Form 424B3 Fathom Digital Manufactu

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-262194

PROSPECTUS SUPPLEMENT NO. 1

(to prospectus dated May 2, 2022)

FATHOM DIGITAL MANUFACTURING CORPORATION

45,423,250 SHARES OF CLASS A COMMON STOCK

9,900,000 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK

18,525,000 SHARES OF CLASS A COMMON STOCK UNDERLYING WARRANTS TO

PURCHASE CLASS A COMMON STOCK AND

90,570,234 SHARES OF CLASS A COMMON STOCK UNDERLYING CLASS B COMMON STOCK

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated May 2, 2022 (and as may be further supplemented or amended from time to time, the “Prospectus”), with the information contained in (i) our Current Report on Form 8-K, which we filed with the Securities and Exchange Commission (“SEC”) on May 16, 2022 (the “Current Report”) and (ii) our Quarterly Report on Form 10-Q, which we filed with the SEC on May 16, 2022 (the “Quarterly Report”). Accordingly, we have attached the Current Report and the Quarterly Report to this prospectus supplement. Capitalized terms used but not defined in this prospectus supplement have the meanings given to such terms in the Prospectus.

The Prospectus and this prospectus supplement relate to the resale from time to time by the selling stockholders named in the Prospectus or their permitted transferees (collectively, the “Selling Stockholders”) of: (i) up to 36,661,014 shares of Class A common stock, par value $0.0001 per share (the “Class A common stock”) issued to the Legacy Fathom Owners in connection with the closing of the Business Combination, (ii) up to 4,770,000 shares of Class A common stock held by Altimar Sponsor II, LLC (“Sponsor”) and the other Altimar II Founders following the closing of the Business Combination, (iii) up to 2,724,736 Earnout Shares issued to certain Legacy Fathom Owners, and (iv) up to 1,267,500 Sponsor Earnout Shares. The Prospectus and this prospectus supplement also relate to (a) the resale of up to 9,900,000 Private Placement Warrants to purchase shares of Class A common stock held by Sponsor, (b) the issuance of up to 18,525,000 shares of Class A common stock upon the exercise of outstanding Public Warrants and Private Placement Warrants to purchase shares of Class A common stock, and (c) the issuance of up to 90,570,234 shares of Class A common stock issuable upon the exchange of New Fathom Units (together with a corresponding number of shares of Class B common stock) held by certain of the Selling Stockholders (including 6,275,264 Earnout Shares presently represented in the form of unvested New Fathom Units).

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Class A common stock is traded on the New York Stock Exchange (the “NYSE”) under the symbol “FATH.” On May 16, 2022, the closing price of our Class A common stock was $6.12 per share. Our Public Warrants are currently listed on the NYSE and trade under the symbol “FATH.WS.” On May 16, 2022, the closing price of our Public Warrants was $0.78 per Public Warrant.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 17 of the Prospectus. Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May 17, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 16, 2022

FATHOM DIGITAL MANUFACTURING CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-39994 |

|

98-1571400 |

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

1050 Walnut Ridge Drive

Hartland, WI 53029

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (262) 367-8254

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading |

|

Name of each exchange |

Class A common stock, par value $0.0001 per share |

|

FATH |

|

NYSE |

Warrants to purchase Class A common stock |

|

FATH.WS |

|

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. |

Results of Operations and Financial Condition. |

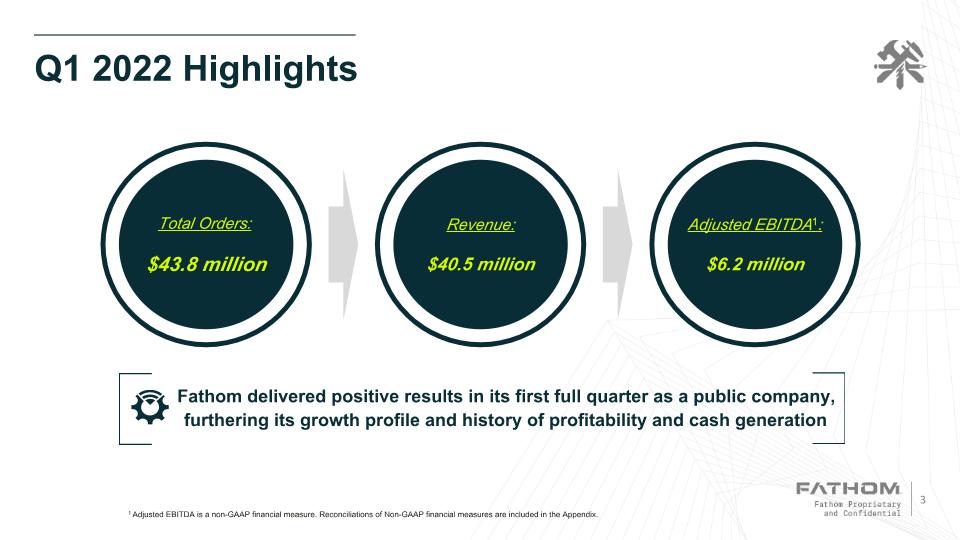

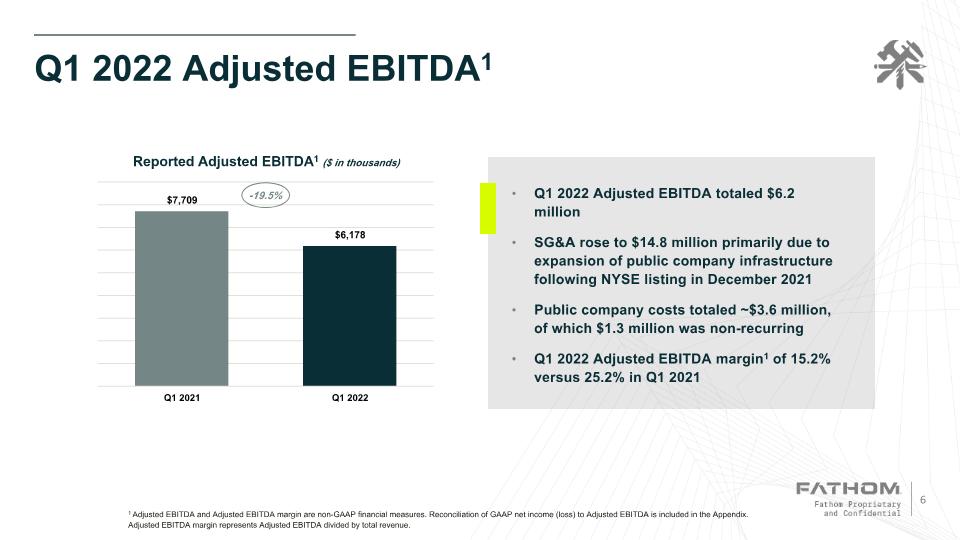

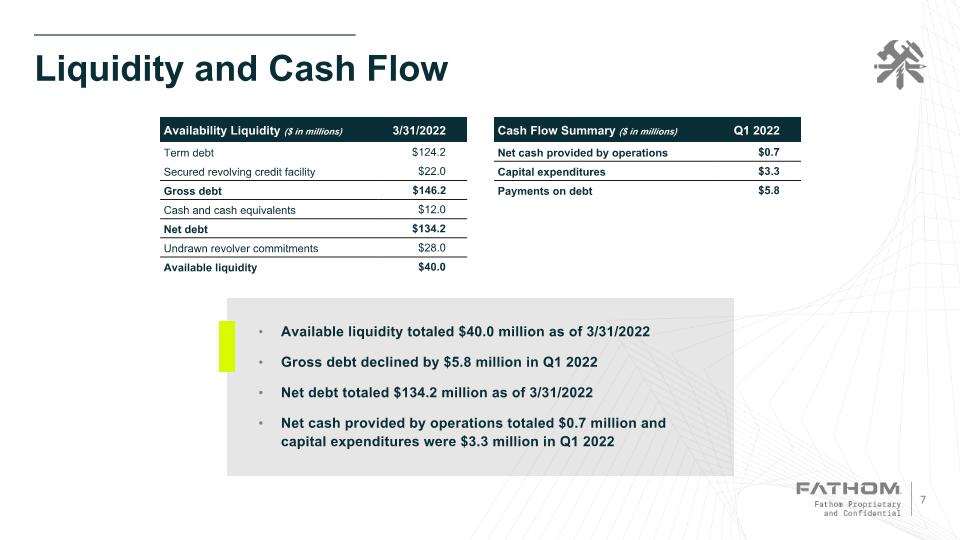

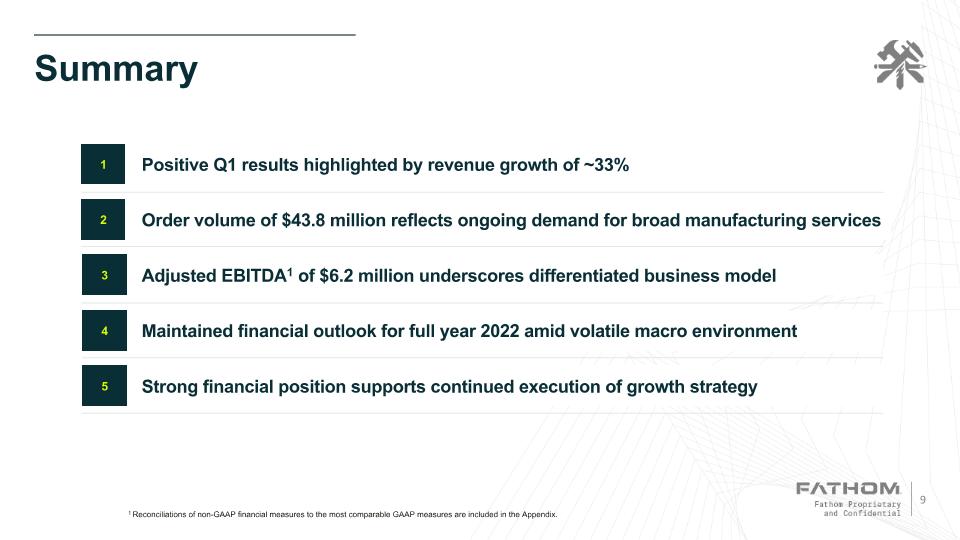

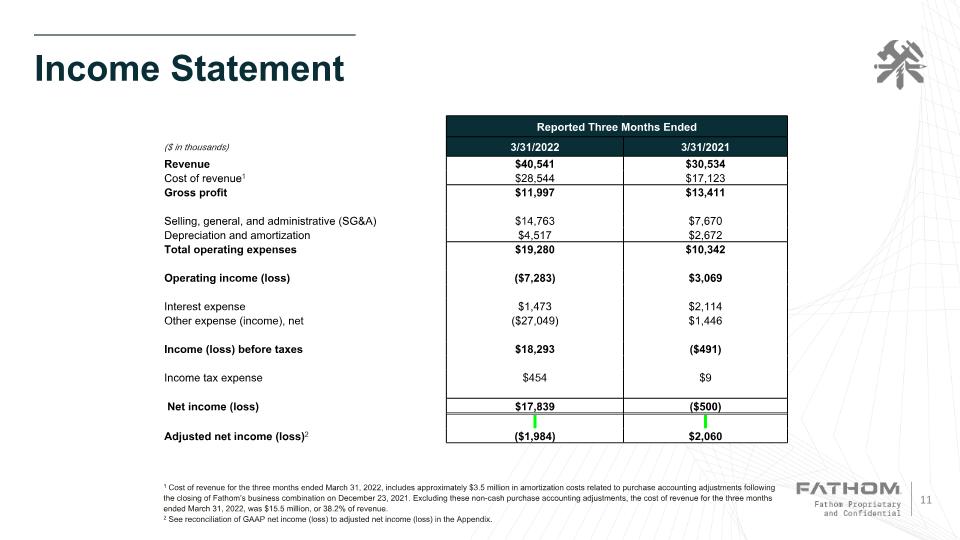

On May 16, 2022, Fathom Digital Manufacturing Corporation (“Fathom”) issued a press release announcing its financial results for the quarter ended March 31, 2022. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information contained in Item 2.02 of this Current Report and in Exhibit 99.1 is being furnished and shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section and will not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

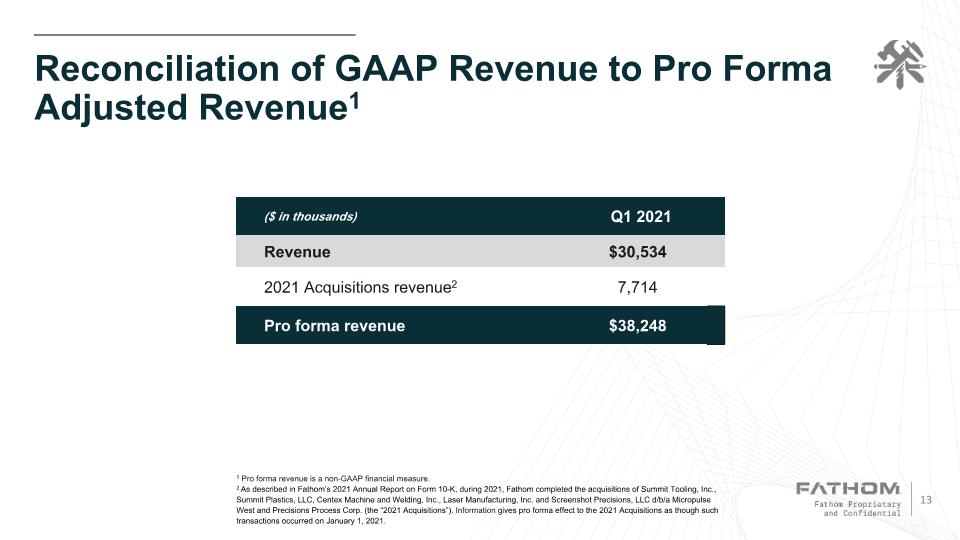

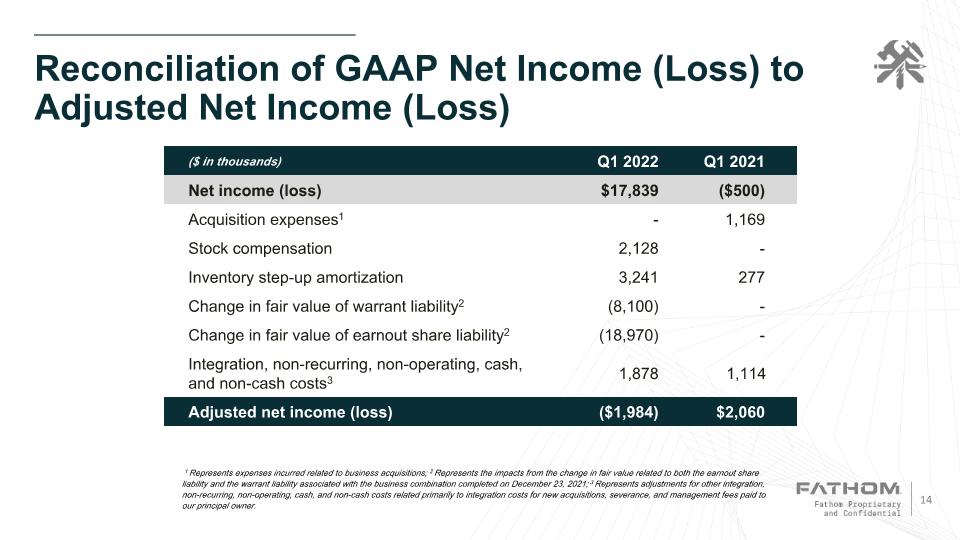

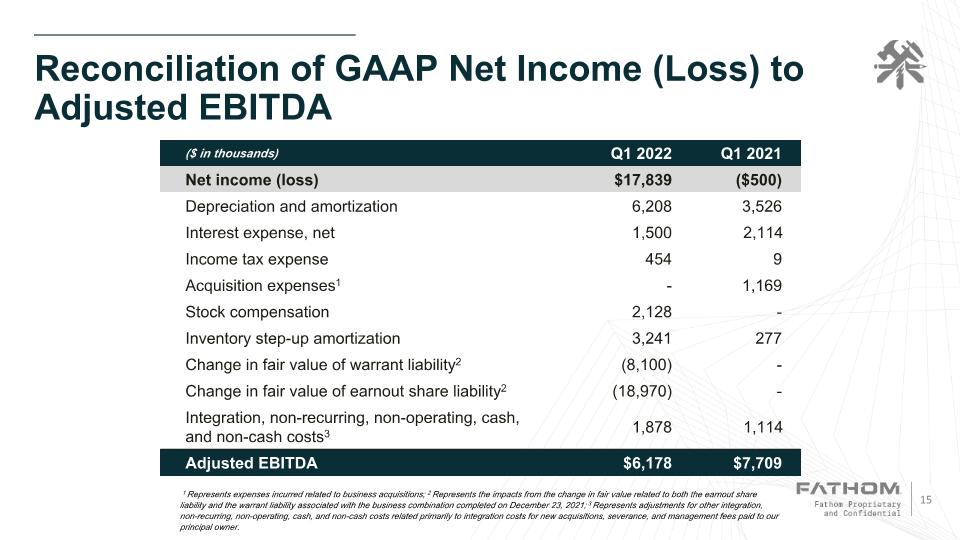

Exhibit 99.1 to this Current Report contains certain financial measures that are considered “non-GAAP financial measures” as defined in the SEC rules. Exhibit 99.1 to this Current Report also contains the reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles, as well as the reasons why Fathom’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding Fathom’s results of operations and, to the extent material, a statement disclosing any other additional purposes for which Fathom’s management uses the non-GAAP financial measures.

Item 7.01. |

Regulation FD Disclosure. |

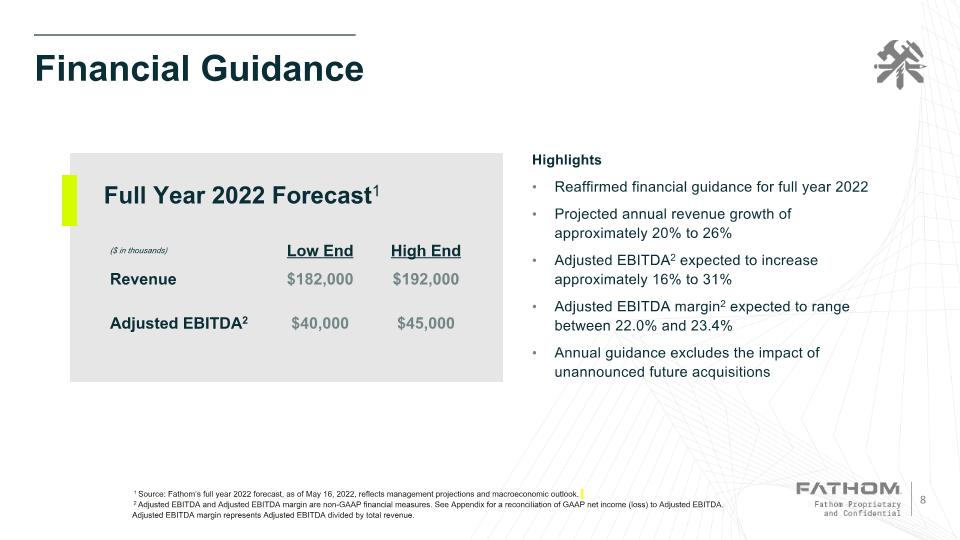

Fathom is posting an earnings presentation for the quarter ended March 31, 2022 to its website at https://investors.fathommfg.com. A copy of the presentation is being furnished herewith as Exhibit 99.2. Fathom will use the presentation during its conference call on May 16, 2022 and also may use the presentation from time to time in conversations with analysts, investors and others.

In accordance with General Instruction B.2 of Form 8-K, the information contained in Item 7.01 of this Current Report and in Exhibit 99.2 is being furnished and shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section and will not be incorporated by reference into any registration statement or other document filed under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

The information contained in Exhibit 99.2 is summary information that is intended to be considered in the context of Fathom’s filings with the SEC. Fathom undertakes no duty or obligation to publicly update or revise the information contained in this Current Report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

Exhibit 99.2 to this Current Report contains certain financial measures that are considered “non-GAAP financial measures” as defined in the SEC rules. Exhibit 99.2 to this Current Report also contains the reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles, as well as the reasons why Fathom’s management believes that presentation of the non-GAAP financial measures provides useful information to investors regarding Fathom’s preliminary unaudited results of operations and, to the extent material, a statement disclosing any other additional purposes for which Fathom’s management uses the non-GAAP financial measures.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit |

|

Description |

|

|

|

|

|

||

99.1 |

|

|

||

99.2 |

|

|

||

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

FATHOM DIGITAL MANUFACTURING CORPORATION |

||

|

|

|

By: |

|

/s/ Mark Frost |

Name: |

|

Mark Frost |

Title: |

|

Chief Financial Officer |

Date: May 16, 2022

ROC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2022

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-39994

Fathom Digital Manufacturing Corporation

(Exact name of registrant as specified in its charter)

Delaware |

98-1571400 |

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer |

1050 Walnut Ridge Drive Hartland, WI |

53029 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (262) 367-8254

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share |

|

FATH |

|

New York Stock Exchange |

Warrants to purchase Class A common stock |

|

FATH.WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☒

As of May 11, 2022, there were 51,306,971 shares of the registrant's Class A common stock outstanding and 84,294,971 shares of the registrant's vote-only, non-economic Class B common stock outstanding.

Table of Contents

|

|

Page |

|

|

|

|

3 |

|

|

|

|

PART I. |

4 |

|

|

|

|

Item 1. |

4 |

|

|

4 |

|

|

5 |

|

|

Consolidated Statement of Shareholders' Equity and Redeemable Non-Controlling Interest |

6 |

|

Consolidated Statement of Class A Contingently Redeemable Preferred Units and Members' Equity |

7 |

|

8 |

|

|

9 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 |

Item 3. |

31 |

|

Item 4. |

31 |

|

|

|

|

PART II. |

32 |

|

|

|

|

Item 1. |

32 |

|

Item 1A. |

32 |

|

Item 2. |

32 |

|

Item 3. |

32 |

|

Item 4. |

32 |

|

Item 5. |

32 |

|

Item 6. |

33 |

|

|

34 |

EXPLANATORY NOTE

This Quarterly Report on Form 10-Q includes information pertaining to periods prior to the closing of the Business Combination (as defined in "Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations" of this Quarterly Report). Refer to Note 1 “Nature of Business” and Note 2 "Basis of Presentation" of the notes to our consolidated financial statements contained in this Quarterly Report for further information regarding the basis of presentation.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements made in this Quarterly Report on Form 10-Q are “forward looking statements.” Statements regarding our expectations regarding the business are “forward looking statements.” In addition, words such as “estimates,” “projected,” “expects,” “estimated,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. The forward-looking statements contained in this Quarterly Report on Form 10-Q and in our other periodic filings are not guarantees of future performance, conditions or results and are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under "Risk Factor Summary", “Item 1A. Risk Factors”, and "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the "2021 Form 10-K"). Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We may face additional risks and uncertainties that are not presently known to us, or that we deem to be immaterial, which may also impair our business, financial condition or prospects. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

3

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

Fathom Digital Manufacturing Corporation

Consolidated Balance Sheets

(In thousands, except share and unit amounts)

|

|

Period Ended |

|

|||||

|

|

March 31, 2022 |

|

|

December 31, 2021 |

|

||

Assets |

|

(unaudited) |

|

|

|

|

||

Current assets |

|

|

|

|

|

|

||

Cash |

|

$ |

11,993 |

|

|

$ |

20,357 |

|

Accounts receivable, net |

|

|

28,157 |

|

|

|

25,367 |

|

Inventory |

|

|

12,541 |

|

|

|

13,165 |

|

Prepaid expenses and other current assets |

|

|

4,873 |

|

|

|

1,836 |

|

Total current assets |

|

|

57,564 |

|

|

|

60,725 |

|

Property and equipment, net |

|

|

46,248 |

|

|

|

44,527 |

|

Right-of-use operating lease assets, net |

|

|

8,808 |

|

|

|

- |

|

Right-of-use financing lease assets, net |

|

|

2,417 |

|

|

|

- |

|

Intangible assets, net |

|

|

265,017 |

|

|

|

269,622 |

|

Goodwill |

|

|

1,189,762 |

|

|

|

1,189,464 |

|

Other non-current assets |

|

|

252 |

|

|

|

2,036 |

|

Total assets |

|

$ |

1,570,068 |

|

|

$ |

1,566,374 |

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

||

Current liabilities |

|

|

|

|

|

|

||

Accounts payable(1) |

|

$ |

13,860 |

|

|

$ |

9,409 |

|

Accrued expenses |

|

|

6,806 |

|

|

|

5,957 |

|

Other current liabilities |

|

|

5,014 |

|

|

|

2,058 |

|

Current operating lease liability |

|

|

2,937 |

|

|

|

- |

|

Current financing lease liability |

|

|

185 |

|

|

|

- |

|

Contingent consideration |

|

|

2,748 |

|

|

|

2,748 |

|

Current portion of debt |

|

|

25,423 |

|

|

|

29,697 |

|

Total current liabilities |

|

|

56,973 |

|

|

|

49,869 |

|

Long-term debt, net |

|

|

119,083 |

|

|

|

120,491 |

|

Fathom earnout shares liability |

|

|

47,690 |

|

|

|

64,300 |

|

Sponsor earnout shares liability |

|

|

7,020 |

|

|

|

9,380 |

|

Noncurrent contingent consideration |

|

|

850 |

|

|

|

850 |

|

Noncurrent operating lease liability |

|

|

5,917 |

|

|

|

- |

|

Noncurrent financing lease liability |

|

|

2,278 |

|

|

|

- |

|

Deferred tax liability |

|

|

17,546 |

|

|

|

17,570 |

|

Other noncurrent liabilities |

|

|

1,608 |

|

|

|

4,655 |

|

Warrant liability |

|

|

25,800 |

|

|

|

33,900 |

|

Payable to related parties pursuant to the tax receivable agreement |

|

|

4,600 |

|

|

|

4,600 |

|

Total liabilities |

|

|

289,365 |

|

|

|

305,615 |

|

Commitments and Contingencies: |

|

|

|

|

|

|

||

Redeemable non-controlling interest in Fathom OpCo |

|

|

836,723 |

|

|

|

841,982 |

|

Shareholders' Equity: |

|

|

|

|

|

|

||

Class A common stock, $0.0001 par value; 300,000,000 shares authorized; 50,785,656 issued and outstanding as of March 31, 2022 and December 31, 2021 |

|

|

5 |

|

|

|

5 |

|

Class B common stock, $0.0001 par value; 180,000,000 shares authorized; 84,294,971 shares issued and outstanding as of March 31, 2022 and December 31, 2021 |

|

|

8 |

|

|

|

8 |

|

Class C common stock, $.0001 par value; 10,000,000 shares authorized; 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021 |

|

|

- |

|

|

|

- |

|

Preferred Stock, $.0001 par value; 10,000,000 shares authorized; 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021 |

|

|

- |

|

|

|

- |

|

Additional paid-in-capital |

|

|

468,475 |

|

|

|

466,345 |

|

Accumulated other comprehensive loss |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

(24,508 |

) |

|

|

(47,581 |

) |

Shareholders’ equity attributable to Fathom Digital Manufacturing Corporation |

|

|

443,980 |

|

|

|

418,777 |

|

Total Liabilities, Shareholders’ Equity, and Redeemable Non-Controlling Interest |

|

$ |

1,570,068 |

|

|

$ |

1,566,374 |

|

(1) Inclusive of allowance for doubtful accounts of $1,322 and $1,150 as of March 31, 2022 and December 31, 2021, respectively

(2) Inclusive of accounts payable to related parties of $1,180 and $1,246 as of March 31, 2022 and December 31, 2021, respectively

The accompanying notes are an integral part of these unaudited consolidated financial statements.

4

Fathom Digital Manufacturing Corporation

Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(In thousands, except units, shares, per unit, and per share amounts)

|

|

Three Months ended |

|

||||||

|

|

March 31, 2022 (Successor) |

|

|

|

March 31, 2021 (Predecessor) |

|

||

|

|

|

|

|

|

|

|

||

Revenue |

|

$ |

40,541 |

|

|

|

$ |

30,534 |

|

Cost of revenue (1) (2) (3) |

|

|

28,544 |

|

|

|

|

17,123 |

|

Gross profit |

|

|

11,997 |

|

|

|

|

13,411 |

|

Operating expenses |

|

|

|

|

|

|

|

||

Selling, general, and administrative (4) |

|

|

14,763 |

|

|

|

|

7,670 |

|

Depreciation and amortization |

|

|

4,517 |

|

|

|

|

2,672 |

|

Total operating expenses |

|

|

19,280 |

|

|

|

|

10,342 |

|

Operating (loss) income |

|

|

(7,283 |

) |

|

|

|

3,069 |

|

Interest expense and other (income) expense |

|

|

|

|

|

|

|

||

Interest expense |

|

|

1,473 |

|

|

|

|

2,114 |

|

Other expense |

|

|

116 |

|

|

|

|

1,540 |

|

Other income |

|

|

(27,165 |

) |

|

|

|

(94 |

) |

Total interest expense and other (income) expense, net |

|

|

(25,576 |

) |

|

|

|

3,560 |

|

Net income (loss) before income tax |

|

$ |

18,293 |

|

|

|

$ |

(491 |

) |

Income tax expense |

|

|

454 |

|

|

|

|

9 |

|

Net income (loss) |

|

$ |

17,839 |

|

|

|

$ |

(500 |

) |

Net loss attributable to Fathom OpCo non-controlling interest (Note 14) |

|

|

(5,259 |

) |

|

|

|

- |

|

Net income attributable to controlling interest |

|

|

23,098 |

|

|

|

|

(500 |

) |

Comprehensive income (loss): |

|

|

|

|

|

|

|

||

Loss from foreign currency translation adjustments |

|

|

(107 |

) |

|

|

|

(107 |

) |

Comprehensive income (loss), net of tax |

|

$ |

22,991 |

|

|

|

$ |

(607 |

) |

Earnings per Share: |

|

|

|

|

|

|

|

||

Net income (loss) per unit attributable to Class A and Class B common unit holders (5) |

|

|

|

|

|

|

|

||

Basic and Diluted |

|

|

|

|

|

$ |

(0.36 |

) |

|

Weighted average Class A and Class B units outstanding |

|

|

|

|

|

|

|

||

Basic and Diluted |

|

|

|

|

|

|

7,723,592 |

|

|

Net income per share attributable to shares of Class A common stock |

|

|

|

|

|

|

|

||

Basic |

|

$ |

0.45 |

|

|

|

|

|

|

Diluted |

|

$ |

0.13 |

|

|

|

|

|

|

Weighted average Class A common shares outstanding |

|

|

|

|

|

|

|

||

Basic |

|

|

50,785,656 |

|

|

|

|

|

|

Diluted |

|

|

135,839,973 |

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

5

Fathom Digital Manufacturing Corporation

Consolidated Statement of Shareholders' Equity and Redeemable Non-Controlling Interest (Successor)

(Unaudited)

(In thousands, except share amounts)

|

|

Class A Common Shares |

|

|

Class B Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Successor: |

|

Number of Shares |

|

|

Amount |

|

|

Number of Shares |

|

|

Amount |

|

|

Additional Paid-in Capital |

|

|

Accumulated Deficit |

|

|

Total Equity Attributable to Fathom |

|

|

|

Redeemable Non-controlling Interest |

|

||||||||

Balance at December 31, 2021 |

|

|

50,785,656 |

|

|

$ |

5 |

|

|

|

84,284,971 |

|

|

$ |

8 |

|

|

$ |

466,345 |

|

|

$ |

(47,581 |

) |

|

$ |

418,777 |

|

|

|

$ |

841,982 |

|

Equity based compensation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,130 |

|

|

|

|

|

|

2,130 |

|

|

|

|

|

||

Cumulative effect from adoption of ASC 842 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

82 |

|

|

|

82 |

|

|

|

|

- |

|

Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

22,991 |

|

|

|

22,991 |

|

|

|

|

(5,259 |

) |

Balance at March 31, 2022 |

|

|

50,785,656 |

|

|

$ |

5 |

|

|

|

84,284,971 |

|

|

$ |

8 |

|

|

$ |

468,475 |

|

|

$ |

(24,508 |

) |

|

$ |

443,980 |

|

|

|

$ |

836,723 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

6

Fathom Digital Manufacturing Corporation

Consolidated Statement of Class A Contingently Redeemable Preferred Units and Members' Equity (Predecessor) (Unaudited)

(In thousands, except unit amounts)

|

|

Class A Contingently Redeemable Preferred Equity |

|

|

Class A Common Units |

|

|

Class B Common Units |

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Number of Units |

|

|

Amount |

|

|

Number of Units |

|

|

Amount |

|

|

Number of Units |

|

|

Amount |

|

|

Accumulated |

|

|

Accumulated |

|

|

Total |

|

|||||||||

Balance at December 31, 2020 |

|

|

1,167,418 |

|

|

$ |

54,105 |

|

|

|

5,480,611 |

|

|

$ |

35,869 |

|

|

|

2,242,981 |

|

|

$ |

14,450 |

|

|

$ |

(14,232 |

) |

|

$ |

(68 |

) |

|

$ |

36,019 |

|

Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(500 |

) |

|

|

- |

|

|

|

(500 |

) |

Foreign currency translation adjustment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(107 |

) |

|

|

(107 |

) |

Balance at March 31, 2021 |

|

|

1,167,418 |

|

|

$ |

54,105 |

|

|

|

5,480,611 |

|

|

$ |

35,869 |

|

|

|

2,242,981 |

|

|

$ |

14,450 |

|

|

$ |

(14,732 |

) |

|

$ |

(175 |

) |

|

$ |

35,412 |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

7

Fathom Digital Manufacturing Corporation

Consolidated Statements of Cash Flows (Unaudited)

(In thousands)

|

|

Three Months ended |

|

||||||

|

|

March 31, 2022 (Successor) |

|

|

|

March 31, 2021 (Predecessor) |

|

||

Cash Flows from Operating Activities |

|

|

|

|

|

|

|

||

Net income (loss) |

|

$ |

23,098 |

|

|

|

$ |

(500 |

) |

Adjustments to reconcile net income (loss) to net cash from operating activities: |

|

|

|

|

|

|

|

||

Depreciation |

|

|

136 |

|

|

|

|

116 |

|

Depreciation and amortization included in cost of revenue |

|

|

1,695 |

|

|

|

|

854 |

|

Amortization of intangible assets |

|

|

4,374 |

|

|

|

|

2,301 |

|

Amortization of inventory step-up |

|

|

3,241 |

|

|

|

|

277 |

|

Loss on disposal of property, plant and equipment |

|

|

24 |

|

|

|

|

- |

|

Foreign currency translation adjustment |

|

|

(107 |

) |

|

|

|

(107 |

) |

Share-based compensation |

|

|

2,130 |

|

|

|

|

- |

|

Non cash lease expense, net |

|

|

169 |

|

|

|

|

|

|

Deferred taxes |

|

|

(24 |

) |

|

|

|

- |

|

Non-controlling interest share of Fathom OpCo net loss |

|

|

(5,259 |

) |

|

|

|

- |

|

Change in fair value of Fathom earnout shares liability |

|

|

(16,610 |

) |

|

|

|

- |

|

Change in fair value of Sponsor earnout shares liability |

|

|

(2,360 |

) |

|

|

|

- |

|

Change in fair value of Warrant liability |

|

|

(8,100 |

) |

|

|

|

- |

|

Amortization of debt financing costs |

|

|

100 |

|

|

|

|

96 |

|

Changes in operating assets and liabilities that provided cash: |

|

|

|

|

|

|

|

||

Accounts receivable |

|

|

(2,790 |

) |

|

|

|

890 |

|

Inventory |

|

|

(2,617 |

) |

|

|

|

202 |

|

Prepaid expenses and other assets |

|

|

(1,170 |

) |

|

|

|

(2,006 |

) |

Accounts payable |

|

|

4,062 |

|

|

|

|

594 |

|

Accrued liabilities and other |

|

|

848 |

|

|

|

|

(587 |

) |

Net cash provided by operating activities |

|

|

840 |

|

|

|

|

2,130 |

|

|

|

|

|

|

|

|

|

||

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

||

Purchase of property and equipment |

|

|

(3,346 |

) |

|

|

|

(1,348 |

) |

Cash used for acquisitions, net of cash acquired |

|

|

- |

|

|

|

|

(10,835 |

) |

Net cash used in investing activities |

|

|

(3,346 |

) |

|

|

|

(12,183 |

) |

|

|

|

|

|

|

|

|

||

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

||

Proceeds from debt |

|

|

- |

|

|

|

|

11,500 |

|

Payments on finance leases |

|

|

(77 |

) |

|

|

|

- |

|

Payments on debt |

|

|

(5,781 |

) |

|

|

|

(227 |

) |

Net cash provided by (used in) financing activities |

|

|

(5,858 |

) |

|

|

|

11,273 |

|

|

|

|

|

|

|

|

|

||

Net (decrease) increase in cash |

|

|

(8,364 |

) |

|

|

|

1,220 |

|

|

|

|

|

|

|

|

|

||

Cash, beginning of period |

|

|

20,357 |

|

|

|

|

8,188 |

|

Cash, end of period |

|

$ |

11,993 |

|

|

|

$ |

9,408 |

|

|

|

|

|

|

|

|

|

||

Supplemental cash flows information: |

|

|

|

|

|

|

|

||

Cash paid for interest |

|

$ |

173 |

|

|

|

$ |

1,945 |

|

Cash paid to related parties |

|

|

1,810 |

|

|

|

|

2,502 |

|

|

|

|

|

|

|

|

|

||

Significant non-cash investing activities: |

|

|

|

|

|

|

|

||

Right-of-use assets acquired through lease liabilities |

|

$ |

11,986 |

|

|

|

$ |

- |

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

8

Fathom Digital Manufacturing Corporation

Notes to Unaudited Consolidated Financial Statements

(In thousands, except share amounts)

Note 1. Nature of Business

Fathom Digital Manufacturing Corporation (“Fathom”, "Successor", or the “Company”) was incorporated as a Delaware corporation on December 23, 2021 as part of the business combination as defined below. Fathom was previously named Altimar Acquisition Corp. II ("Altimar II") before deregistering as an exempted company in the Cayman Islands. Fathom, through its consolidated subsidiary, Fathom Holdco, LLC (“Fathom OpCo”), is a leading on-demand digital manufacturing platform in North America, providing comprehensive product development and manufacturing services to many of the largest and most innovative companies in the world.

Fathom OpCo was formed on April 16, 2021 as a limited liability company in accordance with the provisions of the Delaware Limited Liability Company Act, for the purpose of holding a 100 percent equity interest in MCT Group Holdings, LLC and its subsidiaries (“MCT Holdings”) and holding a 100 percent equity interest in Incodema Holdings, LLC and its subsidiaries (“Incodema Holdings”). Capitalized terms used but not otherwise defined herein have the meanings given to such terms in the Company's 2021 Form 10-K.

Note 2. Basis of Presentation

The accompanying unaudited consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States of America ("United States" or "U.S.") and, of necessity, include some amounts that are based upon management estimates and judgments. The accompanying unaudited consolidated financial statements include assets, liabilities, revenues and expenses of all majority-owned subsidiaries. Intercompany transactions and balances are eliminated in consolidation.

In the Company's opinion, the accompanying unaudited consolidated financial statements contain all adjustments, consisting solely of adjustments of a normal, recurring nature, necessary to present fairly the financial position, results of operations and cash flows for the periods presented.

The accompanying unaudited consolidated financial statements have been prepared by the Company and do not include all disclosures as required by accounting principles generally accepted in the U.S. and should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2021 (the "2021 Annual Report on Form 10-K").

Recently Adopted Accounting Standards

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2016-02, Leases (Topic 842) Section A - Leases: Amendments to the FASB Accounting Standards Codification. The standard requires lessees to recognize the assets and liabilities arising from leases on the balance sheet and retains a distinction between finance leases and operating leases. The classification criteria for distinguishing between finance leases and operating leases are substantially similar to the classification criteria for distinguishing between capital leases and operating leases in the previous lease guidance. The Company adopted this standard and related amendments in the first quarter of 2022, using the modified retrospective approach. Using the modified retrospective approach the Company determined an incremental borrowing rate at the date of adoption based on the total lease term and total minimum rental payments.

The modified retrospective approach provides a method for recording existing leases at adoption with a cumulative adjustment to retained earnings. The Company elected the package of practical expedients which permits the Company to not reassess (1) whether any expired or existing contracts are or contain leases, (2) the lease classification for any expired or existing leases, and (3) any initial direct costs for any expired or existing leases as of the effective date. The Company also elected the practical expedient to use hindsight when determining the lease term, and the practical expedient lease considerations to not allocate lease considerations between lease and non-lease components for real estate leases. As such, real estate lease considerations are treated as a single lease-component and accounted for accordingly. The Company excludes leases with an initial term of 12 months or less from the application of Topic 842.

Adoption of the new standard resulted in the recording of $3,122 and $8,195 of current lease liabilities and long-term lease liabilities, respectively, and $11,986 in corresponding right-of-use lease assets. The difference between the approximate value of the right-of-use lease assets and lease liabilities is attributable to future rent escalations. The cumulative change in the beginning accumulated deficit was $82 due to the adoption of Topic 842. There was no material impact on the Company’s consolidated statement of operations or consolidated statement of cash flows. The Company’s comparative periods continue to be presented and disclosed in accordance with legacy guidance in Topic 840.

9

Fathom Digital Manufacturing Corporation

Notes to Unaudited Consolidated Financial Statements

(In thousands, except share amounts)

Note 3. Business Combination with Fathom OpCo

On December 23, 2021, Altimar II and Fathom OpCo closed a series of transactions (collectively, the "Business Combination") pursuant to the Business Combination Agreement dated as of July 15, 2021, as amended (the "Agreement"), that resulted in the combined Company becoming a publicly-traded company on the New York Stock Exchange ("NYSE") with the Company controlling Fathom OpCo in an "UP-C" structure. At the closing on December 23, 2021 ("Closing Date"), Altimar II domesticated into a Delaware corporation, and the Company, Fathom Digital Manufacturing Corporation ("Fathom", the "Company", "we", or "our") , was formed. Following the closing, the public investors, the investors that purchased Class A common stock in the private placement offering ("PIPE Investors") and the Founders collectively held Class A common stock representing approximately 10.4% economic interest in Fathom OpCo, and the CORE Investors and the other Legacy Fathom Owners collectively held 89.6% of economic interest in Fathom OpCo in the form of Class A common stock. Additionally, the Company issued to the legacy Fathom owners shares of Class B common stock, which have no economic rights but entitle each holder to voting power (one vote per share). Subsequently to the closing, the Company controls Fathom OpCo and is a holding company with no assets or operations other than its equity interest in Fathom OpCo.

The Business Combination was accounted for using the acquisition method with the Company as the accounting acquirer. Under the acquisition method of accounting, the Company's assets and liabilities were recorded at carrying value, and the assets and liabilities associated with Fathom OpCo were recorded at estimated fair value as of the closing date. The excess of the purchase price over the estimated fair values of the net assets acquired was recognized as goodwill. For accounting purposes, the acquirer is the entity that has obtained control of another entity and, thus, consummated a business combination. The determination of whether control has been obtained begins with the evaluation of whether control should be evaluated based on the variable interest or the voting interest model. If the acquiree is a variable interest entity, the primary beneficiary would be the accounting acquirer. Fathom OpCo met the definition of a variable interest entity, and the Company was determined to the be the primary beneficiary and is therefore also the accounting acquirer in the Business Combination.

As a result of the Business Combination, the Company's financial statement presentation distinguishes Fathom OpCo as the "Predecessor" ("2021 Predecessor Period" or "Predecessor Period") through the Closing Date. The Company is the "Successor" ("2022 Successor Period" or "Successor Period") for periods after the Closing Date. As a result of the application of the acquisition method of accounting in the Successor Period, the unaudited consolidated financial statements for the Successor Period are presented on a full step-up basis, and are therefore not comparable to the unaudited consolidated financial statements of the Predecessor Period that are not presented on the same full step-up basis.

In connection with the Business Combination, the Company incurred $19,010 of transaction expenses. These costs were recorded on the income statement of Altimar II prior to the Business Combination. Since the Predecessor period for purposes of these financial statements was deemed to be the historical results of Fathom OpCo, these transaction costs are not presented in either the Company's consolidated statement of comprehensive income (loss) for the 2021 Predecessor Period. However, these transaction costs are reflected in the accumulated deficit balance of the Company in the consolidated balance sheet as of December 31, 2021 (Successor).

The seller earnout contingent consideration below represents the estimated fair market value of the 9,000,000 Fathom Earnout Shares issued in conjunction with the Business Combination. The Fathom Earnout Shares will be settled with shares of Class A common stock or New Fathom Units and are accounted for as liability classified contingent consideration. The Fathom Earnout Shares vest in three equal tranches of 3,000,000 shares each at the volume-weighted average share price thresholds of $12.50, $15.00 and $20.00, respectively. The earnout period related to the Fathom Earnout Shares is five years from the date of the closing date. These estimated fair values are preliminary and subject to adjustment in subsequent periods.

In conjunction with the Business Combination, the Company recognized a deferred tax liability $17,573. The deferred tax liability was recorded on the standalone books of the Company with an offset to goodwill. The deferred tax liability is included in the other noncurrent liabilities caption in the table below.

The Business Combination was accounted for using the acquisition method of accounting and the fair value of the total purchase consideration transferred was $1,364,220. See below for a summary of the total consideration transferred.

|

Total |

|

|

Consideration Transferred: |

|

|

|

Total cash consideration |

$ |

53,332 |

|

Fathom earnout shares |

|

88,160 |

|

Class A common stock transferred |

|

375,478 |

|

Tax Receivable Agreement obligations to the sellers |

|

4,300 |

|

Total consideration transferred to sellers |

|

521,270 |

|

Non-controlling interest |

|

842,950 |

|

Fair value of total consideration transferred |

$ |

1,364,220 |

|

10

Fathom Digital Manufacturing Corporation

Notes to Unaudited Consolidated Financial Statements

(In thousands, except share amounts)

The following table sets forth the fair value of the assets and liabilities assumed in connection with the acquisition

|

Total |

|

|

Assets acquired: |

|

|

|

Cash |

$ |

9,577 |

|

Accounts receivable, net |

|

24,712 |

|

Inventory |

|

12,825 |

|

Prepaid expenses and other current assets |

|

3,172 |

|

Property and equipment, net |

|

44,397 |

|

Goodwill |

|

1,189,762 |

|

Intangible assets |

|

270,000 |

|

Other non-current assets |

|

2,200 |

|

Total assets acquired |

|

1,556,645 |

|

Liabilities assumed: |

|

|

|

Accounts payable |

|

9,808 |

|

Accrued expenses |

|

4,860 |

|

Other current liabilities |

|

5,226 |

|

Current portion of debt |

|

152,000 |

|

Other noncurrent liabilities |

|

20,531 |

|

Total liabilities assumed |

|

192,425 |

|

Net identifiable assets acquired |

$ |

1,364,220 |

|

The purchase price allocation is preliminary and subject to change during the measurement period, which is not to exceed one year from the acquisition date. At this time, the Company does not expect material changes to the assets acquired or liabilities assumed. Goodwill represents future economic benefits arising from acquiring Fathom OpCo's equity, primarily due to its strong market position and its assembled workforce that are not individually and separately recognized as intangible assets. A portion of the Goodwill is deductible for tax purposes. Goodwill is allocated to the Company's sole reportable segment and reporting unit.

Identifiable Intangible Assets |

Provisional fair value |

|

|

Provisional useful life (in years) |

|

||

Trade name |

$ |

70,000 |

|

|

|

15 |

|

Customer relationships |

|

180,000 |

|

|

|

19 |

|

Developed software |

|

4,300 |

|

|

|

5 |

|

Developed technology |

|

15,700 |

|

|

|

5 |

|

|

$ |

270,000 |

|

|

|

|

|

The weighted average amortization period for the amortizable intangibles assets is 16.9 years.

Note 4 - Fathom OpCo Predecessor Period Acquisitions

Fathom OpCo completed an acquisition of Summit Tooling Inc. ("Summit Tooling") and Summit Plastics LLC (“Summit Plastics”), together with Summit Tooling, (“Summit”) on February 1, 2021 in which it acquired 100 percent of the equity interests of Summit. In conjunction with the equity purchase, Fathom OpCo acquired the real estate in which Summit performs their operations. Summit Tooling designs and manufactures plastic injection molds and Summit Plastics provides molding of precision plastic components for a variety of industries. The primary reason for the acquisition was to expand Fathom OpCo's capabilities in manufacturing and expand its customer base of high-quality manufacturing and industrial technology companies in North America.

The transaction was accounted for using the acquisition method of accounting in accordance with Accounting Standards Codification ("ASC") 805 - Business Combinations and the fair value of the total purchase consideration transferred consisted of the following:

Consideration |

|

Total |

|

|

Cash |

|

$ |

10,875 |

|

Fair value of total consideration transferred |

|

$ |

10,875 |

|

The consideration excluded $892 of buyer transaction expenses that are included in other expenses within the Predecessor Period consolidated statement of comprehensive loss. In addition, Fathom OpCo paid a transaction fee of $225 to an affiliate of the majority member of Fathom OpCo.

The goodwill recognized as part of the acquisition primarily reflects the value of the assembled workforce acquired and the value of future growth prospects and expected business synergies realized as a result of combining and integrating the acquired business into Fathom OpCo's existing platform. The goodwill recognized is partially deductible for tax purposes.

11

Fathom Digital Manufacturing Corporation

Notes to Unaudited Consolidated Financial Statements

(In thousands, except share amounts)

The following table sets forth the fair values of the assets acquired and liabilities assumed in connection with the acquisition of Summit:

Recognized amounts of identifiable assets acquired and liabilities assumed |

|

Total |

|

|

Cash |

|

$ |

40 |

|

Accounts receivable, net |

|

|

627 |

|

Inventory |

|

|

339 |

|

Property and equipment, net |

|

|

4,371 |

|

Intangible assets |

|

|

5,000 |

|

Total assets acquired |

|

|

10,377 |

|

Accounts payable |

|

|

40 |

|

Deferred revenue |

|

|

776 |

|

Other current liabilities |

|

|

1,418 |

|

Total liabilities assumed |

|

|

2,234 |

|

Total identifiable net assets |

|

|

8,143 |

|

Goodwill |

|

$ |

2,732 |

|

Below is a summary of the intangible assets acquired in the acquisition:

|

|

Acquisition Date Fair Value |

|

|

Estimated Life (Years) |

|

Trade name |

|

$ |

400 |

|

|

5 |

Customer relationships |

|

|

4,600 |

|

|

11 |

|

|

$ |

5,000 |

|

|

|

The amounts of revenue and net loss of Summit since the acquisition date included in the consolidated statements of comprehensive loss for the 2021 Predecessor Period are as follows:

|

|

Period From January 1 - March 31, 2021 (Predecessor) |

|

|

Revenue |

|

$ |

1,175 |

|

Net (loss) |

|

$ |

(1,271 |

) |

Note 5. Revenue

The Company accounts for revenue in accordance with ASC 606. Revenue is recognized in five steps. The Company identifies the contract with the customer, identifies the performance obligations in the contract, determines the transaction price, allocates the transaction price to the performance obligations, and recognizes revenue when (or as) each performance obligation is satisfied. Collectability is a required component of a valid contract. The Company assesses collectability based on a number of factors, including the customer’s past payment history and current creditworthiness. If collectability is not considered probable at inception, the Company will not have a valid contract.

Most of the Company’s revenue has one performance obligation and is recognized on a point-in-time basis upon shipment. The majority of the Company’s injection molding contracts have multiple performance obligations including one obligation to produce the mold and sample part and a second obligation to produce production parts. For injection molding contracts with multiple performance obligations, the Company allocates revenue to each performance obligation based on its relative standalone selling price and recognizes revenue for each performance obligation on a point-in-time basis upon shipment. We generally determine stand-alone selling price based on the price charged to customers. The Company’s payments terms are consistent with industry standards and never exceed 12 months.

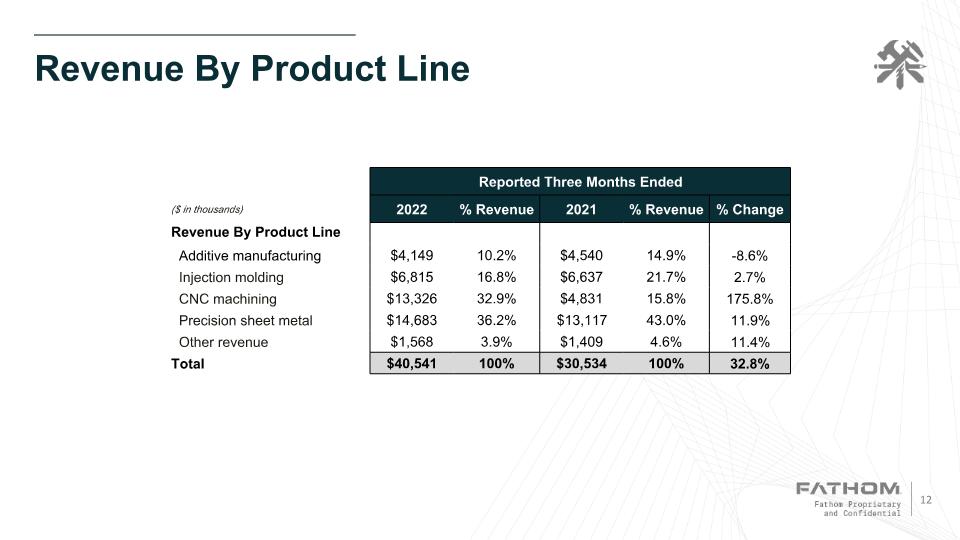

Revenue by product line for the three months ended March 31, 2022 and March 31, 2021 are as follows:

|

|

Three Months Ended |

|

|||||

|

|

March 31, 2022 (Successor) |

|

|

March 31, 2021 (Predecessor) |

|

||

Revenue: |

|

|

|

|

|

|

||

Additive Manufacturing |

|

$ |

4,149 |

|

|

$ |

4,540 |

|

Injection Molding |

|

|

6,815 |

|

|

|

6,637 |

|

CNC Machining |

|

|

13,326 |

|

|

|

4,831 |

|

Precision Sheet Metal |

|

|

14,683 |

|

|

|

13,117 |

|

Ancillary Product Lines |

|

|

1,568 |

|

|

|

1,409 |

|

Total revenue |

|

$ |

40,541 |

|

|

$ |

30,534 |

|

12

Fathom Digital Manufacturing Corporation

Notes to Unaudited Consolidated Financial Statements

(In thousands, except share amounts)

Note 6. Inventories

Inventories are estimated at the lower of cost or net realizable value (“NRV”), with NRV based on selling prices in the ordinary course of business, less costs of completion, disposal, and transportation. Costs are determined on the first-in, first-out (“FIFO”) method.

Inventories consisted of the following:

|

|

Period Ended |

|

|||||

|

|

March 31, |

|

|

December 31, |

|

||

Raw materials |

|

$ |

3,388 |

|

|

$ |

4,967 |

|

Work in process |

|

|

7,839 |

|

|

|

5,368 |

|

Finished goods |

|

|

1,689 |

|

|

|

3,506 |

|

Tooling |

|

|

604 |

|

|

|

605 |

|

|

|

|

13,520 |

|

|

|

14,446 |

|

Allowance for obsolescence |

|

|

(979 |

) |

|

|

(1,281 |

) |

Total |

|

$ |

12,541 |

|

|

$ |

13,165 |

|

Note 7. Property and Equipment

Property and equipment, net, consisted of the following:

|

|

Period Ended |

|

||||||

|

|

March 31, 2022 |

|

|

|

December 31, 2021 |

|

||

Machinery and equipment |

|

$ |

34,570 |

|

|

|

$ |

33,182 |

|

Furniture and fixtures |

|

|

322 |

|

|

|

|

180 |

|

Computer equipment |

|

|

671 |

|

|

|

|

804 |

|

Property and leasehold improvements |

|

|

5,910 |

|

|

|

|

7,180 |

|

Construction in progress |

|

|

6,058 |

|

|

|

|

2,859 |

|

Transportation equipment |

|

|

450 |

|

|

|

|

454 |

|

Total |

|

|

47,981 |

|

|

|

|

44,659 |

|

Accumulated depreciation and amortization |

|

|

(1,733 |

) |

|

|

|

(132 |

) |

Total |

|

$ |

46,248 |

|

|

|

$ |

44,527 |

|

Depreciation expense included in operating expenses for the three months ended March 31, 2022 and March 31, 2021 was $136 and $116, respectively. Depreciation expense included in cost of revenues for the three months ended March 31, 2022 and March 31, 2021 was $1,465, and $854, respectively.

Note 8. Goodwill and Intangible Assets, net

A rollforward of goodwill is as follows:

(in thousands) |

|

|

|

|

Balance at December 31, 2021 |

|

$ |

1,189,464 |

|

Measurement period adjustments |

|

|

298 |

|

Balance at March 31, 2022 |

|

$ |

1,189,762 |

|

Intangible assets, net consisted of the following:

|

|

March 31, 2022 |

|

|

|

December 31, 2021 |

|

||||||||||||||||||

|

|

Gross |

|

|

Accumulated Amortization |

|

|

Net |

|

|

|

Gross |

|

|

Accumulated Amortization |

|

|

Net |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Trade name |

|

$ |

70,000 |

|

|

$ |

1,283 |

|

|

$ |

68,717 |

|

|

|

$ |

70,000 |

|

|

$ |

98 |

|

|

$ |

69,902 |

|

Customer relationships |

|

|

180,000 |

|

|

|

2,601 |

|

|

|

177,399 |

|

|

|

|

180,000 |

|

|

|

252 |

|

|

$ |

179,748 |

|

Developed software |

|

|

15,700 |

|

|

|

863 |

|

|

|

14,837 |

|

|

|

|

4,300 |

|

|

|

6 |

|

|

$ |

4,294 |

|

Developed technology |

|

|

4,300 |

|

|

|

236 |

|

|

|

4,064 |

|

|

|

|

15,700 |

|

|

|

22 |

|

|

$ |

15,678 |

|

Total intangible assets |

|

$ |

270,000 |

|

|

$ |

4,983 |

|

|

$ |

265,017 |

|

|

|

$ |

270,000 |

|

|

$ |

378 |

|

|

$ |

269,622 |

|

13

Fathom Digital Manufacturing Corporation

Notes to Unaudited Consolidated Financial Statements

(In thousands, except share amounts)

Aggregate amortization expense related to intangible assets, excluding goodwill which is not amortized, for the three months ended March 31, 2022 and March 31, 2021 was $4,604 and $2,301, respectively. There are no intangible assets, other than goodwill, with indefinite useful lives.

The following table represents the estimated aggregate amortization expense for each of the five succeeding fiscal calendar years.

Year |

|

Aggregate Amortization |

|

|

2022 |

|

$ |

18,140 |

|

2023 |

|

|

18,140 |

|

2024 |

|

|

18,140 |

|

2025 |

|

|

18,140 |

|

2026 |

|

|

18,041 |

|

Note 9. Warrant Liability

As of March 31, 2022, the Company had 8,625,000 Public Warrants outstanding with a fair value price of $0.76 per Public Warrant, and 9,900,000 Private Placement Warrants outstanding with a fair value price of $1.94 per Private Placement Warrant.

The below table summarizes the number of outstanding warrants and the fair value as of March 31, 2022. See Note 13 for further information.

|

|

Fair Value |

|

|

# of Warrants |

|

||

|

|

|

|

|

|

|

||

Public Warrants |

|

$ |

6,600 |

|

|

|

8,625,000 |

|

Private Placement Warrants |

|

$ |

19,200 |

|

|

|

9,900,000 |

|

The below table summarizes the number of outstanding warrants and the fair value as of December 31, 2021. See Note 13 for further information.

|

|

Fair Value |

|

|

# of Warrants |

|

||

|

|

|

|

|

|

|

||

Public Warrants |

|

$ |

7,600 |

|

|

|

8,625,000 |

|

Private Placement Warrants |

|

$ |

26,300 |

|

|

|

9,900,000 |

|

Note 10. Debt

On December 23, 2021, Fathom OpCo entered into the New Credit Agreement, which included a $50,000 revolving credit facility and $125,000 term loan. The Company's borrowings under the revolving credit agreement were $22,000 at March 31, 2022. The loans made under the New Credit Agreement will mature in December 2026.

The Company recorded deferred financing costs of $1,828 in conjunction with the New Credit Agreement and the balance is presented net within Long-term debt, net on the Company's consolidated balance sheet. The Company amortizes the deferred financing costs using the effective interest method.

The revolving credit facility under the New Credit Agreement is available for working capital and other general corporate purposes and includes a letter of credit sub-facility of up to $5,000. The New Credit Agreement also includes an uncommitted incremental facility, which, subject to certain conditions, provides for additional term loan facilities, an increase in commitments under the New Credit Agreement and/or an increase in commitments under the revolving credit facility, in an aggregate amount of up to $100,000. The Company is subject to various financial covenants, including quarterly net leverage and interest coverage covenants. The Company is in compliance with all debt covenants related to the New Credit Agreement as of March 31, 2022.

14

Fathom Digital Manufacturing Corporation

Notes to Unaudited Consolidated Financial Statements

(In thousands, except share amounts)

The Company’s debt as of March 31, 2022 and December 31, 2021 is as follows:

|

|

As of March 31, 2022 |

|

|

As of December 31, 2021 |

|

||||||||||

Debt Description |

|

Interest Rate |

|

|

Amount |

|

|

Interest Rate |

|

|

Amount |

|

||||

New Credit Agreement Revolver |

|

|

3.99 |

% |

|

|

22,000 |

|

|

|

3.60 |

% |

|

|

27,000 |

|

New Credit Agreement Term Loan |

|

|

4.51 |

% |

|

|

124,219 |

|

|

|

3.72 |

% |

|

|

125,000 |

|

Total principal long-term debt |

|

|

|

|

|

146,219 |

|

|

|

|

|

|

152,000 |

|

||

Debt issuance costs |

|

|

|

|

|

(1,713 |

) |

|

|

|

|

|

(1,812 |

) |

||

Total debt, net |

|

|

|

|

|

144,506 |

|

|

|

|

|

|

150,188 |

|

||

Less: current portion of debt |

|

|

|

|

|

25,423 |

|

|

|

|

|

|

29,697 |

|

||

Long-term debt, net of current portion |

|

|

|

|

$ |

119,083 |

|

|

|

|

|

$ |

120,491 |

|

||

Interest on all debt is payable in 90 days increments, with the unpaid amount due upon maturity. Interest expense associated with long-term debt for the three months ended March 31, 2022 and March 31, 2021 was $1,473, and $2,114, respectively. Included in interest expense, net on the accompanying unaudited consolidated statements of comprehensive loss is amortization of debt issuance costs for the three months ended March 31, 2022 and March 31, 2021 was $100, and $96, respectively.

In December 2021, Fathom OpCo entered into a financing agreement through its insurance broker to spread the payment of its annual director’s and officer’s insurance premium over a ten-month period. Total financed payments of $3,001, including a $35 financing fee at a 2.57% annual rate, are to be made between January 2022 and October 2022. As of March 31, 2022 the Company recognized $2,176 of prepaid assets and $2,090 of other current liabilities in the unaudited consolidated financial statements. For the three months ended March 31, 2022 the Company recognized $842 of insurance expense in selling, general and administrative ("SG&A") expenses.

Note 11. Other (Income) Expense

Other income and expense, net is comprised of the following for the periods ended March 31, 2022, and March 31, 2021:

|

|

Three Months Ended |

|

||||||

|

|

March 31, 2022 |

|

|

|

March 31, 2022 |

|

||

Acquisition expenses |

|

$ |

- |

|

|

|

$ |

1,339 |

|

Loss on sale of assets |

|

|

24 |

|

|

|

|

83 |

|

Other |

|

|

92 |

|

|

|

|

118 |

|

Other expense |

|

|

116 |

|

|

|

|

1,540 |

|

Change in fair value of Fathom and Sponsor Earnout Shares |

|

|

(18,970 |

) |

|

|

|

- |

|

Change in fair value of Warrants |

|

|

(8,100 |

) |

|

|

|

- |

|

Other |

|

|

(95 |

) |

|

|

|

(94 |

) |

Other income |

|

|

(27,165 |

) |

|

|

|

(94 |

) |

Other (income) expense, net |

|

$ |

(27,049 |

) |

|

|

$ |

1,446 |

|

Note 12. Shared Based Compensation

On December 23, 2021, the Company executed the Fathom Digital Manufacturing 2021 Omnibus Incentive Plan (the "2021 Omnibus Plan") to encourage the profitability and growth of the Company through short-term and long-term incentives that are consistent with the Company's objectives. The 2021 Omnibus Plan provides that the Company may grant options, stock appreciation rights, restricted shares, restricted stock units, performance-based awards (including performance-based restricted shares and restricted stock units), other share-based awards, other cash-based awards, and any combination of the foregoing.

Stock Options

The stock option valuation assumptions for the three months ended March 31, 2022 are provided in the table below.

|

|

March 31, 2022 |

|

|

Expected term (years) |

|

4.5 |

|

|

Expected volatility |

|

|

58.7 |

% |

Expected dividend yield |

|

|

0.0 |

% |

Risk-free interest rate |

|

|

1.91 |

% |

Fair value of share |

|

$ |

4.26 |

|

In February 2022, the Company granted stock options to purchase up to 317,091 shares of Class A common stock at a weighted average exercise price of $8.71 per share which generally vest over a requisite service period of three years. The total intrinsic value of options exercised during the three months ended March 31, 2022 was $0.

15

Fathom Digital Manufacturing Corporation

Notes to Unaudited Consolidated Financial Statements

(In thousands, except share amounts)

At March 31, 2022, there was approximately $1,312 of total unrecognized compensation cost related to unvested stock options granted under the 2021 Omnibus Plan. That cost is expected to be recognized over a weighted average period of 2.92 years as of March 31, 2022.

The Company currently uses authorized and unissued shares to satisfy share award exercises.

Restricted Stock Units

A summary of the status of the Company's restricted stock unit activity and the changes during the three months ended March 31, 2022 are as follows:

|

|

Shares |

|

|

Weighted Average Grant Date Fair Value |

|

|

Aggregate Intrinsic Value |

|

|||

Non-vested at December 31, 2021 |

|

|

6,472,617 |

|

|

$ |

8.21 |

|

|

$ |

- |

|

Granted |

|

|

727,601 |

|

|

|

9.01 |

|

|

|

- |

|

Vested |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Forfeited |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Non-vested at March 31, 2022 |

|

|

7,200,218 |

|

|

$ |

9.01 |

|

|

$ |

- |

|

At March 31, 2022, there was approximately $10,259 of total unrecognized compensation cost related to unvested restricted stock units granted under the 2021 Omnibus Plan. That cost is expected to be recognized over a weighted average period of 2.85 years as of March 31, 2022.