Form 424B2 JPMORGAN CHASE & CO

|

Underlying supplement no. 11-I To the prospectus dated April 8, 2020 and the prospectus supplement dated April 8, 2020 |

Registration Statement Nos. 333-236659 Dated October 18, 2021 Rule 424(b)(2) |

JPMorgan Chase & Co.

Notes Linked to the J.P. Morgan QUEST Cyber Security Index

JPMorgan Chase Financial Company LLC

Notes, Fully and Unconditionally Guaranteed by JPMorgan Chase & Co., Linked to the J.P. Morgan QUEST Cyber Security Index

Each of JPMorgan Chase & Co. and JPMorgan Chase Financial Company LLC may, from time to time, offer and sell notes linked in whole or in part to the J.P. Morgan QUEST Cyber Security Index (the “Index”). The issuer of the notes, as specified in the relevant terms supplement, is referred to in this underlying supplement as the “Issuer.” The Issuer will be either JPMorgan Chase & Co. or JPMorgan Chase Financial Company LLC. For notes issued by JPMorgan Chase Financial Company LLC, JPMorgan Chase & Co., in its capacity as guarantor of those notes, is referred to in this product supplement as the “Guarantor.”

This underlying supplement describes the Index and the relationship between JPMorgan Chase & Co., JPMorgan Chase Financial Company LLC and the sponsor of the Index and terms that will apply generally to notes linked in whole or in part to the Index and other relevant information. This underlying supplement supplements the terms described in the accompanying product supplement, the prospectus supplement and the prospectus. A separate term sheet or pricing supplement, as the case may be, will describe terms that apply to specific issuances of the notes. These term sheets and pricing supplements are referred to generally in this underlying supplement as terms supplements. The accompanying product supplement, the relevant terms supplement or another accompanying underlying supplement will describe any other index or reference asset to which the notes are linked. If the terms described in the relevant terms supplement are inconsistent with those described in this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus, the terms described in the relevant terms supplement will control. In addition, if this underlying supplement and the accompanying product supplement or another accompanying underlying supplement contain information relating to the Index, the information contained in the document with the most recent date will control.

Investing in the notes involves a number of risks. See “Risk Factors” beginning on page S-2 of the prospectus supplement, “Risk Factors” in the accompanying product supplement and “Risk Factors” beginning on page US-3 of this underlying supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus. Any representation to the contrary is a criminal offense.

The notes are not bank deposits, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

October 18, 2021

TABLE OF CONTENTS

Page

| Summary | US-1 |

| Risk Factors | US-3 |

| The J.P. Morgan QUEST Cyber Security Index | US-9 |

| Supplemental Terms of the Notes | US-19 |

| Annex A: The J.P. Morgan QUEST Cyber Security Index Rules | A-1 |

The Issuer and the Guarantor (if applicable) have not authorized anyone to provide any information other than that contained or incorporated by reference in the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement or the prospectus with respect to the notes offered by the relevant terms supplement and with respect to the Issuer and the Guarantor (if applicable). The Issuer and the Guarantor (if applicable) take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The relevant terms supplement, together with this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus, will contain the terms of the notes and will supersede all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials of the Issuer. The information in each of the relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus may be accurate only as of the date of that document.

The notes are not appropriate for all investors and involve a number of risks and important legal and tax consequences that should be discussed with your professional advisers. You should be aware that the regulations of Financial Industry Regulatory Authority, Inc., or FINRA, and the laws of certain jurisdictions (including regulations and laws that require brokers to ensure that investments are suitable for their customers) may limit the availability of the notes. The relevant terms supplement, this underlying supplement, any other accompanying underlying supplement, the accompanying product supplement, the prospectus supplement and the prospectus do not constitute an offer to sell or a solicitation of an offer to buy the notes under any circumstances in which that offer or solicitation is unlawful.

In this underlying supplement, “we,” “us” and “our” refer to the Issuer, unless the context requires otherwise, and “JPMorgan Financial” refers to JPMorgan Chase Financial Company LLC. To the extent applicable, the index described in this underlying supplement is deemed to be one of the “Indices” referred to in the accompanying product supplement.

Summary

The J.P. Morgan QUEST Cyber Security Index (the “Index”) was developed and is maintained by J.P. Morgan Securities plc (“JPMS plc”). The description of the Index and methodology included in this underlying supplement is based on rules formulated by JPMS plc (the “Rules”). The Rules, and not this description, will govern the calculation and constitution of the Index and other decisions and actions related to its maintenance. The Rules in effect as of the date of this underlying supplement are attached as Annex A to this underlying supplement. The Index is the intellectual property of JPMS plc and its affiliates, and JPMS plc and its affiliates reserve all rights with respect to their ownership of the Index. The Index is reported by Bloomberg L.P. under the ticker symbol “JPNLPCYB Index.”

The Index attempts to provide exposure to large-, mid- and small-capitalization companies in developed markets that may have ties to the cyber security industry. The composition of the Index is determined in part based on the application of a natural-language algorithmic analysis of news articles and press releases (each, a “news item”) performed by RavenPack International S.L. (“RavenPack”), a data analytics provider, with results made available through RavenPack databases accessible by the Constituent Determination Agent (as defined below). In connection with each quarterly rebalance, the Constituent Determination Agent consults the RavenPack databases to determine the number of included news items for each month over the preceding 24 months that are relevant to each potential Index constituent, counting only the first news item relating to a given event for a given potential Index constituent over each 24-hour period. The Constituent Determination Agent then determines, for each potential Index constituent, the average monthly percentage of those news items (as defined under “The J.P. Morgan QUEST Cyber Security Index” in this underlying supplement, the “Theme Relevant Score”) that use one or more words related to the cyber security industry, including cyber security, firewalls, malware protection, antivirus software, cyber-defense and other similar terms, provided that references to the terms “cyber security” or “cybersecurity” are disregarded if found within the same paragraph as the term “forward-looking statements.” The Index then seeks to track the potential Index constituents with a Theme Relevant Score that exceeds a specified threshold and that meet the other eligibility criteria of the Index, with weights determined using an optimization model. Subject to liquidity and size constraints, a higher Theme Relevant Score will generally result in a higher weight and a lower Theme Relevant Score will generally result in a lower weight.

No assurance can be given that this methodology for identifying companies that may have ties to the cyber security industry will be successful. See “Risk Factors” in this underlying supplement for additional information.

RavenPack’s natural-language algorithm seeks to identify companies and events mentioned in news items and to identify the roles played by those companies in those events. The algorithm also assigns scores to those companies or events across a variety of metrics, including relevance and novelty:

| · | Relevance. The relevance score for an entity associated with a news item is an integer score between 0 and 100 that indicates how strongly related the mention of that entity is to the events included in that news item, with higher relevance scores indicating greater relevance. A relevance score of 0 means the entity was passively mentioned while a relevance score of 100 means the entity was prominent in the news story. |

The relevance of an entity in a news item is based on criteria established by RavenPack, including where the entity is first mentioned within the news item, how frequently it is mentioned, its role in the events of the news item and the number of entities mentioned in the news item. An entity will be assigned a relevance score of 100 only if it is found to be playing a key role in the first event detected in the headline of a story. Usually, a relevance score of at least 90 indicates that the entity is referenced in the main title or headline of the news item, while lower relevance scores indicate references further in the story body. If an entity is identified only in a “source” role, then it is given a relevance score of 10. A source may be a publisher, data provider or firm that authored, originated or is referenced in the story.

US-1

Only news items with a relevance score of 70 or greater for the relevant entity are considered for purposes of determining the Theme Relevant Score of a potential Index constituent.

| · | Novelty. The novelty score of an event associated with a news item is a score between 0.00000 and 365.00000 that indicates how many calendar days have passed since a similar event was detected in an earlier news item. A value of 365.00000 means that the most recent news item with a similar event has a timestamp that is at least 365 days before the timestamp of the current news item. A value of 1.00000 means that the most recent news item with a similar event has a timestamp that is 24 hours before the timestamp of the current news item. |

Only news items with a novelty score of 1.00000 or greater for the relevant entity are considered for purposes of determining the Theme Relevant Score of a potential Index constituent.

On any given day, the closing level of the Index (the “Index Level”) reflects the weighted performance of the Index constituents (without adjustment for dividends), converted into U.S. dollars. The Index Level was set equal to 100.00 on September 30, 2021, the base date of the Index. The Index Calculation Agent (as defined below) began calculating the Index on a live basis on October 8, 2021.

JPMS plc is currently the sponsor of the Index (the “Index Sponsor”), the determination agent of the Index constituents (the “Constituent Determination Agent”) and the determination agent of disruption events (the “Disruption Determination Agent”). Solactive AG (“Solactive”) is currently the calculation agent of the Index (the “Index Calculation Agent”).

See “The J.P. Morgan QUEST Cyber Security Index” in this underlying supplement for additional information about the Index.

No assurance can be given that the investment strategy used to construct the Index will achieve its intended results or that the Index will be successful or will outperform any alternative index or strategy that might reference the RavenPack databases or the Index constituents.

The Index is described as a “notional” or “synthetic” portfolio of assets because there is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. The Index merely references certain assets, the performance of which will be used as a reference point for calculating the Index Level.

US-2

Risk Factors

Your investment in the notes will involve certain risks. Investing in the notes is not equivalent to investing directly in the Index or any of the equity securities underlying the Index (the “Constituents”), or any futures contracts or exchange-traded or over-the-counter instruments based on, or other instruments linked to, any of the foregoing. You should consider carefully the following discussion of risks, as well as the discussion of risks included in the relevant terms supplement, the accompanying product supplement and any other accompanying underlying supplement, before you decide that an investment in the notes is appropriate for you.

Capitalized terms used in this section without definition are as defined in “Summary” above.

Risks Relating to the Index

JPMS plc, the Index Sponsor, the Constituent Determination Agent and the Disruption Determination Agent, and Solactive, the Index Calculation Agent, may adjust the Index in a way that affects its level, and JPMS plc and Solactive have no obligation to consider your interests.

JPMS plc, one of our affiliates, currently acts as the Index Sponsor, the Constituent Determination Agent and the Disruption Determination Agent and is responsible for maintaining the Index and developing the guidelines and policies governing its composition and calculation. Solactive currently acts as the Index Calculation Agent and is responsible for calculating the Index and determining any adjustments upon the occurrence of corporation actions or other corporate events. In performing these duties, JPMS plc and Solactive may have interests adverse to the interests of the holders of the notes, which may affect your return on the notes, particularly where JPMS plc, as the Index Sponsor, the Constituent Determination Agent and the Disruption Determination Agent, and Solactive, as the Index Calculation Agent, are entitled to exercise discretion. The rules governing the Index may be amended at any time by the Index Sponsor, in its sole discretion. The rules also permit the use of discretion by the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent and the Disruption Determination Agent in relation to the Index in specific instances, including, but not limited to, the determination of whether to make an adjustment upon the occurrence of a corporation action or other corporate event and any adjustment to be made; whether to replace the Base Reference Index (as defined under “The J.P. Morgan QUEST Cyber Security Index” below) with a substitute or successor upon the occurrence of certain events affecting the Base Reference Index and the selection of any substitute or successor; whether a market disruption has occurred; and the interpretation of the rules governing the Index. Although JPMS plc, acting as the Index Sponsor, the Constituent Determination Agent and the Disruption Determination Agent, and Solactive, acting as the Index Calculation Agent, will make all determinations and take all action in relation to the Index acting in good faith, it should be noted that JPMS plc and Solactive may have interests adverse to the interests of the holders of the notes and the policies and judgments for which JPMS plc or Solactive is responsible could have an impact, positive or negative, on the level of the Index and the value of your notes.

Although judgments, policies and determinations concerning the Index are made by JPMS plc, JPMorgan Chase & Co. ultimately controls JPMS plc. JPMS plc has no obligation to consider your interests in taking any actions that might affect the value of your notes. Furthermore, the inclusion of any Constituent in the Index is not an investment recommendation by us or JPMS plc of that Constituent. See “The J.P. Morgan QUEST Cyber Security Index.”

The Index may not be successful or outperform any alternative strategy that might be employed in respect of the RavenPack databases or the Constituents.

The Index follows a notional rules-based proprietary strategy that operates on the basis of pre-determined rules. No assurance can be given that the investment strategy on which the Index is based will be successful or that the Index will outperform any alternative strategy that might be employed in respect of the RavenPack databases or the Constituents.

US-3

The methodology used by the Index to identify companies that may have ties to the cyber security industry and to weight the Constituents may be unsuccessful.

The composition of the Index is determined in part based on the application of a natural-language algorithmic analysis of news items performed by RavenPack, with results made available through RavenPack databases accessible by the Constituent Determination Agent. In connection with each quarterly rebalance, the Constituent Determination Agent consults the RavenPack databases to determine the number of included news items for each month over the preceding 24 months that are relevant to each potential Constituent, counting only the first news item relating to a given event for a given potential Constituent over each 24-hour period. This methodology relies on RavenPack’s natural-language algorithm to identify companies and events mentioned in news items and to identify the roles played by those companies in those events.

Natural language algorithms tend to significantly underperform humans in understanding the meaning of text. For example, natural language algorithms may misunderstand the meaning of text due to a failure to identify the correct meaning of a word in context, a failure to identify the correct scope of qualifiers, a lack of common knowledge, an inability to draw inferences from open-ended statements or an inability to recognize sarcasm, irony or other tones, intentions or emotions. The methodology used to determine whether a news item is sufficiently relevant or novel to be considered for purposes of determining the Theme Relevant Scores may fail to include highly relevant news items or may include irrelevant news items, perhaps with a high rate of error. The algorithm does not learn from news items it processes or adapt to its environment and, as a static algorithm that will not be updated over time for purposes of the Index, will continue to use the same mathematical rules to process news items, even as news develops over time or as RavenPack creates newer versions of the algorithm. In addition, any news items considered for purposes of determining the Theme Relevant Scores may include material inaccuracies, and the RavenPack databases may not have access to all news items that could potentially be relevant. In addition, the use of a 24-month lookback period could cause companies that no longer have ties to the cyber security industry to be included and could cause companies that have only recent ties to the cyber security industry not to be included.

The Constituent Determination Agent determines the Theme Relevant Score for each potential Constituent based on the percentage of relevant news items that use one or more words related to the cyber security industry, including cyber security, firewalls, malware protection, antivirus software, cyber-defense and other similar terms, provided that references to the terms “cyber security” or “cybersecurity” are disregarded if found within the same paragraph as the term “forward-looking statements.” This step of the methodology is a simple text search and does not make use of RavenPack’s natural language algorithm to attempt to determine context or relevance to the relevant entity. The search terms are not comprehensive and may be under-inclusive in some respects, leading to relevant news items being excluded, and overly broad in other respects, leading to irrelevant news items being included. The search terms will not be updated over time in response to industry changes or otherwise. No assurance can be given that this methodology for identifying companies that may have ties to the cyber security industry will be successful. Some, perhaps many, of the Constituents might have no ties to cyber security, and a significant number of companies that do have ties to the cyber security industry might be excluded from the Index. The listing, size, liquidity, data availability and other eligibility criteria could also exclude companies with strong ties to the cyber security industry.

Subject to liquidity and size constraints, a higher Theme Relevant Score will generally result in a higher weight and a lower Theme Relevant Score will generally result in a lower weight. A higher Theme Relevant Score may not be indicative of closer ties to the cyber security industry, and no assurance can be given that Constituents with higher Theme Relevant Scores will outperform Constituents with lower Theme Relevant Scores.

No assurance can be given that the methodology used by the Index to identify companies that may have ties to the cyber security industry and to weight the Constituents will be successful or that it will outperform any alternative strategy.

US-4

The Index is subject to risks associated with cyber security companies.

Cyber security companies may have limited product lines, markets, financial resources or personnel. These companies typically face intense competition and potentially rapid product obsolescence due to rapid technological developments, frequent new product introduction, competition for the services of qualified personnel and competition from competitors with lower production costs. Cyber security companies may be negatively affected by the decline or fluctuation of subscription renewal rates for their products and services, which may have an adverse effect on profit margins. Cyber security companies may also be adversely impacted by government regulations and may be subject to additional regulatory oversight with regard to privacy concerns and cybersecurity risk. Cyber security companies are also heavily dependent on intellectual property and patent rights. The loss or impairment of these rights may adversely affect the profitability of these companies. Cyber security companies tend to be more volatile than companies that do not rely heavily on technology. Cyber security companies may also be the target of cyberattacks, which, if successful, could significantly and permanently damage a company’s reputation, financial condition and ability to conduct business in the future. The customers and/or suppliers of cyber security companies may be concentrated in a particular country, industry or region. Any adverse event affecting one of these countries, regions or industries could have a negative impact on cyber security companies.

Industry sector concentration risks may adversely affect the value of the notes.

Because the Index’s exposure will likely be concentrated in a limited number of industry sectors at any time, you will not benefit, with respect to an investment in notes linked to the Index, from the advantages of a diversified investment, and you will bear the risks of a concentrated investment, including the risk of greater volatility than may be experienced in connection with a diversified investment. You should be aware that other investments may be more diversified than the notes in terms of the number and variety of industry sectors. The Index is currently primarily concentrated in the information technology and industrial sectors. The exposure of the Index to industry sectors may vary over time.

Market or economic factors impacting information technology companies and companies that rely heavily on technological advances could have a major effect on the value of those companies. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs. Stocks of information technology companies and companies that rely heavily on technology, especially those of smaller, less-seasoned companies, tend to be more volatile than the overall market. Information technology companies are heavily dependent on patent and intellectual property rights, the loss or impairment of which may adversely affect profitability. Additionally, companies in the information technology sector may face dramatic and often unpredictable changes in growth rates and competition for the services of qualified personnel. These factors could affect the information technology sector and could affect the level of the Index and the value of your notes.

Industrial companies are affected by supply and demand both for their specific product or service and for industrial sector products in general. Aerospace and defense companies, a component of the industrial sector, can be significantly affected by government spending policies because companies involved in this industry rely, to a significant extent, on U.S. and foreign government demand for their products and services. Thus, the financial condition of, and investor interest in, aerospace and defense companies are heavily influenced by governmental defense spending policies, which are typically under pressure from efforts to control the U.S. and other government budgets. These factors could affect the industrial sector and could affect the level of the Index and the value of your notes.

The Index should not be compared to any other index or strategy sponsored by any of our affiliates (each, a “J.P. Morgan Index”) and cannot necessarily be considered a revised, enhanced or modified version of any other J.P. Morgan Index.

The Index follows a notional rules-based proprietary strategy that may have objectives, features and/or constituents that are similar to those of other J.P. Morgan Indices. No assurance can be given

US-5

that these similarities will form a basis for comparison between the Index and any other J.P. Morgan Index, and no assurance can be given that the Index would be more successful than or outperform any other J.P. Morgan Index. The Index operates independently and does not necessarily revise, enhance, modify or seek to outperform any other J.P. Morgan Index.1

Your return on the notes will not reflect dividends or other distributions on the Constituents.

Your return on the notes will not reflect the return you would realize if you actually owned the Constituents and received the dividends or other distributions paid on the Constituents. This is because the Index Calculation Agent will calculate the level of the Index, in part, by reference to the closing prices of the Constituents without reflecting the dividends or other distributions paid on the Constituents.

Hypothetical back-tested data relating to the Index do not represent actual historical data and are subject to inherent limitations.

Hypothetical back-tested performance measures of the Index are purely theoretical and do not represent the actual historical performance of the Index and have not been verified by an independent third party. Hypothetical back-tested performance measures have inherent limitations. Hypothetical back-tested performance is derived by means of the retroactive application of a back-tested model that has been designed with the benefit of hindsight. Alternative modelling techniques might produce significantly different results and may prove to be more appropriate. Past performance, and especially hypothetical back-tested performance, is not indicative of future results. This type of information has inherent limitations and you should carefully consider these limitations before placing reliance on such information.

If the prices of the Constituents change, the level of the Index and the market value of your notes may not change in the same manner.

Owning the notes is not the same as owning the Constituents. Accordingly, changes in the prices of the Constituents may not result in a comparable change in the level of the Index or the market value of your notes.

The Index comprises notional assets and liabilities.

The exposure of the Index to the Constituents is purely notional and will exist solely in the records maintained by or on behalf of the Index Calculation Agent. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Consequently, you will not have any claim against any of the Constituents.

The Index has a limited operating history and may perform in unanticipated ways.

The Index was established on October 8, 2021 and therefore has a limited operating history. Past performance should not be considered indicative of future performance.

The Index methodology may be modified upon the occurrence of certain extraordinary events.

As described under “The J.P. Morgan QUEST Cyber Security Index — Extraordinary Events” below, certain extraordinary events may affect the ability of the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent and the Disruption Determination Agent to reference data sources including the RavenPack databases, the optimization software, the Base Reference Index and other sources referenced by the Index. As described in the Rules, upon the occurrence of any of those extraordinary events, if practicable, a successor or replacement may be identified and the Rules will be amended accordingly, provided that the Index Sponsor may, in its discretion, at any time and without notice, terminate the calculation or publication of the Index, including, without limitation, subsequent to the occurrence of an extraordinary event. The Index Sponsor is under no obligation to continue the calculation and publication of the Index.

US-6

The Index is subject to market risks.

The performance of the Index is dependent in part on the price performances of the Constituents. As a consequence, your investment in the notes is exposed to the price performances of the Constituents.

The Index is subject to risks associated with mid- and small-capitalization stocks.

Some of the Constituents are issued by mid- or small-capitalization companies. Mid- and small-capitalization companies may be less able to withstand adverse economic, market, trade and competitive conditions relative to larger companies. Mid- and small-capitalization companies are less likely to pay dividends on their stocks, and the presence of a dividend payment could be a factor that limits downward stock price pressure under adverse market conditions.

The Index is subject to risks associated with non-U.S. securities markets.

Some of the Constituents have been issued by non-U.S. companies. Investments in securities linked to the value of securities of non-U.S. issuers involve risks associated with the securities markets in those countries where the relevant non-U.S. securities are traded, including risks of volatility in those markets, governmental intervention in those markets and cross shareholdings in companies in certain countries. Also, there is generally less publicly available information about companies in some of these jurisdictions than about U.S. companies that are subject to the reporting requirements of the SEC, and generally non-U.S. companies are subject to accounting, auditing and financial reporting standards and requirements and securities trading rules different from those applicable to U.S. reporting companies.

The prices of securities in non-U.S. markets may be affected by political, economic, financial and social factors in those markets, including changes in a country’s government, economic and fiscal policies, currency exchange laws or other laws or restrictions. Moreover, the economies of these countries may differ favorably or unfavorably from the economy of the United States in such respects as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency. These countries may be subjected to different and, in some cases, more adverse economic environments.

Some or all of these factors may influence the level of the Index. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors. You cannot predict the future performance of the Index. The level of the Index may change in a manner that would adversely affect any payment on the notes.

The Index is subject to currency exchange risk.

Because the prices of the non-U.S. Constituents are converted into U.S. dollars for the purposes of calculating the level of the Index, the holders of the notes will be exposed to currency exchange rate risk with respect to each of the currencies in which the non-U.S. Constituents trade. An investor’s net exposure will depend on the extent to which those currencies strengthen or weaken against the U.S. dollar and the relative weight of the non-U.S. Constituents denominated in each applicable currency. If, taking into account the weighting, the U.S. dollar changes in value relative to those currencies, the level of the Index and any payment on the notes may be adversely affected.

Of particular importance to potential currency exchange risk are:

| · | existing and expected rates of inflation; |

| · | existing and expected interest rate levels; |

| · | the balance of payments in the countries issuing those currencies and in the United States and between each country and its major trading partners; |

| · | political, civil or military unrest in the countries issuing those currencies and in the United States; and |

US-7

| · | the extent of governmental surpluses or deficits in the component countries and the United States. |

All of these factors are, in turn, sensitive to the monetary, fiscal and trade policies pursued by the governments of various component countries, the United States and other countries important to international trade and finance.

The Issuer and the Guarantor (if applicable) have no control over exchange rates.

Foreign exchange rates can either float or be fixed by sovereign governments. Exchange rates of the currencies used by most economically developed nations are permitted to fluctuate in value relative to the U.S. dollar and to each other. However, from time to time governments and, in the case of countries using the euro, the European Central Bank, may use a variety of techniques, such as intervention by a central bank, the imposition of regulatory controls or taxes or changes in interest rates to influence the exchange rates of their currencies. Governments may also issue a new currency to replace an existing currency or alter the exchange rate or relative exchange characteristics by a devaluation or revaluation of a currency. These governmental actions could change or interfere with currency valuations and currency fluctuations that would otherwise occur in response to economic forces, as well as in response to the movement of currencies across borders. As a consequence, these governmental actions could adversely affect an investment in the notes.

The Issuer and the Guarantor (if applicable) will not make any adjustment or change in the terms of the notes in the event that exchange rates become fixed, or in the event of any devaluation or revaluation or imposition of exchange or other regulatory controls or taxes, or in the event of other developments affecting the U.S. dollar or any relevant foreign currency. You will bear those risks.

The relevant terms supplement or a separate underlying supplement will provide additional risk factors relating to any other index or reference assets to which the notes are linked.

US-8

The J.P. Morgan QUEST CYBER SECURITY Index

The J.P. Morgan QUEST Cyber Security Index (the “Index”) was developed and is maintained by J.P. Morgan Securities plc (“JPMS plc”). The description of the Index and methodology included in this underlying supplement is based on rules formulated by JPMS plc (the “Rules”). The Rules, and not this description, will govern the calculation and constitution of the Index and other decisions and actions related to its maintenance. The Rules in effect as of the date of this underlying supplement are attached as Annex A to this underlying supplement. The Index is the intellectual property of JPMS plc and its affiliates, and JPMS plc and its affiliates reserve all rights with respect to their ownership of the Index. The Index is reported by Bloomberg L.P. under the ticker symbol “JPNLPCYB Index.”

The Index attempts to provide exposure to large-, mid- and small-capitalization companies in developed markets that may have ties to the cyber security industry. The composition of the Index is determined in part based on the application of a natural-language algorithmic analysis of news articles and press releases (each, a “news item”) performed by RavenPack International S.L. (“RavenPack”), a data analytics provider, with results made available through RavenPack databases accessible by the Constituent Determination Agent (as defined below). In connection with each quarterly rebalance, the Constituent Determination Agent consults the RavenPack databases to determine the number of included news items for each month over the preceding 24 months that are relevant to each potential Index constituent, counting only the first news item relating to a given event for a given potential Index constituent over each 24-hour period. The Constituent Determination Agent then determines, for each potential Index constituent, the average monthly percentage of those news items (as defined below, the “Theme Relevant Score”) that use one or more words related to the cyber security industry, including cyber security, firewalls, malware protection, antivirus software, cyber-defense and other similar terms, provided that references to the terms “cyber security” or “cybersecurity” are disregarded if found within the same paragraph as the term “forward-looking statements.” The Index then seeks to track the potential Index constituents with a Theme Relevant Score that exceeds a specified threshold and that meet the other eligibility criteria of the Index, with weights determined using an optimization model. Subject to liquidity and size constraints, a higher Theme Relevant Score will generally result in a higher weight and a lower Theme Relevant Score will generally result in a lower weight.

No assurance can be given that this methodology for identifying companies that may have ties to the cyber security industry will be successful. See “Risk Factors” in this underlying supplement for additional information.

On any given day, the closing level of the Index (the “Index Level”) reflects the weighted performance of the Index constituents (without adjustment for dividends), converted into U.S. dollars. The Index Level was set equal to 100.00 on September 30, 2021, the base date of the Index. The Index Calculation Agent (as defined below) began calculating the Index on a live basis on October 8, 2021.

No assurance can be given that the investment strategy used to construct the Index will achieve its intended results or that the Index will be successful or will outperform any alternative index or strategy that might reference the RavenPack databases or the Index constituents.

The Index is described as a “notional” or “synthetic” portfolio of assets because there is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. The Index merely references certain assets, the performance of which will be used as a reference point for calculating the Index Level.

Composition of the Index and Index Rebalancing

Except under the circumstances described below, the Index is rebalanced quarterly on the last Index Scheduled Trading Day of March, June, September and December (each, a “Scheduled Rebalancing Date”) to reflect the composition and weighting of the Index determined in respect of the fifth immediately preceding London Scheduled Business Day (the “Rebalance Selection Date”) in accordance with the methodology described below and in the Rules.

US-9

An “Index Scheduled Trading Day” means a day other than a Saturday or Sunday (each, a “Calculation Day”) on which each of the New York Stock Exchange, the Deutsche Börse Xetra, the London Stock Exchange and the Tokyo Stock Exchange is scheduled to be open for trading during its regular trading session, whether scheduled for a full-day regular trading session or a shortened-day regular trading session.

A “London Scheduled Business Day” means a day that is both (i) a Calculation Day and (ii) a day on which the London Stock Exchange is scheduled to be open for its regular trading session.

Identifying the Eligible Stocks. The stock universe for the Index, in respect of a Rebalance Selection Date, includes each of the constituents of the MSCI World Investable Market IndexSM (the “Base Reference Index”), as available to the Constituent Determination Agent at approximately 8:00 a.m. local time in London, United Kingdom on the London Scheduled Business Day that immediately follows that Rebalance Selection Date (the “Data Reference Time”) (each, a “Universe Stock”). See the Rules for additional information about the various data sources referenced in determining the composition of the Index.

The Base Reference Index is designed to measure the equity market performance of the large-, mid- and small-cap segments of certain developed markets. The Base Reference Index currently consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The Base Reference Index covers approximately 99% of the free float-adjusted market capitalization in each country.

A Universe Stock in respect of a Rebalance Selection Date will be eligible to be included in the Index in respect of that Rebalance Selection Date (each, an “Eligible Constituent”) if (a) that Universe Stock corresponds to a listed security (a “Listing”) that is included in the RavenPack Analytics Data and RavenPack Mapping Data (collectively, the “RavenPack Databases”), (b) the RavenPack Databases include all of the inputs and related information for that Listing and its issuer (a “Reference Entity”) necessary to make all of the determinations required under the methodology governing the Index and (c) that Listing and its Reference Entity satisfy the listing, size, liquidity, data availability and other criteria described under “— Eligibility Criteria” below (the “Eligibility Criteria”). In addition, any Index constituent already included in the Index with a positive weight on a Rebalance Selection Date will also be an Eligible Constituent in respect of that Rebalance Selection Date if the 1 Month Dollar Notational Trading Estimate (as defined in the Rules) in respect of that Rebalance Selection Date is not a disregarded value.

If, in respect of a Rebalance Selection Date, the inputs and related information necessary to make all of the determinations required under the methodology governing the Index is available in respect of fewer than 200 Reference Entities, then no changes will be made to the composition of the Index in connection with that Rebalance Selection Date and no rebalancing will occur on the associated Scheduled Rebalancing Date.

Calculating the Theme Relevance Scores. In respect of each Rebalance Selection Date, the Constituent Determination Agent determines the “Theme Relevance Score” for the Reference Entity associated with each Eligible Constituent by taking the average of the Monthly Theme Relevance Scores for that Reference Entity over the 24 calendar months preceding the calendar month in which that Rebalance Selection Date falls (the “Reference Period”). The “Monthly Theme Relevance Score” for a Reference Entity in respect of a calendar month is equal to the percentage of Relevant Stories for that Reference Entity and that calendar month that include any of the following key words: “cyber security,” “cybersecurity,” “firewalls,” “malware protection,” “antivirus software,” “anti-virus software,” “cyber-defence,” “cyberdefence,” “cyber-defense,” “cyberdefense” and “anti-spam,” provided that references to the terms “cyber security” or “cybersecurity” are disregarded if found within the same paragraph as the term “forward-looking statements.”

A news item will be a “Relevant Story” for a Reference Entity in respect of a calendar month if that news item (a) is included in the RavenPack Databases, (b) has a relevance score of 70 or more for that Reference Entity, (c) has a novelty score of 1.00000 or more for an event for that Reference Entity and

US-10

(d) has a timestamp that falls within that calendar month. Each news item’s timestamp corresponds to the time at which RavenPack receives that news item.

RavenPack’s algorithm seeks to identify companies and events mentioned in news items and to identify the roles played by those companies in those events. The algorithm also assigns scores to those companies or events across a variety of metrics, including relevance and novelty:

| · | Relevance. The relevance score for an entity associated with a news item is an integer score between 0 and 100 that indicates how strongly related the mention of that entity is to the events included in that news item, with higher relevance scores indicating greater relevance. A relevance score of 0 means the entity was passively mentioned while a relevance score of 100 means the entity was prominent in the news story. |

The relevance of an entity in a news item is based on criteria established by RavenPack, including where the entity is first mentioned within the news item, how frequently it is mentioned, its role in the events of the news item and the number of entities mentioned in the news item. An entity will be assigned a relevance score of 100 only if it is found to be playing a key role in the first event detected in the headline of a story. Usually, a relevance score of at least 90 indicates that the entity is referenced in the main title or headline of the news item, while lower relevance scores indicate references further in the story body. If an entity is identified only in a “source” role, then it is given a relevance score of 10. A source may be a publisher, data provider or firm that authored, originated or is referenced in the story.

Only news items with a relevance score of 70 or greater for the relevant entity are considered for purposes of determining the Theme Relevant Score of a potential Index constituent.

| · | Novelty. The novelty score of an event associated with a news item is a score between 0.00000 and 365.00000 that indicates how many calendar days have passed since a similar event was detected in an earlier news item. A value of 365.00000 means that the most recent news item with a similar event has a timestamp that is at least 365 days before the timestamp of the current news item. A value of 1.00000 means that the most recent news item with a similar event has a timestamp that is 24 hours before the timestamp of the current news item. |

Only news items with a novelty score of 1.00000 or greater for the relevant entity are considered for purposes of determining the Theme Relevant Score of a potential Index constituent.

The algorithm does not learn from news items it processes or adapt to its environment and, as a static algorithm that will not be updated over time for purposes of the Index, will continue to use the same mathematical rules to process news items, even as news develops over time or as RavenPack creates newer versions of the algorithm. No assurance can be given that this methodology for identifying companies that may have ties to the cyber security industry will be successful. See “Risk Factors” in this underlying supplement for additional information.

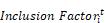

Determining the Preliminary Weights. In respect of each Rebalance Selection Date, the Constituent Determination Agent determines the number of Eligible Constituents (each, a “Thematic Eligible Constituent”) that have been issued by a Reference Entity with a Theme Relevant Score in respect of that Rebalance Selection Date of more than 10% (the “Thematic Relevant Score Threshold”). If the number of Thematic Eligible Constituents is less than 30, then the Thematic Relevant Score Threshold will be reduced in increments of 2% until the number of Thematic Eligible Constituents is greater than or equal to 30. If the number of Thematic Eligible Constituents is still less than 30 after the Thematic Relevance Score Threshold has been reduced to 0%, then no changes will be made to the composition of the Index in connection with that Rebalance Selection Date and no rebalancing will occur on the associated Scheduled Rebalancing Date.

US-11

If the number of Thematic Eligible Constituents is greater than or equal to 30 in respect of that Rebalance Selection Date, the Constituent Determination Agent will determine the “Theme Score Percentage” of each Eligible Constituent as follows:

| · | in the case of an Eligible Constituent that is not a Thematic Eligible Constituent, 0%; and |

| · | in the case of an Eligible Constituent that is a Thematic Eligible Constituent, (a) the Theme Relevant Score of the Reference Entity that issued that Thematic Eligible Constituent in respect of that Rebalance Selection Date divided by (b) the sum of the Theme Relevant Scores of each of the Reference Entities that issued a Thematic Eligible Constituent. |

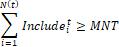

The Constituent Determination Agent will then attempt to determine the weights of the Eligible Constituents within the Index in respect of that Rebalance Selection Date using an optimization model (the “Output Weights”). Subject to constraints described below, the optimization model seeks to minimize the sum of the squares of the difference between the Output Weight of each Eligible Constituent and its Theme Score Percentage. Subject to the constraint described below, a higher Theme Score Percentage will generally result in a higher Output Weight and a lower Theme Score Percentage will generally result in a lower Output Weight. The constraints of this optimization are as follows:

| · | the sum of the Output Weights of the Eligible Constituents must be 100% and the Output Weight of each Eligible Constituent must be greater than or equal to 0%; |

| · | the Output Weight of any Eligible Constituent that is not a Thematic Eligible Constituent must be 0%, provided that, if the Current Weight of that Eligible Constituent as notionally held by the Index on that Rebalance Selection Date is greater than the Maximum Liquidity Percentage for that Eligible Constituent in respect of that Rebalance Selection Date, the Output Weight of that Eligible Constituent must be the Current Weight of that Eligible Constituent as notionally held by the Index on that Rebalance Selection Date minus the Maximum Liquidity Percentage for that Eligible Constituent in respect of that Rebalance Selection Date; |

| · | the Output Weight of each Eligible Constituent that is a Thematic Eligible Constituent must not be greater than or less than the Current Weight of that Eligible Constituent as notionally held by the Index on that Rebalance Selection Date by more than the Maximum Liquidity Percentage for that Eligible Constituent in respect of that Rebalance Selection Date; and |

| · | the Output Weight of each Eligible Constituent that is a Thematic Eligible Constituent must not be greater than the smallest of (a) 5%, (b) the Maximum Liquidity Percentage for that Eligible Constituent in respect of that Rebalance Selection Date and (c) the Maximum Free Float Market Cap Percentage for that Eligible Constituent in respect of that Rebalance Selection Date (the “Maximum Weight”), provided that, if the Maximum Weight for that Eligible Constituent in respect of that Rebalance Selection Date is less than the Current Weight of that Eligible Constituent as notionally held by the Index on that Rebalance Selection Date minus the Maximum Liquidity Percentage for that Eligible Constituent in respect of that Rebalance Selection Date, the Maximum Weight for that Eligible Constituent in respect of that Rebalance Selection Date will be deemed to be the Current Weight of that Eligible Constituent as notionally held by the Index on that Rebalance Selection Date minus the Maximum Liquidity Percentage for that Eligible Constituent in respect of that Rebalance Selection Date. |

For purposes of determining the composition of the Index:

| · | the “Current Weight” of an Eligible Constituent as notionally held by the Index on a Rebalance Selection Date is calculated in the manner set forth in the Rules and is calculated based on the U.S. dollar value on that Rebalance Selection Date of the number of shares, if any, of that Eligible Constituent notionally held by the Index on that Rebalance Selection Date as compared to the U.S. dollar value on that Rebalance Selection Date of the shares of each of the Index constituents notionally held by the Index on that Rebalance Selection Date; |

US-12

| · | the “Maximum Liquidity Percentage” of an Eligible Constituent on a Rebalance Selection Date is equal to the 1 Month Dollar Notional Trading Estimate divided by $1 billion, where the 1 Month Dollar Notional Trading Estimate is determined in the manner set forth in the Rules and represents an estimate of an average of the daily U.S. dollar value of the shares of that Eligible Constituent traded during the 30 calendar days ending on and including that Rebalance Selection Date, with the three highest and lowest daily values excluded in calculating that average; and |

| · | the “Maximum Free Float Market Cap Percentage” of an Eligible Constituent on a Rebalance Selection Date is equal to 3% of the Dollar Base Reference Free-Float Market Capitalization (as defined in the Rules) divided by $200 million, where the Dollar Base Reference Free-Float Market Capitalization is determined in the manner set forth in the Rules and represents an estimate of the U.S. dollar value of the free-float market capitalization of that Eligible Constituent on that Rebalance Selection Date. |

If the optimization model fails to produce Output Weights for the Eligible Constituents, then the Constituent Determination Agent will reduce the Thematic Relevance Score Threshold in increments of 2% until the optimization model produces Output Weights for the Eligible Constituent. If the optimization model fails to produce Output Weights for the Eligible Constituent after the Thematic Relevance Score Threshold has been reduced to 0%, then no changes will be made to the composition of the Index in connection with that Rebalance Selection Date and no rebalancing will occur on the associated Scheduled Rebalancing Date.

If the optimization model produces Output Weights for the Eligible Constituents, then those weights will be the “Preliminary Weights,” provided that the Preliminary Weight of any Eligible Constituent with a weight from the optimization model of less than 0.0001% will be deemed to be 0%. Once the Preliminary Weights are determined, the Constituent Determination Agent provides a list of the Eligible Constituents with Preliminary Weights above 0% (the “Preliminary Constituents”), along with their Preliminary Weights, to the Index Calculation Agent. Notwithstanding the foregoing, if there are fewer than 30 Preliminary Constituents in respect of a Rebalance Selection Date, then no changes will be made to the composition of the Index in connection with that Rebalance Selection Date and no rebalancing will occur on the associated Scheduled Rebalancing Date.

Identifying the Constituents. In respect of each Scheduled Rebalancing Date, the Index Calculation Agent determines the “Constituents” as consisting of each Preliminary Constituent that has not been delisted from its primary exchange or quotation system or suspended from trading on its primary exchange or quotation system (other than a limitation of trading in shares of that Preliminary Constituent by reason of movements in price exceeding limits permitted by the relevant exchange or quotation system) from and including the immediately preceding Rebalance Selection Date to and including that Scheduled Rebalancing Date. The “Constituent Weight” of each Constituent is equal to its Preliminary Weight.

Rebalancing the Index. Except under the circumstances described above, the Index will be rebalanced on each Scheduled Rebalancing Date to reflect the Constituents and the Constituent Weights determined in respect of the associated Scheduled Rebalancing Date. A Scheduled Rebalancing Date on which the Index is rebalanced is referred to herein as an “Effective Rebalancing Date.” In the event that one or more Constituents is affected by a market disruption on an Effective Rebalancing Date, the Index may postpone or cancel its entry into, or postpone its exit from, its synthetic position in any such Constituent. See “— Index Market Disruption Events” below.

Eligibility Criteria

A Listing and its Reference Entity will satisfy the Eligibility Criteria in respect of a Rebalance Selection Date only if:

| · | that Reference Entity has a Theme Relevance Score in respect of that Rebalance Selection Date that is greater than 0%; and |

US-13

| · | that Reference Entity has at least 50 Relevant Stories within the Reference Period in respect of that Rebalance Selection Date; and |

| · | that Listing is represented in Thomson Reuters Datastream as accessed via QA Direct at approximately the Data Reference Time; and |

| · | that Listing has a Dollar Base Reference Free-Float Market Capitalization in respect of that Rebalance Entry Selection Date; and |

| · | that Listing is not subject to a suspension in trading on its primary exchange or quotation system that has occurred or is continuing on that Rebalance Selection Date (other than a limitation of trading in those shares by reason of movements in price exceeding limits permitted by its primary exchange or quotation system); and |

| · | that Listing is associated with any of the following exchange codes in respect of that Rebalance Selection Date: “XNGS” (NASDAQ Global Select), “XNYS” (New York Stock Exchange), “XSWX” (SIX-Swiss Exchange), “XAMS” (Euronext Amsterdam), “XPAR” (Euronext Paris), “XTKS” (Tokyo Stock Exchange), “XLON” (London Stock Exchange), “XHKG” (Hong Kong Exchanges and Clearing), “XTSE” (Toronto Stock Exchange), “XETR” (Xetra), “XCSE” (Nasdaq Copenhagen), “XASX” (Australian Stock Exchange), “MTAA” (BrsaItaliana), “XMAD” (Bolsa de Madrid), “XBRU” (Euronext Brussels), “XSTO” (Nasdaq Stockholm), “XSES” (Singapore Exchange), “XDUB” (Irish Stock Exchange), “XHEL” (Nasdaq Helsinki), “XNMS” (NASDAQ Global Market), “XNCM” (NASDAQ Capital Market), “XOSL” (Oslo Bors), “XASE” (NYSE Mkt), “XLIS” (Euronext Lisbon), “XTAE” (Tel Aviv Stock Market), “XNZE” (New Zealand Exchange), “BATS” (CBOE BZX US), “XWBO” (Wiener Boerse AG), “FNSE” (First North Sweden), “XJAS” (Tokyo Stock Exchange Jasdaq), “XNGM” (Nordic Growth Market) or “FNFI” (First North Finland); and |

| · | that Listing has a 12 Month Dollar Notional Trading Estimate (as defined in the Rules) in respect of that Rebalance Selection Date of more than $1,000,000, where the 12 Month Dollar Notional Trading Estimate is determined in the manner set forth in the Rules and represents an estimate of an average of the daily U.S. dollar value of the shares of that Eligible Constituent traded during the 364 calendar days ending on and including that Rebalance Selection Date, with the ten highest and lowest daily values excluded in calculating that average; and |

| · | that Listing has a 1 Month Dollar Notional Trading Estimate in respect of that Rebalance Selection Date of more than $1,000,000; and |

| · | in the case of any Reference Entity with multiple Listings that satisfy each of the above Eligible Criteria, that Listing is the Listing among those Listings with the highest 12 Month Dollar Notional Trading Estimate; and |

| · | that Reference Entity is not J.P. Morgan Chase & Co., Visa Inc., MasterCard Inc., or any successors to any of those entities, and is not otherwise an affiliate of the Index Sponsor; and |

| · | that Reference Entity is not subject to any applicable law, regulation, order or rule that would directly or indirectly prohibit or restrict holding, purchasing or selling securities of that Reference Entity or derivatives on, or other exposures to, those securities, as further described in the Rules. |

Calculation of the Index Level

Except as described under “— Index Market Disruption Events” below, the Index Calculation Agent will calculate and publish the Index Level in respect of each Calculation Day as soon as reasonably practicable on or after that day. All Index Levels will be rounded to two decimal places for purposes of publication only before being published. The Index Calculation Agent may vary its rounding convention in its sole discretion, provided that it will not publish the Index Level with fewer than two decimal places.

US-14

Notwithstanding anything to the contrary, the Index Calculation Agent may calculate and maintain the Index Level to greater accuracy for the determination of upcoming Index Levels or other calculations.

The Index Level was set equal to 100.00 on September 30, 2021, the base date of the Index. The calculation of the Index Level for each subsequent Calculation Day takes into account the Index Level in respect of the immediately preceding Calculation Day and the weighted performance of the Constituents (without adjustment for any dividends), converted into U.S. dollars, since the immediately preceding Calculation Day, subject to adjustments as described under “— Index Market Disruption Events” and “— Index Calculation Agent Adjustments Due to Corporate Actions and Corporate Events” below. See the Index Rules for additional information about the calculation of the Index Level.

If the Index Level on any Calculation Day is less than or equal to zero, the Index Level for that Calculation Day and each subsequent Calculation Day will be zero and the Index Calculation Agent will no longer calculate the Index Level as described above.

Index Market Disruption Events

The calculation and publication of the Index Level and the rebalancing of the Index will be affected by the occurrence of certain market disruptions relating to the Constituents. These events are set out in full in the Rules and include, without limitation, suspensions or disruptions of trading or data unavailability relating to the Constituents or related futures or option contracts that the Disruption Determination Agent determines in its sole discretion could materially interfere with the ability of market participants to transact in positions with respect to the Index, the Constituents or related futures or option contracts.

If a market disruption affecting a Constituent has occurred or is continuing on an Effective Rebalancing Date, that Effective Rebalancing Date will not be postponed, but the calculation and publication of the Index Level for that Effective Rebalancing Date and each subsequent Calculation Day will be postponed until the prices of all Constituents have been determined. If any Constituent exiting the Index on that Effective Rebalancing Date is affected by a market disruption, that Constituent will be removed from the Index at a price equal to its closing price on the next following Constituent Scheduled Trading Day for that Constituent on which that Constituent is no longer affected by a market disruption, provided that, if that market disruption persists for ten Calculation Days, that Constituent will be removed at a price of zero. If any Constituent entering the Index on that Effective Rebalancing Date is affected by a market disruption, that Constituent will be added at a price equal to its closing price on the next following Constituent Scheduled Trading Day for that Constituent on which that Constituent is no longer affected by a market disruption, provided that, if that market disruption persists for ten Calculation Days, that Constituent will not be added to the Index. Any Constituent exiting or entering the Index on an Effective Rebalancing Date that is not affected by a market disruption will be removed from or added to the Index, as applicable, at a price equal to its closing price on that Effective Rebalancing Date.

Except as described above with respect to market disruptions affecting an Effective Rebalancing Date and subsequent Calculation Days, the Index Level will generally be calculated and published on each Calculation Day, even if one or more Constituents is affected by a market disruption. Under these circumstances, the Index Level will be calculated using the last non-disrupted closing prices for any Constituents affected by a market disruption. However, if more than 20% of the weight of the Index is affected by a market disruption, the publication of the Index Level will be postponed until less than 20% of the weight of the Index is affected by a market disruption or until the next Effective Rebalancing Date, whichever is earlier.

“Constituent Scheduled Trading Day” is defined in the Rules and generally means, in respect of a Constituent, any day on which the principal exchange or quotation system on which that Constituent is listed and each exchange or quotation system where trading has a material effect on the overall market for futures or options contracts relating to that Constituent are scheduled to be open for trading during their respective regular trading sessions.

See the Rules for additional information about market disruptions and their effects on the Index.

US-15

Index Calculation Agent Adjustments Due to Corporate Actions and Corporate Events

It is expected that the Index Calculation Agent will from time to time make adjustments to the composition of the Index (1) in respect of Corporate Actions that impact a Constituent, (2) in respect of Corporate Events that impact a Constituent Company and (3) in respect of other circumstances or events (collectively, “Constituent Events”). The Index Calculation Agent will make adjustments to the composition of the Index in respect of a Constituent affected by a Constituent Event that are consistent with the adjustments made by the calculation agent of the Solactive GBS Developed Markets All Cap USD Index PR (the “Identified Reference Index”) in respect of that Constituent and that Constituent Event for purposes of maintaining the Identified Reference Index (or, if that Constituent is not included in the Identified Reference Index, consistent with the adjustment that would be made if that Constituent had been included in the Identified Reference Index).

A “Corporate Action” is an event that impacts shares or shareholders with a prescribed ex-date and includes, without limitation, distributions, capital increases, capital repayments, rights issues, entitlement offers, stock conversions, share splits (sub-division), reverse share splits (consolidation) and scrip issues (capitalization or bonus issue).

A “Corporate Event” is an event that impacts a company or its shares or shareholders and that may impact an index (depending on its rules), including without limitation, a de-listing, liquidation, bankruptcy, insolvency, winding-up, nationalization, consolidation, amalgamation, merger, binding share exchange, acquisition, takeover offer, exchange offer, tender offer or similar event.

Because the Index is a price return index, it is expected that no adjustment or change will be made to the Index to account for the declaration or payment of a distribution in the form of an ordinary or extraordinary cash dividend.

Extraordinary Events

Certain extraordinary events may affect the ability of the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent and the Disruption Determination Agent to reference data sources including the RavenPack Databases, the optimization software, the Base Reference Index and the Identified Reference Index. As described in the Rules, upon the occurrence of any of those extraordinary events, if practicable, a successor or replacement may be identified and the Rules will be amended accordingly, provided that the Index Sponsor may, in its discretion, at any time and without notice, terminate the calculation or publication of the Index, including, without limitation, subsequent to the occurrence of an extraordinary event. The Index Sponsor is under no obligation to continue the calculation and publication of the Index.

Corrections

If any publicly available financial or other information used in any calculation or determination is subsequently corrected or if the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent or the Disruption Determination Agent identifies an error or omission in any of the calculations or determinations in respect of the Index, and if the Index Sponsor determines that the correction, error or omission is material, then an adjustment or correction may be made to the Index Level.

The Index Sponsor and the Index Calculation Agent

JPMS plc is currently the sponsor of the Index (together with any successor sponsor or assign, the “Index Sponsor”). The Index Sponsor may appoint a successor sponsor or assign, delegate or transfer any or all of its rights, obligations or responsibilities in its capacity as Index Sponsor in connection with the Index to one or more entities (including an unrelated third party) that the Index Sponsor determines is appropriate.

The Index Sponsor is also responsible for the appointment of the calculation agent of the Index (the “Index Calculation Agent”), the determination agent of the Constituents (the “Constituent Determination Agent”) and the determination agent of disruption events (the “Disruption Determination

US-16

Agent”), each of which may be the Index Sponsor, an unrelated third party or an affiliate or subsidiary of the Index Sponsor. Solactive AG is currently the Index Calculation Agent, and JPMS plc is currently the Constituent Determination Agent and the Disruption Determination Agent. The Index Sponsor may at any time or for any reason terminate the appointment of any of the Index Calculation Agent, the Constituent Determination Agent or the Disruption Determination Agent and appoint an alternative entity (or entities) as that entity’s replacement. Each of the Index Calculation Agent, the Constituent Determination Agent and the Disruption Determination Agent (unless that entity is the same entity as the Index Sponsor) must obtain written permission from the Index Sponsor prior to any delegation or transfer of that entity’s responsibilities or obligations in connection with the Index.

The Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent and the Disruption Determination Agent are responsible for making calculations and determinations as described above and in the Rules.

Index Sponsor, Index Calculation Agent, Constituent Determination Agent and Disruption Determination Agent Determinations

Each of the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent and the Disruption Determination Agent will act in good faith and in a commercially reasonable manner in making determinations, interpretations and calculations pursuant to the Rules. All determinations, interpretations and calculations of the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent or the Disruption Determination Agent relating to the Rules will be final, subject to the “Corrections” section above. No person shall be entitled to make any claim against the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent, the Disruption Determination Agent or any Relevant Person in respect of any determinations, interpretations or calculations of the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent or the Disruption Determination Agent.

None of the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent, the Disruption Determination Agent and any of their respective affiliates and subsidiaries and any of their respective directors, officers, employees, representatives, delegates and agents (each, a “Relevant Person”) will be under any obligation to revise any determination, interpretation or calculation made or action taken for any reason in connection with the Rules or the Index or have any responsibility to any person (whether as a result of negligence or otherwise) for any determinations, interpretations or calculations made or anything done (or omitted to be determined or done) in connection with the Index or any use to which any person may put the Index or the Index Levels.

An action (or failure to act) on the part of the Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent or the Disruption Determination Agent in relation to the Index may have a detrimental effect on the Index Level or the volatility of the Index. The Index Sponsor, the Index Calculation Agent, the Constituent Determination Agent or the Disruption Determination Agent may make certain determinations or calculations based on information obtained from publicly available sources without independently verifying that information.

Amendment of the Rules; Termination of the Index

Economic, market, regulatory, legal, financial or other circumstances may arise that may necessitate or make desirable an amendment of the Rules. Notwithstanding the foregoing, the Index Sponsor may amend the Index Rules as it deems appropriate. These amendments may include (without limitation), correcting or curing any errors, omissions or contradictory provisions; modifications to the methodology described in the Rules that are necessary or desirable in order for the calculation of the Index to continue notwithstanding any change to any economic, market, regulatory, legal, financial or other circumstances; or modifications of a formal, minor or technical nature.

Following any amendment, the Index Sponsor will make available (as soon as practicable) the amended version of the Rules and will include the effective date of that amendment in the new version of the Rules. However, the Index Sponsor is under no obligation to inform any person about any amendments to the Index (except as required by law or regulation).

US-17

The Index Sponsor may, in its sole discretion, at any time and without notice, terminate the calculation and publication of the Index.

US-18

Supplemental Terms of the Notes

The following supplemental terms of the notes supplement, and to the extent they are inconsistent, supersede, the description of the general terms of the notes set forth in the accompanying product supplement. Except as noted below, capitalized terms used in this section without definition are as defined in “The J.P. Morgan QUEST Cyber Security Index” above.

Postponement of a Determination Date

Notes linked solely to the Index

Notwithstanding any contrary provision in the accompanying product supplement, for notes linked solely to the Index, the following provisions will apply. If a Determination Date (as defined in the accompanying product supplement) is a Disrupted Day (as defined in the accompanying product supplement), the applicable Determination Date will be postponed to the immediately succeeding scheduled trading day that is not a Disrupted Day.

In no event, however, will any Determination Date be postponed to a date that is after the applicable Final Disrupted Determination Date (as defined in the accompanying product supplement). If a Determination Date is or has been postponed to the applicable Final Disrupted Determination Date and that day is a Disrupted Day, the calculation agent will determine the closing level of the Index for that Determination Date on that Final Disrupted Determination Date in accordance with the formula for and method of calculating the closing level of the Index last in effect prior to the commencement of the market disruption event (or prior to the non-trading day), using the closing price of one share of each Constituent (or, if a market disruption event or a non-trading day that affected that Constituent has occurred, the calculation agent’s good faith estimate of the closing price of one share of that Constituent that would have prevailed but for that suspension or limitation or non-trading day) on the scheduled trading day immediately preceding that Final Disrupted Determination Date.

Notes linked to the Index and other reference assets