Form 424B3 Permex Petroleum Corp

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-265883

PROSPECTUS

98,970,113

Common Shares

Permex Petroleum Corporation

This prospectus relates to the resale by certain selling shareholders of Permex Petroleum Corporation, a corporation organized under the laws of British Columbia, Canada (the “Company”), identified in this prospectus of up to 98,970,113 common shares (the “Resale Shares”) of the Company, no par value, including 51,841,488 Resale Shares issuable upon exercise of outstanding warrants. All of the Resale Shares were purchased from the Company in a private placement transaction.

The Resale Shares may be sold by the selling shareholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this prospectus.

The prices at which the selling shareholders may sell the Resale Shares will be determined by the prevailing market price for the Company’s common shares or in privately negotiated transactions. The Company will not receive any proceeds from the sale of the Resale Shares by the selling shareholders; provided, however, the Company will receive the proceeds from any cash exercise of warrants.

The Company will bear all costs relating to the registration of the Resale Shares, other than any selling shareholder’s legal or accounting costs or commissions.

The Company’s common shares are presently listed on the Canadian Securities Exchange and the Frankfurt Stock Exchange under the symbols “OIL” and “75P”, respectively, and quoted on the OTCQB tier of the OTC Markets Group, Inc. under the symbol “OILCF.” The closing price of the Company’s common shares on August 5, 2022, as reported by the OTCQB was $0.104 per share.

Investing in the Company’s common shares involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 15 of this prospectus and elsewhere in this prospectus for a discussion of information that should be considered in connection with an investment in the Company’s common shares.

The Company may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

The Company is an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements. See “Prospectus Summary - Implications of Being an Emerging Growth Company.”

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated August 12, 2022

| -2- |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We have not and the selling shareholders have not authorized anyone to provide you with different information. The selling shareholders are offering to sell, and seeking offers to buy, our common shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common shares.

For investors outside the United States: Neither we nor the selling shareholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our common shares and the distribution of this prospectus outside the United States.

This prospectus is a part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission. The selling shareholders may from time to time sell the common shares covered by this prospectus and, in certain circumstances, we or the selling shareholders may provide a supplement to this prospectus that will contain certain specific information about the terms of a particular offering by one or more of the selling shareholders or to add information to, or update or change information contained in this prospectus. You should read this prospectus or any supplement to this prospectus before deciding to invest in our common shares. You may obtain this information without charge by following the instructions under “Where You Can Find Additional Information” appearing elsewhere in this prospectus.

| -3- |

Unless otherwise indicated in this report, natural gas volumes are stated at the legal pressure base of the state or geographic area in which the reserves are located at 60 degrees Fahrenheit. Crude oil and natural gas equivalents are determined using the ratio of six Mcf of natural gas to one barrel of crude oil, condensate or natural gas liquids.

The following definitions shall apply to the technical terms used in this prospectus.

Terms used to describe quantities of crude oil and natural gas:

“Bbl.” One stock tank barrel, of 42 U.S. gallons liquid volume, used herein in reference to crude oil, condensate or NGLs.

“Boe.” A barrel of oil equivalent and is a standard convention used to express crude oil, NGL and natural gas volumes on a comparable crude oil equivalent basis. Gas equivalents are determined under the relative energy content method by using the ratio of 6.0 Mcf of natural gas to 1.0 Bbl of crude oil or NGL.

“MBbl.” One thousand barrels of crude oil, condensate or NGLs.

“Mcf.” One thousand cubic feet of natural gas.

“NGLs.” Natural gas liquids. Hydrocarbons found in natural gas that may be extracted as liquefied petroleum gas and natural gasoline.

Terms used to describe our interests in wells and acreage:

“Basin.” A large natural depression on the earth’s surface in which sediments generally brought by water accumulate.

“Completion.” The process of treating a drilled well followed by the installation of permanent equipment for the production of crude oil, NGLs, and/or natural gas.

“Developed acreage.” Acreage consisting of leased acres spaced or assignable to productive wells. Acreage included in spacing units of infill wells is classified as developed acreage at the time production commences from the initial well in the spacing unit. As such, the addition of an infill well does not have any impact on a company’s amount of developed acreage.

“Development well.” A well drilled within the proved area of a crude oil, NGL, or natural gas reservoir to the depth of a stratigraphic horizon (rock layer or formation) known to be productive for the purpose of extracting proved crude oil, NGL, or natural gas reserves.

“Differential.” The difference between a benchmark price of crude oil and natural gas, such as the NYMEX crude oil spot price, and the wellhead price received.

| -4- |

“Dry hole.” A well found to be incapable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of such production exceed production expenses and taxes.

“Field.” An area consisting of a single reservoir or multiple reservoirs all grouped on, or related to, the same individual geological structural feature or stratigraphic condition. The field name refers to the surface area, although it may refer to both the surface and the underground productive formations.

“Formation.” A layer of rock which has distinct characteristics that differs from nearby rock.

“Gross acres or Gross wells.” The total acres or wells, as the case may be, in which a working interest is owned.

“Held by operations.” A provision in an oil and gas lease that extends the stated term of the lease as long as drilling operations are ongoing on the property.

“Held by production” or “HBP” A provision in an oil and gas lease that extends the stated term of the lease as long as the property produces a minimum quantity of crude oil, NGLs, and natural gas.

“Hydraulic fracturing.” The technique of improving a well’s production by pumping a mixture of fluids into the formation and rupturing the rock, creating an artificial channel. As part of this technique, sand or other material may also be injected into the formation to keep the channel open, so that fluids or natural gases may more easily flow through the formation.

“Infill well.” A subsequent well drilled in an established spacing unit of an already established productive well in the spacing unit. Acreage on which infill wells are drilled is considered developed commencing with the initial productive well established in the spacing unit. As such, the addition of an infill well does not have any impact on a company’s amount of developed acreage.

“Net acres.” The percentage ownership of gross acres. Net acres are deemed to exist when the sum of fractional ownership working interests in gross acres equals one (e.g., a 10% working interest in a lease covering 640 gross acres is equivalent to 64 net acres).

“NYMEX.” The New York Mercantile Exchange.

“Productive well.” A well that is found to be capable of producing hydrocarbons in sufficient quantities such that proceeds from the sale of the production exceed production expenses and taxes.

“Recompletion.” The process of treating a drilled well followed by the installation of permanent equipment for the production of crude oil, NGLs or natural gas or, in the case of a dry hole, the reporting of abandonment to the appropriate agency.

“Reservoir.” A porous and permeable underground formation containing a natural accumulation of producible crude oil, NGLs and/or natural gas that is confined by impermeable rock or water barriers and is separate from other reservoirs.

“Spacing.” The distance between wells producing from the same reservoir. Spacing is often expressed in terms of acres, e.g., 40-acre spacing, and is often established by regulatory agencies.

| -5- |

“Undeveloped acreage.” Leased acreage on which wells have not been drilled or completed to a point that would permit the production of economic quantities of crude oil, NGLs, and natural gas, regardless of whether such acreage contains proved reserves. Undeveloped acreage includes net acres held by operations until a productive well is established in the spacing unit.

“Unit.” The joining of all or substantially all interests in a reservoir or field, rather than a single tract, to provide for development and operation without regard to separate property interests. Also, the area covered by a unitization agreement.

“Wellbore.” The hole drilled by the bit that is equipped for natural gas production on a completed well. Also called well or borehole.

“Working interest.” The right granted to the lessee of a property to explore for and to produce and own crude oil, NGLs, natural gas or other minerals. The working interest owners bear the exploration, development, and operating costs on either a cash, penalty, or carried basis.

“Workover.” Operations on a producing well to restore or increase production.

Terms used to assign a present value to or to classify our reserves:

“Possible reserves.” The additional reserves which analysis of geoscience and engineering data suggest are less likely to be recoverable than probable reserves.

“Pre-tax PV-10% or PV-10.” The estimated future net revenue, discounted at a rate of 10% per annum, before income taxes and with no price or cost escalation or de-escalation in accordance with guidelines promulgated by the SEC.

“Probable reserves.” The additional reserves which analysis of geoscience and engineering data indicate are less likely to be recovered than proved reserves but which together with proved reserves, are as likely as not to be recovered.

“Proved reserves.” The quantities of crude oil, NGLs and natural gas, which, by analysis of geosciences and engineering data, can be estimated with reasonable certainty to be economically producible, from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations, prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

“Proved undeveloped reserves” or “PUDs.” Proved Reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. Reserves on undrilled acreage are limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. Undrilled locations can be classified as having proved undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time. Estimates for proved undeveloped reserves are not attributed to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, or by other evidence using reliable technology establishing reasonable certainty.

“SEC Pricing” means pricing calculated using oil and natural gas price parameters established by current guidelines of the United States Securities and Exchange Commission (the “SEC”) and accounting rules based on the unweighted arithmetic average of oil and natural gas prices as of the first day of each of the 12 months ended on the given date.

| -6- |

This summary highlights information contained in this prospectus. It does not contain all of the information that you should consider in making your investment decision. Before investing in our common shares, you should read this entire prospectus carefully, including the sections entitled “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes. Except as otherwise required by the context, references to “Permex,” “the Company,” “we,” “us” and “our” are to Permex Petroleum Corporation, a corporation organized under the laws of British Columbia, Canada, individually, or as the context requires, collectively with its subsidiary. Certain operational terms used in this prospectus are defined in the “Glossary of Terms.” All references to “U.S. Dollars,” “USD” or “$” are to the legal currency of the United States, and all references to “CAD$” and “C$” are to the legal currency of Canada. All references to “M$” are in thousands of dollars.

Company Overview

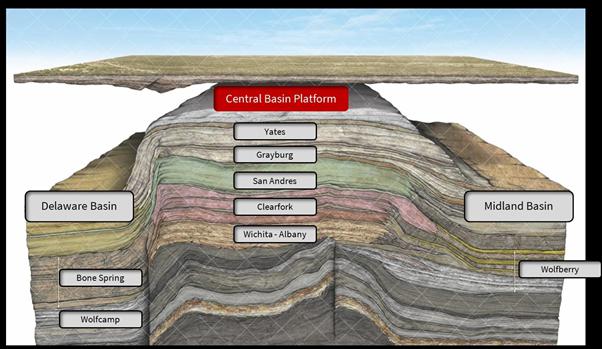

We are an independent energy company engaged in the acquisition, exploration, development and production of oil and gas properties on private, state and federal land in the United States, primarily in the Permian Basin which includes the Midland Basin and Delaware Basin. We focus on acquiring producing assets at a discount to market, increasing production and cash-flow through recompletion and re-entries, secondary recovery and lower risk infill drilling and development. Currently, we own and operate various oil and gas properties located in Texas and New Mexico. In addition, we hold various royalty interests in 73 wells and 5 permitted wells across 3,800 acres within the Permian Basin of West Texas and southeast New Mexico. Moreover, we own and operate more than 78 oil and gas wells, have more than 11,700 net acres of production oil and gas assets, 67 shut-in opportunities, 17 salt water disposal wells eliminating water disposal fees and decreasing OPEX and 2 water supply wells allowing for waterflood secondary recovery.

Oil and Gas Properties

The Company hired MKM Engineering, who prepared for the Company an Appraisal of Certain Oil and Gas Interests owned by Permex Petroleum Corporation located in New Mexico and Texas as of September 30, 2021 (the “2021 Appraisal Report”) as well as an Appraisal of Certain Oil and Gas Interests owned by Permex Petroleum Corporation located in New Mexico and Texas as of September 30, 2020 (the “2020 Appraisal Report” and together with the 2021 Appraisal Report, the “Appraisal Reports”). MKM Engineering is independent with respect to Permex Petroleum Corporation as provided in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers. MKM Engineering’s estimates of the Company’s proved and probable reserves in each of the Appraisal Reports were prepared according to generally accepted petroleum engineering and evaluation principles, and each of the Appraisal Reports conform to SEC Pricing. The Appraisal Reports are each filed as an exhibit to the registration statement for which this prospectus is a part of.

The Appraisal Reports were each specifically prepared by Michele Mudrone, an employee of MKM Engineering, a registered Professional Engineer in the State of Texas, and a member of the Society of Petroleum Engineers. Ms. Mudrone graduated from the Colorado School of Mines with a Bachelor of Science degree in Petroleum Engineering in 1976 and has been employed in the petroleum industry and directly involved in reservoir engineering, petrophysical analysis, reservoir simulation and property evaluation since that time Ms. Mudrone certified in each Appraisal Report that she did not receive, nor expects to receive, any direct or indirect interest in the holdings discussed in the report or in the securities of the Company. Because the Company’s current size, the Company does not have any technical person at the Company response for overseeing the preparation of the reserve estimates presented herein (or have any internal control policies pertaining to estimates of oil and gas reserves) and consequently the Company relies exclusively on the Appraisal Reports in the preparation of the reserve estimates present in this prospectus.

Since all of the Company’s reserves are from conventional reservoirs, MKM Engineering assumed for the purposes of its appraisal reports that the technology to be used to develop the Company’s reserves would include horizontally drilled wells, fracturing, and acidizing.

The following tables show a summary of our reserves as of September 30, 2021 and September 30, 2020 which have been derived from the Appraisal Reports and conform to SEC Pricing.

| -7- |

Composite Proved Reserve Estimates and Economic Forecasts for the year ended September 30, 2021.

| Proved | Proved Developed Producing |

Proved Non-Producing |

Proved Undeveloped |

|||||||||||||

| Net Reserves | ||||||||||||||||

| Oil/Condensate | MBbl | 6,199.4 | 399.3 | 188.1 | 5,612.0 | |||||||||||

| Natural Gas | Mcf | 3,018.3 | 314.4 | 97.5 | 2,606.4 | |||||||||||

| Revenue | ||||||||||||||||

| Oil/Condensate | M$ | 347,051.0 | 21,920.1 | 10,468.6 | 314,662.3 | |||||||||||

| Natural Gas | M$ | 8,906.8 | 949.0 | 286.9 | 7,670.9 | |||||||||||

| Severance and Ad Valorem Taxes | M$ | 26,171.1 | 1,927.3 | 774.5 | 23,469.3 | |||||||||||

| Operating Expenses | M$ | 43,511.4 | 8,048.8 | 3,057.0 | 32,405.6 | |||||||||||

| Investments | M$ | 71,700.0 | 791.9 | 689.6 | 70,218.5 | |||||||||||

| Operating Income (BFIT) | M$ | 214,575.4 | 12,101.2 | 6,234.4 | 196,239.8 | |||||||||||

| Discounted @ 10% | M$ | 100,772.6 | 6,356.0 | 3,644.6 | 90,772.0 | |||||||||||

Composite Proved Reserve Estimates and Economic Forecasts for the year ended September 30, 2020.

| Proved | Proved Developed Producing |

Proved Non-Producing |

Proved Undeveloped |

|||||||||||||

| Net Reserves | ||||||||||||||||

| Oil/Condensate | MBbl | 3,706.4 | 254.9 | 294.5 | 3,157.0 | |||||||||||

| Natural Gas | Mcf | 740.3 | 64.9 | 17.6 | 657.8 | |||||||||||

| Revenue | ||||||||||||||||

| Oil/Condensate | M$ | 149,380.6 | 10,201.3 | 12,077.9 | 127,101.4 | |||||||||||

| Natural Gas | M$ | 1,313.0 | 58.7 | 32.6 | 1,221.7 | |||||||||||

| Severance and Ad Valorem Taxes | M$ | 11,404.2 | 903.6 | 863.4 | 9,637.2 | |||||||||||

| Operating Expenses | M$ | 38,863.8 | 5,590.5 | 2,818.4 | 30,454.9 | |||||||||||

| Investments | M$ | 26,262.9 | 630.1 | 807.0 | 24,825.8 | |||||||||||

| Operating Income (BFIT) | M$ | 74,162.6 | 3,135.8 | 7,621.7 | 63,405.1 | |||||||||||

| Discounted @ 10% | M$ | 29,113.0 | 1,806.4 | 4,057.76 | 23,249.0 | |||||||||||

Composite Probable Reserve Estimates and Economic Forecasts for the year ended September 30, 2021

| Probable | Probable Non- Producing |

Probable Undeveloped |

||||||||||

| Net Reserves | ||||||||||||

| Oil/Condensate | MBbl | 7,466.5 | 119.8 | 7,346.7 | ||||||||

| Natural Gas | Mcf | 10,252.1 | 6.3 | 10,245.8 | ||||||||

| Revenue | ||||||||||||

| Oil/Condensate | M$ | 411,745.8 | 6,686.4 | 405,059.4 | ||||||||

| Natural Gas | M$ | 30,171.8 | 18.4 | 30,153.4 | ||||||||

| Severance and Ad Valorem Taxes | M$ | 23,511.2 | 478.1 | 23,033.1 | ||||||||

| Operating Expenses | M$ | 50,336.3 | 1,061.2 | 49,275.1 | ||||||||

| Investments | M$ | 102,884.9 | - | 102,884.9 | ||||||||

| Operating Income (BFIT) | M$ | 265,185.3 | 5,165.5 | 260,019.8 | ||||||||

| Discounted @ 10% | M$ | 123,329.8 | 1,957.5 | 121,372.3 | ||||||||

Composite Probable Reserve Estimates and Economic Forecasts for the year ended September 30, 2020

| Probable | Probable Non- Producing |

Probable Undeveloped |

||||||||||

| Net Reserves | ||||||||||||

| Oil/Condensate | MBbl | 439.4 | 121.9 | 317.5 | ||||||||

| Natural Gas | Mcf | 126.3 | 6.3 | 120.0 | ||||||||

| Revenue | ||||||||||||

| Oil/Condensate | M$ | 17,637.2 | 5,024.7 | 12,612.5 | ||||||||

| Natural Gas | M$ | 232.3 | 12.3 | 220.0 | ||||||||

| Severance and Ad Valorem Taxes | M$ | 1,279.6 | 359.4 | 920.2 | ||||||||

| Operating Expenses | M$ | 2,404.2 | 952.6 | 1,451.6 | ||||||||

| Investments | M$ | - | - | - | ||||||||

| Operating Income (BFIT) | M$ | 14,185.7 | 3,725.0 | 10,460.7 | ||||||||

| Discounted @ 10% | M$ | 5,844.7 | 1,489.9 | 4,354.8 | ||||||||

Probable reserves are unproven reserves that geologic and engineering analyses suggest are more likely than not to be recoverable. They are not comparable to proved reserves and estimates of oil, condensate, and gas reserves and future net revenue should be regarded only as estimates that may change as further production history and additional information become available. Such reserve and revenue estimates are based on the information currently available, the interpretation of which is subject to uncertainties inherent in applying judgmental factors.

| -8- |

Conversion of Undeveloped Acreage

The Company’s process for converting undeveloped acreage to developed acreage is tied to whether there is any drilling being conducted on the acreage in question. During the fiscal year ended September 30, 2021, the Company did not commence drilling on any undeveloped acreage and no undeveloped reserves were converted into proved developed reserves. The Company has also did not make any investments in, or make any progress towards, converting proved undeveloped reserves to proved developed reserves during the year ended September 30, 2021. The Company also has not begun drilling on any undeveloped acreage or make any investments in undeveloped reserves during 2022 as of the date hereof.

An aggregate of 5,612 MBO and 2,606 MMCF, of the Company’s proved undeveloped reserves as of September 30, 2021, are part of a development plan that has been adopted by management that calls for these undeveloped reserves to be drilled within the next five years, thus resulting in the conversion of such proved undeveloped reserves to developed status within five years of initial disclosure at September 30, 2021.

Proved Undeveloped Reserves Additions

From September 30, 2020 to September 30, 2021, the Company had proved undeveloped reserve additions of 2,779.78 MBoe, mostly as a result of the acquisition of an aggregate of 6,046 net acres of new properties located in Martin County, Texas during the fiscal year ended 2021, being partially offset by the sales of certain acreage at the Company’s Peavy property in Young County, Texas and the Company’s property in Gaines County, Texas to a third party and a reclassification of 120.85 MBoe from proved undeveloped reserves to probable undeveloped reserves at the Company’s West Henshaw property in Eddy County, New Mexico. This reclassification was the result of a determination in 2021 that certain proved undeveloped reserves on the West Henshaw property were not a direct offset to a producing well and consequently should be categorized as undeveloped probable reserves. The specific changes to the Company’s proved undeveloped reserves from September 30, 2020 to September 30, 2021 were as follows:

| Breedlove | Peavy | Gaines County | Henshaw | Royalty Wells | Total | |||||||||||||||||||

| Beginning balance at September 30, 2020 (MBoe)(1) | — | — | — | — | — | 3,266.59 | ||||||||||||||||||

| Production (MBoe)(1) | — | — | — | — | — | — | ||||||||||||||||||

| Revisions or reclassifications of previous estimates (MBoe)(1) | — | — | — | (120.85 | ) | — | (120.85 | ) | ||||||||||||||||

| Improved Recovery (MBoe)(1) | — | — | — | — | — | — | ||||||||||||||||||

| Extensions and Discoveries (MBoe)(1) | — | — | — | — | — | — | ||||||||||||||||||

| Acquisitions/Purchases (MBoe)(1) | 5,584.14 | — | — | — | 0.23 | 5,584.37 | ||||||||||||||||||

| Sales (MBoe)(1) | — | (70.40 | ) | (2,614.00 | ) | — | — | (2,684.40 | ) | |||||||||||||||

| Price Change (MBoe) | — | — | — | — | — | 0.66 | ||||||||||||||||||

| Ending balance as of September 30, 2021 (MBoe)(1) | — | — | — | — | — | 6,046.37 | ||||||||||||||||||

| (1) | Natural gas volumes have been converted to Boe based on energy content of six Mcf of gas to one Bbl of oil. Barrels of oil equivalence does not necessarily result in price equivalence. The price of natural gas on a barrel of oil equivalent basis is currently substantially lower than the corresponding price for oil and has been similarly lower for a number of years. For example, in the year ended September 30, 2021, the average prices of WTI (Cushing) oil and NYMEX Henry Hub natural gas were $57.69 per Bbl and $2.94 per Mcf, respectively, resulting in an oil-to-gas ratio of over 19 to 1. |

Financing of Proved and Probable Undeveloped Reserves

The Company currently estimates that the total cost to develop the Company’s proved undeveloped reserves of 5,612.0 MBbl of oil and 2,606.4 Mcf of natural gas as of September 30, 2021 is $67,940,950.The Company expects to finance these capital costs through a combination of current cash on hand, debt financing through a line of credit or similar debt instrument, one or more offerings of debt or equity, and from cash generated from estimated revenues from sales of oil and natural gas produced at the Company’s wells.

The Company currently estimates that the total cost to develop the Company’s probable undeveloped reserves of 7,346.7 MBbl of oil and 10,245.8 Mcf of natural gas as of September 30, 2021 is $102,884,900. The Company expects to finance these capital costs through a combination of joint ventures, farm-in agreements, direct participation programs, one or more offerings of equity, a debt offering or entering into a line of credit, and from cash generated from estimated revenues from sales of oil and natural gas produced at the Company’s wells.

Drilling Activities

The Company did not drill any wells during the last three fiscal years. As at September 30, 2021, the Company had 95 gross wells and 17.29 net productive wells, with 89 wells producing oil and six wells producing natural gas, and the Company’s gross developed acreage totaled 5,177 and net developed acreage totaled 3,942 with the following geographic breakdown:

| Property | Gross Developed Acreage | Net Developed Acreage | Gross Productive Wells | Net Productive Wells | ||||||||||||

Pittcock | 818 | 664.63 | 1 | 0.81 | ||||||||||||

| Henshaw | 1,880 | 1,353.60 | 2 | 1.44 | ||||||||||||

| Oxy Yates | 680 | 489.60 | 2 | 1.44 | ||||||||||||

| Bullard | 241 | 187.98 | 1 | 0.78 | ||||||||||||

| Breedlove | 1,558 | 1,246.4 | 16 | 12.80 | ||||||||||||

| Royalty Interest Properties | - | - | 73 | 0.01 | ||||||||||||

The Company has 6,000 gross undeveloped acres and 4,800 net undeveloped acres. All of the Company’s undeveloped acreage is on the Company’s Breedlove property.

The Company’s leases are held by production in perpetuity. If a field/lease is undeveloped it typically has a 2, 3 or 5 year term of expiry. The Company has over 340 leases covering undeveloped acreage and less than 3% of these leases have a two year expiry date from the date of this prospectus.

| -9- |

Sales and Production

The average sales prices of the Company’s oil and gas products sold in the fiscal years ended September 30, 2021, 2020 and 2019 was $46.86, $38.51, and $51.79, respectively.

The Company’s net production quantities by final product sold in the fiscal years ended September 30, 2021, 2020, and 2019 was 30,623.69 Boe, 20,112.44 Boe, and 1,112.87 Boe, respectively.

The Company’s average production costs per unit for the fiscal years ended September 30, 2021, 2020, and 2019, was $23.56, $27.93, and $32.59, respectively.

The breakdown of production and prices between oil/condensate and natural gas was as follows:

| Net Production Volumes | Fiscal Year Ended September 30, 2021 | Fiscal Year Ended September 30, 2020 | Fiscal Year Ended September 30, 2019 | |||||||||

| Oil/Condensate (Bbl) | 947 | 16,240 | 25,513 | |||||||||

| Natural Gas (Mcf) | 1,410 | 9,196 | 13,121 | |||||||||

| Average Sales Price | Fiscal Year Ended September 30, 2021 | Fiscal Year Ended September 30, 2020 | Fiscal Year Ended September 30, 2019 | |||||||||

| Oil/Condensate ($/Bbl) | 58.36 | 41.09 | 49.67 | |||||||||

| Natural Gas ($/Mcf) | 3.40 | 1.44 | 2.04 | |||||||||

The breakdown of the Company’s production quantities by individual product type for each of the Company’s fields that contain 15% or more of the Company’s total proved reserves expressed on an oil-equivalent-barrels basis was as follows:

Breedlove

| Net Production Volumes | Fiscal Year Ended September 30, 2021 | Fiscal Year Ended September 30, 2020 | Fiscal Year Ended September 30, 2019 | |||||||||

| Oil/Condensate (Bbl) | - | - | - | |||||||||

| Natural Gas (Mcf) | 419 | - | - | |||||||||

Henshaw

| Net Production Volumes | Fiscal Year Ended September 30, 2021 | Fiscal Year Ended September 30, 2020 | Fiscal Year Ended September 30, 2019 | |||||||||

| Oil/Condensate (Bbl) | - | - | 1,519 | |||||||||

| Natural Gas (Mcf) | - | - | - | |||||||||

McMurtry-Loving

| Net Production Volumes | Fiscal Year Ended September 30, 2021 | Fiscal Year Ended September 30, 2020 | Fiscal Year Ended September 30, 2019 | |||||||||

| Oil/Condensate (Bbl) | - | - | 2,634 | |||||||||

| Natural Gas (Mcf) | - | - | - | |||||||||

ODC San Andres

| Net Production Volumes | Fiscal Year Ended September 30, 2021 | Fiscal Year Ended September 30, 2020 | Fiscal Year Ended September 30, 2019 | |||||||||

| Oil/Condensate (Bbl) | 14,464 | 11,570 | - | |||||||||

| Natural Gas (Mcf) | 4,982 | 2,605 | - | |||||||||

Texas Properties

Breedlove “B” Clearfork Leases

In September 2021, we, through our wholly-owned subsidiary, Permex Petroleum US Corporation, acquired 100% Working Interest and 81.75% Net Revenue Interest in the Breedlove “B” Clearfork leases. The Breedlove “B” Clearfork properties situated in Martin County, Texas are over 12 contiguous sections for a total of 7,870.23 gross and 7,741.67 net acres, of which 98% is held by production in the core of the Permian Basin. It is bounded on the north by Dawson County, on the east by Howard County, on the south by Glasscock and Midland Counties, and on the west by Andrews County. There is a total of 25 vertical wells of which 12 are producers, 4 are saltwater disposal wells and 9 that are shut-in opportunities. In January 2022, we began the pilot re-entry on the Carter Clearfork well #5, which is one of 67 shut-in wells that we currently own. In addition, we have begun the permitting process for two locations on the Breedlove property for drilling and development. Upon approval of the permits by the regulatory body, we expect to compete in the Spraberry and Wolfcamp formations with possible fracking.

Pittcock Leases

The Pittcock Leases are situated in Stonewall County which is in Northwest Texas, in the central part of the North Central Plains and consists of the Pittcock North property, the Pittcock South property and the Windy Jones Property. It is bounded on the north by King County, on the east by Haskell County, on the south by Fisher and Jones Counties, and on the west by Kent County. The Pittcock North property covers 320 acres held by production. There is currently one producing well, ten shut-in wells, two saltwater disposal wells, and a water supply well. We hold a 100% working interest in the Pittcock North Property and an 81.25% net revenue interest. The Pittcock South property covers 498 acres in four tracts. There are currently 19 shut-in wells and two saltwater disposal wells. We hold a 100% working interest in the lease and a 71.90% net revenue interest. The Windy Jones Property consists of 40 acres and includes two injection wells and two suspended oil wells. The sole purpose of the Windy Jones property is to provide waterflood to the offset wells being the Pittcock wells located east boundary of the Windy Jones Property. We hold a 100% working interest in the Windy Jones Property and a 78.9% net revenue interest.

| -10- |

Mary Bullard Property

We acquired the Mary Bullard Property in August 2017. The Mary Bullard Property is located in Stonewall County, about 5 ½ miles south west of Aspermont, Texas. It is bounded on the north by King County, on the east by Haskell County, on the south by Fisher and Jones Counties, and on the west by Kent County. The asset is situated on the Eastern Shelf of the Midland Basin in the central part of the North Central Plains. The Mary Bullard Property covers 241 acres held by production and is productive in the Clearfork formation at a depth of approximately 3,200 feet. There is currently one producing well, four shut-in wells, and two water injection wells. We hold a 100% working interest in the Mary Bullard Property and a 78.625% net revenue interest.

New Mexico Properties

In December 2017, Permex Petroleum US Corporation, our wholly-owned subsidiary, acquired the West Henshaw Property and the Oxy Yates Property.

West Henshaw Property

The West Henshaw Property is located in Eddy County, New Mexico, 12 miles northeast of Loco Hills in the Delaware Basin. Eddy County is in Southeast New Mexico. It is bounded by Chaves County to the north, Otero County to the east, Loving County, Texas to the south, and Lea County to the west. The West Henshaw Property covers 1,880 acres held by production. There are two producing wells, seven shut-in wells and four saltwater disposal wells. We hold a 100% working interest in the West Henshaw Property and a 72% net revenue interest.

In January 2022, we began the pilot re-entry on the West Henshaw well #15-3. The recompletion was successful and came online at an initial rate of 30 barrels of oil per day (“bopd”) and has stabilized at 15 bopd. Management believes the production rates from this mature, long-life well to continue with less than 10% decline year over year.

In April 2022, we began the re-entry on the West Henshaw well #6-10. The recompletion was successful and came online at an initial rate of 15 bopd and has stabilized at 10 bopd. Management believes the production rates from this mature, long-life well to continue with less than 10% decline year over year.

Oxy Yates Property

The Oxy Yates Property is located in Eddy County, approximately eight miles north of Carlsbad, New Mexico in the Delaware Basin. It is bounded by Chaves County to the north, Otero County to the east, Loving County, Texas to the south, and Lea County to the west. The Oxy Yates Property covers 680 acres held by production. There is one producing well and nine shut-in wells. The Yates formation is located at an average depth of 1,200 feet and overlies the Seven River formation and underlies the Tansill formation. We hold a 100% working interest in the Oxy Yates Property and a 77% net revenue interest.

Royalty Interest Properties

During the year ended September 30, 2021, we acquired royalty interests in 73 producing oil and gas wells located in Texas and New Mexico.

Business Strategy

The principal elements of our business strategy include the following:

| ● | Grow production and reserves in a capital efficient manner using internally generated levered free cash flow. We intend to allocate capital in a disciplined manner to projects that we anticipate will produce predictable and attractive rates of return. We plan to direct capital to our oil-rich and low-risk development opportunities while focusing on driving cost efficiencies across our asset base with the primary objective of internally funding our capital budget and growth plan. We may also use our capital flexibility to pursue value-enhancing, bolt-on acquisitions to opportunistically improve our positions in existing basins. | |

| ● | Maximize ultimate hydrocarbon recovery from our assets by optimizing drilling, completion and production techniques and investigating deeper reservoirs and areas beyond our known productive areas. While we intend to utilize proven techniques and technologies, we will also continuously seek efficiencies in our drilling, completion and production techniques in order to optimize ultimate resource recoveries, rates of return and cash flows. We will explore innovative enhanced oil recovery (“EOR”) techniques to unlock additional value and have allocated capital towards next generation technologies. For example, we have already completed extensive waterflood EOR studies in Pittcock North and Pittcock South. Through these studies, we will seek to expand our development beyond our known productive areas in order to add probable and possible reserves to our inventory at attractive all-in costs. |

| -11- |

| ● | Pursue operational excellence with a sense of urgency. We plan to deliver low cost, consistent, timely and efficient execution of our drilling campaigns, work programs and operations. We intend to execute our operations in a safe and environmentally responsible manner, focus on reducing our emissions, apply advanced technologies, and continuously seek ways to reduce our operating cash costs on a per barrel basis. | |

| ● | Pursue strategic acquisitions that maintain or reduce our break-even costs. We intend to actively pursue accretive acquisitions, mergers and dispositions that are intended to improve our margins, returns, and break-even costs of our investment portfolio. Financial strategies associated with these efforts will focus on delivering competitive adjusted per share returns. |

Development

We believe that there is significant value to be created by drilling the identified undeveloped opportunities on our properties in conjunction with the stimulation and rework of our shut-in wells. While our near-term plans are focused towards drilling wells on our existing acreage to develop the potential contained therein, our long-term plans also include continuing to evaluate acquisition and leasing opportunities that can earn attractive rates of return on capital employed.

Risk Factor Summary

Our business is subject to a number of risks of which you should be aware before making an investment decision. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common shares. Among these important risks are the following:

| ● | If we fail to obtain the capital necessary to fund our operations, we will be unable to continue our operations and you will likely lose your entire investment. Even if we can raise additional funding, we may be required to do so on terms that are dilutive to you. | |

| ● | Our indebtedness could adversely affect our ability to raise additional capital to fund operations. | |

| ● | Oil and gas prices are volatile, and declines in prices may adversely affect our financial position, financial results, cash flows, access to capital and ability to grow. | |

| ● | The actual quantities and present value of our proved oil, gas, and NGL reserves may be less than we have estimated. | |

| ● | Our acquisition strategy may subject us to certain risks associated with the inherent uncertainty in evaluating properties. | |

| ● | We may be unable to successfully integrate recently acquired assets or any assets we may acquire in the future into our business or achieve the anticipated benefits of such acquisitions. | |

| ● | Drilling for and producing oil, natural gas and NGLs are high risk activities with many uncertainties that could adversely affect our financial condition or results of operations. | |

| ● | Our future success depends on our ability to replace reserves. | |

| ● | Our business depends on third-party transportation and processing facilities and other assets that are owned by third parties. | |

| ● | The development of our proved undeveloped reserves may take longer and may require higher levels of capital expenditures than we currently anticipate. Therefore, our undeveloped reserves may not be ultimately developed or produced. | |

| ● | Weather conditions, which could become more frequent or severe due to climate change, could adversely affect our ability to conduct drilling, completion and production activities in the areas where we operate. | |

| ● | We may incur losses as a result of title defects in the properties in which we invest. | |

| ● | Fuel conservation measures, technological advances and negative shift in market perception towards the oil and natural gas industry could reduce demand for oil and natural gas. | |

| ● | Our operations are concentrated in the Permian and Delaware Basins, making us vulnerable to risks associated with operating in a limited geographic area. | |

| ● | Increased attention to environmental, social and governance matters may impact our business. |

| -12- |

| ● | The COVID-19 pandemic has had, and may continue to have, a material adverse effect on our financial condition and results of operations. | |

| ● | The unavailability, high cost or shortages of rigs, equipment, raw materials, supplies or personnel may restrict or result in increased costs for operators related to developing and operating our properties. | |

| ● | Our business is highly regulated and governmental authorities can delay or deny permits and approvals or change legal requirements governing our operations, including well stimulation, enhanced production techniques and fluid injection or disposal, that could increase costs, restrict operations and delay our implementation of, or cause us to change, our business strategy. | |

| ● | Failure to comply with environmental laws and regulations could result in substantial penalties and adversely affect our business. | |

| ● | The market price of our common shares is volatile and may not accurately reflect the long term value of our Company. | |

| ● | We are a British Columbia company and it may be difficult for you to enforce judgments against us or certain of our directors or officers. |

Corporate History

We were incorporated on April 24, 2017 under the laws of British Columbia, Canada. At June 30, 2022, we have one wholly-owned subsidiary, Permex Petroleum US Corporation, a corporation incorporated under the laws of New Mexico (Permex U.S.). We own and operate oil and gas properties in Texas (Breedlove “B” Property, Pittcock North Property, Pittcock South Property, and Mary Bullard Property), and Permex U.S. owns and operates oil and gas properties in New Mexico (Henshaw Property and the Oxy Yates Property).

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley Act”), and the requirement to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in the registration statement of which this prospectus forms a part. We are currently utilizing or intend to utilize both of these exemptions. We have not made a decision whether to take advantage of any other exemptions available to emerging growth companies. We do not know if some investors will find our common shares less attractive as a result of our utilization of these or other exemptions. The result may be a less active trading market for our common shares and our share price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, such an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have chosen to take advantage of the extended transition periods available to emerging growth companies under the JOBS Act for complying with new or revised accounting standards until those standards would otherwise apply to private companies provided under the JOBS Act. As a result, our consolidated financial statements may not be comparable to those of companies that comply with public company effective dates for complying with new or revised accounting standards.

We will remain an “emerging growth company” until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, (c) the date on which we have issued more than $1.0 billion in nonconvertible debt during the preceding three-year period or (d) the last day of our fiscal year containing the fifth anniversary of the date on which we complete our initial public offering of securities.

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and in our filings with the SEC that are incorporated by referenced herein. As a result, the information that we provide to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests.

We are also a “smaller reporting company” as defined under the Securities Act and Exchange Act. We may continue to be a smaller reporting company so long as either (i) the market value of shares of our common stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of shares of our common stock held by non-affiliates is less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and have reduced disclosure obligations regarding executive compensation, and, similar to emerging growth companies, if we are a smaller reporting company under the requirements of (ii) above, we would not be required to obtain an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

| -13- |

THE OFFERING

The following summary is provided solely for convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus.

| Common shares offered by selling shareholders | 98,970,113 common shares, including 51,841,488 common shares issuable upon exercise of outstanding warrants. | |

| Offering price | Market price or privately negotiated prices. | |

| Common shares outstanding after this offering | 115,956,026. | |

| Use of proceeds | We will not receive any proceeds from the sale of the Resale Shares by the selling shareholders; provided, however, we will receive the proceeds from any cash exercise of warrants. See “Use of Proceeds” | |

| Risk factors | Investing in our common shares involves a high degree of risk. See “Risk Factors” in this prospectus for a discussion of factors you should carefully consider before investing in our common shares. | |

| OTCQB symbol | “OILCF” |

The number of common shares shown above to be outstanding after this offering is based on 115,956,026 common shares outstanding as of August 2, 2022. This number of common shares excludes:

| ● | 5,575,000 common shares issuable upon the exercise of outstanding options, with a weighted average exercise price of $0.24 per share; | |

| ● | 65,825,806 common shares issuable upon the exercise of outstanding warrants, with a weighted average exercise price of $0.21 per share; | |

| ● | 666,667 common shares issuable upon conversion of an outstanding secured convertible debenture in the principal amount of $79,000 (C$100,000); and | |

| ● | 6,020,603 common shares available for future issuance under our 2017 and 2022 Stock Option Plans. |

| -14- |

Investing in our common shares involves a high degree of risk. You should carefully consider the risks and information below and elsewhere in this prospectus, including our consolidated financial statements and the related notes thereto, before making an investment decision. We describe risks below that we currently believe are the material risks of our business, our industry and our common shares. These are not the only risks we face. We are subject to risks that are currently unknown to us, or that we may currently believe are remote or immaterial. If any of these risks or events occurs, our business, financial condition and operating results could be harmed. In that case, the trading price of our common shares could decline, and you might lose all or part of your investment in our common shares.

Risks Related to Our Financial Position and Need for Capital

If we fail to obtain the capital necessary to fund our operations, we will be unable to continue our operations and you will likely lose your entire investment.

We are in the early stages of our operations and have not generated revenue in excess of our expenses. We will likely operate at a loss until our business becomes established, and we may require additional financing in order to fund future operations and expansion plans. Our ability to secure any required financing to sustain operations will depend in part upon prevailing capital market conditions and the success of our operations. There can be no assurance that we will be successful in our efforts to secure any additional financing or additional financing on terms satisfactory to us. If adequate funds are not available, or are not available on acceptable terms, we may be required to scale back our current business plan or cease operations.

Even if we can raise additional funding, we may be required to do so on terms that are dilutive to you.

The capital markets have been unpredictable in the recent past. In addition, it is generally difficult for early stage companies to raise capital under current market conditions. The amount of capital that a company such as ours is able to raise often depends on variables that are beyond our control. As a result, we may not be able to secure financing on terms attractive to us, or at all. If we are able to consummate a financing arrangement, the amount raised may not be sufficient to meet our future needs and may be dilutive to our current shareholders. If adequate funds are not available on acceptable terms, or at all, our business, including our results of operations, financial condition and our continued viability will be materially adversely affected.

We have a limited operating history.

We have a limited operating history and our business is subject to all of the risks inherent in the establishment of a new business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with development and expansion of a new business enterprise. If we are unable to achieve profitability, we may be unable to continue our operations.

Our indebtedness could adversely affect our ability to raise additional capital to fund operations.

We currently have one outstanding secured convertible debenture in the original principal amount of $79,000 (C$100,000) (excluding interest accrued thereon) issued to Mehran Ehsan, our Chief Executive Officer, President and director, which is secured by all of our right, title and interest in the Properties (as defined in the Security Agreement between us the Mehran Ehsan dated February 21, 2020) together with all engineering reports and intellectual property related to, or generated by us, in connection with the Properties (collectively, the “Collateral”). The secured debenture remains outstanding as of August 2, 2022.

If we cannot generate sufficient cash flow from operations to service our debt, we may need to, among other things, dispose of some or all of the Collateral or issue equity to obtain necessary funds. We do not know whether we will be able to do any of this on a timely basis, on terms satisfactory to us, or at all. Our indebtedness could have important consequences, including:

| ● | our ability to obtain additional debt or equity financing for working capital, capital expenditures, debt service requirements, acquisitions and general corporate or other purposes may be limited; | |

| ● | a portion of our cash flows from operations may be dedicated to the payment of principal and interest on the indebtedness and will not be available for other purposes, including operations, capital expenditures and future business opportunities; and | |

| ● | we may be vulnerable during a downturn in general economic conditions or in our business, or may be unable to carry on capital spending that is important to our growth. |

Risks Related to Our Business

Oil and gas prices are volatile, and declines in prices may adversely affect our financial position, financial results, cash flows, access to capital and ability to grow.

The prices we receive for our oil and natural gas production heavily influence our revenue, operating results, profitability, access to capital, future rate of growth and carrying value of our properties. Oil and natural gas are commodities, and, therefore, their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand, as well as costs and terms of transport to downstream markets.

Historically, the commodities markets have been volatile, and these markets will likely continue to be volatile in the future. If the prices of oil and natural gas experience a substantial decline, our operations, financial condition and level of expenditures for the development of our oil and natural gas reserves may be materially and adversely affected. The prices we receive for our production, and the levels of our production, depend on numerous factors beyond our control and include the following:

| ● | changes in global supply and demand for oil and natural gas; | |

| ● | the actions of the Organization of Petroleum Exporting Countries; | |

| ● | political conditions, including embargoes, in or affecting other oil-producing activity; | |

| ● | the level of global oil and natural gas exploration and production activity; | |

| ● | the level of global oil and natural gas inventories; | |

| ● | weather conditions; | |

| ● | technological advances affecting energy consumption; and | |

| ● | the price and availability of alternative fuels. |

| -15- |

Volatile oil and natural gas prices make it difficult to estimate the value of producing properties for acquisition and often cause disruption in the market for oil and natural gas producing properties, as buyers and sellers have difficulty agreeing on such value. Price volatility also makes it difficult to budget for and project the return on acquisitions and development and exploitation projects.

Our revenues, operating results, profitability and future rate of growth depend primarily upon the prices we receive for oil and, to a lesser extent, natural gas that we sell. Prices also affect the amount of cash flow available for capital expenditures and our ability to borrow money or raise additional capital. In addition, we may need to record asset carrying value write-downs if prices fall. A significant decline in the prices of natural gas or oil could adversely affect our financial position, financial results, cash flows, access to capital and ability to grow.

The actual quantities and present value of our proved oil, gas, and NGL reserves may be less than we have estimated.

There are numerous uncertainties inherent in estimating crude oil and natural gas reserves and their value. Reservoir engineering is a subjective process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner. Because of the high degree of judgment involved, the accuracy of any reserve estimate is inherently imprecise, and a function of the quality of available data and the engineering and geological interpretation. Our reserves estimates are based on 12-month average prices, except where contractual arrangements exist; therefore, reserves quantities will change when actual prices increase or decrease. In addition, results of drilling, testing, and production may substantially change the reserve estimates for a given reservoir over time. The estimates of our proved reserves and estimated future net revenues also depend on a number of factors and assumptions that may vary considerably from actual results, including:

| ● | historical production from the area compared with production from other areas; | |

| ● | the effects of regulations by governmental agencies, including changes to severance and excise taxes; | |

| ● | future operating costs and capital expenditures; and | |

| ● | workover and remediation costs. |

For these reasons, estimates of the economically recoverable quantities of crude oil and natural gas attributable to any particular group of properties, classifications of those reserves and estimates of the future net cash flows expected from them prepared by different engineers or by the same engineers but at different times may vary substantially. Accordingly, reserves estimates may be subject to upward or downward adjustment, and actual production, revenue and expenditures with respect to our reserves likely will vary, possibly materially, from estimates.

Additionally, because some of our reserves estimates are calculated using volumetric analysis, those estimates are less reliable than the estimates based on a lengthy production history. Volumetric analysis involves estimating the volume of a reservoir based on the net feet of pay of the structure and an estimation of the area covered by the structure. In addition, realization or recognition of proved undeveloped reserves will depend on our development schedule and plans. A change in future development plans for proved undeveloped reserves could cause the discontinuation of the classification of these reserves as proved.

Our acquisition strategy may subject us to certain risks associated with the inherent uncertainty in evaluating properties.

Although we perform a review of properties that we acquire that we believe is consistent with industry practices, such reviews are inherently incomplete. It generally is not feasible to review in-depth every individual property involved in each acquisition. Ordinarily, we will focus our review efforts on the higher-value properties and will sample the remainder. However, even a detailed review of records and properties may not necessarily reveal existing or potential problems, nor will it permit us as a buyer to become sufficiently familiar with the properties to assess fully and accurately their deficiencies and potential. Inspections may not always be performed on every well, and environmental problems, such as groundwater contamination, are not necessarily observable even when an inspection is undertaken. Even when problems are identified, we often assume certain environmental and other risks and liabilities in connection with acquired properties. There are numerous uncertainties inherent in estimating quantities of proved oil and gas reserves and future production rates and costs with respect to acquired properties, and actual results may vary substantially from those assumed in the estimates. In addition, there can be no assurance that acquisitions will not have an adverse effect upon our operating results, particularly during the periods in which the operations of acquired businesses are being integrated into our ongoing operations.

We may be unable to successfully integrate recently acquired assets or any assets we may acquire in the future into our business or achieve the anticipated benefits of such acquisitions.

Our ability to achieve the anticipated benefits of our acquisitions will depend in part upon whether we can integrate the acquired assets into our existing business in an efficient and effective manner. We may not be able to accomplish this integration process successfully. The successful acquisition of producing properties requires an assessment of several factors, including:

| ● | recoverable reserves; | |

| ● | future oil and natural gas prices and their appropriate differentials; | |

| ● | availability and cost of transportation of production to markets; | |

| ● | availability and cost of drilling equipment and of skilled personnel; | |

| ● | development and operating costs including access to water and potential environmental and other liabilities; and | |

| ● | regulatory, permitting and similar matters. |

| -16- |

The accuracy of these assessments is inherently uncertain. In connection with these assessments, we have performed reviews of the subject properties that we believe to be generally consistent with industry practices. The reviews are based on our analysis of historical production data, assumptions regarding capital expenditures and anticipated production declines without review by an independent petroleum engineering firm. Data used in such reviews are typically furnished by the seller or obtained from publicly available sources. Our review may not reveal all existing or potential problems or permit us to fully assess the deficiencies and potential recoverable reserves for all of the acquired properties, and the reserves and production related to the acquired properties may differ materially after such data is reviewed by an independent petroleum engineering firm or further by us. Inspections will not always be performed on every well, and environmental problems are not necessarily observable even when an inspection is undertaken. Even when problems are identified, the seller may be unwilling or unable to provide effective contractual protection against all or a portion of the underlying deficiencies. The integration process may be subject to delays or changed circumstances, and we can give no assurance that our acquired assets will perform in accordance with our expectations or that our expectations with respect to integration or cost savings as a result of such acquisitions will materialize.

Drilling for and producing oil, natural gas and NGLs are high risk activities with many uncertainties that could adversely affect our financial condition or results of operations.

Our drilling activities are subject to many risks, including the risk that they will not discover commercially productive reservoirs. Drilling for oil or natural gas can be uneconomical, not only from dry holes, but also from productive wells that do not produce sufficient revenues to be commercially viable. In addition, drilling and producing operations on our acreage may be curtailed, delayed or canceled as a result of other factors, including:

| ● | declines in oil or natural gas prices, as occurred in 2020 in connection with the COVID-19 pandemic; | |

| ● | infrastructure limitations; | |

| ● | the high cost, shortages or delays of equipment, materials and services; | |

| ● | unexpected operational events, pipeline ruptures or spills, adverse weather conditions, facility malfunctions or title problems; | |

| ● | compliance with environmental and other governmental requirements; | |

| ● | regulations, restrictions, moratoria and bans on injection wells and water disposal; | |

| ● | unusual or unexpected geological formations; | |

| ● | environmental hazards, such as oil, natural gas or well fluids spills or releases, pipeline or tank ruptures and discharges of toxic gas; | |

| ● | fires, blowouts, craterings and explosions; | |

| ● | uncontrollable flows of oil, natural gas or well fluids; | |

| ● | changes in the cost of decommissioning or plugging wells; | |

| ● | maintenance of quality, purity and thermal quality standards both for commodity sales and purposes of transportation; | |

| ● | members of the public have engaged in physical confrontations or acts of sabotage to impede or prevent transportation of hydrocarbons; and | |

| ● | pipeline capacity curtailments. |

In addition to causing curtailments, delays and cancellations of drilling and producing operations, many of these events can cause substantial losses, including personal injury or loss of life, damage to or destruction of property, natural resources and equipment, pollution, environmental contamination, loss of wells and regulatory penalties. The occurrence of an event that is not fully covered by insurance could have a material adverse impact on our business activities, financial condition and results of operations.

| -17- |

Our future success depends on our ability to replace reserves.

Because the rate of production from oil and natural gas properties generally declines as reserves are depleted, our future success depends upon our ability to economically find or acquire and produce additional oil and natural gas reserves. Except to the extent that we acquire additional properties containing proved reserves, conduct successful exploration and development activities or, through engineering studies, identify additional behind-pipe zones or secondary recovery reserves, our proved reserves will decline as our reserves are produced. Future oil and natural gas production, therefore, is highly dependent upon our level of success in acquiring or finding additional reserves that are economically recoverable. We cannot assure you that we will be able to find or acquire and develop additional reserves at an acceptable cost. We may acquire significant amounts of unproved property to further our development efforts. Development and exploratory drilling and production activities are subject to many risks, including the risk that no commercially productive reservoirs will be discovered. We seek to acquire both proved and producing properties as well as undeveloped acreage that we believe will enhance growth potential and increase our earnings over time. However, we cannot assure you that all of these properties will contain economically viable reserves or that we will not abandon our initial investments. Additionally, we cannot assure you that unproved reserves or undeveloped acreage that we acquire will be profitably developed, that new wells drilled on our properties will be productive or that we will recover all or any portion of our investments in our properties and reserves.

Our business depends on third-party transportation and processing facilities and other assets that are owned by third parties.

The marketability of our oil and natural gas depends in part on the availability, proximity, capacity and cost of pipeline and gathering systems, processing facilities, oil trucking and barging fleets and rail transportation assets as well as storage facilities owned by third parties. The lack of available capacity on these systems and facilities, whether as a result of proration, growth in demand outpacing growth in capacity, physical damage, scheduled maintenance or other reasons could result in a substantial increase in costs, declines in realized commodity prices, the shut-in of producing wells or the delay or discontinuance of development plans for our properties. In addition, our wells may be drilled in locations that are serviced to a limited extent, if at all, by gathering and transportation pipelines, which may or may not have sufficient capacity to transport production from all of the wells in the area. As a result, we rely on third-party oil trucking to transport a significant portion of our production to third-party transportation pipelines, rail loading facilities and other market access points. In addition, concerns about the safety and security of oil and gas transportation by pipeline may result in public opposition to pipeline development or continued operation and increased regulation of pipelines by the Pipeline and Hazardous Materials Safety Administration (“PHMSA”), and therefore less capacity to transport our products by pipeline. Any significant curtailment in gathering system or pipeline capacity, or the unavailability of sufficient third-party trucking or rail capacity, could adversely affect our business, results of operations and financial condition. Our contracts for downstream transportation service include those that may be adjusted on a month-to-month basis, impacting underlying economics of our production. Our downstream contract transportation counterparties include entities that are far larger than we are and have greater market share in their markets than is the case for us in our markets.

The development of our proved undeveloped reserves may take longer and may require higher levels of capital expenditures than we currently anticipate. Therefore, our undeveloped reserves may not be ultimately developed or produced.

Approximately 92% of our estimated net proved reserves volumes were classified as proved undeveloped as of September 30, 2021. Development of these reserves may take longer and require higher levels of capital expenditures than we currently anticipate. Delays in the development of our reserves or increases in costs to drill and develop such reserves will reduce the PV-10 value of our estimated proved undeveloped reserves and future net revenues estimated for such reserves and may result in some projects becoming uneconomic. In addition, delays in the development of reserves could cause us to have to reclassify our proved reserves as unproved reserves.

Weather conditions, which could become more frequent or severe due to climate change, could adversely affect our ability to conduct drilling, completion and production activities in the areas where we operate.

Our exploration and development activities and equipment can be adversely affected by severe weather such as well freeze-offs, which may cause a loss of production from temporary cessation of activity or lost or damaged equipment. Our planning for normal climatic variation, insurance programs, and emergency recovery plans may inadequately mitigate the effects of such weather conditions, and not all such effects can be predicted, eliminated, or insured against. In addition, demand for oil and gas are, to a degree, dependent on weather and climate, which impact the price we receive for the commodities we produce. These constraints could delay or temporarily halt our operations and materially increase our operation and capital costs, which could have a material adverse effect on our business, financial condition and results of operations.

We may incur losses as a result of title defects in the properties in which we invest.

The existence of a material title deficiency can render a lease worthless. In the course of acquiring the rights to develop natural gas, we typically execute a lease agreement with payment to the lessor subject to title verification. In many cases, we incur the expense of retaining lawyers to verify the rightful owners of the gas interests prior to payment of such lease bonus to the lessor. There is no certainty, however, that a lessor has valid title to their lease’s gas interests. In those cases, such leases are generally voided and payment is not remitted to the lessor. As such, title failures may result in fewer net acres to us. Prior to the drilling of a natural gas well, however, it is the normal practice in our industry for the person or company acting as the operator of the well to obtain a preliminary title review to ensure there are no obvious defects in title to the well. Frequently, as a result of such examinations, certain curative work must be done to correct defects in the marketability of the title, and such curative work entails expense. Our failure to cure any title defects may delay or prevent us from utilizing the associated mineral interest, which may adversely impact our ability in the future to increase production and reserves. Accordingly, undeveloped acreage has greater risk of title defects than developed acreage. If there are any title defects or defects in assignment of leasehold rights in properties in which we hold an interest, we will suffer a financial loss. Additionally, hydrocarbons or other fluids in one reservoir may migrate to another stratum or reservoir, resulting in disputes regarding ownership, the entitlement to produce, and responsibility for consequences of such migration of the fluids.

| -18- |

We conduct business in a highly competitive industry.

The oil and natural gas industry is highly competitive. The key areas in respect of which we face competition include: acquisition of assets offered for sale by other companies; access to capital (debt and equity) for financing and operational purposes; purchasing, leasing, hiring, chartering or other procuring of equipment that may be scarce; and employment of qualified and experienced skilled management and oil and natural gas professionals. Competition in our markets is intense and depends, among other things, on the number of competitors in the market, their financial resources, their degree of geological, geophysical, engineering and management expertise and capabilities, their pricing policies, their ability to develop properties on time and on budget, their ability to select, acquire and develop reserves and their ability to foster and maintain relationships with the relevant authorities. Our competitors also include those entities with greater technical, physical and financial resources. In some markets, our products compete with other sources of energy, or other fuels (e.g., hydroelectricity) that may from time to time become more abundant or experience decreased prices. Finally, companies and certain private equity firms not previously investing in oil and natural gas may choose to acquire reserves to establish a firm supply or simply as an investment. Any such companies will also increase market competition which may directly affect us. If we are unsuccessful in competing against other companies, our business, results of operations, financial condition or prospects could be materially adversely affected.

Decommissioning costs are unknown and may be substantial. Unplanned costs could divert resources from other projects.