Form 424B2 ROYAL BANK OF CANADA

|

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-259205

|

Pricing Supplement No. WFC167 (to Prospectus and Prospectus Supplement each dated September 14, 2021)

$771,000

Market Linked Securities—Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the ARK Innovation ETF, due December 19, 2022

Principal at Risk Securities Linked to the ARK Innovation ETF, due December 19, 2022

The securities described in this pricing supplement are issued by Royal Bank of Canada (Royal Bank or the Issuer), and

are Senior Global Medium-Term Notes, Series I of the Issuer, as described in the prospectus supplement and prospectus each dated September 14, 2021.

|

Agent:

|

Wells Fargo Securities, LLC. The agent may make sales through its affiliates or selling agents.

|

|

Principal Amount:

|

Each security will have a principal amount of $1,000. The securities are not principal-protected. You may lose up to 87.50% of the principal amount of the securities.

|

|

Pricing Date:

|

September 14, 2021

|

|

Original Issue Date:

|

September 17, 2021

|

|

Valuation Date:

|

December 12, 2022, subject to postponement as described below.

|

|

Maturity Date:

|

December 19, 2022, subject to postponement as described below.

|

|

Interest:

|

We will not pay you interest during the term of the securities.

|

|

Fund:

|

The return on the securities is linked to the performance of the ARK Innovation ETF (Bloomberg symbol: ARKK), which we refer to as the Fund. The Fund is actively managed and

is subject to additional risks. Unlike a passively managed fund, an actively managed fund does not attempt to track an index or other benchmark, and the investment decisions for an actively managed fund are instead made by its investment

adviser. See “Risk Factors—Risks Relating to the Fund—An Investment in the securities is subject to risks associated with actively managed funds” below for more information.

|

|

Payment at Maturity:

|

The amount you receive at maturity, for each security you own, will depend upon the change in the price of the Fund based on the Final Fund Price relative to the Initial Fund Price, and whether

or not the Final Fund Price is below the Buffer Price.

(i) If the Final Fund Price is greater than the Initial Fund Price, the maturity payment amount per security will equal the lesser of:

|

|

(a) $1,000 + ($1,000 x

|

Final Fund Price – Initial Fund Price

|

x Participation Rate); and

|

|

|

Initial Fund Price

|

|

(b) the maximum maturity payment amount

(ii) If the Final Fund Price is less than or equal to the Initial Fund Price but greater than or equal to the

Buffer Price, the maturity payment amount per security will equal $1,000.

(iii) If the Final Fund Price is less than the Buffer Price, the maturity payment amount per security will equal:

|

|

$1,000 – ($1,000 x

|

Buffer Price – Final Fund Price

|

)

|

|

|

Initial Fund Price

|

|

In such a case, you may lose up to 87.50% of your principal.

|

|

|

Maximum Maturity

Payment Amount:

|

$1,170.00 per security

|

|

Participation Rate:

|

150%

|

|

Initial Fund Price:

|

$116.86, which was the fund closing price of the Fund on the pricing date.

|

|

Final Fund Price:

|

The fund closing price of the Fund on the valuation date.

|

|

Buffer Price:

|

$102.2525, which is 87.50% of the Initial Fund Price.

|

|

Listing:

|

The securities will not be listed on any securities exchange.

|

|

CUSIP Number:

|

78016EN52

|

Our initial estimated value of the securities as of the pricing date was $967.13 per $1,000 in principal amount, which is less than the public offering price. The market value of the

securities at any time will reflect many factors, cannot be predicted with accuracy, and may be less than this amount. See “Risk Factors” and “Supplemental Plan of Distribution – Structuring the Securities” for further information.

The securities will be unsecured debt obligations of Royal Bank of Canada. Payments on the securities are subject to Royal Bank of Canada’s credit risk. If Royal

Bank of Canada defaults on its obligations, you could lose your entire investment. No other company or entity will be responsible for payments under the securities or liable to holders of the securities if Royal Bank of Canada defaults under the

securities. The securities will not be issued by or guaranteed by Wells Fargo Securities, LLC or any of its affiliates.

The securities will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation (the “FDIC”) or any other Canadian or U.S. government

agency or instrumentality. The securities are not subject to conversion into our common shares under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act. For a detailed description of the terms of the securities, see “Summary

Information” and “Specific Terms of the Securities” below. Defined terms used in this cover page are defined in those sections.

The securities have complex features and investing in the securities involves risks. See “Risk Factors” beginning on page PS-10 below and page S-2 of the accompanying prospectus

supplement.

|

Per Security

|

Total

|

||

|

Public Offering Price

|

$1,000.00

|

$771,000.00

|

|

|

Underwriting Discount and Commission(1)(2)

|

$21.50

|

$16,576.50

|

|

|

Proceeds to Royal Bank of Canada

|

$978.50

|

$754,423.50

|

(1) The agent will receive an underwriting discount and commission of $21.50 per security. Of that underwriting discount and commission, each dealer that sells securities will receive a

selling concession of $12.50 for each security that such dealer sells. Such securities dealers may include Wells Fargo Advisors (“WFA”) (the trade name of the retail brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors

Financial Network, LLC). In addition to the selling concession allowed to WFA, the agent will pay $0.75 per security of the underwriting discount and commission to WFA as a distribution expense fee for each security sold by WFA. See “Use of Proceeds

and Hedging” and “Supplemental Plan of Distribution” in this pricing supplement for information regarding how we may hedge our obligations under the securities.

(2) In addition to the foregoing, in respect of certain securities sold in this offering, our affiliate, RBC Capital Markets, LLC (RBCCM), may pay

a fee of up to $1.00 per security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to other securities dealers.

None of the Securities and Exchange Commission, any state securities commission or any other regulatory body has approved or disapproved of the securities or passed upon the adequacy or

accuracy of this pricing supplement. Any representation to the contrary is a criminal offense.

Wells Fargo Securities

The date of this pricing supplement is September 14, 2021

SUMMARY INFORMATION

This document is a pricing supplement. This pricing supplement provides specific pricing information in connection with this issuance of securities. This summary includes

questions and answers that highlight selected information from this pricing supplement and the accompanying prospectus supplement and prospectus to help you understand the Market Linked Securities Leveraged Upside Participation to a Cap and Fixed

Percentage Buffered Downside Principal at Risk Securities Linked to the ARK Innovation ETF, due December 19, 2022 (the securities). You should carefully read this pricing supplement and the accompanying

prospectus supplement and prospectus to fully understand the terms of the securities and the tax and other considerations relating to the securities. You should carefully review the section “Risk Factors” in this pricing supplement and the

accompanying prospectus supplement and prospectus, which highlight certain risks associated with an investment in the securities, to determine whether an investment in the securities is appropriate for you.

Unless otherwise mentioned or unless the context requires otherwise, all references in this pricing supplement to “Royal Bank of Canada”, “we”, “us” and “our”

or similar references mean Royal Bank of Canada. Capitalized terms used in this pricing supplement without definition have the meanings given to them in the accompanying prospectus supplement and prospectus.

What are the securities?

The securities offered by this pricing supplement will be issued by Royal Bank of Canada and will mature on December 19, 2022. The return on the securities, if any, will be

linked to the performance of the ARK Innovation ETF, which we refer to as the Fund. The securities will not bear interest and no other payments will be made until maturity. You may lose up to 87.50% of

your investment in the securities.

As discussed in the accompanying prospectus supplement, the securities are debt securities and will be part of a series of debt securities entitled “Senior Global Medium-Term

Notes, Series I” that Royal Bank of Canada may issue from time to time. The securities will rank equally with all other unsecured and unsubordinated debt of Royal Bank of Canada. For more details, see “Specific Terms of the Securities” below.

Each security will have a principal amount of $1,000. Each security was offered at an initial public offering price of $1,000. However, on the pricing date, our initial estimated

value of the securities was less than $1,000 per security as a result of certain costs that are included in the initial public offering price. See “Risk Factors—Our initial estimated value of the securities is less than the initial public

offering price” and “Supplemental Plan of Distribution—Structuring the Securities.” To the extent a market for the securities exists, you may transfer only whole securities. Royal Bank of Canada will issue the securities in the form of a master

global certificate, which is held by The Depository Trust Company, also known as DTC, or its nominee. Direct and indirect participants in DTC will record your ownership of the securities.

Are the securities principal protected?

No, the securities do not guarantee any return of principal at maturity. If the Final Fund Price is less than the Buffer Price, you will be exposed on a 1-to-1 basis to declines

in the price of the Fund beyond the Buffer Price. Accordingly, if the Final Fund Price is below the Buffer Price, you may lose up to 87.50% of your principal.

What will I receive upon maturity of the securities?

At maturity, for each security you own, you will receive a cash payment equal to the maturity payment amount. The maturity payment amount to which you will be

entitled depends on the percentage change in the price of the Fund calculated based on the Final Fund Price (as defined below) relative to the Initial Fund Price (as defined below), and whether or not the Final Fund Price is below the Buffer

Price (as defined below).

PS-2

The maturity payment amount for each security will be determined by the calculation agent as described below:

| • |

If the Final Fund Price is greater than the Initial Fund Price, the maturity payment amount per security will equal the lesser of:

|

|

(a) $1,000 + ($1,000 x

|

Final Fund Price – Initial Fund Price

|

x Participation Rate); and

|

|

Initial Fund Price

|

||

|

(b) the maximum maturity payment amount

|

||

The Participation Rate is 150%. The maximum maturity payment amount is

$1,170.00 per security.

| • |

If the Final Fund Price is equal to or less than the Initial Fund Price, but greater than or equal to the Buffer Price, the maturity payment amount per security will

equal $1,000.

|

| • |

If the Final Fund Price is less than the Buffer Price, the maturity payment amount per security will equal:

|

|

$1,000 –

|

(

|

$1,000 x

|

Buffer Price – Final Fund Price

|

|

Initial Fund Price

|

If the Final Fund Price is less than the Buffer Price, the amount you will receive at maturity will be less than the

principal amount of the securities, and you may lose up to 87.50% of your principal. If the Final Fund Price is zero, the maturity payment amount will be $125.00 per security, and you will lose 87.50% of your principal.

The Initial Fund Price is $116.86, which is equal to the fund closing price of the Fund on the pricing date.

The Buffer Price is $102.2525, which is 87.50% of the Initial Fund Price.

The Final Fund Price will be determined by the calculation agent and will be the fund closing price of the Fund on the valuation date,

determined as described in the section “Specific Terms of the Securities”.

The valuation date is December 12, 2022, subject to postponement as set forth below.

See “Specific Terms of the Securities—Fund Closing Price”, “—Closing Price” and “—Adjustment Factor” for information on the determination of the fund closing price on any

trading day.

You should understand that the opportunity to benefit from the possible increase in the price of the Fund through an investment in the securities is limited because the amount

that you receive at maturity will never exceed the maximum maturity payment amount. The maximum maturity payment amount represents a maximum appreciation on the securities of 17.00% over the principal amount of the securities. If the Final Fund

Price is less than the Buffer Price, you will lose 1% of the principal amount for each 1% that the Final Fund Price is less than the Buffer Price. Accordingly, if the price of the Fund decreases below the Buffer Price, you will lose up to

87.50% of your principal.

PS-3

Hypothetical Examples

Set forth below are four hypothetical examples of the calculation of the maturity payment amount based on the following hypothetical prices (the numbers appearing in the

examples below have been rounded for ease of analysis):

Hypothetical Initial Fund Price: $100.00

Hypothetical Buffer Price: $87.50

Maximum maturity payment amount: $170.00

Example 1—The hypothetical Final Fund Price is 50.00% of the hypothetical Initial Fund Price, which is below the Buffer Price:

Hypothetical Final Fund Price: $50.00

|

Maturity payment amount

(per security) |

=

|

$1,000 – [$1,000 x

|

(

|

$87.50 – $50.00

|

)

|

] =$625.00

|

|

$100.00

|

Since the hypothetical Final Fund Price is less than the hypothetical Initial Fund Price and below the hypothetical

Buffer Price, the amount you will receive at maturity will be equal to the issue price of $1,000 per security minus $1,000 times the difference between the hypothetical Buffer Price and the hypothetical Final Fund Price, divided by the

hypothetical Initial Fund Price, and you would lose some of your principal. Since the hypothetical Final Fund Price declined by 50.00% from the hypothetical Initial Fund Price to the hypothetical Final Fund Price, your total cash payment at

maturity would be $625.00 per security, representing a 37.50% loss of the principal amount of your securities.

Example 2—The hypothetical Final Fund Price is 95.00% of the hypothetical Initial Fund Price, which is below the Initial Fund Price, but above the Buffer

Price:

Since the hypothetical Final Fund Price is less than the hypothetical Initial Fund Price but greater than the hypothetical Buffer

Price, the maturity payment amount per security will equal the principal amount of $1,000.00.

Example 3—The hypothetical Final Fund Price is 110.00% of the hypothetical Initial Fund Price:

Hypothetical Final Fund Price: $110.00

|

Maturity payment amount (per security) = $1,000 + ($1,000 x

|

|

$110.00 – $100.00

|

x150%)

|

|

|

$100.00

|

|

=

|

$1,000 +

|

$150.00

|

= $1,150.00

|

Since the hypothetical Final Fund Price is greater than the hypothetical Initial Fund Price, you would receive the

principal amount of $1,000 plus 150% of the amount of the percentage change in the price of the Fund times $1,000, subject to the maximum maturity payment amount of $1,170.00. As the calculation of the maturity payment amount without taking

into account the maximum maturity payment amount would generate a result of $1,150.00 per security, your maturity payment amount would not be subject to the maximum maturity payment amount of $1,170.00 per security. Your total cash payment at

maturity would be $1,150.00 per security, representing a 15.00% total return.

Example 4—The hypothetical Final Fund Price is 140.00% of the hypothetical Initial Fund Price:

Hypothetical Final Fund Price: $140.00

PS-4

|

Maturity payment amount (per security) = $1,000 + ($1,000 x

|

$140.00 – $100.00

|

x150%)

|

||

|

$100.00

|

|

=

|

$1,000 +

|

$600.00

|

= $1,600.00

|

> $1,170.00

|

Since the hypothetical Final Fund Price is greater than the hypothetical Initial Fund Price, you would receive the principal amount of

$1,000 plus 150% of the amount of the percentage change in the price of the Fund times $1,000, subject to the maximum maturity payment amount of $1,170.00. Although the calculation of the maturity payment amount without taking into account the

maximum maturity payment amount would generate a result of $1,600.00 per security, your maturity payment amount would be limited to $1,170.00 per security, representing an 17.00% total return, because the payment on the securities at maturity

may not exceed the maximum maturity payment amount.

PS-5

Hypothetical Returns

The following table is based on the maximum maturity payment amount of $1,170.00, and assumes a hypothetical Initial Fund Price of $100.00 and a range of hypothetical Final

Fund Prices and illustrates:

| • |

the percentage change from the hypothetical Initial Fund Price to the hypothetical Final Fund Price;

|

| • |

the hypothetical maturity payment amount per security; and

|

| • |

the hypothetical pre-tax total rate of return to beneficial owners of the securities.

|

The figures below are rounded for ease of analysis and are for purposes of illustration only. The actual maturity payment amount will depend on the Final Fund

Price as determined by the calculation agent as described in this pricing supplement.

|

Hypothetical

Final Fund Price

|

Hypothetical Percentage

Change from the Hypothetical

Initial Fund Price to the

Hypothetical

Final Fund Price

|

Hypothetical Maturity

Payment Amount per

Security(1)

|

Hypothetical Pre-Tax

Total Rate of Return

on the Securities

|

|||||||

|

$0.00

|

-100.00%

|

$125.00

|

-87.50%

|

|||||||

|

$10.00

|

-90.00%

|

$225.00

|

-77.50%

|

|||||||

|

$20.00

|

-80.00%

|

$325.00

|

-67.50%

|

|||||||

|

$30.00

|

-70.00%

|

$425.00

|

-57.50%

|

|||||||

|

$40.00

|

-60.00%

|

$525.00

|

-47.50%

|

|||||||

|

$50.00

|

-50.00%

|

$625.00

|

-37.50%

|

|||||||

|

$60.00

|

-40.00%

|

$725.00

|

-27.50%

|

|||||||

|

$70.00

|

-30.00%

|

$825.00

|

-17.50%

|

|||||||

|

$80.00

|

-20.00%

|

$925.00

|

-7.50%

|

|||||||

|

$87.50

|

(2)

|

-12.50%

|

$1,000.00

|

0.00%

|

||||||

|

$90.00

|

-10.00%

|

$1,000.00

|

0.00%

|

|||||||

|

$95.00

|

-5.00%

|

$1,000.00

|

0.00%

|

|||||||

|

$100.00

|

(3)

|

0.00%

|

$1,000.00

|

0.00%

|

||||||

|

$105.00

|

5.00%

|

$1,075.00

|

7.50%

|

|||||||

|

$110.00

|

10.00%

|

$1,150.00

|

15.00%

|

|||||||

|

$111.333

|

11.333%

|

$1,170.00

|

17.00%

|

|||||||

|

$115.00

|

15.00%

|

$1,170.00

|

17.00%

|

|||||||

|

$120.00

|

20.00%

|

$1,170.00

|

17.00%

|

|||||||

|

$130.00

|

30.00%

|

$1,170.00

|

17.00%

|

|||||||

|

$140.00

|

40.00%

|

$1,170.00

|

17.00%

|

|||||||

|

$150.00

|

50.00%

|

$1,170.00

|

17.00%

|

|||||||

| (1) |

Based on the maximum maturity payment amount of $1,170.00.

|

| (2) |

This is the hypothetical Buffer Price.

|

| (3) |

This is the hypothetical Initial Fund Price.

|

PS-6

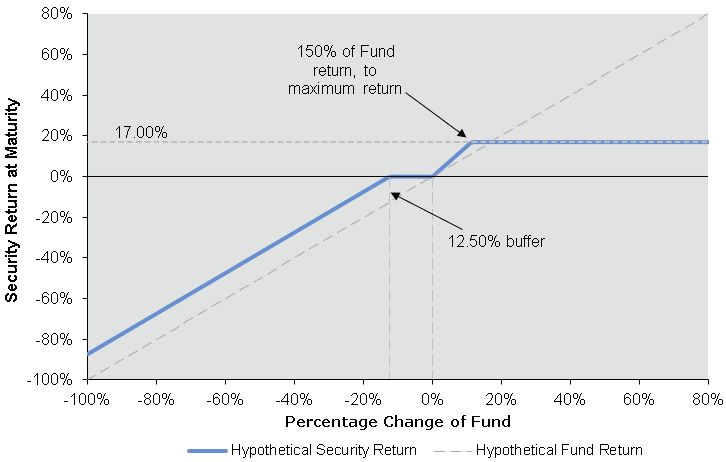

The following graph sets forth the return at maturity for a range of hypothetical percentage changes of the Fund price, based on the maximum maturity payment amount of

$1,170.00 per $1,000.00 security (17.00% over the principal amount).

Return Profile of Market Linked Securities —Leveraged Upside Participation to a Cap

and Fixed Percentage Buffered Downside Principal at Risk Securities vs. the Fund

and Fixed Percentage Buffered Downside Principal at Risk Securities vs. the Fund

Who should or should not consider an investment in the securities?

We have designed the securities for investors who seek exposure to the Fund, who believe that the Fund price will increase over the term of the securities, and who want to

participate in 150% of the possible appreciation of the Fund (measured by the percentage change in the price of the Fund based on the Final Fund Price relative to the Initial Fund Price), subject to the maximum maturity payment amount of 17.00%

over the principal amount of the securities; who understand that, if the Final Fund Price is less than the Buffer Price, they will lose money on their investment; and who are willing to hold their securities until maturity. Investors in the

securities should be willing to risk up to 87.50% of their investment.

The securities are not designed for, and may not be a suitable investment for, investors who are unable or unwilling to hold the securities to maturity, who seek principal

protection for their investment, who are unwilling to make an investment exposed to downside performance risk of the Fund or who are unwilling to purchase securities with an initial estimated value as of the pricing date that is lower than the

initial public offering price. The securities may not be a suitable investment for investors who prefer the lower risk of fixed income investments with comparable maturities issued by companies with comparable credit ratings.

What will I receive if I sell the securities prior to maturity?

The market value of the securities may fluctuate during the term of the securities. Several factors and their interrelationship will influence the market value of the

securities, including the price of the Fund, dividend yields of the common stocks held by the Fund, the time remaining to maturity of the securities, interest rates and the volatility of the Fund. Depending on the impact of these factors, you

may receive less than $1,000 per security from any sale of your securities

PS-7

before the maturity date of the securities and less than what you would have received had you held the securities until maturity. Assuming no change in market conditions or other relevant

factors, the price, if any, at which you may be able to sell your securities prior to maturity will be less than the initial public offering price and, subject to the discussion regarding secondary market prices during the three months

following the original issue date in “Supplemental Plan of Distribution” below, will be less than the initial estimated value of the securities set forth on the cover page of this pricing supplement. For more details, see “Risk Factors — Many

factors affect the market value of the securities” and “—The price, if any, at which you may be able to sell your securities prior to maturity may be less than the initial public offering price and our initial estimated value” below.

What is the Fund?

According to publicly available information, the ARK Innovation ETF (the Fund) is an actively managed exchange-traded fund that invests in domestic and foreign equity

securities of companies that are relevant to the Fund’s investment theme of disruptive innovation. The Fund defines ‘‘disruptive innovation’’ as the introduction of a technologically enabled new product or service that potentially changes the

way the world works.

You should be aware that an investment in the securities does not entitle you to any ownership interest in the Fund or in the common stocks of the companies held by the Fund.

For a discussion of the Fund, see “ARK Innovation ETF” below.

How has the Fund performed historically?

You can find a graph setting forth the daily closing prices of the Fund for the period from January 1, 2016 to the pricing date in the section entitled “ARK Innovation ETF —

Historical Closing Prices per Share of the Fund” in this pricing supplement. We obtained the historical information from Bloomberg Financial Markets without independent verification. You should not take the past performance of the Fund as an

indication of how the Fund will perform in the future.

What are the United States federal income tax consequences of investing in the securities?

By purchasing the securities, you agree (in the absence of a change in law or an administrative or judicial ruling to the contrary) to treat the securities for all U.S. federal

income tax purposes as pre-paid cash-settled derivative contracts in respect of the Fund that are “open transactions.” If the securities are so treated, subject to the potential application of the “constructive ownership” rules under Section

1260 of the Internal Revenue Code of 1986, as amended (the “Code”), a U.S. holder should generally recognize capital gain or loss upon the sale, exchange or maturity of the securities in an amount equal to the difference between the amount a

holder receives at such time and the holder’s tax basis in the securities.

Please read carefully the section entitled “Supplemental Discussion of U.S. Federal Income Tax Consequences” in this pricing supplement, the section entitled “Tax Consequences”

in the accompanying prospectus and the section entitled “Certain Income Tax Consequences” in the accompanying prospectus supplement. You should consult your tax advisor about your own tax situation.

What are the Canadian federal income tax consequences of investing in the securities?

For a discussion of the Canadian federal income tax consequences of investing in the securities, please read carefully the section entitled “Tax Consequences” in the

accompanying prospectus and the section entitled “Certain Income Tax Consequences” in the accompanying prospectus supplement. You should consult your tax advisor about your own tax situation.

Will the securities be listed on a stock exchange?

The securities will not be listed on any securities exchange. There can be no assurance that a liquid trading market will develop for the securities. Accordingly, if you sell

your securities prior to maturity, you may have to sell them at a substantial loss. You should review the section entitled “Risk Factors—There may not be an active trading market for the securities” in this pricing supplement.

Are there any risks associated with my investment?

Yes, an investment in the securities is subject to significant risks, including the risk of loss of up to 87.50% of your principal. We urge you to read the detailed explanation

of risks in “Risk Factors” below and in the accompanying prospectus supplement.

PS-8

ADDITIONAL INFORMATION

You should read this pricing supplement together with the prospectus dated September 14, 2021, as supplemented by the prospectus supplement dated September 14, 2021, relating to our

Senior Global Medium-Term Notes, Series I, of which these securities are a part. This pricing supplement, together with these documents, contains the terms of the securities and supersedes all other prior or contemporaneous oral statements as well as

any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours.

You should rely only on the information provided or incorporated by reference in this pricing supplement, the prospectus and the prospectus supplement. We have not authorized anyone

else to provide you with different information, and we take no responsibility for any other information that others may give you. We, Wells Fargo Securities, LLC and any other dealers are offering to sell the securities and seeking offers to buy the

securities only in jurisdictions where it is lawful to do so. The information contained in this pricing supplement and the accompanying prospectus supplement and prospectus is current only as of their respective dates.

If the information in this pricing supplement differs from the information contained in the prospectus supplement or the prospectus, you should rely on the information in this

pricing supplement.

You should carefully consider, among other things, the matters set forth in “Risk Factors” in this pricing supplement and the accompanying prospectus supplement, as the securities

involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers before you invest in the securities.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • |

Prospectus dated September 14, 2021:

|

| • |

Prospectus Supplement dated September 14, 2021:

|

| • |

Our Central Index Key, or CIK, on the SEC website is 1000275.

Please see the section “Documents Incorporated by Reference” on page i of the above prospectus for a description of our filings with the SEC that are incorporated by reference therein.

PS-9

RISK FACTORS

An investment in the securities is subject to the risks described below, as well as the risks described under “Risk Factors” in the accompanying

prospectus supplement and prospectus. The securities have complex features and are a riskier investment than ordinary debt securities. Also, your securities are not equivalent to investing directly in the Fund or the common stocks held by the Fund.

Investors in the securities are also exposed to further risks related to the Issuer of the securities, Royal Bank of Canada, which are described in Royal Bank of Canada’s most recent annual report on Form 40-F, filed with the SEC and incorporated by

reference herein. See the categories of risks identified and disclosed in the management’s discussion and analysis of financial condition and results of operations included in the annual report on Form 40-F. This section (and the management’s

discussion and analysis section of the annual report on Form 40-F) describes the most significant risks relating to the securities. You should carefully consider whether the securities are suited to your particular circumstances.

Risks Relating to the Terms and Structure of the Securities

Your investment may result in a loss of up to 87.50% of your principal

We will not repay you a fixed amount of principal on the securities at maturity. The payment at maturity on the securities will depend on the percentage change in the price of the

Fund based on the Final Fund Price relative to the Initial Fund Price, and whether or not the Final Fund Price falls below the Buffer Price. Because the price of the Fund is subject to market fluctuations, the amount of cash you receive at maturity

may be more or less than the principal amount of the securities. If the Final Fund Price is less than the Buffer Price, you will be exposed on a 1-to-1 basis to declines in the price of the Fund beyond the Buffer Price. Accordingly, if the price of

the Fund decreases below the Buffer Price, you will lose up to 87.50% of your principal.

You will not receive interest payments on the securities

You will not receive any periodic interest payments on the securities or any interest payment at maturity. Your payment at maturity will depend on the percentage change in the

price of the Fund based on the Final Fund Price relative to the Initial Fund Price, and whether or not the Final Fund Price is below the Buffer Price.

Your yield may be lower than the yield on a standard debt security of comparable maturity

The yield that you will receive on your securities, which could be negative, may be less than the return you could earn on other investments. Even if your yield is positive, your

yield may be less than the yield you would earn if you purchased one of our standard senior non-callable debt securities with the same maturity date. Your investment may not reflect the full opportunity cost to you when you take into account factors

that affect the time value of money. Unlike conventional senior non-callable debt securities, the securities do not guarantee the return of all of the principal amount at maturity. In addition, no interest will be paid during the term of your

securities.

Your return is limited and will not reflect the return of owning the Fund or the common stocks held by the Fund

You should understand that the opportunity to participate in the possible appreciation in the price of the Fund through an investment in the securities is limited because the

amount that you receive at maturity will never exceed the maximum maturity payment amount. The maximum maturity payment amount represents a maximum appreciation on the securities of 17.00% over the principal amount of the securities. Although any

positive return on the securities is based on 150% of any percentage increase of the Fund, in no event will the amount you receive at maturity be greater than the maximum maturity payment amount of $1,170.00 per security.

Owning the securities is not the same as owning the shares of the Fund or the common stocks held by the Fund

The return on your securities will not reflect the return you would realize if you actually owned and held the shares of the Fund or the common stocks held by the Fund for a similar period. First,

because the maturity payment amount will be determined based on the price of the Fund, the return on the securities will not take into account the value of any dividends that may be paid on the Fund or the common stocks held by the Fund. Second, as a

holder of the securities, you will not be entitled to receive those dividends, nor will you have voting rights or any other rights that holders of the shares of the Fund or the common stocks held by the Fund may have. Even if the price of the Fund

increases above the Initial Fund Price during

PS-10

the term of the securities, the market value of the securities may not increase by the same amount. It is also possible for the price of the Fund to increase while the market value of the securities

declines.

The securities will be debt obligations of Royal Bank of Canada. No other company or entity will be responsible for payments under the securities

The securities will be issued by Royal Bank of Canada. The securities will not be guaranteed by any other company or entity. No other entity or company will be responsible for

payments under the securities or liable to holders of the securities if Royal Bank of Canada defaults under the securities. Royal Bank of Canada’s credit ratings are an assessment of our ability to pay our obligations, including those on the

securities. Consequently, if we default on our obligations, you could lose your entire investment, and actual or anticipated declines in our creditworthiness may affect the value of the securities. The securities will not be issued by or guaranteed

by Wells Fargo Securities, LLC or any of its affiliates.

The tax treatment of the securities is uncertain and gain on the securities may be treated as ordinary income under the constructive ownership rules

The tax treatment of the securities is uncertain. We do not plan to request a ruling from the Internal Revenue Service (IRS) or from the Canada Revenue Agency regarding the tax

treatment of the securities, and the IRS, the Canada Revenue Agency or a court may not agree with the tax treatment described in this pricing supplement.

Since the Fund is an exchange-traded fund, while the matter is not entirely clear, there exists a substantial risk that an investment in the securities is a “constructive ownership

transaction” to which Section 1260 of the Code applies. If Section 1260 of the Code applies, all or a portion of any long-term capital gain recognized by a U.S. holder in respect of the securities could be recharacterized as ordinary income, in which

case certain interest charges would apply. See the section entitled “Supplemental Discussion of U.S. Federal Income Tax Consequences – Supplemental U.S. Tax Considerations – Potential Application of Section 1260 of the Code” below.

The IRS has issued a notice indicating that it and the U.S. Treasury Department are actively considering whether, among other issues, a holder should be required to accrue interest

over the term of an instrument such as the securities even though that holder will not receive any payments with respect to the securities until maturity or earlier sale or exchange and whether all or part of the gain a holder may recognize upon

sale, exchange or maturity of an instrument such as the securities should be treated as ordinary income. The outcome of this process is uncertain and could apply on a retroactive basis.

Please read carefully the section entitled “Supplemental Discussion of U.S. Federal Income Tax Consequences” in this pricing supplement, the section entitled “Tax Consequences” in

the accompanying prospectus and the section entitled “Certain Income Tax Consequences” in the accompanying prospectus supplement. You should consult your tax advisor about your own tax situation.

For a discussion of the Canadian federal income tax consequences of investing in the securities, please read the section entitled “Tax Consequences” in the accompanying prospectus and

the section entitled “Certain Income Tax Consequences” in the accompanying prospectus supplement. You should consult your tax advisor about your own tax situation.

Risks Relating to the Secondary Market for the Securities

There may not be an active trading market for the securities

The securities will not be listed on any securities exchange. There can be no assurance that a liquid trading market will develop for the securities. Even if a secondary market

for the securities develops, it may not provide significant liquidity and transaction costs in any secondary market could be high. As a result, the difference between bid and asked prices for the securities in any secondary market could be

substantial. If you sell your securities before maturity, you may have to do so at a discount from the initial public offering price, and, as a result, you may suffer substantial losses.

Wells Fargo Securities, LLC and its broker-dealer affiliates may make a market for the securities, although they are not required to do so. As market makers, trading of the securities may cause Wells

Fargo Securities, LLC or its broker-dealer affiliates to have long or short positions in the securities. Because we do not expect that any other market makers will participate in a secondary market for the securities, the price at which you may be

able to sell your securities is likely to

PS-11

depend on the price, if any, at which Wells Fargo Securities, LLC or its broker-dealer affiliates may be willing to buy your securities. See “Supplemental Plan of Distribution.”

The amount to be paid at maturity is not linked to the price of the Fund at any time other than the valuation date

The payment at maturity will be based on the price of the Fund only on the valuation date. Therefore, for example, if the fund closing price of the Fund decreased precipitously on

the valuation date, the payment on the securities may be significantly less than it would otherwise have been had the payment been linked to the fund closing price of the Fund prior to that decrease. Although the actual price of the Fund on the

maturity date or at other times during the term of the securities may be higher than the Fund price on the valuation date, you will not benefit from the fund closing price of the Fund at any time other than the valuation date.

Many factors affect the market value of the securities

The market value of the securities prior to maturity will be affected by factors that interrelate in complex ways. It is important for you to understand that the effect of one

factor may offset any increase in the market value of the securities caused by another factor and that the effect of one factor may compound any decrease in the market value of the securities caused by another factor. For example, a change in the

volatility of the Fund may offset some or all of any increase in the market value of the securities attributable to another factor, such as an increase in the price of the Fund. In addition, a change in interest rates may offset other factors that

would otherwise change the price of the Fund, and therefore, may change the market value of the securities. We expect that the market value of the securities will depend to a significant extent on the amount, if any, by which the market price per

share of the Fund during the term of the securities exceeds or does not exceed the Initial Fund Price. If you choose to sell your securities when the price of the Fund exceeds the Initial Fund Price, you may receive substantially less than the amount

that would be payable at maturity based on this price because of the expectation that the Fund will continue to fluctuate until the valuation date. We believe that other factors that may also influence the value of the securities include:

| • |

the volatility (frequency and magnitude of changes in the price) of the Fund and, in particular, market expectations regarding the volatility of the Fund;

|

| • |

market interest rates in the U.S.;

|

| • |

the dividend yields of the common stocks held by the Fund;

|

| • |

our creditworthiness, as perceived in the market;

|

| • |

changes that affect the Fund, such as additions, deletions or substitutions;

|

| • |

the time remaining to maturity; and

|

| • |

geopolitical, economic, financial, political, regulatory or judicial events as well as other conditions may affect the common stocks held by the Fund.

|

Risks Relating to the Fund

An investment in the securities is subject to risks associated with actively managed funds

The Fund is actively managed. Unlike a passively managed fund, an actively managed fund does not attempt to track an index or other benchmark, and the investment decisions for an actively managed fund

are instead made by its investment adviser. The investment adviser of an actively managed fund may adopt a strategy or strategies that have significantly higher risk than the indexing strategy that would have been employed by a passively managed

fund. As an actively managed fund, the Fund is subject to management risk. In managing an actively managed fund, the investment adviser of a fund applies investment strategies, techniques and analyses in making investment decisions for that fund, but

there can be no guarantee that these actions will produce the intended results. The ability of the Fund’s investment adviser to successfully implement the Fund’s investment strategy will significantly influence the price of the Fund and,

consequently, the return on the securities.

PS-12

An investment in the securities is subject to risks associated with disruptive innovation companies

The Fund’s investment strategy involves exposure to companies that the investment adviser believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or

create new markets (“disruptive innovation companies”). However, the companies selected by the investment adviser may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology. Companies

that develop disruptive technologies may face political or legal challenges from competitors, industry groups or local and national governments. These companies may also be exposed to risks applicable to sectors other than the disruptive innovation

theme for which they are chosen, and the securities issued by these companies may underperform the securities of other companies that are primarily focused on a particular theme. The Fund may invest in companies that do not currently derive any

revenue from disruptive innovations or technologies, and there is no assurance that any company will derive any revenue from disruptive innovations or technologies in the future. A disruptive innovation or technology may constitute a small portion of

any company’s overall business. As a result, the success of a disruptive innovation or technology may not affect the value of the equity securities issued by that company. All these factors may adversely affect the price of the Fund and,

consequently, the return on the securities.

An investment in the securities is subject to risks associated with mid-size, small and micro-capitalization stocks

Some of the equity securities held by the Fund have been issued by mid-size, small or micro-capitalization companies. Mid-size, small and micro- capitalization companies may be less able to withstand

adverse economic, market, trade and competitive conditions relative to larger companies. Mid-size, small and micro-capitalization companies are less likely to pay dividends on their stocks, and the presence of a dividend payment could be a factor

that limits downward stock price pressure under adverse market conditions.

The securities are subject to risks associated with foreign securities markets, and emerging markets in particular

The Fund holds, among other stocks, certain foreign equity securities from emerging markets. You should be aware that investments in securities linked to the value of these foreign

equity securities involve particular risks. The foreign securities markets comprising this Fund may have less liquidity and may be more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from

U.S. or other securities markets. Direct or indirect government intervention to stabilize these foreign securities markets, as well as cross-shareholdings in foreign companies, may affect trading prices and volumes in these markets. Foreign companies

are subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies.

Prices of securities in foreign countries are subject to political, economic, financial and social factors that apply in those geographical regions. These factors, which could negatively

affect those securities markets, include the possibility of recent or future changes in a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to

foreign companies or investments in foreign equity securities and the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the possibility of natural disaster

or adverse public health developments in the region. Moreover, foreign economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment,

resources and self-sufficiency.

Countries with emerging markets may have relatively unstable governments, may present the risks of nationalization of businesses, restrictions on foreign ownership and prohibitions on

the repatriation of assets, and may have less protection of property rights than more developed countries. The economies of countries with emerging markets may be based on only a few industries, may be highly vulnerable to changes in local or global

trade conditions (due to economic dependence upon commodity prices and international trade), and may suffer from extreme and volatile debt burdens, currency devaluations or inflation rates. Local securities markets may trade a small number of

securities and may be unable to respond effectively to increases in trading volume, potentially making prompt liquidation of holdings difficult or impossible at times. Any of these factors could have an adverse impact on the performance of the Fund

and the return on the securities.

The securities are subject to currency exchange rate risk

The value of the Fund will fluctuate based in large part upon its net asset value, which will in turn depend in part upon changes in the value of the applicable currencies in which the

non-U.S. stocks in which it invests are traded. An investor’s net exposure will depend on the extent to which these currencies strengthen or weaken against the U.S. dollar. If

PS-13

the dollar strengthens against these currencies, the net asset value and the value of this Fund and the market value of, and amount payable on, the securities will be adversely affected.

Recent executive orders may adversely affect the performance of the Fund

Under recent executive orders, U.S. persons are prohibited from engaging in transactions in, or possession of, publicly traded securities of certain companies that are determined to be linked to the

People’s Republic of China military, intelligence and security apparatus, or securities that are derivative of, or are designed to provide investment exposure to, those securities. If the issuer of any of the equity securities held by the Fund is in

the future designated as such a prohibited company, the value of that company may be adversely affected, perhaps significantly, which would adversely affect the performance of the Fund. In addition, under these circumstances, the Fund is likely to

remove the equity securities of that company from the Fund. Any changes to the composition of the Fund in response to these executive orders could adversely affect the performance of the Fund.

The performance of the Fund may not correlate with the net asset value per share of the Fund, especially during periods of market volatility.

Because the shares of the Fund are traded on a securities exchange and are subject to market supply and investor demand, the market price of one share of the Fund may differ from its

net asset value per share; shares of the Fund may trade at, above, or below its net asset value per share.

During periods of market volatility, securities held by the Fund may be unavailable in the secondary market, market participants may be unable to calculate accurately the net asset value per share of the

Fund and the liquidity of the Fund may be adversely affected. This kind of market volatility may also disrupt the ability of market participants to create and redeem shares of the Fund. Further, market volatility may adversely affect, sometimes

materially, the prices at which market participants are willing to buy and sell shares of the Fund. As a result, under these circumstances, the market value of shares of the Fund may vary substantially from the net asset value per share of the Fund.

Historical prices of the Fund should not be taken as an indication of the future prices of the Fund during the term of the securities

The trading prices of the common stocks held by the Fund will determine the Fund price at any given time. As a result, it is impossible to predict whether the price of the Fund will rise

or fall. Trading prices of the common stocks held by the Fund will be influenced by complex and interrelated political, economic, financial and other factors that can affect the issuers of those stocks held by the Fund.

Risks Relating to the Initial Estimated Value of the Securities

Our initial estimated value of the securities is less than the initial public offering price

Our initial estimated value of the securities is less than the initial public offering price of the securities. This is due to, among other things, the fact that the

initial public offering price of the securities reflects the borrowing rate we pay to issue securities of this kind (an internal funding rate that is lower than the rate at which we borrow funds by issuing conventional fixed rate debt), and the

inclusion in the initial public offering price of the underwriting discount and commission and hedging and other costs associated with the securities.

The price, if any, at which you may be able to sell your securities prior to maturity may be less than the initial public offering price and our initial estimated value

Assuming no change in market conditions or any other relevant factors, the price, if any, at which you may be able to sell your securities prior to maturity will be less than the initial public offering

price and, subject to the discussion in the next paragraph, will be less than our initial estimated value. This is because any such sale price would not be expected to include the underwriting discount and commission or hedging or other costs

associated with the securities, including the estimated profit that we, our affiliates, and/or any of our hedging counterparty(ies) expect to realize in consideration for assuming the risks inherent in hedging our obligations under the securities. In

addition, any price at which you may sell the securities is likely to reflect customary bid-ask spreads for similar trades, and the cost of unwinding any related hedge transactions. In addition, the value of the securities determined for any

secondary market price is expected to be based in part on the yield that is reflected in the interest rate on our conventional debt securities of similar maturity that are traded in the secondary

PS-14

market, rather than the internal funding rate that we used to price the securities and determine the initial estimated value. As a result, the secondary market price of the securities will be less than

if the internal funding rate was used. These factors, together with various credit, market and economic factors over the term of the securities, and, potentially, changes in the price of the Fund, are expected to reduce the price at which you may be

able to sell the securities in any secondary market and will affect the value of the securities in complex and unpredictable ways. Moreover, we expect that any secondary market price will be based on Wells Fargo Securities, LLC’s valuation of the

securities, which may differ from (and may be lower than) the valuation that we would determine for the securities at that time based on the methodology by which we determined the initial estimated value set forth on the cover page of this document.

As set forth below in the section “Supplemental Plan of Distribution,” for a limited period of time after the original issue date, Wells Fargo Securities, LLC may purchase the

securities at a price that is greater than the price that would otherwise be determined at that time as described in the preceding paragraph. However, over the course of that period, assuming no changes in any other relevant factors, the price you

may receive if you sell your securities is expected to decline.

The securities are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your securities to maturity.

The initial estimated value of the securities is an estimate only, calculated as of the time the terms of the securities were set

Our initial estimated value of the securities is based on the value of our obligation to make the payments on the securities, together with the mid-market value of the derivative

embedded in the terms of the securities. See “Supplemental Plan of Distribution—Structuring the Securities” below. Our estimate is based on a variety of assumptions, including our internal funding rate (which represents a discount from our credit

spreads), expectations as to dividends on the securities held by the Fund, interest rates and volatility, and the expected term of the securities. These assumptions are based on certain forecasts about future events, which may prove to be incorrect.

Other entities, including Wells Fargo Securities, LLC in connection with determining any secondary market price for the securities, may value the securities or similar securities at a price that is significantly different than we do.

The value of the securities at any time after the pricing date will vary based on many factors, including changes in market conditions, and cannot be predicted with accuracy. As a

result, the actual value you would receive if you sold the securities in any secondary market, if any, should be expected to differ materially from our initial estimated value of your securities.

Risks Relating to Conflicts of Interest

Hedging transactions may affect the return on the securities

As described under “Use of Proceeds and Hedging,” we, through one or more of our affiliates or hedging counterparties, may hedge our obligations under the securities by purchasing

shares of the Fund, common stocks held by the Fund, futures or options on the Fund or common stocks held by the Fund, or exchange-traded funds or other derivative instruments with returns linked or related to changes in the trading prices of common

stocks held by the Fund or the price of the Fund, and may adjust these hedges by, among other things, purchasing or selling any of these assets at any time. Although they are not expected to, any of these hedging

activities may adversely affect the trading prices of common stocks held by the Fund and/or the price of the Fund and, therefore, the market value of the securities. It is possible that we or one or more of our hedging counterparties could receive

substantial returns from these hedging activities while the market value of the securities declines.

Potential conflicts of interest could arise

We, Wells Fargo Securities, LLC and our respective affiliates may engage in trading activities related to the Fund or the stocks held by the Fund that are not for the account of holders of the securities

or on their behalf. These trading activities may present a conflict between the holders’ interest in the securities and the interests we, Wells Fargo Securities, LLC and our respective affiliates will have in the proprietary accounts, in facilitating

transactions, including options and other derivatives transactions, for our customers and in accounts under our management. These trading activities could be adverse to the interests of the holders of the securities.

PS-15

We, Wells Fargo Securities, LLC and our respective affiliates may presently or from time to time engage in business with one or more of the issuers of the common stocks held by the

Fund. This business may include extending loans to, or making equity investments in, such companies or providing advisory services to such companies, including merger and acquisition advisory services. In the course of business, we, Wells Fargo

Securities, LLC and our respective affiliates may acquire non-public information relating to these companies and, in addition, one or more of our affiliates or the affiliates of the agent may publish research reports about these companies. Neither we

nor the agent make any representation to any purchasers of the securities regarding any matters whatsoever relating to the issuers of the common stocks held by the Fund. Any prospective purchaser of the securities should undertake an independent

investigation of these companies as in its judgment is appropriate to make an informed decision regarding an investment in the securities. The offering of the securities does not reflect any investment or sell recommendations as to the Fund or the

securities that the Fund holds by us, Wells Fargo Securities, LLC or our respective affiliates.

Anti-dilution adjustments relating to the shares of the Fund do not address every event that could affect such shares

An adjustment factor, as described herein, will be used to determine the Final Fund Price. The adjustment factor will be adjusted by the calculation agent for certain events affecting

the shares of the Fund. However, the calculation agent will not make an adjustment for every event that could affect such shares. If an event occurs that does not require the calculation agent to adjust the adjustment factor, the value of the

securities may be adversely affected.

The calculation agent may postpone the valuation date and, therefore, determination of the Final Fund Price and the maturity date if a market disruption event occurs on the valuation

date

The valuation date and, therefore, determination of the Final Fund Price may be postponed if the calculation agent determines that a market disruption event has occurred or is

continuing on the valuation date with respect to the Fund. As a result, the maturity date for the securities would be postponed. You will not be entitled to compensation from us or the calculation agent for any loss suffered as a result of the

occurrence of a market disruption event, any resulting delay in payment or any change in the price of the Fund after the valuation date. See “Specific Terms of the Securities — Valuation Date” and “—Market Disruption Events” below.

There are potential conflicts of interest between you and the calculation agent

The calculation agent will, among other things, determine the amount of your payment at maturity on the securities. Our wholly-owned subsidiary, RBC Capital Markets, LLC, will serve as the calculation

agent. We may change the calculation agent after the original issue date without notice to you. The calculation agent will exercise its judgment when performing its functions. For example, the calculation agent may have to determine whether a market

disruption event affects the Fund. Since this determination by the calculation agent will affect the payment at maturity on the securities, the calculation agent may have a conflict of interest if it needs to make a determination of this kind. In

addition, the calculation agent determined the initial estimated value of the securities set forth on the cover page of this pricing supplement.

PS-16

SPECIFIC TERMS OF THE SECURITIES

The securities are to be issued pursuant to the terms of the Indenture dated as of October 23, 2003, between Royal Bank of Canada and The Bank

of New York Mellon (as supplemented to date, the “Indenture”).

The information contained in this section and in the prospectus supplement and the prospectus summarizes some of the terms of the securities and the

Indenture. This summary does not contain all of the information that may be important to you as a potential investor in the securities. You should read the Indenture before making your investment decision. We have filed copies of the Indenture with

the SEC.

|

Issuer:

|

Royal Bank of Canada

|

|

Specified Currency:

|

U.S. dollars

|

|

Principal Amount:

|

$1,000 per security

|

|

Aggregate Principal Amount:

|

$771,000

|

|

Agent:

|

Wells Fargo Securities, LLC

|

|

The agent may make sales through its affiliates or selling agents.

|

|

|

Agent Acting in the Capacity of:

|

Principal

|

|

Pricing Date:

|

September 14, 2021

|

|

Original Issue Date:

|

September 17, 2021

|

|

Maturity Date:

|

December 19, 2022, subject to postponement as described below. The maturity date will be a business day. If the maturity date would otherwise be a date that is not a business day, the maturity

date will be postponed to the next succeeding date that is a business day and no interest will accrue or be payable as a result of that postponement.

|

|

Valuation Date:

|

December 12, 2022. If such day is not a trading day, the valuation date will be postponed to the next succeeding trading day. If a market disruption event (as defined under “—Market Disruption

Events” below) occurs or is continuing on the valuation date, then the valuation date will be postponed to the first succeeding trading day on which a market disruption event has not occurred and is not continuing; however, if such first

succeeding trading day has not occurred as of the eighth trading day after the originally scheduled valuation date, that eighth trading day shall be deemed to be the valuation date. If the valuation date has been postponed eight trading days

after the originally scheduled valuation date and a market disruption event occurs or is continuing on such eighth trading day, the calculation agent will determine the closing price of the Fund on such eighth trading day based on its good

faith estimate of the value of the shares (or other applicable securities) of the Fund as of the close of trading on such eighth trading day.

If the valuation date is postponed, then the maturity date of the securities will be postponed by an equal number of business days.

|

|

The Fund:

|

The return on the securities is linked to the performance of the ARK Innovation ETF (the Fund).

|

|

Payment at Maturity:

|

At maturity, for each security you own, you will receive a cash payment equal to the maturity payment amount. The maturity payment amount to which you will be entitled

depends on the change in the price of the Fund based on the Final Fund Price relative to the Initial Fund Price, and whether or not the Final Fund Price is below the Buffer Price.

|

PS-17

|

The maturity payment amount for each security will be determined by the calculation agent as described below:

• If the Final Fund Price is greater

than the Initial Fund Price, the maturity payment amount per security will equal the lesser of:

|

|

(a) $1,000 + ($1,000 x

|

Final Fund Price – Initial Fund Price

|

x Participation Rate); and

|

|

|

Initial Fund Price

|

|

(b) the maximum maturity payment amount

• If the Final Fund Price is less than

or equal to the Initial Fund Price but greater than or equal to the Buffer Price, the maturity payment amount

per security will equal $1,000.

• If the Final Fund Price is less than the Buffer Price, the maturity

payment amount per security will equal:

|

|

$1,000 – ($1,000 x

|

Buffer Price – Final Fund Price

|

)

|

|

|

Initial Fund Price

|

|

In such a case, you will lose up to 87.50% of your principal.

If the Final Fund Price is less than the Buffer Price, you will lose up to 87.50% of your principal. If the Final Fund Price is zero,

the maturity payment amount will be $125.00 per security.

If any payment is due on the securities on a day which is not a business day, then that payment may be made on the next day that is a business day, in the same

amount and with the same effect as if paid on the original due date. No interest will be payable as a result of that postponement.

|

|

|

Maximum Maturity Payment

Amount:

|

$1,170.00

|

|

Participation Rate:

|

150%

|

|

Initial Fund Price:

|

$116.86, which was the fund closing price of the Fund on the pricing date.

|

|

Final Fund Price:

|

The fund closing price of the Fund on the valuation date, as determined by the calculation agent.

|

|

Buffer Price:

|

$102.2525, which is 87.50% of the Initial Fund Price.

|

|

Closing Price:

|

The “closing price” for one share of the Fund (or one unit of any other security for which a closing price must be determined) on any trading day means the official closing price on such day

published by the principal United States securities exchange registered under the Securities Exchange Act of 1934, as amended, on which the Fund (or any such other security) is listed or admitted to trading.

|

|

Fund Closing Price:

|

The “fund closing price” on any trading day means the product of (i) the closing price of one share of the Fund (or one unit of any other security for which a fund closing price must be

determined) on such trading day and (ii) the adjustment factor applicable to the Fund on such trading day.

|

|

Adjustment Factor:

|

The “adjustment factor” means, with respect to a share of the Fund (or one unit of any other security for which a fund closing price must be determined), 1.0, subject to adjustment in the event of certain events

affecting the shares of the Fund. See “—Anti-dilution Adjustments Relating to the Fund” below.

|

PS-18

|

Market Disruption Events:

|

A “market disruption event” means any of the following events as determined by the calculation agent in its sole discretion:

• the occurrence

or existence of a material suspension of or limitation imposed on trading by the relevant stock exchange (as defined below) or otherwise relating to the shares (or other applicable securities) of the Fund or any successor fund on the

relevant stock exchange at any time during the one-hour period that ends at the close of trading on such day, whether by reason of movements in price exceeding limits permitted by such relevant stock exchange or otherwise;

• the occurrence

or existence of a material suspension of or limitation imposed on trading by any related futures or options exchange (as defined below) or otherwise in futures or options contracts relating to the shares (or other applicable securities) of

the Fund or any successor fund on any related futures or options exchange at any time during the one-hour period that ends at the close of trading on that day, whether by reason of movements in price exceeding limits permitted by the

related futures or options exchange or otherwise;

• the occurrence

or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, shares (or other applicable securities) of the

Fund or any successor fund on the relevant stock exchange at any time during the one-hour period that ends at the close of trading on that day;

• the occurrence

or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, futures or options contracts relating to

shares (or other applicable securities) of the Fund or any successor fund on any related futures or options exchange at any time during the one-hour period that ends at the close of trading on that day;

• the closure of the relevant stock exchange or any related futures or options exchange with respect to the Fund or any successor fund prior to its scheduled closing time unless the earlier closing time is announced by the relevant

stock exchange or related futures or options exchange, as applicable, at least one hour prior to the earlier of (1) the actual closing time for the regular trading session on such relevant stock exchange or related futures or options

exchange, as applicable, and (2) the submission deadline for orders to be entered into the relevant stock exchange or related futures or options exchange, as applicable, system for execution at the close of trading on that day; or

• the relevant stock exchange or any related futures or options exchange with respect to the Fund or any successor fund fails to open for trading during its regular trading session.

For purposes of determining whether a market disruption event has occurred:

(1) “close

of trading” means the scheduled closing time of the relevant stock exchange with respect to the Fund or any successor fund; and

(2) the “scheduled

closing time” of the relevant stock exchange or any related futures or options exchange on any trading day for the Fund or any successor fund means the scheduled weekday closing time of such relevant stock exchange or related futures

or options exchange on such

|

PS-19

|

trading day, without regard to after hours or any other trading outside the regular trading session hours.

|

|

|

Anti-Dilution Adjustments

Relating to the Fund:

|

The calculation agent will adjust the adjustment factor as specified below if any of the events specified below occurs with respect to the Fund and the effective date or ex-dividend date, as

applicable, for such event is after the pricing date and on or prior to the valuation date.

The adjustments specified below do not cover all events that could affect the Fund, and there may be other events that could affect the Fund for which the calculation agent will not make any such

adjustments, including, without limitation, an ordinary cash dividend. Nevertheless, the calculation agent may, in its sole discretion, make additional adjustments to any terms of the securities upon the occurrence of other events that affect

or could potentially affect the market price of, or shareholder rights in, the Fund, with a view to offsetting, to the extent practical, any such change, and preserving the relative investment risks of the securities. In addition, the

calculation agent may, in its sole discretion, make adjustments or a series of adjustments that differ from those described herein if it determines that such adjustments do not properly reflect the economic consequences of the events

specified in this pricing supplement or would not preserve the relative investment risks of the securities. All determinations made by the calculation agent in making any adjustments to the terms of the securities, including adjustments that

are in addition to, or that differ from, those described in this pricing supplement, will be made in good faith and a commercially reasonable manner, with the aim of ensuring an equitable result. In determining whether to make any adjustment

to the terms of the securities, the calculation agent may consider any adjustment made by the Options Clearing Corporation or any other equity derivatives clearing organization on options contracts on the Fund.

For any event described below, the calculation agent will not be required to adjust the adjustment factor unless the adjustment would result in a change to the adjustment factor then in effect of

at least 0.10%. The adjustment factor resulting from any adjustment will be rounded up or down, as appropriate, to the nearest one-hundred thousandth.

(A) Stock Splits and Reverse Stock Splits