and Consent Solicitation, or if we waive a material condition of the Offer and Consent Solicitation, we will extend the Offer and Consent Solicitation to the extent required by Rules 13e-4(d)(2) and 13e-4(e)(3) under the Exchange Act. See “The Offer and Consent Solicitation — General Terms — Amendments to the Offer and Consent Solicitation.” |

4

Table of Contents

| Conditions to the Offer and Consent Solicitation |

The consummation of the Offer and Consent Solicitation is conditioned on (i) holders of at least 50% of then outstanding public warrants tendering their warrants in the Offer and thereby consenting to the Warrant Amendment, and (ii) holders of at least 50% of the then outstanding private placement warrants consenting to the Warrant Amendment. The Offer and Consent Solicitation is also subject to customary conditions, including the effectiveness of the registration statement of which this Prospectus/Offer to Exchange forms a part and the absence of any action or proceeding, statute, rule, regulation or order that would challenge or restrict the making or completion of the Offer. |

| The Consent Solicitation is conditioned upon receiving the consent of holders of at least 50% of the number of then outstanding public warrants (which is the minimum number required to amend the Warrant Agreement with respect to the public warrants), and the consent of at least 50% of the number of then outstanding private placement warrants and at least 50% of the number of then outstanding public warrants (which is the minimum number required to amend the Warrant Agreement with respect to the private placement warrants). We may waive some of the conditions to the Offer. See “The Offer and Consent Solicitation — General Terms — Conditions to the Offer and Consent Solicitation.” |

| We will not complete the Offer and Consent Solicitation unless and until the conditions above are met or waived and the registration statement described above is effective. If the conditions of the Offer and Consent Solicitation are not satisfied or waived prior to the Effective Date, or if the registration statement is not effective at the Expiration Date, we may, in our discretion, extend, suspend or cancel the Offer and Consent Solicitation, and will inform warrant holders of such event. |

| Withdrawal Rights |

If you tender your public warrants for exchange and change your mind, you may withdraw your tendered warrants and thereby automatically revoke the related consent to the Warrant Amendment at any time prior to the Expiration Date, as described in greater detail in the section titled “The Offer and Consent Solicitation — Withdrawal Rights.” If the Offer Period is extended, you may withdraw your tendered warrants and thereby automatically revoke the related consent to the Warrant Amendment at any time until the extended Expiration Date. In addition, tendered warrants that are not accepted by us for exchange by January 10, 2023 may thereafter be withdrawn by you until such time as the warrants are accepted by us for exchange. |

| Holders of private placement warrants that consent to the Warrant Amendment may not revoke their consent. See “The Offer and Consent Solicitation — Withdrawal Rights.” |

| Federal and State Regulatory Approvals |

Other than compliance with the applicable federal and state securities laws, no federal or state regulatory requirements must be complied |

5

Table of Contents

| with and no federal or state regulatory approvals must be obtained in connection with the Offer and Consent Solicitation. |

| Absence of Appraisal or Dissenters’ Rights |

Holders of warrants do not have any appraisal or dissenters’ rights under applicable law in connection with the Offer and Consent Solicitation. |

| U.S. Federal Income Tax Consequences of the Offer |

For those holders of warrants participating in the Offer and for any holders of warrants subsequently exchanged for Ordinary Shares pursuant to the terms of the Warrant Amendment, if approved, we intend to treat your exchange of warrants for our Ordinary Shares as a “recapitalization” within the meaning of Section 368(a)(1)(E) of the Code pursuant to which (i) you should not recognize any gain or loss on the exchange of warrants for Ordinary Shares, (ii) your aggregate tax basis in our Ordinary Shares received in the exchange should equal your aggregate tax basis in your warrants surrendered in the exchange, and (iii) your holding period for our Ordinary Shares received in the exchange should include your holding period for the surrendered warrants. However, because there is a lack of direct legal authority regarding the U.S. federal income tax consequences of the exchange of warrants for our Ordinary Shares, there can be no assurance in this regard and alternative characterizations are possible by the U.S. Internal Revenue Service (“IRS”) or a court, including ones that would require U.S. holders to recognize taxable income. |

| Although the issue is not free from doubt, we intend to treat all warrants not exchanged for Ordinary Shares in the Offer as having been exchanged for “new” warrants pursuant to the Warrant Amendment and to treat such deemed exchange as a “recapitalization” within the meaning of Section 368(a)(1)(E) of the Code, pursuant to which (i) you should not recognize any gain or loss on the deemed exchange of warrants for “new” warrants, (ii) your aggregate tax basis in the “new” warrants deemed to be received in the exchange should equal your aggregate tax basis in your existing warrants surrendered in the exchange, and (iii) your holding period for the “new” warrants deemed to be received in the exchange should include your holding period for the surrendered warrants. Because there is a lack of direct legal authority regarding the U.S. federal income tax consequences of the deemed exchange of warrants for “new” warrants pursuant to the Warrant Amendment, if approved, there can be no assurance in this regard and alternative characterizations by the IRS or a court are possible, including ones that would require U.S. holders to recognize taxable income. |

| See “The Offer and Consent Solicitation — Material U.S. Federal Income Tax Consequences.” |

| No Recommendation |

None of our Board, our management, the exchange agent, the information agent or any other person makes any recommendation on |

6

Table of Contents

| whether you should tender or refrain from tendering all or any portion of your warrants or consent to the Warrant Amendment, and no one has been authorized by any of them to make such a recommendation. |

| Risk Factors |

For risks related to the Offer and Consent Solicitation, please read the section titled “Risk Factors” beginning on page 17 of this Prospectus/Offer to Exchange. |

| Exchange Agent |

The depositary and exchange agent for the Offer and Consent Solicitation is: |

| Continental Stock Transfer & Trust Company |

1 State Street, 30th Floor

New York, New York 10004

Attention: Corporate Actions Department

| Information Agent |

The information agent for the Offer and Consent Solicitation is: |

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

| Shareholders, Banks and Brokers |

Call Toll Free: 888-680-1526

| Additional Information |

We recommend that our warrant holders review the registration statement on Form F-4, of which this Prospectus/Offer to Exchange forms a part, including the exhibits that we have filed with the SEC in connection with the Offer and Consent Solicitation and our other materials that we have filed with the SEC, before making a decision on whether to tender for exchange in the Offer and consent to the Warrant Amendment. All reports and other documents we have filed with the SEC can be accessed electronically on the SEC’s website at www.sec.gov. |

You should direct (1) questions about the terms of the Offer and Consent Solicitation to the Company at its address and telephone number listed above and (2) questions about the exchange procedures and requests for additional copies of this Prospectus/Offer to Exchange, the Letter of Transmittal and Consent or Notice of Guaranteed Delivery to the information agent at the below address and phone number:

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Shareholders, Banks and Brokers

Call Toll Free: 888-680-1526

7

Table of Contents

Risks Associated with Our Business

The following is a summary list of the principal risk factors that could materially adversely affect our business, financial condition, liquidity and results of operations. These are not the only risks and uncertainties we face, and you should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors”, together with the other information in this Prospectus/Offer to Exchange.

| • | Our business depends on the success, including win or hold rates, of existing and future online betting and gaming products, which rely on a variety of factors and are not completely controlled by us. |

| • | Competition within the broader entertainment industry is intense and our existing and potential customers may be attracted to competing betting and gaming options, as well as other forms of entertainment such as video games, television, movies and sporting events. If our offerings do not continue to be popular with existing customers and attract potential customers, our business would be harmed. |

| • | Although the spread of COVID-19 infections and mortality rates appear to have receded in all of our key markets and COVID-19 related restrictions have widely been lifted, historic restrictions have nonetheless affected our business, financial condition, results of operations and prospects. We cannot be certain that a new strain of the virus will not lead to future reductions in the quantity of global sporting events, closures or restrictions on business operations of our suppliers, partners and sports organizations or a decrease in consumer spending. Pandemic restrictions that led to increased activity in online casino gaming have since been loosened or removed, resulting in at least partial return of customer activity to pre-pandemic levels in some markets. We cannot be certain of a full return to pre-pandemic levels in online gaming activities. |

| • | We rely on third-party service providers such as (i) third-party providers to validate the identity and identify the location of our customers, (ii) third-party payment processors to process deposits and withdrawals made by our customers into our platforms, (iii) third-party marketing and customer communications systems providers, (iv) third-party casino content, product and technology providers, (v) third-party sportsbook technology providers, (vi) third-party sports data providers for real-time and accurate data for sporting events, and (vii) third-party outsourced services providers, among others. If our third-party providers do not perform adequately or terminate their relationships with us, our costs may increase and our business, financial condition and results of operations could be adversely affected. |

| • | We license the Betway brand, for a fixed fee, for use by DGC USA in the United States and, for a fixed fee plus an additional fee equal to a percentage of Betway’s global brand marketing spend, to a third party for use in China, Thailand and Vietnam. A decline in such third-party operators’ financial performance or a termination of the brand licenses by such third parties could have an adverse effect on our business. |

| • | Our financial guarantee arrangement under DGC’s loan facility with Standard Bank may limit our operational flexibility or otherwise adversely affect our results of operations or cash needs. |

| • | If we fail to detect fraud or theft related to our offerings, including by our customers and employees, we will suffer financial losses and our reputation may suffer which could harm our brand and reputation and negatively impact our business, financial condition and results of operations and can subject us to investigations and litigation, which could ultimately lead to regulatory penalties, including potential loss of licensure. |

| • | We rely on strategic relationships with land-based casinos, sports teams, event planners, local licensing partners and advertisers in order to be able to offer and market our products in certain jurisdictions. If we cannot maintain these relationships and establish additional relationships, our business, financial condition and results of operations could be adversely affected. |

8

Table of Contents

| • | The requirements of being a public company, including compliance with the requirements of the Sarbanes-Oxley Act and maintaining effective internal controls over financial reporting, may strain our resources and divert management’s attention, and the increases in legal, accounting and compliance expenses associated with being a public company may be greater than we anticipate. |

| • | As a private company, we were not required to document and test internal controls over financial reporting nor was our management required to certify the effectiveness of internal controls or have our auditors opine on the effectiveness of our internal control over financial reporting. Failure to maintain adequate financial, information technology and management processes and controls could result in material weaknesses which could lead to errors in our financial reporting, which could adversely affect our business as a public company. |

| • | If our existing material weaknesses persist or we experience additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls in the future, we may not be able to accurately report our financial condition or results of operation, which may adversely affect investor confidence in us and, as a result, the value of our Ordinary Shares and our overall business. |

| • | Economic downturns, abrupt or unexpected changes in interest rates or increases in inflation or inflationary expectations, reductions in discretionary consumer spending and political and market conditions beyond our control could adversely affect our business, financial condition and results of operations. In the event of any such impacts happening, we cannot be certain as to the extent or duration thereof. |

| • | We are susceptible to macroeconomic events and geopolitical factors, which may adversely affect our business, prospects, financial condition or results of operations. |

| • | We face significant regulatory challenges associated with our participation in the Ontario market. |

| • | The gaming laws of different jurisdictions vary in both nature and application, and may be subject to alternate interpretations. Jurisdictions may or may not incorporate regulatory frameworks that provide a clear basis for the licensed provision of our gaming products and services to their residents. As a consequence, legal and enforcement risk may be unclear or uncertain in a number of the jurisdictions in which we operate and from which we generate a significant portion of our revenue, and there is a risk that regulators or prosecutors in these territories may seek to take legal action against us even in jurisdictions in which we believe our offerings are lawful based on advice from local counsel. Furthermore, we have in the past faced claims from customers contesting the legal basis of our services in certain jurisdictions, and may face similar claims again in the future. |

| • | Failure to comply with legal or regulatory requirements in a particular regulated jurisdiction, or the failure to successfully obtain a license or permit in a particular jurisdiction, could impact our ability to comply with licensing and regulatory requirements in other regulated jurisdictions, or could cause the rejection of license applications or cancellation of existing licenses in other regulated jurisdictions, or could cause financial institutions, online and mobile platforms, advertisers and distributors to stop providing services to us which we rely upon to receive payments from, or distribute amounts to, our customers, or otherwise to deliver and promote our offerings. |

| • | We are party to pending litigation and regulatory and tax audits in various jurisdictions and with various plaintiffs and we may be subject to future litigation and regulatory and tax audits in the operation of our business. An adverse outcome in one or more proceedings could adversely affect our business. |

| • | Failure to protect or enforce our intellectual property rights, the confidentiality of our trade secrets and confidential information, or the costs involved in protecting or enforcing our intellectual property rights and confidential information, could harm our business, financial condition and results of operations. |

9

Table of Contents

| • | Our collection, storage and use, including sharing and international transfers, of personal data are subject to applicable data protection and privacy laws, and any actual or perceived failure to comply with such laws may harm our reputation and business or expose us to fines, civil claims (including class actions), and other enforcement action. The protection of personal information is becoming increasingly regulated and changes in applicable laws may require changes to our policies, practices, procedures and personnel which may require material expenditures and harm our financial condition and results of operations. |

| • | We will rely on licenses to use the intellectual property rights of third parties which are incorporated into our products and offerings. Failure to maintain, renew or expand existing licenses may require us to modify, limit or discontinue certain offerings, which could adversely affect our business, financial condition and results of operations. |

| • | We rely on information technology and other systems and platforms, and any failures, errors, defects or disruptions in our systems or platforms could diminish our brand and reputation, subject us to liability, disrupt our business, affect our ability to scale our technological infrastructure and adversely affect our operating results and growth prospects. Our games and other software applications and systems, and the third-party platforms upon which they are made available could contain undetected errors. |

| • | Our internal forecasts are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding future legislation and changes in regulations of the jurisdictions in which we operate, or seek to operate, our business. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations. |

| • | The coverage of our business or our securities by securities or industry analysts or the absence thereof could adversely affect our securities and trading volume. |

| • | Because we are incorporated under the laws of the Island of Guernsey, you may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. courts may be limited; and |

| • | the other factors set forth under “Risk Factors.” |

10

Table of Contents

SUMMARY CONSOLIDATED HISTORICAL AND OTHER FINANCIAL INFORMATION

The following tables sets forth our selected historical consolidated data and other data. The consolidated statement of profit or loss data and consolidated cash flow data for the years ended December 31, 2021, 2020 and 2019 and the consolidated statement of financial position data as of December 31, 2021 and 2020 are derived from SGHC’s audited consolidated financial statements included elsewhere in this Prospectus/Offer to Exchange. The SGHC consolidated financial statements for the years ended December 31, 2021, 2020 and 2019 included elsewhere herein have been restated following the merger between SGHC, Super Group and SEAC as such transaction was accounted for as a capital reorganization, with such consolidated financial statements reflecting recapitalization and the effects of the share exchange for all periods presented, which effects predominantly earnings-per-share and share disclosures. The statement of financial position data as of December 31, 2019 is derived from SGHC’s audited consolidated financial statements not included in this Prospectus/Offer to Exchange. We derived the consolidated statement of profit or loss data and consolidated cash flow data for the six months ended June 30, 2022 and 2021 and the consolidated statement of financial position data as of June 30, 2022 from our unaudited condensed consolidated financial statements included elsewhere in this Prospectus/Offer to Exchange. The following selected consolidated financial data should be read in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this Prospectus/Offer to Exchange.

Our audited consolidated financial statements are prepared and presented in accordance with International Financial Reporting Standards as issued by the IASB (“IFRS”). Our unaudited condensed consolidated financial statements are prepared and presented in accordance with International Accounting Standard 34 Interim Financial Reporting Standards as issued by the IASB (“IAS 34”).

The following historical financial information of SGHC is impacted by business combinations (the “Reorganization Transaction”) which took place during 2020 and 2019 and impact the comparability of financial information between the year ended December 31, 2020 and 2019. The Reorganization Transaction is more fully described in Note 1 and Note 4 to SGHC’s audited financial statements, and the SEAC Merger is more fully described in Note 4 to Super Group (SGHC) Limited’s unaudited condensed consolidated financial statements, which are included elsewhere in the Prospectus/Offer to Exchange. The historical results included below and elsewhere in this Prospectus/Offer to Exchange are not necessarily indicative of the Company’s future performance.

| € ‘000s | For the six months (unaudited) |

For the six months (unaudited) |

For the year ended 2021 |

For the year ended December 31, 2020 |

For the year ended December 31, 2019 |

|||||||||||||||

| Consolidated Statement of Profit or Loss Data |

||||||||||||||||||||

| Revenue |

€ | 655,295 | € | 667,010 | € | 1,320,658 | € | 908,019 | € | 476,040 | ||||||||||

| Direct and marketing expenses |

(466,417 | ) | (448,062 | ) | (896,494 | ) | (612,689 | ) | (430,984 | ) | ||||||||||

| Other operating income |

5,293 | 4,997 | 8,042 | — | — | |||||||||||||||

| General and administrative expenses |

(72,455 | ) | (79,060 | ) | (149,859 | ) | (114,538 | ) | (69,967 | ) | ||||||||||

| Depreciation and amortization expense |

(31,169 | ) | (41,981 | ) | (83,560 | ) | (55,407 | ) | (30,460 | ) | ||||||||||

| Transaction Fees |

(21,611 | ) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit/(loss) from operations |

€ | 68,936 | € | 102,904 | € | 198,787 | € | 125,385 | € | (55,371 | ) | |||||||||

| Finance income |

665 | 688 | 1,312 | 257 | 158 | |||||||||||||||

| Finance expense |

(663 | ) | (5,755 | ) | (6,370 | ) | (10,991 | ) | (7,735 | ) | ||||||||||

| Gain on derivative contracts |

1,712 | — | 15,830 | — | — | |||||||||||||||

11

Table of Contents

| € ‘000s | For the six months (unaudited) |

For the six months (unaudited) |

For the year ended 2021 |

For the year ended December 31, 2020 |

For the year ended December 31, 2019 |

|||||||||||||||

| Gain on bargain purchase |

— | 10,661 | 16,349 | 34,995 | 45,331 | |||||||||||||||

| Foreign exchange on revaluation of warrants and earnouts |

(24,029 | ) | — | — | — | — | ||||||||||||||

| Share based payment expense |

(126,252 | ) | — | — | — | — | ||||||||||||||

| Change in fair value of warrant liability |

34,614 | — | — | — | — | |||||||||||||||

| Change in fair value of earnout liability |

194,936 | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit/(loss) before taxation |

€ | 149,919 | € | 108,498 | € | 225,908 | € | 149,646 | € | (17,617 | ) | |||||||||

| Income tax expense |

(14,582 | ) | (6,011 | ) | 9,970 | (429 | ) | (333 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit/(loss) for the |

€ | 135,337 | € | 102,487 | € | 235,878 | € | 149,217 | € | (17,950 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings/(loss) per share, Basic and Diluted |

€ | 0.28 | € | 0.22 | € | 0.50 | € | 0.32 | € | (0.04 | ) | |||||||||

| € ‘000s | As of June 30, 2022 (unaudited) |

As of December 31, 2021 |

As of December 31, 2020 |

As of December 31, 2019 |

||||||||||||

| Consolidated Statement of Financial Position Data: |

||||||||||||||||

| Total Non-current assets |

€ | 263,622 | € | 284,920 | € | 287,675 | € | 193,207 | ||||||||

| Total Current assets |

519,926 | 559,152 | 263,477 | 149,728 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

€ | 783,548 | € | 844,072 | € | 551,152 | € | 342,935 | ||||||||

| Total Current liabilities |

361,839 | 309,112 | 437,312 | 396,677 | ||||||||||||

| Lease liabilities |

9,939 | 10,896 | 6,754 | 8,068 | ||||||||||||

| Deferred tax liability |

8,666 | 9,248 | 9,211 | 5,146 | ||||||||||||

| Interest-bearing loans and borrowings |

— | 764 | 27,001 | 7,220 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

€ | 380,444 | € | 330,020 | € | 480,278 | € | 417,111 | ||||||||

| Issued capital |

273,435 | 269,338 | 61,222 | 55,001 | ||||||||||||

| Foreign exchange reserve |

(2,094 | (2,094 | ) | (1,278 | ) | (890 | ) | |||||||||

| Earnout reserve |

(249,955 | ) | — | — | — | |||||||||||

| Accumulated profit |

384,093 | 246,808 | 10,930 | (128,287 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Equity/(Deficit) |

€ | 403,104 | € | 514,052 | € | 70,874 | € | (74,176 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

12

Table of Contents

| € ‘000s | For the six months ended June 30, 2022 (unaudited) |

For the six months ended June 30, 2021 (unaudited) |

For the year ended December 31, 2021 |

For the year ended December 31, 2020 |

For the year ended December 31, 2019 |

|||||||||||||||

| Consolidated Cash Flow Data: |

||||||||||||||||||||

| Net cash flows generated from/(used in) operating activities |

€ | 32,615 | € | 130,140 | € | 209,853 | € | 151,325 | € | 3,591 | ||||||||||

| Net cash flows (used in)/generated from investing activities |

€ | (42,233 | ) | € | 32,207 | € | (18,160 | ) | € | (5,838 | ) | € | 49,637 | |||||||

| Net cash flows used in financing activities |

€ | (72,715 | ) | € | (28,836 | ) | € | (39,763 | ) | € | (81,088 | ) | € | (7,889 | ) | |||||

Non-IFRS Financial Measures

In addition to the Company’s results determined in accordance with IFRS, this Prospectus/Offer to Exchange includes EBITDA and Adjusted EBITDA which are non-GAAP company-specific performance measures that Super Group uses to supplement the Company’s results presented in accordance with IFRS. EBITDA is defined as profit for the period before depreciation, amortization, financial income, financial expense and income tax expense/credit. Adjusted EBITDA is defined as EBITDA less gain on bargain purchase and gain on derivative contracts plus transaction costs. The Company believes that EBITDA and Adjusted EBITDA are useful in evaluating the Company’s operating performance as they are similar to measures reported by the Company’s competitors and are regularly used by securities analysts, institutional investors and other interested parties in analyzing operating performance and prospects. EBITDA and Adjusted EBITDA are not intended to be a substitute for any IFRS financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry.

Because of these limitations, EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with IFRS. Super Group compensates for these limitations by relying primarily on its IFRS results and using EBITDA and Adjusted EBITDA on a supplemental basis. You should review the reconciliation of net profit/(loss) to EBITDA and Adjusted EBITDA below and not rely on any single financial measure to evaluate the Company’s business.

13

Table of Contents

The table below presents our (unaudited) Adjusted EBITDA reconciled to profit / (loss), the closest IFRS measure, for the periods indicated:

| € ‘000s | For the six months ended June 30, 2022 (unaudited) |

For the six months ended June 30, 2021 (unaudited) |

For the year ended December 31, 2021 |

For the year ended December 31, 2020 |

For the year ended December 31, 2019 |

|||||||||||||||

| Profit/(loss) for the period |

€ | 135,337 | € | 102,487 | € | 235,878 | € | 149,217 | € | (17,950 | ) | |||||||||

| Income tax expense |

14,582 | 6,011 | (9,970 | ) | 429 | 333 | ||||||||||||||

| Finance income |

(665 | ) | (688 | ) | (1,312 | ) | (257 | ) | (158 | ) | ||||||||||

| Finance expense |

663 | 5,755 | 6,370 | 10,991 | 7,735 | |||||||||||||||

| Depreciation and amortization expense |

31,169 | 41,981 | 83,560 | 55,407 | 30,460 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

€ | 181,086 | € | 155,546 | € | 314,526 | € | 215,787 | € | 20,420 | ||||||||||

| Transaction fees |

21,611 | — | 7,107 | — | — | |||||||||||||||

| Gain on derivative contracts |

(1,712 | ) | — | (15,830 | ) | — | — | |||||||||||||

| Share based payment expense |

126,252 | — | — | — | — | |||||||||||||||

| Foreign exchange loss on revaluation of warrants and earnouts |

24,029 | — | — | — | — | |||||||||||||||

| Change in fair value of warrant liability |

(34,614 | ) | — | — | — | — | ||||||||||||||

| Change in fair value of earnout liability |

(194,936 | ) | — | — | — | — | ||||||||||||||

| RSU expense |

3,376 | — | — | — | — | |||||||||||||||

| Gain on bargain purchase |

— | (10,661 | ) | (16,349 | ) | (34,995 | ) | (45,331 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

€ | 125,092 | € | 144,885 | € | 289,454 | € | 180,792 | € | (24,911 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

14

Table of Contents

An investment in our securities involves a high degree of risk. You should consider carefully the risk factors below, as well as the other information contained in this Prospectus/Offer to Exchange before making an investment decision. Any of the risk factors could significantly and negatively affect our business, financial condition, results of operations, cash flows, and prospects and the trading price of our securities. You could lose all or part of your investment.

Risks Related to Super Group’s Business

Our business depends on the success, including win or hold rates, of existing and future online betting and gaming products, which rely on a variety of factors and are not completely controlled by us.

The sports betting and online casino gaming industries are characterized by an element of chance. Accordingly, we employ theoretical win rates, probability distributions and related models to estimate what a certain type of sports bet or online casino game, on average, will win or lose in the long run. Our revenue is impacted by variations in the hold percentage (the ratio of net win to total amount wagered), or actual outcome, on the sports betting and online casino games that we offer to our customers. We use the hold percentage as an indicator of an online casino game’s or sports bet’s performance against its expected outcome. Although each sports bet or online casino game generally performs within a defined statistical range of outcomes, actual outcomes may vary for any given period, particularly in the short term.

In the short term, for online casino wagering and online sports wagering, the element of chance may affect win rates (hold percentages); these win rates, particularly for online sports wagering, may also be affected in the short term by factors that are largely beyond our control, such as unanticipated event outcomes, a customer’s skill, experience and behavior, the mix of games played or wagers placed, the financial resources of customers, the volume of wagers placed and the amount of time spent gambling. For online casino games, it is possible a random number generator outcome or game will malfunction or is otherwise misprogrammed to pay out wins in excess of the game’s mathematical design and award errant prizes. Factors that are nominally within our control, such as the level of incentives or bonuses or comps given to customers, might, for various reasons both within and beyond our control, not be well-controlled and hence in turn might impact win rates. For online sports wagering, it is possible that our platform erroneously posts odds or is otherwise misprogrammed to pay out odds that are highly favorable to bettors, and bettors place wagers before the odds are corrected. Additionally, odds compilers and risk managers are capable of human error, so even if our wagering products are subject to a capped payout, significant volatility can occur. Similarly, inadvertently over-incentivizing customers can convert a sports wager or casino game that would otherwise have been expected to be profitable for the Company into one with a positive expectation for the player.

As a result of the variability in these factors, the actual win rates on our sports betting and online casino gaming offerings may differ from the theoretical win rates we have estimated and could result in the winnings of our sports betting or online casino gaming customers exceeding those anticipated. The variability of win rates (hold rates) also has the potential to negatively impact our business, financial condition, results of operations, prospects and cash flows.

Our business relies for its success on entertaining customers by means of a wide range of potential wagering opportunities. In recent years an increasing percentage of sports betting wagering has been derived from “in-play” or “in-game” wagering, which refers to the wagers that customers make during the course of a sports event (as opposed to “pre-game” or “ante-post” wagers made before the start of a sports event) on the outcome of related events that occur pursuant to the primary event. Examples of this include “Scorer of the next goal” in a soccer match, or “Winner of the next point” in a tennis match. Where such wagers are allowed, there can be no assurance that regulators will not in the future seek to prohibit such forms of wagering, and where such wagers are not yet allowed there can be no assurance that regulators will ever allow them. If such “in-play” wagering is prohibited in any market then our business, financial condition, results of operations, prospects and cash flows might be negatively impacted.

15

Table of Contents

Similarly, for casino games there can be no assurance that existing casino game features will always be allowed or that new casino game features will be allowed or that regulators will not seek to constrain the operation of games in any way, for example by limiting the rate or speed of game play. If game features or other relevant aspects of casino game design are constrained then our business, financial condition, results of operations, prospects and cash flows might be negatively impacted.

The success of our business depends on the quality of our strategy and our ability to execute on it.

Our business strategy makes a number of assumptions about the current and future state of the industry that we operate in, including but not limited to environmental factors such as the current and future state of the markets and economies that we operate in, the current and expected future actions of governments around the world, the current and future capacity and effectiveness of our competitors, and the current and future desires and wants and means of our customers. Our strategy also makes assumptions about the current and future state of our own business, including our capacity and effectiveness and our ability to respond to all of the aforementioned environmental factors, amongst others. All of these assumptions are informed by data and information that is publicly available and which we gather for ourselves and by our ability to process and understand such data and information. Any or all of our assumptions may prove to be faulty and/or our data and/or information may be inaccurate or incomplete, in which case our strategy may prove to be incorrect or inadequate for the demands of our industry. Even if our strategy is a good one, we cannot be certain that our business is equipped to execute the plans and actions that might be necessary to achieve success. If any of our assumptions are incorrect and/or our strategy is poor and/or we are unable to execute on our strategy then our business, financial condition, results of operations, prospects and cash flows might be negatively impacted.

The success of our business depends in part on our ability to anticipate and satisfy customer preferences in a timely manner.

As we operate in a dynamic environment characterized by rapidly changing industry and legal standards, our products are subject to changing consumer preferences that cannot be predicted with certainty. We need to continually introduce new offerings and identify future product offerings that complement our existing platforms, respond to our customers’ needs and improve and enhance our existing platforms to maintain or increase our customer engagement and growth of our business. We may not be able to compete effectively if our sports betting odds pricing and casino game design are not competitive and/or unless our product selection keeps up with trends in the digital sports entertainment and gaming industries in which we compete, or trends in new gaming products. If we are unable to anticipate and satisfy customer preferences in a timely manner and/or we are unable to provide competitive and appealing products to our customers, then our business, financial condition, results of operations, prospects and cash flows might be negatively impacted.

Competition within the broader entertainment industry is intense and our existing and potential customers may be attracted to competing betting and gaming options, as well as other forms of entertainment such as video games, television, movies and sporting events. If our offerings do not continue to be popular with existing customers and attract potential customers, our business would be harmed.

We operate in the global entertainment betting and gaming industries within the broader entertainment industry with our business-to-consumer offerings, including sports betting and online casino gaming. Our customers are offered a vast array of entertainment choices. Other forms of entertainment, such as television, movies, sporting events, other forms of non-gambling games and in-person casinos, are well established and may be perceived by our customers to offer greater variety, affordability, interactivity and enjoyment. New and alternative product categories are continuously evolving that may be perceived by our customers to offer equivalent or better entertainment, including casual games, daily fantasy sports (a variation on fantasy sports leagues), and apps and websites that offer the trading of financial instruments in a manner that incorporates elements that are similar to gambling. We compete with these other forms of entertainment for the discretionary

16

Table of Contents

time and income of our customers. If we are unable to sustain sufficient interest in our product offerings in comparison to other forms of entertainment, including new forms of entertainment, our business model may not continue to be viable.