Form 424B3 Lion Electric Co

Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-256633

PROSPECTUS

152,276,690 Common Shares

This prospectus relates to the offer and sale from time to time by the selling securityholders or their permitted transferees (collectively, the “selling securityholders”) of up to 152,276,690 common shares in the capital of The Lion Electric Company. This prospectus also covers any additional securities that may become issuable by reason of share splits, share dividends or other similar transactions.

The shares covered by this prospectus include (i) 132,867,990 common shares held, or issuable upon exercise of the Specified Customer Warrant (as defined herein), by certain selling securityholders that were securityholders of The Lion Electric Company, a corporation existing under the Business Corporations Act (Québec) (“Lion”), prior to the closing of the business combination (the “Business Combination”) between Lion, Lion Electric Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of Lion, and Northern Genesis Acquisition Corp., a Delaware corporation and (ii) 19,408,700 common shares issued to certain securityholders in connection with the closing of a private placement offering at a price per share of $10.00, for gross proceeds of approximately $200,402,000, which closed concurrently with the Business Combination on May 6, 2021.

Lion is registering the offer and sale of the securities described above to satisfy certain registration rights they have granted. Lion is registering these securities for resale by the selling securityholders named in this prospectus, or their transferees, pledgees, donees or assignees or other successors-in-interest that receive any of the shares as a gift, distribution, or other non-sale related transfer. The selling securityholders may offer all or part of the securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. These securities are being registered to permit the selling securityholders to sell securities from time to time, in amounts, at prices and on terms determined at the time of offering. The selling securityholders may sell these securities through ordinary brokerage transactions, directly to market makers of Lion’s shares or through any other means described in the section titled “Plan of Distribution”. In connection with any sales of common shares offered hereunder, the selling securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”).

All of the common shares offered by the selling securityholders pursuant to this prospectus will be sold by the selling securityholders for their respective accounts. Lion will not receive any of the proceeds from such sales.

Lion will pay certain expenses associated with the registration of the securities covered by this prospectus, as described in the section titled “Plan of Distribution”.

Lion’s common shares are listed on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange (“TSX”) under the symbol “LEV”. On June 11, 2021, the last reported sale price of Lion’s common shares as reported on the NYSE was $19.76 per share.

Lion may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

Lion is a “foreign private issuer” under applicable Securities and Exchange Commission rules and an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, is subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of material risks of investing in our securities in “Risk Factors“ beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities or Canadian securities regulator has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated June 14, 2021

Table of Contents

| IMPORTANT INFORMATION ABOUT IFRS AND NON-IFRS FINANCIAL MEASURES |

ii | |||

| ii | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 6 | ||||

| 7 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 50 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

69 | |||

| 95 | ||||

| 105 | ||||

| 114 | ||||

| 119 | ||||

| 121 | ||||

| 124 | ||||

| 132 | ||||

| 141 | ||||

| 145 | ||||

| 146 | ||||

| 146 | ||||

| SERVICE OF PROCESS AND ENFORCEABILITY OF CIVIL LIABILITIES UNDER U.S. SECURITIES LAWS |

147 | |||

| 147 | ||||

| F-1 |

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. Neither Lion, nor the selling securityholders, has authorized any other person to provide you with different or additional information. Neither Lion, nor the selling securityholders, takes responsibility for, nor can Lion provide assurance as to the reliability of, any other information that others may provide. The selling securityholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and Lion’s business, financial condition, results of operations and/or prospects may have changed since those dates.

Except as otherwise set forth in this prospectus, neither Lion nor the selling securityholders has taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

Table of Contents

IMPORTANT INFORMATION ABOUT IFRS AND NON-IFRS FINANCIAL MEASURES

Lion’s financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

This prospectus makes reference to certain non-IFRS measures, including Adjusted EBITDA, and other performance metrics, including the Company’s order book. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS.

For more information on non-IFRS measures, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-IFRS Measures and Other Performance Metrics.”

CONVENTIONS THAT APPLY TO THIS PROSPECTUS

In this prospectus, unless otherwise specified, all monetary amounts are in U.S. dollars, all references to “US$,” “$,” “USD” and “dollars” mean U.S. dollars and all references to “C$” mean Canadian dollars.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus includes certain trademarks, such as “Lion,” “LionBeat” and “LionEnergy,” which are registered under applicable intellectual property laws and are Lion’s property or for which Lion has pending applications or common law rights. Solely for convenience, the trademarks, and trade names referred to in this prospectus are listed without the ®, and (TM) symbols, but Lion intends to assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensors to these trademarks, and trade names.

Industry and market data presented throughout this prospectus was obtained from third-party sources and industry reports, and from publications, websites and other publicly available information, as well as industry and other data prepared by Lion or on its behalf on the basis of Lion’s knowledge of the markets in which it operates, including information provided by suppliers, partners, customers and other industry participants.

Lion believes that the market and economic data presented throughout this prospectus is accurate and, with respect to data prepared by Lion or on its behalf, that Lion’s estimates and assumptions, as applicable, are currently appropriate and reasonable, but there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market and economic data presented throughout this prospectus are not guaranteed and Lion does not make any representation or warranty, express or implied, as to the accuracy of such data. Actual outcomes may vary materially from those forecast in such reports or publications, and the prospect for material variation can be expected to increase as the length of the forecast period increases. Although Lion believes it to be reliable, it has not independently verified any of the data from third-party sources referred to in this prospectus, analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying market, economic and other assumptions relied upon by such sources. Market and economic data, including estimates and projections relating to addressable markets, competitive position and market share, is subject to variations and cannot be verified due to limits on the availability and reliability of data inputs, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Lion’s management estimates are based on internal research, their knowledge of the relevant market and industry and extrapolations from third-party sources. While Lion is not aware of any misstatements regarding the industry and market data presented in this prospectus, such data involve risks and uncertainties and are subject to change based on various factors, including those factors discussed under the section entitled “Cautionary Note Regarding Forward-Looking Statements.” Lion has no intention and undertakes no obligation to update or revise any such information or data, whether as a result of new information, future events or otherwise, except as required by law.

ii

Table of Contents

This summary highlights certain information about The Lion Electric Company, this offering and selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the securities covered by this prospectus. For a more complete understanding of The Lion Electric Company and this offering, we encourage you to read and consider carefully the more detailed information in this prospectus, any related prospectus supplement and any related free writing prospectus, including the information set forth in the section titled “Risk Factors” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety before making an investment decision.

Unless otherwise stated or the context otherwise indicates, references to “Lion,” “we”, “our,” “us” or “Company” refers to The Lion Electric Company, a corporation existing under the Business Corporations Act (Québec).

Our Company

Lion is a corporation incorporated in 2008 and existing under the Business Corporations Act (Québec). Lion believes it is a North American leader in the design, development, manufacturing, and distribution of purpose-built all-electric medium and heavy-duty urban electric vehicles (“EV”). Lion gained distinct industry expertise and a first-mover advantage in the medium and heavy-duty urban EV segment through more than 10 years of focused all-electric vehicle R&D, manufacturing and commercialization experience. Lion’s vehicles and technology benefit from over seven million miles driven by over 390 of its purpose-built all-electric vehicles that are on the road today, in real-life operating conditions.

Lion’s growing line-up of purpose-built all-electric vehicles consists of seven mid-range truck and bus models available for purchase today. Lion further has an active product development pipeline and expects to launch eight new mid-range truck and bus models over the next two years. By the end of 2022, management believes Lion will have among the broadest mid-range EV offerings in the medium and heavy-duty urban segment, with an expected total of 15 vehicles comprising Class 5, 6, 7 and 8 electric trucks designed for specific applications, Type A, C and D electric school buses, as well as an electric medium-duty shuttle bus and an electric ambulance.

Lion’s EVs are tailored to satisfy the needs of its customers and are entirely designed, manufactured and assembled in-house in North America, without relying on traditional combustion-engine vehicle retrofitting or third-party integrators. To achieve this, Lion has developed its own purpose-built for electric chassis, truck cabins, and bus bodies, incorporating its proprietary battery technology with modular energy capacity and its proprietary Lion software.

Like others in the EV space, Lion has adopted a direct-to-customer sales model tailored for EVs, avoiding reliance on third-party dealerships in most instances. As part of its go-to-market strategy, Lion assists its customers through the EV transition journey in all critical aspects of vehicle selection, purchase and adoption, including EV education and training, identification and seeking of any applicable governmental grants, energy requirements, charging infrastructure, maintenance and advanced telematics solutions. To enhance customer experience and help drive repeat purchases, Lion leverages its growing network of Experience Centers, which are dedicated spaces where prospective customers, policymakers and other transportation industry stakeholders can interact with EVs, learn about their specifications and advantages, meet a sales representative, discuss grant and subsidy assistance, receive vehicle training, and have existing vehicles serviced. Services available on-site at Lion’s Experience Centers include product demonstrations and sales support, full-service training, charging infrastructure assistance and maintenance support. There are currently nine Experience Centers strategically located in key markets in the United States and Canada, with additional centers expected to be opened within the next two years.

By capitalizing on its significant first-mover advantage, broad EV line-up available today, turnkey customer experience and rapidly growing customer base, Lion’s management believes Lion is strongly positioned to gain significant market share in the medium and heavy-duty mid-range vehicle segment.

1

Table of Contents

Recent Developments

Closing of Business Combination Agreement with Northern Genesis Acquisition Corp. and Concurrent Equity Private Placement

On May 6, 2021, Lion completed its previously-announced business combination transaction pursuant to a business combination agreement and plan of reorganization dated as of November 30, 2020 (the “Business Combination Agreement”), among Lion, Northern Genesis Acquisition Corp. (“NGA”) and Lion Electric Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of Lion (“Merger Sub”), pursuant to which (i) Merger Sub merged with and into NGA through a statutory merger under the laws of the State of Delaware, with NGA surviving the merger as a wholly-owned subsidiary of Lion (the “Business Combination”), and (ii) as consideration for the merger, each outstanding share of NGA’s common stock held by an NGA stockholder was converted into the right to receive one newly issued common share of Lion (each, a “Lion Common Share”), and each outstanding warrant to purchase shares of NGA’s common stock, with each such whole warrant exercisable for one share of NGA’s common stock at an exercise price of $11.50, was converted into a warrant to acquire a number of Lion Common Shares (each, a “Lion Warrant”) equal to the number of shares of NGA’s common stock underlying each such warrant of NGA. At the time of closing (“Closing”) of the Business Combination, NGA held (net of the redemptions exercised by NGA’s stockholders holding 20,449 shares) approximately $320 million in its trust account.

Immediately prior to the completion of the Business Combination, Lion completed a reorganization (the “Pre-Closing Reorganization”) which included a share split pursuant to which each Lion Common Share outstanding immediately prior to such share split was converted into 4.1289 Lion Common Shares. Immediately prior to the completion of the Business Combination, Lion also completed a private placement (the “PIPE Financing”) pursuant to which a number of investors agreed to purchase, and Lion agreed to sell to such investors, an aggregate of 20,040,200 Lion Common Shares, for a purchase price of $10.00 per share and an aggregate purchase price of $200,402,000.

The Business Combination and the PIPE Financing resulted in proceeds of approximately $490 million, net of transaction fees. Approximately $90 million of the net proceeds were used to repay outstanding credit facilities and debt instruments. See section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Update with Respect to Certain Debt Instruments.”

Following the closing of the Business Combination and the PIPE Financing, the Lion Common Shares began trading on the TSX and on the NYSE under the new symbol “LEV”, and the Lion Warrants began trading on the TSX under the new symbol “LEV.WT” and on the NYSE under the new symbol “LEV WS”.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

As defined in Section 102(b)(1) of the JOBS Act (as defined below), Lion is as an emerging growth company (“EGC”). As such, Lion is eligible for and relies on certain exemptions and reduced reporting requirements provided by the JOBS Act, including (a) the exemption from the auditor attestation requirements with respect to internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act, (b) the exemptions from say-on-pay, say-on-frequency and say-on-golden parachute voting requirements and (c) reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements.

Lion will remain an EGC under the JOBS Act until the earliest of (i) the last day of the fiscal year in which the market value of Lion’s Common Shares that are held by non-affiliates exceeds $700 million as of the last business day of the second quarter of that fiscal year, (ii) the last day of the fiscal year in which it has total annual gross revenue of $1.07 billion or more during such fiscal year (as indexed for inflation), (iii) the date on which it has issued more than $1 billion in non-convertible debt in the prior three-year period or (iv) the last day of the fiscal year following the fifth anniversary of the date of the Closing.

Lion qualifies as a “foreign private issuer” as defined under SEC rules. Even after Lion no longer qualifies as an EGC, as long as Lion continues to qualify as a foreign private issuer under SEC rules, Lion is exempt from certain SEC rules that are applicable to U.S. domestic public companies, including:

| • | the rules requiring domestic filers to issue financial statements prepared under U.S. GAAP; |

2

Table of Contents

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events; and |

| • | the selective disclosure rules by issuers of material nonpublic information under Regulation FD. |

Notwithstanding these exemptions, Lion will file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC or Canadian securities legislation, an annual report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

Lion may take advantage of these exemptions until such time as Lion is no longer a foreign private issuer. Lion would cease to be a foreign private issuer at such time as more than 50% of its outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of its executive officers or directors are U.S. citizens or residents, (ii) more than 50% of its assets are located in the United States or (iii) its business is administered principally in the United States.

Both foreign private issuers and EGCs also are exempt from certain more stringent executive compensation disclosure rules. Thus, even if Lion no longer qualifies as an EGC, but remains a foreign private issuer, Lion will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an EGC nor a foreign private issuer.

In addition, because Lion qualifies as a foreign private issuer under SEC rules, Lion is permitted to follow the corporate governance practices of Canada (the jurisdiction in which Lion is organized) in lieu of certain NYSE corporate governance requirements that would otherwise be applicable to Lion. For example, under Canadian securities laws, Lion is not required to have a board of directors comprised of a majority of directors meeting the independence standards described in the listing rules of the NYSE (“the NYSE Listing Rules”). In addition, under Canadian securities laws, Lion is not required to have a compensation committee or a nominations committee that is comprised solely of independent directors.

If at any time Lion ceases to be a foreign private issuer, Lion will take all action necessary to comply with the SEC and NYSE Listing Rules, including by having compensation and nominating committees that are comprised solely of independent directors, subject to a permitted “phase-in” period.

Risk Factors

An investment in the Lion Common Shares involves a high degree of risk. Below is a summary of certain key risk factors that you should consider before deciding to invest in the Lion Common Shares. However, this list is not exhaustive. For more information about the risks related to an investment in the Lion Common Shares, see the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” Some of the significant risks include:

| • | Lion’s ability to economically develop, manufacture and distribute its vehicles at scale and meet its customers’ business needs. |

| • | Lion’s ability to successfully implement its growth strategy and manage future growth effectively. |

| • | Lion’s current and future dependence on its manufacturing facilities. |

| • | Lion’s ability to raise additional funds to meet its capital requirements. |

| • | Increases in costs, disruption of supply or shortage of raw materials, particularly lithium-ion battery cells. |

3

Table of Contents

| • | Unfavorable economic conditions, such as the effects of the global COVID-19 pandemic. |

| • | Lion’s ability to successfully attract new customers and secure firm orders from them and to retain existing customers and engage them for additional deployments in the future. |

| • | The inability of suppliers to deliver necessary parts or components according to Lion’s schedule and at prices, volumes and quality levels acceptable to it. |

| • | The trucking and busing industries and Lion’s other customers’ willingness to adopt battery electric vehicles and specifically Lion’s vehicles. |

| • | Developments in alternative or analogous technologies affecting the demand for Lion’s vehicles. |

| • | Competition within the battery electric vehicle industry. |

| • | Unfavorable changes in U.S. or Canadian laws or regulations and trade policy. |

| • | Information technology and cybersecurity risks to operational systems, security systems, infrastructure, integrated software in its vehicles and solutions and customer data processed by it, third-party vendors or suppliers. |

| • | Volatility in the share price of Lion Common Shares. |

| • | The significant influence of certain of Lion existing shareholders will continue following completion of the Business Combination. |

| • | Provisions in Lion’s constating documents may have the effect of delaying or preventing certain change in control transactions or shareholder proposals. |

Corporate Information

Lion was incorporated by Marc Bedard, Lion’s CEO—Founder, and Camile Chartrand under the Business Corporations Act (Québec) on July 28, 2008 as “Lion Buses Inc.” Over the years, Lion’s articles were amended in order to, among other things, amend the terms and conditions of Lion’s share capital in connection with strategic investments made by investors, including the strategic investment made by Power Energy Corporation (“PEC” or “Power Energy”), a wholly-owned subsidiary of Power Sustainable Capital Inc., in October 2017, which resulted in Lion’s authorized share capital being amended to provide for only one class of common shares. On November 24, 2020, Lion filed articles of amendment to change its name to The Lion Electric Company. On May 6, 2021, Lion filed articles of amendments, which resulted in Lion’s authorized share capital being amended to provide for (i) an unlimited number of Lion Common Shares and (ii) an unlimited number of “blank-cheque” preferred shares issuable in series, and immediately thereafter filed articles of consolidation to consolidate its articles.

Lion’s principal and registered office is located at 921 chemin de la Rivière-du-Nord, Saint-Jérôme, Québec, Canada J7Y 5G2, and its telephone number is (450) 432-5466.

4

Table of Contents

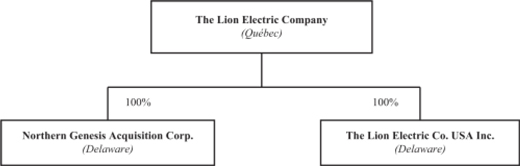

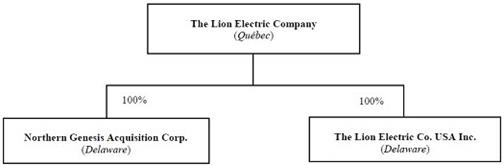

The following chart reflects Lion’s organization structure (including the jurisdiction of formation or incorporation of Lion and its subsidiaries):

5

Table of Contents

| Common shares that may be offered and | ||

| sold from time to time by the selling | ||

| securityholders | 152,276,690 common shares | |

| Common shares outstanding | 188,497,602 common shares | |

| Offering price | The common shares offered by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the selling securityholders may determine. See the section titled “Plan of Distribution”. | |

| Use of proceeds | All of the common shares offered by the selling securityholders pursuant to this prospectus will be sold by the selling securityholders for their respective accounts. Lion will not receive any of the proceeds from such sales. | |

| Transfer restrictions | In connection with the Business Combination Agreement, Lion and the existing shareholders of Lion entered into lock-up agreements (the “Lion Lock-Up Agreements”) pursuant to which such shareholders agreed not to transfer Lion Common Shares for 180 days following the Effective Date, subject to customary exceptions and the terms therein. In addition, in connection with the Business Combination Agreement, Northern Genesis Sponsor LLC (the “Sponsor”) entered into a stockholder support agreement with Lion pursuant to which the Lion Common Shares issued in exchange for the NGA common stock (the “NGA Common Stock”) issued to the Sponsor prior to NGA’s initial public offering became subject to a 365-day lock-up following the Effective Date, subject to customary exceptions. | |

| Dividend policy | Lion anticipates reinvesting earnings to finance the growth of its business, and does not anticipate declaring any cash dividends to holders of Lion Common Shares in the foreseeable future. Subject to the prior rights of the holders of Lion Preferred Shares (as defined below) as to dividends, the holders of Lion Common Shares will be entitled to receive dividends as and when declared by Lion’s Board out of the funds that are available for the payment of dividends. See the section titled “Dividend Policy”. | |

| Market for our common shares | Our common shares are listed on the NYSE and the TSX under the symbol “LEV”. | |

| Risk factors | Investing in our securities involves substantial risks. See “Risk Factors” beginning on page 7 of this prospectus for a description of certain of the risks you should consider before investing in our common shares or warrants. | |

6

Table of Contents

Investing in Lion Common Shares involves a high degree of risk. In addition to the other information set forth in this prospectus, you should carefully consider the risk factors discussed below when considering an investment in Lion Common Shares and any risk factors that may be set forth in the applicable prospectus supplement, any related free writing prospectus, as well as the other information contained in this prospectus, any applicable prospectus supplement and any related free writing prospectus. If any of the following risks occur, Lion’s business, financial condition, results of operations and prospects could be materially and adversely affected. In that case, the market price of Lion’s common shares could decline and you could lose some or all of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Related to Lion’s Business

Lion’s success will depend on its ability to economically develop, manufacture and sell its vehicles at scale and meet its customers’ business needs. Lion’s ability to develop, manufacture and distribute vehicles of sufficient quality and appeal to customers on schedule and at scale is unproven.

Lion’s future business depends in large part on its ability to economically manufacture, market and sell its vehicles at sufficient capacity to meet the transportation demands of its customers. Although it currently develops and manufactures vehicles from its manufacturing facility in Saint-Jérôme, Québec, Lion will need to scale its manufacturing capacity in order to successfully implement its growth strategy, and plans to do so in the future by, among other things, building a large-scale manufacturing facility in the United States and building a battery assembly facility. Although Lion has experience in developing and manufacturing buses and trucks from its existing facility, such operations are currently conducted on a limited scale, and Lion has no experience to date in high volume manufacturing of its vehicles. Lion does not know whether it will be able to develop efficient, automated, low-cost manufacturing capabilities and processes, or whether it will be able to secure reliable sources of component supply, in each case that will enable it to meet the quality, price, engineering, design and production standards, as well as the production volumes, required to successfully mass market its vehicles and meet its business objectives and customer needs. Even if Lion is successful in developing high-volume manufacturing capability and processes and can reliably source component supplies in sufficient volume, it does not know whether it will be able to do so in a manner that avoids significant delays and cost overruns, including as a result of factors beyond its control such as problems with suppliers, or in time to meet the commercialization schedules of future vehicles or to satisfy the requirements of its customers. Lion’s ability to effectively reduce its cost structure over time is limited by the fixed nature of many of its planned expenses in the near-term, and its ability to reduce long-term expenses is constrained by its need to continue investment in its growth strategy. Any failure to develop and scale such manufacturing processes and capabilities within Lion’s projected costs and timelines could have a material adverse effect on its business, results of operations or financial condition.

Lion may not be able to successfully implement its growth strategy, on a timely basis or at all, and it may be unable to manage future growth effectively.

Lion’s future growth, results of operations and financial condition depend upon its ability to successfully implement its growth strategy, which, in turn, is dependent upon a number of factors, some of which are beyond Lion’s control, including its ability to:

| • | economically manufacture and sell its vehicles at scale and meet customers’ business needs; |

| • | effectively introduce new products and implement new technology-driven services and solutions; |

| • | complete the construction of its planned battery assembly facility and planned large-scale U.S. manufacturing facility, in each case at a reasonable price and on a timely basis; |

| • | secure and maintain required strategic supply arrangements; |

| • | keep pace with technological change affecting the battery electric vehicle industry; |

| • | effectively compete in the markets in which it operates; and |

| • | attract and retain management or other employees who possess specialized market knowledge and technical skills. |

7

Table of Contents

There can be no assurance that Lion can successfully achieve any or all of the above initiatives in the manner or time period that it expects. Further, achieving these objectives will require investments which may result in both short-term and long-term costs without generating any current revenue and therefore may be dilutive to earnings. Lion cannot provide any assurance that it will realize, in full or in part, the anticipated benefits it expects to generate from its growth strategy. Failure to realize those benefits could have a material adverse effect on Lion’s business, results of operations or financial condition.

Even if it can achieve the above benefits and successfully implement its growth strategy, any failure to manage its growth effectively could materially and adversely affect Lion’s business, results of operations or financial condition. Lion intends to expand its operations significantly, which will require it to hire and train new employees across all divisions; accurately forecast supply and demand, production and revenue; control expenses and investments in anticipation of expanded operations; establish new or expand current design, production, and sales and service facilities; and implement and enhance administrative infrastructure, systems and processes. Failure to efficiently manage any of the above could have a material adverse effect on Lion’s business, results of operations or financial condition.

Failure to drastically increase manufacturing capacity and efficiency could have a material adverse effect on Lion’s business, results of operations or financial condition.

Although Lion’s existing Saint-Jérôme, Québec, manufacturing facility, which has a current capacity of approximately 2,500 vehicles per year and which was used in 2020 to manufacture 84 vehicles comprised primarily of LionC (Type C school bus) and a few Lion 360° (cowled-chassis bus) buses and Lion6 and Lion8 urban class truck prototypes, is able to satisfy Lion’s current manufacturing requirements, the future success of Lion’s business depends in part on its ability to drastically increase manufacturing capacity and efficiency. Lion may be unable to expand its business, satisfy demand from its current and new customers, maintain its competitive position and improve profitability if it is unable to build and operate its planned large-scale manufacturing facility in the U.S. and otherwise allow for increases in manufacturing output and speed. The construction of such a facility will require significant cash investments and management resources and may not meet Lion’s expectations with respect to increasing capacity, efficiency and satisfying additional demand. For example, if there are delays in Lion’s planned large-scale U.S. manufacturing facility becoming fully operational or achieving target yields and output, Lion may not meet its target for adding capacity, which would limit its ability to increase sales and result in lower than expected sales and higher than expected costs and expenses. Failure to drastically increase manufacturing capacity or otherwise satisfy customers’ demands may result in a loss of market share to competitors, damage Lion’s relationships with its key customers, a loss of business opportunities or otherwise materially adversely affect its business, results of operations or financial condition.

Lion is and will be dependent on its manufacturing facilities. If one or more of its current or future manufacturing facilities becomes inoperable, capacity constrained or if operations are disrupted, Lion’s business, results of operations or financial condition could be materially adversely affected.

Lion’s revenue is and will be dependent on the continued operations of its Saint-Jérôme, Québec, manufacturing facility as well as its other planned facilities, including its planned large-scale U.S. manufacturing facility and battery assembly facility. To the extent that Lion experiences any operational risk including, among other things, fire and explosions, severe weather and natural disasters (such as floods and hurricanes), failures in water supply, major power failures, equipment failures (including any failure of its information technology, air conditioning, and cooling and compressor systems), failures to comply with applicable regulations and standards, labor force and work stoppages, or if its current or future manufacturing facilities become capacity constrained, Lion will be required to make capital expenditures even though it may not have available resources at such time. Additionally, there is no guarantee that the proceeds available from Lion’s insurance policies will be sufficient to cover such capital expenditures. As a result, Lion’s insurance coverage and available resources may prove to be inadequate for events that may cause significant disruption to its operations. Any disruption in Lion’s manufacturing processes could result in delivery delays, scheduling problems, increased costs, or production interruption, which, in

8

Table of Contents

turn, may result in its customers deciding to purchase products from its competitors. Lion is and will be dependent on its current and future manufacturing facilities which will in the future require a high degree of capital expenditures. If one or more of Lion’s current or future manufacturing facilities becomes inoperative, capacity constrained or if operations are disrupted, its business, results of operations or financial condition could be materially adversely affected.

Lion may in the future need to raise additional funds to meet its capital requirements and such funds may not be available to Lion on commercially reasonable terms or at all when it needs them, which could materially adversely affect Lion’s business, results of operations or financial condition.

The development, design, manufacturing, sale and servicing of Lion’s battery electric vehicles is capital-intensive. Although Lion believes that it will have sufficient funds to meet its short to medium term capital requirements, it may in the future need to raise additional funds, including through the issuance of equity, equity related or debt securities or through obtaining credit from government or financial institutions, to meet its capital requirements, and the availability of additional funds to Lion will depend on a variety of factors, some of which are outside of its control. Additional funds may not be available to Lion on commercially reasonable terms or at all when it needs them, which could materially adversely affect its business, results of operations or financial condition. If additional funds are raised by issuing equity securities, shareholders of Lion may incur dilution.

Lion has a history of losses, and negative cash flows from operating activities and expects to incur significant expenses for the foreseeable future, and there is no guarantee it will achieve or sustain profitability.

Lion incurred net losses of approximately $16.1 million for the quarter ended March 31, 2021, approximately $97.4 million for the year ended December 31, 2020, approximately $3.1 million for the year ended December 31, 2019, and approximately $5.4 million for the year ended December 31, 2018. Further, Lion had negative cash flows from operating activities of approximately $10.1 million for the quarter ended March 31, 2021, approximately $27.1 million for the year ended December 31, 2020, approximately $7.4 million for the year ended December 31, 2019, and approximately $2.2 million for the year ended December 31, 2018. These losses and negative cash flows are the result of the substantial investments Lion made to grow its business, and Lion expects to make significant expenditures to expand its business in the future. Lion expects to incur significant expenditures in connection with its growth strategy, both in the United States and Canada, including as a result of the expected increase in costs related to: the construction of its planned battery assembly facility and planned large-scale U.S. manufacturing facility; the design, development and production of its new products; the hire of additional employees across all divisions; the production of an inventory of its vehicles; the buildup of inventories of parts and components for its vehicles; the expansion of its design, development, installation and servicing capabilities, including the planned construction of additional research and development centers and Lion experience centers; and an increase in its administrative functions to support its growth. Lion also expects to continue spending on technical and other operational enhancements to its business and to increase investment in research and development as it continues to introduce new products and solutions with a view to offer full turnkey transition services towards fleet electrification to its customers. While Lion expects to generate positive cash flows over time, the aforementioned anticipated increased expenditures will make it harder for Lion to achieve profitability and positive cash flow and Lion cannot guarantee it will achieve either in the near term or at all. If Lion is unable to generate adequate revenue growth and manage its expenses, it may continue to incur losses and have negative cash flows from operating activities and there is no guarantee it will achieve or sustain profitability or positive cash flows. To the extent Lion has negative cash flows from operating activities in any future periods, all or a portion of the funds raised in connection with the Business Combination and the PIPE financing may be used to fund such negative cash flows. See the section entitled “Risk Factors—Lion may in the future need to raise additional funds to meet its capital requirements and such funds may not be available to Lion on commercially reasonable terms or at all when it needs them, which could materially adversely affect Lion’s business, results of operations or financial condition.” Even if Lion is able to successfully and economically develop, manufacture and distribute its vehicles on schedule and at scale, there can be no assurance that it will be commercially successful.

Lion may make decisions that would reduce its short-term operating results if it believes those decisions will improve the quality of its products or services and if it believes such decisions will improve its operating results over the long-term. These decisions may not be consistent with the expectations of investors and may not produce the long-term benefits that Lion expects, in which case Lion’s business, results of operations or financial condition may be materially and adversely affected.

9

Table of Contents

Lion may not succeed in establishing, maintaining and strengthening its brand, which would materially and adversely affect customer acceptance of its vehicles, which could materially adversely affect its business, results of operations or financial condition.

Lion’s business and prospects heavily depend on its ability to develop, maintain and strengthen the Lion brand. If it is unable to establish, maintain and strengthen its brand, Lion may lose the opportunity to build and maintain a critical mass of customers. Lion’s ability to develop, maintain and strengthen the Lion brand will depend heavily on the success of its marketing efforts. The battery electric vehicle industry, and the alternative fuel vehicle industry in general, are highly competitive, and Lion may not be successful in building, maintaining and strengthening its brand. Many of Lion’s current and potential competitors, particularly automobile manufacturers headquartered in the United States, Japan and the European Union, have greater name recognition, broader customer relationships and substantially greater marketing resources than Lion. Failure to develop and maintain a strong brand would materially and adversely affect customer acceptance of Lion’s vehicles, could result in suppliers and other third parties being less likely to invest time and resources in developing business relationships with Lion, and could materially adversely affect Lion’s business, results of operations or financial condition.

Increases in costs, disruption of supply or shortage of raw materials, particularly lithium-ion battery cells, could materially adversely affect Lion’s business, results of operations or financial condition.

Lion may experience increases in the cost or a sustained interruption in the supply or shortage of raw materials. Any such increase in cost or supply interruption or shortage could materially adversely affect Lion’s business, results of operations or financial condition. Components in Lion’s vehicles are made of various raw materials, including aluminum, steel, carbon fiber, non-ferrous metals (such as copper) and other materials and minerals used to manufacture lithium-ion batteries. The prices for these raw materials fluctuate depending on market conditions and global demand and could materially affect Lion’s business, results of operations or financial condition. While Lion manages some of these risks through long-term contractual arrangements with suppliers with respect to the supply of certain key components of its vehicles, including lithium-ion batteries, it does not currently hedge its long-term exposure to price fluctuations of raw materials and supplies. Therefore, Lion is nevertheless exposed to multiple risks relating to price fluctuations for lithium-ion cells. These risks include:

| • | the inability or unwillingness of current battery manufacturers to build or operate battery cell manufacturing plants to supply the numbers of lithium-ion cells required to support the growth of the electric vehicle industry as demand for such cells increases; |

| • | disruption in the supply of cells due to quality issues or recalls by the battery cell manufacturers; |

| • | increased regulation of supply chains to account for, among other things, environmental and/or human rights risks; and |

| • | an increase in the cost of raw materials used in lithium-ion cells, such as cobalt. |

Any disruption in the supply of battery cells or other key vehicle components could temporarily disrupt production of Lion’s vehicles until a different supplier is fully qualified. Moreover, battery cell manufacturers may refuse to supply electric vehicle manufacturers if they determine that the vehicles are not sufficiently safe. Furthermore, various fluctuations in market and economic conditions may cause Lion to experience significant increases in freight charges and raw material costs. Substantial increases in the prices for raw materials would increase Lion’s operating costs and could reduce Lion’s margins if the increased costs cannot be recouped through increased vehicle prices. There can be no assurance that Lion will be able to recoup increasing costs of raw materials by increasing vehicle prices.

Lion’s vehicles use lithium-ion battery cells, which have been observed to catch fire or vent smoke and flame.

The battery packs within Lion’s vehicles use lithium-ion cells. On rare occasions, lithium-ion cells can rapidly release the energy they contain by venting smoke and flames in a manner that can ignite nearby materials as well as other lithium-ion cells. While the battery pack is designed to contain any single cell’s release of energy without spreading to neighboring cells, a field or testing failure of Lion’s vehicles could occur, which could result in bodily injury or death and could subject Lion to lawsuits, product recalls, or redesign efforts, all of which would be time

10

Table of Contents

consuming and expensive. Also, negative public perceptions regarding the suitability of lithium-ion cells for automotive applications, the social and environmental impacts of cobalt mining or any future incident involving lithium-ion cells, such as a vehicle or other fire, even if such incident does not involve Lion’s vehicles, could materially adversely affect Lion’s business, results of operations or financial condition.

In addition, manufacturing of Lion’s vehicles requires it to store a significant number of lithium-ion cells at its facility. Any mishandling of battery cells may cause disruption to the operation of Lion’s current or future facilities. While Lion has implemented safety procedures related to the handling of the cells, a safety issue or fire related to the cells could disrupt Lion’s operations. Such damage or injury could lead to adverse publicity and potentially a safety recall. Moreover, any failure of a competitor’s electric vehicle or energy storage product may cause indirect adverse publicity for Lion and its products. Such adverse publicity could negatively affect Lion’s brand or could materially adversely affect Lion’s business, results of operations or financial condition.

Lion may not be able to adequately forecast the supply and demand for its vehicles, its manufacturing capacity or its profitability under long term supply arrangements, including the MPA with the Specified Customer, which could result in a variety of inefficiencies in its business and hinder its ability to generate revenue.

It is difficult to predict Lion’s future sales and appropriately budget for Lion’s expenses, and Lion may have limited insight into trends that may emerge and affect its business. Lion will be required to provide forecasts of its demand to its suppliers several months prior to the scheduled delivery of products to customers. Currently, there is limited historical basis for making judgments on the future demand for Lion’s vehicles or its ability to mass develop, manufacture and deliver vehicles at scale, or Lion’s profitability in the future. If Lion fails to accurately predict its manufacturing requirements, it could incur additional costs or experience delays. If Lion overestimates manufacturing requirements, its suppliers may have excess inventory, which indirectly would increase Lion’s costs. If Lion underestimates manufacturing requirements, its suppliers may have inadequate inventory, which could interrupt manufacturing of Lion’s vehicles and result in delays in shipments and revenues. In addition, lead times for materials and components that Lion’s suppliers order may vary significantly and depend on factors such as the specific supplier, contract terms and demand for each component at a given time. If Lion fails to order sufficient quantities of product components in a timely manner, the delivery of vehicles to its customers could be delayed, which could materially adversely affect its business, results of operations or financial condition.

In addition, the MPA (as defined below) with the Specified Customer (as defined below) requires Lion to reserve necessary manufacturing capacity to deliver up to 500 trucks per year from 2021 to 2025 and the greater of 500 trucks per year or 10% of Lion’s manufacturing capacity from 2026 to 2030, which could hinder Lion’s ability to capitalize on future business opportunities. Moreover, some of Lion’s customers, including the Specified Customer under the MPA, operate on a purchase order basis, which means such customers are not required to purchase any specified minimum quantity of vehicles beyond the quantities in an existing purchase order and may in certain circumstances cancel or reschedule purchase orders on relatively short notice. Cancellations or rescheduling of customer orders could result in the delay or loss of anticipated sales without allowing sufficient time to reduce, or delay the incurrence of, corresponding inventory and operating expenses, which could materially adversely affect Lion’s business, results of operations or financial condition.

Lion’s operating and financial results may vary significantly from period to period due to fluctuations in its operating costs and other factors.

Lion expects its period-to-period operating and financial results to vary based on a multitude of factors, some of which are outside of Lion’s control. Lion expects its period-to-period financial results to vary based on operating costs, which it anticipates will fluctuate with the pace at which it increases its manufacturing capacity and continues to design, develop and produce new products. In addition, Lion’s revenues from period to period may fluctuate as it develops and introduces new vehicles. As a result of these factors, Lion believes that quarter-to-quarter comparisons of its operating or financial results, especially in the short term, are not necessarily meaningful and that these comparisons cannot be relied upon as indicators of future performance. Moreover, Lion’s financial results may not meet expectations of equity research analysts, ratings agencies or investors, who may be focused only on quarterly financial results. If any of this occurs, the trading price of Lion’s Common Shares could fall substantially, either suddenly or over time, which could have a material adverse effect on Lion’s business, results of operations or financial condition.

11

Table of Contents

Lion may experience significant delays in the design, production and launch of its new products.

Lion is still in the development and testing phase with respect to certain of its vehicles, including, among others, the Lion8 Tractor, Lion8 Bucket, Lion8 Boom, Lion7, Lion6 Utility and Lion5 all-electric trucks, the LionD all-electric school bus and an all-electric ambulance. The commercial deliveries of such vehicles are not expected to begin until later this year or 2022 (depending on the product) and may occur later or not at all. Any delay in the financing, design, production and launch of any such new vehicles, including future production of the aforementioned all-electric trucks, school buses and ambulance, could harm Lion’s reputation or materially adversely affect its business, results of operations or financial condition.

Failure to carry adequate insurance coverage may have a material adverse effect on Lion’s business, results of operations or financial condition.

Lion maintains liability insurance, property and business interruption insurance, cargo insurance, cybersecurity insurance, automotive liability insurance and directors and officers insurance, and such insurance coverage reflects deductibles, self-insured retentions, limits of liability and similar provisions. However, there is no guarantee that Lion’s insurance coverage will be sufficient, or that insurance proceeds will be paid to Lion in a timely manner. In addition, there are types of losses Lion may incur but against which it cannot be insured or which it believes are not economically reasonable to insure, such as losses due to acts of war and certain natural disasters. If Lion incurs these losses and they are material, its business, results of operations or financial condition could be materially adversely affected.

Increased freight and shipping costs or disruptions in transportation and shipping infrastructure could materially adversely impact Lion’s business, results of operations or financial condition.

Lion uses external freight shipping and transportation services to transport and deliver its vehicles as well as subcomponents and raw materials incorporated therein. Adverse fluctuations in freight costs, limitations on shipping and receiving capacity, and other disruptions in the transportation and shipping infrastructure at important shipping and delivery points for Lion’s products, as well as for subcomponents incorporated in Lion’s vehicles could materially adversely affect Lion’s business, financial condition and results of operations. For example, delivery delays or increases in transportation costs (including through increased fuel costs, increased carrier rates or driver wages as a result of driver shortages, a decrease in transportation capacity, or work stoppages or slowdowns) could significantly decrease Lion’s ability to make sales and earn profits. Labor shortages or work stoppages in the transportation industry or long-term disruptions to the national and international transportation infrastructure that lead to delays or interruptions of deliveries or which would necessitate Lion securing alternative shipping suppliers could also increase Lion’s costs or otherwise materially adversely affect its business, results of operations or financial condition.

Lion is highly dependent on the services of Marc Bedard, its CEO—Founder, and the rest of its senior management team. Lion’s inability to retain Mr. Bedard or attract and retain management or other employees who possess specialized market knowledge and technical skills could affect its ability to compete, manage operations effectively or develop new products or otherwise materially adversely affect its business, results of operations or financial condition.

Lion’s success depends, in part, on its ability to retain its key personnel, in particular management and other employees who possess specialized market knowledge and technical skills. Lion is highly dependent on the services of Marc Bedard, its CEO—Founder and second largest shareholder. Mr. Bedard is the source of many of the innovative ideas driving Lion and their execution. If Mr. Bedard were to discontinue his service for Lion due to death, disability or any other reason, Lion would be significantly disadvantaged. The unexpected loss of or failure to retain one or more of Lion’s key employees could adversely affect Lion’s business, results of operations or financial condition. Lion does not currently maintain key man life insurance policies with respect to Mr. Bedard or any other officer, and Lion will continue to evaluate whether to obtain such key man life insurance policies.

Lion’s success also depends, in part, on its continuing ability to identify, hire, attract, train, develop and retain other highly qualified personnel with specialized market knowledge and technical skills. Experienced and highly skilled employees are in high demand and competition for these employees can be intense, and Lion’s ability to hire, attract and retain them depends on Lion’s ability to provide competitive compensation. Lion may not be able to

12

Table of Contents

attract, assimilate, develop or retain qualified personnel in the future, and Lion’s failure to do so could materially adversely affect its business, results of operations or financial condition. Any failure by Lion’s management team and employees to perform as expected may have a material adverse effect on its business, financial condition and operating results.

Any deterioration in relationships with Lion’s employees as well as any work stoppage or similar difficulties could have a material adverse effect on Lion’s business, results of operations or financial condition.

None of Lion’s employees are currently unionized. The maintenance of a productive and efficient labor environment and, in the event of unionization of employees, the successful negotiation of a collective bargaining agreement, cannot be assured. A deterioration in relationships with employees or in the labor environment could result in work interruptions or other disruptions, or cause management to divert time and resources from other aspects of Lion’s business, any of which could have a material adverse effect on Lion’s business, results of operations or financial condition.

Lion’s employees and independent contractors may engage in misconduct or other improper activities, including non-compliance with regulatory standards and requirements, which could have a material adverse effect on its business, results of operations or financial condition.

Lion is exposed to the risk that its employees, independent contractors or other parties it collaborates with may engage in misconduct or other illegal activity. Misconduct by these parties could include intentional, reckless or negligent conduct or other activities that violate laws and regulations, including production standards, federal, state and provincial fraud, abuse, data privacy and security laws, other similar laws or laws that require the true, complete and accurate reporting of financial information or data. It is not always possible to identify and deter misconduct by employees and other third parties, and the precautions Lion takes to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting it from governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations. In addition, Lion is subject to the risk that a person or government could allege such fraud or other misconduct, even if none occurred. If any such actions are instituted against Lion and it is not successful in defending itself or asserting its rights, those actions could have a material adverse effect on its business, results of operations or financial condition, including, without limitation, by way of imposition of significant civil, criminal and administrative penalties, damages, monetary fines, disgorgement, integrity oversight and reporting obligations to resolve allegations of non-compliance, imprisonment, other sanctions, contractual damages, reputational harm, diminished profits and future earnings and curtailment of its operations.

Lion has and may in the future make strategic alliances, partnerships or investments or acquisitions, all of which could divert management’s attention, result in Lion incurring significant costs or operating difficulties and dilution to its shareholders and otherwise disrupt its operations and materially adversely affect its business, results of operations or financial condition.

Pursuing potential strategic alliances, partnerships or investments or acquisitions and/or inorganic growth opportunities is part of Lion’s growth strategy. There are risks associated with any strategic partnership or arrangement, the termination or operation of joint ventures or other strategic alliances and pursuing strategic acquisitions or investment opportunities, including:

| • | the sharing of confidential information; |

| • | the diversion of management’s time and focus from operating its business; |

| • | the use of resources that are needed in other areas of its business; |

| • | unforeseen costs or liabilities; |

| • | adverse effects to Lion’s existing business relationships with partners and suppliers; |

| • | litigation or other claims arising in connection with the acquired company, investment, partnership or joint venture; |

13

Table of Contents

| • | the possibility of adverse tax consequences; |

| • | in the case of an acquisition, implementation or remediation of controls, procedures and policies of the acquired company; |

| • | in the case of an acquisition, difficulty integrating the accounting systems and operations of the acquired company; and |

| • | in the case of an acquisition, retention and integration of employees from the acquired company, and preservation of its corporate culture. |

Lion may have limited ability to monitor or control the actions of any third party involved in any such transaction and, to the extent any of these strategic third parties suffers negative publicity or harm to their reputation from events relating to their business, Lion may also suffer negative publicity or harm to its reputation by virtue of its association with any such third party. Participation in strategic alliances, partnerships or investments or acquisitions may also result in dilutive issuances of equity securities, which could adversely affect the price of the Lion Common Shares, or result in issuances of securities with superior rights and preferences to the Lion Common Shares or the incurrence of debt with restrictive covenants that limit Lion’s future uses of capital in pursuit of business opportunities. Lion may also not be able to identify opportunities for strategic partnerships or arrangements, acquisition or investments that meet its strategic objectives, or to the extent such opportunities are identified, may not be able to negotiate terms with respect to such opportunity that are acceptable to it. At this time Lion has made no commitments or agreements with respect to any such material transactions.

The terms of Lion’s indebtedness contain, and the terms of its future indebtedness may contain, certain covenants that restrict its ability to engage in certain transactions and may impair its ability to execute its growth strategy and respond to changing business and economic conditions.

The loan agreement with Finalta (as defined below) contains restrictive covenants that may limit Lion’s discretion with respect to certain business matters as well as covenants that require it to meet certain financial condition tests. Lion may also incur future indebtedness that might subject it to additional covenants and restrictions that could affect its financial and operational flexibility. Such restrictions may prevent it from taking actions that it believes would be in the best interest of its business and may make it difficult for it to execute its business strategy successfully or effectively compete with companies that are not similarly restricted.

Lion’s ability to comply with the covenants and restrictions contained in the instruments governing its indebtedness may be affected by economic, financial and industry conditions beyond its control. A breach of any of these covenants or restrictions could result in a default under the applicable debt instrument that would permit applicable lender(s) to declare all amounts outstanding thereunder to be due and payable, together with accrued and unpaid interest, or cause cross-defaults under Lion’s other debt. If Lion is unable to repay its indebtedness, lenders could proceed against the collateral securing the debt. In any such case, Lion may be unable to borrow under the agreements under which such other indebtedness is issued, which could have a material adverse effect on its business, results of operations or financial condition.

Fluctuations in foreign currency exchange rates could result in declines in reported sales and net earnings.

Lion reports its financial results in U.S. dollars and a material portion of its sales and operating costs are realized in currencies other than the U.S. dollar. For the year ended December 31, 2020, approximately 49.5% of Lion’s revenues were realized in Canada. Lion is also exposed to other currencies such as the Euro, and may in the future be exposed to other currencies. If the value of any currencies in which sales are realized, particularly the Canadian dollar, depreciates relative to the U.S. dollar, Lion’s foreign currency revenue will decrease when translated to U.S. dollars for reporting purposes. In addition, any depreciation in foreign currencies could result in higher local prices, which may negatively impact local demand and have a material adverse effect on Lion’s business, results of operations or financial condition. Alternatively, if the value of any of the currencies in which operating costs are realized appreciates relative to the U.S. dollar, Lion’s operating costs will increase when translated to U.S. dollars for reporting purposes. Although these risks may sometimes be naturally hedged by a match in sales and operating costs denominated in the same currency, fluctuations in foreign currency exchange rates, particularly the U.S.-Canadian dollar exchange rate, could create discrepancies between Lion’s sales and

14

Table of Contents

operating costs in a given currency that could have a material adverse effect on its business, results of operations or financial condition. Fluctuations in foreign currency exchange rates could also have a material adverse effect on the relative competitive position of Lion’s products in markets where it faces competition from manufacturers who are less affected by such fluctuations in exchange rates, especially in the U.S. market.

While Lion actively manages its exposure to foreign-exchange rate fluctuations and may enter into hedging contracts from time to time, such contracts hedge foreign-currency denominated transactions and any change in the fair value of the contracts could be offset by changes in the underlying value of the transactions being hedged. Furthermore, Lion does not have foreign-exchange hedging contracts in place with respect to all currencies in which it does business. As a result, there can be no assurance that Lion’s approach to managing its exposure to foreign-exchange rate fluctuations will be effective in the future or that Lion will be able to enter into foreign-exchange hedging contracts as deemed necessary on satisfactory terms.

Unfavorable economic conditions, such as consequences of the global COVID-19 pandemic, may have a material adverse effect on Lion’s business, results of operations and financial condition.

Lion has been impacted by the COVID-19 pandemic, and Lion cannot predict the future impacts the COVID-19 pandemic may have on its business, results of operations and financial condition. Beginning in March 2020, numerous government regulations and public advisories, as well as shifting social behaviors, temporarily and from time to time limited or closed non-essential transportation, government functions, business activities and person-to-person interactions, and the duration of such trends is difficult to predict. Mandated governmental measures have forced Lion to reduce operations at its Saint-Jérôme, Québec, facility and establish work-from-home policies for certain of its employees, and some of its suppliers have been subject to similar limitations and may also have been required to shut down production. Limitations on travel by Lion’s personnel and personnel of its customers and increased demand for commercial trucks within its customers’ fleets caused some customers to delay electrification of their fleet, and future delays or shutdowns of Lion’s facilities or those of its suppliers’ could impact Lion’s ability to meet customer orders. Lion cannot predict if current restrictions and limitations to its or its customers’ and suppliers’ operations will be maintained, or if new measures will be implemented.

Lion’s operations and timelines may also be affected by global economic markets and levels of consumer comfort and spend, including recessions, slow economic growth, economic and pricing instability, increase of interest rates and credit market volatility, all of which could impact demand in the worldwide transportation industries or otherwise have a material adverse effect on Lion’s business, operating results and financial condition. Because the impact of current conditions on an ongoing basis is yet largely unknown, is rapidly evolving and has been varied across geographic regions, this ongoing assessment will be particularly critical to allow Lion to accurately project supply and demand and infrastructure requirements globally and allocate resources accordingly. If current global market conditions continue or worsen, Lion’s business, results of operations and financial condition could be materially adversely affected.

Natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, boycotts and geo-political events could materially adversely affect Lion’s business, results of operations or financial condition.

The occurrence of one or more natural disasters, such as hurricanes and earthquakes, unusually adverse weather, epidemic or pandemic outbreaks, such as the ongoing COVID-19 pandemic, boycotts and geo-political events, such as civil unrest and acts of terrorism, or similar disruptions could materially adversely affect Lion’s business, results of operations or financial condition. These events could result in physical damage to property, an increase in energy prices, temporary or permanent closure of one or more of Lion’s current or planned facilities, temporary lack of an adequate workforce in a market, temporary or long-term disruption in the supply of raw materials, product parts and components, temporary disruption in transport from overseas, or disruption to Lion’s information systems. Lion may incur expenses or delays relating to such events outside of its control, which could have a material adverse impact on its business, operating results and financial condition.

15

Table of Contents

As a result of the Business Combination, Lion could be treated as a U.S. corporation for U.S. federal income tax purposes.

Under current U.S. federal income tax law, a corporation organized under Canadian law is not treated as a U.S. corporation and, therefore, is treated as a non-U.S. corporation. Section 7874 of the Code and the Treasury Regulations promulgated thereunder, however, contain rules that may cause a non-U.S. corporation that acquires the stock of a U.S. corporation to be treated as a U.S. corporation for U.S. federal income tax purposes under certain circumstances. If, as a result of the Business Combination, Lion were treated as a U.S. corporation for U.S. federal income tax purposes, among other consequences, it would generally be subject to U.S. federal income tax on its worldwide income, and its dividends would be treated as dividends from a U.S. corporation. Regardless of the application of Section 7874 of the Code, Lion is expected to be treated as a Canadian tax resident for Canadian tax purposes. Consequently, if Lion were to be treated as a U.S. corporation for U.S. federal income tax purposes under Section 7874 of the Code, it could be liable for both U.S. and Canadian taxes and dividends paid by Lion to its shareholders could be subject to both U.S. and Canadian withholding taxes.

Lion does not expect to be treated as a U.S. corporation for U.S. federal income tax purposes, and Lion intends to take this position on its tax returns. Lion has not sought and will not seek any rulings from the IRS as to such tax treatment, and the closing of the Business Combination was not conditioned upon achieving, or receiving a ruling from any tax authority or opinion from any tax advisor in regards to, any particular tax treatment. Further, there can be no assurance that your tax advisor, the IRS, or a court will agree with the position that Lion is not treated as a U.S. corporation pursuant to Section 7874 of the Code. Lion is not representing to you that Lion will not be treated as a U.S. corporation for U.S. federal income tax purposes under Section 7874 of the Code. The rules for determining whether a non-U.S. corporation is treated as a U.S. corporation for U.S. federal income tax purposes are complex, unclear, and the subject of ongoing regulatory change. Lion’s intended position is not free from doubt. For more information about the application of Section 7874 of the Code to Lion, see the section entitled “Material U.S. Federal Income Tax Considerations —Tax Residence of Lion for U.S. Federal Income Tax Purposes”.

If, as a result of the Business Combination, Lion were to be treated as an inverted domestic corporation under the Homeland Security Act or other relevant state and local rules, the U.S. federal government and certain state and local governments may cease doing business with Lion, which could substantially decrease the value of Lion’s business and, accordingly, the value of the Lion Common Shares.